When will it get messy for our Drunken Sailors? Not now.

By Wolf Richter for WOLF STREET.

Mortgage balances outstanding ticked up by 0.9% in Q4 from Q3, to a record of $12.3 trillion. Year-over-year, the increase was only 2.8%, according to data from the New York Fed’s Household Debt and Credit Report.

This small increase in mortgage balances is the result of a strange mix: Purchases of existing homes have plunged by one-third, and mortgage origination volume has collapsed, with existing home prices still sky high; but new house sales have held up, as prices have dropped 17%. And homeowners with these infamous 3% mortgages are not selling, and they’re not buying, and so they’re not paying off their 3% mortgages, and they’re not getting bigger new mortgages.

But HELOC balances resurge from rock-bottom.

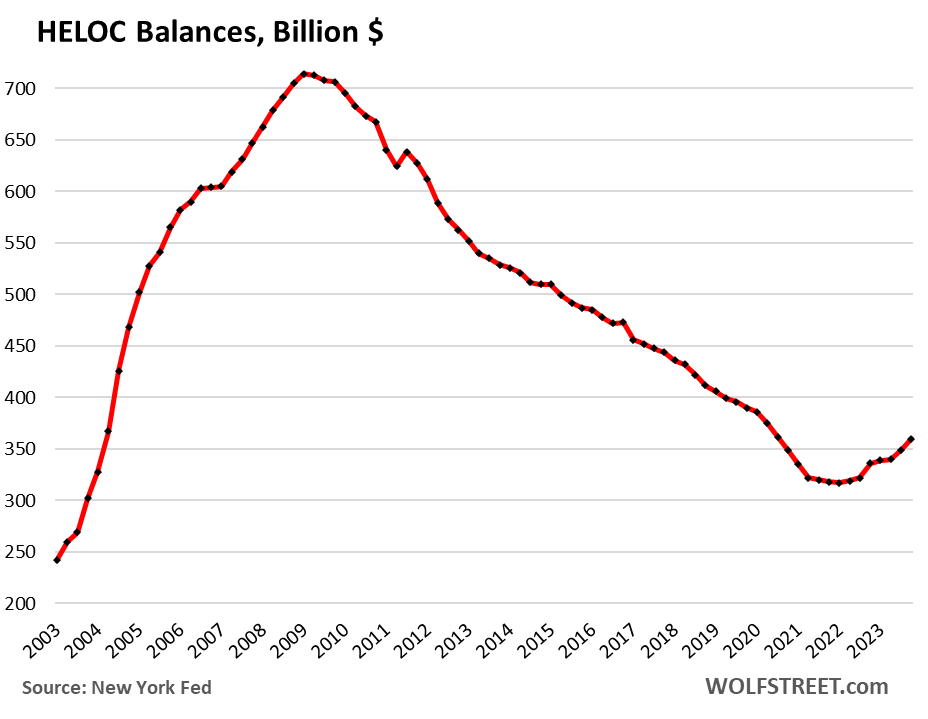

HELOC balances jumped by 3.2% in Q4 from Q3, by 7.1% year-over-year, the 7th consecutive quarter of increases, and by 13% from two years ago. So HELOCs (home equity line of credit) at $360 billion, are still historically low, but the high mortgage rates have changed the trend.

HELOCs – a way for homeowners to extract cash from their home equity – are now powered by the much higher mortgage rates that make cash-out refis very unattractive because homeowners would swap a 3% rate for a 7% rate on the entire amount of the mortgage. And refi volume has collapsed. With a HELOC, they can extract cash and pay only 7% on the much smaller HELOC amount while continuing to pay 3% on the much larger mortgage. So HELOCs are coming back.

In dollar terms, HELOC balances increased by $24 billion in 2023, and most of this $24 billion was earmarked for consumption, from home improvements to vacations. They represent another, if light, tailwind for our tireless drunken sailors.

The aggregate burden of mortgage debt.

