This is just freaking nuts. It explains the record trade deficits, bottlenecks, shortages, and inflation pressures, among other distortions.

By Wolf Richter for WOLF STREET.

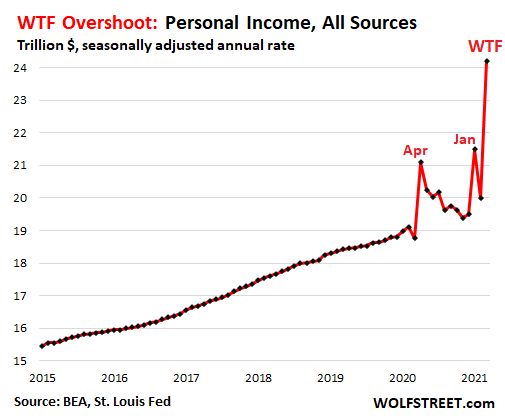

Personal income from all sources, including the free-money-from-the-sky $1,400 stimmies, spiked by 21% in March from February, and by 31% from March 2019, to a seasonally adjusted annual rate of $24.2 trillion, a historic WTF moment that shows the effects of the historic WTF overshoot triggered by the last round of stimulus payments.

A month ago, after personal income in February had plunged, following the January spike triggered by the $600 stimmies that started going out at the end of December, I said: “We’re awaiting with feverish anticipation what this chart will look like for March and April, when the $1,400-stimmies arrive. It’s going to blow our socks off.”

Hahaha, sure did. This is just freaking nuts. So here I present you the latest and greatest WTF chart of the year:

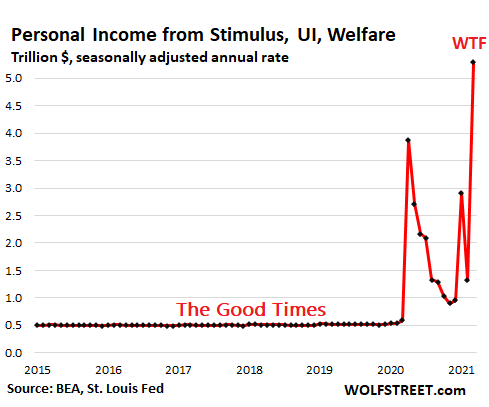

Income from stimmies, unemployment insurance, and welfare benefits exploded, driven by the stimmies that arrived in the personal treasuries of millions of households in March, according to data released by the Bureau of Economic Analysis today. Unemployment compensation ticked up a smidgen in March from February, but was lower than in January, and at an annual rate of $541 billion, was just 10% of the total:

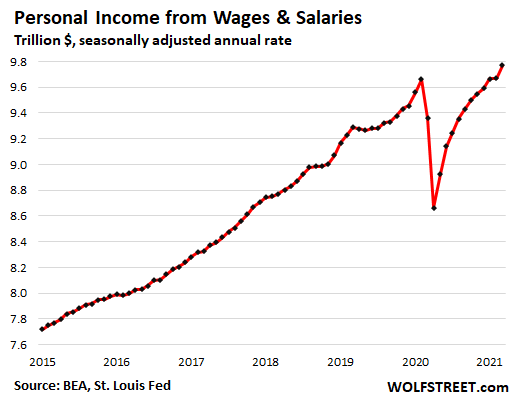

Income from wages and salaries in March rose 1.1% from February, to a seasonally adjusted annual rate of $9.8 trillion. More workers in the hospitality industry, including restaurants and hotels, were hired back. And some pay increases including higher minimum wages at state and local levels flowed into the data.

A year ago, higher-wage earners that worked in offices kept their jobs but switched to working from home. And at the high end, especially among executives, there have been lots of increases in pay packages. Job losses were concentrated at the lower end of the income scale, particularly in the hospitality and travel industry. This lower end has been hiring back some of the workers:

Folks spent some of the free-money-from-the-sky stimmies.

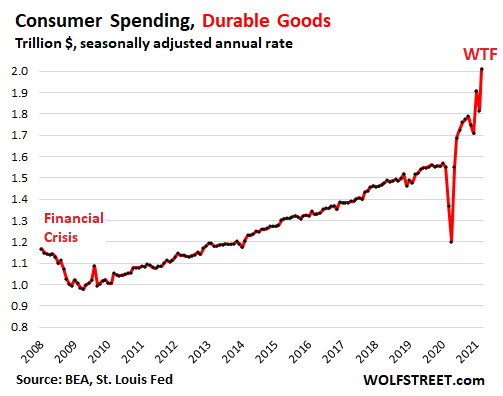

Spending on durable goods spiked by 10.8% in March from February, to a seasonally adjusted annual rate of $2.0 trillion, up 33% from March 2019.

A month ago, when February durable goods fell after the $600 stimmies got spent in January, I said, “So now everyone is counting on the big-fat new stimmies to turn this fiasco around.” And they did, for another WTF moment:

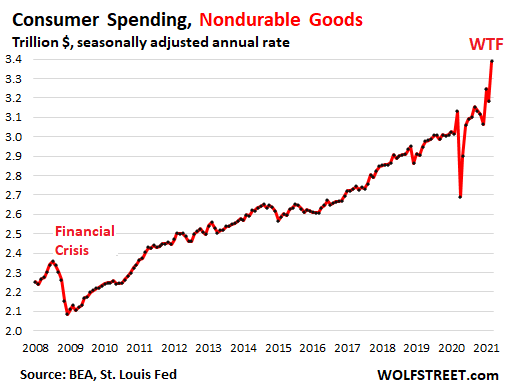

Spending on nondurable goods – mostly food and gasoline – jumped by 6.5% in March from February, to $3.4 trillion (seasonally adjusted annual rate), up 15% from March 2019:

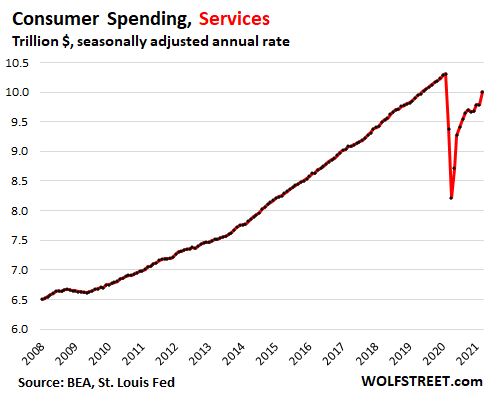

Spending on services, which had gone nowhere for six months, rose 2.2% in March from February, to $10.0 trillion (seasonally adjusted annual rate), but was still down 2.9% from the peak in February 2020.

Services include rents, mortgage interest payments, health care, education, insurance, travel bookings, subscriptions for cellphone, broadband, and streaming services, electric utility services, haircuts, ballgames, movie theater tickets, gym memberships, etc. For services the Pandemic has been a very mixed bag, with a few services, such as streaming services, killing it; and many other services, such as gyms and travel bookings, getting crushed.

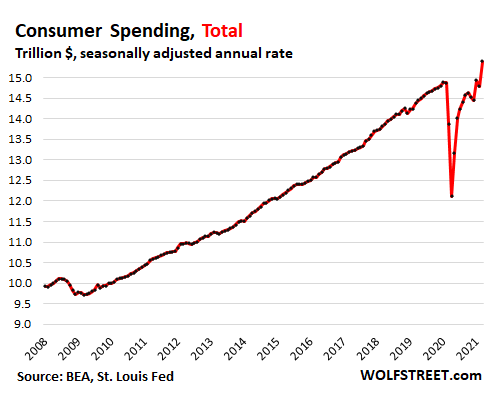

Total consumer spending – nurtured so beautifully by this free money from the sky – jumped 4.2% in March from February, and by 7.2% from March 2019, to a seasonally adjusted annual rate of $15.4 trillion:

Inflation galore but not included.

Inflation has been surging in recent months, and this has cropped up everywhere at all levels of the economy, as companies are facing skyrocketing input costs and are having to raise their prices to try to protect their margins, and as their customers – other companies and consumers – are paying those higher prices.

In the first quarter, this has shown up in the GDP data release yesterday, where the inflation index used to adjust GDP to inflation jumped by 3.8% annualized in Q1, more than double the rate in Q4, showing the extent to which inflation has accelerated. So part of the increase in spending displayed here in all its glory comes from big price increases.

The whole stimulus thing explains the record blowout trade deficits since a lot of these goods are imported, the bottlenecks, numerous shortages, the blowout freight spending, and the massive inflation pressures building up along the way, among other distortions.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I have a new theory for these shortages and skyrocketing prices of parts and raw materials. When it comes to the real goods economy WFH and distance work are a giant productivity failure. It might be ok to sell insurance this way, or curate TikTok videos, but when comes to repairing a computerized saw mill, or getting the software in a resin factory working it is a loser. I have noticed this on n my purchasing of materials. An inquiry and purchase that used to take one phone call when the inside sales person is at a desk next to the warehouse , now takes 4 emails and a whole day or two now that they are working from home.

