Was it the Swiss National Bank that Borrowed $60 Billion via “Foreign Official” Repos for the Credit Suisse takeunder?

By Wolf Richter for WOLF STREET.

On the Fed’s weekly balance sheet as of Wednesday, released this afternoon, we find some interesting stuff about the liquidity facilities that the Fed rolled out or dusted off after Silicon Valley Bank and Signature Bank collapsed, and when Credit Suisse was taken under by UBS with support of the Swiss government and the Swiss National Bank.

Here’s the summary:

- Discount window: -$43 billion, to $110 billion.

- Central bank liquidity swaps: no activity, to $0 billion.

- Repos with “foreign official” (SNB?): +$60 billion

- Bank Term Funding program: +$42 billion to $54 billion

- Credit extension to FDIC bridge banks: +$37 billion, to $179 billion.

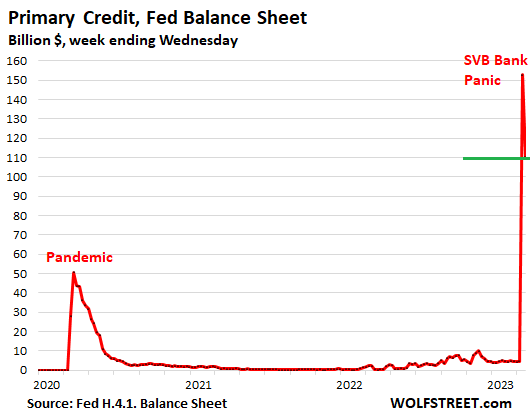

Primary Credit (“Discount Window”).

Fell by $43 billion in one week, to $110 billion.

After the spike on the prior balance sheet, I expected a decline, and said so a week ago. This is expensive money for banks. Following the rate hikes yesterday, the Fed charges banks 5.0% to borrow at the Discount Window, plus banks have to post collateral valued at “fair market value” (unlike under the Bank Term Funding Program, where collateral is valued at “par value”).

So banks have every incentive to pay back this money as soon as they can – and they are paying it back rather quickly, and will continue to do so.

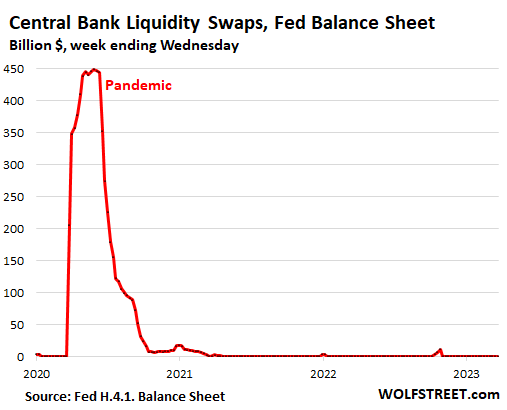

Central Bank Liquidity Swaps:

No activity, LOL.

A hilarious to-do was made when the Fed issued a press release on Sunday, March 19, evocatively titled: “Coordinated central bank action to enhance the provision of U.S. dollar liquidity.” This would be some kind of mega-QE or whatever.

But those swap lines have been open for many years, and I have been reporting on them in my regular Fed balance sheet updates. Under these swap lines, a handful of foreign central banks can exchange their currency for US dollars, for a set term, such as seven days. When the swap matures, the Fed gets its dollars back, plus a little interest, and the other central bank gets its currency back.

With the announcement, all the Fed did was change the frequency of the 7-day swaps from once a week to every weekday, to “commence on Monday, March 20.” This would be the day that the Swiss National Bank (SNB) might have needed lots of dollars to provide dollar-liquidity to support the Credit Suisse takeunder by UBS over the weekend. And it looks like this was why the frequency was changed, so that the swap could be done on Monday.

Alas, there has been no activity to speak of in recent days and weeks, and this facility was not used:

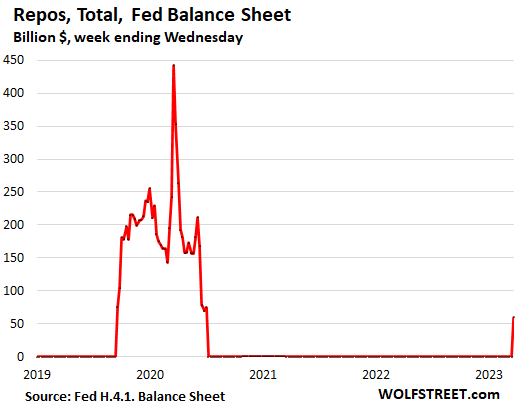

But… Repos with “foreign official” counterparties. The SNB?

Rose by $60 billion in one week, from $0.

The Fed has “standing repo facilities” to engage in the repo market, with repurchase agreements (“repos”) and reverse repurchase agreements (“RRPs”).

