Biggest declines: San Francisco, San Jose, Austin, Denver, San Diego, Seattle, Dallas, Salt Lake City, Honolulu, Phoenix, Portland, Houston, Los Angeles, Nashville, Charlotte, Tampa

By Wolf Richter for WOLF STREET.

Our series, “The Most Splendid Housing Bubbles in America,” started in 2017 to document visually metro-by-metro the massive surge in home prices that was starting to happen after years of interest rate repression and QE by the Fed. About 10 days ago we explained why we’d replace the Case-Shiller Home Price Index data that this series was based on with the “raw” Zillow Home Value Index (ZHVI). Today is the day! The ZHVI for August was released today.

Just to recap: The ZHVI is based on millions of data points in Zillow’s Database of All Homes, including from public records (tax data), MLS, brokerages, local Realtor Associations, real-estate agents, and individual households across the US. It includes pricing data for off-market deals and for-sale-by-owner deals. Zillow’s Database of All Homes also has sales-pairs data.

The data for the geographic areas that both indices cover are very similar: See our comment with charts. We cited three reasons for abandoning the Case-Shiller Index: It’s limited to 20 metros and excludes even big ones like Houston and Philadelphia; it lags months behind; and it’s not in dollar-prices, but only in index values set at 100 for the year 2000, which makes it impossible to compare price levels in different metros.

Visual depictions of the 28 “Most Splendid Housing Bubbles in America.”

To qualify for this list, the market must be one of the largest Metropolitan Statistical Areas (MSA) by population, and it must have a current ZHVI of over $300,000. The metros of New Orleans, Oklahoma City, Tulsa, Cincinnati, Pittsburgh, etc. don’t qualify because their ZHVI is below $300,000, though they too had huge runups of home prices in recent years.

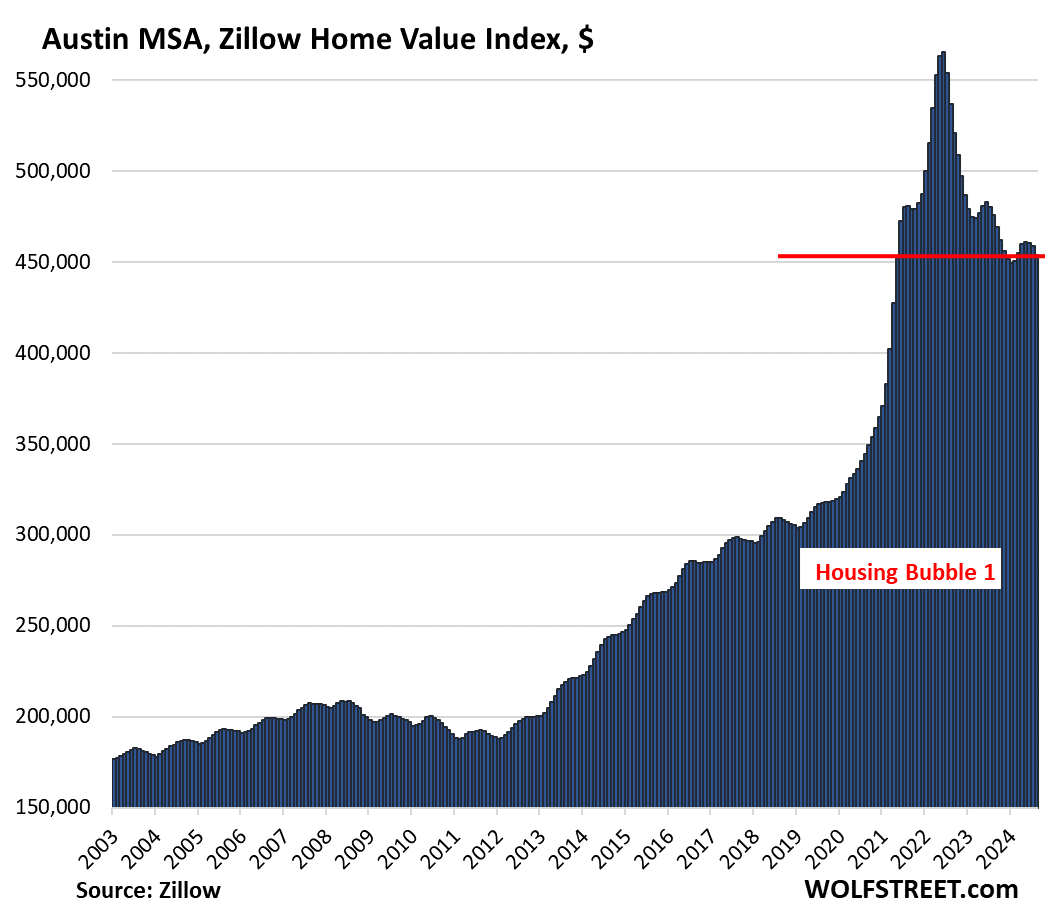

Down from their 2022 peaks: Home prices of 19 metros, of the 28 metros on this list, were down from their peaks in 2022, ranging from -19.8% in Austin to -1.2% in Minneapolis. The percentage below their 2022 peak is indicated for each metro below.

Declines in August: home prices in 25 metros, of the 28 on this list, declined month-over-month (MoM) in August, most notably these 15:

