As buyers wait for lower prices, even lower mortgage rates, and higher wages. Mortgage rates already dropped to 6.15% from 7.9%, but that didn’t help at all.

By Wolf Richter for WOLF STREET.

We’ve been saying this for many months, and now Fannie Mae’s Economic & Strategic Research group is saying the same thing – the Buyers’ Strike is expected to continue despite much lower mortgage rates and a very sharp increase in active listings — because prices are too high:

“Although mortgage rates have fallen considerably in recent weeks, we’ve not seen evidence of a corresponding increase in loan application activity, nor has there been an improvement in consumer homebuying sentiment,” Fannie Mae said in the report today, lowering its forecast.

“We think it’s likely that many would-be borrowers are waiting for affordability to improve even further, and that some may be anticipating additional declines in mortgage rates given expectations that the Fed will lower the federal funds target rate,” Fannie Mae said.

And so, potential buyers are waiting for even lower mortgage rates.

“Others may be waiting for household incomes to improve further to offset some of the recent home price growth, or they may be thinking that future supply growth will ease affordability.”

The last phrase means lower prices, because prices are too high, and so potential buyers are waiting for prices to come down.

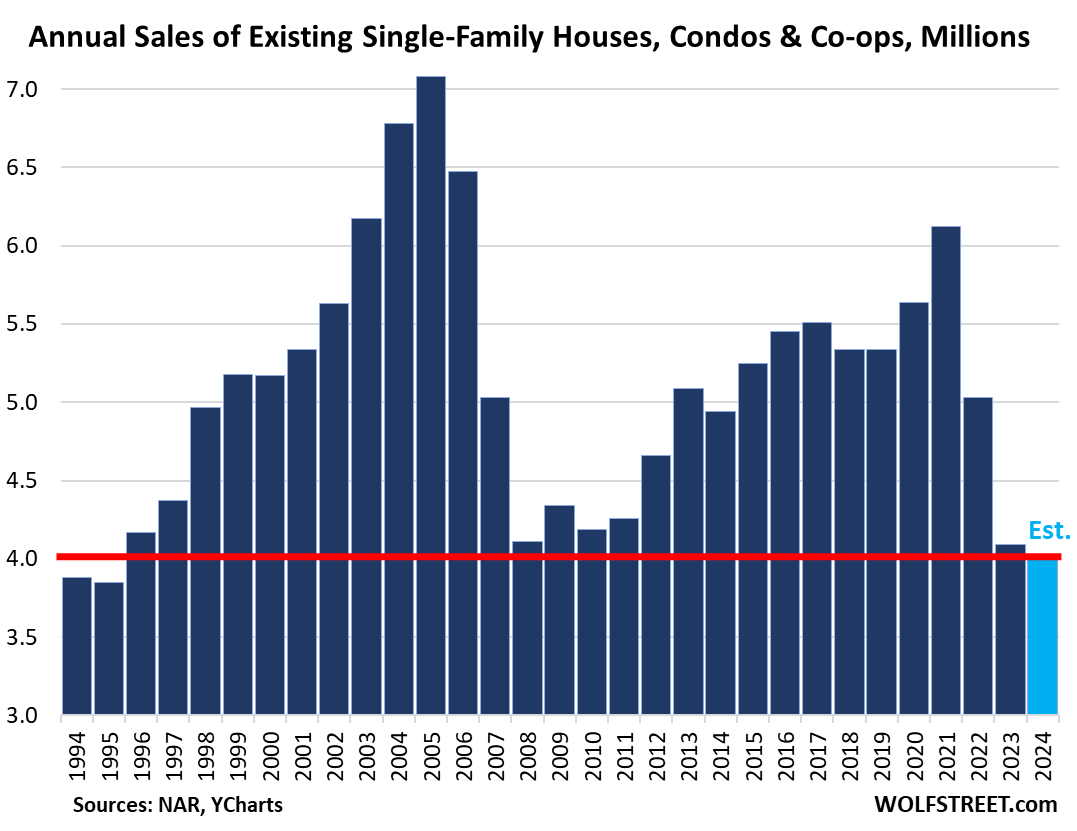

“Regardless of the lever, we expect affordability to remain the primary constraint on housing activity for the foreseeable future, and we now think full-year 2024 will produce the fewest existing home sales since 1995,” Fannie Mae said.

