How do they stack up against the most splendid housing bubble in America? Holy cow!

Canadian housing markets are in a category of their own. No housing market in the US – no matter how crazy Housing Bubble 1 was, which began to implode in 2006, or how crazy Housing Bubble 2 is or was – can hold a candle to the most splendid housing bubbles in Canada. Instead of a Financial Crisis and a mortgage crisis and Housing Bust 1, the bubbliest Canadian markets only had a little-bitty dip, and within months were back on track to what would be an 18-year housing boom that is now coming undone.

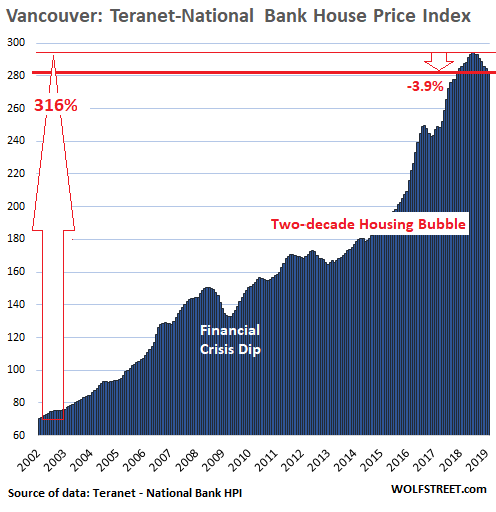

Vancouver:

In the Vancouver metro, home prices fell 0.7% in February from January, and are down 3.9% from the peak in July 2018, according to the Teranet-National Bank House Price Index. This 3.9% decline in seven months was the sharpest seven-month decline since February 2013:

From January 2002 to the peak in July 2018, the index soared 316%, the biggest increase of any major housing market in Canada over this period — and as we will see in a moment, far more splendid than anything the US has to offer. When something is up 316% (the index for Vancouver soared from 70.7 in January 2002 to 294 at the peak in July 2018), it means that it more than quadrupled.

The Teranet-National Bank House Price Index tracks the rate of change of single-family house prices, based on “sales pairs,” similar to the S&P CoreLogic Case Shiller index for US housing markets. It compares the sales price of a house in the current month to the prior transaction of the same house years earlier, based on property records (methodology). Using “sales pairs” frees the index from the issues that plague median-price indices and average-price indices.

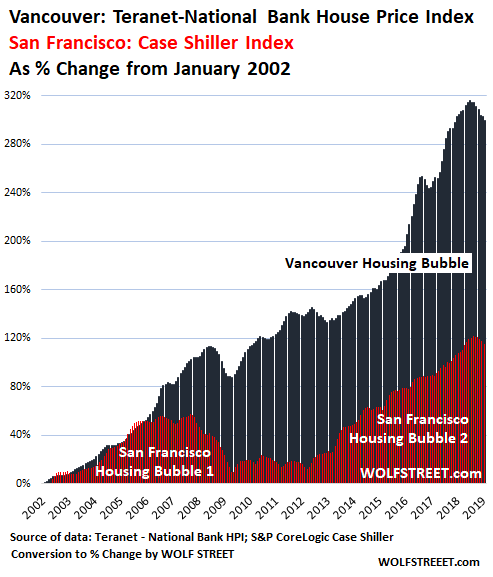

So now let’s have some fun and let’s compare Vancouver to the crazy insane mind-blowing Housing Bubble 1 and Housing Bubble 2 in the five-county San Francisco Bay Area that I feature prominently in the Most Splendid Housing Bubbles of America.

Since the Case Shiller Index and the Teranet-National Bank HPI both use “sales pairs” as their method of tracking price changes, it makes them comparable. To do that, I converted the index data of price changes into “percent change from January 2002.” So this tracks the same data, but is denominated in “%-change,” and the chart looks the same. I did this for Vancouver and the San Francisco Bay Area, which allows me to put both indices on the same %-change scale on the same chart.

Holy Cow!

Vancouver house prices soared 316% since January 2002 through the peak (July 2018); San Francisco Bay Area house prices soared 121% through the peak (November 2018). And what we get is a chart that shows how the majestically splendid housing bubble in Vancouver (black) totally crushes, annihilates, and ridicules the crazy insane mind-blowing house price increases in San Francisco (red):

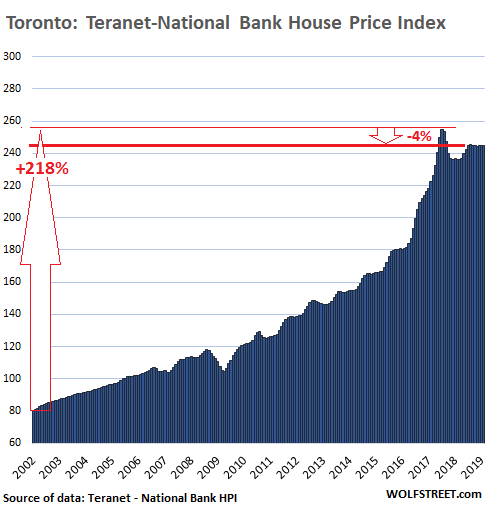

Toronto:

Staying on the same scale to show how housing markets in Canada vary, with less bubbly markets showing more white space, we move on to Toronto. House prices fell 0.2% in February and are down 4.0% from the peak in July 2017. Mild as it seems, it was the steepest 19-month decline since May 2009.

From January 2002 through the peak in August 2017, the index skyrocketed 218%. That’s huge. It means house prices more than tripled. But it’s not even in the same ballpark as Vancouver, where house prices more than quadrupled. So in the chart below, there is a little more white space above the index. Note the utterly nutty spike from January 2016 through July 2018, peaking with a 40% year-over-year gain:

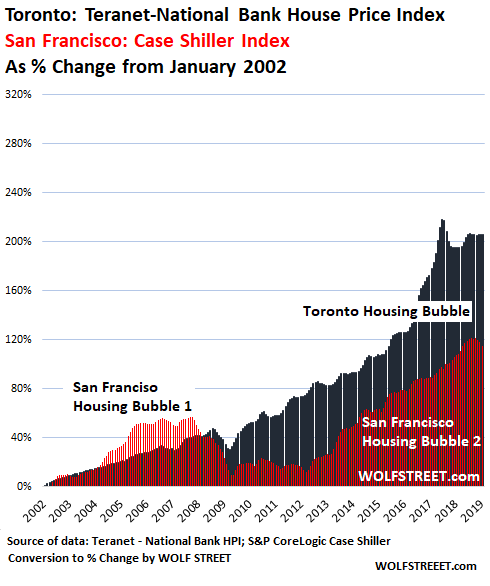

I converted this Toronto index to “percent-change since January 2002” and compared it to the crazy insane mind-blowing housing bubble in the San Francisco Bay Area. And Toronto just blows away the Bay Area for another holy-cow moment:

