This is still an astonishingly tight labor market: astonishing because the Fed has hiked rates for a year and not much has changed.

By Wolf Richter for WOLF STREET.

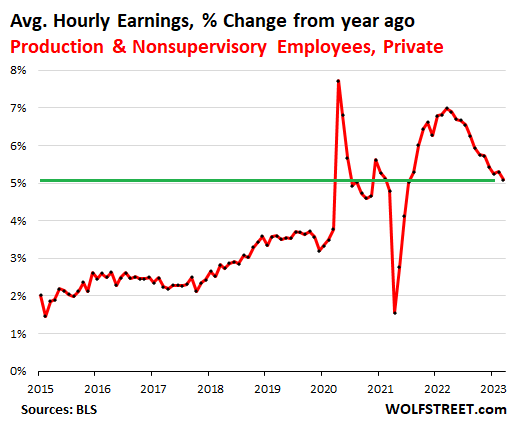

When we compare this labor market to the labor market of the Good Times before the pandemic, we see that job creation has recently been running at about double the rate as in 2016 through 2019, that the number of unemployed people looking for a job is near historic lows, that average hourly earnings of non-management workers are still rising at over 5%, about double the rate during much of the Good Times, that the labor force participation rate of 24-to-54-year-olds is now the highest since before the Great Recession.

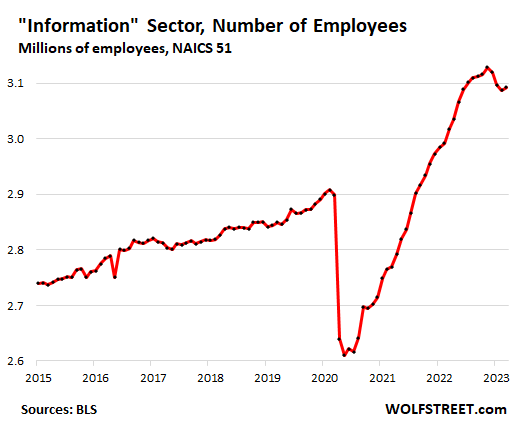

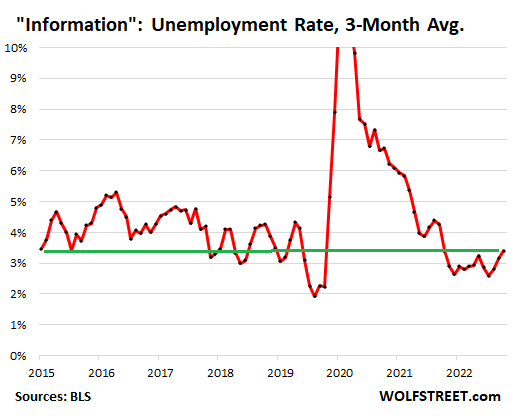

And we see that even in the beleaguered Information sector – the hotspot of layoff announcements – employment is ticking up again after a small dip and is far higher now than during the Good Times, and that the unemployment rate in the Information sector, though it has ticked up, remains at the low end of the range during the Good Times.

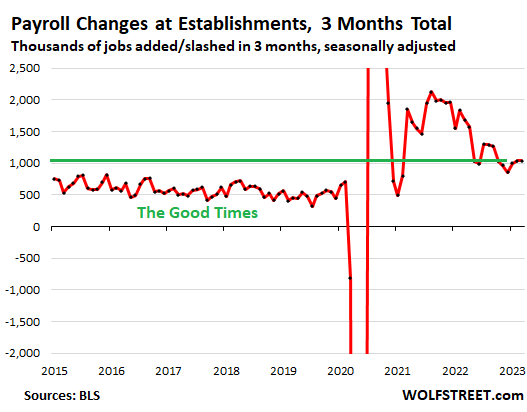

In March, 236,000 jobs were created by employers, according to the Bureau of Labor Statistics today. Over the past three months, 1.34 million jobs were created. This three-month total, which irons out the month-to-month variability, is nearly double the average three-month rate during the four years of 2016-2019 (of 549,000). Compared to the Good Times job market, this labor market is still hot.

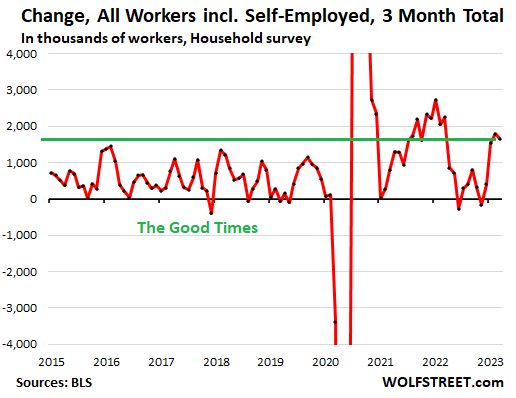

The labor market may even have heated up in recent months, based on the data obtained from households, which show that total employment – payroll-type jobs at establishments plus the other types of work, such as the self-employed – has shot higher over the past four months, after languishing for part of 2022.

In March, the number of workers reported by households jumped by 577,000. Over the past three months, the number of workers jumped by 1.65 million, which is roughly three times the average three-month total in 2016 through 2019 of 565,000. These are huge numbers:

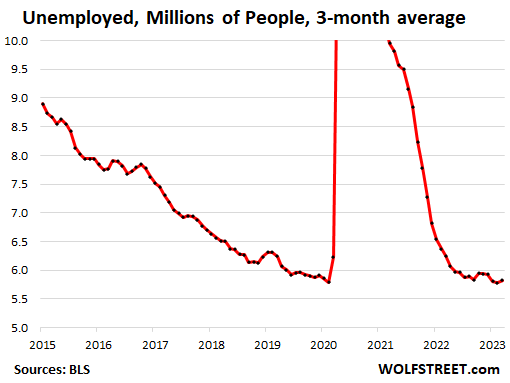

The number of unemployed people who are actively looking for a job dipped to 5.84 million in March and has been in the same historically low range for months.

The three-month moving average of the number of unemployed people through March ran at 5.82 million. There was only one month during the Good Times, in February 2020, when the three-month average dipped below that:

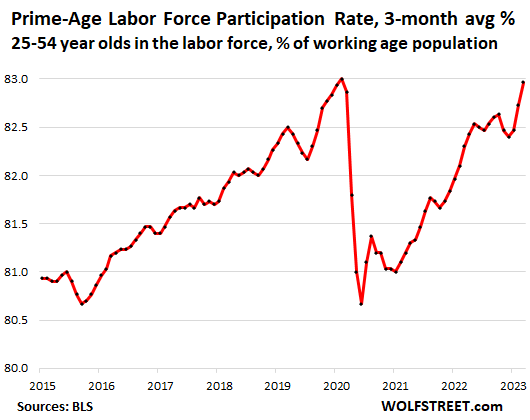

The prime-age labor participation rate – so people aged 24 through 54 either working or actively looking for a job – reached 83.1% in February and March, the highest since before the Great Recession. In terms of the three-month average, it rose to 83.0%.

The prime-age labor participation rate eliminates the complex issue of the so-called “excess” retirements that have bedeviled the labor force during the pandemic. In other words, people in their prime working age are strongly participating in the labor market, working or actively looking for work.

Average hourly earnings of employees in non-management and non-supervisory roles rose by 5.1% year-over-year, compared to much smaller increases during the Good Times. These are engineers, teachers, bartenders, technicians, drivers, retail workers, wait staff, construction workers, nurses, etc. in non-supervisory roles.

But here we see that some pressure is coming off, perhaps more driven by public rhetoric about a gazillion layoffs that may intentionally and successfully have intimidated some workers.

The number of employees in the Information sector rose in March to 3.09 million, after three months of declines. This is the hotspot of many of the layoff announcements in the tech and social media sector. But since the peak in November 2022, employment in that sector has dipped just 1.1%, and is still up by 6.4% from the peak of the Good Times in February 2020:

In this beleaguered Information sector, the unemployment rate in March dipped for the second month in a row, to 3.1%.

But the three-month moving average of the unemployment rate, which includes the January-jump (3.9%) and which gives us a better feel for the trend, rose for the third month in a row, to 3.4%. So even here, in this sector that is beset by all these global layoff announcements, the unemployment rate is still comfortably in the range of the Good Times.

The Fed isn’t having a lot of luck cooling this labor market.

The labor market is just barely cooling off in some sectors, such as Information, and not cooling off in other sectors, and remains tight overall by Good Times standards.

Today’s data is confirmed by different types of labor-market data, including the number of claims filed for unemployment insurance, and actual layoffs and discharges (not announcements), voluntary quits, and job openings.

