Some demand destruction due to high prices, particularly gasoline. Shortage of new vehicles not helpful for spending on durable goods.

By Wolf Richter for WOLF STREET.

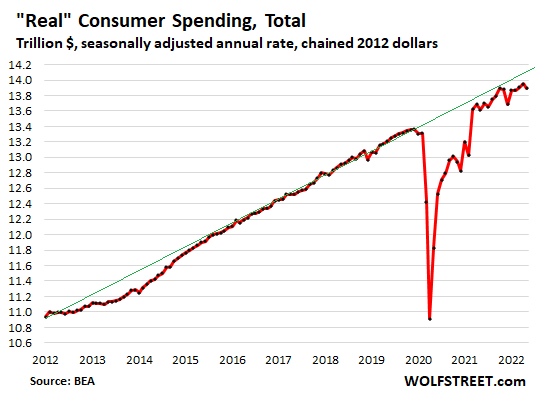

Consumers have been shifting spending from goods back to services since last year, following the stimulus-fueled spending binge on goods into the summer of 2021, and the collapse in spending on discretionary services during the pandemic. Given the magnitude of inflation these days, we will discuss all income and spending measures here in inflation-adjusted (or “real”) terms.

Spending on services rose in May, but spending on goods fell – all adjusted for inflation. The decline in spending on goods was in part driven by the decline in inflation-adjusted spending on gasoline, where the price spike is now destroying some demand, as measured in barrels per day. This economic phenomenon of “demand destruction” by spiking prices is also visible in used vehicles, and some other goods. Spending on durable goods continues to be handicapped by the ongoing shortage of new vehicles.

And overall spending, adjusted for inflation, dipped 0.4% in May from April, the first month-to-month dip in five months, according to the Bureau of Economic Analysis today, but was up 2.1% from the stimulus fueled binge a year ago, and was up by 5.2% from May 2019. It remains below the pre-pandemic trend (green line):

Spending shifts back to services.

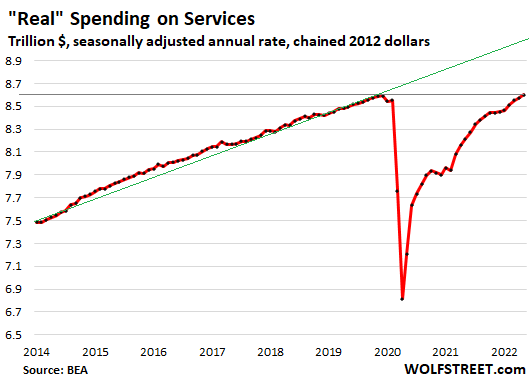

“Real” spending on services – healthcare, housing, education, air fares, hotels, rental cars, entertainment and sports events, haircuts, all types of repairs, subscriptions for communications, internet, and streaming services, etc. – rose by 0.3% in May from April, and by 4.7% year-over-year, and by 1.2% from May 2019, having now edged past the pre-pandemic high for the first time. But it remains well below pre-pandemic trend (green line in the chart below).

As consumer spending patterns continued to normalize, the share of spending on services rose to 61.9% of total spending, the highest since before the pandemic, and up from the 59% range during the stimulus-fueled goods-spending binge last spring. But consumers have some way to go: The share of spending on services remains below the 64% range that prevailed during normal times.

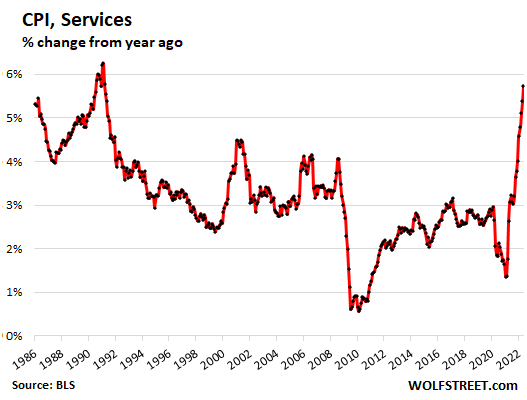

In terms of inflation, this shift in demand from goods to services is also showing up in the CPIs for durable goods, where some of the blistering heat is getting less hot, and in the CPI for services, which has started to spike:

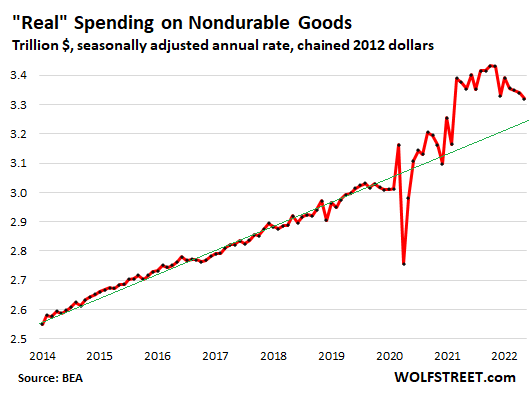

“Real” spending on nondurable goods, after stimulus binge, declined, still at high levels.