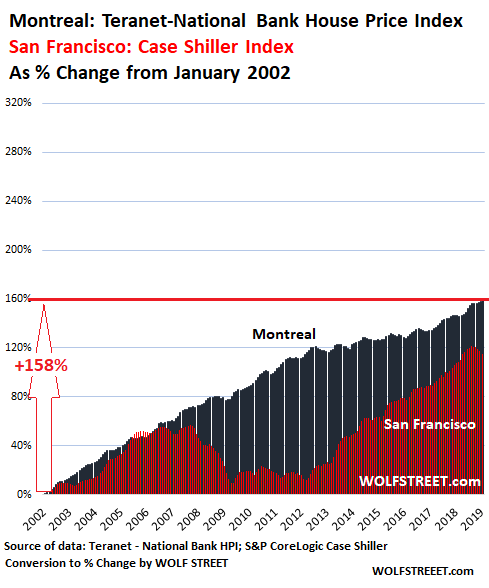

Montreal:

In Montreal, home prices ticked up to a new record in February, the only city in the 11-city index to see a month-to-month gain and a new record. The index is now up 158% from January 2002, and even this gain, which seems rather lousy compared to Vancouver’s 316% gain, beats San Francisco’s gain (121%) by a big margin. But the white space is beginning to get ample:

The Montreal index never experienced any kind of measurable dip. It trucked right along with San Francisco up through Housing Bubble 1. But during the Financial Crisis, when the San Francisco index imploded, the Montreal index just kept on trucking with the cruise control set on max, varying the speed only slightly for seasonal reasons.

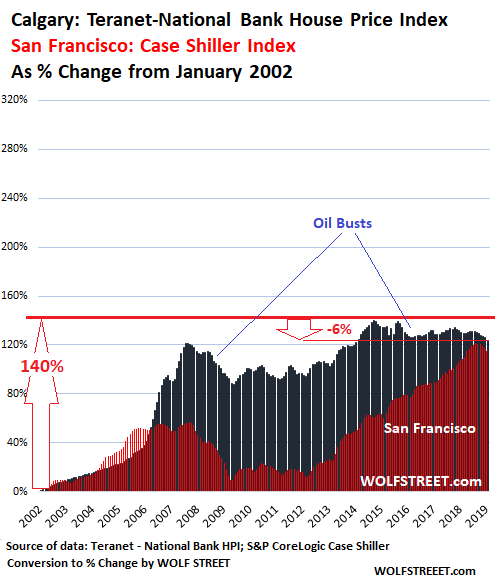

Calgary:

The housing market of oil-boom-and-bust town Calgary experienced a blistering boom in 2005 to mid-2007, along with the oil boom. When the price of oil collapsed, the housing market went south. Then there was another oil boom and the index reached a new peak in October 2014, at the time 140% up from January 2002.

And you know what’s coming. That oil boom too turned into a bust in the fall of 2014, and home prices have since zigzagged lower. In February, the index was down 6.3% from its peak in October 2014. But it remains 124% up from January 2002. So even oil-bust town Calgary is beating San Francisco:

No magic involved.

These home prices in Canada are no miracle. The index measures how the price of the same house changes over time. This house didn’t get bigger or better or more opulent. It just got older.

What has changed in a major way is the purchasing power of the Canadian dollar with regards to assets, particularly with regards to homes: This purchasing power has plunged. And what you’re seeing here are the effects of asset price inflation, or more precisely home price inflation.

These “sales pair” indices are a good measure of inflation for home prices, as they track the price changes of the same house, just like consumer price indices are a measure of consumer price inflation by tracking price changes of individual items. No magic involved – just the loss of purchasing power of the Canadian dollar, and thereby the loss of purchasing power of Canadian labor that is paid in these dollars.

The San Francisco Bay Area and Seattle lead with biggest multi-month drops since 2012; San Diego, Denver, Portland, Los Angeles decline. Others have stalled. A few eke out records. Read… The Most Splendid Housing Bubbles in America Get Pricked

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Canada to US: This is how you blow a real bubble HIHIHI

What to do ?.Sale and wait with cash or stay out for total collapse …?

Vancouver and San Fran have the same 300% run up if you start the comparison just six years earlier (1996). Probably due to the SF dot.com boom from 1996 to 2002.

https://i.imgur.com/J7yXxwe.png

300% up, 3% down. That’ll show them speculators.

I know eh? And the kicker, oil prices are on the up again. Housing prices are mostly stable year on year. I have a condo outside calgary….it’s gone up a few percent, not that I’ll be selling it any time soon. The cad dollar is still competitive, turn on the immigration spigot and prices will stabilize further.

Congrats Nicko2. You own the only condo in all of Calgary that went up in price this year.

Correction your condo is still is falling in price. Any resale condo in Calgary is only worth about half today that it was worth at the peak at the start of 2008. Edmonton is even worse townhouses and condos were worth more than double 12 years ago than they’re worth today. Both cities not inflation adjusted.

“turn on the immigration spigot and prices will stabilize further”

I keep hearing this insanity in the USA as well but the thing is, based on what my eyes see, immigrants coming to the USA aren’t going to be buying up $1,000,000 starter homes.

Maybe “Canada” has a better class of immigrant……….

Relax Andy. Grab some popcorn and enjoy the show. Just first pitch in the first innings….

Foreign millionaires (90% Chinese) competing with middle class Vancouver incomes. All a function of outsourcing manufacturing jobs to China. That is the play, with a large portion of Central Banking credit expansion and interest rate suppression.

Nominal Canadian GDP rises 50% over time, and the Royal Bank balance sheet expands 100%. Basic math.

Yes, as interconnected Canuckia and the US is, a crash in the former should absolutely affect the latter, possibly triggering a crash there also.

Extremely annoying adds on here. Edges of page are surrounded and overlap on to text by adds blocking view, making reading impossible without constantly pausing to wait till add passes only to be followed by another.

Depends on what platform and browser you are using. On Android with Opera it is now more jumpy, and some ads mess with settings and text entry. On DuckDuckGo presentation is stable and no ads…but I am used to Opera options (bookmarks etc), Operamini has adblock and those options…so really just have to choose browser well I think…and if you find one you are happy with store a backup apk of it for in case it gets a poor update. All I am able to suggest.

timbers,

There should not be any ads that overlap text. So something is not right.

Where are you seeing these ads? At the base, on the side? Can you send me a screenshot? howlatwolfstreet@gmail.com

What device do you use? Android smartphone, iPhone, PC/Laptop?

Are you located in the US? If not, where?

Thanks.

I had that ad earlier. It was literally a frame around the entire screen, and because the contents weren’t shrunk to fit the frame, the ad blocked the periphery content.

Ditto for me. Google chrome on my android phone.

