Third month in a row of declining retail sales, “seasonally adjusted.” But the curveball from ecommerce caused me to dig and doubt. 15 whiplash charts of retail sales.

By Wolf Richter for WOLF STREET.

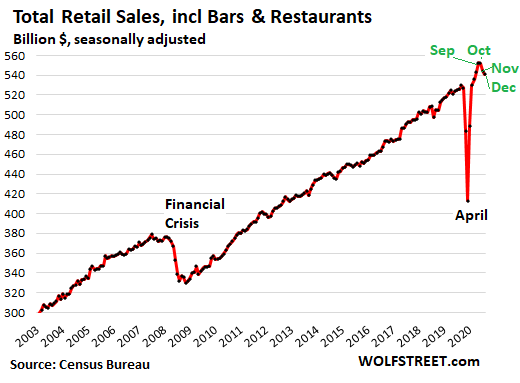

Retail sales in December fell for the third month in a row, on a “seasonally adjusted” basis, down 0.7% from November, to $541 billion, and down 2.1% from the peak in September, according to the Census Bureau this morning. And even without restaurants and bars – many of which were shut down in December – retail sales fell on a seasonally adjusted basis for the third months in a row.

For the whole year 2020, retail sales inched up 0.6% to $6.26 trillion, not seasonally adjusted, after the historic collapse in March and April, and the historic surge in the following months, fueled by stimulus and extra unemployment benefits and by the Pandemic-induced switch from services which are not included in “retail” sales – such as airline tickets, movie tickets, hotel bookings, and haircuts – to goods, such as cars, appliances, and laptops.

Have the massive shifts during the Pandemic messed with seasonality?

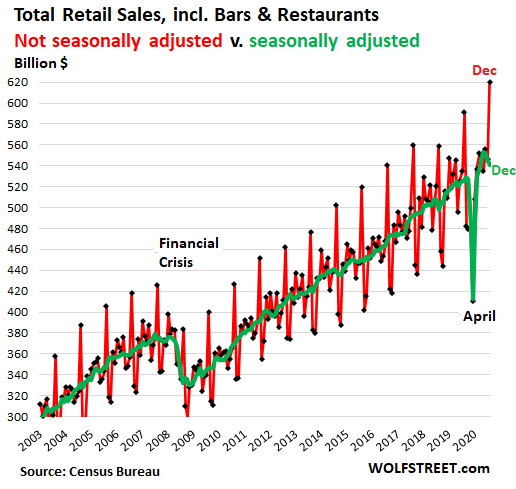

Retail sales are enormously seasonal with a huge burst in November and December, followed by a collapse in January, when retailers are taking back stuff they sold in November and December. Returned merchandise becomes a negative sale. Most brick-and-mortar retailers end their fiscal year in January in order to balance the surge in November and December with the collapse in January. Before the Pandemic, the plunge from December sales to January sales ranged from 18% to 22% every year. Massive seasonal adjustments attempt to smoothing this drama into oblivion.

But the Pandemic has shifted many things around, preventing people from going on vacation, keeping people at home, causing people to buy things they wouldn’t normally have bought, and thereby causing the normal seasonal patterns to change. And the seasonal adjustments that would normally smoothen out these seasonal patterns may have gone awry – particularly for online sales – and we’re going to take a look at the guts of it…

“Not seasonally adjusted” retail sales in December, at $620 billion, were up 4.8% from December last year. This was strong, a full percentage point more than the average 3.8% year-over-year increase for Decembers going back to 2011.

The green line represents the seasonally adjusted retail sales, same as in the chart above; note the dip at the end. The red line is not seasonally adjusted, and it spiked as it does every December:

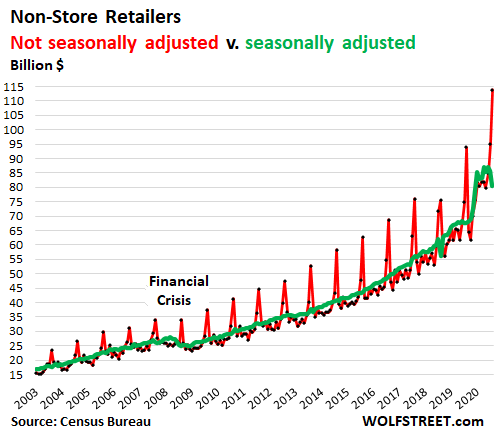

Ecommerce is playing a huge role in this battle between seasonally adjusted and not seasonally adjusted sales. Ecommerce in today’s data release is approximated by “non-store retailers.”

Sales at ecommerce sites and other “non-store retailers” (mail-order operations, stalls, vending machines, etc.) in December, seasonally adjusted fell 5.8% from November, to $81 billion. That triggered my curiosity because the data on ecommerce sales, released by private companies, had pointed at a huge increase for ecommerce sales.

Not seasonally adjusted, sales at non-store retailers spiked by 19.7% in December from November to a new record of $114 billion, up 22.2% year-over-year, pushing them to a record share of 18.4% of total retail sales. For the entire year 2020, sales at non-store retailers jumped by 22.1% to $971 billion. That is a huge move:

The “seasonal adjustments” for December slashed the sales figure at non-store retailers by $33 billion, or by a record 29.3%, from $114 billion not seasonally adjusted to $81 billion seasonally adjusted.

This huge adjustment is a bit of a head-scratcher. A year ago, the seasonal adjustment for December was 28.1%. In December 2018, it was 25.6%. In December 2017, it was 26.3%. The current seasonal adjustment was big enough to move the needle for overall retail sales.

This issue of seasonal adjustments gone awry might have also occurred in other categories, and the reported decline in seasonally adjusted retail sales for November and December might have been due to seasonal adjustments gone awry.

I put this out there for the policy makers that are now busy crafting the next wave of free money to enable Americans to buy more goods from China, Mexico, Germany, and other countries to stimulate those economies: Look beyond the huge seasonal adjustments of retail sales!

To avoid permanent vertigo, we revert to seasonally adjusted sales.

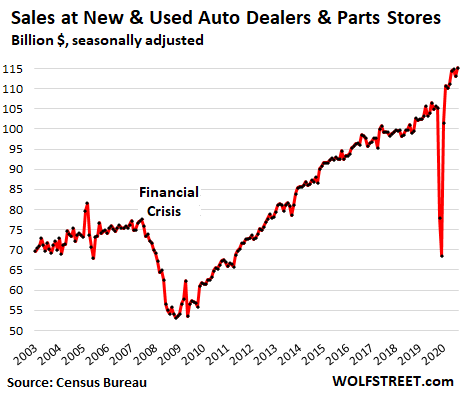

Sales at new & used auto dealers and parts stores rose 1.9% in December from November to a record $115 billion (seasonally adjusted) and were up 9.9% from December last year. They accounted for 21% of total retail sales. For the entire year 2020, despite the plunge in March and April, sales still eked out a 1.1% gain, to $1.25 trillion.

But the number of new and used vehicles sold fell sharply in the year 2020. What happened was a historic price spike in used vehicles; and in new vehicles, a combination of factors that caused the average transaction price to soar 9% year-over-year, to $38,077 by December. Fewer vehicles, but more expensive vehicles – and voilà, sales in dollars are up. These retail sales are not adjusted for inflation:

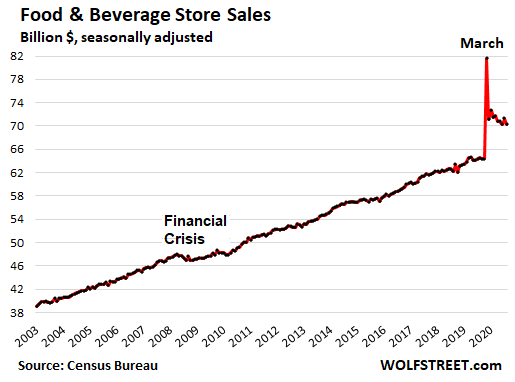

Sales at Food and Beverage Stores fell by 1.4% in December from November to $70 billion (seasonally adjusted) but were up 8.9% from a year ago, as consumption switched to the home from restaurants, cafés, cafeterias, office vending machines, and office supply closets. For the entire year, sales jumped by 11.5% to $853 billion:

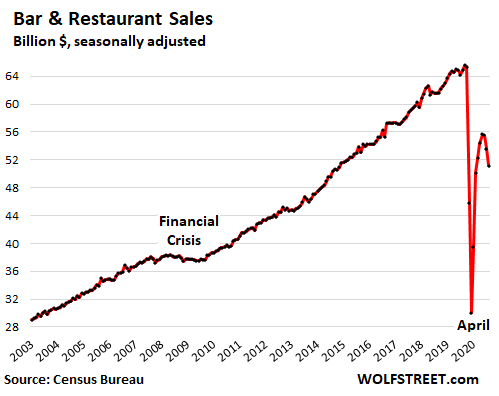

Sales at Restaurants & Bars fell 4.5% in December from November, as new restrictions due to surging virus infections were put in place. At $51 billion (seasonally adjusted), sales were down 21% year-over-year:

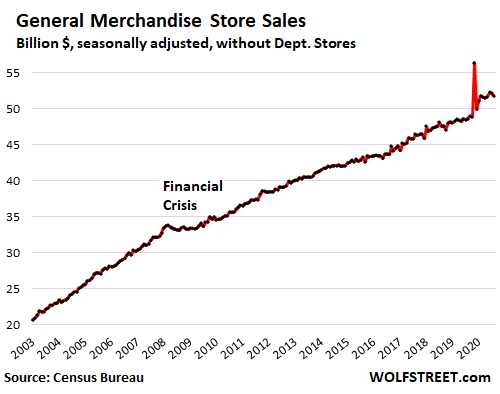

Sales at general merchandise stores (minus department stores) fell 0.7% in December from November, to $52 billion, but were up 6.5% from a year ago. Stores in this category include the brick-and-mortar stores of Walmart, Costco, and Target, but not their ecommerce sales (which are picked up by the ecommerce category):

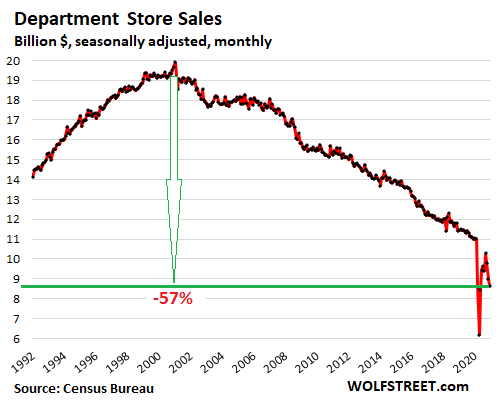

Sales at department stores dropped 3.8% in December from November, after having dropped 7.7% in November from October, to just $8.6 billion (seasonally adjusted), having plunged 21% year-over-year. For the year 2020, department store sales have plunged 18% to $111 billion, by far the lowest in the data going back to 1992, despite 28 years of population growth and inflation.

This includes the brick-and-mortar sales of the surviving department stores, but not their ecommerce sales. Macy’s ecommerce site had long been one of the top 10 ecommerce retailers, according to eMarketer, but in 2020 it dropped off the list. Macy’s ecommerce sales are not included here. Only its ever-shrinking sales at its brick-and-mortar stores are included.

A bunch of department store chains filed for bankruptcy in 2020, after years when numerous department store chains, including the biggest one, Sears, had already filed for bankruptcy and were liquidated.

This iconic American way of shopping is moribund. For mall owners, it’s just a matter of slowing and controlling the disappearance of these stores, as Simon Property Group and Brookfield Property are doing with their purchase of J.C. Penney out of bankruptcy.

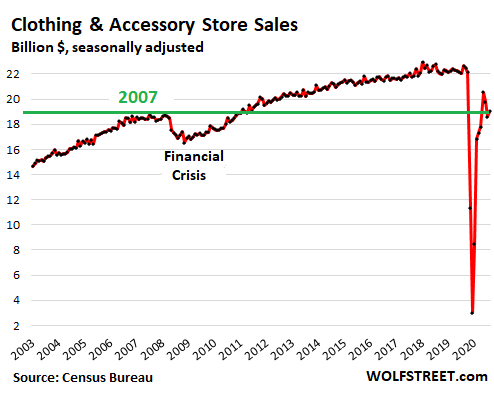

Sales at clothing and accessory stores rose 2.4% in December from November, to $19 billion (seasonally adjusted), but were down 16% year-over-year. For the year 2020, sales collapsed by 26% to $196 billion, as previously reluctant folks have figured out how to buy clothes online. Others already figured this out long ago. Hence peak sales in 2018 and current sales at 2007 levels:

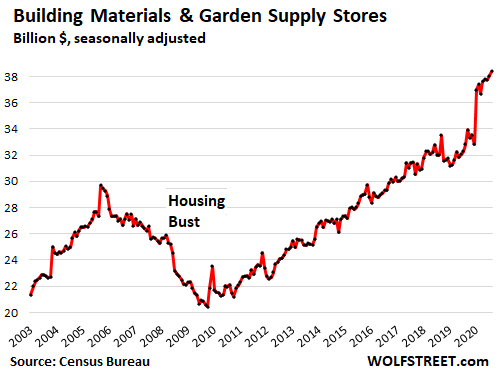

Sales at building materials, garden supply and equipment stores ticked up 0.9% in December from November, to a new record of $38.4 billion, and were up 17% year-over-year, among the big Pandemic winners, as Americans were sprucing up their homes, now that they’re spending a whole lot more time there for their staycations, work from home, study from home, and eat at home. For the year 2020, sales jumped by 14% to $438 billion:

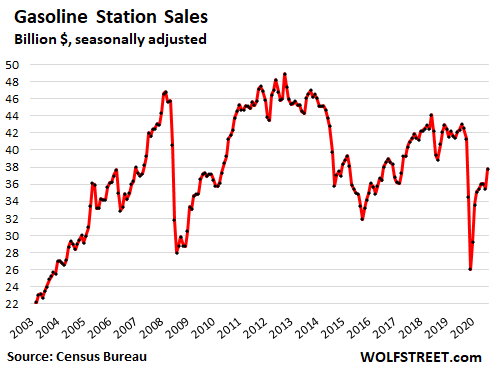

Sales at gas stations jumped 6.6% in December from November to $38 billion, but were still down 12% year-over-year. These sales include everything a gas station sells, not only fuels but also snacks, sodas, motor oil, and the like. Fuel sales are a function of volume and of the highly volatile price of fuel; and by the end of December, the average price of gasoline, according to EIA data, had jumped 6.7% from a month earlier:

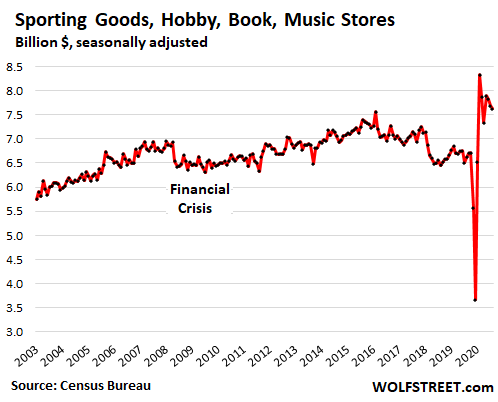

Sales at sporting goods, hobby, book and music stores fell 0.6% in December from November, to $7.6 billion, but were up 15% year-over-year. For the year 2020, sales rose 5.7% to $84 billion:

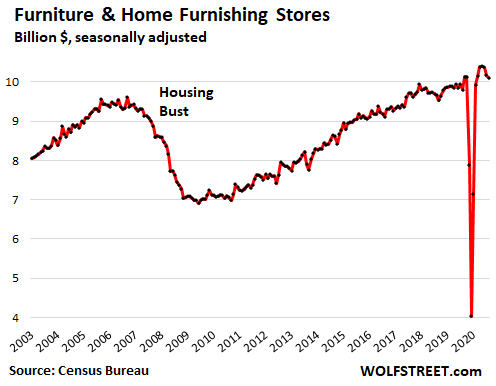

Sales at furniture and home furnishing stores ticked down 0.6% in December from November, to $10 billion (seasonally adjusted), but were up 3.1% year-over-year. For the year 2020, sales fell 5.4% to $111 billion.

