We already know the factors that will make this much tougher going forward.

By Wolf Richter for WOLF STREET.

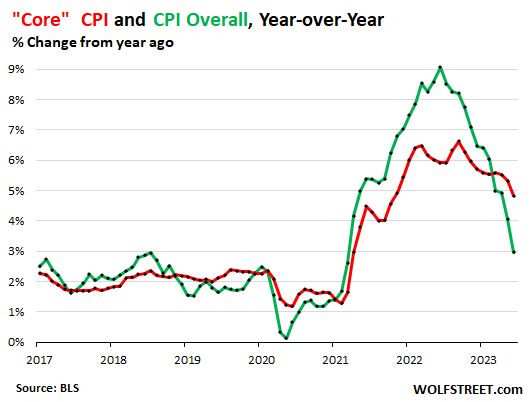

The “Core” Consumer Price Index rose by a still hot 4.8% in June compared to a year ago, but that was down from an increase of 5.3% in May, according to data by the Bureau of Labor Statistics today. June was the smallest increase since October 2021. As a measure of underlying inflation, core CPI excludes the prices of food and energy products that tend to move wildly in either direction.

Overall CPI rose by 3.0% in June year-over-year, the lowest since March 2021.

The chart shows core CPI (red) and overall CPI (green). The year-over-year plunge in energy prices (-16.7%!) pushed the overall CPI increases below those of core CPI. When energy prices stop plunging on a year-over-year basis, overall CPI will once again be above core CPI.

But it’s getting tougher in the second half because, based on what we know already, no forecasting required:

- Energy prices can’t keep plunging forever; in fact, they ticked up again on a monthly basis.

- The infamous “base effect” will fade next month for the rest of the year. The “base” for today’s year-over-year calculation is the surge of the index through June 2022. But in the second half last year, the index slowed sharply, which will be the lower base going forward, providing for bigger year-over-year increases.

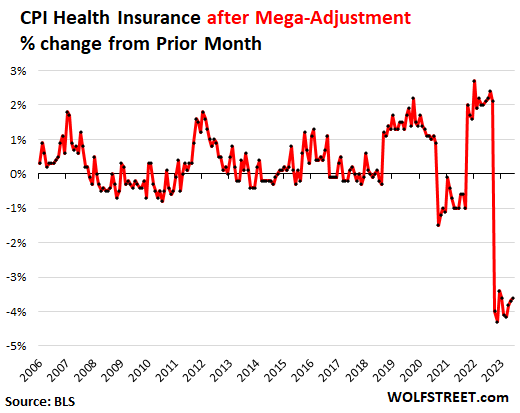

- The notorious “health insurance adjustment” pushed down CPI for health insurance to -24.9% year-over-year, which pushed down the entire medical care CPI to 0%. And this is a biggie. This adjustment ends in September and might swing the other way (more in a moment).

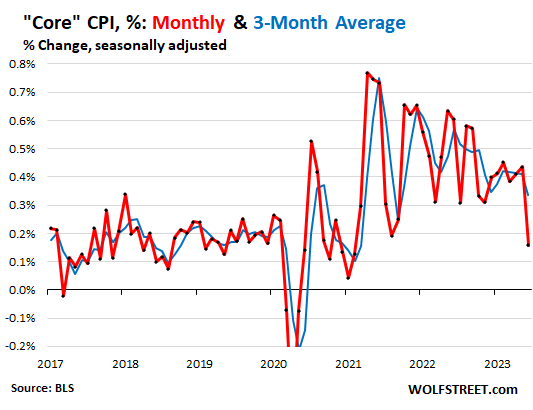

On a month-to-month basis, core CPI increased by 0.16% in June, compared to 0.44% in May, after two monthly increases (red line in the chart below).

The three-month moving average of core CPI rose by 0.33% (blue line), after four monthly increases above 0.4%. This was just below the December value, which had given everyone a lot of hope back then, but was then followed by a series of increases.

Precisely what we’ve seen before: a large change in one month, only to be reversed a month or two later. Now waiting for the bounce.

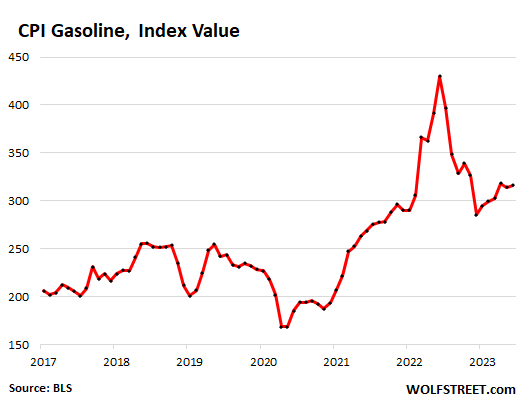

Energy prices plunged year-over-year, but rose on a monthly basis, on price jumps in gasoline and electricity services.

| CPI for Energy, by Category | MoM | YoY |

| Overall Energy CPI | 0.6% | -16.7% |

| Gasoline | 1.0% | -26.5% |

| Utility natural gas to home | -1.7% | -18.6% |

| Electricity service | 0.9% | 5.4% |

| Heating oil, propane, kerosene, firewood | -1.4% | -28.8% |

Here is the CPI for gasoline as index value, not percent-change. It accounts for about half of the total energy CPI. It has been rising for six months:

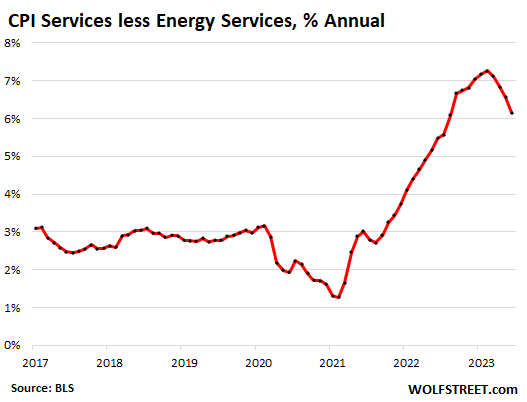

Core Services inflation (without energy services).

The index for core services (without energy services) increased by 0.25% in June from May, compared to an increase of 0.40% in the prior month (red line).

This is where the massive “health insurance adjustment” weighs heavily. It has understated medical care services since October 2022, but it will end in September 2023. In June, the CPI for health insurance plunged 24.9% year-over-year.

Other items that pushed down core services CPI were airline fares (-18.9% YoY, -8.1% MoM); car and truck rental (-12.4% YoY, -1.4% MoM); video and audio services and cable (-4.3% YoY, -0.5% MoM); and lodging including hotels and motels (-2.3% MoM, but +5.0% YoY).

Year-over-year, the core services CPI jumped by a still red-hot 6.2%, compared to 6.6% in May. February had marked a 40-year record of 7.3%.

Nearly two-thirds of consumer spending goes into services:

| Major Services without Energy | Weight in CPI | MoM | YoY |

| Services without Energy | 62.2% | 0.3% | 6.2% |

| Airline fares | 0.6% | -8.1% | -18.9% |

| Motor vehicle insurance | 2.6% | 1.7% | 16.9% |

| Motor vehicle maintenance & repair | 1.1% | 1.3% | 12.7% |

| Pet services, including veterinary | 0.6% | 0.5% | 10.4% |

| Food services (food away from home) | 4.8% | 0.4% | 7.7% |

| Rent of primary residence | 7.5% | 0.5% | 8.3% |

| Owner’s equivalent of rent | 25.4% | 0.4% | 7.8% |

| Postage & delivery services | 0.1% | 0.3% | 6.4% |

| Hotels, motels, etc. | 1.0% | -2.3% | 5.0% |

| Recreation services, admission, movies, concerts, sports events | 3.1% | 0.5% | 5.9% |

| Other personal services (dry-cleaning, haircuts, legal services…) | 1.4% | 0.2% | 6.5% |

| Video and audio services, cable | 1.0% | -0.5% | -4.3% |

| Water, sewer, trash collection services | 1.1% | 0.4% | 5.7% |

| Medical care services & insurance | 6.5% | -0.8% | 0.0% |

| Education and communication services | 4.9% | -0.3% | 2.4% |

| Tenants’ & Household insurance | 0.4% | 0.3% | 1.0% |

| Car and truck rental | 0.1% | -1.4% | -12.4% |

The “health insurance mega-adjustment” understates CPI, core CPI, services CPI, and Medical Services CPI through September.

Every month since October, the CPI for health insurance, thanks to this adjustment, plunged month-to-month by 3.4% to 4.3%. Year-over-year in June, it plunged 24.9%.

BLS undertakes annual adjustments in how it estimates the costs of health insurance and then spreads those adjustments over the following 12 months. Normally, the adjustment isn’t big, but for the prior 12 months through September 2022, CPI overstated health insurance inflation (+28% yoy in September 2022). That overstatement is being adjusted away every month since October 2022 (more here), and will continue through September 2023.

Then there will be a new adjustment coming in October for the next 12 months. In the past, those adjustments tended to swing in the opposite direction, as you can see in the chart below.

The Fed’s favored inflation measure, the core PCE price index collects health insurance inflation via a different method and doesn’t suffer these adjustments.

The CPI for housing as a service (“shelter”).