What you describe is no doubt true, and can complicate the ordering process, requiring more annoying time on the phone, but it can’t create a shortage of material.

Sure it can if you assume the same thing is happening upstream. The purchasing manager at the steel mill is having trouble getting ore, limestone and coking coal in a timely manner because his contacts are working remote, this causes production stoppages, and so on and so forth.

A steel mill is not a retail customer ordering or small biz ordering for next day’s or next week’s ore. A steel mill can’t just abruptly shut down and restart when fuel arrives, this could damage the mill, resulting in huge liability for the supplier. (This was a factor in breaking the famous UK coal strike. The union wouldn’t give permission for an emergency delivery to the old ‘Mary’ Furnace. The coal miners knew it might never restart if shut and disobeyed the union)

No doubt something like this has happened, but for the majority of cases the cause of shortages will be those described in the article: an unexpected wave of orders caused by the Fed showering money like rain everywhere. It’s a tribute to how well our supply chain usually works, that when it doesn’t, people think something weird is happening. In other parts of the world, delivery of anything is uncertain.

The other day a guy on WS was saying the chip shortage was a scam to raise prices.

But wouldn’t Ford pay double to keep the F 150 line running? If the shortage was artificial why would the big Taiwan maker be spending 100 billion on new factories? Why can’t the explanation be the flood of new orders caused by a flood of Fed money?

The chip shortage is a scam to keep the labor market from reaching the benchmark at which QE tapering begins. CA stages a work slowdown, and uses the inflation bogey to raise prices and offset the decline in production. Those price hikes will not be rolled back when the economy recovers. The scam is similar to Powells quid pro quo with Trump on lower interest rates. Give me a trade war and I will give you ZIRP and REPO, and all the stock market confetti you want. Now he has laid down a similar gauntlet for Wall St. There is a surplus of vaccine, workers should be back in the office.

Ambrose Bierce,

“The chip shortage is a scam to keep the labor market from…”

What, dear friend, are you drinking so early in the morning? Can I have some too?

Now Wolf, thats not nice. I think conventional wisdom s%$^ the bed awhile ago and look forward to unconventional thinking such as Mr. Bierces. Have you ever read any Ambrose Bierce? The man had a firm grasp on human nature. Didn’t call him Bitter Bierce for no reason.

In fact i would compare the world economy since 2008 to his very famous story “an occurrence at owl creek bridge”. Anybody familiar with that one? Can you see the semblance?

nick…

Anybody that has dealt in the real world knows that DELAY means something. It usually means they are stalling … now why would they stall? To make sure to keep you on the hook while they try and solve the issue. What is the issue? Can only mean they can not ‘push the button’ to get you the goods. They dont want to miss the sale..so they stall….Now why would that be?

See above: the idea that nothing is what is seems, that nothing has an obvious answer, was dealt with by Hippocrates in his advice on diagnosing illness: “When you hear the sound of hooves, do not think of zebras”

We’ve lost an entire generation. The generation that was told “learn to code”. Somehow tapping on your Dumbphone and reacting to someone else’s ding every minute like Pavlov’s dog, was supposed to be a substitute for hands on experience.

I just spoke with another friend who, like I, owns a sawmill business. He could add another shift, as I also could, but there are no candidates with any experience whatsoever, and we are not going to train people who do not want to be there, and for a market that could be over in 30 days.

The U.S. and the entire Western World has undercut the foundation. And there is no coming back.

If we were having a credit crisis and letters of credit were not being honored (i remember something like that happening in 08) would that not lead to supply chain SNAFU’s?

Kam,

“we are not going to train people”

Given your expressed attitude, I don’t think you were willing to train people before…I think you simply assumed that through desperation somebody else would pay for the training that you could then subsequently take advantage of.

As for technology use (from programming to you name it) in general it requires methodical thinkers, who in general make better workers.

So being anti-smartphone, etc. per se doesn’t strike me as particularly…smart.

The same kind of people interested in coding tend to be people interested in how machinery works (a program is sort of a disembodied machine).

So again, running down interest in technology per se seems to be counter productive.

I agree with kam. That commercial where the zombie tries to pick up the TV remote, his arm falls off, he shows mild frustration, and then says, “Show me….” says it all.

Perhaps you are having a wrong look at the next economy?

Besides it is confusing to digest what you gave me here?

My shoe shine person has a better grasp of this tabloid.

He be, We be in the know.

Care to elaborate more?

Before one salary, now 4 salaries…voila’ more spending!! (I am joking here, but then again…??).

Its ironic how taking money by force from producers and giving it away to freeloaders after skimming 70% off the top for themselves, the Politicians now refer to this as “Free Money- Stimmies” ..how cute and innocent.

Is no one else concerned about the shift from productivity to welfare based economy? Where is the future “welfare” going to come from?

Actually, there was a lot of inflation being created by the biggest freeloaders of all, the banksters, whose privately owned but deceptively named “Federal” Reserve has been printing US legal tender with larcenous delight like there is no tomorrow, e.g., to buy over $2 TRILLION in UNCOLLECTIBLE, mortgage-backed securities in 2019 to now with EVEN MORE being bought at a rate of $40 BILLION more each month even in 2021. See “The Fed isn’t going to stop buying MBS just yet” in housingwire.

Hyperinflation may be arriving thanks to their “Fed.” Shadowstats has not yet fully quantified the 2021 inflation but I bet that it will be far greater than the small, income increase that the poorer 90% of Americans have obtained. Its inflation rate so far has been only about 10% with the more accurate, 1980 measurement method or about the same as 2020’s real inflation. See its alternate inflation charts.

Thus, trust me, the poorer 90% of Americans are not the “free loaders.” The ultra-rich, bankster parasites that have bribed our politicians to take over our government and financial system as discussed by the IMF’s former economist Simon Johnson in “The Quiet Coup” are the real free-loaders who have received TRILLIONS in free money for many DECADES. See, e.g., “The Size of the Bank Bailout: $29 Trillion – CNBC” in CNBC. See “Big Banks Got the Sweetest Deal From the Covid-19 Bailouts” in kcrw. See “Turns Out That Trillion-Dollar Bailout Was, in Fact, Real” in Rollingstone. See “Trillions of Dollars in Bank Bailouts: Socialism for the Rich?” in pbsnewshour. See “The Fed’s $16 Trillion Bailouts Under-Reported” in Forbes Magazine.

Even a tiny fraction of what the banksters have stolen EVERY TWO years could house and take care of America’s entire homeless population or cancel all student debt in the USA. (This computation actually refers to the two trillion being spent on the F-35 but those TRILLIONS being stolen by the banksters could accomplish the same if we could stop the stealing. See “Cost Of Military Jet Could House Every Homeless Person In U.S. With $600,000 Home” in huffingtonpost. See “This Country Is Spending $1.7 Trillion on Planes That Don’t Work” in esquire.)

Well in this case they didn’t take it from *you* at all, they just created it out of thin air. Federal Reserve notes have the name of the true owners printed right on them. You don’t actually own your dollars. People like you believe the world should be a certain way. It’s filled with shoulds about fairness and shoulds about rewards. When it comes to society, culture, and human law, we create our own reality. Other people like you who are much more powerful and want to create the world as they want it to be, will roll right over you. If you don’t want to be perpetually shocked and dismayed like a toddler at the circus, get rid of all the shoulds and expect nothing.

Excellent observation.

Which agrees with my thesis that WFH/WFA phenomenon will be on a very short leash going forward for many remote workers.

Companies that keep workers in office/headquarter/work site will eat the lunch of many of those firms that believe remote workers are just as useful as onsite workers.

This assumes that many back office jobs that really do nothing (healthcare, some banking, higher ed) actually have competition that will eat their lunch.

Many so-called jobs have little or nothing to do with productivity. Having worked for a government I speak from experience.

MrH

Read David Graeber’s “Bullsh*t Jobs” for his usual great perspective on all this. Tragedy he died after writing it.

If anyone is still in this room tyler durden aka abc media recently published online their take upon the 90 year old crank from Berkshire 3 hour blabbering.

Now I think this ZH article and comments help immensely for me to grasp the psycho financial world we live in.

Have a read and for those whom still love their mothers…

Happy Mothers Day!

Can a ponzi ever taper?

Mo

Of course a ponzi scheme tappers. That’s how the skimming off the top begins.

This happens every day 24/7 banana….

It’s kind of like drinking vodka because there is a desire not to get drunk ever agian.

