Another reason why the Fed can let the CRE swoon rip.

By Wolf Richter for WOLF STREET.

The multifamily segment of Commercial Real Estate – apartments – is holding up better than office, retail (the Brick-and-Mortar Meltdown since 2017), and lodging, though it’s cracking too with some spectacular defaults over the past 12 months or so. Yet, US banks and thrifts and foreign banks hold only a small-ish portion.

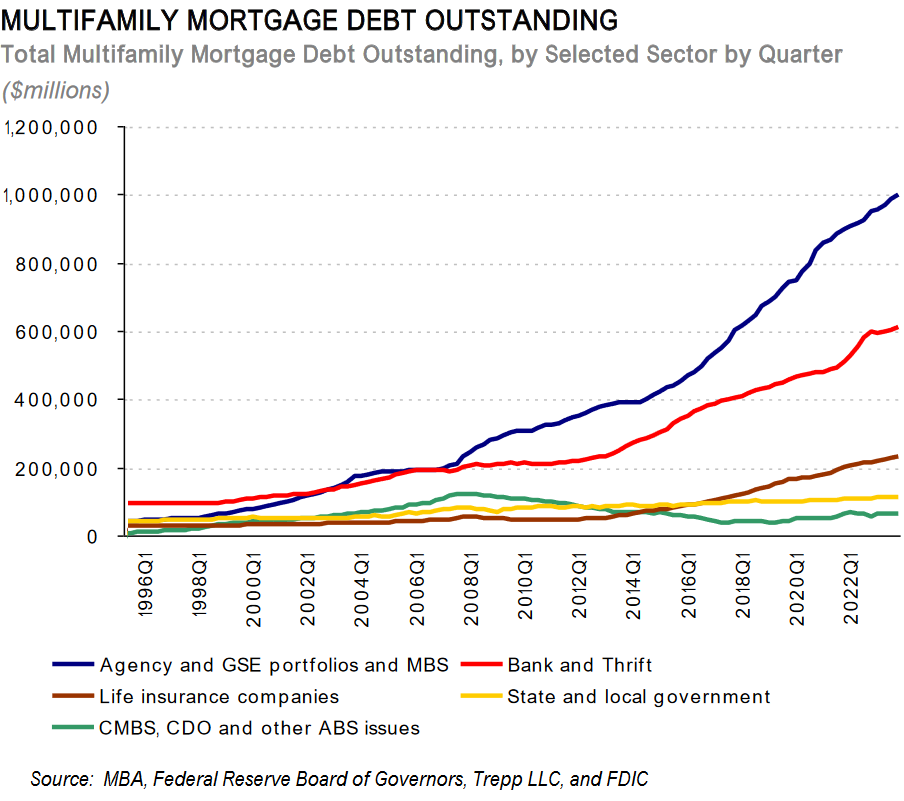

Total mortgages backed by multifamily properties rose by 4.4% year-over-year in Q4, or by $88 billion, to $2.09 trillion, according to the Mortgage Bankers Association, based on its own data, and on data from the Federal Reserve, Trepp, and the FDIC.

Of those mortgages:

- US government agencies, US Government Sponsored Enterprises (GSEs, such as Fannie Mae that securitize the mortgages and sell the “agency CMBS” to investors), state and local governments, and state and local government pension funds held 54.8%, or $1.09 trillion.

- US banks and thrifts and foreign banks held 29.3%, or $612 billion.

- Life insurers held 11.3%, or $235 billion.

- Another 3.2%, or $67 billion, had been securitized into private-label (not government-backed) CMBS, CDOs, and ABS, and those securities were held by investors.

- Other investors, including private pension funds and REITs, held 2%.

The blue line represents federal government backed entities – including MBS issued and guaranteed by those entities. Quite an interesting trend (chart via MBA):

The MBA excludes loans for acquisition, development and construction, and loans collateralized by owner-occupied commercial properties.

For about a year, we’ve been reporting on how non-bank entities, from CMBS holders to PE firms, were on the hook for office and other CRE mortgages, how the biggest losses have hit these investors, particularly the CMBS investors, and not banks. And among the banks that it did hit, there were a slew of foreign banks.