In other words, this is still an astonishingly tight labor market – astonishing because the Fed has been hiking rates for a year, and not much has changed in the labor market.

And so the Fed isn’t having a lot of luck cooling off consumer demand. A labor market like this means that consumers are working and making money, and incomes are rising, and they’re spending this money. And when consumers spend this money, as they’re doing, they’re helping to fuel inflation, and that’s what we’ve seen. And I’ve discussed it here: Consumers Got Whacked by Inflation, High Interest Rates, Layoff News, Asset Prices Falling from Lofty Peaks… And They’re Still Not Slowing Down.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

As expected, no recession is sight.

Let’s see how quick oil finds $90. 30YFRM are falling like a ton of bricks. Let’s see if they push below 6% soon. As I said 3 months ago, housing will stabilize this spring, which it’s doing even in those really high-priced markets that have seen the most YoY drop in prices.

Added together, inflation is forming a bottom trough and stands a better than 50/50 chance to rise as summer arrives.

BENW

So all of those Issues ” As expected, no recession is sight.”

indicate the Rate Hikes to if nothing else remain in place Yes ?

Perhaps a Continuation of .25 Macro Rate increases heading toward %6

Is on the Plate

With the 34 Felony charges toward Trump perhaps some sobering Agenda shall come forth from the Fed ?

There’s a facetious saying in legal circles about the ease with which prosecutors can secure indictments in grand jury cases: You can get a grand jury to “indict a ham sandwich.”

Especially if the ham sandwich committed multiple crimes and left a paper trail.

Pea Sea, we call those, ‘crumbs’.

With a $4 Trillion Fed Balance Sheet at the start of 2020 and a $9 Trillion, creeping toward $8.5 Trillion BS today, I would say there is a lot of liquidity yet to be mopped up.

Tell me again how Fiscal Deficits of $3 Trillion plus are going to get financed without the help of the Fed leaving most of the $5 Trillion they conjured, out in circulation? The mop up is going to be mighty slow.

There’s orange hair on my ham sandwich!

Inflation is already rising. See April end CPI in mid May.

Also, No one is buying houses at 6% mortgage at current prices. The only deals going through are now from people moving around: those who sell house in one place and use cash to buy it in another place.

$90 oil will make mortgages less affordable, not more.

Fed isn’t unlucky. It’s not evem trying. We call that LAZY in America.

Leo

Not true

People around here are buying houses even at the 6% mortgage rate. Starter homes are in demand. However, you have to go into a crime ridden neighborhood to get one that is affordable. All of our work recently has been in these places. They are hellholes. Most of the supporting infrastructure is broken, small business have many that are boarded up. The people there have to put up with no police protection, litter all over, food deserts, maniac drivers, unemployed people doing nothing all day etc. Not a great place to live but people are buying newly renovated properties there.

Are you in DC, SC?

Yep. I agree. I have a rental in what is considered a low-income area.

30% of the houses have been renovated the past 3 years and have now tripled in price. More are still being remodeled. The were $50k pre remodal and now are selling $150k to 200k and selling like hotcakes. They look great. Granite counter tops. Stainless steel appliances. Bathrooms with all nice tile.

The neighborhood is looking much better. Trees are being trimmed. Yards are being mowed and weeded. The demographics is changing as the lower income people cannot to afford to live there.

I am getting 2 or 3 postcards or text a week with offers of cash. This is different than HB1. During HB1, housing prices rose some but all the buyers were subprime and the none of the newly purchased houses would be fixed up or remodeled. The neighborhood looked low-income and in a few years 50% of the houses were forclosed and were in worse shape than before HB1.

This time is different. This time it is investors buying the houses and totally remodeling them and they look brand new. This time the demographics are changing, and these are not subprime buyers. They are not going to have their teaser loans reset 2 years after they buy the house and see default like the subprime buyers.

I should say this time is different for this specific neighborhood. ;)

I sold a MH park – a dumpy C- property with equivalent tenants last year

bought 3 houses in NICE neighborhoods

went from C- to B(+) tenants

makes big difference

DawnsEarlyLight

This is in Washington DC, Ward’s 7 & 8 over the Anacostia river. There is no gentrification occurring here yet. It will not happen for another 30 to 40 years if it ever does. The buyers are taking a big risk buying here just to get a starter home. The investors were equally stupid to invest money in these neighborhoods.

Back in the day you could brag about your 6% mortgage.

Of course, there is no way we’ll ever see a 21% ff rate again.

When my mortgage refinanced in 1990 s I was thrilled ,new normal and higher . These interest rates run in cycles,Deflation is a bitch.pretty easy to stop inflation STOP BUYING shit you don’t need.works for me but grew up in a different era

Most people are getting either standard ARMs or something called a 5-3-1 mortgage. Gotta friend who was telling me last Nov when rates were above 7% that EVERYONE financing a home was doing this new loan. And, they were buying down the initial rate.

Yes, houses are still being sold at 6%. I’m not saying these people are smart, but there’s still FOMO out there.

I’d be focusing on doing wrap

keep underlying 3% mortgage and cash out equity

I’ve known folks, folks who make nice scratch and are intelligent, who have been buying multiple homes and luxuries since at least 2012 (using debt instruments). I asked one what the logic was. In a few words, he stated that his greatest risk was simply foreclosure. And, he didn’t care.

“Better to have bought and lost, than never to have bought at all” I guess was the thought process.

Risk calculus for many has changed over the years. As have concepts for responsibility, accountability and who shoulders the burden.

You are about as wrong as possible. The Fed’s reaction to the “banking crisis” was to throw money at banks and had a similar effect to QE in the short term, so essentially the markets have see a small rally here.

Long term rates are key here. Depositors fleeing from banks paying zero interest with risk of loss for balances over insurance limits has moved into interest bearing assets, pushing down rates. This move is temporary. Somewhere between now and July will be the top on bond prices (low on yields) and then rates will move up rapidly, just as they did the last time the debt ceiling was raised. There are other factors at play, but overall central bank tightening will finally be felt globally, the result is higher interest rates.

Home sales have staged a small bump of the totally stupid, who are going to be crying as their equity evaporates over the coming 3-4 years.

The Fed will need to quell this market by raising rates again (although to be honest short term rate increases with plunging long term rates is NOT tightening), but before that, we go into earning reports for regional banks which could prompt more depositor runs on these banks.

Consumers are still spending every dime they make and goosing the economy, but that is temporary. Credit card balances have begun a steep rise and bank balances continue to burn off the extra cash. The one stimulus that continues is the the Fed government continues to deploy the last stimulus program money.

State governments are swinging from big surpluses into massive deficits (ala California) and with a Repulican congress, there will be no bailouts.

Pent up demand in certain areas, like travel, will continue into early summer, but start to fall off.

The big issue that still persists is what happens to regional banks. Impossible for the Fed to paper over the massive commercial real estate losses that are coming. Question is whether they engage in massive liquidity programs to try to save all of them. That will be highly unpopular, but they seem to get away with whatever they want.

Nice comment.

It’s astonishing people think Fed has the answers or solutions.

In April 2021, annual inflation rate had shot past 4%.

Fed’s total holdings at that time were roughly 7.6Trillion Dollars.

Inflation denying Fed then took it all the way to 8.97 Trillion Dollars. The level still hasn’t dipped below 8 Trillion mark.

To top it, Fed’s now also on hook to bailout trillions of uninsured bank deposits.

And cre = reset of money .we’re getting poorer by the day

Great observations. Many economies outside the US are facing even more dire circumstances.

“with a Repulican congress, there will be no bailouts.”

LOL

gametv offered eight paragraphs of very astute comments, and a cheap one-liner is all that you could add?

Lots of inconsistencies here.

Other than for very short term maturities, yields don’t reflect the “now”. So how are yields bottoming when you list so many factors that weaken this fall?

The real economy is not poised to drop “today” or “tomorrow” but in the next 9 months it looks extremely likely. The bond market reflects that reality.

Savings balanced are running down just as rates impact more and more people (not everyone needs or wants to buy a large item today but over a period of time, a larger and larger share will and the cumulative relative impacts will be noticeable). These same effects will be reflected and compounded in the labor market.

The Fed has ample reason to pause now and the market view on a pivot is absolute correct.

I hope you enjoy your pivot orgasms.

Long term rates are key here. Depositors fleeing from banks paying zero interest with risk of loss for balances over insurance limits has moved into interest bearing assets, pushing down rates.

While I agree with you that long term rates are key, I fail to follow the rest of your logic.