You are agreeing, disagreeing, debating and disallowing the same old same old drek day in day out.

2B

With an army, a navy and an air force you can make anything you want happen.

Temporarily.

An empire will grow and endure by military might as long as the benefits of military force exceed the costs of doing so. The best known example is the Roman Empire, which grew by military might but ultimately could not support its vast armies.

It also depends on whether the benefits of being vassals of a foreign country exceed the costs of resistance as perceived by the subjugated people. The American Revolution is is an example. However, Puerto Rico hasn’t rebelled, nor has Guam.

Why would they? They don’t pay U.S. federal income taxes, but whenever there’s a natural disaster, FEMA is there to bail them out, plus they get the benefit of our military.

They’d be stupid to rebel.

Yes, a ponzi is tapered after the SEC appoints a receiver. Always results in losses, except for the attorney appointed receiver.

WTF is fine, but I prefer TIAB — to infinity and beyond!

And more stimmies, rent/lease deferments, etc., and people will see working for a living as anti-human rights.

That might already be the case for some (overschooled) young people today. (I only barely made

it through grad school with my work values intact)

Larry…….funny!!!! I just saw the Three Stooges lined up in PRINT!

Curly

Not to worry, there will be new $2-3 Trillion spending bill just in time. No more nonsense about debt ceilings.

Finally, the humanity have reached the point of fulfillment without back-breaking toil. Amazon has all I need.

Even more amazing that no one in the history of civilization has ever tried to do this before…

My personal favorite, with may parallels to today, is the French Assignats in the 1790s.

“Even more amazing that no one in the history of civilization has ever tried to do this before…”

Yah, never before….except the previous administration and the administration before that and the previous one to that and the other before all those….

Remember….tax cuts for the rich increase revenue and balance budgets. So does military spending. Social Security and Medicare cause deficits, and only government spending cause deficits.

That’s why all those record shattering deficits from tax cuts for the rich that were done before….and before and before…have been air brushed out of your reality.

It’s like heaven on earth without the dying part!

What’s that saying?…

“Capitalism without bankruptcy is like Catholicism without hell.”

Capitalism with the FED is as satisfying as telephone sex.

The government had no concerns spending $2T on credit just two months ago. Now the government does not want to increase the deficit without raising tax revenue. Something does not make sense here.

It’s about feelings – soak the rich, tax the rich, eat the rich – not so much about the numbers.

G has no semblance of fiscal responsibility and the Fed is an overly willing accomplice.

It partly has to do with the previous $2,000 worth of stimmies already being in the pipeline prior to the current president taking office.

At this rate, the $ recycling from FED to China through AMZN will continue until the last consumer in the US finishes remodeling the third bathroom to fit his/hers seventh 72″ 4K tv into it.

7th TV?… Only 7 ??

My Brother in law has 9 of the damn things scattered throughout his 5,000 sq. ft. house. Some are in the bathrooms.

Employees gone. Logistics in shambles. Commerce stuck in a two headed vice. Remind you of anything? Yup. A war. Producers produce less and charge more in hopes of staying relevant. Central banks pump new money down the income ladder. Replacing spending that evaporated. Sending more cash to the already wealthy just boosts the prices of stocks, bonds and property. A waste of money. Socialism for the rich. WTF is not sustainable. Debt deflation is more likely than hyperinflation.

The last chart is interesting. It looks the last point is slightly below the trend line pre-pandemic.

Services, the biggie (=70% of consumer spending) is still down from the peak.

They didn’t spend the stimulus checks on the rent and the mortgages.

Bingo.

And the student debt payments went unpaid.

Forbearance of all kinds of personal debt has worked synergistically stimulus proceeds and other transfer payments to the public.

Helicopter money plus forgive, extend, and pretend.

So Wolf, what does all this stimulus money amount to in total dollars (after subtracting the usual, non-stimmy sources of personal income)?

But we see from your charts where most of it went- into the consumer economy.

Don’t you worry, Mr. Wolf.

The J team is going to get right on it. They will get that next stimulus passed in no time, just need one or two Dumbos to fall in line, not to mention Joe #2 from WV. Easy enough to bribe them.

Joe#2 can get a statue or two in his honor like his honorable predecessor Mr. Byrd.

The Dumbos, just toss Susan and Lisa a few bones. Open up the Arctic circle for drilling, and whatever minor things that Maine wants. Then the spigot will open up for the service economy. (or not, but that doesn’t matter cause government stimulus will help ensure everyone keeps getting paid)

I like the way Mitch would always choose Susan to waste a vote to help her get re-elected when he could spare one….Lisa is second in line for that assist, I think.

Post office ruined my stimmy check, and I can’t cash it. Accountant called and said I have to pay extra for my 2020 taxes. WTF indeed!

Don’t feel bad. I never got neither of mine

Please explain just how “the P/O ruined your check so it couldn’t be cashed”. Thanks, others may want to know also.

If you are just embellishing your venting with some add on BS, then skip it, lots of people are upset for many different reasons, and most aren’t fortunate enough to even have an accountant, much less one that calls them.

Aren’t you friendly. They sliced off part of the envelope with the check inside. The routing number is incomplete.

It’s sort of a weirdly specific complaint to invent. But he can just get the stimulus by filing his 2020 tax return anyway. So it’s hardly a big deal.

I’m tired of P/O bashing. I was homeless at 38 and the P/O (plus the wounded Viet Vet points added to my test score) saved me. The 80’s recession was nasty, many millions never came out of it, so when I saw a very unlikely scenario based on 17 years as an electronic tech (with 84 weeks of training on postal machines at their Tech Center in Norman OK there) I questioned it. My response was deleted, probably for being excessively rude. I apologize, but I still stand by it’s content.

For what it’s worth the stim was perfect timing for me…two major breakages needing crowns…..dentist and endodontist got it (or will get) all. I know the dentist likes to go to Indy almost every year, and the edodontist plays good CW music and poker. Both have nice homes paid for (which both almost burned) so I can make a good guess at some, but not all of what was “stimulized”.

Can’t WTF to see the charts next year. This tsunami of unearned money has pulled so much demand forward that I expect deflation in the things everyone is buying today.

That’s what I’m thinking also. This inflation , then disinflation and no or little growth. Then they’ll be ready with the digital currency and the Fed will directly deposit funny money into your account. Inflation up the wazoo.

Biden has more trillions coming. He calls it the American Family Plan i.e. bacon at 50 dollars a piece plan.

Once in a generation he says…

now why would that be?

Because it is so effing expensive that only one generation at a time can fall for the rouse.

Smells like the American Dream or is it the American Fart?

It’s the Fed Hussle.

Biggest game-changer of 2020 was Fed’s abolishment of all reserve requirements.

Straight from the horse’s mouth:

https://www.federalreserve.gov/monetarypolicy/reservereq.htm

Fed creates monetary base,your local bank does the rest by extending loans. Since March 2020 sky is the limit.

Now everything can be randomly chosen and pumped up beyond all reasonable limits:

BTC,Dogecoin,Norwegian Cruise Lines (all ships are still docked but the stock price keeps soaring, sometimes 15% a day),Paris Hilton Bottled Fart etc…

While scanning MSM headlines I get a feeling that they regard the current resident of the WH as a deranged but affable patient of the nursing home:

“Joe wants $4T for this,Joe wants $8T for that…Look at him,is not he a cutie pie ???”

And the wishes of Joe will be granted w/o bothering to vote for raising Statutory Debt Limit.

Fed Funds zero ….3.8% under quarterly CPI reading…ever happen before?

30 yr mortgages (2.9%) well below the inflation rate…..for a 30 yr!

Last time the CPI was this level 1999 and 2006, 30 yr mortgages were 6%!!

The Federal Reserve is ROGUE…off the rails, not honoring its mandates, imposing inflation tax, and minting hand over fist……the last two are Congressional powers not delegated to the Fed under the Federal Reserve Act.

Replacement costs of houses jumped nearly 35% due to copper, lumber etc….in the PAST 5 MONTHS!!!

CTV News (Canada) reported that building materials prices are up 170% — in just six months.

Didn’t realize the full implication of the fed lowering the rates to zero until this comment. I just viewed it as “more irresponsibility”. But after reading what you said, I shuddered.

Brent,

Yes it cut “reserve requirements” to zero, but it not change its “capital requirements.”

Reserves are huge and plentiful. In some countries, there are no reserve requirements to begin with. And some central banks think they’re not needed.

But the Fed did not lower the “capital requirements.” The capital requirements are key to financial stability. They’re what absorbs losses and limits risk taking. And “capital requirements” stayed in place.

Mr Richter;

About 20 years ago WSJ regularly printed US Treasuries auctions data and series### of Treasuries sold to foreigners.