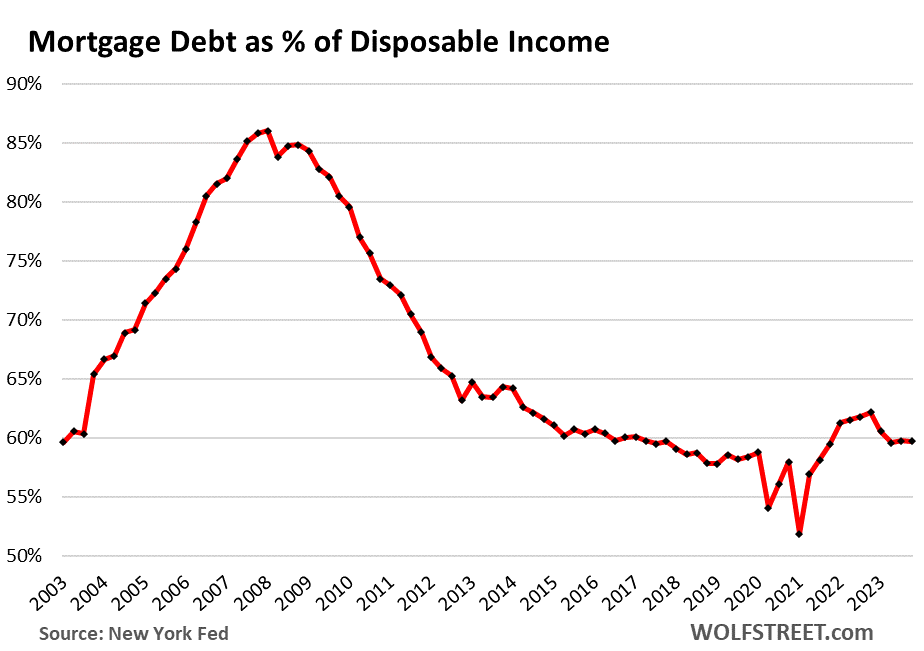

Homes are lot more expensive today than they were 20 years ago, but the effective interest rates on mortgages outstanding are a lot lower than they were, and consumers make a lot more money too, they’ve gotten the biggest pay increases in 40 years, even as mortgage debt barely increased, and there are a lot of renters, and they don’t have any mortgage debts, including the many “renters of choice,” who have relatively high incomes and live in higher-end rentals.

So in aggregate, the entire $12.3 trillion in mortgage debt as a percent of total disposable income is roughly where it had been for years, and even in 2003.

Disposable income is income from all sources except capital gains, minus taxes and social insurance payments. This is the cash that consumers have left to spend on housing, food, cars, debt payments, etc.

Delinquencies aren’t even normalizing yet.

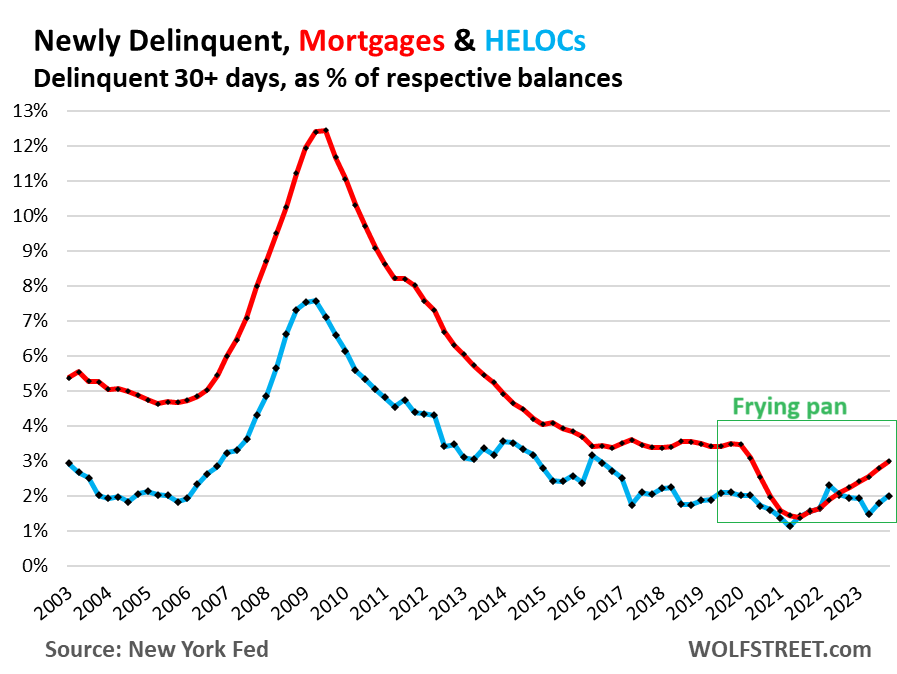

Transitioning into delinquency: Mortgage balances that were newly delinquent by 30 days or more at the end of Q4 ticked up to 3.0% of total balances — still lower than any time before the pandemic and down from the 3.5% range in 2017 through 2019 (red line in the chart below).

HELOC balances that were delinquent by 30 days or more ticked up to 2.0% — at the low end of the range in 2017 through 2019 (blue line).

Note how mortgage delinquencies are forming a “frying pan” pattern, as I call it (though here “wok pattern” might be better?) as they come out of the lows from the free-money and forbearance era of the pandemic when delinquent mortgages were moved into forbearance and then didn’t count as delinquent.

This shows that mortgage delinquencies haven’t even normalized back to the Good Times levels yet.

Serious delinquency: Mortgage balances that were 90 days or more delinquent by the end of Q4 edged up to 0.57%, about half the rate before the pandemic (red line in the chart below).

HELOC balances that were 90 days or more delinquent dipped to 0.62%, the lowest since before the Housing Bust (blue line).

