Second major US ratings agency to downgrade the US to ‘AA+’. The first rating agency got whacked by the US government.

By Wolf Richter for WOLF STREET.

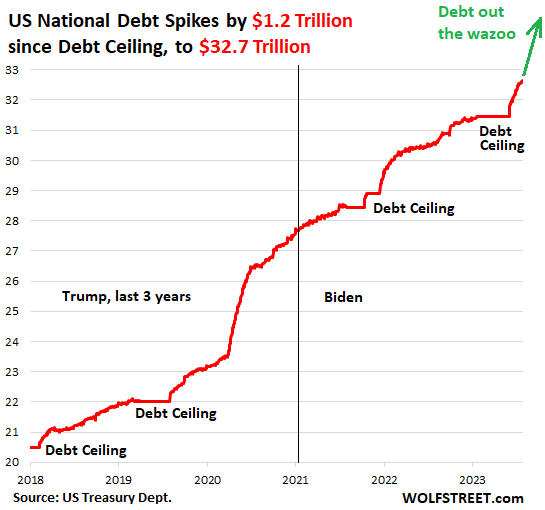

Following the shocker of an announcement by the Treasury Department yesterday that it would have to borrow $1 trillion in the quarter through September and another $852 billion in the quarter through December, on top of the $32.6 trillion the government already owes, Fitch Ratings threw in the towel today and became the second major US rating agency to downgrade the US of A.

Fitch cut the long-term credit rating of the US to ‘AA+’ from ‘AAA’. It already had the US on negative outlook, meaning a downgrade was possible. With the downgrade today, Fitch removed the negative outlook and assigned a stable outlook.

As reason for the downgrade, Fitch cited a litany of issues, which it summarized:

- “The expected fiscal deterioration over the next three years

- “High and growing general government debt burden

- “Erosion of governance relative to ‘AA’ and ‘AAA’ rated peers over the last two decades that has manifested in repeated debt limit standoffs and last-minute resolutions.”

Here are some key points that Fitch made:

“Erosion of Governance”: Fitch cited “a steady deterioration in standards of governance over the last 20 years, including on fiscal and debt matters, notwithstanding the June bipartisan agreement to suspend the debt limit until January 2025. The repeated debt-limit political standoffs and last-minute resolutions have eroded confidence in fiscal management.”

“The government lacks a medium-term fiscal framework, unlike most peers, and has a complex budgeting process. These factors, along with several economic shocks as well as tax cuts and new spending initiatives, have contributed to successive debt increases over the last decade.”

This is what the last half of these “successive debt increases over the last decade” looks like:

Rising Government Deficits: Fitch said that it expects the general government (GG) deficit to reach 6.3% of GDP this year, from 3.7% in 2022, “reflecting cyclically weaker federal revenues, new spending initiatives and a higher interest burden.” Fitch forecasts the deficit to reach 6.6% of GDP in 2024 and 6.9% of GDP in 2025.

Rising Government Debt: Fitch said that the debt-to-GDP ratio at 112.9% in 2023 is “well above the pre-pandemic 2019 level of 100.1%.” It expects the ratio to reach 118.4% by 2025. “The debt ratio is over two-and-a-half times higher than the ‘AAA’ median of 39.3% of GDP and ‘AA’ median of 44.7% of GDP,” it said.

“Fitch’s longer-term projections forecast additional debt/GDP rises, increasing the vulnerability of the U.S. fiscal position to future economic shocks,” Fitch said.

Medium-term Fiscal Challenges Unaddressed: “Over the next decade, higher interest rates and the rising debt stock will increase the interest service burden, while an aging population and rising healthcare costs will raise spending on the elderly absent fiscal policy reforms,” Fitch said.

But the US of A still has some strengths, Fitch said: a “large, advanced, well-diversified and high-income economy, supported by a dynamic business environment.” And of course, inevitably, the US has the dollar, “the world’s preeminent reserve currency, which gives the government extraordinary financing flexibility.”

Fitch projects a US recession in Q4 this year and in Q1 next year, the same recession that has gotten moved out every quarter for over a year. Someday we’ll get it. Even the Fed has given up on its recession call for this year. Fitch is still clinging to it.

Fed Tightening: Fitch pointed at the rate hikes so far, and “expects one further hike” by September. “The resilience of the economy and the labor market are complicating the Fed’s goal of bringing inflation towards its 2% target,” it said. It sees no rate cuts until March 2024. And it cited QT, “which is further tightening financial conditions.” Though, however, but, uhm, the financial conditions have barely tightened outside the banking sector.

Second downgrade for the US of A.

Fitch has now become the second of the top three US rating agencies to knock the US off its triple-A ratings.

In 2011, S&P downgraded the US to AA+, from AAA, after another especially entertaining debt ceiling farce in Washington. But the downgrade did not go over very well. Politicians from both parties lambasted it. The Justice Department started to investigate S&P’s role in the rating of some MBS that blew up during the Financial Crisis and ultimately sued S&P and its parent McGraw Hill Financial, in 2013, accusing it of defrauding investors, and seeking $5 billion. In 2015, S&P settled the allegations for $1.375 billion. So that was an expensive downgrade.

Not that it mattered. Downgrades should make it more expensive for governments to borrow. But they don’t.

Japan, which is in even worse fiscal shape than the US — and which Fitch rates ‘A’, four notches below the US’s new ratings — has the lowest yields rates in the world, not because of any credit ratings, but because of central bank policy.

US Treasury yields continued to meander lower after the S&P downgrade in 2011. By August 2020, the 10-year yield had dropped to an all-time low of 0.5%.

