Because prices are still way too high. So the Buyers’ Strike continues.

By Wolf Richter for WOLF STREET.

The new motto: Lower mortgage rates and too-high prices cause demand to wilt as potential buyers wait for still lower mortgage rates, lower prices, and higher wages – something that Fannie Mae also noted. This is the buyer’s strike in effect.

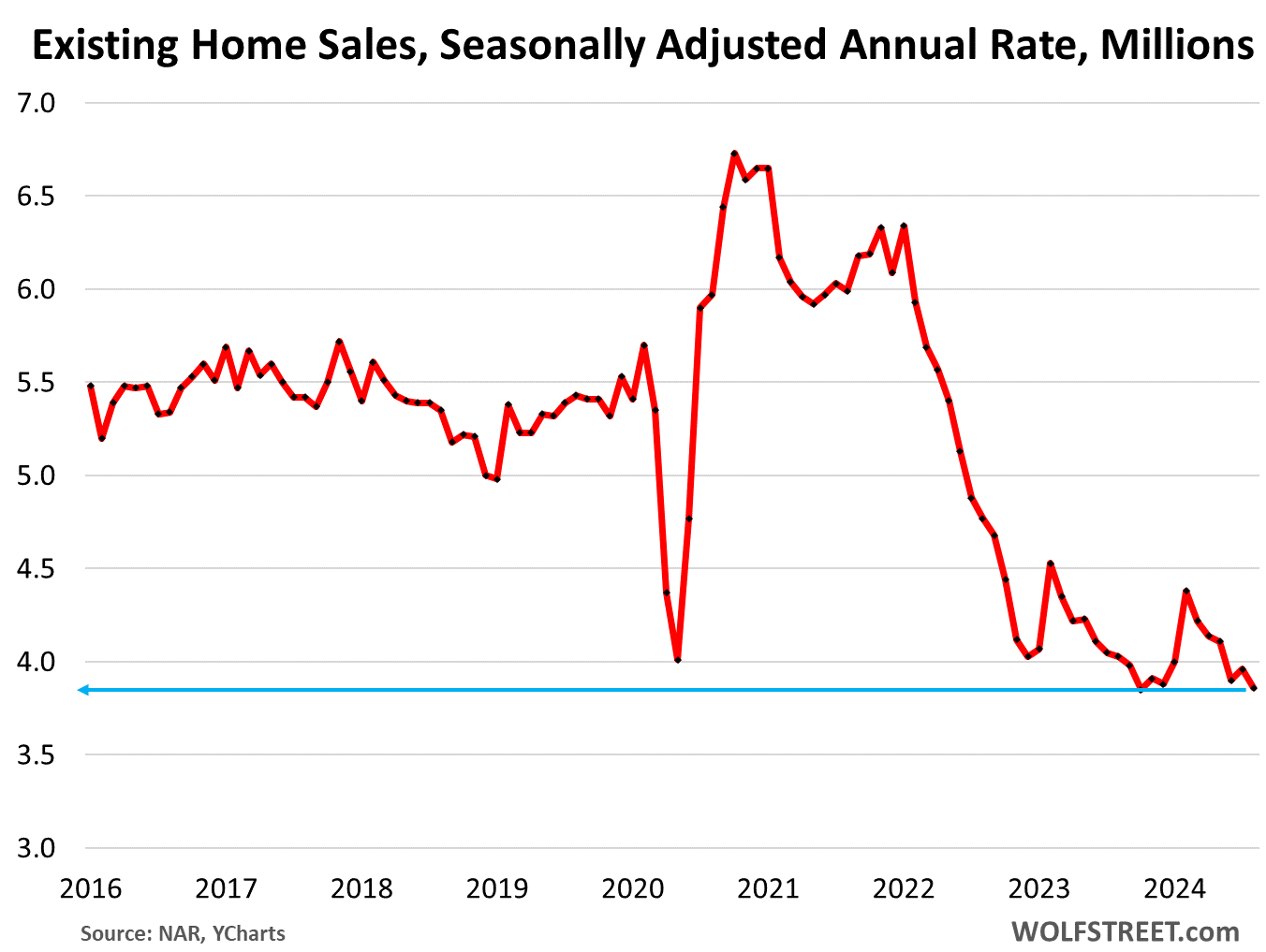

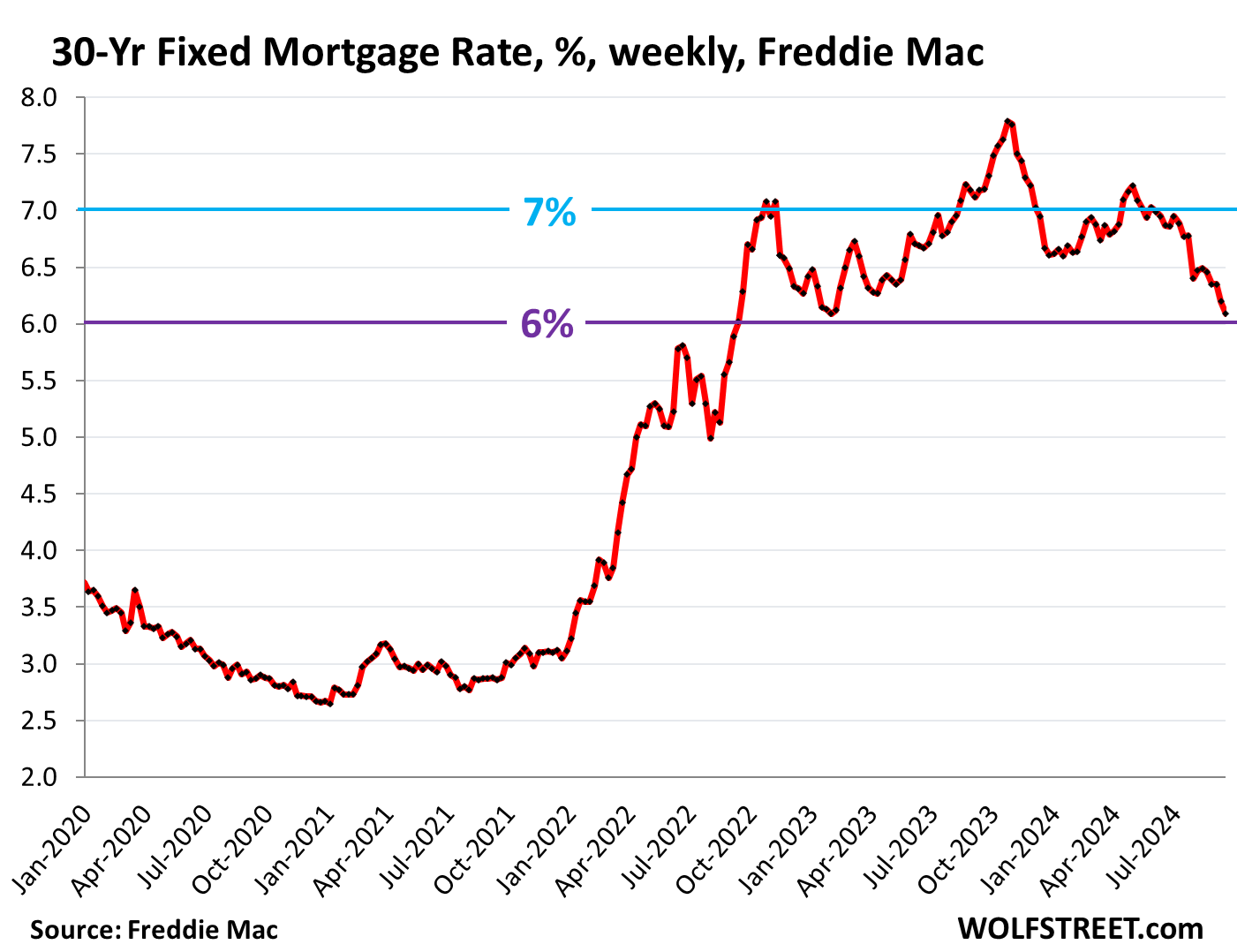

So, despite mortgage rates dropping to 6.09%, from 7.9% 10 months ago, sales of existing single-family houses, condos, and co-ops dropped further to a seasonally adjusted annual rate of 3.86 million in August, according the National Association of Realtors today.

Sales were down by 2.5% from the wilted levels a year ago, down by 36% from August 2021 and down by nearly 30% from the same period in 2018 and 2019 – these are the worst sales since the depth of the Housing Bust – while supply surged to highest for any August since 2017 (historic data via YCharts):

“Home sales were disappointing again in August, but the recent development of lower mortgage rates coupled with increasing inventory is a powerful combination that will provide the environment for sales to move higher in future months,” the NAR said in the report.

Alas, “the recent development of lower mortgage rates” isn’t all that recent. Mortgage rates started plunging in November 2023 from the 7.8% range and have now reached 6.09%, according to Freddie Mac today. Mortgage rates have plunged for 10 months and hit a two-year low.

