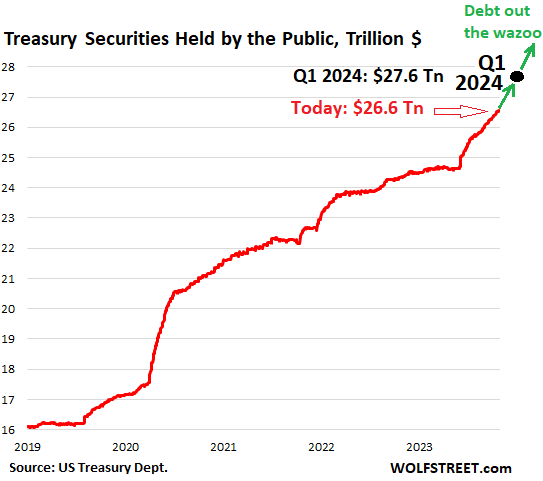

Including $1.56 trillion in Q4 2023 & Q1 2024 combined. Government has gone nuts.

By Wolf Richter for WOLF STREET.

The US government is borrowing such huge amounts to fund its gigantic and reckless deficits that the whole world is paying attention. The Treasury Department’s Quarterly Refunding announcements are normally greeted with a global meh, but under the current tsunami of new issuance of debt, it has turned into a hot button.

Today, the net amounts of marketable Treasury securities to be sold to the markets in Q4 2023 and Q1 2024 were released; and on Wednesday, the financing details, such as the amounts of longer-term Treasuries and auction sizes, will be released. The financing details of the last Quarterly Refunding announcement turned into a real hoot, leaving markets rattled by the upsized auctions of longer-term Treasuries, and longer-term yields rose sharply.

Both quarterly net borrowing amounts for Q4 and Q1 assume a quarter-end balance of $750 billion in the government’s checking account, the Treasury General Account at the Federal Reserve Bank of New York. So according to the Quarterly Refunding announcement today:

- Q4 2023 net borrowing: $776 billion, lower than its July 31 projection for Q4 of $852 billion, “largely due to projections of higher receipts somewhat offset by higher outlays.”

- Q1 2024 net borrowing: $816 billion.

In total, over those two quarters marketable debt will have increased by $1.59 trillion! This follows the $1.01 trillion increase in Q3, and the surge in June after the debt ceiling ended.

At the beginning of Q4, marketable debt outstanding was $26.04 trillion. The government will add $1.59 trillion to it, pushing it to $27.6 trillion by March 31, 2024.

Over the 10 months between June 1 2023 through March 31, the government will have added $2.85 trillion to the marketable debt, which is totally nuts – in an economy that is growing nicely.

In terms of today, current marketable debt as of Oct 27 reached $26.56 trillion (red line). By March 31, five months from now, it will be $27.6 trillion, as per the Quarterly Refunding data today.

Roughly $600 billion of the $1 trillion in new debt in Q3 was used to refill the checking account, the TGA, which had been drawn down to near-zero during the debt ceiling fight as the government continued funding its unmitigated deficit spending. The TGA ended Q3 with a cash balance of $657 billion.

As of October 27, the TGA balance was $828 billion.

The total amount of Treasury securities outstanding has reached $33.68 trillion. Of that amount, $26.56 trillion are held by the public, and $7.12 trillion are securities held by government entities, such as government pension funds, the Social Security Trust Fund, etc. Those securities “held internally” are not traded and don’t have direct consequences on the supply of new securities to the market.

Here we’re talking about the debt held by the “public,” such as foreign holders, the Fed, cash-rich corporations, banks, bond funds, insurance companies, individuals, and folks like me. And that public is going to have to buy the additional $1.59 trillion in securities by the end of Q1.

Foreign holders have been increasing their holdings at a glacial pace, much more slowly than the issuance increased, and foreign holders’ share of marketable securities has dropped sharply.

The Fed, as part of QT, has shed $860 billion in Treasury securities so far, and its holdings’ share of marketable Treasuries has declined sharply.

So US investors, pension funds, insurance companies, bond funds, etc., need to be persuaded to step up to the table and buy those securities. And to pull ever more buyers to the table, yields have risen, and the tsunami of new issuance indicates that even more buyers, reluctant buyers, will have to be pulled in with even higher longer-term yields to come.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Yellen Treasury buying older long term T debt, then selling new debt to same sellers at lower prices = higher rates.

Can’t call it QE but the effect opposes QT for now…and much longer?

This proposal has zero to do with QE and QT. It replaces debt that has been issued some time ago and is not often traded and fairly illiquid (hard to buy/sell) with new debt that is heavily traded for a while before it too becomes more illiquid. It is designed to address long-standing liquidity issues in the bond market.

Another purpose is “cash management,” as the government gets huge amounts of cash on four dates a year (quarterly tax deadlines), and then this cash sits in the TGA and earns no interest, while the government pays 5.5% to borrow it. Buybacks would allow the government to manage its TGA better and save some interest.

The buybacks go across the yield curve in “buckets” of maturities, from 0-2 years (bucket #1) to 20-30 years (bucket #7) to TIPS (buckets 8 &9).

The amounts of the buybacks are obtained by selling new debt. There is no money-creating involved at all. It replaces older debt with new debt.

“…the effect opposes QT for now…” that’s just fantasy BS being mongered out there to the credulous.

The political ambitions of the federal money apparatus in what will soon be an election year mean it’s not business as usual.

Especially in as foggy a climate as they operate.

Credulity cuts both ways.

It is very simple.

Over time, deficit would keep on increasing. Govt won’t curtail its spending.

At some point in time, FED would find a way to cut rates and start QE again. Don’t believe me, just look at March 2023 when FED bailed out banks with 100s of billions of stealth QE to make their millionaire depositors whole.

jon,

LOL, yes, March 2023, but two months later, the Fed yanked the money back out and QT blew it all away. Yes, it’s very simple: you refuse to accept the new reality of the Fed’s insta-liquidity suck.

That’s the New Regime: If there is a problem, the Fed responds with short-term liquidity; and a couple of months later, that short-term liquidity gets sucked back out.