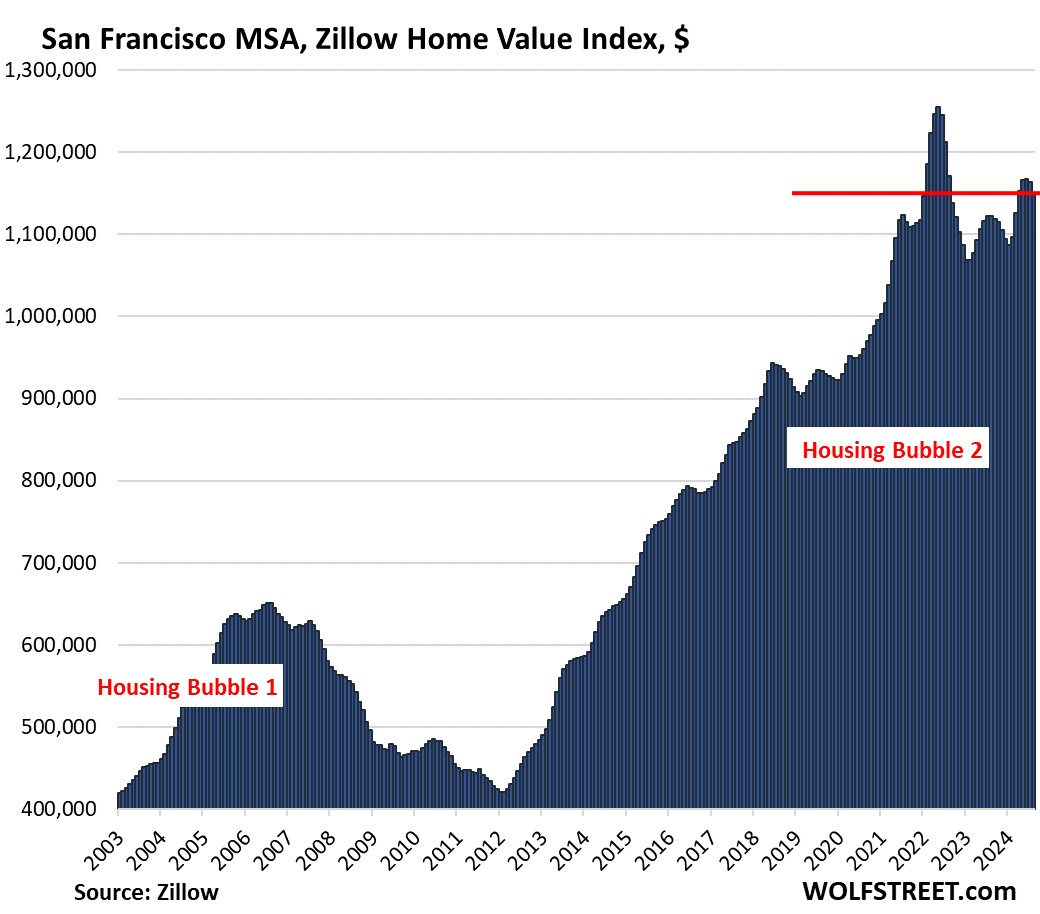

- San Francisco: -1.3%

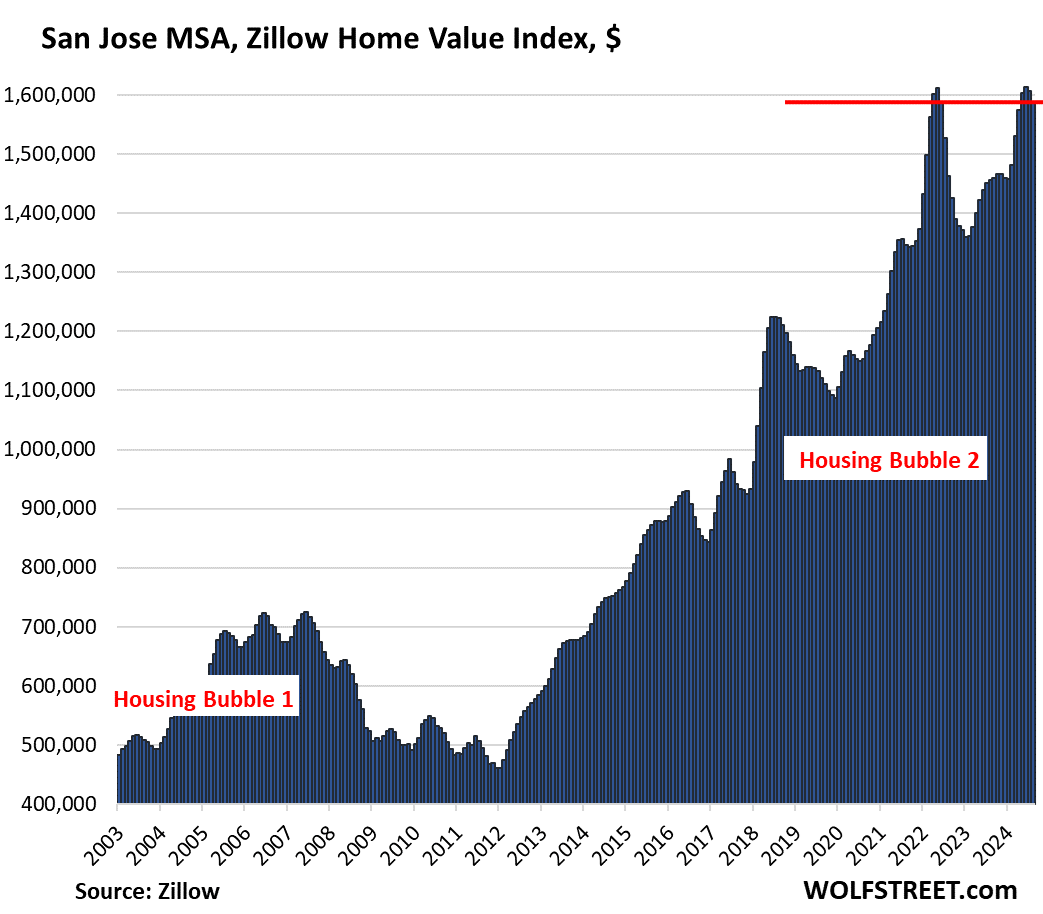

- San Jose: -1.1%

- Austin: -1.0%

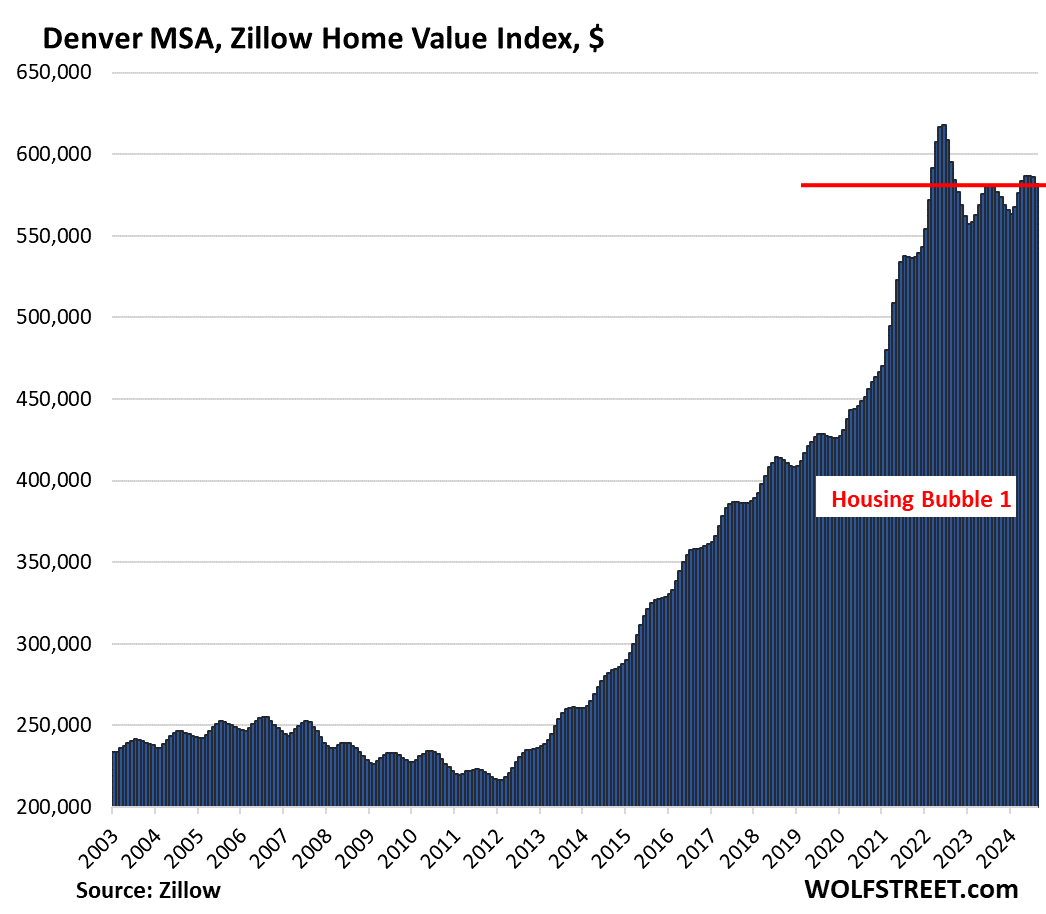

- Denver: -0.7%

- San Diego: -0.6%

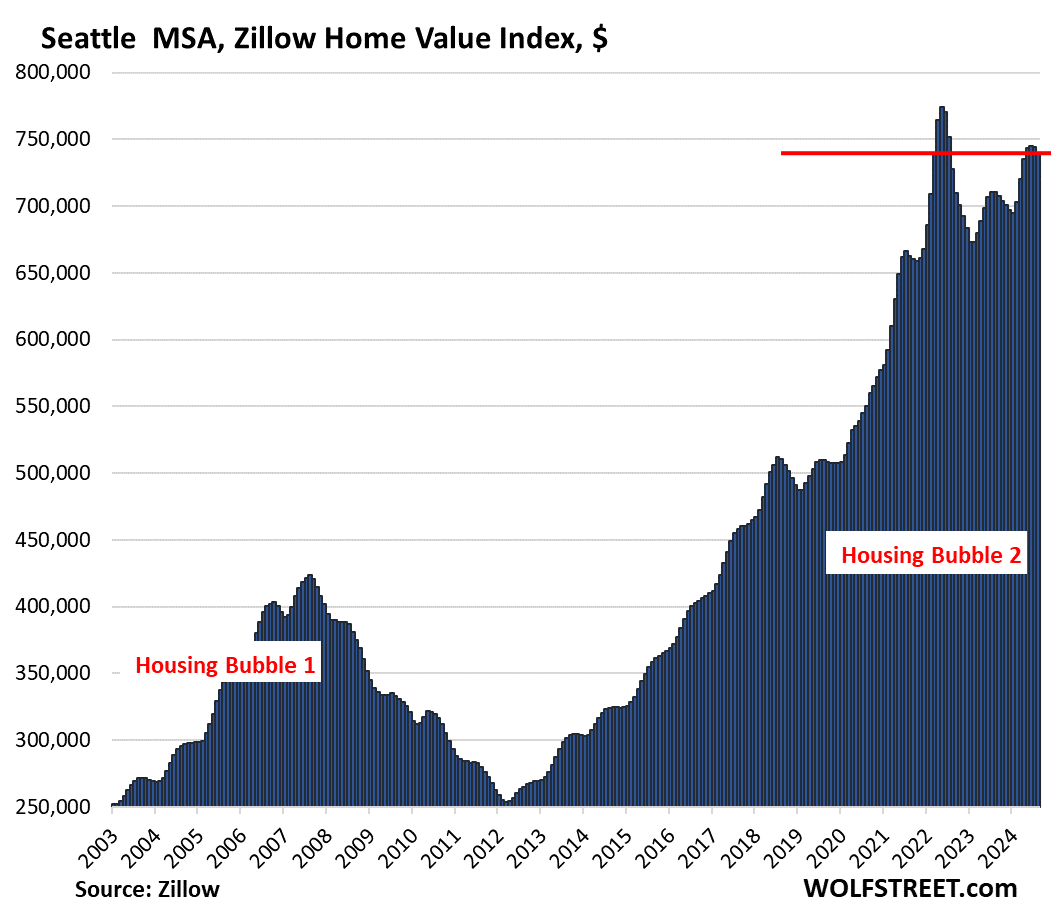

- Seattle: -0.6%

- Dallas: -0.5%

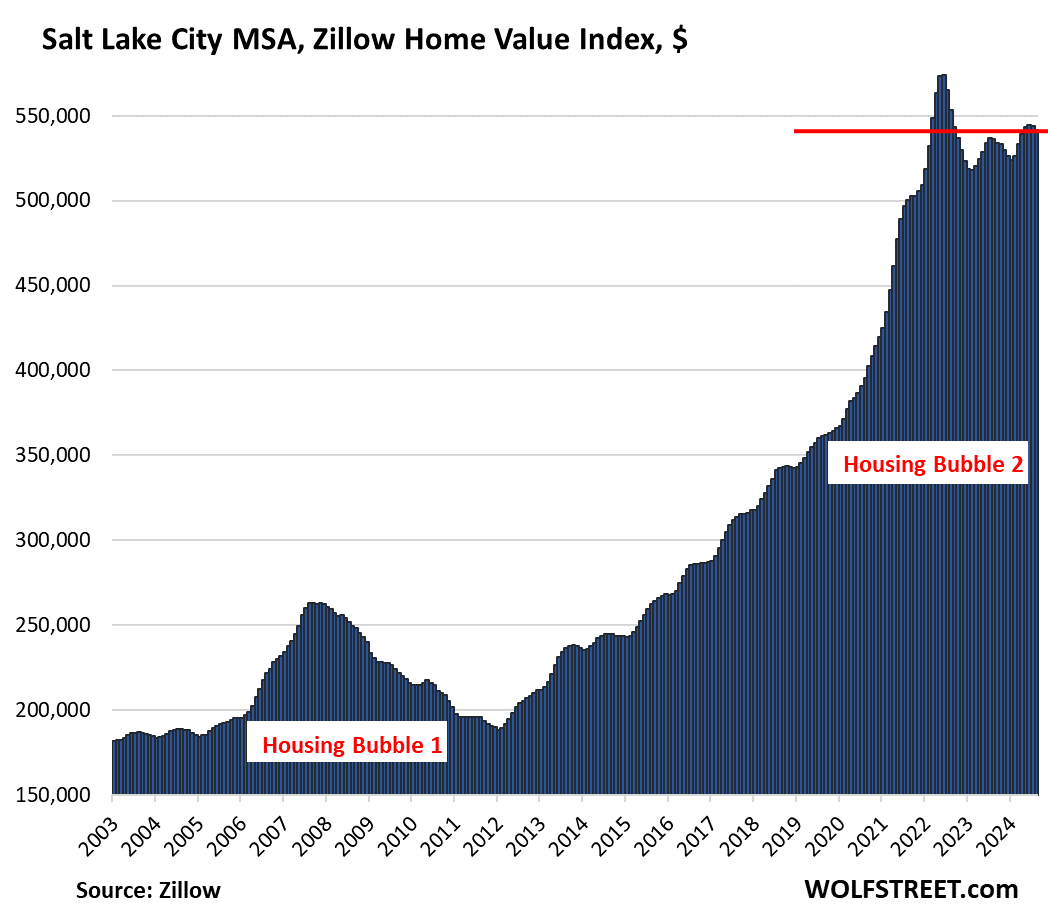

- Salt Lake City: -0.5%

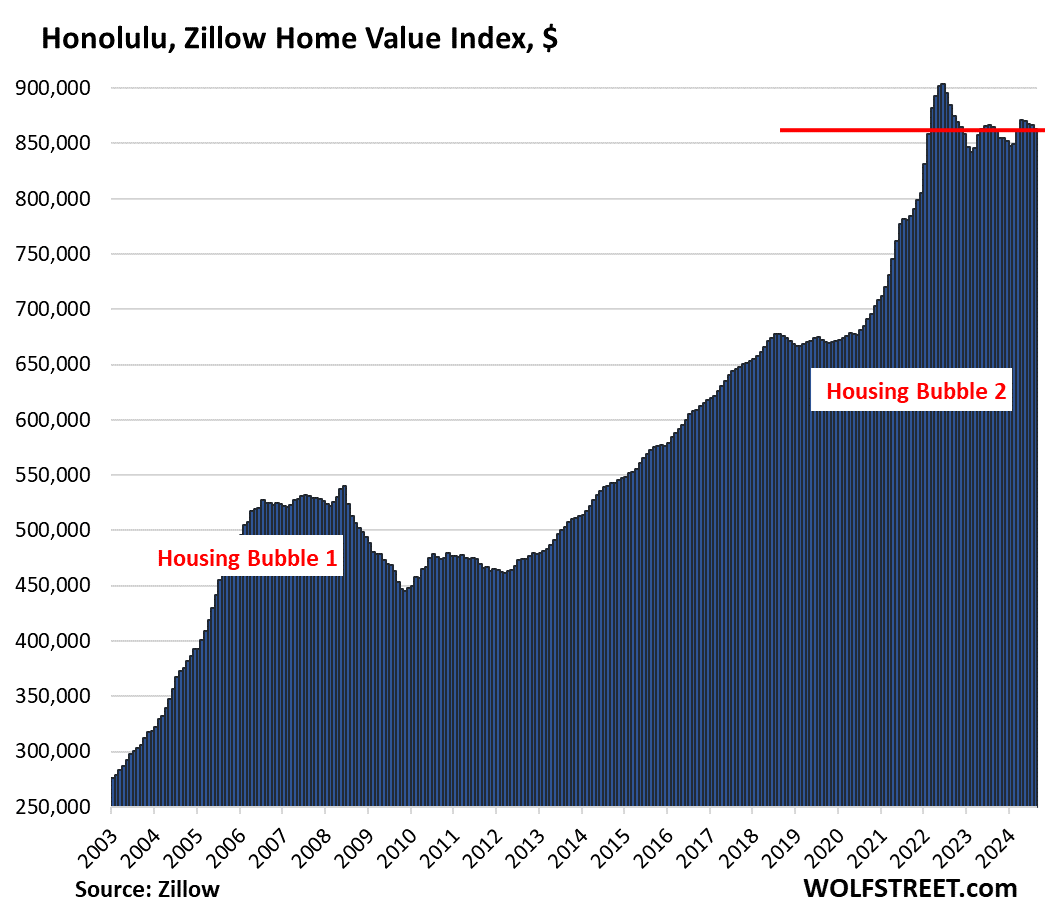

- Honolulu: -0.4%

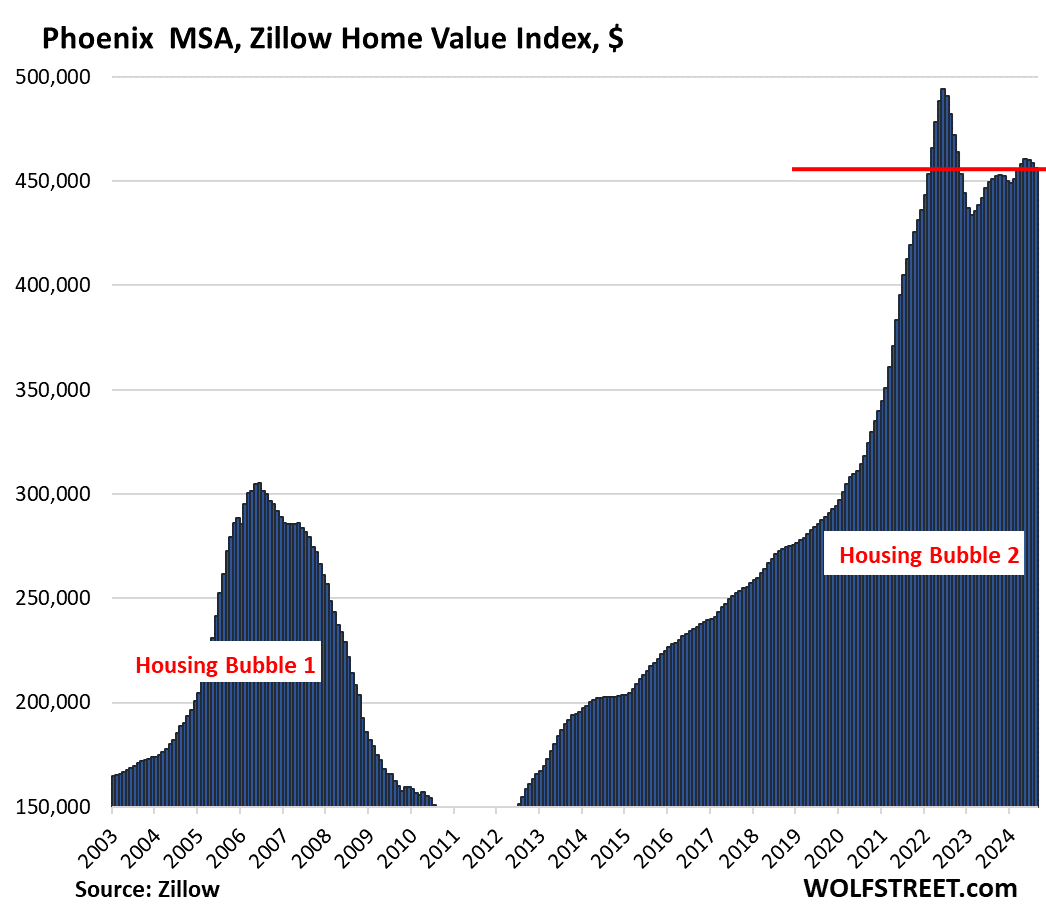

- Phoenix: -0.4%