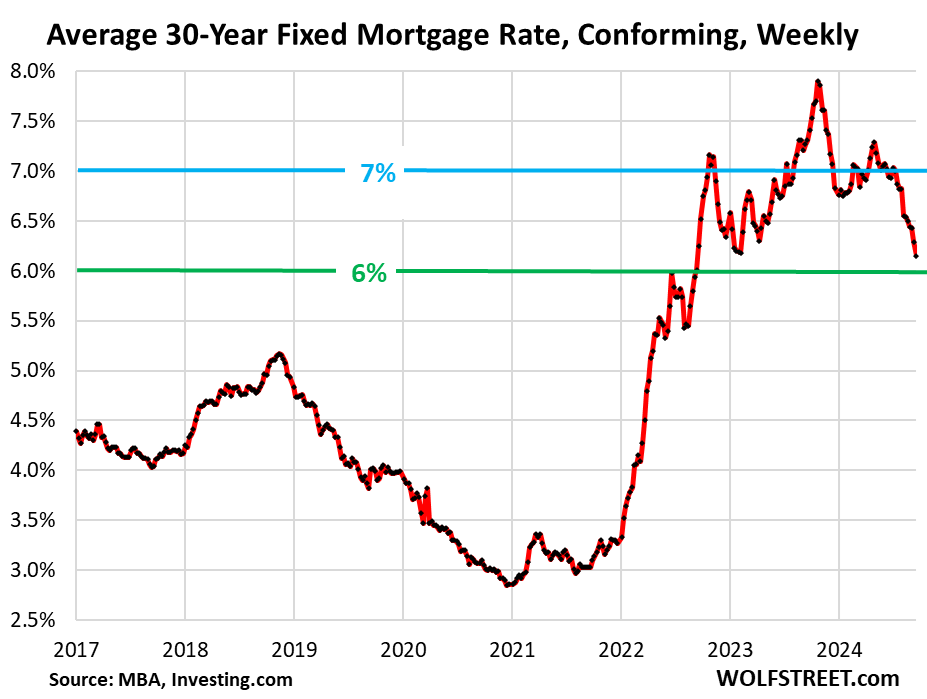

And mortgage rates have already come down a whole lot. Except for a three-month period between mid-January through mid-April, mortgage rates have zigzagged lower incessantly since November 2023.

According to the Mortgage Bankers Association today, the average 30-year fixed rate has dropped to 6.15% in the latest reporting week, that’s down by over 1.6 percentage points from the rates 10 months ago.

So Mortgage rates have come down a lot, paralleling the moves in the 10-year Treasury yield, in anticipation of a whole bunch of rate cuts by the Fed. With so many rate cuts already baked in, mortgage rates may not fall a lot more.

Fannie Mae today estimated that the 30-year fixed mortgage rate will “average” 5.9% next year, and it has already fallen to 6.15%, from 7.9% in November last year:

“Despite a significant decline in mortgage rates and improved supply in some parts of the country, existing home sales are not expected to pick up meaningfully through the remainder of 2024, with the annual pace now forecast to be the slowest since 1995,” Fannie Mae said.

Based on its own data, Fannie Mae expects annual sales of existing homes to fall another 0.3% in 2024 from 2023.

Here are annual sales of existing homes through 2023, as reported by the National Association of Realtors, which appears to differ slightly from Fannie Mae’s data. Year-to-date through July, the NAR’s metric is down by 2.0% from the same period last year, which had already been the lowest since 1995 (estimate for 2024 based on sales rate YTD, historic data via YCharts):

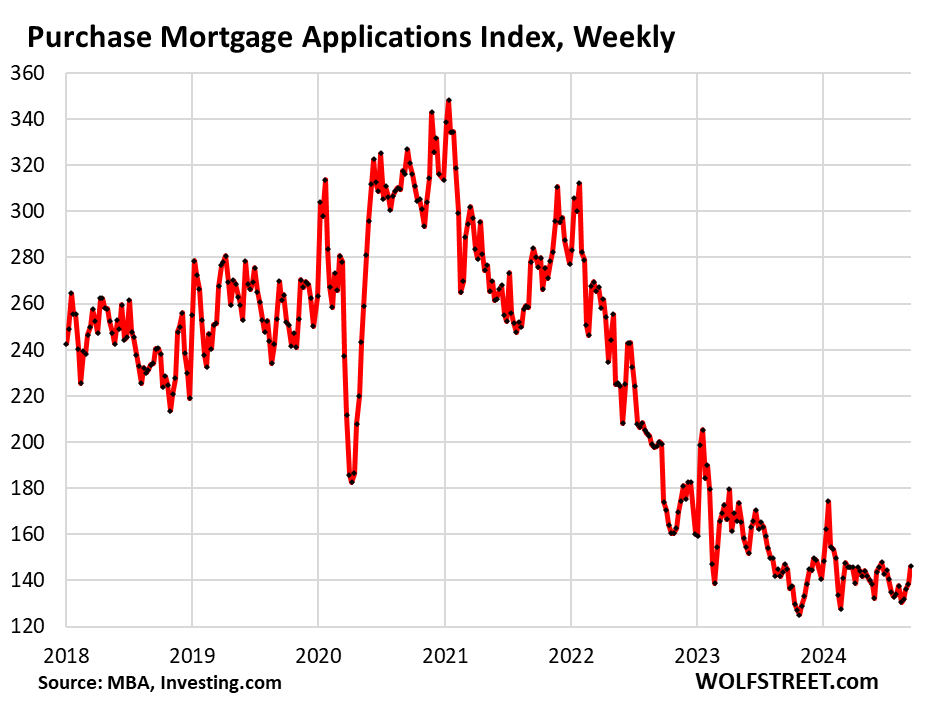

“Recent data, including softness in pending home sales [we covered their amazing plunge to record lows here] and purchase mortgage applications, continue to suggest limited home-purchase demand at current affordability levels,” Fannie Mae said.

So, these applications for mortgages to purchase a home have collapsed over the past year to record lows in the data and have hovered near those lows ever since. In the latest reporting week, they ticked up a tad from the prior weeks, but are still down by 46% from the same week in 2019 and by 54% from the same week in 2021. Those multi-year declines have been roughly the same over the past six months:

Demand for mortgages has collapsed, despite the much lower mortgage rates, because prices are too high. And people are waiting for even lower mortgage rates and lower prices, and for their incomes to rise while they wait for mortgage rates and lower prices.