As amazing as it might seem, even furniture sales have wandered off to the Internet, and Wayfair, an online furniture retailer, has become the 8th largest ecommerce retailer in the US, according to eMarketer; but its sales are not included here:

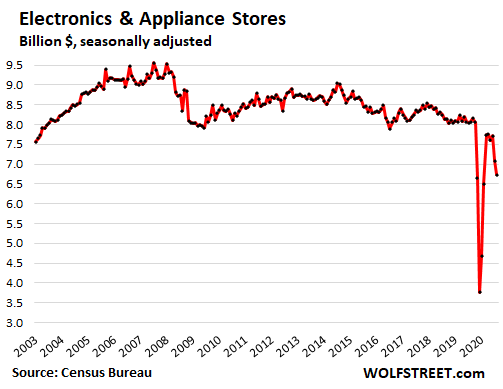

Sales at Electronics and appliance stores fell 4.9% in December from November, to $6.7 billion (seasonally adjusted), and were down 17% year-over-year. For the whole year 2020, sales plunged 14.6% to $83 billion, which is ironic because Americans bought more electronics than ever, from laptops for their kids to network equipment for the work-from-home parent, but they bought it online.

This is another moribund brick-and-mortar category. Best Buy’s brick and mortar stores are in this category, and those stores are dying, and are now essentially being relegated to pick-up locations. But Best Buy got the memo years ago and has become the sixth largest ecommerce retailer. And Apple stores are in this category, but Apple’s booming online sales made it the 4th largest ecommerce retailer in the US. That’s the direction where this is going, and mall owners need to figure out what to do with that land:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

We’ll see a temporary bounce back starting this month I am guessing. Also no rent till September? More firepower.

What happens when a bank forecloses on an owner, and the later has tenants? All of them booted out together or just the owner?

If a commercial tenants lease was executed anytime during the default process the lease is non valid.

In the event the lease was executed prior, then the tenants lease continues and the bank/ next purchaser inherit the tenant.

Technically (depending on local rules), whoever forecloses gets to make that call.

Some will toss out anybody in arrears, and the property will sit empty, a target for vandals & theft.

Others will allow as many as possible to stay to prevent vandalism & theft.

The latter scenario happened to me as a renter some 20 years ago. I got free rent on a rural home for about 6 months (through the fall/winter/spring) while the former owner’s bankruptcy went through the courts.

It was very nice.

I had hoped that the announced plan to release now all vaccines held in reserve for the second doses would provide relief to the economy as millions of vaccinated people resumed their lives. However, the lack of such reserve of millions of vaccines until they are manufactured means that there is not likely to be any economic bounce.

I suspect that, at some time in the near future, investors might open their eyes and finally appreciate the new, economic realities. In LA, a report that I read is that one in three is now infected. We might actually get to the dream of “herd immunity” at that rate this quarter, like a rain deer herd surrounded by packs of wolves: through massive attrition.

The value of sales in these charts is shown in dollars and does not show the number of units sold, so I suspect that the decline in sales is even worse than shown: e.g., the bags of chips are now smaller, so people watching a game will likely eat more bags. Other items are hugely more expensive, like computer parts. Except for essentials, I think that Americans are becoming aware of the oncoming economic train wreck and preparing themselves by conserving their assets.

Because so many deserving, small and mid-sized businesses are going to disappear, I am particularly enraged at the upcoming bailout of the banksters and of the ultra-rich that will soon unfold. I am not talking about the $2 TRILLION paid by their “Federal” Reserve bankster cartel to the banks owned by the same banksters to take their uncollectible or deeply depreciated mortgage backed securities from them in 2019 to 2020.

I am talking about the recent and upcoming further payments to the ultra-rich and banksters. See “The Truth About The COVID-19 Bailouts” in Forbes Magazine. Leaving aside the parasitic banks, which would be best taken over by the government and rolled into one bank mostly owned by the government, if the US will bail out larger companies, e.g., Boeing or the airlines, it should not do so for free.

As pointed out in that and many other articles, the corporate owners and their true, hidden masters (the owners of just enough stock plus corporate stock proxies to control each particular, bailed out corporation) should suffer for their foolish decisions. They mostly over-leveraged and under-capitalized their companies.

They ran huge risks with them. E.g., I would not get into one of Boeing’s planes made in its South Carolina’s plant after the news reports about the poor quality control on planes manufactured in that plant. The 727 Max reportedly might have been a decent plane and well received, if the system designed to counter its more powerful, bigger engines had been explained very careful to pilots, cautioned about, trained for by pilots, and more easily turned off by pilots.

In short, while companies like Boeing are essential to the USA and should be bailed out, the US treasury should get convertible bonds in exchange for its bailouts convertible to say 99% of Boeing’s stock, so that the US tax payer will drive a fair profit from the bailouts, not the incompetent owners of Boeing, whose massive greed led to its problems. I do not mean to pick on Boeing, because most or at least, huge numbers of corporations are in the same position and were as poorly managed. The US taxpayers through their government should get convertible bonds in exchange when it bails out ANY of them.

The US reportedly faces over $211 TRILLION in liabilities that it must meet in coming years, has a demographic cliff facing it as its Baby Boomers and older generations retire, avoid major purchases and unnecessary spending, and seek to sell their real estate and securities. All face the oncoming threat of a growing, Nazi-like tyrannical regime in Beijing, which has close allies in Wall Street and among the banksters.

To protect most of Asia, US/allied countries’ companies, and its allies, the US government is now having to get into an arms race with a corrupt, parasitic, tyrannical, genocidal, regime again: i.e., tyrant Xi’s CCP parasites. To avoid future collapse, since it might not be able to meet its obligations even if now if interest rates took off, it should get the future profits from those companies by demanding convertible bonds, not the ultra-rich that drove them into the ground.

I mostly concur with what you wrote. It is excellently written and well thought out.

Thank you.

You think this is weird. Wait until the weirdest economy ever gets even more weirder as they push to require vaccine pass to enter malls, theaters, planes trains and oh oh my… that will create some interesting charts.

Yes, but with China’s leading health experts recommending against mRNA vaccines from the two approved versions so far, there could be… consequences as far as availability of said vaccine passports are concerned.

But never fear, tech is here. Microsoft, SalesForce, and Oracle are collaborating to bring you… the digital vaccine passport. Wait until that gets monetized, like Apple is considering monetizing its podcast app. But I think this combo needs a third company… M, S, O, just doesn’t make a good acronym… how about Twitter, M.O.S.T. that’s at least workable. The three former companies develop a passport, while Twitter is used to shame anyone who doesn’t have the said passport.

That would be rich….

Heck, we don’t need digital stuff.

I can buy an entire new identification kit with drivers license (my photo too!), green card, SS card and some counterfeit Benjamin’s in Houston for $250. You can bet that a vaccine passport can be added for a few bucks more. (wink)

not sure about the price you quote aa, though very clear about the availability of such as you mention:

may only be different than what lots of very good workers in a company i was involved in, and who all trusted me, as a speaker of their spanish, etc., not to fink/rat, which i never did

almost all of the hispanic folks had bought their entire ”legal” history , in every case totally bullet proof including passing all of the e check or whatever it was called, south of the border for $500,,, and that was a couple decades ago now a days…

VVN, the digital world has changed all of that now. It’s much easier to make forged documents.

With us living in an area of 4+ million residents, of which the majority population is Hispanic, I see and hear a lot of stuff. I will guarantee that our lawn service guys and housekeepers are not legal and they have been here for years. But they are very nice, hard working peaceful folks with families and homes.

Vin Vet-

Lived in Tucson 09-10, and hung a lot around ’07-14. Had it from good source they expected 10-15M in the Phoenix-Tucson corridor (figured there was enough water, too).

Anyway, developers hired thousands of illegals to build thousands of houses and support buildings in the scorching sun and monsoon rains, paid them dirt wages and cheated them at every opportunity.

Developers/contractors all got filthy excess rich and now are in the Catalina Foothills, (and other enclaves), but that’s the big one.

Well, all these retired escapees from the north and snow birds never quite fully materialized after GFC.

