What makes it work: Securitizing subprime auto loans and selling the Asset-Backed Securities to yield-hungry investors.

By Wolf Richter for WOLF STREET.

Subprime auto loans are making breathless headlines again. Subprime-rated borrowers tend to get in trouble with their debts, which is precisely why they’re rated subprime in the first place.

Only about 14% of total outstanding auto-loan balances are subprime – and most of them have been securitized into Asset Backed Securities (ABS) and sold to investors who’d bought them to get the higher yields. Typically, subprime-rated borrowers purchase older, such as 10-year-old or older, used vehicles with those loans because that’s the only thing they qualify for.

Subprime auto lending is not a factor in new vehicles. There is little subprime lending in new vehicles. New vehicles are largely reserved for prime-rated customers and for cash-buyers. New vehicle unit sales jumped 20% year-over-year to 4.08 million vehicles in the quarter through September, with the Average Transaction Price (ATP) rising to $47,420. These vehicles are not the hunting grounds of subprime-rated car-buyers.

Interest rates to finance new vehicles have risen, and buyers wince and gnash their teeth. But the captive auto lenders, such as Ford Credit, are buying down interest rates, and automakers are subsidizing leases, and prices are up, inventories are back, and new-vehicle unit sales are up 20% year-over-year.

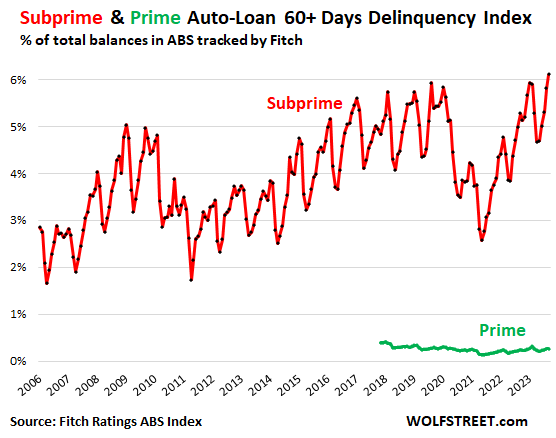

Prime-rated auto loan delinquency rates are minuscule. Prime-rated auto loans account for 86% of auto-loan balances outstanding. And they’re in pristine condition. Fitch, which rates auto loan Asset Backed Securities (ABS), reported that the 60+ days delinquency rate of prime auto loans in September was 0.27%, below where it had been in the years before the pandemic (green line in the chart below).

Where the shoe pinches is in subprime. It always does. A substantial portion of subprime auto loans is always in trouble. That’s why they’re subprime. It’s a high-risk, high-profit but relatively small corner of the used-vehicle market, and it regularly makes for breathless headlines.

The 60+ days delinquency rate of the subprime-backed ABS that Fitch tracks rose to 6.1% in September, eking past the prior record of 6.0% in October 1996 and of 5.9% in August 2019, the Good Times.

This chart shows the 60-plus days delinquency rates based on the ABS tracked by Fitch Ratings of subprime-rated borrowers (red) going back to 2006, and prime-rated borrowers going back to September 2017 (green). Remember: only 14% of all outstanding auto-loan balances are subprime, 86% are prime:

Government largess during the pandemic bailed out subprime too. People got all kinds of cash from the government, and they got mortgage forbearance and student loan forbearance and they were protected by eviction bans, and many of them used this extra cash to get caught up on their auto loans, and the subprime delinquency rate dropped to a multiyear low of 2.6% in May 2021 (just after the stimmies had gone out).

So subprime lenders got very aggressive, and some of them then blew up in 2023. This drop in the delinquency rate, backed by the general mayhem of investors chasing yield in a 0% interest-rate environment, caused specialized subprime dealers and lenders to get very aggressive, with huge loan-to-value ratios, and with loosey-goosey underwriting standards. But the fun didn’t last very long, and some specialized national chains have now blown up.

Subprime lending is a risky business – and there can be slimy aspects to it – but companies do it because it can be very profitable, with very high interest rates and huge profit margins on the vehicles, and investors pile into it because of the juicy yields.

But when the subprime dealer-lenders get too greedy, and too loosey-goosey with their lending standards, they blow up, including the two PE-firm-owned heroes that we’ve covered here:

- US Auto Sales, a 39-store specialized subprime dealer chain owned by a private equity firm shut down in April and filed for Chapter 7 bankruptcy liquidation in August.

- American Car Center, a 40-store subprime dealer chain also owned by a PE firm, shut down in late February, and in March filed for Chapter 7 liquidation.

What makes it work: Subprime auto-loan-backed ABS. Specialized subprime lenders or dealer-lenders work the same way: They make high-risk high-interest-rate loans to subprime-rated borrowers to fund the purchase of older overpriced used vehicles with huge profit margins, knowing that a substantial portion will default.

Periodically, they then securitize their pools of subprime auto loans into ABS with different tranches, from the equity and deep-junk tranches to tranches with investment-grade ratings. An equity tranche is generally retained by the dealer. The equity tranche and the lowest-rated tranches take the first losses, but they have also the highest yields. As the losses get bigger, the higher-rated tranches start to take losses.

