Tsunami of issuance meets Fed QT, Skittish Foreign Buyers, and US buyers demanding to be compensated for the risks of out-of-control deficits in an inflationary environment.

By Wolf Richter for WOLF STREET.

Yields of longer-dated Treasury securities have surged by about 150 basis points since April this year, from about 3.5% to above 5% for 20-year and 30-year yields, and to just below 5% for the 10-year yield, which has caused a historic bloodbath for holders of these securities and bond funds, such as the TLT. There is now a lot of navel-gazing in some quarters as to why this jump in yields could possibly have happened. And here and there, some fancy theories are getting trotted out.

But it boils down to supply and demand. Supply is a tsunami of Treasury securities being issued as the government has to borrow unspeakable amounts to fund its scandalous deficits even in a strong economy.

And this tsunami of supply must find demand. Yields must rise until they meet demand. Yield solves all demand problems. There will always be demand if the yields are high enough, so it’s not a question of finding buyers, but at what yield those buyers can be found.

And that’s what we’re looking at: To what level will 10-year yields have to rise to entice even me to buy some of them? For me, 10-year yields are not there yet. And as each wave of issuance gets bought, new buyers need to be enticed with sufficient yields.

Obviously, something could change that would lower yield expectations by potential buyers, such as inflation miraculously vanishing or something scary happening that will make even an unappetizing 10-year yield look better than the alternatives. But we’re not there yet.

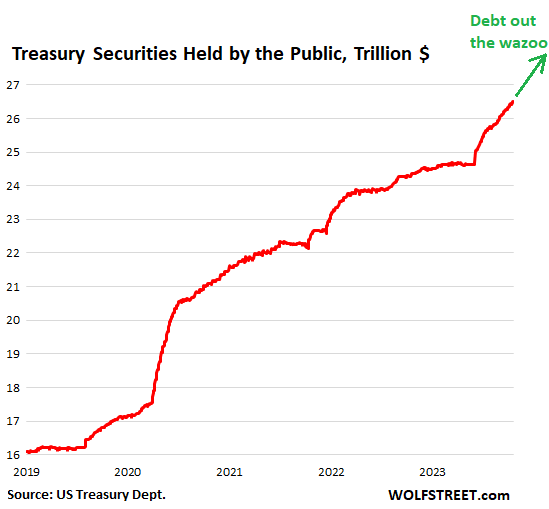

Here’s the tsunami of supply.

The total amount of Treasury securities outstanding has now reached $33.6 trillion. Of that amount, $7.1 trillion are securities held by government entities, such as government pension funds, the Social Security Trust Fund, etc. They’re not traded, and those entities buy the securities directly from the government, and so they don’t have a direct impact on supply and demand in the market.

The remainder, $26.5 trillion, are Treasury securities held by the “public.” The public includes foreign holders, the Fed, banks, bond funds, insurance companies, individuals, and me (only T-bills so far).

These securities held by the public spiked by nearly $1.8 trillion in the five months since the end of the debt-ceiling standoff, and by over $10 trillion, or by 65%, in five years, from $16 trillion in January 2019 to $26.5 trillion now!

This new issuance of $1.8 trillion in five months needed to find buyers. And yields must rise until every last one of these securities is purchased by the “public.”

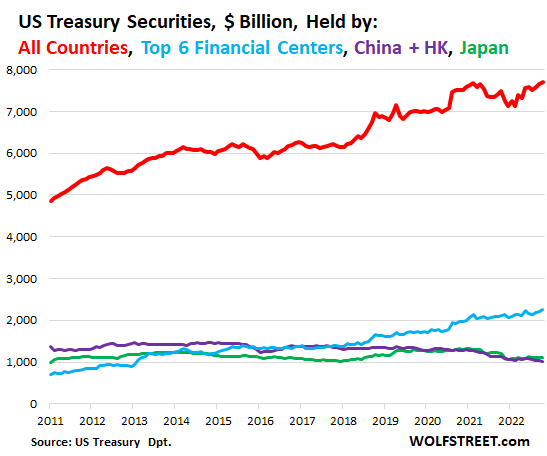

And here is demand by the biggies: International holders and the Fed.

International holders are still buying but not keeping up. They increased their holdings of Treasury securities to a record $7.71 trillion in August, as of the latest TIC data by the Treasury Department (red line in the chart below):

- Japan, #1 US creditor, increased its holdings to $1.12 trillion (green).

- China and Hong Kong combined, #2 US creditor, further reduced their holdings to $1.01 trillion (purple).

- The top six financial centers (London, Belgium, Luxembourg, Switzerland, Cayman Islands, Ireland) increased their holdings to a record $2.27 trillion.

So on net, foreign holders are still adding to their stash of Treasury securities, with some, such as China and Brazil, unloading; and with others, such as the biggest financial centers, India, and Canada, adding to their stash.

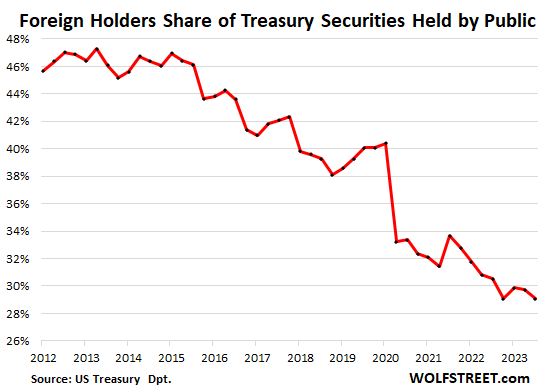

But they haven’t kept up with the US government debt that has been ballooning at an incredible speed in recent years, with trillions whooshing by so fast they’re hard to see.

And so the share of foreign holders of the US debt held by the public has plunged. Ten years ago, they held 45% of the public US debt; but now, despite the increase of their holdings over this period, their share has dropped to 29%.

In other words, they’re still adding, but not nearly fast enough to keep up with the growth of the US debt. And other buyers have to be enticed with higher yields to fill the gap.

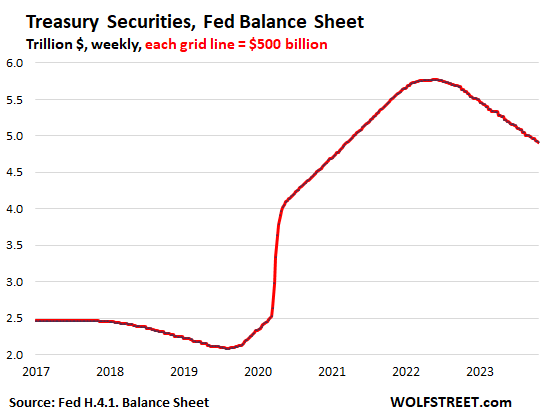

The Fed, oh dear. During the huge binge of QE, when it interfered in the bond market on a daily basis by buying trillions of dollars in Treasury securities of all kinds over the years, the Fed turned into the biggest most relentless bidder in the bond market, thereby repressing yields across the yield curve. Then it ended QE, and did the opposite, QT.

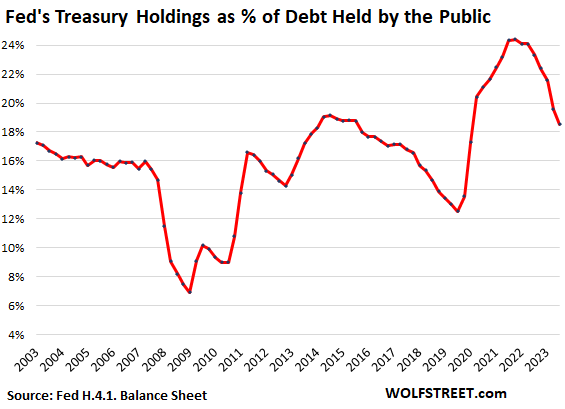

Since ramping up QT to full speed last September 2022, the Fed has been shedding Treasury securities at a rate of about $60 billion a month by letting maturing securities roll off the balance sheet without replacement. Since the peak, it has unloaded $840 billion in Treasury securities, with its Treasury holdings shrinking to $4.91 trillion (we discuss the Fed’s QT in detail monthly, most recently here).

Going from QE, which in the end ran at $120 billion a month, to QT of $60 billion a month, represents a swing of $180 billion a month.

When the government refinances the securities that mature, including those that the Fed held, it must borrow new money to pay off existing creditors, including the Fed. Since the Fed is not buying securities to replace those maturing securities, other buyers must be enticed with higher yields to pick up the slack.

