Regular folks need not apply.

By Wolf Richter for WOLF STREET.

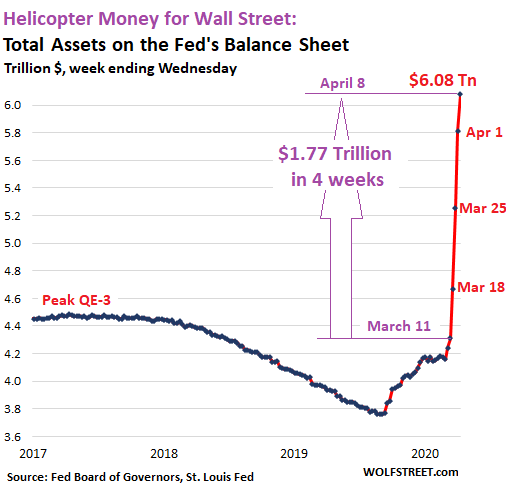

Total assets on the Fed’s weekly balance sheet jumped by $272 billion in one week, to $6.08 trillion, according to the Fed’s release Thursday afternoon. Since the Fed started this spree of Wall Street and asset-holder bailout programs four weeks ago, total assets have exploded by $1.77 trillion.

But note: This increase of $272 billion is less than half of the increases in the prior two weeks. You can see this in the chart as the distance between the two markers this week shrank by half compared to the prior two weeks:

The assets on the Fed’s balance sheet are mostly composed of Treasury securities, mortgage-backed securities (MBS), repurchase agreements (repos), “foreign central bank liquidity swaps,” and “loans.” We’ll go through them one at a time.

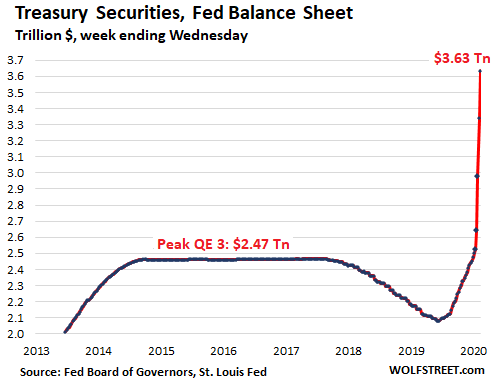

Treasury securities.

The Fed added $293 billion in Treasury securities during the week of the balance sheet. But the total balance sheet increased by “only” – so to speak – $272 billion. So some of the other assets actually declined. And we’ll get to them.

This $293 billion spike in Treasury securities this week was also lower than the spikes in the prior weeks which averaged about $350 billion. This is one factor in the cut-in-half QE-4. For now, the Fed is sticking to its announcement that it would drastically cut QE from the prior weeks.

The Fed is now adding only Treasury securities with maturities of over one year (coupon Treasury securities, TIPS, and Floating Rate Notes). The balance of T-bills (non-coupon securities with maturities of one year or less) has remained roughly flat for four weeks, at $326 billion, and the Fed has only bought enough to replace T-bills that matured.

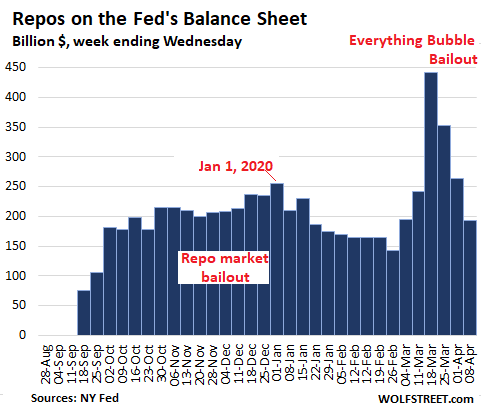

Repos on their way to irrelevance.

The Fed is offering $1 trillion per day in overnight repos plus over $1 trillion a week in term repos with various maturities reaching up to 84 days. Overnight repos unwind the next day. But term repos unwind on the maturity date, and via term repos, the market could load up on several trillion dollars in a few weeks. But that’s not happening. There are only a few nibbles every now and then.

As of today’s balance sheet, the total balance or repos outstanding has plunged by 56% from the peak on March 18, to $192 billion. Over the 7-day period, repos dropped by $70 billion, which is another factor in the shrinkage of QE-4:

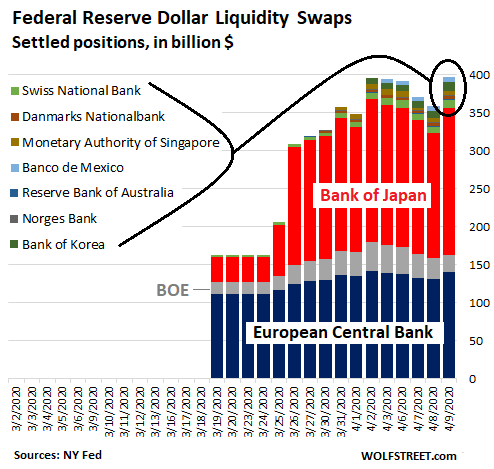

Central Bank Liquidity Swaps: Biggies BOJ & ECB

As part of its bailout scheme, the Fed now operates “dollar liquidity swap lines” with the ECB, the BOJ, and the central banks of Canada, England, Australia, New Zealand, Norway, Sweden, Switzerland, Denmark, Singapore, South Korea, Brazil, and Mexico. Of note:

- The lion’s share of the outstanding balances are with the Bank of Japan ($193 billion) and the ECB ($141 billion).

- Trailing far behind is the Bank of England ($22 billion).

- There has been no activity with the central banks of Canada, Australia, Brazil, New Zealand, and Sweden.

- The remaining central banks split up the crumbs amongst each other.

The Fed’s weekly balance sheet closes Wednesday evening, at which point the total outstanding swap balances were $$358 billion, up by $9 billion from the balance sheet a week ago.

The chart below shows daily balances by country, and includes today’s balance (right column), which jumped to $397 billion:

The two central banks that use this liquidity swap line the most – the BOJ and the ECB – preside over export-focused economies that have large trade surpluses with the US and therefore obtain a constant flow of dollars from those trade surpluses with the US.

Also, their currencies are the second and third largest global reserve currencies: The dollar’s share is down to 61.8%; the euro’s share is 20.1%; and the yen’s share has risen to 5.6%. In addition, the BOJ sits on $1.2 trillion in US Treasury securities.

So the BOJ and ECB don’t need the dollars for trade. But in both Japan and the Eurozone, banks and companies have large amounts of dollar-denominated debts and speculative positions, and when they roll over, they need to be refinanced with cheap dollars at the lowest possible cost (yield). And those swap lines make that possible.

With these liquidity swaps, the Fed lends out newly created dollars and takes the other central bank’s newly created domestic currency as collateral. The exchange rate is the market rate at the time of the contract. These swaps have a fixed maturity, currently 7 days or 84 days. When the swaps mature, the Fed gets its dollars back, and the other central bank gets its own currency back. The Fed carries these swaps on its balance sheet valued in dollars at the exchange rate set in the agreement.

“Loans”

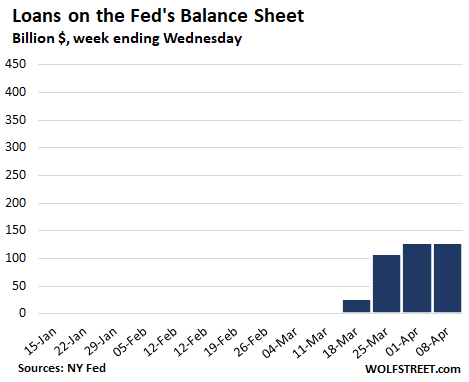

The line item “Loans” is a group of asset accounts that were essentially inactive after Financial Crisis 1. Over the past four weeks, they rose from near-zero to $130 billion, but since last week, the amount has been essentially unchanged. This is what the Fed has lent out as part of its new bailout liquidity programs and direct lending programs, by category:

- Primary credit: $43 billion

- Primary Dealer Credit Facility: $33 billion

- Money Market Mutual Fund Liquidity Facility: $53 billion

The chart is on the same scale as the chart for repos above, giving these loans some room to grow into:

MBS.

