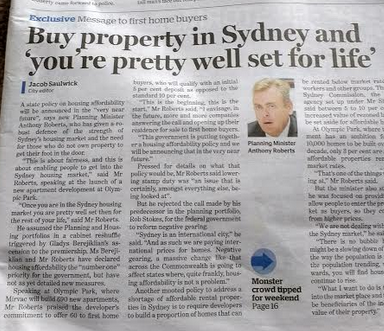

“Buy property in Sydney and you’re ‘pretty well set for life’”: Government to first-time buyers.

How far can a desperate government go to keep the whole overleveraged edifice of a housing bubble from tumbling down and doing God-knows-what to the economy and the banks? Australia is trying to find out.

The housing bubble in Sydney and Melbourne, by now among the top in the world, is taking on grotesque proportions, not only in price increases, but also in political pronouncements. So much of the economy depends on this bubble that no politician can imagine bringing it down to earth.

Prices for all types of homes in Sydney jumped 19% in March year-over-year, according to CoreLogic, with houses up nearly 20% and “units” (we’d call them condos) up 15%. Sydney’s home prices have nearly doubled since 2008.

In Melbourne, overall home prices jumped 16%, with houses up 17%, and condos up 5%. The index for all dwellings in Canberra and Hobart also rose in the double-digits. In Adelaide and Brisbane, prices rose in the mid-single digits. Perth and Darwin showed declines in the 4.5% range.

The CoreLogic index is not based on sales pairs, such as the Case-Shiller index in the US, or on median prices, but on its own “hedonic methodology,” which, like the other two methods, has plenty of critics.

The government has its own Residential Property Price Indexes. The latest edition, released on March 21, was for Q4 2016, so a little slow. Based on the median price, the index for Sydney jumped 10.3% and for Melbourne 10.8%.

Real estate is highly leveraged, and household debt is at an all-time high. Wages even in Sydney haven’t risen at the same pace. So the inevitable is beginning to happen. Affordability becomes a political issue, and delinquencies become a financial issue.

Standard & Poor’s warned on Thursday that delinquencies of mortgages underlying Australian prime residential mortgage-backed securities rose to 1.29% in January, from 1.15% in December. The largest increase occurred with mortgages that were 31-60 days delinquent, a sign that more borrowers had failed to make mortgage payments for the first time.

Allegations of mortgage fraud and other misconduct, including “liar loans,” have been documented in the media and by researchers for a while. LF Economics has submitted a report to the Senate Standing Committees on Economics of the Australian Parliament, which boils down to this:

[O]ur research into the mortgage market and banking system provides evidence to suggest many borrowers have or are at risk of becoming a victim of fraud, committed by lenders.

So it’s all there. Well, there was also this…

On February 24, Anthony Roberts, New South Wales Minister for Planning and Housing, was speaking at the launch of a 690-unit apartment development at Olympic Park, a suburb of Sydney, heaping praise on the developer for having committed to offer 60 units first to first-time buyers.

A new policy on housing affordability would be announced in the “very near future,” Roberts said. But as a first step, he threw in an incentive for first-time buyers. Instead of the normal 10% down payment, they’d only need to make 5%. “This is the beginning, this is the start,” he said.

And in hyping the Sydney housing market and the importance of getting in now or be priced out forever, he also said this:

“This is about fairness, and this is about enabling people to get into the Sydney housing market. Once you are in the Sydney housing market, you are pretty well set then for the rest of your life.

The Sydney Morning Herald’s headline went viral (sent by Mark):

But regulators are worried. Not that they will seriously try to prick it, but they’re trying to “contain” it, as it were. In that regard, the Australian Prudential Regulatory Authority (APRA) introduced in December 2014 an annual “speed limit” of 10% on how much banks could expand their loans to investors. This hasn’t helped, obviously.

So on Friday, APRA told banks to slash new interest-only loans to 30% of total new mortgage lending, from 40% now, according to Reuters. It also threatened to do a lot of “monitoring,” “scrutinizing,” and “observing.”

The mortgage industry isn’t exactly quaking in its boots. But banks have been raising their interest on variable rate loans to investors. Reuters cites loans from Australia’s largest mortgage lender, Commonwealth Bank of Australia, whose rates are “as high as 5.94%, compared with 5.25% for owner occupiers and an official cash rate of 1.5%.” So no problem. Fat profits for the bank for now.