But people are waiting for still lower mortgage rates, and lower prices, and higher wages – because prices are still way too high, after exploding in recent years, that’s the problem in the housing market – see our Most Splendid Housing Bubbles in America:

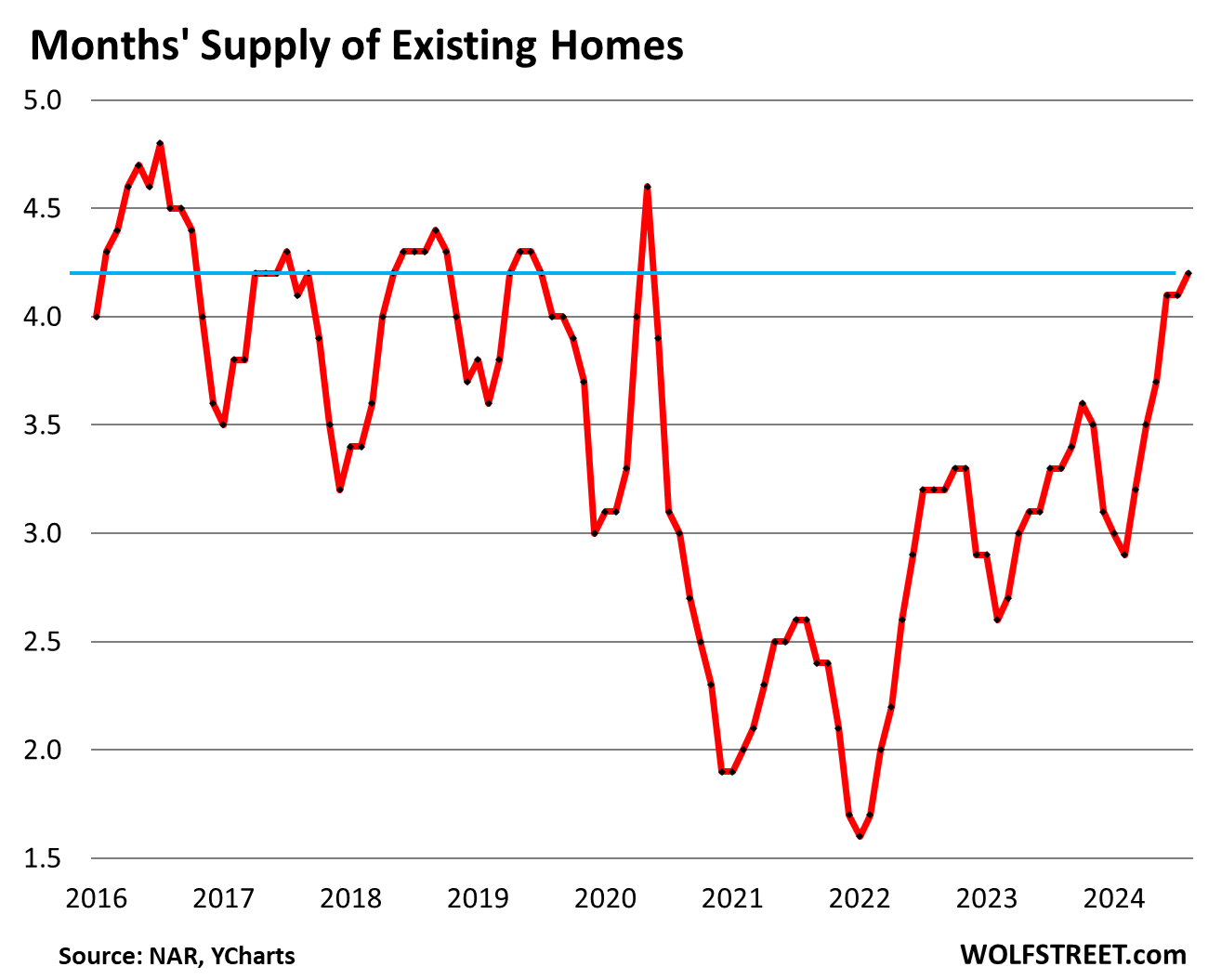

Inventory and supply rose to multi-year highs, as demand has wilted. Unsold inventory rose to 1.35 million homes, up by 22.7% from a year ago, and the highest since October 2020, according to NAR data.

Supply rose to 4.2 months at the current rate of sales, up 27% from a year ago, and the highest for any August since 2018.

The spike in supply in recent months is the result of the wilted sales and the rise in inventories of vacant homes that homeowners had moved out of some time ago but kept off the market to profit from the price spike all the way to the top; and now they’re putting them on the market without having to buy another home because they already bought one some time ago. (historic data via YCharts):

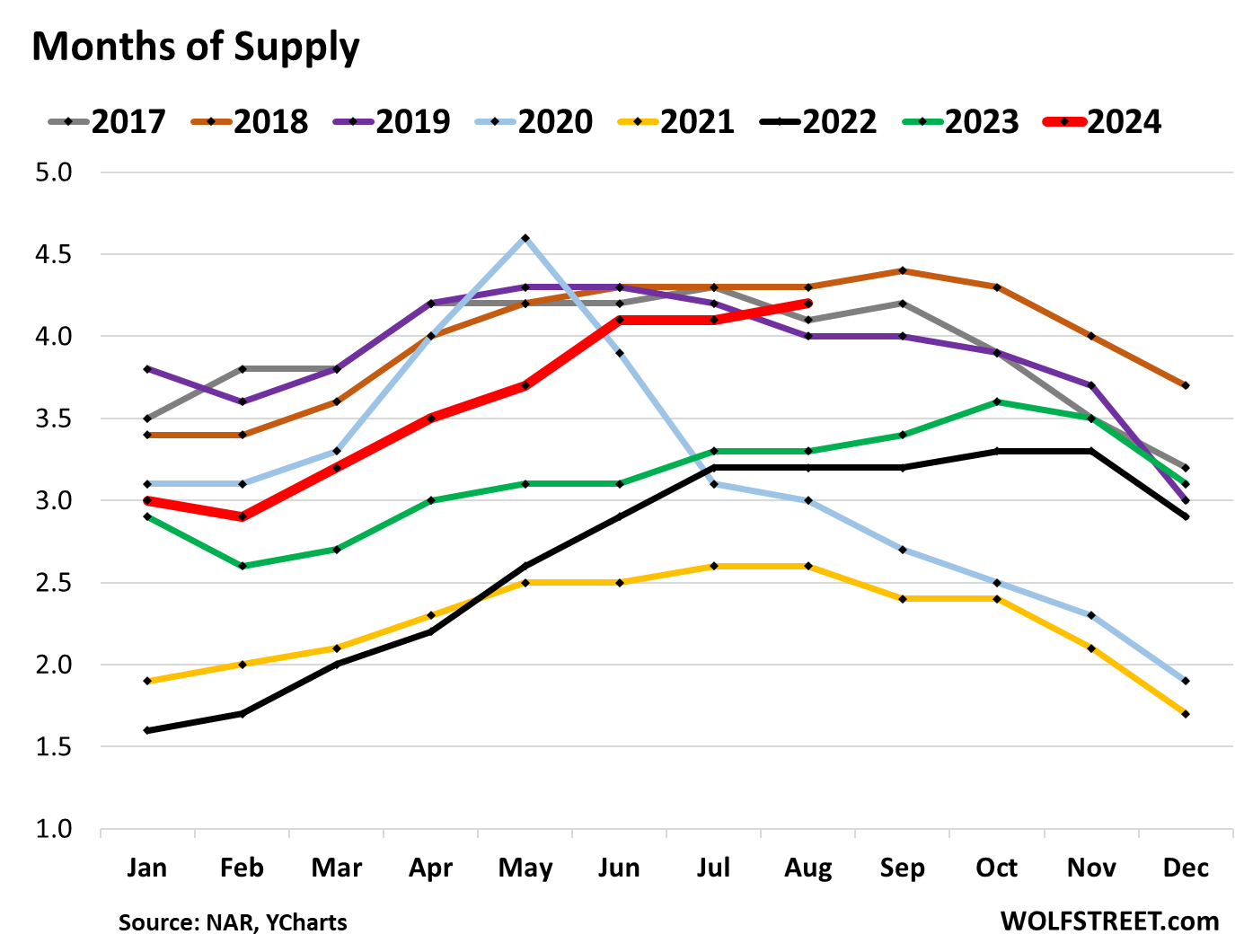

The stacked chart looks beyond the seasonality of supply. August 2024 (red line) was just a hair below August 2018 (brown line), which had the highest supply of any August in those years going back to 2017. 2018 was the final stage of a rate-hike cycle. Mortgage rates had risen past 4% and were on their way to max out at just over 5% by November 2018.

