San Francisco -11% from peak, Seattle -10%, followed by Las Vegas, Phoenix, Portland, Denver, Dallas, San Diego, Los Angeles, Tampa.

By Wolf Richter for WOLF STREET.

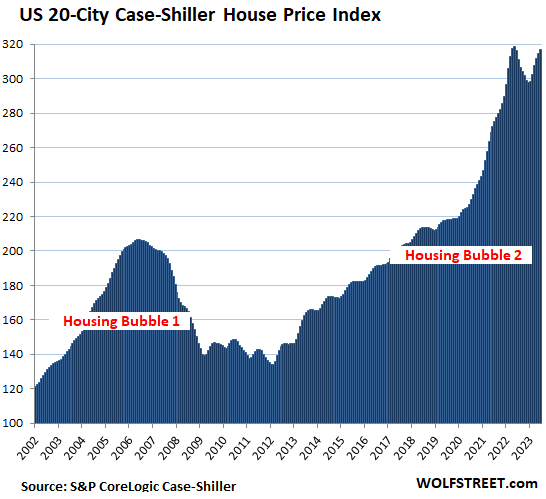

The S&P CoreLogic Case-Shiller Home Price Index, released today, for the 20 metros it covers ticked up 0.6% in July from June, the smallest month-to-month increase since February, continuing the trend of ever-smaller month-to-month increases following the powerful bounce in the spring, when three months in a row, the month-to-month jumps were 1.5% or higher.

Compared to the peak in June 2022, the index was down 0.6%. Year-over-year, the index was essentially flat.

Today’s index for “July” is a three-month moving average of home prices whose sales were entered into public records in May, June, and July. That’s the time frame we’re looking at here.

Prices were down from their peaks in 2022 in 10 of the 20 metros in the index (% from peak):

- San Francisco Bay Area: -10.8%

- Seattle: -10.1%

- Las Vegas: -7.2%

- Phoenix: -6.7%

- Portland: -4.5%

- Denver: -4.3%

- Dallas: -4.1%

- San Diego: -2.5%

- Los Angeles: -1.7%

- Tampa: -0.8%

Prices set new highs in 10 of the 20 metros in the index (% YoY):

- Chicago: +4.4%

- Cleveland: +4.0%

- New York: +3.8%

- Detroit: +3.2%

- Atlanta: +2.2%

- Washington DC: +1.9%

- Miami: +1.9%

- Charlotte: +1.8%

- Boston: +1.3%

- Minneapolis: +1.0%

The most splendid housing bubbles by metro.

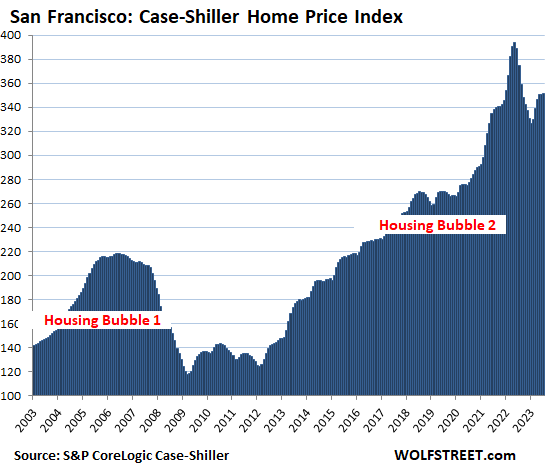

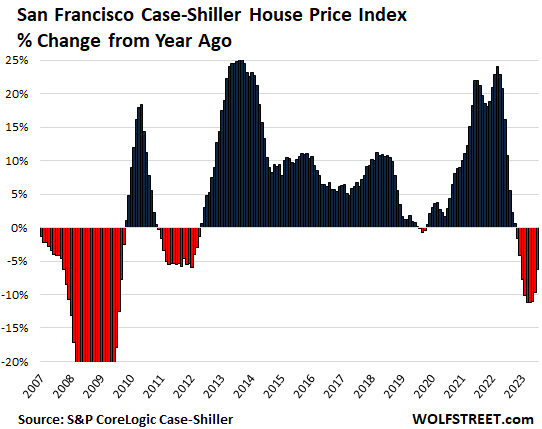

San Francisco Bay Area:

- Month to month: +0.1%, unchanged for three months

- Year over year: -6.2%.

- From the peak in May 2022: -10.8%.

This was the 9th month in a row of year-over-year declines. Note how during Housing Bust 1 the waves of declines were interrupted by year-over-year increases:

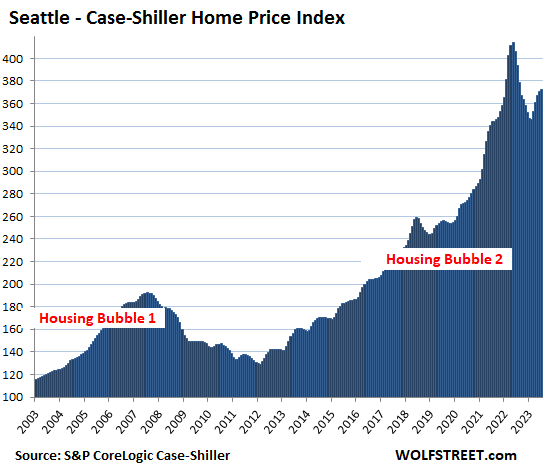

Seattle metro:

- Month to month: +0.5%.

- Year over year: -5.5%.

- From the peak in May 2022: -10.1%.

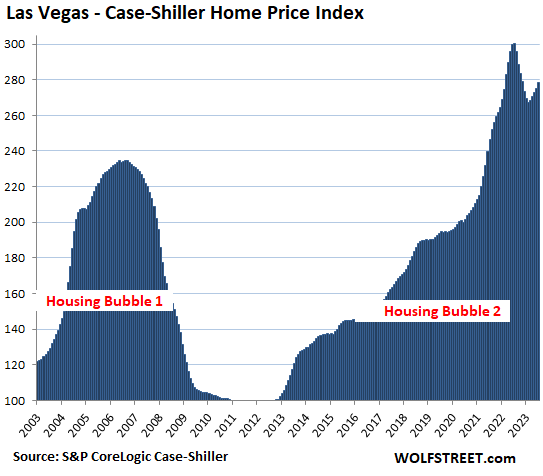

Las Vegas metro:

- Month to month: +1.1%.

- Year over year: -7.2%.

- From the peak in July 2022: -7.2%.

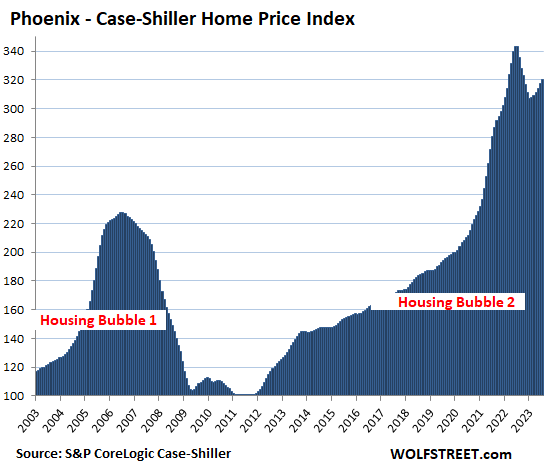

Phoenix metro:

- Month to month: +0.9%.

- Year over year: -6.6%.

- From the peak in June: -6.7%.

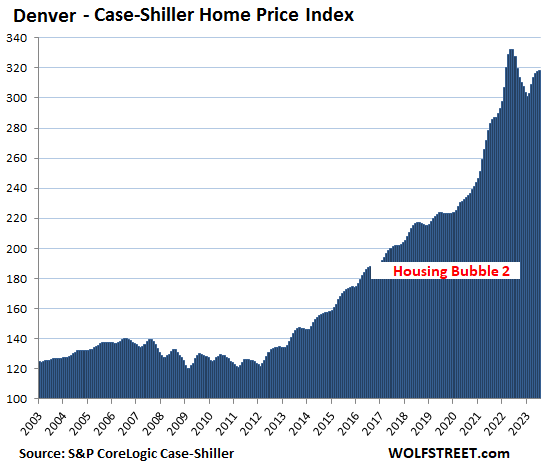

Denver metro:

- Month to month: +0.2%.

- Year over year: -2.8%.

- From the peak in May 2022: -4.3%.

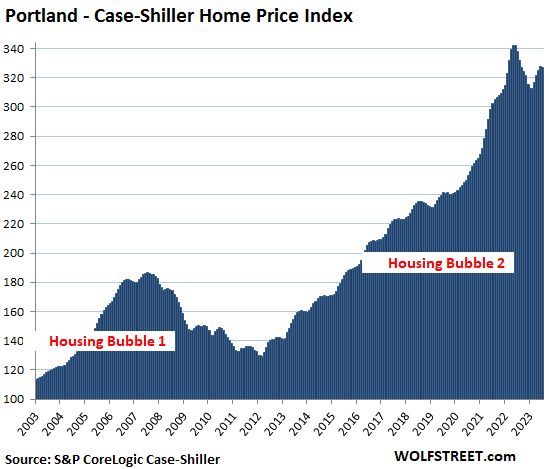

Portland metro:

- Month to month: -0.2%.

