We laugh, but it’s a start. SVB Financial collapsed with investment-grade ratings.

By Wolf Richter for WOLF STREET.

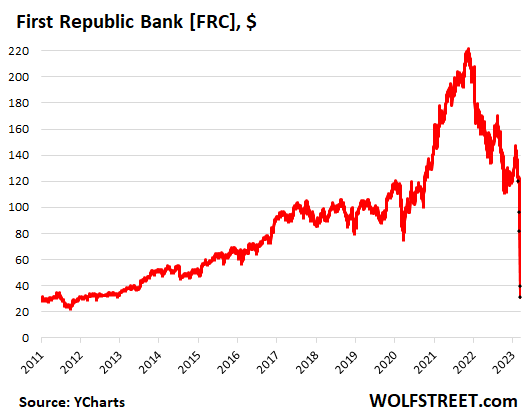

San Francisco-based First Republic – a bank catering to the billionaires and millionaires of the Free-Money startup scene – has been teetering near the cliff as said billionaires and millionaires have been yanking their money out amid big unrealized losses on its unhedged holdings of long-term bonds. Its shares have collapsed by 86% from peak consensual hallucination in November 2021. Its unsecured notes have plunged by 55% over the same period. And yet, it was rated a respectable confidence-inspiring-LOL “A-” by S&P Global Ratings, four notches into investment-grade, until this very morning.

And now, after investors already took huge losses, S&P Global downgraded First Republic by four notches to “BB+” – so into junk. But hilariously, this is still just one tiny notch into junk (my color-coded cheat sheet for corporate credit ratings by rating agency).

This comes after the fiasco of SVB Financial, which was rated comfortably inside investment grade by S&P Global and Moody’s until March 10, the day it collapsed, when Moody’s slashed its ratings by 13 notches in one fell-swoop to default, and S&P slashed its ratings by 10 notches to default. SVB’s preferred stock, a form of unsecured bonds that had been rated investment grade, violated the WOLF STREET dictum that “nothing goes to heck in a straight line,” and went to heck in a straight line.

Yesterday evening, S&P Global had put First Republic on review for a downgrade, a day after Moody’s put the bank on review for downgrade. And now S&P Global reviewed the bank, and downgraded it four notches. Moody’s is still reviewing the bank, with a downgrade coming soon. So that’s a start. But it’s way late for investors in its bonds that had relied on these ratings and have already taken massive losses.

“We believe the risk of deposit outflows is elevated at First Republic Bank despite the actions of federal banking regulators and the bank actively increasing its borrowing availability to mitigate risk associated with the bank failures over the last week,” S&P Global said in the statement, cited by Morningstar.

“We believe that First Republic’s deposit base is more concentrated than most large U.S. regional banks, which presents heightened funding risks in the current environment,” it said.

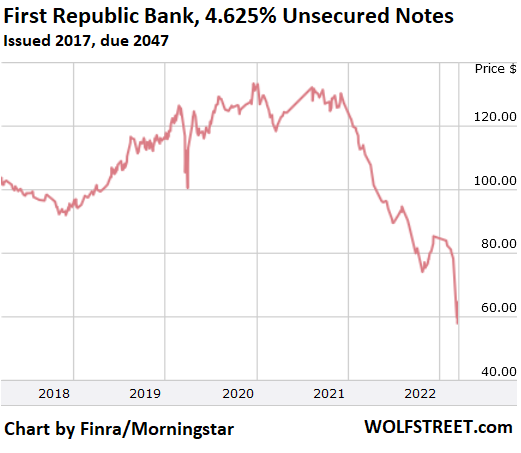

Upon the news, the subordinated notes First Republic issued in 2017, with a coupon of 4.625% plunged to a new low, after the bounce over the past two days, to 58 cents on the dollar, down by 56% from 132 in August 2021. These bonds are in line to get bailed in, along with shareholders if the same fate befalls First Republic that had hit Silicon Valley Bank (chart by Finra/Morningstar).

And upon the news, or for whatever reasons, shares of First Republic plunged 21% to $31.64 at the moment, giving up its huge dead-cat bounce yesterday, following the 61% collapse on Monday, whereupon the stock was anointed a hero in my pantheon of Imploded Stocks. Shares are down 86% from peak consensual hallucination in November 2021 (data via YCharts):

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

What’s that saying “something about closing the door after the horse already bolted”. Only I don’t think the ratings agencies are stupid, we have seen this before. The ratings agency are a joke; it’s like asking the pimp if his product is “germ free”.

Right. It’s the entire system that’s the problem. It’s rigged. The wealthy special interests have rigged the entire US economy and system so they can feed off of it like the parasites they are.

PICK YOURSELVES UP BY YOUR BOOTSTRAPS!

TULSA OK SYNDROME!

GO TO MARS WITH ELON!

Stop shouting.

Those could be headline statements, where shouting is appropriate!

The government and all peripheral agencies like FED are all owned by rich and elite. They all work for their masters.

Anyone expecting good from these guys are mistaken in my humble opinion.