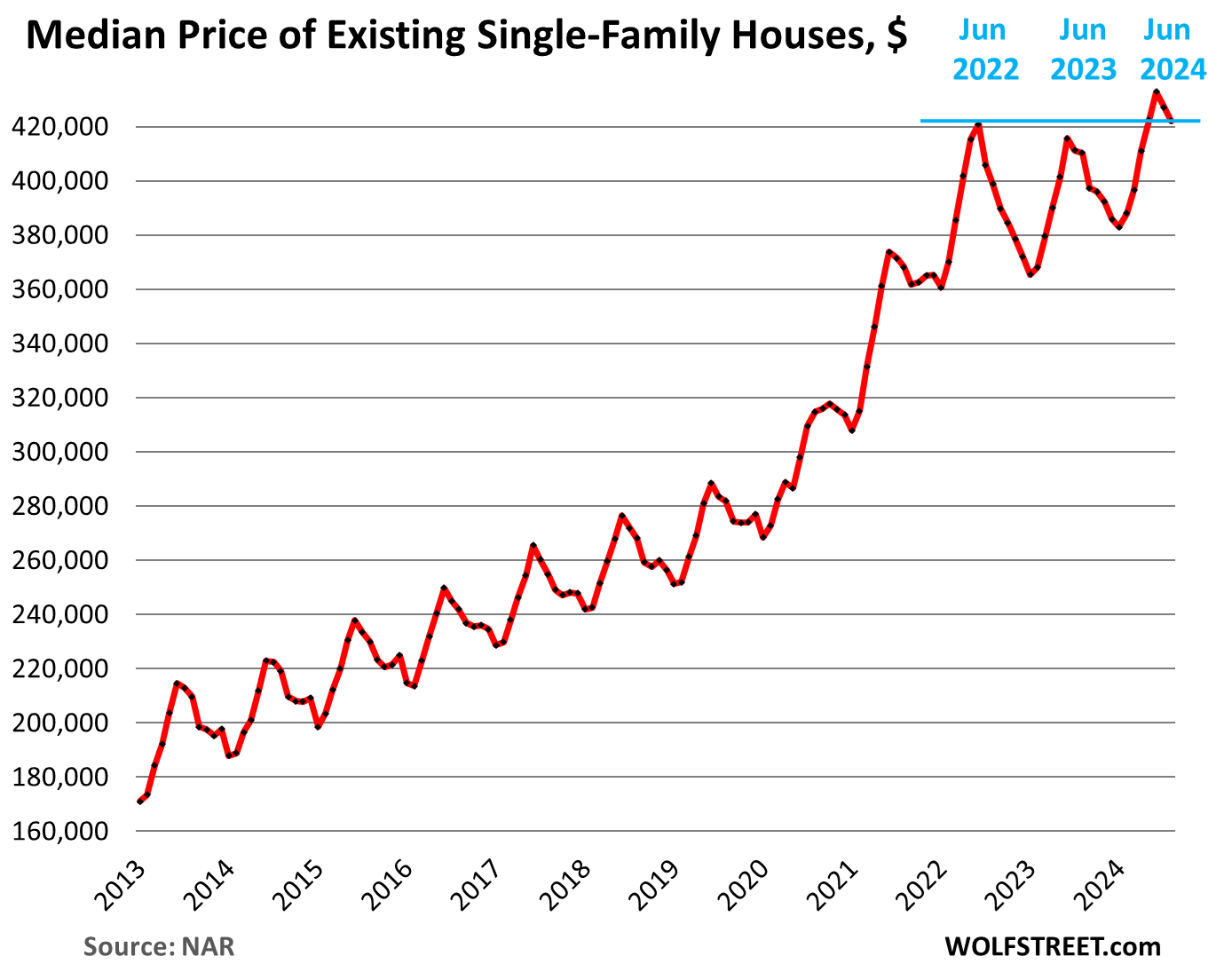

The median price of single-family houses fell to $422,100 in August, the second month of seasonal declines from the seasonal peak in June. In August, the median price was about the same as in June 2022.

The year-over-year gains have been whittled down each month for four months: In August to +2.9%, from +3.9% in July, +4.1% in June, +5.2% in May, and +5.4% in April.

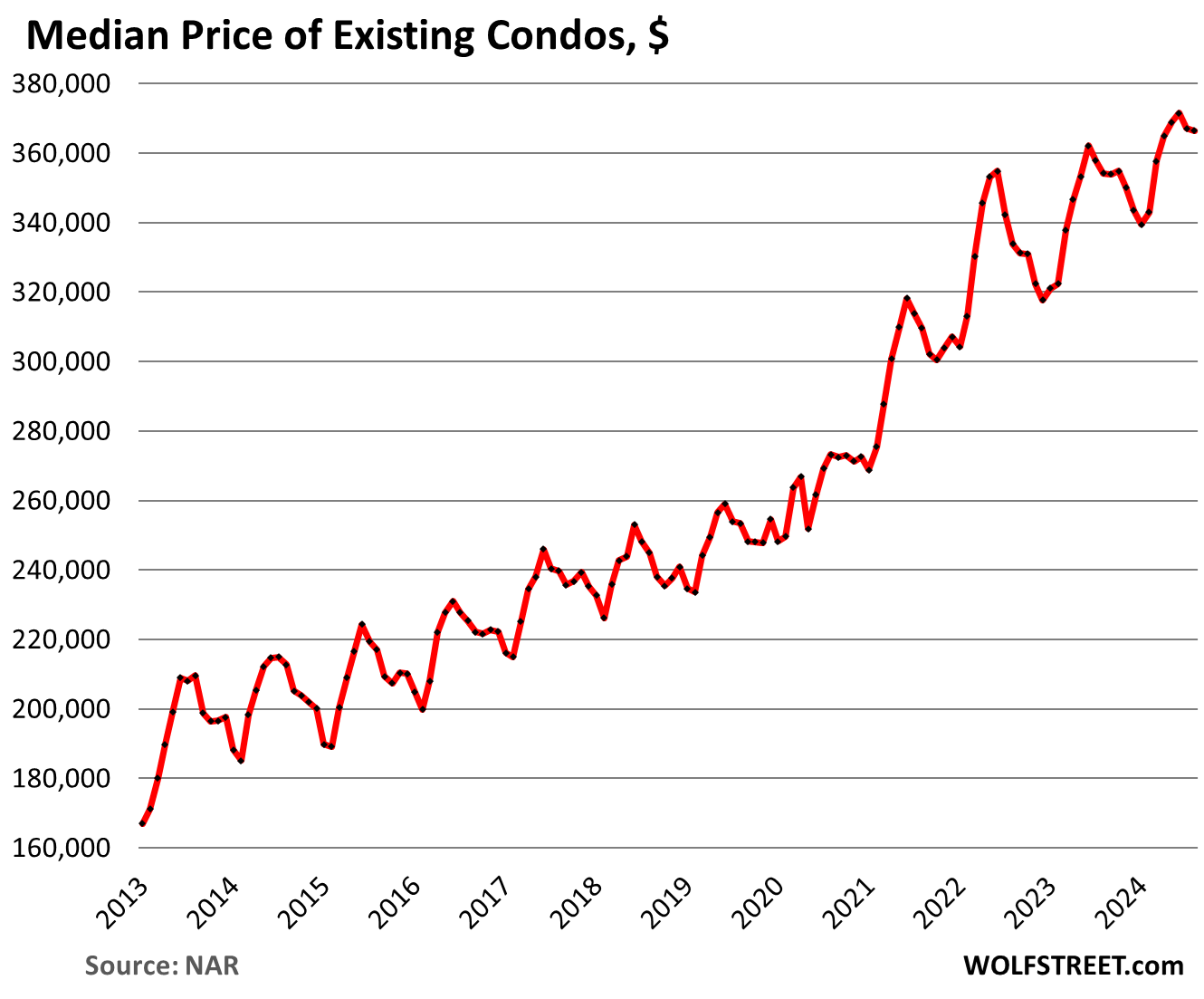

The median price of condos and co-ops dipped to $366,500 in August, and was up 3.5% year-over-year. The year-over-year increases through July had been getting smaller from the 8%-plus range late last year. Unlike single-family house prices, condo prices didn’t book any year-over-year declines in mid-2023.