- Year over year: -3.3%.

- From the peak in May 2022: -4.5%.

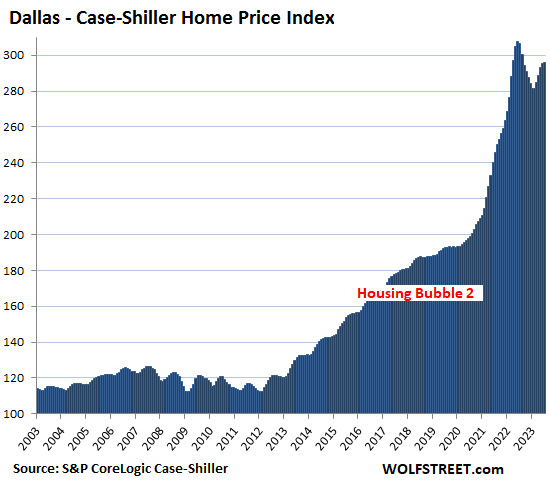

Dallas metro:

- Month to month: +0.3%.

- Year over year: -3.4%.

- From the peak in June 2022: -4.1%.

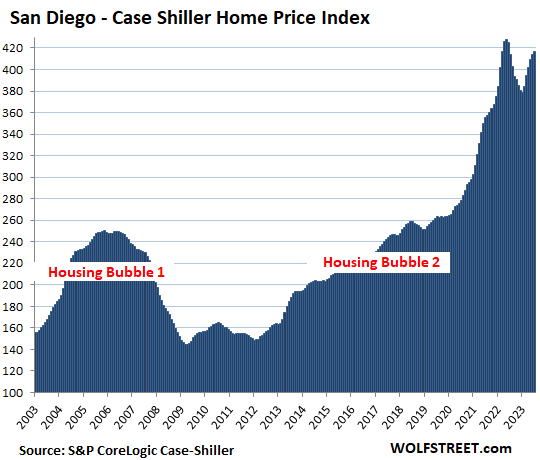

San Diego metro:

- Month to month: +0.7%.

- Year over year: +0.7%.

- From the peak in May 2022: -2.5%.

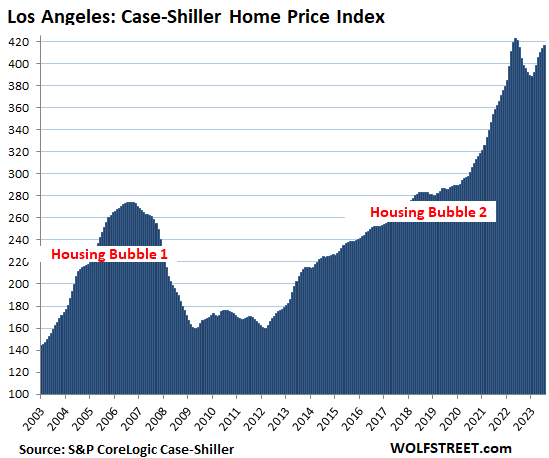

Los Angeles metro:

- Month to month: +0.6%.

- Year over year: +0.4%.

- From the peak in May 2022: -1.7%.

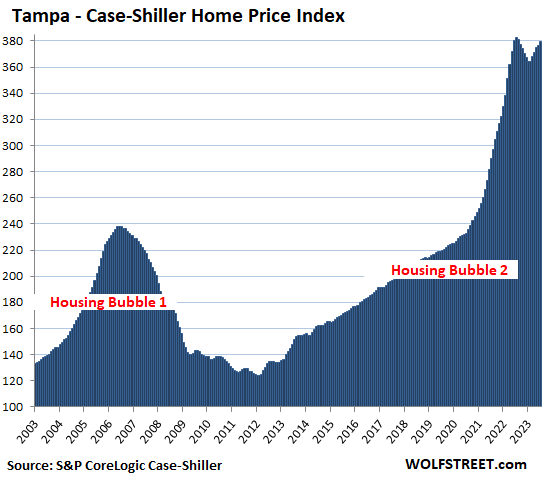

Tampa metro:

- Month to month: +0.7%.

- Year over year: -0.8%.

- From peak in July 2022: -0.8%

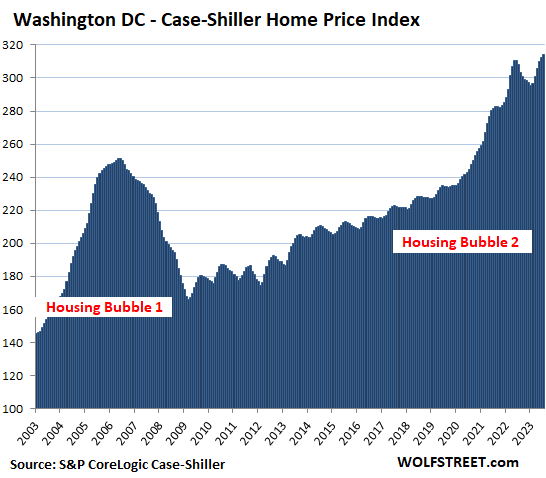

Washington D.C. metro:

- Month to month: +0.6%.

- Year over year: +1.9%.

- Set new high.

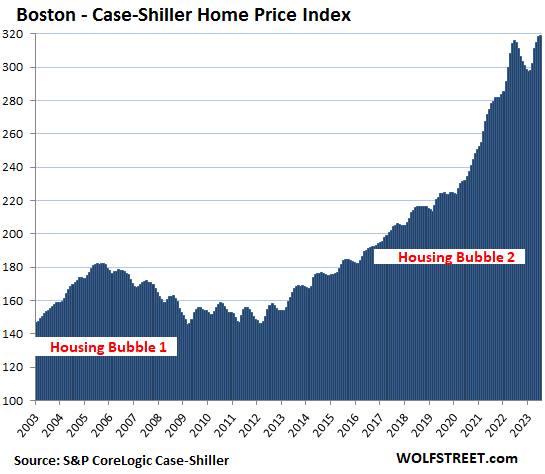

Boston metro:

- Month to month: +0.1%.

- Year over year: +1.3%.

- Eked out new high.

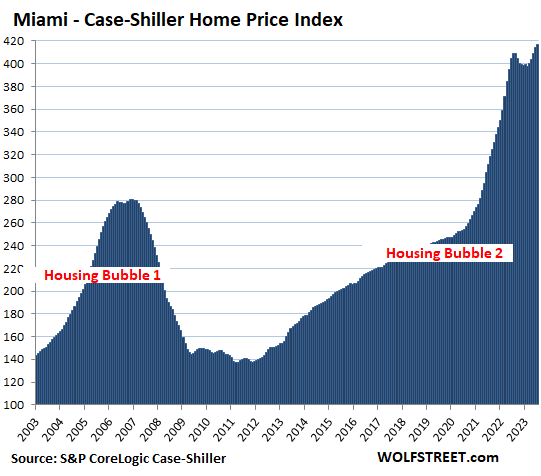

Miami metro:

- Month to month: +0.7%

- Year over year: +1.9%.

- Set new high.

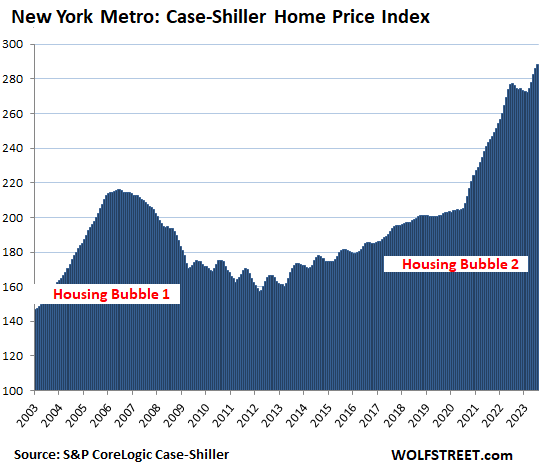

New York metro:

- Month to month: +0.8%.

- Year over year: +3.8%.

- Set new high.

The Case-Shiller indices were set at 100 for the year 2000. This means that the index values of 417 today for Miami and San Diego are up by 317% since 2000, making those two metros the #1 Most Splendid Housing Bubbles in terms of price increases since 2000, followed by Los Angeles (+316%).

Methodology. The Case-Shiller Index uses the “sales pairs” method, comparing sales in the current month to when the same houses sold previously. The price changes are weighted based on how long ago the prior sale occurred, and adjustments are made for home improvements and other factors. This “sales pairs” method makes the Case-Shiller index a more reliable indicator than median price indices, but it lags months behind.