And the share of the Fed’s declining Treasury holdings as a percent of the ballooning pile of government debt held by the public has shrunk to 18.5% currently, from 24.4% in October 2021:

That leaves the rest of the buyers – banks, bond funds, insurance companies, pension funds, other institutional investors, and individuals – to deal with the tsunami of issuance.

Some of them are forced buyers; but others are reluctant buyers that want a decent yield to compensate them appropriately for the risks posed by out-of-control government deficits in an inflationary environment, and they’re looking at the current bloodbath of investors, including banks, that had bought two years ago, and they’re not overeager to bid, but they will bid if the yields are high enough, and that’s what we’re looking at.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Wolf, do you have any thoughts on when 10 year TIPS become attractive?

I think I had read the wolf saying that around 6 percent yield on 10 year notes is about right at these inflation rates

If that is the case, with inflation at about 3.7% then the real yield on TIPS would be attractive at 2.3% which it currently exceeds. I dunno, I would want something closer to 3% I think.

I have short term CD coming due

offering 5.1% for 10 months – NOT GOOD ENOUGH ANYMORE

gonna go hunting for real assets at discount

bet I could buy nice vehicle in UAW strike area’s at big discount

Julian,

I don’t think I said that. I think someone else said that. I don’t have a strong opinion on TIPS. To me, they’re a mixed bag. I hold I-bonds for inflation protected securities, and regular stuff for the rest. TIPS come with some issues I personally don’t like.

You recommend holding I-bonds? I just sold mine and moved them into 3-12 month treasuries/brokered CD’s

A A Ron,

1. I don’t recommend anything. I replied to “Wolf said” something that I don’t think I said, and it was about some personal opinion on TIPS.

2. You SOLD your i-bonds? How did you sell them? Who did you sell them to?

I had some I bonds. Then I had issues gaining access to my account that were not my doing. The only way to fix it is over the phone. Then it happened again. When I finally restored access I took everything out, and put it on TIPs. I wish you could purchase I bonds via your broker.

DRM – I leaned the hard way not to forget my TreasuryDirect password.

It only took being on hold for about 4 hours to get that fixed…

Comment noise elimination. Ron and DRM fell off the wagon at the same time. Met at usual watering hole and when wasted, swiped each other’s wallets with TD PW’s.

There, a possible scenario that cleans it all up, IMHO. I’ll go back to staying in the older articles now, I’m just not the leader type….think too much….just as bad as not thinking.

Oh yeah, they did all transactions wasted and are still trying to recall what they did…..loose end on my part, sorry.

I agree, TIPS are tricky. The biggest problem is they are not liquid and the market fluctuates a lot. If you can wait until maturity, they are perfect now, better than 2008 even.

It wasn’t me forgetting password. I printed out the screen shot. The password was good. The security questions were the issue and both times they were badly garbled. I spent more than 4 hours. When I finally got someone the 2nd time, they reset things, and waited for me to try it. Locked me out again. Was told there was something weird with my account. Put on hold, and then told my entire account was reset and I’d have to enter it all from scratch. They politely waited on me to try it. It worked that time. If they had a more reasonable way to recover it would be okay. Calling multiple days on hold when something happens with no other recourse did not sit well with me. Might never happen again, but I’m not giving it a chance.

Think you had better stick with my scenario…..saw relative’s TD account when thinking about I-Bonds per Wolf……just not worth my time to have another account. Not enough money saved. I just downsize more, and am basically invalid and past expiration date. Friends back when we used to meet for coffee (last owner operated shop in large suburban area, 20+ mi of 101 corridor) and we used to joke about how we are all in the “death zone” (above 26K on Everest) and could go anytime. Several have.

Anyway, I’ve done worse things drunk…..even jail time….at the honor farm and upstairs at main jail with the real bad guys, not just drunks. One “career criminal” even said, “This used to be a nice place till all you drunks showed up” (70s)

Shit happens…

..don’t sweat your image here…I don’t….(I don’t even care if I don’t wake up tomorrow…nice way to go)………everyone’s different…. and hopefully learning. Good luck.

Wolf, Understood re:advice… I just was curious if I had overlooked something. I also clumsily worded “sold”, in fact I redeemed my I-bonds on treasury direct

” And this tsunami of supply must find demand. Yields must rise until they meet demand. Yield solves all demand problems. There will always be demand if the yields are high enough, so it’s not a question of finding buyers, but at what yield those buyers can be found.”

That is a brilliant synopsis in several ways. However, it minimizes the effect of the Fed withdrawing liquidity, which I’m currently solid with, for the next nine hours, as the principle cause of the bond market’s public, projectile vomiting.

The yield curve is still under the control of the Fed. As your curves show, the Fed has barely begun reducing the excess reserves that are regularly employed to assist markets to reach their goal.

What can one think may be the logical outcome from the Fed’s decision that the criminals that were never prosecuted were made whole. QE.

Following their massive, Fed funded, gambling spree losses, the aristocrats that own your employer, were bankrupt, according to the precepts of corporate accounting rules specified by the NASB, the national accounting standards board.

They were too big too fail. The problem is that become the mantra, exceeding even the villain’s that were rescued expectations.

What do I think will happen in the bond market long term interest rate ? Well, I’m faced with the same risk profile as you which begins with the fact I have no idea but have a working hypothesis about what might happen that has been wrong often enough that I actually consider it a contrarian indicator.

The ten year should be at 7.5 pct. The FFR, at six, seems okay. The 30 year at 5 seems like a suckers bet.

I’m buying 3 mo treasuries. Have completely abandoned the bond funds because the majority of the securities that they own are ZIRP bonds. One loses money at the moment one invests their hard earned money as the price of the fund declines to offer the same return that is currently, on proffer. Without even complicating the wrong headed investment decision with the ramifications of duration.

Life is a long slog, often colored by the impact of wrong decisions.

Amen. Get ready for bubbles to pop. These rises in rates will make it impossible for overleveraged, legally insolvent companies and banks to roll over their debts, or get investors because the payments would exceed their net revenues. Like FTX, or more so, most will be shown to give company money to their mistresses-personal assistants, for corporate housing for cronies in what amount to palaces, co. cars, etc. Avoiding taxation of US income has been absurdly easy for many decades.

Rather than letting Nature take her course and letting Bankrupt Investment Banks fail, the Politicians gave them more Public Money and Credit to start the fire all over again.

Now the question is, “Is the USA too big to fail?”

kam – the core of ‘Murican ‘exceptionalism’?

may we all find a better day.

I noticed one thing in the charts that we must be exceptional at….money laundering!

All 6 of those money laundering centers are our allies, and holding over $2 trillion in our treasuries!

Our law enforcement pals stash bonds issued by the same outfit that the IRS is part of!

You’d think they would want to keep the money elsewhere (and probably do that, too)

Fearless!…..and exceptional.

Agreed, Wolf’s concise summaries of the current yield environment should be standard lessons on Econ 101, since even our own media and leaders seem to have forgotten them. At least ever since Volcker. Subtitle here is also right on the spot- “tsunami of issuance meets Fed QT, Skittish Foreign Buyers, and US buyers demanding to be compensated for the risks of out-of-control deficits in an inflationary environment.” Exactly what’s going on. And this why uncontrolled inflation is so damaging to a country especially with deficits also out of control. The media and pivot-mongers keep trying to claim that all this fiscal irresponsibility, loose money and speculation (while savings and earnings from work get penalized) are not a problem even as cost of living gets worse and Americans keep getting squeezed. But this time really isn’t different.

First, a technical analysis:

Keep buying and rotating TBills till 10 year yield is 3% higher than Max of (CPI and TBill yield) = 3% + max(4% + 5.5%) = 8.5%.

*Please note that I expect CPI to rise to 4% for October.

Second a fundamental analysis using Austrian economics:

To be a worthy investment, someone must create value by doing productive work using principal and generate profit above interest. Also, the risk that this profit is not generated must be factored in demanding higher interest. In this case, the worker is US government, and it’s questionable productivity and profitability demands atleast a 20% interest rate for risk itself. Add BLS cpi × 2 (because BLS CPI seems to replace house cost with cost of a shitty shelter).

So that would be 20% + 2*4% = 28%.

When does it get to the point the yield isn’t high enough to entice buyers

It sounds like you’re really asking “when does the bond-buying public think the US Treasury will no longer be a trusted to repay the principal on bonds.”

To which I’d reply “still the cleanest dirty shirt”

There is also a question if the US Tresury will repay with something of any value.

