Corporate America rerouted its supply chain to other countries.

By Wolf Richter for WOLF STREET.

The biggest standout in the US trade data released today by the Commerce Department is China (I combined the data for China and Hong Kong because a lot of merchandise is transshipped and/or invoiced via Hong Kong): The US trade deficit with China plunged by 18% from a record of $388 billion in 2018 to $320 billion in 2019, which was where it had been in 2016.

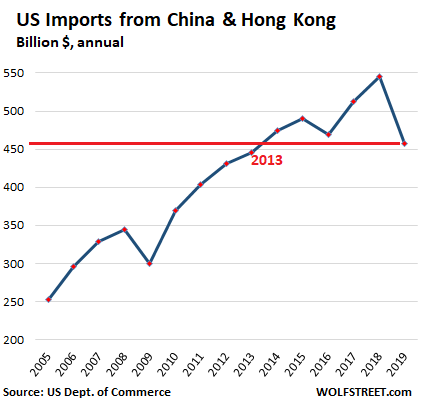

US exports to China fell by $20 billion (to $137 billion) but US imports from China plunged by $89 billion, to $457 billion, the lowest since 2013. This 16% plunge in imports was a result of the threatened and actual US tariffs imposed on imports from China. In response, Corporate America rerouted its supply chains through other countries. In percentage terms, it was the biggest plunge in imports from China in at least three decades. In dollar terms, it was the steepest plunge in US-China trade history:

And the plunge of imports from China had an impact on the overall trade deficit — but not much since Corporate America rerouted its supply chains from China to other countries, and only a small portion was routed back to the US.

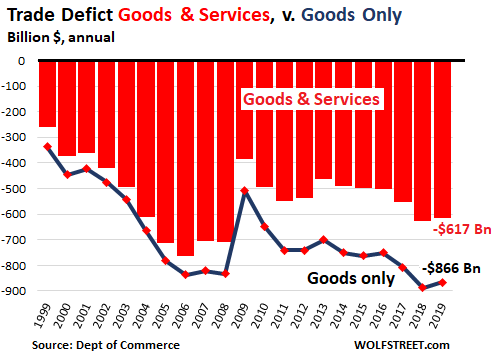

Overall, the US goods trade deficit (exports of goods minus imports of goods) improved by 2.4%, or by $21 billion to a slightly less catastrophically huge $866 billion deficit. This was the second-worst annual goods trade deficit ever, after the worst-ever record in 2018 to $887 billion.

The US ran a services trade surplus again, but it declined by 4.0% to $249 billion. All combined, the trade deficit in goods and services improved (got less bad) by 1.7%, to $617 billion, after having jumped by 13.7% in 2018, the worst since 2008. In 2019, it was the second-worst since 2008, but a small step in the right direction:

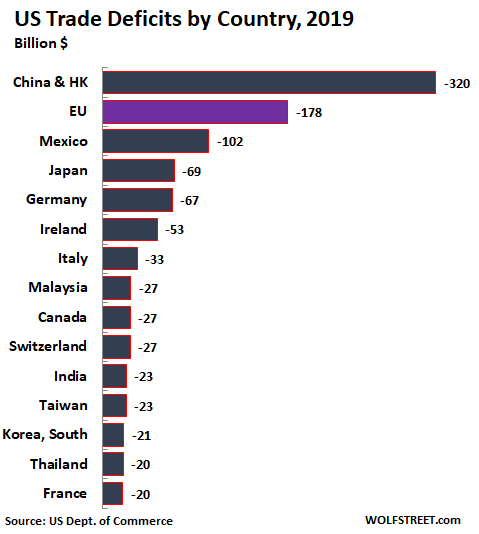

The Goods Deficit, by Country

US exports of goods fell by $21.3 billion in 2019, to $1.65 trillion. Imports of goods fell by $42.6 billion to $2.52 trillion. Hence the $21-billion improvement of the goods trade deficit. Below are the 14 countries plus the European Union (purple bar) with which the US has the largest trade deficits in goods. Services are not included:

The opaque nature of international trade transactions – transshipments, trade invoicing, tax dodging, etc. – can produce peculiar results. For instance, the US had a trade surplus of $15 billion with Belgium and of $21 billion with the Netherlands, but not because they’re big end-users of US products, but because they have large ports that serve the EU markets. With the EU overall, the US has a huge trade deficit of $178 billion.

Then there is tiny Ireland, with which the US has a surging and huge goods trade deficit, reaching $53 billion in 2019. The US exported only $9 billion in goods to Ireland, but imported $62 billion in goods from Ireland (up from $45 billion in 2016).

Part of the US pharmaceutical industry has set up their headquarters in Ireland via mergers with pharma companies that had already been headquartered in Ireland. This was done for tax-dodge purposes. In addition, Ireland has long had a vibrant pharma industry. It added up: in 2019, pharmaceutical products imports from Ireland rose to a record of $39 billion – about 63% of total imports from Ireland.