It’s Home-Price Inflation. By measuring how many dollars it takes to buy the same home over time, the Case-Shiller index is a measure of home price inflation. In my discussions of CPI inflation, I compare the Case-Shiller index to the CPI for Owners Equivalent of Rent, which shows the stunning distortions between home-price inflation and rent inflation (here, scroll down to the housing CPI section).

The remaining 6 of the 20 markets in the Case-Shiller index (Chicago, Charlotte, Minneapolis, Atlanta, Detroit, and Cleveland) had far less house price inflation since 2000, and don’t qualify for this list of the Most Splendid Housing Bubbles.

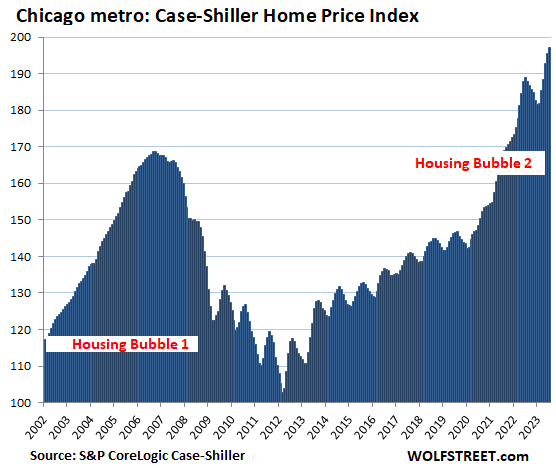

The Chicago metro still doesn’t qualify for this list, with an index value of 197, which is up by “only” 97% from 2000, and 91 points below the lowest-ranked metro of the Most Splendid Housing Bubbles, New York (index value = 288). But prices are on a roll in the Chicago metro. So here it is anyway:

- Month to month: +0.8%.

- Year over year: +4.4%

- Set new high.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Spin it any way you like, but the salient fact here is that last year’s mini-correction in existing housing has been erased. Almost erased if you look at this index, entirely erased and then some if you look at the national index. Either way: erased. It’s time to stop being delusional about this. During the entire spring season, people around here plugged their ears when I tried to tell them that housing was very much on the rebound. Time to take your fingers out and listen: the bubble isn’t popped. God only knows what will pop it–something will, eventually–but 7.5% interest rates and “careful” QT didn’t do it.

Of course, prices are set at the margin, and this stunning return of Bubble 2.0 (can we call it Bubble 2.1?) is happening on minuscule trading volume, but that doesn’t help anyone trying to buy. Here in SoCal, people are more house-horny than ever; a lot of them just can’t qualify. But the ones who can, or have cash, are spending jaw-dropping amounts of money on any shack with four walls.

…just so I don’t sound like a complete Debbie Downer, I’ll point out that in this market the actual junk is still mostly sitting on the market for months, except for the exceedingly rare cases where it’s actually priced like junk. This tells me that experienced flippers are either being a lot more careful what they buy, or are short on money/leverage.

I’m going to have so much fun with you, like you won’t believe. Look at the data instead of your gospel. You’ve had your day in the sun.

What did happen is that the Fed’s $400 billion in quickie liquidity injection in March boosted all markets, housing and stocks, for a few months. Then the Fed withdrew all of the $400 billion plus another $400 billion so far…

Stocks have already turned south from the sucker-rally peak in July. The NAR’s median price, which lags about two months of deals being made, has already turned south. The Case Shiller here lags 4 months. It’s a three-month moving average through July, so it’s slow moving and behind. So you will see it turn south. In a number of metros it was already about flat MoM, or down. And that will spread.

Makes sense

“I’m going to have so much fun with you, like you won’t believe. Look at the data instead of your gospel. You’ve had your day in the sun.”

Wolf, you’re taking this very personally. You’re also misunderstanding what I’m trying to tell you. I stated clearly that this is a bubble and that it will pop. When it does, I’ll be celebrating along with you. But what I’m also pointing out is that you and many of your commenters underrated the extent to which the reversal in the housing market this year was more than just a little spring selling season bounce. You dismissed it as such at the time, but little spring bounces during an actual housing correction don’t bounce all the way back up to the peak and make new highs. It’s OK to admit that you underestimated the stamina of this housing bubble. You’re in very good company, many very smart and savvy people got this wrong.

“…don’t bounce all the way back up to the peak”

Look at EACH city. THAT’S WHY I POSTED THEM. There are 10 of the 20 where prices didn’t bounce back all the way, far from it. Then among the other 10, there are some where prices barely dipped, and they bounced back and set new highs. This goes market by market, and not in lockstep. That’s why it takes a long time for the national average to move down. Some of those cities that set new highs had a pretty good bounce left. But others barely eked out a new high, and the top is rounding off. So you will see the number of cities that set a new high decline, and each month you can count them down.

From your previous article:

>>>”Sales of previously owned houses, condos, and co-ops continued to fall on a seasonally adjusted basis, to an annual rate of 4.04 million homes in August, roughly level with the deep-dismal rate of March 2020, which had been the lowest since the Housing Bust in 2010″<<<

——-

There are about 2 million real estate agents in the United States and their industry is now in a full-on recession…but that fact doesn't show up in unemployment stats because they don't get laid off, but they make a lot less money…. The same holds for house flippers and now for stock flippers… all of these people, (some make a significant amount of money during the rise in asset prices) but their declining incomes do NOT show up in the employment stats …but their declining incomes usually precede downturns in the overall economy (something that

most people are not paying attention to…)

Realist,

You’re back recession-mongering? You’ve been trolling this site for months under different logins with this cherry-picked little bitty stuff that you don’t even understand, while GDP is tracking hot. Relentlessly posting the same stuff month after month is a signature of trolls.

So let me shoot down your BS line by line:

1. “…doesn’t show up in unemployment stats…” ignorant BS. When a Realtor is out of work, they show up in the BLS jobs report just fine, they show up in the labor force, they show up in the number of unemployed, and they show up in the unemployment rate. Where they might not show up is in the claims of unemployment insurance.

2. If you think that some Realtors that lose their work will trigger a recession in an economy with 165 million working people, you’re nuts.

3. The mortgage industry already laid off a lot more people (started in late 2021), and it didn’t trigger a recession either.

4. In terms of your “2 million real estate agents…” Licensed real estate agents are just that — people that have a license. No telling what they do in their day jobs.

So there’s a different metric from the National Association of Realtors: “Total U.S. SentriLock cards rose 2% year-over-year to 228,910. SentriLock cards, comprised of SentriKey® and SentriCard®, allow REALTORS® to access the Sentrilock® lockbox and are an indicator of the number of REALTORS® who conduct the showing.” August. Looks like they’re in no mood to give up:

Wolfs response made me as happy as captain Ron when the coast guard saved the fam from those pirates!

Woo!

Wolf you are an eye opener, thank you.

re: ” sucker-rally peak in July.”

I didn’t see your sell signal. But mine was on the 21st.

spencer,

Mine started in 2021. I described how the market was beginning to blow up beneath the surface in the spring of 2021, one stock after another, which is when “Imploded Stocks” were born. Nasdaq peaked in Nov 2021 and has since then dropped by 19%.

On Nov 29, 2021, right at the peak of the Nasdaq, I have you another big sell signal:

https://wolfstreet.com/2021/11/29/microsoft-ceo-nadella-dumped-50-of-his-msft-stock-in-one-day-following-in-elon-musks-footsteps/

I have said many times over the past year that QT will bring down asset prices. Because that’s what it does and did. The $400 billion in bank liquidity boosted markets for a few months, but QT ate it all up by June, and so stocks dropped again. This stuff is all over my site, including in the comments where I talk a little more freely about this stuff.

“Total U.S. SentriLock cards rose 2% year-over-year to 228,910.”

This is no indication of Realtor employment nor showings but more like an indicator of how lazy Realtors have become. They don’t want to waste their time showing properties anymore. They don’t want to open the property for home inspectors. They don’t want to open the home for the appraisers. They just want to send a code on their I-phones to open the lockbox, and sit on the beach, while everyone else has to do the work they should be doing. Then they want a fat commission for doing nothing. The NAR put out this data. Who believes anything they have to say.

Realist is most famously known as the Big Fat Bastard on ZeroHedge. Actually has kind of a cult following over there. But he hangs out mostly at Housing Bubble Blog, Ben Jones blog. He fits the collapse agenda over there. Easy to identify with the ‘cratering’ links.

Cassandra has spoken…. BUT WE’RE AT ALL TIME HIGHS HERE IN MIAMI!!! Speak louder please.

What we have is a poor governance bubble. Look at the down markets. See anything in common????

Better get these comments in while you’re still looking at peak housing season and before the cold seasons put the market on ice. As if it wasn’t already on ice.

Now try creating a house affordability index. Here 300 on case shiller = $1 Million in loan, can index as EMI calculated as per 30 year FRM loan.