Also narrative-du-jour was that China has no other options but to buy US Debt to cover huge China-US trade deficit.

Now UST auctions data are markedly absent from WSJ.They are somewhere out there, like US Treasury web site, but one has to look for them.

For the past 5 years Japan and China holdings of UST are around $1T each.China’s even went down by $200B recently…

China is getting rid of $$$ generated by trade buying everything worth buying in Africa.

Long story short-presently US financial institutions and their foreign subsidiaries are well-capitalized by holding UST.

Capital requirements are met.Yay !!!

Which is piece of cake,Gordon (Gekko),thanks to 0.0% Fed reserve requirements.

Mortgages and student loans are not considered to be particularly precious capital assets and are transfered ASAP to Gov entities like Sally Mae,Fannie Mae etc.

PHEW! Thanks for that clarification, being economically illiterate, I was afraid “fractional banking” now meant “no reserves (fractions) needed”. To me they are low enough to be scary as it is, all central banking craziness aside.

I guess the only bright side is the 30 year is over 2%….I guess at this website that’s not saying much, as I get interest rate repression and the problems from being a long time reader. Using that as a “bright side” I guess I’m saying we don’t stink as bad as Japan or Europe, but we also don’t make much to export, except raw materials….almost feel like we are a colony.

NBay,

There are currently $3.9 trillion in excess reserves (all reserves are now “excess reserves” since there are no more “required reserves”) that the banks keep on deposit at the Fed. The banking system is awash in reserves. The Fed pays the banks 0.1% interest on those reserves. Cutting required reserves from 10% to 0% has changed nothing in this environment of excess reserves. In fact, reserves have skyrocketed since the requirement was cut to zero:

https://fred.stlouisfed.org/series/WRESBAL

Thanks again.

Yes, reserve requirements are irrelevant now because the capital requirements are always the limiting factor. Besides, we are moving towards full reserve banking anyway with CBDC.

NB

Low interest = low price of money ie big supply with little demand.

The World is awash with money, it gets parked somewhere easy and fluffs everything with a return down to tiny returns.

The govts are trying desperately to get people in the west to invest in worthwhile future long term growth projects to give people worthwhile jobs but we keep blowing the money on higher house and stock prices, and share buybacks and bonuses etc.

If we can’t solve this problem we are all ‘stuffed’

Just returned to that chart after some study. For me it simplifies understanding our banking system to not have two types of reserves. Whether in itself it’s bad or not, I have no idea, sounds like it doesn’t really matter….the amounts obviously do. I still think fractional banking was a risky thing to turn loose on society, but IIRC the Dutch started it 300 years ago.

And there are other factors involved here besides just “banking”.

Thanks for helping me learn something I have a built in resistance to, because, as a lifelong W-2 or on my own guy, I find it hard to like managers, string pullers, etc, and wealthy bean counters, or have much empathy for their problems. Got along fine with small company bookkeepers, though.

As far as price of money goes, I still remember what was called the 3 biggest lies in LA (the North Ca/LA feud goes way back);

The Benz is paid for.

I can get all the money I want at 10%.

It’s only a cold sore.

Some things have changed since then.

I’m skeptical about stimulus checks as the primary cause. The Atlantic, for example, reported that deforestation, caused by beetles, is reducing lumber supplies at the same time demand is ramping up. Chip shortages have several causes not related to stim checks. That jam up in the Suez caused some delays. Not to say that a one-time jolt of spending couldn’t cause bottlenecks. Too much cash sloshing around is partly Fed policy but I think the longer trend concentration of wealth could mean a glut in financial assets.

“Shortage” seems like a lie when it comes to lumber. I saw shortages last summer in certain wood products like siding, plywood, etc. This year, everything is full to the brim. There’s a lot of BS out there – narratives to justify price bubbles.

I don’t get this “chip shortage” at all and never did. Is it like a bunch of chip factories burnt down, or everyone all of a sudden wanted different ones?

Something seems fishy.

NBay,

SUDDEN DEMAND. Look at the friggin “Durable Goods” chart. That’s why I posted them. Many/most durable goods that consumers buy have chips in them, something thousands of chips, like cars. And you cannot build dozens of chip factories in two months if demand surges by 30% from one month to the next.

Yeah, I forgot TVs, washing machines, clocks, coffee makers, etc, etc, etc, etc, and was just thinking cars only for some reason. And yeah I’m very aware of what’s in a car, but in the aggregate, it pales in comparison.

Mea Culpa.

@Nbay

And to add to what Wolf said: not only can you not build dozens of chip factories to accommodate the surge in computer and other goods demand – companies were cutting capacity prior to COVID.

Intel closed down 2 of the fabs prior to COVID, for example.

The “surge” from stimulus plus WFG was entirely unexpected – and won’t last either. On the computer side – demand will literally die out as companies either sell off their unused in-office compute or the WFH will mean workers have over-powered laptops that they won’t replace for 5+ years.

Ditto cars: the average car on the road is around 12 years old. Every “excess” new car purchased during COVID fiat splurge will impact future sales for more than a decade.

Home remodeling, etc – same thing.

@c1ue yes it is the perfect setup for a classic boom-bust cycle.

Ah ha, there you go. The Atlantic has spelled it out clear as day. Nettles are almost certainly a manifestation of climate change…. must accelerate NGD to deal with this problem. $5 T more in “infrastructure” spending. That should be a good down payment to resolving a crisis that will end the world by 2040… or is it 2050, the science is always so confusing on this, heck I remember the ABC special that said the world will end by 2020 cause of climate change…

What does modern science say?

?

Mainstream ‘science’ tells us that climate change debate is settled and we will be roasted unless we act fast… Just ask Greta.

No kidding, it’s been settled forever… any moron would know that more humans will have an impact on the environment.

Just like any closed system where more of some one thing or other will effectively alter the environment.

The twist is how our scientists have been so dead on right in the last fifty years about the irrevocable climate conditions that will end the world. New ice age, unstoppable warming, rising seas, set to destroy humanity in 2000, 2010, 2015, 2030, 2050, and so on… science that is so precise that it may as well have come from a bunch of political science majors…

H

Believing in ‘models’ is not science as I knew it.

It used to be ‘BELIEVING’ nothing until you could repeat it exactly by experiment.

But, what the Hell, this could be so bad we can’t afford to take the chance. Not science, astrology.

Back to the good old pre-enlightenment days, you’ll even get garrotted for questioning the orthodoxy.

So this is just a subject for humor to you folks? Sad.

If it becomes obvious to you within our lifetimes, saying “I told you so” would be stupid on my part. Future humans are going to WISH they ONLY had macro financial system problems, and yes, besides a Massive Green New Industry and Conservation Program, ZPG has to be addressed, and I have no idea how to approach that one, but we sure can start the other, if we care about people Greta’s age…..otherwise you are saying F ’em all.

Have a good laugh.

Popular science sez go long Bermuda shorts, tee shirts and sandals.

If you were a god taking bets on Earth you would give odds against it surviving until climate change kills it. All the species has done for 20 K years is war. Unfortunately in 1952 we succeeded in literally stealing the sun. the H Bomb creates a small star on the earth’s surface. There are about 18,000 that we know about. There have been half a dozen near misses where one side was minutes from launch.

But it’s yesterdays woke issue. Hopeless?

I support efforts re: climate change but why not sharpen the issue and call it atmosphere change. During the Texas Freeze 8 died and 1100 were hospitalized with CO poisoning. You can’t burn stuff without changing the air. Large scale burning of coal is only 200 years old, oil and gas about a hundred. Nothing in atmospheric time but already detectable.

Nice to hear someone else gives a damn about our species, nasty as it is. But is isn’t just climate, here is why the coral reefs ecosystems are dying, along with the things that are bottom level food sources.

https://oceanservice.noaa.gov/facts/acidification.html

Welcome to progress. Do you want to see how the cancer has grown in the last 200 years?

At about 7X increase over that time frame, any ecosystem would see a change. Especially considering how much of the land surface of the planet we’ve covered.

It should not be a surprise to anyone right? The point is not that there is no impact, only a fool would say this. The point is that the full result and dynamics of those impact is impossible to know and crazy prognostications about when human civilization must end if we don’t do something nebulous today really need to stop.

Because whenever those do not pan out, it actually pushes people to become more skeptical of the science, until science itself gets treated like politics, which is insane. Science is never complete simply because there is no way people today can even begin to account for the countless variables that enter into something as complicated as climate change, I would wager that we don’t even know all of the variables yet. But, ah well, let’s go all out and do something which we don’t know the effect of, because we have to reduce the harm.

Certainly a master of things nebulous, so I guess you’d likely know it when you see it…….

