I’m in awe of how a tiny automaker with less than 1% global market share is a Supernatural Phenomenon and the 7th most valuable US stock.

By Wolf Richter for WOLF STREET.

Let’s get this straight: Tesla is led by a CEO who is regularly seen walking on water, and its shares are a supernatural phenomenon. Today, those shares, trading for the first time after the 5-for-1 split, surged from $442.61 at the open to $498.32 at the close and then on to $514.74 after-hours at the moment. That’s a 16.3% ride in one day, following weeks of supernatural moves into the heavens.

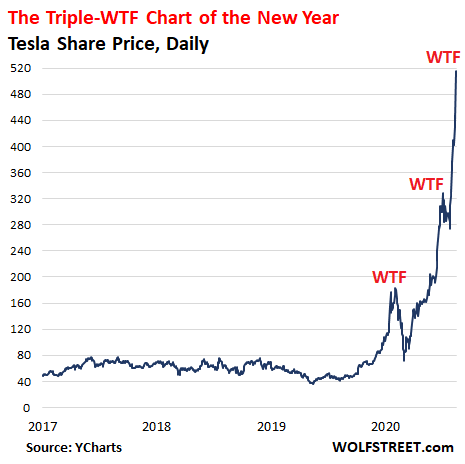

Below is my Triple-WTF Chart of the Year because it just blew away and annihilated my WTF-Chart of the Year of February 4 and my Double-WTF Chart of the Year of July 1 (stock prices via YCharts):

The stock split did the job, based on the logic that a five-dollar bill broken into five ones makes each of those ones suddenly worth $1.16 — or $1.87 if you start counting since the announcement of the split on August 11. I mean, it’s just pure supernatural, and if you don’t get it, too bad, it’s a sign that you just don’t have the right stuff.

Back on July 1, Tesla surpassed Toyota as the most valuable automaker in the world. At the time, Tesla traded at $226 a share ($1,130 pre-split). Since that propitious date two months ago, Tesla has skyrocketed another 127%.

At the time when it blew past Toyota, the value that the market put on Tesla (outstanding shares times share price) was $210 billion, which was – and I mean was – a huge number. Now, after-hours, Tesla’s market capitalization, according to YCharts, is $476 billion.

Today alone, Tesla’s market cap soared by $64 billion in eight hours, including after hours. That’s $8 billion in “value created” per hour.

If you have to ask, “value created by doing what,” then you don’t have the right stuff. Simple as that.

In the second quarter, Tesla’s total revenues were $6 billion, down by 5.8% from Q2 last year. Today, its value rose by $8 billion per hour. Over the past four quarters, Tesla’s total revenues were $26 billion. Today, its value rose by $64 billion.

Tesla’s shares are now valued at about 20 times annual revenues. You see what I mean? If you have to ask, you don’t have the right stuff.

In terms of market cap, this makes Tesla the seventh most valuable US company – not counting Alibaba. BABA is an ADR listed in the US, not a common stock; it represents a mailbox company in the Cayman Islands that has a contract with the Chinese company Alibaba.

So here are the seven US companies with the highest market capitalization:

- Apple $2.21 trillion

- Amazon: $1.73 trillion

- Microsoft: $$1.71 trillion

- Google: $1.11 trillion

- Facebook: $835 billion

- Berkshire Hathaway: $521 billion

- Tesla: $476 billion ?

I’m not going to even try to outline the factors that make Tesla’s stock a supernatural phenomenon – things like Tesla, the minuscule automaker with a global market share of less than 1%, isn’t actually an automaker with stagnant revenues in a long-term stagnant or declining industry, but a data company with a secret government contract to populate Mars or whatever. You just have to put your brain on Tesla Autopilot and believe in it.

Tesla’s share of the EV market in Germany plunged to 8.7% year-to-date, from 18.4% last year. Competition is now huge and across the spectrum. Tesla faces the same situation globally. Read… Tesla Gets Crushed in Germany by EVs from Volkswagen, Renault, and Hyundai Group: It Woke Up the Giants

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Next up.

Tesla crypto plus COVID vaccine.

Should be worth another doubling.

Bitcoin = Capital Flight I guess now its Tesla’s turn.

Pshhhh only a doubling?

It will end very, very badly.

For whom?

MB,

For those who believe that they can also walk on water.

That includes fund managers who might be managing your money.

Quite right. The US sharemarket is packed full of funds whose commission salesmen fund managers have put those funds into shares with no asset backing, extracted their commissions, certainly not put their own money into the same shares, and have carried on, and will carry on doing the same commission investments until they are found out and sacked some time in the future. They will then live quite happily with their commission money.

Wolf,

TSLA not a stock. It’s a cult.

What the Fed have wrought.

Powell is handcuffed and can only continue to print…until it explodes

Not for Elon, that’s for sure.

This market feels as if everyone at a coke party expects the cops to show up any minute now (i.e. Biden gets elected) so the attendees sniff as many lines as possible before the bust.

I have been reading Wolfstreet regularly for over a year now. I can’t tell you how many times I’ve seen the comment “this will not end well”…

And so far all I’ve seen it not end well for are the poor & working-class. I just read a story on NPR about a family that got evicted in Texas. They had to move to Florida to live with friends. They had applied for rental assistance & found out after they left that their landlord received the assistance money for back-rent & they legally could have stayed- but landlord failed to inform them of this. There was also an older lady in San Diego that took out all of her retirement savings to fund a move to a cheaper city, possibly to live with her 90yr old parents in a tiny house.

“You see what I mean? If you have to ask, you don’t have the right stuff.”

Thanks Wolf for keeping it real. ✊

Legally the landlord cannot rent that property if the tenant, or an agent of that tenant has paid the rent. They also cannot legally enter the unit to do repairs, or remodel. Collecting rent on a unit without a tenant is only a minor convenience.

I remember not all that long ago Tesla was selling in the 200’s (presplit) and I thought it the short of the lifetime. Fortunately I didn’t have the guts. On the other hand, for a lousy 200K then you would be a millionaire now….

Short now. For a lousy 200K now you will be Millionaire.

Interesting comment following the eviction comment. Unfortunately I don’t have a lousy 200k to “play” with.

The United States is going to implode any day now, and that will be a sight to see. A kind of suicide of greed, ignorance, and gluttony. I mistakenly thought the country was something we all now know it isn’t.

‘the value that the market put on TESLA’ .. has taken it to supernatural status .. The Money Spinner Possessed .. where is there an exorcist when you need one !!

What kind of money creates supernatural magic .. most certainly not hard earned dollars .. that’s for sure.

Has anyone noticed ??