Here we’re talking about “repos,” an asset on the Fed’s balance sheet. This is when the Fed essentially lends money to a counterparty against collateral consisting of Treasury securities or agency MBS. There has been no use since the summer of 2020 when the Fed raised the interest it charges on repos. Yesterday, as part of the rate hikes, it raised the interest to 5.0%.

And there has been no use by regular counterparties, such as banks or mortgage REITs, and the balance on today’s balance sheet = $0.

But the “foreign official” repo account spiked from $0 a week ago to $60 billion today. This is likely where the SNB got $60 billion in dollar-liquidity to support the CS takeunder, and this maybe why it didn’t use the central bank liquidity swap lines.

Bank Term Funding Program (BTFP):

Rose by $42 billion in one week, to $54 billion.

This is the new liquidity program that the Fed announced on Sunday, March 13. Under this program, the banks can borrow for up to one year, at a fixed rate for the term, pegged to the one-year overnight index swap rate plus 10 basis points. Banks have to post collateral, which is valued “at par.”

To be eligible per term sheet, the collateral has to be “owned by the borrower as of March 12, 2023.” So banks cannot buy securities at market price and post them as collateral at par.

For banks, this is still expensive money because they have to post collateral; when they borrow from depositors or unsecured bondholders, they don’t have to post any collateral.

But it’s less expensive for banks than borrowing at the Discount Window. And it seems the $42 billion increase might have been banks shifting borrowing to the BTFP from the Discount Window, which fell by $43 billion.

“Other credit extensions” to the two FDIC bridge banks:

Rose by $37 billion in one week, to $179 billion.

These are loans to the FDIC-owned bridge banks that hold the assets and liabilities of the collapsed Silicon Valley Bank and Signature Bank. This facility is part of what the Fed announced on Sunday, March 13.

The FDIC already lined up a buyer for a big part of the assets of Signature Bank. It estimated, after the deals it has made so far, that its loss from Signature Bank will only be about $2.5 billion. The rest will be covered by asset sales.

I expect the FDIC to announce a deal soon – lots of rumors out there now – to sell pieces or all of Silicon Valley Bank.

As the FDIC sells the assets of those banks, and as those sales close, it will use the proceeds to pay down the advances from the Fed, and this balance will decline sharply.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I suppose Switzerland itself might qualify as too big to fail.

Now Fed gets to bailout other countries and thier banks using US taxpayer money.

Wonder which constitution ammendment made this possible?

Every big entity in developed world has gotten converted into “too big to fail”. We should just deprecated “Chapter 11” and create “Chapter 111: take over and bailout by fed”.

Where are you getting “bailout” from in the above article?

The repos with SNB are collateralized with treasuries and agencies. The Fed is just providing dollar liquidity to the SNB. It’s going to get those dollars back, with interest.

Let the free market provide that dollar liquidity at appropriate interest rate to cover the risk.

Wait, the free markets knew the risks and so interests were so high, that Fed had to step in.

This and trillions of printed dollars in spent on other activities, are all unconstitutional and therefore illegal under the US Constitution. The Federal Reserve, FDIC, Social Security, Medicare and more are all businesses. The Constitution granted the govt authority to REGULATE interstate commerce, not ENGAGE in it. And there is no authorization in the Constitution for any kind of what is called welfare today, such as bailing out failed businesses or depositing currency in people’s accounts.

Don’t believe me? Go ahead and pull up a copy, it’s not long at all, and show us where the federal govt is authorized to print currency out of nothing, use it for what the things they do with it now.

The constitution hasn’t been followed for a long time. The last war declared by Congress was WW2. The government has spied on millions of Americans without probable cause. Government even droned two American citizens without due process. The first amendment has been abused. Get used to it.

I have a tough time with money being “free speech”, and corps being “people”, and religious outfits paying no taxes.

That in the Constitution?

The constitution is an aspirational document and not all inclusive. The amendment process should be easier.

Aspects of it are developed by case law, interpreted by the three branches of gov and fed agencies who promulgate rules. Then, there are subsequent fed legislation that started social security, modern banking, fed many by interpreting the ICC.

Keep reading Texan.

Also, it says nothing about what can go on in the bedroom….

well…almost…….except for those folks who like get uniforms and play UPS, Cable TV, Phone Co man games.

It does completely ban soldier uniforms, which seems kinda weird to me, but then they were smart guys and pretty much thought of everything that could happen in 200+ years.

BLAM 35 you express the prevailing view, but the prevailing view is incorrect

For now, the people love the prevailing view, and vote for it enthusiastically, but just because the view is popular doesn’t mean it’s correct, or that it leads to good outcomes

Tex,

Are you telling Blam that Mohammad had it right?!?!

That sure WOULD make the prevailing views incorrect.

Government by ‘the people’ throughout history and today is most often some form of oligarchy within a nanny state environment, not freedom. Freedom requires self-responsibility and self-restraint and most people don’t want that.

Excellent article. Revenge of the Wonks. Coming to Netflix in 2025.

