“Housing market will have to go through a correction … to where people can afford housing again”: Powell

By Wolf Richter for WOLF STREET.

The FOMC voted unanimously to hike its policy rates by another 75 basis points, the third hike of this magnitude in a row. This brought the target for the federal funds rate to a range between 3.0% and 3.25%.

At every meeting, the Fed has increased its projections where its policy rates would be by the end of 2022. As per its “dot plot” today, the median projection by FOMC members for the mid-range of the federal funds rate jumped by a full percentage point from the last projections, to 4.4%.

This means a target range between 4.25% and 4.5% by the end of 2022, which means an additional 125 basis points in hikes spread over the next two meetings, much higher and much more aggressive than expected.

According to the dot plot, 12 of the 19 FOMC members now see the federal funds rate between 4.5% and 5% by the end of 2023.

In the statement, the Fed said it “anticipates that ongoing increases in the target range will be appropriate.”

“In my view and the view of the Committee there is a ways to go,” Fed Chair Jerome Powell said at the press conference.

“We’re taking forceful and rapid steps” to get this inflation under control, he said.

“The longer the current bout of high inflation continues, the greater the chance that expectations of higher inflation will become entrenched,” Powell said.

The Fed is now purposefully crushing the entire Fed-pivot fantasy that has been widely propagated for months.

“Restoring price stability is essential to set the stage for achieving maximum employment and stable prices over the longer run,” he said.

“Price stability is the responsibility of the Federal Reserve and serves as the bedrock of our economy. Without price stability, the economy does not work for anyone. In particular, without price stability, we will not achieve a sustained period of strong labor market conditions that benefit all,” he said.

“We will keep at it until we are confident the job is done,” he said.

The Fed raised all its policy rates by 75 basis points today:

- Federal funds rate target range, to 3.0% – 3.25%.

- Interest it pays the banks on reserves, to 3.15%.

- Interest it charges on overnight Repos, to 3.25%.

- Interest it pays on overnight Reverse Repos (RRPs), to 3.05%.

- Primary credit rate it charges banks, to 3.25%.

Quantitative Tightening continues at full speed.

QT, which shifted into full speed in September, will continue at that pace. Powell pointed out several times during the press conference that QT was an important tool in cracking down on inflation.

Asked when the Fed would shift policy and start outright selling mortgage-backed securities (rather than just letting them come off via the pass-through principal payments), Powell reiterated what had been said before many times that this would be an option later on in the QT process, after QT is already “well underway.”

The Theme: People are suffering from inflation.

At least since the July meeting, the Fed has been hammering home the theme that the people, particularly those at the lower end of the income spectrum that have to spend all their income on necessities, are “suffering from inflation.” And that’s why the Fed has to crack down on inflation, even if unemployment rises and the economy slows – and Powell repeated that theme in the press conference today several times.

“People are seeing their wage increases eaten up by inflation,” Powell said today. When you spend all your money on necessities, and then those prices go up, that hurts, he said.

High inflation is “very painful” for people at the lower end of the income spectrum, he said. “Inflation is really hurting.”

Housing market “will have to go through a correction.”

The housing market is interest-rate sensitive, and is already reacting to the rate hikes, he said. After the “unsustainable” price increases recently, “the housing market will have to go through a correction … to get to where people can afford housing again,” Powell said.

And he expects that the CPI for housing costs, which are now a big driver behind overall CPI, would remain elevated for a while.

Labor market still “extremely tight,” must get back into “balance.”

Despite the slowdown in economic growth – the median dot plot projection for GDP growth this year was lowered to 0.2%, and for next year to 1.2% – “the labor market has remained extremely tight, with the unemployment rate near a 50-year low, job vacancies near historical highs, and wage growth elevated,” Powell said.

There are “not many signs” that the labor market is cooling, he said.

“The labor market continues to be out of balance, with demand for workers substantially exceeding the supply of available workers,” he said.

To crack down on inflation, the Fed is trying to bring the labor market back into “balance.” The median projection from FOMC members for the unemployment rate rose to 4.4% by the end of 2023 – which would be somewhere around recessionary levels.

Warning against premature loosening.

Powell warned repeatedly against premature rate cuts. “A failure to restore price stability would create much greater pain later on,” he said.

“Restoring price stability will likely require maintaining a restrictive policy stance for some time. The historical record cautions strongly against prematurely loosening policy,” he said.

The effects of changes in monetary policy on inflation are not immediate but come after the often cited “long and variable lag.” At some point, the Fed will have to slow its rate hikes and then hold rates steady to see how it’s going. And at some point, they may cut rates. Where is this level?

Powell wouldn’t say. But he did say what they’re looking for. They want to see “compelling evidence” that inflation is heading back to 2%.

And he said that various core measures of inflation really haven’t gone down at all. And so further rate hikes are needed.

The “Real EFFR” and rate cuts.

With the Fed’s target range for the federal funds rate at 3.0% to 3.25%, the effective federal funds rate (EFFR) will be around 3.08% going forward.

CPI inflation in August was 8.3%. On this basis, the inflation-adjusted or “real EFFR” is still a negative 5.22%.

The Fed’s slowness last year and early this year in reacting to inflation is unprecedented in modern times. The Fed is now catching up, but even with today’s policy rates, the Fed may still be pouring fuel on the inflation fire.

Note that the Fed has never started to cut rates when CPI was above the EFFR. So as Powell said, “there is a ways to go.”

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I’d like to see the Fed increase QT to $120 billion/month. That would be a good, steady state level to apply downward pressure.

Looks like Powell fooled Dems big time with “inflation is transitory” and “We have a plan to control inflation before Nov 2022”.

While previous administrations since 2002 are all complicit in inflating this everything bubble, the current administration will face voter fury for redirecting all pain to us 99% peasants through inflation.

Either Dems are faking optimism for midterms or they are hallucinating with no idea of what’s gonna hit them

The polls are actually showing surprising Democrat strength given public sentiment regarding the state of the economy. And it seems like economic concerns have taken a backseat to social & culture-war issues which are increasingly becoming the core focus of modern elections.

The democrats love to fight those culture wars. I think that as the stock market melts down, the jobs start to disappear, people will get focused again on the economy.

But the supreme court ruling on abortion was a godsend for the Democrats. The stupid Republicans need to let go of that issue. It is killing them with female voters.

The Republican party would do so much better if it went back to its roots of fiscal conservatism that embraces everyone except the ultra-rich and stupid.

gametv,

“It is killing them with female voters.”

And male voters. Men pay for lots of abortions in this country. It’s part of the deal. You do it, you pay for it.

It’s the independent voters that decide who wins at the national level – and running off independents is very costly, for whichever party does it.

Abortion is to Republicans what “Defund the Police” was to Democrats. Republicans gloriously made hay out of this “Defund the Police” stuff promoted by a handful of left-winger Democrats, and it did a serious amount of damage to Democrats in 2020 because it scared some independents away. Now Republicans face similar dynamics. Piss off the independents at your own risk.

Have you ever considered that polls are used to create an illusion and nudge people in a certain direction (or the herd if you will)? Remember when all the polls had Her Highness winning in 2016?

Mr. House,

Her highness did win the popular vote by a good margin. And polls picked up on that. But that’s not how it works in the US. Polls weren’t very good at sorting out the peculiar electoral-college math that determines who becomes president.

Granted Wolf, but her highness knew them were the rulez when she ran. Not to mention she skipped various states which many pointed out was stupid at the time. Doesn’t invalidate my point.

Also you seem to forget she rigged the 2016 primary and uh then had the gall to claim the 2016 election was rigged. I love crocodile tears!

Jackson Y, Polls are like statics, they can point to anything the statisticians want them to…I give them very little credence. Last week, Nate Cohen wrote a good article for the NY Times talking about the 2022 polls. He provided a quote from one famous Democrat pollster who said that Democrats who are believing the polls for 2022 are engaging in a false optimism because every poll that has came out recently showing Democrats surging has oversampled Democrat voters and undersampled Republican and Independent Voters. As Bill Clinton’s buddy James Carville recently said on a CNN panel discussing Roe v Wade and the affect it will have on the election, he said that he wished it was different, but there was a reason he coined the phrase, ” It’s all about the economy, stupid, ” because by November people will be thinking about their pocketbooks when they vote, not on abortion.