In case you missed it: The Most Splendid Housing Bubbles in America: Price Declines Spread to 25 Metros of Top 28, with 19 Below 2022 Peaks. 3 Set New Highs.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Music to my ears

same – now that I’m bit flush after selling property couple weeks ago

need another fixer to add to my rental portfolio

multi-unit still out of control price wise

“We think it’s likely that many would-be borrowers are waiting for affordability to improve even further, and that some may be anticipating additional declines in mortgage rates given expectations that the Fed will lower the federal funds’ target rate,” Fannie Mae said”

With a couple of more FED rate cuts this and next year, those mortgage rates will entice people back in and accept buying million-dollar crapshack is the norm, as long as they can squeeze into that monthly mortgage, even if they hit a35%+ DTI, at least that’s my prediction for the SoCal market. Hopefully, I am dead wrong about this, time will tell

Those rate cuts whereof you speak ARE ALREADY PRICED INTO MORTGAGE RATES as you can see from the chart.

One more time, and louder for those in the back…

Wolf, what are your thoughts regarding the spread between 10 yr Treasury rates and 30 yr mortgage rates?

The spread was still at about 2.5 percentage points on Thurs, down from north of 3 pts sometimes within the past couple of years, but still significantly higher than the spread’s sub 2 pt historical average (1.7 pts?).

Based on that, it seems there could still be room for the spread (and therefore mortgage rates) to come down a bit further, without higher Fed rate cuts than those already baked in, no? If the spread came down another .25 to .5 pts (landing still above historical average), we’ve got average mortgage rates starting with 5.xx%, and people with optimal credit situations and/or any amount of discount points south of 5.5%, which seem like potentially significant psychological thresholds (below the historical average mortgage rate).

You seem bearish on all of this, though, and I always like getting different perspectives.

“You seem bearish on all of this, though…”

No, I’m hopeful — and we’re seeing the signs of it — that these ridiculous home prices are finally coming down. These ridiculous home prices are a scourge on the real economy. They suck huge resources out of the real economy into the financialization sector. The best thing that can happen to the US economy long-term (not short term) is a significant (relative to wages) decline in home prices. So I’m rather bullish long-term for the economy, I’d say. But if I see QE and ZIRP again, I will re-turn bearish on the economy because that stuff tears up an economy.

In terms of the spread…

The spread narrowed during the time when the Fed bought MBS — which is why the Fed bought MBS. The Fed is now shedding MBS and has the intention of getting rid of them entirely. It removed the cap of the MBS roll-off. So as refis surge (they tripled from the low levels late last year) and as people sell their homes to buy another one, the MBS roll-off will accelerate from the low levels (and has already done so). So I think the spread will be somewhat wider on average than during QE times.

But mortgage rates aren’t as volatile as the 10-year Treasury yield so the spread between them varies widely (which creates the crazy chart below). This has the effect that if the 10-year yield rises sharply, mortgage rates might follow more slowly, and the spread widens.

The chart below shows the rate difference between the 10-year yield and the 30-year-fixed mortgage rate. You can see how the spread narrowed on average in 2009 when the Fed started buying MBS, and it stayed somewhat narrower on average than between 1998 and 2008, though during the MBS mania in 2004-2006, the spread was also very narrow. Another period of narrow spread was in the 1990s, and perhaps this was caused by the “bond vigilantes” that refused to buy longer-dated Treasury securities after the decades-long bloodbath through 1982, and longer Treasury yields remained much higher, but mortgage rates didn’t track them all the way up.

“The best thing that can happen to the US economy long-term (not short term) is a significant (relative to wages) decline in home prices. So I’m rather bullish long-term for the economy, I’d say.”

Sorry, Wolf, you can’t have it both ways. Rate cuts, which you wanted so badly, are mutually exclusive to the sentence above. The FED has backed up another parade of fuel tankers to the speculative orgy inferno which was the cause of the spike in house prices to begin with.

buyers in our market are asking(and getting) upwards of 8% to buy down rates – so you don’t see the price discount

my wife sold her mom’s home in July and buyer paid full price but got 8% discount to buy down interest rate/pay for appraisal/etc.

Wolf,

Wages need to rise. Dollar debasement of 25% since 2020. You won’t see a drop in prices, especially if one of these yahoo’s gives away 25k to first time buyers.

Stocks market flirting with ATH.

Home prices ATH.

Cryptos very high as they being worthless to begin with.

Financial conditions still very loose.

Economy still producing 140K jobs/month.

Un employment rate bit above 4% is historically low.

@WR: My friends are still looking for job for last 1 year but they were getting $500K/year and want similar job.

Job market at higher end is tight, but middle/lower spectrum of wage, is still quite hot.

Despite above all, FED cut 50bps. It does not take a rocket scientist to see what is FED upto.

Affordability — where’s the average slob gonna come up with a 10% down payment on a $600k house?

Median home price is $412,300 — sure, there’s a wide range of potential homes available, but the lower range is still out of reach for someone making average income of apparently $80k’ish?

With savings rate way down and cumulative inflation still killing the average person, pretending people are excited about mortgages dropping is plain stupid.

This reset or recalibration will take years, because, home prices have to get crushed, rates need to stay low and people have to save money and keep jobs — this isn’t exactly an easy situation going forward — a lot of things have to line up for a soft landing to materialize, versus a crash landing, where a lot of things fall apart.

Time is a huge constraint in this affordability dynamic.

Wolf’s chart seems to show that house sales have had a crash landing. Sales back to 1995 is mind-boggling given the massive population growth over the last 30 years. There was a time when housing construction defined the economy in many areas. If it were still the case, we’d be in a pretty serious recession.

