It’s time again to look at the trends in claims for unemployment insurance benefits.

By Wolf Richter for WOLF STREET.

The funnies this morning were the headlines about weekly initial claims for state unemployment insurance benefits. They rose to 231,000 seasonally adjusted, “the highest level since August,” Bloomberg’s headline exclaimed. So let’s see. August was of course in the middle of the infamous Q3 2023, when economic growth boomed 4.9%, more than double the normal rate for the US.

Not seasonally adjusted, initial claims for unemployment insurance inched up to 209,000, the highest in, let’s see, three weeks, according to today’s data from the Labor Department. Their seasonal high of 318,000 occurred at the beginning of January when the temporary shopping-season workers file for unemployment claims.

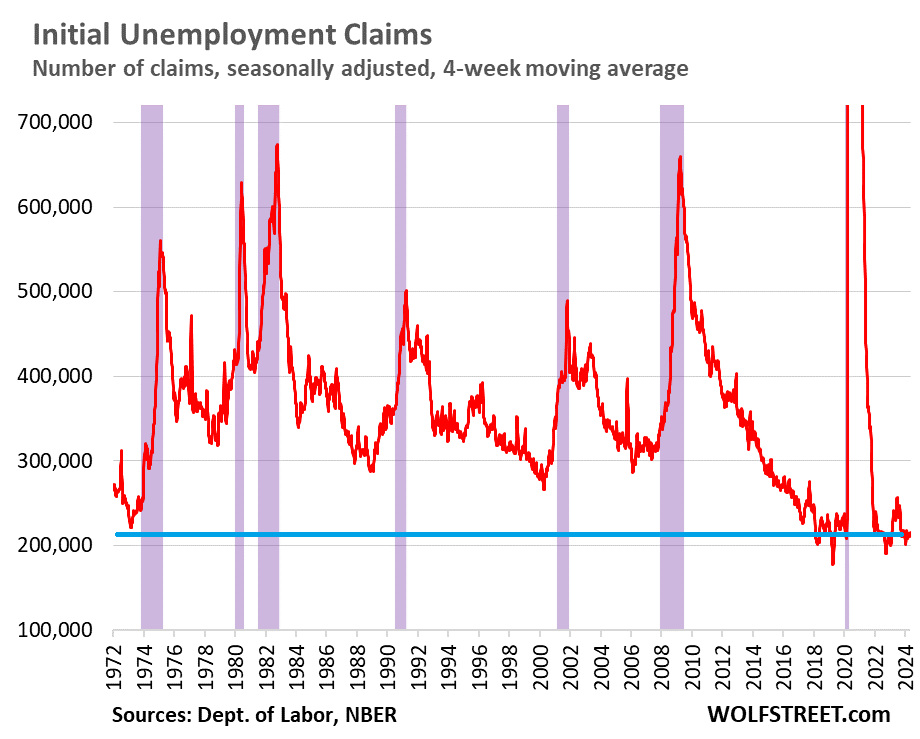

The four-week moving average of initial claims, which the Labor Department also provides, irons out the week-to-week squiggles. It inched up to 215,000, having been essentially flat at historically low levels. We note that now vanished little hump between February and September 2023 that had possibly been the result of the layoffs in tech and social media:

We pay attention to claims for unemployment insurance benefits because they’re fairly raw and unruly data that give a good warning about an oncoming recession. The data is not based on surveys, but on actual claims for unemployment benefits, and it reacts a notch more quickly then the huge monthly pile of survey-based data in the jobs report.

This is the long-term view with recessions marked in purple. It shows just how historically low these initial claims for unemployment insurance are, especially when considering that employment and the labor force have increased over those decades, along with the population:

Our recession-watch here started shortly after the Fed kicked off its rate hikes in March 2022. The National Bureau of Economic Research (NBER), which calls out the US recessions, has always defined them as broad economic downturns that include downturns in the labor market.

So, we’re looking for sharp increases in weekly claims for unemployment insurance benefits (charts above), and we’re looking for a surge in continued claims for unemployment insurance (charts below). They are our most immediate measure of the labor market; and they’re highly correlated with recessions as defined by the NBER

Our favorite recession indicator.

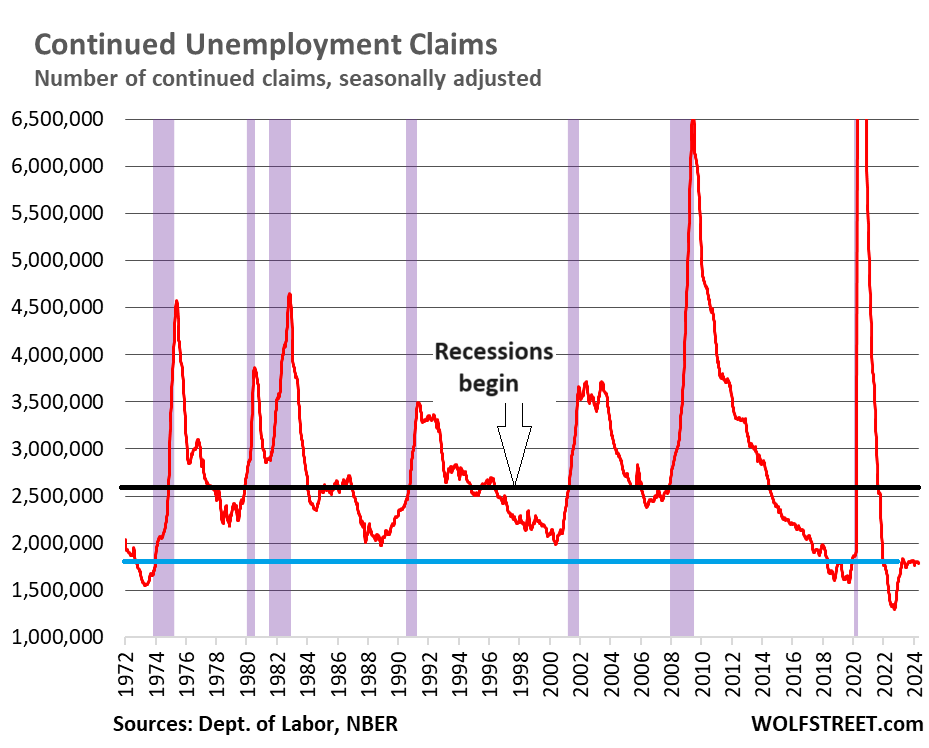

The number of people who are still claiming unemployment insurance benefits at least one week after the initial application – people who haven’t found a job yet – started rising out of the historic trough from late 2022 through March 2023. But by summer 2023, the number stabilized at what is still a historically low level, currently at 1.78 million.

A higher level of continued claims suggests that it takes a little longer on average for people to find a job after they got laid off.

This “frying pan” pattern, as we have come to call it, has started cropping up in a lot of economic data coming out of the pandemic, formed by an undershoot and then a return to normalization.

Recessions from the Great Recession back through the early 1980s began when continued claims for unemployment insurance spiked through about the 2.6-million mark (black line in the chart below).

Our indicator for an oncoming recession is when the blue line gets close to the black line. Today’s level of 1.78 million is far below recessionary levels, pointing instead at a labor market that is still tighter than in nearly all periods of the past 50 years.

What this labor market is telling us recession watchers here is that there is still no recession in sight, and we’ll just have to keep watching for it.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Funny, I thought with this kind of good news, the market would act to the downside since that means higher for longer and no QE anytime soon, their favor kind of ya-yo but instead they are taking it as face value

Apparently bad news is good news and now good news is also good news..

Thanks WR for this report.

