What happens when the marginal buyer is the money launderer whose goal isn’t to buy a house, but to clean the money — and the more money the better?

By Stephen Punwasi, Better Dwelling:

Money laundering in Canadian real estate is a widely accepted fact of life these days, but the impact isn’t. Government and academics are still debating how much money is needed to distort a market. The truth is, not a whole lot is required to distort any asset market. This is a problem the stock market has been dealing with since the 1920s, and the reason it’s so highly regulated.

The key to understanding how laundering impacts prices, is understanding the marginal buyer. If you understand how prices are set, it doesn’t take long to see it’s not the amount of money that’s the issue. Price distortions can be the result of capital velocity, and the intention of the marginal buyer.

Squad Goal: Money Laundering

First, let’s clarify laundering. Money laundering is the process of making illegally-gained proceeds appear legit. Those proceeds can be from monstrous activity, like fentanyl trafficking. Sometimes it’s less nefarious, like earned income evading a country’s arbitrary capital controls. All of it is illegal however, and is people are trying to hide it. There’s a few ways to do it – but the all follow the same basic process.

Money laundering is usually done in three phases – placement, layering, and integration. Placement is the introduction of cash into a legitimate system. Layering is conducting multiple transactions through multiple accounts, to obfuscate a trail. Integration is working the money back into the legit system. Properly laundered money should be extremely difficult to tell from legitimate business.

One last time, the goal is clean money. Parking cash long term in assets is not typical – these aren’t investors. That said, the layering process usually involves moving cash around very quickly. Fast moving cash often leaves a wake, especially if it’s moving through real estate. To understand why, you need to understand a few concepts – marginal buyers, money laundering, and sales comps.

Marginal Buyers Be Cray, Cray

The marginal buyer is an important part of any asset market, especially fast moving ones. This is the person(s) or company that’s willing to pay the most for an asset. They are a small percent of the potential buyer pool, but the ones that actually buy the assets. The competition between marginal buyers is key to asset price escalation. Every market has one on the way up, but skill and motive determine how healthy the outcome is.

If the marginal buyer is a rational investor, they’re thinking about liquidity. They’re restrained in their bidding price, because they need to be able to make a profit. Rational consideration helps to keep a market sane. If the buyer isn’t bound by rationale or logic, things start to get sloppy.

A cannabis company making $20 million a year in revenue fetching close to the valuation of GM? An investment condo that produces negative cash flow? The buyers of these things aren’t making rational decisions. It doesn’t mean they can’t make money, but they are playing a game of greater fool. You’re hoping that the next buyer is more irrational than you – whether you know that’s the plan or not. When you have an influx of irrational money, it’s hard to figure out what’s real.

The Objective of Money Laundering

When you buy an asset, whether a home or an oz of pink kush, you try to get the best value for your time and money. You want a deal. The seller is trying to extract the maximum price they can get from you, without driving you away. They don’t want you to get a great deal. The balance of interests go back and forth, and is a fundamental part of a functioning market. Opposing interests help balance things, plus or minus a dash of exuberance.

If you are money laundering, that’s not the case. The objective is to move as much cash, as fast as possible. This often involves large assets, and the bigger the price – the better. Especially if there’s a recurring payment component. Both the seller and the money laundering buyer want the highest acceptable price.

Sellers often feel somewhere between a genius and a lottery winner when they find this buyer. Competition between interests align, and there’s minimal friction preventing prices from going higher. The seller assumes their master negotiation skills prevailed. The money laundering buyer gets to move more money than they were asking for. The buyer seems “irrational,” but that’s just the market. Real estate agents without a clue, begin to rationalize and normalize this behavior. There’s no more land is a popular explanation.

Understanding How Real Estate Prices Are Born

We all know how prices are born. When a homeowner finds a selling agent they love, they go into a quiet backroom, make a few strokes, and boom! The multiple listing service spits out the comparables, a.k.a. your comps. Comps are a fancy way of saying what has sold around you, like the neighbor’s house. These numbers are then used to establish a baseline price, which a selling agent tries to push higher.