Buy doing endless rounds of gargantuan QEs, FED inspired almost a new cult of “homes are for buying, not selling”. I see many people repeatedly buying and never selling homes. When they need to move, they are renting the existing one and buying a new one, because they have no doubt that any home will appreciate 5-10% in average each year, as it did so for last 15 years. Any price softening was met a new round of ever increasing QE by FED, pushing the prices even more higher every time. The sentiment is that this cycle will go in the same manner forever.

Fannie mae and Freddie mac has alsobig responsibility for affordability crisis, by continuously increasing the credit limit, finally over 1M in the pandemic, which was totally ridiculous. Because of this stupidity, FED cannot risk lowering the house prices, as a decline will endanger the viability two and many mortgage BS under the guarantee of govt.

Pretty fine summary.

It *is* telling/scary that the speculative contingent of home buyers (ZIRP-built from 2001 to 2022, with rare departures) basically rode out/white knuckled through the 2022-today tightening cycle (“The Pivot is Coming!, The Pivot is Coming!”).

If it had been me, I would have been on the first train after the start of unZIRP – not knowing when fellow speculators were likely to panic.

The 2022-today lack of for-sale inventory is the great mystery of the tightening cycle.

This is because people believe the gov’t will always bail them out. Housing is how you get rich. Just hold…. that message has been sent time and time again.

A majority of RE buyers and sellers have no finance background, whatsoever. Many rely on gut instinct, which seems to correlate nicely with price momentum. The concepts of opportunity cost or buy v. rent are not parts of their thinking. Monthly payment and nicer digs (now, not tomorrow) are primary considerations.

The past decade, there was always a glossy-eyed buyer willing to satisfy a greedy seller because prices were rising. Nobody even bothered to put pencil on paper. You were good to go after filling out the one-page application on RocketMortgage.

When the price trend reverses because the rug is pulled from under these glossy-eyed buyers, momentum shifts and it’s a different story. Everything goes into reverse.

This time around, there’s a lot of foreign money with no better place to go, so it could take a while to shift the momentum. Even foreign buyers with a bias towards RE investing don’t want to lose hard earned money.

gladly put down 20-30% if they’d approve me

only have 823 mid fico

of course I’m self employed so they throw me out window

How long have you been self employed for? With a couple years of stable tax returns showing the SE income you should be able to get approved.

If you’re running into issues I’d check with multiple lenders. I know many self employed people who are also home owners.

Amen to this and sadly this is the new normal…great for existing asset owners, especially the one that got in early or got the timing right…sucks for the rest paying steak price but fighting over scraps..

New poster here. Don’t you think the cult of “homes are for buying, not selling” is really true for all assets in general? That’s why stocks are so high. People buy, but nobody wants to sell, convinced that prices will always be higher next year.

“where’s the average slob gonna come up with a 10% down payment on a $600k house?”

I’ll agree 600k for an average house is symptomatic of bubble prices – but is 60k down really that unreasonable?

Considering that historically, it was difficult for the buying millions to come up with $15k-30k down payments…yes, a $60k cash down payment would *seem* to present issues.

Yet another mystery revolving around the vastly dysfunctional US housing market (Son of ZIRP) – where are the down payments coming from? Why is the so little for-sale inventory? Does a $150k house in 2000 *really* cost $450k to build in 2024? etc.

As part of a selling a home in FL recently, I found out there are many local programs that provide down payment assistance to buyers. I sold a home to a buyer that had an FHA mortgage with 3.5% down payment, but a local down payment assistance program reduced the down payment to about $500. This was on a $200k to $300k home.

They offered full price, of course, largely because they had nothing to lose.

It’s a good thing prices rose 10% after that, otherwise they’d be living without any equity cushion.

Yes, yes it is. I have had 3 years of a good paying job $80k+ the amount taxes I paid each year was someones yearly income, others that made more than me decided to not defer much in their 401k in more years with higher pay was paying almost $30k. Our income is W2 and not investment income, so we got Fd.

It’s a massive injustice that people who have “capital gains” from stocks which, for many, required almost no real work and zero sweat equity, receive special tax breaks (65% off!) whereas W-2 income earners get fully taxed on that income.

You know what’s funny…the average home price in SoCal over $1M, something decent will be around $1.3- $1.5M….even 20% on the low end is around $240K to $300K. With that, you’re looking at insane monthly mortgage alone….Even if I put $700K, monthly still comes out more than what you can rent comparable.

I guess people around here have $250K or more just eager to buy…these price doesn’t seem to discourage many from buying…just insane…

I suspect it’s the $600k that is unreasonable. The “slob” may be signing up for a lifetime of indentured servitude trying to pay off an overpriced shack.

The median earner doesn’t own the median house, because not everyone is a homeowner. The median earner owns a below-average house.

They can get a FHA loan and put 3.5% down ($21K on a $600K home) Google found: “FHA loans require a minimum 3.5 percent down payment for borrowers with a credit score of 580 or more.

But should that person who can only muster a 3.5% DP on that house really afford its monthly payment?

Don’t know what state you live in, but here in California first-time home buyers can get in with virtually zero down payment through the Cal HFA program.

The good news is that baby boomers like myself are approaching 80 and will be downsizing to retirement facilities about that time. They will have to sell and use the money to fund nicer living accommodations and their kids will inherit what is left over. I live in L A and my neighbors are generally retired people with homes that are 10 times what they paid for them.