But with the multifamily segment of CRE, it’s mostly federal, state, and local government entities, including their pension funds that are on the hook – meaning the taxpayers are on the hook for 54.8% of all multifamily mortgages.

Most of the mortgages that taxpayers are on the hook for are held by the GSEs (such as Fannie Mae) that securitized the mortgages and sold these “agency CMBS” to investors. The Fed bought about $10 billion of them in the spring of 2020 and still holds about $8 billion of them. If landlords default on the underlying mortgages, it is the taxpayers that carry the credit risk, not the holder of the agency CMBS.

And the Fed couldn’t care less about taxpayers. The Fed is worried about the banks, not a few individual banks, but about contagion across the banking system triggering a banking panic. But with the 4,026 US banks with $23 trillion in total assets holding only $612 billion in multifamily mortgages – well, that’s less than 3% of their total assets. In other words, the banking system overall isn’t fundamentally threatened by bad multifamily loan.

Even if many of the banks’ $612 billion in multifamily loans default, they’re secured by multifamily buildings with some value, so the losses are going to be only fraction of the $612 billion, spread over 4,026 banks with $23 trillion in total assets.

As always, some smaller banks with concentrated exposure in some markets may eventually topple under defaulted multifamily loans. Fitch thinks 49 tiny banks are heavily exposed to troubled multifamily loans, and some of those banks may topple. In nearly every year, some banks toppled, and it’s just part of the risks in the banking system, and it’s the FDIC’s job to mop up those local messes at investors’ expense.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Hopefully next shoe to drop is residential RE, probably unlikely as everyone and their mom think RRE can only go up and this time is definitely different..maybe they are right and this will only be contain to CRE.

However if there’s any sign of weakness, hopefully the FED will carry the same mindset and let the tax payers or in this case FOMO buyers and mom and pop RE investors take the hit and not come to the rescue.

Pretty sure that gov.usa will be there to help in case of problems.

Seems surprising that the securitized cmbs etc crap is only 3.2%.

Best of luck taxpayers

I hope you’re right but any construction and material to remodel or build the house in NJ is outrageous. For example 2×4 used to be $2 went up to $6 but it settled now at $4. Just new roof on small garage I got the estimate $6,200 with new plywood to be precise. Sheet of plywood $70! On top of that in Begen County supply of new houses is basically non existent. New house is around $800k- 1mln. Old houses usually show up on the market when someone dies and they need a lot of work.

well all I can say is that in our local market

MULTI-UNIT is hot to hotter – Tucson

when I sold MH park to california investor(who’s pricing out all tenants)

I ended up buying SFR and using those as rentals instead

recently looked at some multi-unit given high interest rates

they’re 20% higher than 2 years ago

no cash flow to match – not even close – but proforma rules

The devaluation of the dollar due to inflation is where the price drop is going to be. If they devalue the dollar 20% that’s at least the equal of a similar decrease in asset prices.

Congress likes devaluing the dollar, it makes the debt they accrued less. It also decreases the cost of the pensions and other entitlements. Never mind the consumer who’s buying power is disappearing faster than they can make money. People on fixed incomes are screwed.

My billionaire club is thanking me for this. I told them to dump most of CREs to taxpayers so that we use this as an excuse to bailout CRE in future with another vehicle + QE.

CRE losses without this bailout will be 50%, i.e. Banks will lose >$300 Billion and I won’t let that happen to my club.

Regarding RRE, my club owns a lot of that and so I will keep protecting it. With all bailouts and handouts to protect all fake asset prices (RRE, Stocks, Mag 7, Bitcoin) you can expect inflation to keep rising.

So my club will get richer and you will get poorer.

All for bitcoin rising as would be nice to see El Salvador getting out from under the fist(thumb felt to small) of the IMF. Thanks J Powell for thinking of the global South.

It’s a terrible idea for them to be leaching all their money into bitcoin.

If it goes down, they can’t sell. If it goes up, they can’t tell how far up it will go…so can’t sell.

Bitcoin is an investment that isn’t producing returns, and they have no idea when they should or can cash out.

For example, if you are a poor eighteen year old, and your parents give you a 1 time assistance of 2000$ and kick you out. Which option is your best bet?

