Walmart U.S. gave us some color: ecommerce sales +27%; grocery sales +12%; non-grocery brick-and-mortar sales -10%.

By Wolf Richter for WOLF STREET.

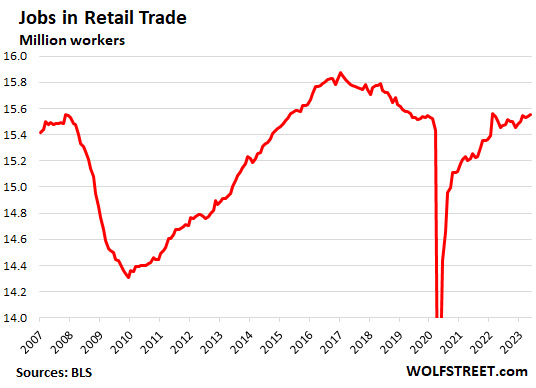

The question that came up after my detailed report on jobs by employer category was this: Why were jobs in the “retail trade” in May, at 15.55 million, still down from the peak in 2016? And why were they about level with where they’d been at the end of 2007 before the Great Recession, even as total jobs at all “establishments” have grown by about 13% since 2007 and by 8% since 2016? Turns out, jobs in the “retail trade” are on a structural decline, despite surging retail sales, in part because of the way jobs in the “retail trade” are defined.

Jobs in the employment report are categorized by the NAICS (North American Industry Classification System) code of the location of the business where those jobs are.

Jobs in the retail trade include workers at brick-and-mortar retail stores and other retail locations. It does not include jobs in office buildings of ecommerce operations, such as tech workers or customer service workers; and it does not include drivers and warehouse employees, who are in their own respective categories based on location. The retail trade also doesn’t include restaurants; they’re part of Leisure & Hospitality.

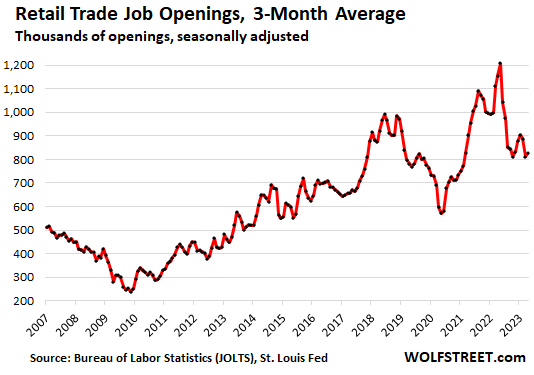

And it’s not like the retail trade has a huge number of job openings it cannot fill (unlike some other sectors where labor shortages persist). Job openings at retail trade locations are now about where they’d been in 2018 and 2019:

What’s happening to jobs in the retail trade?

Walmart explained part of the phenomenon in its last earnings report. Walmart U.S. ecommerce sales jumped by 27% in Q1 year-over-year; grocery sales jumped by 12%; but sales except groceries at its brick-and-mortar stores fell by 10%. And so overall sales at Walmart U.S. rose by 7%, on booming ecommerce, strong grocery sales, and dropping sales at the other aisles in its stores.

Walmart is the largest grocery chain in the US and the second largest ecommerce retailer behind Amazon. Walmart figured out some years ago that it wants to survive, and it went where the sales are: ecommerce and groceries.

| Walmart U.S. | Q1 2023, Billion $ | Q1 2022, Billion $ | % change |

| Total sales | 103.9 | 96.9 | 7% |

| Grocery sales | 63.4 | 56.8 | 12% |

| Ecommerce sales | 14.5 | 11.4 | 27% |

| Non-grocery brick-and-mortar sales | 26.0 | 28.7 | -10% |

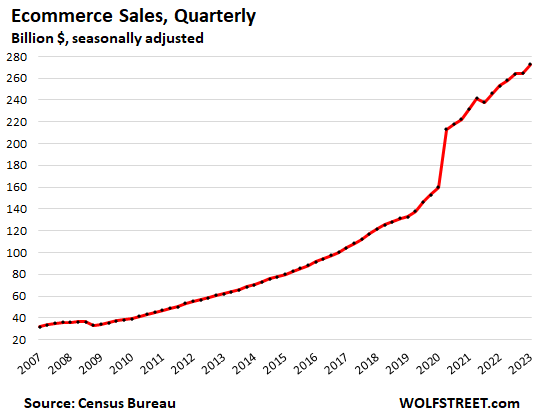

Ecommerce is booming, but its jobs are not in the “Retail Trade.”