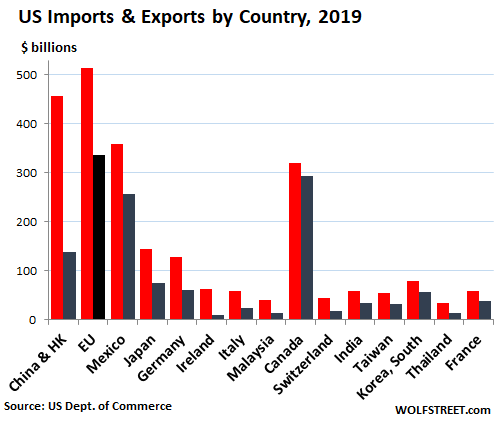

The chart below shows US imports (red) and exports (black), in order of the magnitude of the trade deficit with each country. As imports from China plunged, imports from the EU surged 5.5%. The trade bloc that doesn’t shy away from using tariffs to protect key industries and industrial policy to boost exports. It is now the largest source for US imports.

But the massive bilateral trade relationship with Canada in goods alone remains one of the most balanced for the US.

Much of the blame for the now slightly smaller but still gargantuan trade deficit falls on Corporate America that is taking advantage of US incentives to offshore production, and that is chasing after cheap labor and other cost savings available overseas.

Imports and exports matter for the overall economy, and what’s good for corporate earnings per share is not necessarily good for the overall economy: Imports reduce economic activity, and exports increase economic activity. And the US trade deficit, which nets all this out, reduced economic activity, and GDP, by the amount of the trade deficit, namely by $617 billion. Shrinking this trade deficit would be good for the economy though Corporate America would squeal – and that’s why any progress, if it happens at all, will likely be only measured in tiny baby steps.

In total, 2,000 tech, admin, and management jobs to be cut and Macy’s offices closed around the country. In addition, one-fifth of Macy’s stores to close. Brick & Mortar Meltdown. Read... Another Major Employer Leaves San Francisco, 1,000 Jobs Vanish: Macy’s Shuts Tech Center in Broad “Optimization”

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

So basically no jobs came back and all we did was hurt our stocks for no reason and move wealth from one foreign country to another.

Oh and bankrupt a bunch of family farmers in the process.

Hurt our stocks?

What are you talking about?

Family farms have been shrinking in numbers for over a generation.

Bankruptcies, the kids don’t want to do it, intense competition, developers, etc.

The laws favor corporations and corporate farms over family farms, as they favor corporations over people in every important respect, and payola from unscrupulous politicians won’t change that.

Like brick-‘n-mortar retail, affordable higher education, civil rights, and snow in the winter, family farms are on course to become a thing of the past.

“family farms are on course to become a thing of the past.”

Few people are employed in the agricultural sector in prosperous economies

https://ourworldindata.org/employment-in-agriculture

Exactly. The Chinese have businesses OUTSIDE CHINA. They have factories in Vietnam, Cambodia, Rest of Asia, Africa, etc. Even Taiwanese firms are same.

Wilbur Ross is wrong. These factories are not coming here because our Labor Costs are sky high.

I’d think that is not really the issue. The actual issue for China is control over their business and political stability.

China will not invest where their investment can just be confiscated, summarily by sanctions or gradually by attrition by the mob, the local boys running the ‘inspectors’ or the US State Dept. doing a drive-by to bump some moron two points in the latest opinion polls.

In the ’emerging economies’, Chinese investments means something both to the government and the local people. The Chinese gain influence there, a lot more influence than they would gain by investing the US, that influence protects their investment and smoothes the way for the Chinese business operations – unlike the USA where Chinese influence will be seen as an attack on the nation state and things going well for a Chinese business is a flaw to be erased by legislation or sanctions.

I can speak for Egypt, which has special free-trade deals with the US (thanks to the peace treaty)….China is now the top investor in Egypt, launching new projects and factories on a monthly basis. …and exports to the US from Egypt are booming, thanks to those Chinese owned factories.

Yes, our labor costs far exceed those of Mexico. I should know as we compete directly with Mexico. Our selling point is that we make molds that work in production without incoming inspection and other large costs. The Mexico machine shops scrap large numbers of plates that preclude any labor cost advantage that they have.

I should know as we also supply them with the precision ground plates that they cannot produce.

So we pay far more for plating costs because we don’t pollute the local river with chromium salts.

One of our problems is the lack of machine tools made in the USA or even in Europe. A surface grinder of the size that we use weighs 90,000 pounds and requires 48 inches of reinforced concrete under it. I suppose that it would be tough to pick up and move.

A,

At a minimum, T (for all his manifest shortcomings) has used tariffs to mitigate our dependency on a single huge import source – one that has proven itself hostile to international trade norms for over 20 years.

China has used internal controls over export proceeds to prevent those huge amounts from being recycled into American exports, which would have limited the enormous trade imbalance of the last two decades.

Despite damaging the US industrial base and economy in general, DC turned a blind eye to the Chinese gvt’s manipulation – because China funneled its captured export proceeds (taken by law from its exporting citizens) and instead routed them into DC’s habitually degenerate, deficit addicted coffers.

This went on for 15 to 20 yrs…and DC didn’t do sh*t.