The fix is pretty simple and could have been done decades (and multiple busts) ago.

A tiny tax/fee could be levied on corporate debt issuance and used to fund truly neutral ratings/forensic accounting.

Multiple accounting firms could be assigned to a pool so as to divide the work. Rotation could also be implemented.

None of this is rocket science.

Hell, you might even be able to use the same morally compromised ratings agencies (Fitch, S&P, etc)…they will do whatever work they get paid for.

They probably don’t *like* looking the other way…but that’s what they have been paid to do for decades.

They are bent enough, that if they are paid to be honest…they’ll be honest.

(We’d probably want to decapitate their leadership first, if only for a fresh start/public confidence)

Again, absolutely zero rocket science.

Sooner or later it is going to be proposed by a pol and we have seen enough busts, close enough together, for it maybe to go through.

(Definitely the next bust…)

Or private insurance could be offered to deposits over $250k. A profit motivated company would review the financials of the bank and price risk. Unsubsidized insurance would be a great risk evaluation tool.

The fee would be tiny or large. It would also be voluntary. It would force transparency.

DC

since 2009 they have added 23 Trillion in debt and pumped it into the markets and economy and government

since 2009 the Fed pays on excess reserves

since 2009 the Fed has sopped up 2.7 Trillion in MBSs

since 2009 the Fed has sopped up nearly 35% of all treasuries with maturities of ten years or longer

AND the “fixers” gobbled all this liquidity up and made themselves filthy rich.

AND our economy is still in trouble. I guess it worked for some.

It is not only wealthy who want bailout or salvation. Everyone wants bailout and salvation, save my job from foreigners, let other people pay tax, let healthcare be free, save environment, provide safety nets…free lunches

@max

also NIMBY

The way out is strategic non-participation to the degree you would like. What that percentage is I am not sure, but 50% would be a good start, even 25%. This means taking a sacrifice. This means living not using credit. There are 1000 ways to drink water.

Germ Free,,,, HEE HEE,, Thanks

Advertising agencies have more credibility than rating agencies at this point, regarding statements about their clients.

The current banking crisis was caused by the many years of ultra low interest rates. The recent PBS program “the Age of Easy Money” explains the ultra low interest rate regime (from the early 2000s not 2009) that made the subprime mortgage bond crisis grow and grow until 2008-9 and was then continued until the recent time —to the bankers’ profit. The ultra rich also loved the inflation that the privately owned “Federal” Reserve cartel thereby created: their liabilities and employees’ wages got reduced each year while they passed down to us any inflation-caused price increases in their costs.

They did this to get Americans their low, low-paying jobs? Nuts. Consider the possibility that the ultra rich that own and control the Fed always only look out for themselves (and cronies) and can manipulate the stock market to make the crazy Fed decisions that they wanted seem reasonable. Now, they sucked up Americans’ wealth by low interest rates that gutted pensions, etc., US wages and Americans’ humble savings “coincidentally.’ Sure, “coincidentally. ” LOL

I love you, Karen Petrou!

Powell is not as much to blame as prior “Fed” leaders— except for not having a spine and caving to pressure.

I would not buy a used car from the Fed’s Mr. Clean, or anything else.

RH.. Are you sure we watched the same show? The Fed had only a few tools in their tool box.. increase or decrease the fed funds rate, increase or decrease bank reserve requirements or print money and buy bank assets. In 2008 they wanted to get the banks to lend to get the economy out of free fall. Every time they tried to take “money” off the table WS and the 1% whined. They specifically mention public policy beyond their control which was the money printing by each administration, huge tax decreases and corporate americas 5 trillion in stock buybacks vs capital investment. No infrastructure was built on the cheap (Which would have helped the working classes) and because of a divided congress and the crazy “no tax” Tea Party no money was ever taken of the table.

They interviewed many retired Fed Bank Presidents. Neel Kashkari the Minneapolis Fed President was the only Fed Current President who agreed to be interviewed. He continuously talked about income inequality and the bottom 50% finally seeing an increase in real wages. He is a voting member of the Fed Open Market committee this year. I bet he will be gunning for a 50 basis point increase. There will be no pivot not after the ECB just raised .50. And unlike the US they are spending money on infrastructure. We continue continue to fund speculation. The definition of insanity.. Doing the same thing over and over again. Rinse snd Repeat..

Before or After use?

Not just the ratings agencies’ – this gem from in the Finanical Times today:

KPMG stands by audits of Silicon Valley Bank and Signature Bank

KPMG was General Electric’s auditor during the Welch/Immelt reigns!

A very sad era as “Crony Capitalism” in America is being criticized by the entire world, with America being seen as a huge hypocrite for pushing a global $250,000 FDIC insurance limit, yet bailing out rich elites bank that is not systemically critical to the banking sector, as per the FT article titled:

European regulators criticise US ‘incompetence’ over Silicon Valley Bank collapse

The US has claimed SVB’s failure will not hit taxpayers because other banks will cover the cost of bailing out uninsured depositors — over and above what can be recouped from the lender’s assets.