Ecommerce sales hit $1.1 trillion in the past four quarters. And employment has boomed. But jobs in ecommerce operations are not jobs in the “retail trade.” Jobs in office buildings, warehouses, and delivery operations are not jobs in the retail trade. Retail trade jobs are those at brick-and-mortar retail locations.

So the employees working at a Walmart store are retail jobs. The employees working at a Walmart fulfillment center are warehouse jobs, Walmart drivers are in the category of drivers. Walmart’s tech jobs in an office building are in one of the NAICS categories that tech jobs fall into.

50% of retail sales are largely protected from ecommerce:

About 50% of retail sales (excluding food services such as restaurants) are in these three huge categories that have been mostly protected from ecommerce:

- New and used vehicle and parts dealers (largest retailer category).

- Food and beverage stores

- Gasoline stations

But even…

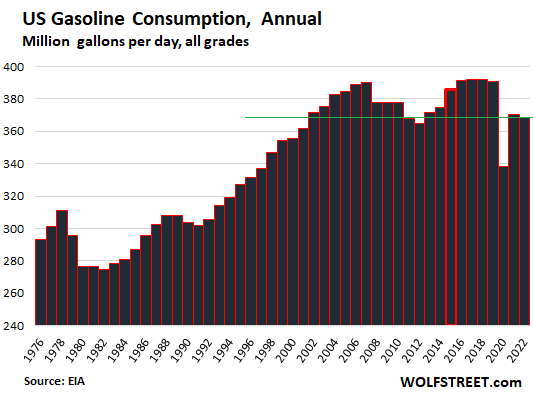

Gas stations are now seeing a persistent decline in demand for gasoline. Many of them have become convenience stores. The decline in demand is now being accelerated by the large-scale sales of EVs. Gasoline consumption in millions of gallons per day is below where it had been in the year 2002:

Some used-vehicle sales have wandered off to ecommerce, and all major used-vehicle dealers engage in ecommerce. But new-vehicle dealers are protected from ecommerce intruders by state franchise laws. You cannot buy a new vehicle from the automakers, you have to buy from a dealer. Dealers have websites. But the dealership does the deal. The exception is Tesla, which was granted exemptions in many states back when it was a nothing and no one took EVs seriously.

Some grocery sales have wandered off to ecommerce, but so far, Americans largely stick to going to the supermarket to buy food.

The other 50% of retail sales…

They’re exposed to the brutal force of ecommerce. But they’re hanging in there for as long as they can. Tens of thousands of stores have closed since 2017, when I started tracking this phenomenon under the category of “Brick-and-Mortar Meltdown.” In terms of Commercial Real Estate debt, retail is by far the worst, and has been for years, with huge default rates year-after-year.

Countless major retail chains have filed for bankruptcy and have been liquidated. Zombie malls are everywhere. Zombie malls in good locations are being bulldozed and redeveloped as housing. Even non-zombie malls are being redeveloped as residential or partially residential, such as Stonestown Galleria in San Francisco which is being redeveloped as mixed-use, with over 3,000 housing units, plus some retail.

And jobs don’t instantly vanish when a retailer files for bankruptcy. Bed Bath & Beyond, which filed for bankruptcy in April, is liquidating, and they now have their liquidation sales, and those employees are still counted as jobs in the retail trade.

Sears Holdings collapsed in slow motion and finally filed for bankruptcy in 2018. There are still something like 15 decrepit Sears stores around somewhere, out of 3,500 stores that Sears Holdings operated, and workers at those 15 stores still count as jobs in the retail trade. JC Penney got bought out of bankruptcy by giant mall landlords Simon Properties and Brookfield to keep the stores that anchor their malls from getting shut down. Many of its other stores were shut down. There are only a handful of department-store chains left, and they’ve all been aggressively shrinking their store count, and their jobs in the retail trade, from Macy’s on down.