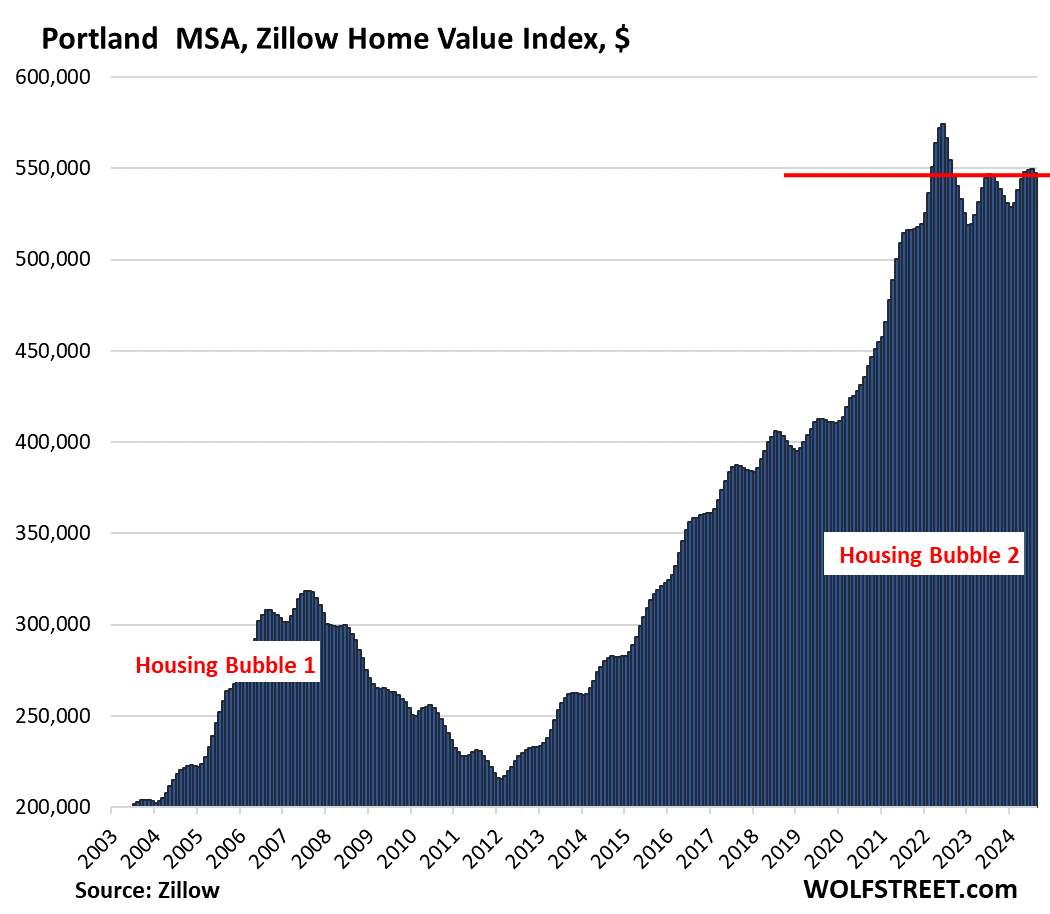

- Portland: -0.4%

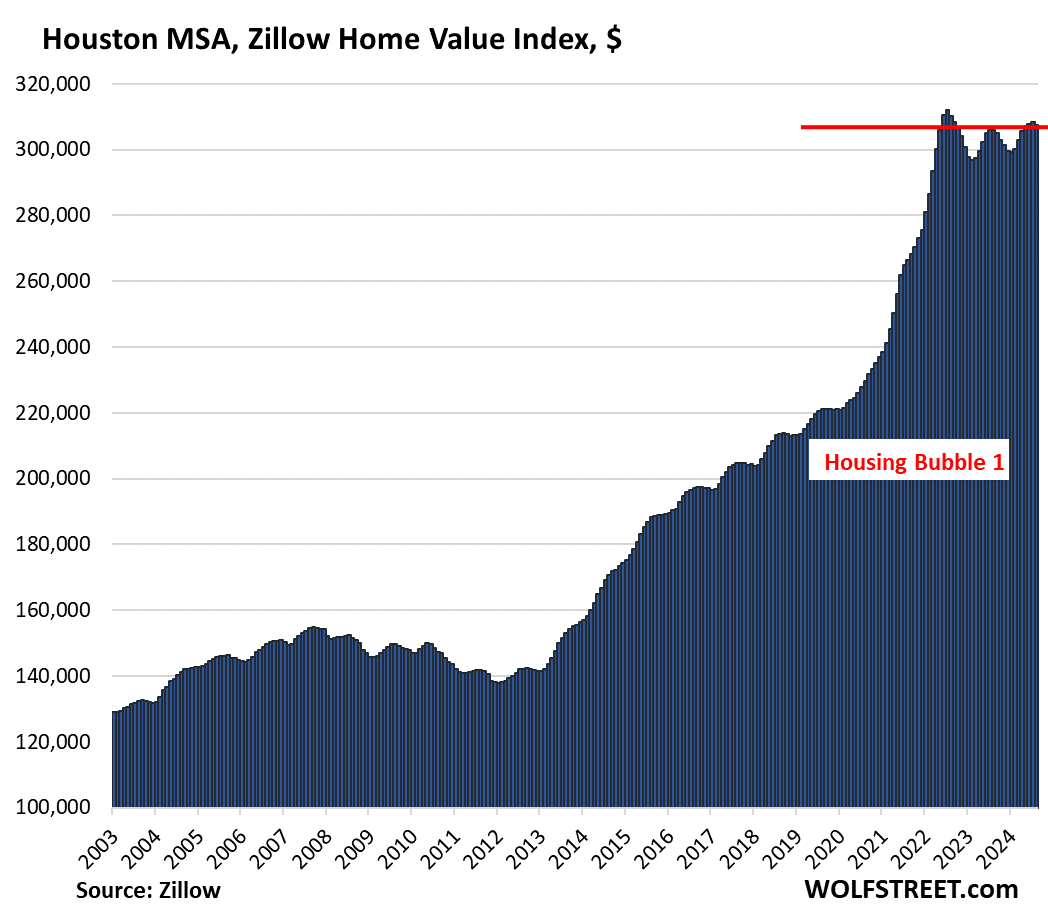

- Houston: -0.3%

- Los Angeles: -0.3%

- Nashville: -0.3%

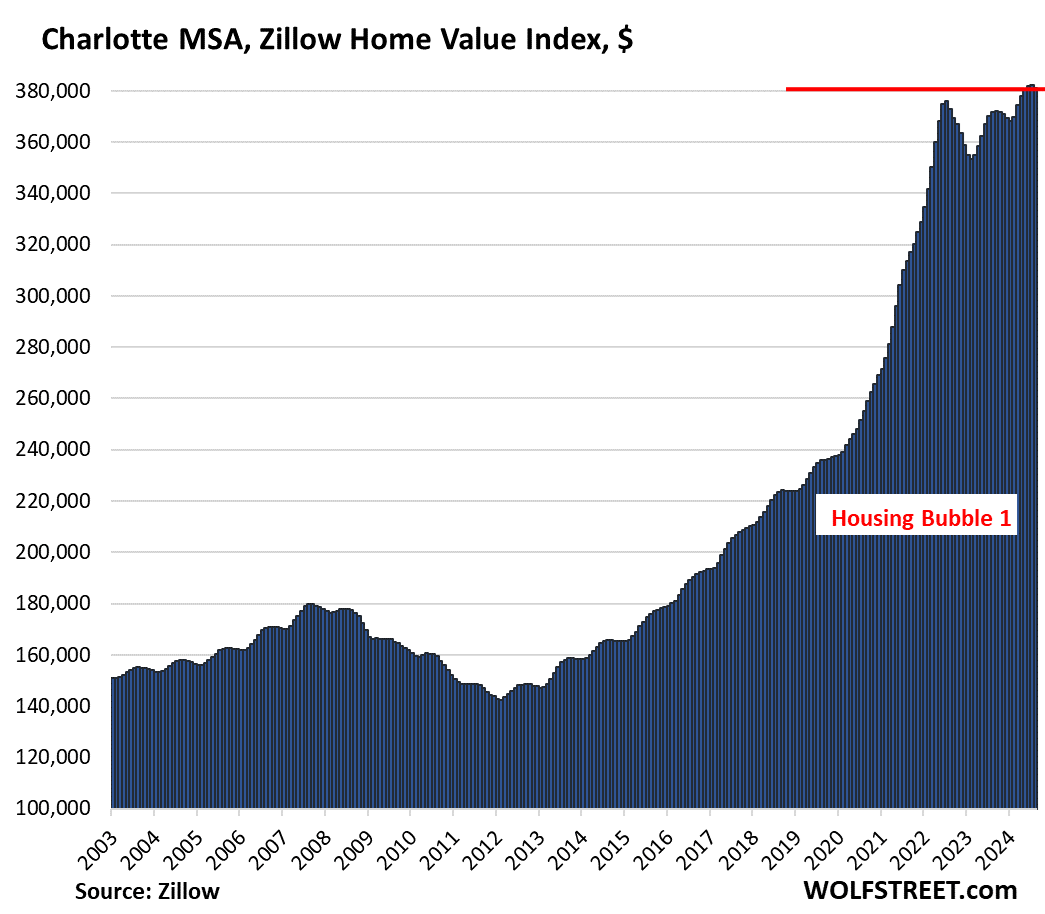

- Charlotte: -0.3%

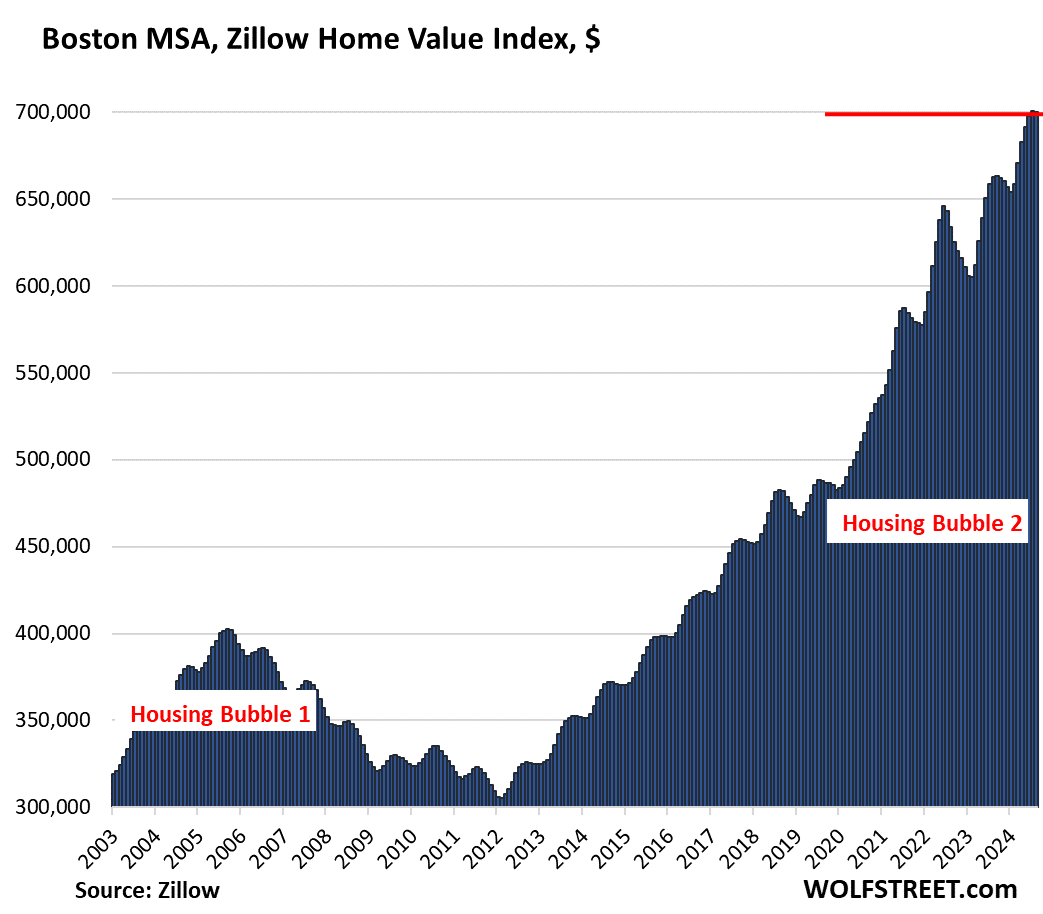

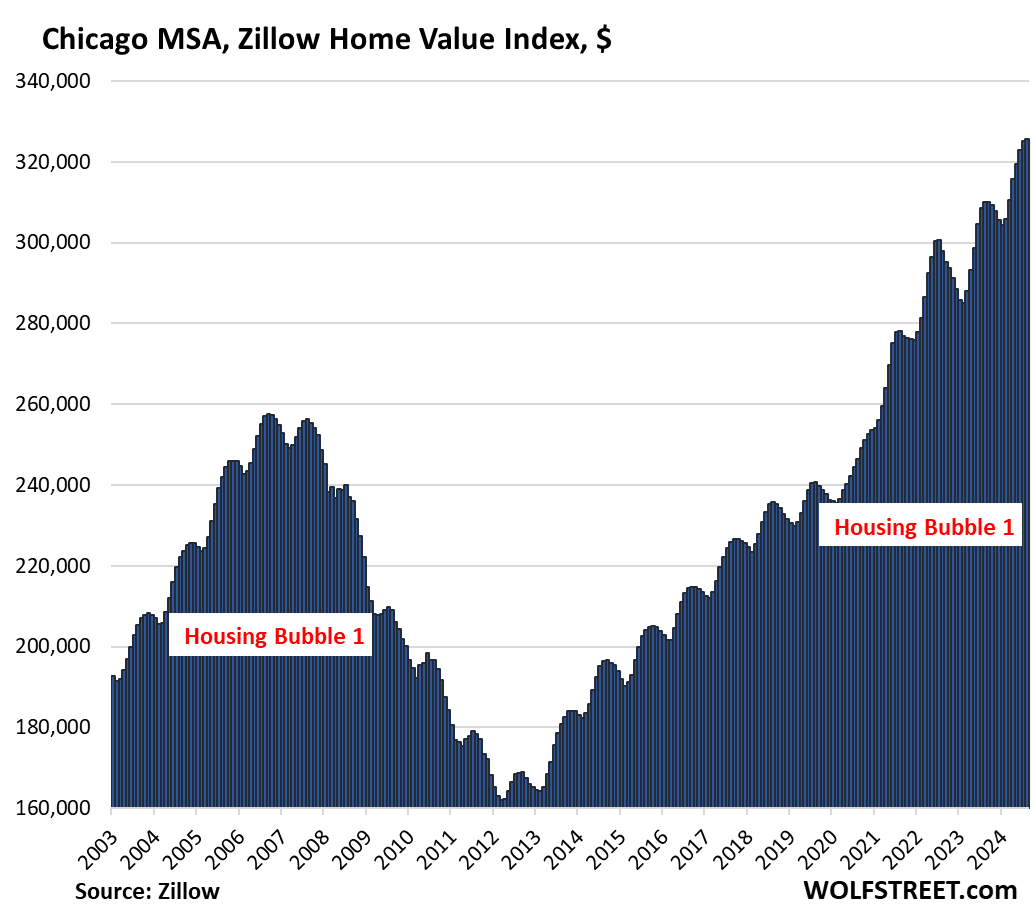

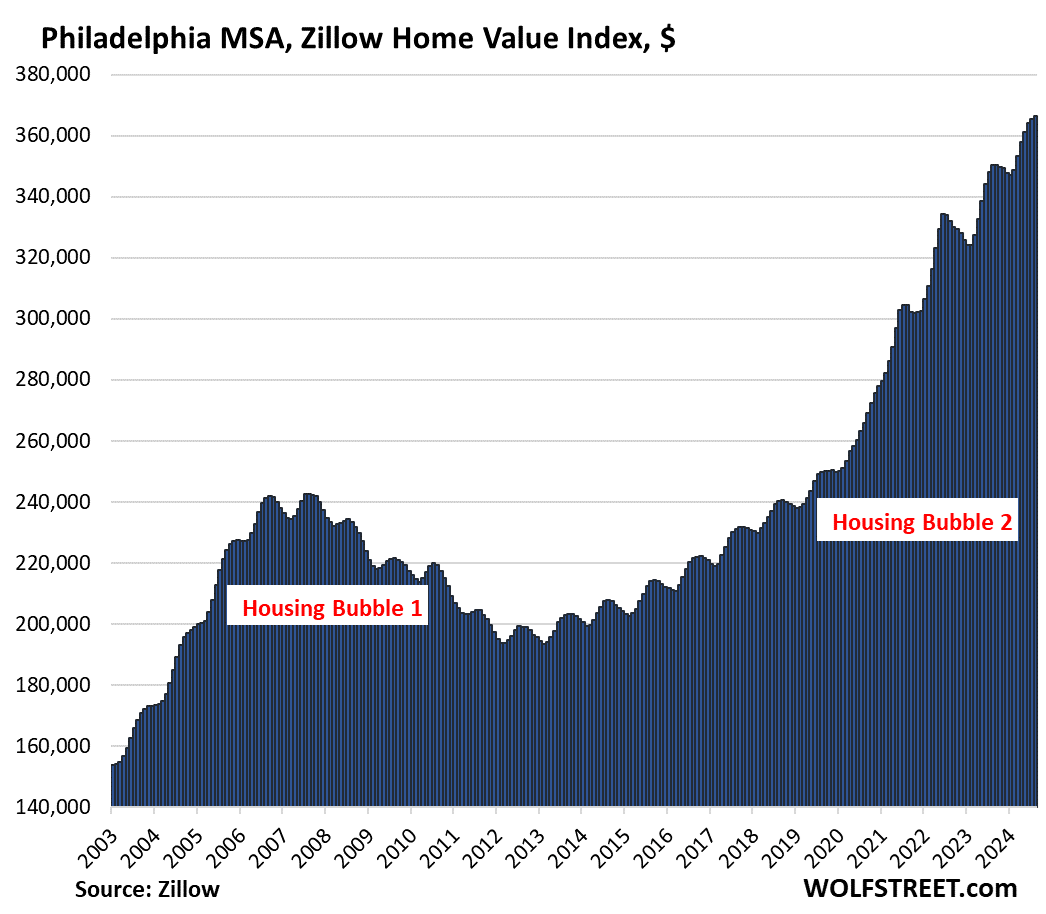

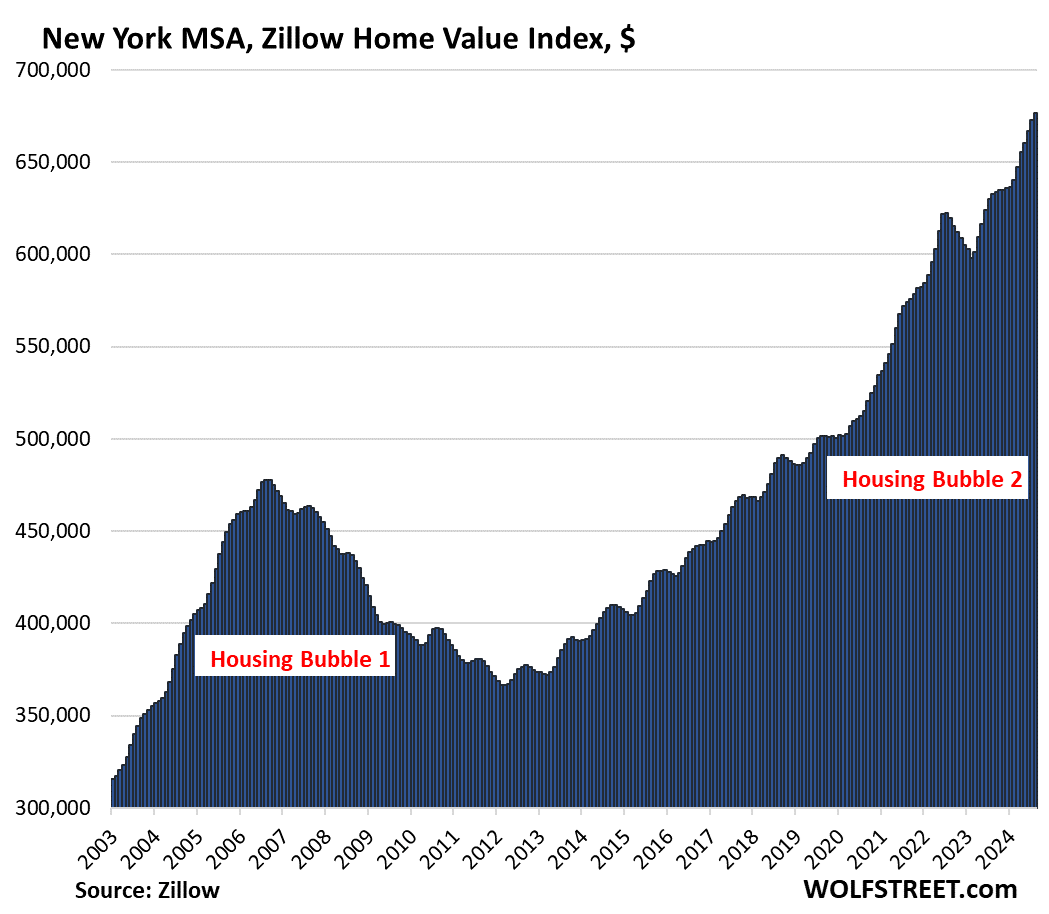

New highs: Only 3 of the 28 metros set new highs: Chicago, New York, and Philadelphia.

So here we go.