But political resistance could mount to regulators’ however feeble efforts to contain the housing bubble. The infamous words – “Once you are in the Sydney housing market, you are pretty well set then for the rest of your life” – indicate that politicians are going to promote this game to the bitter end.

They fear that property prices that fall for an extended period of time until they’re actually affordable can send a lot of economic and financial shrapnel in all directions that no politician wants to catch. And it’s not just politicians. Reuters:

Regulators are also worried about the risks from a slowdown in the home-building boom. According to official estimates, every A$1 spent on residential construction generates A$1.31 worth of spending elsewhere in the economy, and every A$1 million creates 17 full-time jobs.

Not to speak of the banks. Once a bubble reaches this grotesque level, there are no longer any good options. So trying to lure new people into it to keep it inflated for as long as possible becomes the name of the game.

But some places in Australia are already getting hit. It shows what happens when “Ponzi finance schemes are stuck firmly in reverse gear.” Read… Commodities Bust Crushes Incomes, House Prices, & Rents in Western Australia

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

It’s certainly crazy. Nothing comparable in history. My client paid abt $800K for a inner suburban terrace -12′ wide 1bedroom- in 2010. We spent about $500k on renovations and already she could on-sell for a $200 -300k profit.

The average price in my suburb is over $3mil, without it being the most expensive one. 27,000 live here, so it has lots of RE.

Problem is, there is still a housing shortage so there is plenty of demand.

Eastern Australia has 535 tower cranes operating, so the industry is going gangbusters and carpenters take home $A 70-80/hour. Not so in WA as you have shown .

To reset at a reasonable level 50% would have to be knocked off the prices.

In economics, Demand = Desire * Money, so more accurately, there’s plenty of Desire.

Japanese real estate fell by 87% after 1989.

The stupider it gets, the further you have to fall on the other side.

The Japanese got very stupid and have never recovered.

“Japanese real estate fell by 87% after 1989.”

Really?

Did the entire RE market in Japan fall by 87% or was it mainly confined to those nifty, high flying commercial buildings in Tokyo, Osaka, and Nagoya?

Sorry to burst YOUR BUBBLE, but the price of RE to the ordinary person in Japan didn’t mean squat. They bought, were never going to sell, and didn’t leverage the value of their house to buy other assets in Japan or overseas.

One very interesting aspect of Japanese RE (single family houses) is that the value of the building falls over time and after a certain point in time has no value. The only value remaining is the land.

And by the way, the hot investment in Japan over the past four or five years has been………….real estate in the big cities which has in fact gone up quite a bit.

Yet the losses have grown to staggering levels regardless wether it sells. The longer it’s held, the greater the losses.

It’s nearly 30 years since the bubble burst in Japan and it hasn’t recovered.

It had nearly recovered but then wall street blew up in 2008 and put it back again.

A 30 year recovery gives you an indication of the size of the problem that caused it. Paying back all the debt from the boom is a long and painful process.

It’s a record at the moment, Australia may beat it.

wake up!!

Governments treat citizens like cattle. That chute ahead leads to the slaughterhouse not the pasture. Wolf your work offers a great deal of clarity for us cattle. Thanks.

Too bad they don’t have a reference point from history to show them how bad things can get.

You’re the sausage king of Chicago?

Wolf, thanks for bringing some light into this obscene far corner of the world.

I took a river cat (harbor taxi) up the Paramatta river this last weekend and saw that very development mentioned above. It’s build above an old abattoir site on Swamp land, can’t tell you how undersirable the place is, as its full of mosquitos….and about as far from anything interesting.

Well there’s a Costco out there….and plenty of ‘New Australians’….ie those who don’t speak English at home. Not to be overtly racist, since this is a lovely place where people can get along. It’s bring up a policy of Big Australia.

Immigration can cure Australia’s woes for another generation….give it’s the money laundry capital of the world (Hot Asian Money, HAM) housing is the only game.

The Australian stock market is still below its 2007 peak. You can hear crickets….nobody’s interested…as even my Banker Mates are interested in getting their next investment only property on an interest only loan.