Trump has diversified America’s import dependency at a minimum – and the new import partners don’t answer to the Chinese gvt and don’t coordinate with its trade abuses.

At a minimum, we are today less vulnerable to Chinese manipulation – in fact, any single abusive foreign government’s interest, FX, and trade manipulations.

Whether reshoring occurs at scale or not (time will tell), the US economy is safer today than before the tariffs.

cas127, I’ll buy your explanation.

Before income taxes and the IRS tyranny the goomint lived off of tariffs.

While I hate to defend Trump, and I predicted that no jobs would come back to the US because that was a creative statement of reality, Chinese communists were making preparations to take over the South China sea: those parts that they have not already, effectively taken. It was only a matter of time, before they turned to Taiwan or the Senkaku islands.

This coronavirus will only hasten the divestment that was occurring since I suspect that the Chinese communists have been understating the seriousness of the pandemic. Their factories will probably remain closed for months, until the coronavirus epidemic burns out with summer, hopefully.

Weakening an aggressive, totalitarian regime that oppresses its own minorities is always good. I just fear that the virus may also spread in the US like the 1918 flu, because already it is transmitting itself, without symptoms, from person to person in other countries, whose incoming travelers to the US are not being screened.

Likely some high value, complicated manufacturing stayed here rather then offshored to China. Remember reading some US companies felt only China could pull it off. Hard to quantify.

Clearly Wall Street doesn’t want to share their wealth with main Street Americans.

They never have.

The trick is to stop bailing them out, start putting them in jail for fraud and stop feeding them cheap/easy money.

The trick is how to do that. Got any ideas?

how to do that. Got any ideas?

elect people who believe in:

constitutional small government

honest money ( commodity money )

no central bank

Raising interest rates from 2 pct might be a start – ultra low rates encourage/compel idiotic risk taking behavior.

A measure of how debilitated the US economy is? In the 90’s, interest rates were 6 to 8 pct and the economy survived where it did not thrive.

The ZIRP of the last two decades has created a junkie stock mkt that dropped 20 pct in late 2018, after rates had barely budged from 2 to 3 pct.

It would be good if the interest rate went to the point of inflation from deficit spending. That would be about 4.7%.

1) Tax the billionaires – the only way someone gets that obscenely rich is corruption and tax avoidance. They don’t deserve it.

2) Put white collar criminals in jail instead of handing them stacks of OUR money through QE.

1) Billionaires have an army of accountants and tax lawyers. They can move their fortune to anywhere in the world. They are friends and benefactors of the worlds politicians and power brokers.

You ain’t getting their money.

And that is why every “tax on the rich” becomes a tax on the poor and middle class. Hint: The 1913 income tax was sold to the public as a “tax on the rich.” How did that turn out?

2) Hard to do when you have massive amounts of QE after QE after bailout after bailout and an AG that actually stated “too big to jail.” Maybe things will change. QE ended three years ago (but a stealth QE recently) and bailouts have ended. DJT would cement a 2nd term with a few banker perp walks.

The 1913 income tax was sold to the public as a “tax on the rich.” How did that turn out?

It worked pretty well until the 1950s, when corporations started buying up politicians to make the poor and middle class pay the taxes formerly paid by the rich, and every pub president since Nixon has escalated the practice. The trick was to get the great unwashed to vote against their own interests by pushing their buttons on concocted social issues.

“A” makes a good start by taxing the rich and prosecuting their economic crimes. While you’re waiting for that to happen, maybe somebody can provide a rational explanation for why Jeff Bezos needs so many billions in welfare.

If we can’t tax billionaires and ain’t getting their money – and corporations – then why have we been cutting their taxes so darn much these past 20 under last several POTUS? You’d better them them we weren’t getting their money anyways, so they better raise those taxes back up on the rich & corporations.

The state has Kinetic Power. If it comes to that, it can send people with guns to kick in the doors required, presenting the accountants and lawyers the choice between life in jail or turning ‘witness protection’ ratting out those numbered accounts. Russia is somewhat less subtle about oligarchs getting above their station.

No billionaire actually earned it??? You sound so jealous. Maybe you believe no one should have that much wealth, but I’m pretty share Bill Gates, Warren Buffett, Steve Jobs, and Elon Musk didn’t cheat the system to get rich. They created something of value which a lot of people bought.

I would like to see more of the wealth distributed to the employees by making them shareholders so they have some skin in the game.

Because working your whole life ain’t skin in the game? Thanks for insulting most of humanity that works for a living. May I ask what planet you live on? And these billionaires you talk of can’t live long enough to spend all their money – well except buying elections like Seth Klarmam just did in Iowa – do you point is moot. Tax the rich – HEAVILY. And yes the CAN be taxed and have so in the past.

Gates – Serial Monopolist. That used to be illegal.

Buffett and Musk – political connections.

Jobs’ original fortune was suspect. The iPhone bit seems legit but maybe I just don’t have the whole story?

In the summer of 1984, Richard Schulze hired me to sell audio and video products at the little company he founded and built up.

You see, in 1966, Richard mortgaged his home in order to open up a retail store in St Paul. At first he called his stereo shop ‘Sound of Music’. Later he changed the name to Best Buy.

