But unlike homeowners, homebuilders know how to sell into a down-market: by cutting prices. So a shift to new home sales.

By Wolf Richter for WOLF STREET.

The housing market is now in peak spring selling season. This is when sales volume surges and when home prices rise and when everything is rosy no matter what else is happening. But not this year, and we’ve already seen that with pending home sales that plunged 23% year-over-year in April, and we’ve seen it with closed sales in March that plunged 22%, and we’re now seeing that the situation got worse into late April and early May.

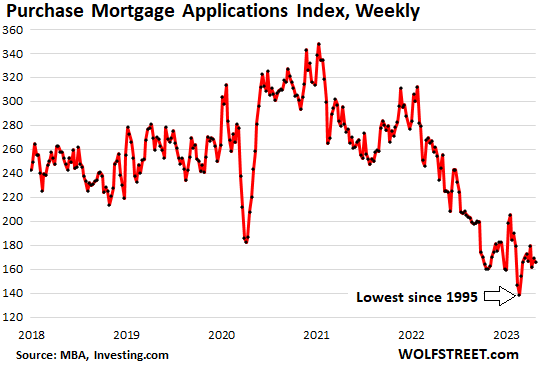

Applications for mortgages to purchase a home, a leading indicator of home sales, dropped again in the latest week, and have remained solidly below the lockdown lows in April 2020, according to data from the Mortgage Bankers Association today. Compared with the same week in prior years, purchase mortgage applications were down:

- By 32% from the same week in 2022

- By 40% from the same week in 2021

- By 36% from the same week in 2019

The MBA’s purchase mortgage index has now been hovering for weeks at the lows last seen during the bottom of Housing Bust 1. During the last week of February, it hit a 28-year low.

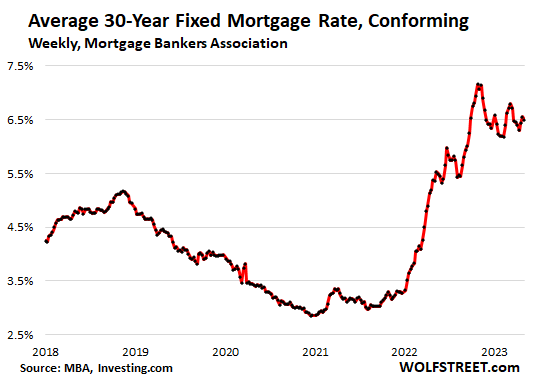

Mortgage rates really haven’t budged off the 6.5% range since coming down from the 7% range in November last year, with the average contract interest rate for conforming 30-year fixed-rate mortgages at 6.50% in the latest week, according to the Mortgage Bankers Association today:

So the housing market is not thawing out at 6.5% mortgage rates. A healthy housing market needs to have sellers and brokers that are in touch with reality, and the reality is set by potential buyers who’re waiting for prices to come down further.

Which has led to an interesting shift: from buying used homes to buying new homes, because there is a large supply of new homes, and homebuilders – unlike homeowners – are data-driven pros, they know how to sell into a down-market: by cutting prices. And they’re doing it, and buyers are flocking to it.

They’re offering lower price points, and they’re buying down mortgage rates for a set period, such as the first two years of the mortgage, which for buyers translates into a lower mortgage payment, which effectively feels like a price cut. Homebuilders can afford to because their costs have come down.

But homeowners are still stuck with in March 2022 pricing ideas. Those prices are now history, but potential sellers are having trouble adjusting, and so they’re not putting their homes that they have already moved out of on the market, hoping for better times, hoping for lower mortgage rates, while muttering, “and this too shall pass.”

For homebuyers, new houses may offer a better deal, and so there has been some shift in that direction.

But accepting a mortgage-rate buydown is risky if the buydown is only for a limited time, such as one year or two years, and then the mortgage reverts to a higher rate, and therefore a higher monthly payment that the buyer may have trouble making. Buyers are betting that by then mortgage rates will have dropped back to 4% or 3% or whatever, and that they can refinance at a rate similar to the buydown rates. That is a risky bet. If inflation stays high, rates won’t go back down, and then the mortgage payments jump, but so be it. That’ll be a problem for another day.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Do any of these national homebuilders have quality of workmanship near that of a random Irishman contactor in the SW/W burbs of Chicago?

What these national new house builders don’t have is: Decent lot sizes for new homes.

It’s not the sellers who are detached to reality. It’s the Fed, the govt, the banks that join together to not sell MBS outright, keep rates low, and give loans that will make net loss to put excess deposit money to use.

All because FDIC and Fed can put taxpayer money to bail everyone out.

Finish Fed put and Let financial markets decide rates based on risk, and all fake problems will be solved in 1 week.

You got that right. All the new home developments give you a small fenced in prison yard to look over while sitting on your 8-by-8 patio.

Based on the looks of the new properties when resold, the small lawns work great for dog urination, and that’s about it.

“All the new home developments give you a small fenced in prison yard to look over”

It depends on location. In suburban areas you get a decent size and it varies from state to state too. Some builder give you an acre. Can’t generalize.

Keep in mind, most folks nowadays don’t want to keep themselves busy with doing yard work.

