Massive gyrations on the balance sheet after FDIC’s take-down of First Republic, sale of its assets to JP Morgan, and FDIC’s loan to JPM.

By Wolf Richter for WOLF STREET.

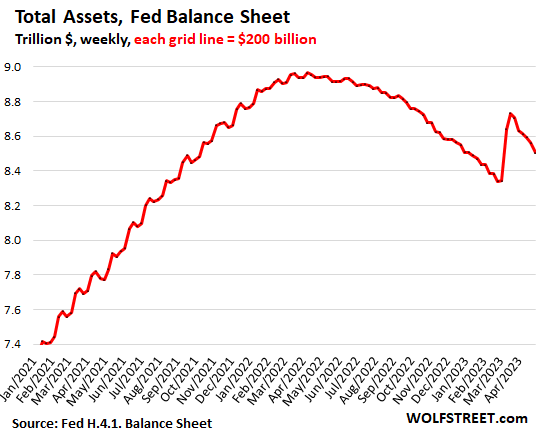

Today we were served a special spectacle on the Federal Reserve’s weekly balance sheet. Total assets dropped by $59 billion in the week, and by $230 billion in the six weeks since peak bank bailout, to $8.50 trillion, as QT continued on track with a big Treasury securities roll-off, and as First Republic, the FDIC, and JP Morgan were splattered all over this balance sheet.

Looking at total assets with a magnifying glass to see the details of the banking crisis:

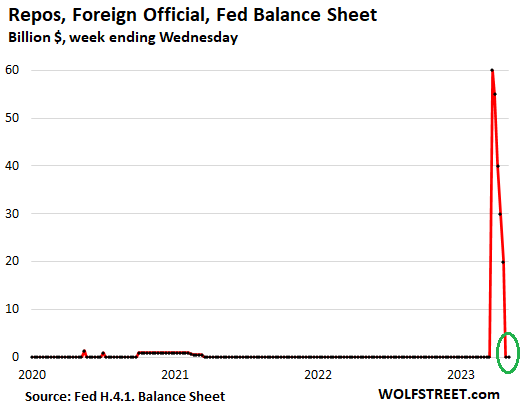

Repos with “foreign official” counterparties: paid off in the prior week. This was likely the program that the Swiss National Bank used to provide dollar-liquidity support for the take-under of Credit Suisse by UBS.

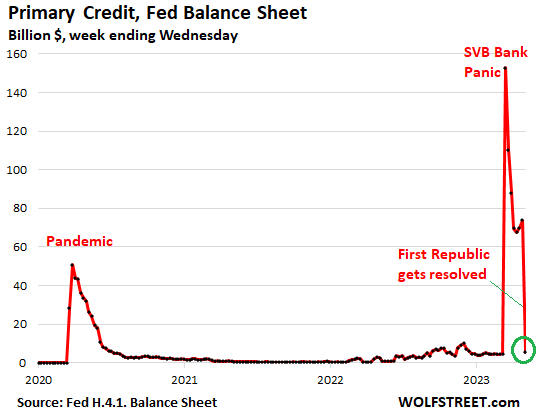

Discount Window (“Primary Credit”): -$68 billion in the week, to just $5 billion.

Since the rate hike yesterday, the Fed charges banks 5.25% to borrow at the Discount Window. Banks also have to post collateral, valued at “fair market value.” This is expensive money for banks that can normally borrow from depositors for a lot less without having to post collateral. It’s where they go when they need a lender-of-last-resort. And when they don’t need it anymore, they pay off those loans.