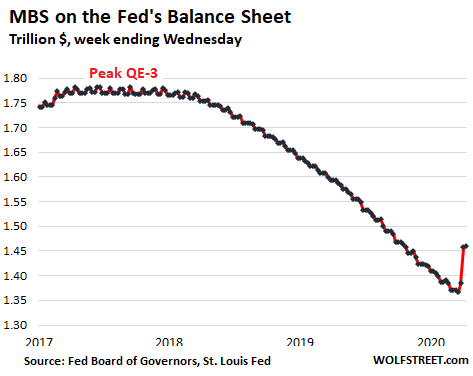

During the week of the balance sheet, the Fed purchased $109 billion gross of MBS, bringing the total in gross purchases of MBS since March 11 to $428 billion. The MBS market was blowing up, mortgage REITS were blowing up, mortgage rates were rising under that pressure, and the Fed decided to bail everyone out rather than to let the market sort this out.

But it’s complicated, as they say. Holders of MBS, including the Fed, receive pass-through principal payments as the underlying mortgages are paid down or are paid off. Currently, there is a boom in mortgage refinancing due to the lower interest rates, and these pass-through principal payments resulting from those refis have become a tsunami for the Fed. If the Fed didn’t buy any MBS, its balance of MBS would shrink rapidly.

But over the past four weeks, some of the $428 billion of gross purchases of MBS just filled in the holes left behind by the pass-through principal payments. The remainder increased the size of the Fed’s MBS balance.

But, but, but… MBS trades take a while to settle, and the Fed books them only after the trades settled. So what we’re seeing on the Fed’s balance sheet hasn’t quite caught up with reality. And what we’re seeing is that after the $73 billion spike last week, the balance of MBS has remained flat this week at $1.46 trillion:

If…

Since March 11, the Fed created $1.77 trillion and handed it to Wall Street either by purchasing financial instruments or as loans. The sole purpose of this was to inflate asset prices and bail out asset holders. It’s apparently against the law in the US for the Fed to allow the wealthy to lose their shirts, or something. The crumbs offered to small businesses or the real economy have not materialized yet. Those are future projects, if they ever materialize.

If the Fed had sent that $1.77 Trillion to the 130 million households in the US, each household would have received $13,600. But no, this was helicopter money exclusively for Wall Street and for asset holders.

Gut-wrenching. The hope is that most people will be rehired as the health crisis becomes more manageable and lockdowns are loosened. Read… Week 3 of the Collapse of the US Labor Market

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

This is worrisome, but nothing compared to when they start adding zeroes to dollar bills next year.

@andy

The Fed applauds you for continuing to worry about currency inflation. Stay focused on that! Run around like crazy trying to put futile hedges against currency inflation

-AND-

Pay no attention to the Fed becoming the legal owner of the house you live in, the car you drive, the business you work for,the politicians you enthusiastically vote for, the schools your children attend. . .

(For the naive- FYI the lienholder is the legal owner- look it up)

Raging Texan:

There has to be a “recorded trail” (paper) for the lienholder to collect.

I’m trying to remember during the “aftermath” of the ’08-’09 crash when some banks somewhere in the US (or could have been a foreign one) tried to collect in court they couldn’t produce the “original” lien (instrument of ownership) that they were voicing claim to.

It kind of goes back to the “great financial sausage machine” that makes all those derivatives……lots gets thrown in that doesn’t belong there and lots that just rots.

Anyway, your post jolted my memory about the court case that turned away one of those banks back then.

So somebody has to produce the original documentation…….to collect.

Yep some people didn’t have to pay their mortgage cause it had been sold so many times into various tranches without the proper work trail. However, when they realized that people were getting out of paying mortgages, I believe they changed the necesary paper trail that the MBS must follow. It had to do with MERS- the mortgage electroni banking system

Sheesh!. A lienholder has only a legal “security interest” in a collateral. A lienholder cannot transfer title without perfecting the claim through the courts.

Why the heck do you think it takes so long to foreclose on and sell a house?

@Lisa Hooker

Oh so when the Fed owns mortgage securities, US Debt, Junk Bonds, ETF’s and stuff than it’s not actually the owner.

Phew! I thought they were trying to enslave us by buying everything. Great to know that the courts have the back of the common man, too. I guess the Fed must just be propping up asset prices to be nice to the avg joe so his home value doesn’t go down.

Well then I guess I’m ready to sell everything to the Fed now.

Tex, you do have the gist of it. If you stop paying, after they go through the courts that you can’t afford, they’ll just take the stuff.

Currency inflation, physical and digital, is a legitimate concern. It is a necessary part of the toolkit used to practice their theft.

Absolutely. Remember Weimar. Hold on to cash though for the deflationary period that comes before: cars, houses, stuff, workers – all half price.

Notice the record PE fund raising closings lately? A bargain season for the history books is coming.

I’m hoping for a nice, if relatively brief, period of deflation. Let the savers have a win before blowing everything up with the inflation that will eventually follow this mess.

When I was a kid we used to use DM to supplement monopoly money as there was so much of it floating around.

With the USA debt/GDP at 160% before the covid bailout what is it going to be after.

Some of those fancy named FED schemes allow a iBox leverage so they can buy 10% junk bonds. So junk bond etfs went up in value and bailed out that market too. So no price discover for risk assets??!!!

Does that mean the stock market is going to continue to bubble on? All the wall street investment houses are calling for a recovery by year end!!

This dead cat bounce could take the S&P up again!!

Hear! Hear! Great article. This is worse than Pres. Hoover’s response to the 1929 crash. The “Federal” Reserve privately owned bankster cartel has been so focused on robbing most Americans (the bottom 95%) that it did not even think how their helping main street now might mean they will be able to steal more money from them later.

The true goals of the Fed banksters will be seen more and more clearly by intelligent Americans: to use its ability to create US legal tender to allow infinite gambling by banksters. I am sure that with Fed bankster help via ultra low, way, way below FMV interest rate loans, the corrupt, rich banksters will soon get to control more US companies at rock bottom prices– which is probably why they will never help main street businesses.

I meant the Fed bank cartel will give billions in way below FMV loans to banksters to buy US compa’ stocks when those hit rock bottom prices. That has not happened yet.

The markets have not yet fully collapsed. The real crash is rushing towards us rapidly with the slow exhaustion of many companies’ resources eventually forcing them into bankruptcies.

Debt eventually get paid by the taxpayer through taxes or inflation. Another way of thinking about it is your billionaire-friendly government took $13,500 from you and gave that money to the billionaire class.

Oh, this is going to end well ( sarc off)

Yeah, we need trillions in stimulus because of a virus. Has nothing to do with the trillions of debt in the economy.

Go wash you hands, Bro.

Go wash your hands like Pontous pilate, no wonder JC flogged the money lenders out of the temple

My hands are clean thanks In every way

Amen. Some will invent more efficient guillotines which word like companies’ (into compas’ whatever that is) above is being mis-corrected by this Fire tablet repeatedly.

What’s next, the Fed buying junk bonds? Oh wait, what’s this?

Yep. Just read that in Barrons. The FED’s buying junk bonds and equity ETFs.

So illegal.

“If the President Does It, That Means It’s Not Illegal”, or something like that.

Is that all junk bonds or just bonds that got downgraded to junk post C19?

Moral hazard? We don’t got to stop no stinking moral hazard. We are the Fed!

For it to be a moral hazard, must the party involved first be required to have morals? … :-)

Following four decades of monetary distortion central banks are now left with two choices, inflationary collapse or deflationary collapse. The choice they’ve made is clear.

Tangible assets offer refuge from inevitable consequences.

When will it end? Racking up the national debt I mean.

Never. Just accept it. Or don’t. You have the power to organize and strike back. We don’t though, because we’re indoctrinated by a culture of selfishness.

I dunno. Unemployment 25%, DOW 30,000 might spark rioting or a General Strike.

Many Americans are going hungry now, and hungry people are dangerous. The Fed has played this round very poorly. EVERYONE can see what they are doing now.

Sadly, hungry broke people so often only prey on those who are also poor and hungry, burn their own neighbourhoods and make it all even worse.

“Many Americans are going hungry now, and hungry people are dangerous.”

Hungry people are more willing slaves too. The corporate barons will rehire for dirt cheap.

Front page article in today’s Minneapolis Star Tribune:

‘Minnesotans Buying Guns Like Never Before’

Kory Krause, owner of the Frontiersman gun store in St. Louis Park (just west of MPLS), “We did more than a month’s worth of sales over just a four-day period.”

Krause said the run on guns is a result of people, “wanting to protect their family and their stockpile. The shelves are nearly empty of shotguns.”

Minnesota Nice, meet Minnesota Beware of Anyone Approaching I reckon.

There are a lot of problems with lunatics running the federal government but NO ONE in the US is going hungry. Just park at the neighborhood Quicky Mart or Walmart and you will see huge whale people moving like dinosaurs towards the Cheetos aisle. The biggest issue the “poor” in the US face is obesity induced diabetes. Wanna see hungry turn on the old commercials from the seventies with Biafran’s starving.

