Those who lost out on the Fed’s “wealth effect.”

Here’s a mystery: Has this “wealth-effect” economy that the Fed so beautifully engineered since the Financial Crisis gotten a lot riskier, scarier, and uglier in some profound ways for lower-income Americans, those making $30,000 or less a year?

One of the questions that Gallup posed was this:

Next, I’m going to read a list of problems facing the country. For each one, please tell me if you personally worry about this problem a great deal, a fair amount, only a little, or not at all? First, how much do you personally worry about –

Then came 13 issues, including “hunger and homelessness.”

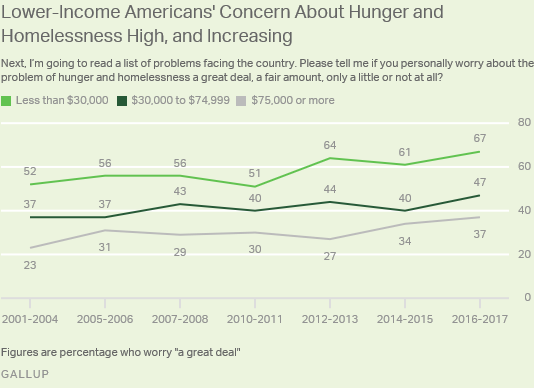

Turns out, among Americans making $30,000 or less a year, 67% worry “a great deal” about hunger and homelessness! Food and shelter, two of the most basic human needs. That’s the highest percentage ever in Gallup’s data series on this question going back to 2001.

It’s up from 52% in 2001/2004; up from 56% in 2007/2008; and up from 51% in 2010/2011.

Median annual household income in February was $58,714, according to Sentier Research. On an inflation-adjusted basis, this was about flat with February 2016 and below February 2000. Median income means 50% make more and 50% make less. Other studies have shown that incomes have risen sharply at the upper end of the spectrum, but have fallen at the lower end, with the gap widening. Thus the median might have stagnated, but for many of those below the median, things haven’t turned out so well. And there are a lot of them!

With the prices of stocks, homes, art, classic cars, commercial real estate, and the like inflated to dizzying heights after eight years of radical monetary policies, why would these folks, making $30,000 or less – worry more than ever about such basic and dreadful conditions?

More on that in a moment. There are other elements in this mystery: Even among people making $30,000 to $75,000, a record 47% worry “a great deal” about hunger and homelessness, up from 40% in 2010-2011. And even among high-income Americans, the percentage, though small, has risen (chart by Gallup):

Rising worries about hunger and homelessness can have a number of causes, including media coverage of those topics, or coverage of rising income and wealth inequality in America. In its survey report, Gallup points out that occasionally, when something terrible happens, such as 9/11, it might be “dominating the national consciousness,” and hunger and homelessness recede as primary concerns.

We get that. But Gallup goes on:

Since 2001, worry has been highest among those residing in lower-income households, likely because those with limited financial resources are more at risk of going hungry or becoming homeless. A consistent majority of lower-income adults worried about the problem before 2012, but that has only increased in the past five years.

Lower-income Americans worry about basic problems, in this order:

- Hunger/homelessness

- Crime/violence

- Healthcare

- Drug use

- Terrorism

- Social Security

- Economy

At the upper section of the spectrum, at incomes over $75,000, things look different, in that order:

- Healthcare

- Budget deficit

- Economy

- Social Security

- Environment

- Race relations

- Hunger/homelessness

Lower-income Americans worry more in general than those with higher incomes. Everything is riskier and tougher for them. But nothing compares to the worries about hunger and homelessness. Gallup:

On average, across the 13 issues, the percentage of lower-income adults who worry a great deal is seven percentage points higher than among middle-income Americans, and 17 points higher than among upper-income Americans.

But differences in concern about hunger and homelessness far exceed those norms. In fact, the 20-point difference in worry about hunger and homelessness between lower-income and middle-income Americans is higher than for any of the other issues. Similarly, the 30-point difference in worry about hunger and homelessness between lower-income and upper-income Americans ties for the highest, along with concern about crime and violence.

In the dazzling glitter and excitement of soaring asset prices that central banks around the world, and particularly the Fed, have tried so hard to engineer, it’s easy to forget that not everyone has those assets, that a lot of people can’t get “rich” just sitting on inflated assets, that they have to work long hours in measly jobs just to stay one paycheck ahead of hunger and homelessness.

These Americans are paying the price for the Fed’s efforts to “heal” the housing market. The Fed has implemented elaborate strategies since 2008, among them: cutting its policy rate to near zero, embarking on QE, and bailing out banks and their richest investors, including Warren Buffett and his financial and insurance empire. In 2011, the Fed began encouraging and enabling Wall Street’s biggest private equity firms and other investors to buy up hundreds of thousands of homes out of foreclosure to push up home prices.

This has led to soaring housing costs that have by far outpaced wage growth, if any. And it made it that much harder for these Americans to stay that one paycheck ahead of hunger and homelessness. There are a lot of them. They’re consumers too. And this could be why the economy, which has been ruined for them, has since then not been able to grow at a reasonable pace.

And so, America becomes “Landlord Land.” Read… So Who’s Pumping Up this “New Normal” Housing Market?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Well the big end of town always gets taken care of no matter where.

For example, here in Australia companies just got a A$24 BILLION tax cut spread over a number of years.

What did the ‘little people’ get?

If you are on a government pension or some kind of hand out you got……………………….

A$75.

Yep, a one off payment to ‘help’ for electricity costs (Those have more than doubled in the last 8 years or so.)

Total cost to the government for this? About A$260 million.

A 100 to one pay off to companies compared to the ‘scum’ on the bottom………..

SEE:

http://www.theage.com.au/federal-politics/political-news/turnbull-government-company-tax-cuts-hanging-in-the-balance-20170331-gvazr3.html

Lee,

That is such a leftist comment. One that has poisoned and populated media of recent times. A little study by yourself would reveal that these tax cuts are for small to medium companies, those that employ most Australians and to at least try and allow those employers to compete with other tax beneficial countries around the world.

The big end of town rightfully get nothing!

Are the tax cuts tied to real investment in equipment and wages? If not, it’s a giveaway to the business class that will unfairly increase wealth disparity and the long-term health of the economy.

The fact of the matter is that when John Howard left as Prime Minister of Australia the federal government here had virtually no debt and people were worried about running out of bonds for the government bond market.

Fast forward to today and the federal government here has around $400 billion plus debt.

The government here shouldn’t increase handouts to anyone, regardless. Especially to those making $80,000 or more a year. Too much spending and too much upper middle class welfare here and that includes those companies.

The government here cuts back on those at the lowest end of the income levels and hands out tax cuts to those making $80,000 a year. (For example, they cut the energy supplement to those new people qualifying for the government old age pension at the same time handing out those tax cuts.)

Do you really think that any of that tax cut will find its way into the pocket of the workers at those companies?

You have got to kidding.

Do you really think that a cut of that nature would allow them to compete? If the margins are so small that a 1 1/2% cut in income tax rates makes a difference then they shouldn’t be in business in the first place. There is so much slack and ways to game the tax system here for companies that it is ridiculous.

Shortsighted, even idiotic energy and environmental policies by various governmental entities is the chief reason electricity costs are spiraling out of control in Australia…50% renewables mandate by 2030, no new baseload capacity built since the 70’s, etc, all conspire to impoverish the average consumer…and yet the policies continue.

It never ceases to surprise me how the well off “slaves in the masters house” always see things from the masters perspective. They trade in any integrity they had as a working poor just so they can wipe the butt of the 1% and get a seat in the house of the master.

These “slaves in the masters house”, the courtiers of the 1%, are the greatest obstacles to economic reform because they defend the broken economic system from which they are benefitting. “Slaves in the masters house” are merely tools of the 1% as a buffer to keep at bay the lower 50% who are the working poor slaves.