Think about this. The Federal Reserve has pumped 2.5 trillion into the MBS market and still needs to liquidate it. That is propping up the real estate market.

There are still suckers out there that just dont understand that housing is the asset class backed by debt and we have a debt bubble that is being deflated, albeit slowly. The Fed Reserve still has a LONG way to go and the ECB and BOJ have not even started to liquidate the debt bubble. Get rid of that bubble and real estate markets around the world will implode. Demographics are also bad for real estate as most of the developed countries dont have birth rates high enough to grow the population, yet housing development continues to increase the housing stock.

Nope, only worse than that

The USA 30 year fixed effectively allows home “owners” to hold to maturity instead of being forced to mark to market.

Canada has 5 year fixed, and many took out variable rate to eek out a tiny bit better rate to join the one way ticket to untold riches (train now cancelled).

Will the USA hold for long enough to throttle Canada?

I suspect they will. So does Trudeau. His only action has been to increase immigration rates to put upward pressure on housing. No industrial plan. No upskilling. Just doubling down.

500,000 new immigrants per year. And everyone wanting to live in a city within 30 minutes of the U.S. border.

99.99 % of Canada not attractive to foreigners that are not used to freezing temperatures and feet of snow.

3 month summers, maybe. 9 months of winter or tough sledding in the rain and mud.

“Multiculturalism” having strangled Canadian culture.

“Multiculturalism” strangled Canadian culture

Do you know who natural ” Canadians” are?

Obviously not. These are the Inuit. If you are not like that, then you also belong to the’ ‘multiculturalists’ ‘

I’m pretty sure the First Nations took the land from somebody else.

Really, Jon? You actually think there were already people in the Western Hemisphere when the first intrepid people crossed the land bridge from Siberia? Are you writing your own natural history devoid of any connection to reality?

Escierto- The land bridge from Asia closed 10,000 years ago. That is a lot of time for folks on this side of the Atlantic to massacre one another for territory without help from the Europeans. The dearth of written records does not mean that folks on this side of the Atlantic weren’t brutal to one another. See e.g. Aztecs…

It’s not quite that bad. In Ontario Spring is May 15 to June 15; Summer is June 16 to September 15; Autumn is September 16 to November 14; and Winter is November 15 to May 14. Six months of winter are awful, but nobody’s trying to kill you, unlike many developing nations. If Canada had open immigration it would be inundated despite the horrible weather.

Ontario ? Which Ontario ? Southern Ontario with a population approaching the density of Europe? Or Nothern Ontario where the ratio of bugs to humans is 100,000 to 1.

Native Canadians. I went to school with First Nations people. And Metis, the French and the Scots. Canada then ,as now, is divided by class not race. CBC’s claptrap notwithstanding.

Look up Kennewick Man. And look really, really hard because the truth appears to be the current Native populations, indeed, are unlikely the first occupiers of North America.

That sounds like northern New England. Except summer is only two months, July and August. Nights get cold the first week of September.

You are 100% on point, and I would add some wider doom, if you don’t object.

Here in Canada the RE is so deep underwater that if it doesn’t decompress ASAP it will suffocate the country itself, but we are hostages to political/financial incompetence. Our politicians at all levels still sell the same “affordable housing through more regulations” schtick, because RE is the most broadly held asset class held/aspired by majority citizens. Nobody rallies for cheaper stocks and more affordable bonds. Not even gold. Few have it, few aspire to have it. It’s what you do with the excess. What people have or want is a home, which is also an inflated asset up for global competition.

Many years of loading up on globally stolen wealth, rather than being the resource extraction and management peeps, ultimately comes at a higher social-economic cost.

Mark Cohodes knows the white collar crime well and has correctly stated just the other day: “Most Financial Criminals have cut their teeth in Canada, have lived there and or flow money thru that Cesspool”

That’s key @Georgist…..

30y fixed rates is a huge plus for owners and is not a common thing around the world. In Germany they mostly have 15 or 20y fixed rates. Plus, in the US you can refinance to another 30y even if you are older. Think about it, you are in your late 50’s and refinance 3, 4 or more houses to another 30y w low rates> reducing your mortgages to a small amount while renting out the houses at market rent prices….

My trusted REALTOR® said there never has been a better time to buy. She also said that there is no inventory and that prices will go up again as we get into the Summer busy season, the Fed Pivot or something like that.

I mean, she would never lead a buyer wrong?

No absolutely not, never, realtors adhere to the strictest code of conduct and undergo months of ethics training. They’re almost as trustworthy as low budget motel cleaning crews, just with higher salaries.

Hire a fudiciary financial advisor and ask him this question. It will cost you some, but can save you a lot.

BS, what if they are wrong?

A Realtor would absolutely know those bad Russkies blew up there own milti-billion dollar revenue pipeline too.

Trust them.

“Low budget motel cleaning crew” is coincidentally the name of my indie band.

A used house salesperson is just about as trustworthy as a used car salesperson.

No worries, you can trust your realtor as much as you can trust Pow Pow or Greenspan. Inflation is transitory, not thinking about thinking about raising rates or there’s no housing bubble in 08 all aged like fine wine..