Lumber futures have to be getting pumped now. $1500? No one in their right mind would be paying almost $10 for an 8 ft 2×4. Everyone I know has delayed most jobs unless it’s absolutely essential.

Yes, there is a lot of home building (if you like low interest, stupid prices) but there are a heck of a lot of small time things being put off (decks, fences, small buildings, shop buildings, etc.). I bet I can hold out longer than these prices.

The real problem is that this is now the “baseline.” Unless the $3 trillion in “stimulus” every year is renewed in perpetuity, economic activity will drop like a rock.

They’ll find an excuse to keep the “stimulus” going.

Yeah, until the bond market finally tells them no.

Who makes up this bond market?

The Fed can be the bond market, just like the Japanese Central Bank.

The FED can buy all the bonds like they did in 1920s IIRC.

But then what? What value will the dollar have if there is no market for treasuries?

The dollar? The rich don’t care about that. It’s just one way of recording their wealth. There are other ways.

There are no such thing as bond vigilantes.

Look at Japan: their CB has literally bought up all their bonds and most of their stock market.

Yes, and Japan is a creditor nation that doesn’t need a foreign market for its stocks/bonds. We are not, so we do.

@RightNYer

We’re are a debtor nation in dollars – which we can print anytime we want (and have been).

So is that really a debtor nation?

If we have reached peak stimulus, there is a possibility that treasury yields have already peaked. I don’t want to look like a fool suggesting a trade where I never pull the trigger to take an initial position. This brings me to:

The Angry Trade (Part 2)

Part 1 was posted in the comments section of the transcript for “It’s a Perfect Time to Sell a Home”. To recap, the Angry Trade is meant to put cash to work in an overvalued market where prudent investors are punished at the expense of leveraged speculators who are continually bailed out by the world’s central banks. The Angry Trade hopes for a crash in risk assets, but does not require it to be profitable.

In Part 1, I suggested waiting waiting for the 30 year yield to double-top at around 2.5%. That is the safer option, but I went ahead and went long treasuries at a yield of 2.3% as I will explain below.

An important aspect of The Angry Trade is getting paid to borrow money. This is accomplished by going long treasury futures contracts that trade in backwardation. These contracts expire 3 months apart, so they need to be rolled 4 times in a year to maintain the position. The backwardation effectively results in a positive carry. In other words, if interest rates remain constant, you are being paid to hold the position. This is largely thanks to other investors who want to short the treasuries and are willing to pay a counterparty to do so.

For those unfamiliar with futures trading, the thinkorswim application allows you to trade “paper money”. Your account is funded with fake money and you can trade like in a real account without risking anything, until you understand how it works.

There are four long-dated treasury contracts that are of interest. The Ultra Bond /UB contract can be thought of as having a 30 year duration. It has an $8000 margin requirement and for that money you speculate on treasuries with a notional value of around $185,000 at current prices, effectively giving you 23x leverage. The most actively traded contract is currently the June contract. The price difference between the June and the September contract is currently around $1650, which is similar to a 3.6% yield. However, the value of the contract decreases by more than a year’s worth of yield if the interest rate rises a mere 12 basis points in one year. It can easily rise that much in a single hour. Hypothetically, if the 30 year yield went back to where it was in 2018, you’d lose around $40,000.

The 30 year bond /ZB contract behaves more like a 20 year bond. It has a $4000 margin requirement and has a notional value of around $157,000 at current prices. Here the price difference between the June and September contract is around $1500, similar to a 3.8% yield. A 19 bps rise in the interest rates effectively wipes out a year’s worth of yield. (Currently the spread between the 20 year and 30 year yield is 10bps. The last time interest rates peaked around 2018, the spread was around 10bps as well. In 2018, the /UB traded in contango and I didn’t touch it, but /ZB traded in backwardation.)

The 10 year Ultra Bond /TN behaves like a 10 year bond. It has a $3100 margin requirement and has a notional value of around $145,000. The price difference between the June and September contract is around $1300, similar to a 3.6% yield.

The 10 year Bond /ZN behaves like an 8 year bond. It has a $1700 margin requirement and has a notional value of around $132,000. The price difference between the June and September contract is around $800, similar to a 2.4% yield.

The actual specifications and mathematics underlying treasury futures is complicated and discussed at length in a downloadable CME publication. What I’ve covered is a more intuitive explanation.

Currently, I believe there is a risk that the 10 year yield will rise faster than the 20 or 30 year yield, so the initial trade is to go long /ZB at a price of 155’22”. That’s the exact price at the time I’m posting this and it has been near this price all morning today. If interest rates go back to 2018 levels, I expect to take a $20,000 loss on this contract. In part 3, I will discuss the strategy for doubling down on the trade as interest rates rise further.

Orthodox Investor:

Thx for giving me a headache!

You man $3 Trillion plus adding in the inflation factor each year. Compounding, you know!

That’s right. What is govt spending….33% of GDP?

So govt spending drops, GDP drops, Fed keeps rates at zero to stimulate the economy (stock market), cost of borrowing for massive spending bills stays near zero…more spending programs…

round and round and then boom!

Yep. Classic boom-bust setup. And an extreme one at that.

In BC people always rant when there is a cash infusion around land claims settlements with local native bands. (There were almost no signed treaties here so it’s a wee bit late dealing with the issues, and certainly more expensive doing it now). I always just shrug and say it gets recycled right back into the economy as the windfall gets spent pronto. I would imagine it is the same for this situation, for aggie subsidies in farm towns, etc etc. The dealerships do well, restaurants (if they ever open), clothing stores, etc.

What’s the big deal?

The super rich don’t pay taxes and either do behemoth corporations. I guess they’ll just have to start one off these days, won’t they?

For me, $1400 would be nice but I don’t need it. For many it will be a Godsend. There should have been a means test and way to clawback from high wage earners…as well as requiring the slackers who don’t/won’t pay taxes into the common good when they should have been doing so all along. What, a recent political billionaire proud of paying $750 taxes for years, and none for many more? This is a pandemic and many need a hand up. It could have been done better but at least something was initiated.

I hate to say it but it looks to me like printing money and giving it to the 99% actually infuses money into goods and services transactions.

Give Bill Gates $1400 and he’ll put it in financial assets. Or maybe fold it to stick under the leg of a wobbly table.

Give $1400 to someone who wears a paper hat at work and they go buy products and services.

There’s a lesson in here somewhere. First item of business is whether the sudden jolt in demand crashed headlong into a dysfunctional supply system that wasn’t ready for it. Then you have the chip shortage that’s killing auto production.

So there are a lot of moving parts but the thing that stands out in my mind is that the original approach (QE, etc) put the expanded money supply into the hands of people least likely to spend it into the real economy. We got inflation by definition but it went into financial assets and engineering.

This time small amounts of money given to a very large number of people seems to have done what the Fed couldn’t.

Just sayin’.

Yeah, but what was the benefit? If people are using printed money to buy Chinese made goods sold by Amazon, that has very little multiplier effect. At least if they’re paying someone to make them a meal at a restaurant or to build them a deck, the money is staying in the economy.

Uh, are you kidding, it has a fantastic multiplier effect for China. The J team is Best thing for XJP since Obama/Bush/Clinton.

That Trump aberration was a freak of nature.

And to your point, the money is staying in the economy…. the global economy, not like it’s going to Mars.

Unless the contractor or restaurant hires illegals, or even some legals. The money leaves the country in the hundreds of billions back to the home country. There goes your multiplier effect.

Who says the money has to go to China? Let’s just stay on topic here and compare Fed money printing vs Congressional redistribution via the much-reviled stimulus checks. Reviled, that is, by those didn’t get one.

It’s a complicated process to analyze but there’s no denying that QE failed the 99% spectacularly and caused a wider rift in terms of wealth.

Secondly it cannot be ignored that giving the money directly to citizens instead of the convoluted bullshit Fed process that serves Wall Street first has been followed by what appears to be demand-pull inflation colliding with a system rendered dysfunctional by covid.

Whether or not there is a causal connection remains to be resolved. Bear in mind that people are still arguing about the 1930s so we may never know.

Nevertheless we simply MUST consider the failure of QE (and the horrendous economic distortion) after more than a decade compared to the dramatic results of bypassing the bankster process after one year.

Well said MG.

Also time to enforce trickle down with taxes…for the National Debt’s sake, right? Beef up the IRS, especially on the “death tax”…we don’t want these dynasties interfering with the democracy effort do we?

The government has the power to PRINT and TAX…..why be so skimpy with the latter for so damned long? (although I know that is just rhetorical…..as do the 1%.)

I really don’t know why people keep putting forth this strawman. I oppose QE for ANY reason, whether it’s to give to Wall Street or to finance government spending. If the government tis going to spend, the real cost shouldn’t be masked.

