Fed and ECB combined removed $4 trillion in liquidity. Inflation, after decades of calm, is hammering some sense into these central banks.

By Wolf Richter for WOLF STREET.

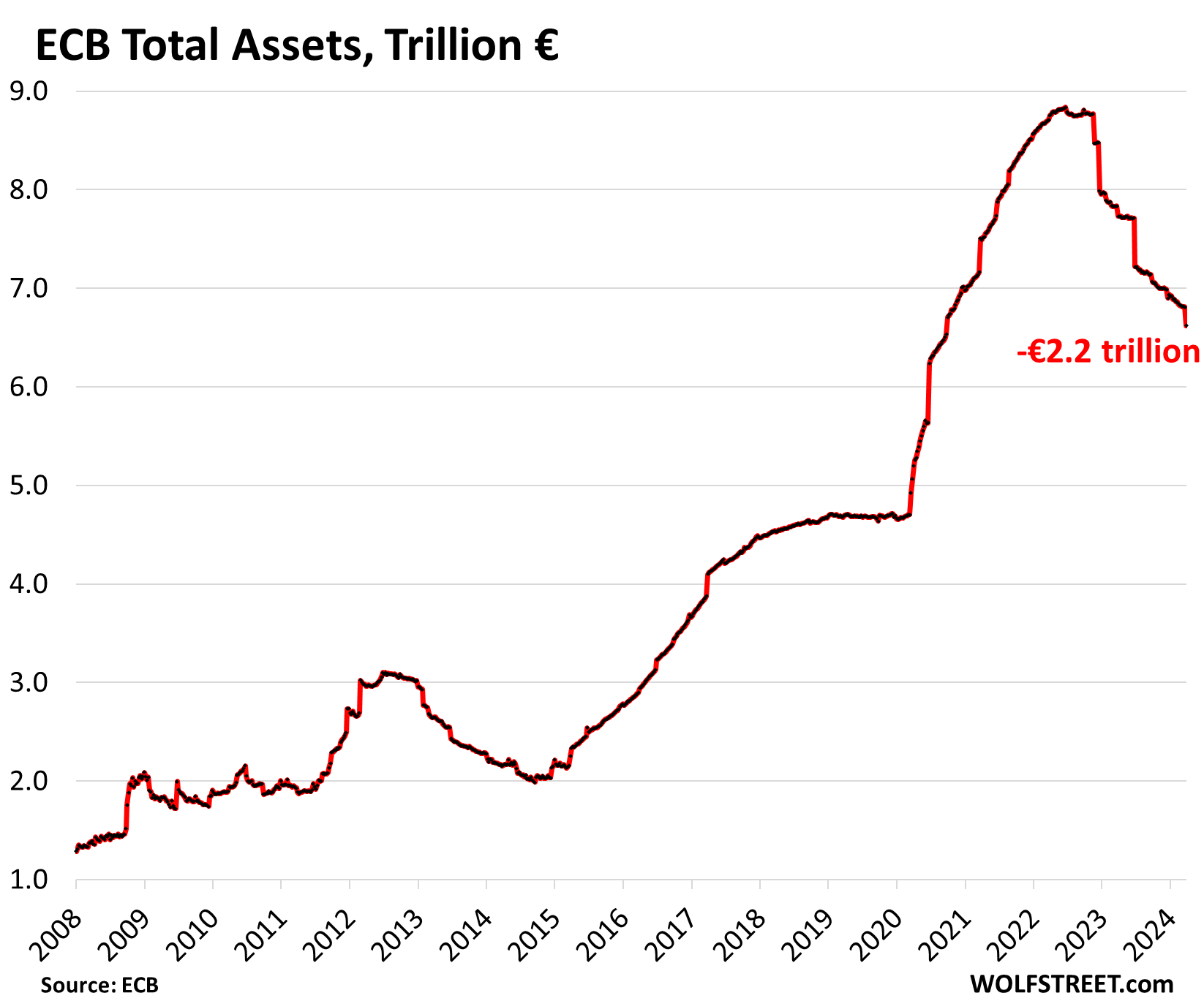

Since the ECB began Quantitative Tightening, it has shed €2.22 trillion of its assets, as of the latest weekly balance sheet released on April 4. Its total assets are now down to €6.62 trillion, the lowest since September 2020.

In USD at the current exchange rate, the ECB has shed $2.40 trillion in assets, while the Fed has shed $1.53 trillion. Between the two, they’ve removed nearly $4 trillion in QE liquidity, something that was completely unthinkable just a couple of years ago. The resurgence of inflation, after decades of calm, is hammering some sense into these central banks.