However, a European regulator said that claim was a “joke”, as US banks were likely to pass the cost on to their customers. “At the end of the day, this is a bailout paid for by the ordinary people and it’s a bailout of the rich venture capitalists which is really wrong,” he said.

They also usually have a clean audit just before the bottom falls out.

You misunderstand ratings agencies and their business. They aren’t a public service. They get paid by the organization raising funds. Their job is to rate new bond issues (or other financial instruments) specifically, not the company. Yes, the two are intertwined, but they’re different. Perhaps Mr. Richter could write an article about ratings agencies given the public’s misunderstanding. BTW, not trying to defend the agencies, just noting the public’s misperception.

I know you love grammar help, so wanted to point out:

“unsecured bonds”

Did you mean, unsecured bombs?

Lol

“unrealized losses on its unhedged holdings of long-term bonds” So…

1. How many banks/shadow banks/Hedge Funds are insolvent by marking their bonds to market?

2. Lots of talk about hedging, but who is going to provide “insurance” against loss in value of bonds, and at what price?

Hedging interest rate risk is quite common. According to Investopedia:

“Interest rate derivatives are often used as hedges by institutional investors, banks, companies, and individuals to protect themselves against changes in market interest rates, but they can also be used to increase or refine the holder’s risk profile or to speculate on rate moves.”

It would have cost SVB to hedge its interest rate risk. However, that cost would have been much lower when rates were still low before the Fed started its hiking cycle, but after it announced a change in policy. I suspect better managed banks did hedge their risk. SVB probably didn’t want to take the hit to earnings from the cost of hedging.

SVB was too busy courting to act like a bank. Their deposits nearly quadrupled from 2018 to 2023, from $49 billion to $173 billion.

In case you were wondering where all the pandemic free money went.

And now see how difficult it is to claw back money from these people and useless companies.

Inflation gonna be a hard nut to crack.

Urgh…this damn bank better not collapse behind next week’s FOMC meeting…if it does then all bets might be off and Pow Pow might not want to destabilize the market anymore by going .25 or .50 at least that’s the narrative MSM will sell you…

and then I will have to hear non-stop about the Pivot making a comeback…double urgh…

It’s got access to enough liquidity to not collapse, including from JPM and the Fed. If it is deemed insolvent by regulators, they can shut it down. But I doubt they will do that. Looks to me like a long hard struggle for the bank to survive, including capital raises that will be devastatingly dilutive for existing shareholders.

Good, like you said one less thing for Pow Pow to not raise and QT to combat inflation, last thing he needs is another excuse to lean back on “Financial stability” excuse to let his medicine do its thing…

Inflation at near double digits isn’t financial stability either.

And I think that’s what they’d have for certain with even a pause in rate rises.

Rock and hard place, irresistibly closing, but hardly noticeable for those enjoying the show in slow motion with all the attendant ‘noise’

I wonder if FRB will continue to “out price” mortgage rates to other competitors (loan brokers and/or lenders) with their “relationship” pricing they were offering their client’s that held funds in their institutions (and some did not have that much funds to really give the client below market rate pricing)… I for one, hope they stop giving away the rate as they have… Now look at them… Any thoughts?

The Saudis may be looking for a new bank to throw money away in today, coincidentally…

Taken in conjunction with *China* brokering Iran/Saudi detente (something the US failed at/intentionally torpedoed for decades) this may be the beginning of the end for petro-dollar recycling.

The Saudis aren’t stupid and nobody likes getting repeatedly ripped off.

If Western political/economic leadership had just been a little less crap…

KSA’s sovereign wealth fund is the ‘go to’ when looking for dumb money … just ask Softbank

“FIRST Order” and “Galactic REPUBLIC” are from Star Wars. Thus is the “First Republic” a Rebel Alliance or a Galactic Empire owned and operated bank???

And if Empire owned, should the taxpayers bail them out as I’m pretty sure the Empire is galactically non-ESG compliant.

I’m guessing all these failing banks are Empire owned as in the movies the Empire leaders make crazy stupid decisions, which matches with CEO patterns of the failing bank’s inability to understand simple concepts such as treasury duration, hedging of risks, etc.

Who is the Empire in real life, and are the rest of us just Rebel scum???

All I know is the Ewoks didn’t agree to pay for it & they seem pretty certain of that not being in their customs.

Wolf, what about the Alex Lehmann Moment, over at Credit Suisse?

I’ve been waiting for years to use that line. :)

The only thing that I don’t hound people for is their name, LOL

This is the game now. They learned and they agreed to take everyone for a ride of their life time to the death. You and myself may be long dead before the game is over. Hence, I stress now non-participation. That means sacrifice. I do not use credit. I wait until I want something good and I then have dry powder ready to purchase. It is actually very rewarding to operate like this. Occasionally, I have more dry powder than before and I splurge a little.

There are 1000 ways to get a drink of water. Non-participation also 1000 ways to cut back and let them bleed. In this game, obviously, there are two players the sucker and the scammer so to speak. What if the sucker walks away? That takes a little courage and greater purpose inside oneself.

