If it’s unleashed at the “first hint” of a rate cut, it “would create upward pressure on prices.” But it may be too late, it has been unleashed by rate-cut mania.

By Wolf Richter for WOLF STREET.

Atlanta Fed President Raphael Bostic came up with a new risk to the inflation scenario, or not really a new risk – because it’s been there and it’s already happening – but a new phrase to describe that risk, a phrase that will resonate here: “pent-up exuberance.”

“Pent-up exuberance” is that businesses, “ready to pounce,” would unleash a torrent of new hiring and investment at the “first hint of an interest rate cut,” which would unleash inflation all over again.

It has already been happening. The rate-cut mania has loosened financial conditions to pre-rate-hike levels, employment has surged over the past few months, hourly earnings have spiked, and inflation in services has begun to re-accelerate. So this rate-cut mania has already unleashed the first wave of this “pent-up exuberance.” And Bostic nodded in that direction:

“It is premature to claim victory in the fight against inflation,” Bostic said in his speech. “January inflation readings came in surprisingly high, the latest reminder that the path to price stability is not a straight line.”

There’s a “new upside risk” in town: “pent-up exuberance.”

“As my staff and I have talked to business decision-makers in recent weeks, the theme we’ve heard rings of expectant optimism. Despite business activity broadly moderating, firms are not distressed. Instead, many executives tell us they are on pause, ready to deploy assets and ramp up hiring when the time is right,” Bostic said.

“I asked one gathering of business leaders if they were ready to pounce at the first hint of an interest rate cut. The response was an overwhelming ‘yes,’” he said.

“If that scenario were to unfold on a large scale, it holds the potential to unleash a burst of new demand that could reverse the progress toward rebalancing supply and demand. That would create upward pressure on prices,” he said.

“This threat of what I’ll call pent-up exuberance is a new upside risk that I think bears scrutiny in coming months,” he said.

Fear that this “pent-up exuberance” could reignite – or already has reignited – the inflation fire is valid. We have seen instances over the past few months.

Putting three rate cuts in 2024 into the dot plot at the FOMC’s December meeting and letting markets assume six or seven rate cuts in 2024 and run wild with this rate-cut mania, has turned out to be a strategic blunder of colossal proportions by the Fed.

And ever since, Fed officials have been backpedaling on the rate cut scenario, and markets have dialed back their rate-cut mania by a couple of notches. But it may be too late. That pent-up exuberance may have already gotten out of the bull pen, and it’s doing its darndest to make the inflation fight harder and longer.

Here’s that un-pent exuberance at work.

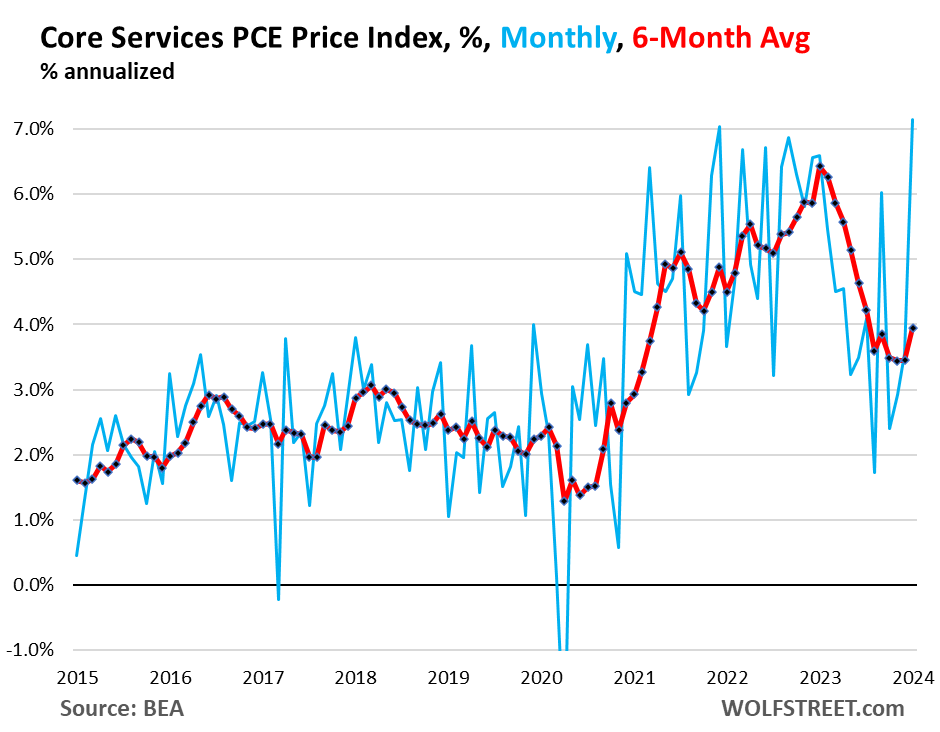

The core services PCE price index spiked to 7.15% annualized in January from December, the worst month-to-month jump in 22 years (blue line). Drivers of the spike were non-housing measures as well as housing inflation. The six-month moving average, which irons out the month-to-month volatility but is slower to react, accelerated to 3.95% annualized, the worst since July, after having gotten stuck at the 3.5% level for three months in a row (red):

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Re “ready to pounce at the first hint of an interest rate cut” …

So in addition to failing to tame inflation, the Fed has also failed to tame the speculative mania behind the current Everything Bubble. “Pent-up exuberance” wouldn’t be found in a sound economy.

Nah, no bubble here, you mean to tell me the graph for Dogecoin/Shiba Inu coin and Nvidia stock looking like the Burj Khalifa is not nature?

Remember this time is different as they say…market is tightening straight up…

When one can’t see the cause of the problem, they should look in the mirror.

That pent-up exuberance has a divergent explanation than “the animal market spirits”.

There is too much fiat currency liquidity in the system favoring speculation over sustainability.

Imagine the sucker who bought Dogecoin at the 21 cent peak yesterday. Less than 20 hours later it was at 13 cents – a 38% loss. Greed out, get burned. This whole sector is ripe for another collapse, perhaps to zero this time.

Thanks

Pent-up exuberance is a natural effect of withholding wants from humans. Much like a dieter who eventually binges to replace the loss, not of calories but of comforts.

Thankfully, we discovered an incredibly efficient system of wealth transfer in cryptocurrencies. Even more so, now that these can be bundled up in ETF and mutual funds. Cryptos will calm the raging hearts of speculative investors.

Sadly we all stand to suffer the future taxes needed to replenish the public pensions that will be drained by crypto.

In early 2023 everybody was talking about two scenarios: “soft landing” or “hard landing”. After one year we are experiencing “no landing”. Assets are even going higher and higher. After the stock market indices, BTC also broke its record today.

FED bears the whole responsibility. In 2023, FED gave this message to the markets: “We are ready to print money any time. Hold all your assets, buy even more.” No one else to blame.

They printed ~5T in two years, paused for 6 months, then drained about ~1.5T in 1.5 years. ~1T QT/year. Too slow. And even now, they are talking about slowing down QT even more, which will eventually be followed by a stop (with over 6T balance). Markets are naturally rampant. Welcome to the inflationary environment.

FED bears responsibility but it has ZERO accountability. What are the checks and balances for a rogue institution that it is?

The track record is beyond scandalous.

Just a reminder, it’s a privately owned entity with intransparent corporate governance at odds with the US Constitution that states “no state shall make anything but gold and silver coin a tender in payment of debts”.

“Just a reminder, it’s a privately owned entity with…”

Common misconception here. The Fed is a hybrid organization.

The Federal Reserve Board of Governors is a federal government agency, and all its employees are federal government employees with a government salary and a government pension, including the seven members of the Board, including Powell. These seven members of the Board of Governors are appointed by the President and confirmed by the Senate. The Board of Governors has lots of employees, and they’re all employees of the Federal Government. They’re headquartered in the Eccles Federal Reserve Board Building, the main office of the Board of Governors of the Federal Reserve System. This is a federally owned building on 20th St. and Constitution Avenue in Washington, DC.