The ECB has now shed 25% of its total assets from the peak, and 53% of the amount in assets that it had piled on during the pandemic:

The ECB handled QE with two very different types of assets, and it is now unwinding both of them, but at a very different pace:

- It offered loans under favorable conditions to banks, and it was up to them to deploy the liquidity.

- It purchased securities, including government bonds, corporate bonds, covered bonds, and asset-backed securities, thereby handing financial markets this cash.

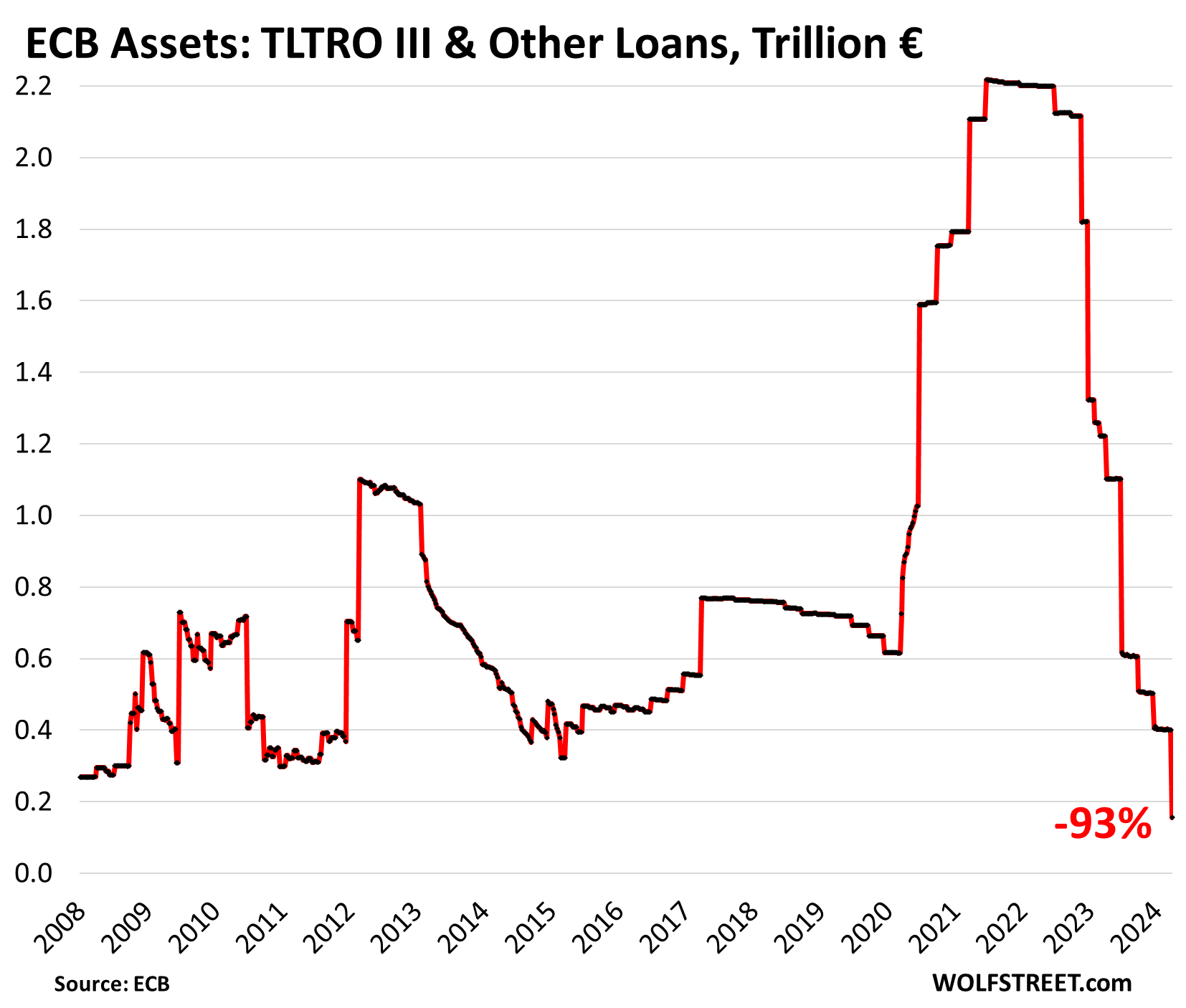

Loan QT: -€2.06 trillion or -93% from peak.