No comps in your neighborhood? No problem, we’ll use the neighborhood next door. Eventually, the arbitrary line disappears that separates the pricing in neighborhoods. This is when you hear dumb things, like “Shaughnessy Heights adjacent.” This spreads like a virus, from one neighborhood to the next.

Vancouver Real Estate Prices Overheating

A time-lapse of real estate sales in the City of Vancouver. Herd behavior can be observed in clusters, as people pay over or under the list price – based on whether other people are doing it.

Poisoning The Comp System

Smarter real estate agents can already spot the problem here. Let’s look at an example, say you’re shopping for a home in Anyplace, BC. You’re watching the homes in the neighborhood climb at an average of 5% from last year. You find a place you’re ready to put on offer on, do some research, and come up with an offer. All of a sudden, a money launderer shows up, and offers the owner 10% over ask for a “quick close.” You’re not too worried, your agent told you the place a few doors down is going to be on the market next week.

Unfortunately, the new place now uses the home owned by the money launder as a comp. Now the ask is 10% more than you were expecting, because the marginal buyer set the price down the street. Someone else bites, and buys it before it “goes too high.” Now the money launderer’s buy was just validated in the system. But wait – there’s more.

Remember, the goal of laundering isn’t to buy a house, it’s to clean the money. They list the home again, let’s say another 10 points higher than bought. Bonus points if they can turn it into a wash trade, and sell it to another associated launderer. A regular family shopping down the street uses your washing machine as a comp for their buy. Behavior typically only seen in the frothiest of asset bubbles, can surface quickly. Exuberant buyers, both illicit and legit, compete and drive prices higher.

Driving Exuberance In Canadian Real Estate

An index of exuberance Canadian real estate buyers are demonstrating, in relation to pricing fundamentals. Once above the critical threshold is breached, buyers are no longer using fundamentals. Instead they resort to market momentum, and the possibility of reward is justification enough.

Now in this example, just a few sales would have helped to push the comps up to 21% higher. There would also be hundreds of sales validating the price movements in between. Each time the launder injects capital, they inject a new marginal buyer. The whole time, Boomers are stoking the coals on this fire, explaining this is “earned equity.” If you want your own, you need to work as hard as they did. Standing by as each irrational player enters the market is exhausting work. Boomers also had to save uphill for a down payment… both ways, in the snow or something.

“It Wasn’t That Much Money”

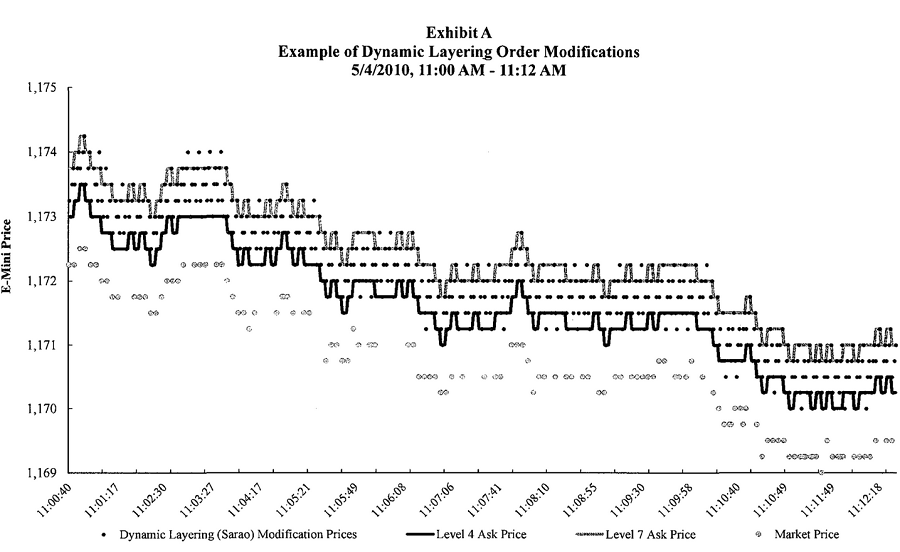

Still think a small amount of money can’t influence prices? Clearly you’re not familiar with another asset class – stocks. CNBC host Jim Cramer once ranted that his fund could manipulate stock prices with as little as $5 million. Nav Singh Sarao, spoofing just $170 million worth of orders, set off events that led to the DJIA losing $1 trillion in just a few minutes. Note: the orders were spoofed – meaning he only had a fraction of the money. More formally, academics determined traders can use less than $500,000 to raise a stock price 1%, by targeting the bottom half of the liquidity spectrum.

