Oh no, coffee! Commodities are not moving in lockstep.

By Wolf Richter for WOLF STREET.

We’re going to look at a few spectacular wild rides in commodities – but not including crude oil, gasoline, and natural gas which I discuss here separately quite a bit and in greater detail.

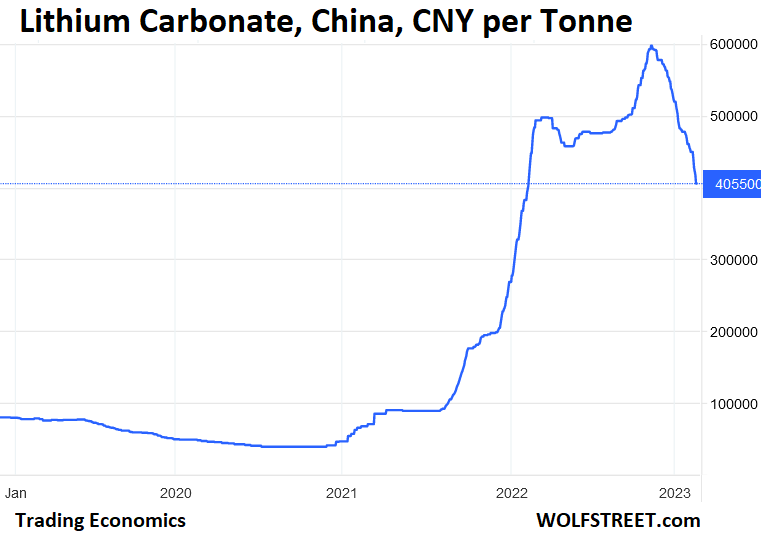

Lithium. Remember, just last year, the world was going to have a shortage of lithium carbonate, one of the key raw materials for EV batteries. With all the hype about supply shortages, and booming demand from manufacturers of EV batteries, the price of lithium carbonate spiked. The China lithium carbonate index, a benchmark price, exploded by a factor of 15 in two years, from CNY 40,000 per tonne in November 2020 to CNY 600,000 per tonne by November 2022. And then that was it.

New supply was being put on the map, including in Australia – makes sense at these crazy prices – and demand was strong but not that strong, and all that became clear late last year, and when the hype fizzled as it always does, the price began to plunge. At the moment at CNY 405,500, the price has plunged by 32% in two months, and is now below where it had been a year ago (all charts here via Trading Economics):

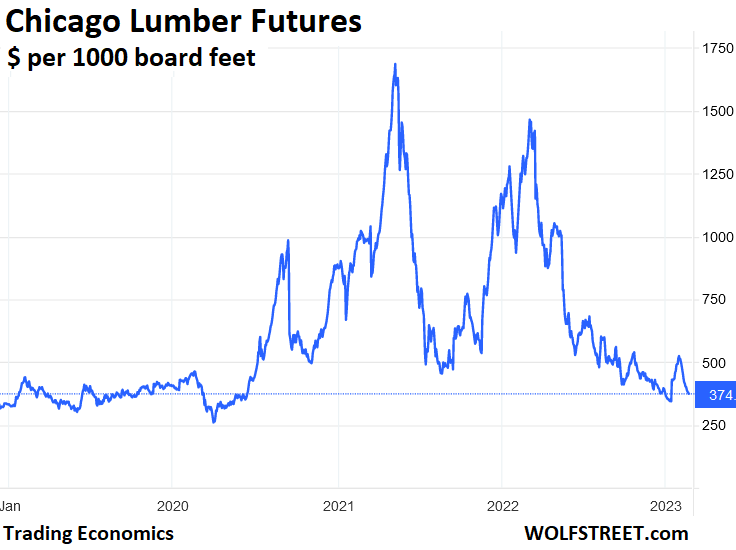

Lumber. The price of Chicago lumber futures went through epic gyrations during the pandemic, spiking by 350%, then plunging, then spiking all over again, the plunging all over again, and now it’s back where it used to be, currently at $374 per thousand board feet:

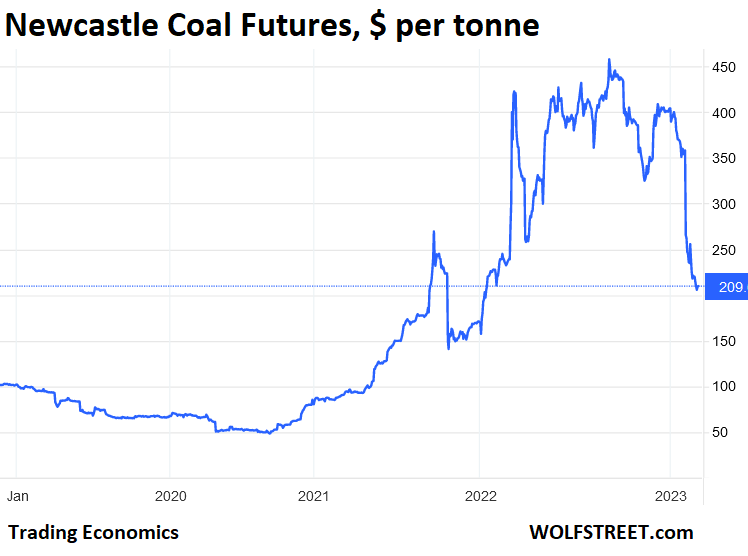

Coal spiked when global natural gas prices began to spike starting in 2021. “Spiked” isn’t really the right word, because the price of coal multiplied by a factor of nine. Here are the ICE Newcastle Coal Futures, a benchmark for the Asian market, shooting from roughly $50 per tonne in September 2020 to $450 in August 2022, and then the big plunge, currently to $209, which takes the price back to September 2021:

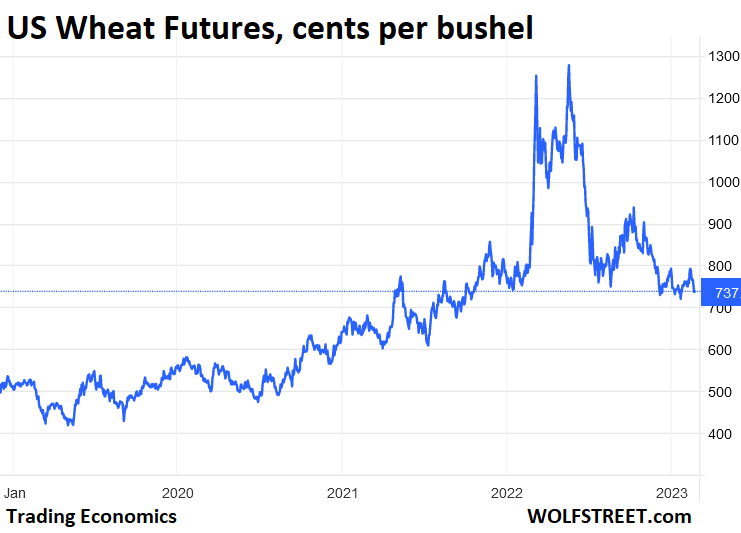

US Wheat futures have worked off their entire double-spike that started in February 2022 with Russia’s invasion of Ukraine, and now at $ 7.37 per bushel are back where they’d been in May 2021:

But some commodities re-spiked.

Commodity prices are volatile, and they jump and plunge, but not in lockstep. There’s always something that is spiking or re-spiking.