Well, that’s why bond buyers have been shying away from duration, and longer bonds have come up in yields.

If you don’t trust that inflation will be mostly lower in say 5 years, you want to be compensated with a higher yield for those 5 years. Hence, 5 year yields rise to find buyers.

That’s the whole point of this article.

The answer is complex, but probably not in our lifetime. Get out of government debt long term. Short is okay. We have entered a high inflation regime with violent swings. Nobody can predict inflation in 5 years, let alone 30. And it’s all under government’s control, and they will always print, until the end of the currency. The deflation story is over, even stocks will do better than bonds long-term. Probably not next 10 years though if you buy here, Lol.

“When does it get to the point the yield isn’t high enough to entice buyers”

Hyperinflation when everything is too hot to hold.

That’s called hyperinflation.

Not yet. Hyperinflation is generally considered a month-to-month inflation rate of at least 50%.

So under the minimum inflation that would be considered hyperinflation, 50% month-to-month, your $10 loaf of bread in October will cost $15 in Nov 2023, $22.50 in December 2023, $34 in January 2024, $51 in February, $76 in March, $114 in April, $171 in May, $256 in June, $375 in July, $577 in August, $865 in Sep, $1,300 in Oct, $1,950 in Nov, and $2,925 in Dec 2024. That’s the minimum inflation that would be considered “hyperinflation.”

I know there are some people here who will say that that sounds about right where we are today, but….

Your core readers…

/s

LOL! Jk

I experienced hyperinflation in 1996. Bread costs 5 units in the morning and 10 units in the afternoon. The next day, the sellers would put in prices that had occurred to them during the night, and so on. People who had their native currency saved by the banks lost their shirts. This lasted for 1 month and finally the people took over the parliament.

The government introduced a currency board for 1 night. They equated our currency to the German mark. When the euro appeared, they equated the currency to the euro. To this day we are still in a currency board. The good thing is that the exchange rate has not changed by a cent.

But today inflation is 8.5 percent in national currency even though the national debt is one of the lowest in the world.

Julian:

Germany?

Low National Debt but the Guarantor of all of the debt of Europe.

So not technically hyperinflation, but used cars and all sorts of other things rocketing in price by 50% in a little over a year’s time is a real f**k job, and dangerously flirting with hyperinflation. Yet “fed pause.”

Depth Charge,

A lot of these prices of goods have reversed, including used cars, whose prices have dropped by a bunch from the price peak in late 2021 and early 2022. It’s time to acknowledge, Depth Charge, that raging inflation in goods, where it first exploded, has really subsided.

Inflation has shifted to services, but is lower there than it was in some goods, such as used cars. The problem with inflation in services is that it’s very sticky and takes a long time to slow down no matter what the Fed does, and a few months don’t make any difference, and so it makes sense to wait and see.

Policy rates are at 5.5%, and long-term Treasury yields are now at or over 5%, mortgage rates at 8%, other borrowing rates are even higher. These higher long-term rates have started to impact all kinds of things. So wait-and-see is now a pretty good policy at this point.

I understand and appreciate that you’re very frustrated with the many years of destructive monetary policies and what they have wrought, and that you won’t be happy until the Fed raises rates until everything blows up. But that’s just going to trigger more QE and 0%, and we start all over again. Wait-and-see at this point is a much better alternative than blowing everything up and restarting QE and 0%, no?

I bought a Baldor 5hp Electric motor 5, maybe 10 years ago. Motor still works but need to replace the bearings.

$420 for the 2 bearings.

No inflation. Nope.

Friend owns Industrial Repair Shop. One of his customers had a hydraulic pump go out on an excavator. John Deere price, $27,000. For the pump alone, not the machine. Korean copy? $6500, after resale from Import Broker.

He also says most repair parts from JD “remanufacturing centers” are offshore anyway.

Are you accusing Deere of ripping off its customers on repairs? You wouldn’t be the first one. But you got a much cheaper Korean part, so is that DEFLATION??? 🤣

In terms of your electric-motor bearings, unless you bought the same bearings 12 months ago, or 24 months ago, you’re just complaining about the deal you got, not inflation. To measure inflation, you need to measure the price increase of the SAME item over time, so today v. 12 months ago, for example.

Thanks, Wolf. I appreciate that you take the time to do this!

I don’t know why, but I was surprised to see the Fed’s treasury holdings as a percent of public debt was so high in 2003. Is that close to historic normal? Could percent of public debt be something the Fed uses to decide to stop QT?

I was curious when you pointed this out so I looked up the GAO report on the public debt in 2003. Here’s a quote from it:

“At the end of fiscal year 2003, debt held by the public stood at $3.9 trillion or 36 percent of the annual size of the U.S. economy. Debt held by government accounts was $2.9 trillion. Debt held by the public plus debt held by government accounts represent total debt, or gross federal debt.”

The Fed’s holdings as a percentage are high because debt held by the public was “only” $3.9T in 2003. Hard to believe debt held by the public is now over $26T now. The massive increase in debt masks the massive increase in the percentage of Treasuries held by the Fed.

I hope the Fed doesn’t use the percentage as an excuse to stop QT because the percentage means something different when the debt itself increased over 6 fold during the period.

“The massive increase in debt masks the massive increase in the percentage of Treasuries held by the Fed.”

I should have said: As a percentage, the massive increase in debt masks the massive increase in Treasuries held by the Fed.

You have stepped on the wet cow pie and are not welcome to stride through the kitchen in the soiled boots.

Every penny of the massive increase in debt has been spent to make your wife and children safer in their beds. Zero terrorism is good for business and good for you, we are assured. No matter what the cost, we in control of America, declare that there is no cost too excessive in our protection of freedom.

Whatever, but why not post this diatribe about the debt generally instead of in response to me? Did I say anything about how the massive increase in the debt was incurred? What an odd comment.

“….into your life it will creep…..”

Buffalo Springfield?…Panhandle?…..was pretty wasted in those days, but we were still right about excess consumption….maybe you’ll see, maybe I will…….

ChS

Why is that a surprise? The Fed has always had a big balance sheet, like any big bank. But the public debt was a lot lower, and so the Fed’s share was relatively big.

I guess it just isn’t something I thought much about before. Just sort of surprised the balance sheet was so high in more “normal” times. If that is “normal”, then the FED should normally hold about 6% of GDP worth of debt.

Franky there shouldn’t be any such rules for the Fed. The only reason for the Fed to own Treasury is to provide more reserves into the economy (increase money supply).

Theory suggests that they should do this in proportion to the growth in the economy (GDP is good proxy but should ideally be less because electronic payments increase money velocity)

The other exception is to increase liquidity in times of bank panics and lender of last resort (against good collateral).

But our dear Fed has a policy reach addiction. They feel they need to intervene to solve every problem….which creates the next problem and so on.

Whether they will learn and stop intervening OR whether they will take us to the demise of the dollar remains to be seen.

I think it’s ridiculous to buy the ten year under 5.5% considering the 4% inflation that we are experiencing and strong possibility of over %3 inflation for the foreseeable future.

As an individual I won’t buy long term under 6.5-7%, the next decade is to unpredictable to lock oneself to anything less than that.

Agreed, given the economic and political landscape, 10 year needs to be 7-8% at least.

What would 30 yr mortgage rates be around that range?

10-11% I think. Housing is toast as it is, if we see mortgage rates in the double digits I’ll have to adjust my prediction of houses selling for half off the peak to 25% of their peak price.

My understanding is that 30 year fixed rate mortgages are typically around 3% additional over the 10 year. So 7-8% 10 year would mean 10-11% 30 year fixed. If I remember correctly, 10 year is used as a benchmark as that is typically the length of time the average homeowner holds a mortgage. However, I’m very curious if this average length might increase over the next decade+ due to so many homeowners feeling locked in to their low rates from ZIRP. If yes, then perhaps it isn’t an accurate benchmark anymore and really mortgage rates should use the 20 year as a benchmark? Or some middle ground between the 10 year and 20 year?

Land prices need to fall 90% in many areas. That’s where the bubble was, not in the actual shack.

Rate would be high, but not many takers due to recession.

I agree yields should be higher, but I also think a 10-year @ 5% can make sense in some cases.

I bought a 10-year CD @ 5% for my 401(k) earlier this year. I can’t touch that money for at least another 30 years anyways…

Its a brokered CD – I forget the bank itself that sold it.

I was also considering a nibble at some 20-year paper. If yields drop (unlikely) I can sell for a gain, but if they don’t I’d just collect the coupon for the next couple decades.