Yes, no recession in sight.

With good news, the market goes up because the economy is strong.

With bad news, the market goes up because it believes FED has its back covered.

I wonder how would next week CPI print would be.

Many ‘pundits’ are claiming, it’s gonna be a low print. who know ?

that’s basically right. with good news, worldwide stock markets go up because the economy is strong and earnings will grow into the valuations. with bad news, rates will be cut immediately back to 0 and tina, there is no alternative, is back.

i think this might be wishful thinking, but that’s the way the worldwide stock markets are pricing it.

Wouldn’t be surprised to see the market, at this point, drop 50 percent. A dirth of pessimism and an ungodly amount of missalocated capital.

larry, that would be very tough unless the central banks don’t react. every time there’s any sustained drop in markets, european or u.s., someone buys thinking they’re getting a sale.

as it is, u.s. stocks are priced as though there is no risk free option.

I’d guess pundits right on this. gasoline prices are easiest to check, and we’ve been in slight decline since the start of April after a pretty severe run-up from year start to April; it’s been substantially affecting monthly CPI data. Powell decided to explicitly affirm Fed targets oil and gas prices, so even though it’s rather “noisy”, it’s meaningful noise.

Here in the desert, gas prices follow sport ball schedules. Just like groceries and booze. Waste Management tournament? To the moon! Spring training? Bam! More recently the Final Four…. gas dropped more than half a buck when that nonsense was over. Even Costco is in on the joke.

The sheep never realize they’re being sheered. Look at Snotsdale’s sales tax structure. It’s telling.

Locals know when that nonsense is about to commence. Load up on staples and ride the wave.

From NOAA,

“Seven separate billion-dollar disasters have struck this year: There were five new billion-dollar weather and climate disasters confirmed last month, including three severe storm events that impacted the central, southern and eastern U.S. in mid-February and early April. There were also two winter storms that impacted the northwest and central U.S. in mid-January.

In total, there have been seven confirmed weather and climate disaster events this year, each with losses exceeding $1 billion. These disasters consisted of five severe storm events and two winter storms.” Poor nat’l debt……but where is Ins Co money gonna come from….if at all?

Don’t worry, the very likely 2024 heat waves will be relatively cheap…just dead poor people…actually SAVES money, I bet…..no AC or money to run it, much less buy a UPS Generac system….or even a cheap Harbor Freight set-up.

Enjoy….if you still can.

NBay – …more whiffs of slowly-simmering frog…best.

may we all find a better day.

NBAY….ya gets what ya vote for!

I didn’t realize climatologists maintained a weather disaster metric. Thewre be good and bad hurricanes?

Is it inflation and population density adjusted?

Dustoff,

I figured if I put spacecraft problems in DOLLAR terms it might get more attention from these max-“hard earner”-max-consumer types.

Back to what matters, did ya get my reply on the Western Fence Lizard? in Buffet article.

I may not have ever seen Hawaii or taken a cruise, but I saw something cool very few have… Pure right place right time.

Later buddy.

IIRC, this Jefferys is just a (MUCH more than usual) confused/ consumer/troll………

In my POLITE and HUMBLE opinion.

Dust,

You probably know about the constant Earth Photos from the DISCOVR satellite link somewhere between us and the sun….really drives the situation home and always shows daylight all over the spacecraft…everyone I sent it to loves it…tried twice to sneak link by Wolf but no go…..no direct relation to things fiscal?……yet…….

Ahh well, his site, his idea, and I’m lucky to get to post anything here hating most all pure managementers/excess consumers as much as I do.

Think it’s just envy and I don’t know it? Can I burn in the lake of fire even if unaware of my sin?

NBAY….lol!

I now know your bent of mind when responding on zero knowledge! It’s a troll!

You, however, understand not a wit of who I am, my history or how I spend my time.

Wave the flag, pop the bag

Rock the boat, skin the goat

Trap the rat, bell the cat

Ball the jack, chew the fat

We’re all going to melt!

Yawn.

NBay – WFL’s (‘tyrants’ and all) certainly are constantly delightful in observation! Best-

PJ – reckon thirst, hunger and mass-migrations resulting from climatic capriciousness will be occupying many human minds/actions long before we ‘melt’ (…well, minds, mebbe…). ‘You do you’, as the saying goes…

may we all find a better day.

Ikki, Why should markets go down??? Just because so many people are pissing and moaning about everything?

There’s an awful lot of GOOD news out there – employment is up, spending is up, inflation is down, interest paid on savings is up, home equity and net worth is up, stocks are up, longevity is up, energy prices are cheap, car prices are dropping, credit card debt delinquency and foreclosures are low.

Things are not bad. Just the bonds vigilantes are taking their talk.

Things aren’t bad if you own a house and make decent money.

I can assure you that the renters and lower 50% of earners hate the economy right now.

“There’s an awful lot of GOOD news out there…

1) inflation is down,

– Not compared to 2019 prices it isn’t

2) interest paid on savings is up,

– After decades of ZIRP

3) home equity and net worth is up,

– at 75% of the ZIRP home sales volume…heading to 50%

4) stocks are up,

– at record high PEs, survivors of ZIRP delusion (now please hype AI for me…)

5) longevity is up,

– Compared to the million killed in the pandemic? Or 2019?

6) energy prices are cheap,

– Compared to when?!?!

7) car prices are dropping,

– Not compared to 2019

What theme does all this happy talk have in common?

1) Crappy policies and execution cause historical damage to the median American,

2) Things get *marginally* less worse, and

3) Paint-huffing political hacks piss on our leg (in election year) and tell us it is raining.

“6) energy prices are cheap,

– Compared to when?!?!”

Natty gas hasn’t been this cheap since 2020.

While I agree that CCCB is painting an overly rosy picture, Wolf’s point still holds. The data does not suggest in any way that the labor market is on the verge of tipping into a recession. Granted, this could all change by later this year. My best guess is that the trend upwards in unemployment will be more gradual than years past as we move through the 6 choppy months that lead into a recession.

The effect of the deficit spending can’t be ignored. There’s virtually no modern parallel. 1983 @ 5.7% deficit to GDP is the closest we’d get. For the foreseeable future, we’re looking at 6%+ and that’s outside of a recession. And IMHO, comparing the deficit to revenue is a much better gauge of how things are going. This year it’s likely to be $1.7T / $4.7T or 36% which is VERY HIGH and will stay that way for a good long time and will worsen once a recession arrives.

If things were really that great, why would the government need to spend so much? The government is just paying people to work at this point.

Obviously, the government (Congress decides) doesn’t need to spend that much. But Congress is stuffed to the gills with the ultimate vote-buying Drunken Sailors.

elbow – …’pay people to work’…these days an interesting, seemingly ill-defined/understood concept, as interesting and ill-defined/understood a concept as: ‘pay people NOT to work’, or DON’T pay people to work (…as well as the term ‘work’, itself…oh where IS that happy medium, or better alternative concept, beyond that of interested parties ‘pretending’ to perform, as the old joke goes?)…

may we all find a better day.

Holy smokes, Wolf’s observation is worth repeating -Especially that last sentence. No truer words are spoken! Perfect!

“Wolf Richter

May 10, 2024 at 10:19 am

Obviously, the government (Congress decides) doesn’t need to spend that much. But Congress is stuffed to the gills with the ultimate vote-buying Drunken Sailors/”

stock markets should not go down because there is good news out there, including that stocks are up? that’s a bit circular, no?

deficit govt spending is way up

You sound like an asset holder.

Another 12 martini lunch, huh?