Inflation-adjusted spending on nondurable goods – food, fuel, household supplies, etc. – declined by 0.6% in May from April, and was down by 1.0% from the stimulus-miracle spike in May 2021. It was still up by 10.8% from May 2019, and is reverting to pre-pandemic trend (green line)

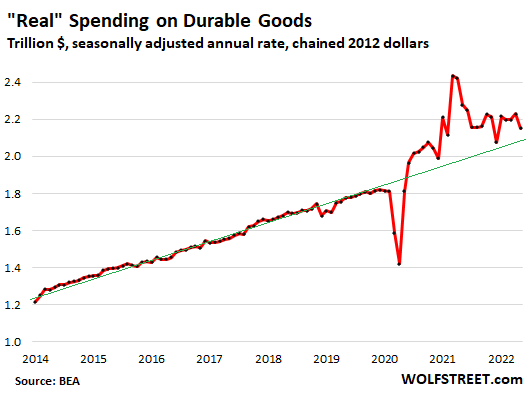

“Real” spending on durable goods falls, still at high levels.

Inflation-adjusted spending on durable goods fell by 3.5% in May from April, and was down by 5.6% from the fading stimulus miracle in May 2021, but was still up by 21.1% from May 2019, and remains above pre-pandemic trend.

The biggest component in spending on durable goods is new and used vehicles. Spending on new vehicles is limited by new vehicle shortages – consumers cannot buy what dealers don’t have – and new-vehicle inventories remain desperately low, and sales are way down because of these shortages.

“Real” income below pre-pandemic trend.

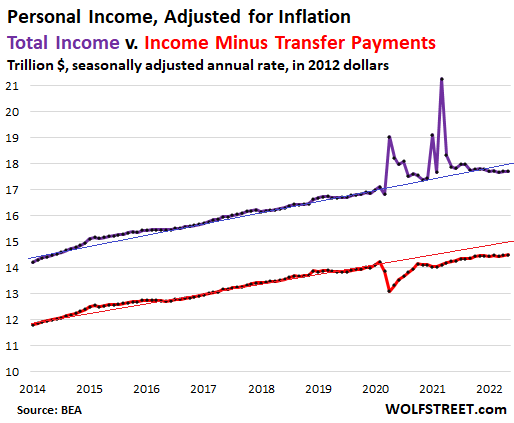

Personal income from all sources and adjusted for inflation dipped 0.1% in May from April, and fell by 1.0% from a year ago when the stimulus money was still flooding into consumers’ coffers. This includes income from wages and salaries, dividends, interest, rentals, farms, businesses, and government transfer payments (stimulus, Social Security, unemployment, welfare, etc.), but does not include capital gains. This real income from all sources was up 6.0% from May 2019 (purple line).

Personal income without transfer payments and adjusted for inflation edged up by 0.1% in May from April, and by 1.8% from a year ago, and was up by 4.7% from May 2019. It has remained stubbornly below pre-pandemic trend as income increases have not kept up with inflation (red line).

Per-capita disposable income, adjusted for inflation… you guessed it.

The income trends laid out above describe dynamics in the overall economy by all consumers combined – they’re designed to be a measure of overall income, and not of the income of the average consumer. The difference between the two is population growth, which cuts the income pie into more slices.

Then there is an additional element: taxes. After consumers get through paying taxes on their incomes, what’s left is “disposable income.”

Those common economic terms are a hoot when you accidentally think too long about them: The consumer’s sole purpose in the world is to “consume,” which means spend their income, first on taxes, and then “dispose” of the remainder by paying for other goods and services.

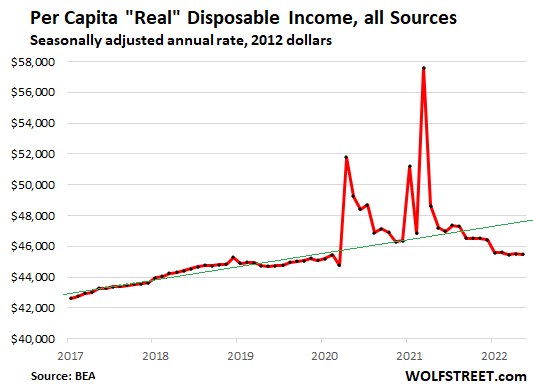

This per-capita disposable income – per-person after-tax income from all sources – adjusted for inflation, dipped 0.1% in May from April, and was down 3.6% from a year ago, but was still up 1.8% from May 2019.

After coming down sharply from the stimulus miracle period, per-capita “real” disposable income has remained essentially unchanged for four months. It fell below pre-pandemic trend in September last year, as inflation began to out-surge incomes, and has since then fallen further below pre-pandemic trends:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The two I am really keeping an eye on, are real disposable income, and consumer sentiment. Both are looking dismal. Atlanta Fed has cut it’s estimate for real GDP, growth in the second quarter of 2022 has been cut to a contradiction -1.0%. Not exactly what I would call a “strong economy” but then it’s not my job is not lie to the public….

Most economists are still predicting low but positive growth for Q2, as Atlanta’s forecast acknowledges.

A negative Q2 number, combined with Q1’s, would be a technical recession, but NBER makes the final call.

In any case, if the US economy shrank by ~0.7% (not annualized) in the first half, it’s still considered a mild downturn.

Jdog,

According to the small print of the GDPNow release today:

Estimate for Q2 real consumer spending was +1.7%, which is pretty good.

What killed it was the -13.2% plunge in “real gross private domestic investment”.

So this negative GDPNow print is NOT related to consumers but to private investment.

Most economists are wrong most of the time. You cannot sustain spending without income, unless of course you are the Federal Government, and can print the money you do not earn. We are currently seeing money begin disappear at a pace not seen for some time as 401K’s and home values sink. In my area, which is considered a booming economy we are seeing restaurants begin to close on a weekly basis. Inflation is taking its toll, and while the statistics are not alarming at this point, the overall environment is not healthy by any means. There is no doubt in my mind that if we are not already in a recession, that we soon will be. Falling personal wealth, and falling disposable income cannot induce economic growth.