The ECB has always handled QE via waves of loans: during the Financial Crisis, the Euro Debt Crisis, the period of no-crisis, and the pandemic. The ECB gave these loan programs different names: Longer-Term Refinancing Operations (LTRO), then Targeted Longer-Term Refinancing Operations (TLTRO); then numbered TLTRO programs. During the pandemic, the ECB called that generation of loans TLTRO III.

TLTRO III loans amounted to €1.6 trillion at the peak in June 2021, on top of the other outstanding loans from prior programs, all in all, €2.2 trillion.

When the ECB announced QT in October 2022, as a first step, it made loan terms unattractive and it opened more windows for banks to repay those loans, which banks did in big waves, which removed liquidity from the financial system via the banks.

As of the most recent balance sheet, banks paid back €2.06 trillion, or 93%, of all loans outstanding since the peak. Only €156 billion in loans remain on the balance sheet. In other words, loans are essentially gone.

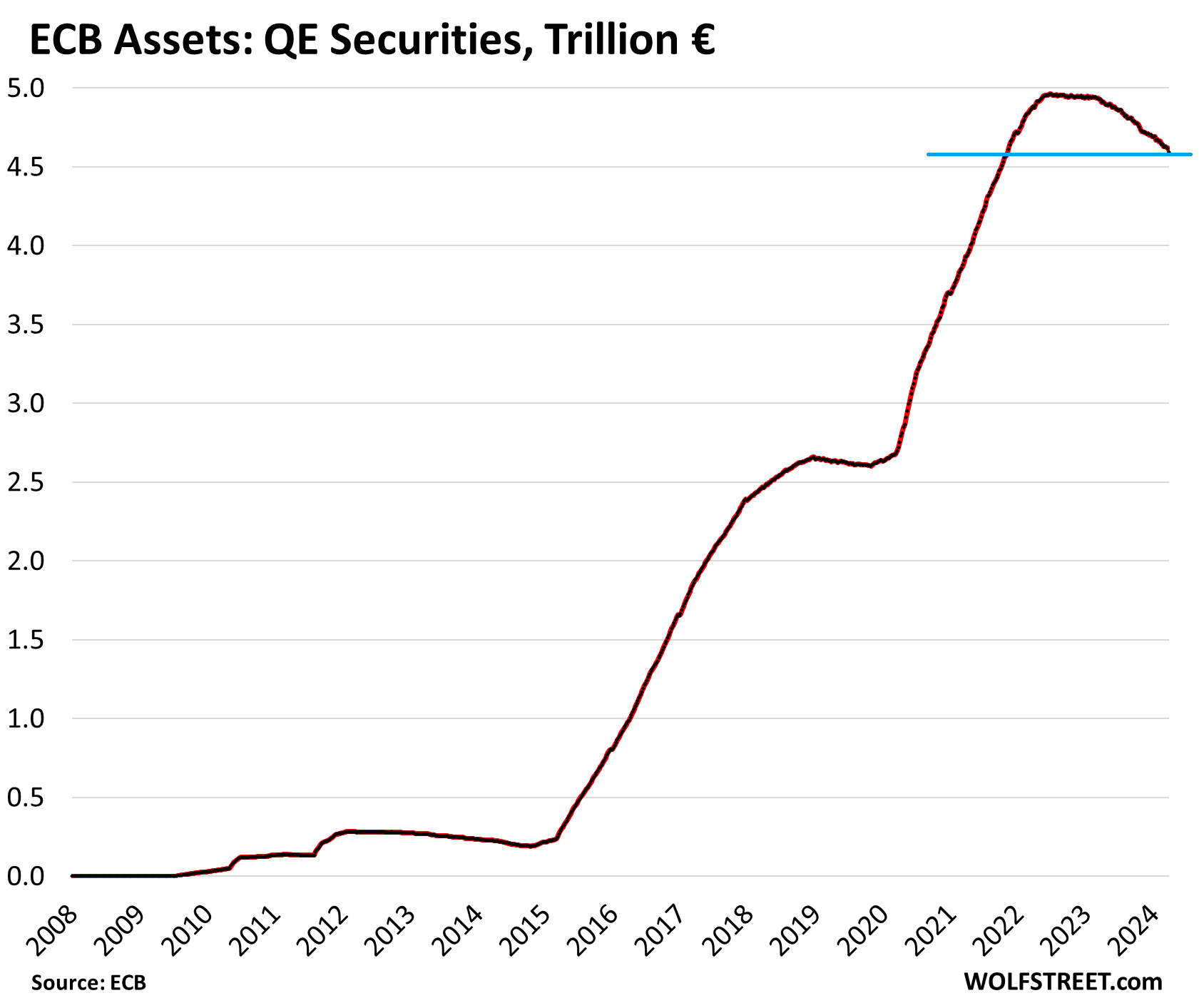

Bond QT: -€369 billion from peak.