(2000 is about how much each mother between the age of 16-36 under the poverty line in elsavidor would get if they sold all the bitcoin they have.)

Would you, spend all 2000 while waiting for another handout?

Invest in a long term investment with no apparent timeline for maturity?

Would you secure transportation (buspass, bicycle or used mopad)and a first/last/deposite on a crappy apartment(after barrowing a friends couch for a few weeks), and get a job ASAP while doing gig work in the meantime?

Not 100% sure what the details of the last example translates to for a struggling nation, but in general it would mean stability>production.

Stability means law and order, enough infrastructure, secured individual property rights, stable currency and banking system, and business and investment encouraging laws. If you have all these (and low taxes), the investments will come naturally.

They should be able to pick out examples of other countries that pulled it off and use various pieces of those examples as templates. Instead they just went to the casino.

It’s truly sad that you can make rapist, murderers, and drug addicts look like Marry Poppins. You truly are the scum of the earth. You greedy evil bastards.

War is peace

Freedom is slavery

Ignorance is strength

Howdy JPow. I must compliment you again. How many imprisoned at 3%? Those old homes should be safe from foreclosure so get that New Home Bubble going ASAP.

Hahaha, “imprisoned at 3%” ???

They’re thanking their lucky stars day and night for having intentionally or accidentally locking in the lowest mortgage rates in history!

Howdy Again JPow. Sorry forgot to add, I know creating bubbles is what you do best. If you had anything to do with lining up all licensed RE Agents against home buyers??? WOW , good for you, that will help keep those prisoners in their homes too.

Thank You, J. POW for accepting me into your club! My family is eternally grateful.

I thought I was house poor and trapped with my 3% mortgage. You saved us.

When should I expect my polo pony?

Do I still have to vote for Vermin Supreme to get it?

It’s coming in JUNE,be ready

What, do you see a problem with a busted up old trailer on 1/3 of an acre for $350k?

I wish they were that cheap.

And the insidious thing about buying modular is they always come with crazy monthly HOA fees – at least in my area.

Needing to cough up an extra $200-$400/mo negates all the affordability of going this route.

Well, the government is on hook for most of the residential real estate too. From the Urban.org Monthly Housing Finance report for January 2024.

Government Agency back 70% of residential real estate MBS. Banks own about 20%. Others own 10%.

Here is some more interesting data:

Total Residential Home Value: 45.5 Trillion / (2006 =22 trillion)

Total Mortgage Debt: 12.9 Trillion / (2006 = 10 trillion)

Total Home Equity : 32 Trillion / (2006 = 14 trillion)

Wha is interesting since Peak HB1, Debt has increased 2.9 Trillion while home equity increased 18 trillion. Hmmm

Composition of US Single Family Mortgages

Agency Backed (GSEs) = 9 Trillion (70%)

Unsecured First Lien (Bank Portfolios) = 2.6 Trillion (20%

Unsecured First Lien Other = 1.3 Trillion (10%)

Private Label = .4 trillion

The data is from the urban.org Monthly Chartbook report for January 2024

“Wha is interesting since Peak HB1, Debt has increased 2.9 Trillion while home equity increased 18 trillion. Hmmm”

Well, that is way better than if it was the other way around…

45.5 != 12.9 + 32

22 != 10 + 14

I get your point, and the numbers are fairly close, but the accounting does not quite add up. Not that is easy to estimate total value of all homes , or the instantaneous mortgage balances, either.

“government is on hook“

Bwahahaha

Phoenix,

Total value of the us housing market, from what I can find, is $47 Trillion. You really think you want to see that market tank? I doubt it. Were you around in 2008? It was a bloodbath for the entire country, especially homeowners, but also any entity that invested in MBS, like pension funds holding folks hard earned dollars for their retirements.

I know it’s popular commentary here to bash the real estate market, but make absolutely no sense.

Nice…spoken like a homeowner with vested interest because of how insane valuation have gotten over the last decade, especially the last 3-4 years..

