One-year yield rose to 5.05%, highest since December 12.

By Wolf Richter for WOLF STREET.

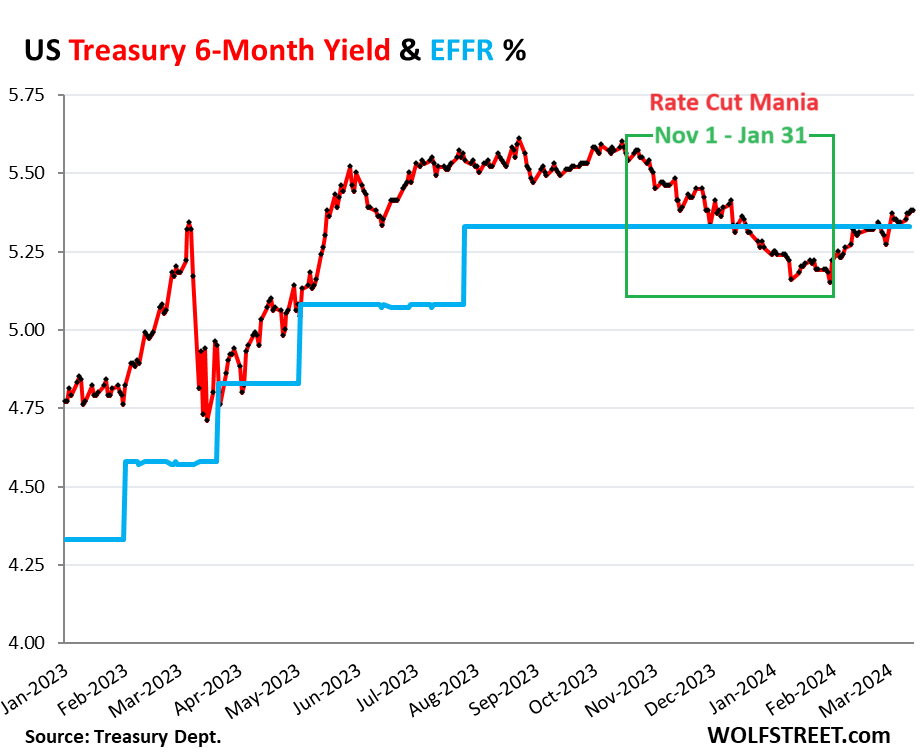

From mid-October through the end of January, the 6-month Treasury yield had dropped by about 43 basis points, from around 5.58% to 5.15% (green box in the chart below). This means roughly, that at the end of January, the 6-month yield – a calculated composite representing securities with about six months left before they mature – saw two rate cuts within its six-month window, spread over the three FOMC rate announcements on March 20, May 1, and June 12. So roughly two rate cuts by the June meeting.

But since then, the 6-month yield has risen by 23 basis points, to 5.38% today, which is right in the middle of the Fed’s target range for the federal funds rate of 5.25% to 5.50%.

And since then, the end of its 6-month window has moved into September; so it’s now starting the process of walking away from even one rate cut by the July 31 meeting. The 6-month yield is now solidly above the current Effective Federal Funds Rate (EFFR, blue), which the Fed targets with its headline interest rate.

The FOMC’s September 17-18 meeting is already outside the six-month yield’s window, and the six-month yield is silent on it. We’ll look at the 1-year yield in a moment to get some answers.

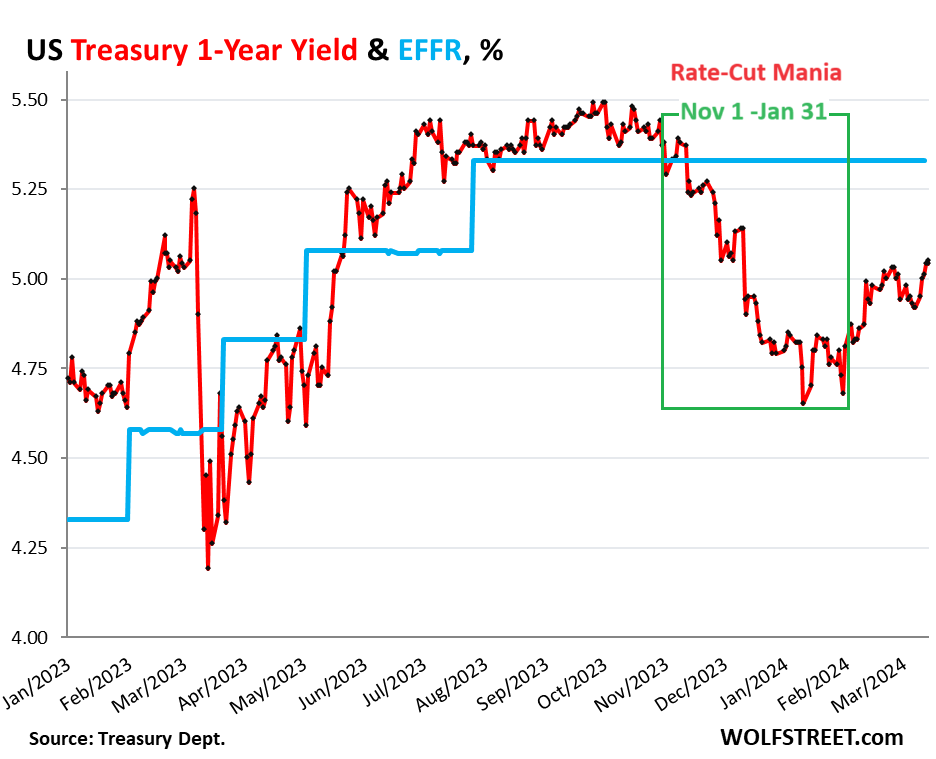

Rate-Cut Mania began in early November and by mid-December whooshed gale-like through the markets. The federal funds futures market at one point bet on seven cuts in 2024, starting at the Fed’s January meeting, and if not in January, then with near 100% certainty at the March meeting, which is next week.

But the January rate-cut hopes were met by the FOMC’s push-back statement, followed by Powell’s push-back press conference, which was followed by lots of Fed speakers’ push-back comments, amid nasty-surprise CPI reports, PCE price index data showing the worst core services inflation in 22 years, and an increasing mess in the PPI data.

Every Fed speaker, from Powell on down had packaged any rate-cut expectations in a big-fat IF … if inflation continues to decline toward our 2% target. They all wanted to be “confident” that inflation was heading that way before cutting rates.

But inflation started turning around late last year and has been heading higher, thereby sapping the Fed’s “confidence,” instead of building it. Gradually it’s sinking in. And Rate-Cut Mania is getting dialed back.

The short-term Treasury market never bought fully into the Rate-Cut Mania that took off in the federal funds futures market, but also started pricing in some rate cuts.

The 1-year yield had dropped by 82 basis points from the peak close to 5.50% in October to 4.68% at the end of January.

Since the end of January, it has risen by 37 basis points, to 5.05% today, the highest since December 12. It is just one rate cut below the Fed’s current target range.

The Fed is now in a wait-and-see mode – waiting to see if inflation is cooling or re-heating and if the labor market is cooling or re-heating. Wait-and-see is a safe place to be at this point, with rates at 5.5% at the top of the range. Data is inconsistent and volatile, and it can go all over the place, and no one wants to make a decision on just one data point. The longer they wait, the more data points they have, and the clearer the picture gets.

Next week, following the FOMC meeting, we’ll get the Fed’s rate decision, and it won’t be a rate cut, obviously, though the federal funds futures market was nearly 100% certain two months ago that we’d get a rate cut.

And we’ll get a new Summary of Economic Projections (SEP), which the Fed releases at the meetings that are near the end of a quarter. The last one was released at the December meeting. The SEP contains the infamous “Dot Plot,” where each FOMC participant projects where they see rates to be at the end of the year. The Dot Plot is a messaging tool to communicate the status of current thinking; it’s not a commitment of any kind.

On the December Dot Plot, the median projection was three rate cuts in 2024.

Now the question is: will the median projection of rate cuts change? Will it drop to two rate cuts in 2024? We’re sitting on the edge of our collective chair.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

It is so surprising that even with these high rates none of the assets are getting repriced. In fact all the assets (house, stock indexes,…) prices keep rising…. when do you think assets will get repriced?

Huge repricing going on in CRE.

One class at a time?