All this and the 2yr note drops from over 5% on march 7 to just over 3.8%

Banks scrambling for money and yields drop.

Should be near the floor on yields IMO but we’ll see. Long term rates haven’t moved as much so maybe that is telling.

Odds of a pause are over 70% so that’ll need to be unwound if it becomes clear that another rate hike is happening. Per the dot plot from yesterday it is going to happen but the market doesn’t want to believe the Fed until it has no choice

PCE could move the needle if it’s hot like wolf has anticipated

I’d typically agree with you on yields, but I started following Felix Zulauf in early 2022 when I saw his Dec 2021 Barron’s article. He’s been terrifyingly accurate. The Dec 2022 follow-up article has also been, too. Said we would see oil back to $50-60s by summer (already in $60s). 10 year would drop 200 basis points by summer (half way there from Oct 2022 high). Then Fed would slow down thinking inflation is defeated…just to be wrong again with round 2 inflation double digits in 2024+ (deglobalization as one cause). Between Wolf’s detailed data compiling and Felix’s macro interpretations, I haven’t needed to read anything else.

10 year has been up and down and I suspect will continue to be volatile. It was over 7 just a couple of weeks ago. PMI came out hotter than expected today, so I’m not sure about the Fed capitulating soon, at least I hope not.

Some banks are scrambling. Bank of America sure does not want you cahs for long term. Maybe they thing cash long term is trash?

I took a look at BAC CDs.

The 7 month is paying 3.2.

The 13 months is 3.5.

The 25 months is 2.9.

The 37 months is 0.05%

I thought the longer duration CD always paid the most.

I notice several big banks have the same pattern. Chase was only paying 0.05% on long term CDs too.

Chase with a CD of less up to 10k.

3 months = 2%

12 months = 3%

24 months = 2%

48 months and longer = 1.5%

I am not sure what to think about these rates.

Who would want to only earn .05% in a CD right now?

Do he banks think in 2 years inflation will be at 2% and the FED Fund rate will be back down below 1% ?

I’m also scratching my head on why long term rates (treasuries & CDs) are still so low.

Right now, best yield seems to be on 1 year CDs with 5.1-5.3%

With the recent rates drop, I’ve been selling my T-bills and opening new 1 year CDs.

They are believing Powell is going to kill inflation and growth is going to be slow. Good estimate is inflation plus growth. 2% + 1.5% I think.

Sorry for the typos.

They really are betting on a pivot back down to ZIRP.

If you look at smaller regional banks, this is not the case. Here is a local bank

91 Days $1,000 2.47%

1 Year $1,000 3.91%

2 Years $1,000 4.30%

3 Years $1,000 3.92%

4 Years $1,000 3.63%

5 Years $1,000 3.72%

why bother w/ CDs when MMF like Schwab’s SWVXX offer 4.66% with full daily liquidity, no lock up time?

Powell. One foot hard on the accelerator, the other foot hard on the brakes.

No. It’s: “Stepping on the brake with one foot while putting an arm around the baby to keep her from hitting the dashboard.”

Thank you for another excellent article!

Uplifting.

Long term yields are finding support here, but might break it. The big story here will be the impact of the debt ceiling. After that gets resolved the Treasury will need to sell a ton of debt to bring balances back up, and bonds should sell of violently. That is what happened last time we passed the last debt ceiling. July timeframe, although the market could anticipate it.

When the Treasury starts selling all that debt, there might not be buyers until yields dramatically rise. The Fed will be executing QT at the same time.

I have heard the Fed discussed continuing to sell off assets even after interest rates had peaked and they were able to bring the interest rates down again.

Iti is my guess that the Fed cant get anywhere close to selling back down to the 4 trillion level we had before COVID without a massive market plunge.

We are still in the early stages of a global debt bubble collapse.

I am beginning to think that the small and regional banks are in real trouble as far as having a sustainable business model. I am leaning toward things spiraling downhill until revised banking system. Shoot, we are early in the default phase and banks are already going under.

OS

Perhaps this is all part of the digital central bank currency promotion?

I wonder if Barney Frank (of Dodd-Frank fame) a director of

Signature Bank has $2.5 billion available to reimburse the FDIC when the FDIC comes after him and the other directors and officers of Signature Bank for their negligence.

Only a $2.5 billion loss????

And who eats that?

“The FDIC already lined up a buyer for a big part of the assets of Signature Bank. It estimated, after the deals it has made so far, that its loss from Signature Bank will only be about $2.5 billion.”

The FDIC-insured banks eat it. They’re paying into the fund.

“The FDIC-insured banks eat it. They’re paying into the fund.”

At the end, it will come out of customer’s pockets – either in terms of lower interest on savings and checking accounts and/or increased fees like atm fees, late payment fees, overdraft charges, etc.

They will always sock it to the little guys while the big guys make off like bandits with their executive bonuses.

No wonder the little guys are all pissed and we see a clamor to burn everything down. Very unfortunate.