What are you saying? The “trickle-down theory” hasn’t worked for Average Joe?

Are you sure? That would counter everything I’ve been told over the last 30 years.

The Grapes of Wrath- no more Oakies

I’d complain too-

but all my comments are “waiting moderation”

hi wolf

And you know why!

We start to receive the estimates of the cost of the lockdown.

Bernanke estimated the US GDP could fall 30%+ for 2020Q2.

France’s GDP fell 32% during 2 first weeks of national lockdown started mid-March (source : Banque de France).

I forgot to indicate, that these numbers do not include the cost of added debt.

When we start holding our leaders in the federal government responsible for there ineptitude and malfeasance.

Guillotine 2020

That was not my point.

Every decision has a price.

Everything is the question of a trade off.

I am not saying that the current anti-covid19 strategy is good or bad.

I just hope that those , who decided for us the lockdown, have thought of as many consequences as possible

Just another wealth transfer from the poor to the rich.

Main Street has never mattered and still doesn’t matter.

Pure corruption!

I don’t know. Goldman Sachs CEO sounded very hopeful about people’s prospects in CBS interview this morning.

https://www.cbs.com/shows/cbs_this_morning/video/_InI0ZALiMXdQ5V_2N97Vy8OR68Cq8Yl/goldman-sachs-pledges-550-million-to-small-businesses-amid-pandemic/

But what do the poor have that the rich want to buy?

Organs?

Wolf, as the 4.5 trillion SPV money goes out, will we be able to see any of that? Or is that all just secret sauce?

Loans > Secondary Credit in the h41, still at zero.

We can all take our 3d printed zip guns and shoot the ceos / managers / their family and friends of the +700 companies that issue the +3000 toilet paper held by LQD/HYG and its ilk when it goes above zero and take their bailout funds and assets afterwords, law of the jungle style.

Why do you keep on bringing up SECONDARY credit as part of the LOANS in the balance sheet when it is PEANUTS compared to everything else? On December 30, 2009; one of the highest balance of secondary credit was only 980 million with an “m”.

Concentrate on the alphabet soup first, then only primary credit; in my opinion.

Federal Reserve System’s discount window:

Primary credit is a lending program that serves as the principal safety valve for ensuring adequate liquidity in the banking system. It is available to depository institutions that are in generally sound financial condition, and there are no restrictions on the use of funds borrowed under primary credit.

Secondary credit is a lending program that is available to depository institutions that are not eligible for primary credit. It is extended on a very short-term basis, typically overnight, at a higher rate than the primary credit rate. In contrast to primary credit, there are restrictions on the uses of secondary credit extensions. Secondary credit is available to meet backup liquidity needs when its use is consistent with a timely return by the borrower to a reliance on market sources of funding or the orderly resolution of a troubled institution. Secondary credit may not be used to fund an expansion of the borrower’s assets. Moreover, the secondary credit program entails a higher level of Reserve Bank administration and oversight than the primary credit program. Reserve Banks typically apply higher haircuts on collateral pledged to secure secondary credit.

Seasonal credit is a lending program that is available to assist small depository institutions with demonstrated liquidity pressures of a seasonal nature and will not normally be available to institutions with deposits of $500 million or more. Institutions that experience and can demonstrate a clear pattern of recurring intra-yearly fluctuations in deposits and loans – caused by construction, college, farming, resort, municipal financing and other seasonal types of business – frequently qualify for the seasonal credit program. Eligible depository institutions may qualify for term funding for up to nine months of seasonal need during the calendar year, enabling them to carry fewer liquid assets during the rest of the year and, thus, allowing them to make more funds available for local lending. The interest rate applied to seasonal credit is a floating rate based on market rates.

I knew that nebulously, so thanks for the proper explanation.

Because it represents trying to address to the stresses to those most marginal to the credit system while still being in the purview of the federal reserve, not to say anything of its efficacy.

Much better rational than you thinking that FRBNY repo with the primary dealers matters much in the global $ denom repo markets (of which most is OTC and not reportable) and thinking rehypothication of USTs is only 2x because “laws” (as if they’re weren’t any way to structure transactions to make it seem better than they are on the books…).

So REPO is secondary credit? And that isn’t important? Well I never thought it was, anything else besides a payday loan to investment bank trading desks. And sure REPO has no takers, (what happened to the bull market?) Who wants to buy stocks on a revolving credit line to achieve incremental gains when the larger bear market forces can leave you with buyers remorse? My broker asked me about 2005, why don’t you own financial stocks? I said, I don’t know how they make their money? I called him in 2009, and said, you see I was right, I didn’t know how they made their money.

I listened to a clip today of a ceo who said that this was a little guy on Main Street bail out immediately after praising the fed for buying high yield and junk bonds. Main Street little guy piss ant like me just got hosed again but this time they used an even bigger one.

I haven’t really been hurt yet, except that I didn’t believe in this stock market and have too much “safe” investments. Seems pretty clear though that “they” are rewarding everyone who buys risk assets as a way of owning real things, and given up on the USD being a store of value for long term. I suppose that writing has been on the wall for 10 yrs or more and obvious to see except for those bone-headed savers and value investors who were too idealistic to “play along”. Having said all that, I’m still having a hard time buying into what is still almost the All Time High.

Meh! I shorted some indexed because I believed Brexit would be a disaster and then Covid-19 comes along and makes me 10x what I though the Brexit clowns would do.

I think My Next Project is to weld up a proper reflow distillery column – in case everything goes to shit. I believe that gut-rot whiskey and vodka will eventually be a useful currency.

Agreed! I’ll trade you some grass fed beef for that there whiskey.

What this CEO said makes sense in his mind. When you feed an ostrich, you are also providing food for dung beetles, the following day.

Bobber : thanks for the promotion from a piss ant to a dung beetle. I feel “empowered” I never liked my fellow mindless little piss ants anyway. I am now a “woke” dung beetle.

infinity that is the word

FED & Treasury & Government will give away trillions to help-save first Wall Street the finance : hedge funds funds ETFs Blackrock …banks MBS Junk bonds funds, hugh yield funds …every thing everyone in the finance

They will get FREE MONEY

Then Main Street will get LOANS, no free money

and in the meantime banks will earn as well because they will be the lenders

and finaly helicotper money for everyone.

INFINITY means a new system

no boundaries, no price discovery, everything manipulated

larger monopolies = no more competiton , no law inforcement to protect the predatory malfunctionning way to do buisness.

and small and medium companies being bought by large ones or vanishing

more centralization of money -credit and power in the hands of the central bank large corporations & large funds like blackrock

and then digital money that is not money to ? erase all these debts

“They will get FREE MONEY

Then Main Street will get LOANS, no free money”

The Main Street should be glad that they at least get loans. That is also ONLY because if even small crumbs like that is not thrown at the hoi-pollio now there would have been pitchforks. This way they will be on a leash for some time AND IT WILL APPEAR THAT THEY ARE DOING SOMETHING FOR THEM. The temerity of such thinking is astounding. In all likelihood given the scale of the problem it is likely they will be in for a rude awakening. It does not take much for a person who has nothing to lose to do some damage that then leads to a detonation, when the affected public gets into the act. The fuse is lit just waiting for the match.

That these guys can still think of the loot ONLY, when business and individuals are in deep trouble just shows how depraved the system is.

Yeah, the loans really are a moving target and not well defined. The Portland alt-weekly has a guest editorial from a resturant/bar owner and why he isn’t applying for a loan. It provides good perspective into the average business owner’s considerations during the shutdown. “Even If Offered a Loan from the Paycheck Protection Program, I Probably Won’t Take It”

https://www.portlandmercury.com/blogtown/2020/04/07/28258799/guest-editorial-even-if-offered-a-loan-from-the-paycheck-protection-program-i-wont-take-it

“He’s not an “average business owner”. He services drag queens brunches and alcoholics with his employees relying on tips and probably under reporting their income. Bar business is lucrative, but then so is prostitution. When it comes time to legitimize and join the parade of normal business, then it’s not so good.

Well Ned, I’m a dentist and in the exact same situation. We are barred from working by state order. Why take a payroll loan when we can’t work?

Claude:

Another commenter reminding me of “things forgotten”….

Way back when I was involved (business) in the wholesale produce business and supply management for a major global grocery chain….