Money has a supernatural energy all of its own .. poorly sourced & illegal money is allocated by forces beyond ones control .. no matter what you try to do with it .. it just fly’s out the door at anything & the fridge is always empty & you end up broke.

Weird or what !!

Nasty Business Practice.

Tax Deductible Loss .. can an investor / company claim its losses ??

“we earned too much this year .. we need to shed some skin .. give in friendship .. here Musky old mate”

Pulled up tulip bubble chart. Looks very similar to Tesla chart. Also pulled up Mississippi stock chart. That took a a while to collapse, but once it did, it was fast.

The logo on the front of the car will be changed from the flaming thumbtack to a tulip.

Yep. I’ve started re-reading Galbraith (“The Great Crash”) and Kindleberger (“Manias, Panics and Crashes”).

As Jdog and I were discussing yesterday – when the infinite printing press finally meets the unstoppable deflation, what happens?

Do you mean inflation?

It’s funny too that I just read an article how there is an EV car bubble in China. You don’t ever want to compete with the Chinese in a category because their goal is not about getting a return on capital. If they want to be in a sector, they will over build it like steel production and the world will end up with twice too much capacity. The US will probably block Chinese cars like they did with Chinese steel, but I predict over capacity just like Chinese solar panels.

If there is a glut of Chinese made solar panels in the USA, why are systems so expensive there?

The electric utilities lobby to keep solar out of their service areas or to tax it to make it noncompetitive. I lived in Florida “The Sunshine State” where solar was effectively banned by regulation. The regulation stranglehold there started to lift only a few years ago.

Solar panels are expensive because the process to make a high-quality solar panel is very energy intensive. Except for limited applications, they make no economic sense. That’s the reason for all the tax and regulatory schemes.

Mono Crystal,

Solar panels have gotten a LOT cheaper to manufacture and are no longer that expensive. But you have to buy a whole system, integrate it into your electrical system and the grid, and install it on your roof, and in some cases there are duties to pay — and that makes it a big ticket item.

Not an expert, but there are anti dumping tariffs on Chinese solar panels some over 150% depending on type.

For Petunia: My daughter is utility engineer that used to be main engineer for solar installations in Delaware and part of Maryland. Utilities are currently designed to send electricity in one direction. Once you want to connect grid with solar and send back electricity there is an engineering cost and equipment cost to be able to handle it. It’s up to the utility commission to determine if those costs are going to be born by end user or socialized to all rate payers. Usually the person that sells the solar system doesn’t tell the end user that the utility is not ready to just hook him up and end user gets stuck in the middle waiting for utility to design grid to handle system.

China is one big state sponsored business masquerading as a nation. The communist government is the founder, CEO and board of directors.

And the executives of American companies moved all their manufacturing there to allow them to build an entire infrastucture and ecosystem to produce for the world. And the dumb shits are left with companies like tesla and the “economy”, “structural advantage”, and “innovative thinking” that tesla represents. i.e a ponzi scheme.

Stupid fuckers got what they deserved. Their heads will be on stakes soon.

That’s what people been saying does years but until it crashes the Tesla train keeps going longer than the energizer bunny.

Absolutely insane. Impossible to explain the voodoo going on with this stock. I’d like to say it will end in a trail of tears when the bubble bursts, but something tells me this stock will be back over $1000 per share before you know it.

Yeah- there is no reason to not expect the split stock to just go back to the price it had per share just last Friday.

It’s $2500+ in pre-split terms.

Robinhood traders will pay $1000 in a blink, and think they got great deal.

I remember some analysts calling the top in the tech bubble when Tesla hit $1,000 pre-split. Printed money means no true price recovery.

I think the stock is dynamite with so many people trying to make money. All you need is price movement and the gamblers are all over it with all kind of fancy strategies. If retail would just take their profits and walk away it would work out, but probably the professional best will take the money from the dumbest by the time it’s all over.

I like to read the Tesla community board. Got all the signs of a mania with people bragging about being able to retire early because of Tesla.

I met a young guy last year who had put all his money in Tesla and literally told me he expected to retire on it. He didn’t seem very financially literate, so I warned him not to put all his eggs in this one shaky basket.

Well, the guy has probably retired now. I’m such a fool! :(

Reminds me of all the Enron secretaries and clerical support staffs who were all planning to retire as millionaires because their 401k’s being fully invested in Enron stock. I predict Musk will meet the same fate as Cliff Baxter.

There is literally 100% certainty that Tesla will be worth less than 50 billion dollars at some point in the future (and I personally think the stock will sink far further than that), but there is nothing that says it can’t be worth $5 trillion dollars in the next year.

I think you have to be a fool to short this stock right now. You can’t even really buy the puts at this point with the premiums on them so high. I think, just stay away.

Musk is a high risk taker and in my opinion is not fit to be a CEO. A CEO tries to protect stock holders from getting wiped out. He has rolled the dice a few times and dodged a bullet each time. Eventually you most likely will get caught without sufficient cash to survive and stock holders get wiped out and someone else ends up with the company. CEO with big egos have killed a lot of companies.

Not quite – if you don’t now what the dollar will be worth, you can’t say how many dollars Tesla will be worth.

I think the thing to look for will be Tesla using the stock to buy a major car company. That might be the signal to start shorting.

Yes let’s wait for merger/acquisition while sock is on a parabolic run.

Anyone remember when Porsche was going to buy Volkswagen?

AOL Time Warner v2.0

Yes!

How about Ferrari?

They’re apparently worth more than Ford.

What place did they finish in the F!?

could argue that going electric will kill cars like those Ferrari makes but it is not really a car company. They likely make more with selling caps & Jackets than cars

Theres more to a ultra-luxury car than a drive train, and Ferrari is pretty good at those other parts. They could show Tesla a thing or two in the $100k+ market segment, which Tesla has quite a presence in.

Plus, just imagine the spectacle.

Major car companies that are not state owned (Renault and Volkswagen) or National owned (Toyota, Hyundai/Kia and likely Nissan, BMW, Mercedes). Going bankrupt anyway (FIAT) or owned by the Chinese (Volvo).

That only leaves Ford, GM and Mazda. All with its own problems.

My expectation is that Tesla will take over an electricity company instead of a car company. And if they take over something car related that it will be something like Denso. Tesla seems to like vertical integration.

Bought one testing Tesla put few months out; waited for after-split options. This thing is going vertical, but can’t tell till you bet.

On another note Nasdaq is trading 4 standard deviations from 200-week moving average (per Lance Roberts). Which is like writing on the wall.

So I keep coming back to this question — with interest rates at zero and market psychology convinced Fed will do whatever it must to keep the bubble growing, what possible catalyst is there for a correction?

