Dropping prices cause dollar-sales to drop even if unit sales rise. Home Depot today blamed part of its revenue decline on lower prices.

By Wolf Richter for WOLF STREET.

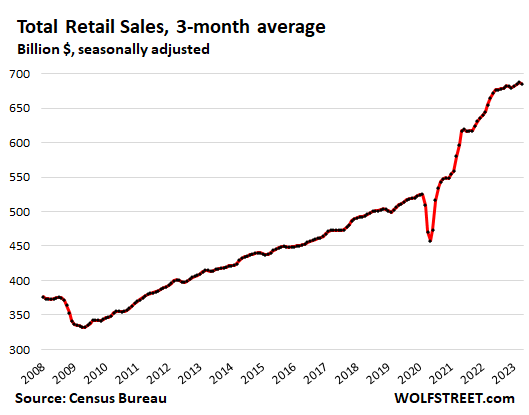

Total retail sales, seasonally adjusted, rose 0.4% in April from March, and 1.6% from a year ago, even though many of the categories of goods that retailers sell have dropped in price, some on a month-to-month basis, others already on a year-over-year basis, as inflation has shifted to services.

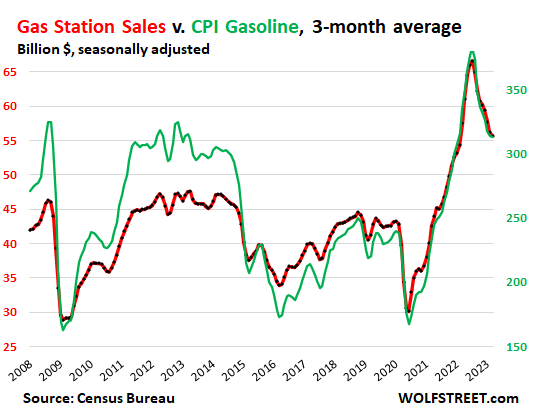

Gasoline prices have plunged by over 12% from a year ago, even as the price ticked up in April from March. Sales at gas stations have plunged in lockstep with the price of gasoline (green-red chart below).

The food CPI dropped for the second month in a row, but is still up 7% from year ago.

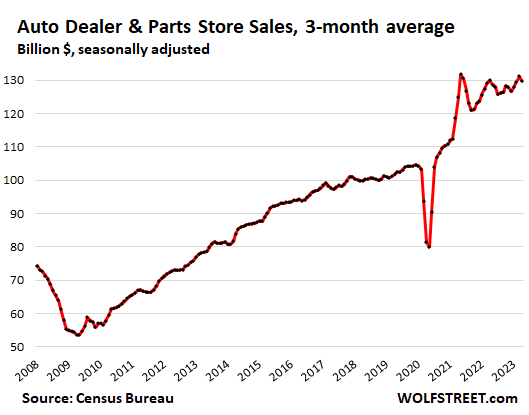

Used vehicle prices have dropped nearly 7% from a year ago, despite the jump in April. New vehicle prices are still up 5.4% year-over-year, but fell in April from March.

These three categories – sales at food & beverage stores, motor vehicle & parts dealers, and gasoline stations – account for about 40% of total retail sales. Dropping prices translate into dropping sales, even when the retailer sells the same amount of goods.

The charts below show the three-month moving average to dodge the useless drama of the monthly ups and downs that obscure the trends. The three-month moving average dipped a hair for April as the big increase in January moved out of it, but was up 3.1% year-over-year.

The trend shows normal-ish sales growth in recent months, after the huge stimulus-induced spike in 2020 and early 2021 that was then further boosted through mid-2022 by the raging price increases that have now abated, with inflation having largely shifted to services, which retailers don’t sell.

Retail sales by category, 3-month moving average, seasonally adjusted.

New and Used Vehicle and Parts Dealers (19% of total retail sales):

- Sales: $130 billion

- From prior month: -1.0%

- Year-over-year: unchanged

- CPI used vehicles: +4.4% for the month, -6.6% year-over-year

- CPI new vehicles: -02% for the month, +5.4% year-over-year.

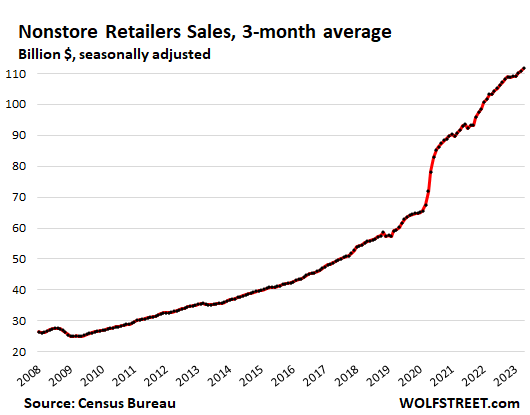

Ecommerce and other “nonstore retailers” (16% of total retail sales), ecommerce retailers, ecommerce operations of brick-and-mortar retailers, and stalls and markets:

- Sales: $112 billion

- From prior month: +0.8%

- Year-over-year: +8.0%

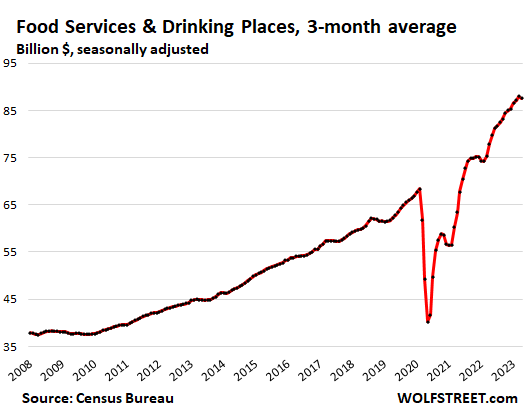

Food services and drinking places (13% of total retail), includes restaurants, cafeterias, bars, etc.

- Sales: $88 billion

- From prior month: -0.5%

- Year-over-year: +12.4%

- CPI for “food away from home”: +0.4% for the month, +8.6% year over year:

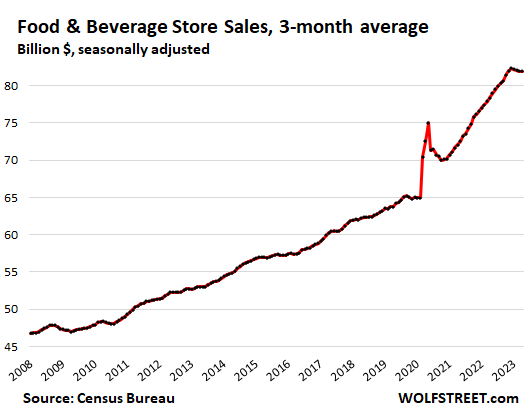

Food and Beverage Stores (12% of total retail):

- Sales: $82 billion

- From prior month: un changed%

- Year-over-year: +4.6%

- CPI for “food at home”: -0.2% month-to-month, +7.1% year over year:

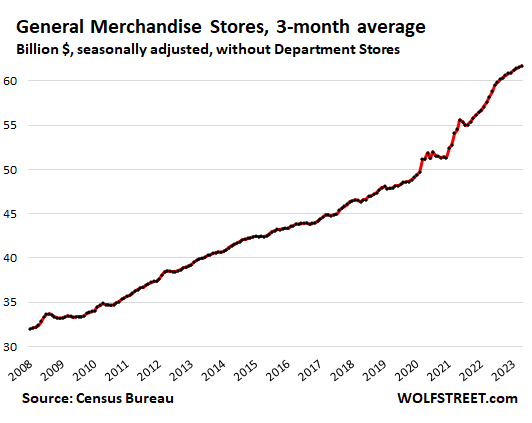

General merchandise stores, without department stores (9% of total retail):

- Sales: $62 billion

- From prior month: +0.2%

- Year-over-year: +6.0%

Gas stations (8% of total retail):

- Sales: $55 billion

- From prior month: -1.1%

- Year-over-year: -9.9%

- CPI for gasoline: +3.0% for the month, -12.2% year over year:

This chart shows the relationship between the CPI for gasoline (green, right axis) and sales in billions of dollars at gas stations, including other merchandise gas stations sell (red, left axis):

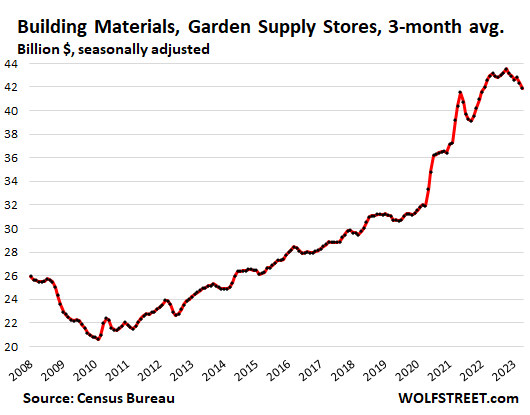

Building materials, garden supply and equipment stores (6% of total retail). Home Depot falls into that category. Today it reported a 4.2% drop in revenues, and blamed part of it on falling prices, such as lumber.