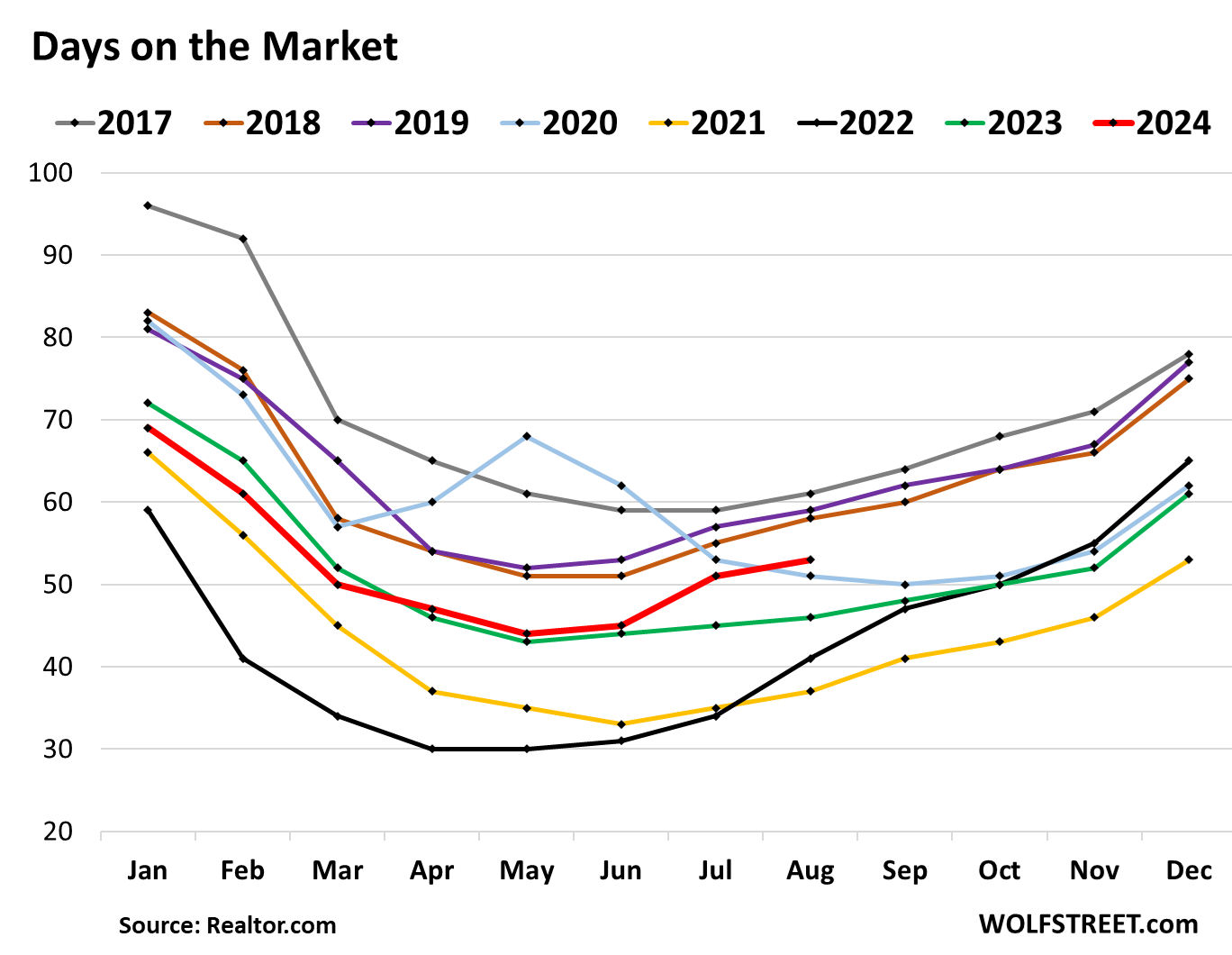

Median number of days a property sits on the market for sale before it sells or before it gets pulled off the market rose to 53 days in August, the highest for any August since 2019, according to data from Realtor.com.

Days on the market is kept down by sellers pulling their home off the market when it doesn’t sell after a few weeks, to then relist it later for sale at a lower price, or to try to rent it out, or turn it into a vacation rental, only to then relist it for sale. The metric tracks the mix of how quickly homes sell, and how aggressively sellers pull their unsold homes off the market.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The biggest factor I see, is from personal experience.

Sold house for $430k end of June 2022.

Dude that bought it, poured tons of dough into upgrades, then listed it for sale this spring for $580k, with literally no offers. He took it off mkt and scrubbed sale effort.

Last week, a home almost across street from mine, which had been abandoned for about a decade, sold for $720k — with tons of upgrades, after being bought for $400k in 2023.

My observation is that the overpriced homes from 2022ish, became money pits, where upgrades took them to a new higher level of unaffordability — supercharging prices and limiting the amount of buyers looking to trade up.

These top end luxury homes that have been updated, lock sellers into higher prices, keeping most buyers away, because they can’t afford the new price point.

The buyers who are able to upgrade are looking for pristine, move in excellence, where absolutely nothing needs done — and paying a premium price to get a perfect location with nothing to do for years.

The vast majority of homes on the market are overvalued and in need of upgrades — which leaves a highly bifurcated mkt that’s either super unaffordable high end, or sellers that are excessively greedy, squeezing lemons.

When all these poor people and new migrants learn how to vote, the just might decide that the rich hill dwellers should be kick out and put under the bridge. Vote for me and on day one all fat cats will now be skinny cats.

Now wouldn’t that be fun…

Bernie is that you?

🧤

😉

Typical Texas thinking they’re the only state that matters

One of the many contradictions of capitalism is evident in the housing crisis. Unaffordable rents, insane home prices and low salaries are just the tip of the iceberg. Housing is a human right. Capitalism makes a mockery of everything, especially need for a decent place to live that doesn’t cost an arm and a leg.

General Strike,

I’ll bite.

“One of the many contradictions of capitalism is evident in the housing crisis.”

What “crisis”? I have a roommate because I like saving money. I do not consider it critical to have a 5 bedroom, 5 bath home. What level of cohabitation with friends or family constitutes a crisis? Can you define this please?

“Unaffordable rents, insane home prices and low salaries are just the tip of the iceberg”

These are the market reactions to government manipulation.

“Housing is a human right.”

Define “housing” please.

“Capitalism makes a mockery of everything, especially need for a decent place to live that doesn’t cost an arm and a leg.”

Are we talking about the same capitalism? The one that has brought a decent place to live to a huge swath of the human population?

This isn’t a result of capitalism, it’s a result of Fed interference in the housing market by artificially holding down interest rates through QE and direct buying of MBS. And to a smaller extent, Fannie Mae and FHA implied subsidies also raising prices.

In other words government interference with the private market.

Property markets without capitalism, or as it is more properly stated, the right to economic freedom and private property, such as the old Communist Eastern bloc, or modern Cuba, people certainly have a right to public housing, it’s just terribly substandard and crappy.

Oops, garbled that last paragraph. Sorry.

Housing is not a human right. You get what you can afford.

Decent places to live are EXPENSIVE BECAUSE EVERYONE WANTS TO LIVE THERE! They cost an arm and a leg. If they didn’t, you wouldn’t want to live there. Section 8 is affordable.

Rents are high, not unaffordable. Not bad with a roommate (but I don’t waaant one). Home prices are also high; don’t buy one. It is a simple decision, not a right. Low value=low $. Become more valuable and MMM: Make more money.

I have 100s of ideas to make money and 0 that involve farting around in college for 4 years to delay making it.

Live in your van and shower at planet fitness for 10 bucks a month.

Stop the drama. You’re entitled to almost nothing. Can’t, won’t, and don’t are entirely different concepts.

Capitalism: deciding to spend 4 years to become a school teacher knowing beforehand the pay is shit but I will do it anyway and be unable to live in a high demand area and complain about it while having 49k in student loans at unforgivable interest rates while protesting the unjustness if others don’t give me said loan in the first place.

“But they should make a livable wage!”

Well they don’t.

Here’s the problem:

Roads are made, streets are made, services are improved, electric light turns night into day, water is brought from reservoirs a hundred miles off in the mountains — all the while the landlord sits still. Every one of those improvements is affected by the labor and cost of other people and the taxpayers. To not one of these improvements does the land monopolist contribute, and yet, by every one of them the value of his land is enhanced. He renders no service to the community, he contributes nothing to the general welfare, he contributes nothing to the process from which his own enrichment is derived…The unearned increment on the land is reaped by the land monopolist in exact proportion, not to the service, but to the disservice done.

— Winston Churchill, 1909

“He renders no service to the community, he contributes nothing to the general welfare, he contributed nothing to the process from which his own enrichment is derived..”

Yeah sure. He just sat on his butt his entire life and all these assets were magically handed to him. Churchill might have been a bit full of it.

Gooberville,

“Yeah sure. He just sat on his butt his entire life and all these assets were magically handed to him. Churchill might have been a bit full of it.”

Actually, he more than likely *did* get the assets magically handed to him by his parents, who may well in turn have been handed them by their parents, and back a few generations. Those “assets” might well have simply been access to quality education and the security of a familial safety net to let you take risks and still have somebody there to catch you, but they were still an enormous advantage.

And that problem is getting worse and worse.

That is assuming an awful lot.

Link?

Painful to read the jaded thoughts of the last ~30 years of government school educated generations.

While your feelings are sad and true, I wish there were a way we could bring back the culture, work ethic, drive and belief system that built this country.

Now, we have back to back generations that are spoiled and righteous. Taught to believe the world owes them “rights” such as 3-5 bedrooms homes, health care, phones , TVs…. It’s unbelievable really.

This truth could not be better shown in the post. Thank you

Goober, if you need links to show you the existence of wealth inequality, and to the plainly obvious that family wealth boosts educational attainment which boosts income, then you must be walking through the world with your eyes closed.

…housing may not be a ‘human right’, but like many other products of the Industrial Revolution, it’s become a major strand in the rope of tug-of-war between speculative interests and necessary modern public utility…

may we all find a better day.

Remember the 2008 meltdown? Wasn’t that traced back to toxic assets (invented by capitalists) providing a source of yield in low interest rate environment? Fed had no choice but to prop up by lowering rates and buying mbs, rather than let the banks go up in smoke.

Socialized losses privatized profits, again.

What about pe and investors buying up housing and inflating prices? Or people buying up air bnb housing?

It’s all just capitalism at work, except profits are privatized and losses continue to be socialized…

Very good point. The only guys who don’t hold wealth are the poor, the young, the immigrant (they are mostly overlapping). And vast majority of them don’t vote.

To my guess, almost 90% of the people who do vote hold at least one RE, so they benefit from price appreciation (in reality, currency devaluation). Chinese were much braver to burst the property bubble. That will never ever happen in this country because the RE holders select who rules the country.

Local appraisal districts in Texas keep those fat cat home owners from getting too smug.

Higher property values means more tax revenue for the state.