I don’t know why there should be any surprise or fear. The economy has been surprisingly resilient especially as evident unemployment which truly drives GDP. RATES need to be where they are till inflation stabilizes. Indices do not really need to reprice other then a needed correction when technicals indicate via overbought Fed should “unofficially “ be accepting a slower decline in Inflation to 3 per cent or less and not “ break” something and not be pressured with raising rates

Why does the Fed get to decide where inflation rate should be?

bro what even are you trying to say, it’s like a word salad.

I believe nerenberg thinks we’ve dug far enough and maybe soon we can refill the hole.

I think we should dig deeper and see who falls into the hole.

Stagflation

From a “boots on the ground” perspective (I own a real estate company in South Florida), we see many that purchased residential real estate in 2021 trying to sell in 2024, trying to decide how much money they are willing to lose at a sales price to close.

Inflation also surged from q3 2007 to q3 2008. Normal end to the cycle?

They forgot the lags this entire cycle.

I doubt this will be pretty. What does Powell know about monetary policy anyway?

Joey,

Why are they selling if they just bought in 2021?

Joey B, I’m in South Florida as well (Palm Beach County) and am seeing the same trend, although from what I’m seeing on the real estate sites, people who bought in 2021 are still trying to sell for 50-100% more than they paid, and it’s the people who bought in 2022 who are trying to get out “whole,” as though “Wait, maybe it wasn’t such a good idea for me to buy at the peak of a bubble, and hopefully I can get out now!”

Bobber, my theories as to why they are selling is that some of them are people who moved down to “work remote” and now have been called back to work. Some of them held off as long as they could.

Others are people who moved down during the pandemic and don’t like it as much as they thought they would.

Also, from my anecdotal research (property records are easily accessible on the web here), a not insignificant number of the 2021-2022 purchases were by investors (I can see that the purchaser was an LLC), and they never intended no living in them. Now they’re trying to get out.

The fact is, there weren’t enough high paying new jobs in Florida to sustain the 75-100% price increase in 2-3 years, and it was bound to start collapsing at some point.

The problems with our hurricane insurance market also don’t help.

The rental market has also noticeably slowed outside of Brickell and Downtown Miami.

Joey B, any other thoughts?

Einhal, bobber and Joey-

Good points, all.

Another problem in SW Florida, but statewide as well: traffic! When does an hour+ drive to travel a few miles to the beaches and find a parking spot dampen renter and SFH-buyer demand?

Perhaps (as with higher prices curing higher prices), higher population cures higher population?

Way Overdue.

Agreed…we already see significant cracks now in residential real estate. This cycle reminds me if how the S&L Crisis played out. Deep and long inverted rate curve, rates increase along with credit standards, CRE blows up, then resi follows.

What is S&L crisis?

Concerned_guy,

https://en.wikipedia.org/wiki/Savings_and_loan_crisis

Back in 1985, when I was in grad school, I wrote an accounting paper on one of the savings & loans, one of the big ones that was publicly traded, and so I could get information on it (this was before internet, and I had to get the filings on microfiche in the library). This was before the crisis had blown up into the open. My accounting prof told me afterwards that he showed this paper to his buddy who was working for the FBI’s financial crimes division, and the FBI guy told the prof that they had a room full of documents that they were going through, trying to figure out what was going on. Later, lots of people that ran these S&Ls went to jail, including the guy that ran the S&L that I had written my paper on.

I was spending a lot of time then in Norman OK, and all over town boarded up S&Ls were covered with graffiti, most common of which was,”Bank of FDIC, new branches opening daily.”

But more to Wolf’s point, when they dug into the paperwork they found things like a $1-200,000 loan, collateral for which was a guarantee a certain HS kid would sign with OU.

A very famous and highly paid OU coach was also caught up in stuff like that, and he vanished, but I think without jail time….(he had enough wealth by then) and S&L people did their short “white collar” time. Don’t rob a 7-11 there, though….3rd time they likely execute you….if you are poor and of the proper color.

I recall people saying when they first got there, “I didn’t realize OK is in the South”.

Football is really important to the people who run that state…..and the peons.

Wolf, what did you find out about the S&L that you researched?

I don’t remember. That was a long time ago. Some kind of massive accounting shenanigans.

I just remember the moment when I was sitting in the library, my eyes glued to the microfiche machine, and I ran into something, and it didn’t make sense, and then I started poking around, and I thought holy shit! I might have actually said it. That changed the topic of my paper. It was just accidental that I stumbled over it. I mean, who in his right mind would go through microfiche of SEC filings like this? The original topic was just a regular grad-school accounting paper topic, I forgot what, just something boring and innocuous.

Imagine being Calpers…buying all those skyscrapers for income to pay pensions, and to be down 70%

Commercial real estate, Bonds, & crypto have gotten wrecked.

Bitcoin will follow the others down the drain. It really is rat poison. Wolf, you are much to charitable to these deviants who pump & dump crypto.

Many of them did reprice already? Many of them are still repriced down 90% from their covid craziness? Then some got bid up back to where they should be, and some got turned into meme stocks again (CVNA, SMCI, et al.), and some ran up way too far again.

It is the old battle between greed (idiot levels of) and fear (long justified, but delusionally denied).

Basically, perpetual, extreme Fed interventions have bred an investing public that 1) insanely believes it can exit every mkt at its absolute peak while 2) blindly assuming the G is some sort of diamond pooping unicorn that can *always* make the bad things go away (somehow, in some way, that is never actually explained…after all, it is a big, magical, diamond pooping unicorn).

34 trillion in debt? Doesn’t matter…last 10,000 cigarettes didn’t kill us either. All those other dead bodies (inflated to destruction economies)…can’t happen to us…after all we have the big-ass unicorn.

But below the surface…everybody knows this is 100% bullshit.

The traditional investing classes have been overvalued for 8 years (post 2008) and really overvalued for more than 20 years (with only a huge 2008 collapse reintroducing reason).

*And most people know it*…so they are primed to perpetuate panics.

Which the G then “fixes” by diluting away the residual private savings that have survived (ie, printing money to crater interest rates to pseudo re-inflate asset classes).

Everybody has seen this horror movie before and everybody knows they are going to be subjected to it again.

I ran across a Poly-Sci prof who came up with this model he calls “Inverted Totalitarianism'” It’s a short read, and fits this country well. Gets better towards the end and is VERY VERY SHORT and worth reading!……..(Cas is trying to describe a lot of similar things, I think.)

I promise!!!!!

Stocks are getting there… Creaking everywhere and once it starts breaking down it’ll probably go back down to where it bottomed back in late 2022 fairly quickly for it’s first stop. Wouldn’t that be a hoot lol

Homes are the one that actually needs to fall and then maybe this could all go away but seems we’ll need job losses or high rates for several more years. The latter is probably ideal if we could get a slower deflated housing market over the next 5 years versus a crash society is probably better off

No one seems capable of understanding why stocks keep going up. So I’ll try again, as its really very simple.

We are living through a monetary crisis, in which persistent inflation is buoyed by war, and war – prep. We are adding a trillion a quarter in debt. Even Powell has said it is no longer sustainable. That’s quite strong language from a usually a-political Fed. Then, add to that, the Chinese, amongst others, who see the inflation (and don’t delude themselves that it is a temporary phenomena) properly, are shedding long term Treasuries. Result TLT ETF moves from 160 to 90, massive sales of US government debt.

As that money moves away from Treasuries in needs to park somewhere. There aren’t many places to move the capital to, so it goes into equities. The debt markets are, at a minimum, 5x the size of what the equity markets are. So when the money moves from big market to smaller, you et a lot of upward pressures. Its not about P/Es and all your usual stock broker 10k-40 and balance sheet blather.

Its just capital flows.

“As that money moves away from Treasuries in needs to park somewhere. There aren’t many places to move the capital to, so it goes into equities.”

That’s silly. Money CANNOT “move away from Treasuries.” Every single Treasury security is held by someone, and if that entity sells it to get their money out to move into stocks, another entity has to buy it by putting into Treasuries exactly the same amount of money that the seller is pulling out, and they have to get this money from somewhere. Same with stocks. Money cannot move out of or into stocks (except through share buybacks and share issuance). But people can lose money in stocks when prices go down. That value just vanishes.

You gotta come up with a better theory about stocks, LOL

China Deals Direct with the issuer…

also – you seem to be unaware of what Open Interest is in Markets.

…call me silly if you want.

Yes, China has to get its dollars from somewhere, it cannot print them. It doesn’t matter if deal directly with the issuer. I too deal directly with the issuer when I buy at TreasuryDirect.gov. So same thing. It’s a fundamental principal. The only exception is the Fed that creates dollars and buys Treasuries with them during QE, and destroys those dollars doing QT.