If things are really this good in your mind then it’s probably the perfect time to sell… All downhill from here lol

Lots of Good news is out there.

My belly is full, that’s good, my car purrs, that’s good.

Maybe we should hand out another 7 to10 trillion to ensure we’re blessed with this goodness for years….but…

There’s a price to pay for wreckless policies. As long as it’s not me paying, I guess it’s okie dokie.

“Why should markets go down?”

Because the risk-free rate is now >5%. That means anything with risk must return a higher yield than that.

Most of these high flying stocks have miniscule dividend yields at current prices. Therefore, they are overpriced.

Inflation is down but nowhere near where we need it. I’m not sure if you’re in business but have you looked at consumables and freight costs? They have nearly tripled since the beginning of covid. Not to mention all other areas of industry. I commend the optimism, but this is a very treacherous time for many business owners. Inflation is coming down but not enough to help small business get on top of their out going costs. Meanwhile interest rates maintain their 12 year high of 4.35%. So the question remains, does the fed drop rates sooner rather than later potentially spiking inflation again, or do they keep them at this rate (or worse) raise them crippling what is left of a very worried economy. Remember, people have been relying on their savings since the rates were raised. Unfortunately for those who did not play their cards right during the period of interest rate free after the GFC, the chickens have indeed come home to roost.

The “smart money” often touts the tread-worn but time tested credo: “sell on good news, buy on bad” (at least, on the margins).

See Warren Buffet article a week ago for details. He’s NOT a pessimist….

Stocks tend to go up with inflation. Why. Because if the company can pass along the cost of inflation, their Revenue and their EPS will rise even though they sell the same amount of product.

So talking heads will say company X had 10% growth even though they never sold more product.

Speaking of warren buffet, his MO exactly!

Government debt is UP

Corporate debt is UP

Personal debt is UP

What could go wrong!?!

Inflation going up

No Recession in sight

10 Year > 5.50%

Pat Connor,

Everything is up: personal income is up, wages are up, corporate revenues are up, population is up, employment is up, spending is up, tax revenues for Q1 will be up when we get good data on it…

So you have to look at the burden of that debt in relationship to income. The problem spots are federal government and junk-rated corporate America. Households are doing fine – here is total household debt to disposable income:

Wolf, Unemployment is also Up from bottom and trend of unemployment is upward! TOO!

https://fred.stlouisfed.org/series/UNRATE

Educated but Poor Millennial

LOL. 3.9%. Near historic lows, too low, sign of a hot labor market. Under 5% used to be too tight. Here are the six unemployment rates, including U-3, which you linked, in a view you can actually see. Note how historically low they are, and they’re inching up from the all-time way-too-lows but still haven’t normalized and are still fueling inflation (helps to read my articles, BTW):

https://wolfstreet.com/2024/05/03/jobs-wages-mass-immigration-full-and-part-time-workers-unemployment-prime-age-participation-rate-and-multiple-jobholders-who-are-they-anyway/

Inflation rate is down not inflation.

Total adjusted returns started a downturn recently for many large companies.

The beauty of free…well almost…gov’t money and low real interest rates for over a decade!

Things couldn’t be better!

Market needs to learn good habits again (for productive assets), and remove the bad history of the last decade which was abnormal. Finally it feels a better market for the investor.

Well, the pattern has been: Fin “analysts” and “propag.. err reporters” cherry pick whatever “good news” they can and headline it no matter what, markets go up, until next bad CPI print or whatever happens that they can’t throw lipstick and glitter on anymmore without looking too foolish, market pulls back, short positions cash out, rinse repeat.

Overall it’s hard for me to see a huge market dump yet, I mean a few startups going belly up here and there hasn’t collapsed the entire economy, nor has the commercial RE mess, people are still working as this article illustrates amd companies are still profitable. So “bad news” regarding employment in context is good news to investors and traders because they hope lower consumer spending slows down inflation while we are still very far from a proper recession, aka “soft landing” 😆. I dunno if I believe it will play out like that but I’m not that smart so..

This market refuses to correct. They “priced in” SEVEN rate cuts -> record highs, we’re now at ONE and quite possibly none – and the market rallies again off a minor correction – and low jobless claims = inflation. The risk now becomes the worst possible scenario – stagflation, which is what I see coming. Oil is is in a 2 year Head and Shoulders Bottom, and if it breaks through $90 in the next 2-3 weeks we’ll have a helluva summer crash.

I own plumbing/ hvac companies.

We are there already.

The work we do now is:

50% Rich people

40% Poor people on state assistance.

10% middle class.

Since the industrial evolution to 2019 was 70% commercial.

The majority of the middle class workers have no money, and finance.

Wages haven’t gone up…

Why..because there’s plenty of people working already,

1,000 people swinging into the US daily to enjoy the American Dream.

I’m an idiot but, I’m not sure of any place in the world where I could:

Free ride, work a skilled trade for cash, send 80% of your cash to another country.

I’m sure if I grab a new wrapped lettered hvac box truck. Go down to Mexico, do hvac, plumbing, electrical, painting, landscaping, roofing. For 20 cents a day with free materials.

Nothing would be said, because I’d be dead….

I’ve had multiple educated Americans looking for work.

No others.

Hey….look on the bright side of life! Wealth continues its inexorable march to complete concentration in the top 1-5%!

The really smart, ethically bounded folks are gaining total control by the day!

At the speed of which the FED Reserve increased rates mean that we could see a faster rise in unemployment claims?

Well, we kind of expected that back in 2022. That’s why we went on recession watch. But it didn’t happen. All we got was that little bitty bump you saw in 2023, that has now already vanished.

You can’t stretch out the “lag effects” forever. They have a freeze-by date. And it they don’t happen by the freeze-by date, they don’t happen.

The Fed’s policy rates hit 5% (top of range) in March 2023. And 14 months later, there’s still no sign of a recession. BTW, FWIW, the Atlanta Fed’s GDPNow forecast for GDP in Q2 is now at 4.2%, which is huge.

We’ve seen you urge caution time after time when commenters reference GDPNow. One must assume you’ve got a pretty good feeling about Q2 despite the FWIW caveat.

I was serious about the “FWIW” caveat because this is still very early in the Q2 data stream, and the GDPNow tends to go all over the place as it gets closer to the GDP release date.

However, this is a pretty lofty eyebrow-raising growth rate. If we look at what caused Q1’s lower growth rate — a drop in federal government spending and a spike in imports — we can kind of figure that they will revert some in Q2. Government spending isn’t dropping, we all know that. There were just some payment delays or whatever. So it’s possible that Q2 growth could be pretty hefty.

“If we look at what caused Q1’s lower growth rate — a drop in federal government spending and a spike in imports — we can kind of figure that they will revert some in Q2.”

That’s the part that’s gonna melt down (melt up?) the mainstream business media, the algorithms, and a bunch of quant jocks. But it’s so damn logical that even Powell could communicate it effectively. If he so chose.

One thing that has been mentioned here and there in the press over the last decade and that I see more and more of personally(as a construction worker in California) is people going on State Disability instead of Unemployment. The weekly pay out is 2.5x more and it seems that it is very easy to find a “doctor” to sign you up…

That program has been around forever. And it has been abused forever. Nothing has changed. It’s just about a constant, not a variable.

“You can’t stretch out the “lag effects” forever. They have a freeze-by date. And it they don’t happen by the freeze-by date, they don’t happen.”

The rate hikes and QT were not anywhere near the same level of response/reaction as the monetary/fiscal stimulus. The FED started a million acre fire in a forest of dry tinder, then thought a squirt gun would put it out. Nah, ain’t happenin’.