Then plot it next to Case-Shiller. Surprise, it would jump more than 25% year on year! That’s the extent of how stupid this market is!

Same here in norcal. The market is very hot, inventory is at record lows, and prices have been going back up since Feb 2023. I am blown away how resilient this market has become

You need to specify where in Norcal, because you’re in the Sacramento area. So here is Sacramento:

Thanks Wolf! Your graph proves my point. Very slight dip in 2022, after a record setting run-up in home prices. Now in 2023, the home prices have been going back up! And no, this is not just “seasonal”. There are way too many government programs kipping this housing market afloat vs 2008: free $, mortgage, student & auto debt forbearance, FHA $0 down payment, FHA 40 year loan mods, cannot foreclose or evict renters, on and on…so yes, it is VERY different this time. IMO, the federal and state governments will not allow meaningful home price deflation (not just disinflation) of home prices and their precious property taxes. Jay “Transitory” Powell is laying an egg with regards to housing prices…still no significant MBS sales. Pathetic.

This comment is chockfull with BS.

*cries in New England*

Seems to be losing steam though. The most egregious listings are cutting prices. Will be exciting to see how next June compares to this.

And every day my T bills grow stronger…

There also seems to be far more new houses built than are showing on many graphs, due to small builders not informing the various sites until they are actually sold. I think you may start to see new builders offering amazing reductions.

On top of that, there also appears to be a bit of a bust in the short term renting market, as many people jumped in around 2020, with variable or short term mortgages. As Wolf, has always said, house crashes appear to take anything up to four years or so.

On top of on top, people in politics can sometimes look like slimy black swans and the USA seems to have more than its fair share of slime.

You arent wrong about what you are seeing, but interest rates are staying higher for longer. This is going to be a slow beat-down on the market and it will get much worse later.

People buying now will lose a fortune.

The same in NJ Bergen County. People are buying just anything for ridiculous amount of money. % rates? Who cares! Most are bought for cash.

Tell me you don’t understand season numbers without actually saying you don’t understand season housing numbers.

Yup…not in paradise. Up and up we go…watching paint dry sure is a painful process…

San Diego metro:

Month to month: +0.7%.

Year over year: +0.7%.

From the peak in May 2022: -2.5%.

Los Angeles metro:

Month to month: +0.6%.

Year over year: +0.4%.

From the peak in May 2022: -1.7%.

Howdy Folks. This bubble had ZIRP, Printing, and lets throw a lock down into the mix. Govern ment papered over so many things, we probably have years or decades to go before we know how this ends. Yall do know inflation is here to stay and this nonsense was planned and executed on purpose…..

Not to pick on certain members of groups, who, while corrupt, were outed for getting “tips” too, while being members of the wrong groups — like Martha Stewart– to the powers that be could keep pretending to do their jobs.

As predicted, although glancing at Chicago chart, the increase looks very obvious than other metros. I do see a slowdown beginning to show finally via price drops on mls (redfin). I also see a significant number of “back on market”.

This past summer it was nothing but price increases and sold over asking in a lot of cases with multiple offers. Amazing, how seasonal FOMO can ignite a price fever.

Who in their right mind would buy in Chicago?

People who want to live in Chicago, or to continue to live there.

Zombies….

I suppose it’s an upgrade from Saint Louis, Detroit, or Toronto ;)

Andy,

We continue to live in DuPage County that is due west of Chicago.

Why?

We love being near our children and Grandkiddies. Added bonus, a lot of both mine and my wife’s siblings are still in the area.

But, then, we are definitely NOT in our right minds 🤪.

Chicago is located on Lake Michigan, freshwater. Where do you think ppl will flock to when their water dries up? I’m buying here

Contrary to what a person hears in the nutter news media, Chicago is a beautiful city for 4 to 6 months a year. An architecturally gorgeous city on a lakefront. Great skyline, great cultural experiences (museums, music, sports, educational systems, etc.) and great food options. Miracle Mile shopping, Millennial Park, lots of lakefront walking and bike paths, world class zoos. Everything a person could ask for.

For the 4-6 months a year when the weather is nice it is near perfect (maybe a bit humid, but not crazy Atlanta humid), no real natural disaster threats. Perfect city.

Of course the rest of the year it is a frozen ice cube with terrible wind making it so cold you never want to go outside except to drive in a grey muck of ice,snow, mud, road debris, and tire debris.

With crazy property taxes in chicago, have people lost their mind or do they have a printing press to be able to pay these exorbitant prices. Exorbitant prices means exorbitant property taxes…..

Cg – mebbe, as the spousal unit and her Chicaga expat family tend to say: “…they know a guy…”.

may we all find a better day.

Most stretch budget left and right. Buying down points etc. From what I see, many budgets are too stretched out to handle any financial hiccup.

However, if they see that houses that used to be $400K, now sell for $500K can trigger a massive FOMO. Property tax bill? Well that’s tomorrows problem…

Gotta love those seasonal FOMO price fevers. Need some Tylenol for those.

“All is well in the garden.” – C. Gardner

Looking at the metro areas in decline, it is a classic double-top formation. Making lower highs with what I suspect will be lower lows. with the possibility of any unpredicted event happening in the next six months, we may see some further price declines in these areas. But as Wolf says the housing market is a slow-moving train and we’ll have to all watch it in slow motion.

Housing market moves slowly, as do the effects of high interest rates. Momentum builds and pricing trends accelerate. Movement to bonds and out of equities is driving stock prices down. Everyone fears a correction in asset prices and we are making preparatory moves to safety.

As we move into Autumn, watch for housing prices to drop more significantly as sellers finally accept lower offers.

Any calls on the price correctly? minus 10%, 20%, or 30%

I heard it’s different this time…

;P

Me too! Different, special, not like the others.

Yes, it is different, like no massive Wall Street fraud – at least not in MBS and their derivatives

They’ve found other ways to screw the retail trade. It’s not in real estate this time

I can’t speak for national markets. But I can speak for Denver where my adult daughter is searching for a starter condo.

Prices here are coming down. Downward revisions in price on every property in her price range. She is waiting patiently for the best price and best location and will then ask for 5% less.

tell her to wait for 3-4 years. as prices begin a long downward trend, the psychology will finally change in another year or two, then in 3-4 years we get tons of distressed properties and that is the time to buy. my guess is that this time around, we might see prices at 50% off.

The brutality of the coming decade from a financial perspective is going to be a thing to watch.

If used house prices decrease, new house prices need to decrease – but inflation increases the cost to built – which will bankrupt builders.

Come on San Francisco! Another 50% down and I can afford to buy!!

😅 yes, that’s part of the problem here. But condos are less expensive, and there are a lot of them. Over half of the transactions are condos. The chart here shows only prices for houses though.

I’ve never lived in a condo but I’ve spent hundreds of nights in various low end hotels and motels.

Is it possible to live in a condo if you are a night worker? Hotels are so loud and annoying with kids running down the halls and people above you having a high jump competition all day and evening. Not to mention the tinder hookups with the screamer types.

I couldn’t imagine the torture of my home being like that.

🤣 comparing low-end hotels to condos is the way to do it.

Interesting that its mostly west-coast metros with yoy declines, while prices in east coast metros have made new highs.

I agree with Genti re double tops in the charts. 8% 30yrfm rates by eoy should hammer down east coast prices.

Bought a 2006 3br 2ba , 2car attached garage on a 1/4 acre near Leigh Acres in 2010 for 45k that someone had originally paid 170k and lost. In 2020 we sold it for 179k. Today on zilliow they say it’s worth 245k. Crazy!

Where’s the second top in housing bubble 1?

There is no rule book. Look at the stock market. It never follows any rules, despite what people claim.

During Housing Bubble 1, there was something that was back then called a “plateau” — “prices are on a permanently high plateau,” or whatever — which was supposed to become the base for the next surge.

I think that’s right. And I think no one can see the future Thx for the article.

What I enjoy doing from time to time to refresh the memory is to go to Google, search “housing market” and filter by news and by archives. There you can still see some of the articles in 06-07 where they explain this higher plateau phenomenon. Prices eeked out a modest gain even in 2007 and a lot of articles were saying the housing recession already occurred and we were on to the next rally.

2007 was different due to the mortgages that spilled into foreclosures.

But it does rhyme :)

As SnakeEater says, go back in the archives, and you can find a lot of rhyming material for various phases of the real estate cycle.

I’m heading down to Laguna Seca Friday for the Rennsport weekend and will be staying with friends at my sister’s weekend place in Pebble Beach and thought I would see how the Pebble Beach real estate market was doing (according to Redfin)

Median Sale Price $2,740,000 -36.1% year-over-year

Median Sale Price per square foot $973, down 19.7% since last year

Number of Homes Sold 17 -19.0% year-over-year

Just to add more data, in my personal favorite investing market, Manchester, NH, prices continue to defy gravity. Zillow home price index up 5.9% YOY with listings going to pending in 6 days. I keep wondering when the heck reality will set in there, but it just doesn’t. Talking to a real estate agent friend of mine there and it seems that people under 30 have decided that’s the place to set down roots and continue to clobber each other with well over asking offers and that’s keeping the prices high.

