Core inflation “has not really moved down. It has not reacted much to our rate hikes. We’re going to have to keep at it.”

By Wolf Richter for WOLF STREET.

Renewed hawkish sentiments are building up at the Fed for the second half this year. That’s what we saw today. While the Fed kept rates steady today “to assess additional information and its implications for monetary policy,” the median projection in the FOMC’s infamous “dot plot” today calls for two more rate hikes this year, bringing the top of the range to 5.75%.

Of the 18 members, only two projected keeping rates the same, and 16 projected one or more rate hikes, going up all the way to one member projecting 1 full percentage point in hikes, according to the dot plot (my detailed discussion here).

Powell pointed at it right up front at the press conference in the prepared remarks: “Nearly all committee participants expect that it will be appropriate to raise interest rates somewhat further by the end of the year,” he said.

“Perhaps more restraint will be necessary than we had thought at the last meeting,” he said, pointing at the dot plot’s projections for core PCE inflation that moved up, for GDP growth that moved up, and for unemployment that moved down.

Forget rate cuts this year. Powell emphasized at the press conference that no committee member projected a rate cut on the dot plot: “I think as anyone can see, not a single person on the committee wrote down a rate cut this year, nor do I think it is at all likely to be appropriate if you think about it.” So he brushed that off the table entirely.

July would be a “live meeting,” Powell said twice at the post-meeting press conference, to make sure everyone got it, meaning the first of those rate hikes could happen at the next FOMC meeting in July.

In terms of pausing and then un-pausing, the Fed isn’t blazing any trails here. The Bank of Canada hiked last week after its pause since March, on resurging inflation fears; and the Reserve Bank of Australia, hiked for the second time since its pause, on inflation fears and surging labor costs without productivity gains. So maybe that’s the new pattern.

Powell said all kinds of worrisome stuff about inflation.

Core inflation “has not really moved down. It has not reacted much to our existing rate hikes. We’re going to have to keep at it,” he said.

“If you look at core PCE inflation over the last six months, you’re not seeing a lot of progress. It’s running at a level over 4.5%, far above our target and not really moving down. We want to see it moving down decisively, that’s all.”

“We don’t think we’re there with inflation yet… If you look at the full range of inflation data, particularly the core data, you just aren’t seeing a lot of progress over the last year,” he said.

“Headline inflation has come down materially, but we look at core as a better indicator of where inflation overall is going.”

“What we’d like to see is credible evidence that inflation is topping out and then getting it to come down.”

“We’re two-and-a-quarter years into this, and forecasters, including Fed forecasters, have consistently thought inflation was about to turn down and typically forecasted that it would, and been wrong.”

“Of course we are going to get inflation down to 2% over time. We want to do that with the minimum damage we can to the economy, of course. But we have to get inflation down to 2% and we will. And we just don’t see that yet.”

“Look at core inflation over the past six months, a year. You’re not seeing the kind of progress we want to see.”

“I still think, and my colleagues agree, that the risks to inflation are to the up side still.”

“Every year for the past three years, it [the median core PCE projection] has gone up over the course of the year. And it’s doing that again. We see that, and we see that inflation forecasts are coming in low again. And we see that it tells us that we need to do more.”

“We’re committed to getting inflation down. And that’s the number one thing. So that’s how I think about it.”

Why slow the pace of rate hikes on the way to the “destination?”

“It seems to us to make obvious sense to moderate our rate hikes as we got closer to our destination. The decision to consider not hiking at every meeting and to hold rates steady at this meeting is a continuation of that process.”

“The main issue that we’re focused on now is determining the extent of additional policy-firming that may be appropriate to return inflation to 2% over time.”

“So the pace of the increases and the ultimate level of increases are separate variables, given how far we have come.”

“It may make sense for rates to move higher, but at a more moderate pace.”

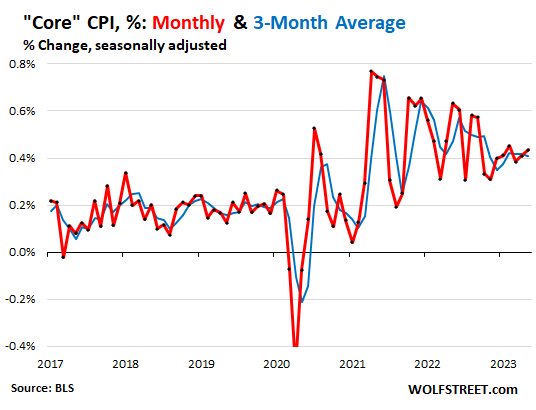

Here is what Powell was talking about in terms of core inflation not having moved down.

What Powell means: core inflation “has not really moved down.”

On a month-to-month basis, core CPI ticked up in April and May. The three-month average hasn’t moved down at all in seven months, running at an annualized rate of over 5%. Month-to-month, three-month-average, and six-month average measures are what Powell is referring to, not the year-over-year rates, which are skewed by the base effect.

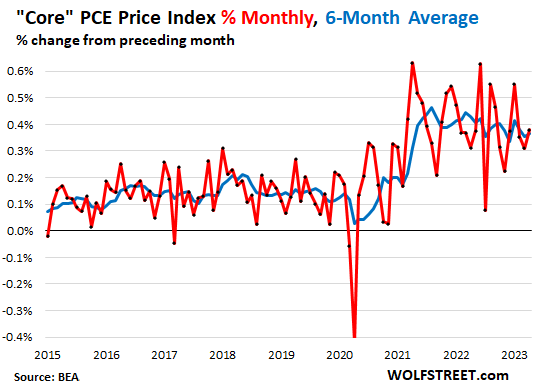

The month-to-month core PCE price index, and its six-month average, which Powell specifically referred to, also ticked up in April and is running at an annualized rate of 4.7%, roughly the same since July 2022:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Seems Wolf and J Pow have some sort of mind meld going on with this idea that inflation is stuck

🤣🧡

Maybe we’re both looking at the same data, no?

That would be a new development. You and the Fed must have been looking at different data in 2021.

Thank you for the excellent report Wolf.

The FED is playing catch-up. That is why we’re at where we’re at.

Wow! Send me a pic! 😘🤦♂️😉

Like Spock and the Horta — “Pain! Pain!”

If they both have the same mind then Powell would have hiked not paused.

And yet bond traders believe that “the fed decides when to lower rates, and the bond market decides when to lower them”, makes me wonder how much the bond traders trying to suppress rates is shielding the public from the effects of higher rates. Leaving consumers to spend like crazy and artificially support the stock market. I suspect the bond traders want to make the fed hike “too high” and cause a recession. Far better trading opportunities than a soft landing

Vulcans, perhaps?

Actions speak louder than words.

I tend to like organizations that have accountability. Did anyone hold Powell accountable for “Inflation is Transitory”? If they did, Powell would still be raising rates.

“I tend to like organizations that have accountability”

Are you familiar with the District of Columbia and our $32 trillion (acknowledged) federal debt?

Yeah. Put that pirate ship and it’s captain (or a facsimile) back in the center of that swamp where it can blow things up that need blowing up, until time is reversed for everyone…..do I have that right?

THAT was some REAL accountability we were cheated out of.

Why that pirate got totally infatuated by royalty, military parades, etc, is beyond me.

Would make any real Long John Silver types roll over in their grave.

That is, reversing time for everyone who COUNTS!

Which is now VERY EASILY determined by net worth and/or skin color.

BTW: I know all you Econ 101 geniuses here know it, but I just ran across an Econ concept called “POSITIONAL GOODS”, which sorta blows hell out of simplistic supply and demand, and is now rather important in explaining today’s situation.

You should all re-read it.

Inflation is stuck because Powell is afraid of killing the stock market by raising rates to the point needed to put a lid on the big companies’ stock prices.

As the last few days (and weeks) show, the investment community is laughing at Powell and the Fed. They are very aware that 5% interest rates aren’t nearly high enough to stop this inflationary spiral, largely now because much of this inflation is in stock prices. And the people at the top in these corporations own a huge amount of stock, so they want only more dividends and higher stock prices.

In addition, many other big investors in the market realize that they can make more money by buying stocks than they can by investing in short term interest-bearing accounts and T-Bills.