To “protect their money”, folks don’t move money from banks to 10+ year bonds. They move money from demand deposits to short-duration instruments like T-bills and money market funds. As such, it has a negligible effect on on long term yields. Given this, and the 10-year at just 3.4%, the market appears to believe the Fed will easily tame inflation in the long run and provides no indication of a rapid rise in rates anytime soon.

You make good points about the flow into tbills rather than 10 year. I am suspicious that something major is going on in bonds that few understand. It seems like there is something driv8ng down the 10 year that isn’t explained by the normal mechanisms. Wish I knew what it is.

Correct, longer dated yields reflect the reality that most inflation has been addressed already and is trending back to normal levels. The last remaining stickiness will be dealt with as labor markets soften due to recession.

Anyone not understanding the 10 year dynamic here likely never set foot on a trading desk, has no background in economics and/or doesn’t grasp the basics.

Truth,

Long-dated yields reflect nothing but current market disagreements between buyers and sellers — and the outcome is sheer stupidity.

The 10-year yield was 0.5% in August 2020. That was market stupidity at its finest. People back then (including you?) said that it was the Truth of the coming negative interest rates, LOL. Such BS. Some of the biggest bond-fund kings were promoting this braindead BS. People who bought into it lost their shirt. Anyone who believes that long-term yields actually know anything about the future is just dreaming.

I love it when you cite long-term yields as predictors without looking back just a little to see how badly those yields failed in predicting anything other than maybe the weather?

The market often best reflects the prevailing interpretation of reality. That reality (or likeliest outcome) changes as events in the real world change.

I was not a buyer of long duration bonds (or stocks) when market peaked. Why? Because my personal assessment of likeliest outcome differed from the market. The market gets too excited about trends – extrapolates too far. Just as many ignorantly project forward inflation too far (the “new paradigm”) and how many dropped out of equities in 2009 at market trough (the world is different, we won’t recover).

But misunderstanding why the market reacts as it does is the kiss of death to an informed contrary opinion.

We will see in 9 months on whether the following play out:

* Fed pivot

* car prices continue a downtrend

* CPI below 4% YoY

In 18 months:

* CPI under 3%

* fed funds under 3.5%

* Nasdaq above 14,000

Very reasonable summary. Thx!

Don’t Fed rates have to rise to at least the inflation rate before they’ll have any noticeable effect? Otherwise there’s still money to be made off of inexpensive money.

It seems the Fed is content to slow walk the way there and hope that inflation comes marginally down as the rates sneak up slowly. This is the whole theory of a soft landing, which has yet to be proven wrong.

I believe in the laws of motion. Once the economy starts trending downward I don’t think the Fed can do anything to curb it, since it is largely driven by psychology as much as actual market dynamics. That and businesses dependent on cheap money and growth will eventually hit a wall.

I hope to be proven wrong, but I’m not quitting my day job any time soon since I’m in a recession proof field. The easy money didn’t tempt me this time around. It did before the GFC and I quit my job at the worst possible time to take a high paying job in a field that evaporated overnight. Lesson learned.

I don’t see any sign of a recession here. In fact, I see just the opposite. Inflation is out of control. Most necessities are going up at double digit annual rates. I’m sorry to say the numbers that the government puts out are total bull s$it. They may be able to fool a lot of people but they don’t fool me. I’ve got the receipts to prove it.

Don’t be sorry. Gov’ment $h1t is nothing new.

We are not in a recession and prices should still be going up according to the CPI data? But. we are now starting to see some weakness in leading economic indicators though.

Government debt is inflationary. As much as the FED might try to tighten, they might not be able to counter the Governments inflationary debt. Time will tell.

Banks are sitting on 2 trillion in asset losses. Will the FED allow some of these poorly managed risk-taking banks to fail or bail them out. So far, it looks like bailing them out is their plan.

ru82

I heard that the banks overall Corporate Debt is 20% below market if they had to sell it. There could be bank runs over this fact alone. I have all my money out of banks except the minimum needed to conduct my financial obligations month to month.

Local SW Fl community just got delivery of new fire engine ladder truck, had been on order since 21, 850k, price for one ordered now is 1.250k with 2 + year wait. Two take aways: inflation at industrial level is unreal; industrial manufacturing capacity is severely limited in many areas.

I agree the numbers seem like bull, but I’m seeing signs.. I’m seeing more and more boarded up businesses in my town and in the towns near me and at the same time huge increases in goods prices including food. I don’t see how employment can be as steady as it’s reported, at least here, or inflation as low as reported.

I suppose sometime after unemployment runs out and people become homeless they are no longer counted as in the labor force.

Contrarily, I’m seeing houses that were taken off the market come back to the market at increased prices (WTF??), although they aren’t selling. IDK what they’re doing. I’ve noticed the real estate market here seems to follow the stock market and crypto more than reality. I wonder if it has something to do with big investors banking in SVB or something. IDK.

There are only two people I follow in housing, one is Wolf and the other is Robert Shiller. We know Wolf’s view. Shiller recently said, “Home prices are very, very high by historical standards. I would extrapolate the downturn somewhat — it’s going to continue.” Ben, it doesn’t sound like Shiller agrees with you.

Come on, we all know that when it comes to the housing market, Lawrence Yun has to be the most objective voice ;)

I could care less about Robert Schiller. He’s not some Oracle. We’re in absolutely uncharted territory. There’s 13T reasons, $$$, why the housing market isn’t done booming.

And the most important reason of all is the ABSOLUTE FACT, SoCalJohn, is that the Fed & Congress have moved to a MMT-based means of managing our economy. This means they will through whatever amount of fiat money & crazy policies at housing to keep it a float and the economy in general for that matter.

Anyone would have to be half marbles to bet against the Fed / Congress rolling out rent & mortgage relief upon the arrival of a real recession. The market doesn’t pick winners or losers anymore. The Fed does.

The 8-10 major markets that are down 10%+ were the ones that were bonkers overpriced. Houses in a lot of areas in the south are barely moving down in price.

Until the labor market rolls over and somehow MMT is thrown out, then we’re not looking at a modest decline in housing broadly across the US. And by that I mean a greater than 10% decline.

They have just ended the programs handing out more money in food stamps and are not restarting them nor extending them. As food prices go up.. They’re not going to re-start rent relief.

It was 10 years ago, maybe a little more.

Shiller interview. My memory isn’t perfect but I believe he mostly said nothing while still speaking. Hemed and hawed… I believe that’s the expression. Probably was discussing whether the stock market was overvalued or not.

I’m ok with pointing out the pros and cons of an issue.

That’s not what I got from the relatively short interview. Nobel prize or not I wasn’t impressed because he mostly shrugged his shoulders and said he was worried about the market but well I don’t know.

It’s true that he doesn’t often commit to a position, which is why I found his recent commitment noteworthy. He looks at data very thoroughly. You may not like his speaking style, but he is knowledgeable in this area.

Well, prices on goods, food, and other places are falling. Agree with Bruce, Lleegggal. We have all posted for quite a while and even tried some war tactics on our own “ government”. Look at Japan. Appears to be in Australia with some hopping Kangaroo’s.

Look at our banks, trying to impose fees where our own children bank. We should look back, keep our eye on a cooling economy and support our leader throughout. We don’t want to be like Japan and play like Australia. Just hopping around to impose terrify to make things much harder.

Imagine if we had supported our leader. Provided great severance with a boost for the economy. Wow, maybe we can even go back to the moon again and lift a few things to see light.

Guessing, one is too creative, too focused & bold.

A demonstration of how absurdly low interest rates were for way way too long. Terrible Fed policy, damaging to a point we have yet to reach.

But Bernanke got the Nobel, Yellen got another pension at Treasury.

Well, Powell has owned it for quite awhile, at least for the Fed. I think the Powell cave-in in 2019, and the prolongation of juicing the system post-pandemic, stand as the biggest lurches into failure. There was along slow rise out of the GFC before the Powell era. There, there was asset inflation, but this across-the-board thing is recent, maybe compounded fiscally, meaning “the will of the people” through Congress.

Bernanke and Yellen are traitors to the USA for what they have done. Powell is equally as bad for caving in in 2019. They have single handedly wrecked the US economy for the next generation. There is now way out at this point.

I fully agree and there was a spillover effect into the rest of the world.

Doubt it Mr. PHLeep.

See the Fed tried raising rates way too much, thus because of the lockdown in 2019 they got stronger, able to see the people and feel the economy.

The will of the people need to see the whole truth. This would mean disclosing the cloning of others, the uppers and lowers that make our economy. Now, just ask yourself…….do we really want this?