And for regular readers of this monthly retail sales column, Home Depot’s revenue situation doesn’t come as a surprise. In the chart, this trend has been developing since late last year:

- Sales: $42 billion

- From prior month: -1.0%

- Year-over-year: -2.4%

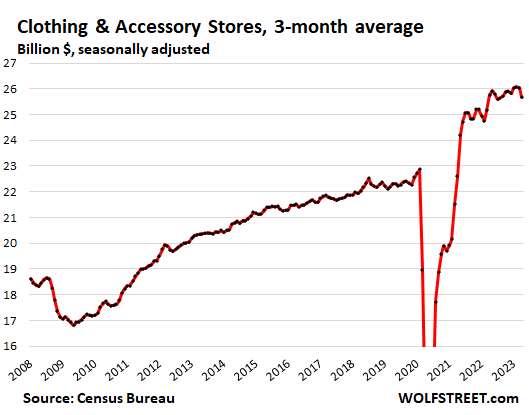

Clothing and accessory stores (4% of total retail):

- Sales: $26 billion

- From prior month: -1.4%

- Year-over-year: -0.4%

- CPI apparel: +0.3% for the month, +3.6% year-over-year.

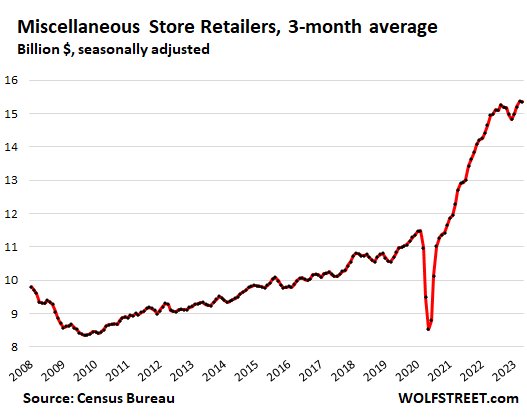

Miscellaneous store retailers, includes cannabis stores (2.3% of total retail): Specialty stores, from art-supply stores to wine-making supply stores. Cannabis stores are the growth driver.

- Sales: $15 billion, seasonally adjusted

- Month over month: unchanged.

- Year-over-year: +2.7%

There is no CPI for cannabis. Cannabis Benchmarks U.S. Spot Index reported that the average price in the US ticked up in recent weeks from the March low, but is still down by 16% year-over-year.

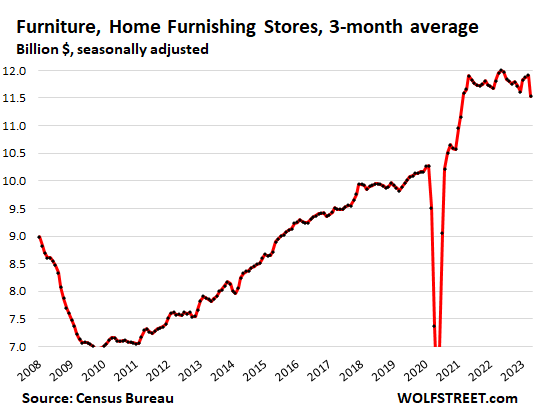

Furniture and home furnishing stores (1.7% of total retail):

- Sales: $11 billion, seasonally adjusted

- From prior month: -3.2%

- Year-over-year: 3.6%

- CPI Household furnishings: -0.4% for the month, +4.8% year-over-year.

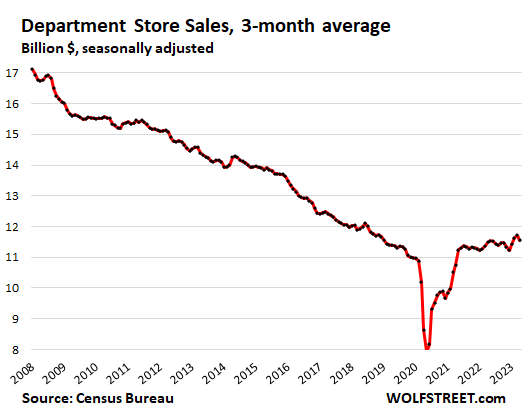

Department stores (now down to 1.3% of total retail, from the 8% to 13% range in the 1990s, as consumers figured out how to buy the exact same stuff online, including at the ecommerce sites of the few surviving department store chains:

- Sales: $11 billion

- From prior month: -1.4%

- Year-over-year: +0.6%

- From peak in 2001: -40% despite 21 years of inflation.

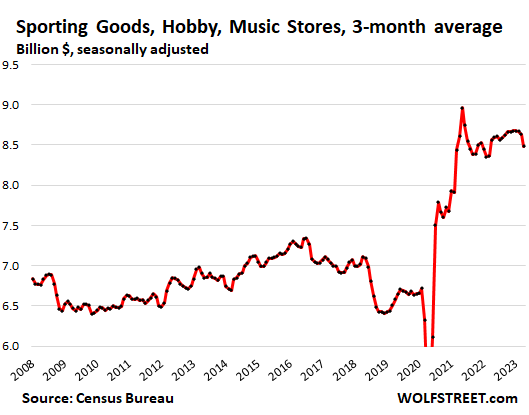

Sporting goods, hobby, book and music stores (1.3% of total retail);

- Sales: $8.5 billion

- Month over month: -1.8%

- Year-over-year: -1.0%.

