Prospects of 7% Mortgages Return. Surge in activity in January from very low levels has fizzled.

By Wolf Richter for WOLF STREET.

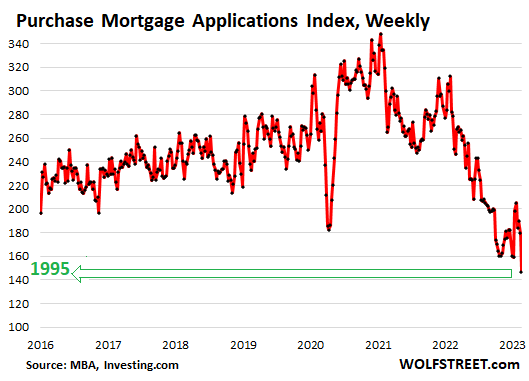

Here we go again. After jumping nearly 30% in January on lower mortgage rates and the beginning of the spring selling season, applications for mortgages to purchase a home plunged to the lowest level since 1995.

Compared to a year ago, purchase mortgage applications plunged by 41%. Compared to two years ago, they plunged by 44%. This is from the Mortgage Bankers Association today.

Mortgage applications to purchase a home are a forward-looking indicator of where home sales volume will be. January had given the housing industry a lot of hope because mortgage rates had dropped on intense Fed-pivot mongering. While activity was still down massively from a year ago, it looked like it all had bottomed out, with mortgage applications to purchase a home bottoming out in early January and then jumping by nearly 30% over the next few weeks. Turns out, that was a false bottom. An ominous beginning of the spring selling season:

After the usually dreary holiday season, when activity stalls, comes the spring selling season that kicks off in January and February in terms of foot traffic and other early measures of buyers’ interest, including mortgage applications to purchase a home.

Improvements in January gave rise to hopes that the spring selling season might actually somehow materialize on hopes that mortgage rates would soon be below 6%, and soon below 5% and heading back to 3%.

But now the whole January thing got blown out of the water by resurging inflation – not that it ever died down but it had backed off some – with inflation in services spiking to a four-decade high, triggering fears that the Fed might actually not pivot asap after all, but might instead push rates to the levels it had loudly projected at its December meeting, or perhaps even further, and keep them there for a lot longer.

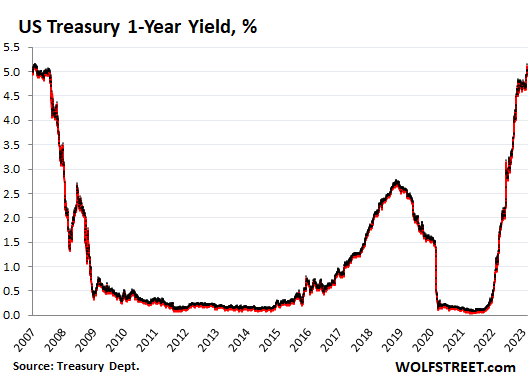

And so Treasury yields surged. The 10-year yield is once again near 4%. The six-month and the one-year yields are now solidly above 5% for the first time after 15 years, as the era of interest-rate repression and money-printing ended.

And the average 30-year fixed mortgage rate has jumped back to 6.88%, after having briefly dipped to 5.99% by February 2, according to the daily measure by Mortgage News Daily. The weekly measure by the Mortgage Bankers Association, released today, jumped to 6.62%.

Homebuilders, in their Q4 earnings calls, reported out of one side of their mouth that sales orders after cancellations (net signed contracts) had collapsed by 40% to 60% across the board year-over-year – these are their future revenues. But current revenues are still based on working off what’s left of their backlog, so OK.

Toll Brothers today chimed in and said out of one side of its mouth that its “net signed contracts” collapsed by 51% year-over-year – its future revenues. And out of the other side of its mouth, it added to the talk of other homebuilders.

Out of the other side of their mouth, they all talked about improving buyers’ interest, and improving buyers’ confidence, and improving contract signings, based on their January activity, which was up from rock-bottom lows, in part because the spring selling season had kicked off after the holidays, in part because mortgages rate had dropped, and also on the hope that the big price cuts some of them implemented would gin up sales orders.

But that was so January. With the 7% mortgage now looming over the spring selling season, the plunge in purchase mortgage applications is giving an early indication of where sales during this so fervently hoped-for season might be headed.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

There is a tremendous gap between seller price expectations and buyer price expectations.

The Fed has broken the real estate market.

Stock market next.

The Fed broke the real estate market years ago with QE and interest rate repression. Now it’s trying to fix it and undo some of the damage.

Hear hear!

And the Stock Market ?

Most certainly they pumped that Up

And Biden is trying to break it again. His administration just announced reducing FHA fees. That doesn’t make housing more affordable. All it does is raises the price that sellers can charge. Just like lower rates.

Mortgage insurance fees are being reduced. On a $400K house that’s about $50. a month. It will have no effect on what a seller asks for a house.

It might help someone qualify to buy a house.

Hi Einhal,

You and Josap (below) disagree.

Its not obvious to me which of you is right or if reality is (more likely) somewhere in between you two.

Kind of like raising the minimum wage. Surely at first it helps the workers. But (possible layoffs aside) do businesses that sell goods to these workers tend to raise prices solely because the workers can now afford to pay the extra

amount ? A person could speculate all s/he wants… but they would need to get some data to back up their hypothesis one way or the other.

Josap, I totally disagree. Will $50/month make a huge difference in sale prices? Of course not. But to harryhowmuchamonth (thanks Depth Charge, I’m stealing this one), the total monthly cost ultimately affects sale price. To Randy’s point, does it happen right away? No, of course not. When interest rates dropped from 4% to 2.8% in 2020, it didn’t happen right away either. But it always does.

Subsidizing things just makes the cost go up, whether it’s housing, education, medical care, or anything else.

“Subsidizing [all] things just makes the cost go up”- Sheesh!

If you were able to elaborate on that as easily as you just spewed it, (which you are NOT) I might get another clue as to how the wealthy have made people like you hate their own government and vote against yourselves.

You are NOT wealthy enough to go along for the ride with the big PRIVATE OWNERS of the USA that are now running the show.

And you will NOT live forever in bliss, nor is there a contactable diety in charge, in case you are “mentally invested” in that particular “existence put”.

@ NBAY – “Existence Put” is just golden! +1,000,000!!

Thanks.

Spread it around, might help things.

The keyword is “trying” honestly as much as I hate Pow Pow, I wish them all the luck in the world to bring down asset prices, especially in housing back to reality and closer to the historical means..I am totally rooting my him to succeed.

There’s nothing that gives me more joy that to see some of these house humpers bragging about their house can only go up in value, discounting overpaying insisting on value will only stay flat as worse case scenario to get a real good smack in the face with reality, there are plenty in California that needs this good reminder. Plus, maybe wishful thinking there’s some level of justice to think hard working people can perhaps buy a house without spending more than 30% of their pay on housing…

Smacking people in the face is pretty harsh. But whatever makes you happy, I guess.

As someone who has been smacked pretty hard in the face with reality multiple times in my life, it sucks, but sometimes necessary, particularly if you are in the grips of a self-serving delusion.

It’s like seeing someone champion casual sex and then getting smacked with the reality of that position in the form of legally-mandated child support.

Good. Prices need to come down a good 30% in Phoenix.

They’re playing catch up big time!

And, the Fed can’t fix housing. That’s the job of foreclosures.

That’s not how it works. That was never how it worked.

The arsonist is finally bringing in the fire department and he wants credit for it. Look ma, we are spraying a record amount of water at that soon to be destroyed building!!! We had to first burn it down just like that village in Vietnam in order to save it ……

Honestly it sucks. We have money and want to buy… Housing is just so overpriced.

I refuse to pay $200k+ more than 2 years ago just because of easy money.

Where we are it’s a bunch of speculators who bought multiple lots/properties trying to get rich. Either that or Canadians who come for 2 months a year.