My parents and most of their friends in their 80’s and 90’s living in Northern California are living in homes that are worth MORE than 100 (one hundred) times what they paid. The Median home price in Burlingame south of SF was $20K in 1960 (well above the national median home price of $15,100 at the time). Google just found: “In August 2024, Burlingame home prices were down 1.3% compared to last year, selling for a median price of $2.4 million” (Palo Alto homes that were $25K in the early 60’s are selling for over $3 million today).

Similar situation locally with median home prices floating around 400k and every new subdivision getting approved starting at 350 but being closer to that median in reality. Locals can’t afford them as the median family take home is also just a nip under 80k, but they still fill up with people moving from out of state so the demand keeps prices high.

It’s great they are laying out a realistic view, hopefully some sellers agents will take note. I think they also miss a very important facet of the slowdown. We have done the getting outbid multiple offers dance and suddenly there is so much inventory we feel like we can wait to overpay for a 9/10 or a 10/10 house instead of overpaying for a 5/10 like most people did the last several years.

The VA is offering financing at rates below 6% as we speak. Buyer are coming out of the woodwork, buying mostly condos which they can afford at these rates. We are busy as hell with no letup. Prices of condos are still reasonable. It’s the only game in town, at least for now.

HOA fees are ridiculous. Rent and let the owner pick up all the costs. Let them hold the bag when the market downturn happens. Wouldn’t it be nice to get rent reductions to keep you in the unit?

Having a HOA means you pay both a mortgage *and* rent to a landlord.

Agreed – HOA fees *are*, and have been, absurd for a number of years.

If not the full equivalent of, say, a 2 bedroom rental…idiotically close (50%-60% of a 2bd rental in too many cases).

So, as you say, a *mortgage* *and* *rent*.

Agreeing to this is just…nuts.

I just saw that the monthly HOA for a 1,727sf 3br 3ba condo in Olympic Valley (not far from Lake Tahoe) was $2,703/month more than the mortgage (with PITI) on my first home. Since few working class people can afford to live in the Tahoe Area today the cost of everything is going higher since you need to pay people a LOT more to get them to drive back and forth to Reno, NV every day.

Yesterday, I heard about an HOA that actually reduced their monthly fees.

(just kidding…)

They charge the HoA fees in the rent.

I mean duh

They can add anything they want to the rent – the owner’s new pair of shoes – but will they get an occupant? And will they have negative cash flow waiting for the Godot of price inflation?

Many sellers don’t want to deal with VA or FHA loans – although this could change if/when sellers get desperate.

Will be interesting to see if things pick up nationwide or only in specific markets. In my little midwest town the inventory is low quality and double the price before the pandemic.

In my little slice of flyover heaven, we are still busy doing new builds

for CLIENTS. Very few spec homes like 05-08.

Existing home inventory is up. Price drops are showing up.

Good house & location….it still sells quickly.

Are we finally popping that bubble?

Sellers are going to be on the defensive, heading into winter, expectations that mortgage rates have further to fall… Lowball those mofos!

Find an r.e. agent who will work with you offering a verbal – don’t keep writing new contracts to buy. Then skip the Zillow estimate of asking to selling price stat. (97%) and go way below asking, especially for a vacant home. I’ve worked with agents who will submit on a verbal offer over the phone. I kept my word on what I’d pay. Why not?? Skip etiquette or find another agent.

If the seller has monthly costs in the area of $2500/mo. or more, they will be highly motivated to ditch that albatross in and around December and January, unless mortgage rates really plummet.

Cash buyers have been trying to front run the drop. Then they can unload when the rates drop further and the buyers who need mortgages step in.

Well that requires good timing. Even with a cash purchase, there are lots of buying costs (garbage fees, et al), and then there’s the selling costs, particularly for the seller. Add in the holding cost, if things don’t go according to plan, potential surprise repairs, and the opportunity cost, of sinking money into a vault, and the upside may disappoint. If the market continues to defy gravity, well then all’s well. If it goes south, you’ll regret at leisure.

Housing will pick up when the lockin effect is negated by low interest rates. This could happen next season, as the consensus is around fed lowering to 3% by end of ’25. The prices aren’t going to do down, just up. Those that locked in might want to upgrade and reap the rewards of buying early in the pandemic. Or those who bought way back and are looking to downsize sell there large family houses. Either way inventory will increase but the demand hasn’t been satisfied. A housing crash isn’t likely. To increase affordability, they need to make it easier for low income families to get loans. That way builders, build low income housing instead of mostly middle-upper class housing. The increase in low income housing would decrease demand for expensive housing.

If the Fed lowers to 3%, mortgage rates will be right around 6%, which is about where they are today (6.15%) because it seems everyone has already priced all these rate cuts into their future scenarios.

So they need to price in more cuts, which means more wait and see mentality.

Easing ultimately tips consumers to wait and see.

I suppose this is why timing easing is so critical.

You can’t start flip flopping otherwise rates fly back up even if you don’t raise rates.

If you decide you need to cut further, suddenly, more wait and see mentality!

Soft landing, yeah right!

That’s how deflation works.

The best thing that can happen to this housing market is lots of wait-and-see added on top of the Buyers’ Strike. It needs to reach the point where potential and actual sellers get desperate. And then they might start facing reality.

6% mortgages are a different animal than 3%. This is an intractible situation. The Fed is washing it’s hands of any responsibility for inflated asset prices. It’s more likely that there’s nothing they can do now to fix this mess. They’re also mindful of political reprecussions and are not willing to keep rates higher for longer given their fears of inciting an unemployment catastrophe. And Congress is of no help due to defecit spending dwarfing QE. The days of the Fed fearing inflation are over – this brief episode was not painful enough to trigger repressed memories. Nothing will fundamentally change unless an unemployment crisis arises or inflation comes back on a larger. It’s worth pondering what, if anything, could cause this as a tipping point. Local governments running out of pandemic money and passing the new reality onto taxpayers? AI decimating high paying jobs? Infrastructure liabilities from aging unsustainable suburbanized development patterns? Or maybe we have moved post boom and bust cycle economics (and that’s a scary thought because it contradicts all recorded history). More questions than answers.