While the 49% (“slaves in masters house”) keep down and thumb their nose at the 50% (working poor), the 1% are laughing all the way to the bank. The 1% stay the 1% because they are smarter and 10 steps ahead of the 99%.

If the government really wanted to stimulate the economy and help small companies that create wealth, it could have introduced export tax credits. Otherwise, this is going to help the bottom line of rent-seeking small companies such as realtors, lawyers, doctors and dentists.

The cats wanting all the cream have gone global. They’re all buddy buddies and are planning on ruling the world. They may not have much to rule after their greed destroys us all, but they don’t seem to always be the forward-thinking scions of wisdom they think they are, do they?

The next decade or so is going to get real interesting . . .

Anecdotal for sure, but on my home to Everett, WA from Seattle, I usually just read a book on the bus but today I was taking in the sunshine, finally. and noticed lots of closed small strip shopping centers that catered to Hispanic immigrants. All of the Mom and Pop operations were tenuous at best but once one closed anther was quickly ready to give it shot. Now entire strips are empty and a number of them too. A not so small business park on 99 in Everett is completely empty.. 68 major projects going on right now in Seattle & (1,100 a week moving to town from wherever) all too expensive for all but the better off and supposedly this gold rush is forcing regular folks into the suburbs.. I didn’t count all of the empty shops but entire strips are closed up and this wasn’t the case just few months ago..

Congratulations are due to neo-liberal believers! This state of affairs is exactly what they want. They want to widen “the gap” between the haves and have nots. Believers, even ones not wealthy want those below them in wealth to not get richer. So if you are poor but still have a job you will still look down on those who are poor and don’t have jobs.

This is what I have been reading. It is systemic dysfunction throughout western society. It’s the ” I’m alright Jack, blow you” mentality. They don’t care that it’s sending the country into a deflationary spiral as well as being a social evil.

Item 2 in the second list, “budget deficit” is comic. It’s so stupid that they worry about the economy going down if the budget doesn’t “fix” the deficit.

The budget deficit is, as I have explained before, the way money is injected into the economy allowing it to grow. Budget surpluses drive recessions.

So they worry the economy might not go into recession! Clever!

“Budget deficits is the way money is injected into the ecomony…”

Talk about short shortsightedness. This kind of thinking is so full of misunderstood academician BS it defies logic.

Borrowing today to inject grown into the economy simple pulls future spending forward. At some point future earnings have to be used to pay off the debt. UNLESS, your arguing that deficit spending can continue in perpetuity?

You simple CANNOT borrow your way to prosperity. But the banks sincerely thank you for buying their dogma.

I would be happy to revise my thinking IF you can demonstrate any time in history where a Government spent its way to prosperity? The only condition is that they had to eventually pay off the debt they built up.

Any government with a fiat currency can create money to pay off its debt. While this option is not available to state governments, individuals, and companies, it’s a simple fact that it’s available to governments and unless they are in a situation with a currency under attack leading to high inflation, they can do so with little consequence. If the US was a South American country, it couldn’t print money without any worries–but the US can. It would be more efficient if the US simply borrowed from itself rather than going through the channels of finance, but it can still create money to pay off the debt. A balanced or even negative budget would constrict the US economy–government spending would be much better if it went directly into the economy rather than to the 1%, but even so it helps boost the economy.

So we continue to expand the size and breath of government along with the money supply due to unending borrowing because its good for the economy. Please explain how this ever ends well?

“A balanced or even negative budget would constrict the US economy…” Not sure I agree but since we haven’t seen a balanced budget since, oh hell, I can’t remember when. Would like to see some data to back that up.

As for inflation, its here. Just look at housing (rents and prices), stock valuations, car prices, food prices, cost of credit for most people (still around 20-30% for CC’s). Those that think that fiat (funny money) can be created without consequences is either in denial or not being intellectually honest with themselves.

Think about it for a minute. If the government could just ‘print’ money to pay debt it could also just print money to pay for wages , goods or services like healthcare. Hell, Janet Yellen could just deposit $10 million dollars in every American’s bank account and go home…. and watch the disaster unfold.

I get up tomorrow morning smiling as I head off to the boat dealer to buy my new 40 foot yacht but it is closed because all the sales people there called in sick so they could go to the car dealer and buy themselves and their wives a new car but there are no cars for sale because the car dealers employees are all trying to buy a new house and so on till you get to the factory floor or construction site whose workers are also out trying to spend some of their newly created ‘wealth’.

WorldBlee you are correct. In Canada between 1939 to 1974 the Bank of Canada (BOC) issued monies for infrastructure projects, hospitals and schools at interest free loans.

This financial game that the world plays is a confidence game. As long as the masses believe in pieces of paper with peoples faces or pictures on them the game continues. The BIS, World Bank, IMF, Federal Reserve and the Primary Dealers are moving slowly to a cashless New World Order financial system. Just look at what is being tried in India. Over time the Federal Reserve Note will not exist and all of us will only believe in debt cards, credit cards and the financial numbers that are on our computer screens illustrated at our financial institutions. We might eventually have a financial chip injected under our skin.

The problem is Steve you’re thinking old school Gold / Silver Standard terms .. or worse … household / small business economics . Where as this is governments we’re talking about … here in the 21st century of magical thinking , Potemkin Village economics and Emperors New Cloths alt facts and reality … where printing a few billion more $ is of little concern

Suffice it to say with the economic mistakes GWB’s administration made post 9/11 ..none of the rules apply any more ,,, especially those rules that apply to the likes of you and I

Why tax at all if revenue doesn’t matter? Let the deficit grow to infinity and you’ll have wonderful economic growth. Not a good idea? Didn’t think so.

Beadblonde, taxes in a nutshell cause demand for dollars. That is the trust in the demand for dollars. No dollars=no buying power and no taxes.

beadblonde, rvette is right. There are essentially two reasons to tax for an entity that can create money, such as the US government/Fed combo: to create first-order demand for the currency, and to rebalance wealth among citizens (in an ideal scenario, to prevent unfair advantage). When taxes are regressive (meaning, those with lower incomes pay a greater proporation of their personal wealth in tax than the rich do), taxes essentially redistribute wealth toward the rich and away from the middle and lower classes.

Modern fiat money, in particular in the US, does not work the way everyone who has been trained from childhood to practice fiscal prudence with their own savings thinks it does. And so your personal morality and the confabulations of your Congressweasels interfere with your ability to form a conceptual understanding. Those who are running the show know this very well and are using it against you in order to consolidate wealth into their own hands by gaming the system. Even if you have moderate wealth ($1m, for instance), you are not one of them.

Imagine that you could walk into a bank, take out an unsecured loan for a few million or a few billion, and never be expected to pay it back. That is a better analogy of what we’re talking about here.

If you’re not already familiar with MMT, you might like to read Warren Mosler’s ‘7 Deadly Innocent Frauds’ paper. You can find a PDF paper of it for free with a google search.

Steve, sovereign country’s government owe nothing to no one when they expand the money supply by paying their bills. Sovereign country’s have the unlimited ability to pay any debt by instructing the Federal Reserve in the case of the U.S. to increase the account of whoever the government wants to do business with. That immediately increases the money supply in the economy and spurs growth without the presumption that the new money must be paid back, as is the case in private bank loans. During WW2 the U.S. had a national deficit some 200% above G.N.P. for the war effort and the economy grew right thru the next 3 decades. Tax revenue from this growth lowered the supposed National Debt to lower levels, but was not neccesary as a sovereign dollar is backed by the full trust in the Federal Government since 1971. Read the Constitution which states the Federal Government is the sole issuer of currency. Banks have succeeded in taking this authority away from the people with intent of profits for their holders, not the people. The U.S. Government can not go bankrupt as they are the only issuer of a sovereign currency, the dollar. A dollar is only a piece of paper stating that the U.S. Government will pay you another dollar, possible in interest at some time or you can exchange that Federal debt (dollar) for some goods or service. By Act of Congress the selling of Treasury Notes and Bonds could end and all present Treasury Notes and Bonds could be redeemed by the Federal Government with no future cost involved. Sovereign debt is not household or private bank debt.