| Austin MSA, Home Prices | |||

| From Jun 2022 peak | MoM | YoY | Since 2000 |

| -19.8% | -1.0% | -4.6% | 165% |

| San Francisco MSA, Home Prices | |||

| From May 2022 peak | MoM | YoY | Since 2000 |

| -8.4% | -1.3% | 2.4% | 299% |

| Phoenix MSA, Home Prices | |||

| From Jun 2022 peak | MoM | YoY | Since 2000 |

| -7.6% | -0.4% | 1.2% | 225% |

| Denver MSA, Home Prices | |||

| From Jun 2022 peak | MoM | YoY | Since 2000 |

| -5.9% | -0.7% | 0.4% | 217% |

| Salt Lake City MSA, Home Prices | |||

| From July 2022 peak | MoM | YoY | Since 2000 |

| -5.7% | -0.5% | 1.0% | 214% |

| Portland MSA, Home Prices | |||

| From May 2022 peak | MoM | YoY | Since 2000 |

| -4.7% | -0.4% | 0.3% | 221% |

| Honolulu, Home Prices | |||

| From Jun 2022 peak | MoM | YoY | Since 2000 |

| -4.5% | -0.4% | -0.2% | 282% |

| Seattle MSA, Home Prices | |||

| From May 2022 peak | MoM | YoY | Since 2000 |

| -4.4% | -0.6% | 4.2% | 241% |

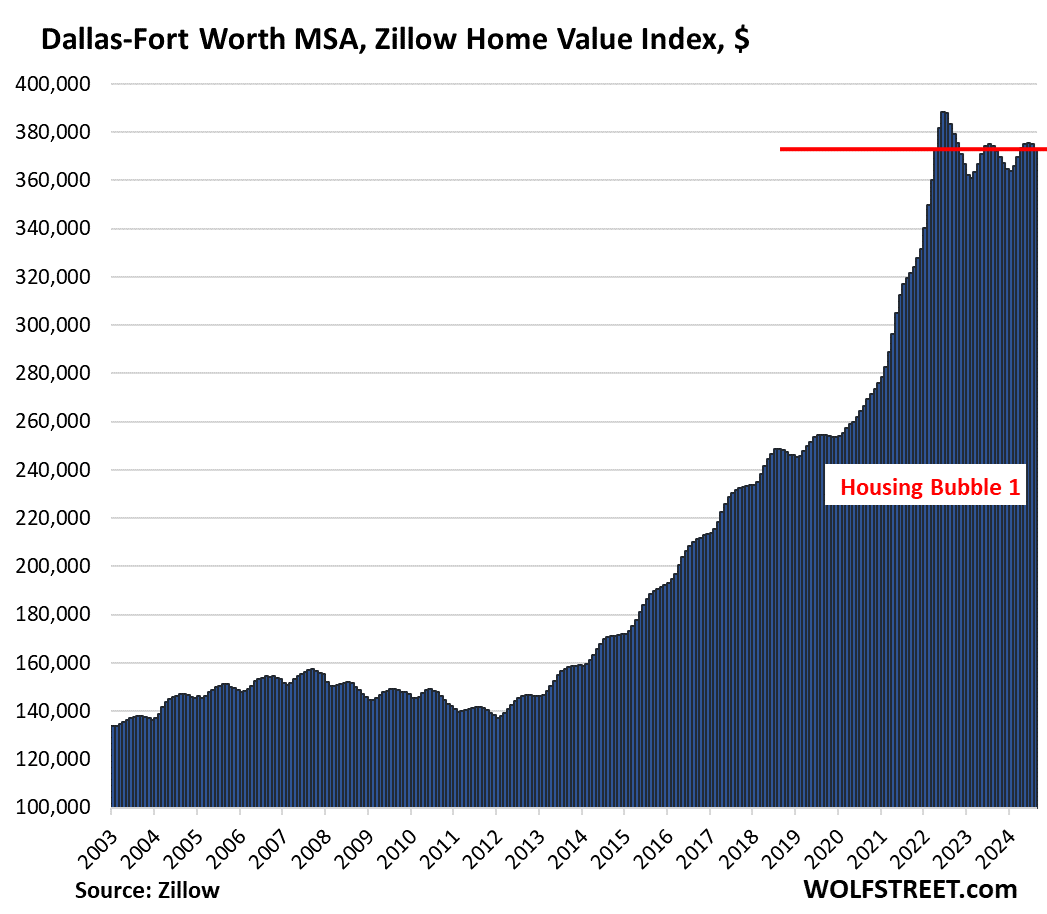

| Dallas-Fort Worth MSA, Home Prices | |||

| From Jun 2022 peak | MoM | YoY | Since 2000 |

| -3.9% | -0.5% | -0.4% | 199% |

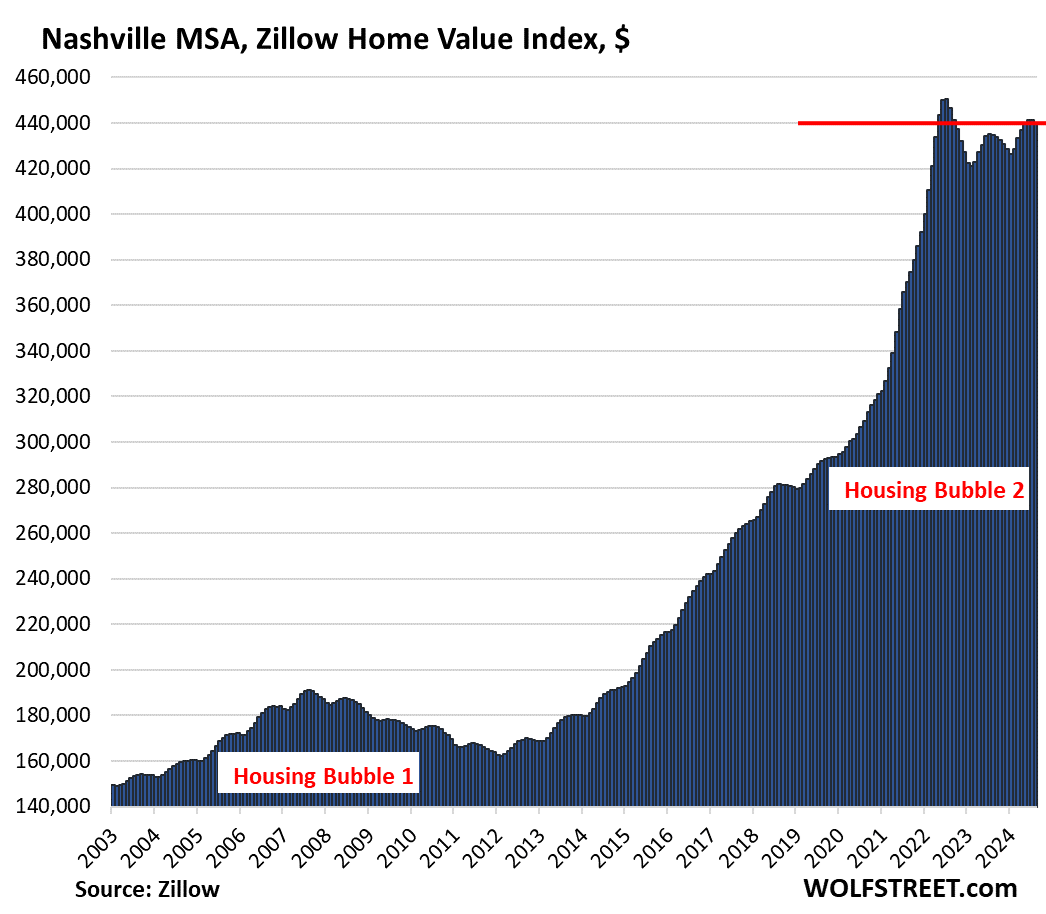

| Nashville MSA, Home Prices | |||

| From July 2022 peak | MoM | YoY | Since 2000 |

| -2.3% | -0.3% | 1.2% | 220% |

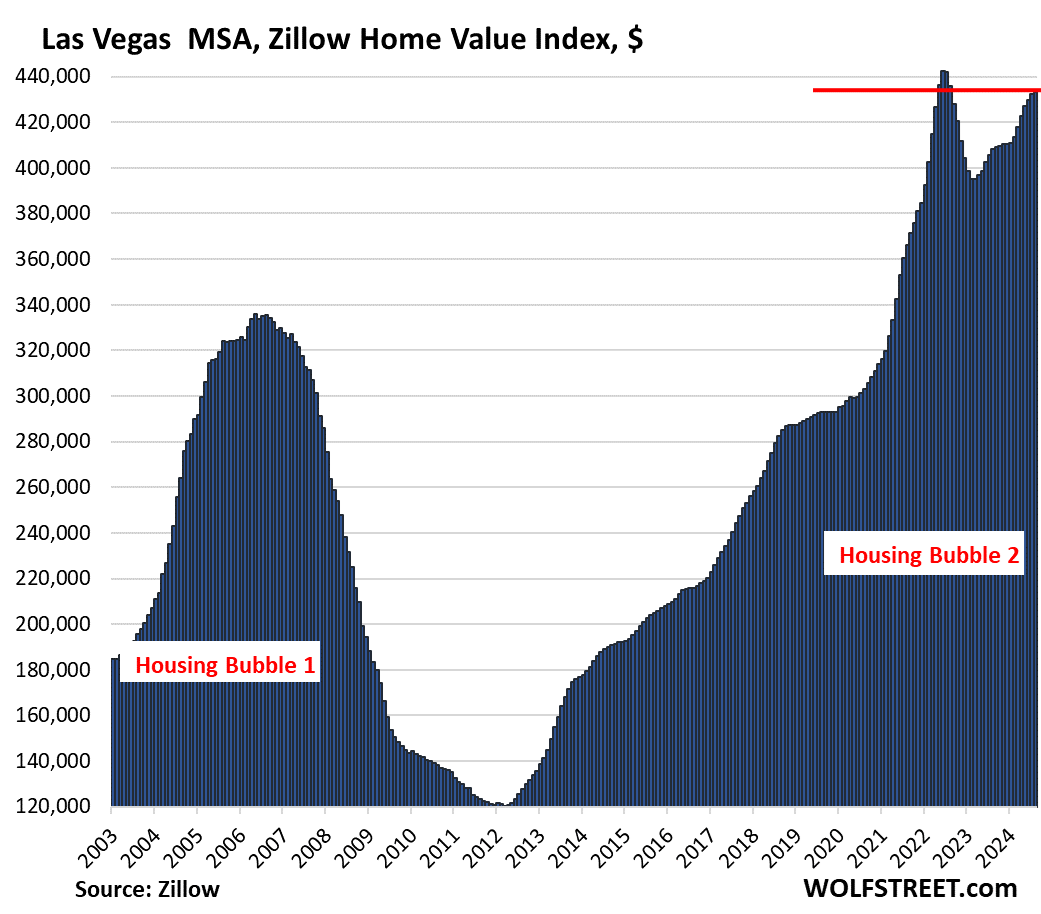

| Las Vegas MSA, Home Prices | |||

| From June 2022 peak | MoM | YoY | Since 2000 |

| -2.1% | 0.2% | 6.1% | 180% |

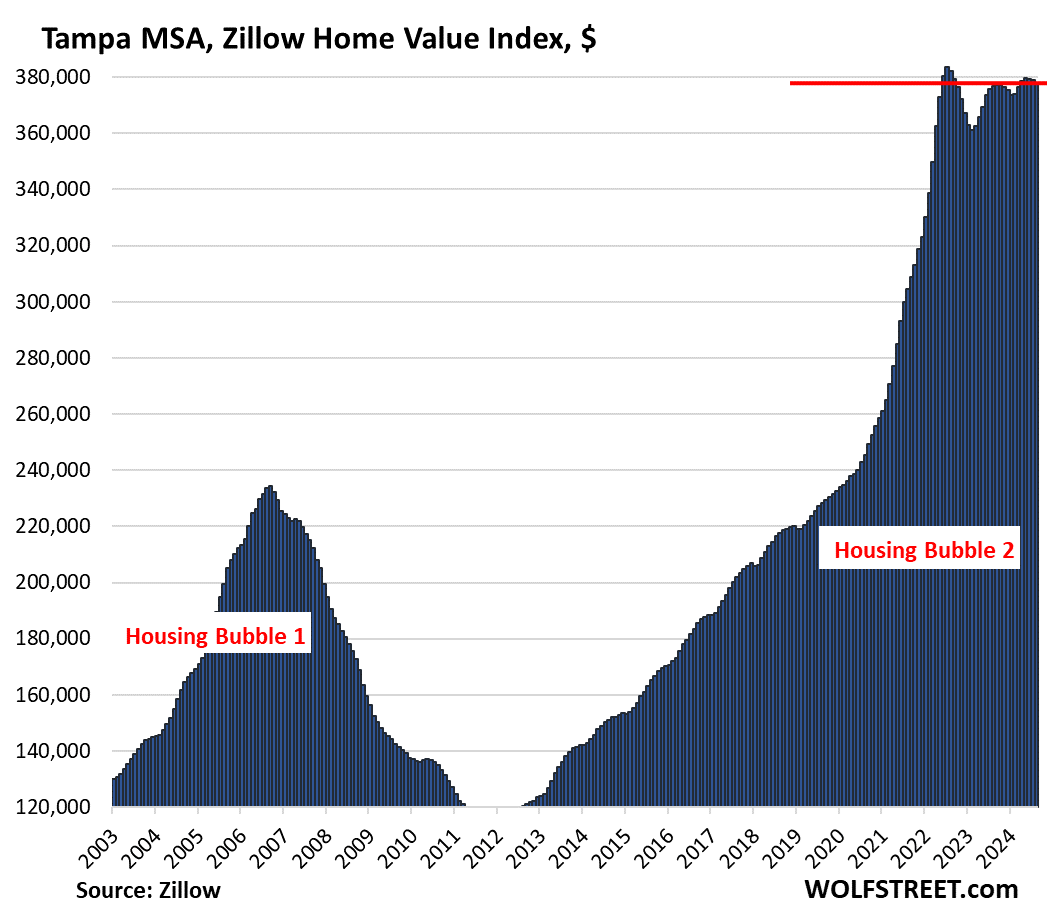

| Tampa MSA, Home Prices | |||

| From Jul 2022 peak | MoM | YoY | Since 2000 |

| -1.8% | -0.2% | 0.1% | 217% |

| San Jose MSA, Home Prices | |||

| From May 2022 peak | MoM | YoY | Since 2000 |

| -1.5% | -1.1% | 9.1% | 340% |

| Houston MSA, Home Prices | |||

| From Jul 2022 peak | MoM | YoY | Since 2000 |

| -1.5% | -0.3% | 0.4% | 155% |

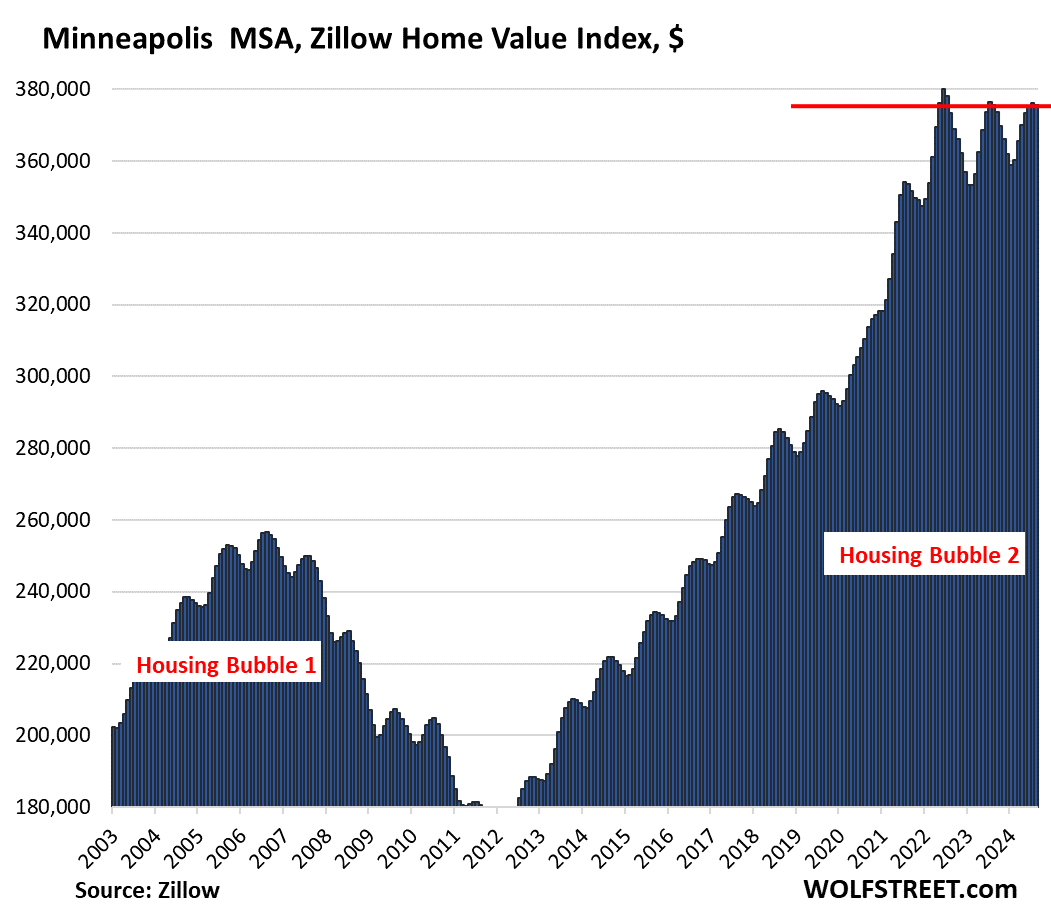

| Minneapolis MSA, Home Prices | |||

| From May 2022 peak | MoM | YoY | Since 2000 |

| -1.2% | -0.1% | 0.0% | 160% |

| Charlotte MSA, Home Prices | |||

| MoM | YoY | Since 2000 | |

| -0.3% | 2.5% | 173.5% | |

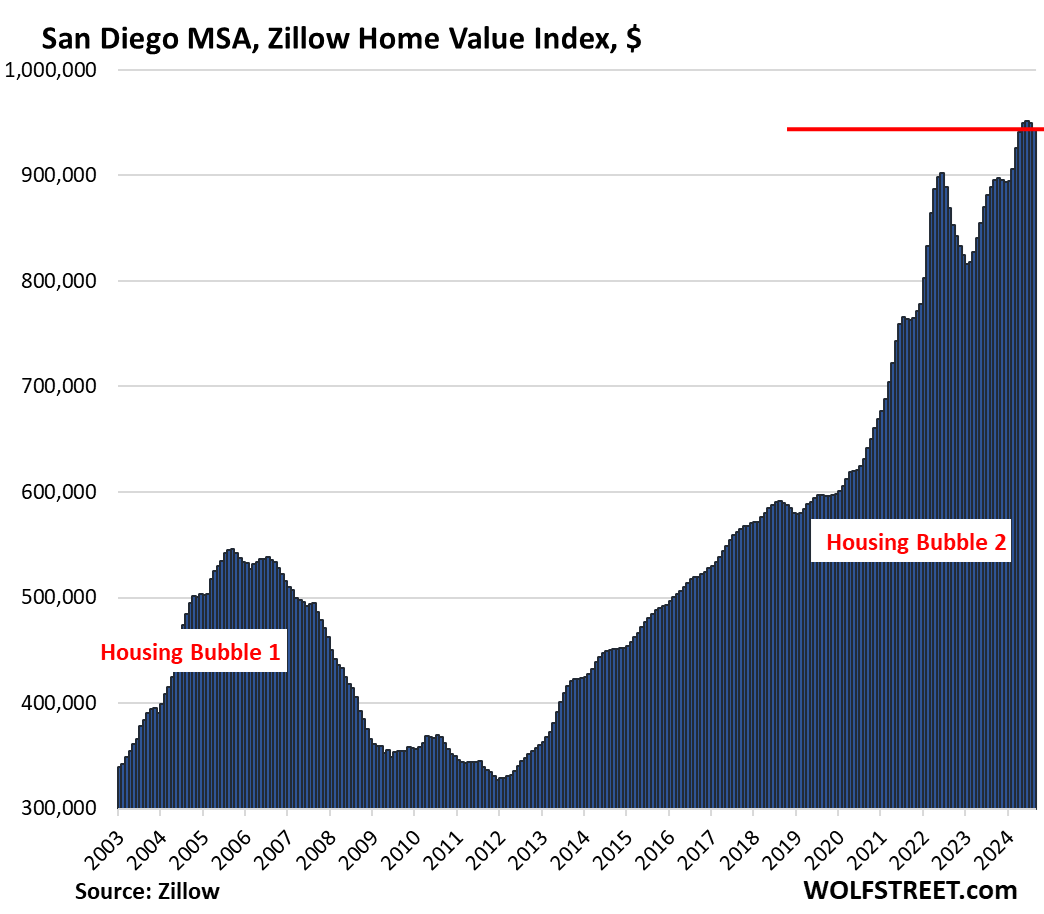

| San Diego MSA, Home Prices | ||

| MoM | YoY | Since 2000 |

| -0.6% | 6.2% | 340% |

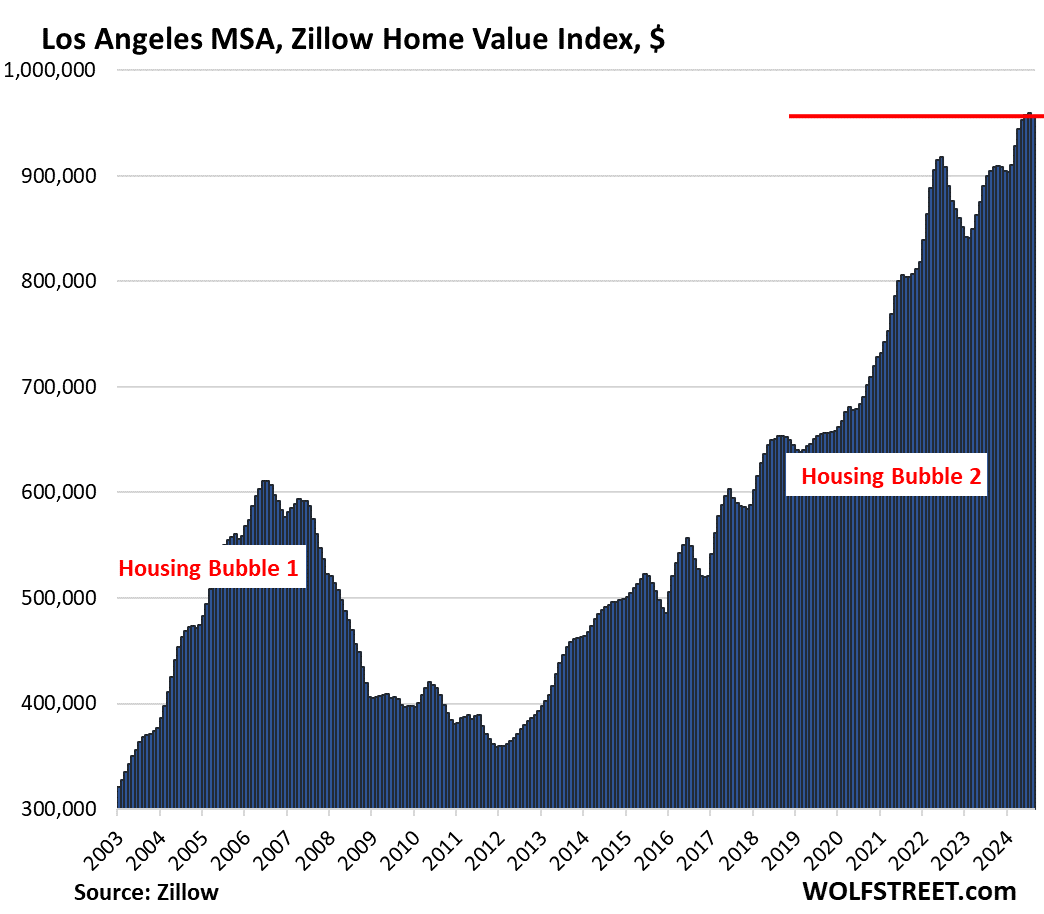

| Los Angeles MSA, Home Prices | ||

| MoM | YoY | Since 2000 |

| -0.3% | 5.7% | 333% |

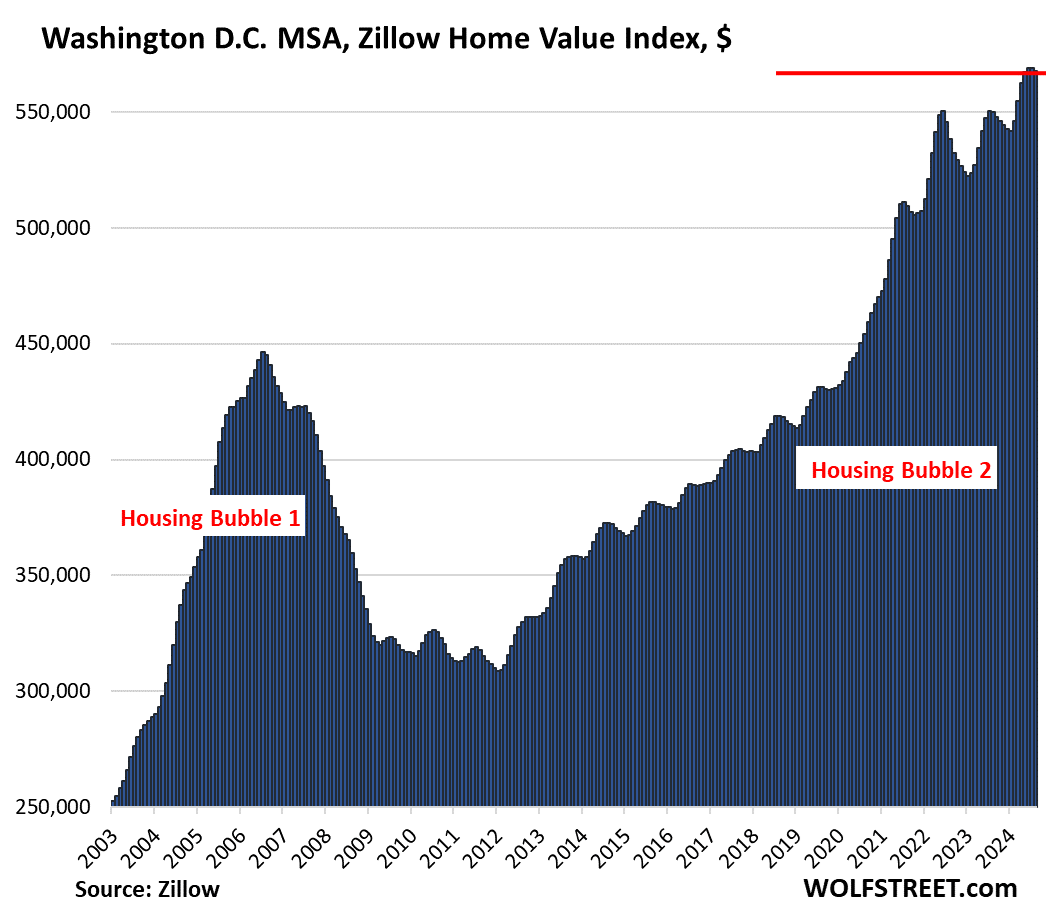

| Washington D.C. MSA, Home Prices | |||

| MoM | YoY | Since 2000 | |