The 12 regional Federal Reserve Banks are private organizations that are owned by the largest financial institutions in their districts. They include the New York Fed, the San Francisco Fed, the Dallas Fed, etc. All their employees are private-sector employees.

The FOMC – the policy-setting committee – consists of the 7 members of the Board of Governors who are federal employees and have permanent votes on the FOMC. The New York Fed governor also has a permanent vote. The other 11 regional FRBs rotate into and out of 5 voting slots annually.

The FOMC is designed to give the 7 government employees a voting majority over the 6 presidents of the regional FRBs.

It’s not at odds with the Constitution. Your quote is from Article 1, Section 10, which addresses several powers denied to States, including, among other things, coining money or making anything but gold and silver coin a tender in payment of debts.

In contrast, Article I, Section 8, Clause 5 gives Congress the authority “To coin Money, regulate the Value thereof…” There is no Constitutional prohibition on Congress declaring anything it wants to be legal tender. You’re misapplying a clause applicable only to States to the powers of Congress under the Constitution.

Hmmmm….

A $7 trillion (bal. sheet) 110 year old institution, with few limits to it’s scope or size, jointly operated by profit oriented banker/owners and self-interested technocrats, and academics (all of whom swap jobs periodically), where authorized price-fixing is achieved through the creation and distribution of credit money in an effort to provide perpetual prosperity.

What could go wrong?!

…. and on top of that, the central bankers are EXPECTED to act strenuously (and even experimentally) during perceived “emergencies.”

Can a reserve currency last once the authority to produce ever-more credit money becomes a voter-approved directive? We’ll learn more when the next emergency erupts…

As far as the idea that increasing liquidity by manipulating the rates downward, reducing the rate of QT, not the cause of inflation.

A new paper from NBER dissects where we went wrong in predicting inflation, actually giving a date in 1983 when the increasing cost of living, given that both price and interest rates were increasing at the same time in which the CPI calculation was changed to the owners rent survey from the expected monthly payment method. The article claims to explain the gap between the expected and the actual level of excess exuberance over the past 75 years ago.

I have been reliably informed by Mr. Biden that the cause of inflation is those greedy greedy corporations making bags of cookies smaller.

Without meaningful job losses, the Fed is simply stuck with higher for much longer or likely having to raise the FFR by 50 basis points later this year.

I would bet for every 25-basis point cut, the 30YFRM will drop 50-basis points. So a 50-basis point cut is likely to send 30YFRM tumbling below 6% which would result in the housing market heating up. New home price declines would cease and turn higher, and existing home prices could see near double digit % increases in prices over the ensuing 12-18 months.

And, again, there are $1.7T reasons why the economy isn’t going to see a major downturn in jobs. Deficit spending will keep the job market buoyant. More on that Friday. And remember, at 3.7% job gains are at the margins, so anything positive is a plus. It doesn’t really matter about the mix of jobs. Positive is positive until it goes the other way.

The economy will definitely “break” after another year of FFR at this level, because there is too much corporate debt out there that needs refinancing. The Fed definitely needs to cut at least 0.25% this year unless they want to tank the economy.

Retirees are making a fortune in T-bills and soon retirees will outnumber workers. So personal spending should increase with increases in interest rates. This is the converse of the 1950’s and 1960’s when workers greatly outnumbered retirees.

All Fed Governors need to keep their mouths shut. They are a big part of the problem. Speak with one voice every quarter and leave the markets alone.

“Putting three rate cuts in 2024 into the dot plot at the FOMC’s December meeting and letting markets assume six or seven rate cuts in 2024, and then run wild with this rate-cut mania, was a strategic blunder of colossal proportions by the Fed.”

YUP. Total fail. And now if they hold, even if the economy DOES slow eventually, it will happen by the third quarter, and then rate cuts will look like political interference, at which point Powell will think, Trump wins, I lose my job.

There will be no rate cuts this year.

They can do a lot to fix it by hiking in March.

I am taking bets now, 99% odds they won’t do this in March. I’ll consider it a win if Pow Pow channel his Jackson Hole self again and leave the market with no doubts rate cut is not happening this year..that I give it 20% chance of happening

My sense is that rate cuts are unlikely because I, personally think it is unwise.

Inflation is too high and rate cuts would be stimulative to an overstimulated economy that sets daily “so called” free market records. It feels like inflation expectations have become anchored.

Which is polite way of the saying that the economic momentum, at the apex of a multi-generational bubble isn’t bothering me any more. Thankfully, God will protect us from religion.

They won’t. They don’t have the guts. Jerome “Second Coming of Volcker” Powell just reassured Wall Street this morning that they are still likely to get their precious cuts this year.

He precisely did NOT assure them. Read what he said. If inflation this, then maybe cuts, but, but, but…

Even ZH called his statement hawkish, LOL

I agree. I would be very surprised to see any rate cuts this year. Only if we go into recession. But the yield curve is still inverted, so no recession yet.

Yield curve has been rendered useless recession indicator because of fed intervention.

Yield curve is good indicator for normal biz cycle with no fed in play

You’d be surprised with coming rate cuts and slowing of qt.

” strategic blunder of colossal proportions by the fed.. ”

there have been far too many of these ‘strategic blunder(s)’ for them to truly be ‘blunders’.

there was ABSOLUTELY NO VALID REASON (in the context of the inflation problem) to put ANY RATE CUTS as forward projections/outlook in the past meeting’s dot plot, if you consider that there were no real meaningful signs that inflation had been extinguished. especially given the history/experience already in the late 70s and 80s.

the fed telegraphs everything, and the market then (over)responds to it.. the fed is not unaware of how it affects markets and the sentiment/decision-making of business leaders. so, telegraphing that its ‘all good’ by dot-plotting a bunch of cuts, was designed for a response outcome that we see today.

i think this so-called ‘blunder’, wasnt one at all. it was designed to take the pressure off the banks and give them some breathing room. the fed serves two masters. one of them is more important than the other. this much is ABUNDANTLY CLEAR when you consider what happened in the 2008/2009 GFC. serving the public good is a second priority. the megabanks got tens of trillions of dollars of support from the fed back then. citibank alone took nearly 2.5 trillion dollars during that time.

this issue with inflation is being ‘fought’ a bit like the US ‘fought’ the war in vietnam: (and i’d argue, pretty much EVERY war since WWII) half-heartedly and with one hand tied behind its back..

the only way to meaningfully combat inflation is to strike SWIFT and HARD, unexpectedly.. the element of surprise coupled with a shocking ‘left hook’ across the face of inflation and the latent ‘pent-up-exuberance’ is what SHOULD HAVE occurred, if that was really the goal.

its past time for some (or most) people to understand that what is being done is merely a ‘stage show’ designed to ‘look’ like one thing, but in reality, be something very different.

The fierce Fed critic Wolf after saying “the most reckless Fed ever” two years ago is now back; this makes many of us so happy.

I wonder what Wolf would do differently if he were Emperor of the Fed for a year (paid, of course). *arched eyebrows* Is it POSSIBLE our Wolf would exceed the bureaucratic mandarins in performance?

Market sentiment already seems to be turning in recent days.

If the March CPI print (for February) comes in hot, shit will hit the fan.

“Cry havoc and let loose the dogs of stagflation”

…THOSE dogs tend to stay/sleep on the porch where their food is, though…

may we all find a better day.

Yes Wolf the dot plot rate cuts were totally uncalled for, or the jawboning about it too. Higher for much longer. I read that same article and Bostic changed his sentiment or view with these cuts coming up with inflation dropping. Almost like they really thought they were winning the inflation battle.