NBay,

Here’s a philosophical question, and a personal question for you:

A person is born in the USA. That person works and succeeds. That person obeys all laws and pays taxes during their lifetime. Upon death, that person has a built up an estate of X number of dollars.

Should Uncle Sam take percentage Y of those X dollars, by rule of estate tax, when that person dies? If so, how much should we assign to Y and X? And if one believes that Uncle Sam deserves some of those X dollars, and it is moral for Uncle Sam to take them, shouldn’t we apply the estate tax rule of law that upon death, percentage Y of every person’s estate belongs to Uncle Sam?

NBay, upon your death, have you directed that your estate will go to your heirs and or charities of your choosing, or will you have it go, by choice, to Uncle Sam?

This is a fair question to ask all of those that advocate that “The Rich” have some of their money taken by the IRS when they die. Do those same people have in their wills a provision to give their own estate, in part or in whole, to the IRS when they die?

I’m just asking …

Dan, sure, fair question, should be asked more here, in fact more personal stuff should….let’s one know where someone is coming from. You are good about it, as are others.

I am even beginning to believe strongly in a Constitutional Maximum Net Wealth, enforced yearly by a strong IRS, as maybe just taxing won’t solve the problem easily. Then it doesn’t much matter as much how much “moral hazard” is running around, as it’s all cleaned up every year before there is too much systemic/democratic damage possible. Might save Capitalism. Give extreme tax payers who keep at it (and they will for the prestige and ability to command) statues and vanity plates to park their Benz anywhere.

Ever notice there are no statues of founding father Tom Paine? The most read man per capita EVER? And right AT the most critical time EVER? Everyone should wonder why.

I have been up close and personal to “moral hazard” at the DC lobbyist, Senatorial, Presidential Candidate level, but just as an observer nephew who refused good job offers, and not privy to the real heavy deal making…although stuff not classified was kinda obvious….and no they won’t/didn’t ever give me a “death dime”, just paid travel expenses and such for a while for visits, gatherings, and intros….actually I was the only immediate family one who was a recent (67-68) Viet Vet, so I was my uncle’s “trophy kid”, as these were military-industrial types like Ike warned about. So “Citizens United, etc, are not just an abstraction to me…I’ve seen them play that game. Along with one of my cousins, I sorta “chose exile”….he’s a retired carpenter, dropped out of the Air Force Academy and also didn’t get one “death dime”.

Anyway, enough to be plenty “incentive” (for those that need it), say $10m net at present….maaaybe $15m.

As for any hypocrisy on my part, have maybe $150-200K (most all in very remote off-grid land with a sorta roads (seasonal) and a started container home/barn project with flexible value, especially with recent fires…I may be lower than I think) will go to the more needy part of family and I see nothing wrong with that. As I don’t intend to die in a hospital or care home, or slowly for that matter, I’m fat city at 74. You judge me.

It’s all about amounts to me, what does it take to be happy?

We have an increasing income tax, what’s wrong with the same for estate, just to limit the democracy buying.

I see nothing philosophical about it, unless you want to debate “what is the good life” which is a very old debate. What degree of “democracy” do we want? And with all respect for your biz, I think it’s better to do sports than watch them…or both, to get more inspired.

NBay,

No judgement from me to you.

I look at life as I did as an athlete. Simple fact is that some are more predispositioned, by genetics, to succeed at an event than others. Some are born to sprint and some are born to run marathons for example. But all the genetics gifts in the world can not make up for lack of mental and physical preparation, in addition to genetics, to succeed.

Such as it is with life and business – to a large degree.

To me, the estate tax and progressive income tax rates are the equivalent to telling people who can and do run fast, that since they are faster than others, they must not be allowed to run to their limit and reach their maximum speed; it’s too fast.

Government costs money; I get that. But taking a chunk out of a fast runner’s estate upon death is simply theft IMO. Taxing people at a higher percentage if they run faster, by genetics, hard work and perseverance than those who are running slower, for whatever reasons, is simply punishing success IMO. The rules of the game should be the same for all – a flat tax rate.

On topic: I got the stimmy checks and cashed them. I did not need them, and they did not change my life in any way. On the other hand, they have helped millions of people put food on the table, and that is a good thing. But, in theory, they will have to be paid for somewhere down the line by a future generation, and that is a bad thing.

Like Wolf, it bums me out that much of this stimmy money goes to China.

By the way, my goal as an athlete was to be the fastest human being on planet earth. At age 27, I was the 5th fastest in the USA. Ever since then, I keep getting slower.

Dan,

All sports have RULES and ENFORCEMENT of same. One can’t cheat in the 100 (ok, drugs) and in most other track and field sports where genetics mostly do rule. But start practicing a more complicated sport at a very early age and one will develop the body and muscle memory to succeed, even with “less” genetic “gifts, almost guaranteed.

This is why equal education opportunities are important, and I’m sure you aren’t naive enough to think they are remotely equal at present, due to ridiculous wealth inequality.

AND, most of all, being able to CHANGE THE RULES with well placed HUGE sums of personal agenda money hardly makes for a fair “wealth/power/fame accumulating competition”, in business, in sport, or in our attempt at democracy.

Kinda like open bidding going on while a play is under review, to use a sports analogy.

Good health to ya, our bodies are all we ever had or will have, from my biologist point of view.

We could debate this nature/nurture thing forever, but if you want the last word, have at it.

NBay,

1 kilometer time trial on the velodrome from a standing start; alone and against the clock. It is in my genetics. Maternal grandfather was bronze medalist in the US Nationals 1/4 mile sprints in 1917 and raced six-day events in Madison Square Gardens.

Yes, peace and health to all WOLFSTREET readers and commenters.

Sorry, Dan, but I just couldn’t resist, but where “fastest human(s)” comes in I have you beat….sorta. In skydiving people who exit late on even as small as an 8 way, well, 12+ for sure, even if you hang 4 outside (some DC-3s had grab rails along the fuselage) and the exit is perfect, (nobody “porks” the door) have to spend some time “standing on their head” and hit 200mph, it even slows you down to look, so you just take quick looks and then “throw it all out” (get big as you can) as you are approaching your friends at 80mph.

But no genetics required, just practice, and earning trust. Low SCS number helped when around unknown people. I’m well under 3000.

Nice, and I’ll bet the adrenaline rush is damn intense.

You gotta read my comment again: “The fastest human being on planet earth.”

That title is in fact held by Todd Reichert. In September 2016, he rode a ‘Canadian team’ designed human powered bike named Eta, the Greek symbol used to denote efficiency in engineering, at 89.59 mph!

World class velodrome riders can now ride a standing start kilometer in just under one minute.

The 2005 U of MN Mech E solar race team used my custom made tube coping machine to build their suspension components on their car, but finished second to U of Mich in the North American Solar Challenge from Austin TX to Calgary Alberta. Efficiency in engineering is averaging 46 mph with only the sun powering you for 2,500 miles!

I bet those speeds on an extreme minimum weight bicycle are also an adrenaline rush….which I guess helps you go faster.

Cheers to all extreme sport and solar high tech! 30 years of VB was great, too. I was a dismal failure at 1/8 mile sportsman “c” flat track, but a stripped down DT-1 against Bultacos and Ossas doomed me, even if I ever did have a chance of getting good. Close riding pal (learned dirt together at 15-19) went on to be consistent winner, sponsored by local bike shop, but only local, regional stuff. My apartment is actually on the site of a big unofficial motocross track in 66…I rode where I sit now…weird.

Cheers to all sport!

PS: On that standing start kilo, what’s speed through the traps at the end?…or fastest portion of entire ride? (Guess that would be like top end at a drag race.)

NBay,

Sorry for the delay, but I was in Charlotte NC for the weekend to hangout with my ex-team mate, friend and IndyCar, IMSA & NASCAR race engineer. Oh yeah, and to retrieve my M4 from his garage & drive home to Minneapolis. Only one speeding ticket – in Tennessee – after squealing off a lot of Michelin on all four corners driving on US 25 between I-40 and I-75.

To answer your question on the kilo: On a 250 meter track, 40 mph = a 13.98 second lap time. The problem with the kilo is it’s like running the 400 meters, but with an extra 100 meter sprint to finish. You run out of aerobic gas at around 45 seconds and start to see stars as you finish. The trick is to maintain pace at the end.

I would start by going from 0 to 40 mph in just under 5 seconds, and finish at around 36 mph. Now the worlds best, who are a bit faster than I ever got to, and have much better technology to ride, hit 40 mph in just under 4 seconds, and run the whole race at close to 40 mph.

World record @ sea level = 59.324 seconds.

Cheers & keep riding!

The Fed, the Treasury, and most economists not named Larry Summers have been making this point for years now.