Then the new skinny cats will use the government to rob the new fat cats, and around and around it goes…

If you’re going to play the cynic, at least be original.

Home Toad, don’t worry about those skinny cats, or the fat cats for that matter. They’re all going to get eaten by the immigrants anyway!

There’s a lot in flux right now as prices adjust. Sellers don’t know what to think, but expectations are reducing.

For example, I was just looking at the sale history of a listing near Sarasota FL. This nice home was just bought in January 2024 for $879k. It was listed for rent at $5,500/mo through May 2024 with no takers. In June 2024 they put it up for sale at $1,225,000 looking for quick gain. No takers. Price was gradually reduced to $1,100,000 through Sept 2024, but still no takers. Now it is being offered for rent at $4,500/Mo., a 20% reduction.

Price discovery is a process. Seller expectations are being reduced as we speak in many markets. To be fair, with all the FOMO that has been out there, it’s hard to blame sellers/investors for starting high.

This investor might have to stomach a small loss to avoid a larger loss. Even if they get $4500/mo, the rental profit would be less than what other investing opportunities would reasonably provide with much less hassle. Live and learn.

Some wealthy people buy property to book a loss on paper but really break even or come out ahead on the real estate investment overall to offset income elsewhere. American real estate and desirable real estate anywhere in the world in 2024 is a pretty safe long term investment.

🍿

Here for the “world is ending” comments.

😆

Doc, it is definitely an affordability problem and if mortgage rates continue to fall closer to or below 5% and we do not get into a recession, we will experience the last leg up in housing prices of this long bullish run that started around 2011/2012. After that happens I would be on the lookout for a popping of the bubble.

That makes sense. I’ll be ready to buy in three years. I’ll have to convince my wife it’s a deal. Being data-driven, I can show her the graphs. I don’t mind buying on the way down from the peak. I won’t wait to buy the bottom, either. I’m just waiting for the favorable conditions.

I just love all the RE hype articles about lines of people out the door ready to purchase. Like you look at the numbers and what they are trying to sell you and they do not line up. It’s scary to me that no matter where you look someone is trying to sell a narrative that helps themselves. Thats why these bleak and often self absorbed commenters give me the feeling I’m at least not being sold a narrative and I actually appreciate that. Always appreciate Wolf and his realism.

So would it be safe to say we don’t have a supply problem but maybe an affordability one?

No, according to your RE agent, NAR and even Pow Pow..it is and always will be a supply problem…solution? build more houses as they say. $1M for a POS house, this is the norm, suck it up, according to them

Phoenix_Ikki,

Lots of supply and lack of demand brings down prices once sellers get desperate enough, or are forced to sell because they’ve run out of money to pay for the carrying costs.

I completely agree with you, I just have a shred of doubt (against my internal consensus) there will be any event on the horizon that will force a lot of hold out sellers to sell in mass…just hard to see and so far any price decrease in certain markets is worse than watching paint dry…

Move in ready homes still seem to be selling fast. What’s sitting is super outdated homes and fixer uppers. And the fact that people list these less desirable houses for the same price as the nice houses in the area. Those are the ones getting price cuts. I’d be really happy if I saw decent looking homes sit for more than two weekends, but it’s not happening in CO right now. Lots extra inventory but a lot of it is undesirable.

@ MM1,

Our daughter is looking for condo purchase in Denver right now, prices for condos are absolutely moving lower, all listings regardless of condition have price cuts, nothing selling promptly. Single family homes are probably a little different, but the condo market in Denver is definitely a buyer’s market.

@MM1 and @Happy1

Prices for Condo’s and Townhouses in the Denver area are definitely moving lower and taking longer to sell. Take a look at my neighbor hos of Pioneer Hills on Zillow (80015, Aurora, CO). Townhouses are taking 60+ days to sell. OUr old neighbors townhouse has been on the market 100+ days (15069 East Poundstone Place). This is due to the significant increase in HOA dues due to insurance premiums almost doubling. So it’s not just Florida where this is happening. The Denver Post had a good article on this (https://www.denverpost.com/2024/08/21/colorado-homeowner-associations-hoa-fees-home-insurance/).

Yes price discovery is still occurring both on the selling side and rental side. Property owners (sellers and landlords) are going to have to start reducing their expectations. Check out the rental townhouse at 15059 East Poundstone Place our old place. I offered $2900/month but wanted a 2 year lease. The landlord countered with $2950/month with a 1 year lease. We found a townhouse for rent in our same townhouse neighborhood for $2800/month and got a 2 year lease. the old place is still not rented and they increase their asking rent to #3100/month for a 1 year lease.

@Happy1 and @Dataman yes condo and townhouses have price cuts. Still significantly overvalued though. Part of the reason no one wants them are because the HOAs are pretty insane and have had some pretty big jumps. Also a lot the affordable ones are in old buildings where there’s a high risk of special assessments.

I was referring to move in ready homes in desirable areas – they seem to be selling in 1-2 weekends with no price cuts. They’re still up 40% from 2020. If you see a slow down in these home sales you’ll know we’re in trouble.

I’m not shocked no one wants to buy a 900 SQ ft condo with a $500/mo his or a house with shag carpet, wood panel walls, a layout that suggests the architect must have been high, and appliances from the 80s at these prices. To me that means the mania is gone and people are sane again. Not that the market is struggling.

@Wolf

That is for sure. The picture I see a lot is that a house gets listed in the Summer and does not sell, because it is overpriced.

Then, Labor Day comes. The lookie-loos dry up, and it becomes obvious to the seller that nobody is going to buy at the listing price. At that point, they become more willing to listen to a lowball offer.

That is why Halloween is one of the best days to make an offer on a house.

Part of the problem is there are ~ 3M short-term rental homes in the US. If that was cut in half, there would be zero supply problems. And the reality is that there’s not a supply problem. There’s a price affordability problem.

^^^ This, no politician seems to want to touch the fact they’ve allowed homes zoned for residential housing to become hotels.

Hmmm where did the housing supply go????

Also immigration – not a political comment but you shouldn’t have massive immigration unless you have the resources, i.e. housing to support it

Most of the short-term rental homes are in resort areas. If we turn every beach house in the Outer Banks, ski cabin in Vail and condo on Maui into a full time rental we won’t solve the housing peoblem in the US but we we will bankrupt a lot of business in the resort areas who don’t get enough revenue from hotel guests to stay in business.

Apt. – respectfully, living in proximity to a tourist area, we’ve had longtime local, tourist-oriented businesses vanishing for some years, now, as the formerly lower-cost ‘locals’ (employee) housing also vanished into the maw of str. Add rising minimum-wage levels, and it’s doubtful that the ‘traditional’ (and outlier or not, how long do ‘traditions’ truly last?) local labor force will reappear any time soon, if ever…

may we all find a better day.

Turning every short term rental into actual housing would solve a major issue of resort towns not having enough workers. Like the lack of housing in Colorado Mountain towns is a huge issue!

If you increase supply the prices will fall.

The fact someone is willing to pay a price for what they want means they have little choice.

If say a Dominoe’s houses LLC popped up to challenge the current Papa Johns houses LLC and dominoes added 5000 pizza houses into the existing supply of papa John’s houses then consumers would have a choice. Dominos would effectively be lowering the prices.

What you have now are builders who sell for as much as they can get. While they are lowering the prices, they are also greedy and don’t care about disrupting the current state of affairs.

And the NAR has no incentive to lower the prices because their agents get quite a large commission. And I think they have the largest lobbying group in Washington of anyone.

So yep, pending a catastrophe where sellers HAVE to sell or new supply dilutes the old supply then nothing will change.

This is America, we don’t have cheap stuff here in the land of the free. People come from afar to get some American pie, or pizza as you put it. So why should anything decrease in price.

Why we needed a recession

But the charts do show that supply of existing homes for sale is increasing quite a bit. So things are changing right now.

Supply/demand has always been the measure. Price and income are two more components that need to be included. All four are in continuous flux. You might even add in the devaluation of currency. These five things seem to be what drives the buying and selling of homes.

As a retiree, I feel sorry for new mortgage holders who are now in a work environment that seems to have a small fraction of the employment stability that we had in the past.

Buying on a price dip, now, I think, is pretty treacherous. Starting from scratch on home ownership, at this point in the housing bubble, I’d rent until a recession hits. I do not believe that the Fed has permanently eliminated recessions.

Exactly. If the prices were affordable, people would buy. But prices went out of control thanks to FED’s multiple infinity QEs.

I expect more supply to come as the rates go down, as lower rates will increase mobility. If FED doesn’t stop QT and start another QE to please asset holders (again), the prices may remain calm.

Wowow Mr Wolf NVDA is going up!!

Homes are for losers buy GPUs!!!

Wolf won’t like this comment because I am “pumping”

He will be out of a job like Spinning Jenny spinsters :]

NVDA $150 EoY

I’m seeing NVDA $230 by next year end.

It’s not a surprise. Is it a gamble? Heck yeah.

High risk. Of course

I see Airbnb houses up for sale in upstate NY. My realtor friend acknowledges as much. I understand some municipalities and very famously Maui are turning against Airbnb, prohibiting the short term rentals in order to increase inventory. As this business model collapses it will help the downward pricing of houses.