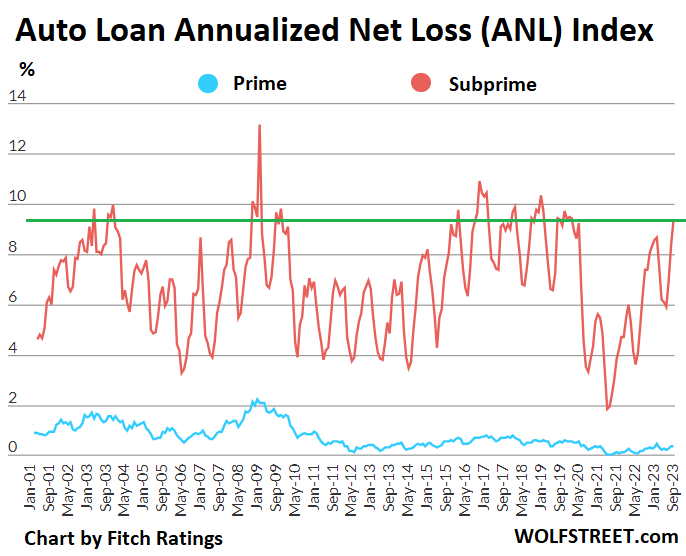

Net losses of subprime-backed ABS normalize, after free-money bailout. Fitch also tracks net losses for the auto-loan ABS that it rates.

Its prime-rated Annualized Net Loss (ANL) Index, at 0.36%, was well below the range in the years before the pandemic (in September 2019, it was 0.53%).

Its subprime-rated Annualized Loss Index rose to 9.23%, which was a tad below the same months in the years before the pandemic (in September 2019, it was 9.27%; in September 2018, it was 9.44%).

In other words, prime-rated auto-loan credit losses remain below the pre-pandemic years and are in pristine condition.

And subprime credit losses have now normalized within the seasonality of this business, compared to the same months in the years before the pandemic. But some of the PE-owned specialized subprime dealer-lenders – as is so often the case when the free money ends – blew up (chart by Fitch).

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I have zero sympathy for predatory lending, dealer markups and stupid people living beyond their means.

This was a display of extreme greed like nothing I’ve seen before.

Ideally, I’d like to see banks, loansharks and WallStreet lose massive amounts of money, rather than average workers.

But maybe this needs to happen, just to learn an important lesson.

Harry,

I think most all of us agree that predatory lending is, well…predatory. I also kinda think that when you are talking about stupid people living beyond their means you are referring to people who buy McMansions when they only need- and can afford- a more modest home. Or the juvenile new lad at the bank who splurges on a BMW while still living with Mommy and Daddy and having just begun to pay the minimum on his student loans. But, as Wolf pointed out in the article, the majority of buyers in this market are buying quite old vehicles. I happened to make the mistake of returning to the USA to teach and I see hard-working people every day who need a vehicle to get to work because we don’t have good public transit where I live. Of course, I suppose there are some rednecks who would trade in a well maintained 5-year old Toyota Corolla to buy a 15-year old beater of a Ford, but I think most of the people in this category are simply trying to keep their job after receiving a ‘promotion’ but needing to work in a location a little more than walking distance away. They aren’t stupid, they are between a rock and hard place.

Whatever the case may be, as a European it’s always hard to digest the level of financialization in the USA.

I do try to look beyond my own upbringing and conviction of not spending beyond my means, but in this case it’s just such a massive cultural difference between Europe and America. I’ve never even considered taking out a loan for a car. A good used vehicle for say, $10.000 which is reliable, isn’t that far fetched.

The main takeaway is that there’s a disconnect becoming painfully obvious that wages haven’t kept up with these enormous pricehikes, regardless of the cause (supply, greed, inflation).

While I understand the need for a car, I don’t see a need to choose for a loan with monthly payments. If you plan ahead and put aside a few hundred a month, that 10k vehicle can be bought cash in 2-3 years.

Maybe I’ll never fully understand, since I wasn’t brought up in the American culture of instant gratification, consumptionculture and taking out loans.

Even the credit-score system sounds completely alien to someone like me that was taught to save up for something you want or need.

Cultural differences or opinions aside, I do feel this is the end of the era of free/cheap money.

And for some people that’ll be painful.

Perhaps the financial system has been de-regulated too much and the power of big finance is becoming too great, the inequality is damaging society and the whole system is just leveraged up beyond sensibility.

Whatever the answer is, hopefully the decade ahead of us will usher in an improved system. But it’s going to be painful for sure.

Credit, lending, borrowing policies have no doubt evolved from corrupt businesses buying corrupt politicians in order to make more and more money. Many sheeple succumb to their uncontrolled desires. And yes creative marketing/manipulation plays a role as well.

Glad there are those that maintain hope! I don’t see any structural changes that will occur, and if anything I think it is more likely the squeeze will get tighter for those most affected. As the cost of labor rises companies will continue to find ways to squeeze more productivity out or eliminate jobs through automation. I am all for eliminating jobs that can be automated but those must be replaced by positions that can’t which seems to seldom happen. Fortunately labor seems to have some power due to tight job market but that will end.

Harry,

“as a European it’s always hard to digest the level of financialization in the USA.”

Just because you don’t know it doesn’t mean it doesn’t exist, LOL.

Auto-loan backed ABS exist in Europe just fine, and have for many years, and Fitch rates these ABS too, and Fitch releases delinquency rates and loss rates on those auto-loan ABS. And the ECB might have actually bought some of them, LOL.

Fitch combines this data under EMEA (Europe, Middle-East, Africa):

Fair enough Wolf.

I don’t deny the existence of autoloans in the EU, obviously.

It just seems that the deliquencyrates compared to the US are so much lower and that the average loansizes don’t even come close to the US.

Then there’s the issue of Fitch combining data from Europe,Africa and the Middle East which makes it very hard to determine the exact delinquencyrates in Europe.

Regardless, I think it’s fair to say that the financialization in the car industry is far greater in the US. And that the average loanvalue is greater too.

Maybe we can conclude that at the moment it poses a bigger issue in the US than in Europe.

Harry,

“It just seems that the delinquency rates compared to the US are so much lower…”

No, the delinquency rates are NOT lower in EMEA. The 60+ delinquency rate is 0.49% in EMEA. In the US, the prime delinquency rate is 0.27%.