I’m friendly with them, but would really like them to go bankrupt tbh. (We need some forced selling)

I’m pissed at the FED. 25 bps when unemployment is still 50 year low. Rip the bandaid quick. Why the slow motion correction? I’m gonna have to rent another 2 years at this rate.

I wouldn’t worry about the speculators. If they haven’t sold, they are dead… An example near me in Laguna – Pike Rd – they guy paid $1.19Mil, borrowed $1.17 mil (only put up $20k – looked it up at OC Clerk office) from a hard money lender in Pittsburgh @ 9%. Threw up some paint and plaster, redid kitchen and baths. Workmanship was shoddy, but I assume he borrowed another $75k for the crappy work. (Took a walk through – used 2ft floor tiles in bath – stepped on one end of a tile and the other end popped up!) Put it out there at $1.49mil. No takers after 8 months. Dropped price to $1.35mil. Did my math – he’s just trying to get out with no profit. Likelihood is he walks on his $20k and it goes into default (unless he can find a sucker to take it…. and they are still out there…)

Dr. J,

For sure West Coast is down.

East Coast has been pretty strong though.

I read that Miami is finally slowing down in sales. Prices are still high in the South though.

Honestly, in our area a lot is short term rentals. A friend’s AirBnb near us made $12k in December (near beach and warm). It’s currently valued at $1 mil. They spent maybe $500k or $600k to total to build it (including land).

I think they’re all insane, but people will spend up until the party is over. Until unemployment increases, people won’t cut spending.

The FED is trying to end the party… but the party just doesn’t want to end

I especially enjoyed the reporting on the conference call, and thanks for all the good articles and big headache moderation.

It reminded me of, Jabbergrab: Heroes of finance, a publication Upton Sinclair invented for a satirical short story titled, A Captain of Industry.

Sadly, it’s still on my reading list.

His quote about a person’s behavior when his salary depends on it, still explains damned near everything, unfortunately…..even a lot of “Science”, as I am discovering more and more in my reading.

Discovered a new unfortunate wrong turn in our cultural evolution, too.

St Augustine….real A-hole.

Just to add to the 410AD religious debate and show how Augustine (who won….eg his thought was adopted and plagues us all to this day);

Pelagius taught that true virtue was not reflected externally in social status, but was an internal spiritual state.[36] He explicitly called on wealthy Christians to share their fortunes with the poor. (Augustine criticized Pelagius’ call for wealth redistribution.)[9]

Familiar?

Your completely accurate

A side note, that could be said about mortgages too. Demand is dwindling, but price, that is interest rate stay high. ;)

The Real Estate market is still very broken with unreal seller expectations. The lower sale volume is now severely hurting Realtors, home builders, agents etc.

Also, inflation is so high, so with half the revenues this year, these guys will have a tough time making ends meet.

As far as the real greedy idiots, who, like Zillow, expanded scope of commissions business to become “real estate investors”, they would just go under.

When last spring, a record 31% of home sales in ATL were to investors, then I would agree that the residential real estate market is screwed up. And, that’s putting it mildly.

BENW,

Read or heard 33% for all of 2021 I think (Atlanta). Close enough.

Jacksonville and one or 2 NC cities mid to upper 20%s.

Dallas County 42% !

Just to its west, Tarrant County (the FW in DFW) 52% !!

Some county in Mississippi was number one at 60 to 61%.

My memory could be wrong but think i heard/saw this from a Reventure Consulting Utube video. Possibly Jason Walter video.

there are still going to be some folks that think the small price discounts offered so far are a really great opportunity to buy a home…because they are still operating under the premise that housing prices always go up.

housing prices went up for decades due to 2 factors – increases in dual income households and decreases in mortgage rates. as women entered the workforce, that drove up the income available for a home mortgage, so home prices adjusted upwards. and of course there has also been a 30 year bond market rally, with lower rates all along.

now we actually are seeing a reduction in the labor participation rate and an increase in mortgage rates.

during the coming years, there will continue to be tranche after tranche of buyers who think that any given point is a bottom. these suckers will buy overpriced homes and then see their down payment get vaporized over time. too bad for them. but these are the same type of people who overspend on everything and are living on the edge financially. so it is hard to feel that bad for them.

Plus with the 2 income families the size of the home also increased because of affordability great comment about dual incomes has had an effect on lots of lifestyles. Something I embrace !

Complete b.s.!! Women had to enter the workforce because of inflation, which includes the price of houses. The cost of living has gone up and up because we are all victims of a shareholder centered economy, whereby corporations continue to raise prices to reward their precious shareholders. Home prices are partly due to inflation, but mostly due to free money through interest rate repression. Women had to enter the workforce so households could make ends meet, this has not driven home prices.

“Women had to enter the workforce because of inflation”

You have that reversed. This is easy to see — home prices relative to household incomes were way lower in the ’70s AND ’80s.

Y’all need a history lesson. Rosie the Riveter is a good place to start. There were economic and social forces at work. Hope this isn’t all leading towards the conclusion that women belong in the home or some such bull.

Speaking as a deeply ignorant dude, it’s my understanding that stagnant wages relative to asset prices have shifted us towards dual-income households. For women, work represented opportunities for empowerment and independence … i.e. being their own person and in control of their own lives instead of under a patriarchal relationship. I’m sure some of the readership here was alive before women could own credit cards, and that’s just off the top of my head.

Talk about complete b.s

Women have always worked during the whole of human history. Only during a small timefame, so short you basically need a microscope were middleclass women able to work “only” on housekeeping, a few children and a lot of DIY hanywork which is difficult to quantify.

And that small, short timeframe was during the economic and productivity boom after the 2nd WW.

Any other time women (& men) had to work a looot more than today.

Toby, I would agree with that. The U.S. boom from 1945-1970 was largely an accident of history. We had a monopoly on manufacturing, as WW2 destroyed Europe’s productive capacity and the current hubs in Asia were still undeveloped.

It’s really all been downhill since then.

Women built all the weapons in WW2.

100%

@Gattopardo,

I remember back to the early 1970s when I was in elementary school. My mom told my dad she wanted to get a part time job. My dad was confused, he said what do you want a job for you don’t need to work! My mom said she was bored sitting around at home, she wanted to do something. She wanted to get out of the house. My dad bought out house in 1962 for $22,000. We sold it in 2017 for $595,000.

Your response is complete BS. Women entered the workforce due to changes in societal norms (more liberated women) and that raised disposable income and that raised asset prices on homes.

Blaming corporations for raising prices is like blaming the wolf for eating the chicken. If you leave a way for the wolf to get in he will do it. A wolf is a wolf. If there is a lack of competition between corporations, then that is a real problem, but it is not the fault of the corporation, it is a fault of our government allowing monopolies/duopolies to form.

It is also RIDICULOUS to blame corporations for increased home prices, since the vast majority of homes are sold from one individual to another individual – with no corporation involved. How exactly are corporations controlling sale prices between individuals?

The only way that corporations impact home prices is that if there is not enough supply of new homes, then competition for existing homes increases. But if that is the case, it is actually more often a problem with excessive building regulations.

Women were NOT forced to enter the workforce to make ends meet, it was societal change. And quite clearly, as disposable income rises, people are willing to pay more money for an asset like a home.

The truth is that what people are willing to spend is totally a result of the money that they have to spend because most people refuse to save.

gametv, you really need to spend a lot less time preaching and a lot more time listening.

And if he is going to just preach, he should do a lot more proofreading. That entire sermon, and especially the concluding paragraph, is badly in need of work.

It’s really a gap between seller’s expectations and buyers ability…which is what frequently causes busts to occur.

The Fed wanted to increase rates during Trump’s term but he refused to let him, Trump wanted to keep that party raging. Then the pandemic hit and the Fed let the QE go WAY TOO LONG. I’m in the mortgage business and my transaction volume has gone off a cliff! My employees just don’t understand, they are really young and this is their first downturn they’ve seen in their lifetimes. Had to cut both of their hours this week and may have to go back to being a one-woman-show again for awhile and ride this out. I believe things are going to get worse before they get better.