Smack That Ask: It’s Not What You Pay, It’s What You Think People Will Pay

An example of Dynamic Layering, the spoofing technique used by Nav Singh Sarao. The lower dots are bids placed, that only sometimes execute as a trade. Free markets can’t effectively determine if participants are executing trades in good faith – required for natural price balance.

Source: US Department of Justice.

Each of the situations are different, but have two common things – influence and intent. While not that much money, each example precipitated events that had a big impact. The actual trades weren’t so important, so much as influencing volatility. Setting the marginal buyer definitely counts as an event that influences market direction.

Each one of these events are also easily mistaken for an accident, which conceals intent. Fat finger, trade algo gone wild, and/or eager market buyer. Each one of these situations could have been caused by regular, everyday occurrences. Now it’s unlikely that money laundering is focusing on systematic trading of homes to inflate prices. It could however, be one of the times an unintentional destabilization of a market is just a side effect.

Velocity may also be playing a large role here. When cash goes into one house, it’s eventually sold. That cash likely gets pumped through multiple transactions for the purposes of layering. That means more houses are being bought with the money, and profits. More sophisticated operations also have combined layering with an integration platform. Bonus points if the integration platform is registered with FINTRAC. That way the integration platform is also in charge of submitting suspicious transaction reports.

Combine this with an opaque comp system with closed data, and it’s really hard to catch. The chances of buyers being able to do their own due diligence on a property buy is virtually nil. Closed systems also mean no wide scale analysis of the transaction. There’s very little way for anyone outside of regulators to actually be able to determine it.

Where’s The Money At?

While Canadian cities are debating whether dirty money impacts prices, the rest of the world made up its mind. Transparency International UK found a significant correlation between shell companies, and elevated prices. London for instance, has 87,000 homes owned by anonymous companies. According to Christoph Trautvetter of Netzwerk Steuergerechtigkeit, the estimated impact from dirty money in London is 20% of the price increases.

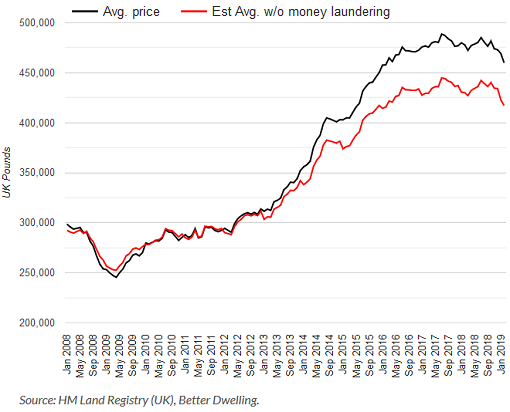

London, UK Average Home Sale Price

The average sale price of a London, UK home. The estimate removes the 20% of annual gains attributed to the influence of money laundering. The number also assumes no laundering was done prior to 2008. LOL.

Source: HM Land Registry (UK), Better Dwelling.

There’s a similar setup brewing in Canada, politicians are just a little less willing to look into it. Transparency International Canada found 50,000+ Greater Toronto homes bought by companies without known beneficial ownership. Even worse, $20 billion of the funds used were not subject to any anti-money laundering checks. In Vancouver, local politicians are still claiming money laundering is over exaggerated. Meanwhile, in European Parliament, Vancouver is literally being used as an example of opaque ownership distorting home prices.

Money Laundering Through Commodities Is Old News, The Velocity Is New

Laundering money through real estate is far from new, but the velocity and volume is. Traditionally, launderers would buy, hold, and sometimes even rent the places out. The lack of scrutiny in real estate transactions, has always made it a prime landing spot. Every city has a few well known families connected to local mobs, that just happen to be in real estate. The impact to home prices are minimal when the volume is low and slow.