The Fed has sold more securities in a short period of QT than China has ever owned. The anomaly price for TLT was 160 during the pandemic QE, 90 is close to par. Yields climbed well above issue price, so price falls to match current yield, not because China is less interested. China is fighting deflation. China was getting less money for its export led economy due to stronger dollar. Selling treasures is a good way to generate funds to buy yuan (more manipulated and fiat than dollar) to support it’s local currency. China has a rotten domestic real estate mess of it’s own that far outweighs any concerns it has over fiscal policy in the US.

People don’t believe the feds will hold raise rates.

Look at rate cut mania. Why would assets reprice if everyone knows that cuts are coming soon?

Why would people believe anything else. Every time there is a Fed meeting the press, the brokers and the banks line up saying that the Fed is going to or has to or now will for political reasons pivot any second and drive rates aggressively back down. Pavlov’s dogs hear zero rates are just around the corner so they hold on tight and if they can continue to spend. This of course drives up inflation. The real question should be why would the Fed cut rates in an economy with better than full employment, higher than acceptable inflation, and a stock market that is gravitating ever higher? They probably don’t want to throw gasoline into the existing fire.

Are these really high rates ?

For the Treasury, do rates really matter, when the consensus is to just borrow whatever as long a foreigners buy our debt or as long as lanes can be built to channel more bank deposits into buying Treasury debt.

Is there a spreadsheet that can tell us how many years this continue ? The answer is probably NO. Maybe when Trump is president (if that happens or is allowed), the incentives will be in place to have the bill come due on his watch ?

He is a real estate guy. That whole game is how to make money with debt and bankruptcy.

danf51,

Inflation inflates tax receipts as nominal (not inflation adjusted) economic growth increases tax receipts. They reduce the burden of the $34 trillion debt. So the figure to watch is interest income as a percent of tax receipts. Congress will let it get a lot worse before they get serious:

If inflation forces rates to go higher, this line could go higher in a big hurry.

Doesn’t inflation only reduce debt to the extent that bond holders cooperate? Inflation was a surprise in 2020

Inflation reduces the BURDEN of debt because inflation inflates the tax receipts that pay for the debt, and it inflates the nominal GDP. That’s why we look at ratios such as debt to GDP (neither one adjusted for inflation) or interest payments as a percent of tax receipts.

Trump…”He is a real estate guy. ”

No, he’s a real estate SALES guy.

These idiots need to quit dreaming. Mortgage rates need to hit 9% to start fixing housing prices. The fed should absolutely be raising rates again, but they won’t. They’ll sit and do nothing while inflation rises again.

The recent NAR commission decision will help prices a little bit, but I suppose realtors will find a way to hide it somewhere else.

Homeowners won’t drop the price even if realtors take a smaller cut. The sellers will just walk away with more. Comps have 6% realtor fees priced in.

The NAR proposed settlement yesterday looks to be a big fat nothing burger. Slap on the wrist. I hope the court rejects it.

9% – NICE! The FFR should have been taken up to at least 6% and possibly up to 6.5%. I agree, it’s going to take a lot of inflation to move the Fed higher on the FFR.

Biden’s budget says we’ll overspend to the tune of $2.12T. With this and the middle east volatility, gas prices may surge substantially over the next 6 months. If this happens, core PCE inflation will easily push up to 4.5%. And remember, when inflation heats up, it takes many months for it to cool off.

With all of this deficit spending, I seriously doubt there will ANY rate cuts this year. The labor market isn’t going to roll over. Companies are cutting the FAT right now, because it makes sense. They’re rightsizing after having grown too large over the last 3 years. It’s not because profits are under stress.

CRE is a red herring. The Fed will backstop it ad nauseum. It’s going to play out over 3 year anyway.

And nobody wants to admit the REAL reason why rent & OER keep climbing higher. It’s all about the extra 10M new persons living in the US. They have to live somewhere.

Guess what? They are not living in my condo complex in San Antonio. Many empty units going begging. This country has millions of empty apartments and houses.

Well, they’re living somewhere, and as far as I can tell, they’re not homeless, by and large. There’s absolutely ZERO chance all of these millions of people are NOT having an effect on rent prices. It’s simply not possible, but I’m not going to try to breakout the exact added cost. But, it’s there. No way around it, and NOBODY talks about it.

They’re living four to a room in their cousins slummy apartment in Omaha. Not as much pressure on prices as you’d think.

“CRE is a red herring. The Fed will backstop it ad nauseum.”

No they won’t. Banks aren’t very threatened by it.

If you think for a moment that the Fed won’t backstop IF it becomes a bigger deal than they expect it to, then you may want to have your head examined. It will take them all of 24 hours to reboot BTFP v2.0 or something like it. We’ve entered into a world where the Fed is going to backstop every single major problem that arises rather than forcing investors to take haircuts.

GuessWhat,

“We’ve entered into a world where the Fed is going to backstop every single major problem that arises rather than forcing investors to take haircuts.”

That’s total bullshit. You’re lying. The Fed only backstopped the DEPOSITORS NOT INVESTORS – and only if it thinks there could be contagion spreading — such as the super-fast runs on the bank by uninsured depositors as a bank panic was spreading, as we saw in the spring of 2023.

It crushed investors, stock holders and preferred bondholders both. It only backstopped uninsured depositors. Investors in those banks got wiped out.

In CRE, investors have taken huge losses, and the Fed is just fine with it. Banks have taken some losses too, and no big deal.

Wolf, I agree with your response in this particular case, but I do see GuessWhat’s general point. If the CRE situation got so bad that the choice was to let JP Morgan or Wells Fargo go down or backstop the entire CMBS market, I have no doubt they’d pick the latter.

NO one seems willing to let any large groups take extreme pain, only moderate pain.

Einhal,

That’s just more nonsense. Those big banks don’t hold enough CRE loans to put them at risk. Even Wells Fargo made $19 billion in net income in 2023, and can take some losses. JPM made $49 billion in net income in 2023. These are huge immensely profitable banks, even the weakling Wells Fargo. They can take big losses. We’ve been talking about this for a year. Some smaller banks might topple because they’re heavily concentrated in CRE, but banks overall — and big banks in particular — just aren’t that exposed that much. INVESTORS and TAXPAYERS are exposed to CRE in a massive way, and they’re taking losses just fine, and the Fed has zero problem with that.

One more just for you, hot off the press:

https://wolfstreet.com/2024/03/18/whos-on-the-hook-for-multifamily-cre-mortgages-1-taxpayers-far-ahead-of-2-banks/

A major reason why rents and price of Homes so high is the ten million new persons living in the U.S. , you got that right. Why Republicans are not saying that in order to win races? I suspect there are many who welcome the additional people in order to keep labor costs lower.

@Allan Barr: Republican races are funded by the billionaires and the oligarchs. They have all taken advantage of immigrants to keep wages low. They will let the Republican politicians do all the dog whistling to get the votes, but will not let any changes to immigration law happen. The clear proof is that none of the Republican presidents have done anything about immigration over the last 40+ years even when they had control of the Senate and the House. People who believe that the GOP is tough on immigration and is for sound fiscal policy need to wake up and smell the coffee. There are similar reasons to complain about the Democrats, so I’m not being partisan here. I’m just responding to your point as to why Republicans are bound to disappoint the voters if they expect true immigration reform from the GOP.

Look at Tyson Chicken in Iowa.

Cutting rates at this time will punish low-income seniors who will have to pay more money for housing and food while the landed gentry laugh all the way to the bank with inflated dollars.

I’m fairly certain that the gentry (landed or otherwise) laugh all the way to the bank regardless of the level of interest rates, since prevailing inequality means they already own the bulk of the assets — both those which give them money via the interest income channel and those which increase in price when interest rates fall.

Where monetary policy is concerned, heads they win; tails you lose. The only way you can get them is via fiscal policy, and then only if you can get legislators who aren’t in their pockets.

Which is to say, we’re screwed …

Dot Plot says Eleventy rate cuts.

Inflation is Transitory.

Subprime is contained.

War is peace

Freedom is slavery

If the economy is doing so great as Politicians and State Media would have us believe, why do we even need rate cuts?

We don’t. Not. At. All.

Wall Street needs rate cuts.

Wall St. doesn’t need rate cuts. They are at all time highs in most assets without them.

Go figure?

And there is the nuance.

Well done, DC.

