16% of the 4 million new vehicles sold in the US in Q1 were assembled in Mexico.

By Don Quijones, Spain, UK, & Mexico, editor at WOLF STREET.

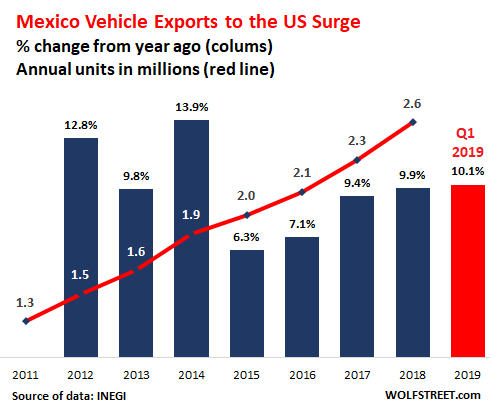

The total number of new vehicles exported from Mexico to the US in the first quarter of 2019 surged 10.1% to 658,243 vehicles, according to figures compiled by the vehicle manufacturers association AIMA and released by Mexico’s National Institute of Statistics and Geography (INEGI). It’s all about “trucks”: 63% of these vehicles were “trucks” — pickups, SUVs, crossovers, and minivans. This Q1 surge in exports to the US comes despite the 3.2% decline in auto sales in the US.

In the last eight years, Mexico’s auto exports to the US have doubled, from 1.3 million in 2011 to 2.6 million in 2018, at annual growth rates between 6.3% and 13.9%. If Q1 is a sign of what’s to come for the rest of 2019, this trend is set to continue:

The latest figures cement Mexico’s position as number one exporter of automobiles to the US, ahead of Canada in second place. According to AIMA, 16% of the 4 million cars and other light vehicles registered in the U.S. in the first quarter of 2019 were assembled in Mexico. Roughly four out of five vehicles that Mexico exports are exported to the US. The remainder are exported to countries around the world, including Canada, Europe, China, other parts of Latin America.

There are two main reasons why Mexican vehicle exports to the US have doubled in the last eight years:

More global car manufacturers have set up shop in Mexico. In 2005 there were just six large vehicle manufacturers (Chrysler, Ford, GM, Honda, Nissan and Volkswagen) producing and exporting cars from Mexico. Today, the total number is 11, after Fiat, Toyota, Audi, Kia, and Mazda joined the fold.

Some of the biggest manufacturers have significantly expanded their operations in Mexico, where salaries for autoworkers are a mere fraction of what they are in the US. In 2011, GM exported 318,149 vehicles from Mexico to the US. By 2018, that had surged by 110% to 666,765, accounting for 23% of GM’s total US sales that year. In the first quarter, GM’s exports from Mexico to the US surged by 28% year-over-year to 181,594 vehicles. At this pace, GM is on track to set another annual record this year.

The other big movers over the last three months were:

- Honda: total exports from Mexico to the US in Q1 jumped by 33% year-over-year to 46,000 units.

- Volkswagen: exports from Mexico to the US in Q1 soared by 39% to 54,577.

- But… Fiat Chrysler: exports from Mexico to the US in Q1 plunged 20.5% year-over-year, to 93,000 units. Like its domestic rival GM, Fiat Chrysler massively expanded its Mexico operation over the last eight years, increasing its total annual exports to the US by over 200%, to 504,793 units in 2018. But Q1 wasn’t so rosy.

In terms of exports to the rest of the world, there are some additional observations:

- Auto exports to Argentina collapsed by almost 80% in Q1 year-over-year, from 9,099 units in Q1 2018 to 1,919 units in Q1-2019, probably a result of the current economic crisis gripping the country.

- Auto exports to Europe in Q1 fell 26% year-over-year, to 50,450 units in Q1 2019.