I don’t expect as severe a correction as the 2008 correction. Homeowners in 2008 had very weak hands. Just about anyone, no matter how unqualified was approved for a mortgage. Homeowners held much less equity in their homes pre 2008 and were significantly less creditworthy. The result ‘weak hands’, a lot of folks walked away from a property they should have never qualified for and did not have much vested in to keep them there. ‘Predatory lending’ in the real-estate market seems to have disappeared since the 2008 correction. What I see today are homeowners that are stronger financially and don’t have the weak hands that the unvested 2008 homeowners had. Sales volume might be good data to analyze along with the Chase-Shiller when comparing the severity of the correction to 2008. Just doesn’t seem as severe this time although it is a bigger bubble. Time will tell.

It all really depends upon interest rates. There is a theory of thought that interest rates are going to be permanently higher and that will mean that once we hit a recession, there is going to be more supply and no buyers. If there were any kind of supply in the market now, we would be seeing massive price decreases.

This is a standoff and there simply are not enough buyers that qualify at these prices and interest rates to keep up with the surging supply that will come with a weaker economy.

What weaker economy? I love how you’ve predicted 14 of the last 1 recessions. Why don’t you put your money where your mouth is and buy a 3x inverse S&P fund? Or short all the housing stocks because none of them will survive the 50% drop you keep predicting in the next two years.

The amount of pontificating you do here is staggering.

Unfortunately I’m in a situation where high interest rates are working against getting a good deal on a house.

We are looking to buy a second home in a 55+ community in Summerville SC looking toward retirement in few years, nice place and amenities but nothing too fancy, at the end of the day these are model houses definitely not custom.

I made an offer on a house in this development in June at 4% below asking (We would have gone a bit more if the owner would counteroffer) and the offer was refused. According to my agent and to my good judgment that house was overpriced. That house sat for the entire summer and suddenly couple of weeks ago after almost 4 months of listing it had multiple offers and went for quite over asking. Another house in the same development just came on the market last week, 6 years old, no warranty left on appliances, no waterfront lot, no upgrades and basically no backyard, your typical slap ’em box (a bit over 3000 SQ/FT) and they are asking 815K!! Even our agent, which she lives in that development, is baffled. Either the owner and his/her agent are crazy or they know something I don’t.

I could bring other examples in the same place or other 55+ developments, houses fully priced and then some going fast.

The house I lost was bought new for about $445+ in Jan 2017 and now it sold for $850!!! Few upgrades yes but we are talking almost 100% appreciation in a bit over 6 years…it would make the good old bubble time Vancouver Canada blush! It is some sort of mini bubble.

I think Wolf explanation applies here….these 55+ community homes are targeted by retired or near retired people that are making very good money on their CDs, MMFs or other cash instruments and they usually do not take mortgages or very small ones at this point in their life. They are filled with cash and they are splurging when they see something they like.

Good luck driving anywhere in Summerville. It’s a mini Chicago albeit without the high probability of getting shot.

By the way…no sign of crisis in my neck of the wood in Seattle as well. True, little inventory but when a house come on the market it goes very fast and quite a few went over asking.

Hi Dominic,

The conservatives in eastern Washington would have you believe you are living in a truly horrible place. One individual with ties to the real estate community here visited Seattle (a year ago perhaps) and wrote an article bemoaning how much it had gone downhill from when he grew up there.

I’m not from Washington state but have lived in both sides of the state for 27 years. The west side is much too expensive for me, thats one reason I left it.

The east side has a pretty lousy climate no matter what some local person might mistakenly think otherwise. I’m okay with 4 seasons, it’s just a bad climate overall.

Wolfs most recent data suggest the Seattle market isn’t doing all that great.

Year over year: -5.5%.

From the peak in May 2022: -10.1%.

A cliche response to this would be to state that its just the less desirable locations that are losing value…quality (but of course) holds up. As if people will pay anything for quality.

How is Eastern WA a bad climate? It gets smokey in the summer, that’s about it. You don’t get the blizzards or super cold temps further inland gets, it doesn’t sustain 100 degree temps. There’s no humidity. It doesn’t rain often.

As far as climates go, the California coast is about the only place better. And that’s only if you like mild year around. If you like seasonal weather, there’s really no better place.

However I will say, Seattle itself is probably the nicest major city in the US. Hence why it’s so expensive. I hate metropolitan areas but if I were forced to live in one it would be Seattle, then Boston, then maybe Sacramento. Spokane is buried by homeless bums and drug addicts though and the cops do absolutely nothing about it. It’s funny when Spokane locals talk about how awful Seattle is when you can’t park downtown in Spokane without worrying about some methhead smashing a window and rifling through your car.

Trucker – always look forward to your posts. As a former Newman Lakeian (’90’s), I recall an ice storm that took our power out for ten days one winter, and another one with -40’f temps for a week (block heater wasn’t enough to keep the ol’ Civic’s oil warm enough to let me start it and go to work. Sounds like the wintertime has eased a bit since? Best-

may we all find a better day.

…oh, yeah, and snow, lots of it (at least for a kid who grew up on the San Diego beaches) always…

may we all find a better day.

“Seattle itself is probably the nicest major city in the US.”

How about Washington, DC?

Seattle is not expensive because it is “nice.” It is expensive because of all the high tech salaries driving up prices.

Compared to Montana and Wyoming yes, Spokane is nothing. I’ve seen negative temps but it’s once or twice a year. And barely below 0. I’ve been in -50 in Montana with a 60mph steady wind.

The old timers tell me that north Idaho would have 2 feet of snow pack in the valleys back in the day. Even around Bonners and Sandpoint you won’t see it build up to a foot usually. Sometimes less.

Most parts of DC I’ve been to have been a slum. Can’t say much positive about any town located on 95 from NYC down to NC.

Seattle is expensive because it’s nice and also wages are high. If Seattle was like Baltimore, it wouldn’t cost 750k for a tiny ranch home on a postage stamp parcel of land. If Seattle was like Baltimore, wages wouldn’t be high either.

I’m also calling out Baltimore because that city and the surrounding areas are the worst parts of the US I’ve been in. Honorable mention to Memphis and Detroit. They’re near the top as well.

For the Seattle MSA:

Median Sale Price

May 2022: 850k

July 2023: 780k

Decline from Peak: 8.2%

Percentages of Homes Sold Above Asking

May 2022: 67.6%

July 2023: 39.9%

Decline from Peak: 27.7%

Source: Redfin Data Center

JCHS. Joint Center for Housing studies uses several data points to come up with its data.

The Seattle-Tacoma-Bellevue

Income required to purchase median priced home: $237k

Median Priced Home: $793K

Monthly Payments: $6146

Taxes and Insurance in Monthly Payment: 1.3k

That being said, lots of cities in the midwest were the Median priced home is between $250k to $300k. Salary required to buy these homes is $75k to $100k.

Wolf’s non-favorite city Tulsa is $79k income to buy a $262k median priced home. LOL

I guess it just depends our your lifestyle on what you want to pay for housing. There are still plenty of affordable housing in the U.S.

Median family income in the US is $76k.

So yes, some areas are in a splendid housing bubble but some are just a tad overpriced.

We sold our house in the Seattle area in May (closed in June). The Redfin estimate is down $100k since then.

I’m really torn right now, I don’t know what I love more. The work you do to find and explain a wide variety of econ data, or the snarkiness with which you respond to comments.

I’ve always wondered does he own WOLF appliances? Cuz I mean it’d totally work!

Some great charts as the bubble prop in the summer with the added liquidity is disappearing. Still waiting for the stock market drop so the wealth effect will take some traction reduction from prices.

“Case-Shiller index is a measure of home price inflation.”

I can’t see why so many WS commenters are blind to this. Home prices alone can’t tell us if it’s a bubble or not. The CS index is a smoothed measure of asset (house) price inflation. In the absence of artificial buying power provided by bad debt, it’s a measure of the value of the dollar, not a measure of a bubble. Bubbles are paid for with ill-borrowed money. Inflation is paid for with newly printed money. There’s no bubble. But there are still trillions of recently created dollars in the money supply, and a $2T/year deficit as far as the eye can see.

If the Fed can stay the course and continue to choke off the money supply, we will continue to see asset prices cool. But nobody should hold their breath… At only a few percent, the 10-year yield almost caused a banking panic which triggered the Fed to inject hundreds of billions back into only a few bank failures. What do any of you suppose banking and corp debt stability will look like with a 6%+ 10-year? What do any of you suppose government stability will look like when 75% of tax revenue is going to interest as soon as late 2024-2025? The Fed is being painted into a corner.

“Bubbles are paid for with ill-borrowed money.”

You say it, but you don’t seem to believe it. Repressing interest rates to the lowest level in human history encourages ill-borrowed money to fund rampant speculation in assets, including houses.