Too many people in our country are still hungry to buy a house.

Too many people believe that housing only goes up and you can’t lose if you buy real estate.

So no, the real estate market will not crash.

Psychology, especially in the marketplace, is a fickle thing, and has a habit of changing direction faster than a politician meeting with a wealthy donor. Careful with your thinking, unless you have solid numbers to back up your premise. All signs are pointing towards a crash, and nothing short of a Fed pivot will halt it.

Correction is just starting….When the psychological negative feedback loop kicks in, watch out.

Yeah believe in your advice and go buy a place now..perhaps value will never fall or crash…what’s better than to be the living proof of your own theory?

yes, these people will buy homes and then lose all their equity and a portion of them will be people who turn in the keys and walk away and provide future buyers with much better deals. i see homes selling in a middle class neighborhood in Orange County for 1.3 million. just crazy stupid. the bottom might be 700K for those homes and anyone buying at 1.3 is going to be underwater by alot.

Middle class neighborhood? *Orange County, California*?

There are lots of middle-class *income* households in Orange County. But they all are house rich and cash poor and basically spend all their money on housing.

In the last bubble the OC Register marked the moment when median house price was 10x median household income.. This was considered an amazing level of inspection unaffordability. I wouldn’t be surprised if the ratio now is 15x or higher.

At that level, even with 3% interest rates, you’re basically paying all of your income for housing, and going into debt for the rest of your essentials. That works as long as housing goes up so your paper gains compensate for the real cash going out the door. But when the crash hits they’re the first to be wiped out. And then they jingle mail the keys and move to Riverside or Arizona.

California has a tremendous survivorship bias effect. Lots of people move there to try to make a go of it, and only a few make it long term. The rest eventually realize the numbers don’t work out (if they can’t get or keep a high paying job) and leave, making space for the next people who want to try. If you just look at the headline numbers it looks like everyone is succeeding, but that hides the tremendous churn of the losers moving away and only the winners staying long term.

There is a big difference between Irvine, Rancho Santa Margarita, Dana Point, Tustin, and Santa Ana, just naming places I’m familar with. Farther south you go, the more affluence on display.

I was one of those survivors having arrived with $500 in the early 00’s and somehow making it work for almost a decade. It’s a real clean, nice place to live that’s a nightmare to get a foothold in if you aren’t rich already.

That is exactly what I concluded, too. I have a friend in OC who is a realtor and mortgage broker. He bought a nice house in Laguna Hills in 2007. At the peak of April 2022, house next door (which he listed @ $1.6mil ) went for $1.35mil.

Business has dried up – both houses and mortgages. He is sitting on $600k of debt – a variable which is skyrocketing – and he has no cash. He’s doing home care for a friend’s elderly mother at $25hr.

He is sitting on equity which is losing value by the month….

If he is smart he’d sell his home and lock the remaining equity.

Business is in BIG Trouble,they overleveraged,with debt being rolled over to higher rates . Some very big companies will claim bankruptcy,lots of job losses . Snowball on the way up ,avalanche o the way down

“Too many people in our country are still hungry to buy a house. ”

Yes, that is apparent. From above, after a 1% drop in mortgage rates, mortgage rate applications rose by 30% from Wolf’s article above.

It is like if you dipped your toe into a pool to see if it was warm, only to have it eaten by a swarm of hungry piranha.

Maybe the Fed was just dipping its toes in January to gauge their efforts.

It must be frightening for them.

“Nimesh Patel is an American comedian and television writer. In 2017, he became the first Indian American writer on Saturday Night Live.”

Watch the movie or read the book

The Big Short

not so long ago.

Their hunger and desire will be eclipsed by their inability to afford a home until the sellers’ homes lose 40% of their value.

It will be a deflated bubble at that point, and then it might crash.

There is a cleaning process that uses ultrasonic baths for some semiconductors. The bath uses vibration of various frequencies, the higher the frequency the smaller the particulate is removed. The process principle is cavitation where the bubble formed explodes removing the contaminant. So as an analog how small in the particle world are people. Does the little guy get blown away?

I have a Branson ultrasonic bath.

Cavitation involves the transient formation of a bubble due to the pressure variation induced by the acoustic waves in the liquid medium. The cleaning effect occurs when the bubbles rapidly collapse and the liquid strikes the surface of the object being cleaned. Higher frequencies result in more rapid and more frequent bubble collapse and thus a more agressive cleaning event.

Regarding your analogy, under the proper conditions, ultrasonic cleaning will not only clean the surface of all contaminants (homeowners/speculators) but also attack the surface (fundamental economy).

It’s already crashing, dude.

Yep, if you bought in may of last year in a place like SF, Seattle, Boise, Phoenix, LV, etc you’re screwed.

It will crash in slow motion, like all real estate crashes. Morons will catch the falling knife all the way down.

It’s good if some assets have the faith of buyers, but aggregate belief does not move markets as strongly as the invisible hand.

“Now it’s trying to fix it and undo some of the damage.” If anything was ever truer, run don’t walk away from… “I’m from the Government and I’m here to help”.

God save us.

Tell that to the people who depend on social workers.

Save the thoughts and prayers for the next mass shooting. Government can work for the public good. The United States as a culture doesn’t believe in that, and I don’t blame them after decades of pro-business propaganda by those who have the most to gain by a fully-privatized society.

Yes, America is a country By the Rich, For the Rich, but I believe in its potential, however far we may stray from that. I will admit, if climate change doesn’t force hands and hard decisions, that the potential won’t be realized in my lifetime.

I’m sorry but Don’t-Think-Too-Hard-About-It sound bytes from Ronnie have done considerable damage to the American public consciousness. For people with are able to put on blinders and march into the arena of business to be economic warriors, he’s practically a demigod. Only the bright glare of an orange sun has blinded people to his legacy.

“…where free unions and collective bargaining are forbidden, freedom is lost….”

– Reagan 1980 Labor Day speech…..Pre-election.

Google it…

….when the script from the rich calls for some more obvious lying, even a B actor can show righteousness and conviction to infiltrate a government “of the people” at the highest level.

He WAS the lie above he made so popular.

LK,

You like to accuse others of ideological thinking when you are dishing it out in spades. You have a lot of projection.

There’s no problem pointing out problems of both parties, but vindictive diatribes are not helpful.

AGREE with Nbay SOOOO much!

RR was a performer start to finish, and from what I saw of him in person, a complete dickwad…

I was one of those teargassed by helicopters after a very peaceful protest march up Telegraph and down Bancroft ended with ONE GUY with a long 2×4 doing damage,,,

The soon after consensus was that guy was planted by FBI, etc., to exacerbate the situation to give ray gun an excuse to do his worst, which he did to ”prove his chops” to the reactionary right.

RR was a proven ”rat fink” earlier, so not much surprise for some elders on both sides of the aisles as he made his way to POTUS after guv er nator…

May have actually been worse, possibly much worse for all actual workers of USA than any POTUS before or since…

Jon, I’ll be the first to admit I got issues I need to work on, and that I have a particular worldview I’m arguing from. Aren’t we all?

I’m no fan of either political party and had to have my blinders pulled off. But sometimes the bullshit is too much on here, but it’s my fault for inserting myself into the comments section of an economic blog populated by boomers and business tycoons.

Maybe you haven’t been hurt as much as my cohort have thanks to people held up as paragons who are actually false prophets that know how to appeal to the base impulses of low-information voters or lost boys.

So maybe instead of judging and chiding, how about you recognize what I just recognized that I need to stop visiting this site for a few weeks and cool off in this *extremely trying time we’re living through thanks in part to 4 decades of fuck-ups and neoliberal capitalism.*

Y’all can chitter from your comfortable positions in peace and privilege in the meantime.

Yes, in theory government can work for the public good, but it usually doesn’t. It usually becomes a being unto itself that crowds out everything else.

I don’t disagree.