Sometimes, it is easier and cleaner to pay our dues for our own mistakes. None of us like cleaning diapers but, we all know when we bring others in, we change a few diapers. When mistakes were made in the economy, such as with NIH and COVID. We bailed out and paid for the errors made. Sometimes, the leaders take a win by keeping others happy and silent.

See, we all know, big brother keeping an eye on us can have reverse effects. This includes sending people to gather photos, track individuals with vehicles, monitoring and creating distraction. See, Yellen took a draw a few days ago. We all know Japan has been doing this for a long time.

Do we really need Congress to point out our faults? Let’s look at our own law enforcement. Japan helped clear our ways for rules & regulations there. Our people only see one side and not the whole truth.

Remember when countries invade others? Remember when Japan proposed and used high inflation? Remember when Spain implemented controls on personal vehicles and without the public knowing.

Now, we all know Japan failed when trying to implement the Oriential express. We all know the queen failed her people in England when she did not give proper retirement to help support others. She used the big brother controls and tried to push others out when they paid the levy’s and taxes. Queen Elizabeth is prime example.

Remember, for every action there is a reaction. For one picture there is another. Example when China tried to use electronic controls to destroy people and reputations. Public was outraged and what they thought was one reaction, there was the opposite. China had to create new regulations and some of their top dogs took a fall.

Now, let’s say people did not know about device management controls. Let’s say that the public did not know about one person living beside another then being relocated close to infiltrate and influence public officials. Let’s say that some did not know about China and the voice recordings, videos or other documentation. Why don’t we look at private and public displays of citizens and in todays economy, the ability to make others look sticky, scared, because of edited voice cloning and photoshop editing.

Congress, people, a long ride could be ahead. Sometimes congress likes to get the officials at the table, like Bruce’s or Randy’s comments…. Leg……Al or settle for our own mistakes?

Just like Amazon, AWS stores any and all data for life through Amazon and not AWS…. Same with our vehicle memories anymore.

Yes, Hellen did get a pension at Treasury on 4-11. Maybe if we had given it to the Fed, kept rates low, they would have retired in April. Just a thought…. Then like Bruce said, we could have avoided many mistakes.

And the news feeds I read this morning tried to paint a different picture which was ignored because the 10 year in a shortened Good Friday trading session was much higher at the close .

No Fed pivot yet that’s all I see except from Wolf and a few others .

Yep, agreed.

No pivot yet. She’s one focused tough breed…. Seeing how devices, apps and tracking using apps and feeds, we all have one long ride.

Wow. This is astonishing. Makes me think JPow and crew will keep doing what they’ve been saying they intend to do all along, even if only for lack of knowing what else they might do. Bad news for the pivot mongers.

Why would you suggest the Fed needs to cool this labor market?

Their legal mandate is to maximize employment.

If this is their doing, it seems like a success.

Did you miss it? The Fed has been pointing at the labor market for months. It’s about inflation in services which is spiking, and labor is the biggest input cost in services, and higher wages mean these services providers are going to raise their prices, and Powell has been explaining all this for months, and I’ve been reporting on it for months, and you missed it???

Yeah, the logic doesn’t follow.

Fewer people providing fewer services doesn’t mean the price of those services will go down.

It also doesn’t follow, if employers have to pay higher wages, you have to raise prices. There’s lots of ways a clever manager can balance that out on the books and increase efficiency.

It’s not even a difficult thought experiment, if getting an oil change costs more money, how is firing the last guy on the team of an overworked shop, or making it more expensive to build a new Jiffy Lube, going to drive the price back down?

With demand held constant, the things that lower prices are innovation, competition, and increased supply.

I know J Powell has said he’s trying to destroy demand by increasing unemployment and that’ll magically get prices back down, but of all the things to be skeptical about from the Fed, why take him on face value for this?

If anything, it’s good for him to do his job of making sure people don’t lose their job.

Losing a job is biggest predictor of violent crime.

Scarce labor allows employees to get higher wages, which increases costs to employers which leads to them raising prices and inflation. More employed people leads to higher consumption and therefore more demand.

Demand is never held constant. Demand is impacted by wages earned and number of people working. Right now, I hypothesize that a very large part of the excess demand is a result of a “middle class wealth effect” due to lots of equity in residential homes. The largest asset of the middle class is not stocks or bonds, but homes.

The only restraint on Powell jacking up interest rates much higher is the potential for massive bank failures.

Christof,

You can believe whatever you want, including about what the Fed SHOULD do based on whatever economic theory you might have, fine with me.

My job here is to look at the data, and at what the Fed folks are saying, and make sense of it and give readers a feel of where interest rates and inflation and the Fed might be headed.

excellent critical thinking Christof! you’re absolutely right that we shouldn’t assume the Fed’s theory about how the economic world works has ANY merit. they have demonstrated zero capability to learn and adapt. in the wild, this type of organization would be savagely dismembered by Wolf … oops … i meant wolves.

“…if getting an oil change costs more money, how is firing the last guy on the team of an overworked shop going to drive the price back down?”

“With demand held constant…”

Big assumption there. I recently switched to changing my own oil.

Agreed, clever managers can balance the books. But, consider taking a look at Trump. When they go line item by line item, the booking systems get trashed and people become accountable in positions. We saw this with corporations and poor management or giving others credit or perks…..

With the new case, Corporate lability is shown not to have a time limit for suits. Look at the boy scouts, churches, and etc. 25 years latter and they are in court?

Japan did make them suffer, but much is owed due to our own mistakes. See, just like corporations using personal information monitoring systems on phones or vehicles. Without full disclosures, upfront “trust” would definitely show receipts for Yellen.

Powell did explain this, but truth is the truth. Inflation has been lowering and due to Powell’s own mistakes, using our own big brother controls, many individuals suffered. Thus, Powell should reimburse for their own lack of responsibility.

Congress, may be able to paint a dirty picture to them, but how do we explain our own groups swapping borders? This must have cost our government. Now, we may be getting some funds, like Yellen. But, we all could have received a good fair share.

lol …… huh?

Just like the deer at the road, just drive by….

Price stability. That is also their mandate. Prices seem stable to anyone lately? It’s easy to maximize employment when you throw price stability out the window. That’s what the Fed has done and is now trying to correct with the only tools they have.

What’s a better world to live in? A world in which unemployment is at historically low numbers and rampant inflation is affecting everyone? Or a world in which unemployment affects a slightly higher percentage of people (let’s say an additional 2 percent) and prices are stable for everyone? That appears the be the trade off at the moment. I wish it weren’t so but something’s gotta give. I’d rather it be an uptick in unemployment that affects a small percentage of people (I realize this potentially includes myself) than the current inflationary scenario that is affecting everyone.

Thus the eternal struggle between capital and labor.

There is a technical term for this, it is called Full Employment. The trick isn’t that this is 0% unemployed people. It is around 95% of the people wanting to work have work. That means that any unemployment roughly at or below 5% is full employment.

That remaining 5% are people between jobs that will get a new job soon (search/frictional unemployment) or people that have the wrong qualifications for the jobs available to them (structural unemployment).

You want to get as close as possible to that Full Employment line but not below it since going below it will (eventually) trigger wage inflation when employers start fighting over the remaining labor.

The US is currently in a Full Employment situation which is sustaining the inflation that the Fed is trying to get under control.

Also remember there is large structural mismatch. More college grads, but less jobs available for this group; more jobs for non college, trades, skilled, non skilled, but less people to fill these roles.

As more boomers with years of experience retire who will do the skilled work such as linemen, heavy equipment repair, highly technical service, etc., that takes years to learn.

In the 70’s on the job training was a thing. Now employers complain they can’t hire anyone experienced but are very slow to want to train people. I think that will change.

Mexicans have been filling this gap . For 20 plus years

Any gov employees interfering in the labor market should be met with capital punishment. This includes the Fed. The people know the Fed’s dirty work. Punishment is forthcoming.

True, but many have suffered due to electronic controls, not having full access to Wi-Fi, radio or etc. Experts found this in the pandemic. Many of our people noticed our own banking system with two books, unsecured browsers, and we blame it on others. Many have seen our own banks cashing in on funds or transactions. Then we call in the Federal Reserve… Really, we have a flawed system.

Perhaps consumers, “the folks” are going kamakazi and throwing caution to the wind and not really investing in assets, not stuffing the 401K, don’t give a damn about the “rainy day”.

It may be the sentiment is that the deterioration of the nation, it’s “traditional” culture and sociology is so acute that it has lead to a “get it while the getting good” mentality. Most middle and lower class Americans don’t have much to lose anyway relative to personal assets, so it is a check on Friday and virtually broke by Thursday syndrome.

It could be the implicit bailout has been here so long, they cannot imagine a world without it. But maybe one of these days, a serious inflection will finally appear, without a credible savior. In ’08, plenty of folks found their way out of the middle class.

