Volatility. Powell mentioned it too. The 10-year yield is hugely volatile, and the drop over the past few days fits right in.

By Wolf Richter for WOLF STREET.

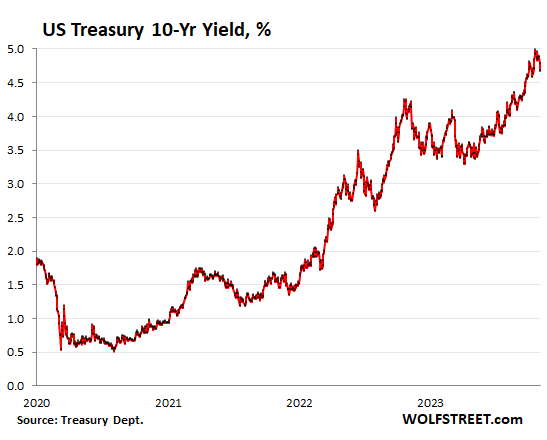

The 10-year yield dropped as low as 4.63% earlier today and now trades at 4.68%. It’s going through its usual gyrations – but at higher yields than before.

In the morning of October 23, it briefly pierced 5% for a few seconds for the first time since 2007, and then “plunged” over the next few hours, turning this into a spectacle in its own right, and it continued to drop the next day, closing at 4.83%, followed by a bounce on October 25 to close at 4.95%, and then it dropped into the 4.88% range for a few days until yesterday at 8:30 A.M., when it let go.

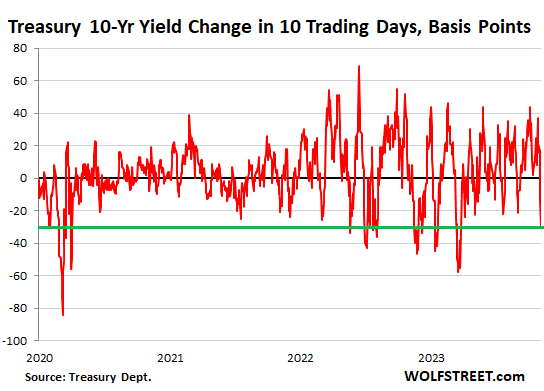

This multi-day drop fits right in with the ups and downs that mark the volatility of the 10-year yield, and no pattern was broken, and there wasn’t any kind of paradigm shift or whatever despite what the hype-and-hoopla organs are spreading around out there:

In terms of closing yields (per Treasury Department data), the 10-year yield dropped from the high of 4.98% on October 19 to 4.68% now, a drop of 30 basis points in 10 trading days. So that’s a pretty big drop.

But when was the last time a 30-basis-point drop in 10 trading days occurred? In March 2023 (-58 basis points); in January 2023 (-45 basis points); in December 2022 (-34 basis points); in November 2022 (-46 basis points); in August 2022 (-36 basis points); in July 2022 (-43 basis points), etc. etc.

You get the idea: The 10-year yield is volatile, as Powell pointed out, and this stuff happens a lot, and to a larger extent.

And all these drops were followed by big surges in the yield, and amid all the ups and downs, the yield kept wobbling higher.

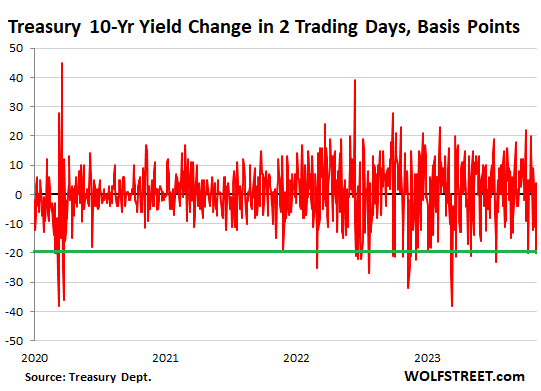

In two trading days from the close of 4.88% on October 31, to the current yield of 4.68%, the yield dropped 20 basis points, which is a pretty big move for two days. How often has that occurred recently? A lot, starting with October 10 (-20 basis points), July 14 (-23 basis points), etc. etc.:

So what happened?