What you’re describing can be summed up much more concisely assuming one is literate as ;

The Gospel of Ayn Rand ..

Where greed is a virtue and blatant outright selfishness is a positive personality trait to be commended – whereas altruism , compassion and civic responsibility are considered faults and personality flaws verging on ‘ sin ‘

But err … then again .. this is the US where 50% of the adult population cannot read above an 8th grade level . so … ahhh .. hmmm

Thanks, TJ. I know little of Ayn Rands beliefs. I read “The Fountainhead” but it’s not so radical as her later stuff. Anyway yes. We live in an age where there is a huge deficit in altruism.

last night On TV here I saw a movie about sugar, “That Sugar Film”.

In it some specialists describe the deliberate intention to make everyone addicted to sugar through manipulating the bliss point. It’s all about the profit motive, of course, as American as apple pie. However apart from ill health these “addicts” have never known an alternative regimen, so they live in a mental fog and think its normal. See it if you can. Sugar is not evil. The manipulation of our desires and health is evil.

I add this because other bloggers here have referred to cheap vs good food etc.and diabetes, an unfolding tragic epidemic.

There is a general welfare clause in the Constitution. Ayn Rand was a profoundly evil woman whose adherents would be quite content to let the less fortunate die of hunger and want in a dog-eat-dog world.

Of course the Fed is to blame. The Fed caused the Great Depression too.

Otto

I’m sure the Fed has culpability but the 1% has some culpability too

Mark Blyth explains in this inter-action with Jimmy Dore

https://www.youtube.com/watch?v=PzbH2YE4a24

Its the Wall Street guys and Oligarchs who’ve made out like bandits.

Mark Blyth explains that for the last 25 years the middle class have had their jobs either exported, or H1Bs have been imported, to take the good middle classes jobs away. That’s why EVERYONE except the 1% have created an indefensible position in the “Hamptons”.

Thanks to Professor Mark Blyth for a great education of the “STATUS QUO”..

John but I thought the FED was the 1 percent essentially or other the .0001 percent anyway

Sigh .. when are y’all gonna finally ‘ get it ‘ ?

We’re all culpable in one form or another .. right up to our little eyebrows .

Suffice it to say without the stupidity and greed of the consumer the Fed wouldn’t need to keep playing catch up and the .1% would’t be getting away with the shell games they play

Which is to say .. quit reaching for ‘ scapegoats ‘ .. and start dealing with the 5 ton I-beam firmly implanted I your own eye.

True, the rest of the is getting wealthier. World wide income inequality is falling. No mention of that.

Too bad Blyth talks politics, not economics. His arguments are riddled with errors, i.e. maybe old people are wealthier than Millenials because they’ve been around 40 years longer. I could go on and on but Blyth wants to focus on labor vs capital, just like Marx. Marx was wrong too.

https://www.brookings.edu/bpea-articles/deciphering-the-fall-and-rise-in-the-net-capital-share/

A lot of people wonder why they don’t have any money when the War On Poverty has been on for decades. That’s because their side lost.

The war on poverty was a jobs program for middle class professionals. It was never intended to help the poor, it was intended to keep them poor, and the professionals employed. So you’re right, the poor lost.

The so-called War on Poverty was designed to create political plantations that would reliably elect representatives from a certain party year after year…and it worked.

Low income is 30,000 or less? If i made 30,000 i could retire in a year or two!

But aren’t there like 11 % getting SNAP, and you can’t make hardly anything… and i think have less than $2000 in savings??

(maybe there mostly children though??)

Now there’s poor!~ what they get $6.25 a day to live on?

(at least here in Tucson,az) .

I know many that get it.

$30,000…$58,000..That’s like being super rich!

unless u live in new york, la, or those places….my next door neighbor moved in and his places is same size as mine, 20 feet by 15 feet and rent is $250 for me and $350 for him, and i struggle week to week and he lives in that space with 6 people!! I see this all over where i live.

I used to live in Tucson. Tough economy if you don’t have a government job or work at Raytheon.

There’s clearly something wrong when a day’s labor won’t provide the basics. Time for reset.

Time for reset is looooooong overdue. But the reason why this broken economic system continues is because there are still far too many “well off” middle and professional class that act as buffer for the 1% by defending the system they profit from against the 50% who are working poor. The 1% know it and intend to keep the 99% divided this way. Creating the have somethings vs the have nots has worked throughout history because the 49% who have something act as foil to the 50% working poor as propaganda that the failed system “works”.

Yup, and sadly many of those professionals are well-meaning neoliberals who don’t even realize that’s what they are. Out of the goodness of their hearts they defend things like the H1B visa program because they see it as progressive multiculturalism and opposing racism rather than as a direct attack by the 1% on middle class wages and employment. And there are plenty of ignorant racists out there to convince them they’re right.

It’s complicated.

If the median household income is $58k, and the median home value is $195k, and the savings rate (after-tax) is around 5.7%… That means the median household could never in a lifetime hope to save enough to buy a median house outright. It would take 2 generations of saving at that rate to buy a simple average house in an average city.

Of course, average people would never actually hope to ever pay for a house in cash, but it does put into perspective the distorted value of these items. It seems like this is a structural problem in the economy, and it’s only one of many problems.

AM

The median house price now is $310,000. The median income now is $30,100. http://www.usdebtclock.org. This makes your argument even more powerful. So some oligarchs have acquired homes cheaply and have driven up prices by over bidding the market. Their wealth will be short lived at best.

We have inflation coming and with that higher interest rates at the “Long end”. A 1% move in 30yr fixed rates lowers my home in value by $62,000. Move interest rates by 3-4% then my house prices by more 3-4 x multiple of that $62,000.

The problem will be that as that happens the worries of homelessness will be being jobless and hungry at the same time.

Smile though there will be less obesity and longevity of lives will increase. ( sorry for my end sarcky comment)

A lot of hot money has also gone into buying houses at the lower end of the price range to use as rentals.

And it’s all borrowed money. Dumb borrowed money.

A lot of that was free money from the Fed to private equity, all to help penalize younger folk. SICK. Foam the runway.

Median price is way lower than $310K. HuffPo says $188K in 2014: http://www.huffingtonpost.com/2014/03/13/median-home-price-2014_n_4957604.html

Your number may be relevant for new homes. Certainly, a 1% move will not reduce the median price by $62,000, unless your house is worth more than a million.

Otto I came up with the $62,000 number from a “cheap” home on the west coast with only a $600,000 mortgage. In San Jose / San Francisco starter homes are in the $1 million dollar + range

Jim Grant’s perception is that we’ll have 6%+ on interest rates and 8% mortgages. I doubt he be wrong. With 8% mortgages almost certainly we’ll see home prices halved again. By the time done with the next down turn we’ll see true 25% + unemployment too. It won’t be pretty.

“average people would never actually hope to ever pay for a house in cash”

That doesn’t detract from your argument. Instead of putting their 5% to 7% into a savings account, they could put it into mortgage payments and they *still* wouldn’t pay for the house in less than two generations.

Is that 5.7% savings rate the savings rate of the median household ? Or is that 5.7% the actual amount of total national income saved ?

I think there is a difference. The top 1% could distort that 5.7%. Maybe the savings rate for the bottom 80% is a lot less than that, say 2% for example.

It’s based on total household savings, a formula that is in its most simplified form the difference between the money earned and the money spent by all households on a national basis. Household savings is very high at the top income levels and zero at low income levels.

Thank you kindly.

I also found it quite an eye opener to read a report from the Kaiser Foundation report showing births financed by medicaid.

We learn something new every day.

http://kff.org/medicaid/state-indicator/births-financed-by-medicaid/

Some will read this very sad article and think, “Good opportunity to buy some futures; rice, beans, pasta…..maybe shipping containers”.