Yeah *** Economic concerns are Never in the backseat in America… You can talk all you want about that. Besides is not just one way street.

On the other hand I have 3 children of school age, and my family as most families on my block and area are not happy with the culture shift in gender BS in grade schools and middle schools.

Schools should focus on, Reading, writing, Math, Science a lot more than queer groups and trans-bathrooms.

They’re pretty good at buying votes, so wouldn’t be surprised to see them win again. Until the sheep wake up and realize that all of these vote buying schemes are inflationary and lead to a lower standard of living, “the beatings will continue until morale improves.”

Funny you say that

Because I remember the previous administration giving me and just about anyone with a pulse thousands of dollars. Not to mention the absolute bonkers amount of cash to anyone with a LLC or above

But I don’t expect you to remember such things, since you have the attention span of a Alzheimer’s ridden goldfish,

Good day to you depth charge

Yep, Troy. The people who politicize recessions, inflation, employment, and other economic problems KNOW that they’re full of crap. They just take every opportunity to twist truth into lies. It’s now normal in the post-truth America.

They’re also good at lying about things like abortion and guns.

Never mind the previous administration dolling out millions in PPP loans with next to no oversite and giving thousands in pandemic relief the people?

You have a conveniently short memory, DC.

It looks like I’ve triggered a bunch of partisan hacks. Good. Piss off.

PS – I can’t stand either party and have never in my life registered for either.

Telling people to piss off when they call out your hypocrisy, amazing.

The Dems may be fools, but they aren’t letting their credibility rest on the performance of asset bubbles.

Everyone (including you) know we are in an everything bubble and it is a huge problem. They are taking one on the chin to address this issue and you call them fools.

Instead, lets talk about the bi-annual border crisis… That will fix our economy.

It’s so disappointing to see so many people stuck in this left vs right (your team my team) paradigm. That’s right where they want you.

“It’s so disappointing to see so many people stuck in this left vs right (your team my team) paradigm. That’s right where they want you.”

Ain’t it the truth! Mixing blue and red gets you violet. Add an n and you get violent. They both love war and free money.

They are playing a different game. We peons all think it’s basketball when they all playing Rollerball. Keep us fighting each other. Win for them

Coffee, I am confused? I must of missed the first 8 years of the asset bubble being created, nurtured, and tauted as a success by a Democrat administration. Both parties were in lockstep with the FED creating this mammoth asset bubble after 08 and loved every minute of it, and took credit for it.

“Looks like Powell fooled Dems big time with “inflation is transitory” and “We have a plan to control inflation before Nov 2022”.”

Yeah, I’m sure Powell wants another few years under a Trump 2.0 after that debacle.

And you bet, despite the fact it takes a long time for monetary and fiscal mistakes to show up, whoever is in office when it does show up is always taking the blame. Gas, inflation, whatever. But Joe knew the job was dangerous when he took it!

Powell either did that deliberately in order to hit the Democrats, or he is an utter idiot that just acts way too late on everything.

Why take it so slow with the interest? He needed 1%-1.5% hikes until the end of the year. He is only causing more pain for an extended time, for people and the economy.

We still have maximum employment, that doesn’t change.

Everyone on the Internet has 100% hindsight. It’s a known fact.

Please stop. Your political views are annoying and irrelevant. Pro-Trump or TDS are not helpful to the situation at hand.

Here’s a shocker: Trump did some things very well, and some things very poorly. Just like every president we’ve had. If you can’t see that fact, you’re a bit unhinged.

These interest rate hikes are a joke given the current rate of inflation, which is underreported. Read the apologists’ in the NY times article “Why has the CPI inflation calculation changed over time.” Granted, part of the latest rise is due to supply shocks and the covid lock downs. However, I opine that there is a huge, UNREPORTED conflict of interest which leads me to predict inflation is here to stay: the “Fed” meat puppets are “coincidentally” failing to take drastic enough action to curb inflation while inflation keeps profiting the banksters and financiers that own the banks that own the ‘Fed” district banks by reducing their liabilities to the tune of over $1 trillion a year, e.g., their depositors’ bank deposits. I say that trillion is motive enough to lie.

There is a policy by the moderator to avoid politics but since this simplistic view is stated over and over again, here are the facts:

First place to begin: the Fed is like the crew of a supertanker, a ship that doesn’t turn on a dime.

The accepted view, back in the days of normal, was that a Fed tap on the rudder would show up in the economy a year later. So… to see the source of the crisis now, you have to go back in time.

In 2018 the Fed tried to take small steps to normalize rates. Then Trump threw an unprecedented fit and PUBLICKLY and personally trashed Powell. It is usual for Presidents to lean on the Fed for lower rates privately but never had such an uncouth barrage been fired publicly. One

term: ‘worse than China’

Powell, like Tillerson, Milley, Mattis, Kelly etc. etc. was not a choir boy but expected norms of civility, professionalism, and what the opponent of McCarthy called ‘decency’. He also might reasonably have been expected adherence to the Trump’s Inaugural Oath to ‘respect the Independence of the Federal Reserve’

Ha ha.

Do I join in criticizing Powell for not standing up to Trump in 2018? Sure, but it was the Fed’s succumbing to Trump that led to the final ‘blow off top’ and today’s need for much more drastic action. A tap on the rudder won’t do, now that the iceberg is dead ahead.

BTW: Trump wanted negative rates, like Japan and EU. In conversation with Economic Advisor Gary Cohn, about the budget he asked ‘why not just print the money?’

Regardless of which party is in the White House, the Fed *should* operate independently and in the interest of its two charges: price stability and full employment. Powell capitulated to Trump’s demands, plain and simple. He’s now attempting to atone. Even if he does put the US economy back on course in short order, I’m not going to forget his acquiescence.

Yep. See also:

Trump’s 2 trillion TCJA tax cut that turbocharged stock buybacks and put is in the hole for …

Trump’s negligent leadership during the pandemic contributing to our current labor participation shortfalls not to mention tragic excess death and long covid.

Etc …

Nick, in case you don’t know this, Republicans do not respond to reason. They’re now in a cult so whatever their worship-worthy leader says is what they will believe.

There’s a fancy diagnosis for what we’re seeing in the political landscape: cognitive dissonance. You choose what you want to believe and pluck out the evidence you want from the past, and, presto-change-o, you have a new belief and you have proof that it’s legit.

The other facts, nah, they don’t even enter consciousness.

Hear, hear, nick kelly. Very well said. The biggest problem we face is the sad fact that the vast majority of our fellow citizens would lose interest after reading your second sentence… Tik Tok is soooo much more entertaining!

Alas, we’ve become a nation of fools that gets the government it deserves.

This entire thread should be shredded unless Wolf wants to open this can of worms.

Too late. The can of worms is open. Now I’m busy trying to keep the worms from wriggling out all at the same time.

If you have chosen a political party ‘side’ then you are part of the problem.

Agreed, this is the kind of crap I rarely see on Wolf Street. I’d rather read comments from folks that haven’t RTGDFA!

I’ll end this stupid argument. Rates should have never went to 0% in 08 and no QE should have ever been implemented. How’s that?

You can keep going back further and further. Why stop at Trump and not go back to the creation of the Fed? Nixon set the stage for the inflation shock of the late 70s and early 80s. Reagan decided to export inflation by exporting jobs. Clinton engineered much of the mess we’re in now by making China relevant/powerful and changing banking regulations which led to a tech boom and housing boom, which we never fully recovered from. Trump’s stimulus was reckless but Biden seemed to take reckless to a higher degree with almost constant stimulus. They all tainted. Only truly unbiased individuals can see this.