It’s just a crowed house (sorry music pun….)…ie trade. It’s the only thing Australians are taking at parties. With everyone on one side of the boat, it’s setting up for a ponzi crash.

After 24+ years of economic prosperity, the cycle will come full circle.

McGrath Real Esate is one of Sydney’s major real estate agency’s.

1 year ago its share price was nearly $2.00. Today it hovers between 60 to 70 cents.

Maybe Sydney’s property market is in for a major correction if the share price of their major property agencies is anything to go by.

https://investor.mcgrath.com.au/Investor-Centre/?page=share-price-graph

Prices are still up, but volume is massively down.

But wait wait there is more runway yet. If interest rates go to zero, then an interest-only loan can go to infinity, with a monthly payment of one cent. Reduce the down-payment to negative, via a kickback from the government, and you *really* have a bubble on your hands. Steve Keen famously lost his bet back in 2010 that prices would be lower, now it is 7 years later and things can still go higher. But, all y’all, if interest rates go *up* 100 basis points, then things, as in Japan, go into Melt Down.

“Lenders have raised borrowing rates on more than 270 products and cut saver rates since the Reserve Bank’s March rates decision.

Rates have been raised on about 113 principal and interest loans, 98 interest-only loans and more than 60 residential principal and interest loans since the RBA maintained the cash rate steady at 1.5 basis points on March 7, according to analysis by Canstar.

During the same period there has been no increases to savings rates and five decreases, the analysis reveals.

The moves create conditions for a billion dollar boost to net profits, analysis of recent borrowing and savings rates reveals.

Lower cash rates are a bonanza for lenders who are failing to pass on the full reduction to lenders or boosting dismal savings rates for savers, analysis of the rates reveals.

During the past two years, the cash rate has fallen from 2.25 per cent to 1.5 per cent, or a dip of 75 basis points. Over the same period, standard variable rates for owner occupied loans have come down by less than half, or 37 basis points.

“Investment rates were decoupled from owner occupied in September 2015 and over the two years are actually up by one basis point.

“Online savings accounts are down 111 basis points over the two years,” said Stephen Mickenbecker, group executive for ratings and financial services at Canstar, which monitors products and rates.

“The online savings rate is not a perfect estimate of bank funding costs, but as a substitute for other sources you would expect it to be bid up higher in the market if other costs were escalating in the reverse direction.

“This is not the case. Home loan margins have widened over the past two years,” Mickenbecker said.”

Well I guess we’ll just have to wait a while longer for the impact on higher rates to hit Australian RE values……………

More profits for banks and borrowers continue to get the shaft.

SEE:

http://www.theage.com.au/business/markets-live/markets-live-iron-ore-slumps-below-us80-20170403-gvcz4z.html

while the offer to reign in investor loans looks like the banks getting on the front foot and being responsible, the reason is they don’t want the RBA to raise rates as it will affect the entire market. A recent report illustrated that a 1% rise in rates would be disastrous for many mortgage holders.

the level of stupid here is appalling. property investment is seen as a viable occupation and everyone from labourers to IT workers have shown you need to have balls and not experience to leverage up and become a wealthy landlord living off returns.

These yields, in Sydney, are pitiful. The only game is capital growth.

One poster mentioned a shortage, well it depends on shortage of what? Definitely not of apartments – Brisbane & Melbourne are going to see a massive increase coming online for sale in the next 18 months and Sydney isn’t far behind. The numbers are much bigger than the current total of sold apartments for the preceding year.

Some in Brisbane’s “2nd ring” are sniffing the wind. Some apartments are being offered up to 39% discount, and its just early days.

The shortage myth has been bantered around for a very long time and it has been proven to false time and time again.

Electricity and water meter check show there are nearly 250,000 empty properties Australia wide, 80,000 in Sydney alone.

Chinese have purchased apartments sight unseen and let them sit empty. You see we have allowed Chinese property developers buy prime real estate, build whatever they like (in most cases tiny unliveable apartments) and sell them exclusively to Chinese nationals. These are land banked for capital gains.

When the tide turns they will dump 10,000’s of crappy apartments onto the market in a rush to the exit.

Those who have leveraged up on interest only debt using the tax rort of negative gearing will bring down our banking system, they account for 40% of all loans taken out last year in a very hot market.