Government is full of people who are too lazy to work and too ambitious to stay home. Busybodies who fight over who gets to stand on the soap box and make lots of distracting noise during a crisis. Not everyone is like that, but too often it is true.

Of course, there are some things government does well. Consumer safety being one of them. The Chinese people don’t trust milk from their own country, they buy imports because they don’t know if it will really be safe to drink. Some company added chemicals to make their liquid look white to sell as milk to children supposedly. Americans don’t worry about stuff like this. Sept 11, firefighters did their job at great personal cost. Etc etc. List is endless of capable government people, yes.

But there are also lots and lots of busybodies and they consume everything good left in the government and rot it into oblivion. Budget grows larger and larger until one day the bellybutton is bigger than the belly. And we go broke. Police officers in LA taking home pension of 1 million a year (pre-inflation) based off their last year income + sick days or w/e. Just absolutely shameless stuff that was never intended to be allowed.

Best to distribute that wealth where it’s safest, in the hands of the common free man with his own business with no dependency on government or unions or their bought leeches who act as cheerleaders and mouthpieces, or the banks, or the exploitative corporations that manage human labor like cattle (which then leads to unions who add a second layer of skim after csuite/shareholders in exchange for small improvement in benefits and nowadays in some unions even that’s a maybe).

Honor the value of a common man’s labor by keeping inflation at 0% as best as possible. Give him avenues for honest investment. (or her). Access to basic necessities for housing, food, water that hey may nourish his body and spirit. He will choose to manage his affairs lest he outsource it to a grifter or a thief. At some point this inflation is going to teach the masses that a small 2k handout at the expense of inflation only benefits the holder of property and equities and will come out of their future income… We should call it the Lobbyment instead of the government…

It sounds to me that you are concerned about institutions growing out of control and the ability of that power to be seized and abused by corrupt individuals or people after power who lack the character to wield it appropriately, whatever that may mean to you.

I agree with the spirit of your comments and won’t go into detail, but if you believe that, then maybe we’re on the same page about the ever-increasing and unaccountable budget of the DoD.

LK, military spending is out of control. I’ve been railing against that since I turned 15 and was old enough to realize that we were subsidizing the rest of the developed world. It’s enough.

There’s no way to get our fiscal house in order that doesn’t involve cutting spending for the military, Social Security, Medicare, and Medicaid. Period.

Any claim that we can do so but working around the margins is just a lie or a fantasy.

LK – There is a role for government, but that role should primarily be in establishing and maintaining the rule of law that governs how our economy works, but doesnt try to distort markets. So government should be concerned with creating laws that increase the creation of value, but it should not pick winners and losers.

Many of the problems in business are related to the lack of commonsense laws and the willingness to enforce them. I saw a documentary on Elliot Spitzer recently and it reminded me that there now really is no government agency that is truly interested in finding the cheaters in the financial industry. Spitzer tried to take on that role, but it put a big target on his back. There are just so many industries, healthcare, higher education, housing, defense contractors, where there is a revolving door between the regulators and the industry. Our market dynamics are massively distorted by government spending and by a lack of enforcement of regulations.

Government is also to blame for our jobs being shipped overseas to China for decades. The solution now seems to be to put tariffs on Chinese production, but that doesnt bring jobs back to the US, it just shifts them to Vietnam, Mexico and other countries. Why has no politician proposed a taxation system that heavily rewards companies that bring jobs and production back to the US or heavily penalizes those that dont?

And the last reason that government is the core problem is that noone seems to care about efficiency. The IRS hired a huge number of people to audit taxpayers and go after cheats, but I just spoke to an IRS agent who says it takes 6 months for forms that are sent into the IRS mail addresses to be entered into their system. Six months!!! The IRS doesnt need more people, it needs an effective computer system and automated scanning of forms. It could also almost do away with mailed in forms if it had online form submission for every single form type. That isnt rocket science. And it is typical of government, AT EVERY LEVEL and EVERY department. Jobs are created for the purpose of buying votes, not because it makes the government better.

If a business fails to create value or be efficient, it goes out of business. If government fails to become efficient, it creates more jobs and politicians love it.

People who love government want someone for nothing. They want handouts and someone to coddle them. Hey, our lives are easy compared with 100 years ago. We need to stop overspending on government and passing the cost onto our children.

– The government, in any decision it makes, picks winners and losers. That is unavoidable. To say it “distorts markets” is to obfuscate the details and justification for its undesirable (to some) effect. “Value” is something more than a line item on a balance sheet.

– Spitzer again. People in positions of power are going to put their thumbs on the scale to have decisions go their way and create an environment that suits them, including lobbyists crafting regulations that only exist to cement competitive advantages and industry positions. They’ll instill FUD and attack the civic spirit to nudge people into division and class warfare. I’ll cite Robert Moses, who is my Go To, about the misapplication of power for power’s sake.

– Manufacturing and other services shipped overseas because of ideology and the decision of business owners *in combination with* government policy & technological changes that lowered logistics costs. It also happened long after attitudes had set in that created a competitive race-to-the-bottom business climate. I’m not saying government is blameless, I’m saying it’s more complicated than your premise.

– Perhaps it isn’t that they don’t care about efficiency but because some profit by those inefficiences and have created an environment to make it difficult to have effective administration. I’d be despirited too if factors outside my job kept me from doing the good job I’d want to do. You think civil servants do it for the money?

All I see are arguments and complaints about the ills of a government staffed by people who don’t believe in it except as a means to tip the scales in their favor.

In other words, a corrupt one. Yeah! I’m against corrupt government too.

If the government backs all the mortgages, then why do I have to pay for housing? I already pay taxes.

“If a business fails to create value or be efficient, it goes out of business.”

This isn’t always true. Look at a company like Uber.

It’s alright Rick, we should just let him have the say he so often wants to have and not let reality get in the way of a good ideological ramble.

Yes, I do think a lot of civil servants do it for the money. In many very blue states, they get paid very well, get free health care with no contributions from the policy holder, and get pensions and early retirement. Do you get rich as a civil servant? No. But many of them are doing much better than they would in the private sector.

Einhal – and, as i’ve mentioned here before, might only demonstrate their good sense in planning ahead given the sea change of corporate ‘Murica discovering in the ’80’s that they could scuttle their worker pension obligations, sometimes even with government assistance, and going on from there to leave any effective worker pensions in history’s dustbin.

(Will miss your thoughts, LK, and look forward to your return…and NBay, a pleasure to see your handle again…).

may we all find a better day.

Chicago at I-57 and 115th Street last Sunday at 10:30 pm didn’t make the national news, I take it?

Mass shootings are no longer “news,” too commonplace to bring up whenever they happen. Now you need some other elements for national media to jump on the story. Uvalde met that criteria.

The only national media organization who would be all over this one because of its alignment with its mission would be Fox.

The speed with which “don’t fight the Fed” became “don’t listen to the Fed” still has my head spinning.

Back months ago when I got out of the mortgage business, the head of the real estate office I often worked with was aghast that I was leaving the biz. “Things will be fine!” he said. “It’s just seasonal!” he said.

Ha!

My old mortgage office, once at 20 MLOs at the peak in ’21/’22, now has 3. There’s blood in the water, and the sharks aren’t even here yet.

for sure. I am in my tenth year in the mortgage loan origination business–I work for a credit union, normally a situation where i trade some of the high commissions of the retail world for the security of a steady income, with a lot of my business coming from credit union leads.

The high rates have been like a neutron bomb dropped on the industry. It is brutal out there right now.

Happened to me in the 90’s as a loan officer. Got the heck out never to return. The most amazing phenomenon is telling people what’s going to happen in this part of the real estate valuation cycle, having the credentials to back it up including a real estate major emphasis in college, and there’s no response as they buy at the peak anyway.

People have been habituated by Fed’s easy money policy to think that real estate can only go up.

Common sense is so uncommon.

Both stock and real estate valuations are quite high for quite some time and one can’t blame people as they have short memory.