The economy and inflation digested those rate hikes and QT then burped with satisfaction. The FED should have raised another 100-150 basis points minimum. The fact that they didn’t even raise to the top of their original dot plot was very telling. They’re pumping asset bubbles.

Depth Charge – you’ve really nailed it with the forest fire and squirt gun analogy

You’re wrong Wolf. There’s again ‘a renewed rate cut expectation on unprecedented weakness in jobless claims..’. Mind you, expected 210k actual 231k. That’s enough to re-ignite ‘rate-cut mania’ with gold and other trinkets flying to the moon. This is not even funny. The society of idiots led by imbeciles…

Very good article and summation. I remember my Dad saying 50 years ago that 4% unemployment was actually full employment for the same reasons we often read about here. And for those wishing for a recession, it isn’t much fun when you are one of the people being reduced or forced to move on. It’s always “trimming the fat”, or “a needed correction” when it’s the ‘other guy’.

The metaphor that comes to mind is forest fires. Not too long ago, we had a zero-tolerance policy on this matter, before realizing that zero small forest fires almost inevitably resulted in a massive conflagration.

Adding to my twitchiness, I don’t get the sense that our politicians are ever looking past the next election.

So I wouldn’t say I’m wishing for a recession, but a mild one would be a bit of a relief.

Our politicians don’t look past the end of their nose.

‘our politicians’ ??

hahaa hah ha..

you guys have jokes!

tell me another one, huh?

the fed telegraphs everything it does so that the market, and by extension.. its owners (the big banks) dont get their feathers ruffled..

they well know that inevitably, there is a massive train wreak coming.. may as well not hasten its arrival with any ‘surprises’.

A lot of us sacrifice higher pay and greater opportunities for better job security, so I don’t feel bad at all when it’s the “other guy” getting cut.

Looking at the graph, the count in 1973 was very close to today First time unemployment number. The St Louis Fed has the labor force for May 1973 at 84,491,000. With that the percent first timers to the labor force…… 1973 at 0.0027% and today it’s 0.0014%.

Wolf, your chart makes me think that the purple zone denotes a fever, red line is some kind of viral count, that it’s up to the individual to determine if they feel well enough/fully recovered, and the jury is still out what the treatment should be or could have been….forever.

Thank you for this post. Can you comment on the recent Sahm Rule’s indicator spike?

https://fred.stlouisfed.org/series/SAHMREALTIME

This was going to be my question too. It’s not really the overall level but the rate of increase that denotes a recession, is one school of thought. There are too many factors that influence the level and the fact that our economy got used to low rates means it could break at much lower levels as these “low-rate” required industries fall apart.

Also, the total number of unemployed persons has been steadily going up (“Unemployment Level (UNEMPLOY)”, from 5.7 million to 6.5 million April Y/Y.

Drewman Group,,

If you look at my chart at the bottom, you see when recessions happen: at 2.6 million (black line). Rate of increase per se is irrelevant. Obviously, when momentum picks up, the rate of increase rises, but the indicator is not the rate of increase, but the level, which is 2.6 million.

BTW, the rate of increase = 0 because there has been no rate of increase in the four-week moving averages over the past 6-8 months, as ALL of the charts show.

“Also, the total number of unemployed persons has been steadily going up”

The number of unemployed rose to 6.49 million (blue). The three-month average rose to 6.46 million, where it had been in April 2018 (red). But the labor force also increased over the period, and so the rate of unemployed people (U-3) has remained low and below 4%

https://wolfstreet.com/2024/05/03/jobs-wages-mass-immigration-full-and-part-time-workers-unemployment-prime-age-participation-rate-and-multiple-jobholders-who-are-they-anyway/

I believe we will see a recession below the 2.6 million mark. In fact, likely by Q4. Unemployment claims is not always a great metric because people out of work for a while don’t file claims and leave the workforce entirely. Or they are only partially employed. Which we are seeing both in greater numbers, not a flat trend. They are contributing less and less to the economy and this will inevitably result in job losses..

I heard an interview with Ms. Sahm a while ago…

She said that the rule could well be violated “this time.” BUT there’s no rate of change (as Wolf points out)

Just guessing, but I’m wondering whether federal spending is propping up labor markets, and some kind of fiscal hangover (and labor market distress, at least relatively) might ensue, circa 2025. Strategically (in terms of elections) that would be the time to deliver bad news, no?

That’s my thought.

If the fiscal deficit is reduced meaningfully from a staggering 7% of GDP its got to have an impact.

Especially since much of employment over the past 12 months has been supported by local and federal government recruiting. While it’s true that much of this is just pandemic recovery and population growth, it’s certainly offset employment decreases we’ve seen in other industries.

Although saying that, neither presidential candidate appears to concern themselves much with the deficit. For his own purposes Trump would probably love another chance to pump up asset prices and inflate away debt. And unless Biden wins large enough to get tax increases on the wealthy through, we won’t see much willing from him either.

Congress writes the budget and makes those decisions. Not the President.

Actually, the president writes the budget and submits it to congress for review/approval.

Budget,

Yes, but no one in Congress actually looks at it. It’s DOA.

Right, and the supreme court are impartial judges interpreting the US constitution.

Kent – the lawful concept (‘separation of powers’) not present in many of our citizen’s mental lexicons (…the concept of the President as an ‘elected monarch’, on the other hand…).

may we all find a better day.

Wolf – ‘DOD’ a sly observation, here: (‘Dept. Of Defense’, ‘Dead On Delivery’, something else)?

may we all find a better day.

“I’m wondering whether federal spending is propping up labor markets”

You don’t have to wonder.

Out of 156 million or so employed, about 23 million are explicitly government workers and somewhere in the neighborhood of 10 million more are shadow government workers (perpetual contractors/industry subsidy recipients whose salary is paid for by the 3 levels of government).

So 33 million out of 156 million (over 20% of all employed, period).

With various forms of government employment accounting for a high share of past year’s hiring (minimum of 25% share – check out the BLS’ own stats – https://www.bls.gov/ces/)

“Out of 156 million or so employed, about 23 million are explicitly government workers”

Total government workers: 23.27 million

of which:

Federal government workers: 2.99 million

State government workers: 5.45 million

Local government workers: 14.83 million

The vast majority of the 14.8 million local government workers are teachers, college instructors, trade school instructors, and others working in public education under the local government. Police officers and the first responders are also big groups.

A considerable part of the 5.4 million state government works are in education, such as state universities and colleges.

https://wolfstreet.com/2024/05/03/which-industries-lost-jobs-which-gained-jobs-longer-term-employment-trends-in-charts/

wolf..

i see what you’re getting at here.. but you omit something significant:

over the past 2-3 decades, there has been a truly staggering amount of increased administrative ‘bloat’ within the education system.. specifically colleges and universities, but also trickling down to the lower levels.

for every one instructor/professor/teacher, there is now a much higher proportion of administrative personnel than there once was. the federal takeover of student lending functions turbo-charged this phenomenon.

just because a person works in ‘education’, does not mean they are actually PROVIDING a education…

and even if they are:

what one full professor used to have purview over.. there is now multiple adjuncts, assistant professors, lecturers, etc that have been added to the mix..

it absolutely is. unlike where i am from, the u.s. can borrow whatever money it wants at reasonable rates. it’s a nice thing to have.

I think the normal business cycle has been upended by the gigantic intervention by govt and Fed.

We may not see recession on paper but working class would continue to suffer with continuous increase in cost of living with wages not able to keep up.

Only asset holders would come out ahead .

Fyi.. in last few decades usd lost 80 percent of its purchasing power.