| -0.3% | 3.2% | 215% | |

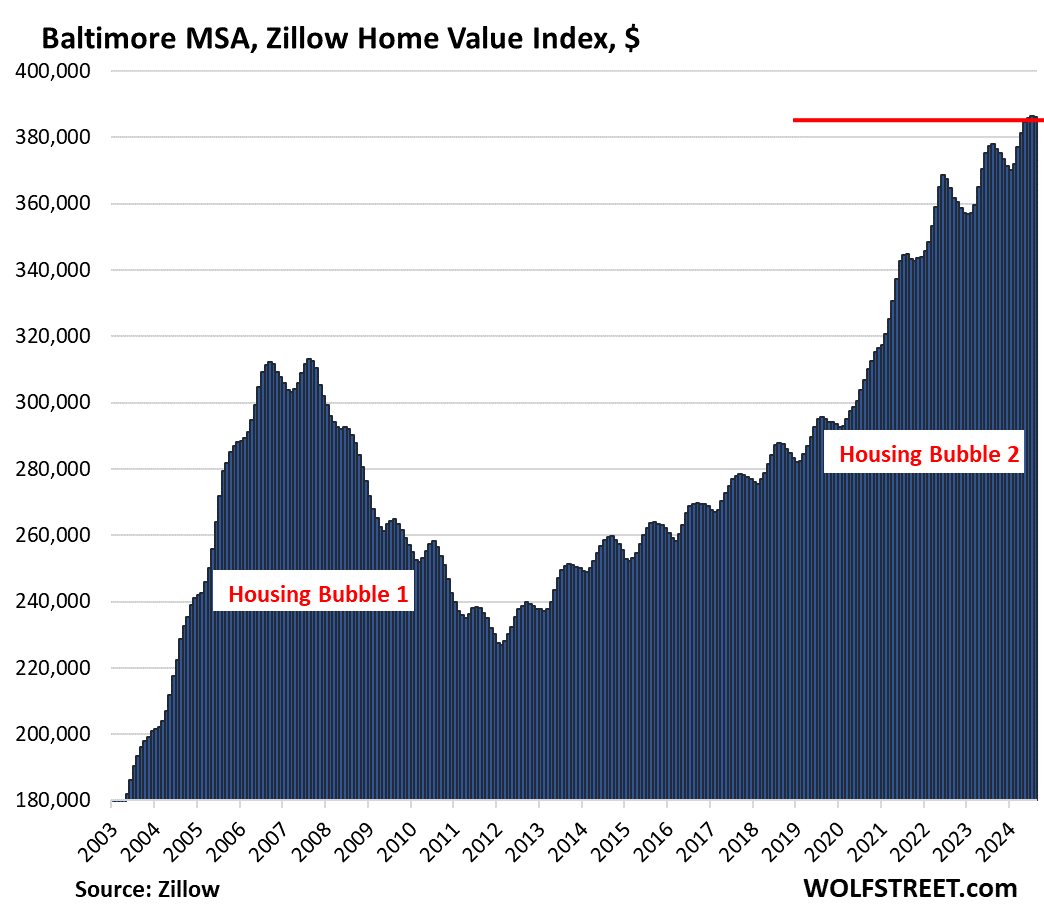

| Baltimore MSA, Home Prices | |||

| MoM | YoY | Since 2000 | |

| -0.1% | 2.2% | 174% | |

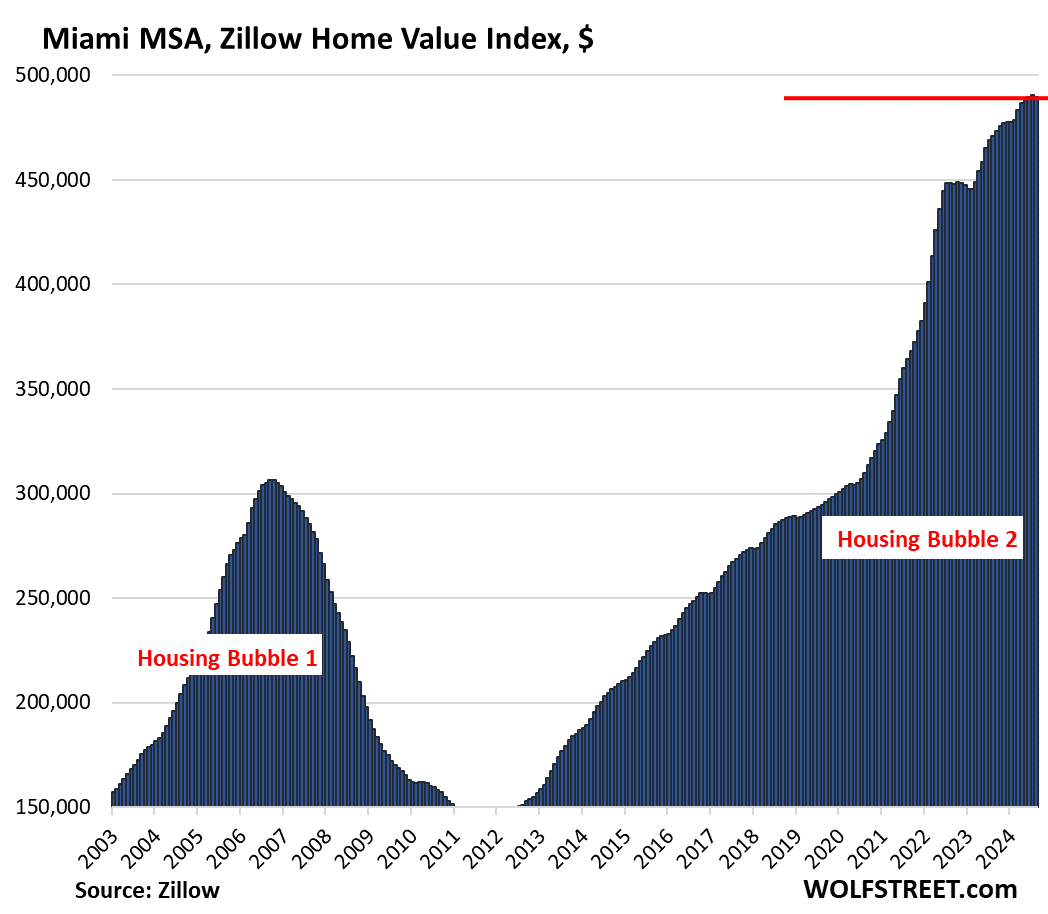

| Miami MSA, Home Prices | ||

| MoM | YoY | Since 2000 |

| -0.2% | 4.0% | 336.1% |

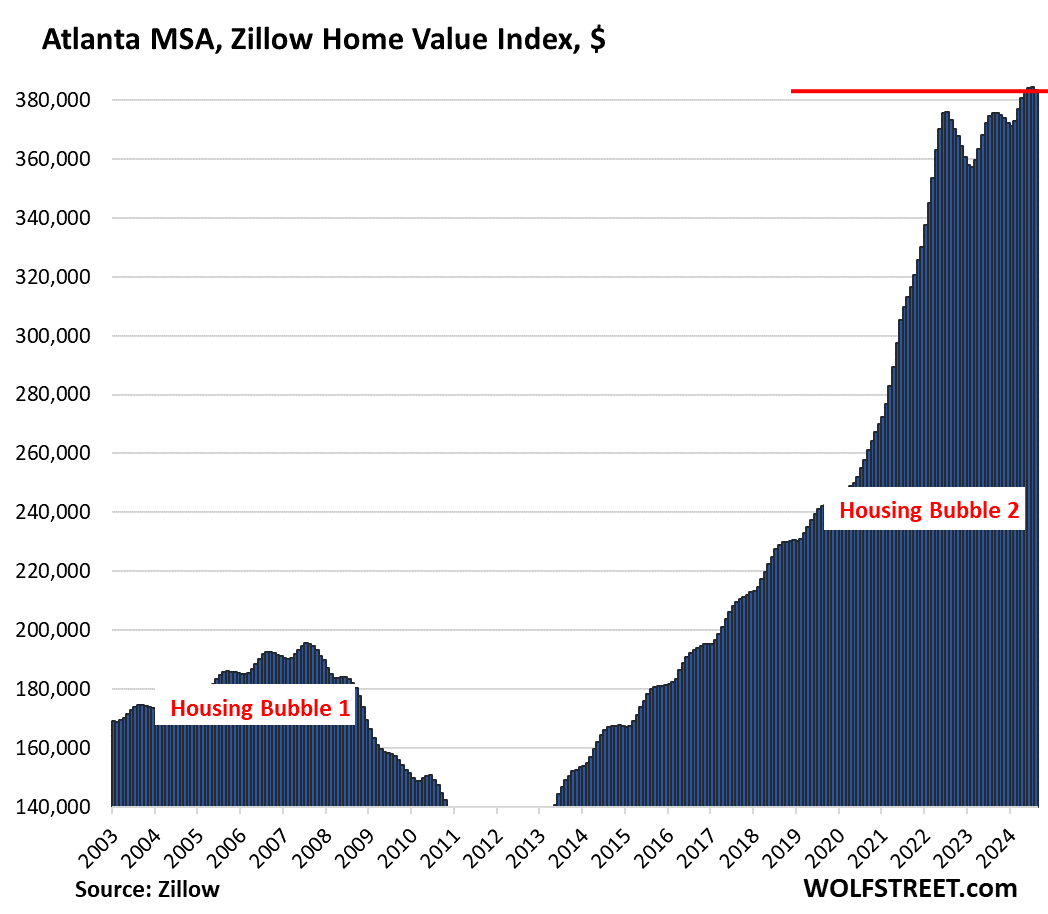

| Atlanta MSA, Home Prices | ||

| MoM | YoY | Since 2000 |

| -0.3% | 2.1% | 167% |

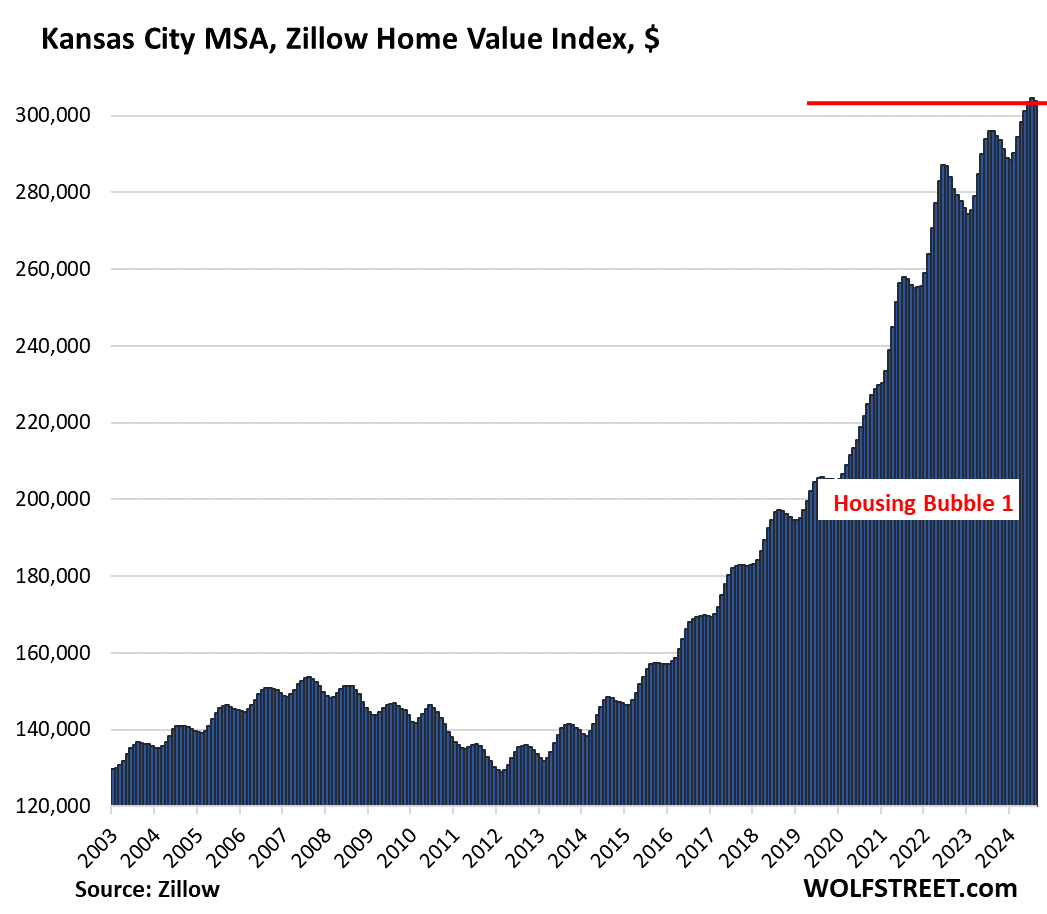

| Kansas City MSA, Home Prices | ||

| MoM | YoY | Since 2000 |

| -0.2% | 2.6% | 179% |

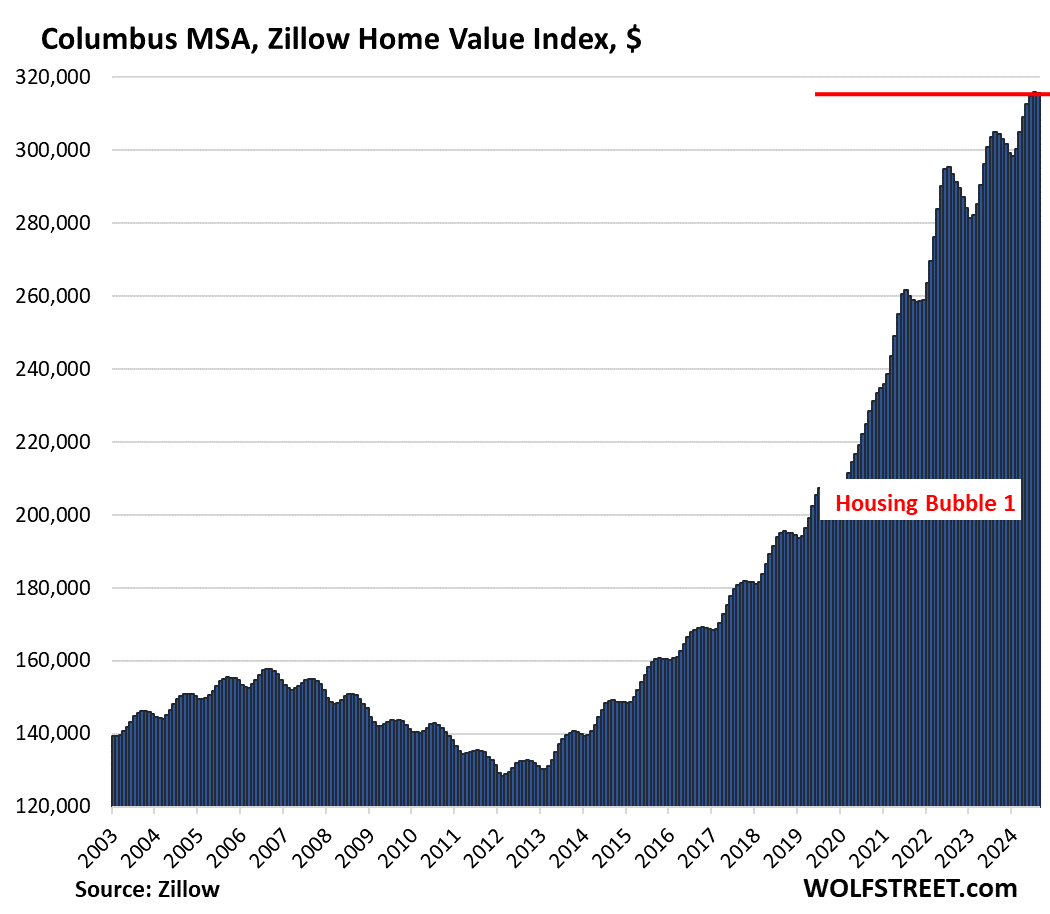

| Columbus MSA, Home Prices | ||

| MoM | YoY | Since 2000 |

| -0.1% | 3.5% | 157% |

| Boston MSA, Home Prices | ||

| MoM | YoY | Since 2000 |

| -0.1% | 5.6% | 229% |

| Chicago MSA, Home Prices | ||

| MoM | YoY | Since 2000 |

| 0.1% | 5.0% | 114% |

| Philadelphia MSA, Home Prices | ||

| MoM | YoY | Since 2000 |

| 0.3% | 4.7% | 202% |

| New York MSA, Home Prices | ||

| MoM | YoY | Since 2000 |

| 0.6% | 7.0% | 211% |

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Just looking through all the pictures in a row like this, I must admit, just visually, this is one screwed-up housing market.

Huge increases, double peaks, triple peaks, plunges in between, weird shapes — a commenter suggested 10 days ago that the Austin chart looked like it was giving the market the finger — you name it, we got it.

Thanks captain obvious. Any peasant could have told you that much, quite some time ago. Bubbles burst. This is called currency devaluation.

“This is called currency devaluation.”

Opposite. When the bubble bursts and prices go down, it’s the opposite of “currency devaluation” because the currency gains in purchasing power with regards to homes.

There is definitely no currency devaluation right now, as Wolf said.

Currency devaluation has taken place between 2020 and 2022 by more than doubling the fed balance from 4T to 9T. If the bubble did burst, the opposite could happen. But the balance is still far too high (7T) and will settle around or above 6T. I am guessing the asset prices will follow the suit. Even stock bubble might possibly burst (though I don’t think they will), RE burst is much smaller probability. It is like carved into the stone this time. It is definitely not like 2008. There are enormous upward pressure: reckless govt spending, increasing immigration, wage pressure, increasing competition and so on.