This will not end quietly, or well. However, to see how far it can go look at Venezuala. Oppression can still hold it to gther, for awhile. Plus, Venezuala has no where near the same levels of surveillance, policing, or potential crowd control forces.

regards

During the Occupy movement, while the police were dealing with the underclass, I was enjoying the irony. The police were doing the dirty work for the people who were actively stealing their pension money. The next time around, the police will be part of the underclass, they just might not know it yet.

Petunia With their money I imagine the elite will always find the required mercenaries to keep us deploreables in check

It is a fatal mistake for the elite to rely on mercenaries. It never takes the leaders of the mercenaries long to figure out their employers have no real authority in which case the leaders kill them and take everything for themselves and become local warlords.

I think what we’re seeing in Venezuela is not oppression but a last ditch stand to keep the 1% from running the country again, as they disastrously did in the past (with much high poverty and lower literacy and levels of economic growth).

The dirty little secret in America is that people working 40 hours a week are going hungry every day. These are the people who don’t qualify for any benefits because they are too well off just having a job.

SNAP is a huge failure, it only benefits the people they employ, and the people who scam the system because they don’t need the help anyway. The rest get nothing or very little.

While crawling out of our financial hole we have had income below the median. We sometimes ate pasta every day. My husband lost a lot of weight eating less so that we could eat more. We are doing better now, but many aren’t, and we know things could change at any time.

This is the new America. The former middle class are living on the edge of poverty and we know it. Is this changing America, you bet.

Petunia

As an aside know that there’s nothing “Wrong” with losing a lot of weight. The cohorts of other diseases such as diabetes heart cancer are much higher with being overweight. I know I am grateful for losing weight too. Dr Michael Mosely explains more here.

https://www.dailymotion.com/video/xvdbtt_eat-fast-live-longer-hd_shortfilms

In 1790 the French Nobility didn’t want to change their tax (status quo) liabilities not unlike with today’s Oligarchs. The French Nobility ended up being guillotined..

John M,

People like you make me want to vomit, really. Do you know that good food in America is expensive, yes, it costs more to eat fresh good quality food. The food poor people eat is low in quality, cheaper, and high in calories. This is why poor people are generally fatter.

BTW, my husband was not overweight to begin with, and when his weigh dropped he had the additional problem of being poorly dressed. Poor people can’t replace their wardrobes either.

All I can say is that I hope I can afford the popcorn when the guillotines come back.

Petunia,

Thank you for sharing your comment on your misfortune. You really deserve our respect for freely sharing your recent tough times.

Most of what you say is true, but also situational for each and every one of us. A lot of how much a family suffers depends on where and how that family lives. I was laid off in ’81 at the age of 24. The company, (and I use that term loosely), used a downturn to reduce services and lay off pilots and support staff for one year in order to break the Union before the busy times returned. I saw them turn down booking after booking simply to avoid calling in staff which would re-start seniority. When my turn came I knew I would never return to work there because they became our enemy in the process. The funny thing was, when the good times returned other companies had already taken over their customers. Go figure. I went to work for one of them years later. :-)

Anyway, I lived in a smallish town, but had 1/2 acre of good garden soil + fruit trees. We had chickens, and I rasied rabbits for meat, + fish. The rabbit manure is mild and went right on the garden, thus increasing yield. I worked under the table and also worked away from home. We ate venison. This under-employment lasted for another 4 years until we finally pulled up stakes and got on with life. I should mention that at the same time our mortgage rates increased to 18%. When we finally sold out, all my years of work and sweat added up to 0. Zero. I guess the only plus is that we were young enough and had time to regroup.

With every meal we had rice, or potatos, or pasta. We never ate out, ever. We made our own bread. I re-roofed our house after hand splitting cedar shake blocks I scrounged in the bush. We survived and it was a struggle. It defined my life in many ways, and certainly produced a wary outlook on life and the current economic boosterism of the day.

After I hit the send button and post this I will go out and run my wood splitter for another cord of wood. In 3 more days my last shed will be filled up and we will be back to having 6 years of wood heat ready and waiting. It is what tough times do for people. You learn to be prepared, expect to work hard, and never take anything at face value. And like you and your family, you either survive or you don’t. I know you have scars from your experience. I also know ‘they’ will NEVER grind you down.

regards

“it costs more to eat fresh good quality food”

Are you sure?

Basic (real) food is often much cheaper than processed food.

Petunia

Our family income is less than the current median income. So I’ll straighten out everyone’s assumption that I am in rich 1% class. I am not.

I never implied your husband was overweight. You volunteered that your husband lost weight. With 1/3 of America facing obesity diabetes / heart disease / high blood pressure / high cholesterol. Losing weight can be a really be a blessing in disguise . The video link I posted earlier basically alluded to that point. I was overweight and have lost 50+ lbs.

As for food prices I couldn’t agree more. They are extortionate these days and I find I shop more and more at Walmart. I scrounge for good prices to make my money go further.

As for clothes and wardrobe the last coat I bought was like new and bought on Ebay for 1/3rd of new price.

I think, we both recognize that the middle class has been vanishing since the year 2000: a point I obliquely mentioned (above) with house prices doubling and stagnant incomes. Unless you are lucky or a 1%ter, it’s hit everyone. Myself included.

In the 1790’s the 99percent rose up and created the New French Republic. I am not advocating for a civil war, it’s that I have studied history, and I see our futures repeating the times of the 1790s of France.

I have written the above to provide clarity and not to abuse anyone.

Amen.

this little side thread here is what makes everything so tragic and why i do fear she’s right about the guillotines.

and JohnM… i know you mean to find the silver lining in all our hells below by intellectualizing suffering so that you can better cut yourself off from the suffering of others, but what you say is shockingly callous and insensitive like when barbara bush said that displaced survivors from katrina would be better off breaking apart from family ties and moving away to houston.

John M,

My response to you was an honest reaction to what I perceived as a total disconnect from what is happening to people in this country. I did all the right things, got educated, stayed out of trouble, worked hard, saved, and in the end none of it mattered. I just want people to know that is possible. People think that only those that have it coming land up in dire straights, not only is this not true, the opposite seems to be truer. I am not complaining about my situation, through it all, we have been more fortunate than many.

Petunia,

I have always wondered why some people living in houses with yards don’t grow more of their own food…………

No reason if you are ‘poor’ and have a yard why you can’t grow good wholesome fruit and vegetables. Spuds, beans, peas, tomatoes, and other vegetables are easy to grow. Save some of the produce for seeds next year and that won’t cost you anything either.

This summer was a bad year here in Melbourne for growing many kinds of vegetables, but we still managed to do well with some kinds.

We harvested about 59 pounds of cherries. Others such as spinach and eggplants were ok. Others were not. The eggplants and green peppers are still going so we’ll have fresh vegetables for another month or so.

Yesterday I picked about 10 pounds of apples and have more to pick over the next couple of weeks. Next the mandarins will be ready and after that some oranges.

The price of food is high in Australia and I’d guess that in a good year we ‘save’ thousands of dollars from growing our own.

But that is now the most important reason: they taste so much better than the crap from the supermarkets and you know that there is nothing put on them. No chemicals, no pesticides, and they are fresh.

I really hate to buy stuff from the markets in winter as it tastes like crap, but it is that or don’t eat it.

“All I can say is that I hope I can afford the popcorn when the guillotines come back.”

If you’re waiting for the guillotines to arrive, it won’t happen within our lifetime. Keep waiting and wishful thinking, because as we all know that always solves problems.

We’ve known about global warming from the 50’s but general population acts like it’s brand new.

You can’t wake someone up who pretends to be sleeping. That is western culture writ large.

The solution? Falling prices.

In normal times, i.e. before the Keynesian fraudsters at the Federal Reserve and their deranged money-printing created grotesque and dangerous economic distortions, median home prices were 3X the median income. Any more than that was considered unsustainable. Now thanks to the Fed’s gift of free trillions in gambling money to BlackRock and other Wall Street speculators to snap up foreclosures, affordable housing is a thing of the past, while the stay-at-home-mom – the bedrock of a healthy family – has become a virtual impossibility.