E Van – that attitude can be traced back to the late ’70’s, stagflation hammering the wisdom of maintaining personal savings coupled with the narcotic of insanely-easy-to-obtain consumer credit.

A goodly portion of subsequent generations were born into, then grew up, with that as their family financial operating norm…

may we all find a better day.

100 million boomers retired,irreplaceable when I go to grocery store 90% of check out and baggers retired,working part time .This inflation is from boomers spending. Because inflation is stealing their money and retirement funds . Wish I had a PHD ,then I could be manipulated into legal stealing,how many fed board members got caught ,no repercussions or convictions. But everyone does nothing about it,so we get what rich fed us = shit

I’m not actually seeing starving people, as I saw outside the USA on trips when I was younger. Some destitution, yeah. But in the very old days, there was no safety net and being old just meant dying, unless you were rich.

It is years since I traveled the world. I did maybe not see starving people in the USA then, but I did see people suffering as they could not afford healt care or dental care. That was people that was employed.

“This inflation is from boomers spending.” Yeah, only one generation is spending lol. What?

The biggest spenders now are millennials, a huge generation that is now in their peak earnings years.

Wait a second! I’m giving them a run for the money! 🤑😱🤧

Good point but is a dollar spent by a working person the same as a dollar spent by a non-working person? My hypothesis would be no.

If millennials, coming into their prime working years, are spending lots of dough, that may not be so inflationary since they are theoretically working to provide the same goods and services being consumed.

As boomers retire and spend more saved money, pension money, or social security money, it would seem logical that these dollars are not necessarily being met by their own production on the other side of the sale.

Another part of this is there seems to be too few people going into productive jobs. A boomer plumber or electrician leaving the job market being replaced by a social media manager at a cash burning startup…and the economy is gradually becoming slightly less productive. That doesn’t help. We keep hearing how short the trades are for people.

Couple that with excessive money printing and interest rate repression and here we are… A very tight job market and plenty of inflation.

So many businesses are currently short on producers. All the savings in the world is useless if there are not enough people do to the work.

BTW Flea, I always appreciate your comments!

Phleep thank u

“Inflation is always and everywhere a monetary phenomenon..,”. said somebody.

I never lectured at the University Of Chicago, but I did stay at a Holiday Inn Express.

65million boomers. Maybe a consortium of boomers should start some non-profit designed to mentor a new generation on how to do those highly-skilled jobs you mentioned. Why leave with all your knowledge when you can have apprentices waiting in the wings to keep the operation running as smoothly as possible? Or maybe this should be a co-venture between boomer employees and corporations to train their successors in those fields

“Why leave with all your knowledge”?

I’ve witnessed this often, and believe the problem can be traced back to modern HR and accounting metrics, particularly ‘headcount’.

Keeping a firm grip on headcount sounds great, in theory.

In practice it often means that the experienced person exits the company on Friday – along with a healthy dose of common sense – before the replacement arrives on Monday.

Corporations don’t want to pay to train ,then employee leaves for more pay. Vicious circle ,but churn has always been a issue it’s getting worse as people now know there just a number.

There’s a pretty big disconnect between boomers and millennials. An even bigger one between gen-z and boomers. The younger cohort doesn’t want the older cohort’s wisdom. It’s a social breakdown as much as an economic one.

“The younger cohort doesn’t want the older cohort’s wisdom.”

That’s nothing new. That’s how it SUPPOSED to be. Boomers did that big time when they were young. We totally rejected any kind of “wisdom” from the prior generations. “Trust no one over 30” was our motto, which we clung to until Mick Jagger turned 30, and then we were gradually forced to re-thing this as we ourselves were turning 30 and then 40 one after the other, the lucky ones that made it this far (several of my friends didn’t). I would despair for the world if young people didn’t try to be different than prior generations and if they didn’t try to learn things the hard way.

Anecdotal, but the Ontario minimum wage is set to increase by 10.1% to C$16.55 this October.

But the politicians have a plan to counter that wage increase by the half million a year by 2025, so the job market will be informal where who accepts lower wages under the table will get a job.

Not all of us can share rent by sharing a bunkbed with several others in a room. We’re individualist as a society.

We don’t even want to share a bed with our significant other much less with a dozen other strangers inside a slum house in Brampton, Ontario.

Yet they still can’t rid of Trudeau after 8 years since he first got elected. Something seriously wrong with the Canadian population. Too much ideological manipulation of the young voters from media and the school.

Rigged elections ,been going on in USA for along time ,by the way try to find out who is a electoral vote ,let me know the answer,we’re idiots

The people from India and Pakistan who live in Canada have very short memories when election day rolls around. They can’t vote NDP because the NDP cut welfare payouts the last time they were in power. So the only party left to vote for is the Liberals as voting Liberal means more of their countrymen can come to Canada.

It’s called an orgy

A little bit out in the sticks from there, independent fuel suppliers, haulers, and furnace /tank contractors are in dire need of skilled people.

Most of the immigrants coming to Canada are poor or penniless. To make things worse they’re very unproductive which is reflected in the productivity stats in Canada which gets worse with each passing year. Canada will end up with rich and poor people and no middle class as the locals leave for other countries leaving only the Chinese and the landed immigrants from the third world.

The raging employment market won’t change until all the kids sitting at home on their parent’s couch get hungry.

The labour participating rate cotradicts your statement. ;)

I think the current inflation is attributable more to increased wealth than a strong labor market.

If a job is added, there is one more unit of demand and one more unit of supply. The price level shouldn’t change that much.

The wealth effect increases demand, but not supply, which creates inflation. Housing has gone up 100% to 300% in many locations, especially the huge markets of the South and West. That is the primary driver. In addition, market indexes are up 40% from pre-pandemic period, which gives the top 10% some incentive to add to their spending, as well as gifting to others that spend. There is a lot of Baby Boomer gifting going on right now.

Not only is there more wealth, the amount of liquidity/cash in the system has shot up 100% or more. The recipients of government deficit spending have plenty of cash in their pockets they want to quickly get rid of it, via spending or other means.

Until asset prices reduce, deficits reverse course, or QT has more time to work, I don’t see inflation subsiding anytime soon, particularly if wages keep growing at 5% or better.

It’s strong labor. Higher wages add to costs of services. You pay someone $20/hr to flip a burger, your burger is going to cost more. Strong labor very much is a cause of current inflation.

Higher wages ARE inflation, not the cause of it.

You need to look deeper, at what causes higher wages and other price increases, to find the root cause.

It’s not just the wealth effect. As Wolf stated, higher input costs cause prices to rise. I gave an example above. There are many root causes of this mess (bad monetary and fiscal policy), but to think it is just wealth effect causing continued inflation is short sighted.

The wording in my second post said it is very much A cause, not the only cause. The first post was a mistake.

You seem to dismiss higher labor costs as a contributing factor. I don’t agree with you. Maybe I misinterpreted it.

I am retired and earn more in my retirement income than a wage earner making $20.00 an hour.

I am debt free. I can’t imagine how difficult it would be to live on $20.00 an hour and provide for a retirement future.

I was stating the way it works, that increased labor costs push up prices. My statement was not an opinion.

The strong labor market is very much a cause of this current inflation. Wages increased as a result of the tight labor market and are very high. You pay someone $20/hr to flip a burger (as opposed to $12 a couple years ago), that burger is going to cost more.

It is both. Increased labor costs cause rising prices, and the wealth effect makes consumers willing and able to pay those prices rather than cutting back.

Sorry for the double post. The first one didn’t show up right away so posted it again.

Without wealth effect employers know they can’t charge more for the burger.

Hence won’t give raises since can’t raise prices.

Today’s socio psychology apparently is not so much along those lines.

I live in Washington state… Seattle they might well pay $20 to flip a burger. Where I live $15 to $17. But 20 or so states of the US still have minimum wages of $7.25, many others around $10. Can’t be a pleasant life trying to live on $7.25/hour especially if rent runs $800 or more for a 1 BR… bottom end near many cities ($1300 in expensive cities).

Its surprising the disparity in minimum wage across the country.

I know Wolf isn’t keen on links but don’t think this is controversial:

https://www.employerpass.com/state-minimum-wage-requirements-chart

But as to your point… you are right but so is Bobber (above post). High inflation or its converse – deflation – can be reinforcing… which is why economists presumably don’t won’t them to become extreme in the 1st place !

“…especially if rent runs $800 or more for a 1 BR… bottom end near many cities ($1300 in expensive cities).”