All along the way, those retail jobs vanished in increments. It’s a slow process, it’s been going on for years, and it will continue to go on for years, I’ve been talking about it since 2017.

At the same time, supermarkets are thriving; some specialty stores are popping up, such as cannabis stores; and some new chains of small specialty stores, funded by investors, give it a go. And they all add some jobs to the “retail trade.”

Jobs in services grew – but they are not in the “retail trade.”

Services that are sold at brick-and-mortar store locations include food services (restaurants, delis, cafes), personal services (barbers, hair salons, nail salons, etc.); pet services, clinics, bank branches, etc. And they now tend to populate strip malls and outdoor malls – which are anchored by supermarkets, which are doing well too. And these types of service providers at street-level locations – from restaurants to bank branches or clinics – do well overall too. So that services-based arrangement is still working for landlords and is still generating jobs. But those jobs are not jobs in the “retail trade.”

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Wolf-

Any idea why bank branches are proliferating so much? Banking websites and apps allow you to do probably 90% of what used to require a visit to the local branch. Almost everything is electronic deposits / withdrawals (no need to deposit checks anymore). And online-only banks have formed.

It seems that bank branches are ripe to follow retail stores down the path to oblivion, and yet they seem more prevalent than ever. Any idea why?

When interstate banking became legal, banks started buying each other, and the number of banks plunged, and smaller banks became branches of bigger banks.

Also, the biggest commercial banks, until then confined to their state, started setting up operations across the US, opening up lots of branches.

So as the number of commercial banks fell …

… the number of branches rose, until it turned around as much of retail banking has shifted to online, ATMs, and mobile devices.

Thanks for the graphs! So overall number of branches has indeed started to decline. That makes sense. It just seems to me, walking down the street, that there are more branches, but that’s probably a function of a) fewer other type of stores around and b) larger banks can afford higher traffic locations and more prominent designs, so maybe I’m noticing them more.

Wells Fargo continue to close branches around here. They now have branches with no parking, and allow homeless squatters to camp out in their lobbies. When they took over from Wychovia in 2009 they were well run and treated their customers fairly well. No More. The same could be said for the rest of the big banks around here. Citibank is a complete joke. Same with BOA. JPM/Chase is a criminal enterprise. I predict they will shrink by 50% or more. I just moved all my accounts to my former DoD credit Union. Mostly Military retires.

but those online-only banks will only grow to be so big. when it comes to money and who is holding it… people will always require the ability to walk in the bank and withdraw right now or talk to a bank manager in person. there has to be a real face of accountability there when you are talking 6 or 7 figures and as long as America is building new subdivisions, a new bank branch from the big banks will be needed to service the needs in that new/growing area.

Quite a few small banks branches in my neck of the woods have become cell phone stores.

Which raises the immediate question of why the *$#@%_!! there needs to be so many cell phone stores.

Cell phones are an easily shippable product and with so many options (think books) that you would think these physical stores would have been Amazoned to death long ago.

My guess is that the margins on phones is so huge, and the physical customers so price-benighted, that it is cost effective to have a bazillion physical locations.

Amazing.

I don’t know if in the US it works the same as in Canada where I live but almost every store selling phones here is either a telecom provider, in which case they’re selling you a plan and maybe a TV and internet package or something as well, or it’ll be a retailer that can sell you the phone, the plan and they probably get commission for signing you up to the plan. So, I think the physical stores and booths at malls etc. exist to capture whatever percentage of the population still opts for in person when the choice is available. Telecom is pretty competitive here and some consumers switch providers often, without a physical storefront you’d probably be missing out on a sizeable chunk of potential clients, and margins on those phone plans must be huge I imagine.

Personally I’ll do a lot of it online except for once in a while but someone like my dad is at the store for every little thing he needs help with, if you don’t have a store then his +1000 a year or whatever he actually pays for all the services he has goes to the provider that will talk to him in person.

It seems that bank branches are ripe to follow retail stores down the path to oblivion, and yet they seem more prevalent than ever. Any idea why?

Are store pickup orders counted under e-commerce or brick & mortar? I.e. a customer orders something through a retailer’s website, but then goes to the store to pick it up rather than having it shipped.

This seems to be an increasingly popular choice by customers.