This will not end well.

Actually was 2x median. And given current record housing inventory, housing is going to get a whole lot more affordable.

Sit tight.

Can’t have falling prices with the level of indebtedness. Falling prices will collapse the system.

Just the opposite. It is falling prices that will correct and salvage the system.

Terrific article Wolf!

I note the following paragraph.

“These Americans are paying the price for the Fed’s efforts to “heal” the housing market. The Fed has implemented elaborate strategies since 2008, among them: cutting its policy rate to near zero, embarking on QE”

My question is – Why does NO ONE have the courage to make this better?

A lot of the young generation (20s and 30s) are already feeling hopeless and see little of a prosperous future.

The burdens of middle agers used to be their aged parents.

That is now more complicated as we see our children struggle to save for a rainy day, much less a down payment on a house today that is now probably equal to the mortgage from 25 years ago.

Forgive me if this sounds rude – but every time Janet Yellin speaks, I feel to throw up.

I am not qualified to judge the FED, but I would love to read the views of the many brilliant folks that contribute to your articles.

Why does NO ONE have the courage? Sanders tried. But evidently he lacked style. Wrong accent. Too old. He was unable to impress the super delegates for the obvious reason that quite a few of them are doing well in this regime. Some number of them were paid lobbyists. The DNC also was committed to their Bob Dole. No question it’s the best government money can buy.

Why are drugs expensive? Why is healthcare expensive? Why is college expensive? Monopolies, that’s why, and all of them approved by a large majority of our representatives.

Agreed. Sanders tried to do the right thing. Instead, Americans voted for Donald Trump. This is a problem of the education and values of the people, not the oligarchs.

No, it was the super delegates at the DNC that rejected Sanders. Had he been in the race, he would have done better than Hillary. I’m sure of it. Among the young voters I know half stayed home the rest split in the general election. The disgust with the DNC will last a long time.

Agree. The only change agents were Bernie and Donald. Hillary was more of the same, and she was only paying lip service to concerns of the middle and lower classes.

If Trump was the only change candidate to vote for, you had to vote for him, even as a Democrat. That’s the way I viewed it anyway. Hillary thought the key issues fell under a theme of “togetherness”, when in reality people wanted simple recognition that labor is valuable.

Sanders and every other career politician are part of the problem. One thing Trump was right about is term limits, you have the McConnells, Waters and the like that “feed” of the working class to enrich themselves for years.

Someone once said “Have you ever seen a poor politician”

Bernie was pushed out by the DNC, it wasn’t his style or accent. This is documented fact now.

Obamacare didn’t help drugs prices as Obama gave big pharma a monopoly – like you said.

Humans are flawed in the modern sense – EO Wilson said it best when he commented that we have paleolithic emotions, medieval institutions, and god like technology. Simply stated we are wired to make decisions that produced survival in the past – and that makes us easy to manipulate if we are not individually cognizant of that fact.

This is – in essence – why history repeats … we as a species simply haven’t changed … and frankly I don’t think we ever will.

That said, life in the US is trying to live under a slow but steady expansion of rackets and monopolies – created and protected by government – to extract every drop of blood from the working population.

Regards,

Cooter

Well, if at the least we created a system that wasn’t so medieval, we might have half a chance. Assuming no global thermonuclear war or runaway polar methane burps.

Why no one has tried….

If you are not 40 years old, I understand why you are still confused about this.

But if you are over 40 years old and have seen enough things, people, please think harder. The answer is NOT easy but simple and brutal.

“easy and simple” are 2 different things.

Excellent article Wolf! Here on this blog we have scribes bitching, moaning and complaining, yet they are doing their commenting from a comfortable home ( where they can afford a computer) or from an office computer ( where they have a job) and complaining about some future crash that may or may not happen in their lifetimes.

And they probably have a full stomach, a warm or comfortable home, coffee at the ready.

They should be in church thanking God Almighty for their good fortune so they can bitterly Carp about the future!

I’m fine but I see many younger people struggling because of a bad policy of goosing asset prices and lending massive money to landlords. No need to thank God Almighty for that. Maybe later when the debt is written off during the big jubilee.

But thanks, Dr. Pangloss.

feel better now, Mr Irony?

(smile)

Kitten Lopez

Know that my car that I drove today is over 21 years old with 190,000 miles on it so I am pretty sure that I don’t belong in with the 1%ters. We cook all food at home & I’ve not eaten out in a restaurant in more than a year.

& Yes I do look for silver linings. I met a diabetic a few years ago who is now a double lower limb amputee. I help him out as best I can. The silver lining (I only perceived this week) I got from him, was that if I didn’t exercise I could end up loosing a foot. Since meeting him I’ve lost a lot of the weight I was carrying.

I actively promote good health as its cheaper, and easier, than fixing a problem after a diagnosis of Type 2 Diabetes is announced by one’s doctor. I have a had raging arguments with friends who are carrying too much weight. I did get a friend to lose 50+ lbs before he got diabetes. He’s now very grateful I got on his case. Alas most folks bury their heads in the sand when it comes to looking after their health.

http://www.diabetes.org/diabetes-basics/statistics/

73,000 people / annum get a lower limb cut off because of diabetes..

That’s the reality of life.. I wish all the best of good fortune to everyone

JM

From @HarariNoah’s new book, Homo Deus, A brief History of Tomorrow:

“In 2012, about 56 million people died throughout the world. 620,000 died due to human violence (war killed 120,000 people, and crime killed another 500,000). In contrast, 800,000 committed suicide, and another 1.5 MILLION died of diabetes.”

Sugar is now more dangerous than gunpowder. Climate change is a problem? Keep dreaming while the world becomes filled with blind amputees on dialysis.

Has it occurred to you that they are complaining because they have a heart (unlike you) and are concerned for people less fortunate than them?

Amen!!!!!!

Reaganomics 2.0 now known as Fedonomics . Funneled the money straight into the hands of the wealthy with 1.0 . Doing the same again with 2.0

Has there ever been a time when the rich and connected didn’t try and increase their holdings at the expense of the less fortunate? I don’t think so.

I remember my mother saying almost 50 years ago, “You want to know about Russians? Remember, 50 years ago they were bought and sold with the land”.

Now in US it’s student loans, car payments, unaffordable housing, unaffordable health insurance, decreasing public school supports, bankrupting pension plans, and shady insider politics. Scapegoating.

Same shit sandwich, people just have an i-phone in their hand.

I trust myself, my wife, my family, and a few close friends. And my doctor, dentist, and mechanic. :-)

Where is Ayn Rand when we need her :-)

Oh? Are you counting on her to come up with a clever scheme to end poverty by killing off the poor?

It’s surely a sad story. It looks as though the lowest rung of the socioeconomic ladder has grown substantially in the last 10 years. I’ve read that the lower half has essentially given up getting married. Perhaps due to qualifying for welfare? Or they just don’t see an economic possibility in forming a family? I don’t know , but I think this may be an indicator of the social fabric unraveling.

Ironic isn’t it? When the need and greed for ever more neverending economic growth as a “normal” ends up unintentionally killing the consumers that fuels the growth by lower and lower birth rates.

That, along with a rapidly aging population, ever lower bargaining power of the masses and rise of robots taking over human jobs are a potent mix has never occurred together on a global scale. May you live in interesting times.

The spotlight is finally where it needs to be….Great article Wolf!!!

Another eye opening statistic is the percentage of babies born on Medicaid. Even in “prosperous” states (e.g. CA, OR,…) it is 50%, in New Mexico it is 72%!! Welcome to the 3rd world. You don’t have to travel…

“Welcome to the 3rd world. You don’t have to travel…”

The 3rd world standard of living is far worse for those in India and many places in this world.. So far. I have been out.. not that we don’t have homeless camps that are approaching or that mimic 3rd world conditions but so far most of our poor still have more than a plastic tarp for a home and 2 to 3 meals a day.