But that era is over. Since August 2020, yields have jumped, thanks to Fed tightening — and not due to any downgrades. Today, the 10-year yield is back over 4%.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

But does this say more about the US, or more about Fitch?

Captain obvious here. Reading the financial report of the United States, I see:

if current policy is left unchanged and based on this report’s assumptions, the debt-to-GDP ratio is projected to exceed 200 percent by 2046 and reach 566 percent in 2097.

Absent a willingness to change course, and I’ve seen none, a credit rating downgrade seems appropriate. The US needs more taxes or less spending.

problem is of course there is tax limit – around 20% before higher taxes = less tax collected

I remember good ole days of 70’s/80’s when personal tax rates were 80%+

I personally saw HIGH INCOME professionals work a couple months per year and then go on vacations

they’d all say same – no need to reward govt for my hard work

I would opine that the US gov needs to:

Go after the 1% who use every trick in the book to hide from the taxman, unlike me a pleb who gets scrutinized closely.

Stop the war machine. Who knows the real #, but around ~50% of our discretionary budget goes to the military industrial complex (DOD has failed last 5 years of audits)

Demand competence, conscientiousness and integrity of elected officials.

BWAHAHAHAHAHA…..ahem… sorry I just read my own comments and realized how utterly absurd I am.

The US gov gifted the tax avoiders with tax avoidance laws, enabling the tax avoidance. (Typically the use of trusts and or separate your money from yourself personally, with your earnings going through a corporate LLC type entity on one hand and you receiving a salary from it.) As a result no one, (in the justice dept,) is going after this kind of tax avoider. Heck most in Congress, e.g Pelosi, will undoubtedly use this quite legally, of course

When I consider Fitch is owned by Hearst Corporation and Hearst Corporation was founded by a William Randolph Hearst (who made his bones with a publishing empire specializing in “fake news”)… A Fitch ratings downgrade is suspect to say the least.

Debts don’t matter. Until they do.

Amen, and the latest FRED data shows that we’re now running an annualized $970B interest expense.

AND!!! This is only through Q2. As such, it seems extremely likely that Q3 will push it past $1T.

AND!!! We still “MAY” have 1, 2, or possibly even 3 more rate increases before it’s all said and done. More on that Friday with the July jobs report.

Higher for long says JPowell, and he seems to mean it. Oh, and tax revenues have turned south and will continue to worsen.

Yes, deficits now matter and so do treasury yields. Unfortunately, Congress doesn’t get it . . . YET.

What is wrong with the tax revenue? GDP growth is better than 2% and unemployment is at all time low. And yet — GOV tax rev is not keeping up. Something is stinking here.

I also hope Wolf does another tax revenue post. I remember one where he said higher interest rate environments were increasing government revenue

Inflation increases government revenues. Those 5% wage increases turn into 5% income-tax increases. That’s the biggie.

Higher interest rates also generate higher income taxes. Lots of people now make $50k or $100k on their CDs and Treasuries when they made near-$0 in 2021. There’s something like $50 trillion in yield assets that now generate lots of taxable income, when they did barely before.

It adds up. That’s why tax revenues have shot up, and will shoot higher, but at a slower pace than income expenses, and you get this chart that I posted here (interest expense as percent of tax revenues).

Capital gains. 2022 was a shitty year for the stock market, and capital gains taxes plunged (part of which would be paid in 2003).

Tax revenue cannot keep up with the climbing interest rates. Just as your credit card and mortgage rates have gone up so has the gov’t cost of borrowing to meet the entitlement spending they promised.

If Congress can’t do it’s job and enforce fiscal responsibility then the gov’t has to pay those increased costs. This is how we burden the taxpayer with having to actually pay for for all those programs.

Really neat article from Paul Krugman yesterday on how well Bidenomics is working in the NYT.

The government portion of GDP is increasing faster than the GDP, thus all growth is unproductive government. BTW, the government does not pay itself taxes.

” we’re now running an annualized $970B interest expense.”

Those lending get to spend a fair return on their money.

The flip side is (suppressed rates) the govt creates debt hand over fist….

Maybe there is 3rd way……

Don’t get in these situations. Do not stimulate when there is no need other than to beautify for political purposes and power. Keep short rates even with inflation, always. And money supply only expands from a “pull” from GDP growth…not GDP growth goosed by money expansion an inflation.

Good start for a long long road ahead ls; however,

”Short term rates” ”should be” clear rate of inflation as measured monthly PLUS at least a couple per cent IF WE, in this case WE the PEONs are to have any kind of fiscal stability.

Surely the GUV MINT folks could figure out how to do this?

IF ”they” wanted it.

Gonna take a whole bunch of education for the paid political puppets to understand it is in their best interests.

WE can hope that all it takes is education and that WE don’t have to put up with any more violent means to get the message across to the puppets and their oligarch masters.

It’s a matter of who gets to spend the money ..

For 14 years, the govt and other borrowers got to spend the “magic” money from the suppressed rates…..under the guise that their spending is “stimulus”.

Now, the lenders get to spend the fair return…..but it is not portrayed as a stimulus. But it is …..just as the other arrangement was. Who controls the “magic”?

Under one arrangement, the suppression is a forced situation.

Under the other, the lender gets a fair return.

I know which one I would pick.

Exactly. There was no reason to dump $2 trillion extra into the economy in March of 2021 other than vote buying. In my estimate, more than half the inflation is due to that.

Over time as the debt is refinanced the interest expense goes up, even if the interest rates just remain at these levels.

The market has been betting on lower long term rates for a long time. maybe that is coming to an end.

This rating downgrade might just be the tipping point.