It will only if you let them. If you don’t let them, it will come out of their profit margin.

Don’t let a bank nickel-and-dime you to death.

I have no bank accounts with fees. But they require a minimum balance, which is fine because I need that much anyway. If a bank wants to charge me fees, I leave. I keep as little cash as possible in non-interest-bearing accounts, just enough to stay above the limits. I use brokered CD if I want a bank deposit, and that’s a competitive market. And I collect from my bank 1% to 2%, and sometimes more, every time I use my credit card.

Bank profit margins will drop by a lot for all kinds of reasons. Banks are going to be shitty stocks to own.

Sean Shasta

You are right. Tax payers holding the bag, ultimately.

All the taxes on the businesses including Banking, will be transferred to customers one way or the other.

–

Q What is the cost of banking crises to the ordinary person?

WT: The federal rescue costs are spread around so thinly that you don’t notice that $200 of your annual income is going, for example, to a $30 billion rescue package. And even if you didn’t, the government does not fund the rescue through tax but rather a special assessment on the banks. The banking system has to figure out how to swallow the $30 billion and spread it around among depositors and shareholders through fees and the like.

Q So it’s not accurate when a politician claims that the taxpayer won’t pay for the bailout?

WT: The taxpayer will definitely pay. It may be spread over 150 million tax returns, but the taxpayer will pay.

————-

WT = Walker Todd was assistant counsel of the New York Federal Reserve, assistant general counsel, and research officer at the Cleveland Fed, and has been actively involved in financial regulation for decades.

Investors will pay — and they’re already paying very heavily.

I understand Wolf must view it as ‘only’ a $2.5 billion loss from a viewpoint of huge banking balance sheets, but I admit trivializing such an amount makes me feel as though I am a slave stick-figure pawn in gigantic game of financial chess, even if I was making over $1 million per year.

Yeah, $2.5 billion is a stack of crisp, new $100 bills 8,300 feet high. Such large numbers can’t be easily imagined.

One billion seconds is 32 years.

One trillion seconds is 320 CENTURIES.

The decimal game in Congress….1.2…….1.3 Trillion ….its just .1 more ….what’s the big deal?

Well, the .1 is 100 BILLION dollars.

Well I have good news for you!

That’s exactly what we are!

2500 million dollars

Yes, 2500 million dollars. And if I am pulling down a really good after-tax (net) income of $250,000 per year, $2.5 billion would be 10,000 years of work at that nice income level.

That would be the equivalent of working for $250,000 per year from the Stone Age (8000 BC) to today.

Musk loses that much in an hour without noticing it, LOL

(I am laughing in a hyenic manner about Musk along with Wolf, with a walled insane asylum’s stone cold bricks unyieldingly looming in the background.)

as these fdic losses mount I really hope there is a mechanism that enforces and makes public the member banks paying their part of the loss assessments. As banks liquidate and fdic losses mount there will be less members to pay these assessments so the FDIC better be transparent in levying and collecting these assessments.

excellent article. Agreed.

Remember the 90/10 rule. Except there will be no legitimate currency,then what . God ,gold, food , who knows .

Wolf,

Thanks for the quick update.

SI, SIVB and SBNY got most of the ink but the gut says there’s much worse across the Pond. Why else would EU banks hold onto TLTRO III loans even after the ECB played Calvin ball by hiking the interest rate arbitrarily? Maybe some having difficulty finding affordable funding due to poor “risk management”?

Also find it interesting that SIVB got halted at $100 and SBNY halted at $70 and neither ever reopened for trading. A huge gift to the CBOE market makers and a huge kick to the groin for those short the shares. Note that CS and SI both still trading.

Powers that be showed in 2008 they don’t tolerate shorting financial stocks when system is it trouble.

I wish there was a way to see how much in assets the SNB has already sold into forward contracts when they saw interest rates were going to go up. After all they have pretty much been the smartest guys forever. And that would have protected the huge profits from their giant investment portfolio.

After all, forward contracts don’t show up on the balance sheet until delivery.

Someday this war’s gonna end…

The following was my theory last Sunday:

Why announce on Sunday the central bank swap program? Because Swiss National Bank #SNB needed supposedly $100B USD reserves on hand Monday to close the Credit Suisse #CS “not-a-bailout”. If swap loan (“line of credit”) not provided, then SNB would have to sell $100B of US stocks+bonds, Fed trying to prevent fire sale.

While essentially correct, Wolf has just unearthed that a different “facility” was used, for all or a large part of the USD needed.

>> Repos with “foreign official” (SNB?): +$60 billion

A bit OT here but KPMG accountants signed off on SVB 2 weeks before its collapse & 11 days before SB’s.