I was watching an interview of an economic analyst and he said yesterday that this was basically the FED saying we nailed the inflation problem

“The Fed is washing it’s hands of any responsibility for inflated asset prices. It’s more likely that there’s nothing they can do now to fix this mess. ”

Sadly this is painfully obvious when Pow Pow stated current housing prices is a supply problem and oopsie, FED can’t do anything to help or course correct…This is the ugly nature of inflation..inflation might slow or even back down to 2% but the ratchet effect is there and with housing it’s a giant ratchet effect

Uh no ru82 Powell literally said “this is not mission accomplished… we have a duel mandate.. keep inflation low and job growth strong.. we’re now focused on the jobs area.”

If you want to sit around and guess how many teeth a horse has for days on end go for it. But it’s better to just go inspect the horse and count. 🐴

Digger Dave, I agree with what you’ve said. I’m really sorry to see the rate cut, in spite of Wolf’s rationale. We really needed some austerity to tamp down the completely insane house prices across all the metros in the U S (and elsewhere). The unicorn-like house prices aren’t just West Coast phenomena.

I think the Fed is suffering from premature ease-actuation.

Seriously now…

It’s not like the liquidity isn’t there to pour back into the RE market. Wolf just put out two articles in the last month pointing out two things:

1. Savings are at an all-time high.

2. The labor market is showing few signs of cooling down.

It’s a legitimate Mexican standoff and the stakes are the OK Corral itself.

I prefer High Noon and shooting Frank Miller dead.

Or perhaps playing one mob off against the other as in “A Fistfull of Dollars”.

…so, who will ACTUALLY shoot Liberty Valance?

may we all find a better day.

He was the greatest of them all.

John Wayne was worried about his acting career which was just taking off during WW2. As a result he not only did not even enlist for safe PR type jobs, but he didn’t waster career building time doing USO shows.

However, once he was very well established, he showed up at a USO show in Vietnam and was booed.

Pretty sure he shot Liberty, though….gotta do something to get an airport named after you.

MY Error: Booing was in WW2. But all else in my disliked and always moderated opinions here still stands. Was just a frivolity thread, anyway…..and maybe my relation to dustoff caused it? Hi DO, anyway and

I lack your patience.

Still scan most articles and comments off and on……still only social media and only financial reading. I still like site, and like Wolf.

Seems about time (actually overdue historically here) for some Income Inequality graphs, what I consider a main (if not THE) economic problem….and likely is my main “fitting in” problem here.

Still actually proud to be boomer economic loser and of lifelong less planetary damage than most, for white American, anyway.

I meant NET WEALTH inequality…..much more troublesome for the USA (in financial problems arena, but still not biggest) than even the Fed actions/results, which I now know quite a bit about for some reason.

As a recent buyer in a formally hot market, here is my boots on the ground reality:

My mortgage was sold twice in 2 months. Fannie owns it now.

My home price is down $10K since we closed 3 months ago. Don’t care.

The mega landlord we bought from has at least 6 houses for sale and 3 rentals available within a two block area from us. They seem to put houses on the rental market for a month or two and if they don’t rent, they put them up for sale. The for sale houses are all over 30 days on the market, none sold over the summer.

The over building is still ongoing in my town. I see smaller homes priced under 300K now.

What area of the country?

Southern state.

Where are you?

Meanwhile county auditor offices are scrambling to lock in these ridiculous home valuations! They are trying to hit us with a 51% increase. While at the same time destroying our neighborhood. This is how rebellions begin. Bunch of wasteful lazy thieving POSs.

The house we purchased was valued for taxes at 405K two years ago, 375K last year, and 325K this year. The tax valuation is above what we paid and above the lender’s apprised value. All similar homes currently for sale are below what we paid in June.

The county where I live has a lower number of students this year than last in the school district, but is still begging for more money. They put something on the ballot for voters to approve, but I will not be voting to give anyone more money. In the last 10 years, I have never voted to increase taxes or borrowing, but they keep getting dummies to give them more money.

I am in the midwest. 3 houses went for sale over the past month in my neighborhood. sold in 2days, 3 days, and 10 days. All were listed about 1% to 2% above the Zillow Z-Estimate.

typical 4 bdrm / w 2 car garage. 2500 to 3000 sq ft.

Prices were $155 sq/ft to $185 sq/ft ($375k to ($425k)

If I remember right, I think you said you’re in Texas?

Wow Wolf what a memory!!

I just live here, LOL

Based on my memory: Petunia has posted a series of interesting comments over many years on their renting experience in Florida and then their move to Texas where they bought. We’ve watched her son grow up here, we know about her background (math major and Wall Street experience?), and she explained to us why she took SS before full retirement age. Reading every comment here since time immemorial, I have watched many people’s lives move on. And some of this stuff sticks and comes out with a bit of prodding.

Or perhaps playing one mob off against the other as in “A Fistfull of Dollars”.

Nothing lower prices can’t fix

For the average guy or gal, the hurdles you cited seem to be stacked up against them.

Prices still too high.