The CPI for housing is based primarily on two rent factors: “Rent of primary residence” (weight: 7.6% of total CPI) and “Owner’s equivalent rent of residences” or OER (weight: 25.5% of total CPI).

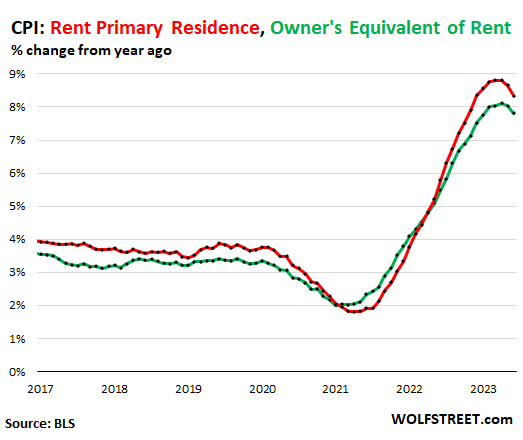

“Rent of primary residence”: +0.47% for June, +8.3% year-over-year (red in the chart below). Over the past three months, the monthly increases amount to annual rate of 5.8%.

The survey follows the same large group of rental houses and apartments over time and tracks what tenants, who come and go, are actually paying in these units.

Owners’ equivalent rent: +0.45% for June, +7.8% year-over-year (green). This is based on what a large group of homeowners estimates their home would rent for.

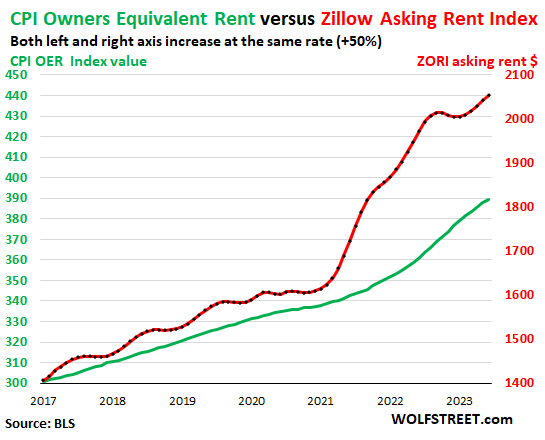

“Asking rents.” The Zillow Observed Rent Index (ZORI) and other private-sector rent indices track “asking rents,” which are advertised rents of vacant units on the market. The ZORI’s huge spike in 2021 through mid-2022 never fully made it into the CPI indices because rentals don’t turn over that much, and not many people actually ended up paying those spiking asking rents.

In late 2022, asking rents began to dip in dollar-terms. But this year, the ZORI rose again and has been hitting new records in dollar-terms since April.

The chart below shows the OER (green, left scale) as index values, not percent change; and the ZORI (red, right scale) as index in dollars.

The left and right axes are set so that they increase each by 50% to keep the proportional increase of both lines in sync, with the ZORI up by 45% since 2017 and the OER up by 30%:

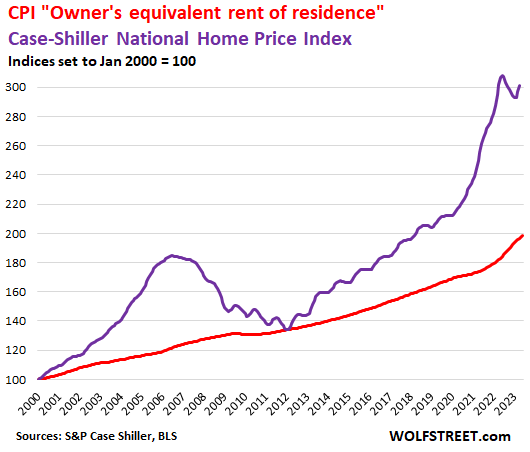

Rent inflation vs. home-price inflation: The Case-Shiller Home Price Index (purple) is experiencing what are largely seasonal upticks, similar to the seasonal upticks this time of the year in other years, even during Housing Bust 1.

The red line represents the OER. Both lines are index values set to 100 in the year 2000:

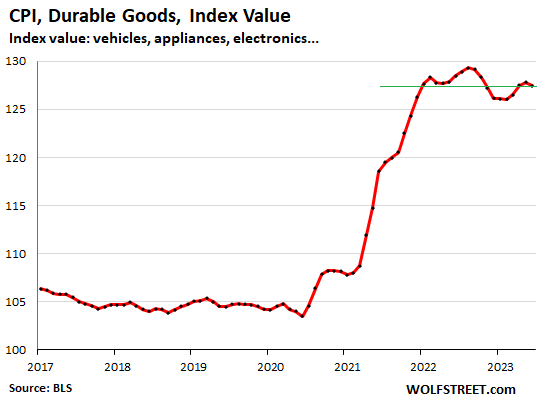

Durable goods prices stabilize at very high levels.

The CPI for durable goods, after a huge spike in late 2020 through 2021, has essentially moved up and down along a flat line since January 2022. In June: -0.3% for the month, -0.8% for the year.

The chart of the index value shows the sideways movement, with the June value being roughly the same as the January 2021 value. In other words, it seems to be normalizing at these very high levels, including the slight downward trend that the durables goods CPI has had going back many years:

| Durable goods by category | MoM | YoY |

| Durable goods overall | -0.3% | -0.8% |

| Used vehicles | -0.5% | -5.2% |

| New vehicles | 0.0% | 4.1% |

| Information technology (computers, smartphones, etc.) | 0.1% | -7.7% |

| Sporting goods (bicycles, equipment, etc.) | -0.3% | -0.9% |

| Household furnishings (furniture, appliances, floor coverings, tools) | -0.4% | 3.2% |

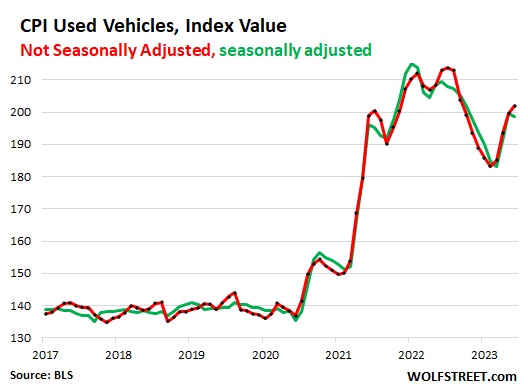

Used vehicles CPI, seasonally adjusted dipped by 0.5% for the month, after two massive monthly spikes. Year-over-year, it fell by 5.2%.

Not seasonally adjusted, the used vehicle CPI rose by 1.2% in June from May, the fourth increase in a row.

The chart shows the index value, seasonally adjusted (green) and not seasonally adjusted (red). This is one of the most confounding charts in terms of the sheer pricing turmoil that persists to this day, with these huge ups and downs:

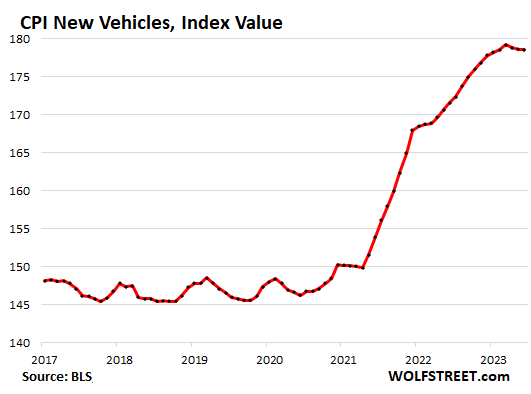

New vehicle CPI dipped just a hair for the month, the third month in a row of timid dips, amid growing supply, still sky-high prices, higher incentives, and strong demand, and amid big price cuts by Tesla and other EV makers, after the stunning surge in prices over the past two years that had been a mix of higher MSRPs, odious addendum stickers, and the near-elimination of incentives.

Year-over-year, the index increased 4.1%, the smallest since May 2021.

This chart of the index value shows just how little of the stunning price increase has been reversed – essentially nothing – and that the index appears to be normalizing at very high levels with a small downward trend:

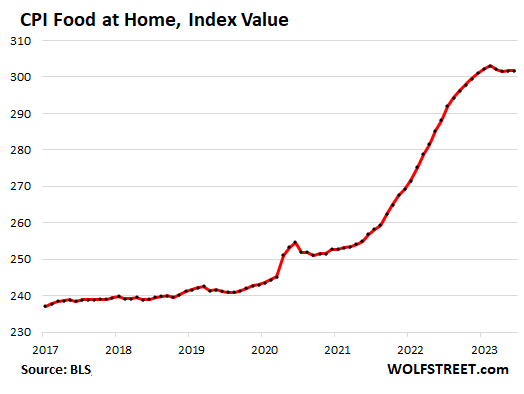

Food inflation.

The CPI for “food at home” – food bought at stores and markets – was unchanged in June from May. And over the past four months, it has inched down just a tiny bit, after what for many households had been a devastating spike in food prices.