Summit County CO has drastically limited STR outside of the actual resort towns. Other CO mountain towns are also looking at limits or have already limited STR.

Airbnb has probably peaked as an enterprise. Lots of condos have been bought as airbnb rentals and that’s going to be an increasingly vulnerable investment. More and more mortgage lenders are not issuing loans to condos with too high a percentage of rentals within the condo complex. I’ve heard that the percentage max is 50%. If that’s too high, and more condos in high % condo communities start defaulting, that ratio is going to lower. Lenders may even add clauses that the condo cannot be rented if the buyers want a condo loan.

Careful. Terms for mortgages change more often than people think. After Volcker jacked up rates, lenders did not allow “fixed” 30-year loans. Adjustable loans were all you could get.

NVDA has been in a downtrend for the last three months. It won’t be funny if the communists keep cutting rates but it will be funny if there are more cuts and nvda keeps declining.

“Days on the market is kept down by sellers pulling their home off the market when it doesn’t sell after a few weeks, to then relist it later for sale at a lower price, or to try to rent it out, or turn it into a vacation rental, only to then relist it for sale.”

AKA virgin again :) Real tough for an used house but they are pulling it off saying NEW or 19 minutes since listed :)

I agree the “days on market” statistics might not be accurate, but the error is likely to understate the number of days because of the off/on listing strategy you mentioned. I assume the statistic does not account for the on/off listings.

So, if the days on market statistic is not increasing, it could increasing in reality. If the statistic is increasing, despite the listing games, look out below.

Despite these shenanigans with days on the market that Anonymous quoted from the article, days on the market have risen to the highest for any August since 2019, see last chart in the article:

Very nice summary. Thanks.

Powell says the Fed can’t fix housing. The Fed got us into this mess (or certainly helped make the problem worse), but now they are just throwing their hands up saying not our problem. Sigh.

The big thing they did to drive up home prices was QE, including buying MBS.

Now they’re doing QT, the opposite, and they lifted the cap off the MBS roll-off, and higher home sales volume and higher refi volume will speed up the MBS runoff.

As a result of QT (higher long-term rates), demand for homes has collapsed. Prices will follow.

Overall prices haven’t really moved much in two years, supply is way up, demand has collapsed, so OK, we’ll see how that turns out.

They’ve been in the process of trying to undo that problem, while trying not to tank the economy.

When did they lift the cap on MBS?

May 1, officially announced, started in June:

https://wolfstreet.com/2024/05/01/fed-holds-rates-at-5-50-top-of-range-qt-slowdown-starts-in-june-acknowledged-inflation-is-a-problem-again/

Technically, they didn’t lift the cap. They effectively did it though, because any runoff over the the cap gets invested in treasuries.

No. They both “technically” and “effectively” removed the cap from the MBS runoff. Whatever MBS run off (mostly through passthrough principal payments) runs off and good bye.

In terms of overall QT, once the MBS runoff exceeds $35 billion a month, the excess will be replaced with Treasuries, but the MBS still run off technically and effectively and good bye.

We need a recession, and that shouldn’t be considered “tanking the economy”.

They are a normal part of the business cycle, necessary to eliminate inefficiency and moral hazards. They also promote economic fairness and an even playing field where stakeholders get several entry points for productive investing, as well as opportunity for a dignified retirement.

When the Fed is over cautious and tried too hard to avoid recessions, it indirectly supports over-speculative and poor investments, inefficiency, and asset price bubbles that last for long periods. Generations can suffer.

Further, the central planners may be successful avoiding several smaller recessions, but it simply allows risks to build, setting the stage for much larger and longer-lasting crisis. Common sense, really.

^^^ This – all it does is create bigger bubbles and bigger recessions when they finally collapse. But that could be next year or a decade from now.

Off topic a bit but the same thing happened with college tuitions. The government gets involved and makes it easier for students to get loans. And what was the result?

Universities raised their tuitions and a ton of students are saddled with college debt.

Reagan was right, the government is not the solution.

Gabriel – reviewing the Gilded Age and the societal/national impacts of trusts, mono- and oligopolies, would respond that unregulated capitalism isn’t the answer, either (methinks sometimes the best one can do is to understand and do their best in limiting the amount of personal collateral damage stemming from WHATEVER contemporary dominant economic paradigm is in effect, and beware the easy slide into Utopian/Millennial (old, non-generational definition) thinking…).

may we all find a better day.

They want their cake and to eat it too. To undo this problem, they have to tank the economy or the job market at least.

If a 0.5% interest rate drop doesn’t help homebuyers, it probably doesn’t help commercial property owners with loans in default or overleveraged companies either. Let’s see what breaks first, the housing market or the economy.

“If a 0.5% interest rate drop doesn’t help homebuyers, it probably doesn’t help commercial property owners with loans in default or overleveraged companies either.”

Agreed. But there’s a big difference between residential and CRE mortgages.

CRE mortgages are often floating-rate interest-only mortgages with short terms, such as five years or 10 years, sometimes just 2 years.

The problems come in two forms:

Those CRE mortgages that were 3.5% and matured proved to be nearly impossible to refinance with payments that fit into the cashflow from the property. The inability to refinance maturing mortgages is why there are so many maturity defaults in CRE now.

In addition, a lot of floating-rate interest-only CRE mortgages saw their interest rates go from 3.5% to 7%, and suddenly the property couldn’t make the interest payments anymore, and so we saw lots of payment defaults.

Those floating rate mortgages are pegged on SOFR, and SOFR dropped by 50 basis points after the Fed made the cut. It’s now at 4.82% instead of 5.34% a week ago. This will provide some relief for properties struggling with interest payments.

Obviously, rate cuts won’t solve the CRE problem, but they will make it easier to sort out.

For homeowners, nothing changes. For homebuyers, well, they already got big rate cuts on mortgages, when mortgage rates dropped from 7.9% in Nov 2023 to 6.15% a week ago. Mortgage rates may not drop significantly from here on out because they already priced in a bunch of rate cuts long before the first rate cut ever happened. And mortgage rates didn’t drop since the rate cut. They actually inched up a little.

““Home sales were disappointing again in August, but the recent development of lower mortgage rates coupled with increasing inventory is a powerful combination that will provide the environment for sales to move higher in future months,””

Always good to see this kind of data, let’s hope this is just another one of their propaganda talking point and not an accurate prediction…time will tell, although I can see they use the next Spring season uptick as some kind of proof of a housing recovery…

Are we sure that rate cuts will lead to lower mortgage rates?

sure glad we sold 2 homes(one in July and 1st week sept)

both got full priced offer

1st one though had 8% finance buydown

2nd one had 35% down with owner carry – now we’ll make even more

—–

I’ll start hunting after thanksgiving when everyone takes holidays off

It’s good for looks. Someone buys the old house, fixes up the yard, paints the house, new appliances, widows, roof. Everyone nods their head in approval at this lovely new wonder on the block. Then it sells.

What a excellent service you provide, your like joedidee Appleseed.

All this talk about concern for affordability….people, if you thought the Fed or .Gov would intentionally draw home prices down, you’re dreaming. And it’s not because the Fed is babying billionaires or whatever b.s. gets thrown around. It’s because millions of recent buyers would have their equity wiped out. I know, lots of you don’t care or even want that. But I remind you, most homebuyers are not STR wannabe overbidders or hedge funds or whatever. They’re ordinary people just like you, who wanted a own a roof over the heads and were willing to stretch to varying degrees to do it.

The Fed/.gov isn’t going to intentionally harm them just so some others can buy more affordably. My guess is their plan/hope is so stop the rise in housing and let wage/downpayment growth catch up.

“They’re ordinary people just like you, who wanted a own a roof over the heads and were willing to stretch to varying degrees to do it.”

Yeah cause you know we all had a gun to our head that we just have to buy a house to survive..who can bare the shame of ever being a renter…

As a New Yorker I grew up being a renter and feel no shame about it.

We recently bought because we were priced out of the rental market by a greedy landlord and were tired of being in a financially abusive relationship as renters. In the last 10 years we have had bad landlords, the mega one, and good landlords too.

Our last landlord raised the rent 25% over 3 years and we were already overpaying for the house from day one. That was our biggest complaint. When we gave them notice they listed the house even higher and now lowered the rent below what we were paying. I doubt they will ever get the rent we were paying again. It is still too high for the area and the house.

This is why renting is not always better. It is not only about the rent. It is about being able to manage your finances in a stable way. I have owned and I have rented, I always had more money renting, but not more peace of mind.

My daughter’s experience with renting out a house she owns in Austin is the same. A year or so ago was the high water mark and she has had to accept lower and lower rent ever since. She wishes she had sold the thing back then.

Folks just trying to keep a roof overhead will just keep on keeping on regardless of what the Fed does.

Who do I call to get a welfare check on Depth Charge?

lol Depth Charge

username fits 🧨

There’s 0 chance mathematically of increasing wages to make current house prices reasonable, the labor market is looking increasingly ugly. I rent for 20-25% of what it would cost to buy a comparable house, and that’s assuming a traditional 20% down payment which is sitting comfortably in tbills paying my rent.