What bothers me is how quickly the US is moving in that direction. And how little those in power seem to even notice it. They are trying to preserver and expand their way of live without caring about their fellow citizens. It is horrific and I believe will be their own down fall in the end.

“And how little those in power seem to even notice it”

They see it and they don’t care, it is part of the bigger plan. Welcome to the new world order. The only thing they haven’t figured out is how to get the guns from the American people, so they can finish what they started.

Thanks GSH. Do you have a link to the source ? That would be awesome.

The most surprising number?

That the lower income folks rank Terrorism 5th on their worry list. That tells so much about the “fear based” alternate reality that many folks live in. For anyone low income terrorism should be at the bottom of the list (heck it doesn’t even make the top list for higher income folks). Literally everything including falling out of bed is more dangerous for them. Unreal.

How stupid are some people? … turns out pretty darn stupid.

Or alternatively, how bad is the US education system? Answer – horrible for a good portion of folks.

Low income people deal with Muslim immigrants all the time. Muslim immigrants live and own businesses in poor communities, they even staff those govt positions that poor people have to interact with all the time. The poor are not the ones living in the alternate reality.

And did I mention the religious recruitment aspects? It goes on all the time, I got a Koran from a Jewish man I know, who got it from someone he does business with.

Muslims aren’t terrorists. They’re human beings with a slightly different set of false beliefs than Christians.

Terrorists are people who launch rockets from drones from a thousand miles away and kill your children.

Go hand out some bibles in the middle east and get back to me.

There are Christians in the middle east who have been there ever since Christ.

What things would have been like without the heavy Ottoman “don’t make trouble” lid and the intentional destabilization after that, I can not say.

Fundamentalists, be they Muslim or Christian, consider it their duty to proselytize. Last week a young guy walked up to me on the street and began to question me about my religious beliefs. When I tried to give him the brush-off, he went into a harangue about a nice lady like me going to hell.

Yes it was annoying and ultimately creepy, but that kind of encounter is the price we pay for religious freedom. If we can tolerate other people’s beliefs while hanging onto a core insistance on the separation of Church and State, we will be fine. If someone gives you an unwanted copy of the Bible or the Koran, so what? You can just pass it on to Good Will

Maybe we should have an organization called “Bad Will”, where we can dump on folks we don’t agree with

Above all they fear hell. Part of avoiding hell involves continually trying to convert people. Notice how he thought you would and should be equally scared. This huge fear drives everything and keeps them from accepting diversity in religious practice

When someone tries to proselytize me, I just tell them that I don’t believe hell exists. Prove that it does and I’ll sign up. There is nowhere to go from there.

Seriously Petunia. I bet you don’t even realize that your statements are extremely racist. Don’t even get me started on how many times I was approached when living in the South (Athens, GA) with people trying to get me to go to this or that Christian church, or giving me the Watchtower on the bus, or any number of non-Muslim faiths pushing their ideologies on me! How about there being bibles in every christian-owned hotel? How about children being “invited” to go to Sunday schools to try to indoctrinate them early? How about all the missionaries recruiting overseas? How about the Book of Mormon being given out by the millions on TV? Don’t dump your small-minded belief system on people trying to deal with your misbegotten electoral choices.

The Fundamentalists of all the Abrahamic religions are feeling the hot breath of Science scorching the hairs on the back of their necks. They see their children increasingly turn away from that Old Time Religion. This is creating an increasingly sense of desperation. I personally, am not an atheist, but to me the beliefs of the Fundamentalists stink of ages of superstition and darkness. They seem more willing to destroy their belief systems rather than allow them to change in the light of our vastly increased knowledge.

A touchstone you might find of value in understanding matters of faith is to realize that faith ultimately is a matter of awareness, not belief. We know very little in truth about “God” but that hasn’t kept humans from coming up with very elaborate theories about the Almighty and claiming these man-made theories as the “word of god”. But just because we actually know very little doesn’t mean we can’t be aware of the workings of a mysterious purpose in the world.

Just my point of view…..

Good luck lecturing her NotMyPresident. She lost her house. Now she is reformed and supports Trump and has ALL the answers LOL. I read her posts for entertainment and certainly not for inspiration. She is less than tuned in. Check her comments on the Civil War for starters or her belief that robots will eliminate the 1% LOL. Tune in for more! Her generalizations are a hoot!

Another interesting complication is that MANY baby boomers were relying on some financial help from their wealthier kids to help make up for social security. Many of them have not saved ANYTHING.

Now, that too will be cut back. Now we have two generations of kids who can’t earn the big bucks, a gigantic national debt that will be paid by our grandchildren, hidden inflation that erodes the little money that the bottom half of the “median income” families earn.

Worse yet, our government is totally corrupt from top to bottom (Federal to local) and unless Trump can fire everyone and replace them with “honest” people, the bottom will continue to fall.

If someone makes the average US income it is damn hard to save enough to retire. If you have a government job in most of the US you’ll be well set. If you’re in the private sector you’ll be dependent upon Social Security and whatever you can scrimp and save.

“replace them with “honest” people”

Wow! That is so subjective.. My reality is your falsehood. Your priority is and vision may take away my lively hood.. Who is honest and who isn’t depends on which side of which fence you live on. Who’s ox gets gored.

What this country needs are people who can do two things. One have empathy for your fellow citizens.. And two, still be able to rise to a position of power/influence. Pretty hard in a society scrambling to stay on top.

Some of the world’s most enduring virtues came out of that aspiration.

Solomon, First Book of Kings

Plato’s philosopher kings

Not me I just started on SS at age 62 and paid my sons way to an MBA from Georgetown And am remarried living in Turkey and building a small bed and breakfast on the coast near Rhodes Food here is organic and very reasonable That which we don’t produce ourselves And the honey is to die for I have health insurance through my wife

This is only a temporary problem.

Robots are taking over and, as medicine advances, people will receive cybernetic implants. As the number of implants per person grows the number of people with robot-like features will grow. Eventually, all many people will need for their off hours is a comfortable place to stand and recharge.

Of course, this is off into the future a bit.

For today, the Fed was explicit on many occasions stating the benefits of their actions over the recent past outweighed the costs. Had the wealthy not become even more obscenely rich, who know what might have happened to the rest of us.

I agree, cdr, although I think “life” in those time will be more complex than merely standing and charging.

In a young married group discussion in a Church in Arlington, VA in 1958, it occurred to me that there would be a discontinuity in human evolution, where homo sapiens would go henceforth as neo-human, inorganic automatons, just as fully self-aware and conscious as we had ever been.

I remember joking at the time “Pass the screwdriver, Honey, let’s have a baby”.

We’ll see …

I have one good example of who lost out on the “wealth effect”, and the resulting inequality that followed. Expanding privatization and growing government contracts have driven an economic boom in the Washington DC. This boom, however, mostly benefits those with government connections and political relationships. Apparently the government gravy train has been good as the Washington Post observes “During the past decade, the region ( Washington DC ) added 21,000 households in the nation’s top 1 percent. No other metro area came close……….The signs of the new Washington are everywhere — from the Tiffany & Co. store that Fairfax County development officials boast is the most profitable in the country to the new Tesla dealership in Tysons Corner.”

https://www.washingtonpost.com/national/capital-gains-spending-on-contracts-and-lobbying-propels-a-wave-of-new-wealth-in-d-c/2013/11/17/6bd938aa-3c25-11e3-a94f-b58017bfee6c_story.html

As a result, DC now has the highest median income in the country:

https://www.washingtonpost.com/news/local/wp/2016/09/15/d-c-and-maryland-have-the-highest-median-incomes-in-the-country/

……while simultaneously producing this country’s fifth highest poverty rate:

http://www.businessinsider.com/the-10-poorest-states-in-america-2014-12

……meaning it has this country’s highest income disparity:

https://www.washingtonpost.com/news/local/wp/2015/06/24/d-c-has-a-bigger-income-disparity-than-any-state-in-the-country/?utm_term=.927f90e40f07#comments

……but plenty of good new luxury shopping for those with the right government connections:

https://www.washingtonpost.com/lifestyle/style/luxury-shopping-returns-to-downtown-dc-is-washington-ready-to-buy/2014/06/05/755aa862-e686-11e3-afc6-a1dd9407abcf_story.html

There is no “wealth effect” to grossly inflated prices. The end result of inflated prices is collapsing demand.