Consumer spending in a high inflation environment is a misleading indicator of the economy because you have a situation where people are paying more and getting less. That is not exactly growth by most peoples definition.

ALL spending data in this article and in my comments is “real” — meaning adjusted for inflation, not overall CPI inflation but the specific category inflation; for example, spending on gasoline is adjusted for the price increases of gasoline.

ALL income data in this article is adjusted for inflation as well.

I explained all this in the article.

Based on government “statistics” which are fantasy to begin with.

I cannot wait for them to adjust their hedonics to say we are actually deriving benefit from getting less quantity in food packaging because we are all over weight to begin with, and therefore are getting more by getting less.

I felt bad for you being the only comment. So…here

BTW Wolf. Great article

Wolf,

Good piece, as usual.

If you are inclined, could you tell us where you usually pull the macro data from?

My guess is FRED, which is so huge that I bet there are some real gold nuggets buried in its vast depths.

FRED has a pretty good indexing system but the thing is so huge it would probably take a crowdsourced effort to explore it thoroughly.

Cas127,

From the BEA site directly. It’s easier to do that on the BEA site because you have all of it in one place when you download it, rather than having to download each time series separately from the St. Louis Fed, which is a hassle. Plus you get a lot of stuff that I cannot find on the St. Louis Fed site.

For example to get spending, go to:

https://www.bea.gov/data/consumer-spending/main

scroll down and click on “Underlying Detail Tables”

then scroll down to for example, “Table 2.3.6” and click on it.

At the table, click “Modify”

In the dialogue box choose the time frame, choose “months,” and click “refresh table”

and you’ve got all the relevant time series in one place (a lot more than I’m showing in the article).

St. Louis Fed is a real hassle, compared to this.

Translation they’d tell you anything so they don’t have to raise the Fed funds rate or raise it as much. Happens like clockwork every time interest rates are supposed to be hiked.

The Federal Reserve’s preferred inflation measure, core PCE, at +4.7% Y/Y is now 4 percentage points lower than the most commonly quoted inflation measure, CPI *including* food & energy.

I wonder what will happen if core PCE slows to 2.5-3% while headline CPI remains at 6-7%. Does the Federal Reserve declare Mission Accomplished? If so, how would they explain to the American people that their relatively obscure inflation metric is the right one?

The Fed looks at all inflation measures and mentions them all in its discussions. But the target is based on core PCE. So yes, core PCE could hit their target while CPI is still at 6% or 7%. But I doubt that Americans will let the Fed declare victory. It doesn’t matter what the Fed says to Americans, it’s what prices say. And Americans are pissed about those prices, and I think the Fed understands the significance of that.

Wolf, I think you were around during the Vockler years when the Fed had balls. What if we see a ton of layoffs/foreclosures? Americans may hate that shit more than inflation. It’s kind of why the Fed let the asset bubble run as long as they did during COVID.

But I admit I wasn’t paying attention during the bad old days when inflation was on everyone’s mind, so maybe I’m wrong here too and people care more about the price of bread than making that bread.

Powell seems like a weathervane more than anything else. I bet he’d crumple like a cheap suit to grandstanding Senators calling it the Powell Recession.

Nate,

I will answer that one. Jimmy Carter lost his re-election in 1980 when inflation was 12.5 percent and unemployment was 7.2%.

Ronald Reagan won his re-election in 1984… WITH 49 STATES… when inflation was 3.9% for three years in a row (even though unemployment had gone up to 10.8% in 1982 before dropping back down to 7.3%).

Bottom Line: Voters HATE inflation!!! Both the Fed AND the politicians know it. The fact that we haven’t had much inflation in 40 years is NOT an accident.

Many younger people are seeking the knowledge how to become more resilient, thus less reliant on services, like cooking, fixing older cars, carpentry etc. Definitely a trend here in suburbia. Talked to a couple 15 year old classmates of my daughter who have bought flip phones, because those are now cool. I gave one to them that was scratched up, had paint on it, she was delighted “So Waby Sabi”, whatever that is.

As to merchandise, we have discovered that pretty much any durable good we want is available on Craigslist, or that Orwellian data harvester, Next Door, either for free, or a very low price.

Better yet, the surplus stuff we’ve collected or saved or gotten for free over the last few decades can easily be sold on Craigslist for as much or more than we’re spending there. Winner winner!

That is an inflation beater. Although if enough people started doing that the depression might arrive fast.

Wabi Sabi is a term from Japan meaning that beauty is found in imperfection. An example given in a book I have is a young monk cleaned a courtyard, and then his master threw a handful of leaves on the clean courtyard. The clean yard was not beautiful until the handful of leaves was thrown on it.

Thanks for the explanation. I have a 10 year old that is infatuated with the Japanese culture. Thanks to Anime, I am always learning something new from him. Now I have an opportunity to share a wise nugget with him!

Chinpokomon!!

Can you use the term “Wabi Sabi” when speaking about the current economy? ……. I mean as far as imperfections go, its pretty imperfect :)

I thought most carriers have turned or about to turn off the 3G frequencies old flip phone use?

My 78 year old neighbor still has one (flip phone) on Verizon (at least she says it still works, but I have no proof of that).

The cost of paying others to do repairs on your home or car is considerable, and usually unnecessary. There is an old saying about finding the cheapest SOB you can to do a job, and in the end it is always you.