Fine wine that my dad once said it’s limited edition, then come to find out they were discontinued so I guess it’s limited after all…

I had to take a long trip yesterday, and getting hungry I desperately got a Big Mac Meal.

Price. C$11.79.

1970? .97

Price increase ? 1200%

Governments stated inflation rate of 2% means today’s price should be about C$2.70

So, if Government isn’t lying then there should be more food. No, no. Not True.

The Hedonistic Adjustment says I should have gotten better value, in taste, satisfaction, etc.

My stomach says no bloody way.

Dog and cat food are up like crazy, too.

It is probaly cheaper to buy one double big mac and feed it to your dog for 1 day and another for your cat for 2-3 days.

Of course, you are probably damaging them more than the animil food would have.

kam,

The problem is that you don’t know how to use a CPI calculator, and instead you make up BS.

So using US figures:

If you put US$0.97 into a US CPI calculator, for 1970, it will spit out the current value adjusted for the US government’s CPI inflation: $7.75.

“The average price for a McDonald’s Big Mac in the US is now estimated at $5.15,” the New York Post said on March 19, 2023.

So CPI says that there was more inflation than the Big Mac tells us. Happy?

Dear Wolf:

The old Big Mac Index.

1. I said Big Mac Meal, not a single burger

2. I also said C$, known as CAD, Canadian dollars. So $5.15 USD times 1.3626 is C$7.02 for the single burger, plus fries plus a drink for Rotten Ronnie’s Combo.

3. 2% compounded for 50 years, by my calculator is a factor of 2.7 times 1.

You misunderstood.

Yes, I do know how to use a CPI calculator, but the “adjustments’ are political and absurd.

And regardless of prices printed on Government Statistics, go buy something and then you will know the retail price.

No, I am not at all happy. Inflation is Theft and it is understated by all Governments. Few if any tax brackets are truly inflation adjusted, if at all.

Most realtors don’t know how our monetary system works.

It’s a bad job that has a low barrier to entry.

Central banks have ensured many of them make more than people doing core jobs that make our society function. In the same vein the same central bankers have eroded the value of real wealth creation. All this was fully understood by the generation who bought low, forcing their own children to buy high, in exchange for a few foreign holidays.

They know exactly how our monetary system works. Lie, obfuscate, mislead, cash in a BIG paycheck for doing very little work, aided and abetted of course by the Realtors cartel and politicians. I do a lot of work in homes as a tradesmen. I can put 100 hours into a job and watch the homeowner sell the home and the realtor does maybe 4 hours of work and even their 25% of the total commission comes to more than the labor I did.

Realtors can make good money but the lifestyle and stress are brutal.

Most successful ones I know work evenings, weekends, and holidays, and they still have to work during business hours because that’s when the escrow companies and contractors work.

Generally makes family life impossible or at least chaotic even though it’s technically “flexible”. How much is your family life worth?

Anyone who thinks successful realtors put in maybe 4 hours worth of work is just admitting that they don’t know anything about the business.

As a Realtor I can tell you very few of us have a bearish attitude! You could poll Financial Advisors and probably get the same percentage of bulls. I for one will and have been warning my clients the market is volatile and will most likely fall for the foreseeable future. Even in my market which enjoys the Great California Exodus with new residents moving here daily we are still down over 12% from peak. “Never been a better time to buy” not in my vocabulary. I understand the drive to sell but how can a little bump in a short lived spring buying season turn 7% mortgage rates and historic un-affordability into any thing but a top. No we are not back to normal and the correction is over.

6.5% Mortgages ? CHEAP.

Unless your working life started 20 years ago.

Financialization, absurdly low interest rates have destroyed Price Discovery. And viable businesses.

We listed our house in mid February (Mississauga, Ontario Canada).

Two weeks of showings, 2 open houses.

Sold in 3 weeks slightly over asking.

When we were considering the offers I asked ” shouldn’t we wait for the spring selling season?”

The agent with 30 years experience said while the seasonality may align with the numbers occasionally it’s an old fashioned view .

Only two houses for sales in our community. They both sat for many, many months. one finally went pending a month or so ago and we all thought it sold significantly below asking…..NOPE! Just found out……Cash buyer at full price. We are talking 1.1M. I guess sellers are still winning this game…..wait until the last fool has bought?

I remember 2010 everyone told me it was a bad time to buy. Bought the house and was one of the best purchases I ever made. Waiting for that sentiment again before purchasing a house. Will continue to rent for a while.

I salute you for your honesty

For some realtor hilarity, google an LA Times article from December 1, 2006 entitled “Optimism is Rising on the Housing Market.” It quotes realtors and “experts” that the housing market finally turned a corner on December 1, 2006 and that was the time to buy. This was right before 5 years of decline. Of course anyone who listened to them went underwater 30-40%.

Excellent point! Mass delusion and propaganda is becoming the new mantra for real estate agents. Many are spending a record number of dollars by attending these positive thinking seminars to sell more real estate listings. They even have how-to-be-great systems which charge over $2,000.00. Realtors are working like crazy to find out that there is nothing wrong with their work ethic-it’s the market stupid.