Oh FED members, if they retire, I recommend them going into politics, everyone of them master double talk, jawboning as good as the current crops in Congress

Phoenix Ikki: Fed members are similar to the judiciary which are most assuredly politicians wearing black robes. Fed members are 100% discredited Keynesian politicians who are pretending to be economists. They only wish they could wear black robes when they vote solely their political leanings.

You obviously have never read Keynes as suggested by your ignorance of his understanding of the macro economic science, a contradiction of terms, that was in it’s infancy, in the wake of the collapse of the European aristocracy.

The only thing surprising about this is the fact that it is just now dawning on these folks. They’ve been way too dovish in their speech and then they are surprised when folks act like, well, people.

When I say dovish I know that taken at true face value the Fed has been pretty balanced. With the news media being what it is and sentiment being what it is the Fed should not say anything that could be remotely construed as dovish until conditions are undeniably favorable.

The markets are self-levitating at this time and have been for a while. They don’t need any hot air at all. All IMHO of course.

Why don’t they just be honest for once and come out and say “as long as the government is running a $2T deficit, it doesn’t matter what we try to do”

Correct. Lest we revisit the 1951 Treasury Federal Reserve Accord

All right Spencer, I’ll bite. Why do you think that the 1951 Accord would present the reason for the Fed to deviate from, at this point, a programmed execution of QT and the FFR policy. Is there something I’m missing.

The Fed generally refrains from commenting on fiscal policy – although Powell himself has eluded to gov’t spending countering the Fed’s tightening goals.

Absolutely, just venting I suppose. Funny that we all come here to digest monetary policy, yet the mainstream and apparently the vast majority of business owners just fly by hoptimism and pent-up exuberance.

Would it not be better if the Fed refrained from ALL comment?

‘Read my lips Greenspan’ initiated the trend and it has done much harm encouraging irrational speculative exuberance.

Better if the Fed STFU and got on with the job.

This market is coddled like the fed’s first new born for what, 15 years now? I remember having nightmares of bernanke sitting in a kings chair telling his minions which lever to pull. This market farts and the fed coddles it with talf, tarp, qe this, qe that, operation twist, bank funding programs that, artificial low rates, bloated Fed balance sheets, lending programs etc etc etc. I say enough already Mr. fed, let that spoiled rotten kid of yours walk for once on its own 2 feet. Either that or changed the name from the dow jones to the feds selected few and be done with it.

I was laughed at in a recent meeting with business professionals when suggesting the market should assign a value greater than zero of getting a rate increase…….instead of assigning zero possibility of a rate increase. Inflation not under control……….how absurd. I suggested there is the risk of resurging inflation and that the possibility of an increase remains. To me it is a real number…perhaps 5 to 7%.

Can you say Red Sea conflict and oil prices? Yeah, oil has gone up. Now that so much shipping is being routed around Africa. That means the cost for everything goes up.

For what it’s worth, an out of the money option for a rate increase would indicate what the current price may be. There are organizations that invest billions betting on the twisted can of worms you so masterly wondered about. Personally, 2 pct, tops.

“Putting three rate cuts in 2024 into the dot plot at the FOMC’s December meeting and letting markets assume six or seven rate cuts in 2024 and run wild with this rate-cut mania, has turned out to be a strategic blunder of colossal proportions by the Fed.”

Blunder would be an understatement to say the least. Gotta love the FED, when are they going to learn or perhaps just willful ignorance that the market is an addict and nothing more. Threaten to take them to rehab will not do a thing and showing them rate cut dot plot when we’re not even at 2% target certainly won’t do the trick. Raise rates next time stopping being in F around and find out mode and cease to let the market have any hint of glues they can sniff, you will get your 2% target and sticking if these people really mean business.

Unfortunately, with each of their epic blunder like trillions in matters of months to transitory comment, average joe gets to pay the price for a very long time, well average joe that’s not an asset or property owners that is. Perhaps this is a feature and not a bug..

A feature of capitalism with America being the extreme. Ideally things get mitigated by the changes by the working class, such as occured in the Scandinavian countries, but different dynamics here. Someday affordable education, right to shelter, employment, healthcare may also be rights, but history shows those are hard fought for and tough to keep. There are no perfect systems but ideally there would be humanity.

Speaking of capitalism….and that there is a lotta money in healthcare, like you said;

RELX’s Scientific, Technical & Medical business provides information, analytics and tools that help investors make decisions that improve scientific and healthcare outcomes. It operates under the name of Elsevier. (just wikipedia stuff….look it up)

I’m not an investor, but many here are. So have at it. And I never liked supply-side…..didn’t seem ‘humane”, but it looks like it’s here to stay……until the planet or the people go to hell…..happening as we discuss money.

I’m gonna go chase this “Hormesis” concept, now.

change that to “a lot of money to be CORPORATELY extracted (mainly) in the healthcare busy-ness”, especially in “magic bullets”.

FN Erlich

Theriac sounds like cool stuff…..was around a long time….not cheap, either, so must be good. I bet Prevegen won’t last as long……even if people do.

“different dynamics here”. That’s hilarious! The vast majority of Americans, including those who would benefit the most, absolutely hate the Scandinavian countries. They would rather kiss the feet of a billionaire (maybe he is?).

You can have the Scandinavian style social welfare democracy or you can have “diversity.” You can’t have both.

I wonder if those Americans who “hate the Scandinavian countries” – and likely believe that “America is the greatest democracy in the world” – understand the relative poor ranking of US democracy.

The annual Democracy Index published by the Economist Group ranks the USA as 29th, with a “flawed” democracy.

The four Scandinavian countries – Norway, Sweden, Finland and Denmark – are all ranked in the top 10 (Norway is No 1.) and considered “full” democracies.

What in anyway does different dynamics have to do with what Americans think of another country or for that matter how it relates to diversity? Perhaps if you addressed from a policy perspective. We are a wealthy enough country to have affordable education, healthcare, shelter, food security but as a culture much of our culture, those often fortunate to benefit from generational wealth or not starting out with a societal disadvantage, believe if you just work hard and long enough everyone can achieve the American Dream. Fixing all of this is completely doable and of course has numerous benefits. We choose to abandon much of the people of this country, clear and simple.

I love The Scandinavians who are not like the median American. Frankly, the two I have known seemed to exude a display of unearned, self importance.

Nice people though. Unaware of their own proclivities for ritual.

Rights aren’t given to you by governments. There is no natural human right to housing or food.

The inalienable rights are innate to being human and have nothing to do with government, except insofar as the government infringes on them. True human rights cannot be taken away and they are not gifts from society.

Stuff, on the other hand, like housing, you have to earn for yourself. Most people don’t appreciate the cost or value of unearned freebies.

Similarly for education, which is earned not given. People are not, by nature, empty vessels to be programmed by government teachers.

If a. Nation wants to provide subsistence to all via socialism, go ahead but it’s a conflation of meanings to call free housing a “right” when really it’s a gift.

America the extreme? There is one other contender who no one can challenge. The median net worth in India is one thousand dollars. One half are above, one half below. The median net worth in Russia is eight hundred seventy one dollars. 1100 people in Russia own 35 % of the wealth. It is in its own class of one.

Or did Powell know what he was doing. 10 yr went from 5.0 to under 4.0 and now slightly above 4.0. This translates into interest savings for the US of A. Maybe he was getting what he could while he could?

The interest rate savings for the USG would be limited to the relatively small amounts of notes and bonds sold during those few months, not on the $34 trillion in outstanding debt. So I don’t think it’s worth the Fed’s attention. If the Fed wants to push down long-term yields over the long term, it needs to get inflation back down to low levels.

Higher for longer.

The elephant in the room is the outstanding $34 trillion and growing govt debt. Why is this being ignored and not being treated as a serious problem? If we ignore it hopefully it will go away.