It’s not Covid – people don’t care anymore and will just let people die … or they will authorize a vaccine and market won’t care if it works or people actually take it.

Election chaos? Maybe. But then we come back to the Fed put.

Any possibilities I am missing?

All kinds of possible catalysts. When a stock has gone THIS vertical, it doesn’t take much for the balloon to burst.

The chart is so vertical it’s almost turning left :)

This. If there’s one thing that signals the end of a bubble, it’s the near-vertical shape of the share price.

For sure C Bern,

I would be selling shares today, but what do I know? One day the buying stops though, always has and always will. It will be very interesting from the sidelines.

No way of knowing. But why does it matter what the catalist is. We may not know even after the fact. Maybe just a critical mass of doubters one fine day.

My guess is when it crashes, that’s when people go to jail. Nobody cares as long as the fantasy rolls in.

Skara, it’ll be the belief that the Fed has lost control of interest rates. In March, the “Fed put” stopped working, as people no longer had confidence that the Fed could fix everything. They lowered rates, and the market continued to plunge.

The Fed managed to reinflate the bubble by instilling confidence that the Fed will do whatever it takes, as you said. But ultimately, the market sets rates, not the Fed. If the Fed loses control, and rates start climbing, then the idea that the Fed is bigger than the markets disintegrates. At that point, there’ll be a mad rush to the exits.

Thank you for the feedback – that makes a lot of sense.

So what will it take for the market to send rates higher – continued decline in dollar? Would that not just trigger “yield curve control” and then we are right back to invincible Fed Put?

Basically, if the Fed announces it will let inflation go crazy, who will pay .7% for a ten year bond? That’s why we’ve already seen yields increase somewhat.

One candidate for catalyzing a selloff would be recurrence of the Sep. 2019 ‘Repo-Madness’. Afaik, that surprised everyone & was widely felt immediately.

My second candidate would be numerous downgrades of BBB-rated bonds currently owned by investment grade bond funds that would have to be sold if downgraded one notch to BB.

My religion holds that major selloffs are sparked by an inability to roll over / refinance debt.

Of course the Fed, like god, can ‘save’ anybody — as long as the USD retains its status as the world’s reserve currency, that is, as long as people retain faith in god.

As long as faith is sustained, major selloffs will not be permitted. We will remain, as Matthew Arnold wrote in 1852:

Wandering between two worlds, one dead

The other powerless to be born.

“Wandering between two worlds, one dead

The other powerless to be born.”

Well done. A well-stocked bookshelf lends many a helping hand.

Time me for me to quote the late great John Prine:

We are living in the future

I’ll tell you how I know

I read it in the paper

Fifteen years ago

We’re all driving rocket ships

And talking with our minds

And wearing turquoise jewelry

And standing in soup lines

We are standing in soup lines

Herb Stein.

Look, Congress spent 7 trillion this year to keep it going on I guess about 3 trillion in revenues. The USA got poorer this year we just haven’t felt it yet. If the virus isn’t over and done by this time next year its going to be pretty obvious the government and Fed has spent us into disaster.

Old School,

Unless the virus simply replicates itself benign, it won’t happen. The US has a strong anti-science and anti-vaxer contingency. 40% are stating they will not get the vaccine when available.

Can’t fix stupid. Mind you, this is a natural result of politics infecting everything. Is there a cure for that?

So Paulo, become a volunteer and take that Darpa funded vaccine .. Come on, you first! Then tell us how you Really feel.

‘;]

The anti-vaxxers are not entirely wrong to be mistrustful of “shiny new” medical stuff.

It’s a pity that activists have made science political (on the one hand), and corporatists have overrun medicine (on the other). Universities are now both political and also overly dependent on federal funding. So too many people have too much profit potential to be trustworthy.

It’s well known that a large fraction (think “about half”) of “scientific” papers – even peer-reviewed ones – are not reproducible. Many also or otherwise hide blatant conflicts of interest which make the results questionable.

The best science is economically and politically disinterested in the consequences. To get back to that, we have to rework the incentive and reward structures. It’s better to have a smaller body of highly reliable results than a large body of stuff that’s over 50% misleading crap.

@Wisdom Seeker

It is some of the social sciences that has a problem with reproducible. The hard sciences don’t have that problem

@Char: Incorrect.

Biomedical has a HUGE problem in this area. All sorts of stuff written on this over past 5 years.

Even particle physics has shifted from a “3-sigma” requirement for a result to be considered significant, over to a “5-sigma” standard.

Overrating the Fed is your first mistake. The Fed can’t do squat. It doesn’t create money, nor distribute it. When confidence is gone, prices plunge.

Exactly. All the Fed has really done over the past four months is jawbone. It’s worked for now.

Bobby: The Fed has a (very) big balance sheet with which it buys up debt that others have spent into existence.

Without the Fed’s rug to sweep it under, that debt would have to find a home in the private sector, and the house o’ cards would indeed fall. Pronto.

That is a very big “squat”!

Yeah, but the only real debt it has bought is stuff guaranteed by the U.S. anyway (tbills and MBS). The rest of it was so minimal as to only really be jawboning.

Hey Polecat,

I’ll take a vaccine recommended by Canada Health or BC’s Dr Bonnie Henry. No problemo.

Well, Paulo .. there’s your out .. but you knew that when you made your comment, didn’t you.

The nature of the catalyst is impossible to predict. Anyone think in advance of Coronavirus?

People eventually recover their senses and realize that Tesla can’t be worth more than every other business in the history of human enterprise combined.

Flying to the haven, but will end up in the hell

It’s sad seeing Google losing its luster. I mean Apple has the cool factor, but like seriously?

Google was great as a search company that saved you time finding information you needed.

Google as an advertising and personal-data behemoth is just frightening.

Wolf. I don’t know, that second dip was actually pretty minor compared to the one that went from 800 to 400; the second one was like 1700 to 1300, not even enough to bat an eye at.

Seriously, at this point, buying Ford would be pointless. Elon should be announcing the electric passenger jet next. Ha ha ha ha.

SO, here is one… what do you get when you split one turd into five smaller turd. According to Wall Street, you end up with a magical eight smaller pieces of turd.

Congratulations to anyone here who is holding that stuff. You guys are f***ing brilliant. The only question is how much to take off the table before the last greater fool.

I think a leveraged buyout of Berkshire is in order. Followed by Facebook. The crazy thing is of the top seven, only Berkshire isn’t a tech company… by virtue of the business they own.

Wolf, you need to IPO Wolfstreet, show user growth via comment section over the last 5 years, and explain your plan to monetize the users, and you too, and then you can start writing about yourself.