That’s how the Fed had done it for decades before 2008, including after 9/11 when markets were shut down for a few days. The Fed used repos at the time, and after the panic had settled down, the Fed let those repos expire, and the short-term liquidity injection was sucked back out. And the dotcom bust continued, with the Nasdaq ultimately plunging 78%.

Now the Fed has returned to that same old model. QE is likely dead. And the Old Regine is now the New Regime.

The Fed got ready for this in 2021 with the re-establishment of the standing repo facilities that had been killed by the Bernanke Fed when QE started in 2008.

Since you have forgotten, here it is again:

Eric,

What does this mean? How is this a response to what Wolf said?

Wolf is so shady on his chart scales. Seriously. Really start the chart at 7.2T, your argument gets watered down if you show the true scale of the entire QE disaster, not just the last three years. And Wolf faith in the Fed is surprisingly strong. Yes, they should absolutely continue QT, but these are fools that got us into this problem. Why are you is he so confident they will become the adults in the room and fix the problem? I lack his faith in the Fed. And just because I think the fed will go back to their poor habits doesn’t mean I am some sort of stock gambler trying to pump up the market, or whatever, LOL, giggles. I just think the fed will act like children when the economy gets weak. Jay Boy ain’t no Volker, he is just a scummy lawyer.

Bill Ferrer,

“Wolf is so shady on his chart scales.”

Lazy moron. Look at my monthly Fed QT articles, and not just the comments, and you will see that there are 9 charts in it, including this one:

https://wolfstreet.com/2023/10/05/fed-balance-sheet-qt-down-1-0-trillion-from-peak-to-7-96-trillion-lowest-since-june-2021-in-september-alone-146-billion/

I would never call Wolf “shady.” That’s really uncalled for. That being said, I don’t like seeing the chart starting at $7.2 trillion and December 2020 either. At least start it February 2020 before this latest QE abortion, which would give us the proper scale of QT. This chart does not do that.

Depth Charge,

See my adios-note to Bill Ferrer above.

Wolf – What are “All Other Sources” in the Sources and Uses Table? I see that it is now consistently negative, where it was relatively small until 2022.

Does this have anything to do with the Fed no longer remitting money to the Treasury? or is it a result of intra-agency funding?

Is this a temporary blip or more of a structural change?

It has a pretty big impact on overall borrowing needs – 268 billion in Q1 24

This is a request in general, directed at all commenters here: Please start a separate thread for these kinds of separate questions. I’ll see it no matter what, and others will too, but these inserted questions make a thread very hard to navigate.

In terms of the “All other sources,” nearly all of it is the Fed’s SOMA redemptions. You can see it started going negative when QT started.

I wish the FED could have gotten back to 4T as quickly as it went to 7T but I guess there is no market to absorb that even the healthiest of times. I guess this balance sheet is a reverse mountain, easily to climb up but difficult to go back down.

Wolf,

I don’t understand and not familiar with treasuries and mechanics of selling. If I buy lets say 6 months T-bills, will I have difficulty selling it? Do I have to sell with a discounted price if new T-bill is offered with higher rate? Any suggestions for an educational link , could you please share with me (email), thank you very much ✌🏻

I’ll start here: I’m not sure why you’d want to buy a 6-month bill if you expect to have to sell it. Why not buy a 1-month bill, hold to maturity, and roll it over every month until you see you’ll need the cash? Or why not a money market fund that gives you next day liquidity hassle free?

If you buy a 6-month T-bill via your broker, you can sell it via your broker.

But it may be more expensive to sell than you think. I no longer buy bonds unless I want to hold to maturity. I’m just the little guy, and each time I sold bonds in the past, I felt like I got ripped off by the time it was all said and done. But those weren’t T-bills, I’ve never sold T-bills, and the results would be better because they’re more liquid.

You can use an online bond price calculator to see what you should get when you sell a 6-month T-bill, given rates and timing.

I’ll give you an example of a 1-year T-bill because it’s a round number and easier to ballpark in my head. So very roughly and simplified:

If you buy at auction, at a yield of 5.5%, it means you’re paying $945 for a $1,000 bill, and in one year you get $1,000, with the $55 being your interest.

If you sell the 1-year T-bill after six months, and yields have not changed, you would get something close to $973 in theory. In practice you get the highest price someone is willing to offer you at that moment, and that could be lower.

If yields go up, you would get a little less. If yields go down, you’d get a little more.

Schwab is my brokerage and I’ve been buying 3-month treasuries lately and rolling them over when they mature. That said, I really don’t know what I’ve actually been buying, only that they mature in three months more or less. They could be the last three months of a five year for all I know. They give me a chart with lots of durations — 1mo, 3mo, 6mo, 9mo (I think), 1yr, etc, with a yield to maturity for each element in the row.

The actual maturity dates vary but if you if you asked for 3mo duration the dates will all be within a couple of weeks of 3mo out. You get the current rate (price), though, it doesn’t matter what the original purchaser paid (just like stocks!). At least at Schwab you have to buy in multiples of $1000.

There are lots of sellers, some have better rates than others. I click on the one I want and fill in an order form of how many thousands of dollars worth I want to buy. You buy at a discount and get the face value back when they mature. The money just shows back up in my account when they do.

I did sell $1000 worth once before it matured — just to make sure I could do it — and the process was about the same. I clicked on the security in my account (something like 20k worth I had bought) and it showed me the current value of it and a sell button. I clicked sell and got a sell order form asking how much I wanted to sell. I entered $1000, submitted the order and it was filled instantly for very nearly what schwab said was the current value. The money was in my account in two days.

So I’m not a sophisticated investor, this is just my personal experience.

@Bemused,

You want to select “buy at auction” rather than buying in the secondary market. There is a specific link for buying at auction, otherwise you are buying from a third party rather than from the Treasury, possibly at extra cost.

“It replaces debt that has been issued some time ago and is not often traded and fairly illiquid (hard to buy/sell) with new debt that is heavily traded for a while before it too becomes more illiquid. It is designed to address long-standing liquidity issues in the bond market.”

This may not be QE, but it sure is a bailout of those who hold ‘illiquid’ debt (whomever they may be). What, the gov’t is now the market-of-last-resort for those unfortunate bondholders who bought all of the 0.1% interst debt?