I don’t ever recall seeing rents that cheap even a decade ago. I rented for nearly 10 years and was never even able to afford a 1BR – never found any below $2k. I always had to share with roommates.

Typically we’d rent 3-4BR (i.e. top floor of a duplex or triple decker) which ran $1800-$2600/mo + utilities. These prices were for the greater Boston area 2012-2021.

Randy’s minimum wage have very little to with wages paid in Omaha $9.25 ,but everyone is paying $12-15

Flea: Exactly. Minimum wage is just that, the minimum an employer can pay by law Many pay much more than in order to attract employees due to wage inflation. Those employers don’t eat the cost. They then pass it on to consumers.

MM,

I’m in my mid 60s. Rented in 6 states.

Owned home in one.

Lost $ on the nice new home bought in Rowlett TX. Held it 10 years. Lost 8%.

89.5k to 82k. Including 3% commission lost over 10%.

Home was in very good condition, lightly used. 1986 to 1996. Maybe realtors did me ….

Rent in eastern Washington now.

Rented near Dayton in 81. Nice apartment, relatively new.

Moved to Jersey. Apartment almost twice as expensive, not as nice (older).

Otherwise I liked Jersey ok.

Rented near Dallas, near Seattle, upstate NY. 1996 near Seattle $595 1 BR. Botgom of market, nice 2 BR.

Left 2000 $775, bad projection.

Spokane 1 BR $315. Over twice that now but of course. 23 years !

Today probably $1600 near Seattle, my former apartment.

Just checked near Seattle north.

Campo Basso at $1380. Others 1400 to 1600 1 BR. Prices may be dropping as

Seattle RE takes a hit.

Boston is not or has not been as expensive as Seattle. Maybe you missed some lower end apartments or Boston is just surprisingly expensive apartments wise.

Was only in Beantown once for Symbolics training 86. Lisp machines.

Ah yes Lisp machines. Good Lisp instructor… jokes not limited to Cars and Cdrs. Got food poisoning before leaving unfortunately. Beautiful falls in Vermont and Adirondacks. Per living in

Rome NY apartment ($165? 1BR) 1980.

MM and my own reply:

Sorry, Correction: 1996 just north of Seattle $595 2 BR. Bottom of market.

It was a 2 BR, not 1 BR. 1996 $595. 2000 summer at $775.

2000, diwnsized to 1 BR Spokane $315.

Tangential but may be of interest to some….

FWIW. I attempted to buy a home during 1996 thru 2000 off and on. Visited Whatcom, Skagit Counties multiple times.

Came within whisker of buying a condo in North Lynnwood or S. Everett but withdrew in end (a crack “appeared” in a dining room wall just before closing… lost deposit… I had an inspection no less !).

Looked at homes from Eugene, Salem, to Portland (new construction mostly) to condos, homes Snohomish county… Mill Creek Bothell Edmonds Lynnwood, Marysville, Granite Falls … you name it but nothing came of it.

Bellingham Lynden Ferndale probably 3 or 4 trips. Should have bought very small new home in Lynden “Homestead” subdivision. 115k at the time! Lowest priced one. Guaranteed worth 3 to 4 times that today. Passed because of very small yards.

I was too picky or something always cropped up giving me concerns. Hence no purchase.

Other stuff happened as well. Saw rent going up 6 to 8% a year. I was being harassed at the Lynnwood apattment complex where I lived… moved sight unseen to Spokane even though meth busts were occasionally in the Spokesmen Review headlines in the 2000 timeframe. Lucked out got a decent apartment for the price.

Saved approximately 170k over 23 years renting in Spokane, not near Seattle. OTOH would have done great had i been able to purchase a quality (after all, not all are !) condo or small home on the “west side” (Washington state). I could write a book, well a chapter or two for sure, about my (negetive harassment) experiences in Lynnwood. Probably will some day.

Restaurants though TERRIFIC.

Himalayas Indian restaurant the very best. Evergreen China, Chens Garden (buffet) also quite good.

Edmonds Community College good, nice wood chip trail around CC 1.5 miles. Smart !

Randy,

“Maybe you missed some lower end apartments or Boston is just surprisingly expensive apartments wise.”

Your prices made sense for the 90s / early 2000s, but fast-forward a decade or two and things have gotten more expensive. Some more specifics:

2014: rented a 4 BR / 1 bath for $1900/mo. 2nd floor of a triple decker in Waltham. Total dump, rats & roaches regularly.

2016: same setup, 4 BR / 1 bath for $2500/mo. Also 2nd floor of a triple decker but this time Watertown. Not a dump but still old building w/ poor insulation (horribly expensive nat gas bills in winter)

2018: rented 3 BR / 1 bath for $2400/mo. 2nd floor of a duplex in Watertown. Much nicer i.e. AC, in-unit laundry.

2020: split a 2 BR / 2 bath with a buddy in an “upscale” building in Lowell – $2500/mo.

2021: purchased a home in Nashua NH. Paying roughly $1500/mo PITA for 900sqft on 1/4 acre.

Also in 2021: started dating a woman who lived in an apartment in East Boston. $1000/mo for a single room (!) in a 4BR / 1 bath unit – top floor of a triple decker.

MM,

Thx for sharing details on your more recent near Boston rental experiences.

I rented in 1981 in Fairborn near Dayton. Nice apartment. Got a job in New Jersey and the apartment in Ocean Township was ok but older and not quite as nice. Memory is it was 60 to 80% more expensive than Fairborn.

In 1990s i lived bear Dallas and was talking to a coworker there. He was from New Orleans and mentioned to me how old everything in Cincinnati (Ohio) seemed to him. I never visited Cincinnati but Dallas suburbs certainly were booming at the time… building everywhere 80s. Perhaps New Orleans as well ?

So, yes, very new in Dallas adjacent cities.

Unfortunately for me and probably tens of thousands (or more) of homebuyers at that time… the S&L crash and oil crash both hurt the Texas economy.

And home prices significantly.

Ignorant people (or misleading) are not aware of the regional housing crashes in our country… masked by nationwide averages. Fortunately I kept my job through most of it.

Inflation shows up first in asset markets that reprice in real time, tick-by-tick. From there it gradually filters into the much slower moving consumer goods and services markets. In other words, when the dollar depreciates against assets, depreciation against consumer goods and services is in the pipeline.

It’s no coincidence that stock prices stopped falling and started higher last October and that progress on consumer price inflation began to stall a month or two later.

Agree wholeheartedly with the need for asset values to reduce. They will, but it will require boomers to blow all their excess monopoly money on overpriced real estate (with profits from their own overpriced reap estate) and new vehicles first. Once that is out of the way, the bottom will begin to fall out. I’d say it will be more of a slow grind rather than a bubble burst.

Seems to me by the number people going back to work is that the stimulus money is finally running out. This is necessary for the Fed to finally grasp control back from the consumer by crushing demand.

That stimulus money was spent a long time ago.

Apple,

There’s 500 billion in Covid emergency money that hasn’t been spent. Time to impound the money before it starts sloshing around and creating worse inflation than we already have.

I thought you were referencing stimulus paid to individuals.

State or county government are hoarding stimulus money has no effect on individuals seeking employment.

Swamp – Good point. I know my state is just starting to spend some of its several billion of COVID dollars on things we don’t need. Like college football stadiums, etc.

It was supposed to be for health care stuff but since Covid is not an issue anymore, they are finding other things to spend it on.

“State or county government are hoarding stimulus money has no effect on individuals seeking employment.”

And you think they’re going to sit on that money forever and never spend it?

Swamp and Apple et al,

I work for small NW muni in what used to be called the building dept. We are still working through C-19 money, but there is an actual “use-it-or-lose-it” clause. Just talked ystdy with cmty health guy who said all his C-19 funds were nearly used up and was “working myself out of a job.” He was kind of worried about what will happen to the homeless cmty that they are “helping” when the $$ runs out. Uh huh.

Dedicated funds for multi-fam mostly used up, and I think if not spent by fall they go back. Seems like it means there’s much lucre still sloshing so I think the idea that we are still early innings is correct, but we might see some real interesting action later this year. Not sure how this relates to employment exactly, but we are quite busy approving projects, with lots of new restaurants (chains and locals) and small commercial remodels. A few mixed use projects have been withdrawn before issuance, so maybe some second thoughts being thunk? For now, it’s busy.

I have a county hwy. nearby that will be finished this summer.

The $$ for it came from the “shovel ready” funds.

Covid $$ going towards public structures will be a long and slow unwind.

The federal gov’t has operated this way for decades, through thick and thin. Gobs of money have been put towards infrastructure with perverse incentives to build new things, Witcher especially things that are not needed. Very few are doing the long term math and realize that end of life cycle maintenance costs are borne by the states and communities, and things will get ugly when new growth can no longer support mindless expansion.