Or… maybe this is what Powell was talking about when he said there would be pain.

“First Republic Downgraded by S&P from Confidence-Inspiring-LOL “A-” Investment-Grade to BB+”

Just like Housing Bubble 1, we find that everything is fictitious in regards to rating bonds and securities, that subprime is given a prime rating.

I see American Car Center with over 40 dealerships in multiple states just went tits up, filing Chapter 7. The article cited delinquent borrowers as a big issue. I’m sure somewhere along the way, their ABS were rated AAA.

Just yesterday I was reading an article on Yahoo that listed like 10 vehicles that people were still paying OVER MSRP for. Are these cash buyers? No. These are loans where oftentimes the loan-to-value ratio is upwards of 150% of the car value. This should be called what it is – AN UNSECURED LOAN. The car is just the tool to lure these suckers in to sign on the dotted line.

Reckless lending by disgusting bankster creeps who lie about the quality and sell them off to pension funds and other institutional buyers by way of these phony ratings agencies is a crime. It’s fraud. This entire everything bubble is built on fraud. And now we get to peel back the onion and see it all again.

Right back to business as usual. Incredible but not surprising.

“Reckless lending by disgusting bankster creeps who lie about the quality and sell them off to pension funds and other institutional buyers by way of these phony ratings agencies is a crime”

Agreed…but there was absolutely *zero* possibility that every buyside participant did not know this in the wake of 2008.

But plenty of them kept buying the crap (junk bonds at 4%, etc).

Basically, their excuse (true but unjustified) is that DC’s ZIRP policy compelled them to buy higher-yielding crapola to even remotely approach the actuarial growth in their poltical bribe liabilities (cue next horrific disaster…)

Every aspect of this crime has been discussed in depth since 2002/2008…but since DC is cowardly and lobotimized, *zero* has been done to address the fundamental underlying problem (rapidly worsening US productive efficiency relative to rest of the world) and “papering over the gunshot” has been chosen repeatedly.

It is horrible…but it has been horrible for decades and DC has displayed nothing but the death instinct.

Yep. And all greedy and simple who buy/bought into the fraud will end up paying. Imho the bottom around 2010-2011ish was equilibrium par and should have stayed there. Possibly slightly lower.

In the UK we get SIPP, self invested pension, so I can choose where the money goes.

Does the USA have similar?

Apathy is the ultimate enabler here.

Yes the rich are bailed out plenty, and the system sucks, but only because the masses are, in aggregate, suckers.

The ratings agencies are catering to the suckers, but being a sucker isn’t mandatory.

The example in this article happens all the time. Like the regulators closing the barn door after the horses have bolted and Wall Street analysts downgrading stocks, warning the bond holders after the price has crashed.

It would be interesting to track downgrades against those “same problem as SVB” lists (of 20-100 banks) that came out last weekend on Marketwatch, etc.

Truly obscene that a couple of decent journos can work with Factset in a day, to generate insights that all the ratings agencies (and regulators) could not generate over *years* (with decades of “experience”).

And the regulators had all the data *on their own reports!!* (That’s where Factset pulled it from)

This is probably the first nail for re sellers. Look out for more price Drops and maybe even new inventory coming to market.

Something something nothing something straight line something heck.

At what point should the CRA’s have started downgrading SVB and First Republic? What would have been the information source and tip-off?

The downgrades could have happened with the first rate hike…100% of the financial community knew that rates had been artificially gutted (to a maximum) for many, many years…and that once rates started to rise (very much at all) *all* existing fixed income securities were going to lose value.

This is corp finance 101 stuff.

With each hike, the problem was only going to get worse.

Everybody knew conceptually but were terrified politically and economically to delve into the specifics…for fear of what they would find (and therefore become legally obligated to act upon)

What would have been the information source and tip-off?

Answer: “unrealized losses on its unhedged holdings of long-term bonds”

Wolf would know, but I’ve read there are $700 billion in unrealized losses on U.S. bank balance sheets.

kam

BAC it self has 110 B unrealized on their sheet

And BAC has a total stock market capitalization of $225B. So, it has eaten thru half of its capital. And the FED will take loans at par value to extend and pretend everything is solvent for one year. Face it — either kill Inflation now and take the medicine, or look for hyperinflation in the future.

So is the maxim now “Nothing goes to heck in a straight line…unless the government in involved.”?

I heard some jackass on CNBC saying he was loading up on First Republic Bank because he said it was a well managed bank. I wonder what he is saying now???

CNBC is the Jerry Springer of financial networks.

That’s right!, or the “National Enquirer” of money.

Was that Jim Cramer? Lol

Jim Cramer was pushing Chinese stocks today on his Mad Money show.

What would be the downside of creating a National or Federal bank where all depositor funds are covered by FDIC?

Banking at the facility(ies) would be strictly limited to taking in and holding deposits and lending to activities that actually are involved in building something. Unutilized funds could be invested in treasuries’ Loans for speculative activities would cease.