Today with the internet, people are willing to give their knowledge away for free. That is a odd concept to me because I grew up in a time when knowledge about how to do things was closely guarded by people who made a living with that knowledge.

No matter what repair you are confronted with, there is probably someone on the internet who has done a video showing you exactly how to do it. It is a great time to be a cheapskate if you are willing to put out a little effort.

It looks like there haven’t been any material changes in spending at all, but there will be this Summer.

Big cut back on driving, vacations, pet stuff like grooming, and non essential car maintenance from what I’m seeing. Discretionary spending is sucking wind

I only buy food on sale ,about 50$ a month on gas utility bills haven’t increased yet,but being frugal is a life lesson my kids,which grew up in the land of plenty which They refuse to listen ,will probably bite them in the ass

Fed has created a screaming disaster in housing market. You just can’t encourage a highly leveraged asset class widely owned to go on a big run without consequences. Now in some areas you have got a lot of new supply coming on the market, but totally unaffordable with 6% mortgage.

Yup. I’m hearing home-owning friends (who’ve ridden this ridiculous market up for the past 3 or 4 years) start to kvetch about their homes not rising at least 10% this year… and now (gulp, spill Martini) possibly declining in value. The horror.

I smile and stay mum (for now) because I wish to continue to receive dinner party invitations. Inside, I’m laughing my ass off. Popcorn.

I received an email from an old co-worker who lives in Dallas who recently bought a home before he listed his:

“……I bought at the high just 6 weeks ago. Paid cash and $50K above asking. I wasn’t the highest offer but they accepted since it was a cash offer. Closed mid June.

I put my current house up for sale June 16th. Traffic has been slow although still a good number of buyers are looking. But buyers not buying. We’ve gone from buyers buying in a day, multiple offers above asking, sight unseen, as is, writing appeal letters, etc, to a market where buyers suddenly find any reason to talk themselves out of buying.

I’m stuck for now. The classic buy high sell low situation. Guess I deserve it. Doesn’t feel good. I just didn’t know it could change this fast. It literally changed in a week. The week of June 12th. At least here in the Dallas area.

Now I own 2 homes. We were trying to downsize and be closer to the grandies on the other side of town. Not sure how I’ll proceed. But the bubble has definitely burst.”

I know this should be in Wolf’s RE article, but I couldn’t stop from posting it here. Anyway, it’s all part of the meltdown that’s in process.

Economist also seeing suggests you can see some shifting if you compare the pecpi to the cpi, although the focus is more on that the cpi might be the wrong thing to focus on.

Overall, I sense some elements of wall street gathering to talk down rate hikes for various reasons, maybe the housing price spikes as that will almost certainly lead to recession if there is a collapse or significant correction in prices. We might need wage inflation and a tight labor market to get out of this mess.

“We might need wage inflation and a tight labor market to get out of this mess.”

There already is a historically unprecedented tight labor market. Where have you been?

There is no escaping “this mess”, not in the manner you seem to be implying.

The country has been living beyond its means for decades, borrowing from the future and the rest of the world to consume above production.

No matter which door anyone wants to choose, every single one either leads to a noticeable decline or crash landing in living standards.

The current environment of high price inflation means those at the bottom and middle of the income and wealth distribution get hammered. Many above that too. Any attempt to increase wages for most or all of them just means more outsourcing and offshoring in the near future which means more unemployment later.

The end of the credit mania (regardless of FRB monetary policy) means the end of cheap or at least cheaper credit for the population which was the only way the majority can and could afford their lifestyle. It also means the end of the asset mania (an ultimate crash landing), a reversal of the “wealth effect”, and the end of financing for uneconomical companies and business investments.

My prediction is a combination of both, the opposite of the experience during most of 1981-2020. During this period, interest rates fell, price inflation was “moderate”, and asset prices soared. Now we get rising interest rates, higher and eventually much higher inflation, and crashing asset markets.

The majority of Americans are destined to become poorer or a lot poorer.

For the first half of the year stocks had worst performance in the last 60 years. And bonds had worst ever. Wait for the housing market to tank. Feeling rich will be distant memory for most.

That’s interesting. It doesn’t feel nearly bad enough yet to me. Guess that’s because the propping up of these markets has been unprecedented.

Yeesh Augustus. I wasn’t saying that we were not already in a tight labor market. That’s pretty obvious. But wage inflation only increased from around 3% to 5%. That’s not going to cut it to fix the bad price to income ratios for housing, price to rents, etc. (i.e. the fundamentals).

Also, let’s lighten up on the doom a bit. Maybe you’re right and we’re Japan 2.0, with assets never to return to their lofty heights. It’s possible, anything is possible! But I’m skeptical. We’ve recently been through a housing boom and bust, and a bunch of crazy booms and busts in the stock markets. If you dollar cost averaged and and held, you did alright over the long term, even if it seems more volatile.

I remember all the sky is falling talk in the early 2000s and the early 2008s. Panic speaks just as loud and certain as mania.

If you were like most workers and stayed out of the markets, you got fucked by the last 50 years. Pretty much all the productivity gains went to the top. Of course, the average worker only starts playing in the markets when they’re at the top, so there go those meager wage gains.

I don’t buy that inflation hurts the poor more than the rich. We just went through an low period of inflation and the top .01% never had it so good. Guess who owns the media that tells us how inflation is such a scourge to the poor and we need to put a stop to it, the tight labor market, and the risk of wages going up?