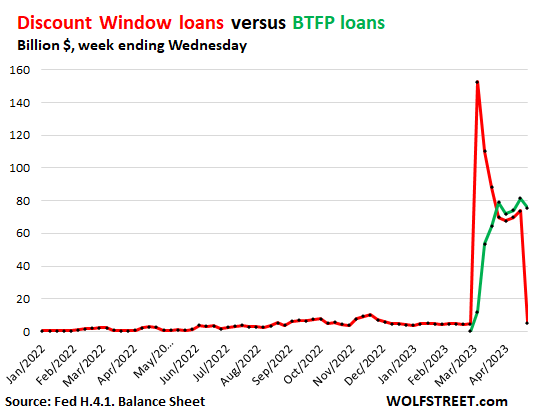

Bank Term Funding Program (BTFP): -$6 billion in the week to $76 billion. Under this program, rolled out on March 13, banks can borrow for up to one year, at a fixed rate, pegged to the one-year overnight index swap rate plus 10 basis points. Banks have to post collateral, but valued “at par.”

Because the BTFP is somewhat less punitive than the Discount Window and provides for one-year funding, there had been a shift in April from the Discount Window to the BTFP. And so we put them on the same chart to see the flows between them.

First Republic’s borrowings at the Discount Window and at the BTFP were paid off after the FDIC resolved First Republic over the weekend and then sold the assets to JP Morgan, which also agreed to take on the deposits and other liabilities. And this is in part what we can see here.

This chart shows both, the loans at the Discount Window (red), which plunged to just $5 billion, and the loans at the BTFP (green), which dropped to $76 billion:

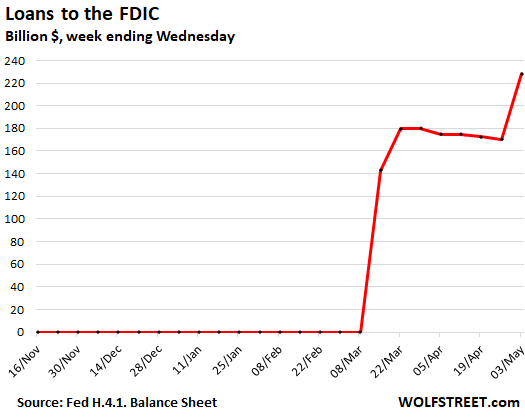

Are you ready for the fun part? Loans to FDIC: +$58 billion in the week, to $228 billion. When JP Morgan acquired the assets of First Republic from the FDIC, it paid the FDIC $182 billion for those assets. The payment came in different forms (we walked through all this in detail here):

- $10.6 billion in cash.

- $92.4 billion by taking on the deposits (liabilities) that are owed the depositors of First Republic.

- $28 billion by taking on the advances First Republic had gotten from Federal Home Loan Banks (FHLB), and which JPM now has to pay off.

- $50 billion loan from the FDIC.

Note the last item. So to boil this down to an example: When you buy a car from a Ford dealer for $50,000, and you pay $2,000 cash down and the dealer arranges a loan through Ford Credit for the remaining balance of $48,000, you will pay $50,000 for the vehicle plus interest over time.

This is kinda what JPM did. It paid some cash down ($10.6 billion), plus it paid a bunch by assuming liabilities that it will have to pay over time to depositors and the FHLB; and it took out a $50 billion loan from the FDIC that JPM will have to pay off over five years.

But just like Ford dealers, the FDIC isn’t sitting on a pile of cash that it can lend out. It seems it went to the Fed and borrowed the $50 billion that it lent to JPM, which then used the cash to pay off the $28 billion in advances by the FHLB and the $30 billion that 11 big banks, including JPM, had put on deposit at First Republic in March to prop it up.

So the FHLB and the banks got their money back, and JPM will now be paying the FDIC the $50 billion plus interest over time, and the FDIC will then pay off the loan it got from the Fed.

This is the kind of stuff that gives a banking crisis such a high entertainment value.