Yesterday at 8:30 A.M., the Treasury Department announced projections for its issuance of longer-term securities as part of its Quarterly Refunding documents. It had already announced on Monday that there is a tsunami of issuance coming to fund the incredibly ballooning deficit. Yesterday came the details.

Yesterday at 8:30 A.M., it said that issuance of longer-term securities, particularly 10-year notes, in Q4 and Q1 2024 would not balloon as much as feared because it would shift issuance from longer-term securities to T-bills (1 month to 1 year) and to 2-year notes.

In other words, issuance of longer-term Treasuries will still balloon, but just not quite as much as feared. Instead T-bill issuance and 2-year note issuance would balloon even more than feared.

It made this announcement specifically to drive down longer-term yields which have become a huge concern for the Treasury department that has to pay the interest, and a blue eye for the current fiscal policies that have become a nightmare.

The Treasury Department listed a dozen reasons in the documents why longer-term yields had shot up, and I made a big deal out of this and listed those reasons. I also included a green-line-versus-red-line chart comparing the August 2 projections to the new projections for the same time period, Q4 and Q1 2024. And the 10-year yield careened lower. And that was the Treasury Department’s goal.

Then came the Fed’s decision at 11 A.M. to hold rates at 5.5% at the top end and leave further rate hikes on the table. Powell confirmed all this at the press conference. He also pointed out that tightening financial conditions – including specifically a higher 10-year yield – would be needed to transfer the Fed’s tightening of monetary policy to the economy.

The increase in longer-term yields “has contributed to a tightening of broader financial conditions since the summer,” he said. Here’s what Powell actually said at the press conference.

“In this case the tighter financial conditions we are seeing from higher long-term rates and also from other sources like the stronger dollar and lower equity prices could matter for future rate decisions, as long as two conditions are satisfied.”

“The first is the tighter financial conditions would need to be persistent. And that is something that remains to be seen. But that is critical. Things are fluctuating back-and-forth. That is not what we are looking for. With financial conditions, we are looking for persistent changes that are material,” he said.

“The second thing is that the longer-term rates that have moved up, they can’t simply be a reflection of expected policy moves from us that would then, if we didn’t follow through, come back down,” he said.

So now the 10-year yield is fluctuating, but it needs to be persistently higher to do the work for the Fed, and so the drop in the yield is not helpful for the Fed’s policy transmission, but what else is new, markets have been fighting the Fed for 18 months.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Wolf,

It looks like all of the major Western democracy central banks are on hold with the exception of Japan and it is a special case.

Any idea how or even if this might affect U.S. treasuries/dollar/and or the FED over the next few months and longer term?

Sorry for the awful-long-complicated question but I don’t have a good feel for this?

Higher for longer?

It used to be Rule#1

Never fight the Fed.

“but what else is new, markets have been fighting the Fed for 18 months.”

@2banana: The markets are rightly skeptical of the Fed’s stated objective because the Fed shot its own credibility by virtue of the Fed Put over the last several years. It has consistently rescued and propped up the markets. Actions speak louder than words, so the Fed has to act more convincingly and its jawboning will get it nowhere.

In the last year, the Fed has done everything it said it would do.

Fight the Fed at your own peril – I’ll take the other side of that trade.

MM,

I am too. Went out on margin yesterday and more this morning. With all the ‘Western’ central banks on hold I think there is room for a rally after this correction and this is the best time of year for equities historically, but I will be watching closely. I don’t ignore Wolf…

Would you rather hava had a national run on ALL banks back in March and the ensuing 1929 style depression?

Would you have rather just let the economy go to sh*t during 2020 and 2021 when Covid shit down the world?