Richard is worth a few billion dollars these days. I reckon he has earned it.

Many of the people who are billionaires became wealthy by building things that people want and use, see Google, Facebook, Apple, etc. Did you invent those things? They deserve what they earned for their efforts, and tens of thousands of people benefit from the resulting employment and we all benefit from the products assuming we use them.

There are certainly also very many corrupt wealthy people, or people who rely on government largesse for their wealth, but any objective evaluation would show that they are far more common in kleptocracies like Russia and China.

Clearly Wall Street doesn’t want to share their wealth with main Street Americans.

Wall St. works hard sucking wealth out of Main Street Americans. That’s where it comes from, you know. Why would they want to give it back after having gone through so much trouble to extract it? That would get the parasite-host relationship completely backwards.

We are a service based economy driven by consumer spending. The trade deficit will never improve until we competitively produce more goods at home. Until then the deficit will continue to grow in the long run. China is our real Wal-Mart.

We are a service based economy driven by consumer spending.

That’s the story, anyway. The fact is that you have an economy managed for optimal extraction driven by cheap capital and low borrowing costs, except for the economic extractees.

When you say “We need to competitively produce more goods at home”, I take it you mean we need to bring wages down to subsistence levels, eliminate environmental restrictions, and minimize taxes on corporations. That’s all free trade accomplishes.

That’s not what I meant at all. But your assumptions speak volumes of your built in bias when you read comments. I meant that the US needs to produce goods at prices that compete with products that are made in other countries so that Americans will buy American made goods. If Toyota can build factories in America and offer competitively priced, high quality products with jobs that provide living wages, I don’t see why other manufacturers cannot do the same.

The increasing ability to automate theoretically should at least bring the cheaper goods. I don’t know about the jobs. Maybe just for construction workers to build the factories and a handful of technicians to run them. Throw in inflation and low yields, the debt incurred from capital investment will be paid off quickly and you’ll sneeze at how cheap everything is after (assuming your paycheck kept up with the inflation, so sneaky!). But what do I know. Tesla builds cars in tents and look at that. Toyota must be doing it all wrong with the advanced manufacturing thing.

Toyota built factories that were non union giving them a huge advantage. GM tried to create a spin off called Saturn to compete but the UAW wouldn’t allow it. That’s how we gave our auto industry to foreign companies.

It probably won’t be long before we have to bail out GM again.

And why, pray tell, do you get a blue name, Mr. Fancy Pants?

I assume because he’s added a website address to the info field when adding his comment.

He look, it works!

Reality,

You can do this too. When you post a comment, there are four boxes: the big one for your comment, and three small ones:

1. “Name” where you put your alias

2. “Email” which is how the system recognizes you.

3. “Website” where you can add a URL to your blog or business website.

If you put a URL into the 3rd box, it turns your alias into a clickable link. And to show that your alias is now a link, it turns your alias blue.

Quite a few commenters here have their own blogs — including “John Taylor,” to whom you replied — and I encourage you to click on their names and check them out.

A few addons:

1) This data doesn’t yet include the effects of the ongoing coronavirus shutdown in China. That could change everything.

2) Pricing on international trade is suspect because of tax-sheltering issues. Especially within supply chains of complex and financially opaque multinationals pretending to do “arms length” transactions.

3) The US will run a trade deficit so long as it’s the world’s reserve currency, it’s baked into the accounting relationships. Maybe a good thing if it’s not so heavily just-with-China?

Wolf has already commented on this:

“The theory that refuses to do die is that the US, as the country with “the” global reserve currency, “must have” a large trade deficit with the rest of the world. True, the US has a huge trade deficit with the rest of the world. But this “must have” is disproven by the euro, the second largest reserve currency: The Eurozone has a massive trade surplus with the rest of the world, proving that a major reserve currency can be backed by a trade surplus. And the yen, the third largest reserve currency, is backed by Japan’s large trade surplus.

The relationship would be the other way around. The fact that the dollar is the largest reserve currency (and the largest international funding currency) permits the US to easily fund its trade deficits. Countries that benefit from their trade surpluses with the US encourage this. They fear that if the dollar were knocked off its perch, the US could no longer fund those trade deficits, and in turn, these exporting countries could no longer run these big surpluses with the US, thus harming their own economies. So knocking the dollar off its perch would get complicated for other countries in a hurry.”

Wolf is great but he hasn’t looked deeply enough into this topic. Read a balance-sheet economics expert (I suggest Pettis) and it becomes clear.

The Euro and Japan were and are different from the US in various ways, and the accounting identity has more terms in it that a simple “trade surplus implies reserve currency” or vice-versa. That doesn’t change the fact that in the case of the US the reserve currency and the trade balance are intertwined.

BTW, Japan no longer has a trade surplus – for the past several years in fact.

And I would dispute the idea that Euro is genuine reserve currency. Time will tell but it hasn’t been around that long and the debt crisis and extreme policies of the ECB ought to make any Euro-savers take pause.

Wisdom Seeker,

“BTW, Japan no longer has a trade surplus – for the past several years in fact.”