Again, the 5% interest rates are minuscule compared to what these big investors think they can make in the stock market…

Your site is the best and most concise source for analysis of Fed behaviour. Believe me, I look at others, but always come back here. You have a bead on their motivation! Thanks so much, Wolf.

That is the reason I donate.

Wouldn’t it be more effective to also accelerate QT given our government wants to spend us into oblivion despite runaway inflation?

AA, my thought exactly. If they really wanted to cool off the economy, I would think pulling a few trillion of “accommodation” out of the system would be more quickly effective than another 25 basis points in interest.

The entire ethos of DC can be summed up in seven words:

“Nobody pays kickbacks on money not spent.”

Agreed, I asked the same question and got no response.

Very simple explanation, I almost hesitate to have to clear this up for ya…..your w street creds and all…..

That’s because you asked laptops instead of boxes.

Could it have anything to do with QT being a joke 🤣

No, but QT has nothing to do with federal government spending.

Powell needs some new gag writers. Comes right out and tells everyone that we really suck at forecasting…but trust us now that we likely only need to hike twice more and all will be well once again.

Jerome must have failed his English courses as he obviously does not know the definition of the term ‘restrictive’.

The 12 member FOMC makes all policy decisions at the Federal Reserve by consensus and that has always been the case.

He calls his dovish monetary policy “hawkish”, and the crowd doesn’t even snicker, let alone boo.

This stupid stuff get old. The Fed raised by 5 percentage points in 15 months. And it’s not done.

I don’t think it’s done, either…

And Wolf, you commented that back in the early ’80s (the double recession) inflation was 4 times what it is now.

If you go back and look at the overall CPI then (a graph showing the percentage change in the CPI for each month), my interpretation of the data is that the inflation back then was only two or two and a half times what it is now, not four times.

So I suspect that we’re still facing a Fed Funds rate of 7 to 8% this round. But of course there are several economic and political variables that differ this time, plus we might be facing another “double recession”, one before the election and one after…

Is Powell following Volker’s script by any chance?

Volcker stopped raising rates before inflation peaked (two months in 1980 and three months in 1981) as the U.S. economy deteriorated, only to resume them in the early 1980s when rising inflation continued.

Not sure why Powell would do the same.

Yeah, but do you know just how high Volcker raised those rates? He wasn’t taking baby steps like Powell.

Inflation was about FOUR TIMES AS HIGH back then. And Volcker let them get that high first.

I always thought it was Arthur Burns that let inflation get out of control. Volker took the helm in August 1979 and by October he announced he was targeting low monetary growth and rates would go where the market took them.

Core CPI hit 11.9% in Feb 1975, then fell to the 6% range and stayed there until early early 1978. Then it rose. By Aug 1979, it was at 9.9%. It then rose to 13.6% by June 1980, dropped to 9.4% by Jun 1981, then spiked again to 11.8% in Sep 1981, before finally declining for good.

Andrew

I was William Miller who was Carter’s Fed chief that let inflation get out of control. He was a moron. His previous employment was as owner of a golf cart manufacturing company.

Wolf – isn’t this not using the same calculation as today? What is our inflation number if we used their methodology?

You CANNOT count inflation based on the basket of goods and services 40 years ago. The entire world has changed. Look at the cars we have today compared to the POS crap they sold in 1980! Smartphones didn’t exist. PCs were boat anchors with floppy drives. Broadband subscriptions? Streaming? Uber? Even healthcare. Forget it. Everything was different. So inflation indices are adjusted to the goods and services that are being purchased today. People that talk about the “Volcker CPI” need to open their eyes a little. They’re either clueless, or they’re trying to sell newsletters.

Not because of all the money MADE during Vietnam?

Borrowed from where I do not know, but the Reagan Handlers sure knew about borrowing to pay everything off and THEN some.

Remember “War is good business, invest your kids”?

Maybe you are too young or uneducated.

Wolf, Isn’t also true that the Fed has changed its metrics for measuring inflation since the late 70s and early 80s? If not mistaken, the implementation of hedonic indexing has significantly lowered today’s reported numbers. According to an article that I read awhile ago, if the Fed used the 1980 inflation metrics, today’s inflation would be around 8% to 9%. I recall past flaps over the Fed/BLS substituting hamburger for steak and compact cars for mid-size cars, etc.

Desert Dweller

“the Fed has changed its metrics for measuring inflation since the late 70s and early 80s?”

1. People need to quit spreading this nonsense.

The Fed does NOT produce the two fundamental inflation metrics we use. It USES those two inflation metrics that are produced government agencies:

— CPI is produced by the Bureau of Labor Statistics;

— PCE price index is produced by the Bureau of Economic Analysis (a version of it is used in “real’ GDP)

2. You CANNOT count inflation based on the basket of goods and services 40 years ago. The entire world has changed. Look at the cars we have today compared to the POS crap they sold in 1980! Smartphones didn’t exist. PCs were boat anchors with floppy drives. Broadband subscriptions? Streaming? Uber? Even healthcare. Forget it. Everything was different. So inflation indices are adjusted to the goods and services that are being purchased today. People that talk about the “Volcker CPI” are either clueless, or they’re trying to sell newsletters, or they believe the people trying to sell newsletters because it fits into their own narrative.

Disinformation.

Wolf: assuming SCOTUS, as expected, soon puts the kibosh on Biden’s student loan forgiveness plan, how material would you expect the impact to be, in terms of further reducing excess liquidity – and by implication aggregate demand – and how much might it contribute to the Fed’s ongoing effort to contain inflation?

Look, I’m going to believe that borrowers are making student loan payments when I see them making payments right in front of me. The White House has come up with all kinds tricks and devices over the years, and they’ll try to pull more of them, to somehow defer this further and exempt big groups, etc.

Once borrowers — and more than just a few — are ACTUALLY making payments again, then I’m going to think about what it means. There is already a lot of targeted student loan forgiveness going on.

With due respect, this is a done deal, part of the debt limit negotiations, passed by Congress, signed by POTUS, people will be paying this fall starting in October.

And unless SCOTUS rules completely counter to expectations, there will be no large scale forgiveness. This is a huge deal for the economy. Basically the reverse of the windfall of the last 3 years.

What about a Congressional order revising the bankruptcy laws to allow students to file for bankruptcy to discharge all the loan obligations.

Whoa, easy there. What are you, a socialist? /s

Loans will come back. So many here act like most with student loans are art history or gender studies majors, when tuition was so jacked up so high in the 00’s it wasn’t possible for a typical low wage college McWorker to attend any college level program without loans and/or heavy family support. A few students in my nursing program were caught living in their cars trying to limit their borrowing for a freaking community college. Even the PSLF forgiveness programs for public servants (which, for some reason, some people still consider a handout) doesn’t apply to every worker in those professions, not most I’d venture to say. Poverty wages that few could afford to work for unless they were still living rent free at home, and working in that setting is often akin to dangling your professional license over a flame. Teachers making $40k still needed Masters degrees (no financial aide for those). Hence the public service incentive came to be, and was a joke in execution anyway.

My initial balance of $15k of nursing loans paid down to around $11k became $40k+, I had to defer initially due to graduating in a bad market (GFC) and defaulted over the difference of a few months’ payments again during a time of extreme hardship (DV divorce, left homeless with two infants on my maternity leave- we’re all good now) but what did it was the servicers up and selling my loans to other servicers who each tacked on $10k administrative fees.

Student loans are a bad contract slid under the noses of high school graduates. They were making a ton of money off them, particularly since they can’t be discharged in bankruptcy, and they will continue to do so. I have no sympathy for the bellyaching over a 3 year pause nor complaining about any effort to reform the loan system. More than a few servicers got out of dodge for a reason.

A $10-20k reduction means nothing to me, and I likely won’t see it anyway. I anticipate they’ll get a good $80k-100k out of me with a balance remaining by the time I kick off.

As far as material effect, anecdotally, driving around my neighborhood a lot of neighbors started selling their cars, boats, RVs, vans this week. Good weather/summer sales of course, but awful lot of unloading going on suddenly and literally the day after the repayment date was set. I welcome the return of payments, its budgeted in and I know they’ll never truly go away, but they may help bring down rents and maybe even houses. Maybe not, but something’s gotta give.