Would you have preferrd to just let inflation run up to 15% last year when the fed started raising rates?

Is the fed perfect? Hell no, but theyre actually doing a pretty decent job overall of dealing with reckless financial institutions, unforseen black swan events and a government (all branches and parties) that think they can continue to spend to eternity.

How many commenters here would pass the test of having the entire country and every news network critique and second guess the work they do every day at their jobs? Not many, I’m sure.

”

Would you rather hava had a national run on ALL banks back in March and the ensuing 1929 style depression?

Would you have rather just let the economy go to sh*t during 2020 and 2021 when Covid shit down the world?

Would you have preferrd to just let inflation run up to 15% last year when the fed started raising rates?

”

Looks like we found another fan of FOMC.

This is what Pivot Mongers have been crying and begging FED to pivot.

In last 3 years, inflation raised the price of life essentials for more than 60% and for people sitting on assets, it was not a big deal.

Ask a common Joe in the street how is he dealing with all things inflated.

Let me tell you: what happened to Banks in March-2023, it was no where close to systemic risk. The FED did what they did to save the rich people. Do you really think that if FED/Treasury has let SVB depositors lost 10% plus of their deposits, we’ d have gotten 1929 like depression ?

We have this inflation where all things for life increased by 60%plus ( don’t trust the govt metrics ) in last 3 years because of FED blunder ( or FED’s deliberate actions to help themselves and their friends )

I LOL at your comment saying FED is doing a pretty decent job, and reminds me of transitory comment.

In my eyes, FED is an abject failure but I also understand FED stands to serve rich and elite and they are doing a fine job of this.

In-fact, WR’s article about FED is also laughable: “Hawkish FED” :-). Just look at the market reaction.

People may believe what FED says, but I hear the things which are not said and I think the market hears the same.

Same goes for housing market.

CCCB-

I believe your comment is an example of counterfactual argument, where you purport to know what would have happened if the fed had not acted as it did. You no more know what would have happened without Fed intervention than I do.

Further, it is possible for the Fed to be loaded with well intentioned and well educated individuals, but to still be institutionally inept and a destructive force, at least as far as monetary policy outcomes is concerned. That’s not to say that a central bank can’t aid the private banking industry with some limited functions that aid funds clearing, etc.

The huge increase in government debt (and along with it, corporate, financial and household debt) in the last 4 decades stands as a testament to the folly of the central planning functions demanded of the Federal Reserve System by our legislators.

The Fed created exactly every single problem it claims to be trying to address or ‘solve’ or ‘combat.’

Abolish the Fed. They are the purest definition of insanity.

How about actually re-establishing law and order and sending people to prison for fraud? If you reward bad behavior, you will only get more bad behavior….

Duh.

First, not all banks would have been run on, as all banks didn’t mismanage risk in their bond positions.

Second, the policy of attempting to rescue by throwing cheap money at things through artificial engineering lower rates for longer has long term unintended consequences. That we’re experiencing now.

The FOMC easy money for longer policy created the inflation that occurred. They had the opportunity to act much sooner and choose not to. It’s the entity creating the situations that you then praise them for attepting to mitigate, wtf?

Yes, I’d have preferred long ago up till now that we let the excesses get wrung out. Businesses fail everyday without being bailed out. Too big to fail is BS. Yet it’s the treasury to the rescue, US doling multiple hundreds of billions to foreign countries while it’s debt burden continues swelling exponentially. This is a sustainable process?

Reckless financial institutions get theirs by going out or being absorbed by another firm. The most reckless is the Fed & our government. No one will be able to rescue them someday.

Yes, it’s been going on for decades and will continue. Idk when, in the past this always ends catastrophically. The burden at some point can be no longer carried. If you live to see it, will you sing their praises then?

Yes to your first 3 questions.

@ Jon, John H, Mike R,

Thanks for debunking a FED apologist …………

This for all commentariat above who think it would be better or best to abolish the Federal Reserve Bank as it is currently.