This is the end game .. usd losing purchasing power over time .

It lost purchasing power a lot less rapidly than most other currencies.

Jon – mebbe, in the end, a case of the aggregate costs of maintaining our human-crewed spacecraft are outstripping the abilities of the crew to pay them?

may we all find a better day.

– Did you look at the proper “recession” indicator ? What is the metric you’re looking at ?

– I see that the amount of mortgages have gone down to the level of 1994, a 25 year low. If you know the internal dynamics of how credit, (mortgage) debts work then you will understand why the US is already in a “recession”.

You’re funny. I have discussed endlessly every month with numerous articles the plunge in sales of existing homes, the plunge in purchase mortgage applications, and the collapse in refinance mortgage applications. You can read the recent ones here:

https://wolfstreet.com/2024/04/23/prices-of-new-houses-v-existing-houses-why-new-house-sales-held-up-as-existing-house-sales-plunged/

https://wolfstreet.com/2024/04/18/home-sales-clobbered-by-mortgage-rates-most-price-reductions-for-any-march-in-years-new-listings-active-listings-surge/

https://wolfstreet.com/2024/04/17/mortgage-rates-over-7-and-heading-higher-housing-market-still-frozen-lots-of-buyers-on-strike-because-prices-are-still-too-high/

This has been going on ever since mortgage rates went over 5% in late 2022. But this reshuffling of homes from one owner to the next has very little impact on the economy and employment (lots of mortgage bankers got laid off in late 2022 and early 2023, but their total numbers are small overall).

What does have a big impact on the economy and employment is new construction, and that has been strong. And residential construction has been fairly strong too, and employment in construction has been growing from all-time high to all-time high.

“Mortgages are a pretty big source of money creation”

So are 5% CDs and T-bills.

The issue with your favorite indicator is that is the same as the altimeter in a plane. A lot of red light flashes long before the altimeter starts to fall.

When the altimeter goes down there is no way back.

Now we have a plethora of red lights flashing, but the altimeter is still looking good. But it won’t look much longer.

People have been saying the same stuff for two years, and the lights are flashing red, green, and blue, like on a Christmas tree. And the plane keeps gaining altitude.

Speaking of airplanes,

In my 60 plus years of investing, the best recession indicator I found is/was the “O’hare Field” Indicator. When the airports are not crowded and the planes are not full, a recession is upon us.

The economy does not get better than it is today.

My personal recession indicator is how full the local train station parking lot is at 10am. For the past year+ it is full nearly every weekday.

When this parking lot stops being cosistently full, then I’ll worry.

I rely on my trusty “Smug’o’Meter”. When everyone on every street corner is an Investing Genius who has the Golden Touch in the stock market, when everyone is a Real Estate Investment Savant, and when the smugness reaches critical mass and red-lines, fueled by recency bias and either a willful or ignorant inability to learn from history, that’s when the bottom is about to fall out.

Saw it in the late 80’s, saw it with dot.com bubble, saw it with RE in the early 00’s, and seeing it again now. We’re not there yet but the ground will cave in under peoples’ feet eventually.

Agree w Falcon:

Remember well hearing the clerk in the convenience store remark how he had just sold a condo ,owned for a week, for a nice profit; conclusive evidence of nearing the end of the bubble in RE.

Advised couple of friends to get out of their very long positions; one did and had a good net, one didn’t and had a small loss because he had got in much earlier.

Crazy bubble around here, w quite livable 2/1 houses that sold for $70-80K few years ago now $300K+ and immediately demolished (another $10-15K.)

Falcon/VVNV – …a long tail back to the ‘stock tips from shoeshine boys’ stories before the ’29 Crash?

may we all find a better day.

I always wonder if participation in the labor force by Americans has gone lower since the covid lock-downs. More one-income earner families and more stay at home mom and dads.

People can file a claim for unemployment, but maybe they just drop out of the labor force after benefits run out.

Boy though, with GDP really rising I’m not sure if the government would claim recession even with say 5% unemployment rates.

Has the Federal Reserve ever tried buying more treasuries as an easing measure before lowering rates? I wonder if they try it just to see what happens if unemployment gets too high. Inflation is just so tricky though.

“I always wonder if participation in the labor force by Americans has gone lower since the covid lock-downs.”

Prime age participation rates are at multi-decade highs:

How about the 1974 recession? This current period data seems oddly similar to the unemployment data ahead of the 74 recession. Any thoughts on probabilities for a recession starting ahead unemployment claims hitting the historical average, similar to how the 74 recession started while unemployment rates were historically low?

The first “oil shock” started in late 1973 (Arab oil embargo), which wreaked all kinds of very sudden havoc, and layoffs in 1974 were a result not a cause of the havoc. The pandemic had a similar effect; you can see that in the frying-pan-pattern chart. Both were triggered by sudden events that were external to the US business cycle and the economy.

Excellent article Wolf. Thank you!

Less QT.

More defecit spending.

No Landing.

I don’t know how unemployment works in the u.s but here in the UK they have been changing policy on how unemployment has been calculated for a very long time so I don’t understand how you can compare the unployment rate overtime.

For example, back in the eighties you could claim unemployment benefit until you went back to work. Over time this morphed to changing unemployment benefit to a different benefit which meant that once you changed to the second benefit you weren’t unemployed anymore. Today there is a unbelievable amount of different benefits to ensure that the official unemployment figures are low. There is big pressure to push unemployed to a self employed model Where you get tax credits to bring up your income to a liveable level even though you’ve only earned £20 on average a week 🤣

So these were are:

#1 “initial claims” — people claiming for the first time after getting laid off. They can file a claim, but the claim may not get approved… that’s afterwards. So the policy changes you describe don’t impact this figure at all.

#2. “continued claims” — people who are STILL claiming unemployment benefits after the initial claim, meaning people who are now in their second week or more being unemployed. Also not impacted by the stuff you describe for the UK.

BTW, the US system is pretty stingy in normal times, such as right now.

“Today there is a unbelievable amount of different benefits to ensure that the official unemployment figures are low.”

To me, it sounds like total BS. When you claim unemployment benefits, you’re counted as unemployed, and you stay in the unemployment figures, and it does NOT “ensure that the official unemployment figures are low.” On the CONTRARY.

It is not worth the time commenting on the sorry mess called the UK economy, where the latest GDP growth of 0.6% is lauded as an outstanding success, if it is even believable. As with the very low EU GDP growth numbers it is ‘Viva Socialism, Viva’ above all and to hell with the economic consequences. Consider yourselves fortunate to live in a country where Capitalism is working well and make sure it stays that way, not necessarily an easy task nowadays.

Anecdotal. Canadian. West coast. Last year l could not find a contractor to build our deck. This year, 5 calls outs, 5 returned calls and made site visit. This deck is part of larger renovation project that was stalled, limping along, from 2020 to 2023. So a completion, not a new start. Just what l see.

Another anecdotal finding. In CA Silly Con Valley, got responses from 5 contractors for a remodeling work on the same days I called them up. Still quote me ridiculous prices, though.

Same in the high country in SWMontana.

Get the bid in the fall for the late spring melt.

Get the call in early march…..sorry man, “something “ came up.

Now you can’t find a builder without a royal arse raping.

I ended up building it ALL myself with friends help.

Anecdotal. I’m in Santa Barbara. I’m not a homeowner. I’m getting five unsolicited calls a month from contractors asking if I need any remodeling or a new deck, etc.

I tell them they have to buy a different list if they’re calling me.

Thanks Wolf,

No recession higher for way longer. Will be looking for that 2.6 mil. problem going forward. GDP at Atlanta Fed 4.2 this coming quarter! WOW!