Thanks. This is very helpful.

Same on iPhone. This problem just started in the past few days.

Hi Wolf. iPhone. USA. SAFARI. Thick black border around entire page. Every 15 seconds. Covers edge of copy. Honda, Folgers Coffee, tv golf as. ugh. What a terrible wake-up to your column this morning. Even restricts typing you this feedback…..!

Thanks. Something has gone haywire. My developer is working on it.

Eeegads. Rapid fire thick borders different colors. Many advertisers. Pop up said “GumGum” ads sponsored by AI. What revolting development!

Apologies. There is a site problem. Developer is working on it.

I’m seeing ads that create a dynamic border that overlays the text on my iPad. It’s a real pain in the rear very distracting.

Mike T.,

Thanks.

Screenshots would be immensely helpful. Email to howatwolfstreet@gmail.com

Anyone else who is having this problem: Is this on a PC/laptop? On a smartphone? On a tablet?

Damn, i’m glad i’m on an old fashion computer, having no issues what so ever, and never surf sites on my phone. My phone is for talking and texting and when i’m not in the office the last thing i’m doing is surfing the internet because i’m out and interacting with people not my phone.

Same here. Had to leave the site, couldn’t read a thing. The black border thing is gone, and it’s better but now whenever I attempt to read a comment, an ad bumps it off the frame and I have to scroll back to it just to be bumped off the frame again.

I dont see it. But then i always decline android system “upgrades”.

I get the same annoying ad on Chrome. It’s like a old fashioned picture frame that encroaches on the screen and goes on and off every few seconds.

4% decline Vancouver in 7 months is hardly noticeable, imho.(respectfully). 40% in 7 months? alrighty then. 40% would be a step towards sanity, and a 70% decline in 1-2 years might be a start towards reality. Many Canadians need a big big wake up because the longer this nonsense continues the worse it is and the more drastic the finish.

I built a 640 sq foot cottage for a friend to rent just last year. Electrical service, all construction from site clearing-concrete to finish and paint, cost me $40,000. Now, I recycled lots of left over siding, cabinets etc from other jobs….so let’s call it $60,000 for materials. labour? part time work for 1 year for just me…let’s call that another $60,000 if I charged myself for myself and paid myself a good wage. :-) $187.50 per sq foot. Land? Well I already had the land but around here I could pick up a nice village lot for $50,000 (with a view!!). Now, we are up to $265 per sq foot all in for everything. last week I saw an advert for a 500 sq ft condo (no land + strata fees + taxes) in Vancouver for $2,000 per sq foot. One million dollars + strata+ taxes for a condo concrete box on Cambie Street, a place no one would live but poor working folks just 25years ago.

Where will our Canadian children eventually live? In their cars?

On vancouver Island you can buy a pleasant almost new modular for $110,000. Pad rental is around $400/month. Or, one could buy a zoned rural lot for around $100,000. Why does anyone live in Vancouver? Why?

What about these options?

https://www.royallepage.ca/en/property/british-columbia/fort-nelson/5703-gairdner-crescent/9150649/mlsr2342558/

https://www.royallepage.ca/en/property/british-columbia/tahsis/359-maquinna-n-drive/8408987/mls445435/

Yes, 4% in 7 seven months is not huge. In the US, it went on for four years. At this pace, the index will fall 30% in four years, assuming that this slow decline remains slow. So a house in Vancouver that someone paid C$1.5 million for will be worth $450K less four years later. Not fun.

That kind of a reduction is totally fun if you want to relocate to Vancouver from elsewhere.

‘When something is up 316% (the index for Vancouver soared from 70.7 in January 2002 to 294 at the peak in July 2018), it means that it more than quadrupled.’

And the explanation:

‘No magic involved – just the loss of purchasing power of the Canadian dollar’

I suggest using the ‘Big Mac’ benchmark to compare both the C$ and Vancouver housing prices. No other asset has quadrupled in terms of the C$.

I sold in Nanaimo in mid 2014 for 370 and the house is up by at least 30 %. The C$ against US$ is down like most currencies but

not that much and the internal purchasing power (RE is not an import) is flat against food, appliances etc.

I suggest that the concurrent run up in SF RE is not MAINLY due to a decline in the purchasing power of the US$.

You have shed a lot of light on the RE bubbles in these places so I was surprised to see ours explained as a currency depreciation.

You have predicted and I agree that a large correction is underway and I think this is because Van RE is a bubble in constant dollars.

I have said many times when discussing US home-price appreciation that US home-price appreciation is a decline in purchasing power of the US dollar with regards to assets, such as homes, and a measure of home price inflation, and more broadly asset price inflation. ANY home price appreciation across an entire housing market is just a form of asset price inflation — or loss of purchasing power with regards to assets in the local currency. Canada is no exception. This is an old theme on WOLF STREET.

Just as an example of how old this theme is, here is one from November 2017, on the Case Shiller in the US, specifically explaining the theme of asset price inflation in housing:

https://wolfstreet.com/2017/11/28/the-us-cities-with-the-biggest-housing-bubbles-4/

There are two distinguishing features of the post-2008 period:

1/ Decline in purchasing power of fiat re certain assets, principally and – most dramatically, real estate; and 2/ Steady erosion -and likely permanent reduction – of real prosperity among the population at large.

I have to say, the current (wobbling) UK bubble is of similar proportions to Canada: in this hot spot, we have seen real estate valuations (fantasies) rise at least 4-fold since 2000, which is certainly not justified by economic performance in that period, greater productivity or wage rises….

And what shoddy rubbish the new housing built on the back of that bubble is! Fascias put up 10 years ago are already rotting……

“I suggest that the concurrent run up in SF RE is not MAINLY due to a decline in the purchasing power of the US$”

How can this be? Either you are wrong or the FED is wrong because the FED has been whining and crying about low inflation for a decade?

I know the answer BTW.

I’ve bought a (small ) coke from a machine for 5 cents. Before that the large 10 oz bottle was 10 cents for 50 years. I can remember noting the first time I had to put in two coins: it needed not just a quarter but a dime also. That was in 1975 when oil took off from 2 or 3 dollars per barrel and took everything with it. That was when modern US inflation began.

Now a coke from a machine can be up to a 1.50, maybe 2 in a clip joint like an airport.

This is the gradual deprecation of the currency affecting ALL assets.

But SF real estate and Van real estate have appreciated faster than that. Much faster. If a coke had appreciated as fast then today you would have to put 5-6 dollars in the machine.

So could we agree that the usual depreciation of the currency has obviously lifted the price of SF and Vancouver RE to some degree (along with all RE) but the quadrupling in these hot spots can’t be explained by that alone.

Wouldn’t want to live anywhere else

They will do what many Millenials are doing in developed economies……they will RENT.