If the G gave the vaguest of craps about its deficits/debt (or the civilian inflation that makes them possible) then a teeny, tiny step could be taken by freezing/cancelling the authorized-but-unspent money in the pandemic “stimulus” bills.

But that isn’t the “DC way” – once the Parties successfully conspire (dare I say collude…) to rob the global 7-11…the loot ain’t never going back. No way, no how.

Never.

No matter what.

Ever.

Everything else is just the empty, perpetually meaningless words of political life forms.

The Treasury’s actions are neither QE nor QT because the Treasury cannot affect the quantity of money in circulation.

QE and QT effect the supply of money in the system.

The Treasury’s actions can influence the demand for money by changing the supply and character of interest-bearing assets available to purchase.

So the Treasury’s actions cannot oppose QT. QT’s direct effect is to reduce the money supply. The Treasury has no power to directly oppose QE or QT because it cannot affect the money supply.

But there are multiple factors involved, multiple variables that are all being tweaked at once.

The supply of money in the economy (reduced by QT).

The supply of interest-bearing Treasuries being issued by the Treasury (tidal wave increasing by government).

The FED is affecting the demand for Treasuries by reducing its purchases (QT).

Inflation in the economy continues to affect the consumers’ perception of the value of money (decreases it), which affects their demand to hold money (they want to spend it).

Lots going on. Hard to really trace and predict the complex strands of cause-and-effect running through the economy.

All the time the government intend to spend the money, the Treasury do probably affect the money in circulation. The question is to what degree the money used to buy government debt was in circulation.

Then, the high interest rates actually generates an amount of money that enter the system and may start to circulate.

CNBC:

The borrowing level appeared to be somewhat below Wall Street expectations — strategists at JPMorgan Chase said they expected the announcement to be around $800 billion.

So this is some progress? Only $776 billion.

And you mention this too: ‘“largely due to projections of higher receipts somewhat offset by higher outlays.”

So we are watching a growing economy increase tax revenues – which is a good thing.

Who cares what wall street’s expectations are. They are neither accurate nor meaningful and are used by wall street to artificially pump up the markets. Wall street is a major part of what’s wrong with this country.

Wall Street is a huge parasitic being that adds no value to America, and just sucks wealth off the top.

Who ever thought Wall Street EVER added anything to America other than the retail guys’ cash to their fat pockets?

Well, remember that the borrowing level is only an estimate, and almost certainly only includes current borrowing under law, not any supplemental bills that Congress may pass before the end of the year.

There is $100 billion queued up in the House and Senate for Israel and Ukraine, we’ll see if it passes. To claim that the spenders in Congress won’t pass anything is bong-smoking madness.

What isn’t clear is how the massive deficit spending will end, and given the potential costs with overseas conflicts, climate change impacts it seems more likely it will just continue to rise. Obviously can’t happen forever but kicking the can for decades has been status quo so seems likely it will happen for a few more. What happens when the next series of corporate bailouts occurs or another health crisis? Probably just more deficit.

Few more decades? I kinda doubt it. When the interest payments exceed the income generated via taxes etc that sounds like the beginning of some version of a doom loop to me.

Seems like there are three options (not mutually exclusive) to address the deficit:

1) Raise taxes

2) Cut Spending, or

3) Reduce relatively via inflation

1). I would support letting TCJA expire in 2025, but that’s unlikely if there’s a Republican trifecta.

2). Roughly 2/3rds of spending goes to Defense, Medicare and Medicaid. There’s tons of bloat in both Defense and Healthcare, but very little interest in cutting.

3). So, let inflation run?

What would you do, Wolf?

Wolf: I read before that this data was to be released at 3 PM, Googled at 3 plus to see any additional news and looked at the market for any reaction. None including the 10 year bond. Perhaps we will see some reaction when the actual auction takes place

Twas a good day, clawed back some!

There were not any real surprises in this info today. Everyone knew it would be bad, and it was bad. The financial details to be released Wednesday morning are the big deal. They will specify how much of that issuance will be longer-term Treasury securities, and that’s what matters to longer-term yields. There is a practical limit to how much the government can fund with T-bills.

But the Fed’s announcement and Powell’s presser will also come on Wednesday, so that will be interesting to sort out for the market.

Yeah, $35T+ by end of CY ’24 Q1. Yikes! That’s bad.

I’ll go ahead and update my ‘FY 24 Q4 annualized interest expense to $1.567T.

We’re starting to see jaw dropping numbers pop up everywhere. Joe Consumer & Congress are spending like drunken sailors.

I really wouldn’t say $35 trillion is a huge amount of money these days. Always adjust for inflation and look at the Gdp.

Debt to GDP ratio still isn’t as drunken as say Japan yet.

Do you think the market can absorb this level of issuance at current rates?

Yes, at a price, which reflects much higher yields (interest rates).

“There is lots of runway for yields to go higher.”

And that’s headline right there, folks!

I at least will not help out absorbing longer-term Treasuries at current yields. For me to get pulled to the table, yields will have to rise. So it depends on how much buying power sits between current yields and the next level.

This is a long-term game. Those deficits will continue. The pressures will continue. The new issuance will have to be absorbed each quarter, not just in Q4 and Q1. There is lots of runway for yields to go higher.

Agree! I’ve been putting my cash (30% of my portfolio) into 1- and 3- month CDs, as well as SWVXX, as I wait, patiently, for those yields to climb to 6%.

The fact that all of Chase’s 6, 9, and 12 month CDs are Callable tells me that nobody has any idea of WTH is happening in future rate action.

That’s like couple of grand per taxpayer per month. Totally manageable.

In the near future you will need to expand your chart up and further to the right.

I give up. Next election I’m voting for the politicians who can blow and steal the most dough. I know, it’s hard to pick the best horse in that D.C. race but I want to feel my vote means something for a change.

While back a veteran bond guy was giving Can gov a hard time for not increasing debt when it was so cheap. The 10 year was 2 % or some ridiculous number. He said: “Shove it out till the market chokes on it…till you see the whites of their eyes’

Gonna be more expense now.

Except… if they had the cash then there would be pressure to spend it right then so we would have ended up worse off.