If you buy online and pay online, it doesn’t matter how you get the item, whether they deliver it to your door, or whether you go pick it up yourself at an Amazon locker, at a store, or wherever.

Best Buy delivers faster than you can pick it up at the store — because the store too has to wait for delivery, and then the next day after the item was delivered to the store, you can pick it up at the store. So delivery may be in 2 business days, and self-pickup will then be in 3 business days.

This is a key point, that so many of the stores now have mega-warehouses that store a majority of product, with the store itself having a minority of the products. For example, I wanted a certain built in outdoor kitchen, and HD only had the grill I wanted online but not at the store. The grill arrived the next day at the house yet would have taken two days to show up at the store. The outdoor refrigerator I ordered was not available at BB, yet it showed up two days later from the warehouse at the house. Thus those two appliances are not “retail”, they are “warehouse”, and thus the warehouse employees fulfilled the order, not retail employees.

This has been the way I have ordered products for the last five to ten years. The selection “online/warehouse” is near unlimited, the brick and mortar stores have much less product lines. Over time, this is reducing the need for “retail workers”.

And is many ways, this may be more energy efficient and more profitable way to do commerce. Instead of a product going from warehouse to store to customer house, it goes from warehouse to customer house. Less miles perhaps, less energy required.

I miss the family run hardware and electronic stores in which I knew the owners. Yet the new warehouse ecommerce way of selling products is likely more efficient and less energy intensive, yet it does come at a societal cost as we become less socially connected…

At my retail job, we have many local customers who specifically prefer to do store pickup – the two most common reasons are package theft concerns and state sales tax arbitrige.

If you’re buying a heavy item that can easily be damaged (e.g. large tool chest, cabinet, etc) it can be a lot easier to ship to store, inspect at store for damage, and then reject if needed, than to ship to home, inspect for damage, and then try to return it if it’s damaged.

That’s interesting. I always wondered how they deliver every tiny thing everyday profitably. Cheaper to keep stock in a warehouse than stock all stores and cheaper to transport direct to consumer than to continually fill the store…

Ahh so these figures are based on where the payment is tendered (online vs in-store) regardless of how the customer takes delivery. That makes sense. There are many store pickup systems which just reserve the product but don’t take payment, which I assume get counted as brick & mortar sales.

Two conditions for ecommerce: 1. order online AND 2. pay online. Both MUST be met for ecommerce. How you get the stuff into your house doesn’t matter. Walking in to a store and ordering in a store is NOT ecommerce.

I buy a lot of used computer equipment on-line. This has worked great since I have 9 operational computers to run the 2 business out of my house. Ebay has saved me boatloads of hassle and money. I’ve got a lot of legacy equipment and Ebay is the one way to get the stuff when something breaks. Other on-line sites have been helpful as well for used cameras and comms equipment and supplies. All delivered right to your door.

9 computers?? Huh, never would have taken you for a bitcoin. miner!

For Walmart, the sum of “ecommerce” and “brick & motar” doesn’t seem to change yoy (~40Billions). The main gain is from “Food” — which we know had a bad inflation for the past year and 10% seemed about right for food.

Ecommerce at Walmart jumped by $3.1 billion; non-grocery brick-and-mortar fell by 2.7 billion.

Walmart’s non-grocery brick-and-mortar sales are shifting to ecommerce. Plus there is some additional ecommerce business from people who never went into a Walmart store. So there is this shift, and an increase. And then there is the loss of sales at the stores, when people who used to buy at a Walmart store now buy at Amazon or wherever.

It’s dog-eat-dog.

To me, the amazing Walmart stat was that food generates 65% of Walmart stores’ sales, despite being maybe 33% of the stores’ footprint.

(I’m sure Q4 spikes non-grocery sales, but still…).

I’d happily trade away 50% of my Walmart’s non-grocery skus in exchange for doubled grocery options (Walmart is the price champion for food…but their grocery product range is pretty meh.

I’m sure some of it is product funneling in order to maximize grocery item unit sales – ie economies of scale and therefore lower costs – but I do think that Walmart would do even better with grocery taking more sf from slower-moving non-grocery.