A perfect example of trickle up economics. Get them in debt early in life and make them pay until they go to the grave. The only thing worse is getting the under 18 into the medical / pharmaceutical cult early and milk them over a lifetime.

Don’t forget that the Fed is a cartel of private banks and will always make sure that they are masters of the financial universe for the one percent.

Another fun thing I learned about the early 00’s college finance racket… so, unless you were legally emancipated from your custodial parents, you can’t get financial aid without entering your parents’ income on the FAFSA, because your parents are considered legally supporting you in some way until 21, even if they weren’t contributing a dime. Which means if you are a young adult pulling it together after leaving a dumpster fire of a family, your only other option if you didn’t secure scholarships (which, given what it takes to get scholarships, is likely) was to, you guessed it, finance through student loans. And so, you were likely gonna max out what you could borrow as its got mighty expensive to pay rent & transportation, work a low wage job, and go to school. Back then, you covered your own healthcare too, and health insurance was mandatory if you entered an allied health program. If you were uninsured, no worries, the college will sell you an outrageously expensive skeleton insurance plan. Nowa days, kids are covered by parents up to age 26.

The finer details are inconvenient and tedious for the average armchair blowhard, but the math added up to a lot of young adults getting saddled with a lifetime of debt just for trying to improve themselves. And then have their noses rubbed in it later. ‘Murica.

Excellent post — thank you

wow i was unaware of the loan servicer racket … $10k admin fees … way out of proportion to the original loan amount. just criminal. are these PE companies?

Contracted federal loan servicers. Memory is a bit clouded but Great Lakes was one.

Should probably also mention, at least in the SUNY system students are/were forced to live on-campus the first 2-3 years (I forget which) in outrageously expensive dorms, and a dining hall meal plan was mandatory even if you didn’t want it. Cheapest meal plan was over $1k/semester and the food was absolute garbage. Books didn’t come in bootlegged PDFs back then either, don’t ask what they cost just know you’d be lucky to get $10 back for them end of the semester.

Universities and colleges should be funding, making, and administering student loans. Banks also if they want to get in on it, which i doubt. Definitely not taxpayers. Another stupid government program.

I seem to remember the asking for loans to rub my nose in it also. Needed the cash for the nose studying.

Wait sorry you are talking about something else. Excuse me

Why are the 3 years that moved inflation up 20% disregarded?

2% is the goal?

The Fed has bubbled 14% off their trend of 2% annual rate. (3 Xs 2%=6.. We got 20%.)

Getting things back on the Fed’s “track” demands price rollbacks (disinflation), yet we hear no effort for that. Why?

price rollbacks are deflation, not disinflation. Disinflation is still inflation, just a little less.

You don’t need deflation. 0% inflation for next 6 years would mean inflation averages 2% this decade.

But although this is the Feds official goal they haven’t mentioned it for two years and no one ever calls them out on it or asks questions about it.

I would be delighted if their goal was 0% for 6 years……

but it is not, is it?

Which basically means that the 2% is a lie. Because during crisis (real or perceived), they’ll print like crazy and way overshoot 2%. But they won’t target undershooting 2% or deflation to compensate, so the real 2% average is more like 4-6%.

The 2% inflation is a lie, and everybody knows it. This is why the main holders of long-term bonds are banks, pension funds, insurance companies, and other institutions that will likely get a taxpayer bailout when things turn dire.

No individual in his right mind would buy a 3.5% treasury when inflation is set to run 4-8% as far as the eye can see.

Long-term bondholders just got whacked in the head with a 30-40% price drop. There’s a lot more of that to come, especially when the next fiscal helicopter drop occurs.

Talk tough but don’t do anything; just wait until July! We’re serious! Just look at our dot plots! Does Powell have his Phd in marketing?

Monetary policy might be at neutral; fiscal policy is highly stimulative; the Fed’s balance sheet remains bloated; unemployment is at generational lows; and the markets clearly would have handled 25 basis points without any whining. 50 basis points today would have demonstrated some backbone at the Fed; instead it paused-skipped. The Fed will declare victory when the PCE measure it favors hits 3.9% and absolutely no one on Wall Street or in Government will complain.

Rate cuts will follow at the first sign of any material wobble in the economy or external stressor. Fed policy has been asymmetrical in favor of easy money for a long time and it isn’t going to change. Because the federal debt to GDP ratio will be reduced by letting inflation run warm to hot, inflation will soon be seen as fiscally responsible. Wait for The Narrative to start beating that drum; it’s inevitable.

The federalreserve web site has a contact page to submit comments to the board of governors. May or may not help, but it doesn’t hurt to write..

It’s not the Fed that one has to write to. It’s the Congressmen.

both

2 decades of QE created a populace that expects easy money.

What these rate hikes need to do is destroy a chunk illusionary wealth that the 1% acquired.

After all QE only benefited the very few at the expense of the many.

Hey Wolf why do many of these people still have their jobs?

These current challenges were very clear years ago yet they proceeded on full throttle.

I have absolutely no faith in whomever runs our monetary system and haven’t for decades .

My guess is when you do a once in 200 year central bank free money policy, you are going to get a really, really catastrophic unwind. How could you possibly get a good outcome?

Wolf I love your podcasts yet you haven’t done one in quite some time.

I hope you consider putting out more episodes maybe 1x month ?

I would love 2x month but even every month would be great.

Thanks for your work , it’s appreciated

Google stopped promoting podcasts on YouTube. It’s now all about videos, where it makes more money on advertising. They announced this a year ago or so. So my podcasts disappear, and only people who go directly to them see them, and it killed the traffic to them.

I post the YouTube version on my site and some people listen to them, but most readers here just wait for the transcript, and some people get them because they subscribe to my YouTube channel, and some of them get shared, but that’s about it. So on YouTube, those podcast only get about 6,000 to 8,000 listens, plus they get a few thousand more on the regular podcast channels, and that’s just not a lot, for how much work they are, and for how big my site traffic is.

We all live and die by Google.

And when I post them on my site, all I do is promote YouTube, and YouTube doesn’t do anything for me anymore.

I’ll still do a few every now and then, when I’m in the mood and have some time.

I somehow have the RSS and plugged that into MediaMonkey. No even sure where I got the RSS, sometimes they are pretty hard to find these days. I am a millennial but some of the podcast infrastructure just plain worked better as it was built, before spotify etc.

So you probably are getting NO revenue from that. Sorry, I did not even think about that. Why not include an advertisement or 2? Does that help at all?

Can you start doing live broadcasts on Instagram?

Spotify heavily promotes podcasts since they dont pay royalties on them. If you just want listeners that get steered towards the site and not ad revenue, may be worth considering.

Actions speak louder than words. Especially when it is Fedspeak.

Powell is bluffing. They can’t raise the rates cuz it’ll break the banks, also he really wants a soft landing.

I think he is done as well. If you just round off that policy works with a 1 year lag then economy is just now digesting about 2% of the fund rates.

Banks are already tightening lending standards and many are insolvent except they are using phony hold to maturity accounting with a skittish deposit base.. Leading indicators negative for about a year. Stock market breadth is narrow. Inverted curve yield curve.

In general, money managers don’t spend much time worrying about long tail risk, as they hope to be rich before one comes along.

It’s amazing how Powell is back to his “disinflation” talk after 6 months where core inflation has not moved. At this rate we might never see 2% in POW POW’s remaining life term.

More likely he already knows that more than one bank and non-financial institution is at the brink: read here, JP Morgan.

That’s dumb nonsense. Where did you get this BS from? What moronic fiction website or drugged-out Twitterer put this stuff out?

Powell was ASKED by the Reuters reporter where “disinflation” was supposed to come from, given that all the inflationary pressures are rising. And Powell had to reply to it.

This was the reporter’s question:

“It feels like there’s been a level shift in the dots. Stronger GDP, less of a hit to employment, slower progress on inflation. Where’s the disinflation coming from? The labor market is going to be stronger. It’s not coming from there. Demand is not coming down that fast according to GDP. You’ve doubled your estimate of GDP. What’s the narrative?”

And Powell had to reply to that “Where’s the disinflation coming from” question.