Excellent time line Dean. Its almost like those who argue for democrats and republicans can’t seem to figure out its the equivalent of rooting for a sports team. They get rich, you get a few hours of thinking you belong to something you dont!

Both parties equally suck. They are two sides of the same corrupt coin. Neither party answers to or cares about their constituents they claim they represent. They take their marching orders from their respective lobbyists and donors, who write the legislation and pad their pockets. I am so bored with the Dem bad/ Rep good or Rep bad/ Dem good arguments, it is banal arguing that needlessly divides…and that is actually what they want so they can retain their power: divide and conquer.

To bring home your point, I still wish that Wolf Ritcher would put grey recession bars on his very useful chart in this article. They would prove the Fed causes big, long recessions with their demand suppression policies, that destroy destroy the economy and millions of jobs in the process. Then the budget tries to mop up the mess with stimulus spending that ratchets up the National Debt. Trouble this time around is Debt now stands at $30.9 trillion, 124% of GDP, and interest on the debt is exploding from rising interest rates.

A better policy would be to raise the supply of goods, which would lower prices. A $5 trillion National Infrastructure Bank to fix our nation’s crumbling infrastructure and re-employ folks in great paying jobs could do that. It worked four times before in our nation’s past, and is proposed in a current bill in Congress, HR 3339 .

“A better policy would be to…”

A better policy would be for the Fed to never-ever lower its short-term rates below the core PCE inflation rate, never-ever buy bonds and other assets of any kind, and let the repo market and money markets blow up and let investors take those losses, instead of bailing them out every time.

Recessions are an essential part of the normal business cycle. This is when economic entities, such as businesses and consumers, shed debts through bankruptcy at the expense of investors and banks, and then emerge with less debt on the other side. Recessions have a cleansing function — like a clean-up crew after the party is over. Trying to prevent recessions is just causing and aggravating lots of economic distortions.

Right now, this economy needs are real recession that is allowed to do its thing all the way until it’s through.

“Recessions are an essential part of the normal business cycle, … when economic entities, such as businesses and consumers, shed debts through bankruptcy at the expense of investors and banks…” Spoken like a true monetarist.

The problem is, this is not how U.S. monetary policy plays out. The Federal Reserve is owned by Wall Street Banks. Wall Street influence is fully embedded in Democratic and Republican administrations. When financial markets crash, Wall Street gets bailed out by U.S. tax payers, and the Fed buys up banks’ bad paper.

The ones who take the hit in the ensuing recession are small businesses and workers. In the absence of any true reform (like a return of Glass-Steagall), we need a large countervailing policy to protect small businesses, workers, infrastructure, and supply chains. That policy is HR 3339.

Index funds buy poorly performing stocks, right along with well managed companies. With the introduction of index funds, isn’t it a lot harder for recessions to properly cleanse?

Every president has influence with the Fed Reserve since they nominate the Fed Reserve governors.

True, Trump and predecessors leveraged their political power to pressure the Fed including Powell against appropriate tightening.

True, Joe Biden also hung Powell’s reappointment over his head, delaying the nomination and the congressional confirmation, to pressure the Fed against raising rates early so as to fund his giant trillion dollar bills.

Larry Summers warned against the spending (vote buying) lobbyment bill as inflationary and Biden and congressional democrats went all in on this, arguing that climate change and infrastructure were critical, re-election for democrats was critical, push the party line, etc etc. I remember this all happening this year and last year so only a partisan would deny it IMO.

Which is why the Treasury Secretary and former Fed Janet Yellen mentioned interest rates may need to rise, and yet Biden and Democrats continued to pressure Powell successfully by hanging his re-appointment over him to not raise interest rates. Spineless Powell complied and the Democrats argued that Powell was a trump appointee and Republican as if somehow that means something and we are supposed to feel better about all this??…

Hence we got massive inflation from government overspending, multiple trillions spent irresponsibly which Trump and prior Fed policy definitely contributed to but the direct arsonist/immediate guilty party here is going to be appropriately suggested as Biden and congressional democrats.

Its like a jug of water that supposed to be only half empty so it doesn’t spill and republicans/Trump irresponsibly and possibly intentionally fill it to the brim and everyone knows its at the brim, and you decide to pour lots water into the jug anyway to hand money to your friends. Now water is flowing over the edge of the jug and on to the floor and you are denying that its happening and pointing fingers at other people and insisting that others are responsible while still continuing to pour water into the jug and trying to convince everyone that its not happening. Who is to blame?

I blame Trump and republicans plenty. But this inflation is on Biden and democrats. Larry Summers clearly opposed this spending as did Jason Furman. They made plenty of warnings this would cause inflation. Even Janet Yellen made comments that spending was causing problems and rates had to rise. Biden ignored it and dragged out Powell’s nomination to pressure him to not raise rates and this weasel put his own career over the stability of the American dollar just like when he folded to Trump previously.

Its important for Democrats to not enable their own party by turning a blind eye and for Republicans to not enable their own party by pointing fingers. Sophism won’t change the fact that we are due for a lot of pain. Regardless of whether the goblet/pitcher is supposed to be full of water or not, you’re supposed to not pour more in if it is and spill the water all over the place! You’re supposed to also know if its near full/full.

Joe Biden and democrats may not be fully responsible for the lack of margin but IMO they are responsible for this inflation and all the mental gymnastics isn’t going to change that. Those were some giant trillion dollar spending bills for supposedly covid, infrastructure, climate, etc etc… It will take years to pull that extra liquidity/handout money from the economy, years of inflation. They screwed our future to buy our present, like Trump did with the first Covid bill. They are all guilty of being arsonists…

Good one anon:

At this point in time, and after watching RE and SM closely for many decades, I can agree, like totally dude or dudettes,,

ALL, repeat ALL the paid political puppets are on the same team.

Should be clear to anyone willing and able to ”parse” the formerly incredible and continuing CORRUPTION.

Anon, that’s a sensible view. I like the pitcher analogy.

Where we differ is the extent to which the later spending contributed to inflation. Certainly the bills in 2022 haven’t contributed much, if anything, given lagging effect and that…they have yet to actually be spent. Same for some of the $ from older bills, where the money is sitting with states.

I’ve not heard the view Powell’s reappointment was used as leverage to delay confirmation, and I question the timing of it vs the Covid bills (see above, why the bills nearest his confirmation didn’t like contribute much).

It’s also interesting to see that inflation has gone (almost) totally global. To me, that’s evidence that monetary policy, QE, is the dominant factor. It’s the gang-ho Fed (and ECB, and…) in 2020 that unleashed the kraken….

BTW, I inadvertently started this worm pile by referring to Trump 1.0 as a debacle. I meant that with respect to Powell, as others have discussed above, that he got publicly and personally roasted by the administration. Who’s want to go through that 2x? So I highly doubt Powell somehow set Dems up for a fall here.

I’m thinking I should never open a thread with an opinion again… :-)

I see the future.

Price discovery.

Yes, price discovery is in Future. Inflation will decrease but not prices of goods and services. That’s price discovery!

The value of dollar doesn’t follow wolfstreet dictum. It keeps going to heck in a straight line.

More on this: Inflation decrease won’t be quick. While listening to Powell, do remember that he is the same guy who said “Inflation is Transitory” and he was buying MBS till a couple of weeks ago to support housing prices.

Now he says that he would like to see housing become affordable!

I know. I’m still trying to wrap my mind around this.

Affordable for who? If the speculators aren’t chased out it’ll just be a discount to cash investors allowing them to buy up large enough percentages in a local market to keep rents elevated. I somehow doubt affordable housing will be for regular people.

It is a fantasy to expect to return to 2% inflation any time soon. The Fed continues to labor under the bubble that we are in “temporary” inflation. Yeah, and homes are “temporarily” increasing in value in prime housing markets.

I sometimes feel half the purpose of the Fed is to blow smoke up their own asses, forgive the crudity.

“It is a fantasy to expect to return to 2% inflation any time soon.”

