Spain’s Big Five banks (already down from the Big Six) could soon be four.

By Nick Corbishley, for WOLF STREET:

The ECB’s NIRP forever policy is crushing Eurozone banks’ ability to turn a profit, warned the CEO of Bankia, José Sevilla, on Monday. “It is clear that the current rate scenario is hurting the profitability of the banking business,” he said. “We think low rates are good and perhaps even desirable. But the same cannot be said of negative interest rates since they destroy banks’ profitability equation. Sustained over time — and we have been negative for five or six years now — they hinder and penalize the profitability of Spanish and European banks.”

In February last year, the formerly bailed out lender launched an ambitious three-year plan (2018-2020) that included an earnings target of €1.3 billion for the third year. By this Monday, that plan was already dashed after the bank unveiled half-year profits that were down 22% year-over-year, prompting Sevilla to admit that the lender will not come even close to achieving its €1.3 billion target for 2020.

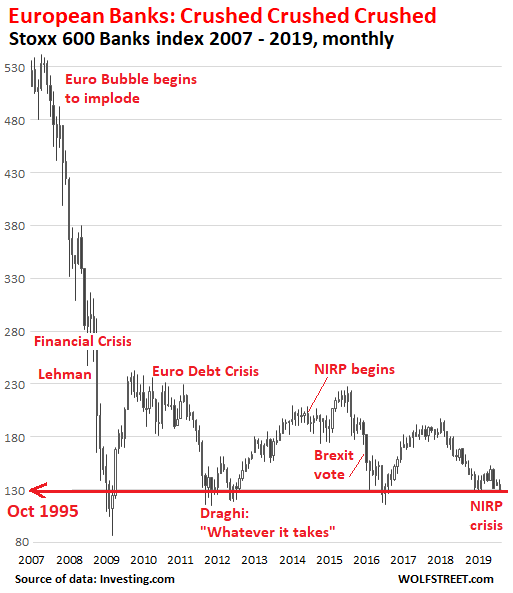

Over the last decade, as rates have gone from low to zero, to below zero, the shares of Spanish and European banks have been crushed, re-crushed and, for good measure, re-crushed again. Over the twelve years since May 2007, when Europe’s seemingly interminable banking crisis began, the Stoxx 600 bank index has plunged 75%, and is now back where it first had been in October 1995:

There are plenty of reasons for this spectacular decline, including the 2008 Financial Crisis, the Euro sovereign debt crisis that quickly followed, and the huge piles of non-performing loans that both of these crises left festering on many banks’ balance sheets. There have also been other aggravating factors such as Brexit and Italy’s ongoing banking crisis, which have further decimated investor confidence in the sector.

But a source of pain for European banks is the ECB’s negative interest rate policy (NIRP), which squeezes the interest margins they are able to earn. Despite all the ECB’s hype, NIRP was never meant to boost the real economy or make banks healthier. Its goal was to boost bond prices and thereby bring yields down, which lowers the costs of borrowing for debt-sinner countries. It’s worked beautifully: now, even Italy, with its 132% debt-to-GDP ratio, struggling banking sector, and recalcitrant government, is able to borrow for free with maturities of up to essentially years.

But there is a high price to pay. And that price is being paid not just by Europe’s legions of forsaken savers, depositors, and yield-hungry pension funds, and future retirees, but also by many banks.

In Spain, the shares of three of the big five banks have fallen by 10% or more since last Thursday, when Draghi telegraphed the further loosening of ECB monetary policy. Bankia’s shares have fallen 13%, to €1.76. Five years ago, they were worth €6 a piece. At the beginning of 2018, when European banking shares were staging a brief recovery, the bank had a total market cap of €11.5 billion. Today, it’s worth just €5.5 billion, a mere fraction of the €24 billion bailout it received in 2012.