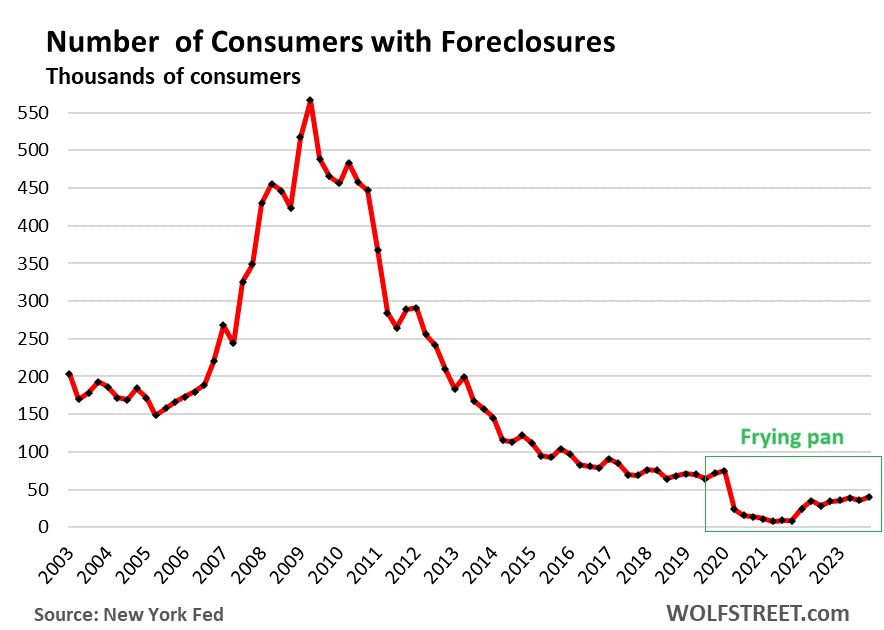

Foreclosures are also in a frying-pan pattern.

The number of consumers with foreclosures has edged up a little after the deep hole during the forbearance era when foreclosures essentially came to a halt and by 2021 had dropped to near zero.

In Q4, there were 40,200 consumers with foreclosures, compared to 65,000 to 90,000 in the years 2017 through 2019. Foreclosures are lower than anytime before the pandemic. They’re not even normalizing yet.

But alas, we can already see some moronic publication come up with a clickbait-go-viral-title about foreclosures “exploding by 400%,” OMG, from Q2 2021. And we’ll get a good laugh out of it and never ever go back to that publication?

When will it get messy?

Homeowners who purchased their homes more than two years ago are in excellent shape on their mortgages – and that’s the vast majority of homeowners – because home prices have surged so much in the years through mid-2022.

If this type of homeowner cannot make the mortgage payment any more, because they lost their job or had a medical emergency, or whatever, they can sell the home, pay off the mortgage with the proceeds, and have some cash left over to put in the bank.

So even if unemployment begins to surge, and over a year’s time a million homeowners cannot make their payment anymore, they can put their homes on the market – the inventory will be welcome – and if they price it right, they can sell it and still pay off their mortgage with it, and go on.

The problem arises when home prices plunge to multi-year lows, and suddenly a larger portion of homeowners are underwater. If lots of people lose their jobs and can no longer make the mortgage payments, then it gets a little messy. The result will be that homes will become more plentiful on the market, and more affordable to buy, which would be highly welcome by lots of younger people.

But that’s not on the horizon. What’s already here and stretches into the horizon are higher-than-we’re-used-to inflation, and higher-than-we’re-used-to mortgage rates, along with the Fed’s QT, the opposite conditions that prevailed when home prices spiked.

Subprime doesn’t mean “low income.” It means “bad credit” – and some is high income. And subprime auto loans are coming home to roost. Read… Auto Loan Balances, Subprime, Delinquencies, and Income: Who Are those Drunken Sailors?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Nearly all of those charts look exceptionally good, but I could be missing something.

What you are missing is:

1. A chart for cash out refinances vs Helocs. Anyone who doing cash out refinance at these higher rates failed to qualify for Heloc and is desperate.

2. Correlation with Fed MBS holdings. The debt and the inability to pay it is at all time high and is hidden in the balance sheets of Fed. Let Fed sell MBS outright and Helocs will go through the roof in a week.

Here are cash-out refis. I put a red box around 2023 (yellow) and 2024 (black). The chart is from AEI Housing Center:

“Homes are lot more expensive today than they were 20 years ago, . . . and consumers make a lot more money too, they’ve gotten the biggest pay increases in 40 years”

Wait, according to FRED data, the average household income has only risen by $5,970 since 2006 through 2022. That’s only an 8.7% rise in income. However, the median Sales price of home rose from $257.4K to $479.5 or 86%.

Are you sure about the consumer income side of things? Seems like home prices have risen 10 times more than wages, right?

What am I missing?

I don’t know what you’re looking at, maybe “real” income adjusted for inflation? If yes, you cannot compare that housing costs that are not adjusted for inflation. You have to keep it apples to apples.

So the St. Louis Fed (actually the Census Bureau) has a “median household income” series. In 2006, it was $48,200, and in 2022 (2023 not yet available but it’s up likely around 5%) it was $74,500. So median household income increased by 54% over this time span.

I’m looking for just these buys

—

yeppir

gonna make HELOC whole and keep underlying 3% mortgage

and gonna flip or make rental

Housing will turn when the economy (labor market) turns in a meaningful way, whatever the cause to be. Access to housing credit is dependent on your income/work history.

Thanks Wolf,reader since 2018 (I think).

That # of foreclosure chart would like even more wild normalized for population. A counter current effect of high mortgage rates might be the it prevents people from overextending themselves with debt.

Anyway I’m sure some experts from zero hedge will explain how these charts predict a total economic meltdown.

Heloc’s are good. They keep the economy sizzling. Bankers like them too, especially with those higher rates of return on money lent. Think of all that bonus potential. If those charts looked much better, central bankers would be full on giddy. From what I see, there will be no fed induced money helicopter drops in the near future. Party on sailors, party on.

Damn, strong f-ing RE market. Only a massive job-loss recession would be able to take this market down. Lower rates in the next couple of years means even more tailwind for price appreciation.

My money is on no crash but slow and steady.

A banking crisis might bring down the residential Real Estate market a tad.