“What do any of you suppose government stability will look like when 75% of tax revenue is going to interest as soon as late 2024-2025? The Fed is being painted into a corner.”

I can’t speak for anyone else, but I think it’s very doubtful. First, if inflation continues to press nominal GDP, and therefore tax receipts, higher, that outcome won’t happen. Second, if GDP growth collapses, along with tax receipts, the Fed will start cutting rates lowering the government’s interest expense. The Fed can respond to changing conditions.

Also, tax revenue is now over $4.8T. That means interest expense would need to exceed $3.6T to be over 75% of revenue. That’s over 10% of the debt currently outstanding at around $33T. Government debt doesn’t rollover fast enough for interest expense to get that high, even with huge deficits between now and 2025. Revenues may crash in a recession, but then the Fed will lower interest rates quickly bringing down interest expenses.

I think your figures and conclusions are alarmist.

“if GDP growth collapses, along with tax receipts, the Fed will start cutting rates”

I disagree. If inflation has not come down meaningfully, this will not be an option.

No need to disagree. I addressed that possibility specifically in my original comment: “First, if inflation continues to press nominal GDP, and therefore tax receipts, higher, that outcome won’t happen.”

Even if real GDP growth collapses, inflation may still push nominal GDP higher, and tax receipts along with it. In which case the Fed won’t cut rates, but interest expense as a percentage of tax revenues will not blow out to 75% of revenue any time soon.

Agree with you here MM, if inflation doesn’t come down and stay down (if anything we could even use some deflation in a few areas temporarily–we’d still have huge net inflation since 2021) then it’s crazy to think the Fed could just re-instate the lunatic easy money policies of the past 40 years and fuel even more inflation. There’s only so much blood that the fiscal and monetary policy can squeeze out of a turnip, and most Americans are already being pressured by inflation as it is, esp for housing and food–the US now has record homelessness, the worst life expectancy in the developed world, plunging birth rates, rising retail theft and crime even fundamentally changing store policies because of it.

Any more unchecked inflation and we get social unrest and a collapse of civilized society, if anything JPow has still been too timid on the QT side of it. And high inflation might be even worse here in the US than some other countries because workers have less power to demand wages match the inflation (that’s policy and even law in some countries). Income increases haven’t matched the inflation here and it’s been very uneven–a lot of Americans just can’t switch into new jobs easily due to things like family responsibilities, schools or specializations, and even for those who can, the new on-boarding often takes months. Retirees, savers and students esp are up a river, and as much flack as government workers sometimes get, we should remember basics like our roads, law enforcement, schools and firefighting depend on them. And things like microwave ovens and the Internet came from government research and funds, same with a lot of medical research and new treatments. Now with a potential shut-down those highly skilled workers can’t even get pay raises to match the inflation and a lot of important work will stop–even worse inflation means a total disaster for a lot of important parts of the US society.

“First, if inflation continues to press nominal GDP, and therefore tax receipts, higher, that outcome won’t happen.”

Rojo, tax receipts are not pushing higher. They’re dropping. Per Fred (FGRECPT data series), receipts peaked in Q2 of last year and are now down a few hundred billion per quarter since then. And if you’ve paid attention to Wolf’s reporting on gov interest as a percentage of tax receipts, you’d know that it’s been climbing in a darn near straight line up for several quarters now. Slowing of the economy and decreases in capital gains taxes could continue to drive receipts down, not up. Receipts decreasing while interest increases means that a larger and larger share of receipts will go to debt servicing. We will reach a point pretty soon where either the Fed (monetary policy) or Congress (fiscal policy) are going to have to blink. I suspect the Fed will blink first.

There are a few things I don’t think you’re considering. There are a lot of moving parts and they all impact each other.

1. You’re right tax receipts have fallen recently. Tax receipts fell because of the decline of the markets in 2022. Tax receipts from stock compensation and capital gains fell, in large part due to Fed tightening. The market has rallied in 2023, so it’s questionable whether tax revenue will continue to fall for that reason. The decline has already moderated with receipts in Q2 2023 down only $13B from Q1 2023 per FRED.

Unless unemployment rises or the markets turn down significantly again, tax receipts will not continue to decline, particularly in an inflationary environment. If receipts do decline due to a slowing economy, then the need to hold interest rates at these levels will likely abate too. If inflation stays the same or rises, even with increasing unemployment, tax receipts will also be inflated.

2. The rate of inflation came down in second half of 2022 and the first half of 2023, so the Fed has slowed rate increases. The spike in interest expense mirrors the spike in interest rates, which is now slowing down.

3. The mathematics of percentages comes into play. The last time I think Wolf reported on this, the interest expense as a percentage of tax receipts was 36.2% on August 30, 2023. That means interest expense has to more than double from here to get to 75%. Since the rise in interest rates has moderated, so will the rise in interest expense. If inflation does rise, then nominal tax receipts will begin to rise with that inflation putting off the date interest expense reaches 75% of tax receipts.

4. I agree with your final comment about someone blinking. As interest expense rises, at some point Congress will be forced to address the deficit like it did in the early 1980s when interest expense exceeded 50% of revenues. On the other hand, maybe the Fed blinks and lowers interest rates. Either way, something is likely to happen that prevents interest expense reaching 75% of tax receipts.

I think the outcome you suggest, interest expense at 75% of tax receipts by late 2024-2025, requires two things that are unlikely to happen together, especially in a timeframe of a little over a year. It requires a significant rise in interest rates from current levels since only part of the Federal debt rolls over in that time frame, and a collapse in nominal tax receipts. If inflation stays hot enough to push interest rates significantly higher, then nominal tax receipts will start to grow with that inflation at some point. Factor in the likelihood Congress and/or the Fed blink, and I don’t think there’s much chance interest expense reaches 75% of tax receipts in the timeframe you suggest.

Totally valid points Rojo. And for sure, there are all kinds of variables I’m not considering which could change the outcome. I don’t think you and I are all that far apart, but perhaps I’m taking on the more pessimistic view.

My overarching point is that if nothing changes, that is if everything keeps moving at the current rate, it is certainly mathematically possible for us to reach 75% of receipts going to interest by 2025. There’s a totally realistic scenario in which higher yields keep stocks from taking off and we keep our $2T+/yr in deficit spending floated by new debt issuance, maybe with a couple more .25% rate hikes tacked on. Add stagnant growth as the free money hangover wears off with cooling asset prices, and there’s certainly a recipe for record high interest as a percentage of receipts very soon. I don’t believe that Congress has the political will or cumulative brainpower to stop it and I don’t trust the Fed to hold their course. My next most likely scenario is that something big blows up, the Fed drops rates, and their balance sheet explodes upward again. So that’s just my two cents, which is worth even less than it was a year ago!

The market has rallied in 2023?

Not Sure,

You’re right, anything is possible, particularly if nothing changes. I guess my point is that things almost always change, particularly when so many different factors are involved.

“First, if inflation continues to press nominal GDP, and therefore tax receipts, higher, that outcome won’t happen.”

I used to go with that reasoning but after re-visiting some lectures from our econ prof, I feel like it’s hard to say something like that with confidence. If inflation gets out of control, it gets to the point that the large majority of a country can’t afford basic cost of living and society rapidly starts to unravel in very ugly ways, and even if GDP gets an initial drug high from the inflation, it soon collapses when the fabric of society can’t sustain it. The price instability means that the value of work itself is shot to pieces, critical community work doesn’t get done, workers are forced to focus on basic survival, trust and cohesion collapse and the government and institutions totally lose legitimacy. This is the reason for that old wisdom about how inflation has brought far more great powers and major empires than any war ever has, it totally guts the basic fabric of society and it’s why Volcker saw his own fight against inflation in the 70’s and 80’s as vital to the very survival of the United States as a functioning country. And he was right.

That’s part of why our old prof and now far more even mainstream economists are debunking and even mocking the idea of a country inflating it’s way out of debt, at least in the modern way countries and government spending is set up. Both fiscal and monetary policy are now too deeply embedded into everything about the national economy, and unchecked inflation just means that government allocations and obligations also go up with the inflation. So we wind up with the worst of all those worlds, high inflation, worsening public misery and anger, and a government that (instead of able to inflate it’s way out of debt) just winds up even more indebted. If it was so easy, then Argentina would have been sitting pretty when the top blew off the inflation there in 1990 and its debts and nominal GDP would have been in better shape. Things obviously didn’t pan out that way, and they won’t for us either if JPow, Kashkari and the current Fed fail to follow in Volcker’s footsteps and fight this inflation as aggressively like he did.

The part of my comment you’re quoting is taken completely out of context. My comment was in response to a comment that interest expense might reach 75% of tax receipts by late 2024-2025. I disputed that conclusion.