Rent…then vote in governments who will deliver them more affordable housing.

You forgot the second part…

Vote in governments that will PROMISE them affordable housing. Results may vary.

In Toronto the sneaks call government subsidized housing “Affordable Housing”. That way they can say say survey results show 9 of 10 agree we need more affordable housing.

Call it what it is and ask the same questions, you’ll get much different results…

The fix to affordable rents is simple: increase the tax on rental income.

Not sure about Canada, but in the US average rents (as measured by aggregate rental income divided by total number of rented units) are up 300% in the last 12 years. This was necessary to prop up the housing market (by reducing the disparity between rent and mortgage cost). But ultimately problematic for the middle class that is being squeezed.

Literally seeing 50% drops in YoY prices in Vancouver now, and 40% is almost common.

Even lower priced suburbs are down guaranteed 25-30% in detached. Condos now following, down 10% by any measure.

Small to mid size builders/developers starting to implode. Big increase in vacant lots for sale “With Plans!” and even some with excavation and foundations built.

Lenders seriously tightening up construction financing. This is no longer “getting bad” it’s there, including job losses and homebuilder companies going under.

Why doesn’t anyone who posts on these sites mention the sh*t eating bankers who started all this, control it all, including the bubble inflation and deflation? I for one am sick to death of being a banker slave. I don’t work for bankers any more.

Wolf, I’m curious – using “sales pairs” is probably the best gauge we’ve got to measure price changes; but I wonder if they don’t distort real price changes a bit as well. They work best when, in aggregate, renovations to houses match depreciation rates. But I would guess that these don’t stay constant over time. Clearly, increased presence of fix & flippers tend to boost prices. And regular homeowners as well who pump more money into renovations will show an a larger increase in price than otherwise.

It would seem that conditions of easy & cheap lending; rapidly increasing real estate prices and a “good” economy/job market would all tend to exaggerate price increases because relatively more investment is being made in renovating.

And the reverse is true. During the GFC there were certainly some properties that were having fixtures, & plumbing & wiring ripped out, massively decreasing prices beyond what a “normal” house would go for. And even when that wasn’t happening, people weren’t investing in renovations.

This might not be huge factor, but it certainly distorts price changes somewhat. However, I’m not sure there’s really any statistic which can account for this change.

In the methodology, the authors of the index explain that properties that have been damaged are pulled out of the pricing pairs. There are other factors that disqualify a home from being in this data set, such as transactions that are not arms-length. The data is adjusted in other ways. And it lags a few months. It’s not perfect. It’s just one indication. But it is not beset by the problems of mix (as median prices are) or the problem of a few big outliers (as average prices are).

I live in Calgary, currently renting a unit in a 4-plex, my landlord put the whole plex up for sale last November for a month, around mid 800s I believe. Relisted last month in the high 700s so a change of around 40-60k in just a few months.

In my neighbourhood in Calgary, the biggest change in residential housing in the last few years is the number of rented homes or even empty homes. I also hear from friends on Condo boards in the City that a lot of rental units are owned by companies. I presume we have a lot of people speculating (investing some might say), and some Chinese money as well. But who is going to buy these homes in the future is the question? Lots of homes coming up for sale now…..

The straw and the camels back.

The Canadian HELOC debt has been on the decline for almost two years, yet still amounts to over three billion dollars.

The Canadian real estate developers debt has hit an all time high, as markets shrink.

Canadian mortgage holders are now paying over 27% more interest than principal. For every four dollars in principal paid, Canadian’s are now paying five dollars in interest!

The sheer volume of liquidity hissing out of the Canadian real estate bubble, has some mortgage holders falling underwater and as consequence drastically lowering prices in a falling market.

You might say that the bankers are laughing all the way to the banks. Only this time the bankers and the country are about to receive their come to Jesus moment!

The balance of personal loans secured by real estate, a.k.a. a traditional HELOC, reached a new all-time high. The outstanding balance reached $263.3 billion in September, up 0.48% from the month before.

For Vancouver the biggest driver of housing prices has been “hot” money from China. Canadian authorities obviously looked the other way while this happened. Vancouver is what happens when foreign corruption is permitted to run totally amuck! This has hurt ordinary working Canadians big time!

Toronto, Canada’s second biggest housing bubble has also been driven by “hot” Chinese money too. The difference is Toronto is a much bigger city than Vancouver so it would take maybe 3 times or more of the “hot” money to duplicate Vancouver housing bubble.

Montreal housing has always lagged Toronto greatly and that is because of the “Quebec” factor. Montreal is never going to be a place where “hot” money from within Canada nor foreign investors will ever feel comfortable investing. Aside from the political risks, mention should be made that Quebec has it’s own French civil code which is very different from the familiar British civil code which most Canadians and Americans are familiar with.

This is Canada’s “dirty little secret” of which nobody mentions in polite company. (99.99% of Canadians are not aware of this and the legal and financial consequences that can result from it. I have been victimized by this first hand! I am also an economic refuges from Quebec (1972) so I know Quebec!)

Traditionally Toronto housing prices are just over 2 times Montreal housing prices. My Father moved in 1973 from Montreal, selling his house in a professional neighborhood for $23,000, moving to Toronto, buying a house for $55,000 in a working class neighborhood. Toronto high schools were a joke! Brother and sister went from “C+” students to “A+” students without doing homework!

Traditionally Vancouver housing has cost about 50% more than Toronto housing.

So if you are offered a job promotion to Toronto from Montreal you are in trouble and may have to decline unless your company offers housing help!

Moving from Montreal to Vancouver? You are in really big trouble as housing is maybe 3 to 5 times more expensive!

If you are in Canada outside of Quebec, a promotion to Montreal will be turned down due to English schooling issues! Would need to go to private schooling!

Living northwest of Toronto, I saw first hand the results of the first insane 40% bubble surge in 2017 in Wolf’s Toronto graph! I watched the house next door being sold almost to the week of the 40% surge top! Bidding war in living room! Absolutely insane!

A $700K house 1750 sq ft selling for $960K! The couple who bought it lived in it for less than 2 months before selling again for a huge loss which probably destroyed their marriage.

The huge run up in property prices has also resulted in a huge surge in property taxes! My house taxes have more than doubled! My cottage property taxes have quadruple!

Government’s, municipal, provincial, and federal have all been the main beneficiaries of the housing boom! That is probably why they have all turned a blind eye towards the foreign “hot” money being laundered in Canada that has badly hurt oridinary working Canadians!

In addition the capital gains on one’s principal residence in Canada is tax free which is a big incentive for many Canadians to buy the biggest house they can afford.

In Canada mortgage interest is not tax deductable per the US. Also property taxes and provincial taxes are not deductable from federal taxes per US. Secondary real estate like cottages faces full capital gain taxes.