:)

Pretty soon the market cap will be more than the annual GDP of Australia……………

“only Berkshire isn’t a tech company”

Actually, it almost is. About half of their current portfolio value is Apple stock!

I am going to say if Apple goes much higher Buffet will sell. He basically in low interest rate environment will pay up to about 20 PE for a good company and hold, but if Apple gets to a PE of 45 or so I think he will sell as the numbers don’t work anymore.

Tesla is about to become a self-fulfilling prophecy. If the stock is that valuable, they now have nearly unlimited access to capital for the price of printing stock certificates.

Musk has very clearly demonstrated that he knows how to apply capital.

Additionally, the transportation industry is on the cusp of major consolidation and re-design. How we transport people and things is going to change a great deal in the next decade. Tesla now has access to the capital required to re-fit that industry.

Futhermore, most of the existing installed capital in the transportation business is outdated, nearly obsolete…at the end of its of technical lifecycle.

If you’ve ever wondered why all these companies, like Boeing and Hertz and ToysRUs and Sears were hollowed out and sold to greater fools, now you know: the underlying business model and all the capital applied to that model was stranded. Dead (technical) man walking.

Tesla will not buy Ford. Why would they? What does Ford have that Tesla needs? Possibly a dealer network, but dealers can be a real pain for a manufacturer. They have opinions, and they own the customer relationship.

Tesla wants to own the customer relationship. Musk is a very smart guy.

How long have we been hearing about self driving cars now. Why hasn’t it happened?

Weren’t we supposed to be working 10 hours a week as well, and what ever happened to flying cars?

Not convinced by your wishful thinking Tom.

Hello Matthew:

My guess is that we’ve been hearing about self-driving cars for about a decade.

The fact that they’re even being tested, and are on the road is incredible to me. I have a little bit of an idea of how tough that set of problems – and they’re legion – are to overcome.

Just to poke the beehive a little: we’ve been hearing about humans traveling to Mars for many decades. And yet…it ain’t happened yet!

Phony prognosticators selling silly dreams, or … the problem is very tough, and we humans have to grow into it.

Which one?

About the 10 hours a week: that could happen right now; automation has eliminated a great deal of work. But, our std of living increased, so we want more, and the benefits of automation are being captured by a relative few. That’s one big reason our economy is struggling so.

We could probably have a 20-hour a week economy right now if we wanted to. Food, shelter, water – the basics are really efficiently produced….so I don’t think that’s too far off the mark.

Berkshire is mostly an investment fund so not even a company

I do not understand what the article is complaining about.

Is not Wayfair even more expensive ?

Rcohn,

The article isn’t “complaining about” anything. It’s in “in awe of how a tiny automaker with less than 1% global market share is a Supernatural Phenomenon and the 7th most valuable US stock.”

Wayfair market cap $29.2B

Shopify market cap $136B

(what does shopify do again?)

Shopify is like Amazon, but you can get in early. That’s all one needs to know really. In a bull market.

Did anyone see the Neurolink pig reveal? Truth is stranger than fiction.

Elon Musk has hyped some stupid looking stuff to me: the boring concept, the stainless steel ugly truck and the three pics. I am hoping the pig marks the top. It would be a good photo of a capitalist pig with Elon’s faced super imposed on pig with computer chip.

Perhaps Elon has been doing some late-night reading .. channeling Margaret Atwood.

“pigoons”

Retail investors are turning blue for Elon.

SEC isn’t the only entity interested in such a thing.

Tesla is a lot more profitable than you think – shorting it is like shorting Los Pollos Hermanos from Breaking Bad.

This whistleblower account is quite phenomenal if you haven’t heard it.

To what whistleblower account are you referring?

I deleted the link. You can try to google it.

Again a brilliant article.

Practically perfect Fibonacci series. Almost there.

I think I can smell Tesla Tulips.

Just make sure they aren’t on your grave.

Humm .. black tulips ….

What a massive Ghucing tulip bubble.

Wait until FB hits 1T.

It is a royal flush.

Then, everything is flushed down into toilet.

If you’re thinking WTF, can you imagine what Uncle Warren is thinking? I’ve been investing for 70 years, and I’m surpassed by a guy with a 5:1 vaporware/product ratio.

It’s kind of funny that Buffet uses the analogy that market is a manic depressive person and if you believe reports Musk is bipolar. Buffets struggling to find much to buy in the USA as prices are high. Buying goldminers and Japanese stocks tells you current USA market can’t be justified by fundamental analysis.

Billions more than TSMC… that is nuts.

Tesla is so emblematic of 2020. Facts? Reason? Why waste brain cells on that when I can believe *my own* facts, or the bigger, better facts of this really loud person in my feed.

Some day, if the human race somehow makes it, students will be reading that Tesla chart under the “Disinformation Era” section.

I would be for government to add one tax to raise money and that is 50% tax on any trade that isn’t held for at least one week. No reason to treat the capital markets like a casino.

@ Old School,

Generally I like your idea. Puts, shorts, and all that betting should also be across the street at the “financial casino”, where only bets are placed on reported numbers and no stocks, bonds, or other financial instruments are bought or sold. No reason to distort financial prices of buying and selling with strict gambling on numbers.

Agreed. HFT and algo trading adds no value to society, IMO

Thanks Wolf, good article. Crazy days indeed. I’m old enough to remember the last Dot Com bubble and it is Deja Vu all over again:

– Companies with practically no earnings (like Tesla) is valued at extreme levels. The P/E ratio of Tesla is now at 1300, making all traditional metrics for valuation completely meaningless. Sounds like a lot of the other companies back then (Global Crossing, WorldCom, QualComm, Enron etc) that were all “disrupting” utility type industries with shy high P/E ratios.

– Established investors like Warren Buffett had no clue of what was going on and sat on the sidelines, often jeered by the younger crowd as being out of touch. Sounds like Warren today

– A lot of talk about a New Economy and things “being different this time”, a classical prelude to disaster. All projections are of the hockeystick type with the future being very bright. Sounds like the forecast numbers for the disrupting App industry

– In 1999 both higher stock prices and confidence that companies would turn future profits made investors willing to overlook traditional metrics, such as P/E, and base confidence on technological advancements, leading to a stock market bubble. Sounds like every Unicorn IPO out there today.

– Between 1995 and 2000, the Nasdaq Composite stock market index rose 400% reaching a P/E ratio of 200. That ended in disaster. Today we “only” have a P/E ratio of 30 for Nasdaq so plenty of room to go…

– In 1999, shares of Qualcomm rose in value by 2,619%, 12 other large-cap stocks each rose over 1,000% in value, and seven additional large-cap stocks each rose over 900% in value. The Tesla of the day. Where are they now?