So $0.4 billion represents a 1% increase over last year for ecomm + non-grocery B&M. Even less when you factor in grocery items that are sold via e-commerce. This does not bode well for other non-grocery retailers.

Wolf, does WMT report unit sales? Without a unit comparison it would be difficult to figure real sales. Food inflation is still very high vs Q1 last year. What portion of overall sales is do you attribute to inflation?

Inflation has shifted from goods to services. Food CPI has been dropping in recent months. All laid out here:

https://wolfstreet.com/2023/05/10/core-cpi-stuck-at-5-5-5-7-range-fifth-month-in-a-row-now-higher-than-overall-cpi-as-used-car-prices-suddenly-spike-again/

Just read Wolf’s article which said that food inflation is up 7.1% year on year and 18.6% over the past two years!

Yes, food inflation has come down recently but WMT surely benefited greatly from inflated food prices. It will be interesting to see how WMT’s sales hold up as they will not benefit so much from inflated prices.

I’ve seen some retailers start online and then open physical locations, Casper mattresses, Untuckit menswear. Are they bucking a trend or are they special case niches?

Here in Silicon Valley there has been a consolidation of malls to about half the peak number, but the ones that are still open seem as busy as ever. Will the decline level off at some point to a new equilibrium?

Mattress stores are money laundering fronts.

There was that mattress company kickback scandal a few years ago…the people in charge of RE acquisitions/leasing went on a huge binge of location openings…because they were getting kickbacks from landlords.

Any time some massively illogical phenomenon seems to be taking place, there is often corruption behind it.

(The DC rule.)

Casper was acquired by a PE firm, CEO was fired, after horrible performance. All they ever did well was hype. You can buy their foam mattresses at Costco today.

Ski in Cupernito CA with AAPL googles for $3,500 to enhance performance.

AAPL made a new all time high, just shy of $3T.

Apple filed over 5,000 patents alone for the $3,499 augmented VR headset. I’ve been part of this same scorched Earth patent policy when I owned a design engineering company and worked for some of the mega corps. And it results in less competition, higher future product prices, and less creative products over time.

At $35,000 per patent, very few other companies can spend $175 million in patents on a niche $3,499 augmented reality headset. At some point Apple will have locked out the majority of competitors from VR development, and the bottom 99% will then need a ten year payment plan to buy their augmented VR sets.

Deep thought, if all the mega-corps lock up their products via thousand of patents, does that lower engineering jobs in the future as competition goes bust? Do less engineering minds working on a product result in more or less creative advancement? I guess we will find out…

Note to Wolf – will need to add an “A.I. Synthetic Jobs” category soon, as the $2,000/hour patent lawyers filing thousands of patents per product, making million per year, will be replaced first as A.I. is very good at word vomit…HA

Disclaimer: I own Apple stock, numerous Apple products, yet still feel they are a monopolistic meta-corp who overcharges for overhyped products, so in some ways I’m definitely part of problem (Apple is addictive, please send help Uncle Sam…HA).

I’ve said it before and I’ll say it again. The only retail brick and mortar stores selling goods that I believe will survive in large numbers are grocery, Walmart/Target (not sure what category those are considered), Home Depot/Lowe’s and CVS/Walgreens. People still need random places to buy things, people are too particular about groceries to want to order it online (plus, the perishable nature of the products means that the online warehouse model doesn’t work nearly as well), and contractors/repair people need a place to buy things that are heavy and hard to ship right before a job.

Home Depot/Lowes have a huge advantage in that much of what they sell doesn’t perish or go out of style, so they don’t tend to lose as much (relatively) if overorder like many stores did in the past few years.

I’d be surprised if any other type of store exists in large numbers by 2030 or so.

Agree. Just bought target at the low. I just believe in it because I can’t walk out that store without spending $200 on nothing.

Their main advantage is that you can buy anything there, so it’s a good one stop shop if you don’t want to wait for Amazon. And while you’re there, you realize you can use some bananas, a pack of light bulbs, some laundry detergent, etc.

I forgot another category I think will survive: Costco/Sam’s Club.

Target is in trouble ,

Target is funding a radical group that wants to tear down Mt Rushmore. Still want to shop there?

Whitten,

“…I can’t walk out that store without spending $200 on nothing”

I can’t even walk into that store, LOL.