At the same time reinstate Glass-Steagall (or something similar) making it illegal for FDIC banks to run as investment houses. If they do then they lose FDIC status.

This could be done overnight but there is no political will.

Everyone bitches and moans about the Fed but the power the Fed has assumed is due to the complete dysfunction of the political system which has become so polarized it is impossible to get anything meaningful done. As a result the Fed becomes the only adult in the room as the children (Dems and Repubs and their bases) squabble over petty nuisances blown way out of proportion.

Deregulation upon more deregulation only muddies the oceans of cash floating around where the sharks smell blood (your earnings) and feast.

There has to be a mechanism that identifies who gets bailed out and who takes the speculative losses. A national banking system would at least create a segment of the economy where money is allocated to activities that adds real benefits.

Carve out the speculative sector. They’ll be on their own.

I think the Fed would be most appreciative of someone else taking the reigns.

“What would be the downside of creating a National or Federal bank where all depositor funds are covered by FDIC?”

It would be much more difficult for that type of bank to buy, I mean donate to, politicians.

Anything that would help everyday people or stabilize the country instead of protecting the assets of the establishment elite and donor class would be considered too woke to consider by today’s politicians and a weaponization of government against the powers that be.

You know, those who rightfully deserve their place at the top of the hierarchy and to dictate how the rest of us should live our lives and admonish us when we fall short of our own individual decisions.

Until the lack of discipline by both the FED and the federal government is corrected and maintained, you can restructure banks in any way you want and it won’t matter.

Do you remember when Goldman got their $23 billion taxpayer bailout, then went on a frenzy of bonuses for themselves for being greedy, ungrateful geniuses ?

Deposits today are loans, not deposits. Bank customers should be given the choice not to make loans to banks and then they wouldn’t need deposit insurance. Of course, they would also have to pay for banking services and wouldn’t earn any interest.

Deposit insurance as it exists today and your proposal is a welfare program for bank shareholders, bank management, and bank customers ultimately backstopped by the taxpayer.

Your missing the point. I think you should do some research on the nature of nationalized banks as virtually none of your response is applicable.

Upon RTGDFA I learned that in fact some things do go to heck in a straight line.

Here is the poetic justice: The CEO of SVB is on (or was) on the board of directors of the Federal Reserve Bank of San Francisco. Barney Frank (of Dodd-Frank fame) is on the board of Signature Bank. Both banks are apparently being liquidated and the assets will be sold and any losses sustained by the FDIC will be reduced by the FDIC suing in Federal Court both Barney Frank and the former CEO of SVB. The FDIC will beat each of them into financial submission. (same thing will apply to First Republic officers and directors if it gets shut down)

Waiting for Credit Suisse blog. Yikes!! Does Mr. Richter cover foreign banks?

He’s the man of the hour or Bank King.

Rarely. Credit Swiss has been teetering for years, for as long as I have had this site, which is over a decade, during which time is has been hobbling from scandal to scandal, each time losing billions along the way, and each time, its shares get beaten to a new record low. The SNB is not going to let it collapse, but they could bail in shareholders (there isn’t much left) and contingency convertible bondholders and other unsecured bondholders to recapitalize the bank and make it shrink further. TBH, after a decade of this same thing over and over again, I’m just tired of Credit Suisse. It needs to get out of my hair.

OK, so maybe that’s the first paragraph of my article?

You’re tired of Credit Suisse, don’t forget Douche bank too..

Can we say the same about Softbank…seems to loose billions and poor investment decision over and over again and still kicking…

Question: within the EU Central Bank, are there “safeguards” or mechanisms that the US System doesn’t have/use, in propping up Credit “Swiss?

It would be up to the SNB to deal with this, not the ECB.

Wolf, how about Deutsch bank and its massive holding of derivatives. Its also gone from one major issue , including Money laundering, Libor fixing etc. and been fined 100 s of millions of dollars in the past ten years. Could not a lot of their derivatives be interest rate sensitive and not required to be marked to market. Not long ago they were approaching a trillion dollars in derivatives and the company was very shaky financially just 4 years ago. Might they be a major headline shortly?

Update: Nothing, except moronically managed banks, goes to heck in a straight line.

The maxim may be dependent on a TTH (Time-To-Heck) that has grown significantly shorter due to how quick communication and decision making has become.

A bank run instigated over Slack and Twitter by VCs plays out a lot quicker than one dependent on reading the daily news with your morning stimulant.

It doesn’t matter which bank, home developer, toy company, biotech, porn shop or government entity around the globe we’re talking abt, this is all about cash burn rates.

Everyone from the Fed to SVB had forecasting processing to engage in budgeting, but a lot of people didn’t factor in the rising inflation rates, that have impacted cash flows.

Regardless if this was an intentional oversight or a conceited strategy, everyone from an Airbnb landlord to a regional CEO has probably ended up miscalculating and mismanaging their cash burn equations.

I think many dominoes will be rearranged.

