Latest data is out. Folks who hoped the Renminbi would break the dollar hegemony have to be very patient.

By Wolf Richter for WOLF STREET.

The US economy and financial system – including being able to maintain and fund the gargantuan trade deficits and fiscal deficits – has become reliant on the dollar being the dominant global reserve currency. And the IMF just released its next installment on how this status has been changing.

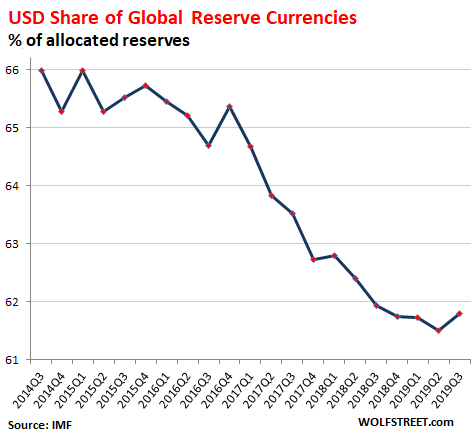

Total foreign exchange reserves in all currencies combined declined 0.6% in the third quarter from the second quarter to $11.66 trillion, according to the IMF’s quarterly COFER data. US-dollar-denominated exchange reserves – such as Treasury securities, US corporate bonds, etc. held by foreign central banks – ticked down 0.4% to $6.51 trillion. But holdings denominated in other currencies fell faster, and the share of dollar-denominated reserves edged up to 61.8% of total exchange reserves. The dollar’s status has declined from a share of 66% in 2014 to a share of 61.8% in Q3 2019:

This data does not include the Fed’s holdings of dollar-denominated assets, such as its pile of Treasuries or MBS, though it includes the Fed’s holdings of assets denominated in foreign currencies ($20.6 billion) — minuscule compared to its $4.16 trillion in total assets, and minuscule compared to China’s stash of foreign exchange reserves of $3.1 trillion. The data also does not include the assets other central banks hold in their domestic currency.

The US dollar’s share of total global reserve currencies declines when central banks other than the Fed proportionately reduce their dollar-denominated assets and add assets denominated in other foreign currencies.

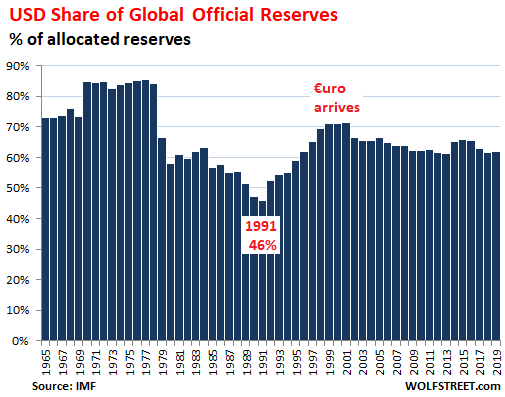

Over the long term, the recent moves in the dollar’s share are relatively small. There have been huge moves from 1977 through 1991, when the dollar’s share plunged from 85% to 46%, and then huge moves as the share rose again to 70% by 2000:

Euro fails to reach “parity” with the dollar.

The creation of the euro came with a lot of hopeful rhetoric that it would reach parity with the US dollar in every way, including as global trade currency, global financing currency, and global reserve currency. The euro has been replacing in phases the national currencies of EU member states, starting with five currencies, including the Deutsche mark, a major reserve currency at the time, but far below the dollar. During the initial phase of the conversion of European currencies to the euro, the euro’s share of global reserve currencies rose and the dollar’s share fell from 71.5% in 2001 to 66.5% in 2002.

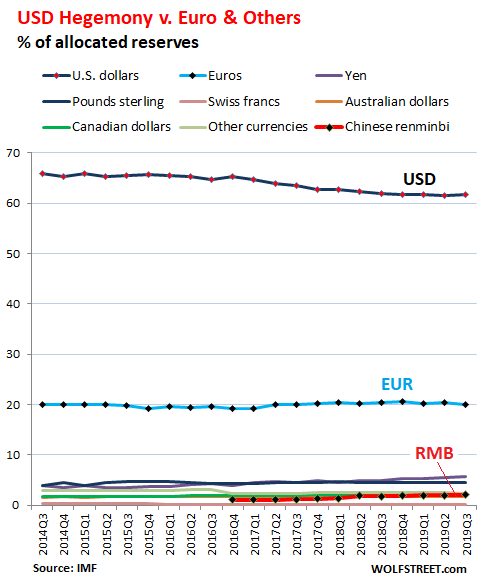

Now, the Eurozone, with its 19 member states, would be the largest economy in the world if it were counted as a country. And it was assumed by euro boosters that given the size of the Eurozone, its currency would reach parity with the dollar and end the dollar hegemony. These hopes were trashed by the sovereign debt crisis in the Eurozone, and the euro’s share has since been hovering in the range of 19% to 21%. In the third quarter, the euro’s share of global foreign exchange reserves ticked down to 20.1%.

Where is the Chinese renminbi?