Again, this is in my 401(k) so I can’t/shouldn’t touch any of this for a long time. In my non-retirement account, I’ve been staying with 6-month bills.

I don’t think an FDIC insured CD is questionable paper. You’re conflating investing in a CD with assuming the credit risk associated with investing in a zombie company or questionable paper such as CRE debt. It doesn’t matter what “paper” the bank invests it in. An FDIC insured CD is functionally equivalent to a Treasury from a credit risk perspective. If the US government goes down, we’ll all have much bigger problems. Locking in a solid rate for the long-term with some of your investable money makes sense to me. Inflation is an issue, so other people may reach a different conclusion.

Good luck MM.

I would buy 5yr Treasury at 5.5% in a heartbeat. And I would buy a lot, 20-30% of my total portfolio.

Guess, what, JeffD? You’re going to get to. So sell off whatever it is you’ll be dumping to buy the UST…wait, you said 5 year, not 10 year. Hmm. Probably still coming your way.

I wouldn’t touch it, but knock yourself out!

I generally agree in the sense that long term interest rates are currently, not logical, especially given the heightened uncertainty about the inflationary path over the next 10 or 30 years. I can attest that I was unable to anticipate the course of monetary econo-philosophy that would be implemented since my coming of age in 1965.

There are two storm clouds, no longer small and no longer on the horizon, that have the potential at some indeterminate future date to “wash” the U.S. and the Foreign-dollar “down the drain”.

They go by the name of “foreign trade deficit” and “domestic federal deficit”. These deficits have an insidious, if not an incestuous, relationship. Positive interest rate differentials are significantly responsible for the dollar’s exchange rate support. And an “overvalued” dollar in turn is the principal contributor to our burgeoning trade deficits.

The viability of the U.S. and Foreign-dollar as international units of account is threatened by the huge trade deficits. Given the present and prospective trade deficits, this situation is not likely to continue for long. Foreigners will simply be saturated with excess dollars.

The volume of dollar-denominated liquid assets held by foreigners is extremely large. Any significant repatriation of these funds, by reducing the supply of loan-funds, will force interest rates up – thus increasing the federal deficit and the burden of all new debt.

These events alone could trigger a downswing in the economy resulting in more unemployment, more unemployment compensation, less tax revenues and larger federal deficits. Truly a vicious cycle.

There is a Keynsesian accounting identity that is used as the yardstick of the wealth of nations, which happens to be the title of his famous treatise.

The basis of his discussion is an explanation of why he thought that the wealth of a nation could be described by a simple algebraic expression

GDP = C + G + E – I

What we are talking about, I think, that is the requirement that, in order for the US to increase its GDP is to run a budget deficit to pay for the trade deficit. That is the starting point to begin to decide what kind of future we hope for.

The trade deficit is running at 6 -8 pct of the US real GDP. Every positive number reported about the growth in the US GDP is an increase in the debt beyond the reported trade deficit.

It is an interesting time to have been alive. Notable in the absolute wrong decisions made by the Ivy League experts in charge.

The more alarming aspect of the deficits is not the effect on interest rates but the effect of high interest rates on the level of taxable income and the volume of taxes required to service a cumulative debt now exceeding $33.6 trillion. Both high interest rates and high taxes induce stagflation, thus eroding the tax base and increasing the volume of future deficits.

Spencer- You’ve raised a question I’ve been thinking about. Taxes seem very unlikely to go up in the near future. And if equity prices fail to continue rising, capital gains tax revenues suffer. Local governments relying on property sales/values for tax revenue must be nervous. Has anyone run the numbers to see how much income tax revenue we lose when unemployment rises?

Not just unemployement – when housing prices finally crash (when not if), what happens to all that prop tax revenue that thirsty muni gov’ts have gotten addicted to? What happens when muni bonds have to offer double digit yields to catch a bid?

Bingo ! Inflation is the official policy otherwise something will break, not a good look in the year before the general election.

The president, and his coattails, are generally elected based on the economic situation that any particular voter is experiencing.

The US budget is based on the similar model that many American homeless people employed, except the US can print dollars to pay for it’s pulchritude.

Tomorrow will take care of itself. Worrying about it today is the cross that the young bear.

Would be nice to see double-digit yield on 10 years..probably not in my lifetime.

If it does happen, sure would be a good talking point to stick it to housing investors and their pathetic cap rate by comparison.

We’re not that far off from double digit 30-year fixed mortgages.

@Phoenix,

“Would be nice to see double-digit yield on 10 years..probably not in my lifetime.”

3 years ago who expected the 10 year to be where it is today. We may see double-digit yield in the near future.

Phoenix, my son has bid on single families in orange county california. He cannot win the bid. He has 15 percent down and is approved for loan. Sellers keep accepting offers with bigger downs. I see the same buyers at open houses and they are having the same problem. 20 percent down is not enough.

Sure there is a clearing price. Argentina has bond buyers too. Not exactly what we want.

It’s not only how much money they’re spending, but look at what they’re spending it on.

My emergency fund is in T-Bills and otherwise I’m paying down my mortgage.

The government can find someone else to fund their idiocracy for the next 30 years. Count me out.

I’ve been slowly buying long dated treasuries for a while now. It’s been depressing watching yields rise, but sooner or later, they’ll come down. The economy over the long haul just doesn’t grow very fast. I expect to see lower rates in a few years.

A two year reversal in a 40 year bond bull market is not much of a reversal. The bear bond market may have a long way to go. Remember the debt is never being paid back. Both principle and interest payments are just being refinanced until they aren’t.

In the last paragraph you mention that “some of them are forced buyers.” I am still trying to learn this stuff but I wasn’t aware of this. Who is being forced and how is that a thing? Is that related to the dealers you mentioned a couple articles ago that purchased all the excess issuance? Or am i in left field?

Passive bond funds, life insurers, hedge funds covering their leveraged short positions, etc.

Jon,

Some investors are forced legally (to enhance safety/stability, since the G can’t, in theory, default…since it can always print more money) and some investors are “forced” prudentially, for the same reason.

Banks, insurers, etc. tend to operate under regulatory regimes that assign “risk weightings” to the various asset classes that they hold – US Treasuries get the most favorable treatment…this greatly encourages the holding of said Treasuries.

(In some banana republics, the G explicitly forces conversion of private savings – pensions, etc. – into Government Treasuries under the pretense of safety, but with the reality that their G’s finances are so screwed up, that private savings have to be forcibly converted to buy the failing G another few years of life…).

In the “normal course of things”, a lot of financial intermediary institutions (like banks) tend to lean heavily on US Treasuries because they want to focus on exploiting/defending against interest rate movements, without having to complicate things by having to incorporate default risk factors at the same time. US Treasuries let them do that.

Those institutions thereby sacrifice some yield, but buy some limited peace of mind and help get regulators (“mysteriously” also from the G…) off their backs.

Thank you both for your explanation!

Cas 127 is BADLY in need of reading some history instead of just inventing it……he is approaching pathological lying in his defense of everything private and damnation of everything government…..like 45 was (but cleverly lied about it all)

Please go read “Banana Republic” in wikipedia, unless you share the same disease and like your alternate facts better. And get ready to LOSE BIG if you WIN (for the plutocrats)…..45’s clientele, pals, and source of his business profits.

Wolf, what’s the magic number on the 10 year to entice you enough to dip your toes in? (*Not investment advice as everyone’s situation and timelines are different – I’m just curious).

I’ve finally convinced my 70 year old Father to move the majority of his retirement nest egg from equities into fixed income – mostly shorter term treasuries for now. That said, for his situation I don’t think it’s unreasonable to purchase a first tranche of 10 year treasuries when and if they pass 5%. If the 10 year blows out in the coming years to say 7 or 8 percent, there’s still the opportunity to cash in some of those shorter term instruments and lock in higher long term yields if they get that juicy. After just having open heart surgery, I would feel very blessed if he can enjoy another healthy 10 years and watch his grandson grow into a young man.

Serious questions: what is the investing objective? Does he want to leave a large legacy? Does he invest to ensure that he will have some money in the future? Is the investment in taxable or tax-deferred accounts? What is his current liquidity position? What debt does he have (if any)? What are his forecast financial needs? What other income does he have? What assets does he own (encumbered or unencumbered)? Will he need to draw down any of this money? I could probably give you 20 more, but I think you get my point.

Asking where to invest is really a cart before the horse question; my only observation (not answer) to your question is that if you are investing for 10 years @ 6% then I think you’re implicitly assuming that 6% will be the peak / near peak for the foreseeable future.