In closing, my brother lives in a nice Detroit suburb and his bigger house has stayed below half of my Toronto house even accounting for the weaker Canadian dollar.

Maybe Detroit is the US’s equivalent to Canada’s Montreal?

Poignant story from my days as SFO CFO:

PriceWaterhouseCoopers audit partner gets big promotion requiring family move from St Louis to San Francisco (high status & price Burlingame was desired residential area). Wife understood housing cost would probably double from their spacious St Louis southern mansion with expansive lawn.

When wife visited for on-site house hunting trip and saw what $1M bought (about 6 years ago, basically a starter home), she was stunned (not too pleased with CA schools either), an immediate family meeting was called, promotion was declined, everybody jumped into their cute little Saab car (not a cool SFO car) and boogied back to St Louis.

Family bribes will get someone over that hump. A colleague of mine got a call on a Friday that he was promoted to a much bigger job elsewhere. He told the CEO thanks and asked to think about it over the weekend. CEO said think all you want, but know that John Smith will be taking your office on Monday.

Depending on the age of the kids, a swimming pool, cars, etc. will get them (and you) through the shock. The wife often requires more strategic thinking. Also good to realize the corps will reward self-destructive behavior, so sounds like the wife in your example got that.

Fascinating to hear about Quebec having different civil laws, but in what way?

>>the legal and financial consequences that can result from it.

Such as what?

Justme: I tried to answer your two questions but the reply ended going to the bottom!

Please Let me know if I answered your question to your satisfaction. WES

Montreal has a very high standard of living and is investing heavily into infrastructure (airports, mass transit) ect…. it is a truly international city that will continue to attract global investors.

Great town, brutal weather… winter and summer.

Michael: I lived in northern Quebec/Labrador for the first 10 years of my life.

Then we moved to Montreal in December. I thought I had moved to Miami!

Then I moved in 1972 to Toronto to continue my post secondary education. I thought I had moved to Miami again!

“Government’s, municipal, provincial, and federal have all been the main beneficiaries of the housing boom! That is probably why they have all turned a blind eye towards the foreign “hot” money being laundered in Canada that has badly hurt ordinary working Canadians!”

Bingo!

Your local “economic development” council is always happy to lend a hand, especially when it comes to handing out tax breaks to wealthy and corporate interests. It’s a national pastime here in the states, and Texas will even throw in a two-tiered property tax system to boot. Greasing the wheel in Texas has become more complicated of late because of the growing pressure to reform school finance and tame high property taxes.

Interestingly, the Texas constitution mandates uniform and equal appraisal/taxation of property, but the state legislature prevents it from happening every year. Little-known provisions in the state code in sections 41 and 42 allow wealthy and corporate interests to sue the local appraisal districts for huge discounts on their assessments. (aka massive, giant loophole) If you have the bucks to sue in district court, burden of proof shifts to the CAD. If you are a regular homeowner, the valuation/assessment from the CAD is taken as gospel.

It is one of the most hilariously corrupt systems imaginable, but the legislature likes it because it keeps the tax dollars flowing. Chief appraisers know they will get sued if they approach anything close to real market value on prime commercial real estate, so they dumb down the assessments to avoid blowing holes in their litigation budgets.

It’s an annual carnival circus, and the property tax consulting firms thrive on it. Comically enough, there is a state senator who runs one of these property tax consulting firms who is leading the charge to “fix” the Texas property tax system. No conflict of interest there. LOL! :)

I wonder how much money the big REITs put into Canadian housing in their buy-to-rent schemes.

It’s possible that their bubble is bigger because the Canadian housing market is smaller than that of the US and therefore more susceptible to floods of hot investor money.

As far as condos and detached or semi-detached houses, it is individual buyers and individual investors driving the bubble. REITs generally stuck to apartment buildings up here. I wish the REITs would build a few more purpose-built rentals, rather than have these stupid condo towers going up everywhere, over half of which are then purchased by investors and rented out. If over half a building is rented out, it makes more sense to have the building owned by a REIT and professionally managed, rather than parcelled out to multiple amateur landlords and flippers.

The worry of depreciating money is a driver.

Search for yield has fueled wild speculation across all assets. Housing & the stock market. Those fortunate to buy at the market bottom in 2009 may be wise to sell now before the Bubble pops again – as it’s already starting to pop. Having seen my house devalue 65% in the Great Recession, I know the drill. The future will be more great buying opportunities for those that have cash & can swoop in. But this time may be much different than any other time before, considering the level of structural problems beneath the surface that have never been repaired.

In August of 2018 we sold our Moms house in southern California for $660,000. The first real estate agent we hired sold us on listing the house for top dollar, even though it needed a lot of cosmetic improvements. He was of the usual sound judgement that real estate in a great location would sell it itself, despite a multitude of imperfections. 6 months and another real estate agent later, we had to sink $15,000 into it & accept $16k less than the original list price. The 2nd RE agent told us the market is starting to turn. Buyers are becomming more skeptical & very selective she said. That was fortelling the future right there. The pendulum has officially swung from speculative seller to hesitant buyer. And it’s only going to magnify moving forward.

Now that all the foreign property owners in Canada are dug in with huge RE price gains and nowhere to go, isn’t it time for Canada to tax the heck out of them?

Bobber: No sadly most foreigners just skip the country without paying any taxes!

There are other home price measures showing larger declines in all those markets. It seems the decline is starting to pickup steam in Vancouver in the high end of the detached home market. Also, the Toronto market is seeing declines in most of the segments above $1.0 million for detached homes. The new mortgage rules have pushed people to compete for the lower end of the market which is mainly condos. It will interesting to watch how it plays out this year.

I would love to see the home prices in Canada will drop back to the 2002 – 2003 levels. Then I will be able to afford to buy a modest home for myself in the GTA with my typical office job salary.

Wolf,

Are the Canadian percentages normalized against the USD? The Canadian dollar has been on a roller coaster, and it would be interesting to see these graphs with the currency normalized to the USD.

Currency exchange rates have no impact on this data. That’s the beauty of the Case-Shiller and the Teranet indices. These charts are not dollar charts and are not based on dollar charts and data. This data is based on price changes tracked in Canada and price changes tracked in the US, as in point differences of the sales price of the same house over time. Each index is set at some point in time at 100.

The price changes for each market are expressed in this non-currency index by the Case-Shiller and the Teranet index providers. I then converted these non-currency indices into “percent-change increases that can be compared. The effect of exchange rates are eliminated in this equation. That’s why I used it.

Jonathan has a point regarding the exchange rates though. Housing is supposedly local, so nothing wrong with your methodology, but with the amount of foreign (read:Chinese) money flowing into both the USA and Canadian markets, it would be interesting to see the data adjusted to USD for the Canadian market to see how much more of a bubble it was for Canada from the perspective of the RMB or USD.