It’s not the realtors fault when buyers want to buy and sign. Nobody forces you to buy. But, but, but they lie!! So what, it’s their job to sell and tell you half-truths. There is enough material out there for people to do their due diligence. Any sales person is going to tell you you should buy now. Low inventory, low demand, sky high prices, low sales volume. The RE industry is hurting and so are potential buyers who are waiting for lower prices.

Patiently waiting for SoCal to crash. In the meantime, finding amusement in how stubborn SoCal sellers are, they obviously didn’t get this memo as now I am starting to see some Refin, Zillow listings in my inbox with now price increase..gotta love that.

Perhaps the increase is related to the “not in my area” and “still bidding wars in my neck of the wood” comments we will likely see in this article.

there are still some suckers buying homes. there will be no pity for them and no bailouts as their homes get foreclosed in three years.

Agree with you. The good news is that these fools are decreasing in number after all

Mortgages from 2008 till now have been re-worded to allow the banks to foreclose easier and not run into the troubles they did in the last housing collapse. They also shored up the MERS issues people could use to delay or stop foreclosures in the past. They also have spelled out the right to go after deficiencies owed by the borrower after foreclosure! People may not get thru this as easy as before. I wonder if the auto dealers will just look the other way when a short sale or foreclosure shows up on a credit report and just go ahead and sell these people a new car like they did last time?

Having spent some time on the automobile side of the equation, the standards used to evaluate creditworthiness for an automobile purchase differ somewhat from that of a home.

Why?

People will do all they can to keep their vehicle – when the SHTF, it’s among the last things they’ll let go. As the old joke went, “you can sleep in your car but can’t drive your house”.

The captive finance company for our mothership had their own criteria to evaluate a customer. FICO scores were only a small part of it. Are they a repeat customer with a satisfactory payoff? Did they pay for their last vehicle (reasonably) consistently and on time? Amount financed vs vehicle price (any equity?). And others….

BK’s and chargeoffs are not taken lightly. However, the vehicle is only a flatbed and an auction away. A house? Not so much.

I just helped put a secondary ABS lender into subprime auto space and they have some great modeling to take advantage of the yield finally

Fico can be beat now with AI modeling for higher throughput and lower deficiency

Add 18 years to 2008 it will tell u when next huge crash is ,then look at trump tax cuts expiring date . SHTF in 2025 -2026 .

Things were showing signs of heating up in San Diego, but I’m seeing the same thing now, not just stubborn sellers but very greedy sellers. Many houses are coming to market at what seems to be unrealistically high asking prices. Inventory is still super low, but stuff is sitting for a while now, and I attribute it to stupid high asking prices. I still think spring sales numbers are going to surprise folks, but a lot of stuff is sitting now at dumb prices.

Some of the “price increases” are nothing of the sort. The seller reduced the price $1,000 10 days ago to get to the top of the online queue and then raises the price $1,000 today to, again, get to the top of the queue and keep the listing “fresh”.

Net price change? $0.

It’s a game. I’ve been watching this for awhile now. These price movements show up in your email if you’ve searched for a property in a specific area. Appears to be more prevalent in Austin, TX as I don’t see it in other areas of interest.

I’ve seen emotional behavior on the part of sellers and buyers.

Regarding sellers, I’ve seen a properties listed at a price that increases as the home stays on market. The homeowners must be thinking supply and demand doesn’t apply to them.

When your home isn’t worth what you thought it was, it’s a hard fact to face. Some would rather deny the facts.

Here are some data for you to contemplate…….

Article from the Melbourne Age. Data from Domain Quartery House Prce Report.

‘Property prices in some of Melbourne’s more expensive suburbs are on the rise, a sign that the market downturn may be recovering after months of price falls.

Economists are not certain if the bottom of the downturn has been reached, given the headwinds the market is still facing, but a bounce in prices in affluent neighbourhoods traditionally heralds a shift.

Suburb Median Annual Change 12 Months from March 2022

Alphington $1,975,000 23.0%

Elwood $2,625,000 14.1%

Deanside $610,000 13.0%

Patterson Lakes $1,345,000 12.8%

Lyndhurst $955,000 11.7%

Maddingley $635,000 10.0%

Lynbrook $814,250 9.3%

Cairnlea $950,000 8.6%

Taylors Hill $900,250 8.6%

Kurunjang $558,500 8.4%

Albert Park $2,500,000 8.2%

Harkness $590,000 8.1%

Springvale $870,000 8.0%

Kew $2,752,000 7.9%

Aspendale $1,395,000 7.8%

Burnside Heights $770,000 7.8%

Clyde $699,900 7.7%

Officer $700,000 7.7%

Wollert $700,500 7.5%

Hastings $715,000 7.3%

The rise in prices in some of the more expensive suburbs, is a turnaround from the market in the December quarter, where Melbourne house prices were falling at the steepest annual pace on record.

Those falls stabilised in the March quarter and Melbourne’s median edged down just 0.5 per cent to a $1,023,116 median.

We sold and moved to SE. I sold too low, but there were other factors. Inventory is rising in the local markets and good inventory is non-existent. We bid 8% over ask and someone bid higher and waived inspection contingency. We were in escrow on a place and inspection report showed structural/foundation issues. They relisted next day and it went off market at same ask price. Disclosure? Doubtful!