Everyone reading my comment right now should be prepared for this. Rates go up… And yet… Assets of a wide variety all go through the roof.

What difference does the how, what, who and why matter ?

You think they won’t lie to you, come up with a cover story after the fact, and print money into oblivion somehow ?

Maybe its not even intentional.

Just don’t say someone didn’t tell you so.

Ryan Merritt,

“Assets of a wide variety all go through the roof.”

Here is what assets actually DID during these inflationary times:

1. Commercial real estate asset prices have plunged, some have collapsed.

2. CRE debt prices have collapsed. The investors holding them are bond funds, life insurers, pension funds, REITs, private equity firms, etc. that are holding CMBS and CLOs, the mezzanine debt, and the mortgages. Banks, including foreign banks, are also taking big losses on those assets as they plunged in value – and so are their stockholders, LOL.

3. Home Prices have edged down from their All Time High in June 2022 (NAR), having failed to set a new all-time high in 2023 for the first time since the Housing Bust.

4. The Nasdaq Composite is down 1.5% from its all-time high in Nov 2021. It has “ground nowhere” in 28 months, while people with T-bills made over 10% over the same period without all the drama.

5. The S&P 500 is up by 6.7% from its prior ATH Jan 3, 2022. So it has risen 6.7% in 26 months, while people with T-bills made 10%, without all the drama. If you include dividends, they’re about even. If you include state income tax benefits of T-bills, T-bills are ahead.

You see, it’s only in your imagination that asset prices only go up. And the Fed is just fine with CRE collapsing and investors getting cleaned out. No biggie.

I hope the windows still open so all the S O B can still jump ! Along with some rope for there friends

I was wondering: What are the chances that the actual rate cuts, whenever they happen, are being set up to be a sell the news event?

For once I agree with you. Usually I simply wish you were correct.

Don’t leave out politicians!

Re: Wolf

“T-bills made 10%, without all the drama”

I’m only getting 5+%, how do we get 10%?

Tyler,

since the Nov 2021 high of the Nasdaq and the Jan 2022 high of the S&P 500. So 28 months and 26 months of income.

Doesn’t the US govt need some rate cuts too? If not won’t the interest expense keep ballooning? I feel like that’s the reason rates haven’t been hiked more…

The 2 trillion dollar annual deficit might be the real problem here

They were used to borrowing at the Fed Window at .5%. Bankers and their friends used this cheap money to buy Grandma’s house as a rental. That game is gone.

Howdy Prisoners….. This inflation cycle should be longer than the 70s 80s inflation cycle. It may never end this time???? Good Luck

DFB:

More encouraging words!

At least my (over) 3% mortgage will defend me against some housing cost inflation! While holding me hostage.

All I need next is my supervisor to retire, so I can get a decent paycheck. Then my corporate prison will be secured!

Howdy The Strangler. Hope that supervisor retires then. HEE HEE. Now if you need to sell your Prison? Good Luck. You can cash out your prison but replacing it is gonna cost you more????

Correct… the story (mostly) everywhere, including your prison. The real prison is the test of time… we’ll save that discussion for another place.

Where would I move? Possibly to another country. For the next decade I will happily raise my children in the prison of my choosing, before releasing them to choose their own fate.

It’s super easy for me to sell/ comparable housing in my area is going for several times what I am paying.

My appreciation is capped/ my sale price is given by my housing authority.

Why would I, and where would I go are the questions.

The answers are: I wont. Someplace more tropical (NOT Florida!).

Thanks for sharing your perspective on where the rates are with the sixth month and one year treasury and notes.i have not looked at it that way before. I’m watching the two year now too, since your last revelation about that one. I saw 4.72 today, I’m watching for that spike you wrote about.

I think something needs to break or inflation

will slowly crush the bottom 80 percent. So far

the Fed’s response has been too accommodative

to the asset holders . Workers and retirees be damned.

Fed won’t care. Even if inflation slows to 2% the plebes will scarcely benefit. The only question is what will be the political outcome. More of the same?

The political outcome can not and will not change with either candidate. They are both deficit-spending money-printers. Get ready for more inflation.

I’ve got all my money in short term Treasuries and 1 year CDs. I’m getting over a 5% rate of return and am very happy with that even though it is not really keeping up with inflation. I’m looking forward to a return of the bond vigilantees. When they return the yields will be much higher and I’ll roll over my CDs and Treasuries at the higher rate. Why fool around with the stock market when you got a sure thing staring you right in the face.

Howdy Swamp. Because their are more Stock Brokers than savers?

Good one!🤑

“Why fool around with the stock market when you got a sure thing staring you right in the face.”

I agree – lots of opportunities in fixed income right now. More than just treasuries too for those seeking a higher yield.

I’m broke lend me a million i promise i’ll pay you back in a year ,haw haw haw lol

Todays announcement on Realtors commissions is just one more step towards turning home buying into a smart phone transaction. My buyers don’t need much from me as a Realtor to buy a home with Redfin and others like Zillow basically duplicating the MLS. I am not surprised by the new process and in a way think it is a good thing. If I represent a Buyer in this new way of buying the only thing I would need is a hold harmless to represent someone. It is moving into a Buyer Beware situation.

Howdy M John. Local MLS information was very detailed during my years. Property history, sales, tax information, ownership, prepaids by sellers. Not sure you can find that at just websites?

You also can’t find the hidden house problems on the websites!

Howdy Anthony Lots of hidden costs, procedures with home sales. Lots of $$$ can be lost or gained by negotiating with representation.

RE anecdote. Get Inspection!!!!

My daughter and son in law were looking for a house about 15 years ago. Their realtor had them all psyched up to make an offer on an old beater. My brother and I are both carpenters and so we were asked to do the inspection for them. It was bad. We nixed the sale. The foundation was crap. and things did not improve the higher we went. That night I got in touch with their rep and told her that if they had bought that house she would have ruined their lives. She was indignant and very angry. The thing is, the realtor did not know a damn thing about construction beyond visual appeal and market trends of same.

Home inspection services can be hit or miss with a bunch of irrelevant data on their checklists, but all buyers need to ensure they make an effort before making the biggest purchase of their lives. Last year a new arrival on my road bought an old crap shack about $250K over value. He did not know the local rural market, and did not get an inspection done as he was a cash buyer. He did not talk to his new neighbours before the purchase. He has since dropped at least $300 K extra to get it up to snuff, and has had so many insurance claims on his leaky roof he can no longer get insurance until he replaces the entire thing…..new trusses, sheathing, and shingles. I figure another $75K by the rants. No one has yet to tell him his septic is also shot and needs replacing with a mound system. Add on another $37K.

Inspections are cheap insurance and even a poor service would have caught every deficiency.

In a bull market buyers often wave inspection subjects. Crazy.

Howdy Paul S. Some agents I dealt with were very good reps for both buyers and sellers. During every purchase, lots of negotiations that can lead to costing either the buyer or seller. The one with the most and best information and guts wins. Could be the buyer or seller during any purchase. The NAR just eliminated the buyers rep. Good Luck Buyers

Hi Bubba. I know Buyers are going to give up some things for a fee free transaction. The next step is to vet Buyers through the new app so they can schedule their own showings and with their smart phone access the lock box to enter. The Seller will be assured the Buyer has met certain criteria before getting the lock box code. I have helped many buyers that are fully capable of handling their own transaction. You will see many transactions going forward with only the Seller having representation and in the new app the Buyer will have access to any forms they need for a fee of course! We will eventually have only two or three online companies handling the sale like Home Depot and Lowes of home improvement.

Howdy M John. Sounds like the Wild West returns. Good Luck Buyers. HEE HEE. Bet there will still be buyers wanting to pay for representation. I would want to know all I can about the property. Filling out forms is one thing, having no representation is another. Thanks for the info….

Hi Bubba. As a realtor I know there are some issues that come up and a seasoned agent can keep you out of court or at least spot potential problems but I have to admit lately buying a home is not rocket science. The most noticeable change will be more and more agents joining the Redfins of the world. They pay per task. An agent gets paid for each showing, inspection, and other tasks. Soon working on the Buyers side will be no more than an Uber or Grub Hub job.

Howdy M John. Pretty crazy. Foreclosures, Short Sales, Auctions, buyers and sellers with the same goal and a marriage made in heaven? Doubt that. HEE HEE Not rocket science but I still say, good Luck to the Buyer then.

Hey Bubba, didn’t you know that everything can be done on a smartphone these days. Heck, you can even find your next wife with it.