I think that has validity. But that’s not the point. The point is that they will NOT cut rates until they see “compelling evidence” that inflation is returning to 2%.

Based on your theory, inflation might not get anywhere near 2% for years. But then rates will be higher for years. That’s the scenario I see.

They want theoretical 2% inflation so they can make the Feds fund rate 0%. They cannot afford the interest on the debt. So they will drive down the Fed bond rate and ignore inflation to monetize their debt.

They want 2% inflation and a FF rate of 2.25% or maybe 2.5%… that’s about their steady-state goal. That’s what they did in 2018, when inflation was at or below the 2% target (core PCE).

I still point to the disconnect..

if the Fed’s target is a 2% trajectory of inflation (stable prices?), then they should be pushing for price rollbacks to get back on that trajectory.

2% or 4% or whatever, stacked upon the 9% spike is NOT a victory, IMO. Nor would it be for most citizens.

Agreed. But that’s not gonna happen. Because that would be “deflation,” the greatest catastrophic evil in the world when your dollars gain a little bit of purchasing power to make up a tiny part of the purchasing power they lost in prior years.

True, they should be pushing for deflation, but this is inimical to the “elastic currency” and the doctrine of perpetual growth. Deflation punishes debt. In the decrepitude of financial primacy, the spectre of deflation is seen not as a caution to prudence, but as a spur to excess.

re “inflation might not get anywhere near 2% for years. But then rates will be higher for years”

$2T of QT only has the effect of the Fed raising rates ~.25%, and at the $60B/mo QT rate it will take the Fed over 2 years to even do that, and inflation is monetary, so until they drain the $2-4T they dumped into the mid/low end of the consumer economy, inflation will not go down to the prior population growth rate. all that support your many years thesis; however, if the Fed lets stagflation continue for years it may get entrenched in psychology, esp. wage gains, and Fed will lose credibility if that goes on for over 1 year, which cuts against your thesis. Making me think the Fed will get a Vulker moment in early/mid 2023 if CPI is not at least trending fast towards back below EFFR.

According to the Census Bureau data, the last time we had inflation during the early 80’s it took about 7 years to come back to mean. And that was with way less debt today.

Therefore, this creates the probability of of minimum 7 years and maximum time moving towards infinity until a new mean plateau is realized, and it would higher than 4% unless we have big deflation.

I was a kid in the 1970’s. New cars in our neighborhoods were rare and modest living standards were commonplace.

We are returning to 1970’s stagflation. IMO, this will take a few years to play out. The everything bubble was an enormous financial boondoggle, it will take a lot of time to unwind(barring a black swan event).

We’ll be in this fight for a long time if they intend to really stick to the 2% target. It’s the only thing I could see them potentially caving on if this drags on for and extended period. They may have no choice at that point.

When something breaks, as it always does, someone will scream “do over!”

I believe that we need cheap Asian goods pouring into the US to balance this inflation. We are not there yet.

The Fed can then go back to battling deflation like they did when inflation was dropping below 2%.

Oh, and for services, we need more people working for cheap wages.

Get off your couches, People! Join the Labor Force! Maybe I should say volunteer for the Labor Force!

Why do you think we have inflation,Asian countries are tired of America paying them nothing in exchange for fiat currency. We better wake up and get a americas coalition ,Canada Mexico USA Brazil Argentina .

Guess I’ll be sticking with 3 month T-bills for awhile but as you point out, the “real EFFR” is that they are still roughly a negative 5.22%.

Glad I’m not invested into RE right now as I was in 2008. I was almost whipped out back then. Those heavily invested in stocks must be losing sleep right about now…

I figured out that go with 8 weeks. So that they expire right before or right after fed meetings. 3 months are too long and you miss some APR gains.

I have to say that trading was crazy volatile from 2 pm forward. At first, stocks dropped like a rock. When Powell spoke, they rose again. Every time he said “and,” the S&P 500 jumped 1%. And every time he said “but,” the S&P 500 dropped 1%.

The Powell Trade was rough today because it was all so volatile, but it kind of worked: According to it, long in the morning until the presser, then early on during the presser, sell everything and go short; cover at leisure the next day.

Last time (July meeting), the second leg of the Powell Trade collapsed. The prior two times, it worked like a charm.

Wolf, I think after going through a cardiac-arrest sine wave, the stock market began to focus toward the close on the unrealistic goal of 2% inflation anytime soon. That meant more tightening into 2023 and higher interest rates for a longer period of time. The economy falling off, and 3rd Quarter GDP not looking good at this point, will take care of labor market imbalances, with the net result being higher Unemployment stats and job opening falling well below the suspect 11 million today.

I think before Paul Volcker passed away, he commented that there is no empirical evidence to support the establishment by the Fed of a 200 basis point inflation target. I think we may see a bump up in that target by this time next year as the Fed and the markets grow tired of an unattainable goal.

But the debt markets are already voting with their feet as they have been most of this year: The spread between the 10-year Treasury Note and 30-Year Mortgage is some 300 basis points vs. the historical average. Default risk on top of inflation risk ride back into town.

The market is not so sure the Fed will accomplish taming the Inflation Genie, much less getting back into the not-so-magical bottle.

The goal is attainable. It just requires higher rates.

Their goal is to let inflation run wild while telling the public they are doing everything possible. They need inflation to monetize govt. debt.

Abomb,

I agree and the rates should be rising much much faster.

Exacto.

Today reminded me of the market response from May and June except the next day crash got front runned late this afternoon. I’d expect “some pain” tomorrow lol but we’ll see!

The point moves seem large due to the inflated index levels. On a percentage basis, today’s intra-day moves and full day declines were not even close to large.

The algos were playing jump rope.

So, folks using credit must roll their paper over at a higher interest rate. So they will charge more. Which fuels inflation, right?

Not necessarily. Earnings, and corresponding asset values, may go down with higher interest expenses. We’ll see what the market can bear.

Or they stop buying stocks back with their excess cash and use it to invest in their business without unnecessarily borrowing “free money”.

I think you give them too much credit. Ba-dum-bum-ching.

There’s nothing to invest in. There was nothing to invest in at 0%, how could anyone think businesses would invest at 3%? They’ll just return the profits to the shareholders and go back to shrinking/dying off. 20 years of low interest rates and the economy is dying regardless.

No, because it’s corporate credit which primarily must be rolled over.

Higher rates are deflationary or disinflationary, not inflationary. Higher rates over time will mean that corporations and their financial backers will not be able to fund uneconomical investments to anywhere near the same degree. This includes employment which provides little if any value add.

Extended artificial low rates artificially inflated earnings and EPS. Extended higher rates will have the opposite effect.

It’s not a unidirectional movement but if the interest rate cycle bottomed in 2020 (as I believe it did), rates are destined to “blow out” later past the 1981 peak.

As Rojogrande said, not necessarily, and that’s what the Fed is counting on: “Earnings, and corresponding asset values, may go down with higher interest expenses.”

I think that this is a trickle-up phenom. As the lower 75% (no longer 50%) need to substitute out higher quality or name brand products, make do with less in all respects, and as smaller companies either fail or shrink, and it moves up in the business hierarchy, a hole in the economy starts to open and widen and sucks more and more into the vortex.

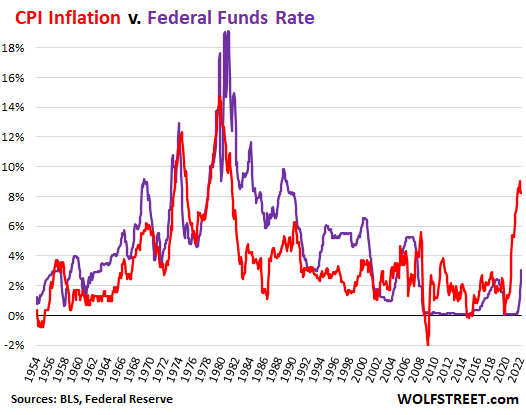

Then Powell and company will have to relent. But, look at Wolf’s charts of PCI vs. Fed Funds Rates, the Fed had four bouts of inflation bursts before it got hammered down in ’82. Did the Fed learn that lesson? If so, we may get the full-on hammering right about now.