Either way though, in Vancouver or Toronto, average income doesn’t sustain average home prices. That boat has long sailed.

Currency does have an influence. One set is done in US dollar price changes, the other in Canadian dollar changes. You might think that there is no impact, but things like replacement costs are influenced by relative currencies (lumber, shingles, kitchen fittings) and so can increase the C$ cost over what they would be if the currencies had remained stable. And as Ex-Cdn notes foreign buyers (big in Vancouver and Toronto) are impacted by foreign exchange rates. They have recently gotten a lot more C$ for their yuan than US$, whereas before it was closer to even.

I agree prices are nuts … but the persistent policy of bringing 1% of the population into the country each year through immigration is putting somewhat of a floor under prices. It would be like the US allowing in 3.5 million folks every year and having them settle in California and New York. there would be an impact. (Note the best data I can find says the US takes in around 1 million a year currently and 1/2 are change of status, so immigration is much less of a factor than in Canada). All we seem to do here is build condos and pave over farmland … not sure to what longer term benefit. The economic distortion worries me most.

I hear a lot of people thinking the market is going to drop big but people have been saying this for over a decade now. I am glad I didnt sell my house. Eventually the price will drop and then over time head back up. Particularly in big cities like Montreal, Vancouver and Toronto. That’s what I have observed over the last 70 years in Canada. If you have seen or experuenced different in the big 3 Canadian cities, let me know with real examples.

Now the US is a different story. You just have to look at formerly large cities that decline because industry leaves and the population declines. Detroit!

Cheers ?

That’s the classic “it’s different here” argument. Canada has not yet experienced a bust like the US did yet, but we have never had a run-up in prices like the past 20 years either, nor have we ever had such insane levels of household debt. Sure, prices will “eventually” recover and reach new highs, but don’t underestimate how painful “eventually” is for millions of indebted homeowners.

Having lived through the ’08-’12 bust in Florida, I can attest that it’s not all peachy bargain-hunting time when values drop by 70%. Yes, the house may be cheaper, but much of the block is empty (due to foreclosures and abandonments) and jobs are also scarce.

Not sure what this means for Vancouver et al, but it was pretty depressing here during that time.

I am not going to lie, I kind of expected a faster correction. The ramp up over the last 3 years has been 100% artificial. The Canadian Dollar dropped drastically in 2015 or 2016 but the housing went through the roof after. (leads me to believe foreign currency saw an affordable price adjustment for the exchange and poured into the market)

I need to resupply my popcorn stash, maybe more butter with the next stash.

What you read in the newspapers is the opposite of what investors abroad do (Globe And Mail online Newspaper). They look for an appreciating currency not depreciating currency when they buy abroad vis-a-vis their own local currency.

After a slow start in Jan, the Southern California beach cities are doing nicely. I see a lot of homes entering escrow. Hard to tell how much prices are increasing.

SocalJim – Sales are down and inventory up across the board in SoCal and many zip codes have double digit YoY price declines. Median price in Manhattan Beach is down 25%. Any zip code that isn’t showing YoY declines at this point is probably still affordable for local buyers or just a complete aberration.

Ed, take a look at the mbconfidential web site. They have the data showing Manhattan Beach is doing quite well after a slow start. The tree section is hotter than last year.

Ed, also, the overpricing seems to have stopped. In Manhattan Beach, ask prices seem to be closer to last sale … to make that happen, some ask price cuts have happened.

Then, there is Boston. Bidding wars are starting again. Boston appears stronger than any California market. Definitely increasing prices in Boston.

LOOL….SURE JIM. Whatever you said….someone didnt save their commission checks during the bubble years LOL

Yep. I live (rent) in Cambridge, next to Boston. Recently Cambridge was the most expensive place to buy property in Massachusetts, and it would not surprise me if that is still the case. When I look at real estate listings, many prices have doubled in the last 5-6 years. Most people I speak to who live in this area feel there will no downturn affecting housing prices in Boston or the surrounding area. If so, it will have very little impact. The prevailing wisdom is if you didn’t buy years ago or when the bottom hit in 2012, you’re “sh*t out of luck”.

I read earlier this month that homelessness is growing at a faster rate in MA than in any other state.

Meanwhile, as it seems in every other major city in the country, new “luxury” apartment buildings have sprung up everywhere including the suburbs. The only problem is, no one can afford the rents.

SuzeB, I agree that they are building way too many luxury apartments and condos in Boston. One would think the overbuilding would bring down metro Boston housing prices. That has not happened … hard to explain. In the meantime, many homes are still seeing multiple offers. I would think we are nearing the end of the multiples … but I thought that for the last few years and I was wrong.

I rode the prices up over the last 25 years, my home made more money than I did in salary, averaged out over that time, despite two deep and nasty recessions. A persons principal home is exempt from CGT in the UK, it was like tax free income, when realised, at the point of sale. I have since moved into a hotel, no taxes, at least directly and no property taxes, again directly, and no maintenance. The hotel is cheaper to live in than local rents by about 50% and a nice nest egg is available and earning 6% interest, with a little luck and some planning it is possible to be a beneficiary of all the money printing and housing bubbles.

That’s called WINNING. Congratulations. ?

That’s called ANNOYING. Congratulations.

And William’s story is that he knew when to hold ’em and when to fold ’em…Don’t think you two are on the same page…

I am NOT sure you are being sarcastic or NOT. Have you realized what William said is that “the system encourages ass sitting on asset wealth transfer and discourages wealth creation working”. If ass sitting asset makes more than your salary and got TAXed less, what are we teaching our children?

What are we teaching our children is “money buys colledge degrees” and that rule is NOT written on the wall so that everybody can see.

Corruption. A nation declines because of this.

6% interest??????

Where on earth are you getting that?

William – It’s funny you mention that because I’ve noticed the same thing in DC and San Fran. Hotels are discounted for day of sales on Hotels Tonight and it’s much cheaper to stay in a hotel than rent a one bedroom in major cities at this point.

Working remote is incredibly valuable these days. A $100K remote salary is a cost of living equivalent of earning $400K in a major city. Even part-time remote work is valuable because Airbnb has crushed the hotel industry. Buying a $300K house two hours away from NYC or DC in a good school district and then commuting and staying in a hotel downtown 2 days a week is a great compromise to spending your entire paycheck on rent or a mortgage at this point.

But what are you doing about food?

It is, obviously, far from healthy (leaving expense aside) to eat in restaurants and hotels, unless by ‘hotel’ you mean a real self-catering dive?

What is that money worth, if your body is poisoned or inadequately nourished?

I do not really see that it can be called ‘winning’….

Milenials eat out every meal already. It’s part of why they can’t afford to buy real estate.

Wolf, Any comparisons available for Australian house prices?