Right now it looks like CRE may be starting to hurt the solvency of some of the big banks…..and they have a lot of deposits not covered by the FDIC.

Maybe Wolf would like to comment further on the problem ?

NY Community Bank lost half of it’s value after reporting a 252 million dollar loss. 185 million was from 2 Commercial Properties. It’s a fractional banking system, the banks are not holding Enough money to cover properties. Plus, people are taking all their savings out just to live, they have Liquidity problems because of this, can’t get your money? You are Right. NY Community bank took over the defunct Signature bank. It’s a downhill slide. The crime level in NYC, remember the fires of 1970’s. The Federal Government wouldn’t bail them out. All that Crime is taking down the values of Commercial properties. Think about it when you vote.

@Joni,

“Plus, people are taking all their savings out just to live, they have Liquidity problems because of this…”

Post of the day!

(in an erroneous and not so good way)

For those who make up their own facts and live in their own crazed fantasies, crime in NYC in 2023 is down from 2022. I was in NYC in the 70s and it felt like a movie about the end of civilization. Move along you crazed lunatics – nothing to see here!

Many police departments and cities including NY didn’t report their crime stats to the feds in 2022. Don’t know if that continues but I wouldn’t be surprised. As an example, it’s very hard to get stats on smash and grabs but I found out recently that the adjacent county had 78 in the last 6 months, so about 1 every other day. Businesses aren’t even bothering to replace their windows as they keep getting broken.

Most cities report their crime stats to the public. So you can look it up. Here are San Francisco’s crime stats from the SF Police Department:

https://wolfstreet.com/san-francisco-homicides-rapes-robberies-aggravated-assaults-burglaries-larceny-thefts-auto-thefts-and-arson/

The reporting to the Feds is for national purposes and comparisons.

It looks like the HELOC phase may be starting. I usually follows price run-ups.

Who knows, maybe it will be a little different this time. I remember during HB1, a neighbor actually had a 2nd and a 3rd mortgage on her house. Money was so loose back then the 3rd mortgage bank let her take out up to 110% of the house value. LOL So when houses prices quit going up and she could not refinance anymore and prices dropped, she walked away. The problem was the holder of the 2nd mortgage and the 3rd mortgage were trying to fight who took the biggest loss on the foreclosure sale.

Should be no fight there – the 3rd is last in line – first to lose, the 2nd is next. That’s why the interest is higher on 3rds – higher risk.

For liquid holders of 2nd and 3rd mortgages, in the case of default of the 1st mortgagee, having the equity of redemption means the 2nd mortgagor can pay off the 1st mortgage and gain ownership of the property. If the 2nd mortgagee forgoes this option the 3rd mortgagee can then clear both the 1st and 2nd and gain ownership of the property.

Especially in rising markets, or in the case of good equity in the property, 2nd mortgage investors, besides having a higher interest return, have this as an investment strategy should they choose to hold the property.

In Canada when I was in the RE business a lot of people with excess funds (doctors, etc) used to grant 2nd mortgages. Better interest and the option to score if the property was attractive.

Very easy for this toad to follow, enjoyable to read.

I was an appraiser for 40 years. I saw tons of HELOCS over my years in the industry and the same people would refi or get HELOCS time and again many multiple times. These folks never got out of debt. They were locked in. IMO people are fairly stupid when it comes to finances.

This economic system is rewarding to those that invest with leverage. Assume one would have bought houses with low down payments in the past ten years. Damn. This has been nothing but a raging bull market. Not saying you should do this. And none of this is financial advice. But the numbers don’t lie. Of course, someone is going to point out: if you bought at the peak you are down %. But I am talking about the past decade…..housing nearly tripled in some areas. one can only wonder what the next ten years will look like.

“This has been nothing but a raging bull market. ”

Raging bull sh it market. If you stay in the house you bought 5, 10 years ago, all you have is a comp and much higher taxes and insurance and maintenance costs. All unrealized gains until you sell, if you sell. I don’t see that as a win for those people. Prices are already coming down in many areas, so their gains may be gone tomorrow, who knows. Nothing positive in our corrupt financial system.

In ten years, there won’t be a country left at this rate.

Sure, I’m getting higher interest rates on my cash which is good, but I’m also constantly worrying when the Fed will take it away to prop up the casino and our excessive consumption driven economy. I’m also paying a lot more for services than I ever could have imagined a few years ago.

Sure the carrying costs have increased, but incomes have increased more than enough to compensate for that.

would have to agree, at the rate we are going i do not like the outcome in my 70ies and going to spend what i have

“ If you stay in the house you bought 5, 10 years ago, all you have is a comp and much higher taxes and insurance and maintenance costs. ”

If you bought ten years ago you are sitting more than pretty. A locked in rate and a constant PITI vs increasing rents. Your mortgage – if you bought ten years ago – is likely what someone pays for a one bedroom today. All depends on location and other specifics.

I am the first guy who would want to see lower RE prices but I am also a realist.

Mgpat:

“Sure the carrying costs have increased, but incomes have increased more than enough to compensate for that.”

So you are no further ahead. What a joke this country has become. I know too many skilled people who are feeling the pinch.

Chris:

Doubtful this can last. I do think this will end and will end badly.

Our society needs to stop perpetuating the lie that owning a house is the greatest investment for most Americans. It’s bad math and some gamblers will win.