Treating real estate like a global commodity market makes it fast and high volume. The real estate industry in Canada encourages foreign capital. In fact, Canadian banks openly helped clients with “placement,” obfuscating deposit trails. The faster you can place, the faster prices rise, and the more they welcome foreign capital – the easier the wash.

This has always been an issue stock markets have had to deal with. Equity is issued, artificial volume inflates prices, and launderers liquidate to unsuspecting victims. Equity markets have increased ownership transparency on larger exchanges, making it more difficult. However, it’s still common, especially on European and Asian stock exchanges. Treating real estate like a stock market encourages the same type of laundering, without the transparency.

Fun fact: The now defunct Vancouver Stock Exchange was popular with money launderers. It was so popular, Forbes called Vancouver the “Scam Capital of The World” in 1989. The Coordinated Law Enforcement Unit in British Columbia warned the government of organized crime on the exchange as early as 1974. Those warnings were largely ignored. Are you also sensing a pattern here?

Money laundering is not the sole reason for much higher prices, but it fans the flames. Low interest rates and easy lending allow regular families to provide liquidity. If a launderer can’t get clean cash, they don’t transact. There’s no appeal without house horny buyers overbidding comps, or rapidly flipping.

Money laundering investors however, can influence the direction of the market. A real estate market is only as good as its last comp, set by the marginal buyer. If that marginal buyer was laundering money, they have motivation to overpay. Regular households buying into this, provide comp validation, and liquidity. Most households never consider where their liquidity is going to come from. By Stephen Punwasi, Better Dwelling.

Looking to launder some cash? Read… Billions in Toronto Real Estate Bought Anonymously, with Funds of Unknown Origin

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Seems like this type of “Hot Cash” can flow out a lot more quickly than normal real estate investment when the situation changes. Easy come Easy Go.

One out of ten houses sets the price for the other nine. Do stocks work the same way?

Yes. It is always the most recent transaction that sets the new comp – which could be 1 in 10, or in the case of stocks, perhaps 1 in 100,000.

Nobody cares where all the stocks traded before. The price you see on the ticker is the most recent transaction, which is but a teensy tiny percentage of all the trades that have ever been transacted on that security.

Good tutorial. Goes to show that price takers (“mums and dads”) are screwed from the get go (in any market).

Time after time after time after time you see behavior that politicians & regulators KNOW are abusive or extremely risky for Joe & Jane Six-pac (and taxpayers), yet government fails to take action.

Test case: what % of global derivatives do you think are properly traded on a competently-regulated exchange?

hint: size of derivitaves market estimated at $1.2 quadrillion (that’s 1,200 trillion, or roughly 15 time the annual global GDP).

Deriviti don’t matter just like deficits don’t matter I remember when Dick Cheney said this when asked about deficits in America ,his response they don’t matter he was right had I invested in stocks and bonds and housing if be rich as hell I should have taken his advice

I ain’t sung yet.

But by now perhaps kitted out with your viking helmet and waiting in the wings for your signal to enter stage, I guess, FL?

What’s the difference between a mobster laundering $10M in real estate and a reputable company like Apple buying $1B worth of its shares using money that belongs to the shareholders, with the only intention to inflate EPS artificially?

What’s the difference between a reputable company like Disney giving $65M to CEO Bob Iger and a mafia thug shaking down a grocer who can’t pay his debt?

Please spare me a lecture on legitimacy or transparency.

Stock buybacks are legal. Mobster laundering is not.

Legal plunder…

The question should be what’s the difference between mobster laundering $10M in real estate vs politicians taking $10M in bribes through backdoor campaign donations.

The 2nd is worse, because it buys influence affecting society.

Old Dog beat me to it.

I was going to use the example of Joe Kennedy. Booze smuggler; illegal. Rinse and wash over time. Buy toney properties and start hob knobing. Next thing you know his kid is President and another one runs the Justice Dept. Hilarious. Or, use laundered money to finance casinos and hotels which are rented to other World bandits. Sound familiar?