– The Nasdaq Composite rose 85.6% and the S&P 500 Index rose 19.5% in 1999, but more stocks fell than rose in value as investors sold slow stocks to invest in Internet stocks. Sounds like today where the FAANG stocks are outperforming every other stock and the “strength” of the market being concentrated in fewer and fewer stocks.

– The market cap of Apple is today higher than the market cap of all shares on Russell 2000. Compared to 12 months ago stocks like Amazon, Apple and Netflix are all up 80% or more. This period includes the Covid dip which is now completely forgotten. At the height of the Dot Com bubble we had among the top ten most valuable companies names like Cisco, Exxon, NTT, Lucent and Nokia. Times they do change….

– An unprecedented amount of personal investing occurred during the Dot Com boom and stories of people quitting their jobs to trade stocks were common. The daytrader was born! The news media took advantage of the public’s desire to invest in stocks and reported on the market with the same level of suspense as the broadcasting of sports events (CNBC!!!!). Sounds familiar? RobinHood trading springs to mind with Millenials blowing unemployment money buying worthless stock whilst giving each other hot tips on YouTube and Instagram.

Back then the triggers to collapse the Bubble included the end of Y2K spending (remember that hype?), collapse in companies like WorldCom and Enron, raised interest rates, Japanese recession etc. At the bottom in 2002 the Nasdaq had lost close to 80% of its value from the peak.

Some other trigger will come along this time (perhaps a Chinese bank meltdown? Another accounting scandal in a major US company? Italy defaulting on debt? Chinese aggression? A US / Iran war?). I find reading the book Extraordinary Popular Delusions and the Madness of Crowds to be refreshing. It shows that the nature of greed and creating bubbles is nothing new and that they all end poorly.

I wish you all the best in riding the upcoming waves. In the words of Hill Street Blues “Let’s be careful out there”.

Smart man Wolf, not trying to explain away how this stock is a ‘WTF’ phenomenon and how much WTF this specific WTF stock is. The fanboys can’t be reasoned with. All you can do is just point to it and laugh, some at your own missing out on the $$$ and some on the geniuses trying to justify the price.

Ford Mustang Mach-e

Nissan Ariya

VW ID.4

Cadillac Lyriq

…

Compelling product from the competition IS coming.

Moreover, given we are still about 5 years away from EV to ICE price parity there is still plenty of time for various players to perfect their offerings.

Tesla WILL come back down to Earth someday but will it will crash or soft-land? Unfortunately no one knows.

Crash.

Company or stock. Stock is so overvalued that only a dollar crash can save it.

What’s the danger..didn’t Uncle Walt build an entire empire on a cartoon mouse? Don’t new generations of the public throw insane money at tickets to see animated garbage? Why should this comic book storyline not end up as the decade’s blockbuster event? To the moon Alice! To Mars Mr. T!! To infinity and beyond!!! I’m out of popcorn, any bonbons left?

Here is the thing. The Fed had helped blow the bubble where many are fooled into feeling rich. It’s not real. Prosperity has been brought forward, but economy is so leveraged up that growth is going to be slow and we are at risk of systemic problem at any moment. For the individual, try to be prudent and not give in to the hype. The Fed never rings a bell at the top.

Meanwhile, the biosphere dies a little more each day …

and us with it!

But go ahead .. ‘invest’ • gamble • throw some more snake-eyes.

It’s ALL Good, right?

“sigh”

yes, the planet got destroyed. but for a beautiful moment in time we created a lot of value for shareholders.

h/t: unamused

Okay. Maybe the Earth is going to be destroyed in six months and Musk has almost completed his escape ship to Mars. So the spikes in Tesla stock value, are the rich, buying their tickets to escape doomed Earth.

Packing the oligarchs into a rocket and blasting them into space might be the only thing that saves the earth at this point.

Elon will soon have those skull implants ready (watch the rather creepy video with the happy implanted piggy) he’ll plug us in and everyone will believe. No dissent, perfect happiness for all.

It’ll end when Musk does a McClendon in one of his own Teslas, and not before.

I haven’t had the “right stuff ” for years now! If you want to have some fun play the Tesla weeklies. Better than Vegas .

But Wolf, is Tesla not just the poster child? How is it that stocks around the world are floating on air whle the economies in which they supposedly live are hammered day after day. Trade has tanked.

The whole financial sector has divorced itself from the rest of us. The banks almost force the money into the hands of the corporations, but the only thing they can think to do with it is to buy back their own stock.

As you have written before, the fire hose of purchases from the Fed, not the economy nor any business model, is dominant. A strange time to be alive. A few thousand people are getting incredibly rich, at a cost that could be existential.

Nothing ever happens to the rich, they might loose a bit of their billions or millions, but thats part of the game. The poor and middle class are the ones that suffer, this will wont change. What is amazing to me is the disconnect and distance that has been created between the rich and the rest. I keep thinking that the end game is something like the movie Elysium, sad.

This isn’t factual. The very rich can and do regularly lose everything, leverage is the key determinant. Plenty of examples. Same for working class, many many people work their way up, but those who overleverage are at risk.

The working class can be whipped out without any fault of their own and without ant leverage.

Robinhood’s partying like its 1999. The only way it ends is with an unexpected spike in inflation, constraining the Fed from blowing bubbles. DXY sitting at 91.82, would hit resistance at 89. If it drops below that look out below.

Don’t know about how or when it will end, but the Fed hasn’t overcame people’s instinct to save themselves by getting out the door before getting consumed.

I am wondering if Tesla’s car business is just a front for all the imaginative

inventions in the works. It seems reasonable, that if we are looking at nearly free HVAC systems, million mile batteries, regularly scheduled spaceship travel and/or 2 hour supersonic travel to Bangkok, and neuralink which will cure a lot of aging and otherwise diseases, Tesla is seriously under priced. I don’t own any, and it does look bubbly, but maybe we will kick ourselves that we didn’t buy shares at the current price. The robinhood kids might be on the right side. In any case, I wish them the best. Wealth has an important property of softening the attitudes toward warfare and revolution.

Don’t you know about the hypersonic loop Elon Musk was proposing? Ninety minutes from New York to Paris, undersea by rail. (Or was that Donald Fagen?)

True Story Time.

I watched .. The Fall Of Civilisation .. Easter Island .. Youtube.

When asked ‘how did your ancestor get these stone statues down the hill & into position?’

‘They walked them.’

With ropes in 3 positions they rocked the 4 – 6 story rock carvings down the hill & into place.