Yesterday I heard El-Ehrain say that the FED should provide guidance that they are finished.

Today I heard Mester say, “Regardless of the decision made at our next meeting, if the economy evolves as anticipated, in my view, we are likely near or at a holding point on the funds rate,”

So, I finished building my beaten-down, large dividend paying, highly interest rate dependent, mostly green energy sector related portfolio.

I know this is a small short term interest rate gamble but you have to buy when others are fearful and they are all solid B or A rated equities with nice histories of large dividends which will be tax free most years for me.

Did you find that story about how the carbon capture ingots or whatever they are called, how they have a massive corruption scheme behind them?

It’s like when my energy company asks me to buy green energy credits. I’m like “dude, like I’m going to give the greediest corporation on earth some free money and trust they will use it correctly. Haha!”

sufferinsucatash,

Never did put much faith in carbon credits. Seemed too easily fraudulent…

I do like the people in the green energy sector that own lots of large solar and wind fields with solid balance sheets and strong dividend histories.

I also like the large diversified miners for similar reasons and the fact that metal demand and scarcity are only going to grow.

Finally, I am not swinging for homers. Just singles and doubles are fine for me.

I was always a singles kinda guy.

Past the short stop or second baseman

Mohammed El-Ehrain is pretty rich guy and I am sure his wealth is deeply tied to assets. That’s why he was begging for FED to pivot lest something big break. He is a very sophisticated speaker for sure but his intent all come out easily.

Something big is already broken:: Essentials of life are not unreachable to middle and poor class.

jon,

Suggest you read El-Ehrain’s bio.

I read it and have been following his comments for quite some time.

He is the Fed should Pivot camp 😀.

OK, just to clarify here: The Fed is only hiking or not hiking short-term rates. Long-term rates are what we’re talking about here. The yield curve has a way of un-inverting that might entail long-term rates rising above short-term rates (rather than short-term rates getting cut below long-term rates). So if the Fed holds at 5.5%, and the yield curve than un-inverts, it means ca. 6%+ long-term rates.

What’s stopping the Fed from buying long-term treasuries?

Inflation.

Hopefully inflation and common sense :)

Fiscally, it’s all too common cents. Don’t worry, the time will come again.

From 01/01/20023 by duration remaining,

10+ years — +2.7%

5-10 years — -13.8%

1-5 years — -13%

0-1 years — -21.1%

https://fred.stlouisfed.org/graph/?g=1auPW

AaRoW,

Ignorant BS concocted by moron bloggers out there and duly spread by people who are clueless.

1. There are about $1.5 trillion in securities on the Fed’s balance sheet (19% of the $8 trillion in total securities) that mature in over 10 years. All of them are 20-year or 30-year bonds. There is not a single 10-year or 7-year or 2-year note in that $1.5 trillion.

2. There are a large number of 30-year bonds on the Fed’s balance sheet that mature in LESS than 10 years that are NOT included in this 10+ years figure because they mature before then.

3. The $1.5 trillion includes ONLY securities that mature in over 10 years from now. The 30-year bonds that mature next year, for example, are not included.

4. The Fed already shed a LARGE NUMBER of 30-year bonds. The number of 30-year bonds on its balance sheet has FALLEN since QT started. A 30-year bond that the Fed bought in the market in 2012 with 11 years left to run comes off the balance sheet in 2023. But since the maturity date is in less than 10 years, it’s not on the list of the $1.5 trillion of over-10-years.

5. When the roll-off goes over the $60 billion a month cap, the Fed replaces maturing 30-year bonds that have rolled off with new 30-year bonds, in the amount that the roll-off was over $60 billion.

So if the roll-off is $65 billion in one month, the Fed will replace $5 billion, spread over the various maturities by buying new securities. There are now many months when the roll-off is below the cap, and no securities are replaced.

6. A 30-year bond that matures and rolls off next month matures in “1 month” and isn’t even in that $1.5 trillion that matures in “over 10 years.” None of the long-term bonds that mature before Oct 2033 (10 years from now) is in the figure of $1.5 trillion.

7. If in one month, $8 billion in 30-year bonds mature, and $50 million (with an M) are over the cap, the Fed replaces $50 million (with an M) in maturing 30-year bonds with $50 million (with an M) in new 30-year bonds because that’s the amount over the cap.

8. The $50 million new 30-year bonds go on the over 10-year maturity list, while the $8 billion in maturing 30-year bonds that rolled off had NOT been on that list in 10 years because their maturity date was less than 10 years in the future.

9. This has the effect that the number of 30-year bonds on the Fed’s balance sheet DECLINES by fairly large amounts on net. But the small amounts of new ones show up on that $1.5 trillion list, while the old ones that matured hadn’t been on the list in 10 years. That’s why this list crept higher, even as the Fed’s holdings of 30-year bonds are plunging.

Only moron bloggers out there who don’t understand how bonds work call this “QE.” Dragging this bullshit from moron bloggers out there into here is one of the 7 deadly sins.

I sure hope we get un-inverted as rates are still too low 2yr plus

Very clear. Thank you!

The entire monetary system is designed to rob from people. Inflation is always gonna be higher than yields on toilet paper by design. So higher rates means higher inflation (not the other way round) that some fools believe.

I’m guessing you weren’t alive in 1982.

I was alive in 1982 …… Fed Funds Rate was 20 % Primne was 21.5%.

Yeah…….The Great Reagan program, including “The Great Mass Crushing of Self Respect”…..it even included a LOT of whites!

Nobody can quantify such a thing, and I was lucky to get out of it……many never have….never will.

They are currently building new jails for the constant increase.

Look up Incarceration in America in wikipedia, and see some of the results…..starting in 1980….the rest are fentanyl and other deaths, homelessness, shootings, and the other social problems.

This IS directed at you……if the shoe fits, wear it.

No, interest rates were pushed well above inflation in 1982. I was responding to Kunal who said inflation will always be higher than yields. My comments make more sense if you read them in context. Reagan never crossed my mind.

Does higher interest help the SS trust to delay the inevitable running out of money?

1. Right now, it still has $2.7 trillion in it, and it dipped by only $50 billion this fiscal year, despite the huge 8.7% COLA. Next year’s COLA will be 3.2%, and so it may actually grow again.

2. Yes, higher interest rates will be a big factor in increasing the inflow, given the huge balance, but it takes a while for those higher-yielding securities to replace the current lower-yielding securities.

If social security continues to collect taxes from workers, then it can’t run out of money unless the US runs out of workers. Maybe at some point collections and the trust fund don’t cover currently promised benefits in full, but that’s a different issue. It’s also an issue worth considering though.

If social security collects less than it pays out it can run out of money.

I don’t think so. It’s the greatest annuity ever, isn’t it?

I need to read up on it’s inner workings.

No, think about it. Social Security will collect more money this week. And next week. And the week after that. A program which constantly collects taxes will always have money. The question is whether it can pay benefits as currently promised, or will need to cut benefits at some point because payouts exceed contributions and the Trust Fund is depleted. As long as workers contribute to the system, however, social security will be able to pay some level of benefits.

People who claim social security will run out of money or cease to exist as if there is some finite amount of money in the system, aren’t considering how the system actually operates. For the most part, current benefits rely on the contributions of current workers.

What you describe is a classic plain vanilla ponzi scheme…

No, it’s not. You should look up the definition of Ponzi scheme. A nationwide social insurance program in which most workers participate and eventually draw benefits from does not meet the definition. The fact current workers pay most of the benefits of current retirees, aside from drawing on the trust fund as needed, does not make it a Ponzi scheme. For one thing, the element of fraud is missing.

I dunno why but I find treasuries, bonds and securities to be an extremely boring part of economics.

Do economists have preferences of what they are experts in?

Yeah, it’s not quite rocket science. I’ve been asking the rhetorical question for 3 years: who exactly wants to lend out 30 years at a fixed rate of 3% backed by a fiat currency? Only the Fed, but surprisingly the banks extended their lending through long-dated T-bonds at historically low yields. Smh…

A life insurance company with actuarial liabilities that are projected to come due in 30 years would buy 30 year treasuries. The low yield would be reflected in a higher price for the insurance policy.

Howdy Lone Wolf and THANKS again for teaching this old fool so much. Off topic? Sorry. Since learning about the FED dot plots here, was wondering did they exist during the 70 s 80 s inflation cycle? How did the FED dot predictions compare to actual FED actions during those years?

Asking for myself and if a stupid question, apologies in advance.