I have to wonder if the mega corps didn’t get into competitive hiring ahead of actual need? According to Wolf, the major tech companies in San Fran were involved in competitive office space acquisition. So if they competed for office space, why wouldn’t they compete for employees, especially during 2021 and 2022? If this is true, then there could be a lot large layoffs and firings in a relatively short period of time based upon some trigger.

Google made record profits this past quarter…and announced more layoffs.

I guess record company profits are the trigger for layoffs.

They beat ‘Estimates” as well as other companies, unadjusted for inflation of course.. In that, you will rarely find a ‘Sell’ recommendation, ever, on Wall street.

Do not get me started on share buy backs. Not only do they have no expansionary plans, they can find no use for excess capital. This allows earning per share are elevated without doing anything except allowing certain hurdles to be meet so bonuses can be paid

It is a fools game but its the only game in town.

Tech layoffs and stock buybacks have me a little stimulated. Momentum for the sake of momentum is fading.

Wow. Perspective is everything. Thank you Wolf.

With over four million people reaching age 65 for each of the next four years, don’t expect unemployment rates to rise anytime soon. That said, I guess they can always start actively flying in one million additional illegal immigrants a year from all parts of the world. We’ll never know though, because illegal immigrants don’t show up in unemploymdnt data.

“We’ll never know though, because illegal immigrants don’t show up in unemploymdnt data.”

That’s wrong.

They show up just fine in the unemployment data. That’s the data that is released monthly in the jobs report. They’re included in the household data, and if they have jobs, they’re also included in the establishment data.

Where they don’t show up is in the claims for unemployment insurance here because they do not qualify for unemployment insurance.

“Where they don’t show up is in the claims for unemployment insurance here because they do not qualify for unemployment insurance.”

If they don’t show up in the data, then blue line is artificially low? I heard there are over 200,000 illegals in NY city. They can’t all be working. Where do you think the blue line would be if they were allowed to get unemployment? Wouldn’t that be a more representative number?

Sorry, this is very confusing.

1. They’ve never shown up in the unemployment insurance claims. That’s a constant, not a new thing. It’s already part of the data.

2. When you get 6 million new workers in a few years and they don’t all find jobs immediately, but maybe 5 million do find jobs relatively quickly, that’s a huge growth of the labor market, and NOT a sign of a deteriorating labor market.

As a diehard pessimist, I remain painstakingly patient, like the NBER, waiting for longer term annualized, revised data patterns. The Real data is glacial, but far more accurate.

I’m not suggesting the current data is wrong, it’s just early and noisy — but — I agree, recession doesn’t seem inevitable or likely anytime soon. Nonetheless, it’s a really bad time to be the boy who cries wolf. FYI, the wolf is not extinct, proceed with caution.

One site predicting a huge miss with CPI next week due to OER. Don’t subscribe so can’t read the entire article. I think everyone knows which site has that prediction. They can’t stop hoping for rate cuts. Lol

that site has zero ** credibility by the way :-)

👍😉

Hey! I may or may not represent that remark. Friday Night Music (USA time) was something I enjoyed in 2008. Marla was a lovely person…. For a woman or not as the facts are still not clear if she was. Doom porn pays dividends.

Loving it. No recession=higher for longer interest and asset appreciation.

Recession=fire sale prices in assets.

It’s good to be king.

“higher for longer interest and asset appreciation”

That’s self-contradictory. That’s not how yield works. Yield works the opposite way; higher yield = lower price. That’s fundament math in bonds, CRE, dividend stocks, and other yield assets. Gambling tokens can go wherever though, at least temporarily.

How long must inflation remain above target and unemployment stay low for the Fed to kick their policy rates up a notch… say 6–6.5%. This seems a more logical level given the significant new supply of debt in recent decades.

Seems that would be the next step in a managed economy that takes both of the first two mandates seriously. If not done early enough, an economic overheat could necessitate an even higher policy rate, violating the forgotten 3rd mandate (moderate interest rates).

Damned if they do, damned if they don’t, it seems.

When/if the 3-month annualized core PCE gets close to the Fed’s policy rates (5.25%-5.5%), they will get very edgy, with twitchy trigger fingers. But we’re not there yet. We’re at 4.4%, and this stuff isn’t linear, it zigzags, as you can see …

Open up the doors to more competition. Stimulate the economy naturally. More people. More businesses. More jobs lower prices

Not “lower prices”: more people means more demand for goods and services, including for rentals, which will cause rents to go up, and it will cause other prices to rise. The huge wave of immigration has been specifically named as one of the factors potentially contributing to higher inflation, potentially needing higher policy rates to deal with:

https://wolfstreet.com/2024/05/05/the-reasons-feds-bowman-is-willing-to-hike-rates-if-incoming-data-indicate-that-progress-on-inflation-has-stalled-or-reversed/

The only reason, recession is put on hold is due to military complex, which keeps up economy rolling not only in US, but also in Europe (many former Eastern Block countries emptied their obsolete military hardware warehouses and now need to be replenished.

Russia keeps up domestic mfg humming, and survives via selling oil and other resources through middle man such as China or India, which also make money that way.

Turkey doesn’t seem to have much to do with major conflicts (other than same old battles with Kurds in Syria) and are facing nearly 70% inflation.

How I see it, this is just another life support. Post Pandemic, virtually every country around the globe was battling huge inflation figures. In many cases double digits. I hardly see any cost cutting or government spending, both domestically or internationally, less maybe Argentina.

Who knows, maybe the latter with hitting the rock bottom are ahead of the curve and demonstrate what’s coming to rest of the globe in near future.

Was listening to Neel Kashakari interview yesterday on Bloomberg.

I think he is one of the reasonable voices on FOMC.

He was saying similar things. Economy doing good, Unemployment low. Everyone is puzzled with this strength and now makes him think Neutral rates have gone up (at least in short term). Most interest sensitive sector Housing has hold up quite well.

Lady interviewer was like everybody here is saying now we should increase the Inflation target to 3%. He killed that narrative immediately.

He clearly said we dont know where the net move. We are data dependent.

IMHO this is most honest and correct answer. They dont know. He clealy said even hike is possible. Nothing is off the table. Bar for them may be high but all options are on table.

He ended the interview also well. He said Financial conditions are loosened up quickly. He felt after 3 inflation reports, they got tighter but as soon as one low job report came, All Euphoria is back in Market.

Personally I dont get What was even rush to indicate the cuts in Dec SEP? Not only that; sticking with 2 cuts even in March SEP. In May Powell said rate hike unlikely. Well how you say it is important. Flat out saying unlikely is silly.

Slow down QT so soon is stupidity. We have 450B in ON RRP and 3.3.T in Reserves. SRF is open. When financial conditions have loosened up, why should they start easing Monetary policy.

Markets are now back to high. Whether right/wrong, Mainstream media painting rosy picture, Cuts are coming hype reasons can be anything.

Stock Markets levels, Consumer Spending, GDP growth and higher forecasts are saying Economy doing good. FED will have tough time to rein in inflation (assuming they REALLY WANT to).

SRK-

“Lady interviewer was …. saying now we should increase the Inflation target to 3%.”

So, if you are having trouble hitting the target, move the target? Sounds like my pathetic golf game. Only problem is that just when I get my stance adjusted to my slice, I hit the “dreaded straight ball!”

I’m not usually a fan of Kashkari, but bless him for nixing that cowardly, lazy and ill-advised suggestion…

Fore!!

Make sure the club head is slightly in front of your physical head as your striking the ball. The slice goes away. It’s all in the hands…

I lost my slice, one day it was there, then it was gone.