When faced with an acute shortage in supply of a particular item such as, asparagus, and to cover the greater need in an advertised situation of that item…….we could contact local buyer reps and instruct them to, “clean the street(s)” of that particular item regardless in most cases of even quality….just as long as we had the necessary “supply” to fulfill end store needs.

I alluded that kind of situation to the FED early on…

The FED is just “cleaning the streets” of paper regardless of quality……….just my take.

And bringing back chuckling memories.

Good article Mr. Richter.

I did apply, modestly like little Oliver Twist with a hand held out and ‘Please, sir, may I have some more?’

But they just sliced it off at the wrist.

That’s OK, because now as a beggar on the street I’ll have a fixed asset capable of delivering a real return: a stump to wave in the faces of passers by.

one day soon there will be no gruel for anyone. the only people with anything to eat will never stoop to eating gruel. it’s pedestrian flavor clashes with the caviar, dontcha know?

Somewhat serious question: do you think that this will lead to a Japan style situation in the medium to long term? What impact does this ultimately have on long term growth prospects ? After all real, true GDP growth was poor going into this and mostly fuelled by debt. If we are stoking the flames of debt much further then couldn’t this cause another Bubble in the short term?

The idea that stocks could rally like crazy last week is just…. unfathomable to me. I really cannot get my head around it tbh

David H – “The idea that stocks could rally like crazy last week is just…”

Well, they’ve all been bailed out. It’s party time for them now!

And now that the elite have been bailed out and there’s no further worry, watch them order everybody back to work.

The elite have used this virus to bail themselves out.

somewhat serious response: a japan-style situation in any of the various terms will most likely look like a 1950’s picnic compared to what’s in store.

It’s becoming quite clear that Wall Street is trying very hard to decouple from the reality that Main Street is experiencing. Washington, D.C., is their unindicted co-conspirator.

They want to bribe Main Street with their own money – they are discussing selling 50 year bonds to pay for the $1200 per adult, so an 18 year old working in a grocery store will pay higher taxes until she is 68 years old in 2070 to pay for the interest.

Another way of looking it at is that you just got an unwanted $1200 cash advance on a credit card, that you won’t be allowed to pay off until 2070, but at least the interest rate will be around ~2-3% instead of double digits.

The $1200 per person is just a smokescreen for the multiple trillions that the Fed and Congress are going to give to the 1% to make good their gambling losses.

They are calling the bailouts “loans” for now, but over time they will be largely uncollectible, and the Fed will quietly write a good share of them off. This works well because the Fed won’t have to worry about selling these assets back into the market, which would create a bigger stir.

Once a debt hits the left side of the Fed’s balance sheet, it will stay there forever or get written off. That is the unwritten unstated rule that investors would be wise to acknowledge.

Rally is a rational response to record stimulus, and some indication that NYC is near peak cases. The real catalyst was the OPEC agreement. Markets were willing to accept the production cutbacks even though everyone knows they are seldom honored. Dropping oil prices are deflationary and feedback through the corporate debt market. HYG had a huge lift. There is some evidence that traders sold the news. Remember (artificially) low interest rates lift all boats, leaky or otherwise. Fed has been bailing out corporate America for ten years at least, no reason to expect them to change. Japanese finance coined the term zombie bank, or corporation. It alludes to nonessential goods or services, which have no market, and cannot make a profit. If you ended up dumping half of GMs output in the ocean, government might still want to keep them going just to provide people with jobs. Enter a few capitalists of high new worth, subsidized by errant Fed policy, and you have the basis for change. So far it is only private equity firms which cull the herd. I liken them to bond market vigilantes, an extinct species. Nature abhors a vacuum, however.

In the UK, the government is paying 80% of the wages of people laid off up to £2500 a month, same kind of for the self-employed, as long as they earn below £50,000 a year. Not sure how this will all end short term but it cannot be good…. We are now in the dangerous world of ” nobody knows”…except it will be bad…but ??????

In the US they are paying $600 a week on top of the regular unemployment payments until July 31.

That’s $15 per hour (assuming a 40 hour work week) to not work, plus the regular unemployment benefits, and with no payroll taxes. They also don’t need to pay union dues, transportation costs, and minor taxes such as local per capita taxes for workers.

A young person who is currently employed, and is still covered by their parent’s health insurance, will probably make more money in the next four months if they quit their job and collect unemployment than if they work.

It’s an ironic way to introduce the $15/hr “living wage” proposed by the left – they are giving it to the jobless first. Actual workers often get less.

There are plenty of people working in grocery stores and exposing themselves to the coronavirus who are wondering why the hell they should bother to show up for work. They’d be better off in the short term if they were fired.

Change “quit their job” to “lose their job”, as voluntary quits don’t qualify for UE.

OSHA law states an employer must provide a safe working environment (proper PPE s). My son quit his job for that reason and was approved for unemployment. Conveniently OSHA took that page down. Nice to know who they really protect.

Nemo, all that they have to do is cough a lot and will be sent away from work to “quarantine in place” thus being able to collect.

In California the unemployment insurance tops out a bit over $500/week. Plus the Federal $600/week that’s around $1100+/week, or $57,200 annualized. A mere $44,440 over the poverty line for a household of one. $27.50/hour isn’t too bad, but have to cut back on the beef Wellington.

A single mom with 3 kids and no job gets about 60 g / yr. Her sig other,not married to her, that collects une and 600/wk would have them making over 100g/yr.

Some day, someone will receive the Nobel prize in economics when looking back at these times, provided that there is a prize to be awarded.

That name “ Nobel” is no longer respected ever since they awarded the peace prize to a ridiculous warmonger in chief

kissenger was never the president. oh, wait, you were referring, i suppose to a different warmonger in chief. there are so many, it gets difficult to keep track.

The “Nobel Prize” in economics was funded in 1968 by Swedish bankers.

It has nothing to do with the tradition of hard science Nobel Prizes, and the original Nobel prizes for Literature and Peace.

Dr. Norm Borlaug won the Nobel Peace Prize in 1970, but it took three calls from Norway to let him know that he’d won it.

My dad was working beside him in an experimental wheat nursery outside of Mexico City when Norm’s wife ran up to let him know. She was a bit embarrassed to also tell him that she thought, at first, that the calls were pranks and had hung up twice.

Dad was the first to shake his hand, and all the scientists at CYMMIT went out to the finest restaurant in Mexico City that evening to celebrate. Since my dad had moved up the ladder, so to speak, from the USDA to private industry a year earlier, he sprang for a case of Dom Perignon at the restaurant.

Dr. Borlaug took my dad under his wing in 1957 when dad began working for the Rockefeller Foundation in Columbia and Chile. They both dedicated their lives to help cereal grain growers feed humanity. May they rest in peace …

Economics is the sister science of Psychology, which was what everyone talked about in the 50’s. Eventually the theories fell out of fashion, and the science devolved into aversion therapy and psych-meds. Economics has already devolved into monetization policy. We already had the pills which I suspect are the real cause of the bull market in stocks.

Central banks do not create wealth. They redistribute wealth. They redistribute wealth in favor of the largest banks.

Wolf,

Are all “foreign central bank liquidity swaps,” between the FED and other central banks called out on the FEDs balance sheet? I have been under the impression that swaps could be off balance sheet, and that those off balance sheet swaps provided stealth liquidity to potentially drive certain financial instrument prices.

They’re on the Fed’s balance sheet, as I pointed out. They’re NOT off the balance sheet. You can look them up:

Item 1. Go down to “Central bank liquidity swaps” — the number you want is in the right column

https://www.federalreserve.gov/releases/h41/current/

This balance sheet is published every Thursday.

In addition, and separately, the NY Fed provides daily swap data by country, which is what I used in my chart.

I understand that too many crappy rumors and click-bait shit floating around out there make it hard to understand what’s really going on.

You are right. Clear information regarding the FED is very hard. You provide a great service. For further clarification ……

HowNow says:

“Yep. Just read that in Barrons. The FED’s buying junk bonds and equity ETFs.”

Joe in LA asks:

“Wolf, as the 4.5 trillion SPV money goes out, will we be able to see any of that? Or is that all just secret sauce?”

Wolf says via https://wolfstreet.com/2020/03/23/what-are-all-the-feds-corporate-investor-bailout-programs-and-spvs/ :

“Indirectly via its Special Purpose Vehicles and its Primary Dealers, the Fed can buy even old bicycles, as long as taxpayers take the losses.”

————————————-

1. Is Barron’s correct in their statement that the FED is currently buying Junk Bonds and equity ETFs? If true, would this have to be reflected on the FED’s balance sheet?