Spain’s third and fifth biggest lenders, CaixaBank SA and Banco de Sabadell SA, have also seen their shares slump since announcing results last week that fell short of analysts’ estimates. Both banks cut the outlook for their core lending businesses and reduced their forecast net interest income — a measure of earnings on loans minus deposit costs — sending CaixaBank’s shares to their lowest level in three years and Sabadell’s to a historic low of 79 cents. In the last two weeks alone, Sabadell has lost almost 20% of its market cap and is down over half since Jan 2018.

The irony is that Sabadell, on the surface at least, is having a much better year than last. The huge self-inflicted IT problems at its UK subsidiary, TSB, are apparently largely behind it, after having cost hundreds of millions of euros to put right. Last Friday, Sabadell reported first-half net income of €532 million, a 340% increase on last year. Yet its shares have responded by plunging every day since, for four main reasons:

- Falling margins. If, in September, Draghi does what he does best and cuts EZ interest rates even deeper into negative territory, the pressure on the bank’s margins is only likely to get worse. Sabadell’s CEO, Jaime Guardiola, has even opened up the possibility of charging individual depositors interest on their accounts, which would send these deposits fleeing.

- Its huge exposure, via TSB, to the UK economy, which could be just three months away from feeling the full brunt of a no-deal Brexit.

- Its wafer-thin capital buffers. Spanish banks have the lowest solvency ratio (11.1% CET1 fully loaded) in the Eurozone, behind even the likes of Cyprus (11.4%), Italy (11.9%), Greece (12.7%) and Portugal (12.8%). And Sabadell has the lowest solvency ratio of all Spanish banks.

- Another huge fine from Brussels could be in the offing. Spanish banks may soon have to pay out billions of euros in compensation to mortgage holders if the European Court of Justice rules, later this year or early next year, that the IRPH mortgage reference index, used in over a million mortgages, was abusive. Sabadell is estimated to have total exposure to IRPH of around €800 million while Caixabank could end up holding a tab for some €6.7 billion, which could be enough to wipe it out completely.

The worse things get for Sabadell, the more investors are reminded of the collapse of Banco Popular in 2016 and its shotgun acquisition by Banco Santander, in which shareholders lost everything. Already, rumors are swirling about the possibility of merging Sabadell with Bankia, an operation that would spawn Spain’s second biggest bank by domestic assets. But just as happened with the creation of Bankia in 2010 from the bedraggled remains of seven semi- or fully defunct savings banks, the risk to taxpayers is likely to be huge. By Nick Corbishley, for WOLF STREET.

Just when European banks need to inspire confidence more than ever. Read… Not Helpful for Crushed European Bank Stocks: Stress Test a Sham, European Court of Auditors Warns

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

How long this ‘pretend and extend’ can go on?

Is there a possible contagion risk to rest of the global banking system, including USA?

Newsflash: it’s going on forever, because any other path would mean admission of failure of policies and mechanisms that are decades old and which are taught as gospel to student economists the world over.

Better to enter the twilight world of negative interest rates, rack up the debts from their already stratospheric levels, and hope the ‘trickle down’ from the asset-owners boosts growth, rather than to allow people to save prudently for their families and futures via normalized IRs.

The lunatics have well and truly taken over the asylum – and appropriated all its operating profits for themselves and their pals.

It will go on until it doesn’t.

History is littered with examples of governments that had tried to deliver “prosperity” and stay in power through the “easy way” of loose monetary/fiscal policy and massive deficit spending.

It always ends the same way. Misery, ruin, bankruptcy, war and a complete change of government (usually violently).

the writing was on the wall when everybody got excited about the hunger games. 1984 missed by a few decades, the hunger games maybe not so much.