I would assume at least 50% of commenters on this site golf on a regular basis. An excellent way to pass the time.

Does wolf golf or play tennis, curious? How does wolf stay physically fit, if you don’t mind me asking, do you go to the gym and work out? All I hear about you is you jump in the freezing water and that you walk up steep roads with packed down with beer.

Home toad,

“How does wolf stay physically fit… All I hear about you is you jump in the freezing water and that you walk up steep roads with packed down with beer.”

You nailed it. I also do upper-body strength training with cases of beer 🤣

Kent-

Thanks for the tip… I’l give it a whirl.

“Wolfstreet, The Stories behind Business, Finance, Money……and Golf”

“Our indicator for an oncoming recession is when the blue line gets close to the black line. ”

Followed by a plot where blue line is drawn parallel to the black …. so, never? :)

No matter what you firmly, passionately believe, always check the data. Increasing inflation. Low unemployment. High growth. These are all consistent with a huge government stimulus (aka deficit spending). I still think the markets are too high (and sold most equities), but perhaps the markets see the no-landing scenario of higher earnings.

What Wolf always reminds me, is “Hey stupid, look at the data”. All hail Wolf.

CWSDPMI-

Given my own propensity to dwell on what could go wrong in the economy (mostly related to deficit/debt or to the perils of technocratic manipulation of the economy), I use a self-imposed minimum equity position that has protected me from myself. (also a self-imposed maximum, though that’s rarely been a temptation…)

For me, anyway, “all” and “none” are scylla and charybdis, and are equally to be avoided by fairly wide margins.

This discipline has been a real aid in this ever-green market. Just throwing it out there.

The CBO projections have the spending pattern you mention baked in for years. Yellen said, “I Don’t See a Financial Crisis Occurring ‘In Our Lifetimes’ “. I think Yellen drank the MMT kool-aid in 2017, and still hasn’t wavered, nor has government. I think the Fed “gets it” now, how MMT is definitely smoke and mirrors, but the political side of the government *loves* backing playbooks that are too good to be true.

JeffD-

“Yellen said, ‘I Don’t See a Financial Crisis Occurring ‘In Our Lifetimes’. I think Yellen drank the MMT kool-aid in 2017…”

Regarding far off effects of today’s actions:

“The task of economics is to tell the remoter effects, and so to allow us to avoid such acts as attempt to remedy a present ill by sowing the seeds of a much greater ill in the future.”

— Ludwig von Mises Theory of Money and Credit, Preface to English Edition

The “ill” to which Mises refers — and which Yellen’s prediction ignores — is degradation of purchasing power of the US dollar. Spoiler alert: if 2% inflation is the target, the actual numbers will be worse.

Slow down has certainly been noticeable in our business.

At my age & no debt, not worried. I may have actually gone the entire week

without a call from a builder.

I’m good with a slow down. Equipment rates for new are 0%, used work trucks coming down sharply. Bikes I have been looking @ for me & the mrs

are dropping…faster than work trucks.

No real recession for 15 years now – the self imposed “pandemic shutdown” dip that lasted all of a couple of months doesn’t count. So the pressure just keeps on building. Maybe there will never be a recession again, or maybe there will be a raging inferno of debt collapse and unemployment second only to the 1930s when it finally does happen.

Oil production and technology have been driving revenues and the economy. Those are big money industries, and nobody matches the world in either.

US in now producing more oil daily than any other country has in oil history.

For many we are already in a recession due to inflation.

Fixed income and lower income are hurting. Work may not be an option.

Rent is up and so is number of people in a household.

Great for my antique interests, as people are selling good stuff out of need.

The family business, 110 years old is hurting as we can’t keep entry level staff.

It is not just money, it is expectations! More people to do the same amount of work.

Inflation is not going away whatever the bank or employment rates.

The world has changed and most charts are useless. If they worked, than anyone using them should be worth billions!?!

You’re contradicting yourself so badly and so dumbly it’s funny.

“The family business, 110 years old is hurting as we can’t keep entry level staff” means that workers find better-paying jobs somewhere else because the labor market is hot, and they have opportunities elsewhere, which is exactly what these charts show. With this statement, you documented for all to see that these charts are correct. And this turns all your other stuff in the comment into BS.

Not really. We pay far more than the going rate, and it has not helped.

I know the world has changed, but few physical jobs have.

Get out in the real world now and then.

“We pay far more than the going rate, and it has not helped.”

Then that’s not the “going rate.” You suffer from a misconception. Which is why your prior comment is BS. In a hot labor market, what you think is the “going rate” (for a given set of working conditions) is therefore below the actual rate that potential workers with lots of alternatives will accept. These are signs of a hot labor market — that’s all I’m saying.

It’s always tough for a small business to hire good staff. But during a hot labor market, when people have lots of good options, it’s even tougher.

“Get out in the real world now and then.” LOL, you’re an idiot, Bear Hunter.

“The family business, 110 years old is hurting as we can’t keep entry level staff.

It is not just money, it is expectations! More people to do the same amount of work.”

Same drivel from people complaining about the improvement in wages. If you can’t keep entry level staff at the wages you’re paying, you’re either (a) underpaying relative to the market, or (b) underpaying relative to the job you’re expecting people to do. Or, likely, both. Your expectations are as out of line as you’re suggesting the entry level staff is. Expectations for workers in this economy has changed. Take care of them with better work + better pay and you create loyalty. Stick to a 110-year old mentality and you can’t get the talent you need. Seems pretty straightforward.

Tom – speculating that Hunter’s family biz probably DID ‘take care of them’ earlier in its history, but like many ‘Murican firms are wont to do (and have done), has fallen victim to the gradual forgetting of a very important component of what brought them to, and kept them in, the dance for so long…

may we all find a better day.

Though I know they’re inevitable, I’m glad there hasn’t been a recession yet.

What happens when a recession happens?

Will all the birds fall to the ground and die, will I still be able to watch “house in the prairie”? Probably nothing happens other than what’s been happening, all the wackadoodles will still be doodling, prices still rising, nothing new.

People lose jobs. 99.9999% of wealthy people are just fine. Little guy suffers.

Wonder if we have a recession when it’s the wealthy who loose money in the market, and very little in the way of job losses?

The little guy just keeps skipping along….loopty do, skip to my lou.

But your sure we must have job losses for a recession, Poor like you?

The economy is great if you’re not a young person who didn’t get to buy a house back during ZIRP. Or a lower income earner. Or you didn’t have to move out of your house that had a low interest rate.

This economy is broken. Great for some and horrible for others. Some people’s wages didn’t keep up with the cost of living increases. It’s not great for them when their groceries and rents have gone up a massive amount in four years. But, I’m sure they’re real happy when the news tells them the economy is great.

The lower end of the income spectrum got the biggest pay raises during the past couple of years. This has been well documented. And those pay raises outran inflation.

Also 65% of American households own their homes, and for them, rent is not an issue.

And of the 35% that rent, many are “renters of choice,” with good incomes that rent fairly expensive places. Landlords love them because that’s where the money is. Nearly all new multifamily construction and build-to-rent single-family houses are for renters of choice, not low-income households (which is part of the problem). For example, in San Francisco, the median asking rent is about $3,300, meaning that half of the rentals on the market in San Francisco want more than $3,300. A nice 2-bedroom is $5,000. People could buy a house for that within commuting distance. So they have a choice, hence “renters of choice,” but they want to live in the City and have easy access to all the things the City offers. People make choices all the time, and thankfully, we don’t all like the same things.