One can look at this as markets being 5-10% “down” from the high peak, or 300% “up” from 2012 lows. Just depends what story you’re trying to tell. Being within 5-10% of insane highs suggests no sign of a bubble bursting, IMO. Cupcake is right- unless/until something bursts, which it hasn’t yet, there is no evidence this is a bubble rather than currency devaluation.

Thanks for these mountain pictures Wolf, some snow on the peaks would look good too.

Instead of a 3 month lag on the housing report, these are less than two weeks old, like fresh from the oven reporting and analysis…thanks again.

There is a reason ski slopes go downward.

People like to go downward.

People hate hiking up a mountain.

Cmon US market! Learn from the ski resorts. Duh. 😆

How do you possibly ‘think’ that overpriced real estate falling in price has anything at all to do with ‘currency devaluation?’ If the value of the currency was falling, prices of real estate such as housing would be increasing and not decreasing.

He’s reporting with a lag.

1) For more or less twenty years (2000-2022) the Fed manipulated interest rates downward (ultimately cutting them by over half) by printing money in various ways (ZIRP and proto-ZIRP).

1) a) Printing money *is* currency devaluation – especially if you acknowledge that soaring home prices are *inflation*.

2) That money printing/gutted rates slashed monthly mortgage payments by half, creating two phony housing booms – despite mostly pretty awful other macro-economic factors.

3) Existing sellers and new home builders gobbled up the overwhelming majority of ZIRP “affordability” benefits by jacking up their offering prices by almost unprecedented amounts in compressed periods of time.

4) Ignorant buyers bought millions of discounted “McMansions” rather than the “half-off” standard homes made possible by ZIRP. This doubled SFH median sale prices.

5) Wiser heads stood aloof, refusing to trade at such distorted, doomed prices. But we all became prisoners of ZIRP’s warped environment – suffering destroyed interest rates for decades and made to pay for vast, foreordained housing implosions.

These are all disasters run on the engine of ZIRP – which was fueled by money printing/debasement/currency devaluation.

(Elaboration – The money printing-to-ZIRP tie results from the fact that the unbacked money printed by the Fed mostly went to buy deficit-riddled Treasuries at prices no private market actor would with a ten foot pole…driving interest rates down by half).

I was having the same experience while looking at some of those charts.

Just wow, I’m speechless. Up and to the right in utter defiance…

Are you able to show those charts with the Fed Balance Sheet superimposed.

Not lazy here, just don’t have access to the data. Or knowledge how to.

I could, but it’s a lot of work. You can do it mentally.

The biggie in most markets is mortgage rates (the 3% mortgage rates were in part of function of QE). In some markets (San Francisco Bay Area), the biggie is the Nasdaq and the startup money, not mortgage rates. I overlaid that too in the past.

What a great addition to include the TOTAL price increase! It really puts things in perspective.

It also shows how even though it may not be the best of all investments, real estate is at least a good store of value over the long run and an investment you can use and enjoy more than a stock certificate. Yes, you still have to maintain it and insure it, but you don’t have to pay ever increasing rents or risk having to move at your landlord’s whims.

Wolf,

Thank you for the time and effort required to shift to the new, hopefully more precise data system.

“I must admit, just visually, this is one screwed-up housing market.”

I know you have said similar things in the past (in a more oblique way) but I’d guess a fair number of commenters are recalling the deathless prose of “Die Hard”…

“Welcome to the party pal!”

Basically, in its pursuit of covering for (many) other policy failures, the Fed/DC has screwed around with the money supply (and therefore interest rates) in a pretty unprecedented way for 20 years (ZIRP and proto-ZIRP).

The housing charts reflect a macro-economy in deep distress, periodically “revived” via the phony boom (but very real bust) dynamics of ZIRP and its hallucinatory effects on monthly mortgage costs (and secondary order corruptions like grossly inflated new home prices).

Housing cost volatility of this scale is a reflection of a macro economy having repeated heart attacks and Fed “defibrillation” that has made the patient sicker, much sicker.

I also know that you are no particular fan of ZIRP and have said so – but “one screwed up housing market” is probably your most clear-throated pronouncement of this.

Pure wisdom served up fresh daily.

A day without Wolfstreet is a day in the dark.

But you like it, Wolf. You are on board with the central bank and their “deflation is the devil” mantra.

They’re both evil.

We need a post discussing “deflation is the devil”.

I think I understand both sides of the debate, which seems to mostly boil down to,

“Deflation helps consumers but might put some businesses out of business”

Or,

“Deflation helps consumers but damages businesses because consumers will wait (perpetually?) for lower prices.”

Or

“Deflation helps consumers but hurts leveraged/debtors since the latter can no longer repay in inflated dollars.”

At this point, after 20 years of ZIRPiness – and its aftermath(s), I have to say I personally think the deflationistas have the better argument (the inflationistas won the policy war/control – and have damaged the country).

Basically, technology has made material human progress inherently *deflationary* – the labor cost of almost everything has gone *down* (sometimes dramatically), sometimes quickly – almost always when measured in decades.

This process benefits *both* consumers *and* producers (their *input* prices go down too).

Politically authored inflation opposes/attacks this inherent process – in the service of what, exactly?

The politicians (who profit from inflation’s transfer of spending power from savers to…themselves, via their control of the printing press) would say the result is “stability” – most crucially in employment.

I understand the argument and the point, but I think the empirical reality of the last 20 years undercuts the persuasiveness of the inflationistas.

I clearly remember the new wave of “deflation is the devil” stories emanating from all the traditional MSM/Establishment orifices in 2002 – it was shocking because it was the antithesis of their historical attitudes…particularly since the early 80’s.

I am still open to being persuaded by new and different arguments (and the “China Price” debate is a related, enormous one).

In excessive deflation, there is an event horizon: when money gets to be too scarce, servicing debts becomes more and more difficult, to the point of cascading defaults, bankruptcies, foreclosures, bank runs etc. Colossal credit freeze. Money hoarding. No one lends because no one can repay. May be signaled by sky rocketing over night rates.

They’re both evil.

So Wolf, I just chose a random San Jose zip on Zillow and it says home prices are up 14.2% over the last year.

https://www.zillow.com/home-values/97992/san-jose-ca-95124/

I have learned to trust your research but wonder where the discrepancy lies in the data. Same results from other zips also.

RTGDFA. And the article I linked. You would have learned that Zillow has a variety of indices including “smoothed” indices (three month moving averages), and with seasonal adjustments, and a “raw” index. It has indices for houses, for houses and condos, for condos only, by size etc. It has indices for MSAs, cities, counties, and zip codes. I use the raw mid-tier index, which eliminates the outliers, minimizes the impact of changes in the mix, and it reacts the fastest to market changes, for the San Jose MSA (the San Jose, Sunnyvale, Santa Clara MSA), which is a multi-county area with 2 million people. But the link you posted uses a smoothed seasonally adjusted index for the zip code 95124, a small part (Cambrian Park) of the city of San Jose. The zip code has 49,000 pop. So RTGDFA and the one I linked before you post more ignorant BS.

DougP, I can tell you from personal experience because I have listed my house in San Jose last week.

– Buyers are missing

– Seller expectations are being reset

– Zillow and Redfin estimates for home prices are so far from reality that they are useless.

I am not a real estate investor so will sell at any decent price. I purchased the house in 2019 (pre-pandemic) and remodeled a bit during the pandemic.

I estimate that after paying for various selling expenses, I will get no more than 5% of what I paid for + spent in remodeling.

Adjusting for inflation…..I am loser. Why? Because in my desire to be prudent, I paid off the 2.5% mortgage when I could.

I guess the Fed created a lot of paper wealth. Feel wealthy till you try to spend it :)

“Zillow and Redfin estimates for home prices are so far from reality that they are useless.”

Just to be clear: these indices here are NOT estimates of what homes might be worth. They’re based on actual transactions and show what amounts homes actually sold for in aggregate — what buyers paid for them.

Zillow does have an estimate of what a home MIGHT sell for, but that’s a different metric. We don’t use that here.

Yes I meant the estimated that Zillow shows on the property page.

I know that your data is based on sale records.

Wolf, I don’t believe you are correct about the above.

https://www.zillow.com/research/methodology-neural-zhvi-32128/

Zillow clearly says that the ZHVI includes Zestimates, which Zillow clearly says is “an estimate of a home’s market value.”

No that’s not what Zillow said. Read the description more carefully. It says Zillow’s huge data base includes a huge amount of data that the Zestimate is based on to estimate the future price of a home). The home price index here is based on the same data in the same data base (obviously, because there is only one database) that the Zestimate is based on, but is NOT an estimate of future prices of a home, but a reflection of the past, in this case, of August.

If you go to the Zillow page of a specific home (in states that allow disclosure of transaction prices), you will see a Zestimate value of the home (what it might sell for in the future), and you will also see past transaction prices when it sold previously, along with past listing prices, property tax data, etc. Those two — an estimate of the future and actual past transaction prices — are two different things on the Zillow page.

The only real losers are those of us who didn’t buy before the pandemic.

2012 era

I don’t see this bubble deflating. Rate cuts are coming and the mania will probably start over where it left off.

LOL. Mortgage rates, which is the only rate the matters for the housing market, have already PLUNGED. They were nearly 8% a year ago. They’re now 6.15% as of today. It seems like they already price in 175 basis points in rate cuts (7 25bps cuts). And yet, demand for mortgages has collapsed and sales are down massively, despite the huge drop in mortgage rates. This is a huge principle at work here that you need to wrap your brain around.

I certainly hope you’re right! I planned to move this year to a different school district but I can’t sign on a mortgage that high so I ended up staying. Rent prices look MUCH better at the moment but I don’t love the apartment life.

rent a nice house and save $2,000 a month?

Why not rent a house or condo? Run the numbers you will likely pay less than the comparable place’s mortgage. This is pretty much universal in SoCal and NorCal, other areas might be less of a difference but probably still cheaper than renting.

Unless you feel ashamed to be a renter because conventional wisdom from normies is that if you’re not a homeowner, you haven’t made it in life…

I agree with phoenix, without a home you are homeless.

Their eating the dogs, their eating the cats.

Homelessness leads to hunger.

It’s possible we are over estimating demand returning. What if they only jumped in because of super low interest rates ending, pandemic remote work shuffle, plus inflation driving greed. Without those 3 aspects removed, they would have never been in the market in the first place. So no one is rushing back in when rates hits 5’s or whatever. Market demand has normalized, but sellers have not come to terms with lower pricing.

Yes, as long as rates are expected to drop, everyone will wait for lower rates.

If the Fed starts hiking again, then they there will be a rush to “lock in” the lower rates. We saw that in 2022. That’s where the spikes came from.

Demand isn’t coming back until the jobs come back. All I see is job losses and lower wages.

My ex landlord just lowered the rent on our former rental to under what we were paying. If he hadn’t been so greedy we would have stayed another year at minimum.

@Wolf I’m confused by the comment “Yes, as long as rates are expected to drop, everyone will wait for lower rates.”

If rate cuts are already priced in, can we actually expect mortgage rates to drop further?

Who is “we?”

Mortgage rates might not drop a lot more. But people are waiting for them to drop more. They’re seeing 3% again. They think 3% is normal, and that mortgage rates are going back to normal. They weren’t around when 6% and 7% were normal.

@Petunia Same here, after one year, landlord decided to ask me how much of an increase I am looking for to renew the lease. Guess they want to adopt the Priceline name your price to the upside or think they operate a AirBnB. Sick of these greedy, incompetent landlords, if you ask me how much my increase should be, either you’re greedy to the moon and looking to get as much as you can or too incompetent to know what cap rate you should be getting from your tenant.

Last I checked, they relisted the place at close to $5K, and slowly coming down but still higher than what we’re paying. Unlike last year though, it didn’t get snatched up right away. Too bad I likely won’t get the joy of seeing him have to lower the rent down to what we were paying or below but if it does, I will enjoy my schadenfreude with some popcorn.

Guess this landlord forgot a place in Long Beach near Calstate Long Beach does not equal beach front property with that asking price…

DownWithRE, if we don’t end up in a recession then I agree with your statement. I mostly look at the SF chart since it is more relevant to me and if you see it side by side with a mortgage rate chart you will start to make some sense of the crazyness. The May 2022 peak is right around the point mortgage rates crossed the 5% line. Additionally, the two low price points near the end of 2022 and 2023 coincide with the mortgage rate peaks of 7% and nearly 8% respectively. Interestingly, starting at the lowest point at the end of 2022, the chart has gone up and down but has overall trended higher, despite a nearly 8% mortgage peak at the end of 2023 and is currently at nearly the closest point to the May 2022 peak since mortgage rates crossed the 5% mark. In my opinion this crazy bouncing around has more to do with lack of affordability due to the rise in mortgage rates and inflation more than anything else. I see us pushing above the May 2022 peak once interest rates get close or below the 5% mark.

San Francisco Bay Area housing is much more linked to the Nasdaq and the startup scene (than mortgage rates), but with a lag of several months. Both crashed in 2022, and so housing in SF Bay Area reacted to that with a lag. Then came the 2023 to early-2024 Nasdaq rally of 80%, and housing reacted to that. But the Nasdaq rally hit a ceiling in July 2024, and many tech stocks are down a lot, which is what is now being reflected in the housing market.

Nice!!!

Nice to see LA and SD decline but at less than 1%, you can barely you can even spot that out in the chart, will this trend continues and accelerate faster? I sure hope so but not holding out any faith, especially if 30yrs fix will continue to go down…

Interesting to see Vegas for some reason still holding strong relative to Austin..etc. Last time it was bad, this time it’s looking unpredictable, I guess people love their 120c heat and 30c winter and super expensive buffet there…

Las Vegas has nightlife and good restaurants. Austin thinks it has good nightlife and restaurants.

The two cities are not really comparable. One is known as a glitzy blast furnace with faux-posh delusions, catering to the pitiful all-you-can-eat vices of the repressed lanyarded convention crowds; the other is an overbuilt/over-speculated college town that’s become ground zero for alpha dorks and also-ran comedians.

So…just imagine how bad the places these oceans of people are coming from must be…

Could it be that Vegas is relatively cheap compared to Austin? If you’re willing to live in that kind of heat, Vegas gets you a lot more house than Austin or Phoenix. I’ve had a number of friends relocate there for that reason, they actually have great access to hiking, mountain biking and rock climbing too without the crowds of CO. Summers are terrible, but sounds like the rest of the year is great.

How bad is Vegas in the summer actually? I’ve never been, but did consider Texas at one point and that place is basically just a giant sauna with weird oversized bugs, and I still liked it.

Vegas-> Phoenix-> Tucson (in that order). That corridor is feeding off of the California exit. You can live in Arizona, but get your paycheck from LA or San Francisco.. do remote work, fly into the office once per week or whatever, and live a lot cheaper.

We are about to get the first set of rate cuts that don’t wildly move the 10 year treasury. I can’t wait to see if realtors are right and a theoretical inventory of buyers waiting for the cuts capitulate and swoop in and buy these languishing 100 days on market homes well outside of the normal selling season. It sounds like a dumb thesis but never underestimate people. Thanks Wolf for sharing a more real time data set than Case Shiller to watch this unfold nationally.

Mortgage rates, which is the only rate the matters for the housing market, have already PLUNGED. In terms of mortgages, those rate cuts are already here. Mortgage rates were nearly 8% a year ago. They’re now 6.15% as of today.

And yet, demand for mortgages has collapsed and sales are down massively, despite the huge drop in mortgage rates.

It really feels like enough inventory suddenly accumulated and now the scarcity mindset is gone, and the focus is shifting to not overpaying. Thank the NAR for that or the Nasdaq rolling over or more likely time x restrictive rates. That said, the behavior of people continually surprises me.

They will plunge much more and we will see 3% mortgages again.

Mark my words.

That kind of thinking is precisely why home sales have collapsed despite much lower mortgage rates. Buyers and sellers are waiting for the 3% mortgages to return. “Waiting for Godot” comes to mind.

When you group metros like Phili and NY, which share workforce due to commuting times and affordability vs one or the other, things start to have regional patterns. Labor is returning to the cities and exiting the pandemic vacation/retirement markets, which are mostly walking sideways from the slow drip exit.

“Labor is returning to the cities”

Given how crazy rush hour traffic has been lately, this makes sense (anecdotally).

If only this were true. Citiots continuing to flee NYC and gobble up Upstate NY RE. They drive like Stevie Wonder on amphetamines and complain in the FB parent groups that the schools aren’t accomodating enough to their kids’ sense of entitlement and feelings. I’m no longer sidelined just by NY prices, but desire to not be housebound to NYS. Lots of locals selling to move somewhere sane.

The range that you can live away from the office with the remote work as expanded where we can all live. I’m seeing this in terms of Vegas, Phoenix, Tucson when it comes to working in LA/California or San Francisco. I’m also from Washington DC, so I see the same behavior as people move further away, such as living in Richmond Virginia while they work in Washington DC. They’re taking their pay with them, and commuting to the office once per week, or month.

You can thank the corrupt Fed for this shtshow of booms and busts.

Man, you should have seen the shitshow *before* the Fed.

You can honestly look at the above charts and the damage the Fed has done over the years and still support the Fed? No wonder this country is in trouble.

A big part of the “trouble” is that you, and other ninnies, do not know the history of banking and why the Federal Reserve was created.

We can probably agree that the Fed fulfilling its original role as lender of last resort isn’t such a bad thing. But we definitely don’t want them to do QE ever again; that was a bad thing.

Hownow.

Yes, I do, you dolt. The prblem is you and your greed are perfectly fine with the Fed and it’s corruption. And you and your ilk are voting unfortunately.

@HowNow,

Yeah, we DO know the financial history of the US before the Fed, almost no inflation, gold standard, frequent busts but much larger and more frequent booms, much faster growth. The Fed presided over, and many financial historians believe, contributed to the Great Depression by tightening money supply. So don’t try to claim the Fed has been a net positive, it’s pretty much all negative.

Happy1, get into the way back machine and enter in the late 1800s. Be sure to land as a plantation owner or one of the railroad magnates, otherwise you might end up sleeping in a cardboard box.

And bite hard on that gold half-dollar because you might be holding a piece of lead.

But, before you venture out there, check some historical records to make sure that the bank you may use to deposit your money in isn’t one that will go bust in a few years, where you lose everything you’ve worked hard to save.

And buying a house: you get interest rates adjusted monthly and the bank or any bank may not renew your mortgage and give you a 30 day notice of that instead. How about that 50% down payment.

Ah yes, the good old days.

One more thing: looking this up… the “middle class” in America only came into existence around 1890. Before that it was upper class and a lower, very poor class. At the turn of the century, the middle class represented between 20 – 30% of the population.