And that was the ONLY occurrence of “disinflation” — and it was pushed by a reporter.

BTW:

“Disinflation” = declining rate of inflation. So going from 9% inflation to 8% inflation is “disinflation,” meaning a little less inflation.

“Deflation” = negative rate of inflation. So if annual CPI = -3%, that would be “deflation.”

Disinflation is a propaganda word made up by the FED.

BS. Look it up in a dictionary. Random House Webster’s traces the origin back to 1875, about 35 years before the Fed was established.

Robert Kaplan former Pres of Dallas Fed gave an interview 2 days ago on Blockworks Macro:

– admitted openly that the Fed monetized government Covid programs in 2020

– fiscal policy (stimulative) is clashing with monetary tightening

– there’s still loads of Covid money from the Feds sitting in state and local government accounts, that must be spent by 2025

– no recession until ’24-’25, due to the above

– low wage workers in a wage-prices spiral which will show in CPI because they spend most of their income, and they are affected the most by inflation!

– housing market stuck

– the banks are not okay!

The Fed and the government are literally locked in a battle over inflation. The Fed is politically and by law subservient, so in the end they will lose.

For now, we’ll play Higherer for Longerer, might even see a bit of deflation if something cracks, before they restart the printer.

The situation is completely opposite to say 2012 when we had fiscal ‘austerity’ and the Fed stimulated. The outcome may also be opposite – higher inflation, lower asset prices.

I cannot figure out the housing market. Lennar reported after the bell. Their revenue is down but they sold more homes Last year they were selling homes for an average of $500k and now it is $449k. So revenue is is down but the stock is higher than last year on less revenue. I guess it is because they have an increase in orders? Of course, the stock is up after hours.

————————–

Mr. Miller continued, “Against this backdrop, our second quarter earnings were $872 million, or $3.01 per diluted share, compared to $1.3 billion, or $4.49 per diluted share last year. This quarter’s results reflect the execution of our previously articulated operating strategies of pricing to market and meeting demand with affordable pricing and incentives. Accordingly, while our average sales price per home delivered was $449,000 in the second quarter, compared to almost $500,000 at the peak last year, our home deliveries were 17,074, up 3%, and our new orders were 17,885, up 1%, year over year

Horton just sold 4,000 mostly not-yet-completed homes to a big landlord. Those are huge sales numbers, but they don’t sell them at retail prices, and they use cheaper finishes, etc. So more homes, smaller amounts per home.

I just read the local news and some company is going to build a 400-house subdivision that will be all rentals. I think that is still a trend. Those houses never show up in the mls for-sale inventory and skews the for sale inventory numbers lower. Just guessing.

Things don’t make much sense at the end of a bubble. As Buffet says it feels best, right before its over. I think that is where we are with housing. Using fundamentals as a value investor should, the buy vs. rent ratio is the worst ever.

Rbt Kaplan….the guy caught front running Fed policy?

In that same interview Kaplan said we needed population growth to increase GDP.

Has real growth been completely abandoned?

No more living standard rises? Companies are fully efficient?

Hams up whose had a real job and thinks their company was efficient!

These suits are the worst.

In my immediate experience, wages aren’t causing inflation; its PE/Corporate-driven greedflation. In my industry (consulting) wages are going down. At my firm, and at competitors, almost everyone got hosed on 2023 bonuses and there have been substantial layoffs – particularly as overlords wake up to how AI can replace whiny analysts. Meanwhile, we took 20% price increases last year, and are under orders to take another 10% this year. We’re now private-Equity owned, so could be the mysterious boys behind the curtain are facing debt squeezes from variable interest rates or something. One of the midwestern Feds (Dallas? Minneapolis?) put out a paper 6 months ago about corporate profiteering driving inflation, and its completely consistent with my experience in the trenches…

I would say a corporation has a duty to optimize profit margins or they should be chartered as another type of organization. The real problem was the government dropped too much money, so people got sloppy on being price conscious. Oner peoples money spends easily.

Waited years for interest rates to return to a normal. THEY caused long term damage with the latest bubbles THEY created. If you are frustrated with the FED and Government, just wait a few years more…..

Certainly respect this work and the comments. However, still am puzzled looking at this without any conspiracy theories. What we know:

1. Powell said that he is going to be data driven and previous article said 7 months inflation is the same, stagnate or a little worse.

2. Power said he us watching small banks ($250 billion max) apparently those with commercial MBS or maybe corporate bonds.

3. The large too big to fail banks supposedly cannot merge with other banks unless it is a rescue like Dimon did.

4. Accounting rules are not Mark to Market, but held until maturity.

5. Doing some form of QT and perhaps putting more bank rescue money (as recently done) on the balance sheet doesn’t have “hood optics.”

6. Bank failures have “bad optics.”

7. The statement fastest raise in interest rates in 40 years true, but misses Volcker rate of increase to battle inflation we haven’t seen since the 1979, 1980… The calculation of inflation today produces a lower result than Volcker’s time.

Puzzle: With all the above Powell has had months to see their results, none are to be seen except energy and yet he pauses a very small 0.25% with only 6 weeks to the next FOMC, unlikely there is wonderful lag clarity in that time.

Question: Might Powell be taking these 6 weeks to organize, loan money to, or arrange big bank rescues not visible to the financial world. Such as loans that don’t have to be disclosed for 2 years with Dodd Frank rules, etc. Perhaps different “tools” or programs either all USA or perhaps international?

Seems unlikely that Powell has decided to just take a “time out” with the entire world’s attention (world reserve currency), huge percentages of low income Americans struggling, and everybody’s wealth eroding.

Good article that stayed true to the facts which I’m not constrained by. As far as an honest critique of the Fed for a journalist like yourself it is impossible. That is why the silicon valley morons stumbled upon the comment section.

My personal opinion is the Fed made a mistake today by not raising the FFR by 25 bpt; Confirming that they are wall street’s bitch.

That fed decision was the first time I’ve seen them panic and show fear.

This fed meeting was designed to protect the dollar.

Inflation is not coming down with trillions of new debt about to hit the market, and few international buyers.

Nice quotes from Chairman Powell. Hawkish. So, uh, why the pause? Is this a “look at what I say, not what I do”, or “look at what I do, not at what I say”?

BTW, you’re graphs would look even more beautiful if you smoothed them using a three month “centered” moving average. This just moves your blue line one month to the left. I use centered moving averages all the time in my publications. Most software plots the moving average the way you do, which i think is called either a leading or lagging moving average (I forgot which).

“So, uh, why the pause?”

READ THE ARTICLE

I read it, I was looking for a legitimate reason for the pause. I didn’t find one in it. I didn’t hear one in his press conference. The best I could come up with is something like “We are going to pause because we think it is a good idea to pause.” I guess some people buy this kind of stuff.

THEY are slowly getting to double digit interest rates?

Because they don’t want inconvenience Wall Street gamblers. Message sent and message absolutely received.

They should have hiked 25bps but paused

It only shows for whom they work for.

I can assure you no hike coming in coming months

They would work with government to manipulate the metrics so that they can show dis inflation.

If Powell was really serious and convinced about core cpe being stubborn then he would have raised a nominal 25bps.

It is a red flag that the Fed’s plan is too inflate the currency too the point that today’s absurd prices seem normal. Us insignificant population don’t even notice what’s going on.

Did Powell say anything about housing?

Mostly related to rents.

Never mind what he said.

Did Powell do anything about housing?

Yes, he bought MBS, outside his mandate, to prop it up.

Having experienced 21000 sunrises, it occurs to me that we tend to take it all not seriously enough

“All the real talent gets siphoned off into the Arts and Sciences, and that leaves the dregs to put it all together”

-Bucky Fuller

“Of course we are going to get inflation down to 2% over time. ”

—————————————————

Which still allows the larcenous cabal to continue their favor for the wealthy class at the expense of those below.

In my mind, love is the only ingredient that makes it all worth while.

Pure, by definition.

…you took more of that stuff again, didn’t you

“Core inflation “has not really moved down. It has not reacted much to our existing rate hikes. We’re going to have to keep at it,” he said.

“If you look at core PCE inflation over the last six months, you’re not seeing a lot of progress. It’s running at a level over 4.5%, far above our target and not really moving down. We want to see it moving down decisively, that’s all.”