Finally, re debt — credit card was kinda flat or went down during COVID, while the huge jump was housing relating. Considering that lending standards tightened, the guys who gorged on debt this time were mostly the middle class and above buyers and the investors (most of them being capitalized by upper-middle class and the rich). This isn’t a poor people got loans by lying on their mortgage applications scenario, best I can tell.

Yes—

Augustus will be correct on the end, but the road there may be a ways away. Long term trend change doesn’t turn on a dime. That is, the S&P top of 4700+ will probably be re-tested, maybe surpassed significantly, and the topping process might even take a couple of years. I also think we could get one more furious bond bear-market counter-rally (that could even last a year) that temporarily brings interest rates back down significantly.

Nate, I’m pleased to see someone else isn’t buying the “won’t you think of the poors!” where inflation is concerned — if nothing else it benefits debtors at the expense of creditors and I find it hard to imagine that many of the latter are among the poor.

The poor have minuscule amounts of debt because they don’t qualify for debt. And what little debt they have, may be credit card debt which is variable interest rate debt that goes up with inflation and therefore gets harder to pay off with inflation. The wealthy can leverage everything, including their multiple homes, their vast financial assets, the shares in their companies (think of Bezos), etc. The wealthy hold a huge amount of debt and in terms of their debts, they’re huge beneficiaries from inflation.

If you close the borders and terminate all trade America will be just fine, and we can pay our workers a fair wage.

Offshoring depend on the relative value of the US dollar. It is not for sure it will hold it`s position.

With apologies to the old Scotiabank promotion, “you’re poorer than you think” …

Hi Wolf – great article as usual – thank you!

Question, within services you’ve covered inflation numbers for how much the various categories are increasing, but do we know what percentage of consumer spending the categories make up?

Lower inflation numbers in higher percentage of income essential categories like housing should push down the overall volume of optional categories like travel, even if travel is seeing higher inflation rates, right?

If I understood your question correctly, you’re looking for inflation data by category of services?

If yes, you can find all of this here:

https://wolfstreet.com/2022/06/10/false-hopes-of-peak-cpi-inflation-prices-of-services-housing-food-fuel-spike-dollars-purchasing-power-goes-whoosh/

I understand that these figures are for the overall economy, but the vast range of income levels in the US makes overall figures somewhat less useful than they would be for a country with a smaller income range. The effects of the current economic environment are quite different for people in various income categories, and it would be helpful so see information about how people in various income categories are responding to the current and projected economic environment.

Average, median and mode. Even the resultat CPI calculated may shift depending on what is looked at.

What on earth difference would any of that make?

The second someone even hints at wealthy folks having it much easier on here you always lose your sh*t like they’re coming for YOUR Lexus RX in particular.

For a start, the weight different items carry in the calculation of CPI depend on what people spend money on. Someone with 25k dollar a year income spend them different than someone with 250k income. The calculated CPI would then differ for these two groups.

CPI is a government generated statistic. The government lies about everything because that’s what governments do.

If you are basing decisions based on government lies, then your results will reflect that.

I agree, Swimmer. Much f*ckery is hidden among the averages when no consideration is given either to the income or wealth distributions. It’s so consistent as to be evidence of malfeasance rather than mere oversight.

Wolf – you see the RH update to their forecast? Demand slowed fast enough from June 2nd -> June 28th to push their YoY revenue projections from 0 to +2% -> -5% to -2%. In four weeks.

Shift away from goods -> services or pricing friction on the higher end from consumers? Wonder if this is finally peak inflation.

Peak Housing Cycle demand inflation. Still have underlying secular inflation from unwinding 40 years of cheap energy, cheap credit, and cheap labor.

Peak inflation for durable goods was already a few months ago, unless it re-heats again. Inflation for services is spiking straight up.

I am guessing services are about to see demand destruction as people look to save money by making their own food and mowing their own lawn?

Possibly for some services, but I can assure you, there is no demand destruction for hip and knee replacements. The place my wife went to for her new knees is packed all the time and they are booked many months in advance. The boomers are getting old.

ru82,

I already contributed to the demand destruction during the pandemic by learning how to cut my own hair, and I’m getting less bad at it, and I’m not reverting to the barber who died anyway. So there is some of that going on, though I think — and the services chart seems to prove me right — lots of people stopped cutting their own hair and doing their own root canals and fixing dented quarter panels in their garages and they’re now gladly returning to the pros that really know how to do all that.

From what I see out there, people are spending money hand over fist on services — just got back from our mini-vacation. People are out there traveling and spending despite sky-high prices, that’s for sure.

For posterity (right or wrong): I think we’re in for a hard landing. Fed’s hands are probably tied b/c RUS-UKR war and China Zero Covid, and OPEC+ claims they don’t have capacity to pump. Prepare to be punched in the face, again.

They had 6-7 perfectly good years to start raising rates. But not for these over-educated dummies. They had to wait for one crises after another to start QT. It’s not like they will lose their jobs or anything.

I’m with you Nate, and andy is deluding himself if he thinks earlier rate rises would have changed any of the factors you itemize.

This all makes perfect sense when you realize that the value of our money is declining at the same time as global supply chains. So as the difficulty and expense of getting new products grows it becomes necessary to pay someone to fix your old car, or boat or just say heck with it and spend the money on mojitos or gambling. This is pretty much what happened in Cuba after the revolution. Keep the 56 chevy running and the rest of your paycheck goes for services as there is not much to buy.

Inflation definitely dropping for commodities but services definitely increases cpi

High inflation is here to stay for a few year my guess, with that said normally housing was the best bet during inflation. So it seems in the comment people are favoring a hard reset of all types of assets. Im missing something ?