Just talked to a retired builder out of Boise who has his entire family in either building or RE sales there and he said PE funds are buying chunks of land and building 30-40 homes per chunk in order to lease out. Whole time hes telling me this I’m wondering if there are jobs to support this? Not familiar with the area but his attitude was RE always goes up and was claiming a quarter acre lot next door and directly on the highway was worth 500k because that’s how much it will cost in prep prior to building.

We shall see.

Prices are coming down and they’ll be coming down some more. You’re just gonna have to deal with it. The Fed doesn’t have your back, bud. QE has been finished for some time.

Then all this talk about falling housing prices…..humbug.

Houses are the topic but the topic could be the strangers who live in these houses. A mail box out front…. the stranger within.

“The Fed/.gov isn’t going to intentionally harm them just so some others can buy more affordably”

That’s hilarious. You really believe the Fed gives a sht about homebuyers. I have never heard anything so naive.

Reading comprehension, dude.

The Fed does, IMO, care a lot about homeOWNERS. They care much less about would-be homeBUYERS.

@DesertRat

Homeowners have a much higher propensity to vote than renters.

That is why the Federales care what they think.

Wanna-be homeowners? Not so much.

Gattopardo,

Who is more deserving of government attention – the family that bought last year, with knowledge that prices were extremely high, or the family that decided to exercise patience and wait for better financial conditions to arrive? That’s your choice. When you give support to one person, you take it from others who are often just as deserving or more so.

I think it’s a great time to evaluate and potentially phase out several RE subsidies in the system that are supporting higher than normal home prices.

Bobber, it doesn’t matter who I think deserves government attention. I’m telling you what I think the government thinks.

I’m with you on phasing out whatever RE subsidies are supporting higher RE prices. Unfortunately, all the discussions I hear currently by politicians are for MORE subsidies/distortion, geared toward lower end/first time buyers. All bad ideas.

Sorry, I misread. Agree on the unproductive RE subsidies, and there are lots of them. Unfortunately, the National Association of Realtors NAR is usually #1 or #2 on the political lobbying list, in terms of dollars spent each year, so legislators are incentivized to perpetuate the problem.

People who aligned their investment strategies to the political contributions ranking have done very well. RE and tech have been at the top of the list every year.

As someone who is part of the buyer’s strike going and have been seriously saving and looking for the right house for 5 years now, these “regular people just like me” have helped drive up pricing. Except they aren’t like me. They are either making a lot more than me or are reckless with their fomo.

Yes I feel bad if they lose their investment, but I don’t feel like propping up their bad investment while I am priced out. If they can afford it, they can afford it if prices drop. They’ll just be paying more than is reasonable, which is what they are doing now

Sarah, I don’t feel bad at all. It’s about time in America that people start suffering the consequences of bad decisions. Over the last 30 years, we’ve been bailing out people from bad decisions, and now our leaders are shocked, SHOCKED, that we’re getting more of them.

The Fed doesn’t have to intentionally harm them. It just has to not to take steps to bail them out. Not the same thing. Also remember that not a lot of people bought during that period.

Your home’s paper value is illusionary. If everybody’s home goes up in value that doesn’t actually make you richer because you’ll still need to translate that roof over your head into another roof if you sell.

The whole thing stinks because people include their home in their networth.

Exactly right. Even the homeowners are not any better off because if they sell, anything they might want to buy is also expensive. This only works if you can move to an area with lower prices. The mystery to me is why San Antonio home prices were always super low in comparison to Austin 70 miles away. And it’s not like Austin is any kind of quality of life paradise either!

Easier to – ‘designer-label syndrome’, mebbe?

may we all find a better day.

Escierto – my apologies, looks the auto-whatever scrambled your handle upon launch…

may we all find a better day.

As expected, market got their Heroixx injection…next stop, forget to the moon, mars, they are heading straight to Pluto. Next orgy speculation will be FED cutting down to 3% by next year…fantasy perhaps but that won’t stop them from adding never ending fuel to this fire

We’re back baby! 💪

Hey everyone has the ability to login to their brokerage and buy buy buy.

“The spike in supply in recent months is the result of the wilted sales and the rise in inventories of vacant homes that homeowners had moved out of some time ago but kept off the market…”

This is inevitable with the rising carrying costs. Eventually something’s gotta give.

The rent, and purchase price, is too damn high.

Also 10 year and 30 year rates higher.

What if the past 2 days’ spike in the 10 year yield becomes a trend, perhaps because of inflation expectations rising due to rate cuts? This could cause mortgage rates to rise and not fall. Then things would get really exciting…

My general take is those that have “theirs” don’t want anything to really change but often want to sound off about the state of things. In simple terms, similar to civil rights eta where people would talk about inequities but really didn’t want to support real actions required to support change. MLK and Malcolm X were very clear on these points, although one has been white washed and one demonized in the rewrite of history. There are those that indeed do not have “theirs” but once in that category they want to remain there and hope for asset appreciation.

Not sure where it goes from here but even on my case where inequity and injustice are important I wouldn’t want to see a 25 to 50% reduction in my wealth given what it would mean. Many want a day of reckoning but seems most would prefer it down the road! Fundamental change will not come with small changes in political and monetary realms but there is no appetite for anything beyond that. There is no fundamental solution which would decrease asset prices without hurting those most disadvantaged and simply just concentrating wealth even more as the past has demonstrated. A choice between a wolf and a fox is still choosing a predator.

Forgive me but I don’t understand that logic. If asset prices drop, asset holders lose paper wealth and wealth disparity declines. Further, those without assets have the opportunity to buy assets at much lower prices.

The most disadvantaged will receive government benefits, no matter what happens to asset prices. They might even get more benefits in troubled times, as we witnessed during the pandemic.

///

The prices will not go down, simply because the pricing is not any more human but algorithmic. Simply put there are software packages that allow each realtor to optimize the price, available inventory and other such that the profit is optimal. And since all algorithms relay on more or less the same data set, they recommend the exact same action> Hold, reduce market inventory and keep the price fixed. And that is what they are doing…That is what everyone is doing. And will be doing, since they all use the same data set and the same algorithm.

///

But the prices in New York where I’m looking are going down. Substantially.

LouisDeLaSmart,

“The prices will not go down, simply because…”

Prices already went down in lots of places because….

https://wolfstreet.com/2024/09/12/the-most-splendid-housing-bubbles-in-america-price-declines-spread-to-25-metros-of-top-28-with-19-below-2022-peaks-3-set-new-highs/

LouisdelaDUMB just got punked!!!!

Referring to that company RealPage being sued or investigated for allegedly facilitating price fixing? So a funny saying could be, “faster than a landlord deletes RealPage”…

That months supply graph looks impressive and it’s good to see we are getting back to normalcy. Unfortunately though, in unit terms nationwide inventory is still almost 30% below what it was in August 2019.

Between now and November is the time of year where seasonally inventory begins to drop off. Last year’s drop off was particularly small. If that happens again this year then we might be able to eat at a chunk of that 30% gap. And if that happens in a meaningful way then we might start to see some significant drop in prices come later next year. The tell will be the unit inventory level in February and how far below it will end up being compared to the annual peak (which is typically around now through November).

Existing home sales have been constipated for years. The end result is predictable.

Just curious what happens when we get a couple bad inflation prints? I have a feeling they’re coming.

Interest rates peaked around the middle of October last year. The November print for the month of October should be the lowest print for the inflation rate and then the inflation rate should head higher after that.

In MetroBoston along the Route 93 corridor from, say, 5 miles North of the city up to 20 miles North of the city – we’ve seen SFH prices drop 3.5-5% since yields on the 10 year bond dropped under 4.5% in early May.

It’s speculation on my part but I’m guessing that non-institutional buyers are now sitting on the sidelines waiting for lower mortgage rates.

In my own town (which lies along that corridor) there definitely has been no increase in the supply of homes on the market, so I cannot come up with any other reason.

I’ve been reading about the crash in condo prices in Florida, a combo of hiked insurance rates and the change in laws and standards re maintenance after the Surfside collapse, meaning hefty special assessments up to six figures.

It seems a lot of buildings were negligent on maintenance because of HOA members’ demands to keep fees low, and are now paying the price.

That happens with all private citizen HOA/Condo associations.

Some busy body gets elected to run the show, they see the general fund and start blowing money painting the asphalt black and other such wastes. Then they raise fees because the HOA becomes insolvent. Then the members vote them out, the HOA is broke, fees are still high and after a year or two of replenishing the savings another busy body gets elected and it all starts over again.

This is fine for 15-20 years when major repairs aren’t typically needed or small suburb HOA’s where the HOA is just a couple wannabe fascists. But for condos it is far different. Suddenly the building gets a special assessment for a 2 million dollar repair while the bank account says $47.52.

Almost all condo HOAs are run by fascists who make up petty rules to annoy the residents. They should be outlawed completely. As is true of voting for government positions, hardly any condo owners vote so the group in charge just continues forever.

Stats are stats and spikes are relative but we still have a supply problem foremost! Prices will come down when supply goes up, and cost to earnings will come down because wages will rise due to a lucrative market’s job creation.

But Buyers Strike sums it up beautifully.

“Prices will come down when supply goes up, …”

DO look at the supply chart (chart #3). The spike is impressive. Over the past 8 years, the only August that was higher (slightly) was August 2018. But prices were a LOT lower back then.

Thank you for sharing the historical months supply of existing housing. I find it very odd this is one of the only metrics FRED does not keep going back more than a year.