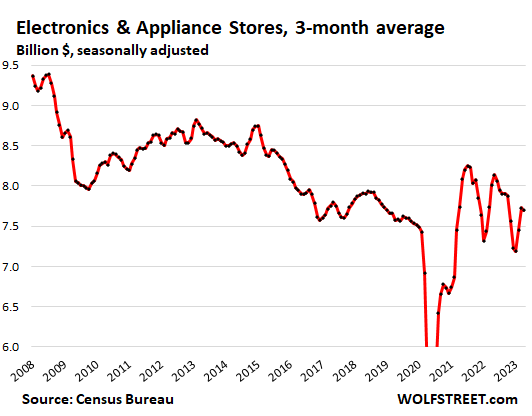

Electronics and appliance stores: Specialty electronics and appliance stores (Best Buy, Apple stores, etc.), not including electronics and appliance sales online and at other retailers.

- Sales: $7.7 billion, seasonally adjusted

- Month over month: -0.4%

- Year over year: -3.9%

- CPI consumer electronics: -0.1% for the month, -9.4% year over year.

- CPI appliances: -1.9% for the month, -0.4% year over year.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

My current observations are these: No matter what day of the week, or time of day I shop at either Costco or Home Depot, both stores are packed with shoppers. It seems to me that shoppers are still out there spending gleefully.

Not in our area, Costco yes and other discounters (esp Aldi) are always packed, but Home Depot shopping is way, way down. We went to get some seeds and potted plants the other day and there were maybe a half-dozen people in the section, there had been dozens there same time last year. Same with the rest of the store. And it wasn’t just HD, all the other home and hardware stores seem to have far fewer shoppers. We’re also in touch with a lot of small business retailers with shops on Amazon and Etsy and they’re also been saying their sales are way down, and the shippers are saying orders are down.

Honestly I don’t know how to interpret any of this, the data’s all over the place. The only thing that matters for us is whether the Fed (and the media squawkers) get the idea of “pivot” in their heads, and here, I think the Fed has every reason to keep raising interest rates and accelerate QT. On one hand, I wouldn’t be surprised if we get a contraction in Q2 GDP partly because businesses are seeing tighter credit conditions, reducing inventories and getting more cautious, and it looks like some consumers are too. On other hand, like Wolf’s saying there’s no evidence of a serious downturn yet, and tighter credit conditions are one of the Fed’s goals to stop some of this stupid speculation leading to the Everything Bubble and reduce liquidity excesses. Maybe a mild recession and even then that’s not clear (we had two straight quarters of contraction in 2022 and it wasn’t a recession), but there’s nothing serious enough to cause the Fed to pivot. Even if we hit a default next month (and it’s hard to see anyway they compromise with how polarized everything is), it’d probably last a few hours at most before the panic causes the Treasury to go 14th Amendment and just say the Constitution says we have to go ahead and pay the appropriations, and even with all the bellyaching nobody’s going to challenge that in court. So even then it’s hard to see a big enough crisis leading to pivot for any reason. The Fed should stay the course.

I agree with you about the big home improvement stores. I’ve seen the same thing.

We recently redid our kitchen. Our counters were delivered and installed in TWO DAYS! They told us that nobody is doing renovations right now (Houston).

Same thing with Floor and Decor. You could toss a grenade into that place and injure no one.

I’m not sure why the home improvement industry did not forecast this.

Many renovations were done during the pandemic with free money. It’s quiet now.

Can’t believe the anti-shoplifting measures that have been put into place in my HD,

most everything of value is locked up!

Now, how do you figure 5 finger discounts into how well a place is doing?

People are pulling screws and things out of the bags, then walking out of the stores without paying. Take a look at the number of open bags at Home Depot. It’s ridiculous what people will do to avoid paying $3-5.

Plus, it’s a tremendous waste of resources. Home Depot can’t sell open bags, so they probably wind up throwing the rest of the bag away.

XC – the tax term in my day was ‘shrinkage’. Recall allowance of about 5% back in the day, dunno currently…

may we all find a better day.

I’m not buying the story that Home Depot sales are falling because the consumer is rolling over. BS. Home Depot sales are falling because of INSANE PRICING. Every time I go in there lately I am both utterly in shock and utterly disgusted.

I personally am finding alternatives to Home Depot and I suspect a whole lot of other people are doing the same.

Sales are not falling because of impending economic doom. Sales are falling purely because of greed.

Prices on all home improvement goods are still more than twice what they were in 2010. I needed a few shelf brackets, I went to a Home Depot, I walked out of the store when I saw what they were charging.

You have to look at the trend, not the wild gyrations due to Covid and government intervention. The economy cannot survive at 5% interest rates. The Fed is always reactive, so it won’t cut until we get a massive event. It’s all baked in already. Recession or depression is guaranteed.