This is the kind of head line MSM is dishing out to people:

How much you’d have today if you’d invested $1,000 in XXX in 2010 ?

I had come into the business after spending 11 years running bars and restaurants–felt it was a way to translate my work ethic and people skills into a more stable career. From 2012 to the beginning of 2022, seemed like a good bet. Looking like rough waters ahead for sure.

F&L,

About a year ago my brother told me his next door neighbors mentioned they might sell and move. I thought it would make an OK investment to own as a rental. I applied for a mortgage.

For 3 weeks solid I was getting 5 to 15 cold calls a day asking if I needed a mortgage broker.

I can’t imagine what its like today with 7% rates.

I’d place even odds that half those MLOs from last year are already out of the business, either from quitting or being “right-sized.” I know our office was 100% commission based, so when things dried up you had guys cold-calling, getting nothing, and leaving in dribbles. Hell, things were still RELATIVELY still good then, too.

I remember one re-finance client I had whose rate when up 1/4% to 3.125%, so she backed out, saying she’d wait for rates to come back down. I calmly explained those low rates were called “historic” for a reason, and short of another global pandemic and lock-down we’d never see rates in the 2s again, but did she listen? I’d love to see her face now…

The Sellers are in the stratosphere with the prices they want. It’s like Sotheby’s having an auction but only Goodwill customers attend. Sellers need to sit for their haircut.

We saw that in 2008 as well. Sellers holding out too long will have to keep lowering the price, looking like fools in the process. You see, there are people who have to sell right away due to circumstances. They will become the comparables of the future. Then everyone else has to drop to that level.

The bottom will be in a couple of years. The turnaround a couple of years after that. If you are looking to buy, start making what *seems* like outrageous low ball offers. Eventually one will be accepted.

During HB1, My friend listed his place for sale at $725K. He was able to sell it after 2 years or so for $485K.

This is what we call chasing down the market.

”Spring sales season gets off to ominous start: Home mortgage applications fall to lowest level since 1995”

I am sincerely happy for you and hope that this will soon happen here in Europe as well

Not sure about a turn around this time. Was there a turn around in Japan?

Thank you for the feedback. Waiting now for the vehicle sales for Feb to see whether the malaise has spread.

January new vehicle sales came in at 16.2 million SAAR, highest sales rate since May 2021. Used vehicle sales were also up. People are buying.

Perhaps a good chunk of that increase is from the rental companies refilling the pipeline by turning over their fleets again, after the Covid hiatus?

Retail SAAR in January was 13.2 million, which is pretty decent, up by 1.7 million from December.

But yes, fleets were essentially cut off during the shortages, and they couldn’t buy what they needed, so now they’re getting some orders filled again, and compared to 2021/2022, their purchases are up. But they’re still not back to normal. Nothing is back to normal.

Housing crash takes a long time but this one is playing out faster, no? The rate things are going, maybe this Spring season will be earlier Christmas for potential buyers…if not by next Spring we will likely get there, assuming rates are still close to where we’re at now

It seems to be playing out much faster than HB1. It might be played out in 2-3 years instead of 4. The Fed is in charge. They won’t make the same mistakes they made in 2001 and 2008. Oops, they already did.

Housing still moves slowly. This bubble is bigger but inflation and wage inflation are propping it up. ie, If someone just bought a 700K house in 2020 at 2.5% interest. They qualified for it then and after some significant inflation based wage increases, they certainly qualify now. With a 2.5% mortgage, they are in no hurry to pay more. Tech may be feeling some pain, but heck, a 700K house on a 350K salary+stocks was very easy. a 700K house with a 200K decreased salary is just easy (but painful). As long as the techie didn’t do something stupid like buy a 2M house in 2020.

However, it is “Game Over” if massive unemployment happens.

More than that. Credit standards are still pathetically weak.

Longer term, no one seems to believe the government will have to reduce its mortgage subsidy, but real austerity is coming, and it won’t be voluntary either.

The government isn’t going to be able to guarantee and subsidize everything forever.

AF – I agree &always appreciate your perspective

Honestly, the so called wage inflation lags quite a lot behind the home price increase.

A person earning $14/hr got a raise so that he now earns $18/hr. This does not do anything to housing where median home prices are $500K.

Person who are high income earner who could afford these homes , their wages are lagging quite a lot.

If the wage hike has kept up with home prices, then we’d not have seen this much drop in sales volume.

Agreed.

Just like I experienced in the 1980’s, wage inflation lags everything. It takes a lot of time and losses due to labor shortages to pry higher wages out of corporations.

However, it eventually catches up. Just like it did in the 1980’s.

House prices are falling slowly. Wages are rising slower.

Inflation is the 1000 lb gorilla pushing the 1 ton economy.

Eventually this will all meet in the middle. HB1 took 4 years. The 1980’s took a little longer.

My comment is that the middle was when housing prices matched inflation in 2012. If house prices again match match inflation (which includes wage inflation) that signifies that speculation has been removed from the housing market, then it is a fair price to buy a house as a primary home.

It will take time. Likely 2-4 years. This is a factor of both house prices and inflation. If wage inflation rises another 10% and house prices fall 25-30%, we will be in the middle again.

This would be about 2019 prices for houses. Home buyers will have higher wages if this happens due to wage inflation.

If you purchased a house in 2019 or before, you will still be above water in 2019 non-inflated dollars and not likely to panic (even though you have not been compensated for inflation).

Is this part of the plan for a Fed Soft Landing? If it works, I think they will announce that it was part of the plan all along. Nevermind the huge MBS losses the Fed could experience due to ineptness in tightening in the wrong order. They should have backed out of the MBS exposure first. Idiots!

We are a long, long, long way from Christmas for potential buyers. Prices are still batshit insane, and FOMO hasn’t gone away.

You know who couldn’t care less about mortgage rates?

I live in a community of long-time boomer owners that are part of the 40% of homes without a mortgage. The main complaint they’ve had over the last few years is that they couldn’t afford a new home somewhere else even if they sold.

With higher rates we’re likely to see things get more affordable for them in the hot retirement centers of the country that have been blown out by investors and remote workers. Sure they would have liked to get a million dollars for their house, but they’ll be happy to get $750k if it means they can finally move on.

They don’t have a mortgage right now and they won’t have a mortgage on the new home they buy with the proceeds.

I think people are going to be surprised at how many of these folks decide to list in the next year or two despite the high mortgage rates.

Interesting perspective, thanks.

Can’t help thinking this bubble might deflate lower for longer:

– recession and layoffs

– more competition between regions thanks to remote work allowing migration to cheaper places

– inventory increase from recent builds, late airbnb and other investors selling, and people moving

– high inflation and market downturn eroding purchasing power

– China situation exacerbating inflation if consumer markets become decoupled

– devaluation in cities due to forced zoning rule relaxation to increase housing supply

– replacement of commercial RE buildings by apartment buildings in downtown areas

– rise of new energy efficient and tech-savy homes decreasing the relative value of old homes

– rise of higher end prefab homes rendered more attractive and affordable by automated manufacturing

– satellite communications allowing folks to move to their dream lot in the middle of nowhere

What am I missing?

GOOD comment, addition to the dialog Wolf supports, as do I,,, IMHO!

Please continue on here when you can C3.

Thank you.

Thank you for making this point. The real estate market has not been meeting the real needs of those who actually need housing for some time. For the person actually looking for a house to live in, selling means cashing out, and walking away. Trading up or down has been made impossible for many people. For about ten years, it’s been a market only in the sense that transactions are made between buyer and sellers, not a place for people who actually need a place to live.

But will they be happy at 400k?

Just curious…is their other side of their mouth happens to location at the lower region between their legs..those words sure smells like it..

“Toll Brothers today chimed in and said out of one side of its mouth that its “net signed contracts” collapsed by 51% year-over-year – its future revenues. And out of the other side of its mouth, it added to the talk of other homebuilders.”

In the army that was called cranial rectal deflilade.

I just told my landlord that I’m not signing a new lease after another 10% rent hike. Looks like another year of being a rent refugee.