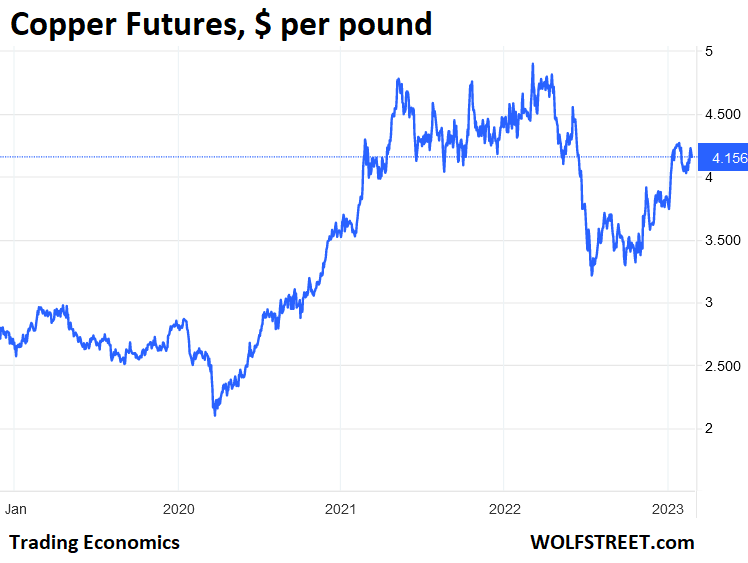

Copper futures soared by 115% in 14 months, from $2.10 per pound in March 2020 to $4.50 in May 2021, then wobbled to a new high of $4.80 in March 2022, and then the bottom fell out. And then the price bounced, and currently it’s at $4.16 per pound, still about double where it had been in March 2020:

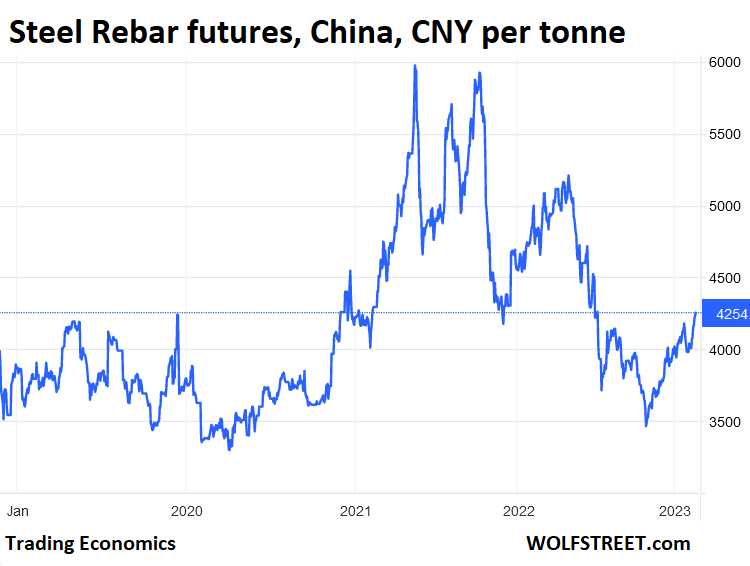

China steel rebar futures – after having nearly doubled – plunged, bounced, plunged, and now bounced off again by 22% since October 2022 to CNY 4,257 per tonne, possibly on a trend of lower lows and lower highs, to be confirmed at the next turnaround:

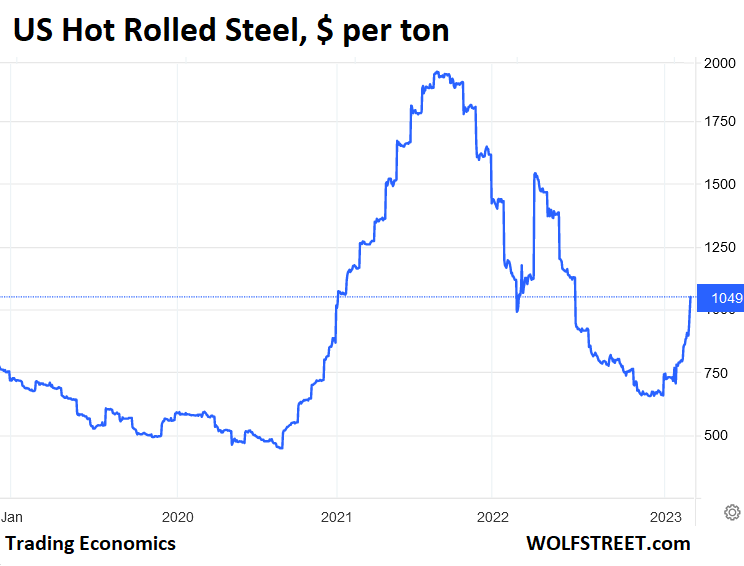

US Hot-Rolled Steel (HRC) has re-spiked by 66% since December, after a monstrous rollercoaster ride:

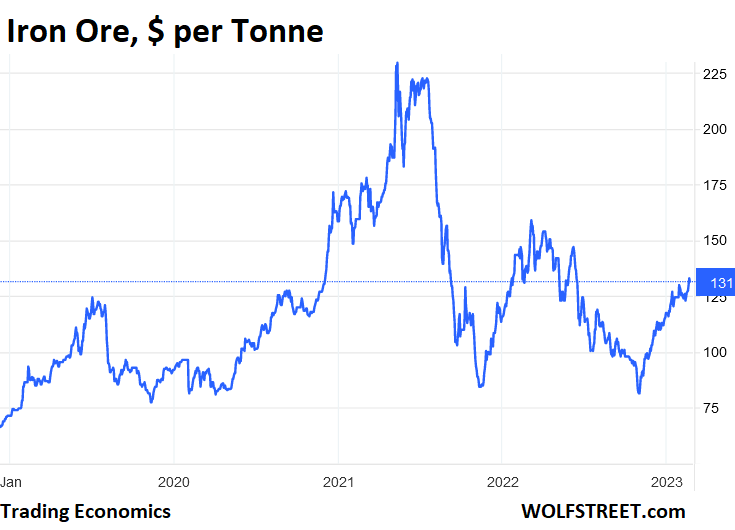

Iron ore. The price of cargoes with 63.5% iron ore content into Tianjin, after some major gyrations, bounced off the recent low in November 2022 and has since then re-spiked by over 60% to CNY $131.50 per tonne:

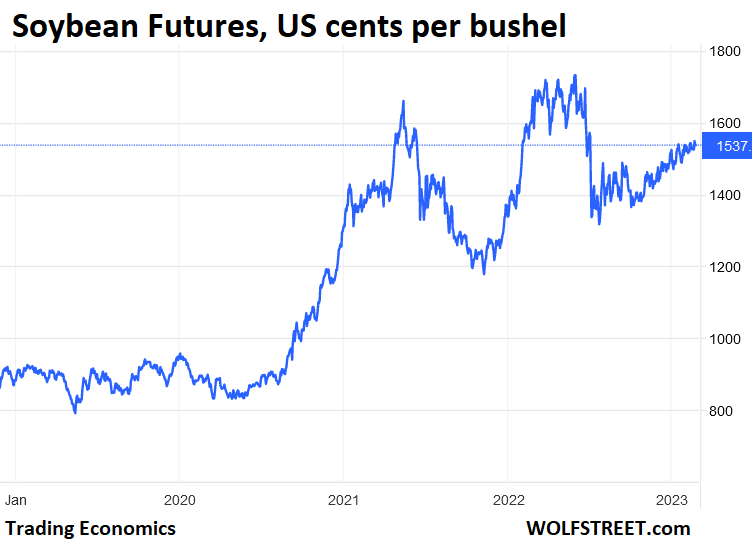

Soybean futures, at $15.37 per bushel, have jumped by 17% since July 2022, and by 85% since May 2020, and are not that far off the recent high of $17.26 in May 2022:

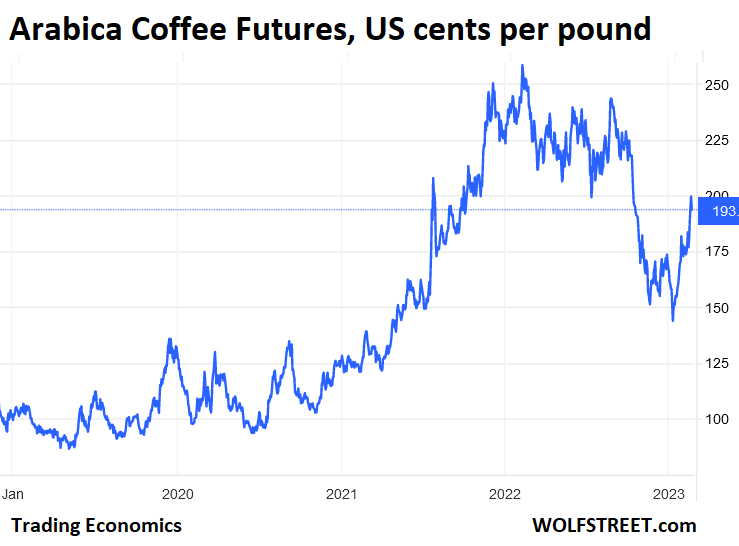

Oh no, coffee! Coffee futures in the US re-spiked, now at $1.93 per pound, double of where they’d been in May 2019:

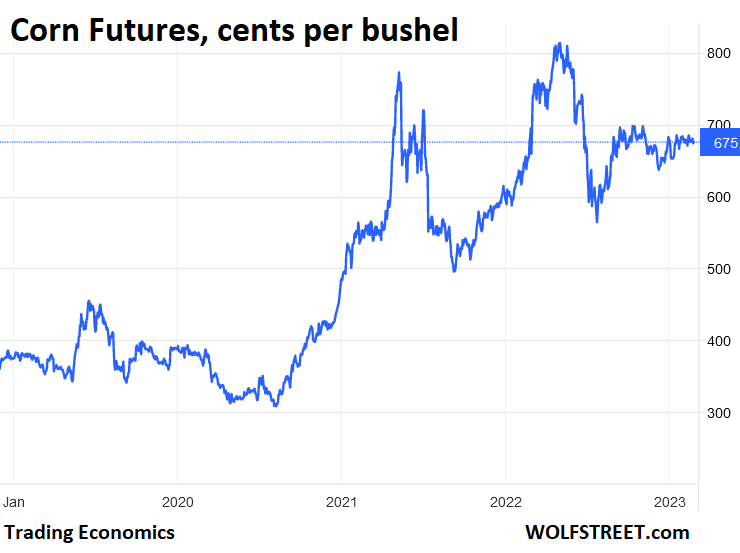

Corn futures, after a majestic spike, have wobbled along at around $6.75 per bushel, more than double the price in the spring and summer of 2020:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

That US hot roll chart still haunts my dreams.

I saved an e-mail from one of several steel suppliers dated April 29, 2021 just as we headed into the worst of the steel price storm. A few excerpts from his letter:

“Today’s market is not comparable to historically tight markets such as 2008 and 2018 because of the hyper-consolidation that’s taken place amongst mills. Now there are just four domestic steel producers that account for 85% of production combined.

Suppliers do not have excess capacity that could be brought online to support existing demand. These supply chain constraints will compound because of pent-up liquid capital, deferred maintenance that can finally be performed, consumer spending on homes, and purchases of steel intensive consumer goods accelerating.

Domestic inventory is at historic lows and there are not enough imports available to make up for the shortage.

Not every company that needs supply will get supply. If you are a steel buyer, no longer will steel come to you. Be prepared to sell yourself more than before.”

Another steel supplier (very old guy) said he’s been in the business for 70+ years and has never seen anything even close to what happened in 2021.

Looking at these charts, it’s a miracle that CPI is still at 7%. Or is it?

Has Fed beaten inflation? Has it even partially succeeded?

Lies, Damn Lies, and Statistics RULES these days Leo, as you suggest.

WE, in this case the folks on fixed incomes WE are SCREWED once again by the mechanism set up in 1913 to make sure the screwing happens to WE the PEONs and never again happens to the rich folks who had lost just as much as us before.