YES, YES, YES!!!

Just as soon as WE, in this case, AT Least WE ”WISE ONES” on Wolf’s Wonder, figure out a or some ”BETTER WAY,”

Until then, and I am not just hypothesizing some theoretical here, actually ASKING for the ”aggregate” of Wolf’s Wonder commenters and, OF COURSE, WR his own self to weigh in…

While IMHO it should be very very obvious at this point in time that the current Federal Reserve Bank is doing it’s duty as the protector/guarantor of the banking system,,, at some point, the guarantees MUST be for WE The PEOPLE instead of the rich banksters, etc…

Otherwise, USA as we know it will just become one more example, similar to the fall of Rome, etc., etc… for the last thousand years or so, with the exact same results.

If long term (>10 years) yields continue to drop, the Fed will have to raise the federal funds rate or keep it at the current rate longer, if they want to compensate for the loosening, ceteris paribus. Tough job being an economist.

“Tough job being an economist.”

They make it tough when they try to centrally plan everything, thinking they know the needs of every citizen and market participant.

Seems like being an economist is an easy job. You get to get paid for predictions regardless of how they turn out and always some variable to blame. Most jobs don’t have that luxury.

so let’s skew this tsunami of new debt issuance to the short end … so we can manage our overall borrowing costs …

ummmm … you had a golden opportunity to skew it to the long end at ZIRP rates and didn’t do it.

look under the hood and see where the corruption is …

Well there were some suckers who snapped up those low coupon long duration bonds. They (the banks and others) now seriously regret doing that. No one in their right mind will ever buy low coupon long duration bonds, ever again, meaning no more ZIRP shananigans.

The buyers of these long term bonds will be lucky if they get back 25 cents on a dollar. And that is on an investment they thought was safe.

Thank you Wolf.

Long bond yields had, quite literally, gone parabolic.

Yields needed a break, just from a chartist/technical standpoint – but the uptrend is still solidly in tact.

👏 HIGHER 👏 FOR 👏 LONGER 👏

So with the announcement to more T bills issuance, does it mean yield will go higher than where they’re at now or will stay the same since I remember reading something about Fed interest rate ties more directly with T bills yield vs longer term bonds like 10 yrs?

If it does drive up T bills yield more, then definitely good to hear, it would also cause more of yield curve inversion right?

I’m wondering the same thing Phoenix… I’m no economist or a money guy, but I’m thinking that if the Treasury is going to issue a ton more short term T-bills, it makes sense to me that the rates would have to go somewhat higher to attract buyers for the increase in T-bills.

But who knows. Maybe Wolf can chime in with his thoughts on this topic.

I don’t think the FED is having any problems attracting people to T-Bills at 5.5%

Just my $0.02

Yep, as pointed out below, in a high tax state tbills are great. Maybe we will see TINA – there is no alternative – apply to them for a while.

Is somebody wants to buy a 10-year note paying 4.6%, with inflation running 4-5%, deficits exploding, a pension crisis in the cards, and multiple wars on the horizon, good luck to them.

We will have an inverted yield curve a lot longer with their current plans of selling mostly short term securities.

Term premium got blown up by the FED and Treasury. It really doesn’t pay to own longer term T-notes. At some point the mortgage will catch up. It will have to reprice to something esle beside the 10years note.

Market is rallying hard so I guess JPowell does serve “some purposes”.

“So now the 10-year yield is fluctuating, but it needs to be persistently higher to do the work for the Fed, and so the drop in the yield is not helpful for the Fed’s policy transmission, but what else is new, markets have been fighting the Fed for 18 months.”

The drop is worrying, especially if it stays down. If this is a temporary drop like the others, then we are okay. I have a funny feeling about this one though. I’m worried it will continue to drop and the Fed completely ignores it and hopes we don’t notice. Sentiment seems off, different. I hope I’m wrong.