Ru 82 here in Nebraska,our infamous university has a budget issue . 32 million deficit not to worry . Just put on credit card or taxpayer,when will the people stop this bullshit . From my perch these academics are idiots ,with no real life experience. Look at FED ,universities,all miss managed financially.

Yeah the $1200 really kept someone going for years.

Lollol.

This is yet another sign that the Fed is way behind in cooling inflation. It makes me wonder just how serious the Fed is.

It’s a sign that there is no connection between high unemployment and high interest rates. I’m sure someone is doing a Ph.d on this right now.

Apple….

Interest rates are not “high”…..historically.

Ten yr note at less than 4% after nearly 20% cumulative inflation in the last 3 years? The rate structure still has built in losses to inflation.

There is a connection, but it takes a while due to debt needing to “roll over” at the higher rates.

I’ve said it before, and I’ll say it again. Had they been serious, they would have allowed the balance sheet to run off by at least 120 billion a month.

Fed has raised the rates fastest in the modern history.

They have one more hike to go.

Fed is trying to walk a thin line .. hike rates but not break anything..

They need to pause and stay high for substantial time.

More aggressive hikes may not do good.

BTW market has already priced in many rate cuts in the second half of 2023

Economy: “ ‘Eres ya dinna’ “

The People: “I want something nutritious, good and filling! Not this slop!”

Economy: “You’ll Eat ya Slop and like it!”

Recruiters used to reach out to me, even up til 2021. I work at the same place, my resume hasn’t changed. I don’t hear from recruiters anymore. Only anecdotal, but something seems really off with the numbers and reality. There’s a lot of cash floating around still, but it isn’t trickling down like it did for middle low incomes

Age?

I have a friend with a great tech resume, got aged out of the company where he was working, was pushed out, and no more recruiters, no more anything. This is ageism at its finest. This happened before the pandemic. He cannot work in his field anymore.

Nope, I’m in my mid 30s. Most I can figure is that they post jobs they don’t intend to fill. Then again I’ve seen some middle admin office positions with hundreds of applicants. These aren’t high paying, but they’re not entry level either. They require 4 year degrees and experience. It all seems skewed.

Ageism is certainly a problem, and it actually works both ways– too young and toooooold, eh

OTOH, not having sought work since 2016 after working from then to mid ’19 when I finally retired, I am still getting emails from recruiters.

Even though they don’t know my age for sure from that last resume because I redacted every possible clue to my age at that time, anyone with as much experience as was shown must be pretty old.

BTW, NO response to resume sent when age related details were included; interviews at every FL company when redacted, and the result was nada, with some BS excuse…

Luckily, a recruiter elsewhere saw the resume, and I connected with a great company for a while, and then worked from home office for same boss when had to return home.

Show up to the interview with a neck beard wearing pajamas and holding a coffee cup.

Meta is paying people $190,000 salary to sit at home and do essentially nothing. This is called hoarding talent taken to extreme levels.

1) The Dow isn’t cooling off either. It’s just 9% from the top and that’s not good enough. The experts predict recession ==> give it to them, send the Dow to 20% below the top, before popping up, for fun.

2) The “experts” will flip from bearish to bullish and square on the media for headers.

3) The banking sector undetected cancer need time to evolve, time will do it’s job, to feast on fat and bones.

4) Before SLV smaller banks had a 84% loans/deposit ratio. This ratio

is rising, though still below 2000 or 2008 highs.

5) Many banks have deposits > 250K. If one explode it will be taken over.

6) The banks might constrict lending especially to small business. Money supply in a low slog down. Without funds small business might slowly choke. Less lending, higher wages, and higher interest rate, SLV might implode next.

7) The Fed will have to fill the money supply gap possibly with digital money to “control” the economy. The Fed total assets might dbl again.

Rates should be at 7% now already and rising. Fed can always drop them later if needed, and were no where near that.

Alec

The inflation rate is double digits right now. I’m getting 4.75% on my Treasury Money Market fund. So, I’m losing over 5% due to inflation.

Why all this talk of tapering to satisfy the crooks on Wall Street and their accomplices in the media.

Rates need to be over 10%. The sooner the better. Let the chips fall where they may.

AT LEAST 10% SC, so we can know there is intended inflation in the owners plans, eh?

Look at the BLS inflation calculator to see the incredible damage to our money the FRB and GUV MINT admit to have perpetrated on WE the PEEDONs since the FED was set up to do exactly that.

I’m getting old, but even I can remember when the 24” sandwich bread loaf was regularly $0.10 – ONE DIME!!!

I’m with Depth Charge::: these folks are criminals.

Worked at bread manufacturer in early 80 s ,bread would go on sale 3/1$ ,was told there cost to produce a loaf of white bread was 5cents, also told it was junk,only buy rye ,wheat,sourdough

Fed may increase demand but business owners raise prices.

No one at this website or other finance sites points this out.

Too obvious ?

Or some other reason ?

+1, we are governed by psychopaths.

Randy – surely you’re not implying that the emperor class is unclothed??? (okay, I won’t call you Shirley…).

may we all find a better day.

The Fed should BEGIN to tighten ASAP. So far, the Fed has just modestly scaled back its easy money…

The Federal Reserve is incapable of stopping this runaway inflation train; hopefully our foreign friends will worry about hyperinflation and massively dump their Treasury holdings, maybe that will give enough boost to interest rates to assist Jerome Powell’s Federal Reserve.

China has been selling ,but we still buy uranium from Russia. I believe all countries are in collusion,have a master plan of one world currency,why do u think there are g- 7 and G – 20 meetings.They make plans to keep peasants poor ,pretty simple

“the Fed has been hiking rates for a year, and not much has changed in the labor market.”

Well, what did they do to the rates for the FOURTEEN years before that? This ain’t church, all is not forgiven with one halfhearted gesture.

14 years.

Homeowners with their low interest rate mortgages. How many of them love Jerome Powell ?

Well ? Millions ? No ?

JP and only JP is responsible for today’s high inflation… Oh really ?

Confounding variables :

1. Trump bad mouthed China and other nations.

Do you believe there would be no repercussions for this ?

2. Supply problems (probably in part related to #1)

3. Too much pandemic money provided to businesses (and perhaps individuals) beyond

what they deserved… that is what I am lead to believe. E.g., the 26k per employee if certain conditions were met.

4. Investors of all kinds and sizes buying up and driving up RE prices. Government sits back and decides there is nothing to be concerned with… no regulation to put limits… LIMITS… on how much they could buy. Because after all that would smack of socialism ?

5. NIMBYism in some areas restricted SFH construction for a number of years. (This however should not be confused with socialism he writes sarcastically). Only in the last 2 of 3 years did it perk up (especially multifamily) to historic highs (I’ve read). But from 2012 to say 2017 it really lagged the historical average… demand supply ratio out of whack… I saw charts representing this. This also helped cause the buyers to over-compete for homes… forgoing inspections lest they displease the seller (and his/her realtor), etc….

6. Others I just am not aware of… financials and economics not my specialty.

Much of the increase in March service jobs is in Private Education & Health Service (65,000) and Leisure & Hospitality (72,000). These areas show very inelastic demand. The concern is that the Fed will overtighten to curb employment growth in these sectors, causing a severe recession in other sectors, and in the overall economy, making yet another mistake. The core February PCE price increase (latest available) has declined to .3% monthly and 4.6% annually, less than the 4.75-5% current Fed Funds rate. It would be best for the Fed to hold off raising rates and let the data come in for a few months especially with the banking instability the economy is now experiencing.

RickV,

In terms of inflation, you don’t listen to what the Fed is telling you. It’s now all about SERVICES inflation, especially non-housing services, and they’re spiking. Goods inflation has settled down. Services is where the inflation is raging, services is two-thirds of consumer spending, and Powell has been hammering on it at every meeting. You need to start paying attention:

https://wolfstreet.com/2023/03/31/services-inflation-rages-at-worst-rate-since-1984-keeps-core-pce-feds-yardstick-in-same-high-range-energy-goods-cool/

“The PCE price index for services jumped by 5.6% year-over-year in February, same as in January, and both are the worst since 1984:”

Housing services are totally out of control in the saintly part of the TPA bay area Wolf:

Paid skilled labor $30-50.00 in 2015, unskilled $10-12,50.

Had to hire a plumber couple months ago, only guy who could do it soon when water heater died was $100.00 per hour, and neighbors who are GCs say similar doubling of almost all rates in last couple of years.

FL irrigation maintenance est.: $85 trip charge, $85/hr + parts.