Now they want all imported slaves gone ASAP!!!….. except for some gardeners, kitchen workers, etc.

Sounds like you had a part in this newer variation on slavery. Maybe the “lost their jobs bunch” should be mad at folks like you instead of the “invading” Mexicans?

NBay-the story across the USA, as well. The greatest critics of the illegal immigrant worker seem to get very vague and deflective when pressed about their resistance/avoidance of citizenship card-check for decades. Increase labor-rate profits, dump immigration-policing agency costs off on the taxpayers…

may we all find a better day.

“with China’s leading health experts recommending against mRNA vaccines from the two approved versions so far”

Got a reference so I can determine if that’s just a case of them requiring the use of a [pejorative removed] version only?

Winston,

You keep using a pejorative for “China” and “Chinese”. In the past, I have replaced that pejorative with “China,” “Chinese,” etc., hoping you would see it and stop using that pejorative. But it didn’t work. This time, I took it out and marked it to let you see it. In the future, your comments with that pejorative will go directly into the shredder.

Look it up on Google; search under Chinese health expert, mRNA, global times…. article from a day or two ago.

China has had a phone app that everybody needs to have to ride the bus or subway or plane, or enter a supermarket or mall or any public place. It is used for tracking people exposed to the virus. It was very important in knocking down the spread of the infection. Other Asian countries all used similar apps and are now living normal lives. Americans will never agree to this and will have to suffer the consequences for a long time.

The issue with such app is basically its dual use nature. By the way, it doesn’t have to be forced on the public, social norms and laws targeting commercial entities are enough.

No scanning the app, no entry into the grocery store.

I have no problem having to wear a simple mask (we have to wear clothes and obey dress codes), or with contact tracing apps (we are already well tracked by big data regarding spending habits, credit worthiness, advertising viewings, NSA, etc, etc), and I will gladly tolerate both to save lives and not turn our hospitals into total chaos ridden services when anyone one of us could need (especially traumatic injury) Covid or non-covid care at any time. I always wear an N95 (old and clogged, but still 10x better than cloth) in public and will report Covid-like symptoms to my doc and tough it out at home. Sister can bring me groceries and leave them at door.

I do draw a personal line at refusing a “warp speed” vaccine for Covid. Last I heard all medical treatment could be refused unless unlucky enough to be unconscious, or deemed unable to make decisions.

I believe I have more than enough education (and still improving it) to make that decision, even though I lack a “ticket”…MD, PhD, etc. Time proven vaccines I have no problem with, should other diseases break out. As an Army brat in Panama, in public school. and again in the Army in ’67,

I’ve had my shots.

Wolf,

This “cutback” is only temporary. Once the next round of stimulus is released like the Kraken… the real Kraken. Then Wall street will get more money courtesy of Robinhood and the various online traders. Oh, and lest we forget, China is going to absolutely kill it with that stimulus coming in.

I was reading SCMP, and read this one bit about yields:

The Chinese government’s 10-year bond yielded 3.159 per cent in local trading late on Friday, well above the yield on the United States Treasury’s 10-year bond of 1.115 per cent, and on the benchmark German 10-year bond yield of minus 0.536 per cent.

I wonder in the end who is going to be more stable. China, that has been stimulated with US money, or the US with a mountain load of crap from China. Yes, there was this other bit about instability due to the sloshing around of money, but see if the Fed cares.

If only we could have direct access to China’s 10 year. The yield is pretty decent. Yeah, there is risk, but it’s better yield than Europe or the US, and dammit, it’s probably safer.

Well where there’s a financial / financialized product, there’s an ETF for it. iShares CNY bond ETF. Ticker: CNYB. Not invested in it but just looked it up.

Interesting, thanks for the note, I didn’t know that. May be have to check it out.

This is what I like about WS, all sorts of useful information if one listens.

If we didn’t have that mountain load of cheap crap from China our inflation rate would be much higher than it already is. Pumping money into the economy would normally create a lot of inflation unless there’s something to buy with that money, which China provides.

The standard definition of inflation is “too much money chasing too few goods.” Well we’ve had too much money pumped into the economy for some time now but without a huge increase in inflation because we’ve had plenty of cheap Chinese crap to spend it on. Take that away and we’re in trouble. The best thing Biden can do is to get rid of all the trade barriers Trump put up so more of that cheap crap can flood into the U.S.

Inflation? It is right in front of you, and it is massive: stock market at all-time highs despite a “viciously fatal” disease, record house prices, astronomical prices for college educations, and ridiculous health insurance. Until a couple of weeks ago, bond prices also supported this narrative… Food prices are up in the past six months, gasoline is even only because people are not driving as much. The inflation is there, we are told to look the other way.

Correct, they’re “inflation dumps” where the rich dump all their excess cash into a few areas creating asset bubbles as opposed to inflation being spread more uniformly over a large basket of items.

That’s why giving more money to the rich is not only a waste of money but can actually do harm to the overall economy and the average consumer by artificially raising prices on essential items like housing.

The purpose of having a lot of cheap Chinese goods to buy is to keep the inflation from spreading to the lower class of goods that it normally would if those abundant goods weren’t available. The trouble is with all the shipping delays that may happen anyway.

A lot of that stuff from China may be cheap but its not all crap anymore. I have a collection of Chinese knives and they are the best made I’ve ever seen

True, but it’s a mixed bag. When you buy something from China you don’t know ahead of time whether it’s good or crap until you actually get it. That’s why Chinese goods as a whole have a bad reputation.

All the personal wrenches, socket sets, etc, came from Harbor Freight’s top line China stuff when I was in JC Auto Shop ’10-’13.

The poor Snap-On guy came in for his traditional presentation and was laughed and jeered out of the room.

Lowe’s has good China tools now too.

All much better than the in the older Post Tools days, and a progression similar to Japans. Who remember’s the phrase,” Jap Junk”, anymore?

DC has strict gun control regulations. We now have a massive crime wave here and you can’t protect yourself with firearms. That’s why those Chinese knives come in handy. Wear one of those ma…fri%ers on the side exposed for all to see and the bad guys run like scaulded dogs.

M.earussi

‘The standard definition of inflation is “too much money chasing too few goods’

All the ‘money created by credit’ went to top 10% who unlike the bottom 90% have no need to buy the CHEAP stuff from China! It all went to stock mkt!

In the past rate of wage growth used to br precursor to inflation (excluding Equity mkts, housing, healthcare +education) Starting late 80s the rate wage growth is virtually stagnant. Of course the inflation is WAY more than Fed’s illusion rate 2%.

Based on what I’ve seen at this website over time, I would say we have a sort of “selective stagflation”.

In the article above, nothing but department store sales seems to have changed really radically overall, so I suppose the real question is how much of it is on credit that will be repaid, or just soaked up by the FED.

Bad time to have my small savings in CD’s and Bonds, but I’m pretty downsized.

Stimmys at many levels will perpetuate this fake propped up economy (just like a drug addict needs more of his ‘fix’ just to stay alive).

As has been noted here many times, in the weirdest economy ever, the Fed in conjunction with guvvermint actually is the economy now— a centrally planned economy.

To be sure, this ongoing consumer stimulus just worsens the trade deficit and China is again the winner.

From what I hear though China is not just buying fake fiat US Treasuries with their windfall— they are investing heavily in their global economic initiative called the China Belt Road which will eventually make them a predominant world economic power.

While China executes a brilliant global economic strategy the US is in the gutter embroiled in toxic politics and societal divisiveness.

I think stimulus has its place, but what I read about it, it’s just so poorly targeted and thought of that it’s a disasterpiece.

This is where having leadership helps, people need to think about incentives behind the stimulus, both our idiot leaders are too busy thinking about how they can gain power from the masses to care about thoughtful legislation or actions.

Rent moratorium / mortgage forbearance coupled with generous unemployment are some of the worst combination of policies possible given the incentives.

It seems like we are so eager to adapt the practices in Europe that we forget that in the past, those European leaders and their policies are the ones who bungled into two world spanning conflicts in a single century, in practice, some of those same “enlightened” policies are the ones that is slowly ripped apart Europe before, now though they are used to rip apart the world at large. NIRP and ZIRP are primary examples of such disease spreading slowly across the globe, the crazy part is that it takes a communist government to actually believe in the mantra of stable currency, even though they are still pegging to the dollar.