I have abstract of my moms house which includes ,a person losing home in a poker game BEAT that

WOW! How can you top to that? I thought I was genius with trading beneficial interest but that is nothing compared to a poker game.

Previous sales, previous asking prices, tax information, yes. All easily available on the usual websites.

Ownership (if by that you mean names) takes a little more digging and you may have to pay, but its there.

Realtor notes, no.

“Prepaids by sellers” I do not know about.

I have bought and sold many homes.

Honestly over time I find realtors redundant.

In socal where average home price is at least a million dollar.. paying 10s of thousands of dollars as commission to realtors does not make sense.

I did very well without the realtors and saved me $$.

Agreed. And I am a Realtor but not a cheerleader.

Stupid ass people all you need is a title company ,they do all the work realtors are house prostituetswolf did i wake you up

Howdy Flea The Local MLS had valuable information about properties and neighborhoods. If still the case today, access to it, and the knowledge to understand it, is the most valuable tool. All in the hands of the seller and sellers agent.

All these information is publicly available for free.

Their are good realtors, their are also some f## who–you wonder who’s helping who.

In this day and age most buyers could purchase on their own without a Realtor. Agree that the title company and a solid loan originator do most of the heavy lifting to get a file to closing. Now on the listing side; I’d still suggest a Realtor.

I sold my last 2 houses without listing or advertising and no agents involved. I’m about to sell another one. With very desirable properties it’s not difficult.

Howdy Folks. With the NAR representing the seller only? Watch and see ?? I may have a new idea for my next million. Represent buyers.

Howdy jr. As long as you have the right information and know what do do with it. YEP, Freedom to choose your way is the best….As a rehabber, the MLS was my best tool for information.

So, I’m reading all this, but somehow a SALESMAN driven by MY best interests…..is….well……still a strange thing to me.

Sure are a lot of you here that are or have played the housing game, too. Made lotsa money, too, I betcha……all hard-earned of course…..seems ALL money is, unless one is talking about someone else…..that’s usually where the whining and bitching starts.

I’ve been keeping a large pile in short terms and money markets that buy them since I never bought into the rate cut mania. I’ll make 5+ risk free all this year, just a question on when I lengthen duration, but won’t buy anything less than 5%, which I expect to happen further out the yield curve since inflation isn’t cooling and government spending keeps going through the roof.

“Wait-and-see is a safe place to be at this point, with rates at 5.5% at the top of the range”

Wasn’t the top of the range 5.75% and they chickened out on the last paltry 25 basis point hike?

I honestly would not be surprised to see the FED cut sooner rather than later, regardless of what inflation is doing. The real people running the show – the billionaires – might just say “you do what I tell you, I don’t car what inflation is doing.” We’ve seen these people are evil. They like hurting others.

You’d like the poly-sci/econ model I mentioned above.

Check it out.

Always can use new angles, material, right? Rest of mass media is Kino a wasteland…..not to inspirational.

Kino=…kind of….

If the other AI is like spellcheck, it’s not to be feared at all……just more digital harassment.

“The Dot Plot is a messaging tool to communicate the status of current thinking; it’s not a commitment of any kind.”

Unfortunately the market doesn’t see it that way.

The ‘markets’ have become just a bunch of very stupid and mindless manic speculators with option trading now exceeding stock trading.

Those are the vaunted “invisible hands”.

It’s mostly the much bigger and VISIBLE ones that control the action.

Only 11% more increase needed as “Volcker the Great” enlightened us.

Inflation won’t go away without a recession. The snail pace of QT is not helping. Biden is borrowing to spend by giving free dollars to companies to invest but the investment is misguided and inefficient. EV investment is down the drain. I am fairly certain the current investment rounds of foundry will go down to the drain as well. Wasted spending still needs to be paid with borrowing.

Traditionally, borrowing should increase interest rate which crowd out private investment. However, the US economy is such a strange beast that even 34 Trillion in debt and 1T more every hundred days, the 10 year rate is still measly 4.3%.

I don’t understand this phenomenon. Has the world gone insane? Buying 10 year US bond at 4.3% when the inflation is more than 3%. Is the world so starved of quality assets, one has to buy US treasury at real return of around 1% for 10 year commitment? Whoever bought the 10 year bonds during the zero percent period must have suffered tremendous loss. These idiotic buyers still do the same?

I am staying higher for longer. That’s for sure!

Is it time to bring back “Whip Inflation Now” buttons? That worked GREAT last time! /s

If you turn a WIN button over, it says Now I’m Mad.

Need a Czar as well. I remember the Great Kahn, inflation czar, appointed to give journalists something to print.

Yep. WIN was just as effective as “Just Say No”.

Recent NY Fed Liberty St Report suggests inflation still bubbling away:

“MARCH 7, 2024

Will the Moderation in Wage Growth Continue?

Will the moderation continue, or will it stall? And what does it say about the current state of the labor market? In this post, we use our own measure of wage growth persistence – called Trend Wage Inflation (TWIn in short) – to look at these questions.

Importantly, we estimate the persistence of unobserved monthly wage growth from year-over-year wage changes. Our measure therefore tends to lead year-over-year wage changes, which are influenced by wages in the past twelve months by construction. This produces a timely measure of wage growth, useful to detect turning points in real time.

What are the implications of persistent nominal wage growth? First and foremost, TWIn adds to other indicators pointing to a still-tight labor market. Many labor market indicators, such as job vacancies or the rate at which unemployed workers find jobs, are still at or above their pre-pandemic level. In addition, persistently elevated nominal wage growth may have repercussions for price inflation, although it may also be the result of wages in nominal terms catching up with previously high price inflation.”

Howdy Youngins So, imagine not having Wolf Street while we live through the 70s 80s AGAIN. Can you understand now how disco got born? HEE HEE Learn to Boogie something cause this is gonna last a long time. If you do it right, you will make it. Get out of as much debt ASAP. You will thank yourself.

What do we do if we already don’t have debt?

You always have debt. It’s how and when you pay it off that matters.

Feel good about it.

Howdy DS Congrats and enjoy that Freedom.

I remember 70-80 so well ,glass of beer went up to a quarter gas from 29 cents – to 75 cents ,rock and roll ,concerts weed ,booze ,chicks .So much fun then 1980 hit like a brick in the face no jobs 18% interest rates, stay home have parties with beer ,liquor and chicks . Did ok course the rich never feel it . Seems to be change blowing in the wind ,lots of youngins figuring it out BEWARE if you wear silk underwire Hahahaha

The Reagan Bomb.

Many and their offspring are still economically disabled from it. I REALLY lucked out after 4 years of misery and got a Postal job with Vet points. Extended wealthy part of family said, “well, that will do for now….” and I said FU! I am STAYING here no matter what.

It’s nice to see Federal Funds Rates back to nearly normal now.

So I get that the start of the rate cuts is getting moved out, the big question i have is not when, but just how low will the Fed take the funds rate in this cycle?

The next move may be a hike? So the question should be: “Just how HIGH will the fed funds rate go in this cycle?”

PeterG, the economists (not Wall Street) think it should be something like target inflation rate plus a natural real interest rate (the infamous r*), perhaps around 1%. So if everything in the data is hunky dorey, the Fed would be looking at around 3%.

Fmr Kansas City Fed President Thomas Hoenig was on CNBC a few days ago and was asked, “Should the Fed move the goal post to 3%?” He replied, literal quote, “I think moving the goalpost would *not* make it easier (his emphasis). We would have 3% inflation, then 4% inflation, and then on and on from there. Once you move those goal posts your credibility goes down.”

Unless the unemployment rate goes above 4% (or lots of banks start failing), the Fed is likely to keep rates at their current levels for a very long time. Inflation is not going under 2% anytime soon with the current rate of GDP growth…so, the Fed will keep rates the same. With tight labor markets, lowering rates will just cause more inflation.

As a real estate Broker in SoCal for 50 years, I bet that Buyer’s Agents will disappear. We will go the way of Commercial Brokers. The Listing Broker will handle both Buyer and Seller for one commission, and that may go down.

I never understood the need for a buyer’s agent. The car business does just fine without them (though there is a niche business of buyer’s agents for special high-end or classic vehicles). The NAR essentially just forced buyer’s agents on homebuyers, and forced home sellers pay for them.

Howdy Lone Wolf. A buyers agent represents the buyer. A sellers agent represents the seller. Negotiating without one puts you at a disadvantage. The person with the most information does not have to disclose everything. Information about a property is and was a very valuable tool for me. The MLS information if lost to buyers will cost buyers.