Nicola Tesla .. “If you want to find the secrets of the universe .. think in terms of energy .. frequency & vibration. The scientists of today think deeply instead of clearly. One must be sane to think clearly but one can think deeply & be quite insane.”

We are connected to the conscious intelligence of the universe .. in deep conscious form .. we can connect to the energy .. intelligence & memory of the universe .. to make the impossible happen .. magic .. after all aren’t we told that we are created in the image of God.

This begs the question Wolf…..do you own any individual shares fo Tesla?

Nope.

But I admire the guy. For example, this morning, Tesla sold $5 billion in new shares to besotted investors at this besotted valuation. As long as there is demand for these shares at these ridiculous prices, Tesla should just sell shares instead of cars. Would be a lot easier and a lot more profitable than trying to make it in the car business.

It’s amazing how he has got these people – from Robinhood stock jockeys to Wall Street and regulators – wrapped by hook or crook around his little finger. That’s his true genius.

It’s the smart thing to do. Musk should issue even more stock if the price holds. This is real hard cash. he can buy something valuable with that.

Shareholders get diluted even more, although $5 is only 1% of market cap and the P/E was already 1300, so it doesn’t really matter.

Alice in Wonderland all over again.

I think the word ‘crook’ alone is doing a whole lot of work in that statement of your’s ..

Wolf,

Do you have a ready comparison of Tesla daily sock trading volumes vs other stock volumes?

Could Tesla be the most liquid stock asset in the world?

If yes, it could explain its attractiveness.

Tesla shares as the new reserve currency?

Hilarious, 60 barrels of oil for 1 TSLA, 1.3 oz of gold for 1 TSLA share.

Not reserve *currency*.

Reserve stock.

Why not?

Today’s $5 billion At Market Stock Offering is like a kind of QE :)

Musk just printing stock and selling it for hard cash, which can be used to buy valuable real assets.

It’s genius and power. It just makes you wonder who are the suckers buying this.

Engin-ear,

It’s one of the least liquid stocks — and that explains part of it. A big part of Tesla stock is held by institutions that have had it from the beginning, and by Musk himself, and they’re not selling. The float is small.

And that’s also why the stock plunges so much when the selling starts.

There you have it, it’s all about supply and demand. No supply, insane demand. So, we might find Musk under a freeway one day, but he’ll still be one of the richest people around because he is refusing to sell even one share. That would be so weird.

At least now, he doesn’t have to crash at the Google bros apartment in Palo Alto when he is in the bay area, he is richer than them, and can afford a studio or something.

Isn’t that true for the entire market at this point? Volume has looked low last few times I’ve checked.

As Old School observed above, this seems to be a classic ‘tulip mania.’

And as Max Power wrote, there are quite a few competent competitors coming on the market soon. This will prove to be challenging for Tesla, but Musk had to have anticipated this a decade ago.

Did Musk just roll the dice when he started Tesla, or was his real plan simply to become filthy rich and then sell the company? Or does he have another trick up his sleeve?

I don’t know if Tesla is all about hysteria or if it’s legit, but the car magazines all seem to find the products compelling.

With a TSLA P/E ratio of about 1290, they may party like its 1999.

Earnings yield: 0.08%

still better than a savings account

Not FDIC insured. May lose value. If it lasts longer than 4 hours contact your doctor.

To understand Tesla you have to realize that it is more like a religious cult than a business. Elon reminds me of the Bhagwan Shree Rajneesh and his cult in Oregon in the 80’s. Gullible people from all over gave him all their money and moved in to cabins on his commune just to be near him. But all at once it came to a bitter end and all the followers worldly possessions were gone in a patch of dust and tumbleweeds.

Seneca.

How about Jim Jones? That movement coined the term kool-aid drinkers. Some people need to be followers, nay, yearn to follow. I always remember the kids in pink robes handing out flowers. Religious groups swaying together on tv. Weird stuff, imho.

Oh well, the World is a mysterious place. The hive calleth…time for breakfast.

A cult indeed. But at the risk of alienating some of the more religious here, I can think of a few cults that have had amazing staying power. Thousands of years in fact. Welcome to the future.

Of course, the old guy in me still screams crash ahead. That voice is getting incredibly hoarse.

SC,

They are only gullible if the people who’ve transited through the stock hadn’t made a fortune already or haven’t covered their base.

The doco is great on this cult, they accomplish some amazing feats building an entire town from scratch, including air field/mini air line. Was intriguing to see what can be done when people actually want to be at work/believe in the cause.

With growth dying, both creditor and debtor are both up to their ends with debt to keep consumption going. Scientism can only go so far. Only so much product can be mustered at once. Eventually growth stalls. 2000 was really a inflection point.

The end result is mass murder and tribalistic orgies. People like Elon Musk won’t be wanted or tolerated.

When interest rates are zero asset evaluations become folly.

Tesla is now “too big to fail”. Even if the stock were to crash the Gov’t would bail it out. There’s absolutely no way this company will be allowed to go bankrupt.

It would have buyers.

It was a “pre” bailout by Obama. Carbon credits.

Can’t someone encase Musk in Carbonite, and be done with it?

He has that static grimace thing down.

In this case we might need Carbomite…just as threatening but entirely non-existent (Kirk trumps everybody in bluffing).

Tesla’s float isn’t that large and that is what is important so no need to safe it. Also the stock is so overvalued that the stock can crash while the company is doing great

Good article… remember that it is Tesssssla.

Where is Wewok when we need even more humor. Thankfully 2021 is fast approaching and everything will be back to normal ??

And the BIG news re: Tesla…in the most discerning car market in the world, Germany. Tesla is running WAY behind the VW Group in July registrations. Something like 30 % VW against 9% Tesla which is also way behind Renault. And..the bumpers don’t fall off!

The only ‘lead’ Tesla has is this ‘self- driving’ bit and it’s now against the law in Germany to advertise a car as self- driving.

Every market craze has historians wondering: what was the pin that burst the bubble? I think when the Tesla phenom meets reality, it may be that pin for the entire market or at least that part of it with PE ratios in the hundreds.

PS: Tesla PE: 1297: 1

To pretend to ‘justify’ this absurdity, you need to invent a parallel universe where Elon has just discovered the electric motor and the Li battery and has a number of patents preventing anyone from entering the business.

Tesla earnings yield: 0.08%

The last argument i had with a TSLA believer – their justification was that Tesla was going to become an automotive monopoly (lol)

This is what happens when you have too many billionaires who can ride the ponzi forever and if they lose, so what?

When it all crashes down, Musk will scramble off to Israel to avoid extradition like WeWork’s Adam Neuman. Johannesburg is not too cool these days.