Thanks Wolf.

It’s hard to see the actual data on the two charts you provided and they’re not the same colour. I see now, so thanks.

This subprime is a nasty business with, as you decribed, predatory profitmargins and interestrates.

I do feel bad for the people that have no other choice than to go for these subprime autoloans.

And, browsing through the comments and reading about the montly payments of some readers, I’m just astounded.

$1200/month and still 67 months left? Oh dear Lord

Harry,

After your post Andy admitted that his needing sympathy because he “still owes $1200 per month for 67 more months” was a joke.

I think y’all both need to review Poe’s Law of the Internet… “unless explicitly made clear that a parodic, satiric, facetious, or sarcastic statement is not to be taken seriously (such as with a tag or an emoji)… it will in fact be taken seriously by some readers.”

Agree with every word.

The sad part? Available credit sets prices.

Without credit card would be cheaper for the average Joe.

Well stated! My dad lived through the Great Depression in the US which may have left him hesitant to buy anything on time or have credit cards. My folks lived modestly, and saved up for big purchases. I have lived my life much the same way, and so does my Gen X daughter.

Rednecks? Your comment comes across snobbish. And if it was a mistake to come here…. to teach? Ha…. Please go home, where I’m sure the quality of life and economic opportunity are fantastic.

“.. most of the people in this category trying to keep their job after receiving a ‘promotion’ but needing to work in a location a little more than walking distance away.”

Probably teaches Probability 101 at Harvard.

Haha, I’m glad I have got a few people talking! My text wasn’t meant to be snobbish, but some of it was meant to create a storyline. One might ask what we should call preying on poor people or lambasting them for their plight? What about making a general admission that all poor people must be stupid? Not snobbish at all.

The redneck vernacular was an admission that some people make stupid decisions, (isn’t that why we have redneck jokes??) but my guess is that most people in the subprime car market need a vehicle to get to work and this is what they are able to find. Not everyone knows someone who will give them a deal.

(Now if you want me to go off on actual Rednecks, don’t get me started because I know y’all around here and I grew up with too many of you. /s)

I worked in China for many years; but I’m an American. China has beat us in so many ways and we are so ignorant and arrogant to not even admit it might be possible. I know I will hear from all the schmucks who think that the USA is the greatest nation on earth, but for anyone who has travelled outside, we know there is more nuance to this conversation.

One example of this arrogance was my needing to get a physical for work and the doctor complained about a Chinese doctor on his staff expressing that in China the hospital system is better for working class people. This is absolutely true for preventive care but this doctor couldn’t possibly conceive of this being true. All he could do was brag about how he makes 350k a year which pointed out exactly what is wrong with our healthcare system- the man checked one ear when I complained about ear problems. He shouldn’t make more than 100k where we live. But greed is good until is isn’t…

I work with special needs people, both in a school setting and an adult setting. Many of my co-workers struggle to make ends meet and are ‘promoted’ (i.e. transferred) into working at locations beyond the bus lines once they accept the job. It makes me sick to hear them talk about how much interest they are paying on their car loans for the extra $160 dollar they earn each month for working in the distant facility. It is predatory and one of the signs that a society has weakened so much that it isn’t willing or is unable to care for those who are working and trying to make a difference but don’t have that ‘special’ degree which equates to instant privilege and wealth.

Yes, yes, I know so many of you have had to walk uphill both ways to school and worked two jobs your entire lives. You also trudged through unbelievable snowpacks- even in Hawaii.

Just in case it wasn’t apparent, there’s a degree of sarcasm in my writing but I know you are all very smart and will be able to figure this out. Cheers!

Buffalo Billion,

How did you end up getting a job in China? The language is impossible. If someone set out to create unlearnable language they would end with simplified Mandarin. I can’t even learn with Chinese girlfriend. Lost hope.

Chinese may have better healthcare because all illness are caused by “heatiness”. And they have just the right brew for that.

What? The average redneck drives around alone in a massive Ute with a gun rack in the back window . Everyone knows that. I didn’t realize that they were paying those heaps of junk off. Not snobbish. Quite accurate.

@Buffalo Billion asks “What about making a general admission that all poor people must be stupid?” All poor people are not “stupid” but (pretty much) “all” poor people have made bad decisions (an stay poor by continuing to make bad decisions like buying a $10K Salvage Title Kia at the “buy here pay here” lot at 28% interest)… As an apartment owner I get to know more lower income people than most and every year the percentage of people making bad financial decisions seems to increase.

Desperation leads to poor financial decisions.

Luckily, there are business able to take advantage of this desperation and make huge profits.

The plight of the poor is related to The Republicans and Democrats, Federal Reserve, both who we continue to vote into power, and corporate lobbying’s demonstrated contempt for the value of the dollar as inflation hurts the poor the most. Poverty is well connected with poorly funded and run schools, broken families, substance abuse, all of which harm kids ability to learn good reasoning and the reasoning of adults under these conditions.

There’s no such thing as predatory lending. There’s good credit, bad credit, and risk assessment for the lender, as the subprime statistics reveal.

Good credit is earned.

Buffalo,

I know many of the people you speak of, and it is very difficult to be black and white on this issue. Yes, many of them are struggling to work, and need a car. But most of the people in the subprime strata deserve it because of their choices. Ex: Woman 50’s living in subsidized housing on SS Disability because she partied so much back in the day she killed her liver and needed a transplant (paid by taxpayers). She could walk to work, but needs to work off the books at a restaurant so far away she needs a car. 2 cars ago she totaled it, probably because she was getting sick with the liver thing, last car impounded by police as evidence in a felony with $$ still owed, cops would not return the car (the generally are not good at returning such property), was not going to make payments on a car she could not use, don’t blame her, default, more time in subprime land.