We live in the age of financialized fiat. Its a dishonest accounting system of what lies beneath which is a real economy. Even you live in Venezuela, you have to figure out how to do the best you can in the system and enjoy life as much as possible.

there is a portion of the US economy which is vibrant, strong, and a group of people that benefit from that. (manipulated industries – healthcare, education, housing, wall street plus high tech industries)

and there is the rest of the economy which is pathetically weak and starved (manufacturing of almost anything)

and there is little middle ground.

game tv

If Fed had not taken nearly 8 trillion more on it’s balance sheet, where would be these assets value! ? Fed’s (easy-peasy) money policies including multiple QEs, stimuli, twist++ what not.

Yes, QEs have made some very, very rich. Top 10% have nearly 90%+ of Wall St wealth. It was NOT built on underlying productive economy, on a fundamental basis. All debts are at record level. All the future demand has been brought forward.

How far this circus can go on, is any one’s guess. If some thing, suddenly breaks, big time, shouldn’t be a surprise for any one except CBers. it can from withing and or from outside.

2008 – ‘No one Saw this coming’

1. The reason treasury TGA is to acquire as much debt as possible since ceiling is suspended until 2025.

2. ratings do not matter and long rates are not going to raise much from here. If anything they will go down.

The fact that the government retaliated against S&P’s downgrade utilizing the judicial process was a sign that banana republic habits were becoming ingrained in US governance. The US fiscal position in the eighties was very much stronger than it is today. Both parties now have embraced deficit spending because the GFC taught them that taxes and spending need not be correlated. The inflation of the eighties had a happy ending; it really is different this time because the US, its government, its people and its fiscal position are all very different.

Back in the late 90s and early 2000s, we used to talk about how we eventually need to pay back the debt. No, everyone accepts that it’ll never happen, and can’t happen.

Operation Choke Point, Letitia James using her office to punish gun related businesses, the current admin using social media to censor, are all also banana republic type actions.

Layoff the propaganda. I have no idea what you’re talking about in the last paragraph, which only tells me that you’re high on some type of Kool aid.

The US Government’s dysfunction is a mirror of it’s population. Getting worked up about selective information that you have to be indoctrinated to even find, so that it reinforces your idiolgy is not healthy.

Hey DD,

You might want to get out more, read more widely especially read many different global sources from OUTSIDE USA, but about USA.

NOT going to find out much other than propaganda by reading main stream USA ”news” sources, that’s far damn shore… with a few exceptions, Wolfstreet.com being one of them.

Digger Dave.

Same holds for your rhetoric.

My rhetoric is nonpartisan, as are my beliefs. We’re talking about debt and a government where two parties are complicit in running it up. When people start pointing out obscure non-sequiturs that only could come from partisan sources (aka propaganda) that have nothing to do with the topic at hand, I’m going to point it out. The fact that multiple people are getting butt-hurt by pointing this out is enough proof that it touched a nerve. But you know what, a large group of people is tired of this nonsensical ideological ranting that comes from both sides, day in and day out, permeating all conversations. This is a blog that usually avoids this nonsense and many here agree that it can be better left elsewhere – the internet is full of other places for spouting drivel.

Rule #3 of the decorum of this forum is to leave the non-related political nonsense out of it. Sorry for calling it out.

government and coporate debt are a mess, but as Wolf has pointed out the consumer is not currently stressed. that will change at some point.

i believe that without the massive government debt spending, the economy would collapse within 4-6 quarters. but at what point will the spending be reigned in?

I’ll take the other side of that bet on duration. Yellen did too when she sold bills instead of lower-yielding bonds to re-fill the TGA.

The only way long rates will go up is if economy grows gang busters for a long time.

Then why did she sell bills at a higher yield?

Or if inflation remains subbornly high.

(It totally will)

Or….if trust is lost in the gov’t and its financing.

I am taking the other side of that bet. Specifically short the 20 year.

” If anything they will go down.”

You must not be aware of the supply coming and the continues QT.

Supply and demand laws are eventually always obeyed.

Yellen is not happy.

She’s yellen!

She’s the clown who said in early 2021 “Go big because rates are low.” What a fool.

Yellen behaves like a criminal.

“behaves” ? just “behaves” oh man

According to Bloomberg US Treasury Bond Futures are up on the Fitch downgrade announcement, because of a flight to quality. Same as when S&P downgraded the US debt rating in 2011. It never ends.

It was too early for Bloomberg to comment on what the market did. The market already changed course, and the 10-year yield bounced back to 4.03%. And it’s still too early to comment. But ultimately, over the week, months, and years, the downgrade has no impact.

Inflation and the Fed are the biggies. The credit rating is just decoration.

You’re right, Bloomberg now says Treasury yields are little changed.

” Bloomberg now says Treasury yields are little changed.”

I dont listen to people who wear bow ties.

Longstreet-

Jim Rogers, James Grant, and Jeffrey Tucker are sport bow-ties. Each is eloquent (in his own way), and all three are worth listening to …

Just saying…

They were eventually correct. ( years)

It took a long time and a lot of pain.

Still, a poor choice of neckwear IMO.

surely fitch and the market are “right” and that’s why the downgrade has no impact.

as risk on USD increases yield on UST increases, in real time.

when Fitch then records USD crossing over a risk boundary UST yields have already moved to confirm that fact.

The Bloomberg US Aggregate Bond Index produced an average annual return of 1.50% in the ten years ending 7/31/23. The S&P 500 index produced an average annual return of 12.66% over the same period. One did not have to be as smart as Warren Buffet to know that the Fed was suppressing market interest rates during this time period. Bond investors were the big losers after inflation.

Looks like it has already flipped. Since Jan 2021, it’s the yield investors that made money and stock investors that lost money. These things take turns, and you’ll see that when you go back further in history.