“We don’t think we’re there with inflation yet… If you look at the full range of inflation data, particularly the core data, you just aren’t seeing a lot of progress over the last year,” he said.”

So, naturally, pausing rate hikes will certainly do it. This guy is a clown with a capital C. Spins a lot of BS.

It’s interesting how the Fed says it will reach its 2% target, but it doesn’t commit to when that will happen. This leaves open the possibility, or likelihood, that inflation will run 4-6% for a LONG time.

We just saw one 20% drop in the dollar’s purchasing power in a short three year window. It looks like we are set to lose another 15% in the 2023 to 2026 period. We’re on track for a 35-50% loss in a decade.

Also, it’s unusual we don’t hear any commenters asking how the Fed can meet its average 2% inflation target when we’ve run 14% above that target the last three years. Isn’t a period of deflation in order? If the Fed doesn’t have the balls to reverse runaway inflation, why did it establish an average 2% target to begin with?

Based on its actions, the Fed is comfortable with spurts of excess inflation that bring cumulative inflation well above the 2% target. Nobody wants to talk about it though.

As long as housing inventory remains low, inflation will remain high. Housing is an inelastic need. People will demand higher wages; They certainly won’t stop needing housing. Construction is not going to solve the inventory problem, since hard assets are the best hedge against inflation. To increase inventory, there will need to be a change in tax policy that makes Single Family Residences unattractive to investors (e.g. phase out depreciation and other investor friendly tax breaks). Muliti-family is clearly meant to be owned and operated by investors, so no need to change tax policy there. Tax changes that increase SFR inventory, and thus overall inventory, would depress rents for everyone.

I live in Florida. Florida has a lot of buildable land, just not where people want to live. Folks want to live on the coasts. That’s where the beaches are, the population, cultural activities, restaurants, etc… Inland, it is just hot and swampy. Lots of cows and mosquitos. My point is that there is not enough land on the coasts to put up enough SFRs to make a sizeable dent in prices in Florida anymore. Some counties are completely built out, you have to tear something down to put something up. And that’s incredibly expensive.

That’s not true. Orlando, Ocala, the Villages are all inland, and very built up, not to mention that many of the areas on the coast are relatively unbuilt (like up near Port St. Lucie, Vero Beach, Melbourne, etc.).

I think there’s just a sense that Florida is growing too fast.

Why not build some houses on the shores of Lake Okeechobee? Advertising them on Realtor Web sites in the Winter in Illinois etc.

Single family residences are already unattractive to investors if they are severely overpaying relatively to rents, due to upkeep taxes, taxes, etc. I’m already seeing that in many places, including in Florida.

They’re only not selling because they’re convinced the pivot is coming.

Love, like all the attributes of human emotion is normally distributed whereby the average is the current favorite.

A person walks into a room of 1000 people with a talent that is one standard deviation from the mean. They have a probability of interacting with 360 of the people in that room.

Now if the same human being with a talent that is two standard from the mean walks into a room of one thousand people they face the odds that only 3 people among the 1000 gathered would understand your thought process.

What

Three standard deviations result in the 3 people odds, but you should probably cut that number in half to capture just one tail. Bottom line, it’s easy not to fit in if you are not part of the Borg.

I got a kick out of the lady that said, “I drink to make other people interesting”.

“Core inflation “has not really moved down. It has not reacted much to our existing rate hikes. ”

Yes, Jay. That’s because

1. There’s still waaaay too much “Money” from”Da good Times” out there

2. The system you created was made to produce even more of it constantly, so that’s what it does

3. The real economy is dead because you killed it so nobody makes stuff any more

You could

1. Speed up QT to destroy more of (1.) At a quicker pace

2. Let some of the banks you “regulate” (har har har) go bust instead of “saving” them all the time which would take care of (2.)

3. Stop paying 5% interest on cash for nothing which would at least make the impression of doing something about (3)

But we both know you won’t. And that’s why it’s all BS.

Your #3 is BS and contradicts some of your other points.

There’s a lot of businesses that are doing just fine with profit margins less than 5%. With the Fed paying 5% risk-free RRP, they’re dead.

If one of those companies takes out a loan they do not need to make more in profit then the fed RRP to benefit from it.

They take out a loan to for example replace machinery. For that to be profitable all that is needed is that the the TCO (which if calculated correctly includes the loan) for the new machinery to be less then the TCO of the old machinery.

If that calculation comes out negative (that is TCO of the new machinery is worse then the TCO of the old machinery) they don’t replace.

Meanwhile they keep making a profit in contradiction to your claim that they are dead. It is just that the profit margin won’t be as good as when they’d take that loan.

Walt Disney World make believe production by the Federal Reserve continues, it’s like choosing to take month vacation or quiet quitting on the job. The circus clowns at the Fed are under pressure, the good old days of leading and lagging indicators not clear enough in crystal ball, besides US economy Is Too Big too Fail.

Inflation is sticky alright! Got told to get some pre sliced Tasty cheese for the mid day sandwiches. I have brought the same 12 slice 250g packet for 20 years. Today it was 210g (16 % shrinkflation) but it was on a “week only” temporary special at 10% off RRP.

This is never inflation is NEVER measured and it is criminal that it is allowed.

Angry ?…. a little !.. actions ?.. paid for it !.. Future actions … “Bud lighted” the brand including its butter milk and cream.

I am only one but that’s a Yearly is $2500 off their bottom line as their are still a lot of 250g Cheese, milk, butter and cream businesses out there who haven’t raised or shrunk.

So true. A lot of things are in smaller packages and very few people noticed it. My daughter loves ice-cream. A few years back, all the packages suddenly shrink by 20% but the price still the same. Now, we all just forgot about it and just pay.

Dairy prices have been plunging all year long. As to cheese, why don’t you try real cheese such as Sargento, as opposed to that low-quality processed stuff which is only about 50% real cheese?

“This is never inflation is NEVER measured”

Nonsense. Prices of food, gasoline, etc. in the inflation basket don’t go by package but by quantity. Liter of gasoline, grams or kg of beef, cheese, apples, etc. Always has.

Shrinkflation, as this is called, is fully accounted for in the inflation indices.

Walmart one pound cheddar bricks are cheap and surprisingly good where I live. The bigger point is we have to fight back against the brands that are obviously trying to screw us. The Bud Light boycott was a wake up call to the corporations. Consumers need to be smart and they need to be active. Shop around. Be willing to change some of your consumption habits.

We need a new vacuum,shopped wal- mart,Home Depot and Menards , Menards Wade cheapest,Home Depot was next ,then wal- mart was highest . They have sold there bullshit lie of cheapest prices for 2 long

Words: we need to raise more

Actions: doesn’t raise more

Unfortunately I only deal in the currency of actions.

Yeah, speak loudly and carry a small stick LOL

Rightly said 😀

Powell is employing the Dean Smith (RIP) ‘four corners offense’ approach for fighting inflation.

Powell and his committee projected a Fed Fund rate of 4.6% at the end of 2024.

Why is this not being discussed?

I might discuss it. The projected rate for the end of 2024 has been raised with every SEP since late 2021. In Dec 2021, it was 2.1%. And it keeps getting raised. At this pace, it will be over 5% in about three more SEPs.

I think this is a very important point that people tend to forget.

This means that the whole inflation fighting will last a lot longer,

keeping rates up high. Banks that are hoping the rate drop in

a year or so now have to face a new reality.

Companies that use debt to finance their survival will be in a tougher time getting the funding they need.

Can’t believe it but the market is popping up like mad and leading the way are the Zombie-stocks.

It means no such thing. Look at where the Fed was projecting rates to be right now in 2021, they can’t predict the future any more than anyone can. If the economy tanks, or even if a few more banks fail, these projections are meaningless. Maybe you can say something about what they will do in July, but everything depends on the status quo continuing indefinitely, which it never ever does.

Sometimes I wonder if Jpow & co are doing this intentionally, in order to not freak out the bond market. They don’t want yields to spike and prices to crash.

Bernanke’s “WEALTH EFFECT” has been denigrated.

This is really interestings time because there are many different outlooks now, some people say fed is done and some people say will continue hiking.