That said, income-producing property, at least under our current tax system, has been a great investment.

This may color my perspective, as I would have liked to buy so many more during the ‘free money’ era. I was sadly distracted by a full-time job.

Nonsense. If you bought 5 or 10 years ago, you would have refinanced a few years ago and locked in a lower interest rate. That lower rate would more than compensate for any increase in taxes and maintenance you would have.

If you really think paying for a house you bought at 2015 prices is too burdensome now, sell it and rent. Somehow I’m betting your total expenses are less than what renting a similar place would cost.

I agree 100%. It’s all just smoke in mirrors

For the majority it’s all about consumption. We (not all of us) move toward and attracted by things that “make us feel good” (ie pleasure), however that depends upon the eyes of the beholder. For many of us, spending money on things we want vs. things we need is easier to differentiate, because it makes those of us, who are are a little more versed in finances “makes us feel poorer” (pain), and hence we avoid it. Simply an economic yardstick

for the pleasure vs. pain analysis.

Larry,

Most of us go through I day soothing ourselves, not working toward a predefined goal.

Most would benefit greatly if tomorrow they asked Why, they woke up, why they ate that breakfast, why they went to work there, why they ate that lunch, why they came home at that time, why they ate that dinner, and finally why they consume that media.

They would find an immediate way to optimize their day, even if it was just defining that vision of what they would like.

My parents bought a house for $12,000 in 1957, it had a $258,000 mortgage balance when my father died in 2009. There were some additions, but a lot of money was used for betting on horses.

The road to HELOCs was played with best intentions.

XC -🤣

may we all find a better day.

What caused the decline in mortgage debt as percentage of disposable income between 2022 and 2023? It looks like it was trending up throughout 2022, but then abruptly came back down.

Don’t really agree with your conclusion about unemployment surging and one million homeowners putting their house on the market and everything being fine. You noted in one of your recent posts that months supply in December was higher than any other year since 2018. And that’s with inventory peaking at around 750k in November. One million additional homes on the market would amount to an inventory glut, if demand stays suppressed. And it would lead to the second scenario you note where prices start to go down.

“…and everything being fine.”

That’s not what I said. What I actually said is this:

“So even if unemployment begins to surge, and over a year’s time a million homeowners cannot make their payment anymore, they can put their homes on the market – the inventory will be welcome – and if they price it right, they can sell it and still pay off their mortgage with it, and go on.

“The problem arises when home prices plunge to multi-year lows, and suddenly a larger portion of homeowners are underwater. If lots of people lose their jobs and can no longer make the mortgage payments, then it gets a little messy.“

Right, but if enough people do it, the prices will drop, of course, and they might remain underwater.

There has been a big increase in for sale signs in my neck of the woods. But the prices are still very high. Good for my house value on paper, but doesn’t seem like much is moving.

Elbow – I do not see much existing home inventory for sale but I am starting to see new construction homes prices come down.

What I noticed is they are now building 3 bedroom homes instead of 4 and making other reductions. Dropping footprint size from (2200 – 2400sq ft) to 1800 sq ft. What is funny is they are getting rid of 1 bedroom but they are keeping the 3rd garage. Maybe they have too because if I recall, right before the pandemic, my city mandated all new SFHs had to have 3 car garages. I think too many people were clogging up the streets?

A 3 car garage is a “California Basement”. If the house is on a slab, there’s no place to store your endless stuff.

Thanks for the response; we’re likely in agreement then. Any thoughts on the first question? Find the drop weird…

S:

There was a refi BOOM and the biggest wage increases in decades from 2021-2023. (First the refis at 1%/ sub 3 into 2022. Then wage increases).

Equal or lower payments divided by more income.

“The problem arises when home prices plunge to multi-year lows, and suddenly a larger portion of homeowners are underwater. If lots of people lose their jobs and can no longer make the mortgage payments, then it gets a little messy.“

This is what happened from 2008-2012. It has happened before, but I think the Fed is trying to prevent this and thread the needle for a soft landing. No politician (or bank) wants to repeat the HB1 crash.

In my humble opinion, house buying mania is still strong but weakening.

I see this with my 20 something kids who do not own houses yet.

They tried to buy 2 years ago but were outbid by 100’s of thousands over asking. I define that as a mania. From their historical perspective, buying a house means 30% yearly gains in value. All of their friends were desperately trying to buy. Even though the disparity with rent at the time was huge, favoring renting.

In 2008, when HB1 collapsed, my co-workers who didn’t own houses suddenly lost interest in buying. It was a reverse mania. house prices were falling >10% per year. Who in the heck wanted to buy a rapidly declining house? Rents were stable or falling. Housing Bubble blogs were predicting no end to the decline. People who owned recently purchased underwater houses were being told by family and friends just to walk away and foreclose and cut their high payment losses. The Fed was under-reacting and very slowly dropping rates. Banks were bailed out but this housing crash affected the entire US economy with a job-loss recession. Finally in 2012 (4 long years), the housing price index crossed over the OER index (as seen here on Wolf’s charts) and the smart money started waking up again. There was a normal market again in 2012(as defined by me who could no longer low ball offers by 20% and win) but the Fed just kept slowly lowering rates throwing fuel on the embers.

No politician or the Fed wants to repeat that again. Especially since the taxpayer now is on the hook for all foreclosures. It would not be popular to bail out all underwater mortgage holders at taxpayer expense.