In October 2016, the IMF included the Chinese renminbi in the currency basket of the Special Drawing Rights (SDR), and the renminbi became officially a global reserve currency. But since then, progress of the currency has been exceedingly slow, and there are no signs the RMB would dethrone the US dollar anytime soon. But it has surpassed the Swiss franc, the Australian dollar, and the Canadian dollar, as its share in the third quarter grew to 2.0% (short red line near the very bottom):

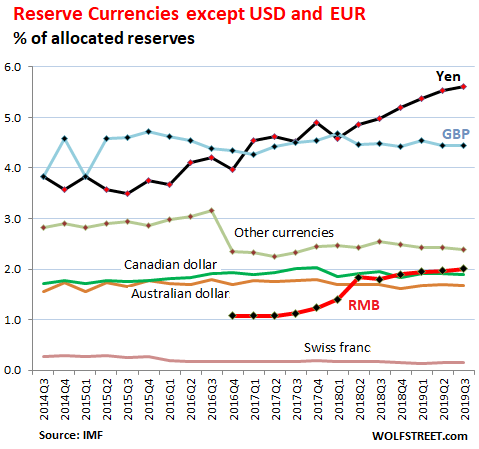

To see what is going on beneath the dollar-euro battle, it’s useful to look at the currencies without the dollar and the euro. The chart below shows that the yen’s share, having surged to 5.6%, has pulled away from the other currencies, including the RMB; and that the pound sterling’s share, despite the Brexit turmoil, has held roughly steady. The share of “other currencies” plunged when the RMB was pulled out of that category in 2016. Since that time, the RMB has increased its share from 1% to 2%, surpassing the Australian dollar in 2018 and the Canadian dollar in 2019:

“Allocated” foreign exchange reserves.

This data is based on data that central banks submit to the IMF. The IMF does not disclose the detailed holdings by individual central banks. It only discloses it in aggregate, as you see here. But not all central banks participate in disclosing to the IMF how their foreign exchange reserves are “allocated” by currency. But participation has been rising. In 2014, 59% of the foreign exchange reserves were “allocated” to specific currencies. By Q3 2019, allocated reserves reached nearly 94% of total reserves.

The relationship between trade deficits and reserve currency status.

The US dollar is the dominant reserve currency, and the US has the largest trade deficit in the world. This gave rise to the theory that the US, in order to maintain the dollar as dominant global reserve currency, “must have” a large trade deficit. But this “must have” relationship is disproven by the euro and the yen, the second and third-largest reserve currencies: their economies have substantial trade surpluses with the rest of the world.

But there is a relationship: The US dollar’s status as the largest reserve currency and the largest international funding currency permits the US to easily fund its trade and fiscal deficits. This enabled policies by the US government, by governments of other countries, and actions by Corporate America that have led to the gargantuan dual deficits.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Hmmm which of these currencies do I want to get paid in? NONE

Looking for a better job

The dollars value always has to be denominated in terms of other currencies and commodities.

Do you want to hold the pound instead of the dollar, given Britain’s seeming inability to compete ?

Do you want to hold the Euro instead of the dollar given the strong separatist movement in Catalonia , the rebellion against forced immigration in a number of countries and the large and increasing EU regulations ?

Do you want to hold the Yen instead of the dollar in a country with a decreasing population ,one with huge budget deficits and who is dependent on the US for its military protection?

Do you want to hold the RNB instead of the dollar in a country whose economic stats are opaque, who steals technology , whose population is increasingly controlled by its military and who is dependent on the US for its trade surplus.?

Do you want to hold gold instead of the dollar.,A country (US ) which runs irresponsible deficits ?

My new lady friend works three jobs, barely has any time to sleep. She is from China and does not speak much English, but she does say she ‘loves benjamins’. Also jade.

@Andy

+1 Jade

Jade it is

@Rcohn I’m already sick of working for this fiat junk it’s all the same no matter what flag

And the problem with gold is it’s in a bubble relative to many other real assets. Not to mention needs special storage considerations.

Gold is in a bubble compared to SF Real Estate? NYC Real Estate? Toronto Real Estate? Fine art? Beyond Meat? Tesla? Apple? Netflix? Uber? College costs? Medical costs?

@2banana

Wheat cocoa oil PLATINUM iron cotton and many others

The rich are sure to get the gold bug sometime soon. Most likely when the Kardashians start wearing panties made from gold (good storage?)

As a last resort, I keep a little gold and silver buried in a national forest in case of government precious metal confiscation. If they ask where it is I’ll just tell them it’s already on your place.

RCohn,

I want to hold my wealth in a store of value that isn’t systematically inflated by a gvt that acquires power through theft.

At this point, that pretty much rules out most/all Fiat currencies on Earth.

There is a reason why cryptocurrencies are a thing – despite all the failures, frauds, and f*ck ups that have accompanied their birth.

Basically, citizens of Western countries have woken up to the fact that most of their gvts are built upon foundations of b*llshit and fraud – there is no secret plan to remedy their cancerous accumulations of debt – just ye olde debasement.

@rcohn

How can crypto’s be any better than fiat as there is no limit to creation of more digital currency.

So not interested in working for crypto either

Cas127

Your 1st problem (and your 2nd, 3rd…) is there is no such thing as money as a (long term) store of value. Money is a moment-to-moment substitute for exchange of labor.

This isn’t necessarily malicious, it’s just 7 billion people engaging in arms-length transactions to determine relative value of different things; sometimes gold (or your hand-full of magic beans) gets valued lower relative other things.

Cryptos can be programmed to have a fixed supply of tokens/coin – Bitcoin is programmed to ultimately stop generating new supply.

Of course, gvt authorized crypto won’t – the gvts only want to make debasement easier.

I agree, considering that any major market reversal will be inherently deflationary, the dollar will win. Wishing for a super strong dollar is the same as wishing for an asset price drop that makes dollars more attractive based on how much more in assets they can buy at lower asset prices, ie purchasing power parity.

Thing is, prices are set at the margin and the next incremental transaction determines the value of the whole pile of assets. Meanwhile a flat revenue whale like AAPL comprises, i don’t know, maybe 20 percent of the gain in important indexes.

If I was a Fed and needed to QE, aka remove “liquidity” from the market, I would let rates rise and drop the value of financial instruments. They would only need to do that to defend the dollar.

Such an asset price drop in and of itself would destroy value and thereby remove cash from the system. So, that’s a way to Passive-QT by letting things run their normal course of cyclical price declines that would incur no blame, blame being a political construct in this sense.