In our other target market anything reasonable goes quickly. Multiple cash buyers. Looked at car plates at open houses- mostly blue states. Discouraging and gonna get a 6month rental this coming week. We still have Cali license plates. The Realtors I have interacted with are mostly worthless.

No inventory worst time to buyGS building new facilities in Dallas and may add 5000 new jobs but for Dallas market that’s not many jobs

Here in Long Island, N.Y. prices are higher than ever before. The new homes I am seeing have INCREASED their prices this week. The covid exodus from manhattan has really effected things. There was a glimmer of hope last November when we saw a few homes priced right and there was fewer buyers. So far this spring everything is selling.

Yes, I understand, not in my town. Alas, here’s what Zillow says that median price is doing in Long Island:

Most of these homes are so not worth 480-500k. Built in 1918, original electric, house hasn’t been reno’d in 50+ years, still selling like mad :-(

Here is what I am seeing.

The Median price has dropped from the peak for many cities. But if you go look at individual houses, it looks to me as if houses priced below the median are going up and many are not above 2022 peak. If you look at houses priced above the median, they are below peak 2022. Especially the top 25% percentile. So I think most people on this board look at homes at below median price and actually see prices are going up. Nothing to validate my thinking but I think there is a big drop in prices at the top and skewing the median price.

In my area, median price is around 320k. Everything under 400k is above peak 2022. Almost Everything above 400k is below peak 2022.

Ru82 – exactly! In one town garbage near 200k gets snapped, good property under 300 gets bought but noe near 275k to a tad higher. For over 350k you can get a really nice house.

In a second market it’s 275k to 325k has strong demand, near 250k is a slam dunk and over 400k you get a really nice home.

The immigration of cash buyers from blue states is stunning

Here in Davis houses are selling like hotcakes at or over asking. Perhaps we are a special case but it is amazing!

Maybe SF folks leaving the city with a load of cash?

Yes, I understand, not in my town. Alas, here’s what Zillow says that median price is doing in Davis, CA:

Wolf – and I suspect the inventory is showing a slow build overall too, and same where we are but “good inventory” is very limited and the median price may be dragged down too. Prices are a tad softer but there remains a demand overhang that has zero interest in marginal areas or marginal properties and unsatisfied demand in “good inventory level.” When you have five offers in a day with four all cash and at least two over ask price by at least 8% then the overall stats have limited application. By my seat of pants reconning and using that real estate app I sent you, it will likely take until Q1 2024 b/f we see meaningful inventory and that is not over-supplied.

Also a consideration is the cost to rent for a year or two and potential loss in purchasing power of cash while waiting.

In Elk Grove (zip code 95757 / 95758), I saw lots of pending home sales. It makes me scratch my head: where do the people get the money from? How could they afford 6.5% mortgage rate with a house price $600K on average?

At least I cannot afford it.

Elk Grove is terrible. The state is suing them Nimbys right now. Jackasses complain about the homeless but dont want housing built lowering their property values.

What realtors are doing now is UNDERPRICING homes trying to make a market. They get the price they are asking , but it is much less than what they were getting last couple years.

Not in my neighborhood :-) /sarc-off.

“Not in my neighborhood” folks: Pease look at WR’s other articles factually telling you how prices are down from the peak!

We have long way to go down and it’d happen slowly and painfully.

Also, more and more lay offs coming.

Yeah, whenever there is posted an article with real estate in the headline, people will show up claiming “not in my town!”. At which point Wolf will post data showing that it’s wrong. Happens every time, LOL.

And yes I do think the job market is headed for some serious trouble.

“those prices are now history”, sadly not nationally yet. Some major metros seem to be post bubble, but NH appears to still be rising. Average time on the market is below 7 days. Theres just not enough inventory for the pool of buyers. With service inflation so high those new homes are also a bit of a stretch. Heres to hoping the North East catches what the west has soon enough.

Wolf’s graphs have me questioning if Im gaslighting myself, but it seems NH is an exception and still not down, flat at least. I have no doubt prices will fall soon enough. “For the morning will come.”

https://www.zillow.com/home-values/39/nh/

“Permanent high plateau?”

With admiring attribution to economist Irving Fisher who’d proclaimed in 1929 that “stock prices have reached ‘what looks like a permanently high plateau.’”

New Hampshire is very hot- we sold a duplex investment of ours in Southern NH in early April 2023 and got 8 offers all over asking by 10% and waiving inspections and included appraisal gaps. All first-time homebuyers.

Yep — burning off the last of the EZ money-fueled greater fools on the slalom to the bottom.

Not that it is a good metric, but I just saw a house in Raleigh market went for 100k over asking.

The bidding wars are back! Might show up in days in about 3-6 months.

There will always be special houses in special locations with special people who really want it that will affect price of a particular property, especially when plenty of people still have plenty of cash. You don’t buy a house through self-checkout that is priced identically to every other house.

I don’t see any comments on the great ERC, Employee Retention Credit. It is a tax refund good ole Uncle Sam has been sending back to all us good payroll tax paying businesses. My friend who has a small restaurant just received 200K. I have about 20 low wage employees and received 500K. How many more around the USA?