Wolf – Thank you for another timely and insightful article. In a world of biased financial news reporting, I would lose my financial sanity if it weren’t for your no nonsense analysis. I agree 100% with your closing statement: “…even more buyers, reluctant buyers, will have to be pulled in with even higher longer-term yields to come.”

Two questions pertaining to *risk* that come from opposite ends of the spectrum:

1) When does the size of the U.S. government debt become so high relative to GDP and/or federal tax receipts that Treasury bills and bonds are no longer considered “risk-free”?

2) What type of major international Black Swan event would it take to send the public market rushing into Treasury bills and bonds in a way that would dampen or even offset future long-term yield increases?

The issue is not credit risk. The issue is yields. And inflation — because these are very inflationary policies. Those are two HUGE risks for existing bond holders. They get wiped out by them. We’ve been through this before. Existing bondholders got crushed in the 1970s and early 1980s by rising yields and inflation. It gave rise to what was later called the bond vigilantes. Yields and inflation will eventually scare Congress into getting serious about the deficit (knock on wood).

Why would anyone buy US government 30 year bonds when they could buy 10 year bonds at a very similar interest rate?

If you believe the Fed will pivot after 10 years (or sooner) and rates will drop back down to 0%, you’d want the 30 year ones.

Some bond traders are still betting on the Fed cutting rates.

Personally, I won’t buy any duration over a year right now. The 6-month bill has the highest yield anyways.

Why would anybody buy 10 year bonds if they can buy 2 year bills at a higher rate ?

1-year bills or 2-year notes… just nitpicking here.

Wolf if deficits don’t come down you think yields keep going up Regardless? Honest question 🤔

It’s hard to believe that interest rates will come down considering the state of the world but what do I know?

The government has been very skilled/lucky in managing all this debt so far. Eventually (gradually, then all of a sudden) I think it will become a serious issue. Remember the directions for dealing with inflation/deflation. During inflationary times, you want to own things, because money is losing its buying power. In deflationary times, the prices of those things are plunging, so you want to own cash.

I would argue that you dont want to own assets that are financed by debt, for example commercial real estate, because the higher interest rates associated with inflation mean that the value of the asset actually drops, because that asset value is based on financing.

I just feel that debt will continue to implode and investors will lose even more money. If you put new money into long term bond funds at the peak, you are down around 50%. ouch.

roddy6667,

I like owning things but I am selective of course. I own mining and energy companies (both carbon and green). They all provide good dividends and have strong balance sheets.

Dividends help protect me against inflation and strong balance sheets against high interest rates

We are in a supply constrained world which means inflation is normal now.

I think this means long term rates will continue their rise and mortgage rates will be in the double digits. Housing is so screwed

Let’s face it Wolf , all this spending, the emptying of the US SPR and build up in the US current Account is to get the present Administration across the line in 2024. What happens post 2024 is cynically probably another person’s problem.

Congress decides on spending, and the House is controlled by Republicans. So quit this BS already.

Seriously. The inflation reduction act was passed by

Republicans? For most of the last century the house was controlled by the Democrats. And let’s not forget the contribution of the republican washington generals like Eric Cantor, Paul Ryan, Arlen Spector and countless others.

Who passed the $2T of unfunded tax cuts in 2017?

The fact is, neither party shows any interest in preserving the nation’s financial security at this time.

Who’s responsible for this? Follow the money. The people benefiting from current US fiscal problems are large corporations, executives, shareholders, politicians, and other asset holders. Workers get inflation with severely lagging income increases they have to fight for tooth and nail.

Republicans support the top 1%. Democrats support the top 10%. No political party supports the bottom with meaningful, sensible, or lasting reform.

I didn’t get squat from the 2017 tax cuts. I lost all my itemized deductions and went on standard deduction. That’s OK if you don’t get sick, don’t give anything to charity, don’t have any increase in property taxes etc. So, I’m paying the same overall amount of Fed taxes AFTER the tax cut as I did before. Only the rich and corporations got any real benefit of the tax cut. The whole thing was a scam.

I like how you are not biased towards any political party.

Keep up the good work.

A bit reactionary, no?

Wolf has pointed out an obvious fact that counters an obviously biased political statement made by a poster. If that upsets you, stick with your biased news feeds.

Bobber,

I didn’t read Ben’s comment as being sarcastic in any way. A lack of obvious political bias is one of the things I appreciate about Wolf’s analysis.

That’s how it is supposed to work.

The House controls the spending.

But it seems every night on the news the President is declaring Billions for this and Billions for that.

Not only is that how it is supposed to work, it is the way it does work.

You are just using sources of (mis)information that deceive you by always making it sound like the President.

Get better sources of information and be better informed.

No, the House does not control the spending. So long as the Democrats control the Senate and the filibuster rule is alive and well in the Senate, any spending cuts the House passes will never get to Biden’s desk to be vetoed. With the filibuster rule in the Senate, the Senate Democrats hold all the cards even with a Republican in the WH.

I am not making a political point here, though I can understand why you think so, but the remark was made to explain the reasonings around the debt situation.

1. Draining the SPR was this Administration’s decision or am I incorrect ?

2. The TGA can be built/boosted/drained to allow for a gush of liquidity at the respective required time – am I incorrect ?

3. If you want to argue it weren’t huge amounts of spending in the System/Budgets before the Republicans took control – am I incorrect ?

Except that you were making a political statement. You just did not recognize it.

What does the SPR have to do with the national debt?

The SPR drain matters less now that the US is a net oil-exporter.

All of this government debt is crowding out capital from private business. It harms us more than most people understand.

Agreed.

And government is a poor steward of financial matters. Private money is usually spent and invested wisely for there is consequence for not being diligent and efficient. Not so much with government.

Government is getting larger with each omnibus bill.

“Private money is usually spent and invested wisely for there is consequence for not being diligent and efficient”

Like buybacks to offset stock compensation for execs? Thanks for the belly laugh.

And that’s the worst part. Private money has been deployed for the past 20 years with the awful incentives of ZIRP. And now the government is running obscene deficits and crowding out private investment.

I don’t see how we can continue to innovate this way.