If I were the Fed, I would hold rates such that the housing and stock market level off or at most don’t fall below the equity of most homeowners (20% from the peak). This will prevent massive foreclosures and the absolute reverse mania seen in 2008. If they hold this long enough, OER (inflation) will rise to intersect the house prices again and there will be a soft landing. Win-win for everyone and my kids can buy a house.

When Wolf’s chart showing OER vs house prices intersect again, it will be a great time to buy a house. It may take awhile.

Great article Wolf. I remember 2008 vividly and we are nowhere near that as your graphs clearly show. But what do you think about the landlords in rent controlled cities like SF and NY where their refinancing rates are exceeding their ability to raise rents?

Don’t know about New York, I think it’s tougher than SF. In SF, landlords can raise rents in rent-controlled units limited to a measure of the local CPI. There is less turnover in rent-controlled units, so even if asking rents are dropping, actual rents still get raised. When the tenant leaves, the unit gets remodeled and goes on the market at market rent.

There was a huge default here by Veritas last year on dozens of buildings with several thousand rent-controlled units, and someone ended up buying the loans, and they now took possession of the buildings. But Veritas had become the landlord from hell in the local media years ago, and had run into all kinds of problems and horrible press, and I think it finally just threw in the towel and walked away and let the lenders take the loss.

Another landlord defaulted on a loan backed by the 750-unit NEMA, a new luxury building that is not rent-controlled. It’s across from the X headquarters. But the lender (special servicer for the CMBS holders) agreed to modify the loan, and the landlord will retain control of the NEMA.

A lot of these deals will get renegotiated at some expense to the lenders because lenders don’t want to end up with the building and have to sell it a big loss.

All this stuff needs to get repriced.

Unlike retail or office CRE, multifamily doesn’t have a structural problem. There’s plenty of demand, and there will be plenty of demand as the population keeps growing.

NYCB provides something like 60% of the rent-controlled lending in NYC. It isn’t just Signature that’s pulling NYCB down.

Gee whiz… with all this good news and no sign at all of any economic slowdown, why doesn’t the Fed raise interest rates again. Say… maybe 2 or 3 hikes by June. Make each of them about 500 or 800 basis points so the lending banks can really cash in on this red hot real estate borrowing market that these charts show, clearly has zero stress in it.

Come on… why not!

Let er’ rip!

Why would they “let ‘er rip?” The fed doesn’t want to torpedo asset prices. It wants inflation to continue, just at a low/manageable rate.

Agree.

All facts (aside from lip action) point to an average annual inflation rate of 3-4% over the next decade. The 2020’s decade will likely see inflation of 40% to 50%. We’ve already had 20% in three years. Jeez.

wish they were at 12%, but we love cheap money.

“If this type of homeowner cannot make the mortgage payment any more, because they lost their job or had a medical emergency, or whatever, they can sell the home, pay off the mortgage with the proceeds, and have some cash left over to put in the bank”

No. Because noone will buy it.

If the price is right (low enough), there will be plenty of buying interest. That’s what happened last time. The problem last time was the banks — they were losing too much money on the mortgages they had on their books. This time, the banks aren’t holding the mortgages, they mostly sold them to the government, so bad mortgages won’t hurt banks that much anymore. They’ll hurt the taxpayers!

“bad mortgages won’t hurt banks that much anymore. They’ll hurt the taxpayers!”

This would be the perfect spot for Michael Engle (?) to post “Pairs trade: long banks, short taxpayers”

Agree with you

people buy in droves when prices rise and don’t buy when prices fall

Prices rise when people buy in droves; and prices fall when they don’t.

ftfy

Pokey Joe. I’m with you. Sort of like following the Japanese 3 times national debt and growing to gdp model, and run less than 1% interest rates all at the same time. Why not? It’s different this time. We got mmt. Cryptocurrency anyone? Of hell ya!

Apparently central banks here and there can do what ever they want, when they want and nary a worry. If the old established rules aren’t working, simply change them. Like someone said, if 3 times debt to gdp is good in Japan, why stop there; run 5-10 ten times debt to gdp and continue to party on drunken sailors, party on. Hey someone’s gotta do gawds work!

This data is much better than I thought. Thanks Wolf! Feeling a lot better about my own rental properties now. Still plenty of demand for single family, and still a shortage of, still overpriced, supply. Increases in rent will hold, especially if mortgage rates stay where they are. Personally, I think we are at the bottom of the first wave of inflation. A larger wave is coming. Higher for longer!

But they are building apartment buildings in masses…EVERYWHERE YOU LOOK. Thisi isn’t going to end well. Credit Card debt is at an all time high, and Cc defaults are on the rise. People are reporting skipping meals in order to make their mortgage payments, home owners insurance is rising along with property tax, and automobile insurance is rising, as well as auto loan defaults. And I agree it will be the taxpayers who ate going to behurt the most. It’s almost like this is being done on purpose and by design.

Something I’ve learned since 1990 is that if you buy a house in a decent area (anywhere except the most leftist cities where things can collapse quickly) then over time it does nothing but appreciate in dollar terms. The entire system is based on the Fed creating enough FRNs to keep asset prices up over time.