The ECB bought bonds under two programs: APP (“asset purchase programme” since 2014) and PEPP (“pandemic emergency purchase programme” since March 2020). Bond QT started slowly in March 2023 and has since accelerated, and further accelerations have been announced.

The initial roll-off of APP bonds in 2023 was capped, but the cap was removed in July that year, and APP bonds have been rolling off without cap. Whatever matures, rolls off without replacement.

On the five weekly balance sheets with a closing date in March, €50 billion in APP bonds matured and rolled off. Since the peak, €369 billion in bonds rolled off, nearly all of it APP bonds.

PEPP bonds will start rolling off in July, which will accelerate the roll-off.

The roll-off reduced the APP and PEPP holdings to €4.60 trillion (€2.93 trillion in APP bonds and €1.66 trillion in PEPP bonds), the lowest since November 2021. But this is just the beginning, and there is a very long way to go.

Bond QT is designed to run for years without fanfare on automatic pilot in the back ground, just quietly removing liquidity in a predictable and transparent manner, so liquidity has enough time to flow to where it’s needed from where it’s in excess, attracted by the higher yields that those who need liquidity are willing to pay.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I think the ECB was smarter than the Fed by giving the money to the banks and letting them distribute it. the Fed made the mistake of dropping money from a helicopter in the form of checks to every single American.

I do not excuse the banks for this, but still the ECB acted sensibly

It wasn’t the Fed that sent checks to everyone, it was the US Congress & the US Treasury. But yes, the Fed backed the giveaway by buying Treasury securities.

These central bank asset graphs need more lower to go. Way more lower.

Here in Canada, every week I go to the grocery store the prices go up by 10-25%, but not a lot of people will notice it because it’s a 25 cent or 50 cent increase per month.

And in Canada, small businesses, especially small grocers pay more in fixed costs and rent which appears to be based off of feudalism. Canada has a way different economy than the US or EU.

So they pull $$ from the general economy but increase the deficit to finance wars and pay interest on that debt..guess what..inflation increases while economies go into recession..great!!

Grocery prices may be increasing, but they are not increasing 10-25% per week.

This would mean prices would be 46%-244% higher every month.

Your $2 can of soup is not costing $3 – $9 in 4 weeks.

Get a grip.

Inflation is lowballed because obsolete technology is considered in the calculations, substituting is done if a brand name is too expensive.

A store brand coffee was $3 a few months ago; now it’s $6.49 at the same store. Same with frozen veggies used to be $2 a month ago, now it’s on “sale” at $2.99. A bag of Doritos used to be $3 regular a year ago, now it’s $4.99.

Food bank usage has skyrocketed in so-called world class city of Toronto.

Food prices are inching up. People are angry at the grocery giant Loblaws.

Jack

“Grocery prices may be increasing, but they are not increasing 10-25% per week.

This would mean prices would be 46%-244% higher every month.”

Lol, correct. I am also in Canada, as an added bonus I have the displeasure of grocery shopping in the North (NWT) 2/3 of the month. My bills are definitely more painful now than a year ago, but not 1400% more painful 😆😂🤣

I don’t know where you are shopping GenZ but you need to switch it up. Last time I went grocery shopping (a week or two ago) I was pleasantly surprised at how many items had come back down closer to their historical level price wise. Not everything of course, there are some things (especially meat) where there is still sticker shock, but even these seem to have mostly stabilized at high levels.

No. The Federal Reserve did not do what you assert at all.

I’m an American and didn’t get any check. No stimmie, no PPP, no ERC, etc. Just paid my taxes like every other year.

At least you can feel noble & justified compared to those users who sponged off the federal government. There is that.

Thanks for that. I’ll try to feel more noble and justified when I write a check for 20k payable to Uncle Sam in 8 days. /s

Paid your taxes every other year? No wonder.

I’m sure that’s what you meant.

I like working hard but I also like free money, it was an easy choice.

During the lock down learned to cut my own hair, which was good, watched a few u-tube videos.. wallah, still doing it.

It’s so predictable right? Americans are all lazy and fat, living off the government. /S. Open season on all of them.

Tell me, what Marxist paradise enjoying the benefits of free money do the intelligentsia in the comments call home? (Besides America)

Most of the heat is reserved for the wealthy and fat.