The prior big loans that the FDIC got from the Fed were associated with the bridge banks that it created for the assets and liabilities of Signature Bank and Silicon Valley Bank. The FDIC has made deals to sell a part of the assets and transfer the deposits to other banks. It’s now auctioning off in bits and pieces the mortgage-backed securities (MBS) and Treasury securities that the bridge banks still hold:

And QT continued:

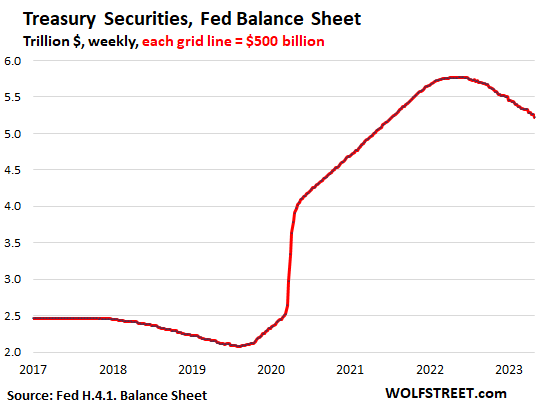

Treasury notes and bonds: -$49 billion for the week, -$549 billion from the peak in June 2022, to $5.22 trillion.

Treasury notes and bonds “roll off” the balance sheet mid-month or at the end of the month when they mature and the Fed gets paid face value for them. Today’s balance sheet reflects the roll-off at the end of April.

In all of April, $58 billion in Treasury securities rolled off, just under the cap of $60 billion.

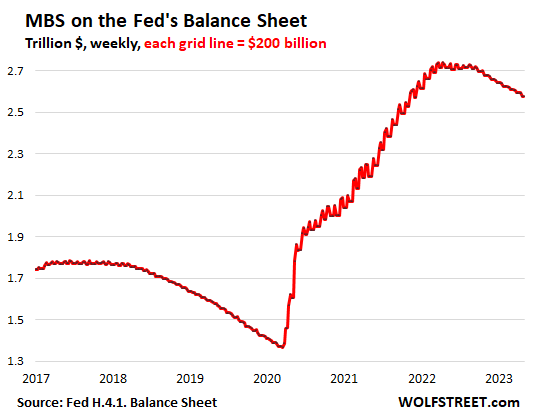

MBS: no change for the week, -$19 billion in April, -$164 billion from peak, to $2.58 trillion. The Fed only holds government-backed “Agency MBS” where taxpayers carry the credit risk.

Mortgage-backed securities roll off the balance sheet primarily through the pass-through principal payments that holders receive when mortgages are paid off, such as when mortgaged homes are sold or mortgages are refinanced, and when regular mortgage payments are made.

The roll-off has been below the cap of $35 billion per month because home sales have plunged and refis have collapsed, and therefore fewer mortgages are getting paid off, and passthrough principal payments to the Fed have slowed:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The FED is a cancer upon society. They have destroyed pricing with these balance sheet antics. QE is the biggest wealth transfer from the poor to the rich in the history of the US. This current crop of money-grubbing, rapaciously greedy pigs make the old robber barons of yore look like pikers.

Speculators and money-changers add nothing to the economy or society in general. They are the “useless eaters” among us. In fact, the entirety of Wall St. is a giant cesspool of useless eaters who are doing nothing good. The term “get a job” comes to mind. These soft-handed worms couldn’t produce anything of value if their lives depended upon it.

I’d like to see Bill Ackman working the fields of the central valley of CA for less than minimum wage, living in a busted up single wide with no air conditioning in 110+ heat. And Jamie Dimon can join him. Pivot to that mothertrucker.

Lol

So true, wallstreet has become a parasite for America.

Any politicians favoring them crooks gotta walk the plank, mate.

We’re a week beyond harvest time for off-season spring wheat nurseries in the Yuma, Arizona region. Working 12 hour days in the field requires good sun protection; wide brim hat & long sleeve breathable shirt. Plus, one hell of a lot of water and a few bananas to keep up the potassium that gets sweated out. Mixing Gatorade with two parts water added to it also helps keep the body working out under the sun.

But, that’s the way to get two generations of hard red spring wheat crop research and development done in one year without going to the southern hemisphere.

Irrigated land in that area is about the most productive on earth. Part of the breeding and selection process, harvesting the heads for “head selection,” is amazing. They’re 50% bigger in the number of kernels per head, and the size of each kernel is larger and deeper in color than the same variety grown in Fargo/Grand Forks. Seed harvested at the end of April there is beautiful.