Year-over-year, the CPI for food at home rose by 4.7%, the smallest increase since September 2021. Since February 2021, the index has spiked by 23.5%, and that little flat spot at the top isn’t much help, but at least food prices have stopped surging. The table below shows the major food categories, some where prices actually dropped, and others where prices still or again rose:

| Food at home by category | MoM | YoY |

| Overall Food at home | 0.0% | 4.7% |

| Cereals and cereal products | 0.1% | 8.8% |

| Beef and veal | 0.4% | 2.7% |

| Pork | -1.9% | -3.8% |

| Poultry | 0.8% | 1.4% |

| Fish and seafood | 0.8% | -0.9% |

| Eggs | -7.3% | -7.9% |

| Dairy and related products | -0.3% | 2.7% |

| Fresh fruits | 1.0% | 0.3% |

| Fresh vegetables | 0.7% | 2.1% |

| Juices and nonalcoholic drinks | -0.2% | 8.6% |

| Coffee | -0.6% | 3.3% |

| Fats and oils | -0.5% | 8.7% |

| Baby food & formula | -1.3% | 7.5% |

| Alcoholic beverages at home | -0.2% | 3.2% |

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Thanks, Wolf, for your work on this. From all the headlines and first few sentences in the finance press, you’d think the Fed’s work is done. Just wow.

+1

Amen to this, just by looking at today’s market action and all the headlines you would be forgiven to think we are now in a deflationary environment than a slightly cool still red-hot inflation environment.

Sadly this won’t make bulls like Tom Lee come out with a proclamation inflation is dead, load up on the stock market now before it goes to the moon..lol

Nasdaq rallied 35% for year, now going to 40%. Poor short sellers who believed in Fed QT!

I wouldn’t say poor for now until if and when the market crash…for now they are the heros, not us cautious type

Poor longs who believed in Fed pivot. One day does not a trend make. Inflation still hot, and the Fed will hopefully continue to stick it to Wallstreet. 40% lol. Hopefully some catalyst brings stonks down for good.

You can’t really calculate an accurate value for Nasdaq type growth stocks.

The boring blue chip dividend payers can be estimated at least on a dividend payout basis and they tell me people are too casual about buying stocks.

I checked out KO and JNJ and they don’t really pencil out with a 5.125% risk free rate at current stock prices. KO looks especially expensive as dividend growth is very slow.

Inflation is no longer a threat. Car prices will keep downward pressure on YoY, as will energy prices as they feed through the system.

PPI is the leading indicator and that is pointing to continued easing. Services inflation will be wiped out as savings are depleted in the second half. All was apparent months ago. The only real risk is now is that the Fed overshot with moving too high.

1. PPI is NOT a leading indicator for CPI. It’s a leading indicator for production costs of goods. Consumer price inflation isn’t set by production costs. And goods account for only one-third of consumer spending. The rest is services. Rents and medical care and streaming and broadband and lodging have nothing to do with the PPI.

2. Where do you get this BS that savings are “depleted?” There are $17 trillion in bank deposits, $7 trillion in money market funds, $33 trillion in Treasury securities, a gazillion in stocks and half a gazillion in corporate and municipal bonds.

What you’re confusing with “savings” is the theoretical “savings rate” (income minus expenses), which describes a quarterly flow of the difference between income and spending (as part of the consumer spending data). It’s not a stock of savings, and it doesn’t even include capital gains. To get an idea of “savings,” you need to look at the household wealth data, and there, savings is anything but “depleted.”

If you base your argument on nonsense, results may vary.

Of course PPI can lead CPI. Supply and demand is more complex than Econ 101 suggests.

When producer costs increase (eg energy price surge) there are often mechanisms to pass full or partial costs through the supply chain. At the final steps (wholesale/retail) decisions are made on the (in)elasticity of demand and the time frame of that elasticity (in the very long run nearly all prices are fully elastic).

In scenarios that have shocks (again, energy spikes, supply shortages) these decisions are made and passed through and the market responds. The market response most recently was positive (mostly) in accepting higher prices without volumes dropping so much as to offset. Why? Well, flush savings (fiscal stimulus) plus loose MP (up until the past 12 months) and confident consumers due to strong wage growth (tight labor market). The kicker? Well, when prices of imports generally increases rapidly as well (as it has) there is less price competition domestically – amplifies the above.

So producer price spikes (combined with supply shortages and higher import prices making the decisions easier) drove attempts to pass costs in an aggressive, concerted manner. Unusually strong pass through. Those pressures have now abated and it is happening at the same time as MP is materially tighter and most fiscal stimulus has been spent. Pass through decisions are now more difficult AND unlikely to yield net positive results.

Of course in normal “meandering” price times, the lead nature is virtually nonexistent – they are mostly coincident to each other. But during the latest surge and now easing, I expect PPI absolutely to lead.

I don’t confuse rates with balances. Rather than focusing on total balances exclusively, I look at relative balances and the fact the distribution suggests large swaths of the population (and the “marginal buyers” setting prices) are seeing depleted savings. If the bottom quartile of US households works through excess savings (balances) vs pre covid by 2H this year, this will lead to a slowdown. It doesn’t matter if the rest of the population still has a gazillion dollars. Those “stretch to spend” consumers are the ones sustaining growth at surprising levels.

They are done. So too, inflation.

One other thing – the contribution of durable consumer goods assets to net worth data (via the SCF) has gone up significantly.

It is a large component and, realistically, overstated and illiquid. Because its share has grown, the decline in net worth in the bottom half (and worse in the bottom quartile) is likely understated.

The typical US household is stretched more than a superficial read of the numbers suggests. The spend at the margin will be exhausted in the next two quarters and we’ll see the bottom fall out.

“It is a large component…”

Consumer durables, from yachts to cars = 4.2% of household net worth (Fed’s wealth distribution data).

Household net worth: $250 trillion

Consumer durables: $10.5 trillion

Have to parse the data further. If you look at the bottom half of households, consumer durables makes up a very sizable share. What happens in the averages / totals is skew from billionaires. They have almost nothing in durables in their net worth. But take the bottom half (or bottom quartile) and durables makes up a very large share of assets.

I think you just contradicted your first comment that savings are depleted. The top half are the big spenders, they’re the ones buying fancy cars and boats and expensive stuff. That’s where much of the $250 trillion in household net worth is. Their “savings” — meaning their wealth — are not depleted at all. They can keep spending, and they’re spending. What will cause them to dial back their spending is a big shock to their net worth, such as through a stock market crash. That happened before, such as during the dotcom bust, and it did trigger a recession. But that’s not happening now. Stocks are down from their peaks, but not nearly far enough for a shock to the net worth of the top half.

But the top half relies on spend from the bottom to support their equities, RE etc.

That is the connection that breaks things (vicious cycle down).

I don’t see a bad recession but A recession is imminent.

It’s all rainbows and unicorns in the news today. I never thought I’d live to see the day where high inflation is celebrated as some sort of accomplishment.

Just wait al little, we will be celebrating hyperinflation woth 20% daily rallies on Nasdaq. Yes, stocks do rally (inflate) with hyperinflation. For proof check other countries whose currencies were crushed.

After all, it’s just Fugazi!

Zimbambwe stocks are up 700% y-o-y but USD is up 1000% y-o-y against Zimbambwe currency. So that doesn’t sound very attractive but who knows? Although higher inflation does not equate weaker currency as we have recently seen in several countries. I find economy is a total mystery and the world has become such a mess that no one can predict anything any more.

Actually for Robert:

SUCH A MESS is putting it, it being the description of the current financial and certainly social and certainly ”geo-political” situation, mildly R, thanks.

Just told couple of great neighbors that although our little street of good and great folks might and probably will continue to honor and help our local neighbors, very clearly that is NOT the case with many and growing every larger number of good folks even in this same small city.

Scary might be one of the terms,,, but just remember that many great sages of all ages have said, ”This too will pass.”

So hold on and keep ALL your powder dry, especially the financial type AKA cash,, eh

It is! For the bankers’ high inflation is wunderbar: it reduces the real value of their liabilities (your deposits with them) and of their over leveraged companies’ bonds by trillions each year. They also can Just pass on any resulting cost increases to their customers.

Read what Paul Volcker did. Unlike some, I do not see him as a saint but I do recognize that he did take the steps necessary to stop inflation rapidly, which the various, Fed leaders (for years now) will not do. No doubt, the prospect of getting $200,000 to $400,000 per boring speech after they retire had nothing to do with their decisions.

Wishful thinking on the part of Wallstreet as always.

Well, wishful thinking is enough. All the hyped QT hasn’t even cut the reverse repo from $2 trillion. There is just too much liquidity out there, so make a wish and Poof!

Uncle Sam went all in on his Casino a few years ago. So while everything else breaks down behind the scenes (mainstreet), the casino (wallstreet) will shine and glitter.

Reserves are down $1 trillion. RRPs are down about $200 billion. Combined $1.2 trillion. They’re both liabilities on the Fed’s balance sheet, and both represent liquidity. QT does precisely that. And it has been expected.

Either we’re going to see one hell of a lack effect one that we have never seen before or maybe this time is different….wishful thinking turns into a reality and then it becomes soft to no landing….crazier things have happened…latter is probably the case

Well, according to the WSJ’s Real Time Economics this morning, we solved inflation back in May. The problem is just that the US measures inflation wrong, we need to adopt the European model:

“If core inflation came in just below 3%, the Federal Reserve would breathe a huge sigh of relief, stocks would head to the races and consumers could relax about the rising cost of living. It isn’t merely a dream: Measure U.S. price changes the way Europe does, and inflation was already there in May. [SNIP] Europe’s measure, known as HICP, doesn’t include the imaginary cost of what a homeowner would pay to rent their house, which makes up about a third of the U.S. core CPI. Known as “owners’ equivalent rent” or imputed rent, the measure has long had its critics. Exclude something that no one actually pays and core inflation’s looking basically fine.”