When Japan shut down all its nuclear reactors following Fukushima starting in March 2011, it began importing large amounts of fossil fuels for power generation. This turned the trade surplus into an instant trade deficit in 2011. Only a handful of nuclear power plants have been put back into service. So the fuel imports for power generation (LNG, coal) continue.

By 2016 and 2017, however, Japan was generating trade SURPLUSES again, despite continued fuel imports.

Then in 2018 and 2019 it generated small deficits as a variety of issues arose. Exports to China dropped 7% in 2019, having to do with the China slowdown and other issues. Exports to Korea plunged 13% in 2019 – as the two countries are in a bilateral trade war over their own issues. Exports to the US ticked down 1.4% in 2019, but imports from the US fell even faster, and the trade surplus with the US increased.

2banana,

Thanks!

Not that I could or would even want to try to persuade Wisdom Seeker to change his mind about his believes or theories, though.

Interesting. Not only does the US pay more for pharamas than other countries, it buys from locations that exist to dodge taxes. And yet the big reset plan is to buy prescription drugs from Canada, never mind that Canada will only sell products surplus to their own needs, mandated by legislation if need be. Meanwhile, the pharma corporations pay less taxes and continue to manufacture overseas.

I guess the bright side is that higher drug prices add to a higher GDP number. None of it makes any sense.

Isn’t big government wonderful?

It is illegal for you, as an American citizen, to:

– fly to Ireland

– pack an empty suitcase with legal/safe cheap prescription drugs that you legally purchased

– fly back to America and sell those drugs for a profit

It is also illegal for drug companies and hospitals to charge different prices to different people depending on their ability to pay. It is illegal not to post prices and/or give estimates. But the US and state governments refuse to enforce prices fixing and monopoly laws against the healthcare industry.

And since Americans want their healthcare for “free” (meaning someone else pays for it) – they don’t really care to find out prices. comparison shop and negotiate.

They also want immortality as long as someone else is paying for it.

I guess the bright side is that higher drug prices add to a higher GDP number. None of it makes any sense.

It makes perfect sense when you figure out that your role as an economic actor, like most people, is to enrich the privileged class at your own expense. Other than that you’re a cost to be minimised if not actually eliminated. Since the laws they wrote for themselves don’t give you any choice your cooperation is neither necessary nor appreciated.

Either that or you’re just being sarcastic and you already knew all this.

Wait – so we’re importing most of our pharma (goods-pills, shots..) from Ireland or is it just the IP transfer?

Just the IP – it is a legal way to lower taxes via internal corporate transfer pricing (Corp costs are shifted internationally so profits are located in lower tax jurisdictions – Ireland- and away from higher tax ones – the US).

DC could change the law in a day if it wanted to. Since it hasn’t for decades – including years of one party rule – DC does not want to.

nope, you wont believe it think virus.

from r. nader radio hour

sept8,2018 – Health expert, Rosemary Gibson, author of “China RX: Exposing the Risks for America’s Dependence on China for Medicine” gives a startling account of the national security threat we face getting all of our drugs from China.

june15,2019 – Katherine Eban, author of “Bottle of Lies: The Inside Story of the Generic Drug Boom”

lenert,

We’re importing most of our actual pharma products from India and China. Pharma is a huge business. The Ireland thing is a relatively small portion of total pharma imports, and is a mix of real pharma products and billing gimmicks.

Wolf,

Idea for post material – recap/summary of 2000-2020 China-US trade flows (likely the largest/most significant in American if not world history) and the internal capital controls that China has used (with US gvt acquiescence) to defeat reciprocal trade flows (and therefore accumulate an astronomic cumulative trade imbalance with US.

The underlying economics/policies are not really that complicated – it is just that the US had been more or less outside of truly heavy intl trade (VS say any given Euro country) historically – making US leadership very, very ignorant of how international trade can be manipulated via apparently domestic policies.

This is an under told story on a topic of huge import(s…)

The USG puts money into consumers pockets, deficit spends, and passes on the costs in a devalued currency, held up nominally by obscene defense expenditures. Who pays for that? If the president is correct they will. DOD used to provide new technology, but that seems have passed. What does the DOD really do? (Other than traffic in armaments, their profits (non consumer) do not exactly lift all boats, unless you consider the people on the other end of drone strikes, consumers.) The pertinent answer (nothing) and response, is to pare back all defense issues to one, a nuclear deterrent. The showdown is a clash over fiscal probity. The US cannot pretend to support global free markets while sanctioning any number of nations that China would gladly do business with.

What does the DOD really do?

It primarly mission is to provide trillions in corporate welfare, but it also promotes US economic interests by exterminating wedding parties and schools by mistake.

“passes on the costs in a devalued currency,”

This.

I think DARPA continues to provide new technology. I remember reading that Russia was studying this business model and was seeking to emulate it.

DARPA ain’t generating anything worth 800 billion per yr (defense and black budget).

For comparison sake, 320 million Americans feed themselves on an annual grocery budget of about $670 billion per yr.

The past 20 years of engorged defense budgets have barely won us marginal victories over opponents with the industrial base of Barstow.