When you’re in the wheat seed genetics business, that’s the way things are.

Somewhat on topic:

Fed’s balance sheet may be shrinking. But Uncle Sam’s debt, and most likely the size of next year’s fiscal budget deficit, and the cost to carry the $32 or so trillion only gets bigger and bigger. That don’t look good to me, but what do I know, eh?

So true regarding debt.

The right way to fix this is: Let zombies fail and write off the debt.

The worst way to handle debt: Keep bailing out zombies calling them too big to fail. Run high inflation to inflate away debt at the expense of taxpayer. More like feeding the living to the zombies.

Department of America’s American don’t stand up for an egg and the banks are gonna take there for a one case the heads finish going to fail and this is gonna be this is worse no I’m misunderstanding easiest worse than hyper place we have to make these people accountable and the people that hold their retirements they should be watching let’s go on instead of sleeping but as we are the day the Americans are asleep completely as the child this week goes down to almost 70% or it doesn’t make sense pink hands no brains no common sense We’re failing we’re an M1

Exactly

Growing wheat in the desert is just crazy.

I’m reading Cadillac Desert right now. its only a matter of time until the “great american desert” returns to its natural state.

You’re right. It’s debt Ponzi and it will implode.

You know, Depth Charge, that it isn’t good to keep all your feeling bottled up like that. I hope that some day you’ll tell us what you really think. 🤣

You and I hit it off perfectly can I take you out for dinner? I need you at my table.

DC

While I agree on your comments on the Fed, and believe we would be better off with a “hard rail” monetary policy regarding short rates (ie FF always equal inflation rate) and that the Fed should stay out of the long end of the market (dual mandate concerns are real time issues of prices and employment) , I believe speculators do indeed serve a purpose to the markets.

Speculators attempt to discover price, and the astute ones, those that discover price best, survive. Those who make poor decisions disappear.

Let no crisis go to waste:

Use the fear of bankruptcies and unemployment to give taxpayer’s money to 1% and make the 99% poorer.

Depth Charge ……

Once again + 1,000 %

“The FED is a cancer upon society.”

The Fed is simply the ENABLER which enables this:

“Giving money and power to government is like giving whiskey and car keys to teenage boys.” – P.J. O’Rourke

The problem is that the government appears to have been inspired by the P.J. O’Rourke classic:

“How to Drive Fast on Drugs While Getting Your Wing-Wang Squeezed and Not Spill Your Drink”

Not to worry Winston, the rich kids got it all, already. Bottoms up!

I think lots of folks would go see that movie.

Amen. A new book is out titled – These are the Plunderers, how Private Runs and Wrecks America. Based on the examples given, I bet that there are PE, or whatever they call themselves, conjuring deals to torpedo banks and then buying them for pennies. After reading this book, I think lobbying is more like bribing. All the cheap money of the past decade is deployed, I hope at least one plunderer loses a fortune and we all get to watch that person cry on TV. Walking the plank would be better-ha. Such drama

Giving corporate entities human rights was the seed of our coming destruction. Free speech interpreted as massive corporate financial gifts to political persons to promote business and social dominance.

The political playing field in a republic is not level when corporations are allowed to compete against individuals and convert it into a financial contest for self interest.

Wait until they gain extra-territorial rights and become like nations.

Have u been following Leon Black disclosures in the WSJ last week?

Look at his “meetings” schedule with alleged Foreign Intelligence asset Epstein:

I ask you, can the CEO of Apollo have an “outside gig”? In the “real economy”, I’ve seen poor waitresses get fired for taking too much time in the toilet. I’ve seen cab-drivers shake leg cramps from sitting too long. I’ve never been to a doctor’s appointment that gets interrupted with me b/c the doc is taking a “foreign intelligence agent” call for personal side business. What is this thing called Murica?