Yup protect an asset class to fall because much like everything else, too big to fail, regular middle class getting F from homeownership, people are slave to their high mortgage..etc so a correction, return to fundamental should never happen…

It could just be a slight dip then a stagnant RE market and let the gdp catch up over like 10 years. That would be a happy middle ground.

For me and my wife(graduating to a 300% income upgrade from college in 2 months), we will save big time until the market comes down, the rates come down, or we can buy most of the next house in cash. Should only take 2 years for the last option.

It would suck, if in jan 2021, you had 30k saved and thought “in 1 more year I’ll have 45k for that 20% on a 22k home”, and instead lost 10k to inflation. And that 220k house is now 300k.

But then, lesson learned. You should always see who is gonna get voted into power and adjust your plans based on that.

Puts that $5.25 trillion of Fed QE into perspective. How about we just start with pulling that $5.25 trillion back out of the economy?

It’s Russian roulette with the everything after 2008

We’re now 5 bullets after the covid crack up of humans hurricane drama we have 5 in chamber

So duectime till it’s over but the good news we probably have till 2030 to depression and the hole thing goes another 50-75 years

Seems like pensions are a scam. You are forced to invest in the system, which puts the money into stuff like MBS, allowing those at the front line to get away with ever higher valuations, and then the system crashes and the pension fund loses its money.

I can’t comment specifically on the scam aspect as I am sure they differ but always good to see how they are funded and the degree of unfunded liabilities. I know my pension funds are slightly over 20% unfunded (CalPers) but I don’t know if that is good or bad or honestly what the exposure is. Pensions seem to be more a black box than 401 programs or simply I haven’t done my research.

Jokes on you my pension is tax payer backed.

If you are talking about a state pension and your state has been experiencing negative population growth for years, take caution. You may eventually have to answer the question: backed by what taxpayers?

I am curious if there are any issues with CMBS for condominium development? It is my understanding that lenders have scaled back investments.

Perfect alignment for a Federal bailout…

We can’t let xxxx government union pension go bankrupt or cut payouts…a promise is a promise!!!

“US government agencies, US Government Sponsored Enterprises (GSEs), state and local governments, and state and local government pension funds held 54.8%, or $1.09 trillion.”

Government pension funds hold only a small portion. This wasn’t clear in the article. I have now added this paragraph:

“Most of the mortgages that taxpayers are on the hook for are held by the GSEs (such as Fannie Mae) that securitized the mortgages and sold them to investors. The Fed bought about $10 billion of those “agency CMBS” in the spring of 2020 and still holds about $8 billion of them. If landlords default on those mortgages, it is the taxpayers that carry the credit risk, not the holder of the agency CMBS.”

And I clarified this line:

“Another 3.2%, or $67 billion, had been securitized into private-label (not government-backed) CMBS, CDOs, and ABS, and those securities were held by investors.”

Hi Wolf,

I’m continuing my reply here from the other thread. I’m not saying that any big bank is exposed. As you’ve demonstrated they are not. I’m just saying that hypothetically, if a large bank were to be in danger of going down because of CRE/CMBS, I believe the Fed would bail them out, moral hazard be damned.

THAT’S is the problem.

If a large bank is threatened — and that’s possible — it won’t be because of their exposure to CRE loans. It’ll be some other thing. CRE debt is just not big enough, and US banks overall only hold a small-ish portion. And big banks’ exposure to it is relatively small. Sure, big banks have some CRE loan losses, but those loan losses will take down only their profits and share prices, not the big bank itself.

Residential (single-family, condo, co-op) mortgages are roughly three times as big as CRE, and that’s what caused banks a big headache during the financial crisis when banks were still holding a lot of those mortgages. But now the vast majority of residential mortgages are guaranteed or insured by the USG and they’re backing “agency MBS” that have been sold to investors. So that won’t be a problem either.

Einhal,

(Btw, I like a lot of your comments).

“if a large bank were to be in danger of going down”

I tend to agree…but as I mentioned in a few other posts, over time banks (and I’m pretty sure the mega, systemically dangerous banks too) have become more and more just Government-securities holding intermediaries (more and more a Potemkin-entity for Fed macro-operations).

Less and less banks are lending to private sector entities…more and more to public sector entities (by buying G-backed Agency debt).