Why would I have to? I wouldn’t buy groceries at Target, and I buy everything online, delivered to the home, biggest no-brainer in the history of mankind.

Target too is trying to survive, so it has gotten bigly into groceries and ecommerce. Walmart’s ecommerce business has gotten big. Target is way behind.

I buy online, drive up, and go in. This comment section is full of older men with handles using the word “redneck” and I’m an upper middle class millennial mom so I’m offering a different perspective. There are packs of us that treat a target run as an outing. I absolutely HATE shopping at Walmart online and in store. I will pay more on Amazon or target to not have to buy on Walmart.com. Maybe once a year if I’m desperate but the customer experience is enough to make me avoid it. It’s probably a demographics thing but I’m pretty young (lots of years of support to go!) and I make about 90% of the purchase decisions for my household. I don’t think target is done yet.

I could be wrong, but my bet won’t break my bank. I’ll continue buying diapers and kids clothes there in person and online until I no longer have to.

Never thought of all the “shopping therapy” options being lost.

Real problem, maybe explains all the anti depressant drugs on TV, overeating, etc. “I go to Tarjeeeh, wouldn’t be caught dead at Walmart”….sorry, a male chauvinist joke based on living with lots of women over 50+ years.

Anyway, good article, simple, straightforward. Question answered.

Amazed at the tangential comments…not that I’m known for sticking to the subject.

And I DID wonder just WHO was buying all those super expensive mattresses….a conspiracy theory?……ya never know.

Hey, you go to Walmart and load up the cart with Castrol Edge full synth oils and a few Fram XG filters in the spring. Then, you’re ready to roll.

“She was a fast machine, she kept her motor clean.”

I forgot the Shopping Therapy Classic;

Wife/GF comes home and says,

“Guess what, Honey, I just saved us (many) dollars!!”

and gives you a big kiss…..maybe even more.

(Generally that one goes with new furniture)

I buy gift cards at my local supermarket for $500 and used them for on-line shopping. So, if I get hacked it doesn’t cause too much damage.

I’m not so sure about all that. Walmart and Target are already declining in brick-and-mortar retail. I personally would be very cautious about calling the bottom of their slide.

Don’t be so sure about groceries. During the pandemic my wife started shopping on FreshDirect. I think they have a good model. They have a central massive warehouse of groceries (including fresh produce, perishable, etc) and then deliver to their customers. This is different than, say instacart which sends shoppers to physical B&M stores to shop for you. This allows them economy of scale (big warehouse that doesn’t have to cater to retail customers); moving large volumes means their stuff can always stay fresh; and they have a generous return policy: if you don’t like the produce they send, they’ll refund the money and you keep the food. People don’t seem to abuse the policy.

The only reason people don’t trust online grocery shopping is because they don’t trust the shopper to be as picky about getting the best fruit, squeezing the tomatoes, etc. But if a place like FreshDirect can guarantee the quality of their groceries, then I don’t see why people won’t trust them (saved you the time of squeezing all those tomatoes :-)

If you’d have asked me 15 years ago, I’d say for sure no one would buy clothes online. I mean, even “standardized” sizes are anything but, colors on a monitor look nothing like colors in real life, etc. And yet, a huge chunk of clothing sales have moved online. If people are willing to buy clothes online, I’m not sure what they wouldn’t buy online…

Not to mention that Taco Bell will be the only restaurant to survive the Franchise Wars. in the future, all restaurants are Taco Bell.

If you are correct, then I will go one step further and say that toilet paper stocks will surge!

On the contrary, that’s what the 3 seashells are for!

(Btw both of my comments refer to the excellent but underated Wesley Snipes, Stallone and Sandra Bullock movie named Demolition Man)

A free colon exam for every $1000 spent at Taco Bell.

I can’t stop laughing!

I don’t see how CVS/Walgreens survives. If someone can ever get prescription deliver done right, there will be no need to ever visit a pharmacy.

Dollar stores will survive, just because they are often within walking distance of their customers and the number of people who can afford to purchase a car is increasing steadily.

Walgreens is now switching to healthcare services in its stores. Last year, it acquired VillageMD for $9 billion. The idea is to have part or a big part of the store be sort of a clinic with a doctor and a nurse, to do basic healthcare stuff.