Defense is as vulnerable to bureaucratic rot as every other arm of gvt.

How are you so sure it’s not the Chinese moving around to another country?

Iamafan:. Obviously they are trying to!

Chinese capital controls didn’t work!

Now coronavirus is cutting off all of their escape routes!

A few years ago I met the Chinese supplier of one of our top sportswear brand. I cannot name names. But this guy was rich and powerful. This Chinese actually stayed in a US territory and had zero plants in China but he was everywhere you could hire slave labor and pay the generals. I met the generals with him, too. I asked him why not in China? His answer was labor too expensive. I was not comfortable to ask anymore questions. Don’t trust the numbers. They are only for Economists.

Iamafan,

The supply chains are moving out of China. Some of it is driven by US companies, some of it is driven by Chinese companies. Like Nike shifting from a supplier in China to a new supplier in Vietnam. But that new supplier in Vietnam may be the old supplier in China that set up shop in Vietnam to supply Nike without the tariffs.

Wolf,

But by shifting production out of China (where gvt controlled Yuan use is used to defeat recycling of Chinese export proceeds into remotely equivalent US exports), the possibility of increased US exports increases greatly.

Every new trading partner is not going to abuse reciprocal trade as enormously (qualitatively and quantitatively) as China.

And even if they do, at least out import supplier base is now diversified – making the US much less vulnerable to embargoes, future price spiking, etc.

In some cases they are: Chinese manufacturers like Fuyao Glass have been steadily moving their operations outside of China, not so much on account of tariffs but to take advantage of lower labor costs in developing countries like Vietnam and big financial incentives in the West.

But in other cases foreign manufacturers have been scrambling from China.

Again, this has absolutely nothing to do with tariffs but a lot to do with labor costs and especially big financial incentives. The Philippines to name but one State have been offering huge fiscal incentives to companies who move there from China, and that’s on top of lower labor costs: companies like Bosch and Zama have already taken up the offer.

Right now the cost of labor in China is about the same as in Romania: it’s pretty low by Western standards but it has increased enormously since 1995. To give an example the cost of labor in Turkey is less than half than it is in China: no wonder car manufacturers are piling there.

But the cost of labor is just one small part of the equation, and several variables have changed in China: a typical example is how local manufacturers who used to supply whatever the customer wanted without questioning at the drop of a hat have now started to push on the foreign customer what they want. They hold the knife by the handle and know it.

I have recently run into similar changes of attitude by Chinese vendors, after being warned of the phenomenon by our great intermediary (“our man on the ground” as I call him) and it’s very obviously due to a whole lot of people having success go to their heads.

That’s absolutely fine with me: let’s see how they do without my money.

“success go to their heads…”

Well, now that they are producing x%+ (my guess is at least 30% – gvt estimates using GDP denominator are designed to be misleadingly low) of all US good physical consumption – they probably figure that they have what is know in the business as..leverage.

The US may have gotten off its Chinese import addiction at the last possible moment. Any exporting nation not using the controlled Yuan is probably a winner for the long term interests of the US.

There’s a golden rule these Chinese upstarts haven’t learned yet: unless your company has very limited or no competition (think Shin Etsu and SUMCO), you are replaceable. In China alone there are dozens of companies producing tungsten carbide: the Krupp patent on Widia ran out decades ago. Don’t like China? Japan and India will be delighted to have your business.

These folks work on two assumptions: the first is they believe themselves to be irreplaceable. They’ll be cured of this delusion soon enough no matter what their government does. The second is they believe there are still plenty (and I mean plenty) of people out there who believe China delivers the absolute best value for money on everything while that particular train left long ago.

Look at induction (impulse) hardening: these days the best value for money is Japan, followed at a distance by Korea. There’s literally no reason to have the process carried out in China apart from bragging that “China is cheaper than Japan and Korea”.

Like it or not China will now have to either radically redesign her production model or re-join the race they thought they had won. Pouring trillions of yuan into a bottomless pit just doesn’t work anymore because literally everybody is doing it.

Thomas Sowell Basic Economics A Citizen’s guide:

If Americans buy more Chinese goods than the Chinese buy American goods, then China gets American dollars to cover the difference. Since China is not just going to collect these dollars as souvenirs, it usually turns around and invests them in the American economy. In most cases, the money never leaves the United States. The Chinese simply buy investment goods—Rockefeller Center, for example—rather than consumer goods. American dollars are worthless to the Chinese if they do not spend them on something. In growth terms, international trade has to balance, in order to make any economic sense. But it so happens that the conventions of international accounting count imports and exports in the “balance of trade,” but not things which don’t move at all, like Rockefeller Center.

What alarms people are the words and the accounting rules that produce numbers to fit those words. A country’s total output consists of both goods and services—houses and haircuts, sausage and surgery—but the international trade balance consists only of physical goods that move. The American economy produces more services than goods, so it is not surprising that we import more goods than we export—and export more services than we import.