Old country song plays.

It’s better to be in the no check crowd than getting a check.

David:

????? Not getting a check? Perhaps morally? However I do enjoy getting my Social Security check every month so I can eat and live somewhere other than under the viaduct.

My understanding, perhaps incorrect, is that Europe use HICP to measure inflation. The BLS does something in this category called the R-HICP-U. While it doesn’t make sense to necessarily compare inflation of different countries from a consumer standpoint, it is a point of curiosity as to how they generally differ in measurements with specific categories and overall meaning.

Coming yourself that you have any shops to go in. My home town, like many others across the UK , have been transformed into what resembles a post nuclear ghetto. The food shops that do exist play some sort of random price generator where an item that has a recommended retail price of sat £1 on the Monday could shoot up to £2.50 on Tuesday, back to £17.5 on Thursday etc etc. the shops are also preventing different prices to people that have a store card for that particular store.

In summary they are using rule price swings to confuse people so they have no idea what the prices should. Add that into shrink flation and quality decline and you have a disaster. However, house prices are high and in the UK that’s all that matters 🙄

Between the GFC and pandemic, GDP growth everywhere was pretty anemic. The bailouts directly to corporations or stimulus for the citizens are somewhat questionable in terms of results.

However, in all cases, social unrest and chaos was never an option and obviously these modern monetary programs are experimental as well as expensive.

The GFC played out with too many banks and zombies benefiting from poorly designed stimulus — and the pandemic was supercharged overkill.

I think the resilient global economy we have today is based entirely on reckless irresponsible behavior from the top down. Ultimately, I’m in favor of speeding up QT and running over every zombie along the way. If the zombies haven’t made it yet, they certainly should be cut off ASAP.

They *caused* social unrest and chaos. The world of 2019 vs 2024 is a very different place, in the wrong direction.

///

In a brief conversation with the head of management (in a German company) he said, and I quote: “We will not be able to have the life our parents had. We will actually have to work.”

To highlight the current work culture in Germany*> I am working on a project where there are only five engineers (I am one of them).

Everybody else is a manager, lead or consultant.

The ratio is 10:1 in their favor.

We are 2 years behind schedule and 50M in the red.

But worst of all, they know where this is going and have absolutely no will to change.

I am truly saddened to see what German engineering has come down to.

ECB is doing a decent job, but they all need to pull. I don’t see that happening.

///

*Although this evidence is anecdotal in nature, I have too many first or second hand stories all of which are indicating towards the exact same conclusion. Hence I believe it to be representative of the actual state of affairs.

///

Duuude, welcome to a large corporation, complete with built in failure. See countless examples in teh USA, and now it is your turn in Germany to see epic top heavy management. Somedays I find it amazing that nobody can manage a ruthless restructuring without first going bankrupt. Even GE never truly managed it. Just some rote bs- never real work. Just monopoly seeking. Be #1 or #2 or get out. Monopoly seeking. And GE had access to immense pools of cheap money and still bombed out.

A lot of German companies are facing their rustbelt moment. It will be interesting to see how they do with their built in union management

///

“A lot of German companies are facing their rustbelt moment.”

Best one sentence summary I ever read!

///

A whole bunch of these German engineers were pushed into early retirement. 50 is old in German employment. Ageism is bad in the US, but it’s much worse in Germany, it starts maybe a decade sooner. Now they don’t have enough engineers. But a 35-year-old German boss isn’t going to hire a 60-year-old engineer, or maybe not even a 55-year-old engineer.

The real question is what happens in the developing world with all the excess liquidity drains in the center economies. Money starvation will start at the periphery, not here in America. So watch what happens elsewhere. Just like in the late 90s, symptoms will start far, and move into the center.

As for housing, well, the Fed put the spike in this week, so we are now just waiting for reality to hit everybody with a $600k house that people can’t afford in the numbers that would fill the market, so down goes Frazier again, in excruciating slow motion. Overpriced housing, meet underwhelming affordability based on the monthly nut. But hey, it’s only 2006, so don’t worry, be happy.

It won’t fall anywhere near as fast, because so much is locked up with low long term rate financing, but it will still drag downward in the formerly hot markets without growing high end employment.

As for the bond market, just punch in 5% plus long term rates until the next big crisis. Everything going on for now is nothing to worry about, and the brics plus developing world financial problems? Meh to the Fed.