Instead drunken sailor deficit spending continues and interest on outstanding debt now matches defence spending which is also out of control fighting ideological proxy wars which pose no direct threat to the US. I fear inflation is here to stay for the foreseeable future.

Because, Andre, the US Federal government debt is net private sector wealth as denominated in $USD.

Do you see anyone volunteering to give it back (which is to say, asking for higher taxes)?

The markets are said to have pretty much priced in rate cuts so I don’t see where “pent-up exuberance” comes into play. BTW, the markets are often wrong as we have seen

I can certainly see where “irrational exuberance” is in play, and has been for some time. The markets are basically nuts, for example note the 500 point drop today in the Dow a half hour before close. MSM will make up some bullsh_t reasons for it, but in the end, the reasons are just the usual bullsh_t.

What isn’t bullsh_t is the retail price of gasoline is up over ten percent the last month. Next headline CPI should be amusing.

“The markets are said to have pretty much priced in rate cuts so I don’t see where “pent-up exuberance” comes into play.”

Read the article and not just the headline, and you might “see where “pent-up exuberance” comes into play.”

Clue: it’s NOT the markets. It already happened there. RTGDFA

““Pent-up exuberance” is that businesses, “ready to pounce,” would unleash a torrent of new hiring and investment at the “first hint of an interest rate cut,” which would unleash inflation all over again.” from TGDFA.

Last I looked investment includes the stock and bond markets, but of course, it includes a lot of other things too, as Pea Sea notes.

As for hiring, I seem to recall the labor market is remarkably robust nowadays. I suppose it could get more robust.

Bostic was referring to the economy, not the markets–specifically, businesses potentially going on hiring binges and investment (presumably into plants and machinery) binges when rate cuts happen.

All how you frame it. I could easily say gas is down 4% from a year ago.

MoM is what drives the markets. Half of YoY measures use data that is over six months old. I have never been much interested in YoY. Wolf’s three and six month averages are alright. But I focus on the most recent datapoint, usually one month, though some like to call it noise.

As Friedman said: “There is no fool in the shower”.

But Zeppelin definitely has them in the rain.

And as usual, he is and was the fool in the shower and therefore intimately qualified to make an accurate observation in this case. A wannabee that longed to be correct, an honor that still eludes him.

“Putting three rate cuts in 2024 into the dot plot at the FOMC’s December meeting and letting markets assume six or seven rate cuts in 2024 and run wild with this rate-cut mania, has turned out to be a strategic blunder of colossal proportions by the Fed.”

That’s the Wolf Richter I remember!

And of course, I couldn’t agree more. It’s not always the markets being delusional, or Wolfstreet commenters cherry picking JP’s statements at press conferences. The Fed really is horrible at messaging.

You’d think an institution that made a deliberate choice to use “jawboning” as a tool to change financial conditions would make, like, literally any effort at all to understand how their signals are interpreted.

Do you suppose it’s possible that the December press conference and the latest dot-plot were trial balloons, intended to help the Fed gauge economic sentiment?

It’s hard for me to rule out—partly because of what Treasury yields were doing last fall. And partly because it seems rather clever.

“Do you suppose it’s possible that the December press conference and the latest dot-plot were trial balloons, intended to help the Fed gauge economic sentiment?”

Well, that would have been a profoundly stupid thing to do, so…yes?

(I’m being facetious here…anything is *possible* but I seriously doubt that that was the purpose.)

I am at the point where I pretty much only care what the Fed does with the Fed funds rate (up, down, or nothing) each meeting. All their verbal stuff and MSM reaction is just more bullsh_t.

Now that we know that they know that we know…..

Good to see WR coming back to senses wrt Fed.

I always was against fed jawboning and dot plots by wr rejected my doubts saying I read what I wanted to read.

It’s not about me.. it’s about market.

Peeked at the daily noise in the markets today and what happens at 3:30pm?

DM: Bitcoin hits all-time high above $69k after two years – then TUMBLES 10% in huge sell-off

Bitcoin hit a record high on Tuesday after a more than two year wait – then immediately tumbled ten percent. It hit $69,200 around 10am ET – topping November 2021’s all-time peak

Its not really an ATH if. $69k two years ago is not worth as much as $69k today.

And here we are, 20 hours after your comment, BTC is back to $67,100.

I would normally be extolling the benefits of BTC but for the wolf street crowd you can have the other side of the equation from me.

Isn’t the dollar trash ? How do you like all these dollars ? There are so many dollars out there that without printing a single new dollar BTC could rip to incredible highs.

All that has to happen is a few people with a few of all those immeasurable dollars need to move them into BTC.

Its just not fair. BTC is so scarce. There is no innuendo, no suggestions, no approximations, no estimates, no rough numbers and no BTC that’s left unaccounted for. We know exactly how few of them there are and where they are at all times.

The dollar, on the other hand….

There is an unlimited supply of cryptos — there are thousands of them and they’re growing by the day — and zero actual demand for cryptos other than fun gambling tokens as no one needs them to do anything with. They’re just gambling tokens to have fun with. So have fun with them.

I see them as a way of transferring cash between counterparties where the countries whose cash they need to transfer restricts the actual cash transfer. Therefore, they can still do the transaction, just using a work around.

I just spit a wad on the floor.

It is scarce, because it is the only wad in the world spit out by me, that is currently wet, anywhere in the known universe. In other words, it is the greatest wettest wad spit out by me in the world.

There is no innuendo, no suggestions, no approximations, no estimates, no rough numbers, just one wet wad. It is priceless, rare, unique. Oh, so scarce!

Your USD though? Toilet paper trash. Unlimited and incomprehensibly vast in number, and increasing by the day.

Which is why that one wad of spit is so valuable and will soon rip to incredible new highs.

And it’s the precise same reason shitcoins like BTC are so valuable and will soon rip to incredible new highs.

Welcome to the Souffle economy.

If over-whipped, it will collapse.

Where will money go? Gold, money markets, etc. S&P expects to end the year at 5400. I can’t speak to that but with sizable profits seems like plenty of money and growth for now.

Yo Glen…good equation….”Where will money go?”

I’ve been asking myself th same question for quite some time now.

I bought 3 & 6 math T-bills x2 with 40% of my “investible funds,” keeping another 45% in physical PM’s. Only 15% or less in the

“stonk mkt.”

After reading Bloomberg’s “Great Take” on NVDA I realized that this AI “craze” is only just getting started, Nividia has been in the game for a longtime and have succeeded to be the dominant player not only because of their chips but also their associated software which is whole new language that NVDA created to function with their hardware!

SO what did I do? I pivoted, to use an overused phrase, & sold one of my T-bills just 1 month prior to expiration (losing about $250 in interest) and invested (not speculated) in NVDA stock!

I’m looking at it as a long term investment & I’m a very skeptical,

cynical person!

Whistling past the graveyard is not the sign of a confident investor. Maybe if one says it loud enough, it may come true, especially if you can work in AI.

Someone who works in AI.. I see lots of competition coming for Nvda.

Nvda is awesome but the valuations is ew…

Same for tesla.. now tesla going back to reality gradually.

How did you lose interest? Usually the pull to par with bills means their prices don’t go down too much, even when the prices of long bonds do.

The main implication of selling bills before maturity is that it counts as a capital gain rather than interest income.

Oy!

Our moves are an atom within a molecule of water contained within a drop that falls in a bucket of water that is then dumped into the ocean that is the market. Our individual choices are relatively meaningless to the direction or level of that market.

The level and direction of the markets are moved by very large influences. One that is under the radar for most is the changes in legislation directing more employee income into the markets. This increasingly steady influx of new money is essentially blind money invested in whatever funds are available in their plan. Most of that mandated contribution will end up in very large index funds.