” . .. client cash burn has remained elevated and increased further in February, resulting in lower deposits than forecasted,” Becker said in a letter to investors seen by Reuters.”

Their clients cash burn increased 2x from 2021, and this is not an isolated incident, just ask the CEO of first republic…

When you run Net Present Value analyses using 2% 10 yr Treasuries as a baseline, a whole lotta more absolute crap investments are going to be made (stimulus!!! bridges to nowhere!!) than if 10 yrs are at 6%.

Again, corp finance 101…and the Fed knew…but they have one tool and and it is a chainsaw tied to a pogo stick.

This cash-burn is related to VC-funded startups, including pre-revenue startups. They have received a combined hundreds of billions of dollars from VCs, from Softbank, from PE firms, from all kinds of funds, and they always burned cash, but now they’re not getting NEW funding, and now they cannot go public and get funding that way, and so when they burn cash, the bank accounts drain. That’s what they’re talking about, and I explained that in my articles about SVB.

In fact, now they’re burning LESS cash than before because they laid off a bunch of people to stick around a while longer, hoping to get to the point where they’re cash-flow neutral before they run out of cash. Lots of them have already shut down or are shutting down as we speak, which ends the cash burn because there is no cash left to burn.

Two items.

Aren’t these favored mismanaged banks now exempt from collapse owing to the “Special Vehicle” or similar access to billions in liqidity support?

And, I looked really hard at the Wolf Street chart of ratings but found nothing under “LOL A”. Must be a special risk rating just for the woke. :-)

@ Einhall, @ anyone who knows

Are all First Republic’s depositors protected to the full extent of their deposits?

Not yet, in theory, LOL. But if the banks gets taken over by the FDIC, then well, we’ll see if regulators apply the same principle they applied to SVB.

I think the first sentence of your article answers that question in the affirmative:

“San Francisco-based First Republic – a bank catering to the billionaires and millionaires of the Free-Money startup scene…”

Approximatelly 500 banks in the US have failed over the last 20 years. Have any of those bank’s depositors lost any of their deposits?

All insured depositors got all of their money back.

Uninsured depositors got SOME of their money back. Haircuts ranged from around 70% to near 0%, I believe. Most of the time, the haircuts are not huge because there are lot of assets at these banks too, and stockholders and most unsecured bondholders get bailed in.

So where is the reinforcement of “the stove is hot, don’t touch it” for these middle school intellectual bankers who continue to lose depositor and investor money but with virtually no down side. They keep touching the stove but there’s no heat.

Looks to me like they will again just do a head fake and pop up somewhere else and squander a whole new gang of investors and customers. Doing the same thing over and over expecting a different result.

@ Wolf –

I appreciate the answer. My research skills yielded no answer and during many hours of “expert” discussion that I heard on Twitter spaces about the Silicon Valley depositor bailout there was no reference to it. Einhall or pro-Silicon depositor bailout writers made no reference to it nor has anyone from the other side, that I know of.

This seems rather essential to me. If I was a losing depositor over the last years i would expect a backpay bailout. And if other depositors have lost money over past years, I think the preferential treatment claim for the wealthy Silicon Valley depositors is magnified.

Of course, it can be droned on about systemic risk, bank runs, and so on …………………..

Buffet must be licking his chops.

Tomorrow is the ECB meeting. We are already flooded with comments that because of the banking problems in the USA and Credit Suisse Legarde will raise the interest rate by less than 0.5. So far I have been optimistic, but if this happens it will be a big blow to the confidence of central banks and their willingness to deal with inflation

None of these banks are an ECB problem.

Wolf, you were looking for a name for this epoch… what about the “Easy-money” bubble , “QE bubble” or may be “FED bubble” ? We live in interesting times !

The Tuco Economy…two boots balanced on a grave marker and a noose around the neck. All the while praying that Powell’s aim isn’t affected by any changes to his share of the spoils. Hanging ropes do tend to fall toward heck in a straight line.

Bernanke getting the equivalent of the Nobel Prize for Economics was the top it looks like. Maybe the Bernanke Bubble or the Fed bubble.

I am happy to say I have made a little money since the panic hit, but I was close to buying a gold miner last week before the panic and I did not hoping for a cheaper price. Would have been a good trade.

USB just said Western Alliance Bank is one of their top picks going forward. You know, the one that dropped 80% last week.

The Big (Blood)Bath theory.

I’ll take issue with an assessment in the article. First Republic did/does not have anything near the embedded losses found at SVB. I looked at First Republic’s call report for 12/22 and the thing that struck me was their asset concentration in residential mortgages – 80% of assets held to maturity (& not RMBS), lack of liquid assets (no treasuries and only $47million of held for sale securities), and a large amount of non-interest bearing accounts (read: checking accounts). Basically, if folks emptied their checking accounts, First Republic was illiquid. I’ll assume alot of First Republic’s mortgage loans are in the Bay area (maybe a reader here has some insight?), and probably underwater given the collapse of housing prices in the Bay area. That would make their value below book, and difficult to use as collateral for raising cash (unless the FED gives them 100% book…). Did not have the impression from the call report that crypto had anything to do with First Republic’s melt down.