New Zealand is today’s most preferred destination for billionaires. Peter Thiel, Musk’s old buddy from Paypal already has a place there.

Tesla will be propped up for a long time by the fed because it has perfected something that both the auto industry and the fed need, ultimate planned obsolescence. The industry is in trouble because cars last too long. The causes weak sales and prevents the Fed from dumping infinite money in to auto finance. But Tesla’s brilliant A.I. lets them retire cars at an early age. Sometimes by spontaneous fire, others by a sudden stop in the back of a fire truck. The former is better as the fan boi can clean up the mess and buy a new one with the insurance proceeds.

Bring back the Ford pinto.

With autopilot!

Tesla is no more than a ponzi scheme fuel by Chinese money. Look when the ascent started..after Musk’s little sojourn to Shanghai. Its chart looks a lot like WAFU, DUO, JFIN, etc. except instead of ensnaring the pikers, it’s going to do a lot more collateral damage.

As we used to say at CR- this is going to leave a big mark- actually more like a smoking crater.

But hey, enjoy the ride, the epic Hangover trip to Mars is going to be EPIC.

In short, A huge number of small inwestors are about to find out about leverage, again, the hard way.

Plus ca change.

After one tech bubble, a housing bubble, commercial property mall bubble, a solar panel bubble, and now an electric car bubble, I guess my capacity is shorted out for folly.

In short, peak asset prices folks. Followed by a long slow slide to be Japan. The irony of Warren B buying stock in Japan should be funny- but he sees companies selling for below book value.

For the US that would be stock market down 20X. Dow 29k, and then the big sleep? I dunno.

The really funny question is who are the boomers going to sell their stuff to? A bunch of broke ass Gen X and minimalist Millennials?

Income is going to be king, and value is, as usual, a fragile consensus.

Everybody keeps worrying about the Fed- worry about the unemployment cascade effects. Right now used car prices are high, but if cars start going repo….then we get a correction, again.

Ugh. Again. Glad I have so much less invested emotionally in this round.

Political paralysis will build a bigger crisis. In short, we face the 1933 Hundred Days issue. It will be chaotic.

It works like this:

Elon Musk, Tesla

Henry Ford, Ford

I explained this on a Bear forum 2-1/2 years ago, the moment the Mars rocket opened to show a mannequin behind the wheel…. and it nearly cost me my life.

With Tesla, you are buying an inverted or interceded Ford, the energy dominating the next 30 years. Ford, during his day, took care of your physical development. With Tesla, the realm beyond your capability to see is revealed.

Elon finally did it! He figured out how to get his cult to remotely smoke the weed he is holding! :)

Wolf – you would have been in awe of the tulip bulb salesman or John Law. Now John Law, I too am in awe of him. How he did it with a straight face is boggling.

Lot of cult like negativity here. I think the fundamental game changing intersection of business models must elude you. I also assume there is a lot of climate denial in the crowd. Not sure why people spend so much energy trying to tear down the future but so be it. Look upon your investing death.. holding onto the models of the past will not protect you.

Agree, don’t fight the last war, but it is so important who you put your trust in. Hint: not everyone is telling the truth. Do your due diligence.

The skeptics are talking about T’s valuation. No comment I saw was against EV’s. There is no company so good it can’t be overvalued.

We learned years ago that adding stock to the float is not dilutive, and reduces share price volatility. We also know that a company buying back shares, causes the share price to rise, and increases market cap. The only thing we don’t know, can a company issue new stock and buy it back at the same time? If both activities result in higher share prices, the answer is yes. Shareholders extract wealth, the company builds wealth, and business revenues barely pay the interest on the debt. Musk is building the Buck Rogers future car. Apple built the Dick Tracy wrist radio. I don’t know anyone who can use one of these things. Is yesterdays future going to align with today’s present. Since the Federal Reserve still writes papers about the 1930’s, I think it could all work.

Sure. The cult of PROGRESS .. forever upward, forever good .. right?

without any negative externalities or knock-on effects – just wave after wave of unicorn$ and $kittles …

Delusional is what comes to my mind’s eye.

Just read your wtf chart tesla article.

The part you don’t mention is that this rise is based on the idea that Tesla will be admitted to the S&P & ETFs (read: America’s retirement funds) will be required to buy Tesla. After which the stock will be free to fall to it’s natural valuation of about 5% of whatever the price is at inclusion.

Doesn’t this strike you as plain & simple theft by some big player? Either some whales or Tesla themselves or combination? I suppose it’s everyone acting on that idea together.

Just that the root of that idea seems so evil. However, it’s hard to complain about it as its so fundamental to how the market works.

Hadn’t thought of that play. Big dogs, pumping and dumping to get this stock to the sucker of last resort – pension funds.

Makes sense for the relentless run-up. Question is timing on this? Out before the ink is dry? If word leaks, panic could shut down the whole Nasdaq

Do they do enough business to qualify?

Two rules for investing

1. Don’t fight the fed

2. Don’t bet against Elon

For some reason, people here continue to break both of these rules on a daily basis.

I’m old enough to remember when Americans used to cheer when American companies succeeded. Especially tech companies. Now a large segment of Americans wish for American tech companies to crash and burn, because they missed out on investing early. That’s really not cool.

I also am old enough to remember when Americans used to have the most prosperous capitalist society on Earth, and good companies and investors were rewarded and bad ones went bankrupt.

That’s the reason we want them to crash. Not because we “missed out” (I have AAPL and a small amount of TSLA in my portfolio), but because we want stability going forward.

So pointing out that a PE of 1200 + is overpriced is unpatriotic?

When GM did well, American workers did well. The reality is you can afford one of these things, and the people who work making them in China cannot. No winners

Curious Wolf, where do you see the techs, Apple, Nvidia, Zoom, etc. going? All of these stocks have been flying since the March stimulus by the Fed. Apple by itself is now worth more than every stock combined on the Russel 2000. They all are great earners…..but wow their valuations. When does this madness end, or is this all the new normal.

The new normal here is people are skipping rents to buy gadgets. That’s all.

The median worker pay at Tesla is $56k a year.

Lenert (and others)

ie Tesla pay….

Family.

In early twenties with boyfriend, both work for Tesla.

$18-20 hr….12 hour shifts, 4 day week mostly; rotate after so many days, from day to night shifts….living in Fremont AirBnB’s; present one with no air cond. Only place to live with $$ in that area. Saving every penny.

Not to be a total buzzkill but the minimum wage would be $24/hr today if it was raised in line with productivity, as it had been from 1938-1968.