“The lower end of the income spectrum got the biggest pay raises during the past couple of years. This has been well documented. And those pay raises outran inflation.”

Yeah, but you’re missing entire economies of scale here. If I’m an hourly worker and my pay was $15/hour (~$31K per year), then a two household income = $62K per year. Even if they got a 20% raise (“biggest pay raises during the past couple of years”), then that household income has only gone up to $75K/year, a net increase of call it $13K/year. Sure, that compounds. But $75K still isn’t buying jack in the way of a house. You can call them a “renter by choice,” but it’s hardly their choice.

When the average home price spiked from $384K in 2018/19 to $500K in 2021, that means their monthly (30yr mortgage) payment went from $1,600/month to $2,700/month. That “biggest pay raise” is gone with just that increase in payment, to say nothing of everything else inflation touched, nothing of the increase in food, utilities, insurance, etc.

Yeah, they (we) all got big pay raises, but much (most/all) of it has been eaten by inflation and other things, and so we become renters “by choice,” but it’s hardly the same thing as an actual choice.

You’re comparing the low end of the income scale with the average home price. Not going to happen. People at the low end of the income scale aren’t going to buy the average home — they never could do that. They’re going to rent at the low end of the rental scale.

Not true, Wolf. Those income figures (2 income earners) = the average median household income compared to the average home/house value. Those folks certainly aren’t renting at the “low end” of the rental scale.

Wolf:

I certainly hope this isn’t a RTGDFA(again) because after I read through I scanned several more times to see if you talked more about it at length… but I looked for that frying pan pattern in your final chart.

Near as I could spot, it looked like 1985 and 2007 had the closest resembling plots to where we currently are (in terms of trend). Is this a “there’s a difference between correlation and bullshit” thing or is relatively normal when there are periods of high inflation?

I guess the stupid question I’m trying to get at is: should we be concerned about the handle of the frying pan being a precursor to worse things on a more immediate(ish) time frame?

“should we be concerned about the handle of the frying pan being a precursor to worse things on a more immediate(ish) time frame?”

Most definitely, looking at the handle of the frying pan, as you did, you should be concerned that you get grease burns on your forearms from an overheating economy.

Apparently there’s a recession in transaction volume on wall street, we’re suddenly trading like it’s Thanksgiving week, with everyone on hiatus.

I guess that means Christmas for June and a new normal? Maybe November will have the January effect and everything will be normal… Nah, not happening.

Why would anyone buy anything at these sky-high prices??? Volume should be zero until prices come down far enough.

I’am old……so my memory is a little shaky.

but I remember Wolf writing about some stuff mid last year concerning the shelter cost adjustment that was going to juice inflation this year. Shelter cost is a big banana in the CPI which everyone is focusing on for next week.

I wonder if that is causing the inflation to stay elevated? Lots of folks are expecting the CPI to be a surprise.

In the six real estate markets I monitor, Indy, Dallas, Portland, Seattle, Northern Ill and Orlando prices are all over the place. Indy, Dallas seem to be firming. Northern Ill is good. Seattle and Portland down a bit,

Orlando falling apart. Of course rents are the way the fed measures mostly but rents generally follow prices.

Lots of data next week to get all excited about.

As for the claims number……one thing I know……it’s trends not a day. If the number is higher the next four weeks…….all H ought to break loose.

Had a tooth implant estimate at $4600 last September. Called yesterday and price had dropped to $3000. Got me in same day. I suspect that discretionary spending is contracting.

I paid $7,000 for mine in 2010, and it lasted 10 years before it came loose. Massive deflation going on in this joint. 50% in 13 years!

Take a vacation to Turkey and get your implant done for $1,500.

How come the Wingstop CEO does not get the same press as the NVDA CEO? Both stocks have returned 400% the past two years.

Fast Casual stocks are on fire. I guess people are downsizing from restaurants and such. Wingstop, CAVA, ShakShack, Chipotle. Incredible stock returns. Consumers like to eat out that is for sure.

I tell you what, I own a couple of rental properties and property taxes and insurance hicks feel like they are getting out of hand.

Plus, any maintenance work is very expensive. Things I repaired just 3 years ago cost 20% to 30% more. Landlords are going to have to increase rent as leases rollover this year. I even told my insurance company I could not sell my house for the replacement price they estimated. They said that is what it would cost to replace your rental if it burned down or hit by a tornado.

My property tax rose over 40% for this year. The neighbor city raised their property tax about 40% too.

I know Wolf breaks all this stuff down but sometimes I forget but these increases will be part of this years CPI challenge for the FED I am guessing.

Thank goodness oil and nat gas prices have pretty much been flat and in a range for 14 years going back to 2010 and not effected by inflation. Just think were prices would be if energy was hit by inflation.

Thanks for – as always – the excellent analysis Wolf 🙏🙏🙏

all i can say is that it seems like there’s a general sense of discontent throughout the western world. whatever the stats show about these economies, people aren’t happy. i suspect it’s because inflation is leaving them worse off, or at least they perceive it that way.

Darn it! The arm chair economists on Youtube (those repeating talking points by politically oriented “groups” and having no actual credentials) are on year THREE of hoping and wishing, and, and trying to force a recession and yet (sigh), everytime they open their yaps, the economy just keeps getting better. Where is the fun in that?

They’ve got an optimistic agenda and it’s just not going to work if people keep succeeding.

S&P 500 hit a low of 2237 in 2020. Sounds like many regret not loading up the wagon back then, 4 years later nearly 3,000 points higher the doom and gloom naysayers are over shadowed by bull market winners. American economy running on all 8 cylinders, imagine if QE started back up tomorrow S&P would skyrocket to 7000 points.

“…imagine if QE started back up tomorrow S&P would skyrocket to 7000 points.”

People keep dreaming about QE. But good luck. Not happening. The problem now is inflation. So we have QT, which is the opposite of QE. $1.6 trillion in QT.

QE ended in early 2022. And now the Nasdaq is about flat with its high in November 2021… so that was 2.5 years ago. Look at a chart, you can draw a straight line across the huge plunge and rise that the Nasdaq when through, and you end up on Nov 21, 2021, about same as today, despite all the AI mania. And you had a lot of white-knuckle days in between.

The S&P is up less than 9% from its January 3, 2022 high, so that’s about 2.3 years ago.

That’s why people keep dreaming about QE. Without QE it’s just not fun.

Wolf,

Aye, the unemployment insurance claims MSM headlines are right out of the ‘State of Fear’ playbook.

Continuing claims remain glued near the lows.

As for the 2.5 MM continued claims baseline in your chart, might want to nudge that a bit higher. Labor force growth…and as you’ve noted many times the BLS is now consistently understating its size.

Yes, the black line is surprising. It shouldn’t be flat. It should rise with the increase in the labor force. But over the past four decades, the numbers were at around 2.6 million. So I hate to move it up, and then next time, it’s still at 2.6 million. This tightened the definition of a recession over the years. But that’s how it has been. My theory is that the people at the NBER, who decide when the recession started, are somehow hung up on something that remains static, rather than go up with employment. Remember, this indicator is just trying to predict what the NBER will do.

That week-to-week jump will likely unwind over the next two weeks. Will be interesting to see the headlines.

Wolf is sounding so bullish on the economy I may subsitute a down payment on Jim Cramer’s investment club instead of my usual quarterly donation.

What this says is that we might not want to expect inflation and interest rates to come down much, if at all.

It’s coming – when you least expect it .

Look for a depression ( would the Fed ever say the word ? ) major recession they may call it now. Should have one but time is hard to call say be safe one could start as early as 2027 but also start 2032 but great chance in that 5 year time frame.