“”Let em” is the right way to go forward with regard to the concerns of and about the CCP version, the current vision/version of China.

Many years and many political currencies have been spent to try to do otherwise with regard(s) to China/Chinese oligarchy (ies) etc., etc.

Might be best to consider all such as only, “”FOREGTTA ABOUT IT.”

And just ”let’s move on” for most of the world…

Thanks again Wolf for your clear charts, a whole new world for some of us watching and hoping since many decades past,,, and, for at least this old guy, learning a ton!

I often wonder how much clout and how organized that Davos crowd is.

I remember JFK saying, “I’m not going to do what a bunch of fn Swiss bankers tell me to”.

C. Wright Mills had some good thoughts on that.

MCH,

“This “cutback” is only temporary.”

What I’m saying is that there may not have been a cutback at all, that this may have been just a matter of “seasonal adjustments” gone awry due to the Pandemic-induced shifts. Look at the “not seasonally adjusted” sales – 2nd and 3rd chart above – and try to find the “cut back.”

I see what you mean… it’s how people are making things look by adding in their adjustments. ?

Basically, torture the charts and add a little here, subtract a little there.

Oh so as Mark Twain said: There’s lies, damn lies and statistics?

Twain had a comment on these $1200, $600….maybe $2000 money dumps, too.

“Go ahead, give the poor all the money you want. The rich will have it all before nightfall, anyway.”

We need big structural changes, not band-aids.

Green New Industry! The money is here for it, and then some, so knock off this stupid “economically feasible” crapp. We did what we had to do during WW2 and it included taxing the rich, heavily. We have to now. It’s our only rational move. Hope the millennials force it down our greedy throats.

I donated to Bernie, AOC, Wikipedia, and a even bit for old Wolf, who lets me bang my head against the wall here.

If you are in the US remember most of your goods and services are dollar based. Currency risk can be a killer if it goes against you.

Prediction: January will come in higher as people buy what they remember they couldn’t get last February and March. Got toilet paper? Paper towels? Rice, Beans? Pasta? Cleaning supplies?

Then there’s the growing pre-boycott of the Biden presidency as conservatives front load their restocking to avoid spending when Joe’s in the White House.

Boycotting shopping is a boycott on the military industrial complex. Not shopping is occupy wall street. I’m glad you’re at the party but it’s not about one person, especially not one boomer.

This has been a “classic” great financial bubble, and each has related to a previous global boom in commodities. The unprecedented hit ot employment was policy-driven and without precedent.

The first was invented with the South Sea Bubble in 1720. That was 9 years after the huge boom in commodities that completed in 1711.

A truly monstrous global boom in commodities completed in 1920 and the “Roaring Twenties” in 1929.

That was the fifth example.

A commodity index is available by month in the 1920s.

So, from global commodity boom to September 3, 1929 counts out to 9 years and 7 months.

As noted above, this bubble has the signs of a “classic” one.

The last peak in commodities was in 2011 and the time to January 2021 counts out to 9 years and 3 months.

And technical excesses are being accomplished right now in stocks and industrial commodities.

It will be fascinating to see how this works out.

If the past continues to guide, it will be deflation in most assets.

Fifty years ago the average holding time for a stock was 6 – 7 years. If you are a value style investor the positive correlation to value is out just past five years on the last data I saw.

Today the average holding time is under six months which means it’s all divorced from fundamentals and is just price speculation, aka gambling. Not saying smart people can’t make money at it, but unfettered fiat has created the largest casino in the world. Thanks, Alan, Ben, Janet and Jerome.

+1

50 years ago only a few in the middle class were even “discovering stocks”. And as I kid in the 50s-60s I heard no parents even talk about them, except as in, “it was something rich people did”.

Most people who wanted more money just started their own businesses, starting with side jobs while working FT elsewhere.

But I do see your “casino/day trader” point.

NBay

NOT TRUE!

When I was a kid some dude in the next block in Westbury, Long Island tried to sell me some mutual fund. I was making $7/week delivering Newsday. The SOB wanted every nickel I was making. I told him to got to hell.

Next My Parents dumped me into General Mills Stock just before Kennedy closed the steel plants. The stock dropped 40%, and I lost nearly all my hard earned savings.

People were greedy back then and they still are. There;s no such thing as “The good old days” . That’s all fiction.

Also, I have no idea what Long Island “middle class” was like.

Speaking only for some Central Valley, bit in LA, and mostly North Ca “middle class” 50s-60s upbringing.

My school (and parents) encouraged a Bank Book.

I don’t get it. From 2010 to the end of 2020 the ‘total retail sales chart’ tells us that total retail sales increased about 64%!!! Who the heck is spending all this money? Most salaries are stagnant with rents from insurance, housing, education, etc gobbling up more and more of the bottom 90%’s paychecks.

So is all that increase in spending done by the top 10% of Americans? Or does Jeff Bezo go out once a month and drop a few billion at Best Buy?

Correction. Actually total retail spending increased 35% over that period. Not as bad as 64%, but still very strong.

Robert. Retail sales YoY are down since the 90s. Adjusted for inflation ie for price increases they are down even more. Wolf posts nominal increases and decreases in dollars not YoY rate. What this all means is that people are actually spending more dollars as time goes by but affording less and to some extent buying less than before with slight exception for new technology etc. Another thing to consider is that retail sales and PCE (personal consumption expenditure) which track each other very well, don’t discriminate between different incomes, so it’s not a good measure of the health of consumption.

Robert,

It’s pure magic :-]

Population growth, plus inflation. Plus… on products such as new vehicles, price increases get removed from the inflation index CPI via “hedonic quality adjustments.” Read and cry…

https://wolfstreet.com/2020/11/11/my-pickup-truck-car-price-index-for-2021-models-crushes-official-cpi-for-new-vehicles/

This chart shows the price increases of the F-150 pickup, the Camry, and the Consumer Price Index for New Vehicles. You can see that even as vehicle prices surged, the CPI for new vehicles didn’t budge. But you don’t pay CPI when you buy a truck, you pay the actual current price. So retail sales reflect what people actually pay, and those prices have gone up a lot, and that’s what you see in the retail sales charts.

Thanks! Makes perfect sense.

Hedonics strikes again!

Pseudo-hedonics….BIG difference.

Wolf, love your analysis. I tend to think that s. 179 of the IRC has caused high income/new worth people to buy the behemoths over 6000 lbs. so they can depreciate them in the year bought. Trucks lack refinements that high end cars have, but they’re getting there. The only hauling these thing so is the soccer team’s gear and only offroading is running over the curb when turning right because the driver can’t cut the turn properly. You worked in the industry, you know this. The twin GMC’s in the driveway for Christmas, etc.

Don’t forget your neighbor being in total awe of you when you come home splattered in mud after out doing “Truck Stuff”.

HaHa….good one.

Maybe just a data point, but our spending this Christmas was not very consumer based. Some “consumer” items, but some more practical items instead of just things.

And overall things we have been buying less as well – after all, how much can person own?

but 99% people ‘buy’ truck via LOAN for 10 years

Truck mark-ups are extreme. Right now there is a 2020 model F-150 XLT loaded to $50,000 MSRP, selling for $35,000 at one of the biggest dealerships in the country who discounts huge all the time. Thus 30% off MSRP…buyer beware as that 6-8% you got is not “a deal” as margins on trucks are extreme…

Wolf – your sporting goods chart shows purchases dropped by about 100% and quicky spiked well above the all time highs. Wall Street panic caused Dicks Sporting Goods to drop from $50 to $13 range, and today it is at $66 so about a 74% drop and then a 400% gain.

Wall Street had a liquidation event, yet it was panic beyond retail sales reality. I love my local store, so I bought a large position June 1st and it is up 82% today, and has saved my portfolio. Sometimes emotional investing creates some lucky outcomes, although I’d say it is less than 50/50.

I think the 2020 three week Wall Street liquidation was a once in a lifetime event (now that the Fed will backstop anything beyond a 10-20% drop). Logical people cashed out of stocks, emotional people cashed into “stonks”, and it seems to me, at this point, the emotional people are the lucky ones. Thus I work on tempering my logic on a daily basis as logic does not work in a “Fed controlled reality construct”.