Did they give their money’s worth? :-D

Ask Arthur Anderson

In terms of criticizing the SVB auditor, hard to say but hindsight is 20/20. Seems to me like the company and the auditor reported everything – if you look at the 10-K annual report for 2022 filed on 3 March 2023, the consolidated financial statements include for example Note 9 – “Investment Securities” with a 7-page long description of investment securities where you can read about amortized cost, unrealized losses and fair value of AFS securities ($2.5 billion at end of 2022 compared to $0.3 billion at end of 2021) and HTM securities ($15 billion at end of 2022 compared to $1.3 billion at end of 2021). It also seems to make sense that this came out shortly after the 10-K was published. Seems like someone knows what to look at in financial statements. However, I would not expect this level of diligence and know-how from a regular depositor, that’s for sure.

Did KPMG note the obvious lack of controls over duration risks?

Review of internal controls is required of auditors.

What was lacking was a gang of bank examiners from the FDIC and the Fed with tiger teeth. Bank examiners raised alarms years ago about SVB’s “concentration risk,” we now find out, but it seems they were muffled, instead of being allowed to tear the CEO’s head off.

As far as we know, SVB wasn’t an “audit” issue that the auditing firm should have flagged, but a banking “risk” issue that regulators should have addressed.

Wolf

Do you know the former CEO of SVB as he was on the San Fran Fed board?

Yes, and he was booted off the board that Friday afternoon, when SVB collapsed.

With these bank CEOs sitting on the regional FRB boards, it’s clear that the Fed’s bank examiners are having a hard time getting heard. My impression is that they were muffled.

“With these bank CEOs sitting on the regional FRB boards, it’s clear that the Fed’s bank examiners are having a hard time getting heard. My impression is that they were muffled.”

Oh gosh, more corruption. You don’t say……

Wolf

How about you to fill his spot?

I always like Tom Hoenig……dissenting voices are of value.

I don’t see a connection because the 60 billion mentioned, was provided in CHF, not USD.

Casting further doubt of a connection, is that the total the SNB provided for the CS undertaking was 200 billion CHF + other guarantees, but all of which was in CHF.

Why would the US government have anything to do with it in the first place?

This was US DOLLAR LIQUIDITY. CS was a global bank, and USD deposits fled and needed to be funded with USD. The SNB provides CHF liquidity directly, but it cannot print USD, that has to come from the Fed to the SNB and from there to CS.

Excellent analysis. Just one thing, i am a bit confused with the “Central bank liquidity swaps: no activity, to $0 billion.”. I see it as increasing by $115m last week from $472m to $587m. I am looking at the wrong thing?

Look at the chart: Even the $11 billion that the SNB took in oct 2022 barely show up on the chart

The amount you mention, $101 million with an M is a MINUSCULE AMOUNT. Multiply by 1,000 to get into the ballpark ($100 billion with B and up) of the liquidity support we’re seeing.

Central banks do amounts in the millions all the time to test the system, and you see these minuscule amounts throughout going back years.

Great article. As always.

Could be Deutche Bank, instead of SNB perhaps?

Yes exactly from the last noises it would seem that it was the Deutsch Bank, then we are from bad to worse;

CS started wobbling (run on the bank) some time ago, and got a big SNB-Fed dollar infusion last fall ($11 billion) via the swap lines. So this is just a bigger repeat via official repos in a sense of the dollar infusion last fall.

Deutsche Bank hasn’t been rolled up by the government yet. These are market tremors you’re seeing. Shares have been in the same range of €5 to €13 for many years. Today’s price of €8.68 is up about 50% from the low in 2019 and about 75% from the low in 2020. Deutsche Bank has a ways to go before it needs getting bailed out. To get that kind of infusion requires the Bundesbank to get involved. That hasn’t happened yet. It might happen, but it’s a ways off.

CS was well ahead.

Question: If it’s true that banks can create money out of thin air why didnt they? All the balance sheets Ive read so far look very dependant on customer deposits

By the means of fractional reserve banking government may secretly and unobserved, confiscate the wealth of the people, and not one man in a million will detect the theft- John Maynard Keynes

bruce,

1. That’s exactly why this assertion that a bank “creates money out of thin air” is total BS. No bank would ever collapse if they could do that.

2. But modern central banks create money out of thin air, and that’s why THEY will never collapse. And they destroy money with QT.

3. The banking system as a whole creates money and destroys money automatically with the ebbs and flows of collateral values (asset prices) that the system as a whole lends against. Higher asset prices create bigger deposits when the assets are sold, and that money comes from the buyers’ loans. This is how loans turn into deposits in the banking system overall. But no individual bank can create money. In a simplified way, the banking system converts asset prices into money via loans and deposits.

4. Money creation turns into money destruction in the banking system when leverage assets (homes, CRE, etc.) decline in price for long enough.

The shorthand way I would describe it is that central banks create money out of thin air, commercial banks create money out of reserves. Commercial banks must have sufficient reserves to make a loan in case the lender’s new money ends up somewhere else.

sorry, borrower’s new money.

>>Commercial banks must have sufficient reserves to make a loan in case the lender’s new money ends up somewhere else.