Yeah, the Fed makes big f*n mistakes. But, if you were seated at the table when Henry Paulson helped decide to offer gobs of liquidity to prevent a further melt-down or complete banking collapse… what would you have done, besides sweat like a hooker in church? These were panic-laden moments. Each black swan event in economics is an unexpected shock, and we’re just lucky that the whole system didn’t implode.

Looking back on the pandemic now we can second-guess the situation. Not so back then.

It’s easy to be a cynic. Personally, I think the Fed governors are trying to be honorable, most of the time. That’s not to say that they don’t f*up in tough circumstances.

@HowNow,

You’ve cited a bunch things that are better now than in the 1800s like FDIC insurance and the development of the middle class and 30 year mortgages.

Those things are all great.

But they have nothing to do with the Fed.

And you ask what I would have done in 2009. I don’t know.

But I know for sure I would have allowed congress to perform it’s legal function and written a law to give structure and limits to anything I thought was useful before just doing it.

And I would have unwound whatever it was within a year or two, and never repeated it, instead of growing it so much that 15 years later, we still have it.

And continued, your comments about the middle class and the Fed are extra ironic.

Who benefits when interest rates are held below market value for 15 years?.

The wealthy asset holders, and more especially, hedge fund and private equity owners and investors who leverage their investments.

Who loses when the cost of a starter home triples and groceries cost 30% more? The middle and working class.

The Fed is increasing income inequality.

But also hyper-credulous buyers who succumb to serial manias, no? And/or the parents of said cohort…

The uber-credulous FOMO buyers, to be sure. Many of whom are probably first-time buyers.

Less so the parents because they are more likely to have first-hand experience with the 2008 – 2012 bust. That experience may have included observing friends and/or family going “underwater” on their mortgage loan. Not a pleasant experience and could easily happen again.

One item to consider. Suppose it is 2012 and a friend is pitching you on the idea of investing in real estate. They show you a projection chart of future home values and it looks like, say, Denver’s chart above. Would you have believed them? Or would you say it looks ridiculously over-optimistic? As other posts have noted, the severe upward slope on those charts is sobering.

Only with substantial Fed/government involvement can a market get so far detached from economic reality. I still don’t think these price levels can hold in the long term. But these highly inflated values have had more staying power than I expected. Seems like a delicate balance though. One black swan and *poof.*

I think you have that right, CitM: “poof”.

That’s the sound I heard when the last black swan arrived.

“Only with substantial Fed/government involvement can a market get so far detached from economic reality. I still don’t think these price levels can hold in the long term. But these highly inflated values have had more staying power than I expected. Seems like a delicate balance though. One black swan and *poof.*”

What’s that saying goes? The market can still be irrational longer than you can stay solvent. Combine that with don’t fight the FED…I think that can provide the case that these price levels CAN hold in the long term, unfortunately, couple that with people buying into housing like first or second religion, the odds of reversing significantly it’s not looking good

Yes, the crux of the matter, affordability. The problem is that the asking, and accepting prices are too high. Most people can’t afford the monthly payment.

Cheap QE financing at work.

This indeed is a very screwed up housing market and the charts made me think about The Tulip Bubble, regardless of its ancient cliche.

Each of these post-pandemic cities with housing bubble prices— must be the equivalent of price patterns for various tulip bulb varieties, somewhere in Holland.

The frequent past reference to mass consensual behavior — or whatever the social phenomena is termed — evolves to a point, where insane behavior is normalized and acceptable — venerated, as being the new normal.

As I was reading up on tulip history, it was interesting to note the influence of spare or excess cash within that region:

“ The expanding interest in tulips coincided with an especially prosperous period in the history of the United Provinces, which, by the 17th Century, dominated world trade and had become the richest country in Europe”.

I think it’s interesting that the pandemic came about at a time when stocks had been doing well and home prices had been drifting higher. Although a recession seemed possible in early 2020, the wealth effect had helped build a tsunami of nest eggs — the gains from the post GFC were massive.

Then, the pandemic hits and a tsunami of stimulus floods the globe — resulting in The Everything Bubbles. Four years later, theses bubbles have been normalized into acceptable dynamics — that are extremely fragile, because as with tulips, there was a point in time when speculators couldn’t afford to make bets — and here we are, with housing charts that look insane!

“And then, overnight, the tavern trade disappeared. In early February 1637, the market for tulips collapsed. This was because most speculators could no longer afford to purchase even the cheapest bulbs. Demand disappeared, and flowers tumbled to a tenth of their former values“

Surprised to see Honolulu make the cut (though also dismayed, but that’s a different story). It really does seem like the bubbles were deflating in 2022, but were re-inflated by BTFP, and not just letting the banks fail and the natural processes play out.

I like how this new data set has actual prices and not just index values. Now with those home values, it would also be interesting to see home values / median income for each area, to gauge which are the frothiest of all the bubbles.

“Letting the banks fail”. “…natural processes play out”. Simple enough. I guess you won’t mind if all of your assets go to sh*t, your money in all accounts go to zero, and you search out a place to sleep for the night.

Fortunately, only unimportant people lose their jobs, homes and accumulated wealth.

They could have just let the FDIC do its thing. The depositors would have taken a minor haircut and life would have moved on.

Agreed. And if short term treasuries stay high then don’t even have to worry about FDIC limits as can park there as short term savings accounts essentially.

In March-April 2023, they DID let the banks fail, and those banks were liquidated. And bank investors (shareholders and preferred stockholders) lost everything. They were bailed in.

What they also did was make all uninsured depositors whole, instead of forcing on them a 15% or so haircut on their deposits.

Because some billionaires had some money on deposit at these banks especially through the VC firms they owned and the startups they funded, it could be considered a billionaire bailout.

Wolf,

I think it was much more about the perception than the actual amount. The gov’t stepping in and giving money away (again) just showed everyone that the gov’t will never let the market go down again.

They will bailout banks, start up QE, and fire up the money printer just like during covid if something starts going sideways. Will they? Who knows. But the BTFP kind of showed everyone to speculate and be irresponsible since Uncle Sugar will always be there.

“The gov’t stepping in and giving money away (again)”

I agree. The gov’t already has an agency to deal with bank failures – the FDIC. Why the need for even more intervention? Just let the FDIC do its job.

Well the people in state government in Hawaii don’t want the “trash” coming to the islands and one way to do that is to try and keep housing costs high.

Higher house prices also mean higher real estate taxes and more income for those in government to waste as well.

There appears to be a level of incest between those in government and those running the hotel businesses in Hawaii as well as shown by the new, strict laws regulating short term stays in condos along with increasing taxes and fees on those type of properties. This forces people into hotel rooms and allows higher prices to be charged for these rooms. Look at the change in revenue per room over the past 5 or 6 years and you’ll see the proof.

Those that used to rent the cheaper vacation condos for longer periods of time (lower income levels) can no longer afford to pay those ridiculous per night hotel charges and no longer visit Hawaii.

The other big change to Hawaii has been the huge fall in the number of visitors from Japan. This is a result of the fall in the value of the yen combined with the higher accommodation costs. The other factor is the appearance of Hawaii not being as safe as it used to be along with numerous stories of single Japanese women being refused entry to the islands in the Japanese press.

So far that fall has been made up by increasing visitors from mainland USA and Canada, but one wonders what will happen when the USA hits some kind of economic problem.

300% plus appreciation in California since 2000 says everyone at that poker table is a winner. Immigration has yet again reset the bottom labor pool. Gen Y and Gen Z will get there pick of the litter as wealth transfers take place among the upper 20%. Tech will continue to drive some cities as the major hubs will provide great jobs, Asset ownership has catapulted many since 2020. Live, work, and $YOLO continues.

“says everyone at that poker table is a winner”

Except the hundreds of millions of people who held USD in savings accounts whose interest rates were destroyed in order to make such RE doomed-booms possible.

Isn’t that the ‘at that poker table’ part?

Casinos aren’t usually allowed to “recruit” customers at gunpoint.

This reminds me of that scene in The Big Short when the professor explains hot hand fallacy to Selena Gomez. I am sure that only applied in 2008 and not this time…

I live in central Austin and the market is definitely cracking. Yes, it’s down to 2022 levels but it’s going to keep diving – it doesn’t have a choice.

With Dell, Google, Facebook, Tesla, etc all laying off thousands of local employees, the demand for upper middle class homes is going to get crushed. The demand is simply gone.

And wage softening is a big deal too. People who were hired during the COVID boom and then got laid off are not getting hired back at 2022 salaries/wages. Period. Less jobs at lower wages equals less demand for hefty mortgages (regardless of interest rates).

The constant, steady drumbeat of technology innovations (via the likes of AI) is akin to the tiger eating its tail. The tech companies are creating efficiencies and destroying their customer base at the same time.

If I create something with limited human involvement in the short term, then who has the money buy it in the long term? That’s what is happening. No cushy job equals no cushy house.

A few years ago the air throughout Central Austin town was tinged with the smell of freshly ripped pine boards and porta-potty cakes, byproducts of house horny millennials, armed with supple down payments from their boomer parents.

Today, there is a sense of nascent sobriety replacing the mania. These shifts & jolts are remarkable to behold. Human/market behavior is fascinating, vexatious and also just real dumb.

Here in south Austin, it’s even worse than that. It’s been a thing aroind here for developers to buy a SFH on biggesh lots from the 1950s., demolish it and put 2 or 3 new houses on the same plot.

A ton of these new houses are for sale all around here now with no takers for months and even more astonishing, is that some of these demolitions and rebuilds have now stopped halfway in their tracks. One nearby is all framed and sided with windows and doors but no shingles on the roof, just plywood. Blue tarp was put on the roof to protect it months ago but it’s now ripped all over and water enters the home each time it rains. There’s been no activity on the property for months.

A couple other new houses a few streets away are the same way. Halfway done and rotting. It’s like the developers couldn’t sell the houses they already completed and now have no money to finish their in flight projects which are now rotting in states of half completion.

Whiffs of the GFCs ghost coming back to haunt maybe, I remember parts of northern California like this in the late 2000s. It’s scary.

Thank you WR for taking time and effort to gives us a fresh data instead of lagging data .

Home prices need to go down a lot for them to be affordable.

Much appreciated

Here in Cleveland houses are sitting longer but still selling near all time highs. Mostly those in the suburbs that are under 350k. A friends house just went 50k over asking, no inspection, 2 days after listing in a C neighborhood. Other listings are sitting for months with substantial price cuts.

For a family looking for a decent school system though, youve got to pay up. Property taxes just got reassessed and are honestly astonishing taking into account local incomes. I predict even cheap cities like Cleveland will get a lot cheaper.

Crash is not happening. Unlike 2008, the current housing price is due to inflation, not speculation. I remember in 2007, my wife, who did mortgage loans, told me that everyone with a pulse can get a loan. The current price, inflation adjusted, is not any higher than 2007, especially in markets like Chicago.

The err logic in your post makes my head hurt!

Typecheck,

“The current price, inflation adjusted, is not any higher than 2007, especially in markets like Chicago.”

You don’t know what you’re talking about.

Chicago is up 202% since 2000 (see the table of the Chicago section). CPI inflation since 2000 was 86%.

Chicago is up 100% since 2012. CPI inflation since 2012 was 38%.

But there was some deflation between 2006 and 2012, LOL.

And Chicago is practically tame compared to some other markets here. Miami, San Jose, San Diego, and Los Angeles are up about 340% since 2000. CPI is up 86%.

Just a rounding error…

Inflation adjusted from when? 2007 or 2012? Looking at the Chicago chart in the article it makes a big difference when the inflation adjustment applies.

To be clear, what I’m trying to understand is if you are saying the prices now are, inflation adjusted, the same as 2007? There was a crash after 2007 so why would you categorically exclude the possibility of a crash now? On the other hand, if prices have tracked inflation from the bottom in 2012, I think you may have a point.

Rojo:

Wolf gave us two comparisons in his comments.

One of price vs. CPI from Y2k thru today, another one 2012 through today.

In both the home price appreciation has outpaced the CPI inflation index.

For any other comparison you can pull up the chart of USCPI and divide any asset price by the index value at any given time.

I find the major indexes “adjusted for inflation” to be interesting: the S&P and NASDAQ have both (barely) touched new inflation-adjusted highs, while the DOW is just below.

These are (potential) reasons to argue:

1. markets will continue to grind higher as the only alternative to hedge against inflation

2. The real demand for equities is not enough to put in a substantially “higher high” relative to inflation and capital is rotating into alternative assets (Gold, RE, ???)

Denial… ain’t just a river in Egypt anymore

From the Texas Dictionary: “Cheer”: Adverb: “Cheer” is used to describe the location of a person, place, or thing, and is often used after a verb or preposition. For example, “Put that bucket right cheer”.

Household balance sheets (on average) are as good as they have been in several decades.

1. Low debt to income

2. Mortgage debt locked in at low interest rates

3. Debt growth also has been reasonable

In this cycle the US government has absorbed all the risk and debt. One person debts is another person’s asset. So government debt is assets of private sector.

The more public networth becomes negative the more private network becomes positive. Also high levels of government debt become stimulative to the economy. The US pays out 1T in interests.

This stimulus will be in affect till taxes are raised to reign in deficits…..

Sorry but a long winded way of saying….no crash coming. This is going to be a slow grind to normal real estate prices. Death by a thousand cuts.

Uncle Sam is the most drunk of all the deckhands.

I think hoke prices would go down a lot with job losses and recession .

In my field of work .. high tech the job losses are plenty and job market is quite tough

This is just anecdotal evidence .

Workers at the lower end of wage spectrum are doing well and in shortage.

But it is difficult to buy a home in coastal ca with ,$25 / hr job .

My company did 5th round of layoffs in last 2 years like google Microsoft Amazon etc.

The straightforward numbers tell you the situation is exactly the opposite of what you assert and the housing prices are due almost entirely to mindless idiotic speculation.

The CME’s Fed Watch tool made a big shift late this afternoon signifying a much higher chance of the Fed cutting by 50 bps next week instead of 25.

A rate cut of 50 would be insane, but I don’t rule it out. It’d send gold soaring, along with BTC, would likely send resi RE higher, and would help CRE, too.

Worst of all, a 50 bps cut would bail out all of the VC and PE investors who’ve been stuck 2022 because of nonexistent “exit liquidity” (due to dead IPO markets that need a lower funding rate.

If the Fed cuts by 50 bps the VC players can write larger checks to Kamo in time to help sway the election.

That would be absolutely terrible, but it’s absolutely possible from Pusillanimous Powell.

The word is: next month’s CPI will tick down because oil prices are falling and China is exporting durable goods deflation.

Byron Allen sold his Aspen Colorado home last week for $60 million, more than double what he paid for it four years ago.

A 50 bp cut . . . while shelter CPI is still increasing!

Pusillanimous Powell is his name.

“The CME’s Fed Watch tool” … CME federal funds futures, which this tool tracks, are nearly always wrong. No one should take them seriously. There are wonderful hairy charts out there about how wrong it has been over the past decades. Hilarious.

So, are you saying to apply the George Constanza or Jim Cramer method and do the opposite with the CME Fed Watch tool?

Powell, in case you don’t know, is a REPUBLICAN appointed as chair of the Fed by Trump.

What is really hilarious is that Tbv3 thinks the same thing The Left does about Powell – that he’s biased in the other direction.

If Powell were making decisions based purely on politics favoring the left, he’d have already dropped rates instead of waiting to the last minute.

I am no fan of the cabal comprising the Federal Reserve Board, but this article is an interesting take on Powell:

If those charts were related to stocks, they would be screaming Sells!

If you want a laugh, just look on Zillow and see what 1M gets you in San Diego. I lived in a number of questionable hoods as a college student there but it was relatively cheap decades ago although not always safe. Now you can live like I did as a starving college student for a mortgage payment that is probably 10x or more what I paid in rent. Is this a great country or what?

Then don’t move to San Diego. Move to Tulsa, where you can buy a decent house for $250K. And that’s up by about 100% from a few years ago, LOL

Healthy cities have housing options for all types of residents. Just look at all the high COL cities closing schools and experiencing worker shortages in healthcare, construction, and other critical skills.

10% of the children in San Diego live below the federal poverty line. Their families should just pick-up and move to Tulsa because current residents want to ban new housing? Enough of this.

I agree it’s crazy. The housing market is NOT healthy.

neither is the stock market. trading at zirp/qe valuations when rates are above 5% and qt is continuing is not healthy.

Yes. Exactly. Just pick up and move if something isn’t working. Better than taking it and doing nothing. Funny thing is I was born in LA and moved 35 years ago to New Mexico because I thought it was too expensive. Living like a king now, literally two minutes from work with a single stop sign in between. House is paid off.

I constantly read comments on the internet of excuses why people will not simply move. I don’t get it. My guess is people are really afraid of change so they make excuses to stay.. there are no jobs, people are this or that, weather is bad, blah, blah, blah.

I remember the first wave of SoCal money that started showing up in the 90’s. So full of entitlement and demanding to be treated like kings. They immediately set about tearing their new communities apart and turned them into a thousand mirror images of the place they left.

But yeah, everyone else was just too lazy to be born in the top equity market in the world.

“Move to Tulsa, where you can buy a decent house for $250K. ”

And you may get featured on A & E cable channel which has a show called 1st 48 hours, about homicides in various US cities. 1st 48 hours has had a dozen shows filmed in Tulsa. The crime is out of control there. They need to do some shows here in DC. Crime is out of control here as well.

Capitalism has worked because people constantly vote with their dollars. If things got expensive people stop buying it and force the price down.

But in recent years, Fed has exercised its majority vote. The usual capitalistic adjustment process is broken. People are gripped with FOMO…..now what is unaffordable is more desirable.

Years of low interest rates and easy monetary policy– before covid and after covid– have created inflation, asset bubbles everywhere, tremendous loss of buying power of the dollar and a correlating increase in the cost of living. Home price charts look like Mount Everest, just like the stock market, although the stock market bottomed in 2009, and home prices didn’t bottom until 2012. Everything will go down again as all bubbles must eventually burst. I am certain that stocks will go down again, because stock valuations make home prices look reasonable.

Flat housing prices through 2030 as wages catch up and mortgage rates stabilize will feel like blessed relief to buyers waiting for their chance, subtle disappointment to owners hoping for a retirement fund bonanza, and crushing defeat to speculators who bought on margin and couldn’t even beat T-bills.

Maybe after twenty years of insanity houses just become houses again. A place to live and maintain that you sell for a bit more than inflation once you’re done with it. But only if the Fed keeps their grubby mitts off the MBS market from this point on.

“Maybe after twenty years of insanity houses just become houses again. A place to live and maintain that you sell for a bit more than inflation once you’re done with it. But only if the Fed keeps their grubby mitts off the MBS market from this point on.”

Never say never but I can’t imagine in my lifetime this will be a thing barring any existential threat to human civilization…once again hope I am dead wrong on this…

Phx: “barring any existential threat to human civilization”

The existential threat is this: the financialization of everything.