We are really at a crossroads. I think when the summer is over and energy prices start going up again, and the market gets smacked in the face, the picture will be a lot clearer with what’s going on. It’s only 2 months out. I mean what we’re seeing in the markets now should be proof that inflation destroys peoples IQ, everybody is on their heroine trip again and think the problems are solved.

The problems are not solved, nobody has even tried to start fixing the problems, and that’s why the problems are going to get worse.

Oil could well be headed to negative $33 per barrel again as the massive deflationary wave continues and intensifies.

I wish.

-$33 sure would be awesome for re-filling the SPR! The Biden admin would become the greatest oil trader of all time.

Oil never sold at negative.

There was a specific type of contract that due to circumstances dropped in the negatives (WTI still traded at over $50 so even included the price drop of the contract that oil was worth at least $13 per barrel).

What happened is that the type of contract in question requires taking physical ownership of the oil at the date specified in the contract. Then due to a combination of COVID reducing demand, fraccing producing an unanticipated increase in supply, and the Saudis dropping by with multiple supertankers of free oil there was no storage space to take physical ownership of the oil.

The result was a mass dumping of these contracts since even paying others to buy them was cheaper then either the penalties for breaking the contract, the insane premiums asked for remaining storage, getting others to sell access to storage they had already reserved, or getting others to vacate their storage.

At no point during the whole process did the price of WTI go negative. The buyers of the contracts still had to honor them at the price in the contract, prices in new contracts are based on the price of WTI not what people were/are paying for contracts and the price of WTI was not influenced by the panic sales due to a temporary storage shortage.

What will the pivot mongers do now?

Monger for a pivot in 2025?

QT, $95b per month, is still in force.

It hasn’t hit $95B since its inception.

Not enough MBS rolloff

“95b per month”

LOL, look at how slowly the MBS (which they never should have bought) is trickling off the balance sheet. Apparently hundred of Fed staffers with their expensive educations and sophisticated econometric models didn’t realize that when you slam mortgage rates to the floor for two years and then raise them to anywhere near a normal rate, refis and sales freeze up.

The Fed must have known that any pause – regardless of how hawkish their dot plots/projections/rhetoric was – would pass through the MSM prism as “inflation is over”.

It’s a big problem. I have a first row seat to the resulting dissonance and it’s bad. Really bad. The still strong labor market is largely a result of leaders watching/reading some MSM “inflation is over” article and betting out of desperation that things will go back to how it was 2 years ago. It’s like watching a gambler put the remaining money left on a bet to chase their loses and try win their money back.

Companies are hiring off a cliff. Underlying revenue and business metrics are terrible. I’m seeing the start of many people who who were let go and reabsorbed into labor market being let go again after only a month or two. The laggards that were keeping the metrics strong are starting to learn the reality. And many people will have less than a year tenure at their last 2-3 jobs and now have no where to go in the coming months.

I think there is something to that. Some people think the deterioration of the job market and the larger economy happens gradually. In my experience, it doesn’t. No one wants to appear “weak” to the market by doing layoffs, so they pretend that all is well until there is a critical mass of OTHER companies doing layoffs that gives them the optics they need to.

I think we’re in that stage where everyone still acts as though everything is fine, but deep down has that nagging feeling that it is not.

The USA is to continue to spend a large budget deficit. On weapons, war, corporate hand outs, pensions and other governmental spendings. Those money create demand for goods and labor.

There will be more monetary inflation with following price hikes untill this comes to a stop.

How high would inflation be if Biden

hadn’t drained the SPR ? The pause was

only to assist the banking system.

It would have had little impact on core PCE and core CPI since they exclude energy. The Fed looks at core measures and bases its rate policies on core measures.

BTW, the SPR was designed to deal with periods of supply squeezes, and so to sell part of the stockpile during a huge global price spike and supply squeeze made sense in two ways: it killed the supply squeeze, and it was profitable: sell high, buy low. Lots of investors did that too. It made the taxpayer a lot of money.

Hmmm… Not sure where to put this comment so I will put it here. Wolf, what do you think of the argument that nearly all of the “professional” economists are making that housing inflation is “a near certainty” to drop in the second half of this year?

https://www.cnbc.com/2023/06/14/housing-inflation-will-almost-surely-fall-soon-say-economists.html?qsearchterm=housing

1. Current rent inflation, month-to-month annualized last three months (March – May), renewals and lease signings, have been in the 6% to 7% range, per CPI rent and OER.

2. This 6% to 7% increase is confirmed by what the largest landlords in the US have reported in their earnings calls that they’re getting at the beginning of Q2.

3. So that’s down from the yoy 8-9% currently, but it’s still way above where the Fed and economists think this is going.

4. The Zillow ZORI, which is based on asking rents has started surging again (6%+ annualized in April and May), after actually falling late last year and early this year. So that’s not helpful either.

5. I think the hopes of rent inflation going to 2% or whatever are going to be crushed.

https://wolfstreet.com/2023/06/13/for-7-months-core-cpi-hasnt-improved-at-all-stuck-at-2-5x-fed-target-services-cpi-accelerates-rents-not-playing-along-used-vehicle-cpi-spikes-but-energy-plunged/

https://wolfstreet.com/2023/05/22/rent-inflation-re-accelerates-to-red-hot-all-three-now-agree-zillow-asking-rents-what-big-landlords-said-and-actual-rents-tracked-by-cpi/

Thanks. My opinion is that I wouldn’t be staking my reputation on ANYTHING being “near certain” when it comes to inflation. Inflation is like a hurricane or a tornado… a Force of Nature that abides by its own rules… and not what you think the rules ought to be.

Whatever the Fed does in July, I predict with certainty that they will not raise in August. Inflation still burns while bankers go on vacation…

1. Correct. There is no meeting in August. The next meeting after July is in September.

2. On a more serious note: What Powell said leads me to think that they’re going back to the hike pattern in 2017/2018: hike at one meeting, pause at the next, hike, pause, hike… four hikes of 25 basis points per a year. higher for longer.

Wolf:

Instead of calling core inflation, core without food etc., perhaps we should just have two categories: Domestic inflation and Foreign or imported inflation. This will give us a sense of where we are and where we are going or have been going. We as a nation are helped by those abroad working their tails off or selling their ever diminishing natural resources (think how long it would have taken for the fossil fuels to form and how fast we are depleting) for quick ruling family’s profits, or sending their precious produce to us while the common person on the streets starve. All because of the reserve status of dollar, our military power and our control of the printing press.

This set of number would also tell us how difficult de-globalization would be (I am not saying we should not do that; that is a different topic) and what kind of sacrifices we may have to make.

We do track import price changes. But not as part of CPI. Lots of imports are raw materials and components that eventually make their way into consumer products.

More importantly, services are two-thirds of consumer spending, and inflation is now in services; and they’re not heavily impacted by imports.

1) Carter and Volcker “beat” inflation. They fought the invincible unions

by sending work to China. They legalized buybacks in 1978. They transferred power from labor to mgt. In the next 40 years real wages sank, while executives salaries, bonuses and perks exploded in real terms.

2) QQQ is up 72% of the move from Nov 2021 peak to Oct 2022 low.

AAPL and NVDA made a new all time high.

3) The banks lent 7 figures mortgages to high tech executives to buy 1M/5M homes. The banks might cash in, sell their QQQ collateral.

4) If QQQ will turn down the wealthy people might park their money in the “safest vault” in the world. There will be no need to raise rates twice to 6%.

5) Number #2 explosion will be cleaned despite the crying.

Correction on #1, large scale trade with China didn’t really start until the 90s. Substitute Japan for China, and I agree somewhat.

Rate increases are only a tool to bring on a recession, it will be the deflationary forces generated by a recession that will finally kill the inflation.

CNN published an article saying that the average 401(k) is now above $112,000. This relatively low amount should lay to rest the ridiculous argument that a bubbled stock market benefits the average American. It doesn’t. Any “gains” in that $112,000 has been more than wiped out by massive increases in the cost of living.

A QE-fueled stock bubble benefits the wealthy, and the wealthy one. There is no reasonable debate.