So there you have it, remove the imaginary stuff, we can pivot, and we can all go back to living in our world of glee and unicorn farts.

And the MSM wonders why we no longer trust them.

If we remove “owners’ equivalent rent” can we also lower the CPI target from 2% to 1%?

If “owners’ equivalent rent” is removed, does the WSJ suggest actual house price inflation should somehow be incorporated into the CPI? It would be odd to entirely ignore most consumers’ single largest expense when calculating CPI. Owners’ equivalent rent is certainly an imperfect measurement, but ignoring the cost of shelter entirely for most people seems even worse.

I’m curious, but don’t have access behind the WSJ paywall.

That’s the crux of it, these people own property already and dont give a shit their children never will. The more debt slaves the better, they wont be one of them after all. Line goes up! All well and good until the pitchforks come knocking and landlord lynchings start

Excelent article, like always.

“The “health insurance mega-adjustment” understates CPI, core CPI, services CPI, and Medical Services CPI through September.

BLS undertakes annual adjustments in how it estimates the costs of health insurance and then spreads those adjustments over the following 12 months.”

Wolf, do you think that this number is being deliberately manipulated to keep the stock market happy with these silly rally stories? Premiums have gone up everywhere I have looked for all friends, family, and coworkers. Ours have been going up steadily and the benefits in the opposite direction: dental, vision, and our main health insurance. In some cases a big deductible as well before we get anything.

Anecdotally, we had a dog bite incident late on the weekend and the hospital told us to avoid the emergency room because it would cost so much, and advised us to look at other treatment options.

“…do you think that this number is being deliberately manipulated to keep the stock market happy with these silly rally stories?”

No. The health insurance adjustment drives me nuts, but it started in Oct 2022 and has been the same thing every month, like clockwork. I explained it back then in greater detail:

https://wolfstreet.com/2022/11/10/services-inflation-spiked-to-second-highest-in-4-decades-would-have-hit-new-high-if-not-slowed-by-biggest-ever-adjustment-of-health-insurance-cpi/

The issue is that it is very difficult to price health insurance because it’s not just the premium: everything changes, the deductibles, the copays, the drug formulary, the treatments, what’s covered, what isn’t, etc. It changes from location to location, from person to person. This is a well-known issue, and if you have ever tried to compare different health insurance apples to apples, you’ll see that you cannot.

If you cannot price it apples to apples, you also cannot figure the price changes.

So the BLS came up with a different system a long time ago that gets around that issue, but covid totally messed up that system. So in 2021 through Sep 2022, that system over-estimated health insurance inflation, and the health insurance CPI topped out at 28% in Sep 2022. That was clearly too high, and it caused part of the spike in CPI a year ago. Then the way the system figures health insurance CPI swung back the other way, for a huge adjustment that they spread in regular increments over 12 months.

We’ll only have three more months of this thing, and then it will be over. This also means we’re going to get some bad “surprises” in core and services CPI in the fall when this thing swings back.

Well, judging from all the new hospitals I’m seeing built with Las Vegas type glitz and glamour, it is apparent someone is making a lot of money over and above what is required to deliver healthcare.

Are you looking at a certain bald Florida Senator? Hehe

The surprises are what keep me up at night.

One of my friends kid was taken to alcohol overdose in 5 mile ambulance ride to emergency. They did some basic test and let the kid go after 5 hours.

The total bill was $10K. Yes inflation is slowing down :-)

Yea,,,but by the time the insurance pays off the contract rate, that bill will be somewhere around 3k. It makes you wonder if doctors and hospitals write off the “loss” of 7k on their taxes to offset all income. I don’t know how that works exactly. Maybe someone on here does.

Providers/hospitals can’t write off the difference btw what is billed to insurance and the contacted rate that is paid. It isn’t considered a loss.

Lisa,

If medical industry providers don’t derive tax benefits from largely fictional pricing, then why has the medical industry persistently engaged in fictional pricing for many decades?

I’m not disagreeing (except maybe at the margin…I do think there may be some write-off/”non-profit” fig-leafing going on in the pricing to the uninsured) but I am genuinely asking – why the enormous, 50+ year edifice of phony medical pricing?

Depending on the plan, insurance may refuse to pay the ER tab at all or pull back payment citing non life threatening condition. In which case the patient is stiffed with the whole bill, not the contracted amount the insurance would pay. Maybe the hospital will knock off 20 percent if the patient pays it off in one payment. Its ridiculous what shenanigans insurance pulls these days.

With all respect, this is just not a world where one can afford poor choices. Over a long time, I prioritized affordable home, no alcohol or similar follies, and good health insurance. The wife did not share my priorities and had to go. I wrote her a huge check and held onto the house. Now it is all paying off. One absolutely cannot fool oneself about priorities. It’s no game. On my healthy everyday walk, I see and interact with homeless folks. The downside is so close and vivid to me.

But then, what?

There’s maybe a smidge more to life than sweating bullets over that dime that fell behind the credenza.

I see this as a world that sanctions and encourages (leveraged) poor choices. So far, they’ve all been swept under an increasingly lumpy rug.

We are all a bad medical emergency away from debilitating medical debt. As I mentioned above, for about 5 years now insurance companies have been pulling back or rejecting ER claims particularly coded Level 5, which is highest severity. They love going after patients who go in with abdominal pain.

Now, abdominal pain could mean your appendix, or maybe abdominal aorta, is about to go Boom! which are life threatening problems. Or, you could just have a bad case of gas, which can hurt like an imminent appendix rupture, gal bladder clog, intestinal obstruction, or pancreatitis, except it goes away with clank of simithecone. And yet it may likely still get coded Level 5 depending on the facility coding cascade. And that will be the most expensive gas you will pass, all because your x-ray vision and/or crystal ball failed to tell you the ER wasn’t necessary that day despite being in sharp, screaming pain.

I’ve seen a claim rejected because an older gentlman fell, as old folks tend to do, except he fell at his son’s house, and the insurance wouldn’t pay because it ‘should be covered by the son’s homeowner’s insurance’. So he’d have to sue his own son to get the bill covered. I defer to the grossly misunderstood “World’s Worst Aunt” case.

And if something more catastrophic happens like a car collision, forget it. You can lose everything even as an innocent victim and be debilitated for years. A big money settlement likely won’t be enough to cover the lifelong medical consequences. Count your pennies, but also your blessings.

Lili, isn’t being a bad medical emergency away from debilitating medical debt a blessing though? That is compared to centuries gone past when it meant being a step away from probable death.

No doubt American’s pay an awful lot compared to Europeans for a similar life expectancy, so I don’t deny something is awry.

phusg I mean, yeah, if you’re happy living in squalor on gov’t assistance with in 10/10 spinal pain, it could be argued that’s an improvement from the Bring Out Your Dead days.

True too, medicinal beer was a thing in Europe before ‘the witches’ were ousted by religious movement (look into it). And a good chunk of our younger folks are being corraled into expensive blood pressure meds, statins, and protein pump inhibitors that may have cascading side effects on their long term health when a proper diet (read: not Standard American Diet) and stress reduction would go miles to address and help correct the underlying cause.

Now throw in activation of chronic disease and middle age bowel cancers at rates not experienced in other countries. And that’s before the financial corruption and maltreatment of HCPs.

The grass is always greener, but I stop short of calling modern American healthcare ‘progress’.

Oh too true that there are massive healthcare gains to be made from improving diets and lifestyles! Top sports people have started taking these things hugely seriously in recent decades; why isn’t this going mainstream?

Thanks, Wolf. Brutal inflation numbers guaranteed the rest of the year yet we see the stupidity of longer-duration Treasury “investors” in the wake of today’s CPI release. They never learn.

Services inflation still looks stuck.

As for energy prices, not sure where the BLS gets its numbers when prices at the pump here on the Left coast are higher than a year ago. Perhaps the numbers are being generated by AI bots?

Natural gas is 2.6, last summer it was 9.6. Natural gas flowing to the LPG export facilities has been limited due to maintenance.

Gas prices have stabilized here in far NoCal. Gas is still around $5.55 pr gal give or take up to 10 cents on most days for the past year or so. Our closest reasonable grocery stores/shopping centers are also 70 miles away. I don’t think there are any electric car charging stations for 70 miles either.

Gas in Oregon up about 25% over a year ago. $4.89/gal, last fill up. The feds are so desperate, they’re lying to us now.

Gas about the same in NY as last summer-$3.79ish.

Thanks WR.

Looking at the first graph, it looks like inflation is indeed going down quite a lot.

I am sure FED and Govt would come out and declare victory in progress.

More pause , then rate cuts then QE coming to USA to help the wealthy by FED.

Only thing I have seen deflating is eggs and milk

You gotta stop stomping while baking cakes man! ;)

Funny for sure.

Yes, we made one once that deflated so much it could have been a spare tire on a scooter.

No reason for QE or rate cuts when the economy is doing fine, but we’ve seen the bastards do it time and time again. I certainly hope you are wrong.

jon,

“…then rate cuts then QE coming to USA to help the wealthy by FED.”