The economy is doing just fine on 5%.

That’s unfortunate, because the rates are going to have to go higher. Free money ain’t coming back. If your livelihood depends on it (it must, because only the pivotmania types claim these very tame rates are going to destroy the economy) you might want to come up with a Plan B.

Right now it’s all a big duh. The gov’t has sunk large amounts of money into the economy (e.g., soc sec increases, pandemic and other moneys from 2021/2022 infrastructure legislation) that ramped up fourth quarter 2022 and first quarter 2023. Real disposable income and consumer spending has tracked these infusions.

We’ll see where this goes for the other three 2023 quarters.

So, you’re basically saying there is no rule of law?

Atlanta Fed is predicting an acceleration to 2.9% growth 2nd quarter.

In SoCal food retailers such as Costco and Walmart busy selling necessities. Home Depot and Lowes not very busy and offering 2 year free financing to move items. Eat dinner out 4 times a week and most restaurants only 30% seating filled. Car insurance premiums in Los Angeles went up 30%. People getting squeezed on basics with little left for luxuries

Child Obesity in US rising to pandemic levels as kids are stuffed with cheap meals made mostly of Added Sugar.

So, the customers have so much money to splurge!

Nah. If people (children!!) drank free tap water instead of expensive sodas, it would cut sugar intake by a huge amount, dramatically change the direction of the obesity problem, and save them a lot of money.

Even sugar free sodas are expensive, and they train the taste buds to become addicted to sweet flavors. Just saying no, and drinking tap water would save people a ton of money and be better for them.

Been drinking tap water all my life. I promise, it works, as long as you have decent potable water coming out of the tap.

Amen

James says…

“Eat dinner out 4 times a week and most restaurants only 30% seating filled.”

4 x $25= $100 a week. So $400 a month and $4800 a year.

Probably more! A nice dinner for 2 could easily be $60-100 in one pop.

I feel like you eating out 4 times a week is a counterargument to what you’re trying to say.

Once you get used to it, it’s easy to eat at home or pack a sammich. Healthier too!!!

H2O – makes me wonder at what point those in the restaurant biz start bringing THEIR lunch to work…

may we all find a better day.

I keep thing that consumer spending has to come down eventually, but every month we get data like this showing the consumer is still strong. Weird times.

First graph is very telling; overall retail sales still very much above the historical trend…

That trend line is absolutely insane. It’s pretty much running double of pre pandemic smooth curve.

Truly crazy times we live in. Certainly a head scratcher all this.

I think it amounts to people spending more when they felt flush with cash, and spending habits being very hard to change. Sometimes people get a taste of the convenience that comes with having a few extra bucks to throw around on delivery fees or new toys and find it very hard to go back to the way it was. Non-store retail chart is a rocket ship that may never come down.

Where I live, pay has gone up and continues to go up fairly dramatically. I see people buying more and businesses selling more. Inflation seems to be ebbing with a couple of weird exceptions. Our biggest grocery chain, Publix, seems to have increased prices on everything 50 – 100% over the last couple of years. And yet prices at competitors in the area are generally way lower. And we have a couple of more upscale restaurants that jacked up prices, but again their competitors increased prices a bit, but nothing like them. Funny thing is, both Publix and these two restaurants seem to have more business than ever.

I am also in a Publix served area, and we have pivoted all shopping to Aldi and/or Winn-Dixie. I realize we’re being anecdotal, but I could only nod my head at your comment in agreement.

I mean a quick example, but for a normal size bottle of name brand mayonnaise publix is at ~$8.00/bottle now. At Aldi, this exact same size and brand is $4.xx.

Another example I noticed was english muffins. Publix was doing a “bogo” on them recently, and I could buy four packs of them at Aldi for the same price.

Like you said, the Publix near me is *slammed*, it’s like people just don’t even care what it costs anymore. Be it food, consumer goods, travel, cars … you name it.

I think Publix preys on the snow birds. I recall when I discovered the $8.99 jar of mayo, I commented to the cashier something along the line of “how do you folks do it”. She said…. you’re not from around here. Go away from the beaten path. Everything is cheaper there.

Found the same situation in Hawaii years ago. The markets frequented by the haole’s had nose bleed high prices. Went away from the tourist areas to where the locals shop and the produce was nicer and far cheaper.

I got hosed for an $18 dollar salad at Publix last week. I would have taken it back if it hadn’t been from the salad bar at the deli.

I will never walk in one of their stores again. Ever. And it was my first job at 14-years old. Where “shopping is a con-job.”

Publix…. Went to FL and had the misfortune of walking into a Publix. A jar of mayo was $8.99 vs. 4.99 for the exact same product here in AZ (Safeway in Scottsdale – not a low income market). Publix is on the “do-not-shop” list.