Priced in FRNs (“dollars”) houses are worth 3-4x what they were in 2001. Priced in gold they have lost 2/3 of their value. I am curious if housing quickly doubles or triples again from here or if gold drops a bit to even things out again. By 2030 we’ll know. I’m not going to buy more houses but I’m certainly never going to sell what I own now.

The “price” of a real asset (house, gold, etc.) in FRN measures the decline in the purchasing power of the FRN.

Gold nor RE will dip meaningfully as long as the FRN/ USD is inflating away it’s “value.”

Home prices to double, maybe gold prices too by 2030?

Gold? Really? In the next decade precious metals will go nowhere. No one under the age of 60 cares about precious metals any more. They are just rocks to young people.

BAHAHAHA!! Gold won’t go anywhere? Don’t tell that to the BRICs when they roll out their new gold-backed currency. As the dollar collapses, you can keep your nice pile of FRN’s and I’ll keep my stack of physical gold and silver and we’ll see who’s the last man standing. I can guarantee it’ll be me. In the meantime, my mortgage is being paid off with my profits from…long-held gold and silver.

I am significantly under 60 and own gold and silver.

Not much tho – its only a tiny position on my overall personal balance sheet. It sits in my safe and I usually don’t think about it.

Its just a way for me to short the US gov’t, really.

JohnD: don’t forget there are 3 precious metals: gold, silver, and lead.

The dollar is still crushing every other asset out there. The gloom and doom crowd must be so disappointed when they see how beaten down their precious metals are. The only people who care about gold are the men (and they are all men) watching Gold Rush on television.

“Leftist cities”? What planet are you living on? Uranus? Nearly every city in the country is a leftist city even here in Texas. Most of the cities that you would hate in the Pacific Northwest and New England have real estate prices that would make your nose bleed. Tulsa? Not so much!

Toronto sales price average May ’23, $1200K, Oct ’23 $1160K, now $850K, spring seasonal uptick, usually starting Jan – Feb not evident yet.

Not much room for HELOCs now, if any, for buyers in recent years.

On the upside, we’re getting 10X the interest income on GICs.

With everything Wolf has expertly presented the past few months, this absolutely no reason whatsoever for a rate cut.

A .50% raise this year seems more reasonable.

As long as there is no reduction in the current pace of QT I think maintaining currents rates will have the desired effect on inflation without causing unemployment.

Howdy Danno and book that. YEP, you are correct but they could pull a Greenspan for a year or two. Down, up, kinda side to side, up, down, up.

Greenspan was then awarded prizes and ( in Wolfs Voice ). MONEY

A 50 bp raise this *month* would have been reasonable. But it didn’t happen, and I seriously doubt that it will happen later this year either. The Fed has run out of stomach for rate hikes, and has telegraphed this clearly. “Hawkish holds” are the best you can hope for at this point, unless inflation reaccelerates so drastically that they’re forced to hike (but that’s also unlikely; more likely is a brutal continuation of today’s hot-but-not-rising inflation, with the Fed nakedly afraid to do anything about it but hold).

“A 50 bp raise this *month*…”

Note: the above post was composed in a pre-coffee state, during which I forgot that we are now a solid week into February. I of course meant last month.

Regarding the HELOC loans: Did i understand this correctly, that the owners are paying their mortgage off with the cheaper HELOC loans?

On the first sight a move that is not stupid, but on the other site, when the housing prices decline, we have the same situation as in the GFC: The home value is higher then the debt.

“Did i understand this correctly, that the owners are paying their mortgage off with the cheaper HELOC loans?”

No, you didn’t understand correctly. The interest rate on a HELOC today is twice as expensive or more than the mortgage interest rate might be. If a homeowner has a mortgage from a few years ago with an interest of 3%, they can borrow an ADDITIONAL amount secured by the home through a “Home Equity Line of Credit” (HELOC) at maybe 7% today.

HELOC borrowers can spend this borrowed cash on whatever, including home improvements (putting in a new kitchen for $100k, for example) or buying a car or whatever.

Many thanks for the Explanation.

Only $100k?

No. Owners who need cash are taking HELOCs rather than refi, because *if you want or need to borrow cash* the HELOC is cheaper, for the reason Wolf explained. You’re only paying the new higher rates on the borrowed cash. With a cash-out refi you would have to pay the new higher rate on the whole thing.

I just want to know where you’re finding a HELOC for 7%. Anytime I’ve looked they’re at least 2% above the going mortgage rate.

For example, ThirdFederal starts at 7.3%

Howdy Folks. HELOCs are wonderful as long as you can add and subtract properly. Purchase a starter home and repair and flip your personal residence a half a dozen times during your lifetime. HELOC with the equity and purchase investment property or small business. In the end , as long as you can add and subtract, WIN WIN………

Have to add. In the olden days. Companies would pay you $$ to open a HELOC.

Bank of America is closing down a lot of its branches as online banking is becoming more and more popular. But, I remember the days of getting a free toaster when you opened a savings account at a bank. People may not need bank branches but they still need toasters…..what gives?

ru82 – everyone knows there ain’t no such thing as a free toaster! (Lunch, on the other hand…).

may we all find a better day.

I still buy 1 property per year cash using Heloc. Even at near 9%, it is interest only and the payment is minimal. Rent property and use cash flow from all properties to pay it off in a few months.

Every property makes the process exponentially faster. Could do 4 per year now, but deals are harder to find and I am passing the work off to the boys for half interest in the properties and they are busy with jobs and kids.