The “QE coming” part is your latest meme that you just keep repeating and repeating until your comments get figured out by my Nvidia-AI-powered troll gigafilter. It’s kind of silly. There won’t be QE unless there is a huge problem. But the huge problem now is inflation.

The Fed doesn’t need QE to stimulate when it can cut from 5.5% to 2.5% over 4 meetings, by which time a recession will have long blown over and inflation will be surging again. This is a different ballgame now. Back to the good old times of higher rates and higher inflation, which is much easier to deal with for the Fed with its classic rate hikes.

I get a pretty good feeling that the Fed has figured out now that QE wasn’t such a great idea.

Whatever FED is doing is not enough.

I am not saying this, but the intent of your articles are saying this.

The partial title of few of your articles are:

Core Services CPI Cools to Still Red-Hot 6.2%, Core CPI to 4.8%.

End of Easy Money: Financial Conditions Loosen Again for Junk-Rated Companies.

Americans Still in No Mood for Recession: New Vehicle Sales Jump 17.5% in Q2 YoY as Inventories Normalize after Shortages

Looking at your articles, it looks like, from your perspective, the economy is still red hot, inflation is still high.

Fed has been fighting inflation for last 1 year plus. It simply means that they have not done enough.

They had no reason to pause last month. But they did pause.

It simply means that FED think inflation is under control based on their action.

If inflation is really this hot with hot economy, then FED should hike by 50 bps.

I can tell you, after few years , FED balance sheet would be much higher than what they have today.

I know you have lot of faith on FED but I believe their actions, not words.

Also, lot of people bring out that fastest ever rate hike. But the fact is: fastest ever rate cuts and largest QE in 2020/21/22 .

Based on your articles citing still hot inflation, job market and economy, whatever FED has done so far, has not made much impact.

I would argue that the FED is having exactly the impact they are looking for.

They know there is a federal debt problem that can only be solved by a bit of inflation.

So the FED wants a little bit of inflation, but doesn’t want out of control runaway inflation. They are getting exactly what they want. Inflation is running at 4-6%, but isn’t out of control at double digits (plus). So we will all see 4-6% inflation for a year or two while the federal deficit is brought back under control. That is higher than people think, but it isn’t runaway Weinmar hyperinflation either. Just mildly high inflation for a while. Sucks for savers, great for debtors.

Granted, this is a rather boring scenario that doesn’t involve crazy conspiracy theories or some deep state control or end if world catastrophe that some seem to want, but it does fit the data.

Wolf,

What is your opinion of Brent Johnson’s “dollar milkshake” theory [that a large portion of foreign central bank liquidity flows into the US capital markets because the US dollar is the world’s reserve currency]?

Do you think that this could explain the major divergences between what is expected with the Fed’s rate hikes/QT and the shocking resiliency of the US stock, bond and real estate markets?

Brent was talking about this recently and said that the rate hikes and QT actually make the capital flows from foreign markets BIGGER, because it makes the dollar stronger.

If this is correct, and the feedback loop between asset markets and inflation is continuing, the Fed would need to go much bigger to overcome the dollar milkshake effect.

Wolf, just curious what was the “huge problem” Fed saw in Sept 2019 when they started increasing balance sheet. Unless they got advanced notice of covid.

What the Fed did in Sep 2019 – Dec 2019 was not QE. It did repos to calm down the repo market where yields were blowing out.

Repos automatically unwind when they mature (the next day, or in five days, or in two weeks, whatever the terms are). Repos were the classic way with which the Fed addressed issues in the markets, such as when markets froze up in the days following 9/11. The Fed has used repos for decades, long before QE.

The Fed had a “standing repo facility” until 2008. But when it started QE in late 2008, it ended its standing repo facility. So the repos of Sep 2019 were a restart of sorts. In 2021, the Fed formalized the re-institution of its standing repo facility to address market issues, as it had done in prior decades, instead of with QE. I discussed this in detail here at the time.

https://wolfstreet.com/2021/07/28/my-thoughts-on-the-feds-back-to-the-future-standing-repo-facilities-announced-today/

This is a very significant change in how the Fed will deal with market issues: short-term liquidity that then vanishes, instead of QE.

After the market calms down, repos vanish because they mature so quickly. Repos are very different from QE (bond purchases) which drags on for years and is specifically targeting asset prices.

What the Fed did in March 2023 (SVB et al.) was similar in purpose to what it did in Sep 2019: a short-term provision of liquidity to fix a specific issue. A big part of the March 2023 liquidity has already unwound and is gone.

Also Fed never actually undid QE since 2008. They just do little bit QT and when market drops they start another massive QE. Effectively they are monetizing debt. Since this benefits top 10% media just happy with this scheme.

“I get a pretty good feeling that the Fed has figured out now that QE wasn’t such a great idea.”

Can you tell me why you have drawn this conclusion? Because I happen to think they love QE and would do it again in a heartbeat.

QE is the Fed’s main tool for repressing long term interest rates. Why would they give that up, especially when the main side effects, wealth concentration and generational theft, don’t bother the Fed. The Fed actually tries to create a wealth effect, which is partner to wealth concentration.

Oh when the market finds out no more QE.

Gonna be hell to pay!

Other than buying MBS what else constitutes QE ?

Also I vaguely recall, or is my memory off by a year, that Powell bought MBS as late as June 2022 (or was it 2021) even though FFR had already been increased a couple times. I believe I read that here… memory correct or not ?

If correct this seems odd… why did JP purchase that long ?

1. QE = increasing the securities holdings on the balance sheet.

2. The Fed phased out buying MBS in the summer of 2022 and stopped buying them in Sep 2022.

https://wolfstreet.com/2022/09/16/the-fed-stopped-buying-mbs-today/

3. Securities were maturing at a faster clip during the phase-in period than the initial caps, and so the Fed replaced the amount that matured above the cap.

4. Treasuries are still maturing faster in most months than the $60 billion cap, and so the Fed replaces the excess with new purchases.

5. If the Fed skuttled the $60-billion cap and didn’t replace Treasury securities above the $60-billion cap, the roll-off would happen faster. In some months, over $100 billion would roll off. But now, with the caps in place, if $100 billion of Treasuries mature, the Fed lets $60 billion roll off without replacement, and it buys $40 billion to replace the excess that matured.

> “I get a pretty good feeling that the Fed has figured out now that QE wasn’t such a great idea.”

Very interesting comment. What do you think they would’ve like to have done?

From what I know of you I doubt you think they would’ve preferred going deeper into negative interest rate territory.

My layman recollection is that central banks wanted governments to do more deficit spending to get credit flowing again during the credit crisis. But how many governments had manageable enough debts that they could afford to do this?

@jon You said, “Looking at the first graph, it looks like inflation is indeed going down quite a lot.

I am sure FED and Govt would come out and declare victory in progress.

More pause , then rate cuts then QE coming to USA to help the wealthy by FED.”

If the Fed does that it will be a carbon copy of the Fed’s actions in the 1970’s which then allowed inflation to roar upwards again with a higher velocity than before.

Doing the touchdown spike at the 10 yard line isn’t going to win the game.

But looking at the graph, everyone is clamoring that inflation is going down.

Can you look at the first graph again and see if it is coming down ?

If I show this graph to any layman who does not know about inflation, would he say it is going down with time ?

Jon,

It also looks like CPI Is backtesting/ verifying a breakout above 3%!

We will know by this time next year, but people don’t believe the Fed and he’s at least laid out and followed the plan.

Look at the last 40 years of the 10-year. Bond traders are showing a sea change, not a dip in prices.

Will it yield 5% this time next year?

Another fine interpretation by Wolf. The Fed only cares about Core PCE anyway. I did notice a chart showing real wages went positive for the first time in forever. Could be bullshit.

Given the structural issues of CPI — including the “health insurance adjustment,” which drives me nuts — I have a lot more respect for core PCE. And I understand now why the Fed relies more on it.

I used to disparage core PCE because it systematically underestimates inflation. But when you know that and when you put that aside, it works a lot better than CPI in showing the trends.

Would be good if Core PCE would include home value as well, it probably will paint even a more accurate picture, especially in ridiculous markets like the West coast.

It’d be good but why would govt want to do this ?

Govt is trying its best to keep this inflation metric manipulated in multiple ways.

Even if inflation goes to zero, the essentials of life are already out of reach of middle class.

Wile E Coyote now hovering in the air.

Just that waiting to look down period now.

…while dialing his broker with a thought bubble to “Sell! Sell! Sell!”

And of course daffy looking on ;)

Again…..convenient points that most MSM and FOMO gospel preachers tend to forget or willingly ignore…guess next month, proof will be in the pudding as they say… better tell those moon boys to come up with some other reason why we are now entering the next stage of a decade long bull market…

“The infamous “base effect” will fade next month for the rest of the year. The “base” for today’s year-over-year calculation is the surge of the index through June 2022. But in the second half last year, the index slowed sharply, which will be the lower base going forward, providing for bigger year-over-year increases.

The notorious “health insurance adjustment” pushed down CPI for health insurance to -24.9% year-over-year, which pushed down the entire medical care CPI to 0%. And this is a biggie. This adjustment ends in September and might swing the other way (more in a moment).”

OER vs Case Shiller is still my fav graph… home prices are still way too high and rents are still way too low.