The pent-up exuberance of hiring and increased employee incomes will directly increase the funds contributed to the market through these legislative changes. In essence, a rising tide that will lift all boats over the next five years.

That is but one influence, regardless of how large. How many ways will the brainiacs in the markets figure out to withdraw all those funds from the markets?

What the Federal Reserve is going to do is get a little more inflation under its belt for the debt, then the money in taxes that would have paid on that debt can stay in rich families pockets, while the 99.9% pay the inflation tax.

A real secondary benefit is if those businesses hire and burn through their rainy day capital. At that point the Federal Reserve can tighten and the businesses go into distress so that the rich .01% to .1% families can get the assets cheap.

A win – win scenario; or “heads they win, tails you lose.”

I know what you are saying but those who think that’s how to succeed are foolish. They will be the losers while the ones who are fair, honest, and just and shun involvement in market rigging and manipulation schemes will be the winners.

If “business leaders” are “ready to pounce” is that necessarily inflationary? Don’t these businesses produce things, increasing supply and thus easing inflation?

What am I missing here?

You missed everything.

“…ready to deploy assets and ramp up hiring…”

“…unleash a burst of new DEMAND that could reverse the progress toward rebalancing supply and demand. That would create upward pressure on prices.”

I missed the part that explains why ramping up hiring doesn’t result in more production.

#1. Job market is very tight right now. There is little to no slack in it.

#2. Companies decide to go on a hiring binge.

#3. Demand for humans suddenly spikes WHILE supply of humans doesn’t.

#4. Companies just end up poaching humans from other companies.

#5. Companies do this by offering these humans higher wages to entice them to their company.

#6. Therefore, price for humans goes up.

#7. However, production doesn’t go up because same number of humans as before.

I assume Bostic didn’t feel the need to explain that because he assumed his audience wasn’t living in a cave for the last 3 years.

https://wolfstreet.com/2024/02/02/great-to-have-a-good-job-market-with-surging-wages-but-rate-cut-mania-takes-a-hit-and-we-fret-about-inflation-reheating/

People need to understand something: manufacturing is only 15% of the economy. Construction is part of industrial production, and construction has been pretty strong. And oil and gas extraction is part of industrial production, and that has been red hot. Even then, 65% of the economy is services. That’s where the action is. That’s where you have to look for the big production increases. This includes nearly all tech. And production in the overall economy has been hot.

It will down the road, but first they have to hire which will drive up wages and buy their raw materials that the use to produce their widgets, which is also inflationary. Pretty obvious if you think about it, labor market is already tight and commodities are creeping up.

Because most of the hires nowadays are unproductive waste. Malinvestments of different kinds. One such is AI, another is DEI, quite quitting is also rampant with lots of brainpower wasted gambling crypto or speculating on housing.

In short, half of the businesses are zombies that better be concerned about how to scale down. And >80% in anything broadly understood as “tech”

Even the mightest Oak tree is held up by its dead wood.

I was kind of thinking the same when I read your post, but I guess there’s firstly a delay between making the investments and arriving at finished products, all the while in between people are getting paid buying things. But I think the main thing here would be the labor market tightening more, would lead to higher wages and hotter inflation.

With all the tech innovations productivity has been stagnant since the 80s. STEM education deteriorated, the population aged, and wholesale imported illegals are not capable of taking on sophisticated jobs (at least yet). Further credit expansion won’t help. The latest figures on productivity are quite telling: $1 debt yields ¢50 GDP.

The Fed, the Fed, the Fed. The Fed was created by and for bankers. It only has the welfare of the elite in mind, not the economy as a whole. While some people have done well with QE, ZIRP, etc most haven’t. This is one messed up economy and there is no guidance from Congress, the President or the Fed.

You say that like it’s a bad thing. America was created by the oligarchy for the benefit of the oligarchy.

Created by clever and brave people who took a deadly chance to sock a king in the mouth to gain freedom for generations to come.

“…and there is no guidance from Congress, the President or the Fed.”

The answer my friend, is twist’n in the wind

The answer is twist’n in the wind

“Putting three rate cuts in 2024 into the dot plot at the FOMC’s December meeting and letting markets assume six or seven rate cuts in 2024 and run wild with this rate-cut mania, has turned out to be a strategic blunder of colossal proportions by the Fed.”

You can say that again, Wolf. And all without the benefit of any actual rate cut. Just talking about rate cuts has undone a lot of the progress the Fed made in hiking them, and may ultimately mean higher actual rates than otherwise would be the case to get the same result.

Overall forward guidance has been a net negative since Greenspan introduced it under the guise of transparency. It’s a form of ease unto itself. At any given level of rates, less uncertainty about future rates invites more leverage and speculation. Not to mention the inherent conflict between being trying to make policy in advance of the data and being responsive to it. The Fed would get more results with less effort and disruption by just setting policy based on the data available at the time and refraining from speculating about what might be appropriate in the future.

The FED enjoys being able to stoke inflation while raising rates. The secondary goal always was inflation after their first goal of enriching the billionaire/hundred millionaire crowd.

Inflation is how they siphon all of the wealth from the lower classes to give it to said billionaires. Bernanke with his QE is the godfather of the reverse Robinhood wealth transfer.

The US is 100% hijacked by the oligarchy, who use the currency, FED, US Treasury and US citizens’ taxes as their own personal bank account.

It doesn’t matter who wins the election this fall, nothing will change. Both candidates and parties have the same goals. Prepare accordingly.

Good to see you realize the difference between Reagan, Trump, Biden, Obama is minor as all support essentially the same thing. Just a slow process of the deprogramming the narrative combined with education. I much prefer the corruption while I lived in Cambodia for 5 years. It wasn’t hidden behind so many smoke and mirrors. Hopefully over time BRICS will reduce the hegemony of the US, both economically and militarily.

Howdy Folks. Are you not entertained? Millions imprisoned in their own homes and do not even know it. ZIRPed and kicked the can for years so we pay for it with inflation. Sent checks and the people really thought it was theirs to keep? Pretty tricky and smart of these folks. I call it MADNESS.

Wouldn’t it be funny if in the end there are no rate cuts at all in 2024 because inflation is just too sticky?

A little while ago the March cut was a given. Now it’s basically off the table. Meeting by meeting the Fed can keep kicking the can but leaving the door open so there’s not a total crash.

That is IF they really care about getting inflation down to 2%…and the jury is out on that one.

It seems the Fed can keep the animals stoked by promising rate cuts someday (probably later this year says Powell to soothe the Congress critters). He may have learned his shtick from Maxwell Smart or even Mr. Wimpy, but it’s magical vapor right now.

good business leaders are paid to pounce on opportunities – that’s their job. is this a revelation for Bostic? seriously?

RTGDFA. ALL OF IT. And try to comprehend it.

This stuff is exasperating.

Trying to reason through narratives is madness. Leads to a cognitive loop: “but, but the mission statement says..”

The purpose of any organization is what it does. Why that is so incredibly difficult for most people to grasp causes you to loop again.

Maybe the FED put out the December dot plot on purpose to lure the markets and their establishment Wall Street media priests into a trap.

What if Powell knew what kind of resistance he would get, so he threw out this little piece of bait to whip the nut jobs into a frenzy just to prove his point that it is suicidal to cut rates anytime soon.

Although I’m not qualified to read tea leaves, my general observation about the swirling chaos I see, is that core inflation hasn’t been this elevated for a few decades. Furthermore, short term borrowing rates haven’t been this elevated for a few decades. The combination of those two realities implies that at some point, reasonably soon, something related to collateral risk exposure is going to expose the absolute stupidity associated with pent of exuberance.

The excess willingness to take on excessive greedy risk will explode, primarily because every economic cycle has risk and rewards — versus perpetual nonstop rewards. It might seem stupid to not be investing in insanity — but that’s exactly when you need to focus on risk.