Hi Debt Free; the seller must fill out property disclosures to sell a home, and of course a buyer can have an inspection and if a mortgage is needed, a full appraisal is completed to ensure the purchase price makes sense. Plus you can sign up to get MLS info for free pretty easily now. Zillow, and other sites make it easy.

Howdy Rick Vincent As long as the Zillow information is the same as Licensed Agents. Let me put it this way.

The value of information, and how to get it. Gordon Gecco

Knowing how to use and understand the information better than a licensed Sellers Agent.

Bubba

Right — but the buyer always ultimately paid both sides, since if there was no sale, there was no fee to be had on either end, right? It was all baked in…

Howdy bulfinch. YES the commission is there and paid at closing on a sale. FSBO properties have been around for years also. Freedom to choose. Now choose a NAR property, the buyer is at a disadvantage.

Due to technological advances thr information is all available free.

Good home inspection is a must .

Few years back I was talking to a realtor to buy a property and her commission was 30k ..

I asked her to cut it half by 50 percent and give me cash back

She told me that you don’t pay the commission .. the seller pays the commission and she is entitled for the commission for few hours of work.

Then I asked her to negotiate the 1 million property to 900k she said she can’t negotiate

I then asked her the value of her service for which she is paid 30k.

She ran away as fast as she can.

Now a days all the information is freely available about the home and neighborhood to people

No need to pay so much to realtors for few hours of work.

When we buy we always make the listing broker the buyers agent.

We never use a broker when we sell. Most buyers cannot make a reasonable down payment for our sellers mortgage if they have to pay a commission. Currently we have dozens of individuals who have made a small fortune selling into this housing bubble.

God bless them.

Howdy Stan Sexton. Sounds like I could now represent a buyer without a License. The NAR only representing the Seller is a bad idea for buyers.

Don’t be a “prisoner” to your old ways of doing bubba, everything is changing, disco, bell bottoms and realtors.

Howdy Home Toad. A prisoner to my old fashioned Freedom thinking cannot be forgotten. My point is NAR still receives its commission, represents the seller and the buyer is now on their own against licensed agents representing the seller.

They will do one rate cut because they promised and its an election year.

.25 basis.

That will be it for the year.

Then when they start cutting for real we will head into a massive recession. Just like we usually do.

Wait…where is this “promise?”

There was no promise. Just a very strong hint.

If we are going to talk about asset prices going up, lets look assets the 0.1% buy, specifically sports teams. Dallas Mavericks $3.5B, numerous NFL teams valued over $4B, Real Madrid over $5B.

Ticket prices for live events are going crazy, and not just for swifties, most season tickets require an upfront membership fee on top of the seat costs. And being in the Paddock Club at an F1 race is more fun than being in the stands, so people pay for it. Prices the top 10ish% have zero problem with.

Not likely any of these see any deflationary pressure in the near future, imo

The LA Rams sold for $19 million in 1972, to give you an idea how overvalued sports franchises are.

Buying a sports team is one of the best inflation hedges there is. A big part of that is blackmailing the host city into spending hundreds of millions for a new stadium. Notice when the new stadium is being considered the team hires the best in the league and ends up in the finals if not winning. Voila, the city holds a parade, the dumb taxpayers agree to increase their taxes for the next 3 decades, and the billionaire owner gets a new stadium that increases the value of his team by 25-50%.

Like I said, people should stop going to games. That would stop all this stuff.

Yes, then a year later they are all suing each other for not doing what they each promised they would do when they both wanted each other so badly. I was so grateful that the 49ers built in Santa Clara instead of my town.

Everything you list here Wolf is a “want”, nothing here is a need. I gave up on this stuff many years ago. It is too expensive and brings nothing except diversion. there are plenty of free diversions out there.

People just need to stop going to games, and then those asset prices will come aplunging, office-CRE-like.

Thanks WR

I have never gone to any of these games despite having free tickets.

It’s sad that some, maybe most of these cities in which, the teams, who get paid way too much for playing a ball game and have a perfectly fine arena or stadium, are asking for an extremely expensive new place, have a plenty of worn out, rutted, potholed roads and a shortage of affordable housing, teacher shortages, stuff that if improved would improve the quality of life of the citizens much more than a new sport venue, or even keeping the team in he city. And they have the selfishness and ignorance to ask for it in times of high debt and inflation burden. The people need to realize what’s best for their families’ and community’s prosperity and tell the sports teams, y’all either stay in the same place, or renovate or buy a new one with your own fortunes.

“whoosh[ing] gale-like through the markets” is pretty much why I have a hard time speculating in any of these casinos these days. Will just stick with making a way higher return on my invested capital with my business. Still gotta work for it tho dammit, but that’s ok, keeps me fit. :)

I gotta say I do like Wolf’s cynicism (reality glasses?) as it regularly matches my own.

@Louie: It takes awareness and some level of introspection to understand what is a “want” and what is a “need”.

In sports, people are effectively brainwashed into a feeling of belonging – the same reason why teens join gangs. That is why even if “their” team performs miserably or is sold/relocated, they still continue to support them. There is a lot of vicarious pleasure (or pain).

The fan(anatics) don’t even realize the players and the owners are making millions and billions off their hard-earned incomes while they have nothing left to show for themselves.

I’m not saying sports and entertainment don’t have their place. But in a sensible world, they would be consumed in moderation just like anything else. Otherwise, it is just toxic to one’s own well-being.

Howdy Sean. Sports in the olden days was just a release and escape from day to day work and life for me. People are now taxed to build the ballparks and have 24 / 7 politics. Cant even talk about the weather unless most know your sign. And even the car you drive to the game is put into a category.

It’s always helpful to remind yourself and those around you of the Seinfeld observation — “we’re cheering for laundry.”

The current federal funds rate is still quite low. People became drunk on fake free money, and we need at least a decade at or above where we presently are to reset their entitled frivolous spending habits. People need to learn to balance budgets, and live within their means.

The monied class became leverage whores. It’s like that old joke, “If you owe the bank a hundred thousand, that’s your problem. If you owe the bank a hundred million, that’s the bank’s problem.” Rates were too low for too long, and liquidity/credit flowed way too easily. Now, this leveraged debt trap is where the country is at, in spades.

I feel like the Fed’s decisions are attempts to fend off political attacks on its independence.

In an ideal world, they would have raised a few more times already, and inflation would be lower. But with folks like Sen. Warren and friends calling for rate cuts, the Fed’s best political move is to hold steady and tease future rate cuts, while letting inflation run a little hot.

Better to allow a little extra inflation and let the rate-cut mongers look foolish than to kill inflation and risk a recession that would give ammunition to those who want direct political control of the Fed.

The Fed is abusing its authority, in your opinion, by focusing on politics rather than the economy?

Simpler explanation – they just aren’t that serious about stopping inflation.

Maybe they really aren’t in control at all and only fiscal policy is flexible and powerful enough to control inflation.

Or maybe they are afraid of causing a severe recession that results in hundreds of thousands of families going unemployed…

I agree on not wanting a recession and allowing inflation to zigzag. Past Fed history tells them to just sit tight where rates are now. I think their bigger worry is higher inflation, and I’m sure they don’t want to even speak of that. I personally do not see interest rates being cut. Looking forward to Fed meet this week.

“no one wants to make a decision on just one data point. The longer they wait, the more data points they have, and the clearer the picture gets.” is probably the most disingenuous thing you said, understood you are channeling Fedspeak. Data is like tomatoes, perishable. This is Feds real problem (after transitory) being data dependent, like hiring a day trader to manage your portfolio. Just how far does the Feds control exert on bond yields? The market seems to think quite a lot, and maybe yields will come down if the Fed cuts interest rates (longest YC inversion EVER). My theory is the pump in yields is risk, not vigilantes, and that one US Treasury credit downgrade is not enough.

LOL. Probably the most confused and naïve thing you posted here.

Describing and analyzing the data, which is what I do, is one thing. Making policy decisions based on this data – decisions that can throw millions of people out of work or cause destructive crazes — is another. I wouldn’t want to make decisions on one-month data. One month isn’t a trend. Several months indicate a trend, and a trend needs confirmation. So three months of a new trend just barely shows the new trend. Six months of a new trend confirms the trend.

Back in very early 2021, when I started screaming about inflation – calling the Fed the “most reckless Fed ever”– the Fed wasn’t even calling inflation transitory. By mid-2021, it began calling inflation transitory. The Fed didn’t raise rates until March 2022. It waited 14 months after I started screaming.