Yep. Really less than 50% of the population owns a stocks and I would guess the number is not much better for 401k participation. So yes, stock markets bubbles really only help the top 20% in my mind. The top 1% really benefit a lot. Now reverse that and a stock market crash really does not hurt the bottom 50%. LOL

Now on to the housing bubble. The housing bubble has helped increase the wealth of anyone owning a home. 65% of households own a home…so that is good for them. A much broader demographics own home. Not good for those who do not own a home.

I know some people in their late 50s close to retirement who have very little in their 401k who saw their homes appreciate by 200k to 300k in just the past 4 years. Now they have a rainy day fund. LOL

I think the FED thinks it can weather a stock market crash and we did see a 20% drop last year. Not that many people really were hurt the drop in stocks. The FED does not want a housing crash. That hurts 65% of families.

I think they would like housing to drop a little or flatten out but they do not want a housing crash.

Right, it hurts 65% of families, but it benefits the 35% that don’t own a home. That extra $200k-$300k in “rainy day fund” came at the expense of people in their 20s and 30s who want to buy a house. It’s not new money, it’s just an intergenerational wealth transfer.

This ^

A house doesn’t appreciate in “value”; what you see is the dollar losing its value.

” know some people in their late 50s close to retirement who have very little in their 401k who saw their homes appreciate by 200k to 300k in just the past 4 years. Now they have a rainy day fund. LOL ”

LOL indeed. Why should somebody who has no house at all have to suffer from permanent unaffordability to bail out somebody with a house who chose not to put money in their 401(k)?

The politics are to accommodate the banking lobbyists which influence the House & Senate Banking Committees (whose “campaign contributions typically exceed all other industry & labor groupings”).

The great German poet & playwright Bertolt Brecht puts it in perspective: “it’s easier to rob by setting up a bank than by holding up (one).”

The European Central Bank raised key interest rates in the eurozone for the eighth time in a row, this time by 25 basis points, and signaled that it is not done tightening monetary policy.

Neither stocks nor bonds (nor most rational folks) believe the FED is serious about inflation…they are killing us slowly…with reinflating asset bubbles and letting inflaion run rampant…it’s at least 10%…the 5% # is ridiculous

Bingo. Food 20% or more, cars 20% or more, housing 30% up since pandemic, and services just revving up now. 10% for the last two years for sure. And property taxes up 50% where I live.

“We’re going to have to keep at it” and “pause” are mutually exclusive. Powell is lying through his teeth again.

Imagine a captain battling a wildfire which was not diminishing in size telling the news media that more would have to be done, but then announcing he was going to send his crew home until next month because……because he was that recklessly stupid. That’s Powell.

Have any of you people been to the Supermarket in the last 2 years? Gone out to eat and actually looked at the bill? Good God!! Everyone who leaves comments here seems to come off as millionaires! Something out there is holding all this nonsense together and I believe none of you really knows what it is! Good Luck when this all falls apart and none of you really have any real-world skills that are useful that can keep your families feed. (And please, don’t acronym me to death!)

Food prices at grocery stores have been falling all year long. Eggs are now down to around $1 to $2 per dozen. Helllooooo?

Great, we all can just eat eggs…and put them in our cars too…and pay the rent with a few while we’re at it. And I’m sure car repair shops and insurance companies would gladly accept them as legal tender…no pun intended

And everything else in grocery store is still increasing soda,beer,veggies,milk ,at least do a fair comparison.

…goods price increasing or dollar’s value shrinking?

Both?

may we all find a better day.

Yes, food prices are an absolute nightmare. Everything processed has at least doubled in price, and every time I visit the store it is liable to go up another DOLLAR! I do not exaggerate — a whole dollar! The smallest package of fresh fruit costs multiple dollars, and again, may go up another whole dollar next time. Even whole foods like cut carrots have more than doubled in price. Baking potates doubled in cost in one store, and are 50% higher in another.

I am a vegetarian who copes by buying brown rice in 15 lb sacks, drinking only tap water, and eating the cheapest fresh or canned vegetables I can find. I have given up everything else because I refuse to be price-gouged.

Iam a pure vegeterian since birth. Not even egg .ofcourse milk,yoghurt,butter ,cheese allowed. The only protein iam having last 60+ years is legume/lentils of all kinds .You can check out tofu also imitating cottage cheese (paneer).

Apart from rice ,You can get turkish /middle eastern pita bread , mexican flat bread ,mexican tortillas in bulk (to make a wrap). You want tasty lentil dishes ,Type in you tube “Dal Makhani ,Dal tadka” etc. also flavoured rice like coconut rice(both sweet & spicy version ), lemon rice, tamarind rice, Pulav ,jeera rice ,veg chinese fried rice can be dished out in a hurry with already cooked rice in fridge. I have survived as a pure veg all my life working in hongkong,china,singapore ,uk&USA etc. Now retired living in 3rd world .so no cans . only fresh vegetables.cheap in $ terms.

Bill — I feel the bite, and I think a lot of others do as well. I took my girls out for some pizza & suds the other week at a little neighborhood haunt here — ostensibly blue collar victuals if ever there were any; 65 dollars with tip. That’s two personal cheese pizzas, two domestic draught beers and a glass of tap water. By damn!

Vote with your wallet! Translate that to Latin and get some t-shirts made. Maybe something aping the classic ‘I Voted’ stickers, but with a graphic of some furling receipt tape in lieu of the stars & stripes. I’ll buy one.

I don’t really go out to eat anymore either. & I certainly see the increases in food as the closest reasonable grocery store is 70 miles away from me. I shop once every month or two and basically eat out of my freezer. Whenever I shop now I see people crying or trying not to cry in the discount grocery stores. Seriously.

The one exception is a small fish market I go to once in a great while – the husband runs the fishing boat and the wife runs the restaurant. Their fish and chips is the best I’ve had on the west coast. As good as Boston’s best. Haven’t been in that direction for a while- I imagine their prices are twice what they used to be now.

Powell is simply trying to protect and levitate the biggest speculative everything bubble in the history of mankind – manufacture a new pricing floor in all assets. The fact that the working class can’t afford shelter is of no consequence to him.

The Federal Reserve is the US central bank and deals exclusively with the banking industry and it is not the job of the Federal Reserve to be some kind of charity or welfare agency to poor common folks. What is so difficult for you to comprehend about that simple fact?

Why are you such a simpleton who doesn’t understand the FED’s mandate? You should learn before you spout nonsense.

Why are you in such denial and/or ignorance as to the reality of what the Federal Reserve is and does? Go read about it at FederalReserve.gov and learn what it is and does.

You are projecting. You don’t know anything about the FED, because you ignore their mandate.

Charity? Where are you coming from?

I’ll bet you also think any wages you pay, directly or indirectly are a charity. That people should be ever grateful for your mere presence. That people who serve you in any way shouldn’t be miffed if they have to sleep in their cars. You are doing them a favor after all.

I wonder where this classist dehumanization stems from?

Agree. That’s why the stock market is up another 1% today. Powell is full of it, and everyone knows it.

Yep. He’s a joker tbh, or a clown. Whichever is worse. Nobody nobody believes anything he says.

And let’s NOT forget this guy and many in FED really WANTED higher inflation not long ago.

“The fact that the working class can’t afford shelter is of no consequence to him.”

It’s of huge consequence to him. It is what’s driving the wage pressure. People entering the workforce are renters, not owners.

“It’s of huge consequence to him.”

No, it’s not. He doesn’t have to be a Fed chairman. And he doesn’t have to rent, or scrimp and save to try to buy a house. He has enough money to buy a hundred houses. He’ll be just fine.

The working class, by contrast, has no choice but to suffer the consequences of his titanic policy error.

I guess Powell thinks he succeeded in what he wanted to ‘accomplish” :

1. Endlessly lied about inflation without getting caught – check

2. Masses are adapting to inflation – check

3. No blood on the streets – check

4. Rich people can keep their “unfair” gain – check

5. Made housing unaffordable for most – check

6. Completely destroyed price discovery for decades – check

7. Transfer of wealth from masses to rich – check

Glory glory Mr Powell! You da man!

Regardless whether it was intended or not, what you stated is what happened. That is a fact.

Also, the Fed is not seeking to roll back these windfalls and wealth transfers, suggesting the results were intended or acceptable.