Yellen re-filled the TGA with bills, rather than lower-yielding bonds. So, she must have had the same concerns privately — otherwise why borrow at a higher rate?

Because she thinks that short rates will soon be dropping rapidly and she doesn’t want to lock in higher rates on longer term instruments? Maybe that’s why Wall Street also thinks rates will soon be going in reverse.

Bills will mature within a year. It would seem that she thinks bill yields will dip below notes & bond within 12 months or so.

Perhaps this was done to keep long yields from going up too much, which may have happened if there was not enough demand for the new issuance at current long yields.

On one hand a lower credit rating is bad as more interest needs to be paid back. However, couldn’t a low credit rating work as an interest rate “hard deck” that the Federal Reserve would be unable to go below? The Federal Reserve apparently suffers from pressures (Wall Street, oligarchs, government, etc.?) that seemingly they cannot resist; a low credit rating would take the load off their back helping them to do their job easier and better. Maybe some credit rating that would give 4% interest rate, in the “B” would be just right; like the goldilocks finance they talk about, not too hot and not too cold.

It’s shocking that the USA Credit rating is a notch above F——.

Least dirty shirt

TINA!

10-year treasury yield made a big jump today. Is this because of the increasing yield needed to entice people to buy these bonds? I know Wolf has written about this, just trying to confirm my understanding of what happened today.

It’s still far from enticing me, LOL. I still don’t why anyone would be enticed by 4%, in this inflation scenario, but there is a lot of demand at this yield, which is what makes a market: people disagree … for one to dump it, the other has to buy it.

“I still don’t why anyone would be enticed by 4%”

It’s 4% above 0%.

Bandaid

I agree 4 percent 10 year makes me wonder about the sub 3 percent yield and the demands for banks and pensions that kept buying that stuff higher for longer I hope get inflation under control inflation is killing me. Retired no pension or SS yet

“reflecting cyclically weaker federal revenues, new spending initiatives and a higher interest burden.”

This would have a been another wonderful opportunity to pull out the most recent Woflstreet graph of gov interest payments as a percentage of tax receipts. The one showing that our government went from paying under 20% of receipts toward debt servicing to nearly 35% over the course of only 4 quarters beginning in 2022. 1 year of reporting took us from the lowest percentage since at least the 70s to the highest percentage since ~1998! At this rate we’ll easily blow past 50% and Wolf will have to re-scale the Y-axis in another couple of years.

With more rate hikes against manic deficit spending and debt issuance, our gov will be stuck collecting tax money and handing half of it over in interest payments by late 2024 / early 2025. High outflow to interest income is stimulative. It was in Volcker’s time and still is now. Short of some surprise financial implosion, we’re in for hot whack-mole-inflation for a long time to come. Do we really even deserve an AA+ rating?

Here we go:

What they did from 1992 to 2001 to go from 50% to 25%?

Bill Clinton

Inflation (which boosts tax revenues) and a growing economy (which boosts tax revenues).

Interest rates started coming down in 1982 as inflation was coming down, and gradually, interest rates paid by the government declined.

“What they did from 1992 to 2001 to go from 50% to 25%?”

The House (Gingrich) forced a “contract with America” in which the budget was technically balanced….. for a heartbeat or two.

Correct me if I am wrong but wasn’t it during Clinton’s time that the boomers came into their peak productivity and earning years?

Newt Gingrich, despite Bill Clinton. The contract with America, back when congress worked together.

During almost all of this period (except for a few weeks in Sept. 2001 after 9/11), the US was not engaged in any major conflicts abroad. Wars are expensive. Even the war in Ukraine in which there are no US troops on the ground is costing the US about $10 billion a month in various types of military and non-military aid to Ukraine.

It was a sort of Goldilocks period with no wars, modest (and declining) inflation, giant productivity gains due to the “computer on every desk” movement, and divided government keeping both taxes and spending in check.

The real wonder of it all is that the interest rates (and interest paid) have stayed so low in the 20 years that followed. National Debt following the end of the Cold War was $3.7 trillion… and following the internet bubble was $5.6 trillion.

It is now almost 35 trillion… without much to show for it as a nation. As Wolf said, credit those continued low interest payments to exceedingly low inflation rates. For most of the past 15 years the Fed was actively trying to RAISE interest rates ABOVE the 2% level.

From the article Fitch say interest component will ne 6.3 % of GDP .. so roughly USD$ 1.6 trillion.

If their tax income is around $4.7 trillion…

Holy Moly your graph is correct….

34% of income gone in interest payments.

If I had a Mortgage where I was spending 34% of my cash to keep a roof over my head, Banks would indeed consider me “distressed” and a High credit risk. If something should affect my earning capacity I would have to sell Up.

AA+ was a gift from Finch and the US Government profligate spending needs a Knife through all of Congress’s pork barreling…

Higher interest rates and inflation are now baked back in for the next 6 months

I think a lot of younger home buyers face mortgage and property tax payments equal to or exceeding 34% of their monthly income, especially in high cost metro areas.

Actually 34% DTI isn’t that bad in the mortgage lending world. I would never do it, but many do.

Peter Schiff points out, the last time FFR was where it is today, the national debt was $5.6T. That was in 2000. Back then, the Defense budget was $400B.

If you refinanced the national debt at FFR (5.25%), back then, you’d have an interest to Defense Budget ratio of 0.75.

Today, the national debt is $32.7 Trillion. Defense budget is $840B. Refinancing the national debt at FFR today, you’d get an interest to Defense Budget ratio of 2.05.

Did interest on the National Debt ever exceed the Defense budget in the 80’s?