Exactly, Joe. Related: All interbank transfers and payments are settled via netted reserve transfers between banks.

>>But modern central banks create money out of thin air

I have always disagreed with this. Central banks

create reserves and give them to the government to spend (increase TGA balance) by accepting new government bonds as backing for the new reserves. This represents a dilution of the value of existing money because there is no increase in the underlying value of the land, buildings and future income of the government (which is in turn the backing of the g-bond debt of the govt). SDO it is not thin air, but a dilution of existing claims.

All money is a CLAIM on something.

Bank of England have published a paper on this. “Money creation in the modern economy”. 14 pages and reasonable easy to read.

I do hope the economic part is better than the reference part, as the author missed out that there is no Nobel Price in economics.😉

“and they are paying it back rather quickly, and will continue to do so.”

“it seems the $42 billion increase might have been banks shifting borrowing to the BTFP from the Discount Window, which fell by $43 billion.”

Is it really “paying it back quickly” if they just shifted the debt from one FED balance sheet to another one? And a more advantageous for the banks debt as well. Maybe I’m not understanding well…

I also don’t how it’s unfavorable for banks to take advantage of the BTFP program when the collateral that they post is marked at PAR and not at low values like it should be?

1. Read it again: yes, they’re paying it back as soon as they can because the discount window is expensive money, and they’re going for less expensive money. And they did already pay back a big junk.

The BTFP is also expensive money, but not quite as expensive as the discount window, and they’ll pay that back as soon as they can, with funding from cheaper sources, such as deposits or asset sales of wherever they can get cash that’s less expensive.

Add the two together, and you see that borrowing by banks via these two measures peaked a week ago and now edged down a bit.

2. “I also don’t how it’s unfavorable for banks to take advantage of the BTFP..”

The BTFP requires collateral (though a little less than the discount window). Banks HATE tying up collateral. They can borrow WITHOUT posting collateral from depositors and from unsecured bond holders. The collateral issue is why they will get rid of the BTFP loans as soon as they have enough cash to do so. This is not cheap money. Cheap money comes from depositors.

I wonder if it was all political talk to claw back the huge bonuses and salaries of some of these failed Bank Executives. I have heard nothing about this again since the start of this latest mess.

It’s all talk. I don’t expect politicos to get anything right. Better to ignore all of them. Unfortunately, the Fed is the true ruler of this country.

We are turning into another Argentina. I heard that SVB made some 50 year Mortgage loans to insiders. This needs to be independently verified. These loans were most likely packaged into securities (like CDO’s) and sold to investors. They are probable down over 50% face value. Notice, you don’t hear much about the SVB loan portfolio. The Fed is too busy bailing out their depositors to worry about little details like this.

There is a generous amount of doomfaring in these posts that has dismissed much of the article. I mean you all *could* be right – but more likely wrong. How about a little more balance and reason instead of focusing on one isolated part of the elephant (it’s shite or speculative parts)?

NoBadCake

Ok….This is NOT like 2008 as there is about $4 Trillion too many dollars sloshing around in the system.

The cost of building a house is high and keeping a support under housing prices.

There.

With all due respect, there is no hope in this case. You have two opposing forces pushing against each other.

The political side continues to call for more spending especially in the new energy and social spaces and the Federal Reserve is trying hard to oppose this stimulus with continued QT and rate hikes.

The latter force is losing as inflation is still raging with February data showing both Manufacturing and Services coming in hotter than expected. Add to this a growing banking crisis.

I ask you and all others how can this resolve?

Longstreet

Concerned Citizen

Post-modern civilization is global and impossibly complex. Human civilization has always teetered on the edge of the abyss. Proper solutions tend not to appear until we’re on the verge of *real discomfort*. Absolutely, let’s discuss our concerns and bat around possible solutions but by no means is the future certain.

Maybe a little more humor and admitted uncertainly would be an improvement over pointless hysterics?

NoBad Cake:

Human civilization has always teetered on the edge of the abyss.

This statement is true and our lives today, even with the current mess, are the best that mankind has experienced in the history of the world. That said, our relative position today is bleak and becoming worse as evidenced by many metrics including debt vs production, value of currency, measure of lifespans…

One Black Swan event and you easily imagine the summer of 2020 times 100 happening in America.

Not the time for levity in my opinion.

Post modern civilization is more of a repeat of history than you think. Here is something to consider written in the 1840s. See the wisdom and the correlation to today.

“A democracy cannot exist as a permanent form of government. It can only exist until the voters discover that they can vote themselves largesse from the public treasury. From that moment on, the majority always votes for the candidates promising the most benefits from the public treasury with the result that a democracy always collapses over loose fiscal policy, always followed by a dictatorship. The average age of the world’s greatest civilizations has been 200 years.” DeToqueville

Longstreet

“Not the time for levity in my opinion”

If you believe we are on the Titanic then I suggest you find the performance hall and enjoy the best 15 minutes of music in your life.