The markets will determine when housing prices are too high, and in most markets housing prices are adjusting accordingly with many housing prices falling significantly. In other markets such as high-end Southern California properties, housing prices are rising accordingly.

Let’s eliminate all taxpayer-guaranteed mortgages, non recourse mortgages, and house-related tax deductions and capital gain exclusions. Let’s also fully reverse the effects of QE. Then, we can let the markets determine the FMV of houses.

But there is no free market as LIFO pointed out.

Housing falling a bit in Scottsdale- longer time on market, lower prices c/w a year ago on average quality home.

Housing prices and rents are both far, far, far, far, far, far, far, far too high.

I don’t think rents should be higher in the moral sense… but being able to rent a property below its carrying costs (PITI) is not sustainable.

There will have to be some combination of property value depreciation and rent increases to rectify this imbalance.

Perception is everything, here. Enough/too many people got lucky selling a house for double or treble what they paid just two or three years earlier and that equity is still stuffed into a lot of pockets walking around out there. This is life-changing money for people. It changes the market and brings out the Fast Eddie impulsivity lurking in all but the most ascetic souls. I think a lot of the moronic buying action you’re still seeing in housing can be attributed to this crowd.

I suspect people feel less inhibited bidding up a house if the money they’re using to back it wasn’t wrung from them in 40 hour installments. It’s just funny paper at some point. That’s the stuff that needs to burn down a bit before organic price discovery can occur. If I’m saving and abstaining for three or four years in order to save to get a place, I can’t compete with the buyer who suddenly has a $300K bill in his front pocket.

This stuff burns off, though. Gotta be patient.

Great comment.

Perception is everything.

People spend far more emotionally, and far less rationally, than most of us realise.

Or just get a one way ticket to Hawaii live on the beach .No problem

bul – nothing like a massive short-term gain that can morph thoughts of ‘…I’m incredibly lucky!!!..’ to ‘…I must be a genius!!!…’.

may we all find a better day.

The OER vs Case Shiller is such an awesome chart.

It shows how far house prices have deviated from inflation due to speculation.

When the lines intersect again, like the did in 2012, it is the time to buy a house. House speculation will be removed and people can buy a house as a home.

Inflation is turning the OER curve up faster but the Case Shiller has a long way to fall. Rampant inflation would also “fix” this curve and make the OER rise faster but with much pain.

Awaiting the base year upwards bump in the CPI later this year. Still awaiting the replenishing of the oil fields.

Seriously there are way too many people already declaring victory over inflation. It’s way too soon to tell. We won’t really know for certain for like a year. We’ll be very lucky if this is it and it’s over for good, but I’m doubtful.

Case Schiller shows “largely seasonal upticks, similar to the seasonal upticks this time of the year.”

For a solid decade, these upticks showed a clear ratchet effect where the previous slow-season low prices were never seen again in the ZIRP days. Will be interesting to see what that chart looks like in 2030. My vote is a 70s style nominal trajectory through the 2nd half of the 2020’s. Boomers live longer than their parents did and very few have a reason to downsize if it means selling into a still high-priced market with higher interest rates… No financial gain from downsizing. We’ll see some minor hikes and pauses. A Fed balance sheet that sorta goes nowhere dancing up and down every time a couple of banks get into trouble. That is until more than a few banks buckle or something currently unknown blows up big and we go back to thinking we’re turning Japanese enough to print some more money when we need to cover ever-increasing government deficits.

I see the 10-year yield is back down well below 4% on today’s “good” cpi news… This post-pandemic economy never ceases to puzzle me.

My gut feeling is that if the FED does not raise this meeting, there will be no more hikes and the next rate change will be a cut. These guys don’t want to hike, they want to cut. They are the money-printers. This era will go down as the worst central bank failure in the history of the world.

At this rate, still quite a long time for Core PCE to hit 2%.

Don’t forget the expectation of a ‘bounce,’ so yea…

“Let it run hot” is alive and well. Powell showed his hand with the premature “pause.” Of course, all of the moneyed special interests, media and politicians will laud him for his prowess, while the working class and the poor are financially skewered by inflation.

Depth Charge-

Sort of a subject change but a UPS strike would definitely rattle the cage a bit.

The market has finally priced out rate cuts for the remainder of 2023. (Still expectations for multiple cuts in 2024, though.)

2 more rate cuts are priced in

The dollar decline is driving market

Why don’t they abolish USPS ,contract to Amazon or ups or fed ex . More efficient

Flea,

Then instead of paying $0.66 to send a check, invoice, or legal documents across the US, you’d be paying $12 to $125. So that would be more “efficient” for companies wanting to extract money from your pocket. Those prices may be OK for some deep-pocketed companies, but for consumers, they’re not OK. No private company would ever pick up a letter from a box in your neighborhood and carry it across the US and deliver it to the recipient’s home or business for $0.66. You need to think a little before you post this silly nonsense.

Because it’s an invaluable utility. Put down that cruddy old Thomas Pynchon novel and come on back down to Earth.

How about if they simply scan all your mail and deliver it to you as a PDF in email? It’s absurd that we’re chopping down forests of trees to make junk mail that gets delivered by a fleet of trucks driving out to nearly every address in the country six days a week, which is then thrown into a recycling bin and later carted away by another fleet of trucks. Enough already.

Corey – sorry you only get junk mail. For me, insisting on posted hard copy has been invaluable on more than one occasion (…btw, check trend lines of pulp-paper production over the last two decades. Also, corrugated paper production, the wonder stepchild of online shopping. Then, renewability and recyclability…).

may we all find a better day.

25bps hike is already guaranteed in July.

But the big question is: is it enough?

In July, Powell would hike by 25 bps and blurt out some dovish statement.

The market would roar higher.

The big answer is: no, of course it isn’t enough. None of what they’re doing is enough.

With 6.2% core services inflation, it seems impossible not to raise FFR unless there is a calamity.

Where’s Wolf’s “Gas Station from Hell”? Haven’t seen it in while. Noticed crude oil prices have jumped up in the last week.

I should take another photo. Last time I actually looked, it was still over $5. I don’t think it every went below $5. That’s sort of the floor, it seems.

We’ve got our own version of the “Gas Station from Hell”. It’s an Exxon Station that has posted $4.69/gallon for regular for the past 6 months. I will let you all know when it budges from this price. I go by it every day. I have fond memories of this gas station. During the Carter gas line era, I used to get up at 3AM and park my car in the front of the line to make sure I was the first one to get gas when the gas station opened at 6AM.

Wolf,

Were you surprised by the rally in bonds after the CPI release?

In reviewing the core CPI, a reading of 4.8% didn’t seem to be cause for a rally.

Also, XLE and oil started to rally on the release, which would be inconsistent with a sustained move down in energy prices, which would be the only logical way to see a move down given the persistence in services inflation.

Any insights on what is going on with the bond market?

> Any insights on what is going on with the bond market?

You are a big [x] insto overseas, and got a bunch of dollar income and even more dollar liabilities, got cleaned out in march with us bank exposure.

What you gonna do for short term liquidity if your __unsecured deposits__ all tied up that you were hoping to use as starting leg collateral in a xccy swap? Hope that Jerome pulls another one out of hat weeks later? lol

OK– but why would you buy long duration treasuries to fix short duration liquidity issues?

Given that more long dated treasuries are coming on the market later this summer, would be hard to collateralize them for liquidity purposes.

> Given that more long dated treasuries are coming on the market later this summer, would be hard to collateralize them for liquidity purposes.

That’s a joke right? Tell me this, in an emergency, would you prefer a 10y bond credited to you on some account you don’t control that can/has been rehpothicated north of 6x during bank accounting periods to regulators (and way higher when its not that time, but you wouldn’t know anyways because you as a client will never have access to this data) or the thing from the indirect you hired sent to you? Now look at it from the perspective of any of the 44 big clearing houses clarusft[dot]com may even talk about in their ccpview all over the world. Would they prefer that 10 year credit or something that could be sent to them in t+3 that’s “unencumbered” (to put lipstick on a pig) before they start backdating liquidations for preferred clients, workouts for so-so, and zero’d for the rest?

Got Collateral,

Not sure I am following.

Why would you go with a 10 year treasury when you could do something shorter (higher yield, lower risk) if you are looking to use it as potential collateral for short term liquidity?

This whole argument sounds a lot like what got SVB and First Republic into trouble.

I can clearly see that, because if you would replace the 10y in my example with 1y or 6m tenors, nothing changes for the ccp from the “unencumbered” perspective. 6m rehypothicated toilet paper is doesnt smell quite the same as 10y “unencumbered” paper.

The “unencumbered” notionals issued at auctions, pales in comparison to the notionals derived from rehypothication with collateral much crappier than us treasury issued toilet paper… duration mismatch is a symptom a broader problems (else why would any other bank stock/paper have gotten sold if it was just limited to just a few)… would be no need for things like ccp basis swaps if it was just a tenor thing…

Got Collateral,

Can you contextualize which entities you are referring to (trade organizations with lines of credit at banks, pension funds, banks themselves), and what geographic areas (US, EU, Asia)?

Given how cheap options have gotten, seems like you could buy futures options on most treasury tenors and still have money left over unless you can’t do that for regulatory reasons.