But to what extent can Mexico’s auto industry continue to rely on rising overseas demand for the vehicles it assembles given the ongoing slowdown in auto sales in its biggest market, the US, as well as the 17.2% rise in Mexican salaries agreed upon in the US-Mexico-Canada Agreement, which will raise input costs in Mexico’s car assembly plants? The agreement should strengthen, at long last, labor standards and rights in Mexico and reduce systematic wage repression in Mexico.

This system of wage repression is now being targeted by the new trade deal. It’s a system where corrupt local officials, corrupt union bosses, and automakers work out long-term contracts that lock in low wages as a condition for investment. This quashes the labor market — but benefits the automakers.

How well the central government in Mexico can enforce the new deal locally, when it’s finally all said and done, is a question many in the US are asking. The deal is also expected to create 76,000 new automotive sector jobs in North America through its new regional content rules, but it’s not yet clear where those jobs will end up materializing, if they do materialize at all. By Don Quijones.

Many Americans are priced out of the new-car market. Read… Used-Car Market Profits from Carmageddon

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Doesn’t GM really “import” cars from Mexico?

Absolutely not. GM exports cars from Mexico.

GM only pretends to be a US corporation, when convenient. It’s really one of those Truly Benevolent Corporate Citizens of the World you keep hearing about. Auto assembly (from parts made by highly-leveraged non-union suppliers) is just a sideline. For decades it’s primary business line has been finance, followed by labor arbitrage.

You might like to track them. After all, they’re tracking you.

aren’t globalized wages nice

Wait. What? I thought we threw out Nafta and got the best new trade deal in the world. Are you sure those numbers aren’t backwards? I was sure we’d be net exporting to Mexico by now… /s

=>Are you sure those numbers aren’t backwards?

Of course they are. It’s fake news. The Greatest Dealmaker in History threw out Nafta and got you the best new trade deal in the world.

Mexico’s biggest export to the US is still Hondurans. Gives US patriots something to practice on.

You can tell the trade numbers must be bogus because everybody knows those overpaid Mexican autoworkers getting three bucks an hour are just loading up on imported American luxuries.

No, really. Would I lie to you about that?

I see TDS here – now take your meds and settle down

Trump’s new and improved nafta isn’t yet ratified in Congress, old nafta is alive and well. Trump isn’t much of a dealmaker.

If people want to buy American, they should really be buying a Tesla.

You spelled Toyota wrong…

The YMCA – uh – USMCA isn’t ratified yet.

So now they’re how much cheaper?

Bulls Eye!!!!!

Don,

Thanks, much appreciated.

Mexican imports gaining market share in a declining U.S. auto market. Not too surprising.

If wage repression would cease (it won’t), border security would likely be a nuisance and not a crisis. Corruption is a way of life south of the border and north of the border. Until that changes, nothing changes.

How come border security became a crisis last November when the Republicans lost the House?

If it was really a crisis, like opiod abuse or the Middle East wouldn’t Trump put in his son in law Jared Kushner in charge?

Not so. Once workers in the US have been crushed like they’ve been in Central America, they’ll stop coming. Some of those in the US might even go home.

US corporations have been working on their solution to the immigration problem for years. All they needed was to get the right people into government.

Some people just have no appreciation for what corporatists try to do for them.

=>So now they’re how much cheaper?

Your credit’s good. Price is no problem.

Mexico’s motto, build cars, not the wall.

Mexico has offered to pay for psychiatric care for poor no-wall 45, according to exPrez Vicente Fox.

Funny how Argentina is being pretty much ignored in the media. Not surprised exports to have dropped given the peso has halved in value over a year. Cds are spiking as well. Maybe this is all now just considered normal for the country.

There is no “Mexican auto industry.”

There is auto-related industrial activity in Mexico, but it is almost entirely foreign-owned, with profits exported with the cars.

thanks for the article. yes, imports from mexico seem to be surging in a number of areas. re: the link to ‘salaries’ article in Spanish…muy helpfuloso! I wonder if the usmca salary number is for all mfg or just auto workers. 17.2% raise on a 1.90-3.60 range otta keep them down on the far…well, were the farm used to be anyways.