Home Depot seems to have dumped many staple products that I regularly use. I use a certain brand of caulk exclusively and a certain brand of wood finish. HD used to stock both, but no more. They now have puke products that aren’t as forgiving as my go-to products. The only place to find my preferred products is Ace, which is more expensive or Amazon. Ace, coincidentally, was a ghost town as well. Was there yesterday AM (early – normal handyman supply pickup time of day) and I was one of three customers in the entire store.

All Good Here Mate-

Greed gone wild. Some stores much worse than others. We will know to cover our shorts and go long when the prices drop.

You just have to remember government deficit spending is goosing the economy at a run rate of well over $100 billion a month. That is keeping the party going as the Pandemic funds run out.

We are addicted to debt expansion and total debt to gdp in much of western world is bumping up against 4X GDP where economic growth gets choked off.

We crossed the point of no return a few months before the pandemic. Expect debt to keep increasing at ever faster rates.

We are earning more dollars and getting poorer at the same time!

OS

There is still about $4 Trillion sloshing around out there that is a result of the COVID over response.

QT way way too slow to have any impact…

As you know, Government cannot default on its debt because it can print money to pay debts. So, there might not ever be a debt reckoning. We might have money printing and elevated inflation instead, as far as the eye can see.

We might not see a currency crash either, given all major countries are debasing their currencies at the same time.

It seems very clear governments want to go in that direction, but nobody wants to say it out loud. Smart market participants are playing along, looking for ways to capitalize on the inflation. Some players can’t play, such as conservative savers, pension funds, insurance companies, banks (to some extent), and so they are the mice. Speculators are the Cobras.

Some would argue inflation is a soft default.

Inflation is a hard default, and unskilled people without assets are particularly hard hit.

It’s not just Federal spending. Lots of local governments are flush with cash from SkyHigh home values / property taxes. In my area, Woodstock GA, there’s been zero price declines. Like ZERO. And, they’re starting to inch up.

I saw a chart the other day that showed the volume of home loans by 1/4 pts from around % up through the currents rates of approaching 7%. As we all know, there’s a ton of mortgages from 2.75 to 3.5%. This will have sales consequences for many years to come. A larger % of those people are now trapped in their homes, if housing doesn’t have a 20% price correction. And it won’t outside of some black swan event.

Future rent & mortgage relief due Uncle Sam stepping in due to a slowing economy will ensure foreclosures don’t get anywhere near 2009 – 2010 levels.

Last, the NYT had a fantastic article on all the major generations from silent to GenZ and what their expected inheritances will be through 2045. $150T will be handed down with the Boomers giving away $78T.

Granted a good portion of this will be lost to healthcare / nursing home care & eventual higher taxes, but a ton is going to get handed down, including houses. I just don’t know if anyone can really predict how all those homes sales will be affected by all sorts of ups & downs that lie ahead for the housing market.

Well had to buy a new fridge ,13 years old.bought a scratch and dent at Nebraska furniture mart $700 .told salesman will just buy another as they’re all junk made in Korea. Looked it up 10 year lifespan when I grew up they lasted 20-30 years made in 40s or 50s

Over the years people have demanded cheaper and cheaper white goods. They’ve now got what they wished for – which is cheap white goods. Likely costs them more in the long run. As is said, only a rich man can afford a bargain. The rich likely buy Miele.

Big difference is energy efficiency. I could get an old freezer for free but its still cheaper to buy a new one. The electricity cost difference can be around 400€ per year.

An average residential freezer in used in the US consumes $42/ year of electricity

Hah! so true. When I moved out of my parents house back in the 80s, my mom found a used refrigerator for me. I think it was at least 25 years old when I bought it. I used for another 12 years.

Yet every *news* entertainment site is saying the consumer is tapped out, and a recession is right around the corner.

Retail Sales up .4 M/M and 1.6% Y/Y before inflation is stronger than expected by most. The huge stimulus pumped into the economy over the past years, both fiscal and monetary, is still supporting spending. But it is slowing, and will probably continue to slow in the current mildly restrictive Fed environment. Where will the economy go in the future. It will probably continue to wind slowly downward towards the Feds soft landing absent unexpected debt ceiling, financial destabilization or geopolitical events.

It helps to be the world’s largest economy.

It’s all on a credit card and china wants there money,only reason for 5% treasuries is to pay china who then buys gold

There is a thing called legacy (meaning old). Not all retailers can actually keep up with certain things. I can find deals from stuff still stuck on the shelf. I’m telling ya. Some of them got stuff they had sitting from before crazy world, and it’s marked at a price congruent to 2-3 years ago. Damn good deals if you can find it. I’m not talking about amazon… but other big retailers and medium sized ones it’s out there folks. I just bought some crossbow heads for half of what amazon is asking for same.