Would anyone be surprised if it shot back to 5% tomorrow? I wouldn’t.

I certainly hope it goes back up. I used to think like Wolf does about the volatility aspect until this week when Treasury came out with their shenanigans. I hope I’m worrying for nothing.

You’ve got to remember, longer-term Treasury issuance will still balloon a LOT and those Treasuries need to find buyers, but it just won’t be quite as bad as feared.

We also need to remember the heavy Treasury supply will flow for years. You don’t turn around $2T deficits quickly, especially if you never try.

So if the treasury is going to borrow more money with short term treasuries, is it possible that could force short term rates to go higher even if the fed does not raise them?

1. Yes maybe a little

2. The real effect that the Fed needs to achieve is raise long-term rates because they matter in the economy because they translate into borrowing rates for consumers and companies. So the Treasury is trying to put some roadblocks in front of the Fed. Fiscal policies and monetary policies are now going in opposite directions.

What else is dysfunctional? I’m afraid to ask.

“So the Treasury is trying to put some roadblocks in front of the Fed. Fiscal policies and monetary policies are now going in opposite directions.”

More like what else is new.

Pretty easy to put roadblocks in front of the Fed when it’s moving at five miles an hour.

They’re moving fast enough to where everyone on Wall Street hates them and wants them to stop, and then put that machine in reverse.

From my perspective I was only looking to go into 10 year if it went up substantially. I am happy to be in shorter bills in the event there is a sizable stock market correction so would like some rotating liquidity. I still have an equity position partly because I don’t sense a massive correction coming super soon but moreso because I need to manage capital gains and taxes, which in California is significant. That is one of the big upsides to treasuries.

Going long now implicitly presumes that we are at or near the peak in interest rates for this cycle. The yield curve (6 month / 10 year) has been inverted since mid-July of 2022 (so about 18 months). The spread ended the year (12/30/22) at 88 basis points; today it’s still 83 basis points.

As other above have said – do you trust JPow to continue with “higher for longer” as he has said (and done) for the foreseeable future OR do you think he’s bluffing and will let rates plateau and then start to cut? Do you go with the “pivot” narrative that’s been wrong for the last 18 months?

And looking at Wolf’s first chart (the portion starting in 2023) all I see is higher-highs and higher lows – which is the textbook definition of an uptrend.

I’m happy in 3 months for now.

Part of my problem is my filters which see politicians and corporations propping up the economy and funding their priorities and not tax payers. Whose to say in 2025 we don’t get a new President and a new board of governors and it all flips. I recognize my cynicism but doesn’t make it easier to comprehend the future. My long term goal is to be an expat and perhaps have residency on a limited basis in low tax state. That is a few years down the road though.

“My long term goal is to be an expat and perhaps have residency on a limited basis in low tax state”.

US Citizens give Uncle Sam his cut even if living in other country. Or, am I wrong?

@ss

Yes but depends to what degree as states have different treatment of almost every tax. The feds will get some money but keeping it at a lower tax rate is the goal. Of course if you have family/ friends in a particular area and enough money then go with what keeps you happy.

And for those of you not from the Golden State: there is no capital gains rate. All capital gains are taxed as ordinary income (as is interest and dividends – no qualified dividends in CA).

Treasury securities are exempt from California State income tax, which can be as high as 13.3%. Granted that rate doesn’t kick in until $1mm +, but a middle class income in CA (a married couple each making $75k) will still pay 9.3% in state income tax.

It’s a big benefit to being in Treasuries.

Interesting. I have a lot of mining shares listed in London which does not tax my dividends. Any idea how CA would deal with that?

Not sure but CA tax laws are complex. Even owning treasuries are part of a managed fund are tricky as they must reach a certain percentage to not be taxed. I’m not a tax expert so can only speak to what I try to understand. CA makes it really hard to avoid taxes as do a few other states.

It is a lot harder and more complex to fill out my CA tax return than my Federal tax return. CA has become an insane asylum and I am looking to get out.