Or are you referring to margin requirements and counterparty risk issues? Currency risk that you don’t want to hedge?

Interesting discussion, but still not sure you want to jump in and buy the 10 year treasury now if you believe rates are likely going up (unless you have to). If you think ZIRP is coming back, then go for it.

Nothing surprises me anymore, LOL.

Overall, inflation is slowing but in fits and starts. No interest rate hikes, but maybe more jawboning.

No significant, if any, rate reductions well into next year. No more QE. QT will have to slow or stop as economy slows.

Lot’s of continued bankruptcies and alphabet soup rescue plans.

Food prices have been PLUNGING at the stores here in Southern California over the past few weeks as people simply refused to buy much at the higher price and there are sensational deals now on almost everything. We just bought 15 pounds of boneless chicken breast for $1.99 per pound at Ralphs (Kroger) along with a 10 pound pork should roast for $8.14 which is less than $1 per pound.

Short-lived rally. Momentum should change with the seasonal inflection point on 7/21/23.

This rally started last year October.

why do you think this is short lived rally.

The Nasdaq actually rallied from the end of December — since that’s the big rallier everyone is talking about. Just quibbling here.

The real bulk of the services inflation is housing with rent and 3x more weight owners equivalent rent (“real estate market”). The only thing that cools off the “real estate market” (pawn shop of the middle class) is interest rates. The current mortgage rate compared to the late 1970s and 1980s would have been a gift from God and considered “stimulative.” Articles one can find say that today’s inflation rate would be much higher if calculated with the same methodology. The interest rates are the problem right there, that literally get lip service at a laughable 0.25% every 3 months if we are lucky.

I am just going to say it: if these foreigners sell their treasuries (direct interest rate reset) and geopolitical pressure is on the dollar and by extension the Federal Reserve (indirect rate reset) is the only way the Federal Reserve will have a “check and balance.”

Here’s the problem with housing from my perspective:

* Both prices and interest rates are abnormally high.

* Inventory is low.

* Lower interest rates would result in even higher prices.

* Higher interest rates would result in even lower inventory.

If you want to simultaneously tamp down inflation and make housing affordable, a process that will likely take years *for housing*, then your only path out is to increase inventory.

Inventory is hard to increase because:

* There is still a huge amount of liquidity out there.

* New home supply surges from builders is being met with similar demand surges from buyers.

This leads me to believe that the only way to create enough inventory to bring down inflation at the moment would be to convince people who are holding onto multiple homes to sell some of them.

Where might the sellers come from?

The short term rental revenue is indeed drying up a little bit, but I doubt that sales of some of the short term rentals would create sufficient inventory to bring down inflation, other than in a few saturated metros.

Therefore, I believe that the only source of creating sufficient new inventory to bring down inflation in the short term is (1) massive job losses, or (2) changes to tax policy to reduce/eliminate some of the investor tax breaks tied to homeownership, as mentioned in LIFO’s comment above. It’s also possible that the resumption of student loan payments causes some people to move back with parents or double up in rental properties, but I see that as a longshot for creating enough of a vacancy change to bring down rents by more than a few percentage points per unit.

The new mantra in real estate of “inventory, inventory, inventory” replaces “location, location, location” over the next few years.

JeffD,

“(2) changes to tax policy to reduce/eliminate some of the investor tax breaks tied to homeownership”

Homeowners who purchase homes for living in get few deductions compared to renting a house.

1) The SALT Cap prevents any deduction of property taxes and state income tax over 10K.

2) Interest is uncapped but anyone who has a 3% mortgage, needs close to a 800K loan to exceed the std deduction. This is changing a bit for 7% mortgages where you need about a 300K loan to deduct the interest. This applies to the first year when the interest payments are highest.

3) No expenses for repair or maintenance are deductible.

4) No deprecation is allowed.

5) You do have a 500K tax gain write-off if you are married and sell for a primary home. That is the only advantage I can see but you have to sell your house to realize it.

6) Your kids see a huge advantage when they inherit with a stepped up basis. However, you have to die first.

Now, if you are an investor and buying houses to rent out, you have a great tax deal since it considered a business.

1) ALL property taxes are deductible since it is a business expense.

2) ALL mortgage interest is deductible.

3) You can depreciate and deduct the entire cost of the house over 27 years.

4) You can deduct the full cost of repairs and maintenance. The gardener and house cleaner are deductible.

Buying a house to rent has huge tax advantages.

For my own home, I take the standard deduction because my taxes hit the SALT cap, and my interest is very low with a pandemic rate. I have no tax advantages vs renting for a primary home. When I pass away into the great CA sunset, my kids will see the advantages when they sell.

Maybe you should buy a house and rent it out to your spouse.

Thanks for spelling it out for others. All the homes are being hoarded by a monied few, and people wonder why there is low home inventory and an affordability crisis. Current tax policy is criminal at this point, by design. Congressmen are anything but public servants. It’s a plutocracy of Ancient Roman senators at this point.

BobE,

I’d also like to add two other important “kickers” for investors not in your excellent list:

(1) The deductions are so large for many investors that they can carry depreciation “losses” forward to future years, offseting future year taxable income.

(2) Each home bought can be used as collateral to buy/hoard yet another home, further depressing available inventory and thus driving up home prices.

A breath of fresh air after the barrage of celebratory financial media reporting the demise of inflation. The not-so-subtle implication being “Message to Fed: More easy money!”.

Ironic to celebrate a supposed end to the loss of dollar purchasing power with a renewed surge … those things priced in real time – stocks, bonds, commodities – all higher, reflecting the leading edge of a renewed loss in the purchasing power of the unit we’re pricing them in. Any temptation to conclude that the Fed’s work is done has it exactly backwards.

Who owns the media?

Finster,

“stocks, bonds, commodities – all higher, reflecting the leading edge of a renewed loss in the purchasing power of the unit we’re pricing them in. Any temptation to conclude that the Fed’s work is done has it exactly backwards.”

Exactly! Dollar down big the last 2 weeks and miners and commodities up.

The CEO of Rio Tinto said on Bloomberg Monday that we have to mine as much copper as has ever been mined to meet current energy transition goals. Also that one big windmill has over 200 tons of steel in it.

Inflation Reduction Act, Chips and Science Bill, and Infrastructure Bill are all throwing long term fuel on this! Inflation is going to be with us for a very very long time.

My investments are betting on inflation.

That just the result of wild inane manic speculation in action yet again which is the root cause of all ‘inflationary’ expectation and the damage that does to the US and global economies.

The Fed’s pronounced habit of rapidly cutting rates and increasing its balance sheet in times of stress while slowly increasing rates and cutting its balance sheet afterwards produces a growing balance sheet and a bias towards lower rates over time. Fiscal policy is also biased towards larger deficits over time as energy transition commitments and social welfare obligations increase at the same time pressure on military spending grows. Any surprises are likely to be inflationary in nature, because even small deflationary impulses tend to produce a fiscal and monetary overreaction. The financial press is in thrall to Wall Street pump monkeys and is desperate to report “good news” on inflation trends.

A mushroom management philosophy prescribing to the theory that to best motivate your employees, you must at all times: keep them in dark and feed them shit. CNN, MSNBC, and Bloomberg constant rants for the all clear Inflation is OVER dance. I hope that the Fed has the guts to continue raising interest rates. It will be impossible to get rid of all the puff and fluff in US economy, I await further demise of crypto currency Ponzi schemes and over leveraged banks. US consumer appeals to the idiot box, keep shopping and spending, high stakes poker in households to keep raising debt ceiling. Lower income groups have started communal living, planting gardens, and taking advantage of all the free things in life money can’t buy.

When they claim health insurance is down YoY, you know the numbers are cooked. Who still believes their adjustments have any integrity?

Our insurance is way up. Health and auto.

Anecdotally, my employer emailed everyone saying the health insurance cost kicking back in Jan 2023 went up 5%, but they were not going to shift it onto employees so our paycheck deductions are unchanged from last year. My auto ins company (maxed out liability coverage here in FL due to ridiculous drivers and lawyers with billboards everywhere) sent me a new bill last week for newer rate and it went up under 5%. A lot less of an increase than the past 2 years where I literally called them asking what happened as it was a big jump at the time.

But you already have the cumulative effect of the large increases over the past three years in insurance. Less inflation won’t cut it. We need prices to come down.

I’m trying to find anything that’s not way up in my life. The sad thing is that I am no longer supporting my favorite local restaurants. The prices are just completely detached from economic reality. The portions are smaller, the prices WAY higher. Many will probably fold.

We need deflation – MASSIVE deflation in everything.

Most fast food is inedible,overpriced ,wonder where all theses people will work when they’re boarded up .of course rich don’t eat fast food or shop . They have no idea of reality.France coming to America SOON

Currently, when you see sales ads banners along the lines, “UP TO 40% OFF!” it is not the sales price being touted, it is the quantity.

And at some restaurants and coffee shops, etc, they shove a tablet in your face with tip options of 20%, 25%, or 30%. Getting a higher tip from the inflation of the menu is not enough. They want a higher tip rate too!

I’m eating out a lot less than before because of those things.

Property and fire insurance in California.. In many rural areas it’s no longer obtainable except through the state and those rates are very high.

Yet I still see rotting shacks with Tyvec siding going on the market with obnoxious prices.