Spanish banks are getting absolutely crushed… Everyone is running for the hills, a few Spanish and Italian banks already all time lows. EU Bank index let’s you know all you need to know, plus no deal baked in the cake, hard to have confidence in EU banks when they are knee deep in bad loans to EU and EM’s. Eurodollar US denominated debt to China in the Trillions, their not getting paid back, China banks and corporations are broke, leveraged to the tits

Dead Men Walking! The sound of derivatives being activated is whistling in the background… Big banks engaging in Interest Rate swaps, somehow both sides show asset gains for years, mark to market con about to explode. DB got downgraded to BBB, just to make it clear in almost every derivatives trade there is a rating clause, if rating goes below investment grade, it all goes kaboom… Once DB hits -BBB, tic toc

Two goodies explaining why European Markets got drillllled today

https://www.bloomberg.com/news/articles/2019-07-30/turkey-tells-its-banks-to-fix-their-36-billion-debt-problem

https://www.bloomberg.com/news/articles/2019-07-30/a-star-ubs-analyst-s-big-new-call-china-banks-need-349-billion

The 40-year-old UBS Group AG analyst, whose star is rising after he issued early warnings about the troubles roiling China’s smaller banks, says the lenders he covers now face a potential capital shortfall of 2.4 trillion yuan ($349 billion). His tally of assets at a broader universe of Chinese lenders in “distress” is 9.2 trillion yuan, or about 4% of the commercial banking system and nearly 10% of gross domestic product.

US Banks seriously began fiddling in the derivatives markets in the early 1990s. What did not get the attention of regulators, at the time, was the reporting of revenues and profits related to “trading” instead of “normal” commercial banking activities. Then the last remnants of Glass-Steagall were bulldozed around 1999, and the global derivatives casino was created. Four areas dominate those markets: Currencies, commodities, credit (mortgages), and interest rates. The credit side may have brought down the house in 2008, but the interest rate side handles over 70% of the transactions in that arena. So we get a pretty good idea why the interest rate hikes between 2015-18 were only 1/4 point each: A quick, steep move would have creamed the fixed rate side of that swap market. Can we imagine global bankers having to weight important decisions based on the impact a particular decision would have on the swaps markets?

Even most pros shy away from discussing the ongoing impact of derivatives. Exponential leverage of the contract creates exponential leverage of the margin call. Privately created and still unregulated, these pieces of paper, devised out of thin air by one institution to sell to another institution, look good because they count as booked revenues. Michel Lewis’ follow-up book, Boomerang, chronicled the booking of revenues before 2008 by EU banks by merely selling and re-selling waaaaay overpriced real estate back and forth to each other. Currency, commodity, credit, and interest rate swaps can be effective hedges, but the greed factor remains uncontrolled.

It will go on until gold explodes upward.

Yawn…so the EU has yet another bank problem.

Looking at past history, the EU is THE bank problem. Ever-popular EU bank supervision is everything but non-existent. If any country (ie Italy, France) breaks the rules, it’s examined & determined to be OK. Amounts of track III debt is astronomical, and EU “Leaders” (whatever that empty term means) do little to communicate that to the population. (I have a PhD Mannheim University professor friend who is in absolute denial that Italy owes Germany something like 1 trillion euros in track III debt).

European bankruptcy law is punitive and horribly slow at best. There is no effective way to close out bad debt even if highly incompetent bank managers wanted to give it a try. My favorite is is the EU’s “lack of stress” test for banks. Why they even pretend is a mystery.

Couple all this to an unelected, undemocratic and unaccountable EU bureaucratic system (did any of the 570M EU citizens actually vote for a single one of any of the several new EU “presidents”? Nope, not a single one.) that generates no great leaders with credibility or vision for the future. It’s a Hugh game of musical chairs with the same failed personalities circling the floor.

Yeah, good luck to the borrowers after Brexit who agree to have their debt contracts adjudicated under European rather than English law.

Agree on the banks. However

“Couple all this to an unelected, undemocratic and unaccountable EU bureaucratic system ”

?

Are you telling me you elect the US civil service? Perhaps understanding the system would help.

The insanity of a fiat currency system and massive government unaccountable deficit spending taken to its logical conclusion. The beginning of the end starts with something like:

“has even opened up the possibility of charging individual depositors interest on their accounts”

All the keep the scam and those in power going a little while longer.

Savers receive minimal interest, if any, on their savings. The “retired generation” would have been looking forward to earning say 5-7% on money they had saved for retirement and this interest would have been spent providing a cushion between the basic state pension and a more comfortable life.