Someday this war’s gonna end…

The discussion so far has focused on the persistence of inflation. In the background, we know full-time jobs are declining, commercial real estate is in trouble, and the Russians, Chinese, and Muslim extremists are in a warlike mood. Yes, the CBs can drain liquidity, but it’s undoing decades of liquidity-fuelled excess. Are the governors going to sit right when the wheels of the commerce of excess seize up? I (still) don’t think so. Austerity alone won’t fix it. This is a global economy in need of rehab. My reason for being a gold/silver investor is “now.”

Central bankers are the scourge of the planet. They have absolutely destroyed pricing, the standard of living, and stolen the future wealth of the young and handed it to the already obscenely wealthy where it now sits in their bank accounts and on their balance sheets.

I hope I live to see a massive asset-stripping of all billionaires. They rigged the system. Their gains are ill-gotten.

What we truly need is a good old fashioned recession that tanks corporate profits and stock prices along with them.

That will give most billionaires and trillionaires a major haircut, since the vast majority of their wealth is tied up in stock against which they borrow, tax free to finance their lifestyles.

For some reason our government will no longer allow recessions to occur, even though they are a healthy part of the economic cycle. It’s like allowing undergrowth in forests to burn occasionally so you don’t have a huge buildup of dead wood and as a result, a major uncontrollable forest fire.

It’s because there is so much fraud and leverage in the the system at this point that it would topple everything in a snowball. The threshold of loss for that event to occur doesn’t have much cushion, either. Watch the movie, “Margin Call” and listen to Warren Buffet interviews concerning that period. So, basically, that is why even tiny recessions are no longer allowed.

That’s a great idea! Punish those SOBs who have a lot of money! Never mind that in a recession it’s the middle and lower class who really suffer.

A recession now would entrench inflation for a decade or more.

Your wish will be fulfilled. The great U.S.middle class boom had its seeds in the great depression. When Wall Street fades, Main Street rises….

LoL Depth Charge, the seeds of asset stripping from the wealthy happen with the next generation, and then the following ones end up splat. When was the last time someone talked about the wealth of the Scaifes or Astors? How about the Gettys? Most of them rapidly dissipate the inherited wealth, and it turns into piles of crap.

As for Central Bankers, they have always been a part of the modern state for 500 years, yet we think we can do without them. While I would rather have a more disinterested Fed, politics now weighs so heavy on the entire system, that true long term decision are nigh impossible.

If this election is the R waterloo moment, then we might even get a New New Deal, with a lot of changes that might ultimately improve our country. But the end of cheap labor arbitrage is going to kick a lot of inwestor’s in the privates.

I get studies have been done with fortunes being passed down although limited. However it is a reductionist view and your examples are not accurate. Scaifes have foundations and were big supporter of climate change denial movement. Brooke Astor was famous for donating money and gave most away but son got some money, although reduced for elder abuse. She said money is like manure and not useful until spread around.

Gettys have plenty of money but in a museum trust worth 7.7 billion or so.

Wish more of the people with fortunes decided to distribute their wealth to positive causes. There are of course those that blow the money as well.

Those foundations are dead money. The real wealth is gone, and they just don’t count for much. The funny part is the comment about the Scaifes, they are conservative players, with the emphasis on players. Wealthy people play at politics with their foundations. The only really influential ones still make money while hiding some of it in their philanthropy.

Art foundations=dead money. Most political donations by foundations=dead money.

That museum trust is not going to do much for the great grandkids- they already got the payout from the original getty trust- $500k each in the 90s

Meh. Dynasties are the exception,not the rule.

Central banks exist to help governments finance themselves by stealthily transferring wealth away from the average person’s savings.

It’s the hidden, but real, reason why central banks exist.

I’ve never understood why Catholics strictly prohibited usury, yet non-Christians could freely bondage commoners with shark loans, bringing commoners to a financial ruin across regions for many centuries?

Two points.

One. Banks have busily financed tech start ups since 2000 and are now navel gazing. Digitised money dont need no middleman just point to point customer to customer transact.

Two. Europe has 50ish families who have had companies for over 200 years – Henokiens. UltraHigh Net Worth or UHNW are being strategically herded by institutionalcircle and cynosurewealthadvisors. Never a good thing when all these families wealth is grouped, directed, and working together. Why have government taxes and voting?

Central banks, bankers, have been very creative hiring maths PHDs to think up * fill in blank * to keep the banking wheels turning in their favour while day to day they exist outside of ethical law and legal punishments. I refer to the libor traders that appear to have had their sentences overturned. Lets face it. AI could think up better wealth sharing for all humanity. Existing system exists in Europe because of 50 families.