After reading your comment I went back and looked at Wolf’s chart. I didn’t realize the Federal Funds Rate was well above CPI all of the 1980s and most of the 1990s. What the Fed accomplished then has been squandered in the last 2 decades. Do they have the will to do what it takes again? We’ll see.

Rojogrande (large red?),

Yep. The FFR changed its position in respect to cpi in 2008, the banking failure. That’s when the fear of deflation took hold.

And, if you remember recent history, the zero-bound rate wasn’t stimulating the moribund economy. They had to resort to QE1, then QE2, and other stimulants.

COVID was truly a black swan and f’d up the relatively weak recovery that FED had worked toward.

Unfortunately the FED was late in recognizing both the bubbles and the inflation that was inevitable from all the stimulus.

They now need to get the upper hand of FFR vz. CPI. Will they before they flatten the economy, I dunno.

How Now,

Yes, I’m a very tall Dutch person with red hair, so I’ve long been called Big Red. However, the nickname is often taken for user ID’s or as part of email addresses. My step father is Mexican and speaks Spanish and calls me rojogrande, so now I use it too.

I agree with you the Fed needs to get the upper hand on the FFR v. CPI, but the chart makes me think that may be much more difficult than I previously thought given the enormous spread between the two. With all the debt in the economy, the economy may be flattened well before they’re successful. It’s a difficult situation.

The crocodile tears shed by the Fed for the poor is sickening hypocrisy. These SOBs have no care for the hardships of the masses and simply seek to defend the profit system. They made the world unaffordable for the masses and now they will force the economy in to recession to try and “fix” the mess they made

There never was any magic fix for what ails America (loss of intl productive competitiveness, especially relative to China).

But by strangling interest rates for years and years (and years), the Fed papered over that blunt, inescapable fact in the service of its political masters.

Creating idiotic, doomed asset bubbles instead of real political and economic reform was standard issue DC poisoned-shiny-apple.

The Fed had to have known that its ZIRP was failing to increase American employment significantly as early as 2004 or 2005, as new homes got produced…but only at record prices, with employment growth crawling (or directed at the illegal aliens trafficked in by DC non-enforcement of laws…for about 2 decades at that time…4 decades now).

When a country gives away its manufacturing,it’s toast. Sweat and sore muscles create a country

In summary, the Fed has no problem with pumping asset prices, but BIG problem with pumping wages.

Always has, JeffD — the Fed is an aristocratic institution.

Historically, the “market correction” for excess wealth has been peasant revolt. The rulers are trying to get in front of that correction, not to save the masses, but to save themselves.

The Fed’s plan is to boot enough workers out of their jobs that they (a) can’t buy food and energy anymore, reducing demand; (b) those that remain employed become too scared to ask for pay rises. This will stop a wage-price spiral, which is their primary concern.

A more sensible policy would use fiscal mechanisms as well, but we’re not allowed to do obvious things anymore because ‘free markets’.

Further the Fed can’t target pain on the economy, so it’s likely that poorer workers will get hit more in this adjustment (i.e. rot in gutter vs have to return the SUV).

Hence the need for the narrative about how this is for the good of poor people.

To be fair, they don’t have any other option. The tools they have do not allow them the finesse required to deliver any sort of equitable solution to either the COVID crisis that started this roller coaster, nor the coming pain that will bring things down to earth.

You are absolutely correct, Jon W, but only Congress has the fiscal levers necessary to do that work, and they abdicated their responsibilities for this decades ago, preferring the fantasy that monetary policy could substitute for fiscal policy and ducking the accountability which a democracy cannot function without.

MS: Agree.

Finally, an open admission they made housing unaffordable.

It’s not going to get more affordable, either. The purchase price of a home may fall as interest rates rise – but mortgage payments will likely stay the same.

People aren’t going to be building more housing until the market improves, and people currently underwater won’t sell voluntarily. There will be foreclosures, retired folks downsizing, etc – but not enough to meet demand.

There is tons of pent up demand that has been kept from being met by zoning regulations. Yes, they will build more housing. People can find the case to make a bigger down payment for a smaller mortgage.

Yep, zoning is the next thing to evil. In California, it is the long term cause of the housing shortage. Then add insane “high codes, low quality” building codes and you have what’s happening now. Crazy High prices on crazy poor quality housing.

It’s Crazy! People, rich or poor, have to have a place to live!

Ccat

You only have tons of pent up demand if people think they can profit by buying a house. If they think they will lose by buying a house then the demand goes in the sewer….

You’re going to be unpleasantly surprised if you think that. This bubble was far worse than the one that popped during the GFC, and guess what, the pain will also be far worse.

Housing inventory is going to spike as “investors” walk away from their underwater shacks, and it’ll spike more when defaults explode from zombie-companies laying off employees in droves. Again, just like last time, and again, even worse because this bubble is far larger. Everything will play out just as it did during the GFC, except even worse.

Even the dumbest among us can see the pattern here.

I agree. We have a whole new investment class of short-term rental landlords that we didn’t have in 2008.

House prices have to fall by at least 20% before just about anyone goes underwater, unlike the GFC.

Scenario: Times get tough, renters stop paying rent in places where it’s hard to evict a tenant, and maybe there’s a rent (or even worse, an eviction) moratorium, and that could shake a whole lot of weak sellers out of the rental holdings. It may be easier to just sell a property than battle courts for 6-12 months to get a tenant out.

Airbnb kingpins are going to feel like pin cushions with hemophilia in a cactus covered desert over the next 1-2 years.

I think the core reason some people dont believe there will be a housing bust is that they look at the housing market as being very fiscally stable because noone is underwater and there was no sub-prime lending. But they fail to consider that housing is almost totally dependent upon mortgage payments for demand. If people cant afford the mortgage it massively reduces the demand. So even if YOU can afford to buy a home with cash, it isnt smart to buy a home that is priced at a massive monthly mortgage premium to the local income statistics.

So dont pay the price you can afford, pay the price that others can afford to finance.

Once prices have fallen for the next six months by an average of 3% a month, then we will start to see some distress in the marketplace. But I imagine that one year to 18 months out will be the time when the level of distress finally rises. Usually housing markets take a while to go from peak to trough, because instead of basing prices on affordability, they are based on comps. You need successive waves of lower comps to finally see the prices adjust fully. The stock market is actually not that different. When a stock gets re-rated, it doesnt fall to the new price level right away, it takes a while for sellers to continuously overwhelm sellers to drive the price down.

There will be plenty of involuntary selling when unemployment rises significantly which it will once the end of the stock mania is confirmed. That I can promise you.

It doesn’t matter that housing is a necessity and people need to live somewhere. They will do what people have done everywhere else and at all times throughout history, double and triple up. This alone will create an oversupply on a large scale eventually.

No one has a birthright to their own housing unit, no matter what Americans may think.

“ No one has a birthright to their own housing unit”

But they should have! Else they are homeless, out on the street.

The northern California town I live in has not zoned/allowed enough lots to house all of those that were born here for decades. That should be illegal!

Ccat

AF, you’re wrong about the “birthright”. If you’re born into wealth, you have a birthright. No matter how untalented you are.

The “free marketers” and “social Darwinists” turn a blind eye to this.

Noone has a birthright to a home, but I think we all hav a right to housing and zoning policies that allow people to build enough homes so that everyone can find housing.

I would like to see a very substantial property tax on undeveloped land. Dont let the developers or rich people sit on vast, unused pieces of land. If they are ranchers or farmers, that is different, it is productive land, but otherwise, very significant taxes on property that is undeveloped would encourage more property to find its way into the hands of people who plan to develop it.

That would be such a simple way to nudge the free market into action that benefits everyone.