She let her car be used in a felony, her fault?? Blameless?? Hard to be morally black and white.

I got a hundred such subprime stories if ya want them.

This redneck drove his 2023 Ford Powerboost F-150 five states away this weekend so I could have Livernois Motorsports crack the encryption in the ECM to add a tune that adds 100hp and 100tq to the wheels.

It probably voids the warranty if Ford ever looks but this redneck wrote an $88K corp check for the truck and I won’t lose any sleep writing a check for something Ford might not warranty.

Be careful, some rednecks are debt free and very well off.

People purchase cars, homes, boats and all sorts of consumer goods they can’t afford and should not purchase. Our government is the master at spending money it doesn’t have. Unfortunately, it’s the American way.

Yes, there are also people, with poor credit, whose auto purchase is likely a necessary one. If you were to look into the spending habits of many of these so-called subprime buyers, you would likely see reckless spending behavior.

Lending to people who don’t or cannot pay their bills is not predatory. It’s a high-risk loan. Of course, progressive leftists see anything not given for free as predatory.

For the outcome of the contemporary progressive philosophy, look to Venezuela or perhaps Argentina for starters.

Harry,

Agree about differences in finacial culture between Europe and USSA (not an expert here).

Currently struggling if I should leave a tip on top of 6% realtor commission. Probably should.

Also remember to turn around and bend over. It’s a culture followed by customers in USA :D.

> Also remember to turn around and bend over. It’s a culture followed by customers in USA :D.

So true! There’s much more sheepish behavior among Americans than among non-anglo Europeans.

I love that trait on Europeans, wish Americans wouldn’t bend over as much as as frequently as they do.

Oh so you have zero sympathy for people. Got it

I think he was talking about predatory lending. Still, I have 67 months left on my $1200/month truck, and could use some sympathy.

For real?

Why would you do that to yourself?

I think the most I ever did was $670 in 2018 for a new suv. Paid it off really early too.

Hang in there!

Wow Andy,

I’m literally speechless with those payments you mentioned. Forgive me, but the size of those carpayments are more than the average monthly mortgage-payments of most people I know.

I’m sure you had your reasons for getting that truck, but….wow.

Guys, come on, I was joking, lol. No one reading Wolfstreet would go for $1200 / 72 month plan. Well, maybe Kunal.

I never financed a car. One time I bought brand new Cadillac on credit card. Paid it off next day. Deal was too good (like 55% of MSRP, if I buy it now).

Just curious. So If I have to leave a 20% tip (or more) for a few minutes of “service” at a restaurant, why isn’t that predatory? A loan is “renting” money for a specified time, so why isn’t a tip renumeration for “renting” the waitress time?

Someone do the math for me. A $50 restaurant bill at 20% tip rate equals a $10 tip. What’s the APR (Annual) on that 20% tip vs. the APR on an average sub-prime auto loan?

My auto mechanic recently raised his shop rates frm $85 per hour to $125 per hour. Was he being predatory towards people strggling to afford auto repairs?

I’m not defending sub-prime auto lending and car dealers in any way, but when I hear/read people complaing about prices being charged as outragious, predatory, gouging, etc. (for ANY product or service) my first responce is to say ok, if it’s that easy, why don’t YOU put your money where your mouth is and go ahead and provide that service/product cheaper.

I know these are not apples to apples comparisons, but it seems like there’s a lot of selective indignation out there.

$125 is a bargain for automotive work.

@Kile:

You’re spot on.

“Predatory lending”? So a suggestion might be that, when you righteous people sell your present car, why not offer zero percent financing to anyone who darkens your door to buy it, even if they are a credit criminal? Why not sell it for below market value to “help the little guy get ahead”? Combine both and make a positive impact on society! Hey, WTF? Don’t forget to accept their personal check too. /s

Uh huh. Right. The same group of peeps that brags about their used car being *worth* more than they paid for it wouldn’t think of trading it in for what they paid (or less) as it benefits them not to do so. That’s “predatory” too. Look up the word “hypocrite”.

Poor financial decisions are not always out of desperation. They’re more often than not the result of poor impulse control. Why do you think they put the overpriced candy and soft drinks by the checkout counter at the grocery / convenience store? Because it’s a good value for the customer or because some dope will buy something on impulse with money they don’t have? Ever notice that most of the displays are on the right? There’s a reason for that too. (Most people are right handed). And, of course, debit cards and credit cards are “for your convenience” (or to divorce the actual cash expense from the *swipe* which the naive don’t consider the cost – at least until the bill comes. Most don’t even check the price).

No one forces anyone to buy a car from a tote the note lot. When we were looking for an “airport car” in January 2022 (one that could be sacrificed to the parking lot gods) we found a 16 year old Civic that had a cracked windshield, 4 dry rotted tires, loose / missing weather stripping / moldings, and was multiple shades of blue. The interior was stinky and looked like the aftermath of a cafeteria food fight. The A/C blew warm. Headlights looked like cataracts. Brakes were questionable. Engine oil looked like crude. The odo had 108,000 miles on it. It did run well and the trans shifted. Purchase price was $500 at the curb in Long Beach, CA. Cash only.

$2,000, and a 2 weeks later, the windshield was fixed (<$200 by Safelite), brakes done (on driveway for $200 with new OEM rotors and fluid flushed), oil changed on driveway ($30 Mobil 1 with new OEM filter), replaced power steering fluid, interior vacuumed and shampooed ($0), some Febreze ($5), washed windows ($0), polished headlights ($0), new Michelin tires ($500 – I don't buy cheap tires), A/C condenser replaced and A/C recharged ($1,000), and shiny multi-colored blue paint. The weather stripping was sourced from a pick-a-part for a few bucks. Title and registration was <$100 for two years. Smog $17. Sales tax was zero as it was a private party sale.