2. Do purchases, direct or indirect, via the SPVs (Special Purpose Vehicles) and primary dealers have to be accounted for on the FED’s balance sheet?

As I said, the Fend can buy anything indirectly by lending to entities that then buy this stuff and post it as collateral.

Now the Fed has said that via these entities it MAY also buy certain types of junk bonds (top end of junk spectrum) but it specifically excluded most junk bonds.

Note in my report above, the Fed isn’t actually doing much of this lending/buying. For now, the amounts are relatively small (“Loans”). The biggest line item of the “loans” is the money-market bailout, where the Fed is lending to an entity that is buying “corporate paper,” which is what money markets invest in.

Wolf,

I believe you wrote in another article that I can’t find, that the FED was being relieved of having to adhere to “sunshine” laws, which means some of their activity can be hidden.

Do you think that this casts doubt on the validity of their balance sheet as to how much money they are digitizing and how much trash they are buying?

Thanks.

I recently commented that the CARES Act relieved the Fed from adhering to the Sunshine Act. If I recall correctly Wolf’s article said approximately same thing but did not mention Sunshine Act.

Of course I have been indulging in my Wolfstreet beer mug so I could be wrong.

@ TXRancher,

and if that is the case, how much credence can we place in the FED’s reported numbers. It would be like placing faith in China’s numbers. Slap me if I’m wrong.

cb,

Nope, I didn’t write that. And the Fed doesn’t need that.

I wrote that about the BANKS — that the Fed allowed the BANKS to end public disclosure of certain summary balance sheet items via the FDIC’s data base. This is done to hide weakness.

The Fed can print all the money in the world. It can never run out of money. There is no weakness to hide. However, the Fed wants to communicate how much it is printing, and that communication is part of its jawboning of the markets.

The Fed cannot buy anything secretly because every single security sold is registered. It’s just an electronic entry, and it’s always known who holds it, sells it, or buys it.

I despite the Fed, but I don’t have to make up stories about the balance sheet because of it. If the Fed were lying about its balance sheet, that would low-level stupid — and that’s one thing the Fed is not.

You’re worried about the wrong thing.

The European Central Bank (ECB) and the Bank of Japan (BoJ) have their own swap lines with a plethora of central banks the US Federal reserve doesn’t bother with: for example the ECB has a large regular swap line with the NBP (Poland) and the BoJ has the same with the Bank of Thailand.

On top of these they have now “emergency” swap lines with other central banks, such as the ECB has with BNR (Romania) and the BoJ with Bank Indonesia.

The euro and yen obtained through these swap line are almost as good as US dollars and if need be can be used to obtain US dollars at favorable rates on currency markets worldwide.

On top of this there are some pretty interesting things going on: for example the UAE Central Bank has its own swap lines with countries like Egypt and Tunisia, albeit they are even more secretive on the matter than the ECB. The UAE dirham is not merely pegged to the US dollar (one quarter buys one dirham since 1997) but is the “cleanest shirt in the laundry bag” among EM currencies. Think of it as a second tier US dollar.

The dirham may not be as glamorous as reserve currencies but it’s well accepted in trade pretty much everywhere. For those who cannot obtain swap lines with the Fed or the ECB it’s the next best thing.

Problem is countries like Egypt and Turkey are going through their dirham swap lines with frightening speed: Turkey, with her large foreign currency denominated debt, will be in big troubles very soon.

Defining inflation as too much money chasing too few goods and services, with the startling rise in UE, there can’t be too much money. While the USG seeks to replace lost wages with helicopter money, it remains to be seen if the replacement gets everyone back to status quo. There may be too few goods and services as businesses crash in this China virus depression. Where the balance winds up is anyone’s guess. But I would argue that it is entirely plausible that inflated prices of goods and services may not be a clearcut result. Now assets are another story. RE may crash, but securities may not. For the sake of 401k’s and pensions, I don’t think the Fed’s supportive actions are a bad thing, even if the ultra wealthy benefit.

Monetary velocity fell steadily after 2008, and seems sure to fall again as consumers have turned (and are likely to stay) more cautious. This makes deflation likelier – in the near term – than inflation. Fed policies seem aimed at inflating asset prices, not consumer prices – the same recipe as in 2008.

What’s harder to understand is how they think they can inflate the stock prices of companies which either (a) have ended up with crushed earnings and/or much more debt; or (b) have gone out of business.

Please tell us, Mr Fed – what’s the right stock price for a bankrupt business?

They will just inflate Facebook website to couple Trillions to make S&P 5 ETF look good.

+1

If the goal is to save 401k’s and pensions, there has to be a better way, than doing anything which allows the ultra wealthy to benefit. If the goal is to save or benefit the ultra wealthy, saving 401k’s and pensions provides good cover.

It is shell game of three card monte.

Engelish:

1) Debt eventually get paid. When will it end? 2070? Never. Just accept it. Or don’t. I dunno.

2) People hungry now = dangerous. See what they are doing now. Hungry broke people so often = dirt cheap.

3) Main Street has never mattered. Or is that all just secret sauce?

4) Piss ant just got hosed but this time they used bigger one. Still at zero. But less than law of the jungle style.

5) Everything manipulated, larger monopolies = no more competition. Infinity is the word. Everything everyone in the finance.

6) Even small crumbs not thrown at the hoi-pollio = pitchforks = rude awakening. The fuse is lit. They just sliced off at wrist.

7) We are stoking flames. Cannot get my head around it.

8) End short term = cannot be good. There is prize.

9) It gets difficult to keep track, all their gambling losses. Bribe Main Street with their own money. 50 year bonds.

10) Why the hell they should bother?

Took an Engelish converter and ran through the comments section.

Number 5 is dead on

The author ( Wolf Richter ) concludes with:

> If the Fed had sent that $1.77 Trillion to

> the 130 million households in the US,

> each household would have received $13,600.

>

> But no, this was helicopter money exclusively

> for Wall Street and for asset holders.

Thousands of years ago, Jesus agreed with

today’s central bankers; saying:

> For whosoever hath, to him shall be given,

> and he shall have more abundance;

>

> but whosoever hath not, from him

> shall be taken away even that he hath.

See: “Parable of the Talents” and

“Parable of the Sower”.

In Matthew 25:30 KJV, Jesus says:

> Cast ye the unprofitable servant

> into outer darkness: there shall be

> weeping and gnashing of teeth.

The idea is that you plant your “seed”

(investment) where you get the highest return;

i.e. you give it to the (proven) rich,

not to the poor (deadbeats).

Don’t cast pearls before swine.

Never try to teach a pig to sing;

it wastes your time and it annoys the pig.

That said, we cannot raise interest rates,

— we cannot pop the asset price bubble —

unless-n-until we provide long-term care

for mentally-ill drug abusers.

Once done, homelessness and wealth inequality

are quite tolerable.

I tell you the truth, it is hard for a rich man to enter the kingdom of heaven. Again I tell you, it is easier for a camel to go through the eye of a needle than for a rich man to enter the kingdom of God. ”

Matthew 19:23-26

Stop trying to justify inhumanity using a book that basically has verses to justify just about anything. That you think human suffering is an acceptable consequence of the actions of an unaccountable few speaks volumes about your moral character.

I’m quoting Jesus, Jonas Grimm.

He explains why it’s appropriate to

steal from the poor and give to the rich,

anti-RobinHood style. Certainly,

it explains what the Fed is doing.

I’m not the Fed, I’m not doing it;

I’m just explaining why it’s been done,

millennia after millennia.

In other words, get used to it;

— society wants it this way —

it’s not going to change.

There is a big time – frame assumption that is being made here. God’s word is timeless and the current story has not yet played out. In the time frame of eternity, those who value money over charity, sacrifice and love for others will reap in abundance. The Bible is pretty clear on this matter.

Whoops make that those who value money over charity, sacrifice and love for others WILL NOT reap in abundance…

Looks like the Fed is hell bent on blowing the next bubble. What is to stop them succeeding as long as they keep buying everything in sight?

The world may be headed for stagnation when massive deflationary consumption and debt servicing meets massive inflationary printing.

The best they can hope for is sustaining the current bubble.

Big Picture:

Wall Street and the rich have been fully protected by the Fed as it uses legal and illegal powers to give free money to them.

The rest of us will see lower wages and a recovery below what we had.

If I were Wall Street, I be hoping for COVID II: The Sequel when this is over.

Hi Everyone….just want to throw this out there, because it likely affects a great many of us here, and IMO this situation is leading us to the next step, phase II, what ever you want to call it. It’s time to band together and use what ever numbers we have:

Please contact your reps and insist they include Federal monies to State and Local governments.