Earliest opening: April 28.

Couple years ago: $50 first hour + parts. Two day wait.

A lot of new homes, same number of irrigation cos. now servicing systems they installed.

I listened to the Fed when they said inflation was transitory and I listened to the Fed when they stopped doing stress tests on banks under $250B. I’m now more skeptical of Fedspeak. Most of Services expense is labor and as my post above mentions: Private Education & Health and Leisure & Hospitality, two sectors with inelastic employment demand, make up the majority of Services PCE Price Index of 5.6%, which incidentally was only up .3% month over month in February. We will have one more PCE report on April 28 to get more clarity before the next Fed meeting. As of now, it would be prudent, with little downside, to hold off on rate hikes and get more data on how the “long and variable lags” of past hikes are moving through the economy. As always, I appreciate your informed commentary and charts.

In live data, I observe the demand for services trending much lower since February-March. 10-15% underwater on a YoY basis. Prices will follow.

This means we’re already in a recession, indifferently of talking heads’ narrative

“10-15% underwater on a YoY basis.”

Maybe instead of data, you live fantasies?

Interest rates are about where they should be ” In a Normal Sane market” in a normal economy something we seem to have Lost sight of !

But with Home prices Way Way Overpriced driven by people mostly still in Office in Charge Etc enjoying the Booty “they simply created ” to meet their ends simply to benefit themselves and all involved leaves few avenues for correction . As such abnormal Means such as possibly almost fantasy Hi Rates / a Vast array of non normal means must be employed for anything to happen at this time or with a timeline that fits current needs to avoid recession if that’s at all possible I would not hold my Breath / These Booty seekers will jump on any abnormal correction trying to find a Edge to profit from most likely derailing any true correction . Since Law enforcement is so very far behind, normal times are cloud covered making correction almost Invisible.

Makes it hard to invest ? Fight them or Join them ? blind alleys are growing . Money printing is a Cancer upon us all now and no cure in sight for Cancer , to almost kill the Patent then try to save them is upon us now. Easy Road out is looking attractive to just leave the Country

In the last recession, unemployment hit bottom about a year after the Fed stopped raising rates, so we’re still in about the 3rd inning here, too early to tell what the final score will be. Given the normal lag time between rate increases and unemployment, if we were already seeing a rise in unemployment, with rate hikes still underway, that would be a big red flag.

Some people say that if interest rates are below inflation, they must be expansionary, others think a rapid rise in interest rates won’t be below inflation for long as they will (after a year or two) crush the economy.

Some say that if the economy is too fast, you can tap the brakes and get it back to the ‘right’ speed, other think that the economy only has two modes, expansion and recession, and a controlled deceleration isn’t possible.

Good news is, we just have to wait a year or two to see who is right.

Goldilocks economy! Powell is a genius.

I do think the Fed is a lot smarter than folks around here are willing to admit.

I think Fed is very smart.

They all are multi millionaires and have growing assets which we don’t have .

They are minting money for themselves and for their friends and masters

QE is perhaps the most powerful neoliberal economic policy tool in the Fed’s toolbox. Excess money creation is highly correlated with asset inflation, this is widely accepted as true. With that said, the mega corps, mega banks, and the uber wealthy own something like 90% of all institutional quality assets.

Time for 100 Billion+ QT every month. It needs to happen.

Anecdotal evidence from Sarasota, Florida, where two of my favorite small businesses closed up shop specifically because of rising labor costs that they could not pass on to consumers. There are cracks in this insane labor market…

Yes, this is a huge problem. Small unglamorous businesses always have trouble hiring good people. But in this labor market it’s really tough. And many of them just give up.

Add on top of that insane, out-of-touch-with-reality real estate rental prices; as well as soul-crushing regulations – this is why we can’t have nice small businesses in our towns anymore.

Carlos – service oriented, mebbe. Retail-oriented? That brick’n mortar cohort has been fighting a losing battle to the online one for some time now (well-documented here by our most-excellent host over the years…).

may we all find a better day.

1) The Fed is fighting a diminishing money supply. If June CPI will be 3%, y/y it will be (-)6%. // Money supply = banks loans + Fed Assets. Banks loans the most.

2) The Fed will keep it’s eyes on the banking system cancer. If the cancer

metastasis they will keep us alive with new doses of money supply.

3) One third of US population is 55 years and older. Mfg are losing experience blue collar workers who can solve real problems.

4) In the flyover areas the elderly are moving out, gen Z are moving in. They are coming out of tech schools and colleges that are tune to businesses in their communities to fill vacant jobs. They are getting married, buy a house and raise a family. Gen Z don’t care about wall street the media bs and DC.

5) Most “experts” are bearish. SPX dma200 is bending up. EMA20 will breach dma50 next week. The Dow is only 9% from the top despite all the efforts. After a short battle with dma200 SPX might become an inverse H&S.

Wolf,

The Fed has widely used QE to push up the markets to support the economy by the wealth effect. This resulted in this massive inflation … So the solution to this ‘wealth effect’ induced inflation will come from the end of the wealth effect, or the market crash ! … what you think ?

Inflation is a very complex phenomenon, and amazingly, its causes are still badly understood. My theory is that it’s a mix of monetary factors (what the Fed did), fiscal factors (what the government did), and mass psychology (what businesses do such as raising prices and thinking they can get away with it; what consumers do, such as paying those whatever prices or refusing to pay them; and what workers do such as arbitraging the labor market for higher wages, which gives them more money to pay those prices and further nourish inflation).

The wealth effect is part of this, but it’s not all of it, in my theory. There are plenty of economists that denied that the wealth effect caused inflation. They’re now being proven wrong, but they were right for the prior 12 years.

“…we were wrong gradually, then all at once…”

may we all find a better day.

Thanks Wolf,

I say wow to 24-54 year old workers doubled from 2016-19. Inflation is definitely and reasonably higher from here with rates higher than five percent!

6) USS Florida visit Gwadar

How is it the Fed and their accomplices in the Treasury haven’t realized this is demographic, not economic?…

It appears to me that economic data needs to be looked at

pre Credit Crunch and post Credit crunch.

Apparently, the post Loan Depositor flight has led to the biggest Two Week drop in Bank loans in history (Data since 1974) h/t Jim Bianco

This may be the catalyst that triggers the much anticipated (and so far unseen and admirably documented by Wolf) Recession

“Apparently, the post Loan Depositor flight has led to the biggest Two Week drop in Bank loans in history”

Nah, that was due to seasonal adjustments gone awry. The Bloomberg reporter was too stupid to point that out, or maybe the article was written by an algo. But it made good clickbait, and you fell for it.

The Fed publishes this bank balance sheet data (H.8) weekly, as “seasonally adjusted” and “not seasonally adjusted.”

“Not seasonally adjusted,” the loans rose for the week and for the two weeks and were up 10% from a year ago, LOL.

I was going to write an article about these seasonal adjustments gone awry, but no one reads this stuff. People instead read and cite the BS you cited.

I have no idea why the Fed seasonally adjusts bank balance sheet data, or why reporters even cite this shit. The only seasonality in bank balance sheets is right at year-end. Any balance sheet data should be in absolute dollars, not seasonally adjusted. Next time, Apple is going to seasonally adjust its balance sheet or whatever.

I didn’t realize that data was seasonally adjusted. Thanks for the clarification Wolf.

Wolf’s right about the labor market. Here’s a big tech anecdote I picked up from some colleagues.

A Meta engineer (electrical) got caught up in the first round of layoffs in November. He was making ~$375k after stock options and bonuses. Got a job at a consulting firm doing electrical engineering support for data center companies like Meta in January. They paid him ~$180k (no stock, no bonuses).

In March, he got a call back from Google for a position he applied for but turned down (wanted him to relocate). They converted it to a remote position and offered ~$250k after stock and bonuses to provide electrical engineering support for power systems for a region of their data centers. He’s in his early 40’s.

So slightly off topic here guys but I know I’ll get some good advice. I want to put some of my money in savings certificate or CDs but not all of it because I am needing money for a down payment on a house. I have been following Wolf for some time now and I always read articles and comments on latest housing data. Should tie my money up in a 6 month, year, etc because the housing is still trending downward? What would best approach be regarding this? I’m conflicted because I want to buy our first home for wife and 6 kids but I don’t believe market will shift dramatically over next 12 months and why not have my money make a little money while it just sits in the bank or credit union? I really appreciate any advice from you guys. Thank you.

Timing the bottom? It will be more than 6 months out.

Check fed charts on interest rate increases leading up

to GFC. Then check out house price chart.

We have not even got to the end of rate increases in this cycle.