I’m moving hundreds of miles to a location where, if house prices correct by 10-20%, it would become barely feasible to own given the local job market. Rent is still 30% less than PITI on the equivalent house, so I’ll wait a year and pray. It’s a gamble, and the smallest bite I can take out of this turd sandwich of a housing market.

Good things come to those that wait.

Have patience. There are so many long term dynamics going on. Wait a year after the Fed stops raising rates. IMHO, the situation will be significantly different both with wages and house prices.

Good luck!

One thing to keep in mind. Due to the debt ceiling fight, the Treasury cannot increase the amount of debt it sells to the market. So supply is being constrained below the level required to fund our overspending government until probably July. Once the debt ceiling is once again raised, the Treasury will start to sell a boatload of debt to catch up. This is coming at the same time the Fed tries to sell off the balance sheet.

The last spurt higher in interest rates was in the months following the culmination of the debt ceiling hike, right when the Treasury was increasing supply of Treasuries and increasing their balances. So if rates are rising higher right now, once the Treasury goes on a selling spree, it is very likely the market sets rates MUCH higher. This could even get out of control, as foreign governments are now also sellers of Treasuries.

No offense intended, but that 1 year Treasury chart needs to show the March 1998 era, to help ponder short term yields and mortgage rate (range).

We’re headed that general direction during this year imho.

Hopefully this isn’t a double post.

I ran a fast affordability exercise the other day, plugging in median family income, median home price, 20% down payment, generous debt profile, current interest rate:

To buy this $467,700 home, NerdWallet recommends that you have a monthly pretax income of at least:

$12,593

That’s an annual income of:

$151,116

I’m sure it’s very possible that two workers can combine incomes and probably have a nest egg, but as rates go higher, this simple equation becomes increasingly risky .

I forget why, but I didn’t write down monthly payments, oops, but this was an example I was looking at:

Monthly payments for the median priced existing single-family home are used to estimate the “qualifying income” necessary to purchase the median-priced family home. Median-home prices, published by the NAR ($174,800 for December 2003 for the nation) and effective mortgage rates, published by the Federal Finance Housing Board (5.82 percent) are used to a calculate a monthly payment ($822).

Wave 5 has most likely begun in mortgage applications. This will bring us to historic lows for buyer seeking loans smack dab in the beginning of the “Spring Buying Season”. Using the chart above for the weekly applications we will bottom out between 100/120 As a Realtor and Investor I am immersed in the market and can tell you Buyers have started earlier and earlier the past 10-15 years. Before the Cell Phone and Zillow the Buyer needed to work with the Realtor to shop. Now they are up to speed before I get involved and most likely have the homes all lined up for me to schedule showings. This means our ‘Season” is going to slow down sooner also. About mid May you see the traffic slow and listings sit with a small bump in October as the school year begins and frees up the parents to shop. After October the market is very slow until February the following year. For rates to jump almost a full point is just a traffic killer and shows the volatility in the market. Volatility frightens buyers. This is not like 2008, It may be worse!

Why would people with kids buy in October after the school year has begun? Unless you are buying in the same school district, it seems like bad parenting to start your kids in one school just to pull them out mid-year (by the time closing happens).

Depends what they’re moving out of and why. For renters, mid-school year moves are a miserable yet not uncommon reality. And with the market as horrid as it is, a deal is a deal even if it is at an inconvenient time.

Parents will never not be accused of bad parenting, even when it’s a matter of moving their family into a purchased, stable home.

Good point J:

Having been in RE market since 1956 – with dad and grandad willing to discuss to help me understand in the early days,,,

Most parents who can do so want to buy in the spring to be prepared and make their kids prepared for the start of the ”school year” in the fall.

Having moved 21 times with my ”birth family” by age 19 ( Per Top Secret application back in the day when FBI did check out) ,,, for the last time to go to active duty in US Navy,,,

I can and do testify it was always a challenge, but,,, OTOH, I made a ton of new friends each and every such move as a kid,,, and based on that, made even MORE new and wonderful friends every move since….

Kinda/sorta like the ”service brats” who had moved even more than we did in those many years when USA was the only bully on the blocks/globe…

North Georgia reporting in. Nothing but crap to buy. So, time to build

My wife and I have been waiting to build for several years. We started the building process. We bought our lot this weekend and I met with the builders yesterday to go over our plans. They said their sub contractors are coming out of the woodwork looking to build residential again as commercial is hitting a wall.

We have been tracking prices and everything seems to be dropping slightly except concrete. Lumber is back down to $0.3735 per board foot.

Our hope is that as we progress through the process this year as we see prices dropping.

My thinking is the Jerome will crank up his QE machine along with the government stepping in to bail out a slowing housing market and we will see inflation pick up.

Excellent, we did that 20 years ago. Friend in VA doing it this year, moves in May. From land to appliances we came in at under 400k with no debt by saving pennies.

First, I follow Wolf and various other financial analysts. Wolf has been the most accurate in his predictions about the Fed’s lack of pivoting and about the mortgage rates and the 10 year bond rates. Please receive my heartfelt congratulations on nailing this, Wolf!

Second, the housing market in the Boston metro area is slow to reduce prices, of course, but the listing volume appears to be substantially lower, if not downright collapsed.

Oh, and in today’s local “paper” (boston.com) there was an article about the Cape Cod (local beach destination, for those who don’t know) Summer rentals. Much much lower demand than in the past years.

Camp sites on the Cape are doing great though. Book early or not at all.

The value of the dollar is deteriorating daily – real estate is a hard asset – for that reason the dip/crash (or whatever you want to call it) won’t be a severe as most expect.

You also have a lot more cash buyers than usual – even with the dramatic rate increases there is no sign of the cash drying up where I sit – which is usually at the closing table.

In relation to precious metals like gold and silver along with foreign currencies, the US dollar is doing very nicely. In fact most of them are being crushed by the dollar. Eventually you may be right but not today.

Care to cite some statistics to support that bold claim?

Wouldn’t cash buyers prefer to have their money in a 5% treasury, as opposed to a declining RE asset? Everything I’ve read indicates RE investors are walking away.

Both ‘price adjusted for inflation’ and ‘price to income’ ratio are way above historical norms. They are actually still above their 2007 bubble top even including the recent drop, so good luck with using real estate as an inflation hedge going forward.

Even if RE prices start to rise nominally again, it’s going to be less than inflation until those ratios are back at more reasonable historical levels. For that we need a 30%-40% drop in real estate real value.

Real estate = hard asset ,hard to make payments,hard to maintain,hard to stop property tax increases,hard to stop insurance increases .

David,

“You also have a lot more cash buyers than usual …”

On the contrary. Quoted from my article yesterday, about this very exact topic:

“All-cash buyers, investors, and second home buyers pulled back further.

All-cash sales plunged by 29% year-over-year, to 67,000 properties, down from 95,000 in January 2022.

Sales to individual investors or second home buyers collapsed by 52% to 37,000 properties, from 77,400 in January 2022.”

https://wolfstreet.com/2023/02/21/mortgage-rates-near-7-for-spring-selling-season-prices-of-existing-homes-fall-13-from-peak-sales-drop-to-lowest-since-2010/

I wish people would understand that most of the cash buyers are flippers. They are the first to flee at the hint of a slowing market. It was simple- borrow the cash to buy the house at 1% per month, push the rehab to the max, and sell four months later at a 20% or more profit. This has been the real estate get rich quick or die trying mode for two decades dammit.

It wasn’t Aunt Doris using her savings from 7 decades of work. As for second homes, tons of them were sold to work from home and airbnb, so now pffffft on so many levels.

Back to a reasonable housing market in five years, but for now, bring on the pain.

I saw 3% 12 month cd at the credit union today.

Now that is up from bupkis..

I’m getting 4.25% in an ordinary savings account.

1 year and 6 month US Treasuries are paying a little over 5%.