This was a very popular program Richard Nixon had, to help local governments short of cash. I believe it was called Revenue Sharing in it’s day.

Most local governments are going to become very short of cash. When that happens, they will be resorting to much higher property and state income taxes. This will impact many of us here. And I believe Wall Street would love to see many of us driven from our paid-for-homes due to rapidly escalating property taxes. I’d almost say, it’s part of the plan, to create a renting surf society.

I reckon money sent to the states will be used to bail out the public union pensions, like in 2009. The little guy never wins, whether the state is run by republicans or democrats.

Only a Convention of States will solve some of the problems.

If that were true it would be a massive improvement over where it’s going now, but Revenue Sharing didn’t allow that so that is not a valid reason to not support it.

Sorry, but I see no reason to subsidize home owners who have seen home prices escalate 10% per year for many years. Paying real estate tax is a nice problem to have in that circumstance.

Talk to me if and when home prices start dropping significantly. There are others more deserving of stimulus at this point in time.

@Bobber – “Paying real estate tax is a nice problem to have in that circumstance.”

Not when you are retired on a fixed income or disabled and can’t work, and the Fed reduces interest rates to near zero.

Lisa Hooker,

You don’t solve the problem you describe by giving RE tax breaks to every home owner, most of whom have good income and have benefited to some extent from rising RE, stock, and bond prices. That’s not very targeted, so it makes no sense to me.

I’d support a hardship RE tax break for elderly with income under $40k or disabled, but I’d limit it to that.

We have too many wealthy people holding their hands out for bailouts these days. Some people call it the swamp. This is also why many people hate government. It’s a pile of money that goes to those who grab the quickest or cry the loudest.

Bobber,

1). Lisa_Hooker is correct.

2). It’s not just about real estate taxes. It’s about the gamut of State and local governments and the services they provide. Everything from trash collecting to traffic lights to unemployment benefits to Fire Dept.

3). So whatta gonna do, let Wall Street get all the free money?

4). Good Richard Nixon Revenue Sharing. It will change you mijnd.

What are you talking about? Homeowners have been the number one beneficiary of the Fed’s largess, to the detriment of the majority.

You are talking about giving bailouts to holders of an asset class that has appreciated the most in terms of aggregate dollars. Saying all homeowners are in need is completely ridiculous.

@timbers – From time to time I have called my Representative and Senators over the years. Sometimes specific Representatives promoting specific bills and amendments.

Over the past couple of months or so no one is answering their telephones. Just a recording. They used to have a staffer answer.

Timbers. An initiative proposal for a split roll property tax has qualified for the November 2020 ballot in CA. If passed–which seems likely in the current environment– all business property will be reassessed to fair market value, beginning on the 2022–2023 lien date.

And not just property owners will be hit. Many small businesses owners like myself who rent will be exposed to large and sudden rent increases due to property tax increases from reassessment. I am currently negotiating a lease renewal and the landlord has already slipped in a “split roll” provision to cover the eventuality. Many properties–like mine–were last assessed years ago and have at least doubled in price due to the relentlessly blown asset bubble. It will be a huge windfall for the state and local governments. Dubiously called “The California Schools and Local Community Funding Act of 2018.”

The entire mess will be apparent when US loses final control over the ME and oil is traded with a different vehicle than US dollars. It isn’t in the headlines, but it is unfolding. Insane debt levels + 30% drop in purchasing power = a day of reckoning in US society. Real reckoning, not AOC virtue signalling.

Lost me two years ago when steel and aluminum tariffs were imposed on top of existing Canadian softwood lumber tariffs. Everything else has just been more piling on, including an incoherent idiot parading about in a daily virus presser, pretending to understand what is happening.

State and Corporate surveillance, worldwide. The war on cash. Corporate control over all economic policy, and now…over every phase of Govt. What’s a person to do? Don’t have personal debt. Throw away your surveillance phone. Live differently before all freedoms are lost (and I’m not talking about that militia 2nd amendment nonsense). This is just the beginning, imho. I think it’s too late, actually. It’s NOT going back to the way it was before, not with these debt levels and the increase of corporate domination. If a person was barely getting by before virus, there is so way to recoup the loss of so much that happened in just the past month. 30 year mortgages? Revolving credit lines? Car payments? Now? I don’t think it’s the same game.

regards

Please enlighten us plebs as what is going to replace the mighty US dollar and all it brings?

Maybe the country who does not have a crushing amount of debt a more dynamic economy and a world ending military.

Yea, I can’t think of one either.

When dollar is no longer reserve currency it will just be our problem and need not be replaced. The rest of the world will be happy to have us out of their hair eventually.

Considering all the stuff that the posters here are predicting for the future, losing the reserve currency may not be so bad.

I think the Swedish pop band ABBA was paid in coal, grain and potatoes for their USSR tour. Vodka and Ammunition was the go-to currencies for the local biznez during the collapse of the USSR.

‘real things’ will replace imaginary things like USD in a collapse (and your fantastic military will set up roadblocks where you get to give to National Security, all veery polite and nice-like).

You place great faith in the giant military-industrial complex, but what happens when that military stops getting paid? Riddle me that, if you will.

Jonas Grimm,

That’s BS. The US via the Fed can print unlimited dollars and pay the military and anyone else. That’s not the issue…

If the government “wanted” to print dollars to pay the military you can be sure the Democratic Congress would extract budget concessions.

Funny how you don’t see the same thing happening in Canada. All of my relatives debt levels are over the top just like Yanks but they see nothing wrong with living on the edge. EVERY western nation is a basketcase.

So then no Infrastructure Week this week?

There will be no further stimulus for the people.The Dems will try to include the funding for their climate change utopian never ending money.

The Repubs will be clamoring for America to return to work by next week.

Infrastructure money is D.O.A.

So a choice needed to be made .Bail out major employers

and hope they keep their workers.Or bail- out of work

people- directly and hope they spend their money at major employers.

America chose the employers but Canada and the UK chose people.

We will soon see how this works out.

Actually, comrade, America chose to bail out both because we can.

Oh, and while we were at it we helped bail out the rest of the world. You are welcome comrade.

King US dollar in the house!!

However, this world debt bubble shenanigans must and will end in tears before the party starts anew.

Bailing out corporations is necessary. They are where value is created and everybody feeds off them taxes for Government wages for people. The problem is no strings attached bailouts . There needs to be so many strings that the word squid can be applied to the bailouts in reverse.

Corporations don’t need a government bailout. They can be reorganized via Chapter 11. You seem to be supporting privatization of profits and socialization of losses. That’s clearly unfair.

Gordian knot,

They’re not bailing out companies. They’re bailing out shareholders and unsecured creditors (such as bondholders and leveraged loan holders). That’s who is getting bailed out here.

If Delta files for Chap 11 bankruptcy and is restructured without bailout, the airline will emerge afterwards with less debt. The shareholders get wiped out, and unsecured creditors such as bondholders take a bath. Delta and other US airlines have done this before. Works fine. Why not now?

Alternatively, Delta could issue $10 billion in new shares, thereby raising $10 billion in new equity capital, and existing shareholders will be diluted to smithereens, and share price might plunge, but the airline will be stronger. No bailout needed.

Wolf Richter says:

> No bailout needed.

The government is giving to the rich

and taking from the poor, as Jesus admonished.

exactly bail outs for share holder and CEO stock options

it is not capitalism it is crony

If a company fails and the sharehoders are wiped out because the CEOs took on to much debt on leverage for the buy backs mainly , another stronger and with a better managment and allocation of funds can take the company over and jobs will still be there

they will cut some but after a while they will get stronger and will hire again

This malfaisance is only helping Wall Street and keep the zombies alive

Wolf, for the less well informed, why are the Fed doing this? Presumably they believe they are doing the right thing, but what does their reasoning look like and what are they afraid of if they didn’t?

Wolf: are you long equities yet??

There’s two titans fighting in this market – the crushing weight of the virus and the fact that this return to normal isn’t going to be quick and pretty much every economic indicator is going to pot. But in the other corner you’ve got helicopter money, massive stimulus and the hope that we can ignore the problem and get parts of society up and running again.

I’m feeling a bit exposed in the bear camp for now with mostly cash and bonds / hedges !

like in the old western movie when the stranger goes in the saloon to get a drink and the bartender says” your money ain’t good here”. Until we tell the fed that their money is not good and start using anything of real value for currency then we as a society are f—ed!

Way forward:

Use the so far dormant power of a state, which their resources in a legal issue will be necessary.