Oophs. There is a special capital gains exclusion—real estate of course.

Why do you assume a free market is helpless? You have zero evidence for that. On the other side you have centuries of evidence and theory indicating free markets are effective.

In a free market, prices adjust quickly to economic events. If weak banks fail, stronger more responsible banks pick up the slack. It’s the only way to keep moral hazards under control.

Imprudent market participants must suffer consequences if economic growth, invention, and prosperity are the goal. If you alleviate all economic pains with artificial stimulus, the market becomes a stimulus addict, which is not a sustainable condition.

“Why do you assume a free market is helpless?”

Unless I missed it or you’re referring to something else, I didn’t read anything suggesting “a free market is helpless” in the article.

This was meant as a response to CCCB above.

Yeah, I thought I missed something.

FED policy have basically killed free market due to its heavy intervention.

So, Free market is not helpless because there is no such thing as free market.

Bobber:

ONE OF,,, if not YOUR BEST ever on here to help US…

Thank you,

Wolf – I enjoy your wisdom and insight on the markets. I almost spit out my coffee yesterday morning when Stanley Druckenmiller used your “drunken sailors” term on Squawk Box.

Does the stock market realize there is a feedback loop between it and the Fed? The Fed is trying to dampen speculative excess in markets. It hoped its hawkish pause, indicating very strongly that no Fed rate cuts are happening anytime soon, maybe not even in 24, would temper the animal spirits of investors. The market is by any metric very highly valued and largely dependent on seven stocks.

There is a well- known human tendency to exaggerate good news, in extremes the mere absence of bad news becomes good news. This is the meaning of the expression: ‘grasping at straws’.

The Fed pause was not good news for stocks, it was an absence of more bad news, with a pointed reminder that real good news was not coming soon. But the market wants a rate cut so badly it reacted as though it got one. It ignored the Fed’s actual message and the Fed has undoubtedly noted this.

As per another article Wolf your continued unemployment claims > 2.6M as a recession indicator and markets exuberance with Treasury issuance and Jay hold means inflation is going to be persistent. Bob Elliot talked about the stages and we obviously don’t have rates high enough. Rising rates->equities fall->demand slowing->earnings deterioration->weakening labour markets->lower wage growth = inflation to fed’s target. Could be a lot of chop for another 1-2 years. SP500 is basically unch since April 2021.

In electronics an impulse will generate a sinc (x) function, kind of like a sine wave including dampening. Since there are algorithm traders at work, it would be interesting if the financial educated commenters see a physical system basis for the volatility. The fun part is if the system can be given positive feedback and become completely unstable like the Tacoma narrows bridge.

@Gary,

“The fun part is if the system can be given positive feedback and become completely unstable like the Tacoma narrows bridge.”

Wouldn’t that feedback be the FED with their repressing interest rates.

In electronics, it would be like you have a nicely functioning oscillator and then the FED comes along and momentarily shorts out the tuned capacitor in your oscillator circuit.

meh, maybe not.

yes, a “sinc-in-time” is a block filter (or brick wall filter) in the frequency domain. Could it be from Fed attempts to stop high frequency basis trades?

meh, maybe not!

I think it’s more like a house of cards. At some point, all it takes is one more card to collapse the whole thing.

The time “10 year” is a bit of meat in the sandwich. I understand people seeking short term up to 5 years. I also understand long term 20-30 years like insurance companies etc. Little unsure who seeks the 10 year time frame, hence bit more volatile?? Compare to home loans the popularity of a 15 or 30 year mortgage….just a thought.

The market giveth and the market taketh away. 10 year yields are back down to 4.5%.

It’s completely idiotic to make policy decisions based on short-term market movements (no matter what Powell said about “persistent” movements – the fact is they just did & publicly justified it with that rationale.)

At this point, it’s probably fine to hold rates steady for the purpose of managing inflation, which peaked in June 2022 and has been on a steady downward trend ever since.