No wonder the BRICS wants a new currency..we have total morons and idiots running our finances! Greg Mannerino is right, they must exponentially increase the the debt in order to sustain our corrupt and evil system.. if our financial system is based on worthless debt, then what happens when some other system is backed by reality.. such things as commodities, gold and industrial growth? We live in a world of fantasies and lies..!!!!

“No wonder the BRICS wants a new currency..we have total morons and idiots…”

The BRICS don’t use the dollar, they have their own messes on their hands. None of the BRICS are even close to AAA. China is AA- at S&P and A at Fitch. Brazil is junk-rated at Fitch and S&P (BB-). Russia is deep-junk (CC and C at S&P and Fitch). You can look up the others.

When I was young, I thought we (The US of A) must have the dumbest government on the planet.

Then I got the pink sheets mailed to me (Financial Times) and read about what everyone else was up to: made us look brilliant by way of comparison.

Thanks as usual! If you need a paywall sign me up. I will gladly pay for information that is this good that is also dumbed down to my level like you always do. You are the best!

Fitch is doing the USA a favor with this warning. I seriously doubt this government will go after Fitch. The bondholders might though…😛

Thanks. I will not put my readers up against a paywall. I want everyone to be able to read this site.

However, readers can donate to support the site (and many do, thank you!). Here’s how:

https://wolfstreet.com/how-to-donate-to-wolf-street/

Thanks Wolf.

+1

Yes, all these people questioning the timing of it, but if not now then when? It’s high time for those in power to wise up to the fact that there are countless examples over the last few years of America’s rock-solid investor-friendly economic, legal and political framework being called into question. Even Biden’s ridiculous student loan forgiveness scheme makes you think, what other kinds of debt might a populist president try to make disappear into thin air

yes oh so shocking and so surprising (sic) and yes indices are within spitting distance of all time highs … oh but wait, let me check the dxy … surely the $ has crashed and burned by now … nope … nothing much to see there. but i do see a lot of digging in my neighbors yard. it’s either his cans of gold or his wife. i better check.

Actually the DXY has moved up strongly today and yesterday. Happy Days are here again for the USD. And you thought it was toilet paper!

If we are running 6.5% of GDP deficits during good times, I shudder to think what the deficit will look like when the inevitable recession arrives. Perhaps it might be the time when the mythical “bond vigilantes” finally appear.

I have been waiting my whole life for the bond vigilantes to come back.

AND WE WILL RISE AGAIN!!!

HOPEFULLY WOLF WILL JOIN US!!!

Fitch said our whole country is Wolf’s drunken sailor

I guess the CBDC’s and suppose to help them manage nominal and real yields, but I don’t see how it’s going to work. The CBDC’s are still a form of fiat money and the amount them them that will need to be created should bring on terrible inflation

Yesterday, Treasury auctioned $73 bb of 3-month bills and $65 bb of 6-month bills. Tomorrow, it will sell $60 bb of 4-month bills, and on Thursday it will borrow $60 bb in 2-month bills and $70 billion in 1-month bills.

That’s a lot of paper to roll EVERY week — with larger auctions still to come. What might follow if a “buyer’s strike” like 2019’s ‘Repo Madness’ were to recur?

Treasury’s increasing reliance upon short-term funding brings to mind memories of Bear Stearns.

I wonder about the impact of the downgrade : does it implies more collateral on repo transactions ?

It means nothing. Credit ratings of countries that issue their own currency are just for decoration. They will never default because they can issue money. Japan has a lowly ‘A’ rating, four notches below the US ‘AA+’

For countries that issue their own currencies, there should be a rating for the risk of inflation. That would make more sense.

It’s 4 WEEK T-bills, not 4 month…

Some folks think that’s the way to go for now, eh?

There’s both the 4-month T-bill (17 week) and 1 month (4 week).

The US is in a ginormous speculative everything bubble of epic proportions, in conjunction with an out-of-control, deranged CONgress who are spending the country into complete and total destruction.

It’s a start, but Fitch is still dancing around the US debt issue.

Did Fitch mention the US has been monetizing debts the past 15 years? A quick look at the Fed’s balance sheet expansion over time leads to that obvious conclusion.

Also, did Fitch mention the US dollar just devalued 20% in three quick years, in the form of inflation? If inflation of 2% per year is the base expectation, that’s a 14% default over three years.

Fitch is pretending to be a ratings agency. After the debacles of 2008, it’s a wonder Fitch even exists.

The US has NEVER ‘monetized’ any of its federal government debt.

Yes, it did. Nearly every dollar borrowed in the pandemic “stimulus” binge was monetized.

” The resilience of the economy and the labor market are complicating the Fed’s goal of bringing inflation towards its 2% target”

This statement proves again the Financial Industry are full of dumb eggs.

If Fed has cut its balance sheet back to $1 trillion pre-2009, or cutting it down as fast as it printed $$, then we won’t have this “puzzle” of Strong Economy, Strong Inflation, and Strong Labor.

Or are they pretending stupid and blind to the elephant in the room?!

Credit ratings are supposed to help an investor weight the risk of default. That’s it. Well, the USA isn’t going to default, at least not for long if there’s some congressional hissy fit that causes one. No one should worry about that.

What everyone should worry about is the debasement of the currency by said borrower to repay. I don’t think Fitch or S&P has a rating for that!

Hey, I would love a bond that requires the Treasury to repay me in a fixed proportion of the money supply. The print 10% more, my bond gets 10% more interest and at maturity. That would be way better than TIPS. I’m suuuuuure Yellen will rush right out and support that one.

It is funny to see people still trusting these rating agencies.

Nevertheless it is a no event.

I suspect that most of the institutional bond buyers are not old enough to remember the inflation caused by the war in Vietnam.

and who back door funds these wars?