Musk is very clearly a genius and a skilled businessman and marketer but I’m still very in the dark about what’s so special about Tesla. The car resemble a jazzed up Ford Taurus with mad speed and a sparse interior. The SUV looks like something you’d ride at Epcot Center to take you between exhibits. I don’t find that speed particularly exciting personally. There are plenty of electric cars out there, so what’s the appeal really? Are they really getting superior mileage on their batteries over the Audi/Porsche/Mercedes competitors? They definitely don’t measure up for styling or handling.

Someone please enlighten me.

I think this stock can play silly valuation games until they run out of cash and can’t sell more shares or bonds to unsuspecting investors. We’ve seen it before.

Musk is probably the most perplexed of anyone.

NIRP guarantees Tesla will be fully funded, so they wont run out of cash.

Will be interesting to see Big Auto and Big Oil sweat as the future arrives and they are 3 years behind the play.

The Fed keyboards new currency and sends to partner banks. Partner banks loan money to places like Robinhood. Those brokers loan on margin to “traders”. Meanwhile Partner banks set up shorts. Wash, Rinse, Repeat.

I was a long term believer in Tesla some time ago. I wasn’t fazed by the shorts or the negative press. Then Musk started making strange comments about cave divers and fascism – (if there is a candidate for the right’s mythical ‘Q’ it is Musk) and I bailed out of my positions with about what I put into them. I just don’t want to support someone like him – but it turns out that as soon as he began the unhinged behavior his stock began to skyrocket – on the negative side, I’m still poor but on the positive side, I’m not one of those Germans who got rich on a Nazi stock.

No, sadly, many people wish for the entire stock market to crash and burn so they might be able to afford houses. At least the people I know. It’s about the wealth gap. If they can afford housing then they can afford other things as well. Right or wrong, people feel the stock market crashing will decrease housing prices. And people blame the stock market for ever increasing costs and increasing bureaucracy of medical care as well.

It’s not about whether it’s an American company. Most large companies offshore and hire people in other countries- so there isn’t much loyalty in the US for them.

This was a reply to EJ.

Thx Lynn – I think your right on that. I admit I spent years so burned from 08 that I kept thinking it was going to happen again. But the irrational hate toward the people focused on building a better future in the face of all these obvious catastrophic problems is really something to behold. But I expect this is nothing galileo, fermi, tesla, etc have not faced. The grand human story in play it would seem.

I don’t want to speak for other people, but I personally wish for the entire market to crash because I’d rather get the pain over with now than have this ridiculous bubble get even bigger and have it crash in two years when the damage is no longer reparable.

A lot of “investors” need to be taught a lesson so that we can have stable financial markets going forward.

Stability is an illusion my friend. The natural state is fits and starts.

Tesla and Musk are very very popular in China. It’s possible a large percentage of stocks are held by Chinese citizens.

There are a number of Chinese companies in direct competition for EVs, such as LI motors.

At the rate things are going with US/ China relations: e.g., US banning chip sales to China, military buildup in South China Sea, first US high level visit to Taiwan since the 90;s, etc. etc. it would not be surprising to see both Apple and Tesla get the boot out of China.

nick kelly,

Half of all iphones are manufactured in one plant in Shenzhen China, which employs some 350,000 Chinese workers. (Source: Business Insider 2018 article about “iPhone City”).

That’s a lot of jobs lost there. Plus Apple still has a lot of technology to steal, er, borrow. Same for Tesla.

Just wait until Tesla declares bankruptcy. Robinhooders will triple its stock price then.

John King,

As long as Tesla can sell $5 billion in shares just like that, as it did today, it won’t ever default on its debts and file for bankruptcy. It raised $2 billion earlier this year, and now $5 billion – that’s $7 billion in cash that it got from selling its shares on the fly.

If its shares were down to $3, it would be a different story. But that’s not the case yet.

It’s a sellers market, definitely

At what point does investing become speculating?

Since 2000.

Rome started burning then, and now suddenly it’s like the Bay Area where everywhere you go, you can smell smoke.

lenert:

“At what point does investing become speculating?”

Since President Reagan “…..let loose the Bull!”

And, confirmed when Alan Greenspan admitted before Congress that he was “wrong” about self-regulating markets…….

If u have to ask the question, Run. Run for the nearest exit!

Lol, that isn’t what meant. Self regulating market is a scam. Somebody somewhere is manipulating. That is what he meant.

Earth to Bobby, Earth to Bobby, anybody there?

Nah, didn’t think so.

I have a theory regarding these crazy tech stocks. All the money that used to go into sports betting and casinos by BarstoolSports Bros are now going into tech options. When everyone bets on the Patriots, the oddsmakers change the line to move action to the underdog. There’s really no countervailing force in stocks when ALL the Bros buy deep OTM TSLA calls.

Funding secured!

Tesla is doing another stock offering for up to $5B brought to you by the fine folks at Goldman Sachs.

Behold the power of FANGMANTIS! (Facebook, Apple, Netflix, Google, Microsoft, Amazon, Nvidia, Tesla, Intel, and Salesforce).

the stock rallies into sept. 22nd battery day. That must have something up their sleeve for sure.

It is conceivable that the prices of selected stocks are managed by central banks in order to blow the stock bubble and to balance global debt. At least it is a demonstrated fact that several central banks invest in stocks. The SNB is publishing figures and is obviously the largest AAPL shareholder. The market economy has finally ended and we are living in a planned economy. It is quite absurd that Russia is today globally one of the remaining pockets of market economy.

it’s software on wheels. cfrt Toyota C-hr, wheels with lousy software.

I just emailed this to my investment advisor. I’m looking forward to his reply, if he does reply.

For every dollar invested the firm returns 8 tenths of a penny.

I know it’s uncool on this site to say anything good about Tesla or Elon Musk, but it’s important to separate the silliness of the investors with the mission of the companies and of the man behind the companies.

If I had to allocate billion$ of the most naive, inexperienced, irrationally exuberant Robinhood stock market money to any person out there, I would choose Elon Musk over Warren Buffett any day. Or over Bezos, for that matter.

Just not with my money. But I’m glad the stupid capital is supporting Musk’s socially-cognizant goals.

Fun fact from Germany: new passenger car registrations in July 2020

total: 314.938 (-5,4% vs June)

thereof EV: 16.798 (+182% vs June)

thereof Tesla: 154 (-67% vs June)

Tesla’s total market share is a whopping 0,05%. And rapidly declining.

Faced with the high demand for its first electric car, the Porsche Taycan, the Volkswagen Group has chosen to strengthen the new plant in Stuttgart-Zuffenhausen. It will do so with a total of 400 Audi workers from the Neckarsulm factory, who will move to the Porsche factory over the next two years.

Ok. Tesla is down.