They know that the retail end is in perma-decline, and their pharmacy sales are getting hit directly by the big HMOs that have their own online pharmacies for their members — who get, along with the medication, a printout of the pharmacist’s instructions in big print so that they can read it over and over again, if they want to, every day as they take the medication.

Doesn’t anything that’s a controlled substance have to be picked up in-store? Also, sudafed can only be purchased at the pharmacy counter now – seems like legally drug stores would have to continue to exist for these reasons.

I had some interesting experiences with over the counter cough medicine that I picked up at the grocery store. They wanted all kinds of ID info. I guess they have some people that abuse the medicine, so I gave them everything they wanted. It think it has some ingredients that make you feel “high”.

Sure, but Walmart/Target/supermarkets have pharmacies too. I tend to agree with Arnold. It seems like CVS/Walgreens are trying to find a niche between a convenience store and a supermarket, but I’m not sure it exists.

Barber shops, beauty parlors and nail salons.

Add gun shops to your list.

Creepto down 5.5%.

Well folks, the numbers may never get back to any kind of normal for decades. The Government spending, bubbles, inflation, lockdowns have probably changed America and peoples habits forever. Still hearing that awful disco music and believe some history will repeat itself.

The UK is a few years ahead of the US on the e-retail curve. Its landmass is smaller and e-retail has thus scaled up (much) faster.

What the UK has seen is e-retail starting to peak (for now) around the 30% level in 2023, as a share of total retail. Many Brits today are drifting back to brick-and-mortar stores, like Aldi. The e-retail novelty is wearing off.

The US is currently around the 15% e-retail level in 2023.

Those relative stats suggest the US will see perhaps another 5-7 years of e-retail growth… and then its growth will begin to tail off… and probably settle around the level of 1/3 e-retail and 2/3 retail.

I honestly hope to god this is how things work out. If I buy anymore clothes online I’ll be dressed like a clown

Walmart is closing 21 stores this year. Underperforming.

Probably low grocery sales.

Or massive theft,I hear it’s a huge problem

Walmart ecommerce sales: +27%

Walmart non-grocery sales at stores: -10%

That’s the problem. It’s in the article!

Retail theft by employees and by people walking in is as old as self-service retail itself. That is nothing new. If you think that it’s new, you haven’t been around. It’s typically “organized retail theft” with big fencing operations behind it. It’s gotten worse with the arrival of ecommerce platforms because they make it easier and more profitable to sell the merchandise, even platforms such as Amazon.

But what is relatively new is a MASSIVE SHIFT AWAY by consumers from buying in stores to buying online. Read the article. Look at the charts.

I can’t stop laughing!

That was to the Taco Bell comment, not this

Theft is just as much of an issue with e-commerce in the form of fraud. Plenty of stories of people getting charged for ripping off Amazon, google it.

Had a Walmart store manager as a patient at an urgent care center where I used to work. Very interesting and eye opening conversation. He is paid very well to switch to problem stores every 1-2 years and fix the theft problem. 10s of millions per year per store, and this is in TN….

That mixed retail in SF ought to do well – watch the looting from the comfort of your living room! Maybe even jump in to grab something you like. Git dem reparations!

It seems most employment data types are significantly different making historical comparison less informative. The trends and work arrangements are so varied and volatile. The quality of jobs (longevity, steady pay, benefits, retirement) and the quantity of jobs seem way out of sync compared to previous years. Seems much easier to cut people loose and not provide much in the way of substantial benefits. Government seems the only place to gain high pay, excellent benefits, and most of all great retirements. I told my wife, a teacher, you get the retirement, benefits, and steady income and I will provide the wild up and down of business income/writeoffs. This to say how hard it is to make sense of employment statistics when the data is questionable in value for analysis as shown in how employment is now going in this new, uncharted water, of the American labor market and how it REALLY works.

Wow, good comment. The American labor market is where it should be, in demand. The greatest labor market in the world currently has the luxury to redefine the work environment, as their grandparents before them did.

Personally, I believe that the young people who own the earth can’t possibly be as incompetent as we were.