Whelp, some of us are thinking if you want housing to not crash you might need wage inflation and Fed needs to go slow. Others believe that assets need to be reset NOW because we’re pretty much already in an asset bubble and the hour is late.

I guess it depends on whether you have a lot of assets (S&P 500, houses, etc.) or sitting on a lot of cash and gold as to what people “favor”? People tend to talk their book.

I spread my bets pretty far and wide when US markets went cray-cray, like the good passive investor I try to be, with a close to equal weight between US and international/developing, dollar cost averaging my paycheck, so I’m not that concerned, honestly. I don’t buy the everything is a bubble. Housing looks bubbly, US tech most certainly was, and crypto was tulips 2.0, but p/e ratios in developing and international markets don’t look terrible and the US p/es are kinda getting close to normal assuming earnings don’t fall off a cliff. But maybe I’m talking my book.

If I bought during the GR, I’ll dollar cost average my way through this next phase. But I also expect to be punched in the face repeatedly as I check out my balances.

Housing probably isn’t the inflation hedge it used to be because now it’s a highly leveraged market making it very volatile.

“The share of spending on services remains below the 64% range that prevailed during normal times.”

I understand what you mean but the pre-pandemic economy was anything but normal either.

According to FRED, “real” median household income and net worth essentially flatlined for two decades (1998 and 1999) prior to 2019. The top of the distribution (from both) kept the economy “growing” substantially due to the asset mania while the economy generally benefited from and gorged on artificially cheap credit.

If I remember correctly the US kind of went on a bar and restaurant binge for a decade or so before the pandemic. I remember Stockman used to always show how a lot of higher paying manufacturing jobs had been replaced by these drink and food service jobs.

Not sure the structure of the business allows for the higher wages now in place without inflation which Powell will kill.

Inflation is a party politics problem. Deflation is a social order and fiscal collapse problem. Guess which one the G always preferred?

The labor shortage and supply chain problems are definitely harming spending on services. I need some car crash repair work done and shops won’t take my car for 2 months. Kitchen floor replacement, 3 months.

Watch u tube do it yourself,usually pretty easy

@flea….says the person who has never actually probably done auto body repair or floor work for anyone other than their mother-in-law…and she’s still mad.

Wolf, ZH just came out with an assessment that the Fed is paying out around $250M *every day* in interest for funds parked in the enormous $2TN+ RRP facility, and bank ‘reserves’. Care to comment on where this interest money is coming from, ie is it just made up/minted every day?

Dora,

#1. Why would I give a f*** about what ZH says?

#2. Apparently, ZH/you? don’t know that the Fed earns about $122 billion a year in interest from the securities it holds (it did last year). That’s an income of $334 million a day. That’s enough to pay $250 million in interest on PPRs and reserves and have a profit of $84 million day.

#3. Sheesh.

#4. What goes on on ZH, stays on ZH. Don’t drag this BS into here.

#5. I cover the Fed’s income annually in January, when it is released. For 2021, read this:

https://wolfstreet.com/2022/01/15/the-fed-released-its-preliminary-financial-statement-for-2021/

ZH info is so cut-n-paste for their own narrative of doom and gloom.

I have read some of the ZH articles that were very bearish and then I went and read the link or report that ZH was referencing, and it was very bullish. They now how to spin any info into a doom porn.

My point is ZH is fun to read but is 90% misleading and their facts are very sketchy.

ZH publishes Michael Every of Rabobank’s newsletter which I find good (follow the links!) and I also find some of the stuff they publish from Nomura interesting.

I believe the real point of that article was about the effect of these interest earnings on the organizations receiving them, not the effect on the Fed, which clearly can “afford” to pay them. Over time these payments can add up to quite an income for these organizations.

I see big increases in this month’s bills: auto insurance, Internet service, etc.

The crowds are not yet at the pain point to exercise some discipline to control this. As usual, it must drift into a real cruel joke level, first. I hope they are having some fun, though. The youths have missed some times I got to enjoy in a very carefree way.

Those things are priced on an annual basis (sometimes 6 months for auto insurance) and are not subject to change monthly.

Micron just warned……big time business downturn……..the semi’s are more sensitive than housing.

Be sure and raise rates Jay……you moron.

Is there any move from here, in which you will not blame Jay?

You are understandably correct……I do sound like a broken record.

However, its not just demand……and the answer is not a serious recession or depression. To explain further would take longer than it’s worth.

Ah, inflation is 8%. Housing prices up 20% from last year. Jay needs to raise rates for several quarters, then keep them higher.

Don’t fight the Fed, or you will lose money.

I am remodeling one of my rental houses.

3 people pulled up this week and told me to stop working on it and they would by the house immediately.

The house fixed up would probably sell for 140k fixed up and rent for 1100.

Received to calls calls out of state this week of investors wanting to by the same house.

Sub 200k housing is still hot in my area. Makes sense since inflation is still higher than mortgage rates.

$140K? It is hard to believe there are still houses that cheap. I imagine the market for cheap housing by people retiring and looking to live affordably, will keep the demand going, until prices increase. I believe I read that about 10K people a day are retiring in the US now, many of them are not in a good financial situation to do it.

fred flintstone,

Inflation is by far the biggest economic problem the US has, not a popping stock market bubble. That’s not a problem anyway. The Fed shouldn’t have created that asset bubble to begin with. Then we wouldn’t have that kind of serious and shitty inflation problem.

fred flintstone,

So I just looked at it (beyond the headline). The issue is in China, consumer spending on tech products in CHINA. Micron said it cut its revenues projection for China by 30%. So you need to make your recommendations to the PBOC, not the Fed.