I don’t know of an Australian index that is based on “sales pairs” (as these two are). That would be the first step to get something close to apples and apples.

Canada is viewed as one of the safest countries in the world for wealthy people. I would leave Hong Kong for Canada if I lived in Hong Kong. Most people don’t move to Canada for the weather.

Except if you value the urban lifestyle that an Asian megapolis like HK has to offer. My aunt relocated from HK to Vancouver just prior to the Communist handover, found the lifestyle/cityscape less than satisfactory and hightailed it back to HK.

Broadly speaking – given the Fed has recently flip flooped on monetary policy and is back to easing, and stated it will move to aggressive easing in the form of all the discussed failed policies of the recent past – if signs of recession, it’s not unreasonable to think real estate and other assets will soon return to bubble-dom.

Also too, everyone else appears to be doubling down on extreme monetary easing and that can flow more asset bubble-dom into U.S.

Interesting. Thank you. Apparently the Vancouver homeless count is up 60 percent for the same time period, along with, I assume, an increased Urban Needle and Fecal Matter Street Count, as with San Francisco.

Vancouver prices barely dipped during 2008-2010. And then went straight up again.

It’s funny how people keep saying Vancouver’s in a bubble. A bubble lasts a few years, maybe a decade. But Vancouver’s housing has been going up in a straight line – with the odd blip here and there – for 40 years. It’s not shown on your graph, but go back to the early 1980s and see when the boom started. It was due to rich people from Hong Kong moving to Vancouver in the 80s and 90s, in anticipation of China’s takeover in 1997. Same thing happened to Toronto’s real estate, although the HK migration didn’t have quite the same impact as Vancouver. In the 1970s, Vancouver was Lilly white, you’d find an odd Chinese restaurant and that was it as far as diversity went. Today, more than 1/4 of the population is Chinese. And all those Chinese (both mainland and HK) came over with suitcases full of money and bought houses/condos.

That’s not a bubble. That’s the new long term reality. If you want to own real estate in Vancouver, it will cost you dearly.

Period.

“It’s not a bubble” heard that before in 2007. Time will tell. I’ll keep the powder dry and buy when the crash is here. Thinking 40%-60% discounts will be reasonable for SoCal.

LOL. No bubble here said some random guy

/S

I don’t think he said that there is no bubble in Vancouver. He did point out that home prices in Vancouver have increased substantially over the last 40 years. That happens to be true.

A home for sale on Vancouver’s West Side is getting a lot of attention, and for the first time in years, it’s because of how low its price is. The large, detached property on Chaldecott Street was recently listed for just under $4 million. It’s more than $2 million under what the same home sold for last spring.”

https://bc.ctvnews.ca/why-is-this-west-side-home-selling-for-2m-less-than-it-did-a-year-ago-1.4335387

That was true until 2016…Remember the bigger the bubble, the bigger the BUST

“That’s not a bubble. “

Exactly. As I said, bubbles are short term, a few years, then pop. Vancouver’s “bubble” is 40 years old. At some point, it stops being a bubble and starts being normal.

It is apparent that a lot of the RE run-up in western North America can be laid to capital flows from Asian. Makes me wonder what the effects of capital flows from Europe will be if/when Brexit and other fiscal/economic issues come to full flower in the euro area. Maybe the US stock markets have only begun to rally.

” Maybe the US stock markets have only begun to rally.”

I am not sure about that. The S&P 500 is beginning to look a little expensive. Apple, Facebook, and Amazon are the same companies today as they were on December 24th last year. However sentiment about their value/worth have changed quite a bit.

The S&P 500 needs to drop at least 10% to begin to look atractive again. Even the FED would be fine with that kind of a pullback without getting rattled.

I wouldn’t buy FB at any price. I don’t see it surviving long term. Google and Amazon however will rule the world for a long time to come. You’ll look back someday and wish you’d bought Amazon at $1700/share.

I believe we will see the bubble in the US start to reflate shortly, especially on the West Coast. Mortgage rates have tumbled, there are a record breaking number of IPOs coming to market, and the stock market is getting back toward its all time highs.

Ultra-dove Powell sees no bubbles anywhere. He is patiently waiting for his next opportunity to smooch Trump’s ass.

Yes, mortgage rates have massively “tumbled” all the way down to April 2018 levels… with the average conforming 30-year fixed at 4.62% this week, instead of 4.8% last August or 4.6% last April.

Mortgage rates sink to lowest levels in more than a year

By Kathy Orton March 14

According to the latest data released Thursday by Freddie Mac, the 30-year fixed-rate average tumbled to 4.31 percent with an average 0.4 point. (Points are fees paid to a lender equal to 1 percent of the loan amount.) It was 4.41 percent a week ago and 4.44 percent a year ago. The 30-year fixed rate hasn’t been this low in more than a year.

And remember at this time last year housing was still on fire. The first 1/2 of 2018 was showing 10-15% annualized returns. It was only when rates started climbing in May/June that prices started leveling off. So if rates are just below or where they were at this time last year, look for price appreciation for the next few months.

Wolf, at these bubble prices every basis point makes a real difference. Since rates were still at emergency levels as of the last cyclical peak, I would say that the drop from there is appropriately characterized as a “tumble.”

The Chinese are tapped out and only buy after at least a 25 percent appreciation in prices. They never ever buy into a falling market of any type only rising markets but they usually wait until prices hit bubble territory and then they all pile in amass and drive prices to the moon.

i think the chinese do that because they want to launder money. i think the seller is probably also on it, reimbursing them after pre-arranged price.

There is a big difference between Toronto and Vancouver. The first one, despite being over-priced, has at least a strong and diversified economy (finance, insurance, automobile, tech, agro-food) with multinational and national corporations that offer big salaries to a small percentage of the population. In Vancouver, there is a very limited amount of important industries/companies, Telus, a few mining and lumbering medium-sized businesses, regional bank offices and regional office tech jobs and a few HQ of hip companies such as Lululemon. It also means that the few good-paying jobs and the real money is all connected to the real estate/Construction/immigration sector (lawyers, real estate developers, etc).

Also, despite the geographical proximity, Vancouver is not comparable at all with Seattle, who has a strong economy with all those big companies (Microsoft, Amazon, Costco, Starbucks, Boeing (except HQ).

Just me: Quebec uses the French civil law. When the British conquered Quebec they let Quebecers keep their French civil code laws and allowed the very conservative Catholic Church to continue control daily life.

(When I say Britain conquered Quebec that really isn’t true! A French appointee of the French King, a certain Mr. Bigot, conspired to deny the French General the use of local Quebec militia. That left the French General out numbered and so Quebec fell as a result! Now back to Mr. Bigot! Yes this Mr. Bigot was only interested in himself, screw everybody else in Quebec! So when you hear someone called a “bigot” you can thank this gentleman’s actions for introducing the new word “bigot” into the English language!)”