Thanks for that book suggestion. Happened a lot after the GFC, a lot of LBO firms swooping in to get distressed assets for pennies on the dollar and then turning around and milking customers for whatever they were worth. Wouldn’t be surprised if some of them licking their chops here.

Bravo!

This, but don’t want to give the Fed all the glory and credit. If anything, they’re also on the business end of tight strings. At some point in the last 4 decades, capitalizing off of crisis (war, health, energy, etc.) became de facto and corporations/investors have their fingers tugging all of it.

Not tin foiling, its undeniable. A prosperous, educated middle class is bad for investors. If everyday people were financially educated and prudent as often lamented here, there would be a lot less profit swishing around.

Hello! 100% agree. I worked 15 years under socialism and 25 years under capitalism. And here and there they come up with ways to take away everything earned.

It’s hard to believe $230 billion was about a quarter of the entire Fed balance sheet pre-GFC. How times have changed.

The US economy GDP is now in excess of $22 trillion a year.

It was 15 trillion a year pre-GFC

Is your point that GDP went up 50% while the Fed balance sheet went up a staggering 9x?

According to the BEA … “in the fourth quarter … a level of $26.13 trillion”

Which is, to me, an almost unimaginable number.

-$164 billion in mortgages. Just guessing the average mortgage is something like $400k? If so, that’s ~400,000 mortgages that have rolled off. Sounds more hawkish expressed that way.

I “feel” smarter every time I read one of your posts Wolf. Thank you.

Every day I stand more boldly on Mount Dunning-Kruger thanks to these articles.

Central bank raises .25%, and 2-year rate drops .25%. Best of two worlds.

28-day Treasury bills sold at auction today at a yield of 5.96% today, wow, almost 6%, wild chaos! A June 1 default X-day is rattling some nerves it seems.

That’s a nice yield for 28 days. Good place to park some cash. T Bills nothing longer than 90 days. You don’t need to go out any farther than that.

Might brokered CD’s be a better place to go if one is concerned about X-day? It is not hard to park cash in $245,000 increments (to allow for insurance of interest) at several banks.

Interesting that there is a flight to “safety” away from banks and to Treasuries when there is talk of a Treasury default while bank deposits are FDIC insured. (Think, lemmings, think…splash!!!)

I got some!

Great timing!

“This is the kind of stuff that gives a banking crisis such a high entertainment value.”

…and makes Wolf Street so good to read. Nobody presents the workings of The Great Machine as clearly. Humor seals the deal.

Yes QE bailed out wallstreet and the non asset holder working folk have been suffering ever sense. Can one remember essential work?

Anybody see a problem? Government deficit 7% of GDP. Powell raising rates to 5% plus. Deposits high powered money fleeing to money market. Timber in 2023.

It seems the best place to put your money is to lend it to the overspending machine in Washington. (Treasuries)

I would suspect that is drawing money out of the private sector into the hands of the most prodigal entity that has ever existed…the Federal Govt.

Economies (and Societies) operate best when money is deployed wisely.

We arent there.

Most people don’t see this problem, since they believe in something for nothing.

The Fed is the biggest and most successful scam in world history. Since 1913, the value of the dollar has fallen 95% due to those jackals. And the theft continues with every dollar they print.

And, johnny mars, the currencies of the vast majority of other countries in the world, have fallen further in value than the dollar…..just better jackals abroad ?

Protection of our fiat currency dominance, in addition to all others are worse, is Americans will always out consume anyone.

If they have two nickels to rub together, they will spend twenty cents.

Yeah, that is pretty bad. The dollar has fallen 95% in the last 110 years. The Argentinian Peso has fallen 20% in the last 4 months.

15% inflation in two years…

and “victory” is being described as adding ever smaller increments to that 15%.

The ‘net” of all that is not a “victory” except for the asset holders. The earners, savers, shelf fillers, truck drivers et al suffer.