When the “new debt” is floated to fund these wars, who steps in to support the debt market?

Imagine if the U S Govt had to sell war bonds for Afghanistan, Iraq, and now Ukraine as they had to do in WWII.

“Imagine if the U S Govt had to sell war bonds for Afghanistan, Iraq, and now Ukraine as they had to do in WWII.”

Good point.

While you’re at it, you might remind the bond buying public how shabbily the buyers of the 4th Victory Bond were treated in the early 1930’s when the bonds matured. The government paid back these patriotic bondholders by reneging on the contract. Instead of paying in gold value as the contract was written, the holders were paid off in deflated dollars.

The economics textbooks that tout U.S. Treasury Securities as essentially riskless skip over that disgusting episode.

U.S. Supreme Court details here:

https://www.law.cornell.edu/supremecourt/text/294/330

Was the inflation caused by the war in Vietnam, or was it caused by the fact that we continued spending and acting as though we had the post-WW2 monopoly on manufacturing, all while going off the gold standard?

In my view, the U.S.’ best days were from around 1950-1963 or so. We’ve been pretending we’re still in our heyday since then.

Einhal:

Agree that at least in 20th century, USA’s best days were between end of Korean war and beginning of VN war, or at least the most active years of that war, in spite of USA being suckered into VN by DeGaulle pulling the wool over CIA and State Dept after the massacre of French paratroopers, both USA depts. headed by Dulles brothers at that time…

NOW however, times have changed, and WE, in this case the ”Electorate” WE can and should IMHO make a very clear choice between the old guys, my age, and the younger folks.

WILL we,,, probably NOT due to the extent of propaganda as has been SO clearly illustrated on SO many sources.

YOUNGER folks have much more to lose when they have to live with their choices,,, eh

You might recall that in 1956, the US did not come to Hungary’s rescue and avoided a major conflict with the USSR. Also in 1956, the US forced Britain, France and Israel to return the Suez Canal to Egypt rather than risk a war with the USSR, which at that time was a major ally of Egypt.

It is very expensive to play the role of the world’s policeman and the average American is paying the price.

Who rates the rating agencies?

From FirstWatch Restaurant earnings call today that sort of caught my attention. It looks like they see food at 2% inflation which seems low. But the kicker was they expected labor costs to increase 8% to 10%.

They serve mostly breakfast food. Not Steaks and Hamburgers. Maybe that helps with the food inflation?

“Commodity inflation continued to decelerate, furthering a trend that began in the second half of last year. For 2023, we expect inflation of our market basket to be in the range of flat to 2.0%. Expectations of labor cost increases continue to range between 8.0% and 10.0%. Combined with improved labor management and menu price increases to offset inflation, the Restaurant level operating profit margin was 20.9%Starting the first day of our third quarter, we increased in-restaurant menu prices by 1.0% to offset the impact of inflationary costs.”

Well color me impressed! Fitch didn’t have to do this. But it has obviously been planning to do so for a while now… and this time the government isn’t going to be able to say “Boo” about it.

It’s amusing enough that there’s a “rating” for the risk-free asset against which all others are priced, let alone the spectacle of the predictable gaggle of chicken-littles running around headless at the news that it’s been changed.

Humanity — the cosmos’ longest running comedy …

Horse and pony show as usual. The US government can never default, so any mention of credit risk is pretty much insane. Now whether the currency will hold its value is a separate matter.

Default is possible. We know that attitudes towards the national debt will change over time.

For example, the US could default if Gen Z and later generations repudiated the debt, a debt they had no role in creating and do not wish to service via payments or inflation. I would not be surprised to see that happen if the government keeps kicking-the-can, aided by the Fed.

Kicking-the-can simply transfers problems to future generations, but it’s a proven easy way out for self-serving weasels.

Or, disgruntled millennials and Gen Z might implement a one-time 10% wealth tax to pay down the national debt, followed by a few more one-time wealth taxes.

It most likely would stem from populist anger towards the top. But it also could stem from lack of options. According to the maestro Bernanke, you can get away such things if people believe it won’t happen again.

Germany defaulted on its foreign debts in 1933. It was not until 2010, that it made the final payment on its defaulted debt/reparations payments incurred during the Weimar years (according to an ABC News item from 2010).

Bobber: when you say future generations might repudiate the debt, what exactly does that mean? Are you saying they won’t get jobs and mortgages, and retirees take a haircut on social security? Will they refuse to pay taxes? I’m just trying to wrap my head around what role Gen-Z plays in the default risk.

“Fitch said: a “large, advanced, well-diversified and high-income economy, supported by a dynamic business environment.” And of course, inevitably, the US has the dollar, “the world’s preeminent reserve currency, which gives the government extraordinary financing flexibility.””

They left out or afraid to say, ours is a hamburger and Starbucks economy. Long time ago, I had a dean who was famous for saying, We can’t be the best nation in the world by polishing the shoes of each other – we euphemistically call that a service economy. Once the foreigners realize that fact, even the dollar will be in the dumpsters :)

Your last paragraph is BS. It shows that you are clueless about the US economy and ignorant about what “services” actually are.

Services include engineers of all kinds, including software engineers and chip designers, architects, the tech and services jobs in oil and gas, the tech jobs in manufacturing, everything having to do with the internet, broadband, streaming, doctors and nurses. Jobs in the finance and insurance sector are services jobs. These are well-paid jobs, many of them highly-paid jobs deep into the six figures, in demanding fields. And they’re huge industries in the US. These are “knowledge industries.”

In addition, the US has the largest oil and gas industry in the world (huge amount of tech involved). The US is the second largest manufacturing country (by output), behind China, and it’s bigger than the next three combined (Japan, Germany, India). The US construction industry is HUGE. Ag is huge, ranging from specialty products to commodities. And on and on.