My question. Were the derivitive RE tranches any less criminal than illegal booze or drugs? They helped destroy people and took their homes. I think not. How about stock holders of companies making corn syrup junk food? Cigarettes?

The legality objection is a pretty fine line. Sometimes it’s all laundering.

We have some a$$holes buying up property in the Valley. They have money from Victoria and a ‘supposed’ inheritance. Are they any less destructive to our RE market than some bandit from Hong Kong? Of course not. Plus, I have no idea where their money actually came from? I do know it wasn’t from legitimate hard work and savings like ours and everone else I call friend.

My neighbours are from France. Vichy France. The entire family has wealth. Connect the dots………..

Paulo

And on the Vancouver BoobTube News, the happy, smug chatter is Vancouver Real Estate, never mentioning the Fentanyl killing users is financing drug dealers killing each other, ultimately is mixed in with all the Chinese money, pricing homes out of reach for Canadian citizens.

And never forget the Hells Angels, who own many businesses, including close to you on Vancouver Island. Businesses which do not need to make money, kill off the competition, because washing the money through, is the highest priority.

Canada is corrupt to the core. But Canadian Media, with their $600 million pay-off from the government, will keep feeding pablum to the audience.

Wow, that is an impressive comment. I’ve been saying this for years. Read the comments section Wolf previous article,

https://wolfstreet.com/2019/03/14/the-most-splendid-housing-bubbles-in-canada-deflate/

And truly marvel at the length to which Canadians go to defend their housing bubble. But in all fairness, this is happening everywhere.

You can see what Apple is doing and avoid the company if you wish. That’s the benefit of transparency.

The mobster is trying to make money whereas Apple is purposely trying to lose money. Apple never heard the line about… a fool and their money are soon parted. Soon being 2021 at the very latest.

Money laundering is a bogus “crime”. Wanna see REAL money laundering? Search for ‘pallet benjamins iraq’. End the WarOnSomeDrugs, end “capital controls” etc. and these market distortions go away. But politicians cling to their illusion of control over these markets. People with so-called ‘dirty money’ are not to blame, they are simply reacting rationally to an irrational situation they did not create.

“End…..” – maybe, but then you are into new definitions of sovereignty, law, property, national economy and so on . An example, are you realistically going to tell China to stop any form of capital control ? What do you do if it won’t, impose your own by not trading with it ? Even if you could end its capital controls, do you know what an undistorted Vancouver market would then look like ? As for money laundering, are you sure you aren’t talking of the use of monetary debasement ? Both of your examples use the same term of money. You see how complex the world has become, in large part because it is more open due to improvement in communication, but also because of inept or corrupted political control, a lot of it being legacy that no one knows how to change, or when they do they do so in a self serving manner. People are people, you cannot blame them for that, rationality is subjective though because we are all in slightly different circumstance, and where those circumstances compete with each other, say watching your neighboorhood getting sold out by what was once your own community, you are not going to think that the profit others choose is quite as rational as they do. Such is life.

Seems to me that when political winds change, or governments become hard up for money it will become common for real estate with even a hint of the taint of money laundering to be confiscated and sold for the good of the public treasury. If you think this is a stretch, look at what already happens to assets of those accused of being in the drug trade, or the recent proposals to nationalize the apartments purchased by Blackstone etc. in Berlin.

They arrested the CFO of Huawei in CA, but to my knowledge have not seized her home or assets? What do you do with it? The medicaid system takes payment in kind, they designate your assets for future payment of medical bills. And yet the system is maligned to the point where Congress denied medicaid funds to the states. They get their pound of flesh, but politicians want their money, clean, crisp and freshly washed.

It is hardly “a little money” in many cities:

“Owing to the shadowy ownership structures that the Land Titles Office hasn’t been able to penetrate—a problem Horgan’s government vows to fix—all that’s known for certain about foreign ownership within Vancouver city limits is that at least 7.6 per cent of all residential properties are now owned directly by non-residents, and roughly one in five condominiums purchased since 2015 are owned by non-residents. Within Metro Vancouver, non-resident ownership accounts for about $45 billion dollars worth of residential property.”

https://www.bloomberg.com/news/features/2018-10-20/vancouver-is-drowning-in-chinese-money

It was a stock rumor in Spain up to 2012 or so that the enormous increase in real estate prices across the country was driven by cash-laden foreigners pricing locals out of the market.