Up until recently (about 1960) when a woman married, her husband became master of any assets she had. Married women where not allowed to own property! The Quebec Catholic church also made divorce nearly impossible. The church also tightly controlled life especially in rural areas and small towns of Quebec. After about 1960 Quebecers started to quietly or not so quietly rebel against the church’s rule. The church and the old French civil laws were some of the main reasons why most people in Quebec (like 75%) do not bother to get married!

Now to try and answer your second question regarding legal and financial.

First only lawyers trained in Quebec can practice law in Quebec (politics). This creates problems if you reside outside of Quebec and your last name isn’t Tremblay. In order to try and get legal remedy you must first hire a Quebec based lawyer! You cannot used a lawyer from outside of Quebec!

Further if you have an non French surname good luck getting to court! I know some people will deny this but just remember I was born and raised in Quebec! I know first hand that “graft” is Quebec’s favorite indoor sport! My Father knew all of the Quebec Premiers and cabinet ministers too! He had to hire their sons for summer jobs!

Now the financial aspect is tied to there being French civil law (verses English civil or common law) and politics. This makes it more complex to describe!

First 99.99% of Canadians do not know that there are two Federal Revenue Canada agencies! An English one and a Quebec (French) one! They do not talk to each other!

So if you phone English Revenue Canada about what the Quebec (French) agency did to you (like double taxation of Ontario estate for example) English Revenue Canada will not be able to help you as their computer system is not tied into the Quebec (French) one! Yes they will be very sympathetic but absolutely helpless to help you!

O.K. So how is it possible for the federal French (Quebec) to tax a non-Quebec estate that has already been taxed by the federal English Revenue Canada? Very simple have some of your assets with a Quebec based financial institution like National Bank for example. The said bank’s backrooom operations based in Montreal just decide on their own intative to seize capital gains tax stuff, withholding taxes, etc. from your estate brokerage accounts!

They then cleverly send the seized money to a special estate account opened in National Bank’s name (i.e. they are the sole trustee of the account) at the federal French Revenue Canada.

So when you try to get English Revenue Canada to credit the estate for double taxation they must say they can’t because they have no record of double taxation! You are screwed before you start! When you complain to the said bank they smartly close your accounts and wash their hands of you! Your long time broker does the same! Complaining to the Ontario secruity commission gets you “No jurisdiction”! Same for your Federal member of parliment! You are royally **ck!

The said bank, hiding behind Quebec laws, has just pulled the perfect crime! There are probably many more varations to this scheme of defrauding English Canadians than I outlined! What I suspect is at a later date someone in the said bank will then used the taxes taken from the esstate account to get a tax credit for themselves or someone in their family! Yes, the perfect crime! And all perfectly legal too!

Just remember “graft” is Quebec’s favorite indoor sport!

The lesson in all of this is make dam sure none of your or family’s financial assets are in a Quebec based financial institution, like National Bank , for example!

This is Canada’s dirty little secret which no one talks about! Don’t say that I didn’t warn you!

The above comment was meant as a reply to “Justme” way above!

The under-discussed question is WHOSE money is flowing into the Vancouver market? Wouldn’t legit money being made in Asia tend to be spent there to enjoy it? Spending “awkward” money (eg. bribes received for bypassing normal gov’t processes, illegal profits, etc) in its home country would risk discovery (public housing clerks shouldn’t own 3 Bentleys), so sneak the “proceeds” out.

From a land of a billion people, 0.005% (50,000) doing this just 1x each per year would cause staggering imbalances in Vancouver’s housing market. Could anything else cause the rapid price increases we have seen? Could recent measures for identification cause a slowdown in the influx of capital here and explain the retrenchments? And since there is no loyalty to Vancouver, if prices of these investments dropped further, could they trigger a fire sale of unimaginable magnitude? Wait for the answer.

Peter S., I think you have answered your own question as to “staggering imbalances in Vancouver’s housing market”. Vancouver has been flooded repeatedly by incoming tides of foreign money looking for a cheap, safe laundromat. Additionally, the attractiveness of personal residences as a tax haven is not to be underestimated in Canada, for in a high-taxation country, speculation in principal residences is one of few legal avenues to tax-free capital gains. That, coupled with Canadian tax authorities turning a blind eye to tax evasion on off-shore incomes, has made Canada a compelling destination for rich foreigners and their money.

Stopping a housing bubble before its too late is something that governments just don’t seem capable of doing. In the early stages everyone loves the bubble, and in the later stages no one wants to be blamed for pricking it. Banks create most of the new money necessary to keep the craze going, though admittedly cash buyers from out of country have contributed this time. At least the cash buyers can’t default.

Governments usually don’t even understand how the problem arises. Banks have to be closely regulated or they will create new money through lending too quickly. I think we may have once known this in Canada but forgot. It doesn’t help that mainstream neoclassical economists don’t even include private debt in their models, when it is often the single most important factor in how the economy is doing.

Don’t worry about Canada’s home prices. Even though falling home prices would be very beneficial to potential buyers, Canada’s Elite are responding to maintain or even further inflate house prices. Increasing immigration in perpetuity is Their magic elixir:

https://www.cbc.ca/news/politics/canada-immigration-increase-350000-1.4886546

It’s quite obvious that if real estate investors realized that the population of Canada were FALLING, and were going to continue to fall, this would be an unmitigated disaster to the Canadian housing industry and would cause house prices to drop precipitously.

But, again, don’t worry because the Elite are adjusting the immigration faucet to wide open. Other first world nations that have perpetual-growth-dependent economies are doing exactly the same.

Immigrants I know are poor with no money ,I highley doubt that Canada’s economy will continue to expand as the rest of the world is almost in collapse mode sometimes you have to look at the macroeconomics of the world and get out of this canada is the center of the universe mentality also canadians are 174% debt to income is almost a world champion at being in debt lol and lastly I get your thinking about the elites keeping housing elevated but trust me they would crash it so bad that they can buy it back for pennies on the dollar ,by the way this is not my opinion but economic history

I suspect you are heavily invested in realestate

Ishkabibble, Thanks for that. I wonder if some of this troublesome Populism in the world grows from the fact that the mainstream doesn’t have any long-term big-picture plan. Canadians must now rapidly SHRINK our effects on the planet to avoid climate change while simultaneously “competing” by GROWING as fast or faster than the rest of the world. We’re living a lie and many know it.

I can see having a policy of immigration sufficient to keep the country’s population constant. This would make Canada a much more interesting place, but I hate to see human populations increase anywhere. It seems that the peoples of the world are going to compete their way into a Hell of their own making.

– TERANET is “organized Real Estate”. Now that they no longer can hide the ugly truth (= falling real estate prices) they are going to publish the ugly facts.

The Australian real-estate bubble is bigger.