There’s a lot of data that I use that FRED doesn’t have. FRED is just a portal for data from all kinds of places. Nar sells its data to subscribers and only gives away the last 12 months of data, which is what FRED has.

The top two articles have to do with increased housing supply/inventory. In the third article down, a reader, Alpha Chicken, points out that both Powell and Kamala both mention lack of housing supply being a major issue and points out basically that they are toeing the party line. Indeed. It’s been that way for several years now, but it’s all fallacy. He doesn’t want to accept credit for the million dollar housing valuations that made so many people rich. Why would he? When they come crashing down big time, which they will (it has already begun), he doesn’t want the angry mob to come his way. Of course, supply will be like water over Niagara Falls at that point, but he will be long gone at the Fed.

Here is supply — I’ll just repost it since so many people seem to have missed it. It’s chart #3 above:

One thing that’s unique about this market is that Sellers aren’t remotely scared. Sellers have plenty of liquidity and *perceived* equity, to stick their heads in the sand for years to come.

The sellers who NEED to sell will sell at a lower price. But existing homeowners can shrug off the sales and say things like “well, their house wasn’t as nice as ours, our countertops are nicer, we have a bigger pool” etc.

Then they’ll take their house off the market and wait for a better day. There’s just not enough pain for a few margin sales to reset seller expectations.

Any updates on percentage of purchases by investors? Cash buyers? If both of those trend down, we are more likely headed for falling prices rather than just sideways.

Nosebleed stock prices doesn’t help in that area, as people can use that money to invest in real estate.

I don’t know how much that happens though.

The “price” is the problem, and the price is still too damn high, relative to wages. Moreover, the services required for owning a home continue to skyrocket. Local municipalities still need the tax revenue. A reasonable hypothesis is that part of The Fed’s decision to lower 50 instead of 25 was to help the real estate market.

As I read the median price graph and look at the price trends now and also BP (before pandemic), it looks like prices could be essentially level for 2 or 3 more years and then would be back on the old trend line from 2019. If I were a betting man, I would get that is what happens, flat prices for the next 2-4 years (overall that is, some markets up and some down as always).

So you’re telling us that the markets have been rising because of low interest rates? That everything you’re making is based on liquidity and not on the inherent value of things?

No surprise there.

The somewhat unexpected Pandemic upended most cycles, if one can believe in patterns.

One interesting cycle that seems worthy of tea leave pondering, is the 18 (18.6) year housing cycle, which loosely suggests we are precisely on the cusp of the new downward trajectory.

As with any pattern or cycle, nothing is predictable except unpredictable outcomes — most predictive analogs or cycles rarely have a consensus, because the gurus using analysis all have different various spins related to their swirling tea leaves — nonetheless, the current buyer strike and the bullheaded seller confrontation — and that collision seemingly will resolve with downward prices.

Incomes and savings are not supportive of moves upward and a reset seems baked into reality.

Old property neighbor finally trying to cash out just too late. 22 acres plus a decent 4ksqft home, listed in June 7.4M, down to 5.9M and heading down in less than 3 months.

The developers who purchased up the properties nearby can’t sell those homes at any decent speed at this point so no one wants to risk buying 22 more acres.

It’s going to be fun to watch the prices slide and inventory ramp up like no tomorrow as this whatever market comes to a grind.

Apparently, home prices are not high enough! Mortgage rate reductions of 1% or more are in the bag and home buyer tax credits on the table, like a box of donuts.

Those incentives go on top of tax deductions for property tax, mortgage interest deductions, like-kind exchange gain deferral, FHA 3.5% down mortgages, MBS remaining on the Fed’s balance sheet, housing tax gain exclusions, local down payment assistance programs, mortgage forbearance programs that come and go, and who knows what else.

The average person buying a home simply needs to turn back the clock and be born pre-2014.

Hi Wolf great article as always. Can’t wait to see what you think about the Government of Canada’s big change on mortgages : 30 year mortgages for all first time buyers + buyers of new builds, up to $1.5M cap for insured mortgages (from $1M), buyers can switch lenders on renewal without a stress test. Government is trying to preserve home prices and lure in first time buyers to the ponzi … what could go wrong?

https://www.canada.ca/en/department-finance/news/2024/09/government-announces-boldest-mortgage-reforms-in-decades-to-unlock-homeownership-for-more-canadians.html

Make sure you read the details of the articles you link, not just the headline, or you will be misinformed.

I did read it hence the summary? What if anything did I get wrong ? :)

Thanks

not wrong, but lacking context, from your comment, including that the cap hasn’t been changed in over a decade, during which home prices have doubled, so it was just an adjustment to price reality. And including that it’s a “30-year amortization,” and not a “30-year mortgage.”

Canada doesn’t have 30-year fixed rate mortgages. The US has them. Your mortgages are variable rate or fixed for shorter terms, but may have 30-year amortizations.

The first time buyer has been gone since the second half of 2016 in Canada where the people who need a job live.

Something seems off in the relationship between “Months of Supply” and “Days on the Market”.

How is it that “Days on the Market” typically increases every Oct-Dec while “Months of Supply” typically decreases during the same Oct-Dec period?

If houses typically stay on the market longer in Oct-Dec I would expect supply to increase during that period. Is there a mix of new and existing homes in one of those charts and not the other?

Nothing is off. But do read the definition provided in the article.

Days on the market is the number of days before a house sells or is pulled off the market without selling. It’s a sign of how aggressive sellers are in pulling their home off the market when it doesn’t sell quickly. The metric does NOT say how long it takes to sell a home.

Months’ supply is inventory at month-end divided by that month’s sales.

I’ve started buying up homes in Fort Wayne, Indiana.

Not only are prices out of control – entire cities are changing due too the demographics that double or triple home values make. Where I am now, the av home price was around 350k in 2015. They are now selling SFH starting at 1.6 million, and good luck finding anything under 800k.

And so the entire town’s demographic, school makeup and residential profile is wildly different than 10 years ago. The only winners I can see in the game are the few early homeowners. It unclear how all other players will fare long term.

Crazy numbers. Mathematically it would only make sense that this resolves with a huge collapse in housing prices but it’s hard to imagine a collapse of that magnitude.

Wolf,

What do you make of the August Monthly Treasury Statement ( if anything)?https://www.fiscal.treasury.gov/files/reports-statements/mts/mts0824.pdf

$307billion inbound collected revenue and $687 billion in outbound spend. This is happening in a supposed ” OK ” economy.

It’s just part of the big deficit. September inflows are huge because the quarterly taxes came in (due by Sept 15). So when the Sept tax data comes out, you’ll see it and then you can repost your question, but you won’t because it doesn’t fit your narrative, LOL. Tax revenues in the in-between months are always low. Helps to understand government tax flows.

The US federal government is currently running a $1.9 trillion dollar a year deficit and it is continuing to get dramatically worse as the US government once again faces imminent shutdown as of 10/01/2024.

“Birds have nests and the foxes have dens but the son of man has no place to rest his head.” Jesus the son of God. People must have been playing Monopoly in the real world nearly 2000 years ago just like today. Modern day players might want to repent before judgment day. By the way the universal declaration of human rights does say that a shelter or a home is a human right.

It isn’t a privilege for the rich. Perhaps not a gift for the poor but the price should be payable by the poor under a reasonable price to income ratio like equal to or less than 3 years pay for one person. If people want to become wealthy there are other less socially destructive ways of doing so.

My tale of home ownership:

In 1999 I bought the home I grew up in from my mom (4 br, 3 bath, 2600 sq. ft mid-century mod beauty, Florida West Coast, designed and built by my uncle for my family of 7) for $110,000. My sister bought out HALF of it in 2016 for $120,000 then I bought her half back 3 years later for $150,000 making the cost basis $300,000. Over the years it was kept in great shape but no major upgrades, so whereas it could have functioned well enough for the right buyer it was decidedly not “move-in ready” for most. Put on the market in August of 2023, listed at $640,000. One offer in the first 3 weeks for $600,000 but buyer pulled out. Sold 3 weeks later for $540,000 w/incentives (no inspection, reduced realtor commision, 3 weeks after closing to clear out and I got to keep my refrigerator). I avoided capital gains tax, yay, and made more than enough to satisfy. Lucky me, as the market seized up completely soon thereafter..

Buyer put $200,000 into upgrades and listed it 5 months (March 2024) later for $950,00. No offers. Price was reduced to $875,000 2 months ago. Still no offers. It’s sitting there looking pretty in a very good, “desirable ‘hood” (no HOA) and still I would be surprised if it sells for that.

Price is not the biggest issue, insurance cost is, as it’s in a flood plane. The reason I sold was because I could not afford to insure it (between home owners and flood insurance, cost was closing in on $15,000/year) and improvements to lower the insurance cost were beyond my budget. I imagine that the improvements (hurricane windows in particular) might lower that but not by much.

I feel very fortunate to have found a buyer, who can not be happy with the circumstances as they’ve developed. Meanwhile, prices continue to drop dramatically in the area.

Like I said, lucky me!

Those who panic first panic best.

During HB1, my friend wanted to sell his house for 760K, he started chasing down the market and finally sold after 3 years for 470K . This is in SoCal.

You got lucky!!