Constitution requires states to tender gold or silver coin in payment of debts. The US mints those coins, but then the US charges a capital gains tax on those coins. Obviously, such a tax means those coins will never circulate as money.

A state brings a claim in proper venue advantageous to it based on the holding from McCullough v. Maryland, where the court held that the power to tax is the power to destroy such that a state couldn’t lay a tax on US bank notes.

The same applies here. A state, by using their powers, gets rid of the capital gains tax on monetary coins, and let the market decide the price and whether they circulate.

You have to admit, the US laying capital gains taxes on the one thing that states may use to extinguish their debts is evidence that our monetary system is completely upside down from that intended.

Very interesting.

My idea of moving forward is for the Federal Government (including the Fed) to step out of the way when it comes to small business and simply help and give money for the States to help their own local businesses and workers.

The IRS can still give out those checks to taxpayers directly.

But let the States handled their own modern day breadlines. I suppose they know what they are doing. Oh, an at least, they are ELECTED.

Makes good sense to have opened a Roth Ira then. At least the tax is likely to be a lot smaller in the future

…that was a gold intesive Roth

@Implicit – Please note that Social Security had no income tax until 1984. Then congress changed the rules and made it taxable. Congress can change the rules for Roths if it suits.

Good plan, but most of real value is made in China :(

Nearly a third of Americans didn’t pay rent this month, new data shows – CNN headline 4/9/20

Grapes of Wrath – Florida spring vegetables are rotting in fields as people do not buy them.

David Hall,

Well, if you just read the headlines, you WILL BE MISINFORMED.

What the article actually said:

A year ago, 18% of renters were behind. This time, 31% were behind.

It’s the difference that matters because a lot of renters are ALWAYS behind. In other words 13% of renters are behind that weren’t behind a year ago. Not one-third.

Wolf – That sounds pretty good to me right now. I am in the shopping center business. The collection rate for April is unbelievably bad!

There are a lot of retail centers out there that will be at 70% uncollected.

Bad for me, really bad for my tenants. Especially the small independents, a couple of months like this and they won’t have the resources to reopen.

Yes, it’s a huge mess in CRE. A friend of mine, whose articles I publish here occasionally, is a retail mall landlord (mostly strip malls). A few weeks ago, he wrote an article where he explained his solution: he said that he would give his smaller shut-down tenants at least one month free rent to get through this.

But there is a difference between someone living in an apartment and receiving unemployment v. a shop with zero revenues. This is very tough! I wish you the best!

Unleash the Government Cheese!

For the honest and simple layman, in order to understand this mambo jumbo, you only have to think about – “it’s the debt (stoopid)”.

Behind all these musical chairs is nothing but a ploy to keep debt from blowing up because of defaults, keeping them “serviceable” (meaning kick the can down the road) in the meantime by shoving them in the dungeons of the Fed away from any mark-to-market reality.

As if you can suspend disbelief forever.

You will probably see foreigners (those who actually save) shying away from putting their hard earned savings into USD denominated assets. The bs about the cleanest dirty shirt just got debunked. They might as well lend to loan sharks in their own native land.

This will leave us having to fund ourselves more and more. The deficits will be the next virus as inflation rears its ugly head.

Yup, the world is going to run to the safer currency known as…

Yea, I can’t think of one either.

Known as any currency backed by the gold standard.

Please all let us know what currency is going to be backed by gold?

Then we can all meet in that fairy land and party with fairy dust.

No currency can be backed by gold unless it’s convertible. If it’s not convertible to gold, then it’s not backed by gold. And a gold standard means that the currency is defined by some specific amount of gold, thus ‘fixed’.

That’s why convertibility was suspended in 1971. The attempt to ‘fix’ the price of the dollar to gold while at the same time fixing other currencies to the dollar caused a run on the US gold that couldn’t be sustained until all the gold would be gone.

Gold is still the settlement ‘currency’ of last resort though, and countries in dire straits can only obtain loans to be settled in a hard currency if they provide gold to back it up. As an example, Venezuela defaulted on a 1 billion US dollar loan and the gold was forfeited. A similar situation caused Zimbabwe to lose the last of its gold some years ago.

Maybea tranche of precious metals; the dinasaur fuels, the “green” rare earth metals, and the earth/property owned by the goverment by confiscation.

The worlds reserve currency is just a bunch of computer digits backed by the full faith and never ending credit of a failing country. Should be around for a very long time. I have all the confidence in the world of American superiority. we are good for at least another 200 years.

All right, how much Treasuries did you buy?

Let’s see who has skin in this game.

The banks and goverment will have merged by than- the BKGT digi will be in play, and taxes from the plebes will be taken out daily. Now get to work with the other half robot, and amped humans

Reminds me of the ferryboat that kept loading passengers as the crew, under orders from the captain, kept drilling holes through the bottom of the hull.

Alot of justified anger expressed here on Wolf Street today.

I’ll try and inject a bit of comic relief.

I live as independently of the macro-economy as is reasonable, but occasionally have to deal with a macro-economic institution.

When the institution’s customers service rep and I are done talking on the phone, the rep often asks “Is there anything else I can do for you today”?

I answer, “I’m 88 years old. Can you take ten years off my age”?

Some responses:

From a gentleman in India; Long pause, then; “Heh! Heh”. Another pause: “Heh! Heh! Heh! Heh! Heh! Heh! Heh! (etc.)”

From a merchant in new York: “We only offer that on the sabbath and we’re closed on the sabbath”.

From a rep at AMPMEX; (Laughing) “That wouldn’t be fair. who would I give it to?”

Me: “Just make it disappear, like the Treasury does when it buys its own bonds” More laughter.

Folks who call service reps are often angry, so it’s a stressful job. A bit of levity maybe helps a little.

Sometimes I get a huffy response, but that’s on them. I turn it into what one of the Bushes (no pun intended) called “One of a million points of light.”

I remember George Gobel during his standup comedy days, when he did a lecture on bird watching. When he started describing the Tufted Titmouse, the audience strated laghing and George deadpanned: “I didn’t come here to be made sport of.”

Neither do the reps – my apologies to one and all.

I always enjoyed Lonesome George. “Did you ever get the feeling that the world was a tuxedo and you were a pair of brown shoes?”

Why the Wealthy Fear Pandemics

The coronavirus, like other plagues before it, could shift the balance between rich and poor.

https://www.nytimes.com/2020/04/09/opinion/coronavirus-economy-history.html

Wake me up when you folks get your $1,200 checks or when the small pizza parlor gets a loan. Meanwhile, I don’t believe a thing will help you or main street other than a FREE vaccine.

I would like a mirror website or something where we all could report when we receive any of the promised peanuts. My wife and I have applied for UI, the EIDL at SBA, and then there is the $2,400 stimulus check we have been led to expect. So far, only a response from the California UI, which was only an acknowledgement email, but they had my wife’s personal data completely screwed up. Among other things, they did not record our address and have down as being born in 1900. This is not something that gives us confidence in our government.

When I lived in California, I was notified by my employer’s HR department that my paycheck was being garnisheed by the state for unpaid taxes, which immediately caused me to leave work in a panic, dig up my tax records, and contact the CA tax department. They could not explain the error, did not apologize, and restored my paycheck back to normal. Imbeciles.

I got $344 from D.C. unemployment. WooHoo!

I also saw a job for my profession in NZ and applied. Wish me luck!

Nice and quiet.

Operation Results for Friday, April 10, 2020

Last Updated: Friday, April 10, 2020 12:01 AM

Number of Operations Today: 0

No operations yet today.

That’s very Good – for a Friday. ;-)

Good Friday. Markets are closed. Happy Easter everyone!

?

This year Easter is an antediluvian holiday in SoCa. We are being buried in water.

Send us some. We’re parched up here in NorCal.

Hopefully all those who do receive any monies thru the “Care Act” will promptly post on this site………..

Better called We don’t Care for the People act. eh joke only ok.

So next week the Fed only plans to buy about $30 billion per day of Treasuries from the open market.

Ok so things you really have to know:

1) They are buying notes and bonds that have much higher COUPONS than what the Treasury is auctioning today. Meaning, they are robbing the pension and retirement funds of YIELD from the past.

2) If you examine the CUSIP codes of some of the largest purchases, they were auctioned in the year 2020. Meaning, the original buyer did not bother to HOLD them. Sounds like front running to me or FORCED selling.

3) last 4/9, the Fed only bought $38.498 billion. So they are already reducing down from 70+, and 50+ daily. They just cannot buy everything or we definitely have a banana rep.