Back then, there was almost no disclosure of anything the Fed thought or did. The dot plot, and all the stuff the Fed now releases are relatively new things. It didn’t even have a weekly balance sheet back then. Volcker talked about the money supply numbers he was trying to achieve. And that was it. Even in the 1990s, people were trying to figure out if the Fed raised or lowered its policy rates by looking at how Greenspan carried his briefcase when he came out of the Eccles building. Maybe left hand meant rate cut, or whatever. When he did talk, no one could understand what he said or meant. Those were the days.

HEE HEE. How he carried his breifcase . THANKS

Yes, those were the days. My first mortgage in 1981 was at 14% – I was so jealous of all those (old) folks with 4 and 5% rates. Still amazed at how low rates were recently.

My 94 year-old mother’s income porfolio has been through one helluva ride.

They didn’t say anything back then (top secret info) because they knew markets would front run. Imagine that! Who could have guessed? Now the Fed telegraphs an outline of its thinking three years out.

Now the Fed tells us everything they’re doing and then some.

Yet stupid banks were still buying long bonds at near-zero rates when they had already started hiking (and said they’d hike more).

Can you imagine a Gen Z era fed chair?

They will be jumping up and down one sentence. Then crying the next.

May have a squad, who knows. :)

Post-FOMC presser will be live-streamed on TikTok

“The Age of Volatility” was a game changer for me. I’d been drinking the efficient market, always be long equities kool-aid until reading that book (cut me a little slack, my frontal lobe was still developing). I realized then that if Greenspan was admitting Rubin pulled the wool over his eyes, and the Ayn Rand kool-aid he’d been drinking was poison (in his own non-commital way), we’re all drinking poison. And as we all know, while a little can be fun, too much will kill you.

Wolf, I know this topic isn’t about housing per se, but here in Brazil there has been some focus on the cash burn rate of Resia, an american subsidiary of a brazilian construction company, MRV.

Aparently, they were bleeding far more cash then expected to sell their houses (I believe the company focuses on the Florida market), and selling them slower. Anyway, maybe you can add this kind of info on future analysys of the housing market, as it may be an indicator of the feasibility of the point buying/incentive strategy presently adopted.

RISK

DM: Fed chair Jerome Powell signals interest rates will NOT go up again at next meeting – as US Treasury Yields reach 16-year high and mortgage rates near 8%

In a much-anticipated speech to the Economic Club of New York, Powell indicated officials would extend the interest rate pause at the next meeting at the beginning of next month.

“Powell signals”

“Powell indicated”

This is why I cut out the middleman and listen to the speeches myself. He talked about how rising long rates are doing some of the tightening for the Fed – NOT that the Fed is done tightening or raising rates.

Yikes, Wolf and I have some similar investment views. We both like T-bills (I ladder six month T-bills, for about the last year and a half) and I-bonds (I have a ton, some old 3.0% fixed rate ones) and avoid TIPS.

Guys, anyone know why stocks are going down today? Nvidia is about to go under $1 Trillion. And Tesla is barely 2/3 of that.

@andy: Higher for longer. Yesterday Powell indicated that he wants the economy to cool down more till it reaches the targeted inflation of 2%. Today, Bostic indicated that he doesn’t see interest rate cuts till the later part of 2024. Markets started pulling back yesterday on Powell’s comments and continued the downward trend today. So the market is finally beginning to hear what is being said instead of being in its own “pivot” echo chamber. I foresee continued pull back over the next few weeks and months.

@andy: Btw, Nvidia’s pull back is to the Biden administration clamping down on selling advanced chips (AI) to China. Tesla announced fairly mediocre results a day or two back and hence the impact to its stock price.

Thanks Sean, that makes sense.

Those advanced AI chips- is that what we used to call graphics cards 10-20 years ago?

Andy, the RTX4090 (a graphics card you can buy today) uses the same technology as the H100 AI processor, yes. The latter has more cores, more memory and is optimised for AI workloads. It also retails for 10 times more money.

MustBeADuck,

Is someone going to figure that out? Is that when NVDA gets to join my pantheon of Imploded Stocks?

The basic technology is not proprietary and grew out of the idea of “programmable shaders” for making graphics look pretty. It’s just a bunch of very small processors that do one thing very fast. AMD, Intel and even Google are already working on competing architectures. I don’t think competition would implode them since (unlike many of your other examples) they do have a solid reputation and long history in the graphics card market. It will certainly make a big dent in their ludicrous market cap, tho.

No, it’s also because they’re idiots that bet hard on an obviously volatile emerging market. If they had chosen to push into AI without doing so at the expense of consumer gpu sales they would be fine. Instead they’ve been trying to push AI nonsense to the consumer space to induce demand for it as well as assuming that AI firms would keep throwing money at them hand over fist, even with rising rates meaning that these companies no longer have oodles of cash to burn on customer acquisition.

If Nvidia had done a better job of not spitting in the face of half of its customers (consumer gaming is about 45% of sales, datacenter about 40) they wouldn’t be in this mess. Instead they bet hard on AI so their cards are overwrought monsters, gigantic chips that cost tons of money to fabricate. About half of the die of the 4090 is dedicated to AI. HALF!

Of course, stock prices rarely reflect reality, so if the spin from Huang is good enough maybe it won’t matter. But nvidia’s consumer fundamentals are dogwater, I’d stay far away.

Stocks are coming to realization although very slowly that there is no ZIRP and FED may not Pivot soon.

Stocks and other assets need to fall much much more to account for 5% 10year yield and other increased rates.

Way overbought and way overpriced.

Wile E Coyote looked down…

I don’t think so. We have Nano-Technology this time. I mean Artficial Technology.. or whatchamacallit

Good thing he ia wearing and ACME parachute…

Will be interesting if Apple takes a hit as iPhone 15 sales aren’t great and while I tend to not believe the media they seem to indicate a swing towards buying Chinese brands. I believe China is 20% of Apples market in that area so not insignificant.

They are going to raise taxes tremendously to pay for all this!

Excellent explanation of US debt!

What happens when the interest on the debt becomes too large for the government to pay? How soon will it happen?

I will have to issue more debt to pay the interest LOL.

And yield solves all demand problems.

You see where this is going? Congress is going to be FORCED to deal with this deficit eventually. Interest expense is the only discipline left in Washington.

Looks like by the end of Q4/23 the annual interest rate bill will top $1 trillion (on an annualized basis using Q4).

Maybe that will catch someone’s attention … but probably not.

The frog appears unperturbed.

Congress is going to be FORCED to deal with this deficit eventually.

I agree, and hope to live long enough to see it. BUT it will be quite the day when they do deal with. I am not sure how that works out.

Most concise two word explanation of future US Government action — Interest Expense. That begs the question, ‘but when’ ?

Will ge interesting to see how this goes for big states like CA first since they need to produce balanced budgets. Typically bonds were used for infrastructure but might be needed soon for deficit.

States, including California, are still siting on huge piles of pandemic cash. CA has a massive “rainy day fund” from before the pandemic. When capital gains tax receipts exploded in 2020 and 2021, CA raked it in. Other states are similar. It’ll be a while before these states run out of cash.

I just heard that BOA has 143 billion in unrealized paper loses on their bond and fixed income portfolio. If they ever had to sell, or mark to market, they would be insolvent.

But if they only sell $10 billion of them, and loses $3 billion, it would be a nothing burger, barely a dent in their income. The bank had a net income of $27 billion in 2022.

These big banks are hugely profitable. They can take some big losses just against their income, without impacting capital at all.

Doesn’t it come down to the speed of bank deposit withdrawals forcing sales of bonds and taking losses ?

Those banks that have relied on institutional funds for deposits

and/ or are unduly exposed to high risk sectors ( commercial RE e.g.)

have greater flight risk and thus more solvency risk I presume.

The government will sprint to bail out the large banks, not a second wasted.

The biggest risk any bank faces is a run on the bank (sudden deposit flight). Even if a bank has no unrealized losses, it still cannot get enough liquidity in 1-3 days to pay off all of its uninsured deposits. That’s the structural problem for all banks. Deposit-taking banks are a very risky structure. So there are lenders of last resort (the Fed, the FHLBs) that will lend banks short-term the funds needed to cover the deposit outflow, so that banks can then take their time selling the assets they have. That has been in place since the Great Depression, and that’s a good thing as long as we have deposit-taking banks.

Wolf-

Above someone asked what yield would coax you into holding some 10 year Treasuries. Later you said, I think, that you currently are parked in Tbills.