Rccmd: Pärt: Spiegel im Spiegel Lisa Batiashvili, youtube.com

Concerned Citizen

I hear ya (T. Urban, 2023, R. Dalio, 2021, I. Khaldun, 1377).

“There are known knowns… known unknowns…But there are also unknown unknowns – the ones we don’t know we don’t know.”

-D.Rumsfeld

You’ve both encouraged me in my meditation practice : ) and I suggest you consider taking it up (J. Kabat-Zinn or E. Easwaran).

Good luck to us all.

Concerned citizen

Long street

No bad cake

The macro economic factors, including the record levels of debt and Geo-political reality++ NOW is entirely different from 2008.

There are several (long) articles online/blogs, where Mr. Satyajit Das has analyzed this situation, currently. Sorry, Too long to summarize.

Satyajit Das, a former banker and author of numerous works on derivatives and several general titles: Traders, Guns & Money: Knowns and Unknowns in the Dazzling World of Derivatives (2006 and 2010), Extreme Money: The Masters of the Universe and the Cult of Risk (2011), Fortune’s Fool: Australia’s Choices (2022)

Economist Ludwig von Mises :

“There is no means of avoiding the final collapse of a boom brought about by credit expansion… The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.”

sunny129

Don’t get me wrong – I know there are many significant risk areas. I think Dalio(2021) wrote something to the effect of your Ludwig von Mises. I’ll admit his book was a stretch for me but I learned a great deal. My issue [today!] is obsessing about isolated elements of complex matters THEN posting pure anxiety online is unhelpful. There’s an old joke about a husband that can’t get his traveling wife’s cat off the roof that would apply. : )

The reason I am a little bit of a doomer is that ZIRP blew up asset values too high by long term measures. Plus 3 sigma, at the 99 plus percentile, or in some cases never happened before situation like $17 T in negative rates. I will eat my hat if Fed can soft land this plane.

“All while the Thucydides’s Trap plays out.”

Indeed, and I predict before Biden’s term is up.

Appreciate the Thucydides reference CC:

How some ever::: In spite of, or possibly perhaps because of such continuing challenges as he not only reported, but suggested, WE the PEONs are in almost exactly the same situation.

IMHO after now six or seven decades into at least watching RE and SM mkts,,, Until and Unless WE,

” CLEAN HOUSE,,, SENATE TOO” of all ,,, repeat ALL of the ”old and older folks” from ALL of the GUV MINT elected AND appointed positions, and replace them with FOLKS WHO WILL LIVE with every decision they make,,, USA is going nowhere near what is needed….

As an OLD GUY,,, I seriously want the younger folks, especially those who have had experience actually doing the daily ”governing” to be the next POTUS…

Please understand that as one the age of both likely candidates, IMO those old folks, similar in age to me,,, and from what we read everywhere SO CORRUPT,,, that I can only hope they will go home and help their grandchildren.

OTHERWISE,,, IMHO, USA will go exactly DOWN with those old folks who do not have to put up with their choices…

CLEAN HOUSE,,, SENATE TOO,,, AND POTUS TOO !!!

Yellen called an emergency financial stability meeting this morning in response to DB. Of course, Wallstreet is hoping for an emergency rate cut. God, they better not do that. I’m so sick of it.

Yellen is a bureaucrat with 3 pensions and a purse full of platitudes and bromides……

compare her to Mnuchin.

She has a “schtick” that is a paradigm for the career govt bureaucrat.

Speak and say nothing.

And she allegedly got speaking fees? (paybacks)

Fed up

FSOC headed by Ms. Yellen is euphemistically called

PPT – Plunge Protection Team.

They made sure today that the indexes will end in ‘green’ at the end ( which were attempting to go RED every 15 minutes!) which can be done by buying call futures, with a lot less money, than buying them directly. This has been done more than once in the past, even though denied by the authorities.

MW: The Federal Reserve’s Bullard says he has raised his endpoint for interest rates by 25 bp to 5.625%

1) People parked their money in US 2Y for better yield. The 2Y plunged

from from 5% to 3.76%. The 1Y from 5.25% to 4.9%. The 3M is rising, no demand.

2) The regional banks tsunami might be over.

3) DB is SIFI. It will never fail.

4) US 10Y minus 2Y gap up to (-)0.38%. The weekly bar is an inside bar. It might popup.

5) DET 10Y minus DET 2Y is (-)0.25%.

I bet 10s2s will be un-inverting shortly..

MM

It heralds the ‘arrival of recession’, with Fed trying to re-invigorate the tanking economy.

Check out all previous recessions and Bear mkts, for correlation.

I hope we aren’t providing any liquidity support to Deutsche Bank, which has $1.3T in assets and only $10B of market cap.

It needs to go.

They should have named BTFP the Bank Equity Loan Program, or BELOC. Then the average American homeowner would understand just how much trouble these banks are in.