The elephant in the room that’s going to drive ever higher deficits & debt is healthcare spending. The core issue here is that healthcare is simply absurdly expensive in the U.S. During the last 50 years or so, the medical industry has become a cartel in this country and it needs to be fundamentally reformed. We need to increase the supply of doctors, nurses, physician assistants etc., and we need cheaper drugs. The Government needs to intervene and fundamentally reform the supply side of the healthcare industry. In most cases the “invisible hand of free market” works fine and no Government intervention is needed but experiences around the world have shown this laissez-faire approach fails with healthcare. Much of the medical education in our country is too long and too expensive. Like much of the rest of the world, we need to establish a Bachelor’s in medicine degree and allow people with such degree to practice family medicine, with additional schooling reserved for specialists. Unless and until we control the cost of healthcare via fundamental reforms, there is simply no hope of ever controling our debt as a percentage of GDP in the long run. The medical industry will surely lobby against any such reforms, but the cost of healthcare is becoming a cancerous tumor that’s growing ever larger and sucking resources away from other industries & productive uses year over year. We regulate monopoly/cartel like industries such as utilities when the seller has disproportionate amount of power, we need to do the same with healthcare. If we don’t do fundamental supply side healthcare reforms, the cost of healthcare will ultimately destroy our economy and our quality of life.

The film Pain Hustler gives an answer to why healthcare costs increase in many countries even if there are other causes linked related to expensive research and free profit.

A high percentage of health care cost is controllable through better eating habits and light exercise. That’s the easiest solution. You can eliminate another huge portion of health cost by limiting invasive procedures after age 85.

That is, until you are 84…..

Not me. I’ve always been the type to apply a strict and realistic cost/benefit analysis.

Agreed! People keep bitching about healthcare costs as obesity keeps rising. Also, the ultra-expensive drugs go generic in about 8 yrs. (at best). So, if you can’t afford them, so be it. They didn’t exist many years before they go generic and lots of them are no more beneficial than an aspirin. There won’t be r & d spent by pharmaceutical companies if their profits go to zero.

There’s a price to pay if you’re a glutton for sponsored entertainment: those ads actually work. People will eat more pizza, wash it down with Coke and sit on their ass while watching soap operas or ridiculously talented athletes pound each other. That ketchup you’ve drowned your fries in is 45% sugar.

“Also, the ultra-expensive drugs go generic in about 8 yrs. (at best)”.

Uh?

“The patent protection for a brand-name drug is usually 20 years from the date of the submission of the patent”.

https://hmsa.com/help-center/what-are-generic-drugs/

The idiotic, and extremely broken, Intellectual Property laws are, I would argue, one of the main drivers for the economic inequality in the world today.

Originally introduced to allow inventors recoup the research effort, fostering innovation. Today is an obscene ratchet for profiteering.

“The first Mickey Mouse cartoon, Steamboat Willy, premiered in 1928 […] As it stands, Steamboat Willie will enter the public domain on January 1, 2024”.

https://artrepreneur.com/journal/disney-copyright-keeps-changing/

Poor Disney, pretty sure 100 years wasn’t enough to regain the grueling effort and costly investment associated with designing our beloved little mouse.

SS,

Pharmaceutical companies apply for patents before engaging in the several layers of non-clinical and clinical trials needed to obtain FDA approval for a drug. The time it takes depends on the nature of the drug and thee trials it requires. If you’re looking at survival for say a heart disease drug it can take a very long time. An allergy drug may take far less time. Ten years of the 20-year patent period, give or take, is often lost to the actual drug development process.

And wait until your 85! Too late for crying!

If I’m still alive at 85 I’ll surely be crying.

Two simple solutions from me.

1. Allow people to purchase most drugs (non-addictive) without a prescription. We are forced to go to a doctor to get a prescription renewed. They ask the same lame questions. If doctors dont have a monopoly on access they will be forced to provide value to the consumer. There could also be an online screening tool to make sure the prescription is not an issue.

2. Allow insurance companies to write limited policies. I want to buy a policy that covers ONLY stuff that cant be anticipated. I’m not going to get heart disease or cancer or diabetes because I have a super healthy lifestyle. And I can get on the internet and fix most things, so I really only need a doctor if I get in a car crash or something falls on me.

“I’m not going to get heart disease or cancer or diabetes because I have a super healthy lifestyle”

That’s what they will put on your gravestone when you die of heart disease or cancer or diabetes.

I had the very same thought after I read his comment! I am 69 and my blood pressure is 113/73 but do I think this makes me immune from the end of life illnesses? No! There are people with “super healthy lifestyles” dying in hospitals every day. Get over it!

“That’s what they will put on your gravestone when you die of heart disease or cancer or diabetes.” If you don’t die with / of those conditions, what they will put on your gravestone is simply “Died”

Wow, are you ever going to be in for a surprise one day!

#2 would fix the outrageous cost of healthcare.

Imagine how expensive auto insurance would be if you went through it every time you put gas in your car.

” I’m not going to get heart disease or cancer or diabetes because I have a super healthy lifestyle.”

LOL

That is astoundingly ignorant.

you are correct. It is a cartel. Just download the Merk manual and the entire medical library and use AI to diagnose and prescribe. No need for doctors or expensive hospitals. They have the Government in shackles thinking only doctors can save lives and people ride with the scam. A pharmacist once told me that most of the drugs he prescribes out are not even needed.

To your last point, Steve, NPR had a lengthy conversation with pharmaceutical researchers, several years back, who said the same.

The problem is that we don’t limit end of life care. 50% of health care spending or something like that is spent in the last 6 months of life. In other countries with single-payer systems, they won’t do quadruple bypass surgeries on 96 year olds. We do.

I’ve read of cases in the U.S. where a teen is building a sand tunnel at the beach, and had the sand collapse on him. He was in a coma in a persistent vegetative state for years, costing Medicaid $40,000 per month.

Doctors said he had no hope of recovery. Why is society continuing to pay for expenses like this?

All of these things, when coupled with our poor lifestyles, are why health care is so expensive in this country.

It also doesn’t help that we invite the entire third world to immigrate here and then pay for health care for them and their children.