Perhaps someday that will change, yet until then, logical thoughts can be dangerous in Fed fantasy land, uhhh I meant our “new normal”…bad logic, baaad logic…

Maybe, you never know for sure. There are a few stocks that I feel like I can value and they got cheaper, but not cheap if you define it as 8% or higher annualized 10 – 20 year return. I agree with you there were some in unfavorable sectors that got pretty cheap.

You have to keep in mind the possibility of a great recession where stock market dipped twice to lose 89% total. First dip looked like bottom, and many went in only to get wiped out.

I think retail spending requires 2 things. Spending money in your pocket ( courtesy of the Fed these days) and optimism about you and your families prospects for the future. When your prospects are uncertain you stash the loot and hunker down. I think with the 3rd wave infection boom, dicey vaccination news and janky elections people are keeping their head down.

And many have kept their heads down for years.

I was thinking about these incredible new deficits piled upon decades of unnecessary deficits and had one thought, “God help us all when/if undeniable inflation takes hold and interest rates must rise.” Although, I suppose that only happens when wages rise and that isn’t too likely in the near future.

How many years can almost 0 interest rates continue? Money is worth less every year, real wages are flat or declining, and the only spending source is cheap credit or Govt stimulus. Surely, this is the end play.

Seneca mentioned stashing loot and hunkering down. I would add to that at the very least do this. People need some cash in the bank and some supplies, like the Mormons have always preached. It is the wise thing to do in uncertain times. And no, I’m not a Mormon.

Very generally speaking a thing is usually worth what is paid to obtain it. Banks are paying you 0.2% or less for it, so I guess it’s not worth much.

LH

One is better off with ‘selected’ banks or bank ETF like KBWB (ytd 12.8% yield 2.63%)

Again, do your own due deligence before any buy.

well we have serious inflation(really though it is DEVALUATION of $dollar)

the list of products that went up 20-50% in 2020 is LONG

so the 2% mantra is completely FAKE

surely the new $15 min wage will help(to raise rents)

I am confident that close-knit, faith-oriented, and self-reliant communities like Mormons, Mennonites, and Amish (I am none of the above) will do quite well when the smelly droppings hit the fan and our national economic charade goes out with a bang … or a whimper.

Utah isn’t as self reliant as you think. Welfare and food stamps are on par with other states because somebody has to support that 2nd, 3rd, 4th….family. And since a certain religion owns most of the businesses, where these transfer payments are spent, it is indirectly subsidized by you and me.

I hire and work with both Mennonites and the Amish. Timber, land clearing, even built a house once. Simple existence works, and I can tell you that I have never signed a contract with them as their word is rock solid. Their lifestyle is not easy by any means, and they are some of the hardest workers you will ever meet, and very religious. We do 50/50 on timber, no contracts, no worries as they are the most honest society of humans I have ever had the pleasure of knowing. Their simplicity allows a level of graditude and contentment that the rest of us can not seem to achive as we sprint on the invisible hedonic monetary treadmill underneath our feet.

I’d suggest anyone who gets the chance, drive to a Amish community and purchase some of their farm and bake goods. The banter and atmosphere will take you back in time about 100 years, it is facinating to say the least. Where I grew up, the local Walmart had a horse carriage parking section for the Amish and I thought it was normal….ha

Paulo,

Well come to MMT! Unfortunately the balancing act to MMT is an increase in tax revenue to combat inflation.

C

We learned sometime in the last 30 years that the US debt was never going to be paid off, but rolled over forever. We now know that treasury rates at any point on the curve can be held to any level required by the Fed buying as many as needed as Japan has done. In some ways it’s where any big democracy based on fiat is going to go as it is a system created by and for politicians to purchase voters with promises that can’t be kept.

Yeah, 2 years supply of everything plus guns and ammo, per my niece who lives north of SLCity. Strange bunch of “christians’, eh?

This is very true. You can see it in brokerage accounts. Margin loans are highest at peak market values and cash highest at the bottom. You might could even make the case that when cash levels are positive in brokerage accounts, you should heavily buy the sp500 and stop buying when cash accounts go net negative. The data is a little delayed, but for long term investors probably good enough.

Seneca’s cliff

Retail needs a third thing…young people… Boomers who are now all above 55 spend much less on everything…. The problem is that boomers are a huge group, not just in the US but world wide… If you don’t have kids then there is nobody to buy stuff. The classic is Italy and Japan, where their population numbers are falling…

The population demographics for the entire developed Western world is collapsing. Fewer and fewer consumers for decades into the future. Africa’s population is growing, but they don’t have any money. (Except for the Nigerian prince with $14 million that I’m currently negotiating with.)

I bought a bunch of “stuff” this November and December including a car, jet ski, etc. I had a great market year and time to savor. Also, paid a number of debt items off. I was broke once and so I know I’m one lucky son of a gun. Enjoying it while it lasts!?

I wonder how long before asset inflation results in real inflation. I for the most part got out of the stock market four years ago. If I had stayed in I could have used the last four years gains to buy an ocean view beach house or nice motor home or other luxeries. Got to be a lot of people ready to take some gains.

well when BIDEN ends stepped up cost basis, raises capital gains rate to income tax rate and then ends 1031 exchanges

you’re gonna see crash in prices of assets

already thinking I need to gift % of assets to kids each year to offset loss of stepped up cost basis

Not to be an ass**** about it, but those intended steps are known as “equality and justice.”

Basically the manipulation of language over long periods of time (though the cycle seem to be getting shorter that even an idiot like me notices) to change perception.

After all folx are the same as folks until folx replaces folks, because that concept has spread everywhere. So that everyone can be equally relegated to the margins.

Why do you think President McConnell would allow tax increases on Big Biz? Why do think Biden even want to reverse those tax breaks for Big Biz? When has a Team Blue ever done that recently, & don’t recall it being brought up on the trail. And corporate owned MSM sure ain’t gonna bring it up

My land business had me worried about the removal of “Like kind exchange” (sec 1031 exchange), yet it looks like it only affects those businesses that make more than $400k per person, so that seems fair to me. Almost all the tax increases are tied to folks who make more than $400,000 income, and that is a lot of money that places one directly in the top 1%.

And the end of step-up basis, that depends on where the exemption limit ends. If it goes back to $1M per person, well your heirs are kinda screwed if you own more than 100 acres of prime farmland, as it is about $10,000 per acre. Thus if you owed 200 acres, and died, your heirs would need to sell about 45-60 acres immediately because the step-up basis was removed, thus the capital gains are due at death and thus 50% due on $1M above the $1M limit is $500,000 taxes due immediately. What this would accomplish is the destruction of smaller landowners and farmers, as the corporate landowners and mega-rich have the cash to pay the step-up basis capital gains taxes on death (Fed free cash that is!) Thus the removal of the step up basis will be a great tool to force the sale of small land owners to the mega corps…and the “There can be only One” mentality will continue. Of course it depends on the exemption limit. I’d guess it will be $3.5 million, where is was last with the previous “team blue” pres…seems fair as $3.5M today was $1M yesterday due to Fed insanity…

I did a little pre-team-blue tax plan hedging by pushing my property tax payments for 2020 into 2021 (I’m 70% confident SALT $10k limit will be removed by team blue)…but to be honest, I do not get too worried as the political class do not typically walk the talk as they lie to buy votes from those easily deceived.

Basically all hat, no cattle…

Speaking of the removal by Team Blue of like-kind (Section 2013) exchange for farmland and “There can be only One” future where Bill Gate’s kids can pay the huge 45-60% tax hit on death, but the bottom 99% heirs will be forced to sell to the top 1%. They will sell it as a tax on the rich, when it really is a forced asset transfer tool from the bottom 99.9% to the top 0.01%…

Per Bloomberg Bill Gates is the largest farmland owner in America:

“After years of reports that he was purchasing agricultural land in places like Florida and Washington, The Land Report revealed that Gates, who has a net worth of nearly $121 billion according to Forbes, has built up a massive farmland portfolio spanning 18 states.”