Paulo,

I agree with your sentiments. What we’re seeing here is mostly a negative reaction to the “undeserving” getting a free hand out.

Nonsense. Most of us had the same negative reaction to TARP, the GM bailout, and everything else.

Don’t confuse ordinary fiscal conservatives with the sycophant leaders in the Republican Party, who are just like their Democratic counterparts.

Thanks to Reagan, lobbyists, Citizens United and on and on, today’s Dems are to the right of Eisenhower. I find the GOP party bickering funny as hell, and watched all of Tucker and some Hannity last night and laughed my ass off.

Also agree with Paulo and makruger…..let’s get some of that fair share paid and quit punching down. Give them all a “Trickle down would have worked given more time” vanity plate.

No, what it is is people who understand math not wanting to get destroyed by the inevitable inflation. When you give somebody $3,200 in a year, but the increase in their cost of living is $10,000, what have they gained?

You are going to get Wolf Street watched by the FBI. I’m bad sometimes, but not that bad.

Who is undeserving? The billionaire rentiers and plutocrats or the poor bastards working for them crushed under their thumbs?

This is the kind of issue that, if not properly addressed, leads to socialism, possibly by revolution. Even the dumbest SOB has started to notice that the wealth gap has widened.

It’s enough to make me quit Austrian economics and wonder if I can still find my Che Guevara shirt from 1972. You can’t apply Austrian economics to this cess pool except to explain why it will end badly.

Wolf,

A thought…

These charts are even more insane when it is realized that 7 million fewer people were employed in 2021. (143M vs 150m in 2020)

And…hmmmmm…hold it….how did the hell did personal income from *wages and salaries* go *up* about 2% (from 9.6T to 9.8T) with a 5% *decline* in the number of people employed.

Does anybody believe that 5.2% raises were handed out to everyone on average during the plague year?

Something is off about those wages stats.

It may be an artifact of the collection methodology, but that aggregate salaries data does not make sense in light of the employment data.

Thoughts Wolf?

Yep.

What is happening is those 7 million is most of those 7 million have more income unemployed than employed

Maybe…but the wages and salaries chart is only supposed to reflect wages and salaries…*other* charts reflect gvt pandemic premia.

There have been lots of pay increases, starting with HUGE pay increases to the tune of tens of millions of dollars per person at executive levels, down to increases in state and local minimum wages. Sandwiched in between are all the companies that are struggling to hire people who are now getting government money, including the extra $300 a week in benefits. A company has to offer more than that to get a potential worker to give up the free money and start working again. I hear this a lot from small business owners. In addition, we know that Amazon, Walmart, etc. they all increased their pay scales.

The people that lost their jobs massively were mostly at the very low end of the pay-scale (leisure, travel, hospitality), and to bring them back in, companies are now having to offer more pay.

That’s right. The private sector is competing with the federal government right now for workers. The dumb ass Feds are paying people more to stay at home than the private sector is willing to pay for their labor. This won’t resolve itself overnight

And I don’t see any politicians talking about this. There is no justification for paying people to stay home anymore. NONE. The vaccinations are available to anybody who wants them. The government is destroying this country.

No, the “dumb-ass feds” have accidentally backed into bypassing the plutocrats and the BS trickle down concept by putting the money into the hands of the victims, not the “undeserving”. I know some of the “undeserving”. They used to work for me before I closed my practice on12/31/20. The most qualified employee I had can’t find work and finally filed for unemployment. Meanwhile the local Dairy Queen owner was complaining he can’t find enough workers.

Are the workers the perpetrators here, or is it the plutocratic predators who REALLY produce far less than they create, yet reap huge benefits?

Until recently I shared the negative opinion of giving money to “pay people not to work”. Then I realized that what we had was Audrey from “Little Shop of Horrors” – an insatiable creature whose battle cry was “Feed me!” – and accommodated by the Federal Reserve, feeding the middle class into Audrey’s gaping mouth.

Well it’s time for the Audreys of the world – the Zuckerbergs, Bezos’, Gates’, Musks, Dimons, Blankfeins and all their ilk – to stop shearing the sheep. I hope the labor market steeple shove this up where the sun dont shine.

Why have QE, TARP, Twist and other Fed interventions not helped the 99%? Is the bypass of the Fed via direct payments to regular citizens the cause of the recent spike in prices? Is this the ultimate repudiation of plutocratic looting disguised as trickle down economics?

Yeah, I know this won’t fly well here but when your narrative fails you need to step back and figure out why. Rinse out your heads and take another look. Stop blaming the victims. If they can do better not working how can you criticize them for not working?

That’s basically what I did when I retired from the hideous creature of American health care. Some of you may recall my posts here 6 years ago about heath care. If you search this site you can see the things I wrote and compare it with what’s finally being done.

Getting back on track, this is the monster the financial system has created. The 99% have neither the psychopatic personal gain initiative nor the sophisticated knowledge to screw things up this badly.

The Minneapolis Star Tribune recently reported that United Health former CEO David Wichmann earned $42.1M last year. And Target’s CEO, Brian Cornell brought home $77.5M in 2020.

As both companies’ stocks are in my portfolio, I say thank you.

I was in the Roseville, MN Target last week, which is the original one that first opened 59 years ago tomorrow, and the place was as busy as I can remember. Ka-ching.

’cause it’s the sweetness of the ready, makes the bell ring on the till -Wreckless Eric

Not sure if you’re rejoicing about the stellar results, or that the CEO got a bigger bonus than all the Japanese CEOs that actually make stuff for the stores. :)

Stellar results; at least on paper. Cash ain’t in the account until I sell them.

A friend and client/customer from tickets, who is long retired, was general counsel at United Health. She is doing quite nicely with the stock at almost $400. However, fourteen years ago, there were some shenanigans with backdating options for CEO Bill McGuire and his successor Stephen Hemsley. Hemsley was former CFO of Arthur Anderson. My friend had to navigate a way forward for the company when the word got out that a few hundred million dollars were in question.

The company and these men were lucky to have her watching their backsides! And it’s a small world: her husband is friends with and was a Yale classmate of the most recent Minnesota governor and US Senator, Mark Dayton. The Dayton family founded Target. Mark was a goalie for the Yale hockey team. A true Minnesotan, eh.

You are the stock owner. If CEO isn’t earning his money, sell the stock.

Old school,

Target’s CEO got most of his 2020 income from long-term equity awards that were granted in previous years but either vested or were exercised by him in fiscal 2020. He made $21.6M in the prior fiscal year.

Target had big success during the Covid times because of what Mr. Cornell had put in place for the company before Covid was on the radar. Cornell was the person guiding the ship for this, and his strategy put them in a great position to offer contactless ways to shop. Their digital sales grew by $10B.

I’d say the CEO has earned his money, and when I walk into a store that’s full of shoppers spending their money, it’s hard to decide to sell out – even though there’s profits to take if I sell now.

Sorry, but no public CEO has “earned” $50 million a year in salary. He’s put none of his own capital at risk, and has no consequences for screwing up other than losing his job.

“Sorry, but no public CEO has “earned” $50 million a year in salary.”

Not to mention the fact that these guys’ version of work is teeing it up at the local country club then having a few martinis afterwards (or during), while maybe breathing a couple of sentences about “business.”

Wolf,

I don’t know…hundreds of companies have slashed dividends…I don’t know if handing out 5% pay hikes while this is going on is likely.

As for “having to” hike pay…when 7 million more are newly unemployed over the last yr?

Pandemic premia may have made hiring somewhat harder…but everyone can see the premia reaching an end (the outright grants are maybe good for a month or 6 weeks expenses…so those are likely already expended. The unemployment premia are *mostly* – not for everyone – only a premia to standard unemployment pay…not a premia to working wages).

So I don’t think huge numbers of employers feel the need to hike pay to,

1) match C19 unemployment pay *below* their std wages or

2) match C19 unemployment pay *above* their std pay…since C19 premia are not forever and in fact are in sight of their likely decline/end, during

3) a time period when said companies have gutted payouts to shareholders.

I will say that I may have neglected to appreciate the monthly nature of the “wages and salaries” chart…earlier months’ results make a lot more sense.

The funny thing is everyone knows a cliff is coming when government largesse has to come to an end, but they also know that this will coincide with the time when the economy comes crashing down… that the end of largesse might be the trigger for this decline. So I applaud the J team to try to head this off with their version of UBI. The problem of course is that this effort will fundamentally create its own problems.

For the rest of us peons, it’s a matter of trying to earn as much as possible while we still can and praying that we can get off the train before it goes over the cliff.

“their version of UBI.”

It is hard to be precise, but it does look like some factions in DC are using the pandemic as some sort of finite-life, dry-run UBI-lite.