Rates, a whole generation used to 3% mortgage money, still scared at 6%

Incomes trying to catch up to inflation.

Maybe there is still a fair amount of “adjustment” needed on all three before the ice melts. Just guessing on my part.

The ten year appears to be climbing (in rates) so maybe we’ve already hit the bottom in mortgages. A 6+% fixed mortgage for 30 years isn’t so bad historically so it’s going to be up to prices and incomes to heal this housing market.

The missing part of the discussion is the increased cost of building, and the related increased costs of maintenance, especially for landlords and the concomitant effect that has on rents. Many would like to think that builders could always cut down on their profits, but there may be less room for that than some think. Possibly, the only realistic option is to start building less-huge, less-grand houses and for all the would-be buyers to recognize that the dream of a mini mansion will stay out of reach for most.

You’re talking about sales of “new homes” — not existing homes. Sales of new homes have been doing well because builders have ratchet down their price points, and because they’re spending lots of money on buying down mortgage rates. Lots of articles here on WOLF STREET about this, including with the most recent data:

https://wolfstreet.com/2024/08/23/inventory-of-new-completed-houses-surges-to-highest-since-2009-triple-from-2-years-ago-exactly-whats-needed-to-bring-down-prices-across-the-housing-market/

To increase home sales and reduce prices why not phase out the gain exclusion. That would cause sellers to move down on price with some urgency. In times like these, you get less pushback if you tax those who benefited from past policy errors.

Also, why not phase out like kind exchange rules.

With housing gains in the stratosphere and deficits too high, it’s the right time.

The reason people lose trust in government is that people are forced to pay for others’ mistakes or somebody else’s windfall. And yes, the RE windfalls did stem from QE and ZIRP, which were obvious errors. Hard to argue otherwise.

The problem with this is that the beneficiaries of those errors don’t see it them as errors. They think they’re brilliant and deserve everything they’ve gotten, and fight like heck to keep them.

This includes my older family, like parents and aunts and uncles.

Gloomier home sales will be supported by more job losses — Bloomberg projects 91,000 additional jobs lost per month going forward, based on QCEW analysis.

Cutting rates will be a symmetrical process mirroring the rate hikes — Fed just getting started as the soft landing runs off the runway at 300 mph

“Fed’s Powell Says We Understand That People Are Experiencing High Prices, And That It’s Painful; Says We Will Mentally Tend To Adjust Payroll Numbers Based On QCEW”

always tell people when they are looking at my property I have for sale

Price, Terms, Interest rate – pick 2

want Price(discount) then term is CASH

want better interest rate and TERMS then pay full price

just sold property at full price – they got better terms and interest rate

still getting better interest than bank CD and it’s guaranteed given the 35% down payment(I’ll gladly take back property for non-payment)

joedidee wrote: ‘Price, Terms, Interest rate – pick 2’

+1000

Well said. I’m stealing that one.

Sounds right to me.

I want to give my experience. I’m 27. Have a decent job that I have been at for 3 years. Was at my first job post college for 2 years.

Myself and most of my peers that I talk to feel like the economy is stacked against us. It doesn’t matter how much we save, houses, stocks, and other necessities of life feel like they’re growing in price faster than we can earn or save. Sure, I save what I can in my 401(k), but the appreciation there is purely hypothetical. It doesn’t help us afford housing, car insurance, medical insurance, or anything else.

All of the politicians pay lip service, but it seems like they’re all in favor of whatever is best for the elite. Discontent is growing, and I wish it wasn’t that way. The only people who are really thrilled with this economy are those with a lot of assets. If you don’t, you’re poorer than you were 3 years ago.

You’re right about all of that, but it isn’t permanent, even if it feels that way right now. Save your money; keep your powder dry; then pounce when the market goes down. Houses won’t be overpriced forever.

If prices are “too high”, why are they up YoY to a new all time high?

Prices in Connecticut and Massachusetts are apparently too low because everything gets bid up in crazy bidding wars. Prices up >10% YoY.

“Bidding wars” my *ss. I’m so tired of this bullshit. Demand in the Northeast has collapsed as much as everywhere else:

And the median price for the US overall, just out today:

https://wolfstreet.com/2024/09/19/demand-for-existing-homes-wilts-supply-spikes-to-highest-for-any-august-since-2018-prices-dip-despite-mortgage-rates-that-have-plunged-for-10-months/

IMHO, Hive mentality FOMO to overbid on any house even with no inspection has ended. It was a human psychological mania back in 2022.

Anecdotally, the mania has ended for my son and his friends. in 2022, my son and all of his friends were overbidding on houses and losing. I continually reminded him that he should buy a house if he planned to stay for 10-15 years. Today, my son and his friends are paying half of the cost of a mortgage for their rent. They see now that the spread is too wide. Lately, nobody is mentioning buying a house. It will take even lower rates and/or prices (or a HUGE increase in rent) to re-ignite the mania.

The good/bad news with lower rates is that homeowners can now extract cash with a refi at a lower rate than a HELOC and much lower than a 30% credit card or personal loan (Drunken sailors are used to drinking and sailing). The good news is the Fed MBS holdings should drop quicker (Was this part of the plan?) . The bad news is that the pile of cash sitting in a house currently for 65% of the US homeowners is very tempting to access and spend.

Plenty of equity at lower rates to keep the drunken sailors spending, the economy booming, and inflation inflating.

You seem to be saying asset price increases lead to higher consumer demand and inflation.

That’s sacriledge!!

When assets are at all-time highs and inflation is running 150% of target, rates shall be decreased.