In this regard, we’re talking about two very different things, apples and oranges, frankly. I’m talking about high levels of inflation relative to a 2% target, and you are talking about hyperinflation. The 1970s and 1980s in the US is the type of inflation I was discussing. You’re discussing “[i]f inflation gets out of control.” I might be wrong, but at this point I don’t consider Argentina-type inflation as a serious near-term possibility in the US.

I am in the camp that long term interest rates are headed ABOVE short term rates and that is primarily a function of the supply-demand equation between too much supply and not enough demand for Treasuries.

I see the stock market continuing to plunge into the end of the year, after a quick bump up in the next couple days. Tax receipts will not be strong in either 2023 or 2024 and the budget is going to become a real problem.

When looking at Case Shiller charts, I always wonder if 1990 was high, low or just right.

NYC, Boston and Chicago still going straight up at a faster pace than anytime during the 2003-2006 bubble. Maybe this time really is different. Someone wake me when unemployment hits 5%

In my part of the Silicon Valley, housing prices have been INCREASING. However, something interesting has been happening– the vast majority of the houses sold have been substantially improved (new pools, etc.).

A lot of the ones which haven’t been updated are withdrawn from the market and don’t show up in the data.

I believe this dynamic is skewing the data to such an extent that some areas which appear to be going up aren’t.

The reason is that there can’t be an apples to apples comparison– a house built in 1970 with minimal updating isn’t a comp for a house which has been fully renovated and had a pool added.

You can’t look at the past data and compare to the present data (at least in this one narrow slice of the Bay Area), because the data points aren’t comparable, for the same reason you can’t look at condo sales prices and compare to single family home prices without making an arbitrary adjustment.

My feeling is that this means the prices are dropping far faster on an inflation adjusted basis than the data reflect.

Does anyone have a perspective on this?

Zillow et al place the value on size of the house, not the condition. That’s where the marketplace comes in and discriminates against rode hard and put away wet domiciles.

Xavier Caveat wrote:

> Zillow et al place the value on size of the house, not the condition.

I have never talked to anyone from Zillow but after using Zillow for ten years it seems like the algorithm assumes that every time a home sells there is some updating and bumps the value if I am looking at a street with three almost identical track homes build in the 80’s the home that is still owned by the original owner will almost always be worth the least and the home that sold every five years will be worth the most. My wife and I were just talking about how people age 40-60 do a lot more home renovation projects than people age 70-90. I know there are exceptions but more often than not when I have been to the home of someone 70-90 the first think I think is “I bet they have not done a single thing to the inside of this house in 20+ years”…

Apt. – 😂 you need to explain this to my wife…

may we all find a better day.

Wolf, I apologize if you have already addressed this 8 billion times, but what is your take on the increasingly popular position that home values will soon plummet as boomers pass on, and the housing inventory exceeds demand?

I see a lot of charts floating around showing that in the next 10 years, folks in their 60s and 70s (who are currently propping up values) may pass into the great beyond, creating a Japan-like situation with HOT metro markets and ice cold rural/suburban towns. I’ll take my answer off the air, thanks.

1. Boomers are being replaced by the biggest generation ever, the millennials who are now trampling all over each other trying to buy homes. People keep forgetting about the millennials.

2. The population of the US keeps growing. And the US keeps adding fairly large amounts of housing stock every year. Japan is an island nation and strictly limits immigration. The US is not and does not.

Is there also some reason to believe that secretly, behind closed doors, the 2 party political soap opera we put on here good cop bad cops immigration in order to ensure housing demand and perpetually guard real estate values with that as an insurance lever? Meaning that if supply ever really did surpass demand, we could just let in X people to balance it upward and hell, even bus them out to specific cities if need be?

I don’t think that any population that needs to ride a government provided bus is going to be in the market for a SFR.

Pure wisdom dispensed daily.

@wolf “ People keep forgetting about the millennials.”

I wouldn’t worry about that. If that ever happens, they’ll remind us promptly of their existence, needs, wants and, especially, feelings!

Don’t worry about the Millennials.

As soon as they amass significant assets of their own, they’ll morph into the same type of individuals as those of previous generations that did what they had to do in order to protect themselves and their families.

I think more people forget that Gen X even exists :) I did read an article, though, that stated the group of people from younger GenX-older GenZ is the largest group of prime home buying age individuals ever in US history (ages 25-49 roughly). It showed why there will be high demand for many years.

…plenty of ‘forgotten’ within, and by, any age cohort one wishes to name…

may we all find a better day.

I believe the eminent recession and high unemployment that will come with it will finally be the catalyst to break the super-inflated real estate bubble. Nothing like losing a job and having to make mortgage payments.

I don’t think we’re that close to forced selling yet. Unemployment is still very low, and a lot of folks are flush with cash.

Personally, I feel its irresponsible to not have extra cash on hand for an emergency like a job loss or major repair.

So basically the same geographic pattern continues… prices down in the Western US, up in the East. It’s like we’re living in two different countries.

CNN reported yesterday

“US home prices continued to rise in July, hitting a new record high and marking the sixth successive month of gains, as historically low inventory pushes up the cost of a home.

Prices rose 0.6% from the month before, according to seasonally adjusted data from the S&P CoreLogic Case-Shiller US National Home Price Index released Tuesday.

Compared to a year ago, the national composite index also rose, with prices up 1%”

Past Fed policy has made the most illiquid of markets, real estate, even more illiquid.

*Sellers expect prices from a year ago when mortgage rates were much lower.

*Buyer expect lower prices due to today’s mortgage rates

*Supply is low because of those locked into very attractive mortgage rates

*The gap between bid and ask widens. Volume of sales drops.

*Conclusion: Price discovery is severely hampered by the illiquidity and any conclusions to true values must be discounted because of that illiquidity.

If the Fed hadnt messed with long rates, a departure from decades of policy, the real estate market would not be in this situation. IMO

Buyers are not just “expecting lower prices”, but most of them just don’t qualify for mortgages with the current rates and prices. Only (would be) sellers HAVE the discretion to change their position in the market, (most) buyers don’t have the discretion. Most just can’t qualify. Most don’t have the luxury to offer more (even if they are willing to) because banks are not giving mortgages with monthly payments over 60% of their monthly income. That’s why (previously owned) home sales are at 30 year lows.

FED irresponsibly propping up prices by unpredictable money printing is raising the expectations of (would be) sellers like a religion and killed affordability for buyers.

The would be buyers being denied mortgages are the lucky ones…

you lost me at CNN reported…

You are right. CNN is a terrible source of information, but given your posting history, I would bet a lot of money it doesn’t even make the top 5 worst sources of information that you use.

Wanna bet?

Nice analysis. FED’s printing $400 billion in March 2023 inflated all types of assets, including housing, stocks and crypto. That’s why housing went up. if the FED stops manipulating the market by printing money again (like they did numerous times), house prices will certainly go down, even in the case of lower mortgage rates.

Now the FED has took that money out and even more. But the psychological effect of the March 2023 money printing madness took a lot of toll around me. I can see that potential buyers around me are greatly in a panic mode now. They are buying whatever the bank allows them to. I see people paying mortgages more than 50% of their income. The people I see around are in a desperate FOMO. They believe that housing will be more expensive next year. So, they don’t care about the rates. Many are insensitive to rates, when making buying decisions now. If the bank (or creditor) qualifies them, they buy. The reason is that, after March 2023, many people lost faith in the monetary policy. They think that FED can print hundreds of billion in seconds any time they feel like it might be necessary, but the houses can’t be built in years. I think that is causing tremendous panic in buyers now. I don’t have much information for businesses, but the retail buyers are crazy about buying. The reason the transactions are incredibly low is not because they don’t want to buy, but they just don’t qualify.

FED has really really really a lot to do to gain confidence about their monetary policy now. How can sb be sure that FED will not print another $400b in March 2024? This is the real problem. They must allow some reckless corporations to fail, just like Chinese government allowed their enormously large constructors to do so. Otherwise, U.S housing market will be like Japan’s in late 1980s.

What terrible circles are you running in, I got friends attempting to sell in the multi million markets and their homes are sitting for months now.

The lower classes are the folks who will suffer the worst once more unfolds.

Folks who bought my mountain home in Colorado are now down 500k easy as my old neighbor listed his home it’s way nicer than my house and a cool 900k cheaper at this point.

I really feel for all the stupid people that bought in 2021 and 2022.

As long as the US government can continue to prop up our economy with $1-2T in annual deficit spending, all things bubble will stay propped.

Not to say there won’t be some adjustments +/-. And of course with real estate, factors that are local/regional have a marked influence.

+/- 10% does not make much difference in he overall housing scheme of things, in my opinion. And I don’t see a major collapse in any markets. Prices are “sticky”.

Thanks for the chance to comment.

It’s not $1T to $2T in annual deficit spending anymore. It’s now $2T to $3T.

I hear FY24 deficit is likely to be about $2.4T.

I thought all those tax cuts for the wealthiest paid for themselves???? Maybe we should cut them further??