10 months later, it required new shocks/struts and control arm bushings for another $1,000. She was a good 10-footer when finished.

So, for @$3,500 there was a reliable, non-stinky, safe vehicle that wouldn't likely be stolen and reasonable to operate and insure. No 28% interest. No tote-the-note lot need apply. Of course, it took some work – but at least it didn't have a 2×4 wedged into the subframe to keep the car from collapsing (true story) onto the pavement.

We also withstood the impulse to put $3,000 worth of rims and tires on it. Them 20's would have looked b*tchin'! /s

18 months and 12,000 miles later, we sold it (no longer needed) to a family for what we had in it. Still ran like a top. On a used car lot, it would have been a $6-7K vehicle. My daughter liked the couple and "paid it forward" so they could get rid of the POS Kia they had that was bleeding them dry with constant breakdowns. (The Civic never failed to start nor ever had any mechanical breakdowns that weren't present when we bought it which were all properly repaired with OEM / OEM equivalent parts).

IMHO, the wrath should be directed at schools (and parents) that fail to prepare youth for the realities of life. They can't add. They can't formulate a complete coherent sentence. Can't understand the significance of the decisions they make. That explains why some even have face tattoos.

And, in defense of some of these used car lots…. it's not *free* to repossess a car. Repo men and tow trucks don't come cheap. Most delinquent customers don't voluntarily drop them off. There is a risk associated with the lending. Some say we need higher interest rates to slow inflation but criticize the guy who gets a fair return on his money for the risk assumed. People make choices… and being stupid is a choice.

Same with house flippers. No one stops anyone from buying distressed properties. The fact is, 99% of the people don't want them. The flippers provide a service by taking junk and renovating it to at least habitable condition, often saving neighborhoods. They often use hard money loans to do so and should be compensated for the risk, their time, rehab costs, interest paid, and so on. Just because someone is too lazy to do it doesn't mean they should benefit and the person who does engage in that type of business is a cretin.

El Katz below claims 99% of the time house flippers are buying something no one else wants.

I dont know what the actual percentage is … 99% sounds high… but its not that unusual for me to read (other sites or comments to a video) someone claiming a flipper bought a home for, say, $350k, put only a small amount of time and money ($25 to $50k) in it, and then sold it for $500k.

I guess that doesn’t necessarily refute what El Katz wrote. But if they could turn around and sell it for $500k w/o putting much money in it … it presumably wasn’t in that bad of shape when they bought it or… their cosmetic improvements worked wonders.

The point is some posters, right or wrong, imply flippers are clever in buying a property and managing to sell it for quite a bit more than the small amount of time/money they invested in it. That’s just what I read – I don’t know any flippers and am not in the RE market.

Please read my comment again, I think you completely misread.

To me, this is twofold. Some dealers have screw themselves by screwing over loyal customers through markups… So, you see manufacturers slowly moving towards the D2C model like Tesla. However, there are other dealers were inflation has simply killed their business model, where they can’t find mechanics etc for competitive wages any longer.

Then there are your keep up with Jones family types, where they can’t be caught dead in anything but a Mercedes or BMW. I’ve brought up the prospect of a “regular” car like a Toyota or Honda to save money and they respond that they don’t care for those “dumpy” cars.

I don’t feel bad for the people that had it coming, but I feel bad for the honest businesses and humble folks that are trying to be successful/enjoy their lives. Those are the people that get screwed by this, not the dealer trying to lease a Honda Odyssey for 1K a month, the dealers selling cars for 10K over sticker, or the snob that just has to have that Mercedes, no matter the burden.

Laws make direct to consumer illegal in many states. Dealerships are guaranteed a cut of new car sales.

Ron DeSantis just signed a law making D2C illegal in Florida. Starting to see Tesla “dealerships” opening up in all the bigger cities. Apparently they’re just a place to pick up your new car or trade in your old one.

Direct to consumer is illegal in many states… and the reason for that is DTC was once allowed and the manufacturers raped the customers as well – anti-trust anyone? Then there’s the history of the Monroney label.

Be careful what you ask for….. historically, the independent dealers were good for competition. However, since there’s now so many public companies in the mix, that competition has been greatly reduced. Here in PHX, there’s 4 dealers for the “brand X” that I’ve shopped for. All are owned by dealer groups. Autonation, “Pesky”, two private cap guys out of CA (known as “mega dealers”). The worse thing that happened to the automobile business in the U.S. was allowing the publics to get their snoot under the tent. It’s been downhill since then.

ElK – as in so many US businesses, it has been the flashing, but consistently-dulled ‘knives’ of the small ‘Main Street’ ones vs. the ‘big’uns’ of corporate and their ‘guns of scale’ for some time, now…

may we all find a better day.

The alternative to “predatory” lending is no lending at all to certain individuals. Choose your poison.

Predatory lending can come in two forms.

One is similar to when our son was suffering through a divorce and required an automobile. He had defaulted on the mortgage on a home as his payment had become larger than his “income.” Solved this by cosigning and him making the monthly payment on time each month.

The other is when an individual hasn’t a backup cosigner and must suffer the higher interest. Some years ago a good friend volunteered for Catholic Charities in helping this type. These are the ones in need of true help. The lenders are using them to make a large amount on each “sale.” Then to repossess the auto and resell again.

Thus the true predatory lender.

Or perhaps these are predatory borrowers who intend to default from the outset because the use value of the vehicle for the period they drive it is greater than the payments they actually make (especially if they can stay ahead of the repo man for a few extra months).

Autos now a days have GPS and disablers installed.

Bingo!

Remote disablers are illegal in many states. One sports star who opened dealerships in MI installed them where they could shut down the car when the loans became delinquent. Guess who got sued and lost? The determinant was a “safety issue” and cost the buy big time (I think he lost his dealerships as a result).