If you speak to the 10 year question, some thoughts on 2, 3, 5 and 7 year “buy target” rates would be interesting too.

(I understand that US Treasuries are probably only one portion of your portfolio. Please pardon if getting to personal!)

Everyone has their own priorities. One thing I will not do is back up the truck and load up on long-dated Treasuries no matter what the yields. When time comes, I will nibble. And when yields go higher, I will nibble some more. But these are long-term bonds, and if I need some cash to do something else with, and I have to sell them, I could take a big loss if yields moved higher still. So for me personally, I’m never going to be all-in on long-dated bonds. But that’s just me and not financial advice.

Consistently wise advice you give for savers:

~ Consider your own situation and temperament.

~ Dollar cost average into bond market.

~ Don’t over-allocate to bonds (or anything?)

~ Be a patient investor.

~ Consider whether you have “staying power” to avoid forced sale situation.

If I could be so bold as to add one item that applies to people like me (retired, conservative, and living off the income from my 50 years of career savings):

~ Now that rates have nearly tripled, put some of your savings out further on the yield curve just in case the notorious “break” that the Fed desires happens sooner than you expect. (I happen to prefer 3 to 5 year maturities, given todays yield curve.)

“Nibbling” as rates rise, as you advise, makes great sense!

Thanks for your great service, Wolf.

Q: can individual investor bid on new issuance? ( or only secondary market ). Also, if gov wants to sell 500 bil At auction- but only get 200 bil sold because rate not high enough. Can they pull other 300 bil ? Forgive my ignorance but doesn’t seem like legit auction.

Chris,

1. “bid on new issuance”: Yes either via your broker, or directly at TreasuryDirect.gov (after you set up an account).

2. Buy in the secondary: yes, via your broker.

3. That would be a failed auction. That’s rare in the US because they check the market to see what yields they should aim for to sell the whole load of debt. Currently, all auctions are “oversubscribed,” meaning many more investors are bidding on the bonds than there bonds available for sale.

In another article i saw a graphic that showed the owners of the private debt and the Fed makes up a really big chunk. All of the other owner segments – insurance companies, general public, institutional owners, make up a much smaller segment.

What i really took away from that chart was that some of the other segments of owners would need to dramatically increase their purchases to absorb the extra debt, since the Fed was decreasing and foreign owners were also decreasing.

One other point that Wolf doesnt make here is that the intragovernmental portion of the debt is being liquidated, because the biggest portion of that, the social security trust fund is being drawn upon each year. By 2032 or so, the Social Security Trust fund hits zero.

So not only does the Treasury need to sell Treasuries to fund the government’s yearly deficit, but it also needs to sell Treasuries to make up for the liquidation of those public IOUs. And the government’s yearly deficit keeps getting bigger simply because it must refinance at higher interest rates. I can easily see the point where interest payments are 2 trillion a year and dwarf any other line item on the federal government budget.

I think that things are going to get a little bit CRAZY before the Congress will finally do some things to shore this up. My guess is that before the next election cycle, Congress will be forced to take action.

The Fed is stuck between a rock and a VERY hard place because it cant just turn on the money printers to buy this stuff because that will lead to inflation or maybe total annihiliation of the value of the dollar.

Think about how the bond market in the UK reacted to that budget and you get a sense of what could happen here.

There is one other factor here that might come into play. The dollar has been pretty strong, due to rising interest rates. What happens if the dollar starts to tank? Will foreign investors want to hold US Treasuries yielding 6% if the dollar falls 15% over a year? NO. They will liquidate as well. It is my theory that the dollar is going to face a crisis at some point, due to the move away from countries trading in dollars and that is going to lead to too many dollars in circulation and the world moving away from dollars.

The big question is…who is the buyer of this junk, except for the Fed, in the next crisis?

The Fed has been the buyer of last resort until now, but with inflation raging, they cant perform that function in the next crisis, unless they abandon price stability.

There are a whole lot of financial people that are calculating these scenarios right now and might decide to really start to liquidate certain assets to preserve wealth.

At its absolute highest point, the Federal Reserve owned only about 20% of the outstanding US Treasuries and that ownership is now around 14% and falling all of the time.

“By 2032 or so, the Social Security Trust fund hits zero.”

I suspect this is not true, and Wolf will be explaining why shortly.

“What happens if the dollar starts to tank? Will foreign investors want to hold US Treasuries yielding 6% if the dollar falls 15% over a year? NO. ”

I disagree and think the answer is YES. If the dollar is crashing (inflating) that hard, other currencies woudn’t be any better. That hypothetical 6% treasury would still yield more than bonds issued in their home currency. Again, cleanest dirty shirt argument.

The Fed has done a good job at keeping foreign investors intertwined in treasuries and USD.

“What happens if the dollar starts to tank? Will foreign investors want to hold US Treasuries yielding 6% if the dollar falls 15% over a year?”

It’s the other currencies that tanked, LOL.

gametv,

“One other point that Wolf doesnt make here is that the intragovernmental portion of the debt is being liquidated, because the biggest portion of that, the social security trust fund is being drawn upon each year.”

I have no idea where you got this BS. Which is why I didn’t make the point.

1. The Trust Fund dipped by only $50 billion this fiscal year ended Sep 30, despite the huge 8.7% COLA. Next year, the COLA will be 3.2%.

2. There are still $2.75 trillion left in the Trust Fund.

3. The Trust Fund is only about one-third of total intragovernmental holdings, the government pension funds make up the rest, and they’re not shrinking anytime soon.

Here are the intragovernmental holdings 🤣

The dollar has been annihilated.

continuously for some time now …………..

Less annihilated than most other currencies.

Even if the trust went to zero like suggested in some articles(CNBC for example) the current money coming in will still fund benefits but perhaps like 80% of current. Really hard to see any of that happening in any event as that is one too important of a voting block for politicians. I tend to see most of those headline articles as click bait.

So I just re-read this article: https://wolfstreet.com/2023/08/02/here-comes-the-tsunami-of-longer-term-treasury-notes-bonds-monthly-auction-sizes-60-by-august-next-year/

The markets appear to be choking on the October Issuance of Bonds. But according to the chart in that article, November issuance is going to jump significantly to 281 Billion. In the meantime, all we hear from the White House is the need to spend $100B more for Ukraine and some undefined amount of money for Israel. No one is seriously taking about cutting anything.

Based on that, is there any reason to think that long term yields won’t continue their rapid march upward next month? Other than a financial disaster that completely destroys inflation (which the rapid rise in long term rates will quickly bring about)?

I’ve been thinking yields might need to take a short break soon – they’ve literally gone parabolic in the last couple months out on the long end.

Long term I don’t see yields being lower for a loooong time.

Wolf, how much further will the Fed do QT? Until balance sheet is zero?

What purpose would it serve if the Federal Reserve reversed QE with QT to any point below where it is now?

Here’s my effort at explaining it and coming up with a range of outcomes:

https://wolfstreet.com/2022/09/05/by-how-much-can-the-fed-cut-its-assets-with-qt-feds-liabilities-set-a-floor/

Wolf, might you be able to suggest links to data that can be watched to assist in assessing when the demand for 4+ year maturity treasuries is matching the supply?

Demand will always match supply. Yield will see to it that it does. When yields rise, it means that investors that were waiting by the sidelines with cash ready to deploy are being enticed by higher yields to jump in.

Wolf — thank you for these continuously educational write-ups.

Please, help me with something; the Fed gets repaid when their treasury holdings mature, and you write that to make those payments more treasuries are issued; but doesn’t the Fed then turn around and deposit the cash they receive at maturity back into treasury?

No, when the Fed receives cash, it destroys it as a matter of routine, in the opposite way that it created the cash when it bought the securities. So this is QT, and the Fed destroy the cash.

There is no “cash” account on the Fed’s balance sheet. Every normal balance sheet has a “cash” account right at the top. But central banks don’t. Instead, they create and destroy money when the pay or get paid.

This is the most important and least well understood feature of central banking — public ignorance about this leads to widespread hobgoblins of the mind.

Its come up before how can the debt have possibly got to this amount, and I think the experience with Russia shows that if the US were to default, then the country gets to keep US investment in that country i.e. the default risk is not on foreign holders of treasuries, but rather on domestic US companies that have invested abroad, and in turn the US domestic stockholders aka the general population but specifically NOT the US government because their financial situation would improve.

So if the US were to default on the holdings of the Chinese, and in turn the Chinese were to appropriate all IP and inward investment of US companies, would that be bad for China?