Why passive QT? That would be to prop up the dollar. I think what we are seeing here in terms of balance sheet expansion is – part set up for a decline in asset prices and concomitant rise in value of the dollar – and part long term defensive posture by the fed to leave options open for battling deflation with asset price declines, which have an element of deniability.

Meant: “If I was a Fed and needed to QE, aka remove “liquidity” from the market…”

Should be, Needed to QT.”

OK, I’m sloppy.

I said: “part long term defensive posture by the fed to leave options open for battling {deflation} with asset price declines, which have an element of deniability.”

Should read {inflation.}

I hope I made my point regardless of my editing. Wish there was an option to edit comments within a time frame so that I don’t have to repair comments and waste time other’s time clarifying my point.

Thing is, prices are set at the margin and the next incremental transaction determines the value of the whole pile of assets.

This is so correct and maybe so wrong.

Exactly the reason why ebay has been so deflationary for “collectables”.

Well, if you put it this way – the russian roubles start to look quite atractive ;-)

Most here should be very grateful they have these esoteric decisions to make. Better that 50% (maybe much higher) of our fellow citizens just want to hold some coin of the realm until the next paycheck without borrowing. And the advertising and rentier pressure to spend is becoming more and more relentless.

@NBay

This forum is talking about unprecedented global corruption- officials with no skin in the game pillaging the weekly salaries of the poor and the savings of those who have any.

Yes we can all be grateful for our daily bread but I for one am working to end the global theft.

Oh.

Well, then you keep up the good work FW.

The article and the commentators succinctly point to the problems with using another reserve currency. However, what must be kept in mind is how a normalcy bias works. It can rupture suddenly and leave you unprepared for disaster.

The US dollar is the “cleanest dirty shirt” now. However, while trends have been favorable for the dollar, because Chinese communists and EU (European bank) bureaucrats have behaved foolishly, we are now producing oil and the Saudis support the petro-dollar, that can change.

This is particularly the case if our leaders operate immaturely on the basis of political considerations and not careful consideration the national interest. E.g., if the Saudi oil fields were contaminated with plutonium (without the use of bombs) by an angry adversary, there would be a wrenching change to the economy, and other oil sources (e.g., Iran and Venezuela) would suddenly become far more critical to oil consumers: China, Japan, the EU, etc. Even if we retaliated (foolishly), we could not undo the damage. Who would want our dollar then if those producers demanded to be paid only in EUs?

I think history should be my guide.

It is quite obvious that no matter what they SAY, the Fed will PRINT to infinity if need be to cover this, that, or anything else, and it doesn’t even matter if it is ethical, let alone constitutional. Given that, I see the needle moving in the direction of “Banana Republic like”, and think it wise to not invest in things dependent on the dollar holding much value long term.

I seriously don’t think they can ever turn back to responsible monetary policy, no different than that the government can never return to responsible fiscal policy. All the ponzi schemes they have in place require the continued increases in spending and debt just to keep the music playing, and therefore it must continue until our portfolio balances will be next to worthless, just like has happened in the places where policies like these (with various different names over the hundreds of years) were all tried and failed before.

Voltaire understood the value of currency…

You get paid in currency but you don’t need to hold on to it. Unload your currency as fast as you can. I understand stocks seem overpriced but if the dollar loses half or more of it’s value this year is the market really over priced? The Fed and the Presidency seem hell bent on the destruction of dollar confidence, I find it hard to believe they won’t succeed.

I would like to have a better alternative to owning stocks at these levels but, other than commodities, I have few alternatives and the dollar is just too dangerous to hold. The rest of the world wants to get out from under the trade dollar and the Swift system, it’s only a matter of time before they succeed.

During the last fiscal year the government spent $4.76 Trillion (plus another $350 billion off balance sheet – yes we now have off balance sheet shenanigans) but only collected $3.65 Trillion in tax revenue. The Fed has now begun monetizing 100% of deficit spending. This means the Fed is printing currency to cover deficit spending of over 25% and this deficit monetizing is growing with each passing day. In other words the government is spending massive sums of printed money into the economy, if this does not lead to hyperinflation it would be a first.

No one in power sees an issue with this debt monetizing, not the president, not congress, not Powell. Everyone in power believes this is a good thing – this is dangerous.

The Fed has two mandates 1) fund out of control government deficit spending 2) inflate assets. Got assets?

I hope for his sake Mr Wolf has reconsidered that short position.

No one is power will ever have to face consequences for their actions or lack thereof.

That 1977-1991 drop in global dollar share was replaced by Yen holdings is my guess. Right? It correlates well with them making it clear to the world that while their upper management were engineers, the USA was still run by marketing idiots.

Even if I give them the fact their factories were newer, I think the blame still falls on upper management. They sold us on having the best fins, wheels, styling, and most cubic inches in the neighborhood and totally ignored the rest of the vehicle.

Guess we were then saved for a while by electronic engineers?

Make that digital EE’s, I remember Zenith TVs were supposed to be better because they were all hand wired….which is really marketing stupidity at it’s best.

Oh yeah, forgot all that Capex blown to hell in Vietnam….2/3 of WW2 cost in equivalent dollars….that gave our budget a jaundiced look in the eyes of the world. But it made some filthy rich, including my A-hole uncle and his lobbyist pals.

The dollars value always has to be denominated in terms of other currencies and commodities.

Do you want to hold the pound instead of the dollar, given Britain’s seeming inability to compete ?

Do you want to hold the Euro instead of the dollar given the strong separatist movement in Catalonia , the rebellion against forced immigration in a number of countries and the large and increasing EU regulations ?

Do you want to hold the Yen instead of the dollar in a country with a decreasing population ,one with huge budget deficits and who is dependent on the US for its military protection?

Do you want to hold the RNB instead of the dollar in a country whose economic stats are opaque, who steals technology , whose population is increasingly controlled by its military and who is dependent on the US for its trade surplus.?