No lending would at least force us to look at important issues as opposed to finding ways to pretend they don’t exist.

People rarely take a serious look at serious issues when they are “forced” to do so. Denial is so much easier. And miscasting blame is more fun.

I’m not against any form of lending with the exception of government backed/guaranteed loans.

What I’m saying is, I don’t feel bad for those that choose to treat customers like crap.. Eventually people vote with their wallets and go elsewhere.

I also don’t feel bad for the people that look down upon others based on the cars that people drive.

Other than that, I’m all for doing due diligence on different types of loans and making sure that the person leasing/financing doesn’t get screwed.

Another thing that they don’t teach in schools outside of finance degrees.

yep, it’s replay of the subprime mess of the GFC in other sectors. This is when the piper gets paid for bad, short sighted loose monetary policy and especially the foolishness of QE with MBS buying. It messes up the incentive structure in society, rewards speculators, reckless borrowers and spenders and debt profligacy, while punishes savers and thrift. Eventually the chickens come home to roost and inflation and cost of living go through the roof, but by then the damage from the bad financial incentives has already taken root every where in the financial system and investing.

“it’s replay of the subprime mess of the GFC in other sectors.”

LOL, no. Auto-loan subprime is small, 14% of used car loans, nearly nothing of new car loans, total $210 billion or so, collateral are liquid vehicles that can easily be sold at auction within days, not illiquid houses that may sit for years, and investors hold the debt, not banks. All explained in the article.

Agreed, didn’t mean it was a replay of the GFC housing bubble in scale or in the banks being on the hook, rather the mentality that allows for subprime to become acceptable at all is repeating itself, sorry if that wasn’t clear. The danger is even if the scale and application starts small, it’s that very mentality and slow creep of subprime being acceptable that allows for ever more reckless lending to spread again. Exactly when the Fed is trying to push against such loose credit conditions for very good reason

Challenging times in general for those trying to make ends meet. Public transit except in generally expensive cities is not built out and then sometimes not even then, and so people often have to take on these excessive loans in order to get to work, and for other reasons. The significant increase in the cost of used cars during the pandemic was also a problem but perhaps those are starting to bottom out as I know at one point during the pandemic I could sell my 4 year old car for more than I paid for it. Now of course not the case at all but 100% telework and driving 4k miles a year, hoping perhaps this is my last vehicle.

Glen,

Mass transit isn’t the panacea that some make it out to be. Many of these systems in the US aren’t kept up to date, not very clean, are not inexpensive to use, and are crime ridden. Not to mention the massive amount of bloat that accompanies it (huge pensions and what not).

That’s part of the design. The US is a car centric society.

The use value of things we buy is usually greater than the price we pay (unless we make a poor purchase decision) and bears no relationship to the cost to produce. An “overpriced” vehicle at an “inflated” interest rate may still be a very good deal to the buyer if the use value to the buyer over the total period of possession is greater than the total of payments made.

This is the Goldilocks economy, folks! All hail the Supreme Leaders who brought us bailouts, handouts, and now the mythical Soft Landing and the Immaculate Disinflation! Pay no attention to the Emperor’s clothes lest you be sent to re-education camp, peasant. There you will learn to take on more debt, own nothing, be happy and eat ze bugz! /S?

RTGDFA. Not just the first six words of the headline. At least read the entire headline before posting BS.

Lol. Don’t need the /s tag.

Scary in light of Wolf’s recent article on labor health, “My Favorite Recession Indicator: No Recession in Sight Yet”

No, not at all. Opposite

RTGDFA. Not just the first six words of the headline. At least read the entire headline before posting this obliterating BS.

Sub Prime a history of poor decisions or buying a used vehicle outside of the prime market and I’m sure a mix of all of the different types . Predatory lending I can’t stand but at same time I want the loan opportunity for the ones that need a car. I want liquidity in the system and strong banks .

I’ve always found people funny who drive a new car bought on credit or an old car but from a well-known brand, but live on rent in a small apartment and deprive themselves of many other necessities of life.

This show is ridiculous

Just a matter of priorities and preferences. Some people don’t give a hoot about owning a house, don’t ever want to own anything like that, and would hate living in one. But they love cars or trucks and they buy what pleases them. Thank god that not everyone likes the same thing. Life has to be fun too, not just drudgery and obligations.

BTW, this wasn’t about new cars, but about subprime lending to purchase USED cars.

I wonder how many people grew up in a small 1200 Sq. Ft or less house and then do not feel comfortable in anything larger?

It’s funny looking back. I still think people do not need to chase the dream of crazy amounts of house room. If anything I need storage of 1500 Sq ft. But really just a 1000 Sq ft living area to heat and cool.

A lot of the younger generation no longer aspire to own a 3,500 sq ft McMansion.

Minimalism or even essentialism are in vogue.

the nicest car is the company car, haha

I’m definately one of those people. I grew up constantly moving and living in apartments, parents bought a house shortly after I moved out. I can’t see myself owning a house with a yard and stuff. At one point I lived in a small townhouse in the city and found that was my sweet spot, no yard to mow or plow snow off of, but still had a small garage to work on my car and more living space where I felt like a king and that I had “made it” 😆.

A dude moved in right next to me, subletting and squatting in the dump home. He has three vehicles parked there. A Porsh sport car, a Ford F150 pickup truck and a Harley motorcycle. I nicknamed him “Axle”. He’s been there 4 months, and I haven’t talked to him.