Foreclosures aren’t likely to be the cause of any issues. People who own just one house to live in at a 3% mortgage made out like bandits. The divergence are people who are renting are the ones who are hurting and they float their expenses on credit cards, not HELOCs. Nobody knows what will cause leverage to blow up, but high leverage eventually does. If house prices go down it’s because people can’t afford them.

The main ones likely to get foreclosed on are the ones who bought at the peak of the market hoping to refinance or took a non conventional financing arrangement.

How is paying $8,000 per month with 50% being interest on a Chase mortgage with $500,000 down on a house with a purchase price of $2,500,000 (really only worth about $500,000) in total in any way ‘making out like a bandit’ which is the situation with my next door neighbor?

Sounds like your neighbor shouldn’t have bought a $2.5M house, unless they have the income to support that monthly payment.

I made out like a bandit with my 2.7% mortgage. My monthly all-in is less than the rent on any apartment I’ve ever lived in. But I didn’t buy a mansion.

“People who own just one house to live in at a 3% mortgage made out like bandits.”

Disagree. Many people who bought when rates were 3% can’t cover the cost of increased taxes, insurance, etc. Not everyone got huge raises. Many didn’t.

Then they should not have bought a house because they can’t afford to own it. Ability to purchase and make the payments is only a portion of the equation.

I wonder if the ongoing economic implosion in mainland China will affect home prices in the US. Lots of CCP white gloves and ordinary Chinese people (good businessmen who made fortunes) bought California real estate as investments per real estate agents.

While they definitely will not bring it back to China, if they can avoid it, economic pressure may cause some of them to sell their last, nest eggs out of desperation: e.g. to finance their businesses’ economic flight out to Vietnam, etc. (Those who expect reform or revolution in China do not know the CCP or realize how it can just imitate North Korea’s Orwellian state even more.)

It looks like those who bought in the USA were smart. They may just move to the USA to live in those houses they bought. That seems to be the trend even if you do not own a house in the US.

In regards to your question. From what I read and it could be wrong, but NAR says Chinese mostly buy expensive houses that will probably be out of the reach of the middle class. They stated the average price was $1 million and more than double the median $380k home.

There is a research company called AIE. They have a bunch of metrics they use but they break down the price of houses via quartiles. Since 2012, their research says the top High End Tier of houses have increased 70%. The low Tier has increased 140%. The average overall price increase is 130%. That tells you the low end, and most affordable houses, have increased the most. Also, this is where inventory % is low. They say Low tier has 2 months of inventory and the high tier has over 8 months.

Thus the lowest quartile homes have increased the most in terms of price percentages over the past 12 years. The high end homes, almost 50% less.

I agree, but in Southern California now, and much of Northern California, $1 million is the price of a house or a higher end, often house-like condo. I do not know about Chinese investment outside California and Hawaii.

It is amazing that apparently communist China is among those E list countries whose citizens can get E2 visas (i.e., investor visas!) LOL!

I see where Zillo is allowing search for rooms for rent.

McDonalds is talking about lowering some prices (the super sized $18 Big Mac meal may be causing some crossed eyes?).

I wonder if it isn’t time to start fighting it out for the last inflation buck?

Warning, I haven’t done well in the markets this year by holding mostly overseas, low P/E, dividend payers, but I keep believing we will get real eventually.

I think Zillow is trying to support bubble prices by helping people get some income to stay solvent so they won’t have to sell. There are some better quality fast food burger places that I miss getting occasionally due to overinflated prices but I’m not a fan of McDonald’s burgers and hope more people quit buying them based on low quality and value. Though it would be sad for their hard working employees, their work ethic can get them a decent job in other places.

“And we’ll get a good laugh out of it and never ever go back to that publication?”

From your lips to God’s ears, my brother. *prayer*

Wolf,

Something else to mull.

Local property tax delinquencies. In my town they just reached a 43 year high. We passed Proposition 2 1/2 to cap property tax in Mass. in 1980.

Property appraisals have skyrockets by about 25% since 2020 where I live.

Cities & towns have been in the pink from property tax revenues. But for how much longer?

Prop 2 and a half is not much of a barrier to bigger tax hikes. In the town I grew up in, the town voted to override it almost every year.

“and consumers make a lot more money too, they’ve gotten the biggest pay increases in 40 years”

MY GOD I WISH I COULD LIVE ON YOUR PLANET!!!!!!!!!!!!!!!!!

Maybe there’s something wrong with your career? That happens.

Maybe it’s my area but the only folks I know getting good raises are the very bottom of the barrel since here in CA the state has raised the min wage $1 every year for at least 5 years. And now they just voted in a $22 min wage for food workers.

Folks at my level make about what I did, adjusting for inflation, 40 years ago. AND I’m not kidding. I was making $14 an hour in 1984, my first real job, working 50 hours a week which is about $40K a year and according to bogus government inflation rates that comes out to $117K in 2024

I was just on indeed.com checking out my industry and most jobs offered were less than that.

Inflation Calculator

If in

1984

(enter year)

I purchased an item for $

40,040.00

then in

2023

(enter year)

that same item would cost:

$117,423.18

Cumulative rate of inflation:

193.3%

I can’t edit but what I want to remind you is that income I was quoting was “entry level” to equate what I would have made then at where my skill level is now my income should be, cause I now have 40 years experience, in the $220K range in 2024.