IIRC, the gubmint did a study and found the tax cuts did pay for themselves.

The issue – as always – isn’t an in-come problem. It’s an out-go problem. Poorly designed programs which are never read by the congress critters that get approved, then some enterprising person looks for the loopholes, and exploit them to the shock and amazement of the idiots that created them. You can’t legislate morality. Witness the PPP debacle.

Good God….. I would love to see these “study” you say the government did that said the Trump tax cuts paid for themselves.

I bet you don’t have anything that says that. Only nutter websites that spin (outright lie) about some study that says something completely different.

I never understand why people continually use sources of information that make them look like fools.

If inflation rages on and gets a little crazy, people are going to want to find a place to put their money that is rapidly worth less, and safe as used houses has done amazingly well for, well, most of our lives.

Imagine a tired 1963 3/2 in Cudahy, Ca. fetching $20 million?

I agree with you.

Now in China it’s a different story. From what I understand, the Chinese people piled their money into buying apartments. Their options for investing were much more limited due to the Chinese government. So they figured that real estate was the way to go. Now real estate isn’t doing so well over there.

Somehow I get this weird feeling that housing may not be immune to a dollar collapse and hyperinflation, as any intrinsic value becomes grossly offset by carrying costs.

Furthermore if the gov’t cant maintain a stable dollar and society, I wouldn’t put much faith in them guaranteeing property rights.

What could you get rid of a whole lotta dollars on in a hurry?

That’s what I see coming down the pike.

You are correct that housing in the U.S. isn’t immune to the collapse of the dollar or to hyperinflation.

However, luckily there is little to no evidence of either of those happening anytime soon.

Might as well mention U.S. housing is not immune to a extinction level meteor strike or a full fledged, empty the arsenal, nuclear war. There is just as much evidence of such impending doom.

Wolf,

Why don’t you write an article on why the federal budget is still 2 trillion dollars higher then in 2019, what is the rationale/justification? I mean i know we’ve been building hospitals on every block and everyone here is happier then ever, but i could still use some clarification on what that extra two trillion is going towards. Funny the silence on that topic. I bet most people don’t even realize its that much higher.

I rail about the debt quite a bit. I discuss the US ability to pay for it. All you have to do is read it. The articles about the debt are here:

https://wolfstreet.com/category/all/debtor-nation/

I generally don’t cover what goes into the budget. Politicking isn’t my cup of tea here. There is no justification for these huge deficits. They happen because Congress wants them to happen, they gotta bring home the bacon and the tax cuts. The only discipline left is higher interest rates. When interest payments take up 50% of the budget, Congress might get the message. That’s how it worked last time. I’ve said this many times, and that’s about as far as I’ll go.

heyj – this.

may we all find a better day.

Yes sir I hope

I mean it’s already happened as we’ve seen with rent moratoriums during COVID, which in some areas pushed landlords into bankruptcy. Imagine what lengths the looters (I mean leaders) would go to in a real crisis. All the investors piling into RE salivating for that guaranteed rent income, may very well end up with lifetime squatters and a bleeding rectum :)

Here in the Rural Red Dirty South, rent is outrageous, existing home inventory is low, any home that has been taken care of under $500K sells super fast, and home owner-funded custom-built home permits are only off 10% from the crazy peak in 2022. I’m building myself. My walkout basement is poured and framing starts in three weeks.

“Flat, year over year.” Given that a big chunk of the housing market is frozen (for reasons discussed in depth in other posts), it is still a bit surprising to see not much of a decline in prices. Of course I am looking at the nation as a whole and I understand some markets like SF have really eaten it. I guess housing in general has a very slow reaction to rising rates. Prices sure went up in a hurry. Maybe its the elevator up and the stairs down kind of thing, just the opposite of stocks.

Mortgage rates are reaching 8%. Many commenters are trying to cherry pick data and say “but not in my neighborhood” to support their confirmation bias. Soon you will learn that physics and economics both adhere to gravity.

I remember in 2008 it took two years for the bottom, but we did get there. And stop it with this housing is scarce BS, it is all about what monthly payment is affordable, and right now many can’t afford it.

When Airbnb and vacation rental collapse begins, watch out. That is where the next housing crisis will begin.

P.S. The main thing I disagree with Wolf is the timing. I believe the speed of the correction will surprise many people as we revert to the mean.

7.65% today for top credit borrowers, already close to 8% for the others.

I’m also of the opinion that we’re very likely to see multiple factors converging. Many owners who must move to a different house, the collapse of the short term rental ownership, a substantial stock market correction, a recession etc. And I wouldn’t count on lower interest rates just because that’s how things worked in the past. But we’ll see if and when any of these things will happen.

What do you think the size of the population who must move versus the population that can choose to sell their house or not? I think the latter is much larger. Magnitudes larger.

Also, what are you basing your prediction of a future collapse of the short term rental market on?

Exactly, a few sales do not define the entire market. Talk about denial.

Interestingly on Airbnbs, I’ve seen some furniture listings on Offerup where people said they are closing their Airbnbs and liquidating all furnishings. Anecdotal at this point but interesting nonetheless.

Redfin CEO: “….the only relief is that it can’t go much lower.”

Holy BANANAS!!! You can’t make this stuff up.

Boston is unfortunately economy extremely dangerous and soft on crime politics were lagging SF, Portland etc but are now catching up.

People paying top dollar must be delusional

You can rent the SAME apartment for 3k a month or buy a mortgage payment for the same place for 6.5k per month

Next few years should be interesting!

Price cuts galore in many places. Funny how some of the commenters see a few sales at list price or above and then extrapolate it out to the entire market as being “hot”. Delusional!

2006+ era saw some decent sales here and there before it finally imploded. God, people are living in denial.

For comparisons sake in San Diego in HB1 the top was Jan. ’06 and the first bottom was June ’09 then a small bump up and then second bottom in mid 2012. Single top double bottom if you will.

A year after the Jan. ’06 top the market was only down about 4%. Just a little itsy bitsy gully. There would be no market crash because of A through Z.

It’s just so hilarious how all the old rhetoric gets recycled.

So the exploding bubble, slow leak bubble, or whatever we want to call the deflating bubble stopped at the beginning of the year in San Diego, and has been reinflating since the beginning of 2023, or at least that’s what the chart seems to indicate. Is the market correction over, or as many folks are saying here, we’re all wrong with what we’re seeing in San Diego. Anytime any of us who actually live here point out what we’re seeing it seems a bunch of trolls who don’t know the area are quick to cast any number of aspersions. I had said several months ago that the most splendid housing bubble reports for San Diego were going to be a surprise to many here. Surprise.

Nothing goes down in a straight line.

Lot of hope out there that FED would pivot.

I am in San Diego and I agree with your assessment.

Housing is a slow moving like titanic and it may take few years for things to become clear like 2008-2009.

My point above was that lots of people were saying in real time in ’06-’07 that it was just a lil ol itsy bitsy gully of -4% YOY, then over the next 5 years it was -40%. Oopsie!

So now people are saying in real time ’22-’23 that it is just a lil ol itsy bitsy gully of -1.75% YOY in SD…..no worries!

My other point is that re SD I heard all the same reasoning beginning in peak ’06 as to why RE values in SD would never crash. Once again…Oopsie!

Wake me up in 2025 when things might start to get interesting.

Hi Wolf!

I know you don’t like links, but you’re getting more (unattributed) credit in RETwit and FinTwit

“He who panics first, panics best” ;-)

I think forecasting the future price of housing in the U.S. is one of the most interesting puzzles.

Right now there are a bunch of forces conflating to make it such an interesting question. On one hand, there is FED QT deflating most asset prices, FED raising interest rates which is pushing down on demand for mortgages, boomers are dying/going into senior housing, which are all pushing down on the cost of housing. On the other hand, there is the Millennial generation (the biggest in history as Wolf likes to point out) hitting their prime house buying years and wage inflation pushing up how much people make putting upwards pressure on house prices.

These two groups are working against each other and both are historically strong. Right now, QT and higher rates are barely winning. They are gradually driving housing prices lower. Higher longer probably means gradually falling prices will probably continue going forward, but the countervailing forces are still strong as well. This likely means there won’t be a drastic drop in the national housing market. There are too many Millennials making more and more money looking for housing to let that happen.

Then there is the wildcard, the future economy. As Wolf likes to say, there is always a recession sometime in the future. The questions are, how long and how deep?

Obviously a long, deep recession would drive housing prices lower. A short, shallow recession in name only might have zero effect of housing.

As someone who is going through the process of selling a house and looking to buy in the near future, I find all of this fascinating.

The real estate problem I had, after leaving Seattle for San Diego, was a less a short supply of houses than a severe lack of quality neighborhoods. Yes, quality is a subjective term meaning—-minimal guns and sirens going off at night and non crapped out schools. East and south of downtown are 90% crapped out. North county offers options at $1MM+. But the mostly “cookie cutter” north county homes avaialable seem to be dropping now.