Sydney currently has an average income to house price ratio of 12.6 times, it is primed to implode.

Wolf is right, our government will not stop it, no one wants to be the bad guy and they would much rather be the knight in shining armour that swoops in and tries to save the day after the fact.

Either way there’s scary times ahead

Wow – 80,000 empty properties in a city with a population of 5 million!!

WHOOOOOOOOOOOOOOPEEEEEE.

What’s that work out to?

Yes, RE is Sydney is priced as ridiculous levels and will fall…………………..eventually, but let’s be realistic.

Quoting figures like that are meaningless as is stating that negative gearing (buying a property and being able to write off any losses against your other income for you Yanks – that in includes non cash deductions such as depreciation) is a rort.

It is not a rort as it is legal and has been done in Australia since Federation.

And a couple of articles for the Yanks to read:

http://www.theage.com.au/victoria/they-came-in-their-thousands-to-live-in-cranbourne-east-20170330-gva0ig.html

http://www.theage.com.au/federal-politics/political-news/victoria-fills-up-as-the-rest-of-the-nation–including-sydneysiders–moves-in-20170323-gv4tm4.html

Yes….negative gearing, politicians and non-recourse loans will save us from the flogging our housing market thoroughly deserves….

Woooo Hooooo !

It means the bottom is a long way down.

Hmmm …. Sydney population == 4.4 million, average density 2.6 per dwelling == 1.69M dwellings 80K/1.69M = 4.7% permanently vacant dwellings. Seems material to me. Maybe you should do a refresher in arithmetic.

Mushrooming supply, plummeting demand, population growth sinking, rents slipping.

Bottom is a long way down.

Yeah, let’s use REAL numbers and not some mathematical calculations based on some FAKE assumptions.

The vacancy rate in Sydney in February 2017 was a whopping 1.9% . Melbourne is at 1.7%.

Rents are going up in Melbourne with some stories of people actually bidding for new rentals.

Here is a story about rent in Melbourne:

https://www.domain.com.au/news/melbourne-tenants-hit-with-record-rent-as-house-median-jumps-to-410-a-week-20170123-gtwyyx/

Hardly cause for concern.

What should of more concern is talk of reducing the number of immigrants coming to Australia on prices or maybe the impact of a booming population has on infrastructure.

Last two days the train line that the kid uses was shut down for ‘improvements’ and I had to take the kid to the nearest station.

It took 40 minutes one day and 45 minutes the next. How far was the station? A whole 13 kilometers.. For you Yanks that works out to 8 miles or less than 18 miles per hour.

After dropping the kid off on the way back you could see the traffic lined up trying to get into the city. One place had three lanes of cars lined up for 2.6 kilometers.

The Monash Freeway (CARPARK) was stuffed up as well taking 62 minutes to go about 33 kilometers according to the road notification. In reality it probably took even longer than that.

This morning the news said it was taking 72 minutes into the city from where I live.

Even trams are being hit:

http://www.theage.com.au/victoria/tram-services-slashed-despite-runaway-passenger-growth-20170404-gvdeuu.html?platform=hootsuite

Welcome to Melbourne “The world’s most liveable city” unless you have to buy a house, rent a house, or travel on roads or public transport.

Chris and Lee – Just a quick distinction:

1. “vacancy rate” usually refers to apartments on the market for rent, to be leased to a new occupant. This number is tracked and known (accurate or not).

2. then there are “empty properties.” These are houses or apartments that someone owns for investment purposes but no one lives in them. They’re not for sale or for rent. They might have the owner in them a few weeks out of the year, and they might not. These units are not tracked. The data can only be gleaned from things like utilities that know that this house or apartment doesn’t use water or electricity.

Lee, I think you’re talking about #1. And Chris is talking about #2.

The innumerati in Australia have decided negative gearing works.

Negative gearing is the ruling that your losses can be marked against your general income.

The innumerati have calculated that if you lose ten dollars and get back (depending on your tax rate) $3 or $4.

You are ahead.

Counter-intuitively negagive gearing does work because so many people are in the innumerati they drive up the value of the underlying asset. Of course this will not last.

…

I am writing from Perth.

There are thousands of locals who are dipping into their pension, paying a penalty tax rate to keep their property dreams afloat.