Thank you Dr J for actually looking at the Bank. Doesn’t seem like anyone else has bothered.

Nothing like SVC. And yes, housing

prices in the Bay Area are down, but far from collapsed. If their clients are all so wealthy, they should be good for for their mortgage payments-right? They seem pretty conservative to me.

Is there a bank that would be remain liquid if of all their depositors withdrew all their money?

“If their clients are all so wealthy, they should be good for for their mortgage payments-right?”

That’s NOT the issue (though it may become an issue). The issue is DEPOSIT FLIGHT by those rich folks. A run on the bank by the rich, and the prices of salable assets on its books have dropped, same as SVB.

Don’t you people ever look at anything????

“DEPOSIT FIGHT”, that is a good one. I can see these old rich folks duking it out with the managers of SVB, First Republic, Chase, BofA, Citi yelling “I’m gonna take my money outta here!”

LOL. FLIGHT. Thanks

Look at the investor presentation on FRC website. 89% of real estate loans are on properties within 20 miles of an FRC office.

Median residential loan 900k, 60% LTV at origination.

34% San Francisco

21% Los Angeles

19% New York

8% Boston

18% Other

Read all about it ir dot firstrepublic dot com

1) By Fri this FRC and CS bs might be over. Wall street got plenty regional

banks, from the weak hands, for few cents/ dollar.

2) The Dow might take a break to fill the tank, before Fannie Mae take it down again.

3) Fannie accumulated mortgages between 3% and 4.5%. Their value is worth half.

4) Fannie wants the transitory inflation cut by half. Shi might help.

5) The Fed is behind the curve. When inflation was 9.1%, in June last year,

Fedrates were only 1.68%. The Fed cannot stop inflation with 2%.

Anna Shwartz : Fedrates are the symptoms. Inflation rise/fall by exogenous causes.

5) Even the Fed research shows that 2.0 inflation rate is not going to happen, minus a deep recession:

Cleveland Fed researchers model projects the FOMC’s unemployment rate path brings core PCE inflation to 2.75% by 2025

“A deep recession would be necessary to achieve” the 2.1% inflation projection…”

“This fraudulent bubble of a financial system is the reason why US, Canadian, British, Australian and German neocons are driving for war around the world.”

Since they have stripped, sold and re-hypothecated to infinity, of course War is the only step left.

Unfortunately the fools have picked Russia and China to fight instead of Luxemburg and Sri Lanka.

Off topic, but I just read in BusinessWeek about an int’l startup called Swvl Holdings Corp that was another SPAC success story. Based in Egypt, listed on Nasdaq, Was worth hundreds of millions, now 9 mil. Interesting story.

Tired of reading banking stories since last Friday.

Allowing the #16 bank (SVB) to be exposed to the amount of interest rate risk that eventually panned out into real losses is really ominous since the overall interest rate environment has retreaded back to historical norms. The interest rate suppression era sure has manufactured new problems. The fed’s been good at mitigating a lot of problems but this is one area that was not properly addressed. I guess it happened too suddenly to prevent a takeover, but what’s the point of picking winners and losers when temporary liquidity is the band aid fix-all that works? It’s just hard for me to see a difference between providing liquidity to the repo market and providing liquidity to a specific member bank that undergoes regular FDIC examinations. Particularly the #16 bank. The bank’s metrics are monitored by the FDIC, no matter if they are several months behind. I wonder what kind of conversations are going on with the examination team that’s been handling that engagement.

I would like to hear the CEO explain why he did what he did. My understanding is somewhere around 100 billion in deposits showed up at the bank. What do you do if you get $100 B? Sounds like he wasn’t much of a banker, but maybe there is more to the story.

CEO of SVB is a board member of the Federal Reserve Bank of San Francisco and thus should have been a banker. Maybe he is a politician impersonating a banker. (like so many political appointments to boards) Anyhow, he was incredibly stupid buying huge numbers of very long term US treasury bonds paying yields at

all time historical lows. What was he thinking that interest rates would never rise again?

FYI: he was ousted from the board of the FRB of San Francisco the day SVB collapsed. By Friday afternoon, he was a goner.

Interest rate levels are back to the normal level of the 60’s but not anywhere near with the same credit quality.

Aggregate credit quality and credit standards have never been lower in the history of human civilization. It’s not just US thing either.

Rates will have to keep marching higher to reflect poor credit quality.

Actually these failures PROVE your dictum. When a “bank” or a “currency” or a “company” is exactly nothing, it DOES go to zero in a straight line, because it was always zero in reality.

Real companies with real products CAN’T jump to zero instantly.

Hi Wolf,

I was wondering what your thoughts are on what is happening with Credit Suisse?

Many thanks!

The dead cat bounces sure are fun though as long as your timing is not off. Can triple your money in a day or lose it all.

Are you telling me I won’t get a toaster with my new account?