I’m getting really tired of seeing this stupid BS here that US is a “Starbucks economy” or that services jobs are hamburger flippers.

Wolf,

You absolutely have my agreement/continuing support to delete such nonsense immediately, if not sooner…

SO tired of the non reality based rumour mongering,,, and far damn shore it has now become part of the problem…

Kudos to those who remember the words of the philosopher dude who said, ”If you are not part of the solution, then you are part of the problem.”

Of course he was put into prison in USA for saying such a thing.

The Fed is trying to slow things down while the government is fueling things with deficit spending.

The easiest and most effective short term fix would be tax increases at the upper end of the income scale (i.e. on the folks that have benefitted the most the last few years.)

It won’t happen because those folks have been using their gains to make sure their reps do no such thing.

The USA will continue its long term slide as the rich get richer and the others get left way behind.

Oh for the good old days when the top marginal rate was 90%, and corporations actually paid taxes.

We don’t need tax increases. We just need the government t stop pumping asset prices. That’ll make the need for taxes unnecessary.

You can’t tax wealth, only income, and the “wealth” gap is what’s the problem.

BTW, the 90% is largely a myth.

“You can’t tax wealth”

Sure you can.

“BTW, the 90% is largely a myth.”

The facts say otherwise.

“The easiest and most effective short term fix would be tax increases”

No, the easiest is to stop the .gov spending. Do you tell an alcoholic that is destroying his liver that the easiest solution is to take someone else’s liver?

“No, the easiest is to stop the .gov spending.”

Won’t happen. Most federal spending is corporate welfare.

Corporations can’t pay taxes.

Only the people that own them, work for them or buy from them can pay taxes.

Corporations are people: US Supreme Court in its Citizens United ruling.

Most likely, after the free-spending liberal democrats are booted from office, the free-spending republicans will emerge as victorious, cutting taxes, cutting social programs and running up deficits.

The tender box is filled with explosive fuel.

I hate to point out reality to you but the Republicans already control the House of Representatives. You remind me of our illustrious governor (Greg Abbott) who ran his last campaign as though he had nothing to do with the previous decade’s fiascos. Of course hardly anyone votes in Texas anyway!

This downgrade is another act in the drama on US spending like debt ceiling.

What will really hit these drunked sailors is good solid inflation with income raising at snail’s pace. It will hurt many but how else can we rein in these drunkards?

Yes but why do this in August then? No one is listening, and Congress is empty.

Some funds can only own certain grades of debt…..and this should restrict some from owning federal debt.

This ERC thing probably isn’t related to government spending, but who can say, and anyway, just a rounding error…

“ Any time this amount of money is being handed out through the tax system, the bad actors show up, and they have shown up in large numbers,” he said.

As of July 26, the IRS said, it had roughly 506,000 unprocessed Form 941-X amended payroll tax returns.

As the IRS works through its backlog of unprocessed amended returns, it’s unclear how many small businesses may have wrongly claimed the credit. But a future audit “could ruin them,” according to Harris.”

According to CNBC headline today “US Debt Downgrade Sinks Global Markets – but Economists Aren’t Concerned.”

Is it responsible to downplay our national debt issues? Is CNBC a legitimate source of news and advice?

@Bobber No, they are an entertainment company and need to put on their show for 12 to 14 hours a day – Cramer basically admitted this in an interview with Jon Stewart a few years back. Search for it on YouTube.

It is just a business for all these networks.

Wolf Street is probably the only news source that tells it as it is. So disregard CNBC and the other “business” networks and go with Wolf.

“Wolf Street is probably the only news source that tells it as it is.”

There are others, but you wouldn’t like them.

Wow, with such a blistering pace of downgrades (S&P in 2011, now Fitch!):

The US will be junk rated by the 25th century!

Anybody who bought and held a long bond after 2011, when debt monetization began, has lost between 5% and 43% of their principle, using the price of TLT as a proxy. Many holders have lost significant money, even after considering interest payments.

I have a feeling things are about to get much worse as default premiums increase across the debt spectrum.

Duration risk is going to sink the banks if rates get too high; the spell cast by the BTFP won’t last forever, and trillion dollar bailouts will send central bank balance sheets back up. That kind of roach motel outcome can destabilize currencies. The resolution of SVB et al temporarily moved the Fed asset needle by 800 billion IIRC, and those banks weren’t SIFIs. European banks have been weak for years and that’s where it is likely to start, once everyone is back from vacation,

“The US will need to refinance almost half of its national debt in less than 2 years. As a reminder, interest rates were at 0% just 15 months ago.” – Tavi Costa

President 42 (Dem) nearly balanced the budget, thanks to tax increases under 41 for which he was roundly castigated. Back then there was talk about Paying Down the Debt, but instead you got tax cuts for the rich under 43 and more tax cuts for the rich since then, which now makes that impossible.

The numbers don’t lie. Without the tax cuts under 43 and 45 for the billionaire class and corporate profiteers, debt as a percentage of the economy would be declining, as it was under 42 (see above chart). But corporate campaign contributors insist on huge returns on their investments in political bribery, which is why corporate welfare is by far the largest federal expenditure and still increasing, often promoted as a bone thrown to the general population.

You can google it: Tax Cuts Are Primarily Responsible for the Increasing Debt Ratio.

This isn’t a problem you can solve by getting rid of the US middle class, reducing most of the population to destitution, and directing the proceeds to the profiteering class, which is the preferred approach of libertarians. It wouldn’t be enough. There’s no such thing as enough. Feeding the rich only makes them hungrier.