If fellows on the East Coast reach through that tax penalty and use their pension to establish a house deposit, to get on the porperty ladder, and this becomes news, the political class will take action. Pensions in Australia are the political third rail.

It’s calculated there are 200,000 empty apartments in Sydney. Hot Chinese money performing land banking is deemed to be nearly completely responsible. However, the national government claims that the overpricing is only due to lack of supply (that old chestnut) and so insist more dwelling structures are the answer, not tackling the empty apartments already existing. They are traitors to their own country.

http://www.dailymail.co.uk/news/article-4270282/Sydney-200-000-homes-foreign-investors-blamed.html

Governments that are bought and paid for by the billionaire “donors” who own the Establishment political parties will do their utmost to aid and abet such speculation, with any and all losses moved to the public ledger. However, the rise of populist movements will likely see more punitive tax measures instituted against foreign oligarchs and embezzlers who park their ill-gotten gains in pricey real estate in cities like Sydney, London, and Toronto. Absentee homeowners will also be low-hanging fruit for the taxman in socialist countries like France as the productive economy deteriorates and the socialists must increase their wealth extraction efforts to make up revenue shortfalls.

http://www.mansionglobal.com/articles/52550-paris-to-triple-tax-on-second-homeowners

Engineered boom-bust cycles every eight years or so are the most efficient means for the Federal Reserve and central bankers to transfer the wealth and assets of the vanishing middle class to their oligarch cohorts. Housing Bubble 2.0 will end just as badly as the first one, with the F***ed Borrowers (FBs) who vastly overpaid for these depreciating assets getting their heads handed to them, while all banker losses will be made whole by taxpayers and the central bank money-printers.

Fear not. Pretty soon all the proles can live in tents, yurts, or cardboard boxes as they are permanently priced out of the housing market. (Heckova job, central bankers).

http://www.businessinsider.com/qube-tent-seven-foot-high-link-together-pitch-two-minutes-camping-festival-friends-2017-4

– The current (M. Trunbull) and the former (T. Abbott) australian prime minister also have vested interests to keep the housing game going. Both have been elected for (electoral) districts that have benefitted the most from 2 government schemes called “Negative Gearing” and “Capital Gains Tax Discount”.

See this video:

https://www.macrobusiness.com.au/2016/04/waleed-aly-crushes-turnbull-on-negative-gearing/

I think the last bilderberger meeting must have been “we elites will use lies to con the whole world. Now gather around everybody and lets discuss the lie/s we will use so that we all have the same agenda”.

America and FED are the responsible of 99% of world’s problem. Their money printing led to make chinese rich and , Chinese smartness led to buy safety assets in Canada,Australia and part of US. Its all America without question……!! In the end they will blame poor immigrants……

Just how “rich” are they considering they’re all using borrowed money?

“If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks…will deprive the people of all property until their children wake-up homeless on the continent their fathers conquered…. The issuing power should be taken from the banks and restored to the people, to whom it properly belongs.” – Thomas Jefferson in the debate over the Re-charter of the Bank Bill (1809)

That’s you, Yellen. You and the Fed are what the Founding Fathers warned us against.

The same schemes as in British Columbia. And you can’t vote it out of power; the next party just picks up where the previous has left it. And they even have the cheek to tell you that it’s all for the children. Until the branch meets the rope, and the rope meets the neck…

I wonder how many migrants the Australian Government will have to bring in to fill all the excess real estate .. all the empty houses & apartments & in suburbs with little infrastructure & no public transport.

Thank you for this article .. may it scare P.M. Malcplm Turnbull to death.

We need inflation, a lot of it, to prick these bubbles.

– Nice short video on the truly insane situation in Melbourne. (Assume that the situation is the same in Sydney). How much appartments are vacant becomes clear when one walks through Melbourne in the evening at 8 o’clock.

https://www.macrobusiness.com.au/2016/05/illuminating-melbournes-ghost-apartments/

or

https://www.youtube.com/watch?v=DS7tcM5CfyA

– Video was published May 2, 2016

It was part of a video called “Home Truth” (length 45 minutes) from the australian TV station ABC.

http://www.abc.net.au/4corners/stories/2016/05/02/4451883.htm