Do you want to hold gold instead of the dollar.,A country (US ) which runs irresponsible deficits ?

The dollar is not only valued relative to other currencies and commodities.

The dollar lost 30% of its value relative to the S&P last year. I expect it to drop another 50% this year as the tag team of Powell/Trump run a furious race to debase.

US exports oil to China, and LNG to Europe. You can’t parse these numbers properly without the energy component. The euro currency is in better shape than the dollar, while Fed is behind the curtain trying to monetize debt spending, never mind deficit spending, using REPO. More ROW Dollar reserves because they are worth-less exchanged in the form of Treasury bonds, which by Feds own admission are worthless, dumping them from the balance sheet to replace them with overnight paper, or cash equivalents, offering silver coins in lieu of cash soon.

I see the yen keeps on ticking forward as a reserve currency, a trend that started in 2016 and seems set to continue. This, very much like the yuan’s slower rise, seems to have come chiefly at the expense of “other currencies”, which I take to be everything from Indian rupee to South African rand.

In short somebody is hoarding yen, but given the IMF doesn’t disclose who holds what we can only imagine what’s going on here.

The yen seems a pretty strange currency to hoard, given how committed to monetary lunacy Japan is, but perhaps it’s better than holding yuan, a pegged currency issued by a country wont to fabricate economic data downright.

To anyone who wants to trust their fortune to the communist Chinese i say “be my guest!”

Go ahead and buy all the RMB and Chinese stocks you want. I’m sure if there’s trouble in the world the first thing Chairman Xi will be thinking about is how to make sure white foreign capitalists’ money is secure. Yep, communists are definitely looking out for you and when the going gets tough, would never stab you in the back!

To anyone who wants to trust their fortune to the communist Chinese i say “be my guest!”

Hordes of US manufacturers can’t be wrong. Can they?

Half of them seem to have headed east and left you with a Rust Belt and millions of unwary voters thrown under the bus. No wonder household debt is approaching crisis levels.

Self-serving corporatist politicians approve. Now that’s bipartisanship.

Legalized TREASON

Privilege has its privileges. Domesticated herbivores don’t mind so long as they get their buttons pushed.

It’s kind of to be expected when we allow essentially sovereign huge fascist states to exist within our borders and then call them “businesses”…..or “citizens”……whichever they choose depending on the situation.

You litterally just described every white venture capitalist out there. When the SHTF they will screw everyone out there to save their asses, just like the Chinese, Indians, Japanese etc. will…

Wolf,

Important topic (given the insane size, intractable tenure, and politically corrupt nature of US trade and fiscal deficits) but I wonder if you don’t bury the lede by failing to step through exactly how the dollar’s reserve status essentially enables America’s junkie habits.

Granted, the Dollar has not died, but the twin deficits are evidence of a fundamental rot at the core of the US economy – whose government has demonstrated a multi decade inability to remotely balance it’s books and whose people have equivalently produced far less than they have consumed, also for decades.

The contingent ability to print money at will to pay off its debts (due to “reserve” status) is what enables such madness.

But in the long run, currency demand must follow productive capacity and resource endowment (ie the only reason to hold a currency is to obtain the real goods denominated in that currency).

Perhaps America’s enormous (but decaying) real asset base accounts for residual internal demand for the dollar – as does China’s refusal to allow a free float of its vastly undervalued currency (in the service of undisputed export supremacy).

They also zealously protect their industrial base, have tariffs in their favor, take manufacturing very seriously and highly limited imports from those countries that they feel do not trade freely/fairly.

Hmmmm…..

“This gave rise to the theory that the US, in order to maintain the dollar as dominant global reserve currency, “must have” a large trade deficit. But this “must have” relationship is disproven by the euro and the yen, the second and third-largest reserve currencies..”

New all time highs daily.

Don’t short stocks when the sap is running up the trees, they say.

Don’t rub it in. S&P futures down 0.65%.

I thought I’ll get things rolling here :)

Wolf,

It seems to confusing to conflate “global reserve currency” with “global reserves”, or “global exchange reserves”. Having dollars on hand is not the same as having corporate bonds on hand.

I have a question: How many dollars are in existence, who owns them, and where are they?

The dollar is a currency. The paper twenties in your pocket are Federal Reserves “Notes” denominated in dollars and are legal tender. They’re also called “currency in circulation.” Corporate bonds are notes issued by corporate entities and denominated in dollars and are not legal tender.

Thanks for the response. I agree that corporate bonds are not currency. That’s why I find it confusing that corporate bonds are used to measure the depth of reserve currencies.

I still pose a question, seemingly one of finance’s most fundamental questions, that I have never been able to get answered.

How many dollars are in existence, who owns them and where are they?

Think of it this way: every piece of land, every house, every usable bicycle, every gallon of fresh milk, etc., they all have a value, and this value in the US is measured in dollars. The public land in the US — from national parks to the Washington Mall — has a dollar value, even if it is not agreed upon yet between a buyer and a seller. The dollar is a way to account for this value and facilitate buying and selling.

So, for example, Jerry is a millionaire because he owns some real estate free and clear and some stocks and bonds, but has no actual dollars in his possession, though he can borrow electronic dollars on his credit card.

Then there is another side: currency in circulation (“Notes”), currently $1.8 trillion in paper dollar bills and metal coins. A big portion of these paper dollars are under mattresses overseas.

Then there is something called “monetary base,” which is currency in circulation plus reserve balances, $3.4 trillion in the US.

And on and on.

In other words, you asked very tough questions with lots of answers but not the answer you’re looking for :-]

Wolf,

You are a very generous guy, and I would be selfish to expect any further response at this time. But think about this.