It’s one of Wall Street’s Ten Commandments, along with “Thou Shall Not Save”, “Thou Shall Not Covet A Higher Wage”, and “Honor Your Banker and CEO”.

God, I’m tired of this BS. You people need to look at the three-month average of nonfarm job creation. With a bunch of down revisions in August, it went from decent to weak in one month. We discussed this here two weeks ago:

“A month ago, the three-month average for July was 170,000 as reported then, which was decent compared to 2018 and 2019. But that drop of the three-month average from 170,000 a month ago to 116,000 now took it from decent to weak.”

They don’t want job creation to weaken further.

https://wolfstreet.com/2024/09/06/the-fed-has-room-to-cut-rates-are-high-relative-to-inflation-and-job-growth-could-use-some-juicing-up-to-maintain-momentum/

The labor market is a lot weaker than people say, if my friends looking for new jobs is any indication. But that raises the question, should policy makers be concerned that the Buffett indicator is at 200%? That seems like scary stuff.

It’s rough for 1st time buyers right now and, realistically, it’s not likely to get much better soon. This is really unfortunate as this is the lowest hanging fruit in terms of improving wealth inequality but the housing market has just been f**ed up so badly by financialization and greed that it’s difficult to see a solution.

I don’t have any stats to back it up, but it “feels” like there’s a lot more desperation building up on the buyer side than on the seller side, understandably so. And so most likely any small dip in mortgage rates and/or prices is going to be met with a wave of buying from the next tranche of eagerly waiting buyers. And so we’re never going to get to the point of true affordability. If 2 years of high(er) rates and rock-bottom sales wasn’t enough to motivate the sellers, it isn’t going to happen. The psychology of houses as hold-forever “investments” just isn’t going to be broken.

The only thing that will break it and motivate sellers is necessity, which will only happen in a recession. And we won’t have a recession because Congress and the Fed won’t tolerate it. The actions yesterday make that abundantly clear.

The months following an election are the best time for recession. Whoever wins the election can let SHTF before they own the economy, then they can claim credit for a recovery.

The Great Recession unfolded as Bush was leaving office and Obama entered. Obama’s first year was rough, but he attached himself to the recovery and was re-elected. Hard to say whether that would have worked if the Fed had not employed extraordinary measures. A recession without QE might be prolonged.

I don’t think they can prevent a recession or depression and indeed all the meddling they’ve been doing will only lead to a bigger downturn than what would have likely happened if we had free markets instead of all this socialism central planning interference. When the inevitable recession or depression comes will people finally stop believing they can be prevented?

The NAR lawsuit has also thrown a lot of chaos into the housing market. Buyers are afraid to enter the market after seeing the scary new forms they are required to sign before touring a single house. Lots of agents have stepped back from representing buyers at all.

“…new forms they are required to sign before touring a single house.”

One NAR tyranny replaced by another.

Yeah I don’t know if this is really that big of a difference in buying demand nor is it the root cause for the continue drop. Then for certain markets in West Coast, not stopping majority from buying because of the NAR rule change

Agents have not really stepped back. Agents would love to represent as many buyers as possible.

The reason sales volume has crashed is not this new rule but just one reason: Prices are damn high.

I talked to my realtor about that. Before she shows a house, there’s a screen that pops up that basically asks, “Did you and your buyer sign an agreement?” She clicks yes, she shows the house, no further verification.

The US used to have little difficulty with housing supply

You really poked the hive today, never seen this many comments. Nice work, Wolf. It took me quite while to scroll through these but James hit the nail on the head: Its a supply problem foremost and of course it’s influenced by buyers strike. Cost to earnings is untenable, combined with exorbitant interest rates and Supply Side Shortages are main driver’s attributing to Buyers Strike.

Re: “ we expect affordability to remain the primary constraint on housing activity for the foreseeable future, and we now think full-year 2024 will produce the fewest existing home sales since 1995,” Fannie Mae said”

That un-affordability factor is definitely impacting 2024, but I think this obviously is a huge issue for 2025 — there’s a massive disconnect betweeen the Fed/wall street narrative that we’re about to enter into a new growth cycle — or a miraculous soft landing, where there’s an explosion in mortgage applications.

CoreLogic’s forecast shows annual U.S. home price gains relaxing to 2.2% in July 2025

I think that’s optimistic, as a tsunami of inventory floods the market, as buyers hesitate to buy anything at bubble prices.

The election cycle and phase into inauguration will humiliate whoever steps into office — and nobody wants to talk about this, especially the Fed!

Notice how they don’t go into why housing is unaffordable. Big part of it is the government spending way too much and was the federal reserve buying the debt with money that nothing was produced to create, artificially supressing mortgage and other interest rates. If the market we’re free and the fed wasn’t holding MBS, houses would be cheaper because mortgage rates would be higher. The article on Sep. 5 showed the federal reserve still held 2.3 trillion in MBS. That’s like buying a billion in MBS every single day for 6.3 years, but they did it a lot faster of course. And Jerome Powell, who repeatedly voted to buy these trillions in MBS, which are artificially suppressing rates, which fuels high prices, lies and says it’s a supply issue. Why do we have Powell and the rest of the fed govs that voted to do this. Because we elected the Republicans and Democrat Congress that nominate and appointed these debt monetizers. If our policy makers aren’t going to do the right thing, we as citizens need to vote them out of office and vote in people who will do what’s right

“In my area” – 3 open houses on a saturday morning. Anecdotally, I haven’t seen this many open houses for 15 years. It’s probably nothing.