After the music stopped it was discovered that, yes, cash-laden foreign buyers did exist but they weren’t really interested in buying where most Spaniards live: they wanted seaside locations, preferably not far from an airport and preferably with a seaside view. What propelled prices were chiefly the mind-numbing 100,000+ (with a peak of 130,000) mortgage approvals per month.

Fast forward to 2019. Again real estate prices are skyrocketing, with average prices across Spain up 10% year on year (if you want to see where all that GDP growth comes from look no further). And again it’s somebody else’s fault: in this case it’s due to all those shady characters scooping up properties to rent them out on AirBnB. Politicians are beating their little war drum and everybody has a theory, often involving gangs of ruthless criminals from Eastern Europe, Chinese money launderers and the usual cast of shifty-eyed foreigners.

But looking at mortgage approvals we see they went from an average 30,000/month in Q1 2018 to an average of 36,000/month in Q1 2019, or up a massive 20%. Why would Chinese money launderers need to take out a mortgage in Spain we are not told, just how we were not told why German and Dutch millionaires needed to take out a mortgage in Spain back in 2008. They may overbid on a few units using their own cash (be it dirty or clean), and that’s all the excuse locals need to become addicted to gambling.

Like Italy Spain is not just depopulating but filled with empty real estate nobody wants (at least at those crazy prices): these are clear symptoms of an economy overheating on dirt cheap credit. Just like Mr Punwasi said this is a “greater fool” game: people buy real estate hoping to sell it at a large profit down the road because prices can only go up.

But most of Spain is not tourist-mecca Palma de Mallorca and these people are in for a world of hurt when buyers will fail to materialize.

Vast amounts of property in Spain was held off the market in Spain post gfc, ending up in the Sareb with something like fifteen years (if I remember) schedule. Banks also simply took their own property, or that which they reclaimed (new and old), off the market and became their own sellers/financers, offering portfolios at higher prices. Investment funds snapped up others for rent. Low rates and resulting managed offer did the rest as far as price increases are concerned. They also completely stopped construction without permits, which many were doing out of the way for own use, using pre-existing as source of income and authority via fines. A class of Spanish love to blame foreigners for everything, and another class will not fear taking full advantage of them at every opportunity. Shame they don’t learn more what their own country is about nowadays, but then they don’t have the same relationship to authority and management etc. we are used to, so everything is viewed more in simple political terms and obvious reward. You know foreigners do take up market, inflate prices, but the Spanish welcomed them in both as tourists, residents (large part British) as well as managers of own monetary policy and investment (EU). They have only themselves to blame I suppose….Euro was really the defining moment of it all, it had all been reasonable till then.

Property was being taken off the market in Spain for one reason and one reason only: because in 2014 it bottomed out at a nationwide average €1450/m². In Q1 2010 it had peaked at a massive €2100/m². Please note that for all the recent inflationary flare up latest data put national average at €1600/m²: five years of manipulation at all levels equaled a miserable 10% price increase, mostly driven by tourist meccas like Alicante, Malaga and Palma de Mallorca. Prices in not-so-hot areas remain sky high but buyers have made themselves scarce: just window shopping for real estate in the interior reveal asking prices with no connection to reality. Even at a 40% discount those places would be expensive for what they are.

However something is turning strange in the Spanish market as construction output, after two crazy years (“whatever it takes…”) has started to fall off in 2019, a strange predictament when prices can only go up… even when sold units, population and home ownership keep on going down!

Italy is in a similar predicatment: with construction/real estate sector (data aren’t separated) worth a massive 9-10% of GDP she has pulled every trick in the bag to prop it up. End result? Construction output is through the roof (up 8% in February 2019, the last available month). But despite the lowest mortgage rates in living memory sold units and home ownership are down. This has started to affect prices as well: the crazy five years sprint Italy shared with Spain ended in February 2019 when prices went down nationwide year on year 2%. Developers, after a sweet five years, have started to go burst again.