We need to make housing into a cost of living, not an asset. When housing becomes a cost of living, people will make sure the cost is relative to the value derived. It would lower the value of the land significantly and make housing prices more related to replacement value of the building. It would actually stimulate more housing development (and even redevelopment) if property prices were much lower. I bet it would even result in development of technologies to lower the cost of building, because with lower land prices and more land available, a more dynamic economy of housing manufacturing would ensue.

Sometimes capitalism needs a nudge in the right direction.

Fine, I will go claim a piece of land and build my own house there. Live on the frontier as I please. Will the government deny my rights? I have as much right to land as anyone born in this country.

And just like that, an unelected bureaucrat in a monetary institution decides US housing policy. Cause free markets! /s

They’ve done this for many years, with their rate cuts and MBS purchases, for the purpose of inflating home prices. Now they’re going the other way.

I guess Powell isnt having lunch with Fink anymore.

He’s having lunch we me, according to sources familiar with the matter.

Agree with Wolf. So long as housing transactions are funded by borrowed money, housing policy pretty much is decided by fed and, probably to a lesser extent, zoning.

People borrow within their expected mortgage payment range, with decision making more consumption (what can I afford, because I deserve the best!) than investment.

Powell also came to my pajama party and pancake breakfast wearing bunny ears and a leather collar. Then he ruined my futon.

He may not be housetrained, but he’s getting an education in housing.

The Fed which is controlled by the banks have been controlling the monetary and housing policy for a long time. Controlling interest rates and purchasing MBS’s more recently to control housing prices. The Fed chair is hired and fired by the President.

We do not have true Capitalism. We have a Fascist economy by definition.

The Fed controls the economy.

While I agree that some control is needed during economic crises, I firmly believe that the the Fed has moved in the direction of Fascism and has taken more control away from true Capitalism.

Whether it is central control by government (Communism/Socialism), or central control by business (Fascism), it is all relying on the someone to decide our financial fates. Historically, this has not ended well.

It reminds me of the Universal Healthcare debate awhile ago. ie Do you want an incompetent government Death Panel deciding whether your medical needs are covered or not? My answer was, yes, it is better than the alternative of having a for-profit business Death Panel who is trying to jack up their CEO salary and their stock price decide what medical needs are covered.

It is good to see the Fed is unwinding their control and moving away from Fascism slowly. We have hope.

Well, that settles it. I’m loading up on SPACS and flying electric bus IPOs.

“Restoring price stability is essential to set the stage for achieving maximum employment and stable prices over the longer run”

Fed should have though about any time from 2008.

Why do these guys even get paid?

Before the Great Financial Crisis the Fed could simply raise and lower interest rates by decreasing and increasing the level of bank reserves in the financial system.

After the 2008 crisis, the Fed flooded the system with bucket-loads of reserves (from $15 billion in 2007 to $3.2 trillion today). With the system full of reserves, the Fed could no longer control interest rates through its previous policy of increasing and decreasing levels of interbank money, even sizeable adjustments no longer influenced the demand curve.

When the IOER (Interest on Excess Reserves) was set up the Fed created risk-free arbitrage regaining control of the money markets that could establish a ceiling on interest rates, but a problem remained to establish a floor so the Fed created the ON RRP for influential Federal Home Loan Banks who were ineligible to earn interest on reserves and sometimes pushed money market rates below Fed targets.

The Fed once again felt it had control of the markets, but it still had one weakness: repo, the shadow banking market that allowed parties to transform their Treasuries into quasi-bank deposits. By 2019, barely any entities other than a few GSEs still participated in the Federal Funds market, as most institutions now had all the reserves they needed.

On Sept 17, 2019, rates in the repo market exploded higher. Everyone wanted cash, but there was a shortage. Corporate tax payments and increases in Treasury issuance prompted a large decline in reserves. As a result banks had to cut back on repo lending. Nobody could provide.

Responding to the demand-supply mismatch, the Fed created the Standing Repo Facility. This allowed specific entities to obtain cash from the Fed at a set rate using U.S. Treasuries, agency debt, or MBS as collateral. Since everyone started borrowing from the central bank, SOFR fell from over 5% to within the Fed’s target range.

Fat forward to July 2021, after Covid QE Infinity, IOER with IORR (interest on excess/required reserves) had grown redundant. The Fed retired these measures in favor of IORB (Interest on Reserve Balances). QE had made the term “excess reserves” meaningless.

Since then, it’s been plain sailing for the Fed (at least for now). If rates soar above its target range, the Fed adjusts IORB or fires up the Standing Repo Facility, bringing rates back into its desired range.

So by implementing a trio of policy rates (IORB, ON RRP, and the discount rate), and utilizing the Standing Repo Facility, the Fed has gained a solid grip on money markets.

The U.S. is gradually gaining authority and power over these markets. By providing central bank swap lines and foreign exchange swaps to its closest allies, opening a FIMA Repo Facility to seemingly supply emergency dollars to China, and issuing $1 trillion in Treasuries every year till at least 2055, America will increase its grip on global finance, with the U.S. Dollar front and center.

Most Fed analysis is ideologically driven, not based on validities, so it’s hard to acknowledge that the system is stable. But contrary to popular belief, the Fed has created a more durable system and increased resilience.

If you add up all the bailouts, stimulus, inflation fighting programs, currency swaps, from 2009 to now it is over $32 trillions.

So much liquidity was created it is hard to believe.

I am surprised it took so many years for inflation finally rear its ugly head.

Why should anyone be surprised that real estate has risen so much. Thank goodness Cryptos were invented to sop up some of this liquidity to keep in contained for awhile. That was until people realized you really cannot do anything with Cryptos except HODL or trade.

I was just reading a good book and the FED after the taper tantrum, and they had to start printing again actually thought about making ZIRP the new normal because all their printing was not causing inflation.

“Thank goodness Cryptos were invented to sop up some of this liquidity to keep in contained for awhile.”

Ah someone is finally catching on!

Now take that thinking, and apply it to 401ks when they were created in the 80s………

Maybe more durable in some ways MS, but it is definitely WAAAY too early to say that after 109 years of FRB compared with the thousands of years of precious metals, gems, RE, etc., and various currencies based on them such as shillings and crowns and pieces of 8.

It MUST also be noted that if or if not durable, ALL the progress has been at the expense of the folks who produce ”real stuff” and SAVE, and with the benefits every increasingly going to those who play with paper and GAMBLE.

Hardly likely to be any kind of long term stable.

$600,000,000,000.00 of ”derivatives” does not seem to me to indicate ANY resilience at all, but rather what is usually referred to as a HOUSE OF CARDS… subject to complete collapse with the slightest tremors of wind, water, or wanton waste as we have seen lately.

Vintage,

The only path to be sovereign as an individual or nation state from the hegemony of the US Dollar system is through self-reliance, and to own self-reliance is to control your natural resources and possess the skills that go with it.

It’s not easy building a stable and resilient domestic order in any state or country because the battle for freedom Vs slavery exists in every corner.

Jajaja

Thanks for that excellent review MS!

Though I’m sure the FED wishes to gain more control over the system, I’m not so sure this latest trick will work long-term, before they need to do yet another trick. At some point the fat man behind the curtain must get exposed, or? Or is this just the transition to the CBDC?

The current $5.5 trillion in reverse repos plus excess reserves has become the monster in the closet that needs more skittles or it will flip over the bed and eat your children.

So much money sitting there on the proverbial sidelines that the sidelines are now dictating the game.

If only we spent 1/4 of that on housing the people on the streets instead of giving it away in essence to frickin banks that park their cash and sit around flatulently and snacking while producing nothing.

If only the people on the streets in the USA were as important as Ukrainians.

There is an implicit and common assumption that the Fed controlling interest rates is a good thing. Many, including me, believe that the free enterprise system aka capitalism, cannot function properly unless the market is allowed to set all terms of interest rates in all locations and circumstances. The Fed has got us into this mess. Why should a “better” Fed make things better? They are only making the impending disaster worse.

Bruce, monetary operations are such that “the market” can only set rates further out the curve — the Fed basically controls anything under 3 months, and if they didn’t pay interest on reserves (or return to open market operations) the overnight rate would fall to zero.