When 10/30 Year Treasuries hit 8%, I’m going almost all in. I’ll pick my target salary for retirement, take all of my savings required to meet that and put it in an 8+% Treasury to achieve a guaranteed safe stable pension for 10-30 years. I will then retire.

500K = 40K/year

1M = 80K/year

2M – 160K/year.

I have a dream.

Yes, most cash buyers were flippers (drying up since house prices are not appreciating as they were), and foreign buyers were a HUGE part of buying with cash.

Anecdotally, we sold my Mom’s house to an cash buyer from China in 2016. Co-workers are reporting that they have sold with all cash to foreign buyers.

What is the status on foreign buyers? Since many were cash, Wolf is reporting that this is drying up also.

@SIAB BOB – I am kind of new to Treasury investing. If you buy a 30 year bond, don’t you have to hold it for 30 years to see the gains? How do you live off that? Thanks

elbowwilham,

I-bonds are designed to be retirement products that accumulate interest tax-free, and pay interest on that interest which also accumulates tax-free. You can redeem them before 30 years if you need the money. When the bond matures, you get the original face value plus the accumulated interest, so an i-bond you bought for $10,000 may pay you $30,000 when it matures.

A regular 30-year Treasury bond pays the interest in cash every six months, and doesn’t accumulate it, and you pay income taxes on the interest every year. And when the bond matures, you get face value back. Each bond = $1,000 when you buy them (you might get a little discount or maybe pay a little premium) at auction. After 30 years, you get $1,000. In between, every six months, you collect your coupon interest.

The idea with i-bonds is that you buy for example $10,000 every year ($10,000 is the limit for purchase, but you can get more via tax refunds) while you’re younger. And you do this every year. 30 years later, when the first i-bond matures, you can supplement your retirement income with it, which might be $15,000 by then. And you do this every year in retirement until the last i-bond that you bought matures.

Go to Fidelity or Vanguard, click on Fixed Income tab – yes, no one has used it for 10 years – look at 90 day zero coupon Treasury bills – 4.8-4.9%….. can’t miss.

elbowwilham,

Wolf has a great explanation above.

Treasury Direct ,gov has a strange but mostly self-explanatory way of purchasing bills and bonds.

My philosophy lately has been:

1) iBonds have been paying the highest interest rates lately. You are allowed to purchase up to 10K/year per SS Number.

The current rate is 6.89% for 6 months then it adjusts based on the inflation rate for the next six months. You must hold the iBond for at least 1 year. You can cash in the bond between 1-5 years with a 3 month interest penalty. After 5 years you can cash in the bond with all of the interest accrued without penalty. Though you will be taxed as Wolf pointed out.

2) Treasury Bills. – These are shorter term “bonds” between 1 month to 2 years. Treasury Direct has the current daily rates and you purchase these like CD’s. You buy them at the going rate (6 month and 1 year are currently over 5%) and at the end of the term, they mature (there is a setting to auto-reinvest) and your cash + interest appears in your bank account. The interest is taxed at the federal level abut not at the state level.

3) Bonds. 10 year and 30 year. Wolf described it very well. You generate a fixed income based on the bond interest rate paid every 6 months. I don’t have any of these currently since I think the interest rates are still too low. They are not very liquid so you may lose money cashing them in rather than waiting for maturity and living off the interest. I see danger in buying too soon. If you lock in an interest rate far below long term inflation, you will likely not be able to survive long term.

All of these are backed by the US Government. If the US Government defaults we are all in trouble. Even FDIC insured accounts.

Thanks for all the great info! Love this blog!

Cash yields for over a decade have been subzero. So there was zero opportunity cost for cash investors to buy income-producing assets.

That’s no longer true. And according to the chart, the biggest drops in demand are coming from the people who’ve seen falling knives in the past, and who can now get risk-free 5% yields from a local bank.

Rea estate is not immune from deflation,in every downturn it deflates ,better look up Great Depression.everything deflated I see this scenario playing out again .It’s to far gone to fix ,no one really knows amount of debt. But as usual retires will have it the worst

The Fed is probably hoping that housing prices continue to drop. If they don’t, housing transactions will continue at extremely low levels, thereby lowering employee mobility and negatively impacting productivity. The seller-buyer stalemate will significantly damage the economy over time.

For example, if you were thinking of hiring a lot of employees for a new plant or operation, you’d need to hire employees from other cities, but that would be extremely difficult or infeasible in the current environment.

I listened to a news story in the Bay Area where they LLM (lying legacy media) was talking about how homes in Dublin, CA we’re in high demand with not enough inventory to meet demand. The most outrageous reason – people are coming over from the more expensive SF areas and (get this), also because more people are moving back to CA.

More proof they’ll try to sell any lie to the public. Look here. Don’t look there 😲

If you moved far away with your high SF salary during the pandemic to work from home, and now your employer is calling you home to work from the office, are you moving back to CA or are you quitting?

I’d quit and try to work local to where I moved but that is my opinion.

I do see some influx back to CA if high paying employers are calling employees home.

It’d work as long as you are able to find work locally.

A bunch of my friends moved to remote areas, working remotely. Now employers are calling them back.

They don’t want to come back but they don’t have job in the location they are in.

These folks are in engineering/hi-tech.

I represent a lot of clients in my line of work including realtors and mortgage brokers. I’m in California in San Diego. I can tell you that the mortgage brokers sales volume has collapsed. When I say collapsed in don’t mean 70% or 80%. I mean 95% collapsed. It’s the biggest freeze in real estate history.

Love love love it…especially for all the people saying SD can never crash..Hopefully this is happening in OC and LA too.

95%? Psssh..let’s make that 100%…go big or go home

You want to necessarily ruin an industry and all those folks who depend on it? Just to poke a hot stick in our eyes? That’s nice.

I don’t think that he necessarily wants to run it into the ground — however this industry celebrated and enjoyed a 40% increase in home prices over a 2 year period and reaped the rewards – and kept prudent buyers out of the market with FOMO and now monthly payments which are not sustainable — so I want to see it crash so I can purchase a home in San Diego that I can afford – not to poke a hot stick in anyone’s eye but to give me an opportunity to own — and to bring prices back to reality!

That seems like a sociopathic comment, wishing pain on people trying to make a living. Do you kick small dogs while you’re at it?

The Bob who cried Wolf & First and Long:

I have debated this myself. Though I never would like to see people get hurt from a housing market and/or stock market collapse – I am very much a spectator as almost every other American.

Unfortunately, these boom-bust cycles have become a reality due to the recklessness of the Fed Reserve and our system of government.

So one can just be sensible and prudent in their own financial affairs. As far as what happens in the economy and its impact on people, there is very little we can do.

I think Phoenix_Ikki’s reaction is born out of frustration that these bubbles are being blown repeatedly with a huge negative impact on the financially prudent rather than wishing anyone ill.

We will all be in better shape if we can settle for a sustainable growth with policies that would ensure sustainable growth and strongly discourage financial recklessness on the part of everyone.

Correction to my last paragraph:

We will all be in better shape if we can come up with policies that would ensure sustainable growth and strongly discourage financial recklessness on the part of everyone.

Since I can’t reply directly to Sean, this will have to do. Yes, you captured my feeling exactly, well said in your reply..

As for kicking small dogs, only if they howl all day long or every time it goes outside for a walk as if the dog is dumb and deaf and the owner is too worthless to train it properly like my current neighbor’s dog (not a small dog btw) then perhaps I would like to, would I actually do it, nope but my frustration is certainly there just like it’s there for the housing market and the people that continue to buy without ever questioning the possibilities of a price decline..

Financial recklessness was driven by the Fed.

This caused the home loan market to boom with hiring during this time up by how much? 1000% ?

Now the mortgage loan business is contracting due to this oops caused by the Fed.

Is the mortgage loan business the same or less than it was in 2018 after 1000% growth?

I’m an engineer, I see this boom/bust every 10 years or so.

The company I work for went from 2000 people down to 200 people during the last bust. Yawn, I’ve seen it all before.