Unless you are in the school of “This time is different” then perhaps there will be no down to this cycle…and who knows maybe this is a shift to new paradigm…after all trillions pumped in liquidity in very short amount of time is unlike anything in history.

Thanks WR for this report.

What a bs statement by this Fed buffoon.

Instead he should have said.. despite feds efforts financial conditions have loosed quite a lot much to their dismay.

This poses a risk to inflation fight.

If fed has balls they would hike in March.

Transitory was inflation, then rapid and large rate hikes, because the data lags, FFR eventually 5.25-5.50. We will keep rates here and look at the data. The dot plots model 3 rate cuts late 23 or 24. Then inflation moving towards our 2% target, and the closer we get we will cut. Inflation goes the other way, higher! Wolf always said services would be a problem. So inflation hit 9% so we are at higher lows now and showing signs of volatility. Moving higher is rate hikes in my opinion, with QT taking years. Inflation is here it goes away with rate hikes not by itself. Money is no longer trash..

Dear John Cash is King . A lifelong motto for a squirrel. Still have my childhood memories of by first savings account book. Save $ and they even printed the amount on the book page for you. Almost brought to tears during ZIRP.

Debt-Free-Bubba, I remember opening my first bank account. I put in ten dollars, got 5% APY. They gave me a little passbook, and the teller would write my new balance in it every time I went in. Sounds like your experience.

I had my money in Super T-Bill accounts at Canada Trust (now Toronto Dominion bank) in the late 1970’s and early 1980’s. The savings accounts were tied to the T-bill rate (I think it was the 90 day T-bill rate) and paid a slight premium for anything over 50 thousand.

I remember buying savings stamps as a kid for either ten or twenty-five cents that you pasted on a sheet until you had the $18.75 needed to get a $25 savings bond.

You reminded me of the EE bonds that I redeemed a few years back. They were 30 year bonds taken out in the late 80s… actual paper bonds that I kept in my safe and brought to the bank at maturity.

I got a little wind-up travel alarm when I opened my first savings account when I was 10. It worked for decades.

“Almost brought to tears during ZIRP.”

Tears, anger, and extreme hatred for wall street for me.

Is this “pent-up exuberance” at all related to Billy Mumphrey’s “unbridled enthusiasm”. Sorry, I couldn’t resist. Canadian mortgage holders have their own unbridled exuberance that it’s paying for as mortgage delinquencies have shot up in BC and Ontario. Does this mean that the government’s “mortgage code of conduct” is theatrical lip service? Thus far it seems so. However, the budget is in April and this government is polling low. Pent-up exuberance aplenty. Sucks that people have to learn the hard way but I’m not in favor of the government juicing the real estate market and trying to sustain unaffordable price levels.

Do these people have a clue as to how to do their jobs? My cat seems to know more.

I guess they don’t have time to address inflation since their main business seems to be giving speeches which indicate to anyone with a brain just how incompetent they are.

Once inflation gets embedded it is h— to get rid of it. Page 1 in any textbook worth 5 cents……but let’s all give a speech and act surprised……and sit at the gym and talk about patience.

I guess if FDR had been more patient, Hitler would have died of a heart attack in 1965 and 490,000 Americans would not have been killed or injured.

The real answer……they are as corrupt as can be……it’s obvious.

Why cannot the Fed go back to the old ways – Show up for the rate meeting, do whatever, announce it and fade into the background. Simple. That way no need to answer the journalists who need to be tasered. No need to backpedal.

Why wave the juicy bone of “rate cut” – has it got anything to do with how the market is doing.

Why open your mouth too much and get into trouble when you can keep it shut and do well.

Howdy kpl. The politicians have the FED ear especially in an election year. The FED is not independent as far as I am concerned……

Greenspan’s magical idea: your friends are happier when they can front run your moves.

KPL – the prospect of free money ranks with, mebbe even above, that of lunch or beer…

may we all find a better day.

D-F-B…you have so many simple opinions about so many different

comments that it really makes one wonder wtf ups know about anything.

Maybe you just like shooting your mouth off like Foghorn Leghorn!

Or is the “squirrel” too old or too young to remember this cartoon character?

Howdy James. Thats what use to be great about America. Some of US never wanted to be the same as everyone else. Individual freedom to do and think what you think is best……Its AOK if no one agrees with you.

It be great if WR added a block button. I know who’d get first treatment.

:)

Heh. I am going to love talking with my local bankers, the ones who were saying that I should get “locked” into CDs before they lower the rates. HA!

One manager was arguing with me about the Feds and rate cuts. How their bank economists were saying this and that (I didn’t know banks had economists on the payroll, maybe consultants?) I was countering that if inflation is under control and this was three months ago. He kind of pissed me off and I am going to show my displeasure by withdrawing some cash from the special rate MMA account and put in a competitor’s bank. They will see the transfer record.

Not worth it anymore where banks want like DCR 1.35 and global DCR 1.50, full recourse, LTV 50-70%. 1-2 points in fees. 8-10% rates. Only kept money there for “relational” banking loans. How is this a special relationship? Fook off. I hope the bank is one of the 50 near collapse banks Wolf was mentioning. Ok, too personal. But what nerve arguing with the guy who has money in their bank. Cash is king, baby!

Howdy The King. Treasury Direct is the place to park cash. No brokers, just a website where you decide what to do.

Back in October, I was “arguing” (politely disagreeing) with the teller at my credit union – their CD rates were barely above 4% yet bills & brokered CDs were yielding 5.5%. I casually mentioned it was difficult to justify keeping my funds at the credit union given their below-market rates.

A week later I see an ad on their website for a 5.5% 6-month CD.

It’s not just businesses, there’s a lot of people (myself included) with a cash in money market and other vehicles ready to get into the markets when they drop. About 35% of my portfolio is cash.

People say that all the time, but the reality is that when a crash starts to happen, people freeze up. No one wants to catch a falling knife.

I don’t know how other people handle it, but I’ve caught plenty of falling knives, sometimes getting cut (PARA) other times coming out great (META and PLTR most recently).

Howdy Dennis. Nothing wrong with keeping some cash. Nothing wrong with always saving some of your $ and never spend it. They ZIRPed or taught a generation or two to NOT save $$. ZIRP imprisoned them into their own homes for decades too. Inflation will not go away for some time. Almost 35 trillion reasons I am correct too.

Somewhere out there, is a great meme of Jerome Powell hitting a piñata, I just can’t find a good one.

Howdy Brandon JPow is just another FED tool in the FED Tool box .

After WWII was over Harry Truman asked his economists “what should we do with this massive manufacturing ‘machine’ we built for the war?” They all said “on the one hand we can do this, or on the other hand we can do that”.

Truman left the meeting saying “what i need is a one armed economist”

still true today

Howdy WIZ. NO economists. Give me entrepreneurs.

People have short memories. Bernanke cut interest rates prior to the GFC but housing prices still fell.

Interest is the price of credit. The price of money is the reciprocal of the price level.

Bernanke conducted the most contractionary monetary policy since the Great Depression.

There couldn’t be pent-up exuberance, unless the money supply was still to large for the economy. Where are these businesses getting the cash to go on a hiring binge? If the money supply matched the size of the economy, this couldn’t happen.

I suppose the Fed will continue QT, but it seems to be operating very slowly.

1. Lots of businesses sit on huge amounts of cash (invested in T-bills and other stuff) ready to deploy.

2. Financial conditions are ultra-loose. This means that borrowing for most businesses, even junk-rated businesses, is way too easy, which is exactly what is worrying the Fed.

It can’t be worrying the Fed that much, or they wouldn’t be acting in such a way as to encourage those ultra-loose conditions. Or do you believe that they’re actually so clueless as not to understand that their pivot signaling is driving the 2021 vibes in the economy and the markets right now?