10 year cratering more this morning due to the jobs report coming in less than expected. Wall Street salivating over its Fed pivot again. Greenspan should be exiled for the Greenspan put. All Fed chairs since Greenspan should be tarred and feathered right out of this country for their crimes against the American people.

I would include Greenspan in the crimes against the American people crowd.

I meant to include him in that statement. Most definitely. He is the Godfather.

Agree. Also, the Mistro created precedent for the verbal word-salads and double-speak that spews out during the conferences. I believe they should keep it short and to the point, and not entertain redundant questions.

If the Fed can’t lay out clear messages and goals they can stick to, because of data dependency, the press conferences have little predictive value. They should just focus on what they did and why, not what they are going to do.

Did a Fed forecast predict anything close to the Great Recession, $8T of debt monetization, $35T government debt in 2023, six years of ZIRP, 10% inflation, or stock and RE prices that move 100% to 300% (depending on location) in the span of a decade? If not, I believe we place way too much reliance on the forecasting ability.

Greenspan is an interesting figure. People might be misreading him. Back in the 50s he was a disciple of Ayn Rand. So you can think of him as a gold bug. He actually confirmed it to a reporter when he was giving his Humphrey–Hawkins testimony.

So we appointed a gold bug to the chairmanship of the Federal Reserve. Now what could we expect a gold bug to do… maybe throw money at every problem that can along? Which is exactly what he did ROFL

While you are assembling the tar- and- feather chain gang, look up the ‘Powell Pivot’ and the unprecedented PUBLIC political pressure applied to the Fed Chair. He was called ‘worse than Xi’ for taking baby steps to normalize the lowest real rates in a century.

This was also a pretty clear violation of the Inaugural Oath.

Nothing Powell can do now can reverse all the damage done by his predecessors. And, he’s already added to the mistakes by keeping interest rate too low for too long. By not speaking up about the Trillion dollar deficits as far as the eye can see, and the 1 Trillion deficit in the last quarter alone, he has failed as the Fed chair. Greenspan and Volcker did speak up repeatedly about the excessive federal spending. The best thing JP could do for the country now is to resign. END OF STORY.

Listened to Rick Rider, Black Rock, say this morning, Friday, that he thought the fed was done because there are a number of economic measures that are gently and slowly rolling over. He did not predict a recession just he is seeing a slowing which is exactly what FED wants.

From my point of view as an investor and trader it is safe to bet on a Fall equity rally as long as the 10 year doesn’t begin approaching 5% again. I will be listening to FED talk and watching other central banks for hikes and clues as to when to go back on the defensive.

Fall rally 😡

Nice Emoji!

Non-farm payrolls come in a little lower than expected, suggesting weaker demand for products, and then the stock market rallies. Based on this logic the stock market should skyrocket if we have a recession or depression. I understand the markets see a weaker economy as a reason for the Fed to pivot. However, I also notice almost nobody seems to want to talk much about stagflation nowadays.

William Leake,

The market rally is based upon a hoped for top in borrowing costs and the associated stability and a slowing more stable economy (from overheated) and less spending driving inflation.

Plus equity just likes too rally (animal spirits?) and we just had a correction so this is a really nice set up for rally.

This is less so of an opportunity for buy and hold but I did start a 5% position in ‘ELON/tesla’ which I intend to hold for a very long time. I have long regretted that I missed ELON.

Now I am hearing that SpaceX may go public in 2 or 3 years. I assume this is so Elon can build out his Mars colony and begin asteroid mining. My what a world we live in!

Hi Wolf, what does “Allotted at High” mean in the treasury auction report? For example in this report https://treasurydirect.gov/instit/annceresult/press/preanre/2023/R_20231011_2.pdf,

High Yield = 4.610%

Allotted at High = 92%

Median Yield 4.530%

Low Yield 4.470%

My thinking is 8% of the competitive bids were below the high yeild of 4.610% but there was a very big bidder who tendered 4.610% (high yield) for 92% of the outstanding offerring (35B in the case of that auction) – It doesn’t make sense to me.