The late, distinguished economist Herbert Stein and a fellow economist co-author put it best: “If all transactions are accounted for, there can be no deficit in the balance of payments.” Money does not disappear into thin air, nor do foreign recipients of American dollars let the money sit idle—and they know that the best place to put American dollars is in the United States. However, because accounting conventions count some kinds of cash flows, but not others, there can be “deficits” and “surpluses.” When flows of foreign investments into the United States are not counted, then the United States can have a deficit and run up “debts”—according to accounting conventions.

Such BS.

Wolf,

Agreed – in the real world 20 years of experience have show that the Chinese did not (were not allowed to by their export proceed grabbing gvt) buy Rock. Center…they bought the US gvt by buying trillions of US Treasuries (used to fund 50 years of deficit addiction) at insanely low rates.

A small fraction of Chinese proceeds from exports to the US were allowed to be recycled into purchases of US goods via the operation of domestic Chinese financial laws.

And the US gvt sat with its thumb up its a**, watching it happen yr after yr.

It never was free trade, it was manipulated trade via domestic Chinese controls instead of tariffs.

Sure, Chinese exporters suffered too by being compelled to only hold continuously undervalued Yuan…as did the Chinese consumer, penalized for any import purchase.

But the Chinese gvt now holds more financial claims against every other world gvt than has ever been the case in human history.

That isn’t what Chapter 30 of Econ 101 said was going to happen…

The Japanese bought Rockefeller Center and that did not turn out well for them. Otherwise I agree with Wolf total BS.

Believing that money transferred through BLS in the form of Treasury bonds somehow sterilizes the trade deficit is a fairy tale. Only now is that artifice breaking down. The other implication is devaluation of the currency in which the bonds are written, when USG cannot raise enough revenue to fund current spending. When China accepts Treasuries and has no private or official public transfer of funds in the way of goods and services they are effectively “buying” the US government; medicare, SSN, DOD. When potus goes to (trade) war with China he is attacking our social services network. Surreptitiously Chinese buy US RE while the FED punches mortgage rates lower and protects their investment. (banks don’t prosper from YC flatness, and Fed is a bank?? (Banks/Investment, do prosper from loss of purchasing value in the dollar, which boosts stock prices. Banks deal in money, not wealth). The real BS is “sterilization” and any and all “off balance sheet” gimmicks.

AB,

This is a major, major topic that is poorly understood by the civilians – how Chinese/US financial policies have massively affected real asset trade flows – and vice versa.

Here or in another thread, it would be useful to go step by step in the most basic possible language and lay out your argument…I am following some, but other parts are opaque enough so that I can’t tell if I agree with you 100 pct.

But the topic itself is crucial, since the US is going to be impacted by international trade flows to an extent never before seen in history.

And the first 20 yrs of this have been fairly ruinous…guess the Fed thought all those China gutted rates would make for a utopia of US housing affordability…instead of a hyper volatile casino wasteland of McMansion inflation.

Funny how they still haven’t learned after two decades of ZIRP.

What happens if a US company sets up shop in China?

Gilead has an experimental vaccine. They took it to China to test Chinese coronavirus patients before FDA approval. China claims a patent on it. That is what happens.

While you’re stewing over that, you might also like to decide whether transnational corporations pretending to be patriotic Americans are selling you out to the Chinese, or if the Chinese are selling you out to said corporations. You know it has to be one or the other. Maybe both.

Are you feeling sold out yet?

Una,

Why do you leave DC – the product of a political/State process – out of the “sell out” equation?

The Left tends to idealize State based objectives while actively ignoring the actual State based results.

DC, with a few notable exceptions, has already sold to the multinationals so it’s in Una’s equation, on the wrong side.

Anarcho-capitalististic predation would be so much easier without interference from government and would be so much more profitable without the expense of government corruption.

They call it Neo-Liberal Policy, and it is neither, nor is it a policy but rather the avoidance of one. Governance without responsibility. The right complains about wealth redistribution, while there is no plan to distribute wealth in the first instance.

David:. Some US companies just need to find out the hard way!

Mark Twain noted the futity of trying to warn people with the truth! They prefer sweet sounding lies instead!

China doesn’t “steal” anything. If you are a company with advanced technology and production system that want to set up shop there you have to play by local government’s rules, and the rules are the same they were over two decades ago: get a local partner, train his people and often hand him over your patents and trade secrets.

Fuyao became one of the largest and most competitive glass manufacturers in the world because Saint-Gobain wanted to get into the Chinese automotive and construction market, and the price to pay was help build Fuyao into a powerhouse. Talk about a veritable Faustian bargain.

If you don’t want to deal with this, there are plenty of countries out there just waiting for you: Sony has long set up shop for sensitive applications in Malaysia precisely to avoid helping nurture their own competitors and Zama was smart enough to avoid manufacturing their two-stroke injection system in China to avoid having to fork the technology over to a local “partner”.

The executives signing along the dotted line are either blinded by short-term gains or just flat out don’t care because until one year before they were selling toothpaste and in a couple of years they will move over to selling canned pineapple. The principle of “growing your leaders instead of purchasing them” is completely alien to most companies and long term they all pay the price for it.

Damn, MC, spot-on! Always refreshing to hear observations from someone actually in the real manufacturing/business trenches than the outsiders (albeit insanely more profitable or ruinous) who think real ‘work’ lies in the endless game to raise next quarter’s share value.