@Swamp Creature Does the guy really have a “Porsche” (not sure what a “Porsh” is) and a Harley? I have been a Porsche Club (PCA) member for 40 years now and I have never met a Porsche owner who also has a Harley and If I had to guess I would say more Prius owners own Harleys than Porsche owners (the F150 is popular with Harley owners since they can put the bike in the back to bring it to the shop when it breaks or to have a shop add more custom chrome accessories)…

Back in the day, my neighbor traded in his Porsche for a high-end F-250 crew cab after he got married to a woman who had a horse ranch. Yawl have no idea what a guy will do. 🤣

You’ve not heard of the Harley Porsche collaboration known as the Harley V-Rod?

Rob D. …while we’re at it, HD’s ill-fated Superbike competition powerplant and the even earlier stillborn collaboration between the Motor Company and Stuttgart on a V4 in the wake of the inline/flat 4cyl onslaught from the Japanese manufacturers (…irony being the v-twins and fours THEY subsequently developed and successfully brought to market…).

may we all find a better day.

Howdy Folks. They tried this very same thing with Real Estate didn t they?

The next issue is to figure out how to get “prime” borrowers default rate synchronized with the “sub prime” market. Perhaps a combination of removing the tariffs on automobiles, along with a recession would be the one, two punch the automobile industry so desperately needs.

We are still in the late stages of the most massive “everything bubble” in the history of mankind. And it was all driven by FED money-printing and .gov fiscal stimulus (which is still going). They pushed so much money out into the system that it permeated every nook and cranny looking for yield.

There is a lot of talk about housing, stocks and autos here, but it went FAR beyond all of that. You can go on Reverb and find used guitars asking $400,000. This stuff is insanity. I don’t think most people realize the extent of the damage done by the FED and .gov. These people absolutely obliterated stable prices.

When things like NFTs and cryptos pop up out of nowhere and create markets in the billions for worthless items with no intrinsic, it should be a massive red flag and warning that something is very, very wrong. Instead, the people in charge of maintaining those stable prices ignored everything, or worse, did it intentionally.

The fact that subprime auto loan delinquencies are already at a record should surprise nobody given the recklessness we’ve seen, but we are not even in the early stages of a reckoning for what has just transpired. The distortions we have seen are a result of millions of people paying nosebleed prices for items whose intrinsic values are destined to crash into oblivion. There is A LOT of financial pain coming for many.

Looks like a giant Ponzi scheme ready to implode.

It started with Greenspan, Bernanke, Yellen and Powell. Maybe it can go on as did Madoff’s, but at some point the game ends.

Only, the Shadow knows if/and/or when or how.

Did you mean “early” stages Depth Charge?

The more I look into it, it all comes back to the financial world sucking the world dry. Banks, central banks, investmentfunds ALL have grown too powerful.

If the average mortgage was 250.000 at 4% interest a few years ago

and 450.000 at 8% now, this would explain the massive, recordhigh profits banks have been reporting.

You’re quite correct, this is PEAK everything bubble and it’s not sustainable.

But I do hear a correction coming, not just reading about it on the internet, but actually hearing it from local businessowners, realtors and carsalesmen. Money is just extremely tight and sales have come down everywhere. Less spending in restaurants, less spending even in supermarkets, less holidayhome bookings, less cars sold, less juwellery.

Monstrous bubbles with Rolexes, Gibsons, Fenders, etc. Peak greed and peek instant gratification.

Thank God for those stupid bubbles bursting. It’s destabilizing and it feeds inequality.

Harry,

I hope you (and Grantham, etc) are right. But Wolf is frequently stating that US consumers are spending like “drunken sailors” usually with some stats to back it up. I thought he would rebut you but he didn’t.

And some other commentator here cited the car mechanic raising hourly price from $75 ($85?) to $125. Just one example, but if he feels he can do this he must not be hurting for business.

I happen to believe a lot of people making over $100k a year are overcompensated. Especially those in the financial industry, but kind of in general.

I’ve lived on about $17k annual for 26 years in a medium sized city. When I hear people complain about making $70k a year I wish I could deport them (I suppose if its dangerous work I’d think twice).

In an alternative universe businesses can’t raise prices. You can only increase profits by becoming more effective (efficient) in running your business. As for new products, services.. well thats a bit more complicated.

SC: I applaud you for making ends meet on $17k/yr. To your point about some people being overpaid, sure there are distortions in the economy. But assuming people still aspire to a middle class lifestyle, $70k/yr is not much. Here are some criteria, borrowed from Charles Hugh Smith:

Can you afford healthcare? Do you have meaningful equity in your home (25% – 50%) and are on track to pay it off? Do you have excess income to put towards retirement? Do you have a reliable, well-maintained vehicle? Can you afford 2 – 4 weeks of vacation each year? Could you support a dependent?

I’m not trying to impose any values on you, just saying the cost of a “middle class lifestyle” costs at least $100k/yr and possibly more depending on where you live.

While not your point you can find great deals on musical instruments of all kinds, including guitars. You might be searching for one made of usable human transplant organs for that price.

How much for an Eric Clapton signed axe?

Haha

sufferin’ – a good observation (…what is the motivation for having the thing? Does one desire something high-performance mainly to show off to others? Or actually use? (Old moto competition saw: ‘…a good rider on a mediocre bike will always beat a mediocre rider on a good one…). That said, though still a mediocre picker after many decades, my departed D-28 and my current J-25, have always rewarded my struggles to be a better player…).

may we all find a better day.

As usual, the headlines are recession mongering b.s.

With only 14% of all outstanding auto-loan balances subprime (86% are prime), as usual, nothing to see here. And I mean, really nothing to see here. Thanks for the dose of reality beyond the headlines WR.

Wolf is hardly the recession mongering type. You must be new around here. You are either too young or already have forgotten the lessons of 2007-2008, which are that what starts within subprime rarely remains contained there. Give it a year and watch as it spreads.

First chart seems to imply a seasonal pattern to subprime delinquencies. I wonder why that is.