So does the price really matter when there are no buyers at that price?

“…the most profitable … new Tesla dealership in Tysons Corner.”

In 1958, At Tyson’s Crossroads there were two businesses: A Freezer compartment for hire facility (home freezers were yet to come) and a gas station.

Some venison from a young deer I had taken was stolen from my freezer compartment and replaced by old deermeat full of buckshot.

“Income transfer” was different, in those days …

Beltway bandits, ie. military, corporate, government contractors. It’s the best gig out there if you have the ‘right’ connections. If you hear Trump pontificating and murmurs of war, I see dollar signs. Long live the US Empire.

The Fed says it has not responsible for wealth disparity. Its believes the huge rise in asset prices is only a temporary condition that will disappear once the economy normalizes. The Fed is talking out both sides of its mouth here because the Fed’s moves clearly indicate it will not let the economy normalize. Any sign of weakness gets a response from the Fed.

If the Fed won’t let the economy go into recession on its own, the Fed IS supporting a wealth divide with no foreseeable end.

Is it responsible for the Fed to create and support a permanent shift of wealth from one class to another? I would argue this is way outside the Fed’s mandate and so unfair as to be considered negligent management of monetary policy.

The Fed also argues rate suppression is necessary to keep poor people in jobs. It argues that without rate suppression, the poor would be unemployed and in an even worse condition. This is completely mis-guided thinking. If the Fed were to let asset prices fall on their own, there would be a recession, but as soon as that recession is over, the economy would come out strong and there would be much better job opportunities for the poor than exists today and much better opportunities for long-term growth and mobility. It should be obvious there is plenty of “smart” capital in CDs and other low-risk instruments that will be deployed more actively into businesses once asset prices fall to reasonable levels. The only thing holding up that progress is current Fed policy. The Fed should let today’s short-term speculators die out so real long-term investors can start to clean up this mess.

If you are sitting on lots of capital in safe short-term instruments, hold your ground for the benefit of the nation. The enemy of progress at this point is the Fed and its negligent leadership. Don’t encourage its folly. Let the Fed come to its senses by refusing to participate in this completely unfair generational shift. Calling it an “experiment” is wrong because there is nothing unknown or experimental about it at this point. This is pure, targeted wealth shifting to the wrong people.

Bobber,

You are right in that the FED is working way outside its mandate. Their actions have caused much of the wealth inequity that the country is facing BUT you have to place their action over the map of the historical events they have been dealing with.. I am not a fan of the FED.. but let’s put the blame where it belongs.

Congress has for the last 6+ years and really since Reagan been unable to deal with the underlying issues facing the nation. They are captured by a system that funds their re-elections with special interest money. So rather than doing the nation’s business, they do the business of their financial support system.

Congress has led the country into a fiscal hell hole. The FED was forced to defend its existence by extreme monetary intervention. The reality the way I see things is that Special Interests have gotten their way for a couple of decades and their way has been to become uber wealthy with no regards to either the nation or its people.

The FED’s only choice was to either go along or have its member banks go out of business and for the FED itself to become irrelevant.

I don’t see it that way at all. The Fed’s job is to control inflation and promote employment. Any reasonable Fed governor would realize this is a LONG-TERM mandate. If short-term recessions are needed to sustain the long-term health of the economy, recessions should be allowed to occur.

This has nothing to do with Congress not doing its job. The Fed should simply let the recessions happen when they are due, let Congress take the heat for this, and let the country repair itself naturally. The Fed’s actions have only exacerbated the situation and created huge long-term risks to our world economy. Plus, the Fed actions have turned an economic problem into a wealth divide and fairness issue.

Let’s not make excuses for the Fed’s behavior.

In 2009 things had gotten so out of balance, the system had become so fragile, derivatives become so pervasive that to let the system re-balance was not even an option. The FED tries unconventional monetary expansion to keep our economic system from just plain imploding. Anyone who thinks that we would have just had a recession was not paying attention and still refuses to look at the bigger picture.

Congress led us into this mess with the ultimate insanity of repealing Glass-Steagal and then passing the Commodities Modernization Act.. They unleashed a period of unprecedented gambling and speculation.

Nothing has been done to reel this behavior in by Congress. Congress could have put money into Main Street instead of Wall Street and they instead argued and pretended. This is still going on..

The ONLY thing that has kept this nation out of the worst recession in our history has been the FED. It certainly wasn’t Congress. Even though much of the monetary benefit went to those with connections. Supporting, the stock market, housing and CRE has kept pension funds solvent along with FNM and FRE. And this has radiated out thru Main Street in that IF this support had not happened, we would have been in a depression instead of just a muddling along sinking economy.

Is Janet and her regional governors going to listen more carefully to what Blankfein, Dimon, Buffett and CNBC tell them is good for America or what congress tell them is good for America.

Sadly, it seems what’s good for the former is often seen as good for the latter. Very little positive impact on main street America at all.

In 2009, Buffett famously quipped that he would have been meeting Becky Quick in McDonald’s for TV interviews instead of CNBC studios IF the Fed had not stepped in to both buy up troubled assets and simultaneously drop rates to the floor in 2008.

Apparently he did not see the crash coming.

Buffett said

Economic Minor,

There a huge difference between emergency liquidity and suppressing interest rates on a long-term basis. The Fed is doing the latter, which is an extreme violation of its mandate because it jeopardizes the long-term health of our economy.

I don’t blame the Fed for providing emergency liquidity. I blame them for distorting the market well after the emergency ended.

Bobber,

Its called propping up a failed economic system.. If they hadn’t, the recession you imagine would be a depression. The problem is, all they have done is postpone it.. and made the readjustment must worse than it would have been.

“Congress has for the last 6+ years and really since Reagan been unable to deal with the underlying issues facing the nation. They are captured by a system that funds their re-elections with special interest money”

Unable/captured? This is naive. These special interest groups and congressmen themselves, are globalists. They have passed laws to subsidize offshoring at taxpayer expense (your grandchildren’s debt?) and participated in those investments.

I won’t quibble about what you wrote!

Congress has the power to have changed what has happened whether they are part of the 1% or not. Only they had/have that power. I look at the current situation and I believe it is to late for them to do anything now other than be the cause of a depression. I think it was in 2009 too.. to late. To much debt spent on speculation and or consumption. The entire country living way beyond its real means supported by future income. No future when mostly consuming, speculating and very little investing.

The Parties own the system we call elections. The parties give us choices from among their top.. Very few get elected that are not part of the party and as such part of the problem.

If the Fed now claims that it is, as you said, “not responsible for wealth disparity,” it is contradicting itself and its own published plan….

In 2010, then Fed Chairman Ben Bernanke explains his wealth effect in an editorial in the Washington Post – that the Fed was taking “strong and creative measures” is what he called QE and ZIRP – to specifically boost asset prices.

He wrote about his efforts to inflate stock prices: “And higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending. Increased spending will lead to higher incomes and profits that, in a virtuous circle, will further support economic expansion.”

http://www.washingtonpost.com/wp-dyn/content/article/2010/11/03/AR2010110307372.html

Then in 2011, the Fed published a report in which it specifically explained its strategies to boost home prices (including encouraging and enabling Wall Street to buy up homes out of foreclosure with the cheap money the Fed was making available). I linked this paper a while back.

Wolf,

You do a great job at getting information out that Mainstream Media won’t. It’s a shame that your e -letters don’t get out to more people, it would definitely enlighten the masses.