No interest = no spending which means lower demand for goods. Those goods are produced by companies who provide pensions for their staff, but with the loss of interest rates goes the Final Salary Schemes for pensions, which again provided a better standard of living, and which again is no longer there.

It is only a matter of time before private pension funds are going to be forced to re-calculate the pensions, including those already receiving a pension based on rates which are but a distant memory.

When I was in my early 40’s I was looking to invest in a topup pension. The large, reputable pension providers would give three quotes based on a 7% investment return, 10% and 13%. By today’s returns, a pipe dream!

When does this end, and who will be the loser in the end?

The trick is some of your financial assets must be allocated to riskier assets … not all of it. Just some of it.

Funny they didn’t complain about low interest rates for their savers, but now I believe NIRP forces them to PAY their borrowers! Hence the screaming about ruining pension funds, etc. They can’t have it both ways. What’s to stop this from spreading to ALL banks that drop to NIRP?

Karma.

Let’s just admit that EU banks are now government-run utilities.

Whereas in the US the government is a corporate-run utility.

Eurozone banks are beggared

Allied Irish Bank announced post tax profits last week. It’s share price barely moved. In a marketing where share prices are red hot, bank share prices remain remain very low.

Investors know that the banks are barely solvent and are wholly dependent in ECB support to survive.

2008 was never rectified.

1) The German CPI fell to 1.01%. All rates between 3M to 9Y

range between (-) 0.519 to (-) 0.783. Spread manipulations.

2) US CPI during oil embargo #1 in 1974 and embargo #2 in 1980 jumped to 11.5%, below effective Fed funds rate.

3) From the x2 tops the CPI fell to 1.5% in 1984.

USD was the strongest in 1985 during 1985 Plaza accord.

4) From 1998 to 2001 the CPI made x2 bottoms @0.8%.

USD formed x3 peaks during that period.

5) In 2009 the CPI was negative for the first time @ (-) 1.3%.

Unexpectedly USD was the weakest ever. USD hit a bottom, at 70, in 2008.

6) Since 2009 US CPI ranged between zero in 2016 to 3%,

averaging 1.5%.

7) Top 50 US inner cities are doing a good job, since the 60’s.

US tax payers paid them to produce and they did plenty : over 50% of the 3.8M babies born in 2018 were came from the inner cities.

8) Money flow to them enriched few narrow strips of the elite,

but caused unsustainable decay and misery for the rest.

What is also destroying the banking system and has added massive uncertainties…

In the computer age…Valuations in the markets.

Brick and mortar is something solid and can only be in limits of being evaluated to worth. Intellectual properties is huge in computers and easily to be hacked or manipulated by the user. Never trust computer games in any form as they can never allow the end user to actually win anything of worth…like slot machines or computer card games, your behavior patterns can be tracked and used.

Computer games on the net is huge with vast amounts of profits and manipulation.

Now that we have a hooked society…what happens when the computer infrastructure breaks down…old satellites, etc…

Deleveraging has to happen, one way or another. I guess this is more preferable than outright default.

I got a question about European banks. The way banks are supposed to work is that they take the depositors money and then lend out the money to their clients who have businesses and want mortgages.

I am getting the feeling that this is not what the banks are doing. I think that they are turning around and then buying government debt with their depositors money which is not what they are supposed to be doing. Only the banks excess capital is supposed to be invested in government debt obligations

fred carach,

All banks are trying to invest the cash from deposits in some kind of profitable asset, preferably loans. And they do. But loan demand is limited, given that they have to stay away from risky lending that would produce large losses. So they also buy assets, including relatively safe assets that count as core capital, such as sovereign bonds. They also keep some of their cash on deposit at the ECB where it is “earns” a negative interest.

Merkel 2012

If Europe today accounts for just over 7 per cent of the world’s population, produces around 25 per cent of global GDP and has to finance 50 per cent of global social spending.

Greatest buying votes program gone wrong!

NIRP an QE forever.