I agree all things could be measured in dollars. However, that measurement is predicated on the availability of dollars, That is precisely why knowing – – How many dollars (physical and digital) are in existence, who owns them, and where they are is so important. Without the answer to that fundamental question, how can one hope to grasp the big picture. How can one grasp asset and liability values relative to the dollar? No one in my circle has demonstrated an ability to answer that question. Not bankers, brokerage houses, financial advisors, financial experts, professors, etc.

I know its a tough question, but at any point in time I think there is only one answer. The answer, if knowable at all, might require inside information.

I should have added this in my first reply: the concept of “credit.” Credit is created by the overall banking system with the ebbs flows of the economy and asset prices. You can borrow money to buy these or any assets, unless the banks refuse to lend to you. There is no limit to how much credit the banking system can issue to meet rising asset prices. But the banking system can freeze up and then curtails the issuance of credit, as it did during the financial crisis, and then the credit-based economy comes to a halt and everything crashes. When asset prices broadly fall, credit falls as well (“deleveraging,” meaning defaults, bank collapses, bankruptcies, etc.).

Credit is a crucial element of prices, and can be a corrupting element to prices and prosperity, as has been evidenced by the FED and the bank bailouts. Bank created, funny money credit, picks winners and losers. It introduces new dollars into the money supply, at the expense of those dollars already in place.

Japan’s CPI inflation rose 0.5% in November

Eurozone CPI inflation rose 1% in November

U.S. CPI inflation rose 2.1% in November

China’s CPI rose 4.5% in November

India’s CPI inflation rose 6.9% in December

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.3 percent in November on a seasonally adjusted basis? What am I missing here?

Care to list all the things CPI carefully excludes?

The US gvt is past master at publicizing metrics like inflation ex inflation and unemployment ex unemployed.

Until you read the methodologies, you are not getting facts – you are getting gvt PR.

AB

I assume David Hall is using annualized numbers…

Ambrose Bierce,

You’re citing the monthly CPI change from October to November. David Hall cited the change in CPI from November 2018 though November 2019 (year-over-year), which is the common way of citing inflation.

David Hall,

“Japan’s CPI inflation rose 0.5% in November

Eurozone CPI inflation rose 1% in November

U.S. CPI inflation rose 2.1% in November

China’s CPI rose 4.5% in November

India’s CPI inflation rose 6.9% in December”

What relevance is that to reserve currencies?

I clearly don’t understand the world financial markets probably like 99.9% of the rest of the world population.

Then how can you not understand the relevancy of cash reserve currencies?

“Cash Reserve Currency” ?

There appears to be no reserve with continuous printing.

And not even printing, just some more pixels on a screen.

The loss of reserve status would go to gold as many countries still see it as a commodity of value and exchangeable.

Every countries currencies would be nul and void and only traded in their own countries.

This is the only way to reset this current system.

A long time ago there was a hockey player named

Frank Mahavolich.He was very talented but not much trouble

until some idiot decided to wake him up by checking

him hard.That was it.Game over .He would score three goals

in short order.

America is like that.Leave them alone to wander over hill and dale.

But scare them and and watch U.S.A pay their deficit off

while blowing your country up.

Boy, that’s hopeful. The US may blow up your country but it will never repay its deficits. Any of them.

The US is liquidating its economy because corporatists couldn’t manage to fully subjugate a population of domesticated herbivores, so instead they decided to just take the money and let somebody else do it. Case in point: AT&T recently got three billion in tax cuts with more on the way and used the funds to outsource thousands of jobs overseas. Once the rest of them finally get the hang of it and go full throttle you’ll be having dirt cookies for dinner and wishing you could still vote.

Not exactly light of the world stuff.

And for what? To empower a small political class to feed us b*llshit for decades?

Perhaps you mean *by* blowing your country up.

Been there, done that. My bet is and stays the USA. I happen to agree with Bogle, most large US companies have foreign exposure anyway.

How crazy this mkt is now, today? AAPL’s Market Cap Increase Today Was Bigger Than The Entire Market Cap Of 300 S&P500 Companies!

Read it again

POwell – I see no bubbles

Go figure!

Wolf you are very popular.

https://www.marketwatch.com/story/a-popular-wall-street-blogger-vowed-to-never-short-the-stock-market-again-until-now-2020-01-02?mod=home-page

I took a screenshot of the front page, when it was the main article, for later use. “Popular Wall Street Blogger…” I love that :-]

Yeah. “Wall St” vs “Financial”. Doubt the adjective choice is lawyer food but I’m a fan of sarcasm.

BTW- You are about even on the short, so it ain’t over. Strange things happen on weekends.

You’ll be right eventually, everybody is, heck we had a drop last year, why not the same?

The Fed changed course, like the say don’t fight the FED, insanity rules the day, I mean rules the USA.

Today’s rally proved that the algos do read your blog and they are out to make sure your options expire worthless or to make you cover at a loss. I am certain you didn’t know you had the power to move markets.

Your timing was off by a couple of weeks.

Here is what you missed. The market is primed to move up for a couple of weeks as it awaits the the trade deal signing. China’s cut in the RRR was not a huge surprise because the Lunar New Year is coming and there are huge demands for cash. The cut was predicted by ZH last week.

The down draft you are looking for will come just before the tariff treaty is signed as the bad earnings hit the market. If you can hold out a couple of weeks, you might get even or cut your loss.

BTW, I am a bigger bear than you. But if you want to be safe or relatively safe, wait for the 10-15% decline and then short the 61.8% retrace with a tight stop loss. Just saying as they say….and good luck with your trade.

But the bet will be more expensive when the market is already down or going down. Maybe it’s cheap to short now and with a one year option.

You are actually advising shorting a dip? Financial suicide. Luckily there likely won’t be a dip to short. The S&P could easily be over 4000 in a month an value measured in dollars is just a number, the dollar is air and the market is a helium balloon floating out of your reach and out of sight.

The market could dip 75% but I’ve learned it will always come back stronger as the Fed has my back – zero fear over here.