Be kind — for everyone you meet is fighting a great battle

That’s interesting considering how desirable SD is in the eyes of socal residents (LA and inland empire) as well as those in Arizona. Of course those areas are melting down worse than SD and command lower prices so not a lot can take advantage of this crash

Interesting but not surprising. Sellers likely think “everyone wants to live here, can’t happen here”, etc., and buyers are wary. Makes sense SD would be one of the most paralyzed markets.

A tale of two extremes.

You want a soft landing??

Maybe if I’m flying your aircraft.

It looks like a slow-motion train wreck to me. Seller’s will fold but probably not this spring or summer, not until they lose hope.

Right Now the Stock Market and the Housing market are tied together , If one go’s down the other follows / This is the Fed’s creation seems

All the “value”was fabricated with ZIRP so yup it’s all going down together… Find your umbrella!

Building more multifamily homes in areas with good public transportation should help reduce some of the costs for everyone involved. Everyone would be better off as a result. The homebuilders, the buyers, he public utility costs for the cities and towns, and the density of tax revenue would increase as well.

Contrast that with building lots of socially and economically isolated single family homes in car centric/dependent communities where there is little ROI for all the utility infrastructure and tax revenue densities are far too low (and need to be subsidized) to pay the future upkeep of the roads, and utilities.

Sounds nice, but where would you store your nonfunctioning automobiles, old bed frames, and blue tarps?

So many benefits. Do you live in a MFH?

This makes me laugh. Seattle did exactly that, as the urbanists narrowly shouted about how everything is supply and demand. While there is merit to your argument, I laugh because the crowd who has been beating that drum in this city has completely ignored the financial underpinnings actually driving prices higher. Yes, more and smarter supply could not come fast enough, but given who’s actually buying and why, you’ll never get in front of the price acceleration experienced over the last 10 or 12 years by building. The net result was the urbanists were a beard for the worst kind of real-estate developers who just don’t care about the impact of their projects – Urban, Suburban, or Rural!

Public transportation is generally expensive and inefficient, especially in terms of the time of those who ride public transit. I live in a city (Austin) which places a priority on public transit, but generally I only ride it when I take my vehicle in for service. It takes me far longer to take the bus from the auto service center than it does to drive to the auto service center. And forget about running errands…

This is top of mind for me, since I will be taking my vehicle in for service today, and am preparing myself mentally for a day or two of limited mobility. I am grateful for public transit as a backstop, but public transit is a grossly inferior product compared with a private automobile.

It’s sadly so true. I live in a city with the one of the very best transit systems in the US, and even here it requires so much subsidization from the public (including from the suburbs). The level of service isn’t great, the riders are often horrendous to be around, blasting profanity-filled music, yelling at each other, sleeping on the bus, dropping their trash, leaving half-full bottles of soda on the seat with no cap, urinating on-board, etc. In fact, yesterday we rode the bus and train to see a show across town, and over half the people didn’t even bother paying. They get free transit on the backs of taxpayers, most of whom rarely, if ever use it. It’s a broken system, and I’m at the point of saying, eff it, let the whole thing rot.

I’ll happily go back to using my car every day if it means I get to opt-out of this disgusting mess of a system.

Spokane Transit is a lot better than what you describe although I only take it maybe 10 times a year.

But it is heavily subsidized, like riders only cover about 20%,of costs. Rest from taxes or private support.

In city pretty heavily utilized. Out here in the Valley not unusual for 0 to 5 people to be on the bus, a full size bus.

Glad its available but high price per rider.

As I shuffle along in my dingy smoking jacket, pushing my walker along, absorbed in economic clouds of dementia ranting, this morning my bingo card points to Walmart.

I think Walmart is representative of the global economy, and if anyone gathered anything from their earnings call, they fear a recession later this year and they’re preparing for a world of economically challenged customers.

That fear, dovetails with a global slowdown in production and inventory, which links to stubborn inflation that’s increasingly impacting earnings growth.

Walmart is interesting, because it represents a demographic range of people who tend to be value focused, versus shoppers at places like Costco, where their customers and employees have a sense of being economically untouchable.

I like that contrast, because it defines the haves and have-nots and acts as a very nice representation of bulls and bears and the contrast between classes of people who are optimistic about their success and those that are living on the edge.

With that as a backdrop, it helps me understand a housing affordability exercise I was tinkering with, which used a median priced home value of $467,700 and median family income of $88,590 with an interest rate at 7.08%.

I had previously tried to post a useless FRED link to a chart attempting to show a relationship between income and home prices, which graphically backs up the concept that home affordability is at a historically bad level.

That exercise was before Walmart earnings guidance.

I returned to my FRED experiment, but this time started thinking in terms of using real disposable income per capita and all transaction home prices index.

That relationship graphically clarified, the initial pandemic recession, then the whipsaw insanity that followed, as home values exploded exponentially, followed by a recent reverse whiplash, explained by increase in income and slight declines in home prices.

What stands out as being important in that chart, is that the initial whipsaw change, early in the pandemic, was a short period where income declined, along with home values — followed by an extended period of abnormal nonlinear home valuation gains, which have only recently been adjusting downward.

Furthermore, the whipsaw of non-affordability, indicates that the normal range of historical home value has changed 20%.

Obviously, that’s a subjective value (wolf vomiting) but there’s a relationship between inflation-adjusted real disposable income and inflation adjusted home prices and the fact that affordability is going to hinder economic growth.

Furthermore, as mortgage rates drift higher, with global recession inching closer to reality, it’s obvious that Walmart being cautious is indicative of knowing the canary in the coal mine will be DOA.

Meanwhile, as we examine the carcass of the canary, what happens to the invincible untouched Costco tribe. Do they simply look away from their excessive portfolio gains, or, are they connected to leveraged assets that will be a huge part of the pending negativity equity tsunami ?

That question will be resolved by time, as cash burn increases and exposure reveals itself, but, going back to disposable real income, the amount of disparity between normal affordability and where we are now, suggests there’s going to be massive global repricing.

Anyone in a stupid leveraged position will be destroyed imho.

Nostradamus

You misunderstand Walmart. Walmart is a HUGE ecommerce player. It has the third-largest ecommerce business in the US behind Amazon and Ebay. Its ecommerce sales grew by 17% year-over-year. If you buy anything online, you’ve run into their products. It sells just about everything online, stuff that you cannot get at the store. Everyone who buys online sooner or later will buy at Walmart’s site. I have bought stuff there, because when you Google a product to see what deals are available, Walmart comes up along with Amazon and others.

Much of the company’s US revenue growth comes from ecommerce. That has been the case for years. Brick-and-mortar stores are challenged.

Dear Sir,

My contention is, there will be less demand for a wide spectrum of goods, whether online or in-store.

The pandemic definitely accelerated consumer adoption of online purchases and that segment will be increasingly dominant. I just feel people will pare back their appetite for hoarding useless retail garbage. If anything, Goodwill stores will be expanding, to serve as a substitute destination to shop for junk.

I’m not just picking on Costco, but every store is packed with soft goods like home decorations, sporting goods, tools, toys, seasonal nick knack crap, garden stuff and miles and miles of aisles stacked with seasonal clothing. I think all that square footage in the retail chains, dedicated to non-essential crap, will become huge liabilities.

The online efficiency of shopping for deals is simply another layer of pressure that retail will be faced with, as cash becomes more scarce.

I’m definitely not arguing and I find the content and comments to be very stimulating (here’).

Good Dr. – the scenario you’ve described via thrift stores already happened in our (?formerly) more-affluent area (Sonoma County, CA), with the SA’s flagship Healdsburg center offering almost unbelievable item selection, quality, and value for some years as the poster child, but crested, that era ending with it’s closure and broad thrift decline in thrift locations and value of offerings over five years ago in these parts.

Reckon MM will always V depending on local circumstances…

may we all find a better day.

Yup, bought from them online (and I use the web site to check store inventory, since there’s a Walmart on my daily commute) — but IF Walmart improved their web site, they’d grow even faster :)