Nonsense. The ERC expired in Dec 2021. You cannot claim it for 2022 or 2023…

Not “is” but “was.”

But what was the asking price? Which neighbourhood? Which house? I mean if I put a $100 bill up for sale at $70 I’m probably going to have a “bidding war” and will probably sell at “over asking”..

Excuse my skepticism but with every RE article wolf posts there’s all these types of comments with no real info to cross check, my realtor also tells me about these “special” houses in “special” neighborhoods every time I talk to him as if I can’t see that 720K properties from over a year ago are up for sale at around 650K-660K and most of them sit there a long time unsold.

Yes, this is exactly what realtors are doing now. Seen it twice now in the last couple weeks. they are telling the owner we don’t want this to be overpriced and end up sitting on the market for months

It was probably mispriced to start with.

Raleigh suburb here, a new build development with tiny 0.14ac lots. Last week the builder put an almost-completed house on the market and crashed our previous development listing price record – it’s the first house here listed for more than $700k. Just for comparison – our next door neighbors got their house in the middle of 2020 and paid less than $350k for it. Most houses here were sold for $400-500k depending on their size and exact timing with a few outliers in low 600s. Breaking $700k is something entirely new for this area.

I honestly thought the craze was over and we’ll see some price declines around here, or at least some price stability, but so far that is not what seems to happen.

If you ask me, most of the houses here are not worth 500k, let alone 700k. I don’t get why folks still buy those overpriced houses, but it looks like they do. Just had another young couple with kids from CA moving here recently.

I’m one of the homeowners who is holding off putting my house on the market. I would like to sell it, but as long as prices remain high and inventory remains low, I’m staying where I’m at.

Here in [city name] houses are [exaggerated enthusiasm about price]. I am seeing [unconfirmable first hand experience], and that’s exactly the opposite of what data shows. Our market is special because [made up idea].

Am I doing it right?

“They’re offering lower price points, and they’re buying down mortgage rates for a set period . . . ”

Ergo, this means builders still have big profits despite a big downturn in sales. Last fall when rates were pushing towards 7%, one of the big boy builders said their gross margins were like 43%.

All that to say, housing has barely begun to correct nationally to the level needed for long-term affordability. We’re maybe in the top of the 3rd inning.

Wolf routinely points out that the last downturn took 5 years to play out. So, it’s reasonable to think this time around will be at least 3 years, and we’re just now getting to the 1-year mark.

You forget that the property bubble of 2008 looked like a diaper compared to the current one. Then prices were falling for 5 years now they may be falling for 8 or 9 or more years

Trying to buy a house too so before you scream RE cheerleader……this ain’t 2008!

Inventory (active listings) were rising from 2005 to 2008 to the tune of 4M.

Today we are hovering at or below 1M active listings.

We all know that you only had to fog a mirror in order to qualify for a loan back then. Nothing like today.

ARM loans back then compared to low-locked in rates for 30y for the majority of owners today.

Back then everyone believed “buy now or be priced out forever”. Today: everyone including their moms forecasts a recession and believes the market will crash.

Again…..I am trying to buy a house too…..I would LOVE a crash but that’s just not in-sight anytime soon.

Big home builders stocks are trading at all time high. Go figure :-)

What’s going to pop this big fat bubble?

Higher unemployment and more rental vacancies.

In Seattle, it seems like people got the memo early on declines and cut prices to make sales. But as things transitioned to the low inventory stare down between sellers and buyers… well it seems to have created some upward pressure. We will see where this ends. Will there be a break through where some forced sellers dump inventory on the market, or will we stagnate through a decade long teeny tiny market with higher prices.

There is no seasonally udjusted upward pressure in Seattle.

It ends with unemployment increasing.

Nobody said anything about seasonality, undergirding my point is the fact that inventory is still low. Yes, the monthly and yearly trends are down, but Seattle still favors the seller. File this under strange but true!

Longtime:

Seattle does not favor the seller, prices are dropping.

The fact that inventory is “still” low is counter to your point. Prices fell dispite low inventory. If inventory was higher, prices would fall faster. Saying it a different way, the demand is so “teeny tiny”, that prices are falling even before the selling starts.

An increase in inventory would drop prices further. Increased unemployment would drop prices further.

https://fred.stlouisfed.org/series/ACTLISCOU42660

Here’s the Case-Shiller chart for Seattle:

Brother just sold his house in Edmonds last month and was happy to get 2 million, lamenting that a nearby similar house with a less spectacular view went for 2.3 million just a few months earlier. He has no illusions that Seattle is still a seller’s market.

Big tech employers in seattle laid off thousands.. one of the reasons for price decline there

I’m not sure if selling is related to layoffs, yet. When rates went up, and sales slowed, the Seattle region adjusted asking prices downward quickly, so I’ve read. Still a long way to go to bottom IMHO

I think the Fed would prefer long term stagnation at higher prices because that would get their inflation statistics back in line whilst preventing any realized losses on ever-sacred assets.

Seattle is CRASHING according to case shiller

On the rate front, market knows for whom the FED works for hence market is up today.