May we all find a better day.

1) USD/CNY was up from 1 to 8, but in 2005 it turned south, but

now its moving up again > 7.

2) James Baker Plaza accord sent the dollar down to a trading

range between 80.60 on Feb 1991(L) and 98.23 on July 1991(H).

3) USD osc around that resistance line @ 98.23 for 5Y.

4) When USD will show signs of strength our trade deficit will shrink, in dollar value.

5) USD can get stronger because either we will produce more and send

less dollars abroad, or because the start of a global recession.

Surely EU should include Germany, Italy and Ireland pushing the total deficit to 331Bn the largest with any trading partner.

The EU listed here has 27 member states, including Germany and Ireland. I included it in the chart as a memo figure to show how the trade bloc compares to China because each EU member state is fairly small, even Germany.

Have you guys actually seen the Costco sales mailers and email promos? You would have thought the tariff would have ended sales. But now, it’s a daily barrage of Chinese made stuff.

Same for almost everything. I am inundated.

eBay and Amazon full of fake Chinese gear. You look at picture, it shows a good looking product. You click and receive some fake sh1t madu up in a trailer somewhere. They spend time and money trying to trick you with sh1t, you spend time and money sending it back. How absurd.

China is ENEMY NUMBER ONE.

And rightly so, this IS a totalitarian nightmare. You cannot open most western media sites when in China. You cannot open youtube. They have over a million people in concentration camps.

Some sent me a BBC Hardtalk episode involving a senior Chinese diplomat in London. When asked about the Uighurs and these gross violation or their rights he said ‘those are you laws and they apply to you – they do not apply to China’

Woooooahhhh so China feels it does not need to comply with international law? They are a law unto their own? And if anyone makes a peep they threaten to shut them out of the China market?

I can see that not going over well in parliaments around the world.

China currently keeps the shelves stocked around the world so the goal surely is to diversify the supply chain.

You can’t kill China completely, but you can knock them down to a level where they can be dealt with – and where their threats are empty because they aren’t holding us hostage.

Fear PORN!!

Millions in concentration camps? The US has more people under lock and key than China.

How many Chinese military bases surround the US? None, that I have observed.

WoW, I opened my phone and I had a message from the NSA waiting for me. When I travel, I know that five eyes, 12 eyes, and other eyes are following my every step.

Youtube? They have Tiktok.

China does one thing with it’s students that a number of other countries emulate. That is to teach them about the Opium Wars, the harassment of Chinese works and bans to exclude them from the US in the 1800’s.

If you don’t want to buy anything from China, then don’t and keep your fear porn to yourself.

Also, if you get a chance, watch the “Coming War On China” by John Pilger (free on state run Youtube). It might open your eyes a bit and help you see who the real aggressors are in the world.

Seems to me that the biggest factor keeping the US trade deficit from exploding in the past few years has been the huge increase in US oil production which has substituted imported oil in very large quantities.

This one single commodity has had a large effect on the US trade balance. Moreover, this situation is also somewhat unexpected as few foresaw the coming of the shale revolution. Remember “peak oil”? Nowadays it seems like the “peak oil” concept has been turned on its head… rather than discussing peak oil in terms of supply, it’s being discussed in term s of demand.

Seems to me that the biggest factor keeping the US trade deficit from exploding in the past few years has been the huge increase in US oil production which has substituted imported oil in very large quantities.

US oil production is largely unprofitable. The explosion came in federal and corporate debt.

True but irrelevant to this discussion.

In the context of this article what’s relevant is that the money for the oil was spent domestically, thus significantly affecting the US trade balance.

Good for you, Max.

I agree that reduction in oil imports has played a big part in overall trade deficit reduction.

But, I wish the component parts of the remaining deficit were clearly broken down by the financial media – the data is out there but is a bit of a hassle to break down by product type.

Bottom line – US is not the tech Goliath Americans were raised to think it is…cell phones and computer tech make up a huge part of the non-oil trade deficit.

China ships us smartphones – we ship them…soybeans.

That is the bottom line as to why the US runs $300 B plus in annual trade deficits with China alone.

How obtuse that business leaders repeat these intellectual property issues in the post colonial world? Remember, we are the master race, we exploit your labor and leave you high and dry. Now Chinese goods ship to the US through third parties or they outsource their manufacturing. China built a port facility in Sri Lanka, then took it over when the local people couldn’t run it. The IMF solution would have been to decimate their financial system with more debt, crash their currency, and then allow the colonialists back in for another round of X-ploy-tation. If the intellectual property argument held water US workers would own the robots which put them out of work.

I am aware of a start up company who buys its precision machined castings from Chinese suppliers. Originally, all was fine. In the past year, shipments are sporadic, and the parts are starting to vary from the approved specs. Lately, their emails and calls are going unanswered for days and weeks. For a few pennies per part, they have located a local US based supplier who has their parts manufactured in Mexico, a much more accessible supplier.

Seems like some are realizing that dealing with the cheapest has other costs, and those other costs just might not be worth it.