Perhaps the true test will be once vacc rates are high (70%? 80%?) and DC tries to extend the unemployment premia again.

When are the current unemployment premia scheduled to end? Sept 30?

The current pandemic induced unemployment will end somewhere around mid October 2024. We can always throw out more variant in the interim to keep the things under control. As for the people, they don’t own things like AC-130, Active Denial, and flash bangs.

The solution to this problem is that people need to stop trying to exchange thier digitally created stimmies for real goods. Instead they should only be able to use these faux earnings to buy faux goods like NFT’s.

More helicopter money on the way.

People moving out of rentals to get a chance at the homeownership jackpot.

Car rental shortages. Disneyland sold out tickets.

Surging stock market earnings.

Yeah, it’s amazing how well large public companies can do when the government forcibly closes their competitors, drops trillions in helicopter money to the customer base, and makes free money available on the capital markets.

But it can’t last without permanent stimulus. That’s the issue for people claiming the markets are “forward looking.”

The chart on financial assets to gdp has a similar leg straight up as these graphs. Financial assets blowing up same as the spending. It’s an illusion of wealth. With mom and pop 70% in stocks due to Zirp, Fed has facilitated a monster.

I am usually conservative with my purchases, but this free money induced inflation expectations are causing me to re-evaluate whether I should buy now what I planned to buy in the future.

China can only produce and ship so much.

Please pull demand forward and buy right now so we can have a deeper recession in the future.

We already did that. The most recent instance was called the GFC. This is GFC part 2 and it’s going to be far uglier than #1.

But the future recession won’t just be because we would gladly pay Tuesday for a hamburger today. It will also be the result of the destruction of entry level jobs that provide young people with new skills, a work history to show new employers, and the chance to build a credit history.

Very few things pump up an economy like the formation of new households. They fuel purchases of homes, furniture, carpet, baby products, paint, dishes, appliances, minivans, school supplies, clothes, and so on.

Where are those entry level workers right now? Maybe sitting at home being “paid not to work”. Was that their doing? Did they conspire in their millions to force a system this stupid, based on the cumulative collective wisdom of 20 year olds? Or is this the result of colossally stupid public policy and regulatory capture?

Michael – some of those prospective entry level workers are studying hard online (MIT, Princeton, UCLA, &c). Or Youtube. And for free. Others are watching streaming movies or free broadcast TV (60/70s sitcoms, WW Smackdown, &c) or video gaming. I hope for the former and am saddened by the latter.

Hey Lisa. Where did that “&c” thingy come from? I get it’s use, but was wondering if it was something out of the software culture.

Maybe like “and around there” or an actual code usage? Just curious, thanks.

@NBay – it’s an old usage of “&” as a ligature for “et” as in “et cetera” shortened to “etc” further shortened to “&c”. When all your code has to fit into 1k or even 512 bytes every byte helps. Also, one character can make or break a page jump. I started using it again to keep my aging mind flexible. ;-)

Thanks Lisa. Not a code symbol, but to shorten the “explanation” (for lack of the correct term) that’s often there after the functional code to help the next guy.

Another off topic tidbit learned here.

Did not credit card debt spike just in advance of the issuance of the stimmy checks, indicating the soon-to-be recipients mentality of, let’s say, the Polar Opposite of Delayed Gratification? It’s comedy.

A Global Pandemic that has shut down huge segments of the economies around the planet and we have a record stock market valuation, record RE sales prices, vertical spike in personal income, etc etc.? And etc. etc. for good measure.

Somewhere, someone is shouting “All Is Well”. Meanwhile I am watching the historic newsreel coverage of the Hindenburg “landing”.

I took all my free gummit money and bought tulips, lots and lots of tulips. What could possibly go wrong?

I was looking to do some upgrades on my desktop and it appears that computer components are 20-25% higher than last year. Can’t find a decent graphics card at any price (well nothing I’m willing to pay!).

It’s funny how I can see this right before my eyes and the Fed refuses to see it.

Yes I know they assume I’m getting better stuff to justify the price. But whether MS Word opens in 2 seconds with new ram vs 2.5 seconds with my older ram is a sick joke.

“Can’t find a decent graphics card at any price (well nothing I’m willing to pay!)”

They’re all being used to solve pointless algorithms for cryptocurrency. You better start grabbing hard drives while you can because those are next with some proof of space coins gaining hype. HD prices are already up 40% in SE Asia.

This is all totally sensible in a world on the precipice of climate destruction of course

Good point.

How many environmentalists are involved in Cryptos?

The energy use is apparently off the charts…..

More hypocrisy…from the Left

Oh man, you gotta practice more nuance if you just want to get your own political digs in…sheesh.

Bummer, because my laptop is really old and I am worried I’ll need a new one in the next year or so. It’s starting to have issues. I think it is 10 years old this year. It’s the best one I’ve ever owned.

Laptop quality has gone down in the last several years. The old IBM Thinkpads were very good quality. They became less so when Lenovo took over, but still above HP. If you don’t need an ultra-portable for travel consider a gaming laptop as they are built to withstand multi-hour gaming sessions at 100% load but have less battery life. Look for the new AMD Ryzen 7nm processors, as they consume less power. Problem is that you’re over-paying for a graphics card you might not need.

A few companies make rugged laptops to Mil Spec but they are more expensive and have weaker processors. If you want something that will last ten years, then you probably have to go with a desktop.

Whatever you buy, look for something where the ram is not soldered in and you can open the case and change the hard drive or battery. Don’t assume you’ll be able to fix anything on the laptop yourself unless you can find it in the manual. You must be able to download the full manual online before you buy the machine. Lenovo is pretty good at this while Acer is terrible. Many manufacturers make it difficult to open the cases today.

IFixit.

They have parts and how to vids.

I just built my first computer this year. A little bit of a learning curve, but if you’re patient and have time you can buy a lot of used parts. Prices are up but I spent less than last time and got a much much better computer. For a laptop, IDK, you might need a small soldering iron for some wires. There’s a lot of information on You Tube, and the kids on the Reddit forums are very helpful.

Mac is a waste of money for what you get. AMD takes time because the Ryzen processors are in short supply- but it’s do-able. Intel is cheaper now than before. I built a desktop around a Ryzen 7 5800x which is plenty for photography and video. Unless your doing that or extreme data processing then that would be way overkill. You could probably find a 7 5600 used.

RAM, processors, fans, cases are good bets used.

If it were me and I needed a laptop, at this point, having built a computer from the ground up, I’d just buy a broken laptop and fix it. Plus change out the power supply. It’s not rocket science, and learning how the parts work is interesting.

Also, if you have to buy something new and everyone is backordered, I went with B&H Photo. They may not be the very fastest promised ordering times, but they won’t over book and then cancel your order last minute either. They seem to be on the “A” list for manufacturer’s shipments as well.

Crypto mining has long since moved from graphics cards to ASICs.

The computer CPU, peripheral (including graphics cards) and other shortages are entirely due to a combination of WFH and stimulus checks.

WFH driving computer sales – because company computers in empty offices are sitting idle while people bought new laptops to WFH.

Stimulus checks and “school from home” gave kids the means to buy the gaming setups they always dreamed of. Gaming is having a banner year.

Graphics cards don’t mine BTC. Ever seen a big mining operation? Lots of hardware, very few screens. But I get your point.

As for climate change, I’m not going to delve into the issue itself other than to point out that the green movement supports EVs like Tesla while Tesla invests in BTC which is HIDEOUSLY energy-consuming.

Is Melon Tusk that clueless? I don’t think so. I think he just makes money where he can. He’s like a fire extinguisher manufacturer who moonlights as an arsonist.

However, I don’t think the vast majority of climate change warriors who buy BTC understand they are undermining their own goal.

I saw a documentary about a BTC factory in China a long time ago. It was in a warehouse next to a remote hydro dam. The “entrepreneur” (or their rep) just kept buying these (then) about $1K mining computers, and they were in rows of racks. Techs lived there, his “leadman” tech ran it. One wall of the warehouse was almost covered in 3 ft fans. Everything seemed quasi legal/hush-hush.

And yeah, Musk doesn’t care where or how money and fame come from as long as he gets it…like most of his kind.

Suppliers get a few graphic cards at a time and they go immediately. You have to keep checking the websites until one you want pops up. My son had one on back order and he was able to find it faster by constantly checking sites. It was not cheap.

What is happening with consumer credit? Doesn’t look like anyone paid down student loan debt. Probably added to it thanks to the clarion call for forgiveness. Did some folks use the Stimi as a down payment on the F150 while they are flush with rent forbearance cash?

Got me thinking. I got all three stimulus checks. They basically offset my taxes for 2020. Otherwise I would have pulled money out of savings to pay taxes. It’s getting a little silly.