SPX is led by few dead horses. In the Dow AAPL is bs. MSFT is third behind UNH & GS and above MCD and HD. In the Dow the top 5 are well below peak, ex MCD. MCD have negative owners equities.

The Dow futures breached the flipping point, trading on the left hand side of a long red flatbed, the upper one, a stepping stone above another long red flatbed, inside the cloud at 4am.

BRK/B is a mini Dow.

BRK.B has been paying my car insurance premiums for years. I bought some shares a long time ago and then called up Geico and got the 10% shareholder discount applied to my account. BRK.B doesn’t pay a dividend, but the price appreciation has been more than enough to cover my insurance premiums every year.

goo for you. I sold at about $190 in 2015. here we are at $325.

Looking at the disaggregated charts by category summarizes the distortion the administration created from the stimulus checks.

Even departmental stores sales increased :)

Eat, drink, and buy lots of stuff, for tomorrow we die. Long-term planning has been conditioned out of the US populace, by and large. I’d say we’re a country of grasshoppers, but I don’t want to insult grasshoppers.

I keep thinking that (per my natural bias), but this little pageant just keeps rolling merrily. It reminds me of the later 90s, long after Greenspan made his “irrational exuberance” remark, and many “prudent” investment managers had folded shop- inn he face of the persistent dot com boom. Likewise stocks and housing finance stayed buoyant in 2005-07, well after the doomsayers had spoken, and began to look foolish. And then …. Not that I take pleasure in this, or in saying “I told you so.” I never made the giga-bucks on the way up, but Im still standing.

I’ve noticed the same re long term planning. Not just with money, but all areas of life among my peer group.

Prices on non-lumber at HD are ridiculously high compared to mom and pop outfits, at least in this area.

So masses are going for the online crowd/convenience factor, and there are bargains for bargain hunters. I hope it isn’t merely a store-closing one–time liquidation sale signalling the end of old retail. If we all find those bargains, retail will survive and so will competition. If everyone goes for convenience/impatience and pays the jacked-up prices, competition disappears and then pricing power is all in AMZ and their cohort. Then the real hosing begins.

Menards has a sale evert day on close outs,

The Menards in Hodgkins Illinois used to have a guy playing a piano near the moving ramp to the second level.

Thank you for your information !

There are still materials you need *right now* and there will always be a place for a well stocked store. The problem is that HD either doesn’t have staples (like paint tray liners) or replaced premium products with crap, but charge the same prices they once charged for premium products.

The other portion of the equation is gasoline pricing. Regular fuel here, in our little corner of paradise, is @$5.00 per gallon. Ace is 10 miles. HD is 19 miles. To save $4 on rattle cans of paint would cost me as much in additional fuel, not to mention time and the higher sales taxes (Yes, Mildred. Scottsdale gouges tourists with their higher sales tax – nearly 2% more than where I live only 2 miles outside their city limit). There’s no savings, ergo, no trip to the big orange box.

Plus Ace delivers, same day, for free at a certain purchase point if I don’t want to beat up the technomobile hauling oversized material. Ace also carries premium yard implements that HD doesn’t. The same brand machinery often isn’t the same from HD as that you purchase at their authorized dealers. It’s a cheaper construct as evidenced by the SKU number often including the letters HD. Replacement parts can be different, with some being unobtainium.

HD also has home delivery. Free if you buy enough or the right product mix.

Not where I live…. I’m outside the boundary for same day. (HD delivery) There’s a few miles of national forest, county park, and reservation land that creates a riff-raff free barrier – but it also is a cut off for cliff dweller services like Uber, Instacart and the like.

Though a small sampling and anecdotal ….

most observations of posters on this site have mentioned

Restaurants packed

Desirable vacation spots jammed

Airline fares elevated

New vehicles tough to come by

and the Govt spending like there is no limit….and apparently there isnt.

All adds up to interest rates STILL way too low and QT way too slow

Amen brother.

Airline fares increased due to the costs of fuel and new pilot contracts. Daughter unit got a hefty raise with the ratification of their new contract. By hefty, IIRC it was 30-ish percent, with 18% being immediate.

Another airline saw an immediate 15% plus additional subsequent raises. This doesn’t mention better benefits that were negotiated as well.

Airlines fares are demand pricing….

I’ve noticed prices on international flights have been trending downwards.

Oh, so now that Home Depot is telling us the deflation and reduced customer demand caused the biggest revenue miss in 20 years. Is it a co-incidence that Tyson saw beef demand evaporate and customer demand shrink? The true employment data is better represented by employment taxes collected which is reported daily.

SPXU on sale $13.12

Harry Houndstooth,

Meat prices dropped a BUNCH. Tyson was ripping everyone off during the pandemic — as were packers in general. My wife works for a company that buys meat by the container and exports them to Asia. The horror stories I heard of 100% price increases during that time! There was NEVER any shortage of meat. But it boosted revenues and profits of those companies.