And you think China ,will stand by and watch ,lol

Most of these guys are academicians who never had to meet a payroll. Their view of the economy is “theoretical” not real world. Moreover, one has to wonder how many members of Congress ever too Macroeconomics 101. It’s depressing.

curiouscat

The elites, PHDs…..live in a bubble and can’t see around the corner.

That’s funny. I have a PhD in Electrical Engineering. I do well, I am a PI leading satellite based sensors development for NASA.

I don’t consider myself to be an elite. I put myself through undergrad doing framing, roofing, sheet metal work.

I graduated with college debt and a lot of credit card debt. All paid off and I do well. Getting my kids through college and saving for retirement.

I read recently that Jared Kushner had started working out because he was optimistic that technology would advance enough that he might become immortal.

People with PhDs are educated. Billionaires are elite.

Don’t say elites. Stop.

That is cringe and subservient. Call them kleptocrats or something else. Anything else, call them hyper parasitic space donkeys. Why is anyone so low in self estimation that they even conceive of “elites” above them? And why gab and kvetch about it?

Because they are taught so.

Being a rich thief is not elite. Calling them so identifies the caller as a simp to plutocracy stuck in predefined slave language that maintains a cycle of abuse where plebes give patronage and assuage the mental consequences of supplicating beneath, and genuflecting to, a group of property owners that will do nothing for them.

Label thieves correctly. Stop saying elites. There are no elites. there are only people

They are “elites” in the sense they think they know better than free market forces. That cant seem to envision the ramifications of their decision making. They are blinded by their certitude.

They toss out historical considerations…”We must unlearn what we know about M2″ (J Powell, after an M2 surge and right before the spike in inflation that they first colored as “transitory”)

It is their hubris to which I refer.

They plowed ahead with 120 billion a month of purchases. There were plenty of observers who said that was insane.

Wolf, you mentioned previously that the Reverse Repo Facility could be unwound from it’s ~$2.3T to 0 in theory.

1) Would this not put assets back onto the Fed balance sheet that they are no longer lending out? Where does the collateral (Treasury securities) come from on the Fed Balance sheet that they use to lend?

2) If the RRP Rate was dropped to 0 again like in 2020, would the banks themselves be able to meet their collateral requirements? My understanding was part of the need for this facility came from a rule change in 2020 that did away with collateral requirements for banking system. in 2021 they found themselves under collateral requirements again and very short of meeting the requirement, hence the need to borrow form the Fed

1. The Fed accounts for RRPs as contracts and a liability (money it owes). The contract specifies that it “lends” (not sells) something and gets cash in return until the next day, when the Fed gets its stuff back, and the counter party gets its cash back, plus interest. The RRPs do NOT lower the assets on its books. It still owns those assets that it lent out and carries them as assets. So when the RRPs vanish, it doesn’t increase the assets either.

2. Not sure if I understood your #2 correctly. But I’ll try: Most of the counterparties of the RRPs are Treasury money market funds, not banks. Banks put their excess cash on deposit at the Fed as “reserves.”

#2 was bad Youtube education. Someone was claiming the banks themselves were short on collateral and thus the need to borrow these treasury securities

You are immensely helpful! Thank you for everything you do

I was a bit player landlord with 4 houses in 2011. But my associates went all out with leveraged purchases, then brought in investor purchases, which presumably were equally leverage, perhaps to the hilt. Now investment properties don’t have to be more than 3% down, and they weren’t required to be 30 yr fixed, especially if you brought in 25-50 homes at a time, which they did. They probably grabbed the lowest interest possible, e.g. variable. So Wolf, I’d like to find out just how much of the REIT/investors own homes with variable rate, 3% down mortgages right now.

“just how much of the REIT/investors own homes with variable rate, 3% down mortgages right now.”

More than anyone will admit – and it is worse in commercial loans which have not only low variable rates but shorter terms and balloons. Banks are about to get fatter on QE low interest geniuses.

Sometimes statistics are not compiled due to the implications of the resultant facts.

Don’t spook the horse. Get it back to the saloon first then sell it, have one last drink and ride out of town.

Given the negative (for now) EFFR and the 4.4 percent projected unemployment rate one year hence, it appears that the Fed is content to let inflation “run hot” for a few years as recommended by some professional economists (morons in my view). With luck, QT will do the heavy lifting in the background and end inflation ahead of schedule.

If it takes the same kind of QT now that it did in the 1970s, it will take anywhere from 3 to 7 years for the current policy to wring out the inflation. See my comment below.

Sure looks that way.

The problem the Fed doesn’t get is their “projected” calcs on anything are just wild ass guesses, which certainly explains the “transient” inflation they’re now raising rates into.

They’re idiots, so they’ll overcorrect just like always, and unemployment will skyrocket like always, and we’ll have yet another massive crisis like always. Honestly, the pattern is easy to see, but most Duhmerikans don’t like history. And the Fed certainly refuses to learn from it, otherwise we wouldn’t be staring into the depths of yet another GFC’ier GFC.

Well said. Curious what they’re projections are based on.

It’s worth keeping in mind that Fed’s policy options for fighting inflation today are not the same as in the 1970s. Do we understand the differences?

In the 1970s, the Fed repeatedly “raised interest rates”, with at least 3 premature policy “pivots” along the way, and inflation was belatedly vanquished after ~12 years. But there was another parallel change going on: the monetary base contracted from ~7% of GDP to ~4%. Raising rates alone (early 1970s), without reducing the monetary base, was apparently not sufficient to stop inflation.

What if reducing the monetary base (QT) is much more important than raising interest rates? Today they are separate policy options. How do we know we have the right balance?

If it’s QT that “fixes” inflation, it will take several years to get the same amount of tightening as was applied in the 1970s. That’s gonna take a lot of Fed meetings!

Yes does raising the base rate even work when you’ve flooded the system with printed funds without an attached debtor to feel the pain. The rate rises aren’t working….

The very fact he’s weighed in with “future guidance”, people must be desperate to dump dollars for real estate and nobody will care about 4% with housing going through the roof.

What I also wonder about is how long the Cantillon effect is, because interest rates take effect about 2 years after, you assume that the money floods in maybe 2 or 5 years, but what if its longer? What if we are seeing money washing in from 2007, because you can imagine swilled around in assets for over a decade without the rich increasing consumption, in that case the reduction in the monetary base would have to be more like cutting by half at least.

https://fred.stlouisfed.org/series/BOGMBASE

Really its kind of frightening if you think about the consequences of a dollar collapse and its a shame because the constitution of the states to be specifically on gold was -entirely- about avoiding this.

My money is GBP and I don’t care what Bailey does, I have no interest and will never have any interest in holding pounds, confidence is something that is lost once. How extremely stupid and greedy the authorities have been. Whenever you look at any economics blog, the advice is to dump the dollar. Always.

Agreed. They should slow the rate hikes and increase the pace of QT.

Nope, we need higher rates to kill off the unicorn companies that havent been able to earn a single penny in profit for years. The VC money is gone, they cant roll over their debt, theyre dead companies walking and raising rates is the stake through the heart that the markets need to clear out the deadwood.

Based on the last meeting I recall hearing that everything was going to be data driven. From the notes Wolf presented I don’t see a whole lot of that being put into use. They still seem like there is a lot of statistical math behind the scenes and prognostications driving the numbers. I agree that this is a balancing act of monstrous data sets which are being tweaked oh so gently. I just wish they acted as rapidly to increase as they do during crisis mode to drop to zero and pump nearly infinite dollars into the system at will. The reverse seems to be like a funnel. Easy in but not easy out

The problem is these clowns openly invite political pressure through their communications and behaviors. There should be no communications from the Fed, other than policy decisions. No forward guidance, no commentary. If the president doesn’t like the Fed chair, he can fire them.