So the risk of such banks’ asset holdings defaulting per se is less-and-less. If G-backed agency CMBS or RMBS loans go bad, DC will “just” have the Fed print more unbacked money to backstop them (shifting the consequences of horrible financial decisions from the banks/government to the general saving public…see ZIRP…)

At 35% or so of bank assets, G securities are probably not yet high enough to really consider banks to be mere Government cut-outs (though we’re heading that way).

But there are a couple trillion in mysterioso “other” bank assets (what, the Fed/Feds/banks can’t be bothered to specifically ID a few trillion in bank assets?) that make me have a few questions about what banks actually hold in toto.

The whole bank-loan-origination, Fed packaging-guaranteeing, sell back to bank do-si-do, is probably worth really re-examining again.

That highly, highly industrialized process incentivizes banks to make fairly crap loans…knowing they can sell them off to the Feds (under questionably strict “guidelines”) only then to repurchase the now-Fed-backed loan securities.

I just heard or read that big banks have large exposure private equity as their loans to PE is much larger than more traditional lending segments. If that’s true, I would think that could be the thing that causes a blowup as so much PE is mark to model and probably owns assets that have lost a lot of value. I hear radio ads all the time for sketchy investments targeting accredited investors and I have to assume they find a lot of suckers or there weren’t be so many of those ads.

“If G-backed agency CMBS or RMBS loans go bad, DC will “just” have the Fed print more unbacked money to backstop them”

Does this have to happen? I’ve been wondering…

MBS on the Fed’s balance sheet are paid off by pass-thru principal payments – i.e. that money goes to the Fed and is then destroyed. And when a MBS matures, the Fed gets ‘paid’ for the value of it – aka they destroy that money.

Since central banks don’t follow normal accounting rules, can’t they just ‘write-off’ the tranches of the MBS in default – i.e. just reduce their balance sheet by the amount of the default, in the same way that the BS goes down via MBS/bond rolloff?

MM, I don’t think it works that way. Since those securities are guaranteed by the full faith and credit of the United States, the treasury has to pay back those bonds, so the Fed will get its money either way.

Wolf said: ““Most of the mortgages that taxpayers are on the hook for are held by the GSEs (such as Fannie Mae) that securitized the mortgages and sold them to investors.”

——————————————————————–

How can a mortgage be held by a GSE if the mortgage was securitized and sold to investors?

GSEs collect the mortgages into big mortgage pools. A mortgage pool then backs the bonds (securitization such as MBS) that are being created and sold to investors. When someone buys MBS, they get the security, not the mortgages. The GSEs hold the mortgages and manage the mortgage pools, take in the interest and principal payments and the payoffs they get from the mortgage servicers and they pay interest to the MBS holders and pass through the principal payments and payoffs to the MBS holders, etc.

“Another reason why the Fed can let the CRE swoon rip.”

Wolf-

Is there a total CRE as % of US Bank assets number you can share, and any comments on its importance, or unimportance to the contagion discussion?

Thanks, and sorry if repeat of past discussions…

US and foreign banks hold $1.78 trillion, or 38% of the $4.69 trillion in total CRE mortgages (MBA data).

Foreign banks have already started to confess about the bad US CRE loans:

https://wolfstreet.com/2024/02/05/us-office-cre-mess-is-spread-far-and-wide-across-investors-banks-around-the-globe-us-banks-eat-only-a-portion-of-the-losses/

It’s pretty likely that after the election, tax cuts will be a priority, which implies only a small subset of taxpayers will be on the hook.

Even though I believe that, I don’t know what that actually means for the CRE future.

Bailout for sure. Bailout = Money Printing = Inflation. Inflation is not the taxpayers problem it is everyone’s problem. I love it when people say ” taxpayers are on the hook”. Unless tax rates are drastically increased it is not on the taxpayers, it’s on everyone through inflation.

Wolf – A question. Has anyone estimated what the total losses in CRE will be?

Someone came up with $1 trillion, or around 22% in total. Some CRE is still performing reasonably well. Interest rates are impacting all of CRE, but only retail and office have mega structural issues that lower mortgage rates cannot resolve. Retail has had these issues since 2017, and even 0% didn’t help those properties; and office started having structural problems when working from home made clear that the market was way overbuilt. A lot of those malls and office buildings are worth only their land value.