This article was read by about 10,000 folks on my site – and it’s still going strong – plus thousands more on other sites. So yes, it would be nice to have more readers, but thankfully, there already are quite a few readers :-)

Heckova job, Bernanke and Yellen.

The Fed’s “No Billionaire Left Behind” are by design benefiting only a corrupt and venal .1% in the financial sector, at the expense of everyone else. Janet Yellen and her ilk are exactly what the Founding Fathers and Andrew Jackson warned us against.

Yup exactly Randy

If you were one of the 1% you’d be forced to go along to keep your position in life.. Which means they are all playing the game and doing a good job of it.

Again the fault isn’t theirs per se but Congress who should have risen above the pressure to give tax deals and access to the few at the expense of the many.

In Monopoly, which is the Capitalistic game being played, you either play or fold.. No sitting on your hands and watching while keeping the Railroads and St James Place..

The sad reality is that the middle and working classes in this country have no political representation or advocates. The Republicrat duopoly has been bought and paid for by its billionaire donors and the globalist corporations whose mantra of “shareholder value” means the decimation of secure, living wage jobs. Trump tapped into a groundswell of middle class anger and economic insecurity in his successful presidential campaign, but notwithstanding his bellicose rhetoric about “draining the swamp” has already been subsumed into the crony capitalist status quo by appointing “former” Goldman Sachs officials to run our fiscal and monetary policies.

We the People are well and truly buggered as a corrupt and venal .1% in the financial sector is concentrating all wealth and power into its own feckless hands, with the help of their political enablers – “our” elected so-called representatives.

I just imagine if I was elected and who I would have access to call upon to fill my cabinet.

I really don’t think Donald thought that he would win.. And when he did, he only had his family to rely upon to help him fill all those positions needed to actually govern. He was an idiot that was ill prepared to be President.

Yet there were enough Americans who thought that enough of what we had was enough… and he won.

So he filled the swamp with more swamp creatures because they were the only ones he knew. He doesn’t know you or I or any of the many very intelligent people on this site. Sad for him and us.

Amen!

Boo Randy OMG please they were slave owning land owners hell bent on not paying for shite. The Founding Fathers were as corrupt as any Billionaire now. Enough of the hero worship. They left because they got sick of paying for things. They were simply cheap and had this sick sad notion that an agrarian utopia was the answer to their tax problems LOL

Now we have that as a virtue and are cursed with the idea the Gov who gives you SS and Medicare as funked up as they are, is a problem. No, not really. Lots of bad choices are the problem, made by folks who are bloody ignorant about basic economics, science and living.

Let me see all the hands raised to not take SS or Medicare or ANY OTHER FEDERAL benefit LOL. Ya ok.

We have a pathetic undereducated fake billionaire, fully failed loser bankrupt so called business man to lead us. Those that are beetching about life just made sure the knife is closer to cutting their own poor throats. Well done dumb poor Murica. Most likely the mirror is showing you who the problem is.

Wolf…excellent description of “real life” financial repression….

The ‘recovery’ since the bank and Fed-engineered collapse of 2007 has just been for the rich. The bank bail outs and wealth and housing transfers that have taken place are disgusting. And then we re treated to watching the rich and powerful grin while they get on and off their jets.

Clearly the Fed has served it s major stockholders (of record; whoever else secretly may own the Fed) and cartel members; the TBTF banks, which are said to be 30% larger now than in 2008. and ignored it s mandate to manage the American economy. -making up phoney employment stats isn t the solution.

-And now it looks like the 8-year zero interest rate scam was a ‘strip-mining’ opportunity for the financial sector and another even larger ‘wealth transfer” from the American pension funds. I suspect that it s going to become increasingly difficult to persuade members of the former middle class that these wealth transfers weren t intentional. Once people understand that the 4 trill added to the Fed s balance sheet since 2009, not only didn t reach ‘Main Street’, but that it financed the private jets, private golf courses, and 100 million plus residences and art works of the silly-rich, but that THEY will be held responsible for the interest on it, things might get touchy- and I think that that will happen even though academia and mainstream journalism has shown that it s part of the oligarchy, and will try to cover for it, no matter what.

We ve been dragged back to a ‘Gilded Age’ that few could have imagined, and the politicians and their pals in finance are like the entitled aristocrats of 18th century France. When the pension fund truth comes out, I suppose as the junk and crap bonds collapse, there s going to be a lot of outrage; and I don t think a war, or laying the blame at Trump, will work.

I was shocked at first to learn that ‘brilliant economist ‘ (oligarch cheerleaders), Like Sommers and Rogoff were planning to end cash and force even the poor to use banks. Don t they know the poor can t afford banks, largely because of the scams (finally) uncovered at Wells Fargo (2 million fake criminally fraudelent accounts to screw working and poor people out of grocery money in phoney ‘overdraft fees”!

But of course they don t know this; they d have to give a shit about the poor to know that.

It might be funny: people from the bottom up will almost certainly start to use barter and alternative currency and both the poor and the ‘economic genius’s’ will come to learn what an economic s undergrad should know: It s not a bunch of self declared genius s getting paid tens of millions per year floating fake bonds and working buybacks with borrowed money, then merging the trumped up valuations into insane fees, who are the economy; it s the shopkeepers, laborers, and small consumers. THEY ARE THE ECONOMY!

And after 8 years of 1.5% annual GDP growth based on trillions thrown at Wall St, it s actually amazing that these self declared geniuses still haven t figured that out….-

-Oh well… the fatal flaw at Versailles was the fact that the aristocracy was clueless about what was going on outside the palace…maybe our genius economist Phd. class should have taken a few courses in history but hey: Apparently they already know everything.

They’ve already collapsed demand via grossly inflated prices which the cratered GPD demonstrates. The only path forward is falling prices.

Remember…. Nothing accelerates the economy and creates jobs like falling prices to dramatically lower and more affordable levels. Nothing.

Agree completely. The Fed, though, thinks it can solve a debt problem by encouraging more debt. The Fed seems to think you cure an alcoholic by giving him more alcohol.

Yes, I keep expecting prices to drop, too, but it hasn’t happened yet! Honestly, I’ve been expecting stocks, housing, healthcare, cars, education to at least plateau if not fall off a cliff (looking at you DJIA) due to how rapidly they have inflated, but the bubble just keeps getting bigger! 2017 has to be the year. Or 2018?

It feels like when I was losing baby teeth as a kid – some tooth would be super wobbly and based on when the other teeth fell out, I woke up every morning thinking “this is the day.” BUT the day never came or maybe my mother got impatient because I definitely had at least one tooth yanked out by the dentist. I don’t know what the economic equivalent of the dentist is but getting rid of Yellen or the entire Fed seems like a good start!

I think a lot of the problem with our economy is bad health, In general people and doctors have no clue how to be healthy and strong, diabetes, pain, depression, fatigue, inability to focus, are rampant. People get sucked into the health matrix after being screwed up by shots, prescriptions, and procedures. One of the things our bodies need as we age is collegan. It repairs skin, and nails, but before it gets there it will repair all the inside of the body, veins, bone, tendons, cartlidge, organs. It’s amazing stuff but do you really want to grow new cartlidge after having a knee, hip, shoulder replacement? It’s a terrible quandary I would encourage everyone to research negative results of any medical intervention before reaching for it. Besides the collegan, anyone with health problems might research parasites. Parasites can cause lots of different symptoms, then the docs treat the symptoms until you have organ breakdown, misery and death.

Thanks to all of you for expressing opinions here on this blog I look forward to reading it.

Healthcare is big business.

Petunia,

Thank you for your reply. I want you and everyone to know that I really get it. What amazes me is that the “Elite” pay lip service to “Getting it”. This link is to a https://www.dropbox.com/sh/vz4dt8n1sr92kj8/AABJVqspLoRDax1YEVPDJ7f9a?dl=0 60 page book called the “Fiat Money of France”. If anyone takes the time to read it, it tells the tale of the 1790’s which is almost identical to the era we currently live in.