If the Fed was honest in their inflation policy, ROLL BACKS of prices to meet their “self authored” 2% goal over the past 3 years would be the objective. (that’s 3 xs 2% = 6%…..not the 15% we have) (sans compounding)

There should be no inflation policy.

Current central bank monetary policy committing to steal (that’s exactly what this inflation target actually is) 2% of all USD dollar holders purchasing power every year forever is a criminal extortion racket. Same thing with every other central bank following the same policy.

Virtually no one believes it because they have been conditioned to accept one standard of behavior for the typical private citizen and another entirely different one for those who act on behalf of government.

It’s a consistent belief in one sense, since they both want and believe in something for nothing.

The majority of the population believes in political math where 1+1 miraculously =3.

“There should be no inflation policy.”

The 2% thing started with Nobel Prize winner Bernanke.

2%, the paltry 2% compounded drops purchasing power around 22% in ten years. How is even THAT “stable prices”?

They tried the “it is stable increases in prices” that is the goal.

Twisting language is the last refuge.

Now they use the convenient YOY window, as if the last two years never happened. Remarkable there is no outcry.

The inflation “target” should be a range of -1% to 1%…

Widely accepted economic theory says that inflation is the result of demand exceeding supply. This excess demand encourages an increase in production, facilitating economic growth. Disregarding exceptions related to dramatic increases in productivity, if there were no inflation it would suggest demand and supply were equal, meaning there would be no incentive for additional supply to be created, and thus an abscence of economic growth. This would equal a per capita reduction in economic output per person in a society with positive population growth, as most societies are experiencing (for now). I.E. small amounts of inflation are necessary in a capitalist system to encourage private businesses to increase production.

Excessive inflation is absolutely an issue and our current bout is a result of the FED being incredibly enabling to our financial system by subsidizing financial failure and privitizing profits, causing a transfer in wealth, as has been discussed. I do not negate this, but I do have issue with the idea that inflation, especially under 2 or 3 percent, is a “criminal extortion racket” instead of a natural byproduct of the principles of supply and demand during times of economic growth.

How is it that all ‘market failures’ are created by the government and not the markets? Shouldn’t it be ‘government failures?’ Because there’s obviously no market ones. Under which cup resides the pea?

If the debt ceiling starts to kick in the Fed’s balance sheet might skyrocket as it makes loans to the Social Security Administration secured by Trust Fund assets and similar arrangements with other federal agencies whose current liabilities are backed by trust funds (e.g. federal pensions) and do not involve unfunded liabilities. The Fed’s mandate can be interpreted very expansively in times of crisis to keep the fiat flowing.

The Federal Reserve is not going to do any of that at all.

To little to late

too the word is spelled too

“I spread my wealth equally between my two sons: half goes to Little, the other half goes to Late,” he said.

love it

Please correct my spelling: “There are three twos in the English language.”

LOL

So why didn’t the FDIC just give First Republic 50b (or 20b) and an 80/20 shared loss agreement?

Basically, that ford vehicle was used, with issues, and owner was behind on payments, dealer repoed vehicle, and sold it at auction to the regional manager at ford credit for half it’s book value. Dealer also provided a 5 year 80/20 bumper to bumper, and a 7 year 80/20 drivetrain warranty, as well as an additional 25% or so cash-back, that the buyer can use to cover his 20% of repair costs.

I misspoke, I thought jpm recieved 50b in cash assets from fdic, not just the 50b liability. Reading comprehension.

This jp deal is really starting to stink pretty bad. If I am understanding correctly they paid 10.6 cash for a loan book of about 140b with practically no risk (80/20) with probably a very good term loan from the fdic. The 92b is way less then there potential loss. So this is as zero risk as you can get.

No, you didn’t understand it correctly.

You ignored the remaining liabilities, deposits and FHLB advances to start.

If you want to get a reasonably accurate estimate of the benefit JPM received (the only one available without doing your own accounting of the transaction), read the press release they issued.

They are expecting 20% ROI, which is practically guaranteed. It’s a huge unnecessary gift.