Sloppy work on my part……its been a long day…….but profitable. Thanks for always being on the job.

Aside from my sarcasm…..I do want the fed to raise rates. I’ve got tons of cash waiting for it. Just frustrating why he didn’t move earlier…..but there goes that broken record again.

Have a nice night. I need some sleep.

It’s pretty clear that Fed kept their foot on the gas one year too long. How do they soft land taking the last year of housing appreciation back?

Every person demanding more consumption is feeding the problem. The (current) problem will subside with demand destruction. That, or a miracle increase in productivity — and don’t hold your breath for that. So there will be one kind of pain or another. There is no painless path.

“a miracle increase in productivity”

Cut worker compensation and you can increase productivity and destroy demand at the same time.

“There is no painless path.”

The billionaire class feels no pain. Still, one must pity the children, knowing they have no future.

LOL You will not see a meaningful increase in productivity until the average worker gets a reality check. Most young workers I see today are pretty much worthless. Most do not even know how to do their job. They think they should get paid to show up and play on their cell phone.

That, in my mind, is the biggest problem the US faces today, a unproductive workforce. I guess that will all change when robot’s become the primary workforce.

But what will the robots spend their money on and consume? ;)

More seriuos, the workers are also the consumers. No consumers, no market.

Automation seems to be the answer ,no people to deal with

You will still have to deal with them….. probably camped out on your front lawn, waiting for you to leave the house……

The big question is if get a negative GDP print and then officially go into recession according to Atlanta Fed: how much will demand fall as Powell is predicting and bring inflation down? Wonder what you think:

1. We will officially enter recession in Summer but inflation will stay stubbornly high, therefore Fed will tighten into a recession.

2. The Fed will pause in September due to recession, but no QE.

‘This per-capita disposable income – per-person after-tax income from all sources – adjusted for inflation, dipped 0.1% in May from April, and was down 3.6% from a year ago, but was still up 1.8% from May 2019.’

I keep hearing that ‘consumers’ (a.k.a citizens) wages are not keeping up with inflation. Your data paints a much more modest picture.

Being that people appear to be buring through their savings and maxing out their credit cards, I would think that there will be an abrupt drop in overall consumption in the near future.

The first half of your last sentence is completely wrong.

Concerning “maxing out credit cards,” despite many years of inflation and population growth, credit card balances (including balances that get paid off every month because people like me are using cards just as a payment method) are below where they were 14 years ago (red line), and other consumer loans, such as buy-not-pay-later and pay-day loans (green line) are below where they were 20 years ago

I don’t understand, since there is a shortage of new vehicles, why are the auto companies paying zillions of dollars advertising new cars.

That’s brand advertising. Companies always do that. No matter what.

But they and dealers are spending a lot less on ads than they used to.

And automaker cut their incentives to nearly nothing, from 10% of MSRP in 2019 to 2% of MSRP in June. They cut incentives on leases to zero. They’re saving many billions of dollars a month cutting out the incentives.

https://wolfstreet.com/2022/06/26/consumer-still-pay-no-matter-what-for-new-vehicles-as-average-transaction-price-hits-record-45844-in-june-amid-inventory-shortages-record-per-unit-gross-profits/

To maintain the pretense that they’re not going bankrupt.

They lost $210 Billion last year. That’s a lot.

unamused,

“They lost $210 Billion last year.”

WTF are you talking about???

In 2021:

Ford made net profit of $18 billion

GM made a net profit of $10 billion

Tesla made a net profit of $5.5 billion

Stellantis made a net profit of $13 billion

Toyota made a net profit of $2.85 trillion yen = $21 billion

etc. etc.

‘WTF are you talking about???’

We’re supposed to feel sorry for the automakers because they’re struggling with those terrible shortages.

Except we’ve already talked about how they’re making up the difference by gouging their customers. Making more by selling less, as it were. Just think of the cost savings!

Of course, if it all goes pear-shaped on them they can always get bailed out, once the recession gets going.

U

I didn’t detect anyone “feeling sorry” for automakers. Wolf was just correcting your misinformation and providing further insight.

BTW, “automakers” are not gouging. The dealers are. Automakers sell the vehicles to the dealers at the same price regardless of market conditions (aka “dealer net”). MSRP is MSRP. The majority of customers want a loaded vehicle and it’s the dealers (in most cases) that spec out the build sheets for inventory based on what they’re allocated.

It’s the dealers that put the ADM sticker on the glass, not the manufacturer. (ADM = Additional Dealer Markup). The dealerships (with the exception of Tesla and other minor players where the manufacturer controls retail) are private businesses with no affiliation with the manufacturer other than the franchise agreement.

Any manufacturer discounts come in after the fact… and if it’s cash to the dealer, then it is the dealer’s choice whether to pass it on or not. Manufacturers have no say in what a dealer charges. Read the disclaimers on most ads that include MSRP: “dealer is free to sell at whatever price” (more elegantly worded). Those pesky Federal laws (Sherman Act, etc.) dictate that practice.

The “junk fees” and required add ons are now currently the subject of FTC scrutiny per Automotive News.

Lastly, IIRC, GM and Chrysler were the only two automakers “bailed out”. Chrysler no longer exists (now Stellantis). GM allegedly paid back the money to the Feds after wiping out the stockholders. Ford and the imports received nothing.