It will be interesting to see how Italy and Spain with their frail governments will deal with this problem, a problem of their own making. The ECB may have given them the matches but it was Italy and Spain who poured the petrol.

Thank you for publishing Stephen Punwasi’s thoughtful and informed analysis of money laundering via Canadian real estate. He has covered the subject very well – the role of the marginal buyer who seeks to increase the sales price, the concealment arranged by interested parties, and the complicity of major financial institutions and government itself.

“Motivation to overpay” is by definition the price action on the NYSE.

Well, I’m spending the week in Dubai, a city built on money laundering. From my hotel window I can see the tallest skyscraper and the largest ferris wheel on the planet. Don’t hate the playa, hate the game. I’m going to Denny’s for breakfast.

I hate both. But then I have ethics, something woefully absent among shameless real estate cheerleaders.

There’s something like two million square kilometers of playa around there…worth visiting, very peaceful. Most people can’t stand being that much with themselves for long though.

This is a good write-up Stephen. What happens in the USA to stop/control these money launderers? I know the penalties are serious but is there some form of reporting, etc., to keep these launderers in check?

I’m wondering. Does Vancouver have to endure a housing crash to save the housing market for Canadians?

I’m a BCer and most of us outsiders just shake their heads at Vancouver and give thanks not to live there. Given enough time there won’t be enough peons living there to wait tables or clean up after the homeless. We give thanks there is a ferry terminal that allows people to totally bypass the city if we travel east or down to the US. You don’t even need to use the airport.

Great write up and knowledgeable comments.

“. In the greater Toronto area the Punjabs and Pakis don’t care what anything costs they’ll pay anything for a house if they can get a mortgage.” – This sounded disdainful of these ethnic groups but perhaps it is regional phrasing ???

Anyway, I’ve noticed a similar thing in Seattle Eastside. Many of this year’s new homes in Kirkland have been purchased by SE Asians.

“Treating real estate like a stock market encourages the same type of laundering, without the transparency.”

You nailed it Wolf.

This goes to the heart of the Faustian bargain the Fed and other central bankers have made to prop up markets. In the process of backstopping their most favored, systemically important constituents, they have obliterated price discovery in many housing markets.

When this mess does finally correct, some of these markets are going to see a major reckoning. For now, it’s just a slow bleed because everything is still stitched together and frothy stock markets are allowing them to keep up appearances with ample liquidity.

The confidence game works…until it doesn’t.

Now this is a very nice writeup. I really like these articles on real estate, please keep them coming!

Notice the Canuck government ALWAYS tells everyone how they exist to take care of everyone, its the basis of “Liberalism”. But they turn a blind eye to destruction of the housing market (unaffordability) just so they get access to increased taxation. NO ONE including government people are altruistic, but this idea is leveraged by government to screw people.

Well, it actually took a long time to morph into what is the current state of affairs. It will take some time to turn the ship back around. Reforming Govt never wins on this. If they move too fast they get castigated as reactionary and if they do too little they are lumped in with the criminals. It takes awhile to decide what to do and pass laws. It was the ‘last’ Free Enterprise govt that allowed this state to develop into the mess it is. The current Govt is labeled ‘Socialist’ at every turn. Sounds like a familiar theme these days, doesn’t it?

The problems were well in place long before the last government. Or the one before that. Or the one before that. They were identified in reports going back at least to 1974.

You are really being too kind, it is corruption at every level of the government. That said, the Ontario government is probably the only government in the western world that is trying to do something about it.

https://news.ontario.ca/mof/en/2017/04/ontarios-fair-housing-plan.html

https://wolfstreet.com/2017/04/20/toronto-house-price-bubble-foreign-buyers-tax-double-ending-by-brokers-paper-flipping-by-property-scalpers/

“oz of pink kush going higher” lol

Wolf, how much do you think profits from illegal Marijuana businesses have influenced real estate prices in CA?

I’ve head a lot of it gets cleaned through RE.