But multifamily doesn’t have that problem. The US population is growing, and there will always be demand for housing. The problem is price — nearly all of the multifamily construction over the past decade aimed at the higher end, because that’s where the money is, and now the question is if these new developments can get the rents they need to have to pay for the mortgages.

Thanks, Wolf.

We’ve got two commenters using “WB” here. This gets confusing. One of you please add something to WB, such as WB01 or whatever. Thanks.

Not sure about that other “WB”…

Anyway, the issue with lower end single family rentals is still the backlog of evictions in the court system and the delays of actually getting these bad tenant kicked out. Until the rule of law is actually re-established, there will not be any investment on the lower end. Why would anyone?

There are only a few jurisdictions where this is still the case. In most places, it’s been back to normal for a while.

Sure, back to normal, but in many places the “normal” is the problem.

Wolf,

Where is the data? In Georgia the average time to eviction is 12-18 months between getting through the courts (and revolving judges) and then getting the marshal on site (who does the actual put-out).

WB,

Here is the data: 1-3 months in Georgia, about the same as before the pandemic, article by property management software company Innago:

https://innago.com/georgia-eviction-process/

In omaha largest rental homeowner in nebraska made you sign your eviction agreement ,along with lease of course him and constable were buddies wink,wink

If rates go higher (as some here wish for and others expect), mightn’t that “$1 trillion” estimated loss be even higher?

And at what point would the Fed consider the expected loss to pose a threat to the banking system?

Thanks in advance…

That $1 trillion was just a guess by someone (a hedge fund manager or similar, I can’t remember). No one knows what will ultimately happen. But a $1 trillion loss in the stock market is a nothingburger. Keep that in mind. Sounds like a lot but it isn’t in today’s world. If Apple and Microsoft both go down only 16% and all the remaining stocks stay unchanged, that’s a $1 trillion loss, like I said, a nothingburger in the overall scheme of things.

Yeah, thanks! To me, that last paragraph was an important “missing” part of the article. Made me glad I am in a low rent (for this area) apt that most here would call a dump. Very glad.

Yes, we are FULL, all 250 hotel style 500sq ft “amenity-less” apts and grounds.

Wolf,

One of the most important bits of information in this segment would be multi-family CRE vacancy rates by city. Is such information available?

There is some data on vacancies, including quarterly from the Census Bureau, and local data.

The better data would be “on the market for rent” because apartment units are vacant for other reasons, such as waiting for remodeling to take place, new construction units that are not 100% finished, etc. The Census Data discusses some of those issues.

I discussed the national Census Bureau data on housing vacancies from time to time, including a year ago here:

https://wolfstreet.com/2023/02/02/what-is-the-actual-housing-vacancy-rate-census-bureau/

A possible analogy?

I went to market 2 weeks ago. Brand new shipment of bananas arrived, still a tad on the green side, so there was only upside, and they were cheap! So I bought 3 cases and took them home, admiring how they were gradually turning a very attractive bright yellow!

Today I went back to check on them, and they are all turning greasy black and oozing.

I guess the potential of the once bright yellow color of MBS just might be turning a bit dark and greasy?

Sorry all, I might just be in a funk today.

Here’s the hot tip on bananas. When you get them home, wrap each one individually with Saran Wrap. Air tight. This will stop the ripening process and they will last 3 times longer. I don’t know if this will work for this other problem you are alluding to but they might figure something out. :)

I did something similar to my greenbacks to hedge against inflation. You see, the more cash I Saran wrapped, the more cash I could squeeze under my mattress. But it turns out, cash is currently a depreciating asset. Who would’ve thunk

/S

Imposter,

your analogy stopped too soon: Make lots of banana smoothies out of your overripe bananas (delicious) and sell them for $6 a class at your roadside stand; with about 1.5 bananas per glass on average, you’re looking like a genius.

” the more cash I Saran wrapped”

If you hide your Saran-wrapped cash in your freezer, you qualify to be a US Congressman.