The biggest lie, which I unfortunately bought into last year was that the Fed is/was serious about lowering the inflation. He just raised the interest rates so he can lower later. Don’t read too much into the hikes.

The one thing the Fed has been consistent on is its desire to maintain high asset prices. Bernanke talked about the need for a wealth effect. Yellen supported it. When asset prices dipped briefly in 2018, Powell flip-flopped and started loosening policy. When asset prices dipped again in the pandemic, the Fed monetized $4T in debt and bought MBS, BBB bonds, treasuries, and other assets.

Stock and RE prices have done nothing but rise since Bernanke declared the Fed would seek a wealth effect.

The Fed should be running a tight money policy, while leaving economic growth to the economy on its own and wealth distribution issues to Congress.

The Fed acts as though its job is to create wealth concentration, but that is a clear abuse of its mandate.

The problem with the “wealth effect” idea is that most “wealth” is held by a small group. So it doesn’t cause the whole population to increase consumption by 10% each. It causes the top 1% to increase their consumption by an enormous amount while everyone else gets poorer.

It might work in the very short term, but it threatens societal stability.

butters

All those comments 1 – 7 could be taken word for word from speeches by Dr Havenstein, the Central Banker in Germany in 1923.

Replace the word “Inflation” with the word “Deficit”.

Actually “1.4T deficit” was projected for 2023. Likely similar amount is required for 2024 and the years after. To finance it through treasury auction market, rate will have to go up. Anyone who had applied for a mortgage, understand this game.

So Powell states core inflation “has not really moved down. It has not reacted much to our existing rate hikes.”

Then he says “It seems to us to make obvious sense to moderate our rate hikes as we got closer to our destination.”

WTF?! How are they getting closer to their destination, unless their actual “destination” is a pre-conceived top-end FFR?

Just a reminder of what Powell said in 2021. This is what puta lot of the regional banks into the dire financial mess they are in. Not only did he raise rates 2 years early….he raised rates faster than any other time in history. Double whammy. Almost impossible for these banks to unwind long term positions that were supposed to be safe for at least 3 years and then most likely a gradual rate increase.

The FED raised 2 years early than he promised.

So who really knows what will happen next. Al least now they said they will watch and then make a decision instead of any promises.

———————————————————————————–

New York MARCH 17 2021.

Federal Reserve officials signalled that they expect to keep interest rates close to zero until at least 2024, even as they sharply upgraded their US growth forecasts because of a massive fiscal stimulus and an accelerating vaccine rollout.

The Fed maintained its dovish stance at the end of a two-day meeting of its top policymakers, noting the improving outlook while cautioning that a full recovery remained distant, the path ahead was uncertain, and the economy still required ultra-easy monetary policy.

Mrs. SOL is an RNICU. Her union was just offered a contract with a 48% pay increase over the next 2 years(St. Charles, Bend, OR).

The pandemic was so horrific for Mrs SOL that she’s enrolled in a Masters program for PMHNP. Another $30k, but who’s counting.

Her secret lover is counting

1) Q3 and COLA are next. The hyperinflation might deflate.

2) Home prices in frog cooking. Mortgage free owners and those with low mortgage rates might lose their capital gain, in real terms, but they don’t care. Pairs like bought in 1995 sold in 2023 are becoming rare.

3) High ticket items sales are down, but middle age people and boomers with good income are spending $50/$200 per table in restaurants. For them it’s crumbs. Restaurants with 10K/20K vol per day are flourishing. Waitresses with sharp elbows, sweat voice and a smile are loaded with cash.

4) Consumer spending is still rising.

It looks like a bull pennant on that core inflation chart.

Vehicles, both new and used, have reaccelerated in price. Never should depreciating assets be appreciating rapidly in price. Inflation is raging everywhere. The standard of living of the bottom 70% of people in the US is crashing.

Dealers all around the US are deeply and steeply discounting the price of new cars on their lots.

I prefer Wolf’s numbers based upon statistics and hard data, not your made up fantasies. Talk to somebody who might care, because your blather bores me to death.

I much appreciate your website and hope that you can continue, Having said that, I cannot fathom why you, or seemingly anyone, ever mentions that our colleges are infested with liberal, filthy rich, entitled teachers (called professors). Hundreds of billions of dollars have been paid to the morons who are apparently at the top of the so-called educational system. It is more difficult to get rid of a parasitic, tenured, professor, than jock itch.

I possibly need to enroll in an African Studies class, or a Women’s Studies, or even a vitally important Climate Change hoax gathering of intelligentsia.

While these wildly overpaid clowns suck at the teat of the gullible public, many live in university provided housing.

Disgusting.

No one ever gave me a house and a protected huge wage.

Michael – why the off topic rant? Perhaps your comment was accidently bounced from one of your other favorite sites…:)

Facebook is a hell of a drug.

Yeah! I can vouch for the jock itch.

Michael Gaff,

Do you feel better now?

Ironically, the answer is probably no. Being constantly vein-poppingly mad at phantoms is a big part of the personality type.

Yes

Weren’t trillions lent out at near 0% prior to 2022? That money is now earing interest and coming back into the economy. If we assume numerous funds and individuals took out long term loans for trillions at 0.5% then they’re now making hefty profits on those funds.

The problem is the Fed was at zero for too long. I suspect the higher fed-funds goes, the more money floods into the economy from those 0% funds. You need to break the economy to kill inflation at this point.

Wake me when Fed funds is above real inflation (7-10%). When my apartment rent near tripled between 2010 and 2020, according to the Fed I was not experiencing inflation.

Sounds like free margin. Good observation.

A bit of ancedotal evidence on jobs. Over the past year I have been moving alot of stuff (home, business, deceased relative’s stuff) so I have rented from U-haul at least seve times in the past 2 years. During the peak of COVID and for nearly all of 2021 and most of 2022, you couldnt find more than one or two workers waiting outside to help move. I tried once to hire someone and they wanted $300 for a day’s work. Pretty good pay for an illegal.

Yesterday I rented a trailer and the place was flooded with guys looking for work. Must have been 12 guys loitering around the place all asking if I needed help.

Job market is starting to get tighter. Wait for the coming stock market collapse over the next three to four months and everything will be much different.

Student loans will suck alot of consumption out of economy. No more large wage increases for workers switching jobs, unless they have special talents.

I see the Dow jumped 428 points today after fhe Fed’s “very hawkish” statement, but very lame action. Well, the stock market goes all over the place from one day to the next. Nonetheless today’s move provides some support to most commenters’ views on this site. Whatever credibility the Fed had is disappearing. I don’t see this as a particularly good thing, but that’s just because I hope for a little consistency in method from these idiots.

The FED is in direct violation of their stable prices mandate. They have gone rogue and instead made skyrocketing asset prices their goal. They need to be dealt with. Obviously this comatose administration and CONgress are not up to the task.

Pausing is ok cause interest rate increase doesn’t do squat to the bloated stock market. But there is no reason for them to keep QT at such a slow price. They can’t even hit their own target, let alone increase it to 120 billion a month, the same rate they did QE for two years. It is criminal. It is deliberately designed to protect the wealth of 1% while prolonging inflation and the pain of ordinary people.

“In February 2022, the Federal Reserve approved a ban on top officials trading stocks and bonds, as well as cryptocurrencies, following scrutiny over whether several people, including Chairman Jerome Powell, could have access to nonpublic financial information.”

“In addition to Board Members and Reserve Bank presidents, the new rules apply to Reserve Bank first vice presidents, Reserve Bank research directors, FOMC staff officers, the manager and deputy manager of the System Open Market Account, Board division directors who regularly attend Committee meetings, any other individual designated by the Chair, and to the spouses and minor children of these individuals.”

Looks like it is okay for their adult children, their parents, brothers, sisters and friends to trade. Wink wink, nudge nudge.

Is is just today’s move or the move up or melt up in general for last few quarters

Nasdaq is up 30 percent for the year

And speculation is getting crazy

I have a question:

If student loans cannot be discharged in bankruptcy court, then what are the lenders to do to collect money from the deadbeats if they have no reportable income and no assets?

And if they have a car, they can do what a friend of mine once did when facing bankruptcy. Park the car around the block to evade the repot man.