“His largest holdings are in Louisiana (69,071 acres), Arkansas (47,927 acres) and Nebraska (20,588 acres). Additionally, he has a stake in 25,750 acres of transitional land on the west side of Phoenix, Arizona, which is being developed as a new suburb.”

Gates now owns 242,000 acres of farmland across the U.S., mostly “through third-party entities by Cascade Investments, Gates’ personal investment vehicle.”

@Yort,

What you mean to say is that it’s a scheme to guys like Bill Gates, who already owns the largest amount of private farm land in America. I wonder if that’s going to be set up for the Gates foundation and given away. I would doubt it.

Screwing the middle class appear to be the game in Washington now, the only question is who will screw the middle class more, the jackasses, the dumbos, or the Feds.

Inflation is how much the price of assets go up. The Fed, CPI, and government should be required to measure inflation chained to stock markets and real estate. Then we would get an accurate inflation figure.

A better definition of inflation would be ratio of money supply and all available products at any time, any other definition is a smoke screen so the elite can continue to extract wealth from society by printing currency for themselves while average Joe has to work his butt off for it.

inflation = govt made up word

it is REALLY DEVALUATION OF FIAT CURRENCY used to pay for spendthrift govt that just keeps spending

remember taxes are govt revenue – ie stealing from viable businesses and peoples wages

Or the belief that you can get something for nothing by manipulation of a manufactured medium, in this case, the value of currency.

Things got scary for brick and mortar in the lockdown. There were actually some good buys in the mix.

One outdoor mall REIT got down to about 2 times 2019 free cash flows. I bought some on the way down and on the way up, but not nearly enough. It’s up 3.15 times it’s lowest share price with the dividend reinstated. Yes dividend is lower but works out to just under 20% off of lowest price. It takes guts to buy when the market is throwing in the towel, but value style investors tend to put in market bottoms because the numbers start working out for long term returns.

Two mall REITs already filed for bankruptcy in 2020, wiping out their shareholders. Be careful.

we went to restaurant last nite(of few we actually go to) and this big place has no were near enough traffic to keep it going for much longer

I predict 1/2 restaurants still open will close by 2022

I live near the second largest mall in America, and while the restaurants were popping, the rest of the mall was NOT. And I’m in South Florida during peak season.

If you plot the inflation rate and the wages, you can easily see where all our societal ills stem from. Wages have lagged inflation big time.

It didn’t have to be this way, but mandating 2% inflation for the plebs while their wages aren’t indexed to 2% inflation is borderline criminal. Within a generation your wealth is reduced in half. When will people realize that the Fed is the enemy?

Yep.

And if we mandated inflation as you and I posted here just above, government entitlement income would be forced to go much higher, transferring wealth to the peasants instead of to Wall Street and Jerome’s Super Ultra Wealthy friends.

Jerome and his cabal at the Fed would likely throw hissy fits and Mr Market would have a massive sad.

But yeh…it’s only fair. After 40 yrs of socialism for the rich, it’s our turn.

Am anxiously looking forward to 3 “free” loaves of double fiber bread per month, courtesy SSC and CPI-U.

Feel very “entitled’…..till Medicare B goes up.

Maybe they will finally get to put SSC in stocks, then I’ll be a real productive citizen, and not just another entitlement drag on society.

It’s a really weird thing that the narrative in the mass media is always that inflation is good and everybody is parroting that, while it is obvious to the majority of the population that this can’t be true. Why isn’t there more pushback on this?

Why is the Fed targeting 2% inflation (and actually much more because of the way it is measured)? Instead of looking at GDP and inflation. If you want economic “growth” to mean that peoples standard of living actually rises, it would make more sense to look at medium real wages. If wages are sticky, you then want a bit of deflation in prices. Things getting cheaper should be the natural consequence of improvements in productivity.

“Why isn’t there more pushback on this?”

Neither degraded political party has any remote hope of controlling/running/surviving the country without an extremely free hand in using the currency fraud tool (printing press in all its many Fed forms).

So the media dildos they use to skull-…caress the populace essentially never bring money printing/inflation up.

Over 50 yrs, DC has grown completely and totally addicted to deficit finance and that doomed the country to debt monetization, despite decades of warnings and decades of political lies about how such deficits “don’t matter” or are “absolutely necessary”.

Well, if the Fed says it’s trying to make inflation higher because it is too low, and is therefore tying to get it up to 2%, – when it’s really 8% or whatever – lots of people fall for the con, so to speak, and repeat the Big Lie, if only to explain what the heck the Fed says it’s trying to do.

See above, media BIMBOZOS,, soothing lies.

“Creeping Austerity”……a variation the old IMF trick.

The fed is also enabling the government spending with low rates as well.

And you can readily see the recent decades disconnect between wages (income) and housing prices (asset inflation) when interposed on a chart.

Fed perpetuates this housing bubble through a number of manipulative sleights of hand, including putting their boot on neck of interest rates and buying up tons of MBS to hide risks that otherwise would boost 10 year treasury market rates (which would otherwise demand more yield). 10 year treasury bond rate is a benchmark for mortgage interest rates.

Here is what is happening. I bought everything I want or need. A car, bicycles, clothing, new shoes, surfboards, detailing, redwood chips for the yard, furniture, videogames, pots/pans, everything.

I have nothing left to do or buy from retail. Not of any significance.

I want to travel, but I can’t. I want to take my kids to amusement parks and zoos… not gonna happen for another month.

Retail is dead because everyone is saturated. It is service that is in demand…. there is no supply of service.

Hernando, you have hit the nail on the head. Add to it something like what is happening in my household, where we are buying used or it getting for free, and we spent even less.

My wife would love to be able to travel, but that is off the table. And we use very few services.

Odd thing is, even if and when this all blows over, I doubt we will go back to spending. Millions like us, I think. I cannot see building a recovery on that.

Brace yourselves for the “Spending is patriotic” campaign…

I think a lot of people broke their spending habits in the past year, just like any other habit. We only spend what we have to in order to maintain our lifestyle, which is extremely modest (we are both on SS and we have a bit of self-employment income). I just bought all of our garden seeds, fertilizer, and canning supplies for this year. At the end of last summer, I bought a used car for cash to replace the previous used car that died (bad Chrysler computer module for the second time in six months). We buy no toys, no travel, no frills, no extraneous stuff. We take day trips around the area and pack picnic lunches rather than going into restaurants. We live not far from Mennonites who supply us with beef, a farmer up the road is raising a pig for us, and another farm sells chickens and cheese. We raise chickens for eggs and meat. At one time in our professional lives, we handed the governments of all levels over $30k each year in taxes. Now, we are due small refunds from state and federal and our net taxes are less than zero.

Perhaps negative nominal US interest rates will inspire the needed “patriotic” consumption.

No problem Hernando. If you’ve plenty of free money, buy stocks. It is obviously the thing to do as American corporations can’t be wrong. Think of all the fun you can have running your shares through your fingers.

So these curves are good for the USA or not?

It seems a lot of spending is now dollars out of the USA to Germany, China etc.

Those dollars are ultimately stimulus/debt dollars.

Those dollars come from treasuries sold to themselves (USA society), and those sold to the same countries above selling goods for USD.

I’m struggling to understand who is actually paying for this.

While the USA takes on debt domestically to just send abroad, then that’s great for China etc… but then that very security (USDT) they’re buying is more risky because of it, which means they want to hold less… which means USA need to buy more USDT with domestic printed money… feels like a nasty feedback loop is brewing?

Why is the Fed targeting 2% inflation? In all the intellectual press conferences the Fed has no one asks the simple question”Why is your goal to raise prices on things people need a worthy goal?”. Fed policy is not constructed on truth and transparency, but on 1984 type language where up is down and black is white.

The older I get the more I understand whoever gets the right to print money gets to call the shots. The British can be thankful they never signed on to the Euro or Brussels would be dangling carrots and sticks to beat them in compliance like DC does US states

“The older I get the more I understand whoever gets the right to print money gets to call the shots.”

At the most raw/extreme end, the G can simply and literally print money, hand it to specific individuals, and thus pay them off to undertake any act from medical care to killing.

50 years ago this was thought to be an inconceivably reckless and obscene way to run any government let alone an American gvt.