Please note that financial crises are only caused by the rentier class and never by the worker bees. People of privilege will always risk their complete destruction rather than surrender any material portion of their advantage, which is precisely what they’re doing, and since there’s no way to rein them in catastrophe is inevitable.

Sorry.

“The real difficulty is with the vast wealth and power in the hands of the few and the unscrupulous who represent or control capital. Hundreds of laws of Congress and the state legislatures are in the interest of these men and against the interests of working men. These need to be exposed and repealed. All laws on corporations, on taxation, on trusts, wills, descent, and the like, need examination and extensive change. This is a government of the people, by the people, and for the people no longer. It is a government of corporations, by corporations, and for corporations.”

Diary entry (11 March 1888) – Rutherford B. Hayes

41 lost his reelection bid to 42 despite what was at one point a 90% favorability rating because of his tax increase and the mild recession that followed. The voters sent a message about tax increases and the politicians have responded. No politician has been punished for the immense and wasteful Covid spending; message received there as well.

That’s because the population has changed a lot from 1992 to 2022.

41 never had a 90% favorability rating. He lost because he pardoned the entire crime syndicate run by 40, who wasn’t punished for the biggest tax increases in US history.

Covid spending was immense and wasteful, but some people still prefer that millions more would die, and not just rabid antivaxxers, rather than feed the pharma industrial complex and not their own preferred corporate profiteers.

41’s approval rating hit 89% in March 1991. Ironically, it was 43 who briefly had a 90% approval rating.

Unamused, you gotta stop with your recurring claim that Clinton nearly balanced the budget. First, the President doesn’t make the budget, congress does. Second, they didn’t “nearly” balance the budget, they ran budget surpluses for four years from 1998-2001. Finally, the 105th and 106th congresses that ran those surpluses were controlled by (R)s in both houses.

It was ultimately a blend of earlier tax hikes and late 90’s spending cuts (especially military cuts coming out of the cold war) plus tax revenues from a bubble economy that did the trick. 2001 was the last surplus we saw and both parties have shown nothing but increasing fiscal irresponsibility ever since. Let’s at least get the facts straight.

“President doesn’t make the budget, congress does.”

The president leads on the budeget by presenting Congress with a budget plan every year. Some things he doesn’t get. Credit where credit is due.

“Second, they didn’t “nearly” balance the budget, they ran budget surpluses for four years from 1998-2001.”

Only if you include the SS surplus, which is deceptive because SS isn’t decretionary spending and isn’t voted on by congress every year. It’s a trust fund, a separate program.

“It was ultimately a blend of earlier tax hikes and late 90’s spending cuts (especially military cuts coming out of the cold war)”

Tax hikes on the rich and cuts to the Military Industrial Complex. There’s your insight into your current budget problems. Hold on to it.

Excuse me…over spending seems more the problem. This mantra of “fair share” is BS. I am not owed anything from you, simply because you have more, and I less. With that said, the tax laws do need revamping. Cut the deductions . also, for “you can’t tax wealth”…. we already do. Property tax, excise tax, personal property tax (Boston). These are taxes on wealth, and you pay every year you own the property. Then when you sell, capital gains tax! And for the boomers…remember, is it a tax or fee?

Wolf,

Thanks for another great article. I want to ask 3 questions,

1) what is the monthly or quarterly interest outgo of the us government? I think we should add this figure to QT because the fed won’t be remitting this interest income as it is carrying a loss, isnt that correct?

2)Also how low do you see bank deposits+ REVERSE repos+before money starts getting drained out of the real economy? In other words how much of a cushion do we have?

3) Finally, regarding the liquidity spike in the fed’s balance sheet, following the last bank crisis a few months ago, how was this added to the market? Repos? How will it be drained?

Shah

Here is the answer to #3. Update coming tomorrow evening with the Fed’s new balance sheet figures:

https://wolfstreet.com/2023/07/06/feds-balance-sheet-drops-667-billion-from-peak-to-8-3-trillion-below-aug-2021-as-qt-continues-bank-panic-support-unwinds/

#1 gets covered separately here, by quarter. Updated article coming soon. With prior data, it was covered here:

https://wolfstreet.com/2023/05/29/update-on-the-us-governments-holy-moly-debt-interest-expense-and-tax-receipts-and-how-they-stack-up-against-gdp/

#2 reverse repos is covered here in detail, including the money market funds that stash their cash there and balances:

https://wolfstreet.com/2023/07/14/the-feds-liabilities-qt-pushed-down-reserves-rrps-by-865-billion-tga-gets-refilled-currency-in-circulation-hits-record/

Weren’t the credit agencies fraudulent during the financial crash? The fact they downgraded the US now speaks volumes and is likely coordinated by the powers that be.

Would be nice to see the actual volume and buyers of US treasuries from the SOMA account.

The Fed rolls over all its maturing T-bills (it has $268 billion in T-bills) unless its maturing notes and bonds are less than $60 billion a month, and then it lets T-bills roll off in the amounts to complete the $60 billion total roll-off. That has happened a couple of times. T-bills mature all the time, and so the Fed replaces them all the time. If more than $60 billion in notes and bonds mature, the Fed lets $60 billion roll off without replacement and replaces the amounts over $60 billion. You can see this activity in the auction results — “SOMA” purchases are listed.

It’s time to call Japan’s situation for what it is – another Weirmar Republic situation. With over 50% of its sovereign debt simply printed up and “loaned” to the government, this characterization of this 50% as “debt” is a veneer, a facade for pure “print and spend”. Since Japan owes the “debt” to itself, it could simply take all the sovereign debt held by the BoJ and toss it into the trash.

Print and spend is Weirmar Republic economics.