The only way out for the private workers in EUssr is the safe heaven of USD, treasuries and USA equities.

2019 estimate for EU:

o population = 743M/7.7B = 9.6% of global

o nominal GDP = $19.1T/$88T = 22% of global

2019 estimate for US:

o population = 329.2m/7.7B = 4.3% (EU more than twice USA population)

o nominal GDP = $21.4/$88T = 24.3%

743M is probably Europe, EU has something around 500M

Yup. I stand corrected.

2019 est EU population =513M/7.7B = 6.7%

Part of the yield curve has been inverted since December. Not everyone will be able to get low loan rates. Credit card lenders are rumored to be asking for 16% interest. Subprime auto lenders and pay day lenders were not charitable either. US home prices are above their 2006 super peak and are rising faster than CPI. Bank stock prices remain depressed due to lack of investor confidence. Cash out refinance deals are becoming more popular again as interest rates drop and home equity percentages rise. Negative interest rates are a rip off. Might find another nation offering more favorable rates. I do not believe negative interest rates increase productivity or growth. Italy might have lower interest payments, but their economy is not resilient because of all their debt and poor investment decisions.

You understand what this is causing, right. The ZIRP NIRP Euro and Japan issue is making more foreign money flow to US long term securities and Equity. If you don’t believe me, check out the annual end of June TICDATA Foreign Portfolio Holdings Survey reports. It’s now more than ever before. More than double where it was during the GFC.

The US wants the World’s money. I can’t think otherwise.

“We think low rates are good and perhaps even desirable. But the same cannot be said of negative interest rates since they destroy banks’ profitability equation. Sustained over time — and we have been negative for five or six years now — they hinder and penalize the profitability of Spanish and European banks.”

Sounds like a sales pitch to start saying “a 2% interest rate target would be ideal”

Savers are being penalized with NIRP.

Banks are being penalized with NIRP

Insurance companies are being penalized with NIRP

Bond prices are bid so high so that bond investors are being penalized with NIRP

P/e s are bid so high that stock investors are virtually guaranteeing a low- negative return in the future.

Who is gaining via the NIRP

1.Zombie companies who can hardly pay the interest on their debt , let alone the principle

2.countries which are de facto insolvent, but still pay their interest.It is inevitable that most will default , the question is when

Beneficiaries in this system look to be government contractors: from military to energy subsidies. All high debt loads with low profit and constant layoffs. They create that loud sucking noise until the cash runs out.

Shady real estate developers love low rates. If anyone was foolish enough to let a real estate developer run the whole system, then they’d rig it so that every loan application gets approved, even if half the application is false, and then real estate developers get all the money to spend, until its gone. Then the real estate developer takes the limited company that was doing that development and goes bankrupt. Meanwhile, the real estate developer is starting a new limited company and filing a new application for a new loan which if the real estate developer runs things will be instantly approved no matter how many times before that the real estate developer has gone bankrupt. The low interest rates are needed and desired by real estate developers to keep the monthly payments on the loan cheaper up until they declare bankruptcy.

You are looking at small fries. Those grifters take tens or hundreds of millions from the system, but when the US government runs over $20 Trillion in debt.( that is a T, remember that) The biggest low rate supporters would be the ones pumping up that much debt, imagine the interest payment on all of that debt as it climbs by .25%, every .25% is another $52.5 Billion to be owed in interest.

shady real estate developers (and their friends) who love low rates and can force them on the population, like Mr. Trump ;-)

But really, it’s not only the elites that are profiting. While savers and in some EU countries pensioners have been losing big time for years thanks to ECB policy, a big chunk of the population has been profiting hugely: homeowners with a big mortgage. E.g. all those “owners” in Spain who have a mortgage tied to Euribor which means they have been paying next to nothing for years. And all those “owners” in Netherlands who have a 100-120% mortgage at a lower rate than even official inflation, while the value of their properties has skyrocketed over the years (+1000-2500% from the early nineties, and often 5x higher from the official introduction of the Euro in 2001, despite a small dip after 2008). Rents in the free rental market are sky-high, often 2-4x higher than the cost of lending a home from the bank. And why worry when the whole house of cards finally collapses? 90% of recent Dutch mortgages are guaranteed against financial loss by the Dutch government (= all those who were stupid enough NOT to participate in the Ponzi).