An enormous percentage of health spending occurs in the last 3 days of a person’s life. In my career in health care, I have seen a sea change in evaluation of the very elderly. 30 years ago, a sick 90 year old was not given any evaluation and was treated with very inexpensive supportive care and life or death depended on overall health. Now vast health resources are marshaled with every small fall or possible stroke, with very marginal benefit and similar overall outcomes, but vastly increased costs. It’s scandalous and largely driven by hospital profit motives.

A close relative, age 91, felt unusually dizzy and called 911. ER trip grew into a weekend where the hospital duplicated all kinds of tests she had recently (by the same network). They sold her on consenting to this as necessary. The bill came: $9,000+. Luckily insurance ate the bill, but in a sense, we all did. Put it on the public credit card!

“It also doesn’t help that we invite the entire third world to immigrate here and then pay for health care for them and their children.”

Why do you let your poor sources of information take advantage of you?

People like you are why this country is falling apart. Democracy requires a well informed electorate. Unfortunately our democracy has a sizable portion of the population following “news” channels that take advantage of their viewers ignorance and bigotry by feeding them crap that make them think that healthcare costs are so high because of the people who immigrate here.

Do better.

I don’t have a problem with doctors or nurses. Insurance and financial industries are the real government entwined rackets. Social security is a 90 year old concept that needs to be expanded and updated to give the elderly poor a chance. Instead we get big pharma crooks stealing with exorbitant drug costs for necessary medications, and financial crooks robbing incomes by demanding the money printing that caused rampant inflation.

Most doctors I have dealt with in the past 10 years are just shills for pharmaceutical companies. Not interested in fixing anything, just take a pill to cover the symptoms. Thankfully I’ve fixed my issues by finding doctors that cared.

I can’t claim to understand the intricacies of US Healthcare costs, but while working in Texas few years back I ran into a dude that told me he charged a hospital $5000 for a single door knob replacement and that they paid it 😆. I mean, all these things like AI replacing doctors and drug patents or whatever everyone is pointing to as a solution, well I’m pretty sure Healthcare costs will still be high if you gotta pay $5000 for a door knob even if it’s to lock the door to the server room that runs the AI doctor

Try Uruguay – all the benefits of western health care without paying for the R&D, and no profit motive. Lots of very competent Cuban doctors living very comfortably on $3-$5k/month

Healthcare is definitely expensive. There are many different facets that the cost is based in. Schooling and pay for docs is real but here are other much larger costs. Maybe I’m just a whiny millennial. Come watch a bunch of people die with me after I pour my heart and skills and life into them. Yes, I spent a lot of money doing it but the legal reality is that I have to spend the money and save someone if they want me to. Or rather their silly guardians or power of attorneys want to. The personnel working within medicine clinically at the bedside have enormous constraints prohibiting cost saving. I would definitely caution that perpetuating mistrust in the clinical bedside personnel will be the end of our system. I have so many colleagues, quitting, having trained for most of their adult life, and then just quitting.

First and foremost for me is tort reform. Litigation for getting sued for the 90 year-old that has three days to live that we pour $100,000 or much more of cutting edge medicine into futility while we wait for family to arrive to say goodbye. Families that want to “take care of grandma” because “she is strong and get through anything”… It’s quite an expensive goodbye party. Cancer drugs over priced with marginal benefit 2% chance of adding 73 hours of life on a miserable end of life schedule with the low cost of $75,000 per week.. this is embellished, but has some truth in it.

There needs to be support and incentives for clinicians to allow people to die or withhold expensive shit from old hopeless situations. I have no idea how to undo any of this. I just go to work and take care of what comes to the door as best I can. I’m not sure I’ll last more than a few years and the attitudes above towards the healthcare system, as a whole are definitely part of why I might quit Young.

I will tell you that if you track physician and clinical personnel pay it goes up linearly and a low rate over time.. If you overlay administrative costs of all the box checking bs of stroke measures, sepsis measures, whatever government mandated bullshit measure and how our ceos also get paid 2 mil a year to walk around my department and tell me how to practice medicine. That cost tracks with the exponential increases of healthcare.

TLDR. Clinicians usually aren’t the primary cost. Admin and the bloat of the system and legal constraints/tort and big pharma costs are from my perspective. Try to save your clinicians and bedside people or all you will have left is an ai robot eventually that doesn’t have enough thumbs to scrape you out of an ambulance and put a tube in your throat to save your life.

Not sure why I chose to rant here off the general topic. I Love reading the comments everyone!

Spice – whether medicine, education, soldier, or any other ‘essential worker’ you care to name, I have always marveled at the expectations of those not on the spearpoint of an endless, unappreciated (and usually under/uncompensated) dedication from those who are…

Thanks for YOUR comment.

may we all find a better day.

“….the government will have added $2.85 trillion to the marketable debt, which is totally nuts – in an economy that is growing nicely.”

That’s WHY the economy is growing nicely, Wolf….

Gattopardo

Lmao the catholic nuns would have slapped me on that comment.

I remember when Ross Perot was hyperventilating over $2T in total national debt. Now, we are adding $2T to the debt every six months.

Yes. He’s the guy who wanted to pare down govt. spending but made ALL of his money on government contracts.

Making money off the government seems the quickest way to get mega wealthy.

It doesnt make Ross wrong, does it?

“Yes. He’s the guy who wanted to pare down govt. spending but made ALL of his money on government contracts”.

So, to his credit, he knew what he was talking about.

I know, I know, only the pious can offer criticism.

Just a debasement of the dollar. The Treasury and Federal Reserve have no idea what went wrong with modern monetary theory. Especially when it is so similar to the Roman financial crisis of 86-91 BC when the coinage was debased by only 10%; as discussed in the writings of Roman statesman Marcus Tullius. In the history of the devastating collapse of the American Empire, Powell and Yellen are certain to be prominently discussed.

It seems to me that a portion of the Treasuries absorbed over the recent past have been short dated Treasuries that were either held by money market funds or individuals, as they withdrew money from bank accounts that provided no yield. I wonder if that trend is mainly behind us and it might be more difficult to attract that much money going forward?

The other issue I am trying to understand is the carry trade and Japan. The BOJ has been a major part of the financial distortion, so any changes to policy might lead to some pretty big changes in exchange rates and demand for Treasuries in both countries.