Now these companies cannot maintain those prices, they lost customers, not only in the US but also overseas. People, wholesalers, exporters, and Asian importers went on a buyers’ strike. And prices had to come down from those price-gouge levels. High meat prices finally killed demand for meat.

Price gouging during the pandemic is now hurting those companies. And it serves them right. The consumer isn’t limitless stupid. At some point, they fight back. And they did. They did in Asia too, against US meat-packer price gouging. You want to piss off your customers, go ahead and gouge them.

So when you look at revenue declines, they’re down from those price-gouge levels. Companies claim that there is weakness in the consumer to cover up the fact that they price gouged consumers, and now consumers refuse to buy from the price gougers at those prices. That’s how price gouging ultimately works.

My old truck driving job,paid17.50$ 3 years ago now 25.70$ dou think they raised price of scholastic books . Of course people will spend on there kids ,even when library is free.

I absolutely second the discussion about home depot. The effing MBA effect of having profit max run every fOcking thing. It is amazing to think they started as the local lumberyard killer, and have transformed into a zombie waiting for the retail apocalypse to get to them. I swear if Amazon stocked warehouses of hardware, lumber, and drywall with same day pull and delivery, HD would be doomed. And it is coming. They also have treated their employees like cattle for decades. Nothing to do but kill them off next.

I truly think that everything is simply going to be online with a truck delivery for everything over $500 in the future. So many businesses are going to find brick and mortar too costly- and the shrink factor is just one part.

HD can die a slow death. Tired of seeing $20 stuff for $50- plumbing parts are insane.

Rant off. But seriously folks, it will happen.

Technically, SPX still has a head and shoulders top on the daily graph with the left shoulder higher than the right. Of course, I could be dead wrong, but at least I am honest. 95% Triple short. 5% cash.

If the markets explode to new highs I will blow the last 5%. After that I will have to ask my wife for more cash.

On the other hand, if the bottom falls out, she will be happy.

Oh dear! You’re massively gambling. I mean, that can be a lot of fun. But with a triple-short ETF?

For the last 12 months, the S&P 500 has gone nowhere. On May 27, 2022, it was at 4,158, exactly where it is today. It’s down about 14% from the January 2022 high. But what it did on the way to nowhere was a big rollercoaster ride.

The Nasdaq Composite is down 23% from its high in Nov 2021, but it too has gone nowhere over the past 12 months.

You’re gambling to hit one of those down-streaks.

But any triple-short ETF will eat you alive due to expenses and decay if you hold it to ride up and down the rollercoaster to nowhere. These funds have lost 50% of their value over the past 12 months, while indices have gone nowhere.

To be enjoyed for day-trading only.

Up 139% last year. Wolf, I will send you every trade.

Down 7% (so far) this year.

I absolutely agree that these 3x short ETFs should be held as short as possible. The decay is bad.

The car market is collapsing (see Lucky Lopez)

Real Estate is stepping off a cliff (see Nick Gerli)

The market is timed to collapse (see Michael Kantrowitz)

Who wants to miss the biggest stock market decline in our lifetime? (see Jeremy Grantham).

Of course, I could be completely wrong, but I am 95% triple short and 5% in cash.

Let’s see what happens.

Your too early getting in in august,just my opinion

I was also in short funds but got out when I realized that the moment I was waiting for would never come (no loss thankfully). I thought, if the government is willing to cover 80% of JPM’s losses then there is no telling what other lengths they will go to to prevent another 50%+ market drop. We are living in a whole new world my friends

In my opinion you never want to put your destiny at the mercy of short term market pricing. Plus if you play the game with excessive risk its just a matter of time before you get completely wiped out. That’s coming from someone who thinks SP500 is 2X too high.

Leveraged ETFs should be totally avoided.

Scary charts here, it’s just awful how the cost of living has increased so much in ten years.

I have doubts that the Fed is serious about bursting all the bubbles.

Tech stocks are going nuts again, ridiculous market caps, back in looney land.

So much for the big valuation reset. It lasted less than one year.

Shopped at tjmax and ross today. Discounts are still ~50% but from a higher price point. The clearance stuff is not as cheap as it use to be as well. Have managed to find some premium brands on my last couple of trips which is more than normal. Lots of shoppers out at lunch time.

The index starts at 525 in 2020, craters briefly due to the big Covid scare, and then jumps to 680 now. That’s a 30% increase over the past three years. I wouldn’t be surprised if the general price level increased 30% over the same time period, regardless of what the CPI says, due to the massive use of helicopter money. At least another 10% to 15% inflation to go on the Covid adjustment unless the bottom falls out, which doesn’t seem likely given the high level of continued stimulus (and price gouging).

i just hope the rising inflation rate will drop…