As usual, FED hiked by piddly 25bps to please their masters.

Spoke too soon,

Looking like market is paying attention to FED now ?

We’d see in next few weeks.

I appreciate data but I can’t live and raise a family in it. I’ve been shopping for a place to live for the last couple months and I’m not seeing much improvement yet over years prior.

Last weekend I toured some neighborhoods 100+ miles away and it’s quite disheartening what little money buys (or rents) these days.

Related, I noticed that as of today Zillow is no longer giving an estimated monthly payment on listings. Now they want me to fill out a pre-qualification form for my “customized estimate.”

Totally your call SF, but that is the kind of thing that a good loan officer should be able to do for you when you get pre-approved. I make sure I am available evenings and weekends for when my clients are out looking at houses so they can know what the numbers are on the property before falling in love with it or making an offer.

I concur with you on money not going nearly as far as it used to, housing wise.

SnotFroth,

Get it over with, buy a house, pay out of your nose for it, thereby helping to prop up this market and allow a seller to get out, and then never look at Zillow again, and don’t worry about how much you’ve lost on it, or how much you’re paying to live there. Just don’t look. Just work hard, make your mortgage payments, maintain your house, and be happy with your family. And after 20 years, look on Zillow and see where you are.

I’m getting kinda worn out by all these millennials sitting by the sidelines griping and expressing their impatience with the house price declines… that they haven’t crashed all at once by a huge amount last month so that they could buy a cheap house.

Alternatively, you can rent a similar house for a lot less. But that doesn’t make you happy.

Yep, I’m getting sick and tired of all these whining dogs who have been sitting on the sidelines waiting for housing to come down so they can afford to buy their dream home. They want it all NOW! I bought my 1st home for $82,000 at an estate sale during the Jimmy Carter Hyper Stagflation. It had one light bulb in the basement and 800 sq foot. I stayed there 21 years and fixed it up and added sq footage to 1,200 sq feet and raised a family there. One car family, used public transportation, bike etc. to get around.

Id gladly pay 600k for a 800sqft home if there were any on the market. Waive inspection, will pay delta on any appraisal shortcoming. Please accept my offer. PLEASE

I think you’re already in the to 10% of whiners around here based on comments. Good for you on your timing.

Wolf, easy for you to say–you and your generation have benefited from one of the longest and strongest bull markets in, well, everything. Forgive us if we’re cautious.

You missed the point, which is many people on the buy-side aren’t cautious enough, based on the amount of impatience and unrealistic expectations seen in these comments.

Building wealth is about patience, discipline, and emotional intelligence.

If I ignored inspection results and bought any of the houses who’s offer was accepted in the past 3 years, I would already be well upsidedown on a humble, 50-80 year old house I couldn’t afford all the significant repairs on because the current ‘affordable’ middle class housing supply is 4 decades older than it was when Boomers bought their first barely functional fixer upper home in nineteen-dickity-two for less than a Mazda and are asking well over $300k+ for. If there was a fixer upper around here, I definitely looked at it and probably bid on it, but not one that didn’t turn up having a buried oil tank, need mold or asbestos remediation or significant structural repair in which the bank required me to pay for an engineer to inspect before they’d consider my mortgage app, and came across not one seller who would budge on repairs nor concession.

Its not 1978-1986’s housing market, and Mommy & Daddy Boomerbucks aren’t funding the down payment (even if they weren’t broke and dead, I’d be SOL there). So yeah, I’m sidelined too, and wisely so.

Probably indefinitely, can’t muster a logical reason to buy in the next 3-5 years. By then kids will be well into high school and my obligation to stay this godforesaken state will be mercifully dwindled to only a fine few more years. Can easily make do basically anywhere between here and CA, so perhaps my 50s will be rosier at a time I’ll just want to rent and travel anyway. Hardly a time to buy then.

Subplot: we’re not even two minutes to midnight, so mayhaps the hands that threaten doom will end the discussion for good. Enjoy that earworm.

I think Wolf’s advice is sound. He’s just getting fed up with the FOMO. I think it’s FOMO buyers capitulating that are part of what’s keeping things aloft.

Maybe stop sharking, save your money, and resolve to buy a place in the next 3-4 years. Live your life in the meantime. Home is in your head, after all.

Meanwhile, this market is swerving to grinding halt — not stopping on a dime.

Yeah, well, I’ll have you know that with that mentality I bought a condo in Feb. 2007 with a 40 year ARM, first 10 years interest only. The pros at the closing table told me I was making an excellent choice, but they wouldn’t look me in the eye. Then I got smashed against the rocks for the next 5 years of recession and depreciation, with leaking pipes pouring water through my ceiling, getting robbed in the parking lot when the neighborhood went to shite, and scarce job security as I work adjacent to automotive. I foreclosed, rented, and rebuilt myself by 2019 and intended to buy in 2020 when another economic calamity struck. So I decided to wait until 2021 and see how things panned out. Big mistake. I put in offers for the last couple years but got blown out of the water by stronger buyers.

You’ve been calling it a bubble since 2014. It’s not a bubble if it doesn’t pop. And unless prices get back to at least 2019, that’s not a pop. That’s just appreciation.