People aren’t just moving money out of low interest bank accts. Our 401k has poor investing options (a stable value fund paying 1.25%, no short term treasury fund, high fees etc). I just discovered I can withdraw/rollover any money I previous brought in from a former employer’s 401k at any time. So I’m moving about half of the balance to my brokerage.

It’s called an in-service distribution. Most plans don’t allow it, or like mine, only allow it on rollover money. After all, they want the fees on your money. But I control our plan’s rules so guess what? I’m going to amend the plan to allow in-service distributions of all money once you reach age 59 1/2 – this is a common option because earlier than that distributions could be hit with a 10% penalty.

If you’re curious about your plan’s rules ask HR to see the Summary Plan Document. They have to provide it upon request.

It seems a bit frightening to consider long term interest rates increasing to the 6% range. That would be quite painful for those who have recently been accumulating long term debt as it’s been approaching the 5% range.

But I suppose with another government shutdown likely, another government debt rating downgrade also likely, and Congress perpetually itching to defund the IRS, the deficit is unlikely to be resolved with any sort of revenue increases (unless it’s a regressive flat tax).

Federal income tax revenue as a share of GDP has been very stable since the 50s, despite all kinds of changes in nominal tax brackets. And tax revenues continued to increase after the 2017 cuts. The US has never had a tax revenue problem. The single biggest factor in individual income tax as a percentage of GDP has always been ups and downs in the economic cycle.

The problem is out of control spending. As regularly documented in this excellent blog, it just keeps going up, no matter which party is in power. And whenever someone tries to rein it in, as the current Speaker of the House is suggesting, media elites vilify and shame them like they are Satan.

And the current administration is the worst in history with peacetime non recessionary spending, increasing 30% in 3 years during a peacetime economy with the lowest unemployment recorded, and it would have been far worse with the blatantly illegal attempt to make everyone pay for essentially all student loan debt.

Happy – how much of the ‘Cold War’ period would carry the same definition of ‘peacetime economy’? (extra credit: Phil Ochs’ “Draft-dodger Rag).

may we all find a better day.

The deficit as a percentage of GDP the last 2 years is by far larger than at any other time except at the close of WW2, there is nothing else and no other time period that is even close. Nothing during Vietnam or the Cold War. It really is a fiscal emergency and the mainstream media gives it a collective yawn and demonized anyone who even threatens to slow the trajectory of the spending,

The new speaker with the plan to finance aid to Israel with a $14B cut in the IRS budget?

No accountability for the TCJA $2B windfall for the donor class at the top of the business cycle that subsequently put us on the backfoot when the black swan of COVID landed?

The money you are talking about is chump change. The IRA is trillions of extra spending, and the administration asking another 100 billion of “emergency” spending for Israel/Ukraine/Maui and a large pile of domestic pork barrel that isn’t remotely “emergent”

And the IRS just got an 80 billion dollar increase in funding, so cutting 14 billion is hardly catastrophic.

The spending needs to stop. It will involve hard choices. Both parties want avoid those choices and consign our grandchildren to poverty. Shame on them!

“And the current administration is the worst in history with peacetime non recessionary spending”

I think you meant the current CONGRESS.

It starting to appear that supply and demand have not gone out of style after all. The Fed may control the short end of the curve, however their power over the long end is debatable.

Increasing amounts of debt to finance.

To attract new money on a grander scale, rates must be more attractive.

Yes, rates will approach 10% in the next few years ????

QT will continue as the Fed drains reserves…….prolonged Bear Market in stocks.

A few financial shocks…..The Fed will temporarily throw a Trillion or two into the market. Wild rides up and down.

US Dollar is safe and secure. No other currency to replace the US Dollar.

I’m not going to buy Japanese Yen, Russian Ruble, nor any other currency. The US Dollar remains safe.

How can you say the dollar remains safe when inflation is so high? Parking it in cash is also problematic. Gotta earn the inflation rate just to break even with purchasing power. That’s the only attraction of short term T-bills – their yield proximity to inflation rates currently.

I’d rather have my money in productive assets that produce cash flow, assuming I have those that will weather the storm. That remains to be seen I suppose.

“How can you say the dollar remains safe when inflation is so high?”

But what’s the alternative? What productive assets are you holding? I haven’t found anything so I do exactly the same thing you mention, treasuries, while I save for a downpayment for a home (one day).

Seba I am self employed so my business is one of my main assets. Turns out only 3.5% of Americans (working, I assume) are self employed so it’s a stretch for the usual Joe.

Building assets like that requires figuring out a niche, which is pretty tough too; but if you think about it, everybody is being employed by someone or thing that is self employed so the security promised isn’t really there either.

Higher for longer, much, much, longer…

We could have done the right thing in 2008/2009 and actually let the bad actors go bankrupt and sent a few to prison, but we didn’t.

“Full Faith and Credit”, so higher for much longer is required to “save” the dollar.

Interesting times.

I am just waiting for the line in the graph to go vertical, not when zoomed out, but even when you zoom in. The real American Dream is getting closer, and that is bacon at 50 dollars a slice.

There will be a reckoning soon as bond buyers require it.

O/N RRPs have fallen to $1,138.035 on 2023-10-30. That’s not an asset swap.

It means more money market funds are shifting cash from RRPs to T-bills because T-bills pay more (~5.6%) than RRPs (5.3%). For MM funds, this is an asset swap.

MM funds keep drawing cash from investors, and so they’re huge buyers of the huge supply of T-bills, thankfully.

Before RRPs paid interest, MM funds kept their cash (needed/excess liquidity) at banks. But RRPs then started paying more than banks paid in 2022, and RRPs are secure, while uninsured bank deposits are not, so you saw this flow of MM cash from bank deposits to RRPs – between April 2022 and April 2023, deposits at commercial banks dropped by $1 trillion – which in part was reflected in the $1-trillion-plus decline in 2022 of reserves. RRPs and reserves are liabilities for the Fed. So when this shift occurred on the Fed’s books, it wasn’t an “asset swap,” but a “liabilities swap,” from reserves to RRPs.

The rock and hard place have clamped the USA firmly in place now.