There’s no UN-financialization. No undo button. The memo has been sent.

The tippy tops of manias are generational and cyclical turning points. See above comments about the necessary introduction of the Fed reserve bank (and the 20 years of financial history that followed). Unraveling, legislative action, demographic shift, war… some, all or none of the above.

“disappointment to owners hoping for a retirement fund bonanza”

No disappointment here. My roof doesn’t get smaller even if my house is worth zero dollars in resale value. My walls still keep me warm at night.

Personal experience hunting for a house in DC for about a year. We just bought.

-Prices are stagnating a bit and drop quite frequently

-No fights over houses

However, if its a good house at the right price they go very quickly (1-3 days)

Picture is a bit different in Arlington. Most move there for school districts and any decent house goes within a day or two with multiple bids.

There is definitely a shortage of good housing.

Hi Wolf. I’ve been out of the loop, wasting my time brainlessly on X. But have you seen the Central Appraisal Districts fraud issue raised by a RE developer Mitchell Vexler of Mockingbird Properties? Interesting story, in short he has claimed to have uncovered massive property tax appraisal fraud and database #’s manipulation by school boards influencing CADs to jack up appraisals for tax revenue throughout TX, and it seems to be much more widespread issue affecting other states. Quite muckraking, but he does appear to have the receipts. Curious of your thoughts.

DM: Fresh Boeing crisis as 30,000 workers prepare to strike after rejecting 25% pay rise

The strike at Boeing’s West Coast factory will halt production of the planemaker’s strongest-selling jet as it wrestles with chronic output delays and mounting debt.

Meanwhile medical professionals received maybe a 3-5% raise since the pandemic.

They want more than 25%? Wow

Medicare has CUT physician pay for most of specialty medicine since the pandemic.

The union is asking for a 40% pay raise. I wonder if the union workers have heard about a certain Chinese plane…

No we haven’t! Insurance costs have gone up but ppl contracted with insurance have seen declines! We are not getting the increase that ppl are getting with their insurance rates. Medical professionals who are out of pocket, yes. Contracted professions, a no.

MW: Treasury yields drop as traders put biggest Fed rate cut in 16 years back on the table for next week

The casino got to live on….gotta say WS is putting some traditional gambling games like Roulette (betting on black or red) to shame, the latter feels like a safer bet as you have 50/50 chance at least…

The only thing more absurd than these chart values, is the notion, that as treasury yields are dropping, as mortgage rates are dropping — we have the Fed preparing rate cuts, to stimulate demand.

We are told to ignore cumulative inflation from the past four years and accept the normalization of a weaker labor market — and apparently accept that these overvalued bubble home prices will rise far higher, because the Fed nailed it (in some bizarre way).

Each day makes less sense.

Everything up at all time highs after four years of brutal inflation and the fed thinks it is time to cut.

Make it make sense.

Hey Wolf,

Quick question, is the Sacramento Metro included in any of the markets? I feel that the capital flight from the Bay Area is causing an observable increase in the volume and construction of housing in that region.

They’re called “Equity Refugees”. Sorry to interrupt. They’ve ruined my town in Oregon.

Ditto.

You just don’t realize there’s a moral responsibility to abandon your community to make room for the money. The good news is that you can move to Tulsa and screw over the locals there. Then they can move somewhere else and do the same! Eventually, a bunch of families become homeless and move back to the city to live in a tent and serve the money. It’s win-win-win!

Sacramento is its own MSA and has its own chart, but I can’t post every chart about every MSA in the US. But forget “capital flight” from the Bay Area, that was a brief period during Covid. So here you go, and no, it’s not different.

Bend median is @$706k. Down from a peak of $775k. Yippee, just a couple hundred K lower and I’ll be buying a home.

I’m about 45 minutes west of you teetering on the East Bay Area. Houses here are in the high 800ks for a crappy cookie cutter tract home with a postage sized lot literally made from gingerbread drywall. When I first started working in this farming town 20 years ago, houses were 275k with a 2 hour commute and a population of 40k. Now the commute is 3 hours each way in and out, with all the houses being bought by people being priced out from the greater Bay Area and Tri Valley. Poorly run city government giving kick backs to developers to demolish the small town feel and create a new housing utopia or hellscape as original multi generational residents call it. Be careful what you wish for. Chasing the mighty dollar is not worth sacrificing quality of life.

Something that has always stuck with me over the last decade was in a blog I read before I found Wolf:

“It’s never a good time to buy an overpriced house.”

Can I request a perfect stock market week post please?

lol

Big Winna! (Slot machine sounds) 💰

And about 26 people are going to read it?

If it bleeds it leads!

Haha

On page 37 section b, we have a good report about the stock market… yawn

My thoughts: If the buyer strike can hold out for another 6-12 months we’ll see further supply increases and decent price declines for the following reasons:

– return to office

– people who moved away and held onto their old properties as rentals in 2020/2021 will hit the expiration of their capital gains exclusion (not tax advice, but my understanding is you need to live in the house 2 of the last 5 years to get the exclusion)

– decrease in travel and work from anywhere impacting airbnbs

– potential for a weakening economy to impact the stock market and thus people have less money, especially those who get stock based compensation

– if the stock market were to decrease an impact to the pyschological wealth affect, when people feel less rich they’re less likely to get into bidding wars and go 100K over asking and instead likely to be more conservative

However, if everyone jumps off the side lines for mortgages in the high 5%’s to low 6%’s and it’s enough to absorb demand then the status quo for pricing is the best we’ll probably get. So I guess how good NAR’s marketing hype? I keep hearing buy now, because in Spring the prices are going to sky rocket thanks to rate cuts.

It is really hard to pin this housing market down. Charts indicate bubble….but

-Low inventory somewhat puts a floor under prices in specific areas. Not enough AIRBNB will go up for sale in decent school neighborhoods to move the needle for the middle class. Maybe in vacation area or a city center area an AIRBNB fallout would would hurt.

– Home Builders are doing well. Good backlog, increasing profit. In HB1, Homebuilders stocks and numbers started rolling over in 2007. Two years before the crash. We are not seeing any stress from the homebuilders. To me, that indicates there is not a surplus of inventory.

– Inflation in construction costs were higher than CPI the past 8 years. I think I read up to 90% So when you see charts adjusted for inflation, they are adjusted per CPI and not construction inflation which has run much higher. Construction Inflation adjusted charts would not look as bubbly as CPI inflation adjusted charts.

Things that may help with a soft or no landing is….

– Lower rates

– Energy prices are historically low

– The US is exporting energy and technology and food. These are economic drivers that are slowing down.

– Government spending more money. Such as subsidizing home buyers and home builders for affordable housing. LOL We can call it Inflation Reduction Act 2. IRA was to lower medical prescription and IRA 2 can help reduce Home Purchasing costs.

But if we have a hard landing. Recession. Government does not step in with a stimulus. Housing prices could go down a lot.

Despite historically low i un employment rate and healthy wage growth, the home sales volume has crashed, not the price though.

Just think what would happen if a recession comes with huge job losses.

With regards to Airbnbs, I think it depends where you live. Denver has one of the highest concentrations of Airbnbs in the US. Lots of single family homes in good school districts are now Airbnbs or LTRs. They were not pre-2020.

It’s clearly a bubble, but what keeps a bubble going everyone’s belief that it will continue to go up so you have to get in now. Despite an “affordability crisis” if people want to buy they can find a way. Rate buy downs, interest only loans, etc. People watched a lot of people get rich coming off the bottom of the 2009 market and are convinced housing doubles every 5 or so years.

The only thing that has made buyers pull back now is waiting for lower rates….

Economic weakness would also do it IF we got some.

RU82

The US used to export food, but due to the trade war with China that stopped in 2018. The current agricultural trade deficit is 32 billion.

Yup, the US is now unable to feed itself.

Just wondering, what the heck do we export besides $100 bills?

“The US used to export food, but due to the trade war with China that stopped in 2018.”

LOL. Such an idiotic BS lie. How stupid do you think readers here are exactly? We report annually on trade, including in food exports.

“Yup, the US is now unable to feed itself.”

LOL. Such BS.

US food exports soared and hit a record in 2022 of $195 billion, up from $145 billion in 2018 (the year you cite as “since”) — consisting of a record $120 billion in bulk products and $75 billion in high-value products.

Total imports rose to $199 billion in 2022. So the deficit overall was $4 billion – on a rise in imports, despite the surging exports.

Trade goes by food category. The vast majority of what the US imports fall into a few categories: fruits (from Mexico) and tree nuts, sweeteners, manufactured sugar and confections, manufactured beverages (wine, beer, etc. because some Americans insist on buying imports instead of enjoying the best in the world made in the USA, but origin is a choice not a need), manufactured milling products from grains and oilseed….

In 2023, prices of commodities collapsed, and exports fell to $174 billion, and imports fell to $195 billion (prices of imported wine, beer, sweeteners, manufactured sugars & confections didn’t drop, but bulk commodities prices collapsed). So the deficit rose on dropping imports and dropping exports.

Exports in dollars fell since prices of bulk products the US exports of lot of fell more, and the gap widened. Not rocket science.

If Americans switch to the best wines and beers in the world, made in the USA, instead of imports, and cut down on sugars, sweeteners, and confections, the US would have had a surplus in food.

So the US has huge exports of food and can “feed itself” just fine. But people are free to make choices as to where they want their wine and beer be manufactured and how much sugar and sweets they want to stuff themselves with.

For your edification:

https://www.ers.usda.gov/topics/international-markets-u-s-trade/u-s-agricultural-trade/u-s-agricultural-trade-at-a-glance/

Government not step in with stimulus during a recession? Ha! I don’t think anyone in DC could refrain themselves.

Thank you for this @Wolf it’s great to have access to data that’s recent and thus actually relevant!

@Wolf how much of sitting on the sidelines do you think is tied to the new NAR realtor commission rules? Do you think people are watching and waiting to see how the buys realtor will be getting paid?

Or waiting for a potential $25K tax credit based on the election results

A translation of your article in a few short sentences: The housing market is screwed. The orgy in housing is over and the Fed can’t manipulate this market any further. Housing Armageddon is up ahead. Prepare yourselves for a crash landing.

Oh, by the way – seat belts in airplanes DO NOTHING. They only make sure you’re strapped down when you get blown to pieces. Seat belts won’t save homeowners.

Seatbelts keep you in your seat when the plane hits an air pocket, thereby it prevents you from hitting the ceiling and breaking your neck.

Not true, many think and maybe they are right there’s no landing this time, Pow Pow did it, he avoided any type of landing and we refuel and heading back to the moon again…

and if there’s any landing, it’s ultra plush, land right in front of a resort type of landing..

Don’t be so hasty.

In my hood, prices increased by 100% in last 4 years. Now down by 0.6%. here is no crash/Armageddon coming..

Obviously that is just vapid manic speculation and not ‘inflation’ at all over the last 4 years.

I just noticed that in Europe that inflation hit a low of 2.6% this summer and is at 2.8% now. This is down from the peak of 11% in Oct 2022.

Debt to GDP has dropped too but total Government debt has risen from 14.4 trillion last year to 14.9 trillion. Debt is still increasing but somehow, debt to GDP ratio dropped from 86% to 82%.

What is interesting is ECB just had its 2nd rate cut yesterday.

“The European Central Bank (ECB) cut interest rates for the second time this year on Thursday 12 September. Euronews Business asked the experts how it might impact your personal finances.

On Thursday, the ECB reduced its interest rates during its September meeting for the second time this year with the new rates set at 3.65% for main refinancing operations, 3.90% for the marginal lending facility and 3.50% for the deposit facility.”

These charts show exactly what the FED has done – created a rush into all asset classes as they print money and destroy the value of the dollar. Unfortunately for those living paycheck to paycheck, there is no way to “rush into assets” as they don’t have a pot to piss in. It’s a rigged game in one of the most corrupt countries in the world.

There’s a ton of things I don’t get with this housing bubble— like, lumber people saying things are good, home builders saying things are good, especially with innovative financing — essentially big home builders are banks that finance construction projects — land developers doing fine, construction labor reasonably ok — but in the other hand, stories of inventories headed higher, price cuts and increasing consumer stress, at least for those that aren’t wealthy,

It’s not exactly a story about a housing correction or even slow down — yet, here are the glorious bubble charts that scream there’s an affordability disaster.

As the Fed cuts rates and efforts are made to stimulate housing, how does affordability play out? Homes in many areas are still rising as wealthy people continue to shop for dream homes — as if their wealth mirrors a new nividia paradigm, where there’s definitely winners and losers — with vast majority losing big time.

Double jeopardy comment—

The absolute main thing I’ve always thought will derail the housing bubble is incomes not being able to sink with home costs.

The affordability aspect of this remains as a structural reality — that has to have a ceiling. Income through labor wages is not going to push prices higher.

We probably gave seen generational wealth transfers, with wealthy parents helping children buy into this bubble— but at this point, that activity probably isn’t a big driver for sustained price chasing.

With generational low levels of mortgage applications, it’s pretty clear that the average worker bees are not chasing after home prices that are significantly out of reach — so, we’re left with handfuls of retiring baby boomers who apparently have excess savings, who are willing to pay exorbitant premium prices to acquire pristine quality homes — I don’t think that cohort will drive the overall market higher either.

There will always be demand and supply, but at these levels, I don’t see how housing can remain in a growth phase much longer— if anything, the pandemic bubble illusion is going to become a patchwork quilt of bifurcation — which probably will be reflective of the bifurcated recession that’s drawing near.

The wealthy will be active consuming everything available while everyone else struggles with lingering inflationary hangovers. The overall shadows of deceleration and decline will overlap the buoyant brilliance associated with wealth and luxury.

This housing bubble also exemplifies the income inequality narrative and the various labor strikes around the globe, and the dissatisfaction working people have, with their inability to keep up with the super wealthy Jones’s — which is really a very ugly offshoot of pandemic inflation.

The housing bubble and these charts are a complex dynamic story that’s getting more and more tangled— with various workers demanding higher wages, that apparently allows them to chase after bubble home prices (driven up by wealthy speculators).

An example of wage deal just rejected:

“tentative proposal included 25% wage increases over four years, but workers said it didn’t cover the increased cost of living”

I think the real villain in all of this is the Fed — playing God saving stocks and pumping bubbles to a point where the economy doesn’t work. By not allowing markets to organically reset, we have multiple overlapping bubbles linked to a deficit that may eventually destroy our country — we have a negative feedback loop that’s like a nuclear meltdown in progress (headed into an epic disaster election)….

Well, that’s a rough draft lol — now I can read a book.

Of course the Fed via its interventions has broken several parts of the economy and capitalistic systems.

They are riding a tiger….it feels good but it is impossible to get off it. The way I see it they will have to choose one of the following

1. A steep/bad recession to liquidate all this and a quick return to healthy

2. A slow grinding economy for decade or more with social unrest and general unhappiness

3. Keep riding the tiger and a blow off inflation

The only unknown is productivity. If productivity improvements continues or accelerate then the Fed would have been bailed out.

Of course macro is impossible to predict….and who the hell knows what will happen

You forgot option 4:

Keep inflation just high enough to help chip away at the gov’t debt pile, but not too high to upset the population. Keep interest rates just high enough to prevent inflation from blowing out, but then lower them when inflation is close to target so it rises a little.

High inflation, high interest rates, and stocks and housing that trade sideways for the next decade+.

In my little slice of flyover heaven lower priced homes are not going pending a day after being listed.

Land buyers, and new builds are still keeping us “busy”.

Yea we are turning away business.

But that is due to worker shortage.

To many retires…no youngsters wanting to do the work.

Raised rates, reduced hours, enjoying life.

A price doubling over 24 years corresponds to only a 3% annual compounding. Would you buy an investment that returned 3% every year for 24 years?

Yes, if that investment also meant I no longer had to pay $1200/mo in rent to have a roof over my head.

20 and 30 treasury bonds have probably averaged around 3% the past few decades, pre-tax, and there has been ample demand. 3% annual interest and a place to house your family seems like a no-brainer in comparison.

I don’t blame the Fed, I blame the idiots that were bidding and buying cash ridiculous amounts, and they were not the only idiots, because there is more idiots, there is idiots still doing this.. Probably the Fed printed some money for them, but the didn’t print any for me.

The disparity is real. The Nation of California has the only charts with a 7-figure price on the left scale.

The deportation of equity to the “next California” is happening throughout the West. This is a big contributor to the price increase in my neighborhood. It’s not Tulsa, that’s for sure!

I wish we could be rid of the federal reserve and govt officials who appoint them because of the huge problems they cause for the country clearly shown in these charts. I think long term, their theory of interest rate suppression to supposedly improve job quality and employment is false and the truth will further show. They need to go on X if they want to promote communist theories instead of inflicting them on people in real life.

It’s nice to see so many people showing interest. I’ll give you my 2 cents. Yes the FED can and probably will rush in during the next big swan event BUT with 36 trillion in debt that strategy just gets the US into more and more trouble . Dont forget we also need to spend trillions on SS, healthcare and keeping all of our armed forces one generation ahead of the opposition capable of fighting two major wars simultaneously too. You have to think of money as just promissory notes. I’ll give you this many notes for that product. How many notes you need to give going up

and up over time is normal. A huge jump in how many notes you have to shell out in a short period of time is not normal. What the market is saying is, things aren’t expensive, it’s your notes (cash) that isn’t worth much so I, Mr Mr’s market need more of those notes to get the same thing. Sure supply/ demand/ transfer of wealth/ remote work all play a part but it’s your cash notes that are for shit. How did that happen? A mature powerful country and its people alway want more and more services and politicians get elected only when they give it to them, and the FED while not technically political is the right arm

of that situation. No pain, nope – never allowed. No pain no gain is not in the FEDs mantra. Will

The FED be part of a 60 trillion dollar debt situation in an unnaturally short period of time? Maybe. The pound sterling was king. The Brits even turned against Churchill after he almost single handedly pulled off a super human feat of galvanizing the people to fight the Nazis to the death when most in government wanted to basically negotiate which was equal to surrendering to Hitler and hoping that would work out . The dollar won’t be king anymore with that kind of debt. Then… there is nothing left, ot can’t work or be serviced and then remember the words of Ray Dalio ( not my favorite person but a student of history) has said , once countries fall from #1, they don’t move into 2nd place… they often go to 5th. Very complicit in some way, very simple in others. Also very sad.

I miss the old days where housing price charts were boring.

Would be interesting to see some of these graphs with additional information regarding average property tax rates. As an example, although Columbus looks fairly tame, you can rock a $15k property tax on a $300k house without too much effort these days.

Superlative post Wolf, and i don’t doubt the trend, but as it is always, ten years back, from the beginning, might have a hockey stick in there. Thanks for making this Keynesian mish mash make some sense.