*Bank Equity Line of Credit

My acronyming is off this am.

Instead of relying on regulation and liquidity support to cover risks in the banking system, some of which are intentionally created, why not increase capital requirements of banks?

It’s the cleanest, simplest, most effective answer to the problem of bank risk. Higher capital requirements would do more effective work than 10,000 bank regulators, at much less cost to taxpayers. The people who create and manage risk would have skin in the game.

Why is there no serious discussion of this? Are legislators held completely captive by the banking industry?

I agree w/ your solution but who would confirm the ratios. And yes, its regulatory capture.

If the defense attnys of those proved culpable of fraud draft the settlement docs, then the the banks write the legislation that regulates their actions.

So is Deutsche Bank the next to drop?

Don’t venture to msm sites. Headlines with “Panic” and mentions of emergency rate cuts. Its really an alternate universe.

DeutscheBank is too-big-to-bailout. It’s had just a sliver of market cap for a LONG time, which has effectively shifted all risk to the public. It’s been subsidized far too long. It’s time for DB to face the consequences of its own actions.

Bobber

If DB goes under, the whole European Banking will at risk, with contagion probably spreading across the Atlantic and probably to the rest of the world.

The global banking system is tightly aligned since GFC. Hence Fed is providing $ swap lines.

The total global Debt to GDP is now over 450%, a record unlike any time in human history. We are in uncharted waters.

Germany will never let DB implode. They may bail in shareholders and some bondholders. The state may take a huge stake in the bank after bailing in investors, effectively or partially nationalizing it. But they will keep the bank up and running. DB is a hugely important industrial bank in Germany, it’s a hugely important cog in the export and import machinery of Germany Inc. And the government will make sure it continues to function as such.

During the financial crisis, the state took a stake in it. I think they sold it meanwhile.

I don’t buy that fear-mongering. Let them fail and sell their assets to stronger banks with more capital.

It’s time to enact new legislation worldwide that increases capital requirements for banks. They need skin in the game. Otherwise, its privatization of profits, socialization of losses. Banks that can’t raise capital should be reorganized. The market is telling those banks they are worthless.

The world needs to face its fears, not watch them grow.

It’s all just financial chicanery by the FED – smoke and mirrors to try to prop up a failed system. “Have printing press, will use it.” That’s all the FED can do is print, and they’re just saying they’ll print if necessary. “Oh, but we’re taking high quality collateral in exchange this time.” FED Get the eff out of the free market and let it work.

Like an alcoholic that keeps drinking to avoid the hangover…

How cone no one is ever expected to take a loss?

The Fed and Treasury are an insulation company… for some

DC

Just think of the last 14 years. Balance sheet goes from under 1 trillion to almost 9,000,000,000,000. National debt goes from 9,000,000,000,000 to 32,000,000,000,000. And then in two years the money supply is expanded by the equvilent Of the entire money supply in 2009. And we still have a problem. It’s the gunslingers the rule breakers and they keep getting saved

Crybaby narcissists who found convenient openings to materially exploit others in powerful positions is another good term to describe these people.

Hello Wolf

This will sound absurd, irrational, but if the Fed loan to Swiss Nat Bank, the collateral posted, could it be someone’s Art?

I’m taking a guess at this, entirely based on your mentioning the word “rose” three times.

Only Treasuries and agency MBS.

Maybe they can throw an NFT into the mix, LOL

I don’t know if these guys are smart or dumb? Big fiscal push and late to raise Fed put a lot of juice in economy to kick can. They kicked debt service problems down the road, but debt service growth rate is 29%. That is unsustainable growth rate in a nominal 5% economy. I am sure they know they can yield curve control as a last measure.

Wolf,

When I go to bed tonite, I am going to pray that I can learn just the things that you have forgotten! Thats all I want.

Wolf, all I can say is that I hope you’re right. If somehow this new money borrowed from the Fed doesn’t get paid back and ends up back in the general economy, chasing assets and whatever else, inflation will skyrocket again.

Einhal

The Fed is trapped between saving (bailing out) the banks vs containing the inflation. They cannot do both, a consequence of their own creation.

sunny129,

They can do both just fine. And they’re doing it right now. See:

https://wolfstreet.com/2023/03/22/powell-explains-the-feds-new-regime-rate-hikes-qt-to-fight-inflation-while-offering-liquidity-to-banks-to-keep-them-from-toppling/

The Fed is never “trapped.” It can do whatever it wants.

Wolf said – “The Fed is never “trapped.” It can do whatever it wants.”

——————————————-

Can they can undo the theft from savers they have extracted over the past several years through their money printing and interest rate suppression scheme?

They can if they want to.

The last 30 years or so has been about leveraging up every nook and cranny of the world from about 1.5 X GDP to around 4 X GDP. We probably are at about peak debt. Maybe debt creation is no longer a growth business and banking sector needs to be a lot smaller.

How has the cheering section protected themselves from letting the banking system go broke???