The inflation trend started in late 2020. Three months into it (very early 2021), it was the beginning of a trend, and I screamed about it. Six months into it (ca April 2021) it was well confirmed. That’s when the Fed should have raised rates by a lot, and it should have never done QE to begin with, and it should have turned it into QT no later than January 2021, when the first signs of inflation appeared. It didn’t do any of that. It waited 14 months to raise rates, and it waited 18 months before it started QT. That was a HUGE mistake, and Powell acknowledged that at the last press conference. It’s the three-month and six-month windows that they should look at – and now they are looking at those windows, and those windows are now showing at re-heating inflation.

The trend for inflation was DOWN for over a year, and down very strongly. Inflation was really cooling a lot, and dropped well before the Fed’s policy rates. And that had been confirmed over and over again. And then in the second half last year, the signs emerged that the down-trend might be stalling, and then late last year, we started getting data showing that the trend is changing direction. The most recent data sets (Feb CPI, Jan PCE) confirmed this. So now the Fed needs to take the rate cuts off the table. That’s the first decision, and wait. Inflation is still below the policy rates. If inflation stays where it is now, they can wait and see. If inflation in the three-month and six-month windows rises throughout the next few months, they need to put rate hikes back on the table. If inflation breaks through the policy rates, they need to hike and keep hiking.

The goal isn’t to shut the economy down and throw 10 million people out of work. The goal is to get inflation down – but that job is made much more difficult by fiscal policies, and the Fed cannot do anything about that.

Wolf,

Have you looked at the weekly interval TLT and ZROZ (long bond proxies) chart?

These charts showed clear deterioration starting summer 2020, meaning that traders actually recognized that inflation was a problem well back then.

Although I have misgivings about technical analysis, it can give very important clues about behavior and what is happening (it doesn’t tell you why).

If the Fed had been watching those charts, alarm bells should have been going off a long time before 2021.

TLT has a small share count too. I believe 131 million. They can move that around pretty well. I look at that daily.

I don’t think traders were worried about inflation in the summer of 2020. They were worried that the long yields had hit the ultimate rock bottom on the ceaseless NIRP hype. In August 2020, the 10-year yield had dropped to 0.5% on hopes that the Fed would cut rates into the negative, like other central banks. And when the Fed kept repeating that it wasn’t going NIPR, those yields came back up. It was crazy to buy 10-year paper with a 0.5% yield. Just nuts, and so it didn’t stick. The TLT reflected that.

Wolf,

Undoubtedly true– but a few people made a killing buying TLT puts back then and holding them. Most didn’t see the move going this far.

TLT and ZROZ have now been in a bear market for almost 4 years.

If we could just get QQQ into a 4 year bear market we could finally make some progress changing investment culture in this country.

4 year bear market? Lol, the PTB will never let that happen. They’ll have genz invading Russia as an excuse to juice the markets yet again if we get 2 down years in a row. On second thought, gen z would get wiped out in about a week and a half. Probably end up invading Canada instead or maybe greenland.

@Bond Vigilante Wannabe

I would stick to QQQ – investing in productivity gains.

TLT is investing in a debt where involved $ was long time consumed, perhaps as election promise 🤔

Biker: TLT and QQQ are both ‘duration’ investments. Tech stocks and long bonds are similarly rate-sensitive.

But BVW is discussing going short on TLT – something one does if they’re predicting higher rate hikes. Higher rates should also similarly weigh on QQQ (should being the operative word).

Inflation was transitory, the rate hikes were to normalize rates and that helps savers. For decades cash savings were a wasting asset. Now you get 5%, so yeah inflation is bad for borrowers, not so bad for savers. And not so bad for people who paid off their mortgage or even those holding one at 3%. What you call inflation I might call not deflation. If car dealers have no more zero APR to offer as incentive, they are going to drop prices. So is the Fed worried about cooling down an overheating economy, or a tight labor market where there are structural issues putting a bid under wages? And the corporate bond market is uber resilient. That supports competition and lower prices.

There’s a curious battle going on between copper prices, as an inflation barometer, and the 10 yr and 3 m treasuries.

The last time the 10 was knocking on the 3 m door, copper prices were lower, thus as the inflation monster revives itself, going into yet another period of stagflation like ambiguity (and Fed pause) seemingly, copper pointing towards inflation, sets up a pretty weird contradiction that kinda suggests rates will head higher, with copper.

It’s a nudge that adds pressure to not cutting rates and being frozen with sticky inflation. This will increase uncertainty and add to instability, especially as election clock ticks away.

Copper prices have shot up in the last couple of weeks… but even with that it is still 20% below where it was 2 years ago.

Free money is the problem and rates need to go much higher to fix the damage it does.

The problem with the markets, there are no investers. Everything is a trade.

Real values don’t change in fractions of seconds. Bear

Howdy NAR enthusiasts. The NAR stopped splitting the commission four ways. It was cut in half and and only gets split two ways. The selling agent will protect the buyer and you will be AOK, Buy TODAY. . HEE HEE People will even believe a 3% Mortgage will give you more Freedom.

How about a RE story? OK, the buyer had a septic inspector requesting risers be installed. 1500 dollars. Buyer requested additional 30 000 in other repairs. Deal fell through. Home goes back on market. Second buyer requests replacement of septic tank at 5000 to 10 000. The septic inspectors were from the same company just 3 months between estimates.

Upon showing the first inspectors report at 1500 for risers, guess who won? Sure, not having a agent to represent you and just a smart phone app? Youngins sure can be silly some times…….

Am I the only one who has fantasies about the Fed doing a Saturday evening emergency 100 basis point rate HIKE and watching financial media have a collective nervous breakdown on national television?

Who on this website wants to get the popcorn and watch that play out?

Count me in. Do you butter on that? Of course, Wolf will caution us and tell us that we should be careful what we ask for, and he is right. But it would be worth it just to see the Wall street boilover.

Quite frankly, the sooner we have something like this happen, the less long term damage there will be.

The real risk is that we don’t get a brief inflationary recession where the Fed has to actually drop the hammer and we end up with 15 years of stagflation.

An 18 month period of inflation culminating with a Volcker like moment, with a course correction for sustainable growth, is the best possible outcome here.

Howdy B V W. Some of US experienced that with Greenspan. Yes , this time around I could care less how they manage this mess. Will take decades worth of popcorn?????

I’d get a cold one and a LAZYBOY. I’d even buy a round at the bar if that happens.

Sorry Investors haven’t a clue The Federal Reserve is under extreme Pressure. The EU will hit TWO Percent Inflation and LaGarde Will Lower Interest Rates June. While The US is still Stuck with THREE percent Inflation and will not be able to lower rates. If the US makes a mistake the US Dollar will collapse.

Other way around. If the Fed holds rates, and the ECB cuts, the euro will drop against the US, but neither currency will “collapse,” LOL

U.S. inflation might move up to 4% by end of summer as base effect headwinds wear off.

Bubba never even thanks Wolf for ignoring comment rule #6.

What % is 25 out of 135?

Bubba gets moderated all the time.

Well obviously not all the time……..

31 out of 154 seems to prove otherwise.

Howdy SougP. Fractions are still a problem for me. HEE HEE. I can add and subtract pretty well.

Howdy DougP, He’s in his element with real estate talk. Info to share.

I as well need to be weary of abusing wolfs site with my gibberish. A work in progress.

Howdy Home toad. Just having fun while learning from the Lone Wolf. Learned quite a bit about the FED here. Really helped this old squirrel sleep better at night…..Calling youngins prisoners is really not bullying is it???? HEE HEE

Bubba seems like the guy who sits down to post after a White Russian and gets a bit of the “posting mania”. This is like the Internet age equivalent of the “dialies” when you call everyone you know after a visit to the bar. It’s just part of the ambience of this place.

Howdy CSH. Just a sober sailor amusing himself while learning what I still need to know. The Lone Wolf is a great teacher and lets his students have a little fun while learning.

I’m not obsessed with watching financial news and pretty bored, basically burned out and growing in fatigue with speculative excess — and rate cut mania, but now I just noticed a whole new chunky tea leaf swirling around the edges of the cup.

Apparently China is in a liquidity trap. Yeah right …

Well, it’s amazing how their rates are crashing down and their stimulus programs have been failing for over a year.

Apparently, the lack of lending and lack of consumer growth are amounting to GFC-like problems with monetary efforts for stability.

China is dropping their 10 year yield to about 2.5%, which is very curious in regard to US 10y, apparently heading higher.