Just saw an old cabin up in Crestline where the sellers increased their asking price by 35K after sitting in the market for something like two weeks.

My Plan G supplemental insurance (Medigap as it’s also called) sent me a premium notice increase of 15% this last week. Yeah, explain that one to me..

My insurance broker friend said that’s a typical increase around here now.

Us retirees are getting pasted from all sides with large increases in cost. I don’t know who the hell is paying up for all the new cars on the road around here, but it sure isn’t a retiree.

You mean PLAN C?

Maryland just gave us retirees a $1,750 tax credit for 2022 Maryland taxes. You need to move to the Blue State of Maryland and get out of that Red State of Texas where they are taking you retirees to the cleaners.

SoCalBeachDude, no, my Plan G is supplemental insurance. Part C is Medicare Advantage plans. It’s confusing, but I am a veteran of 14 years on Medicare and know it well.

“Medigap Plans – N, G, F, etc” all cover what Medicare itself does not cover (about 20%). Each supplemental plan has slightly different coverages. You buy this in addition to paying for Medicare Parts A, and B.

Part C (Medicare Advantage) is what guys like Joe Namath hawk on TV as a “free” plan under Medicare, but it’s really just subsidized (by Medicare) private insurance. Dangerous stuff.

Swamp, I’m not leaving the best BBQ in the U.S. for a measly tax break…..

My auto insurance increase by 60 percent in last 3 years

So many food items have doubled in the last two years so it’s nice to know prices are “Stabilizing” at these levels, right? I believe a family of three or more needs an income of at least $100k now to feel (lower) middle class.

Everyone keeps talking about what the Fed is gonna do but with the government pumping 2 trillion$ yearly deficits, jobs will be here and the same few will still be getting filthy rich.

Vitally important to remember that. Whenever people joyfully proclaim that “inflation has gone down!” it just means that the purchasing power of the dollars you worked for, which have been permanently decimated, aren’t being decimated again for the time being. Break out the champagne!

Inflation is basically euphemism for currency devaluation.

One way I beat food inflation is drink a lot of water ,3 very small meals a day

Good for you! I’m letting shrink-flation make me healthier. I walk with hand-weights I bought 25 years ago — best-value deal in my lifetime.

There’s always peanut butter and jelly sandwiches and didn’t I hear that Warren Buffet likes these too?

Grocery prices have been PLUNGING DOWNWARDS for months.

Plunging? I’m in So Cal, that is not what I see. I do all shopping for food in the house, you must be in Shangri-LA

Yeah — not seeing anything like a plunge.

I shop at Vons, Ralphs, and 99 cent store in Southern California and many prices are WAY DOWN just as I clearly stated including dairy, eggs, and meat. Learn to be a savvy shopper.

Good work. Always a joy to read such fine analysis.

The dollar broke down thru massive support today based on expectations for lower rates. We shall see what the Brics announce in August.

Oil looks explosive.

Given the sluggish nature of any response from the FOMC…….the time period from 2021 to 2025 might go down as one humdinger.

Instead of stagflation……….rocketflation.

A booming economy with high inflation.

The fed does not seem to accept that the millennial generation (largest in history) is now earning and spending historic amounts. The rates (unless the FOMC is replaced with competent, honest economists) are not going to stop them……when you need a house…..you need a house.

The stagecoach horses are at full gallop and the stagecoach driver was left at the station.

A dollar collected on Jan 2021 is now worth $0.86 due to accumulated inflation’s relentless march forward.

Accumulated inflation needs a Wolf chart as very little is discussed on the parasitic effect of “AI” over time. I read a recent estimate that the average middle class family now spends $8,000 more per year on average to continue the same lifestyle, due to “accumulated inflation” since the pandemic.

Tom Lee is a Fear Monger.

Cue the Market Rally.

1) CPI. All items minus shelter in US city average : 0.7% y/y. The downtrend is down. It might cross zero and breach 2020 low, for COLA.

2) Shelter stalled at 7% y/y. The positively biased C/S might be more negative next reading.

3) Housing units under construction 5+ units is up 15.9% y/y to 978K, a new all time high.

4) There are 17 million rented homes plus eleven million vacant units.

5) Wall street is the largest landlord. If wall street whales decide to dump their housing inventory they will send the keys to their CMBS investors, flooding the markets with tens of thousands units.

If you take out all the stuff that went up, CPI is always negative.

I spend $300 a month at WMT.

I spend $300 every 5 years for a mobile device.

I use the calculator, a pencil or my toes and fingers to calculate data.

I will never buy a Tesla.

I bought something once off Amazon.

I do enjoy Google and Youtube.

The Mega Trillion market caps (AMZN, NVDA, GOOG, AAPL, MSFT, META) are worth what?

ETF bubble arbitrage? ETF whack a mole (Wolf TM)?

This insanity valuation is gonna pop.

What percentage of your dollars are spent in the Mega Caps?

Props to Wolf, props to all.

Gary

“The Mega Trillion market caps (AMZN, NVDA, GOOG, AAPL, MSFT, META) are worth what?”

They are worth Trillions so you can read Wolfstreet. :) You need them for the browser, the datacenters, the OS, and the advertising.

Meanwhile, the pipes (Verzion and AT&T) struggle to make any money because they tried to become one of the 6 companies above.

Gary sounds smart and is not a debt slave.

One thing I am working on is trying to optimize Roth conversions before I hit the RMD age. I have been converting about 4% of my IRA for a few years but with the tax rates set to go higher in about 3 years I might push it up.

Its a tough problem because you have to assume future tax rates and future returns. Plus I am wired to defer taxes hoping Congress slips up and gives me a loop hole to exploit.

Amazon is useful if you repair instead of replace. Radio Shack no longer exists, and most places don’t sell parts. Recent items just off the top of my head;

-Large capacitor for garage door motor.

-Rubber mat for custom baffle for industrial chamber sealer (specific thickness).

-Cam gear for ohv pressure washer.

-Burners for grill.

There’s always Mouser, Graybar, Tyco…Digikey…lots of other options over Amazon

Non of the places you mentioned had a 19988a for a garage door. I could have purchased something with a similar capacity and voltage limit, for 4x the price, but would then have to also modify the strap.

For other items, I’ve attempted to contact sellers directly after finding a US based seller through amazon. The shipped price, often times, was higher when buying direct. Neither the buyer nor the seller wants to deal with the extra hassle.

I will keep Mouser in mind for future items, thanks.

It’s cheaper and faster to order replacement carburetors for my 10hp storm generators off Amazon than to rebuild them. Radio shack couldn’t really help those who repaired newer Surface Mounted Device technology on IC boards as discrete devices disappeared. The last radio shack I remember was a phone store below sea level, behind the levee in southern Plaquemines parish in 2011. I bought board-level repair devices, valves, actuators, VFD’s, soft-starts and solenoids from McMaster-Carr, Grainger’s, and Automation Direct. My employers didn’t mind paying their prices to keep the shrimp going into the box. Reliable quality in industrial processes hasn’t ever been cheap.

Wolf, I am glad you explained the ” Base Effect”. Real estate was going through it late last year and early this year. The cheerleaders were saying ” yes prices are down this month but we are still way ahead YOY!” Not many are saying that now?

Case Shiller snd Zillow seem to be better predictive indexes than that which the govt uses.

Insurance costs in FL and CA will soar.

If the Fed truly believes in a 2% inflation trajectory price roll backs should be the mission. Three years ago should be the starting point for measuring inflation fighting progress, not YOY

Adding smaller incremental increases upon a SPIKE is not a win

Trillions in new Debt to be issued in conjunction with the QT will be a bit of reality

China is preparing for war, and our munitions stocks are low and our SPR at decades lows

Yep. The “average” should be 2%, but if you overshoot it, we just CAN’T have deflation to balance it out. That’d be a sin!

agreed.

and I even reject the premise of 2%. That is a new game started by Bernanke after 2008. 2% is NOT stable prices….per their mandate.

And China buyers our farm land ,packing houses try to buy a farm in China .Don’t allow google but tik tok is here .Totally incompetent leaders ship both sides banana republic .Our time is shorty

Chinese companies own just 383,935 acres, less than 1% of foreign-held acres, according to the U.S. Department of Agriculture.

I deal in farm land, and it is the American mega corps and top 0.01% who attempt to buy farmers out on a weekly basis. Much of it due to mineral rights, solar, wind, green etc potential, not so much the actual grains that are grown on the properties.

That could change very quickly as climate change could easily decrease actual crop production, as we are nearing the physical plant and input limits of the near magical “never ending” yield increases that have been keeping the world more easily fed the last few generations.

Climate change is removing the “easy button” energy, food, moderate climate, increasing lifestyles, low inflation, etc.

Plus inflation history by decade, the past few decades have been well below statistical average, due to the perfect storm of factors that Wolf has discussed non-stop over the years:

1970s: 103.98%

1980s: 64.24%

1990s: 33.65%

2000s: 28.76%

2010s: 18.99%

2020s: 17.49% (first 42 months of 120 months)

Sometimes we don’t know what we have until it’s gone…

Yort – well said. Too many will still believe that food spontaneously generates-at whatever price- in the grocery store…

may we all find a better day.

Futures UP!!

Cue the Market Rally

(Sorry for the double post above….dunno how that happened)