Joe,

No, not at all. Read what I wrote about it, it details the deal:

https://wolfstreet.com/2023/05/01/first-republic-zombie-bank-dismembered-pieces-handed-to-jp-morgan-uninsured-depositors-bailed-out-stockholders-some-bondholders-bailed-in/

1) US10Y – 1M = (-)2.39%, lower than in the early 1970’s. Are we in recession : no !

2) US10Y – 3M = (-)1.89%

3) US10Y – 2Y = (-)0.38%

4) US10 – DET10Y = 1.18%.

The German 3M is 2.8%, the 2Y is 2.6% and the German 10Y is 2.2%. Madam ECB will raise rates to attract German’s money to finance Portugal, Italy, Greece, Spain and Ukraine.

5) There isn’t enough LNG to send to Germany’s new LNG terminals next winter.

Interesting, how about CAEY (cyclically adjusted earning yield) compared to 3M yield, e.g. CAEY – 3M = 3.5% – 5.2% = -1.7%, and compare with historical median CAEY-3M of about 2.4% ?

Still at $8.5 Trillion and just working off what they injected in March. They have a lot of work to do and a long way to go. Not impressed thus far.

You’re mistaken. The Fed is not doing QT to impress YOU. But we already have some banks blowing up, and there are going to be a few more, so that’s quite a show already.

No, they’re supposed to be doing QT to reduce inflation and collapse the asset bubble. It’s not working, because they’re going way too slow, a few bank failures notwithstanding.

QT is happening, nonetheless, and no one is talking about it. This is good, as the Fed doesn’t need more attention…

Color me unimpressed as well. I’d say the show on the way down should match the show on the way up.

If you’re going to juice used car prices by 50%, have some housing markets go up 40% in a year, give 10x returns on fake digital currencies, give rise to “meme stocks,” and increase the net worths of the wealthy by obscene amounts that would make Bernie Madoff recoil in horror, then you need to blow shit up bigly on the way down. Yin to the yang.

Instead, it’s so lopsided it’s like putting an elephant on one side of the seesaw and a small child on the other. The FED is telling us the small child will be lifting the inflation elephant. They’re slow-boiling the working class and the poor while entrenching inflation for their rich buddies.

Agree 100%. Slow boil the working class. As a stock trader myself, I don’t want this much asset mania in the market either. Even Apple is being pumped as a meme stock. The market used to be a lot more stingy, which is a good thing because making money is not supposed to be easy. Now they give every stock a free pass. The GME and Bitcoin phenomenon are perfect examples of how morbid money printing corrupts the free market.

ES daily, log. // Mar 23 2020 was the finale, a trigger.

L1 : Mar 23 2020 low to Oct 12 2022 Close.

L2 : a parallel from Mar 23 high, the trigger high.

ES might rise to L2 in the next few months, to 4,400/4,600, unless

ES close < L1.

L3 : a parallel from the the weekly high, Mar 23 2020 high.

about $4 TRILLION to go

($4.24 Trillion in 2020)

No, that’s not how it works. This link walks you through the factors that determine the minimum size of the Fed’s assets — and those factors are all on the liability side of the balance sheet:

https://wolfstreet.com/2022/09/05/by-how-much-can-the-fed-cut-its-assets-with-qt-feds-liabilities-set-a-floor/

I remember your article…..and this is not what I meant.

The starting point of the massive QE COVID response began in 2000 when the balance sheet, per this chart, was on March 18, 2020 $4.68 Trillion.

Your points in the previous article restricting how far it can be reduced are well taken. I just wanted to contrast where we were and where we are now.

Listening to Yahoo Financial channel right now, with experts discussing the alleged multipart equations that the Fed presumably calculates based on all the “data”.

It’s not that complicated. It’s just reversion to the mean.

The central banks decided to stop committing fraud and return to real economics. We’ll never know why they decided to stop the fraud, but it’s the best government decision in 50 years.