I’ve seen that $210B number…. and it wasn’t a loss of profit, but a loss of revenue due to lower production than forecast.

Why are the car companies advertising?

Continued brand / product awareness as new models are introduced and new entries enter the marketplace. People talk like it’s the end of the world and there isn’t a car available for sale nor will there ever be…. then you look at the 2021 sales forecasts and they’re for 14.4 million vehicles.

14.4M isn’t a bell ringer, but it was the range of volume from CY2008-2012. Been in that range for the past two years. Odds are, with incentives lower and rates higher, 14.4M will be about what the market will bear.

Auto advertising, per the agency peeps, was a “three legged stool”. Auto companies were responsible for awareness (buy this), the dealer advertising associations were to build urgency (buy it now) and the dealer’s advertising was to direct the customer to “buy it here”.

Per Atlanta Fed, the 2nd Qtr GDP is now NEGATIVE 1.6%

Technically we are in recession. Final figures will come out early next month!

At last the mea culpa

“We understand better how little we understand about inflation,” said Powell.

IMHO he cannot contain the inflation which erupted after 41 yrs of deflation! Overshoot /Fed’s policy error is already built in!

There is still strong HOPIUM. By comments I read at WSJ, Barrons and MW, many dream/wishful thinking that Mkts back to the previous high within 12 months.

Well as the old saying goes, the best cure for high prices is high prices.

Eventually (as evidenced by the disposal income chart), consumers run out of gas to fuel purchases. First to go was the excess stimulus money they spent freely. Then, any perceived personal savings were used to fund purchases. With both of these tapped, up next will be consumer debt ranging from credit cards to HELOCs to auto loans to consumer credit specials (i.e., think buy now and pay later, much later) to you name it as consumers never seem to waste another lending scam. And eventually, reality sets in (helped significantly by inflation) and the money runs out, forcing spending reductions.

We may not be there yet but its quickly approaching. Just a matter of time and pressure now.

BTW, if you calculate the rate of growth in real consumer spending from the end of 2019 (which looks to be about $13.4 trillion) to mid 2022 (let’s say we get to $14.0 trillion), this amounts to an annualized growth rate of just 1.75% per annum. Certainly nothing to rant and rave about, especially when one considers the amount of stimulus money poured into the economy. What this tells me is that the US economy, led by consumers, has been much weaker for a longer period of time that most people realize.

Growth rates to GDP can be a bit tricky. It takes a lot more money to boost US growth rates then it does some other countries that it gets compared to. It’s why you see countries super high growth rates fall down to earth, eventually. It’s not that they’re “better” or going to definitely overtake the world, often times it’s just they stopped doing as much stupid shit and the multinational corps are labor arbitraging.

You know things are getting bad when you gave your old stuff to Goodwill but now you are shopping there and it’s the busiest store in the neighborhood. But tough times has its advantages. Just patching your pants and wearing your favorite shirt every day.

Here’s some valuable advice ,as a child went to grandmas farm .She cooked eggs I ordered 2 then filled my bowl with grape nuts ,couldn’t finish it all .Went outside to play lunchtime came ,they had roast beef mashed potatoes and a vegetable.Meanwhile I ate my leftover grape nuts ,one of best life lessons ever. Even after 55 years

You know times are really bad when the only jobs available are at Goodwill, and you take one just to get the employee discount.

I don’t want anyone to know but I shop 2nd hand stores. You can actually find things with quality not made anymore.

But don’t tell anyone I have these issues.

Larry Lindsey was on with Maria B this morning and said the recession started in May and it will be no growth for all of 2022. The lower 90% of Americans are getting killed by this inflation and will have little left over to spend on any discretionary items. Unless some Unkown Unknown event occurs such as a massive financial breakdown like 2008, the Fed will keep on tightening until they break the inflation. J Powell has turned into Paul Volcker 2.0 . Let’s see if he can stick with the program.

ENJOY

Well, until just recently, he hasn’t been up to it. I actually thought after Bernanke and Yellen, that we had a chance with Powell. Too soon to tell, but I won’t hold my breath.

I like watching Legarde. Now that lady has a tough job telling lies with a straight face when the ship is sinking.. US has good food and energy production which helps Powell do his job. Energy production expansion was one of the things that kept US GDP from being horrible in first half.

As to consumer spending. Brick and mortar is on the outs and has been, while on-line sales continue to increase, and that takes huge warehouse space prior to distribution. In my area, and I’m in the middle of it, there continues to be a lot of new dirt being moved. 5 acres and much larger under one roof. So, maybe I’m just in that rare spot.

I heard there might be a bubble in warehouse REITS. Haven’t looked into it.

Better look at Amazon there volume is way down,could be why there stock is dropping ,but the talking heads on cnbc scream it’s a buy

It takes a while to turn a big ship around. While Amazon is cutting warehouse space in some areas, they are still building a lot of space in other areas. I believe Amazon stated they wanted to cut ten million square feet. So if they build ten million new, they have to cut twenty million somewhere else. Ouch.

IIRC, the warehouse cuts are in areas where the warehouse itself is mis-located.

There delivery driver’s are quitting because,they have to wait in parking lot with no pay ,until there is a van loaded to deliver True or False

I cannot understand the bitching and doom and gloom on this site. Why, just a week ago, I cut a fat deal with a Nigerian Prince to “help him out” and in doing so, expect a HUGE check anytime soon.

When I get the check, I’m gonna get me some NEW friends….