I’m really getting tired of this twisting of the Fed’s words. You’re spreading BS.

For pete’s sake, Wolf, you yourself said that their dot plot in December was a colossal blunder. That’s precisely what i’m referring to in this last comment. I’m agreeing with you that the signals they sent late last year have contributed to this year’s mania.

I know you are justly exasperated with people spreadimg ZeroHedge bullshit and conspiracy nonsense in here, but I fear you’re starting to lash out at people without carefully reading what they wrote.

The Fed said their FFR is likely at its peak! They want to be sure though that inflation comes down to 2%. It went up though not down. Their dual mandate is stable prices and employment. So inflation was transitory. Strike one. Inflation is coming down to our 2% target and we are looking at our data for cuts sometime this year. Strike two. We will maintain our peak rate 5.25-5.50%. Strike three.inflation is higher. Looking forward to Wolfs articles!

No article coming on this. What Powell said was a rehash of what he said at the last meeting, when he bashed down market expectations: We’re not confident inflation is coming down, need to see more evidence. If — if if if — it comes down further as hoped, we might cut “at some point this year.” If not, we might not.

This is what Powell said in his prepared remark today:

“If the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year.

“But the economic outlook is uncertain, and ongoing progress toward our 2 percent inflation objective is not assured. Reducing policy restraint too soon or too much could result in a reversal of progress we have seen in inflation and ultimately require even tighter policy to get inflation back to 2 percent.”

So he’s leaving the door wide open for no rate cut this year if inflation doesn’t come down further. And if inflation resurges, rate hikes will re-appear on the horizon.

He’s still pimping the markets. He’s not even remotely trying to dial back the speculative mania. If he were, he’d be throwing cold water on it.

Just read the first statement. It literally means “I EXPECT the economy to evolve broadly to the point where it will be appropriate to begin dialing back policy restraint.” He is saying, yes, he believes they will cut rates this year. There is no other way to interpret it.

He is giving Wall St. their fuel. He is STILL doing it. He does not want to stop this rally or inflation. He is juicing and goosing and pimping and pumping. It’s totally obvious.

Depth Charge,

We all know that nothing is going to make you happy other than the collapse of the US economy — on the motto “burn it all down.” Be careful what you wish for. If your wishes come true, they would then trigger 0% and QE all over again. And then you’d be livid again.

Wolf,

You need to go sit in 8 hours of traffic to hit the slopes after all that new snow and get some of that energy out. Then, you won’t feel the need to gaslight me so much. Hahaha. Just kidding.

I don’t want to burn the whole US economy down. That would be dumb. But arresting inflation with higher rates and popping bubbles isn’t too much to ask, is it?

PS – appreciate you very much even when we have differing opinions.

Agreed. Rate cut will not be that important if Powell can withdraw liquidity much more quickly than the current pace. The QT is simply too slow to counter the excess liquidity. And it is fueling all the ridiculous bubbles including bitcoin. Increase it to 200 billion QT a month, we will see bubbles quickly dissipate.

Depth Charge,

Did you see the Twilight Zone episode where aliens come from outer space and threaten the leaders of Earth with annihilation unless they balance their budgets and behave responsibly (among other demands)?

The leaders of Earth decide they would rather fight than do that.

This should give you an idea of how much resistance there is at the Fed and elsewhere to doing the right thing.

Paul Volcker has warned about this in his book. Jerome Powell even held it up at a press conference, before he got too much pushback.

This bubble will pop when an external catalyst causes it to pop.

Or we will have a 10-15 year inflationary period.

The most Wolf can do is to give potential events and timelines.

Like Dutch tulip mania, the South Sea bubble, the railroad bubble, and a bunch of others, this too will come to a very bad ending.

Depth Charge – anymore has figured this out or goes not agree to what you said above, then they are delusional…. and there are lot of people like that out there including some here….

@Depth Charge: I have a slightly different interpretation on what Powell and the Fed are doing. They are putting their fingers on both sides of the scale alternately to make sure either side does not land quickly. This is evident from their statements that they don’t want to stop QT due to any “accidents”.

I think they are going to keep holding the carrots of rate cuts in front of the rate-cut maniacs so that they keep the market going. Unless there is strong evidence that inflation is under control, the Fed will not cut.

The rate-cut maniacs are going to wake up one fine day and realize they have been tricked all along. If they remain fully invested till that time, they will find that market events will gut their investments.

I see normal companies in the S&P 500 (not the so-called Mag 7 or any high growth companies) sporting PE ratios of 70 to 80 or even higher. There is no way in heck that these companies are going to maintain their prices over the next few months.

To my thinking, inflation will not subside until we have major pullbacks in the stock and housing markets and it will happen within the next few months. You can see signs of it with stagnating corporate revenues and tepid forecasts.

And one more thing. If the crypto mania buckles and dies, watch out below. The folks who are dumping money into the stock market will never know what hit them. The big guys will laugh all the way to the bank while the wee little speculators will swear off putting one more red cent into any of these markets their entire lifetimes.

There is too much liquidity, Sean. Until that liquidity is restricted, nothing is going to change. The FED is too slow to withdraw it, so the bubbles will rage on, perhaps even grow bigger (see BitCON, etc.).

We are in the most insane everything bubble in world history, and the central banks are just sitting back and watching like a child who started a 5 alarm fire, his eyes giant with marvel and awe, with no plan other than to just enjoy his handiwork.

The liquidity since the middle of last year has come from the rapid draw down of the Reverse Repo. When that goes to zero, there should be a clear shift in behavior.

@Sean Shasta

The forward P/E of SP500 companies (excluding the Mag 7 and banks) is about 24 and a little higher with the Mag 7.

At this point…it’s better for Pow Pow to just STFU and not say anything. He is not verse in fighting back market hallucination. Even though maybe in his head what he is saying is hawkish and make sense…the market and for that matter consumer sentiment is on another level of high…just STFU and not say anything about a cut now or future…

@DC: I totally agree that it is an “insane everything bubble”. The plan is to methodically stamp out the 5 alarm fire and not have it engulf every nook and corner of the economy.

Unfortunately, this is the only plan the Fed could have. The alternative is to light up 5 alarm fires everywhere and run around trying to stamp all of them out – that would mean the slowing or stopping of QT as well as lower interest rates, both of which are unpalatable.

@DC: You said: “The FED is too slow to withdraw it, so the bubbles will rage on, perhbaaps even grow bigger…”

Well, if the bubbles grow bigger, so will inflation (the wealth effect will ensure that). Which will inevitably lead to chances of bigger implosions.

We can only wait and watch while the Fed does the tightrope walking to bring things back to some semblance of normalcy.

Why is the Fed so afraid to surprise the market?

If Powell finds they are twisting his words and the financial conditions are loose he can very well throw in a 25 bps hike and show them who is the boss.

I see a lot of discussions about money. Please, STOP. “Money” isn’t a problem in a fiat currency world. The issue is money-good COLLATERAL.

As we should all be well aware, especially post-Nixon shock, money/currency can be created or destroyed with the click of mouse.

This fact is understood by a vanishingly small minority of people. You have an uphill battle on your hands, and no mistake. Good luck to you …

The Fed is trying to do their “job”, as described in their charter. CONgress is FAILING to do their only job and balance the budget. GDP expanding only because of MASSIVE DEFICIT SPENDING.

Some of your graphs popped up on reddit. Yes, they gave you credit. They’re under REBubble – “Yall see this?”

Employment statistics are contradictory. The economy created x number of new jobs, unemployment stayed the same, and the number of people in the workforce didn’t increase the same amount of new jobs. Something is broken there. It seems more like for every job that gets destroyed one gets created. A net zero gain. As far as wages go, they are at the lower end of the industry where they’re growing. These won’t drive inflation that much. Wage growth inflation is over rated.