(If you hide your Saran-wrapped *gold* in your spouse’s freezer, you qualify to be a US senator).

Hence the origin of the phrase “cold hard cash”?

It’s clear that the only way to save/preserve the system now is to print, print, print. Every debt hole, every underwater asset, every broken promise with no possibility of recovery can only be saved by more and more and more FRNs firehosed into the system. FRN = Federal Reserve Notes, what we’ve all been led to believe are “Dollars”. They aren’t but that ship has sailed.

Anyway, I’m noticing what seems to be a small pause or pullback in housing prices. Sales are back to 2021 vakues – anyone who bought the momentum into 2022-2023 is now underwater. One house in particular nearby sold for $450 in 2017, 650 in 2021, and is now listed for 650 after successive cuts from 725 and has been sitting for 90+ days. They’ll end up selling at a loss (although to have lived there for three years would have cost about $100k in rent). They might get out at only $600k now.

With massive continuing inflation guaranteed because of the inescapable printing, residential real estate will in the end hold up in FRNs. In 2035 that house might be selling for $1M. Maybe a lot more.

The time to strike in RRE might be near. Not a 2011 opportunity but still an opportunity.

“It’s clear that the only way to save/preserve the system now is to print, print, print.”

That’s silly. CRE is being reprice in the market just fine, even as we speak, and we’ve been discussing this for over a year, and that’s how it works, and how it should work. Debt goes away in bankruptcy or after a foreclosure sale, when lenders accept their well-deserved losses and go on.

We manage more than 200 units in SoCal.

Rents still going up. They have gone up about 30 to 35% post covid.

Zero vacancies, anything comes up goes within 2 weeks.

I see no stress but booming times.

What is your time to eviction?

Maybe you need to manage some units in San Antonio where apartments sit vacant for months before the owners finally accept reality. This whole country needs a dose of reality, good and hard.

I see for rent signs everywhere. Almost every Apt.

@WB if you have just better than average apartments you can fill them with better than average tenants and go years or even decades without an eviction (I have not had an eviction in almost three “decades”).

@Steve people come and go in the apartment business (I turnover about 1/3 of my units every year) and I always have a “now leasing” sign in front of every property (to talk to people that are interested in moving into that building someday)

Imposter-

Not sure how it plays to your analogy, but nearly black bananas make unexpectedly delicious banana bread.

Great gifts for family or friends, and it freezes well…

And the baked bread lasts longer when Saran wrapped! Saran Wrap *almost* solves all…

Duct tape solves ALL problems!

Try it instead of Saran wrap/thank me later.

I will say would not need on banana bread as it has a very small life expectancy with in my arms reach.

See: “Another Banking Crisis Was Predictable – Thomas Hoenig. March 18-19 WSJ 2023. “The original sin was monetary policy”.

Means-of-payment money hit an all-time high in Nov. 2020. How could the authorities be so ignorant?

Powell:

#1 “there was a time when monetary policy aggregates were important determinants of inflation and that has not been the case for a long time”

#2 “Inflation is not a problem for this time as near as I can figure. Right now, M2 [money supply] does not really have important implications. It is something we have to unlearn.”

#3 “the correlation between different aggregates [like] M2 and inflation is just very, very low”.

None of the monetary economists have it right. All their figures have been negative for awhile. Given the current trajectory, long-term money flows, proxy for inflation, won’t turn negative until later this year.

Just let the free markets fix everything. What could possibly go wrong with that? The FDIC can cover the legal amount and the rest follow the established economic system. The government only need protect things that are deemed too important or of national security from failure, which loosely translates to protecting wealthy investors. Can only wonder what happens if Ford starts to go under but appears protectionalist policies will be increasing soon. Back to the 80s again. Perhaps they can bring the Granada back again!

It seems worthy of consideration that an economic system should be designed to endure a few bumps and seems our infrastructure gets worse by the year.

Glen:

Only referring to, ” and seems our infrastructure gets worse by the year.”

OF Course our infrastructure, including especially anything ”built” since the late ’60s/early ’70s, gets worse and worse.