I read this article today:

“Why do banking regulators allow our federally insured and regulated banks to make loans using magic internet money as collateral? That’s a crazy policy, no different than allowing banks to accept buckets of ice cubes in winter as collateral, even though they melt come spring and evaporate in summer”……

Silicon Valley Bank is just one of many federally insured financial institutions that accept crypto currency as collateral for loans. Some banks will loan you 90% of the seemingly value of your crypto, though 50% loan-to-value is more common and that appears to be the standard at SVB based on its web pages.”…..

“In the wake of the second largest bank failure in history, you should be deeply concerned that for more than four decades we have failed miserably at regulating banks. That history contrasts with the period from 1935 until voters abandoned the moderating and successful New Deal banking rules in favor of Reaganomics.”

Who needs these stinking regulations (Deep Sarcasm) – that are the FOUNDATION of our banking system and economic well being, – along with the putrid screwball unregulated CryptoTrash!!

Nothing has been learned after the regulations of the early 30’s – so history will repeat itself, and I read a multitude of financial reports and there isn’t anyone who can say what will happen next, but I will say – all this will end badly, – as fear + panic = Chaos.

One analyst said essentially – How can you value stocks, if you can’t value bonds correctly?

This is worse than playing “3 Card Monte” in the alleyway – LOL

Rubber stamping fraud. It happened again because no one I know of from ratings agencies went to jail for the GFC.

From Wikipedia:

In the wake of the financial crisis of 2007–2010, the rating agencies came under criticism from investigators, economists, and journalists. The Financial Crisis Inquiry Commission (FCIC)[39] set up by the U.S. Congress and president to investigate the causes of the crisis, and publisher of the Financial Crisis Inquiry Report (FCIR), concluded that the “failures” of the Big Three rating agencies were “essential cogs in the wheel of financial destruction” and “key enablers of the financial meltdown”.

It went on to say:

The mortgage-related securities at the heart of the crisis could not have been marketed and sold without their seal of approval. Investors relied on them, often blindly. In some cases, they were obligated to use them, or regulatory capital standards were hinged on them. This crisis could not have happened without the rating agencies. Their ratings helped the market soar and their downgrades through 2007 and 2008 wreaked havoc across markets and firms.”

FDIC insurance rules were changed awhile back. Individual owning an account – $250k. Individual account owner with one POD beneficiary – still $250k (was $500k). Individual account owner with 2 POD beneficiaries – now $500k (was $750k). Individual account owner with 3 POD beneficiaries – now $750k (was $1M). POD accounts are a handy way to increase insurance limits and skirt probate in case you get an unexpected visit from the reaper.

1) CL backbone #1 : Oct/Dec 2004, 55/40. After testing 2008 high oil might drop to BB #1. CL in the mid 40’S will deflate the CPI.

2) For two decades, in the sixties and the seventies the Fed was behind

the curve fighting Murphy law.

3) First the closure of the Suez canal, then oil embargo, ARAMCO,

Iran/Iraq war…

3) After two decades of oil glut a bubble was born. There are no bubbles without backbones.

4) Short sellers will salivate when/if CL reach BB #1. BB#1 will help the doomed banks to cut their unrealized losses. Double humps is better than one. During banking crisis #1, banking crisis #2, #3, #4…many banks will close their doors. Their number might cut by half.

so who’s still lending big to private equity with their mark to fantasy portfolio valuations? this is highly leveraged territory and debt needs to roll at some point. and the same for big VC portfolios. … this is a big trough that billionaires feed at. somebody’s going to be surprised …

Do not forget that Big Tech hyper valued luxury goods companies are at insane valuations.

I shop at a large big box store 6x a week. It has the largest sales volume in the market. Yet the Big tech companies are valued at 30x or more than the sales leader? Each!

Banks imploding are an interesting peep hole view or peep show into the current mess. The grandstand curtain show will be the mega tech bubble pop.

Thank you all for the discourse and wisdom,

GY

5) $250,000, we don’t have your $250,000. We will pay u $250,000 in installment in the next ten years : $250,000 : (10Y x 12 months)

==> $2K/M.

Would better insurance be just buy out put options on the bank?

So, shouldn’t the FDIC be proactively auditing at-risk banks and getting risk managers in their to hedge interest rate risk? Or do so with vulnerable banks with better time horizons?

One hopes this will be occurring in the background?

I have no idea why regulators didn’t do their jobs – why they didn’t crack down. But that’s how it always is.

Based upon the qualifications I see, get the risk managers on Dancing With The Stars.

cCalling Warren where are you,how do you not lose $150 billion in this environment

“How did you go to heck?” Bill asked.

“Two ways,” Mike said. “Gradually and then suddenly.”

— Ernest Hemingway, The Sun Also Rises (slight edit).

Anyone know what’s going on with Prudential? Mostly a life insurance company, correct?

After the previous Co-CEO and President Hafize Erkan left the firm a year ago, it was obvious that the bank is going to collapse. The other senior executive and the board members are incapable of managing a bank of this size. They should bring back Ms. Erkan and her team asap if they want to survive.