Why worry about the billions? It’s pointless. We’re dealing with trillions now. The Fed just told you they will do what it takes. That’s all you need to know. Because of the Fed’s stance, chances for inflation just moved higher, which is why stocks are rebounding and gold is shooting up.

I’m assuming the Fed will keep printing trillions until we see a high degree of consumer inflation, and that may take some time. The stock market will be partying until Son of Volcker arrives.

That’s exactly the point. It’s only $1,200 for YOU.

I would argue that if a quango such as the Fed buys everything, then we have Communism sneaking in through the back door in sheep’s clothing, rather than a banana republic.

At least a banana republic is still a republic, and still has bananas.

Don’t confuse crony capitalism with communism. When Jamie Dimon starts vacationing in the Ozarks and buying his suits at the Mens Warehouse, it might be closer to communism.

It’s forced selling i.e., a liquidity problem… converting assets to cash to pay benefits, liabilities, expenses etc.

Delta joins the junk club. Downgraded by Fitch. Delta’s debt to “BB+” from “BBB-”.

So they join …

Alaska Air downgraded to “BB+” from “BBB-”

American Airlines downgraded by one notch to “B”

JetBlue Airways downgraded to “BB” from “BB+”

United Airlines Holdings Inc. downgraded to “BB-” from “BB”

and the last remaining …

Southwest downgraded to “BBB+” from “A-”

No wonder Buffett got out.

What is the difference between 1920s and 2020s?

At least, back then, there was roaring 20s and depression came later.

Now, depression comes first and there will be no more roaring.

In these difficult times, people loose their jobs and take a pay cut. Now, doctors and nurses are taking a pay cut because hospitals can’t make money! Can you believe it? Why do anyone make enemy out of doctors and nurses? No bailout for them…

I will wait for the money to trickle down…

Just wait for your insurance premiums to go through the roof.

My wife isn’t 65 yet. Because we are both retired, she’s does not have work insurance, and we have to buy from the State Marketplace. In our State, the SILVER plan is the one that has subsidies called APTC (premium tax credit) and cost sharing reductions.

When the bond yields went to ZERO, our unearned earnings will also be ZERO. That will put us at, near, or below the FPL or the Federal Poverty Level. So we can get MEDICAID or the cheapest obamacare plan that’s fully subsidized because they do NOT use you assets as a means test, Just your income.

So I expect the State insurance(s) to explode. Coming soon to a state near you.

Cobalt Programmer your skills are in high demand all the state unemployment offices need help with additional lines of codes to manage the millions applying for unemployment.

I read the same story in ZH or yahoo. Actually, I am neither a COBOL programmer nor a cobalt programmer. Obviously, I cannot debug the COBOL mainframe. I am in my mid 30-s kind of.

You know why the unemployment and food stamps went digital on-line? If all the people come together to fill the forms in person to office at the same time in monday morning 8.am, they would start a riot for sure.

I hope everything went peaceful. Even during -1920s there were no riots right?

Have had several friends in CA who were born and raised in NZ,,, Great folks all.

Have also had a couple of friends born and raised in CA who moved to NZ and never came back, saying they loved the place.

Best of Luck to ya mtnwm

This is a consequence of too much globalism.

If price discovery were really allowed in the market, then the competitor nations would print ( and or just lie about their economic statistics ) and buy the domestic assets at a fire sale price. The price discovery might have worked before when the US was the largest economy and sole super power but we are in a situation now were other economies are of the same magnitude in size. Do you want to loose control? I imagine the Saudis are lining up to buy the shale companies. People are fogged over with the status of the US being the sole super power but don’t appear to realize the context has changed.

Maybe bankruptcy should only be allowed and or a separate process for domestic companies. In this situation allow the price discovery. Or limit it to other nations that have some rule or law or consistent outlooks.

Also, add a parity tariff to even out wage, environment and labor conditions to help reduce the bottom line imbalance.

I might be imagining things but I have noticed during this current stock market rebound that the nightly network, local or national, has been pretty silent about the stock market. Usually every daily news cast is cheering the stock market to no end. Maybe they (corporate media) are worried about appearing to be insensitive to what the general public is going thru right now? . (Not talking about the financial channels which are always cheer leading).

Dow 30K by end of year. All the panic sellers will have been crushed, just like in 2008. Why do people never learn?

… unless the swans, start breeding more cause the petri dish is fertile in this debt ridden agar.

Great insight. Put all your wealth into out of the money call options. Mortgage you home and buy more. You are going to be rich, rich, rich! (Why do people seldom put their money where their keyboard is?)

Thanks Wolf,

Wow, the corona virus changed things. With no virus, would the fed have intervened this way? I don’t think so.

Calling it the Everything bubble seems hyperbolic, IMO. I’m going to start calling it the Central Bank Bubble, as to redirect people’s eyes there.

Maybe the next shoe to drop. The Mortgage Bankers Association said that forbearance requests grew by 1,896% between March 16 and March 30 and the CARES Act stimulus package requires servicers to provide forbearance to any homeowner with a federally-backed mortgage. I see why the Fed want to buy up every mortgage bond in site.

First the mReits. The Fed “needs” to transfer the MBSes into “safer” hands to stop the reits from dumping to a fire sale.

Next are the Taiwanese and the Japanese. They have at least $600B in MBS between them.

The actual BORROWER may not count. It’s the LENDERS that do.

The Fed backed off their MBS purchases because it was blowing out the spreads the mortgage bankers had in place, causing margin calls. Fed’s actions to prop up the political alliance routinely blows up, like the Sept. REPO overreaction. Powell was in front of trade wars, with an emergency meeting (to support the presidents call for lower interest rates) while he missed Covid19 entirely?? Perhaps he too, saw the virus was a hoax. All problems and all solutions here are short sighted, politically expedient, and always partisan. If you thought we were all in this together in 2009, and you still think so now, I offer my sympathy.

“The Fed backed off their MBS purchases because it was blowing out the spreads the mortgage bankers had in place, causing margin calls.”

I was under the impression that The FED was buying MBS to prevent margin calls by pushing up the collateral value of the MBS. Exactly the opposite of what you seem to be saying. What am I missing?

that’s a lot of bs.

There was no market before the fed stepped in.

With no market, you don’t have mark-to-market. You have ‘false’ pricing and large spreads. Lot’s of fails in MBS repo too.

When the Fed started buying, liquidity came in, and deals started to clear. Spreads tightened.

Which story is BS? I’m not following. What do mean by spreads tightened; can you point out the actual interests rates before and after?

It sounds like you are saying that by the FED buying, prices went up. Sounds right to me.

The mortgage bankers put on interest rate spreads to protect them from a rise in rates, and that is the spread that caused the problems. You can google it. Fed’s actions are counterproductive, they don’t understand the markets. As a taxpayer should I subsidize a zero line of credit (endless REFIs) for mortgage holders in perpetuity, people a whole helluva lot richer than I am, so I can earn crumbs on my savings account, which only poor people have.

Agency MBS Transaction Summary = $428.017 Billion

Net purchases from :

April 2 through April 8, 2020: $109,352 million

March 26 through April 1, 2020: $144,571 million

March 19 through March 25, 2020: $156,696 million

March 12 through March 18, 2020: $17,398 million

**Settled holdings are reported on H.4.1

The Fed doesn’t listen to Tom Barrack. They have their own agenda.

Wait… These are just gross purchases. What this data does not show are the pass-through principal payments that the Fed receives, which lower its MBS balance. These pass-through principal payments are HUGE right now, given the historic refinancing boom. So gross purchases don’t show what’s going on in the Fed’s MBS holdings. A big part of those purchases just make up for the pass-through principal payments. See my chart and explanation in the article.

It all comes down to one thing, and that is perceived value. Everything the Government and the Fed are doing, is a elaborate dog and pony show designed to reinforce peoples belief in asset valuations.

Asset valuations are for the most part an illusion. Things are worth whatever people want to believe they are worth. Over the past 30yrs. assets have been inflated at a faster pace than incomes. That value has been used to support confidence in taking on increasing higher levels of debt. If people were to lose confidence in the current asset valuations, it would quickly translate into insolvency and default on debt.

So when it comes right down to it, the real game is whether or not the powers that be can continue to keep you believing that assets are worth what they say they are.

In the 1600’s the Dutch had people believing a few tulip bulbs were worth as much as a house. Today they have you believing equities are worth 20yrs of earnings, and that a house is worth half your lifetimes earnings.

The only question is how long can they keep the fantasy and illusion going.

A major difference between then and now is after the collapse the Dutch still had tulip bulbs they could enjoy.