Unlike what George Santayana said: “Those who fail to learn from history are doomed to repeat it”. In the area of economics, it is more accurate to say that those who believe economic history reveals eternal truths are doomed to error.

I happen to agree. Economic history is a shibboleth, a story, always a lie hiding the truth. Believing the narrative about economic history will surely doom a gambler to error.

That’s because economics and finance isn’t a science; it’s an art. Most people who rise to the top of science, mathematics, engineering, medicine, and computer technology spent years perfecting their craft to the point they rarely make any mistakes, as those mistakes could be catastrophic to the people they serve. On the other hand, the so-called geniuses of Wall Street repeatedly make huge mistakes that destroy peoples’ economic livelihoods yet face little to no repercussions for their actions.

The Walmart app for groceries is incredible. 8.95 a month.

I will never go to a store except for something special ever again, ever….

Gasoline consumption drop attributed to EVs. Any thoughts on whether WFH had anything to do with it?

WFH a much bigger factor than EVs. Just compare the percentage drop compared to 2018 and the growth in EVs over the same time period. My consumption is down 2/3 since I started about 5 years ago.

I already answered that in advance: Miles driven INCREASED in 2022 from 2021, while gasoline consumption DROPPED in 2022 from 2021.

Look at the charts:

https://wolfstreet.com/2023/05/11/evs-made-the-first-visible-dent-into-gasoline-consumption/

Mind niggling article that resulted in the following thought process, that there is a structural change in the retail trade industry that is a likely factor in the struggling or declining employment in the retail trade.

The best vector for someone desperate for a job and teens. I am concerned about what will replace these crucial but trivial wonders of the world.

The bah humbug industry that silicon valley has become. Scrooge eliminating the surplus population by automating their jobs. It is an interesting conversational starter to suggest that silicon valley has been reduced to exploitation as their business model.

Some of them are not American companies at all except in name. Manufacturing all in Asia, a handful of PR employees in the US and it pays no taxes to the country. It hides it’s income from the fools the buy their products.

You showed that retail gas sales are dropping, yet the US still has only a small fraction of car sales that are BEV (I think I recall 4%). In the latest month 60% of cars sold in Sweden are NEV (BEV and PHEV). China is also moving to NEV really fast.

I wonder if increases in cars in less developed countries will replace the global demand in developed countries.

BYD might start to lead the charge into low cost BEV, they have a vehicle that is supposed to start at 10K. Tesla can never compete with that.

Not exactly sure what you said but I agree that the ICE is about to become a relic. The demand balance has already shifted to the point that my next automobile will be an EV charged by the solar panels on my roof.

In Q1 1, EV sales were 20% of total sales in CA. I don’t have the Q1 US figures yet, but last year they were already over 7% of total sales in the US. So this is pretty fast moving. But most automakers (except Tesla) are still having huge trouble ramping up production.

Direct electrical energy from the sun is a panacea,

Electrical energy is much more efficient than the combustion of fossil fuels without the pollution of the atmosphere by the products of combustion. Carbon dioxide gas and the entropy of heat release are the preferred waste products. Not quite benign but acceptable, apparently.

Inflation has many ramifications, like on my time. I have little extra time now and my time is much more valuable than before. So I buy online and save time. I save on gas and wear on my car. This is more efficient for my time and wallet. Retail trade is in a slow constant decline from this and also how Covid made everyone lazy and an online buyer now. My wife is a housewife and she roam shops. Not me. I dont have time. I see the world consolidating in every sector about from inflation. Soon there will only be the few MegaCorps like Amazon and everything will be delivered by drone once google maps out the airspace. It has to be this way. Because equilibrium will make it that way. We’ve seem CRE go, WFH, business transition to online only…this is all stealth equilibrium responding to inflation. Now with AI, equilibrium has its eyes on a lot of services, industries and jobs. It has to go this way. It is the response to rabid inflation and bubbles…equilibrium to the mean. A certainty over time, everything finds a reaction to an action. The more dramatic the actions(Fed), the more dramatic(and probably surprising) the reactions. Thank you retail, but I’m late for work(2nd job). Gotta go.

Damn fine article Mr Wolf. It’s a shame there are not people with you insights in politics, at least then so many stupid mistakes would not be made.