That’s actually a weird conundrum and gets into strange yield differential stuff.

But, what if China is sinking faster than anticipated, and how does that impact things for yellen and Powell?

Hmmn

All according to plan…

Get them running for the “safety” of the US bond market…

Same as it ever was, until it isn’t, and everyone runs for something else…

Howdy Redundant. Yellen and Powell will continue on with the show.

Howdy DFB,

This is a bit above my pay grade, but it adds an interesting currency war dynamic into the current chaos. I assume AI is in control.

From a few days ago:

Investors have been expecting rate cuts in China this year as the world’s second largest economy struggles with deflationary pressures, a years-long property crisis and sluggish demand. The US-China rate differential also has hammered its currency and exacerbated capital outflows amid a weaker-than-expected economic recovery.

“We expect there is limited room for PBOC policy easing before global central banks start to cut rates, as yuan stability remains a policy objective and further widening the interest rate spread with a rate cut would add to depreciation pressure,” said Lynn Song, Chief Economist for Greater China at ING. The central bank may reduce reserve-requirement ratio in coming months before slashing the rates on MLF, he said.

The Chinese yuan has fallen around 1% so far this year despite consistent support by the authorities, as expectations of a Fed rate cut as early as the first quarter have been rolled back due to resilient US inflation. Investors’ bets on more easing in China boosted their frenzy over the nation’s sovereign debt, driving yields to around two-decade low.

Redundant:

I would think that there’s a huge amount of structural problems with Asian countries (and specifically China) in a capitalistic competitive environment.

First is the culture of saving. I have heard that it’s not uncommon for people to save 50% of their wages. In our culture that’s a “super saver.” To them it’s basic responsibility.

Of course with China they have a demographic problem and they will never make it up on immigration while they remain totalitarian.

The lack of a usable currency will continue to keep China at bay (as opposed to the “safe”? Yen). Russia can trade in Yuan or Rubles for oil etc. Not many countries want to store Yuan/Remnibi/ whatever.

Bottom line is found in the feudal systems of olde: When in doubt, take them to war.

Europe has been borderline recessionary for a couple decades (hidden by ZIRP/NIRP etc). The US is “home” to all the big names worldwide. BABA market cap is nothing compared to AMZN and less than half WMT.

The US will gladly take up making cheap plastic crap again, despite green initiatives (as we’re not coal powered at least), thanks to the Inflation Creation Act.

Really, all we need is chips. We probably have a LOT of firepower camping in the south sea area?

Howdy Redundant. Can t help you much. I just know most countries did the same things and used the same tools on their populations. Some of the tools have been around for decades. a very wild ride or show is in store for all of US. Or can they continue to paper their way another decade???? Popcorn time like BVW posted.

As Wolf and several commenters have pointed out, there is still plenty of liquidity sloshing around. Some things are repricing (CRE), but there is a second wave of inflation coming ashore AND the treasury has, by my estimate, 7-8 trillion in debt that needs to be rolled over PLUS another 3-4 trillion that needs to be issued (assuming CONgress keeps spending at the current rate).

Tons of supply coming, and if we are to take Janet (the troll) Yellen at her word, then most of this will be on the short end of the yield curve. So yes, higher for much longer with an even more inverted curve? thoughts?

WB:

Don’t be ridiculous! CONgress won’t keep spending at this rate!

(By definition it must accelerate!)

Interest rates in any given market at any given time are the result of the interaction of all the forces operating through the supply of, and the demand for, loan-funds (no, not money).

In theory maybe. But you forget a biggie: The Fed. The problem is that “market” is now a misnomer when the Fed attempts to control the yields that the “market” produces. There’s no telling where yields would be without the Fed, including the Fed’s huge balance sheet.

There were three basic elements comprising long-term interest rates: (1) a “pure” rate; (2) a risk rate; (3) an inflation premium.

The pure rate presumably reflects the price required to induce lenders into parting with their money in a non-inflationary and risk-free situation.

The risk rate is measured by the yield curve in conjunction with the bond’s duration (counter-party credit quality, & repricing/liquidity, length to maturity, investment alternatives, etc.).

The inflation premium is the expected interest rate differential added to compensate for the future rate-of-change in inflation.

The inflation premium was suppressed by the trading desk’s operations of the buying type.

spencer, only the secondary market is susceptible to “market forces” and even then only when the Fed stays out of anything further out the curve than 3 months or so. Japan is instructive in this regard.

As for overnight rates, the Fed sets those, period — there is no “market.”

Seems like nobody cares about the tsunami of Treasury issuance, but it probably eventually has a material impact on prices.

I’m in the camp that thinks real people will begin to harden their demand for higher yields as the year unfolds. In that light, a big driver will be tangible monthly cash flow, versus any attraction to asset risk and volatility. If your Bitcoin or nividia tokens take a plunge, that’s not gonna pay the bills.

Meanwhile:

“The rate futures market on Friday has priced in a 57% chance of the Fed cutting rates in June, compared to 71% on Monday, according to LSEG’s rate probability app. The market has also reduced the number of rate cuts it expects this year to less than three, from between three and four earlier this year.

Investors are also looking to a highly-anticipated meeting at the Bank of Japan next week.”

Everyone is focused on growth – bitcoin, NVDA, etc. yet these growth assets have little to no div yield.

Meanwhile you can earn anywhere from 6-9% on fixed income assets with much less risk. And if the price of these investments fall, then you’re reinvesting at a lower price.

Also, they are focused companies that buyback stocks.

“Inflation has the upper hand.”

Can’t help but bring to mind the nightmare end of “Seven”…

“tell your people to stay away. Stay away now, don’t – don’t come in here. Whatever you hear, stay away! John Doe has the upper hand!”

To suit itself, DC has put your “pretty head in a box”.

About a week ago:

Bond prices slumped further Tuesday after the US Treasury’s monthly 10-year note auction drew lackluster demand despite yields rising into the bidding deadline on inflation data that exceeded expectations.

Yields across the maturity spectrum climbed to session highs after the $39 billion auction was awarded at a higher-than-anticipated yield, a sign of poor demand. For 10-year notes, yields that were about 5 basis points higher on the day shortly before 1 p.m. New York time, the bidding deadline, rose as much as 7 basis points.

Unfortunately, I’m kinda stuck laying around, so hopefully I’m not overdoing posting.

I’m suddenly very curious about the Fed rate mania, as it relates to the geopolitical/ China dynamics.

Reading about the possibility of a liquidity trap and deflation in China becomes even more strange when pondering their recent quant-quake and puzzle pieces that look like GFC:

“ The crackdown on funds using statistical models and computer algorithms to make trading decisions follows a February market crash dubbed China’s “quant quake”, reminiscent of a machine-driven 2007 Wall Street selloff that preceded the global financial crisis.

China’s stock market plunge to five-year lows showed how statistical quant trading models can lead to market herding and stampedes. Retail investors, who account for more than 70% of trading, railed at programme traders and “flash boys” who flip shares in nanoseconds for quick profits.”

Bottom line, there’s so much crap going on, that’s converging, that it’s almost insane to think economic things are going to get better, and that an immaculate soft landing is going to glide us into the election.

The AI Dream is sailing into The Perfect Storm — filling the cargo hold with unimaginable amounts of fish, while the hurricane approaches…

Howdy Redundant. Cash out and purchase 4 week T Bills and just sit back and watch the show???? HEE HEE. It s what some squirrels are doing and loving it.

Inflation is continuing in the housing market here in the Swamp, just like I reported in a previous post. Appraised a house in a marginal (s$ihole) neighborhood which just went for $750 after it was purchased in 2017 for $650. Comps supported the sale price. This is with the higher interest rates and higher crime rate. People are moving back to the city as the comunting traffic jams, post pandemic, are horrendous.

Howdy Swamp If the story is true concerning the New and Improved NAR.

All licensed agents now representing the seller? Just think what your numbers will show soon. Millions out of the used home game because of 3%. The new American Motto can be…………….

Not just homeownership

Be more American with a NEW Home

This new bubble is brought to you by

Your Friendly Federal Govern ment

[[content deleted by Wolf because it was BS taken from a BS crypto website that misrepresented what Larry Summers wrote. If you see BS on a BS website, that BS stays over there.

Here is the actual paper that Summers co-authored

https://www.nber.org/system/files/working_papers/w32163/w32163.pdf ]]

@Wolf: I took the article at face value, didn’t realize that the information was misrepresented. Sorry about that.