In my country not only government contractors but also many government workers have seen their income increase more than official inflation over the last ten years, while small business owners are bled dry by inflation, high interest rates for loans (if they can even get them) and ever higher taxes.

The question is, why did these countries become insolvent in the first place?

Clue #1 Buying into the PONZI Scheme that is the E.U.

Clue #2 Buying into the EURO.

If the banks go bust -no sweat.

But if the derivatives blow up credit will freeze.

By the time the worker bees find out there will be no hive.

I wouldn’t mind it if a bank actually went bust these days. But no, instead they get to run themselves into the ground, and then the taxpayers are told to fork over all their money to bail out the bank. Apparently so they can then run themselves back into the same hole expecting the taxpayers to come up with trillions more dollars to bail them out again. Repeat until there is a revolution.

Following bailouts after the 2009 financial debacle, a new law (under Dodd Frank) replaces bank bail-outs with bail-ins. The law states your bank deposits legally are assets of the bank and all you have is an IOU. If the bank gets into financial distress, your assets are used by the bank to pay off Wall Street creditors – you don’t get first digs at your money. This is the ‘bail-in’. And good luck retrieving money from the badly underfunded FDIC.

I love the way the bankers like to say that things are down “because of the 2008 Financial Crisis” as if that was some sort of natural event, like a heat wave or a cold snap or a stormy day. I suppose eventually we’ll hear it referred to as an Act of God. Of course, what bankers will never say is that they CAUSED the 2008 Financial Crisis with their greed and theft.

AAAAAAAAMEN Rocki. Well put. I keep saying the same thing.

“what bankers will never say is that they CAUSED the 2008 Financial Crisis with their greed and theft.”

You Believe this lie???

The cause of the 2008 crisis In America was LAX Regulations.

NOT Banks, or Bankers.

To correctly apportion blame, first find the correct people, to apportion that blame to.

THE REGULATION WRITERS IN CONGRESS.

You are blaming bankers, for doing, what the regulations allow then to do.

Which is just like blaming a drug addict’s, for taking drug’s, they now need to live.

To cure a drug addict, first you dry them out.

To cure the banking system abuse issues, first you get CONGRESS, to Change/Reenact the F(*&^%G regulations, THEY repealed. Like Glass Steagal, repealed by THE GOP majority.

You want to blame somebody for a problem, at least blame the correct people.

Otherwise you just end up looking like all the others who blame banker’s, for issues, they did not create.

The cause of the 2008 crisis In America was LAX Regulations. NOT Banks, or Bankers. To correctly apportion blame, first find the correct people, to apportion that blame to. THE REGULATION WRITERS IN CONGRESS.

Congress works for the bankers. Obviously.

No son.

Congress works, for Congress.

That’s why taking bribes (Campaign fund’s Etc), insider trading, and keeping Remaining campaign funds when retiring, are all legal, for members of Congress.

It would be more Objective to say Congress Extorts from bankers, not work’s for them.

Eg you pay me, or I stop you doing X, Y, and Z.

Hello Nick Corbishley,

Are you the columnist formerly known as “Don Quijones”?

Apparently, i have not been paying close enough attention to details.

Nice to see you still posting informative articles on EU banking shenanigans, and of course Mexican financial hijinks.

Brexit will hasten EU demise.

Eu needs UK more than UK needs EU.

On Brexit, falling pound will flatten German and French exports to UK collapsing European banks forcing ECB to call in constituent government loan guarantees.

Constituent govts will default collapsing the EU.

All by Christmas 2019.

So, the Spanish bankers are looking wistfully across the Atlantic, longing for a day when the govt is the glove-puppet of the banksters like in the US. No, the EU is the last bastion of capitalism where failing banks must either restructure or die (think DB).