David,

I’m thinking of testing your theory that algos read my site and then do the opposite: the way I would test it is by writing an article saying that I finally got bullish and bought stocks and margined them to the hilt and borrowed on my credit card, and sold my arms and legs and kidneys to buy stocks…. And then let’s see if I can cause a crash. Would be fun, wouldn’t it :-]

Love your sense of humor Wolf. With Gartman hanging up his newsletter, maybe you could replace him as our contrarian indicator?

Gartman did call the FC low within 3 days or so, I saw him do it on live TV.

I think the problem with the readers on here (including myself) is that we are all thinking logically and what we are experiencing is a totally crazy illogical situation.

We also seem to forget that in reality what is going on doesn’t have any effect on 98% of the 7.7 Billion population that are living on a day to day basis using local currency.

As long as your local supermarket accepts your earned local currency one doesn’t care.

Therefore all this QE, issued bonds, shares rising doesn’t have any direct effect on 98% of people, certainly in the short term.

It is asset inflation that is effecting them, in that they may no longer afford to buy a house. However, even then most people are content as long as they are doing as well or as badly as everyone around them.

“Therefore all this QE, issued bonds, shares rising doesn’t have any direct effect on 98% of people, certainly in the short term.”

If the true China price would have dropped X’s price from 100 to 60, but the Fed’s money printing dropped the dollar’s FX value sufficient to drive X’s US price back up to 100 – the US consumer has damn well lost something…the benefit of much, much lower import prices.

There are all sorts of inflation – including the aggressive total war against deflation…otherwise known as cost savings.

I mean look at how multiple decades of cost deflation has made computing so incredibly rare in the modern world – all producers having been eliminated…deflation is clearly an unquestionable evil that must be destroyed at any price…

The US consumer has lost a lot, in the 1970’s I could rent an apartment, have a GF, and drink beer on $2/hr

In China in the 1980’s I couldn’t spend $20/month, now it takes $100/hour to get around in China

The USA it takes $500/day min, to get around, by that I mean food, hotel, transportation.

IMHO both USA&China have gone astro in expense, but the difference is now the Chinese people make 100X, and the USA get paid the same, about $28k/yr average in early 1980’s same now.

This is why the majority of China has gone from poor to middle class in 30 years, while the majority of USA has gone middle-class to debt-slave in the same time.

Patience IS ALL THEY[Chinese) HAVE!

7,000+ years versus 250- years!

The US Dollar is going to remain the reserve currency until there is no currency or the SDR (Special Drawing Rights) becomes an official world currency.

The US Dollar remains the reserve currency by belief of its value and easy conversion to local currencies and by elimination of the alternatives; Euro, GB Pound, Reninmbi, Yen, Swiss Franc and Singapore dollar.

On a personal side of things, I held cash in Swiss Francs on the basis it should be safe.

Look how the SNB (Swiss Central Bank) was able to print francs, converted them into US dollars, bought US shares with those US Dollars Then the SNB received US Dollar dividends, sold the shares at a profit and had even more US Dollars.

How can anything go wrong?

If one is American living in America, all his costs are in dollars anyway so I find it very difficult to play currencies. I guess inflation can be played easier with commodities. Just my opinion.

If one is American living in America, all his costs are in dollars anyway so I find it very difficult to play currencies.

Could you explain that? You can open a forex trading account or a demo account online in ten minutes flat. Am I misinterpreting your assertion?

I’d have to agree that it would be difficult to impossible to make any money at it because the spreads are so small, and most people lack the high-speed access and high-end computing needed to pile up all the tiny slivers. I can’t see anybody but a TBTF megabank even bothering with it.

U really don’t want to ‘play’ currency’s, its a futures racket, and a quit way to lose money.

PPL who thought the USD would implode 30+ years ago have been wrong,

Best to buy something solid like GOLD, or better yet, cheap real estate rentals in a small college town, and then just buy on 15yr fixed pay off and your set for life.

When the USD goes down GOLD goes up, that’s why gold is up $50 this week, which is because the USD is down. But this doesn’t mean it will stay down.

PPL make their bets, if it looks like the USA loses the Iran war, then yes the USD will plummet in confidence, but as we all known MAD is a real thing, and Russia&China don’t want to die just yet, even though the NEO-CONS are ready

Having SDR (special drawing rights) was one of John M Keynes most stupid ideas, and he had a lot of them. His ideas formed the basis of the Paris accord / Versailles treaty at the end of WW1, which created the conditions for WW2. Keynes bankrupted the British Treasury. And it should be mentioned that even after Keynes death, the IMF continues to destroy economy after economy.

Everyone loves “free” money Keynesian policy… until the bill arrives. There is no free lunch.

SDR is currency issued by a corrupt group of unelected central economic planners, based on the concepts of a dead economist who’s ideas bankrupted his own country.

Instead of regurgitating flawed ideas from a dead economist, let’s get ideas from people who actually run balanced accounts!

How did Keynes bankrupt the British Treasury?

Keynes ideas were behind how Britain financed WW1 and were the foundation of the Paris accord that led to WW2. The only thing Keynes didn’t get was “debt jubilee” of war debts, because Keynesians always promise to pay debts but have no intention of doing so.

The left wing academia has white washed Keynes track record, but in practical Reality… Keynesian policy really boils down to borrowing more than you can ever pay back, and then demanding debt forgiveness. Keynes was a con artist.

Borrowing from the future and not actually paying it back is what Keynesian policy is all about… which is why it appeals to politicians and dead beats everywhere.