Maybe I am an entitled millennial, but I will buy next year, and I will be house poor as you advise. I’m not sure if you have kids, but if things continue on the current trajectory, I suppose mine will be facing $1 million starter homes without the commensurate income. Times have changed, and not for the better.

SF,

Just buy or rent what you can afford. If you can afford to buy an overpriced home and that’s what you want, what’s the problem?

Plenty of people stretch themselves thin and buy a car, a house, golf membership, timeshare, and they seem happy. Nobody is putting a gun to their heads.

You stayed on the sidelines for many reasons. Maybe evaluate those reasons. Just as a quick story, my brother was always against buying a home. The housing crash in 2006-2011ish cemented the idea in his brain. Fast forward to 2020 when he turned 39 years old, that’s when he decides he WANTS to buy a house. COVID hits, prices go through the roof. He is disgusted with the prices. I pointed out that rates are so low, hence it ain’t the price that controls, it’s the monthly payment. Rates drop to 2.25% for a 30 year, and 1.75% for 15 year in early 2022! I can’t believe my eyes! He still won’t “overpay” for a house. Fast forward to early 2022, rates are now creeping up, FOMO sets in. Settles for a condo after not “overpaying” for a house a year earlier.

So, ends up overpaying ANYWAYS, but with a high rate so monthly outflow is bigger. Hindsight is obviously 20/20, but the “OMG house prices are too high” mentality completely took over, therefore ignoring what truly matters….CASH FLOW!!!

Colour me curious!! When we bought our second house [Canada], we paid off our 20 year mortgage in 13 years by paying weekly {bi-weekly is the same thing}. The interest rate was the same throughout – not too bad since it was either higher or changing meant a penalty. Is this option available to people in the U.S.?

You can do the same thing here if the paper doesn’t have a pre-payment penalty. Some banks allow you to set up a semi-monthly payment scheme. Other mortgagees just do it on their own. Once upon a time, we made one extra payment per year, which went entirely against the principal. The only catch is that you have to tell them it’s an extra payment, otherwise they book it as an advance payment and you don’t get the benefit (it gets amortized the same way as a regular payment).

Paying semi-monthly is a smart way to do it as it doesn’t increase your housing costs. Our way did, but – since it was optional – there was no pressure to make that additional payment.

Like in Vegas, if you play too long, your luck runs out.

When you are playing with the houses money, it’s easy to push your luck until its gone.

When it comes to speculative gains, the stock and RE markets are no different. The people who ride it up tend to ride it down.

Now, how long before less demand for mortgages make the price (interest rate) drop? After all, acording to economic theory less demand should translate to lower prices. 😉

Not if supply drops faster than demand. And Fed tightening means less supply of money…

What may be happening is the new homes on the market now will be canobalizing the sale of existing homes. This happened in Florida in the 90s. Builders put up state of the art homes next to existing homes and the older homes plunged in value. I saw this happen with my own eyes. Builders could offer all kinds of incentives not available to existing homeowners trying to sell their bombs. The typical buyer down there figured “why by an old home when I can buy new.”

Buying new with a temporary low interest rate due to homebuilder buy down may work out if inflation continues and wage inflation keeps pace. Seems like a fair chance of that happening.

With all due respect, buyers are switching to new homes because there are so few resale homes to buy. And low down payment buyers are lowest on the list in multiple offer scenarios. Walk over to a new home builder and you can actually get a low down payment loan accepted.

Let’s see, bid on 18 different subpar mediocre homes and lose each time, or go into a new home tract where they give you a bottle of water, a cookie, and sell you a home on the spot?

Wolf’s advice is spot on. Don’t buy now. But if you must buy, buy new, as you will get the most for your money. But also realize that you are buying a place to live, not an investment that is likely to appreciate in the near term. Remember that, if you want to turn around and sell, you will be competing with all of the new inventory being built 2 blocks away. The builders aren’t going to stop so long as they have land…

Simply put, the vast majority of Americans can only afford 50% of last year housing prices. And it is because IRs have doubled. As simple as that. When prices have adjusted to that level it will have bottomed. Before that….it’s smarter to rent. From someone who has virtually never rented.

Can anyone give a quick explanation of a mortgage rate buy down?

There are good explanations on the in the internet. Just google: mortgage rate buydown

I just went through this with a lender. You pay for “points” up front usually to lower your fixed interest rate for the life of the loan. But in the 2/1 buy down you get 2% off the first year and then 1% off the second year, 3rd year you’re back up to whatever APR you agreed upon.

I shopped around and was able to find a lender for 5.375%

Thanks. Sounds similar to an ARM.

The expected market time for 90% of houses in SoCal is 45 days! Prior to Covid it was over 60 days. For the remaining 10% of houses (they are considered luxury) it’s significantly higher. there is no crash in sight whatsoever.

I expected a slow spring selling season and hoped that a seller would accept one of my low ball offers. I prob wait this out until fall/winter.

Would be curious on the exact #’s of luxury units/houses in large metro areas purchased and sitting un-inhabited as a wealthy hidey-hole to park/launder money. Lots of that in NYC, London, etc. ‘Allegedly’ – but folks are also saying it was a sick ostrich.