Corruption in the construction industry, from top to bottom, likely peaked somewhere more recently than those decades,

but it was bad bad bad to the bone those years far damn shore…

Hurricane Andrew, 24aug1992, proved clearly that was the case in the residential real estate in SOFLA, and various regressive analyses since proved it was the case in almost if not every state highway systems since.

But, it’s OK, because the cost of repairs will just be another ”slight” burden on taxpayers,,, eh?

Good points although I was pointing to our economic “infrastructure” but of course that could be equated to real infrastructure. The latter should theoretically be easy to fix!

A random snip:

“Because the 17.26% delinquency ratio on nonowner-occupied loans in Goldman Sachs’ $7.53 billion CRE loan portfolio includes loans that are not accruing interest but are still current, the firm does not consider the ratio a useful indicator of portfolio delinquency, the spokesperson said.”

I can’t help, but think there’s a lot of very creative accounting going on that distorts the perspective on CRE terms and conditions….

I’m blissfully unaware of how the plumbing works.

Wolf,

I know you typically don’t do requests for education, but let’s assume I’m stupid about how these CRE loans are categorized.

In regard to the Goldman loans not accruing interest, how has that metric changed recently?

I’m just curious about how distress is being accounted for. Just read this:

Nonaccrual loans are loans that are no longer generating interest income for the lender because they are considered to be in default or delinquent. This means that the borrower has not made payments on the loan as agreed, and the lender has decided to stop accruing interest on the loan until the borrower brings the account current. Nonaccrual loans are a way for lenders to protect themselves from potential losses, but they can also have significant consequences for borrowers.

Any sort of perspective on this is appreciated

@Redundant: I have 2 thoughts:

1) They are trying to make their own delinquency ratio a little more palatable by claiming that these loans are current. If they are really current, why did they include these loans on ventilator-support in this category?

2) They are trying to understate their interest losses by not accruing interest per the terms of the loan agreements.

Both actions seem to whitewash problems.

Commercial mortgages have a 30-day grace period. That might explain part of it. In addition, a lot of loans are now being renegotiated, sometimes during the grace period, and sometimes afterwards. Everything is now being renegotiated if the landlord doesn’t want to give up the property. And that makes sense. If the landlord doesn’t want the property anymore, they walk away — and they’ve done a lot of that too, big landlords with big properties.

BTW, that $7.5 billion of Goldman’s CRE exposure that you mentioned in your other comment here is a nothingburger, as I said for big banks. It’s 1.4% of Goldman’s total assets of $530 billion.

Do any of the FHLBs hold multifamily MBS?

The FHLBs only lend to banks, and banks have to post eligible collateral. Government-backed MBS qualify as eligible collateral. The FHLBs do not lend to anyone other than banks.

“GSEs (such as Fannie Mae) that securitized the mortgages and sold these “agency CMBS” to investors”

Is there a way that the tax-payer can protect themselves? Or at least sue these GSEs for pushing the losses down their throats.

Everyone could vote differently.

Nice that the gubmint “guarantees” everything. MBS, pensions, student loans, etc. The only thing in the end that matters is they are guaranteeing a huge loss in purchasing power once all that mess is bailed out.

Don’t know what portion of the US you are writing about – – but new multifamily construction is exploding here in Texas. Is it Detroit (sic) ? I would love to get a piece of that Texas action.

These are loans on existing buildings – some of them built decades ago and refinanced. RTGDFA.

Those new buildings are going to add new supply, which is great, because it pressures rents, but then it also pressures the loans further.

end any public pension funds already. It’s just another name for ponzi scheme (well, they’ve been around from earlier but still)

Wolf, kind of a misleading bit of information here brother. Having done Billions in MF acquisitions, I have an opinion: The risk in the MF sector is very real due to massive cap rate compression and WAY too much liquidity. Lets just say it is the Sub Prime crisis all over again and is slowly becoming evident. The difference here is that the lenders were not FNMA and Freddie, in which case the tax payer may be on the hook. The real culprit is bridge lenders such as Arbor that agressively loaned $# based on bulsshit proformas and then offloaded most of the risk via CLOs. Far more agressive than what is fairly conservative FNMA underwriting. Long story but lets not foster fear and speculation here, please. Much appreciation….Steven