The president cannot fire the Fed Chair. They can select a different official after the four year term runs out. Powell was just re-elected. And yes, I acknowledge that Trump threatened to come up with a way to do this and if I recall even he was unsuccessful.

Venkarel,

Just between you and me here: your fake email is so long that you can never remember how to spell it, and each time that you spell it differently, you started out as a new commenter and go into moderation. So I recommend that you simplify your email to something like 4 letters @ 8 letters dot com

Wolf,

Check, dial down on security. The funny thing is I use the autocomplete feature so they should be the same. The problem is probably that I use different email addresses or that I wipe all cookies after every session.

Wisdom

“What if reducing the monetary base (QT) is much more important than raising interest rates? ”

That is a great question. But as noted in a Wolf article, how much can the Fed reduce their balance sheet, ie withdraw that which they created?

They don’t seem willing to sell their 2.7 Trillion in MBSs, nor their 1.4 Trillion in long maturity treasuries. The bank reserves will stay because of the interest paid on those reserves.

No one will buy mbs

“The housing market will have to go through a correction … to where people can afford housing again”. While I try to ignore the Fed’s rhetoric because it can detract from their actions, that really is quite a statement. It will reverberate.

With regard to the chart, “CPI Inflation v Fed Funds Rate”, I can’t help but notice the rapidity of the decline in the rate of inflation once the examples of highly elevated inflation from the past start to pivot. While not in any way meant as a criticism, the chart doesn’t incorporate QE/QT, nor can it, but to my mind that is why it isn’t as guiding as it is perhaps intended to be.

It’s an especially big because of what Powell is doing when he makes the statement.

If housing prices were unaffordable when Powell started this process, how much do they have to fall to make them affordable when the mortgage interest rate is 5 or 6%? It seems like that would be “a lot”.

“how much do they have to fall to make them affordable”

Or. . . . how much do wages have to rise?

They have to eventually meet somewhere to balance the supply and demand.

No reason to believe inflation adjusted wages are going to increase much if at all for the foreseeable future. It took the biggest distortions in history to keep median incomes and median net worth flat since the late 90’s.

Yes, I know that mortgage payments are paid out of nominal income. My point is that whatever improved affordability occurs from wage increases to pay monthly payments should be more than offset by whatever else happens. If it’s inflation as now, any wage increase will be more than offset by increases in other living costs and housing still won’t be any more affordable.

There will be no surge in prosperity after 20+ years of “can kicking”.

The majority of Americans are destined to become poorer or a lot poorer over the indefinite future.

Augustus,

I concur, any increase in wages and the recent surge in unionizing will only feed inflation further passing the cost of production/services back into the market.

I expect an increase in the supply of housing for rent, reducing the supply for sale. I don’t think real estate will suffer too much where there is strong employment as long as wages are high enough to feed the bottom of the market.

In one third of Canada population wise you can’t find a studio apartment for less than $450,000. That’s with prices down about 20 percent already this year.

Good question.

A thing I ponder is what is affordable and at what income bracket would be the target?

There is more affordable housing than people realize but most people do not want to live in those areas or there is no jobs.

/sarc

So lets create a lot of jobs in San Fran or Seattle where we cannot build affordable housing. Who’s fault is that? Is it all the companies who want to be headquartered in San Fran or is it the people who take the job there and then complains about high housing prices.

So the good times of cheap borrowing and credit paying savers nothing is over. I have no sympathy for those that mocked us for saving my money for decades and pulling the low interest rate rug from under us. We are able to live decent now with soon 5% interest. We would rather be cheap than live in fear of being in debt and getting kicked out of our home.

Our house is paid off, no debts, no credit cards we use, no car loans and likely 35 years of income before we even come close to cutting our principal’s savings in half.

Credit cards are a tool ,you can use to your advantage.Just pay off balance monthly,get cash back rewards .Simple reverse manipulation

30 year mortgage rate record low of just 2.65% in January 2021. My how time has compounded interest rates too 6.5% today. Everyone has enjoyed all the free money and vast asset appreciation. We must continue to be grateful to the Fed, Wall St., and Congress. Americans are flushed with cash and the dollar is king.

As a working class individual living in a high value, tech monied city (San Francisco), I would love to see housing cost come down from the stratosphere! Lived here for 18 years and have never been able to even consider buying a place of my own. I’m not holding my breath but we shall see!

Live below your means,save money .it is attainable

The byline is when inflation comes down, so do corporate earnings. Powell kept talking about the good old days of 2% inflation ( we remember it as financial repression). The GDP fantasy dot plots were interesting. He got some blowback in Q&A. Market Stability appeared to be a dog whistle to Wall St. but the event was programmed, as Wolf noted, (3/4 should have been taken as better news than a full point, but it didn’t matter). Inflation is coming down (and earnings) Rate hikes aren’t affecting inflation (he said that), but they provide some lift when they come off, after the market drops far enough to make them care. And with that in mind Wall St set their sights on that (illusory) goal, or capitulation, which should have the effect of stimulating the economy (releasing more bottled up equity). Mortgage bankers aren’t going to mark down their assets, and nobody is going to sell into a falling market. They enjoyed the boom in RE, which didn’t entail Equivalent Rents, now they catch the backside of that.

It also helped inflation back in the late 70s and early 80s that oil prices dropped from a range of $70-$140 down to $20-$50. I seriously doubt that will happen this time around.

Something else is going to have to give. Time to raise cash and pay down debt, if you havent already. This is gonna be a long ugly haul.

The Fed pivot might be a fantasy at the current moment, but as soon as the economy really goes to the dogs, I would expect some eventual loosening of money policy again. However, if the recession leads to stagflation, then I suppose money policy would need to remain tight.

And as others have pointed out, all the leverage and asset appreciation experienced over the last 2 decades is likely to revert to the mean. If that all goes on for an extended period of time (e.g say the next decade) the results could be really painful for the working class.

As an aside, it seems to me Powell isn’t at war with inflation as a whole (he’s seems perfectly fine with it since it erodes the national debt), but rather the oligarchy are heavily leaning on him to put a stop to all the recent increases in working class wages.

It will be a lot more painful than just for the working class. Working class will feel it through employment.

It’s the more affluent than will be in store for a rude awakening. The working class presumably have lower expectations while the “mass affluent” (roughly from the 80th to 95th percentile) have benefited from increases in fake wealth and high paying employment (often with stock incentives) from a fake job market.

In other posts, I’ve noted the difference in number of billionaires recently (735) versus 1982 or 1983 (13).

It’s not just billionaire but (multi) millionaire numbers which are hugely inflated from the last 25 years of substantially fake prosperity and it’s this group (with a few percentiles above them) which is big enough to keep the economy afloat in recessions as long as the asset mania continues.

Once the asset mania is confirmed as over, it will be long ride down of decreased wealth and decreased consumption for many of this group.

From your lips to God’s ears.

I’m hoping for a soft landing. It means rates can stay high. It’d be nice to get 5% risk-free interest again.

In contrast, Wall Street wants a hard landing that reopens the door to more ZIRP, QE etc. Running boom & bust policy leads to a boom & bust economy.

Wealth One Bank of Canada is paying 5.18 percent for a 5 year guaranteed interest rate certificate. Ironically Wealth One Bank of Canada is a Chinese bank in Canada. In Canada they only insure 100 thousand. Manitoba, Canada credit unions insure apparently an infinite amount of money.

A transcript of every speech we’ve heard since Truman said the war’s over: “They’re coming to take me away hee hee ho ho ha ha, to the funny farm where life is wonderful all the time!”. Took a full century last time to play the greatest joke ever…selling out the Republic. Only took 20 years this time…It’s all gonna be just fine. Yeah, right. The day Powell & Company are wearing federal jumpsuits and pounding nails to build habitats for humans is just around that same corner where prosperity is hiding…right next to the printing house across from the digital mint on East Street near Grand Avenue.

Well, it’s over, Powell dropped the big one. Hikes until housing and inflation drop like a stone

I have not heard such a statement for decades, and now we have the ultimate financial stress test coming for Wall Street.