The outcome is inevitable.

Who’ll buy that volume of rapidly devaluing dollars without very compelling yields?

I’d be wanting 10% on a 10yr to risk it.

Who’ll buy that volume of rapidly devaluing dollars…

How about those with even more rapidly devaluing Euro, yen, pound, franc marc, yuan, ruble, rupee, etc?

It seems only Americans are buying t-bills/bonds currently. Americans got in first. Whoever gets in 2nd, 3rd, 4th pays the first.

+++ KL:

ME too,,, far damn shore!!! And hoping to convince my clearly, ”better half” similarly.

Kinda like loaning money to relatives who ya ”almost” know far shore ”they” will never pay back, eh???

Had a cousin who would and did loan to every other relative of the next generation to help them while they were in college(s)…

Told me, when I finally paid him off totally, that I was the only one to pay him back anything, then opened a bottle of cognac costing almost exactly my total debt,,, and we drank it all than night while, for the first and only time he told me of his work in WW2, from a MASH of those days to the two times he was parachuted into Germany when OSS they found he was totally fluent in German after spending his high school junior year in Germany.

Wolf,

So fed preferred measurement of inflation is the PCE index. That is over 6%, I believe 6.2, you mentioned. This being the case then if I’m correct, the Fed should hike a quarter point. That’s how it works right being the feds rate is 5.5-5.75?

I bought physical gold 1998-2001 cost basis $450/oz. It’s interesting that the annual compounded rate of return is 6%, matching the PCE inflation rate.

VERY interesting RR, far damn shore…

Care to add some corroborating data, etc.???

IF so, we might have to at least change a bit of the portfolio, out of mostly RE, and now, with real returns, treasuries.

Thanks in advance,,,

corroborating data…

not much to corroborate.

I bought at 450 and it’s now, let’s say 1800. That’s a quadrupling over , let’s say, 24 years. That works out to 6%/year increase.

“Gold is money. Everything else is credit.”

J.P. Morgan

from one of the guys who started the Fed ……..right?

I bought gold certificates from the Perth mint at the end of 2008. I paid about $900/oz. I sold it in March/April 2022 for $1959. It was held in an IRA. I would probably have been better off just investing in the stock market rather than gold.

You are definitely right. You would have made a lot more in the stock market over that timeframe. Gold is for preservation of capital, nothing more.

Daily News advertised Gold. Took up a whole page, not sure of exact year. Early 2000’s. 250 an ounce then.

I don’t think the Fed should hike. I want to see long-term yields rise above 5.5%. Long-term yields are what actually impact the economy. So that’s what the Fed wanted to accomplish — push up borrowing costs, and most borrowing costs are linked to long-term Treasury yields. So if this is happening, the Fed can let it develop and watch. We haven’t seen the economic effects of 5.5% long-term Treasury yields yet.

By the way, the PCE price indices that the Fed watches aren’t that high:

https://wolfstreet.com/2023/10/27/powells-gonna-have-a-cow-when-he-sees-the-pce-inflation-spikes-in-core-services-housing-and-non-housing-core-services/

This is a very nice explanation Mr. Richter, especially for readers like me with a lot less knowledge in finance and Macro, thank you!

Thank you for a better understanding.

Howdy Folks and Lone Wolf. Really looking forward to tomorrows Wolf Street. Armed with more truth and becoming more confident about my own choices. THANKS

Major (historic) slap down on questionable “Wolf is so shady on his chart scales. ” comment.

The scoreboard reads

Wolf 100

Bill Ferrer 0

Wolf has certainly become popular on Google News. Lots of his articles are posted there.

This one we are commenting on leads this morning in ‘Treasury Borrowing’. The subsidiary following articles are two by CNBC and two by Bloomberg. All of us here understand the value of Wolfstreet and apparently more and more the Google News Robot understands.

“Government has gone nuts”.

Can it be dialed back to the Grover Cleveland Administration?

I’m not sure there are a lot of reasonable alternatives going forward other than QE infinity. Which is far from reasonable. Oy.

Feds take in 4T and spend 6. Raising personal taxes 20% only raises $500B and can Feds cut 20% from spending. Seems, um unlikely. Not much change of GDP growth beyond 2-3% so can’t grow our way out.

The yield on debt can quickly sink the books too (which already look awful) so the Fed is buyer of last resort there.

How does it all play out most likely? The horse has already left the barn for $34T spent.

I suppose a bit of quasi good news is China & Japan own “only” $1T each. Mostly it’s various domestic holders including The Fed, SSI, mutual funds etc.

Wolf, could you quantify the percentage of credit that goes to the consumer and put it into perspective compared to gov. credit? I wonder if credit growth is still above average in total.

Household credit likely shrank in Q3. We’ll get the data in early November. Household debt is in pretty good shape. Government debt is not. And lots of companies are totally overleveraged. And CRE debt is in terrible shape.

When I read about these topics, the image that comes to mind is that of a juggler on a unicycle that matches colored balls, but the problem is that he gets more and more balls and it becomes more and more difficult for him to stay balanced. I don’t know when he will lose his balance but it doesn’t seem too far away.

MW: U.S. fiscal deficit a ‘more serious problem than ever before,’ says Larry Summers

Read the article based on comments.

I’m personally investing in popcorn because we’re going to need a lot of it watching this play out.

Wolf, could you explain the dynamics of Treasury refunding in an article?

My crude understanding the Fed is no longer purchasing treasuries, the Treasury is issuing more bills, and large buyers are cutting back purchases. This results in higher yields, which makes bonds more attractive relative to stocks.

Thanks.

Not much to explain.

Lots of older securities mature all the time, and to come up with the cash to pay them off, the government issues new securities.

In addition, the government issues securities to fund the new deficits. That’s why the pile keeps growing.

Those are the two forces.

The Quarterly Refunding documents are projections and data about that process.

“Over the 10 months between June 1 2023 through March 31, the government will have added $2.85 trillion to the marketable debt, which is totally nuts – in an economy that is growing nicely.”

I believe the totally nuts fiscal deficit is a big reason the e-CON-omy is growing nicely. The infrastructure spending is part of that so maybe the country gets a long term benefit at least from current spending.