Most of the important post-reset countrys want the SDR, gold-backed of course,

The SDR will be a mix of EURO, Yuan, Yen, Peso, … and perhaps a little bit of Post-Reset Uncle-Sam bucks

Major players in reset are SCO-AIIB, which is Israel, Russia, & China. Nobody actually wants to be a reserve currency, that’s why they prefer the SDR which is a basket of currencys where each country get to print as they wish :)

Nobody wants to give up the right to print, as nobody wants to have to borrow in the other guys currency ( this is what causes wars )

The elephant in the room is the $740 billion defense budget. That elephant is silent in the corner and no one is bringing it up. This huge “offense” budget is the last hope of plutocratic supranationals like internet surveillance companies and Boeing whose last hope to fill their order book is another war.

If half of the Not QE goes to fund military action and the other half is to fund social services then there *should* be little net effect on the markets beyond faulty perceptions of market participants. This is just money towards the status quo, not money given to banks to speculate with and absolve past sins like during 2008-2009.

The original QE flowed directly to the banks and from there into the financial markets as planned. This “Not-QE” is only funding current liabilities and backstopping the lack of foreign purchases.

The defense budget is half of the Federal budget deficit of $1.4 trillion.

Higher. Google up ‘two-thirds on defense’.

Nobody will say ‘no’. Even Bernie supports the F-35 fighter, because all have no choice but to temporise with corporate militarism.

Whenever a country threatens to usurp the US dollar as reserve currency, we just send in an IMF official to “help” that challenger country. Problem solved, challenger is destroyed.

The Bank of China was taken over by an ex-IMF director, and now an IMF director is running the ECB. The USD will not be overthrown as long as the IMF continues to “help” the competition ;)

That’s in Part WHY those who can, do avoid using the USD when it isn’t necessary.

The Petroleum+Trade Currency Mechanisms just started undergoing Major Changes this Past Year:

-PetroCNY+Au-Exchange Platforms (Shanghai IEX – Volumes surpassed Dubai and most likely to surpass North Sea Brent)

-1B1R Footprints Established with SCOMember_Banks.

-INSTEX set to circumvent the USD

-IRN trading Petroleum+NatGas in Major Currencies + Barter

-Gazprom no longer accepting USD for Payments.

-RUS/CHN Trading in their Own Currencies.

-EUR/CNY Volumes Increasing.

It wasn’t until 2H2019.CE that those who Supply to CHN – the World’s Largest Consumer of Petroleum – could Trade the PetroCNY.

With IRN and now RUS and VEN avoiding the USD, the PetroUSD Oligopoly no longer fully control the Global Petroleum Trade.

And… Physical_Au Stockpiles are available in RUS, CHN, IND, and DEU.

It would be prudent to say that USD usage by the EuroZone, CHN, IND, RUS, and 1B1R Entities Trading Amongst Themselves will decrease significantly over this Decade.

Brave New Common Era Decade, Brave New World.

ZH had a very recent article named “Helicopter Money Is Here: How The Fed Monetized Billions In Debt Sold Just Days Earlier”. (no need for link here, ok)

The “assertion” of the article is really that dealers simple FRONT RUNNING the Fed purchases. True dat, but at least publish irrefutable evidence.

To provide “proof” the mention the recent 26-week T bill issued last 12/19/2019, CUSIP 912796SV2.

They said that the Fed bought that CUSIP twice – $3,949,000,000 on 12/19/2019 and 1,617,000,000 on 12/20/2019. So the Fed bought a total of $5.566 billion of that CUSIP from Dealers who just got issued $23,656,490,000 of the same CUSIP on the same day, the 19th. They called it the Fed “Put”. This was their story about Debt Monetization.

Make sure you understand the big picture.

(1) The dealers have to buy everything that others don’t buy at auction.

On that particular 6 mo auction (on the 19th), foreign indirect buyers didn’t show up as expected. They bought only half (26.10%) of what they usually buy. The dealers were left to eat the rest of the turkey – a whopping 65.71%. That’s how the dealers ended up with $23,656,490,000 of 6 month T bills.

So, either they show up trying to finance this in Repo or the Fed buys it outright. (this is actually an important distinction)

That’s what this is. And yeah, that’s debt monetization. The Fed gave their dealers a helping hand, so what?

(2) ZH did not mention that the Fed actually both this CUSIP 5 times (not just 2). They bought the same CUSIP – $3,184,000,000 last 12/18, $1,297,000,000 last 12/17, and $739,000,000 last 12/10 for a total of $5.22 billion BEFORE the 26 week bill was even issued!!!

How is that possible? The reason is that the same CUSIP 912796SV2 was originally issued last June 20, 2019 as a 52 week bill. At that time, the dealers bought $13,545,825,000.

Also, do not assume that dealers inventory bills for 6 months then sell it to the Fed. Dealers can buy any bill, note, bond in the secondary market from anyone and sell those to the Fed.

So you cannot tell whether the Fed bought the 26 week bill OR the 52 week bill. Obviously the older ones were 52 week bills. The point is none of this is as fishy as ZH makes it to be. This is simply debt monetization at its best.

Sorry this is a bit off topic but I hope this was educational enough.

I hope this was educational enough.

More please.

Correction. The auction was on the 16th and the bill was issued on the 19th.

The late Barton Biggs’ book “Wealth, War and Wisdom” covers investment performance in major industrial countries in the first half of the 20th century, especially in the years around WWII. If you think history is any guide to the future, this book makes a good read. An investment in French equities in 1900 would have produced a -22% total real return by 1949. The total real return on bonds was -96%. See page 314. If you think equities are overpriced, do know that long term bonds perform terribly in a period of high inflation.

If you can’t find the book at your public library, you can buy a used copy at Amazon for under $7 (including shipping).

If interest rates rise, so many long term treasury buyers will be in wrong side of the trade. Arguably that will also take corporate bonds down and there will be a fire sale of assets.

What just happened in Baghdad???

To quote Sergeant Greer, some funky funky stuff mon.

I noticed that the Fed reversed course on unloading its excess reserves when the market fell. Is this a sign that once they have to reduce their balance sheet the market will fall. Also with so much money in play why is inflation so low?