But 50 years of habitual DC policy failures and political payola have made it the *only* way the current configuration of DC has of surviving.

At some nearing point, the clear fundamentals underlying the US gvt will be so self evidently and irredeemably hopeless (debt to real GDP so awful, mandating ZIRP forever) that the USD will break and DC won’t be able to rule through forgery anymore.

Then they’ll try force and likely/hopefully fail.

Govt and the politically gullible non-critical thinking electorate has removed all penalty for policy failure. At present we are listening to speech from idiots that has storm and fury but of no consequence . That being said I am keeping TOM’s $600 and OWJ’s $1400 and like a trained seal waiting for an airborne mullet ,I am flapping my flippers and barking, awaiting another. I am a good American. I await my moderation reckoning with pride.

“has removed all penalty”

At bottom, it has likely been caused by a “Kang and Kodos” problem (Simpsons reference) or a forced false dichotomy between Dems and Reps, when the reality is closer to being that D/R’s are really just two political mafias fighting over the protection racket money.

The Age of Mass Media (1925 to 1995) just made the problem much worse. Whoever controlled the means of mass communication heavily dominated the flow of information/warnings/possibilities into the minds of and *among* Americans.

So the default narrative/almost sole frame of reference was the World’s Longest Continuous Production of Kabuki Drama…DC.

The two parties alternatively extracted wealth from the mass of Americans in the service of their core constituencies and that fatal process was alternatively presented as either wholly benign or inescapably inevitable.

The internet has been shooting holes in this wholly DC dominated process since 1995 or so…but it simply came along too late and took too long to beat back the political party Mass Media powers.

Too many massive unfundable promises have been made to too many hundreds of millions of Americans and the authors of ruin in both parties will simply disappear like farts in the wind (to show up the following week as 2nd bananas on “Good Morning, Beijing!”).

The mass of Americans will be left with the crippled economy and nightmare finances.

There are some residual resources left to Weimar America and the nation may slowly heal…but DC has needlessly cost us the primacy inherited following WW 2.

Look at this article from 10 years ago on how the Fed has bought the critics, basically if you are an economist and criticize the Fed, your career chances are pretty depressing. Soviet style nomenclatura.

https://www.huffpost.com/entry/priceless-how-the-federal_n_278805

McDonald’s same store US sales increased in Q3, while same store global sales decreased in Q3.

I suspect all restaurants with a drive thru did well in Q3.

since 1971 most of productivity gains have flowed to capital and not labor. If these gains had followed the pre 71 path then your average wage in America would be around 2 and one half times higher. I remember Bill Clinton saying in the early 90’s that what America needed was a lot of 40k jobs. Well guess what Bill? That number is now 80 to 100k.

Seasonality seems to be eventually worked out by time and Real stuff?

FRED

Real Disposable Personal Income: Per Capita (A229RX0)

It’s interesting to compare these two things, but in theory, less income less consumption?

Real Disposable Personal Income: Per Capita (A229RX0)

to

Real Personal Consumption Expenditures, Billions of Chained 2012 Dollars, Seasonally Adjusted Annual Rate (PCECC96)

On a side not: Stimulus checks are not taxed as real disposable income, in fact not taxed at all.

FYI:

FEDS Notes

Twitter Share RSS

January 14, 2021

The Unusual Composition of Demand during the Pandemic1

From the perspective of firms, good producers—particularly those able to sell online—and homebuilders and real estate agents may be able to maintain revenue streams, particularly if fiscal stimulus can mitigate the decline in demand from income losses. But certain service sector firms and retailers with only brick-and-mortar presence may be less fortunate, and more reliant on financing such as the Paycheck Protection Program and various credit facilities to bridge the gap in sales.

And for all the SS folks (oldies but goodies), the CPI this past year measuring inflation was up 1.3%. So far in latest data in Dec it is tracking 1.45% above previous Dec. They sure think we have inflation!

https://www.ssa.gov/oact/STATS/cpiw.html

Drug stores have never been going better, at least in my country. People are so afraid of doctors and nurses getting them Corona, more so with several cases of doctors and or nurses getting entire retirement homes infected, that even in the worst cases drug stores sold more or less the same that the previous year.

If an observer who knew nothing about the US economy saw just the charts etc. above, he would conclude that there had been a very brief but extreme hit to the economy in late 2020 but the economy very quickly recovered to a level equal to or slightly above where it was before the crisis. So he would assume the crisis was over.

If told it is actually getting worse, perhaps he would wonder which factors were masking the economic hit and whether they could last as long as the crisis.

The factor is that the fed clogged the pipes and there is no natural movement until they stop giving out free money and end forbearance.

Fortunately the election is over, so this may be soon.

The business of America is selling user’s data to advertisers for distribution chains of Chinese goods. Oh, and borrowing from some iffy potential future.

So the virus won the war on Christmas?

The stimulus tapered out. The only thing that can stop Americans from shopping is lack of funds.

The strong lives, the weak dies, America justibuys.

It works like this. Inflation goes up 2% and your real pay goes down 2% in value. You get a 2% raise so you break even, except that everything now costs more and you are really behind. You make up the difference by going farther in debt. You think things are OK because you can still get what you want using credit, but your debt level is always increasing. One day the powers that be pull the plug and you are holding the bag for a huge amount of debt for a bunch of crap that is worth far less than what you owe. At that point you finally realize you are not prospering, you are actually poor…..

Then you use your house as an ATM machine as recommended by Alan Greenspan and his 150 PHD economist experts to get cash to pay off your credit cards so you can run them up again. When the house all the equity is stripped out of the house and they decline in value a la 2007/2009 then you leave the mess to the lender who goes to government insurance program to make good on the bad debt. The loss is added to federal spending and the Fed prints the money to make up the difference. The devaluation of the currency is spread around to the entire population.

That’s the plan.

“They lie about everything. Why would they lie about this?!”

Contrary to the inflationista posts here, the Fed is desperate to raise inflation, granted, based on their definition, to 2%+. Powel has now doubled down on his statement he would “not even think about thinking about raising interest rates.” This is based on recent theory on how to move the economy off of the zero bound liquidity trap. I would link articles, but it is not allowed here. Enough to say the Princeton School of Economics has issued a flurry of papers in the 2000s, that can be googled, on what to do when interest rates are at the 0 bound. I will just point out that the option to devalue the dollar against gold from $20 to $32 (a 60% devaluation) used the 1930s is no longer available in the 21st Century and floating exchange rates further reduce the policy options.

We could devalue the dollar against US coins in circulation.. Bring back the $500 and $1000 Federal Reserve Notes as the paper is getting too bulky. Periodic stimulus checks for everyone

Still haven;t got an answer “Who’s picture is on the $500 bill and $1,000 bill?

OK, so I looked it up. It was kind of fun.

$500 bills, on the front:

1918, John Marshall, Chief Justice of the Supreme Court,1801 to 1835.

1928 & 1934, William McKinley, 25th President of the US.

$1,000 bills on the front:

1918, Alexander Hamilton

1928, Grover Cleveland, 22nd and 24th President of the US

Government is always messing with money in a subtle way. When I was 9 years old pureure silver quarters were as common as paper dollars today. For of those quarters would get you about $25 fiat today. Now think about holding a dollar or rolling t-bills for 50 years and what will you have. In real terms, not much. QE is the new debasement.

Wolf, I think instead of calling this the weirdest economy ever, a better term would be to use the term “Deformed” , which is to copy the term used by a former Congressman and divinity school student who used to be Budget director under the “Gipper” .

How about Frankenstein Economy– truly deformed and hideous.

Heinz

Not bad, at least its original

I wonder how much of the nonstore retail money went to electronics? Computer and related parts prices went up, sometimes drastically due to shortages. Evidently there was a shortage of materials because of distribution clogs and the same materials are being used for things other than consumer computers- cars, phones etc. Scalpers seem to be buying a lot of components in bulk to resell online. Mom and Pop computer building stores are having a hard time sourcing parts and some car manufacturers have or had halted lines.

I finally got a CPU at MSR, being shipped now. I hope it’s a good one as returns would take months. All my other parts have been sitting so long they are out of the store warranties.