Money pays government interest no longer cash is trash.

CNBC Newsflash: New York Community Bancorp tumbles 40% and is halted as troubled bank reportedly seeking cash infusion.

Banking issues are not over yet. The Fed has to keep dangling the carrot of rate cuts to keep the market from not crashing down. If it does, they will be forced to take emergency measures which could mean slowing or stopping QT and rate cuts.

It is better they keep talking both sides of the mouth to let the air leak out of the balloon very, very, very slowly.

Someone leaked that they’re trying to do a share offering. So now they’ll try to sell shares at a lower price?

Just about every year, some banks fail and are taken over by the FDIC. There were only a handful of years over the past 50 years when no bank failed. In 1989, the peak year, over 500 banks failed. In 2010, 155 banks failed. So bank failures are normal. Banking (borrow short, lend long) is a structurally risky business, hence the massive regulation and backstop.

If more people really understood how banks work, they wouldn’t perceive them as they do now. That’s not going to happen anytime soon, however.

Wolf, do you have any thoughts on narrow banking as a way to replace the TBTF backstopped system we have had since 2008 essentially? Proponents of the theory have some intriguing arguments.

I find it interesting but not sure if loan rates would explode as this would essentially shift business lending away from the banks. Mortgage rates should be unaffected as they are government backed and could continue to be securitized and sold to investors.

Narrow banking should never be allowed. Narrow banks would have access to the Fed’s money but serve no purpose because they don’t make loans. They just arbitrage the difference between their cost of funds (including from the Fed, the FHLBs, the repo market, etc.), and what they earn on their securities and reserve accounts at the Fed. Well, and so now the crypto bros are trying to get narrow banks approved so they can invest in cryptos with Fed liquidity and backing. The whole thing is a scam, and to its credit, the Fed hasn’t approved any yet.

There are investment funds that do that, no problem, but they’re not a “bank” and don’t have access to the liquidity and backing from the Fed, and if they blow up, they blow up.

A narrow bank differs from an investment fund in that it has access to the Fed’s backing and liquidity. And that should never be allowed to happen. The only reason why banks have access to the Fed’s backing and liquidity is because the borrow short and lend long – which is risky because they can have a run on the bank – but bank lending is an essential function in an economy, and so it’s deemed to be worth the risk. But narrow banks don’t lend.

Markets certainly don’t seem to be in any imminent danger of “crashing down.” The indexes finished moderately up today despite NYCB’s troubles, bouncing off yesterday’s selloff (and Powell’s cooing in their ears this morning probably didn’t hurt).

I wouldn’t worry too much about the markets.

Back to the real world, it looks like New York Community Bank, the 35th largest bank in the US, is in serious trouble. It’s funny, because they got assets from the recently failed Signature Bank. It’s looking like a game of dominoes. Treasury and the Fed already failed their oversight duties with Silicon Valley and Signature Bank collapses. They had to perform some interesting emergency acrobatics to make everybody feel comfortable. I do not see them as increasing confidence in our banking system.

“the 35th largest bank in the US” probably will end up being another nothing burger especially if FED comes to the rescue as expected…wake me up when the bank is in the top 10..

No dominos. By hook or by crook, make no mistake that we will print our way out of the next crisis. The 35th largest bank is no big deal… All the fed needs to do is a few minutes of not-QE to solve a banking scare just like they did earlier in 2023. And by “solve,” I mean take it out your pocket and mine through inflation. All the fed jawboning in the world doesn’t hide the fact that taking a third of the value out of the dollar in a few years was absolutely intentional. So what’s another third to save some banks?

The 35th largest bank just today raised over $1 billion in new equity from investors. No Fed needed, LOL. Just keep dreaming of QE. It’s so sweet.

I think pent-up exuberance is better than pent-up pessimism (or malaise as coined by President Carter).

It is hard to change the inertia of the masses’ groupthink. It takes time or a catastrophe.

My confidence in JP is unchanged……I confirmed it yesterday when I visited my local McDonalds with my grandchildren. Handed the clerk a $50.00 expecting to get $30.00 or so back. She grinned at me, asked if I wanted fries and handed me about $10 bucks.

‘When I got home I thought about the Golden Arches……..and added another 100 ounces of what many here call yellow rocks.

The economy is a runaway train and all I hear is that interest rates of seven percent are a tremendous brake. Seven percent was just about the average rate for most of my life. I cannot stay the word I’am thinking so lets just say my wife likes pussy willow trees……I bet JP likes them too.

Excellent! Yes, me too.

Regarding the “yellow rocks”, Citibank raised their gold price target to $2,150 an ounce. They are a bullion bank, and making this proclamation this early suggest they know something.

One way or another CONgress will be held accountable, and yes, historically, 5% is a very accommodating monetary stance. I think my first auto loan was 18%. Higher for much longer, and the world will survive just fine.

In the big picture, pent up exuberance is all about money hoarding and having too much easy access to Fed programs that have kept the punchbowl overflowing for decades.

In that light, pent up exuberance is a reality but it shines a light on synthetic weak growth versus organic natural cycles — that are being manipulated.

The extra free cash helps companies hoard labor as well.

If the goal is to continue with loose financial conditions and prop up losses, that’s great, but it distorts risk.

It’s insane that a huge range of term spreads are tightly synchronized now, with very short term A2/P2 junk yields equal to 2 year Treasury rates.

That type of risk reward state is unnatural and eventually will show up in collateral mis-pricing — especially when there’s a run for safe assets, like before the Dot-com Bubble and before GFC and at the start of pandemic.

Thank God the Fed and Treasury can provide liquidity for speculation.

I don’t believe the independance of the FRB. I would think the private slot holders of the FRB influence who gets to be nominated for the public slots.

You must prove that you are qualified to be a member of this exclusive club to be nominated, and once in, you go with the flow to get a nice position at a fine establisment after retirement.

BTW, nobody got Martha Stewart treatment after they got caught with their in the cookie jar.

All in all, the FRB is using dual mandate smokescreen to transfer wealth from labor to capital. The rates went up, the economy did not crash, the market at ATH. They could have started rising the rates with no adverse effects to the economy.

Now, they are on the clock. The rates have to come down before the corporate refinancing cycle starts; otherwise the friends and family hurt.

If they were exercising leadership by definition from a moral standpoint, they wouldn’t be putting their employees jobs and companies at risk by gambling on some supposed outcome of rate cuts and they would also know and tell the FED that debasing the dollar never has been and never will be good for the stability and prosperity of the nation.

CNBC Headline: Powell says the Fed is ‘not far’ from the point of cutting interest rates

Just a few days after Bostic talks about pent-up exuberance and the possibility of inflation flaring up if they cut interest rates, Powell comes out and says they are “not far” from the point of doing so.

They are continuing with saying what every constituency wants to hear, never mind the bubbles getting bigger and bigger both in the stock market as well as crypto. This is not going to end well.

I don’t understand rate cuts being talked about. The only rate cuts I have understood were rate cuts during a recession. The Fed’s mandate is strong employment and stable prices. Any cuts I think about would cause higher inflation. Is the Fed signaling more debt or lower interest rates for the debt. I can’t wait for the numbers on February inflation.

“… has turned out to be a strategic blunder of colossal proportions by the Fed.”

Or maybe this was a happy accident. The Fed might have relieved a little short term pressure of the pent-up exuberance by announcing the dot plot by triggering the corporations with the most eager management to deploy their assets early.

Sure, this did cause some reacceleration of inflation, but now the Fed is aware that the exuberance is real and it will force them to keep FFR higher for longer. If they want to even look at cutting rates, the board better be ready for a flood of assets being deployed within a small time-frame, leading to increased inflation, and a repeat of the early/ mid 80’s.

I think the Fed lucked out on this one, as it could have been much worse and has the attention of at least someone with some authority.