“allotted at high” is the percentage of the issue won by bidders paying the high yield 4.61%. That percentages goes all over the place, but this 92% is a big number; often it’s a lot lower (I’ve seen it below 10%). You can also see that the issue’s coupon interest of 3-7/8% was a lot lower than the high yield (4.61%), and the note sold at big discount ($94.23 for $100 in face value) to get to the high yield.

Hi Wolf, have you considered last week’s QRA announcement and its impact upon the bond market in your analysis?

It seems like politicians (and Yellen) are now actively attempting to undo the Fed’s work, so the current move in bonds and equities might not be the typical nothing goes to heck in a straight line, but instead more sophisticated participants seeing this as stimulus. Would love an informed opinion. Thanks!

Yes, been saying that here for days.

Thanks. I didn’t see it when I looked. Guess I need to look harder.

Agreed, you need to look harder, including in this article right here, published two days ago. Quoted verbatim from above:

“It made this announcement specifically to drive down longer-term yields which have become a huge concern for the Treasury department that has to pay the interest, and a blue eye for the current fiscal policies that have become a nightmare.”

and here:

https://wolfstreet.com/2023/11/02/fed-balance-sheet-qt-1-1-trillion-from-peak-to-7-87-trillion-lowest-since-may-2021/#comment-551928

and here:

https://wolfstreet.com/2023/11/01/another-hawkish-hold-with-tightening-bias-fed-keeps-rates-at-5-50-top-of-range-rate-hike-still-on-the-table-qt-continues/#comment-551538

and here:

https://wolfstreet.com/2023/11/02/anything-unusual-in-the-drop-of-the-10-year-treasury-yield-despite-the-hype-hoopla-it-hasnt-done-anything-special/#comment-551841

These are the ones I could find pretty easily. There may be more that didn’t pop right up.

My question is due to all this T-bill buy backs at a higher rate for Q4-Q1 will results in a lower Treasury yield which means investors and institutions will be incentivized to borrow at lower rates meaning more money in circulation ,what im saying is i see us heading into Stagflation so is it possible we dont see complete housing crash like we anticipated?

This stuff is just hilarious. Your question is totally wrong. Every single part of it is wrong. You put your wished-for rumor-mongered BS-answer right into the question, and so the imagined answer to the BS question is BS-squared. BS in, BS-squared out. Not gonna work here, LOL

To quote Fredrick Hayek, the FED is now grabbing the tiger by the tail.

Once a central bank decides to accelerate the process of credit expansion and inflation in order to head off any recession risk, then it continually faces the same choice of either accelerating the process further or facing an even greater risk of recession as distortions build in the real economy.

As part of this process, consumer prices rise at an accelerating rate. Based on current price increases and market participants’ understanding of central bank policy, consumer expectations of future inflation also rise. These create positive feedback that leads to accelerating price inflation that can far outstrip the rate of central bank money expansion and become what is then known as hyperinflation.

With each subsequent round of credit expansion and price increases, people can no longer afford the high prices, so the central bank must expand even more to accommodate these prices, which pushes the prices even higher.

In terms of your last paragraph, the other solution (possibly the real solution) is to allow the economy to decline, allow demand to decline (= recession), that, if long enough, is hoped to wipe out the inflationary impulse. That’s what the Fed is trying to do right now, a decline in demand through rate hikes and QT — not “monetary expansion,” as you say.

So far the FED has only withdrawn a small fraction of just the COVID balance sheet expansion. This has already caused a banking crisis and the lagged effects of the tightening are certain to provoke a deep and painful recession. The real test for the FED is next year, when inflation slows due to the recession. The pressure to drop rates and restart QE will become enormous. If the FED caves in, inflation will come back roaring with a vengeance.