Having said that the risk of confiscation is now an immediate concern so US companies are pulling back from overseas investment which is a current policy goal so that works out.

What I think is a more immediate concern is that there will be restrictions on petroleum exports as the SPR reserve has been run down as effectively an inflation damper. This I think would be seen as a default and drive yields up. Clearly the democrats are reckless in their policies I wonder what they are thinking.

“if the US were to default on the holdings of the Chinese,”

That’s a pretty silly or even funny hypothetical scenario 😁

The US isn’t currently paying off any Chinese debt, there are no future plans to pay off any Chinese debt. That the holding of the Chinese are going down is because they are -offloading- that debt to somebody else and literally just recently the US defaulted on Russian debt (or “froze it”).

If you accept that there are 150 million workers in the USA then thats 50,000 USD per worker currently owed. You think any US president is going to organise the transfer??

Maybe this debt will be left on the books but its certainly not impossible and actually fairly likely.

Sorry double post I had another look because I think this is really thematic to the global treasury market. 2022 there was 120 billion invested in China by the US, prob. its down whichever. So as far as China is concerned they can lend 100 billion extra to the US who are effectively a secured creditor on internal to China assets.

-This- is whats keeping the treasury market afloat and yields down. Coincidentally that amount of borrowing would cover the Biden grant to Ukraine and Israel.

As external US investments falter and the process of onshoring continues, from this, then yields will increase because there is no surety for these loans that are not coming back conventionally. They are effectively perpetuals at this point.

The US Treasury ALWAYS pays off US Treasuries in full as they mature which is what is happening to those US Treasuries owned by the PRC which is not buying new US Treasuries to replace the matured US Treasuries when they are paid off which is why the balance of Treasuries owned by China is falling.

In terms of your first paragraph: These are Treasury securities that mature on their maturity date, and it doesn’t make one flipping iota difference who holds that security – they will get paid off at maturity. China could be selling the securities in the market, or it could just let them mature and get paid face value. Looking at the slow decline, the latter is likely the case. China might also buy other USD securities with the proceeds that yield more, such as corporate bonds or agency debt. In which case, its USD holdings could be stable or growing, but the share of Treasuries would decline. There has been some reporting on this.

Freezing or seizing assets (including yachts and bank accounts) is not the same as a “default” on Treasury securities. Stick that Putin propaganda where it belongs.

The September statement from the US Treasury was just published also. https://www.fiscal.treasury.gov/files/reports-statements/mts/mts0923.pdf The US paid $880 Billion in “Interest on the public debt” for FY 2023, but the headline number published by the media will claim it’s only $659 Billion in “net interest” since we don’t really count all that interest supposedly going to Social Security or those other govt trust funds, hmm? REally gives you faith in the govt accounting system and our retirement accounts, lol. If private corporations did reports like that the CFOs and other executives would be in jail. Our interest costs are much worse than being publicized, which makes you wonder why?

Countries do not default, they just print more money.

Some countries do nationalize (steal) plant and equipment and business of foreign companies on their soil, but it has nothing to do with defaulting. It is not a good strategy for encouraging foreign investment.

The risk free interest rate near doubles and stock values are not discounted downward yet? Basic equity valuation relies on discounted future cash flows. If analysts aren’t adjusting their stock targets down to reflect higher discount rates, doesnt that mean we are dealing with a phony investment complex that has no anchoring or underpinning whatsoever? Sure looks that way to me.

Yes, but there are private investors around that buy companies at values derived the old fashioned way of dcfs etc. I suspect that they will be the big winners soon.

I heard an interesting theory which suggested that a ‘passive bid’ (401(k) inflows) is responsible for keeping stocks afloat despite the tide going out… makes sense given the job market.

MM,

I heard that all day long during the 2000 stock bubble, as people attempted to rationalize the bubble. This time is no different.

I was shorting the NASDAQ when it was around 4000. Lost money as it went to 5000. I closed the short at a loss because of this passive bid 401k theory. I wish I would have kept the short in place, because it all came crashing down as valuations suddenly mattered. The 2000 bubble burst for no particular reason, aside from extreme hopes and valuation.

Lesson #1. Never listen to the strained rationalizations of Wall Street. 95% them are under-qualified, always selling, never thinking. If they never say sell, are they really offering any advice worth anything?

The bankers not be arrested like in Iceland is what keeps the fraud ponzi stock market in America afloat. We’ve seen the Chinese real estate ponzi implode recently leaving only the U.S. major stock market indexes as the last and biggest remaining ponzi on earth.

I think the rising rates are the U.S. Ponzi exploding.

Wolf:

As per your 2nd to last paragraph individuals, in part, are sopping up the tsunami.

I found this tidbit in Market Insiders. Don’t know if it’s reliable but is interesting:

“In fact, households accounted for 73% of net Treasury purchases from 2022 through the second quarter of 2023. That helped offset the net declines at the Federal Reserve, which is shrinking its balance sheet, as well as mutual funds and ETFs.”

Could not find their source material, article didn’t say either.

Any thoughts from you or the much appreciated forum on the veracity and implications of this would be welcome.

Sounds about right, just guessing. But I would say “households directly and indirectly…” (meaning, they’re buying the securities outright, and they’re buying money-market funds with Treasuries in them, they’re buying bond mutual funds with Treasuries in them, and they’re buying Treasury ETFs

for those of you that have a better understanding than me on these government securities, which is probably everyone reading this site, did anyone anticipate these rates going this high and do you or see the rates going higher in response to the Trauma generated by the recent change in rates and bloodbath of the bond market? I feel like I barely understand any of this and I’m just starting to see some of the relationships.

Spiceoflife – People and entities buy and sell in liquid markets for nearly infinite reasons. One person will buy because rates have risen enough for them to buy. Another person will sell because they get fearful of the declining market quotation, or they have a margin call, or want to buy a yacht, or whatever. I know this is a non-answer to your question, and it’s great that you are trying to learn and great you are asking questions, but I will caution you on the risks of relying on one or two sentence explanations of market movements.

Spiceoflife – But now that I’ve cautioned, I will attempt a slightly better answer. Yield goes up when bond prices go down. The prices quoted in the open bond market (as any market) and at government bond auctions is set by supply and demand dynamics. Supply can dry up because either there’s not enough new bond issuance, or two there are more buyers than sellers, sapping supply. The opposite is also true: Supply can increase when there’s a higher amount of bond issuance or when there are more sellers than buyers. When people and entities buy or sell bonds, they are generally looking at multiple factors (not an exhaustive list): inflation (a big factor for bonds), the Federal Reserve interest rate outlook, their outlook on other assets (stock market, for example), economic outlook (“flight to safety” when there is fear), government budget deficits or surpluses, and geopolitical events (again, flight to safety when there is fear). Short term bonds face less “duration risk”: i.e., there’s less time for potential inflation to hurt a short term bond. Historically, long term bonds yield higher than short term bonds to compensate for this duration risk, but that hasn’t been the case lately. This is what people mean whey they say the yield curve is inverted.

So the current market is affected by just about all of the above:

– Inflation has been elevated over the past few years

– Federal reserve interest rates, which have been helping to raise rates on the short end of the curve faster than the long end of the curve

– Some view the the stock market (arguably) at elevated valuations. This is, again arguably, a key factor because money tends to start shifting to less risky assets (like short term bonds) if the risky stuff gets too pricey.

– The economy: Lots of fear out there and people upset about inflation, but no sign of recession yet. But people are habitually on “recession watch” and “inflation watch.”

– Government deficits are growing

– Geopolitical – wars are happening

– Yield curve is inverted

Outlook for all of the above: Who knows? Be careful of those who try to sell you a story from their crystal balls. That’s where analyzing Risk vs Reward in the Here and Now can be a level-headed way to approach investing.

Footnote: When I say “short term bonds” I am referring to US Treasury Bills, which are also sometimes referred to as “cash equivalents.”

And of course, I forgot at least one significant item on my list, and already covered in detail by Wolf, including in the article here we’re commenting on:

– The Federal Reserve also sometimes is a big net buyer (QE) of US treasuries, taking away supply from the market. That was the past. Now, they’re not buying anymore and letting the treasuries they own to mature without replacing them with new purchases. This is QT (quantitative tightening) and means the treasury market has lost a buyer of some significance (for now).

Thanks!

There are other dynamics at play as well, spiceofllife.

One of the big reasons the dollar is kept as reserves by other countries is because they can buy treasuries with those dollars and the USA gov bond market is deep and liquid and they get a modest return on those dollars kept in treasuries.