With the Feds balance sheet shrinking, the M2 money supply must also be shrinking? Correct me if I’m wrong but if the federal reserve balance sheet is shrinking then the Federal Government’s deficit spending is now being funded by the sale to treasuries bought by someone other than the Fed. If so this is a zero sum game with the federal government selling debt in the form of treasuries and the public, banks, foreign entities, and other buyers in essence pulling cash out of the system only to spend it back in. Just thinking out loud.

There is plenty of excess liquidity in O/N RRPs.

Wolf: we are told the FDIC did not use their special statutory authority for systemic risk on resolution of First Republic. Then, if so, how were they allowed to pay off uninsured large depositors? Thought they had to resolve at lowest cost to FDIC fund? Paying JPM assets so JPM can payoff uninsured deposits ( including the $30B) seems illegal?

For First Republic the reason is that JPM agreed to take over all the deposits as they were, there was never a need to the FDIC insurance. The loss for the FDIC with regards to First Republic is due the discount of assets and the loss mitigation insurance.

No depositors were in any way ‘paid off’ and the deposits were simply transferred as a block to JPMorganChase in full. That is no a ‘pay off’ of any kind whatsoever.

Reuters: “These officials also noted the Fed at some point could even lower short-term interest rates as it continues to draw down the roughly $8.5 trillion balance sheet, and that such a move would not be at odds with wider monetary policy.”

The FED should cut interest rates NOW – and continue with QT.

Wake me up when the balance sheet penetrates the March low.

As for breaking things- I don’t think a lot of people understand that the Fed and Powell need to break things to stop inflation, and I fear the Fed isn’t up to the task.

Nothing to be impressed about here.

The future of the United States holds that it will be forced into (1) a high degree of economic isolation, (2) reflect an increasingly totalitarian mold, (3) and operate under a command economy.

DXY is down on a good payroll report.

PACW short cover rally

MW: PacWest stock rockets toward a record rally, after suffering biggest 6-day selloff in its 20-year history

From Reuters May 4,

“The American Bankers Association on Thursday urged federal regulators to investigate a spate of significant short sales of publicly traded banking equities that it said were ‘disconnected from the underlying financial realities’.

…the lobbying group said it had also observed ‘extensive social media engagement’ about the health of various banks that was out of step with general industry conditions (Wolfstreet?).

We urge the SEC to consider all its existing tools and to take measures to reduce the avenues for abusive trading practices and restore investor confidence.

These measures include, at a minimum, a clear message and appropriate enforcement actions against market manipulation and other abusive short selling practices.”

And so the short covering commences.

Looks like today’s “rally” erased all of the “hawkish” losses from Powell’s speech.

Jobs report was good. So far we are having a soft landing. Many pundits last October said we would be in a recession by now.

What has happened. Interest rose even further and we have a small banking crisis but the recession that supposed to start 6 months from now keeps getting kicked down the road….?

How exactly are we having a soft landing? A soft landing means inflation returns to 2% with no recession. We have no recession, but no end to inflation in sight. There’s been no landing at all.

Just look at all risk assets today. Yellow Powell and Co. have failed. They should have raised at least 50 basis points this week. Instead, they continued their snail’s pace to encourage the liquidity to continue to jack up prices of everything.

A mortgage that am bank gives out needs to see 3 components that ad up to the total rate.

1) The base is has to be equivalent to a risk free investment. Where a bank can invest money that is risk free like a treasury.

2) Add in an adjustment for future inflation

3) Add in Risk for the percentage of people who will default.

Lets say inflation is at 2.5%, a non manipulated FED/Government mortgage rate should ball between 5.5% and 7.5% or a 30 year fixed.

Anyone hoping it will be lower than 5.5 needs to hope for a recession and another intervention from the FED. Could happen, but don’t count on it. Anything over 7% means we are experiencing higher than normal inflation.

Even at the breakneck pace of 0.23 Trillion per 6 weeks it would take 4 years to return to the still-inflated pre-covid figure. Except it will never get that far due to a handsome selection of bailouts for fed cronies during those 4 years.