I was thinking the same thing and wondered if it has something to do with tax refund season providing an opportunity to catch-up on payments.

Yes, very seasonal. Some of this has to do with auto sales being very seasonal. Even traffic of this website is seasonal. I find the logic of some of this seasonality stuff baffling, but it is seasonal.

Wolf,

That’s fascinating to me that your site has seasonal patterns. Just curious, do you think it’s financially related (spring / summer house selling, etc.) or more mundane like football cutting into readership? Not that it matters. Thanks for all your work.

I would be just guessing about what might be causing this seasonality. Vacation and holiday patterns have something to do with it, it seems. I have no data to support any reasons. I just see it happening.

@Wolf When I was first renting apartments in the early 90’s I was commenting to an older property manager about a great looking unit I had for rent at a great price in December and he said: “You will rent it next year because nobody ever moves their Christmas Tree” (one of the many reasons that rentals slow in the Christmas season)…

I just want a nice little Colorado pickup for C$5,000. But Canadians seem to be crazy paying this much for a depreciating asset:

Toronto Star headline: Average new car now listing for [Canadian dollars]$67,800 as prices jump by almost 20% in a year

I wouldn’t believe too much written in the Toronto Star. Still lots of nice good quality cars available for 40k in Toronto. Not Mercs or Bimmers but still nice cats.

Why would I need to pay $40,000-$67,800 for a piece of metal which loses value?

I want a nice small pickup to do a side hustle. But Autotrader ads show that it’s at least C$10,000 for a 2011 Ford Ranger or 2013 Colorado. These used trucks used to sell for less than half of this price in 2019.

GZ – …timing is everything?

may we all find a better day.

Thank you Wolf for explaining the deteriorating underwriting standards. Reading the first part of the article I thought this spike in delinquencies might be a sign of a coming recession. NOPE… just lenders being stupid with Other People’s Money.

I’m considering picking up a car when all this crash gets going.

Do people have any thoughts on taking over a lease? I presume people are selling them because they’re unable to continue paying.

Is the monthly always sold on at cost or reduced?

Monthlies get reduced in the form of cash incentives if you get my meaning.

I took over a lease once on a basic little box with no frills and low km because i needed a cheap commuter.

There was 12 months left, with an optional final buyout of $3600, payments were $160/month and the seller gave me a cash incentive in the form of a cheque for $1500. Sweetest deal ever.

Be careful for vehicles that have no mileage remaining… every km driven beyond the lease maximum incurs a cash penalty.

“There is little subprime lending in new vehicles. New vehicles are largely reserved for prime-rated customers and for cash-buyers”

I find it interesting that people who I might assume to be good with money make the wildly extravagant decision to buy a brand new car. Or should I look on it as a shrewd investment in showing off?

America is a car culture. Well, a truck/SUV culture these days. Vehicles for personal use are rarely “shrewd investments.” Most Americans need a vehicle; but in addition, they like driving something that they enjoy and feel good about and like to be seen in. That’s how you sell $80,000 pickup trucks with all the bells and whistles to office commuters. That’s how you sell 500-hp muscle cars to people mostly stuck in traffic. This is a really crucial concept for the US economy.

In addition, lots of people like to buy new vehicles because they know what the vehicle has been through (nothing), and because it’s the latest and greatest, and lots of people like to order a vehicle to their specs so it’ll be exactly what they want, without the compromises they would have to make if they bought a used vehicle. There are lots of reasons to buy a new vehicle, over a used vehicle. But saving money is not one of them.

Could it be predictability that new car comes with warranty that avoids major repair cost during first several years? Many people hate dealing with car repairs and feel they are ripped off by repair shops due to huge know-how disbalance (similar to used car dealers).

Of course none of the above is a reason to buy bigger or more expensive car than reasonably needed.

That’s the only reason why-for the first time in our lives, We here at the snake pit considered a new purchase, or close to new with warranty.

Too expensive is still too expensive, but repairs aren’t getting any cheaper and I’m awfully high mileage shy in the used car market at these prices, with the “quality” of services available in my locale.

Fingers crossed We find something used I’d regret less. I couldn’t imagine how abysmal our option would be if our credit weren’t excellent.

Oh wait I can! *Looks over to several people I know who have had no choice but to sign up for an unreliable money pit on it’s last leg so they can get to work, just to end up in the same spot in less than a year*

One thing hasn’t changed: being broke/near-broke isn’t cheap.

Different markets, different numbers. To me buying new have worked reasonable well cost vise. Also when buying new the chance is larger that the numbers work out as predicted.

But then, when I have bought new cars I have maintained them and keept them more than ten years. Keepig the cars over a longer period is what have made the cost of a new vehicle in line with a used car.

People make the mistake of thinking subprime is an important economic indicator but it’s not. Subprime borrowers ALWAYS struggle, doesn’t matter if times are good or bad, they’re always living paycheck to paycheck.

I’ve been involved in the RTO business for 25 years and I have learned that it doesn’t matter what the economy is doing a certain percentage of customers will always struggle. The people in the bottom 20% are irrelevant in the economy and and financial markets.

Yes, you nailed it.

When discussing the money printing / inflation phenomenon ( pricing for “collectibles” ) a “pristine” Mickey Mantle rookie baseball card recently set a record for collectibles at $12.9 million $ ! These things generally adjust but, it’s the timing of the adjustment ( as well as the degree ) that make it difficult to navigate.

JT – have often wondered at ‘collector’s markets’ and their relation to a nation’s prosperity and zeitgeist (…are they all a manifestation of an ‘art’ market? Some other societal phenomenon? (f’r’instance, not too-many rookie cards still extant for Classic Greek Olympians or Roman gladiators-or interest, for that matter…)).

may we all find a better day.