Assuming excess reserves somehow provide the liquidity to the market or stock buybacks and its twin is repressively low interest rates, then its easy to see the connection. So, Yes is the answer.

Things have changed. Fed never divested their balance sheet, they simply reallocated to shorter maturities. That makes sense, when rates are rising, but it takes the collateral value out of the long bond. This is why they can do REPO and RRPO at the same time, cash and cash equivalents. BUT are they only monetizing in the moment?? You can’t fund government spending on Tbills. This should be wildly inflationary, and maybe the energy market reflects this, BUT Fed is worried about sub2% dotplots. They want to let it run hot.

Please guys don’t be led astray by all this hyperbole on fiat currency. This is how the 99% flock listening to wrong advice, always gets fleeced by the 1% global elites.

I’ll make a long story short with this hypothetical scenario:

Imagine if tomorrow, all the CBs gets together to inflate all the world’s currencies by say 150%, via massive global QE, such that all fiat unit inflates in tandem.

The CBs and the their corporate billionaire bed-fellows will see their financial assets appreciate greatly in notional terms within a day or so (i.e. stock market indices and real estate prices will suddenly “melt up” when measured against their respective fiat currencies); while everyone else who’s holding onto cash gets a sudden big transfer of his/her wealth to the global elites. Those earning paper money for a living also effectively gets a sudden ~66% Wage REDUCTION even though he/she is working in the same job drawing the same salary. Their employers could even humor them and give out a 10% increase in wages and it would still be largely ineffectual against the artifice of such monetary economics.

The best thing in this scheme is that ALL the currency pairs will still remain in the same IDENTICAL ratios the next day, and the typical man in the street will not be any wiser, except when he goes and buy groceries using his now depreciated fiat dollars.

My point is that CBs may or may not be in such an imagined conspiracy, and the fiat debasement schedules for each currency may not even be synchronized together; but when the inevitable inflationary tendencies for each paper currency are played out over decades under CBs malfeasance, the overall NET effect will essentially be the same as the scenario above.

The difference is one of slow-cooking the frogs while the other is suddenly throwing the frogs into boiling water.

It does not matter if USD is stronger than Euro for this year or that Yen or RMB will become stronger in the next. Even in a highly unlikely event that USD loses her preeminence as the world’s reserve currency to some other fiat, it would make little difference in the overall scheme of things, since it will merely be passing the buck (pun intended) to yet another fiat, right? Lol.

All these market gyrations are really inconsequential when the long-term trend is still debasement and every other fiat currency is measured vis-a-vis another equally spurious currency. All such discussions are really like the proverbial frogs in the pot arguing over which fiat currency is better when the fire is still burning below them.

The 1% just need to adjust the fire such that the frogs are not unduly surprised and are comfortably warm so that they may even have time or the inclination to breed and create the next generation of frogs. Once the older frogs are “cooked”, the global elites can serve dinner, and then they can transfer the baby frogs to a new pot again with another slow burning fire.

They may even stir the pot occasionally so that these frogs will excitedly talk about which side of the pot is temporarily better (i.e. which currency is safer or better) for a while before they settle down again….for a slow cook.

https://youtu.be/TyBKz1wdK0M

They pay you interest, grant you loans

So you can buy yourself a home

And drive a car for fun and work,

And promise you those lavish perks.

But fiat money’s just a ruse.

With savings all you do is lose.

Their bailouts, bankruptcies your dues.

I’ve looked at banks that way.

I’ve looked at banks from both sides now,

From up and down, and still somehow

It’s banks’ illusions I recall.

I really don’t know banks at all.

(Sorry Joni. You know how it is.)

There’s more stanzas. Billboard 100 here we come.

Since I started collecting stamps for a few years in the 1950’s, the price of mailing a US domestic letter has gone from 3 cents to 55 cents (currently). I guess that is the boiling frog case in real life. The irony is that today, my standard of living is much higher than it was in 1956. I guess I have a better skill set than most Americans and the market still rewards people for their skills.

If I were to advise a young person, I would recommend getting a college degree that employers are willing to pay up for. I would not put ethnic or gender studies in that category.

and the ANSWER of ZIO USA to the EURO was to DESTABILIZE EUROPE …by ANY MEANS … with the Help of BRIBED EUROPEAN POLITICIANS

The ZIO .USA … just like the ZIO-UK is NOT .. and has never been .. a Friend of EUROPE ..on the CONTRARY ..both have been DEVASTATORS .. and succeeded in getting away with it

In addition to those referenced, we can add Qassem Soleiman’s name to this list.

– The large deficits are also funded by all those US “military adventures” (to put it extremely friendly). It is a froce pushing the USD lower and therefore forces the rest of the world to (partially) pay for those “adventures”.

– A growing Trade Deficit means that the Current Account also will grow and vice versa. But with a shrinking Trade Deficit the Current Account also will shrink and that in turn means that the subsidy from foreigners to the US will shrink as well. While at the same time the need for (foreign) funding will grow (think: growing budget deficits).

Gold is good. Bitcoin is better. The rest is various grades of junk.

We do love our junk though… ? Governments especially.

BITCOIN is SHA-256 hash – NSA

BITCOIN is ECDSA-256k-p elliptic curve -NSA

Nakamoto-SAtoshi was an NSA contractor

Yet people have the the gull to call Bitcoin Non-Gov, go figure

Lastly, remember no algo the NSA ever made public, they didn’t hold the backdoor key.

The original 2009 bitcoin white-paper is a 100% copy of the 1997 BIS ‘how to make crypto currency” doc

Now please tell us how something that came out of BIS ( bank of banks ) and the NSA is safe & secure for the riff-raff??? Got to know

Wolf,

I wonder if there are any historical stats measuring how quickly the Brit Pound was able to fall from pre-eminence to also ran.

That might be very very enlightening