Going back to work at age 70 was a ton of fun, and WE, in this case the family WE were very grateful to the folks in California who were NOT Ageist MFrs as were the folks in the flower state.

Cannot see doing the same thing again at 80, no matter how much I might bring to the table to help…

DOW at 18K, S&P at 1500, FFR at 10% would definitely help us,,, NOT very likely, or at least NOT SO FAR,,, eh

Been in the ag sector over 50 years and learned quickly that the cure for high commodity prices is – high prices. Ag is still mostly about supply and demand and high prices are currently curtailing demand. High prices also encourage more production. We will see this in the U.S. this year as producers are incentivized to plant more acres. USDA just released their outlook for this year and are projecting higher acres.

This year will be especially interesting as both corn, soybeans, and wheat have tight old crop balance sheets (translated = higher prices). Weather will be the controlling factor as always on production prospects.

All true, but it is still unnerving how a handful of perpetual schmucks (Putin, DC) can pretty quickly derange mkts that hundreds of millions/billions rely on to, well, survive.

And to think these same worthies control nuclear weapons.

Well done. I think that financial Dark Arts are at work in Lithium, maybe oil and certainly PM’s. The huge financial sector spoofs bids and shorts, etc. and the prices don’t reflect reality. Silver for example had a spot price that was 70% under the premiums retail investors had to pay fro physical. Now that the PRC has issued a patriotic call to arms for their citizens to buy gold, arguing that the seigniorage in a $100 bill is $99.83, we all need to take note.

Very few of us will take note. I dare say more will buy crypto rather than invest in the barbarous relic regardless of what the Chinese are doing.

I’m following the Chinese lead on that subject

Let’s see if the PRC heeds their own advice and converts some of their US treasuries to more bullion as US interest rates eat away at the value of their longer term holdings and the PoG falls away.

They ACTUALLY converted US Treasuries in the US Agency debt, which yields a little more.

What’s the spread for industrial buyers over silver spot? What’s the spreads between future delivery and spot?

I ask because if it’s far below retail ask prices as I suspect, the wide retail bid-ask spread has nothing to do with any manipulation. It’s poor liquidity.

If investor physical silver is so underpriced due to manipulation, those who believe it should go out and buy every ounce available and there would be nothing available to buy. That’s never happened in the 30+ years since I first heard this claim.

I keep hearing from the people I trust and who nailed market moves in the past that silver is the most underpriced metal of all. In particular the spreads to gold have diverged wildly from their historic averages.

What they also say is that JP Morgan keeps buying all physical volumes available in the markets. And that the long term technical target for silver is closer to 70 compared to the current 20 plus.

Can we get a chart on eggs only? I heard them things are like gold nowadays…I did see Costco limiting purchase per person a while back

But the Vodka, both “American” and “French”, is still cheap.

At least one part of what ATF enforces is still cheap because ammos price has inflated quite a bit as well…

PI – Here is one chart from USDA on egg prices the last 4 years expressed as retail prices per gram of protein comparing six different protein sources.

https://www.ers.usda.gov/webdocs/charts/105830/LDP_chart_Feb_23.png?v=952.4

hopefully the link gets you there.

The wholesale price of eggs has collapsed in price since the first of the year.

From a high of ~$5.20 / dozen large eggs to currently ~$2.20.

To the USDA’s weekly “Egg Report”

https://www.ams.usda.gov/mnreports/pybshellegg.pdf

The lumber volatility is amazing and frustrating. Retail prices surged somewhat less than the futures, but then have since stuck considerably above the now lower futures. Just guessing, but about 50% higher.

Unless their stock turns stale retailers aren’t going to drop the price until they re-stock at the lower wholesale prices.

While certain events may cause supply of some goods to become scarse, other things indicate a recession may reduce demand and the need for those supplies. Business persons who run legitimate businesses do not know which way to jump. That discourages investments, because investors will not want to invest and lose their principal.

scarce not “scarse”

Yes, but this inflation scares people :>{)

…i scarse’ know what to do…

may we all find a better day.

This gives some hope that perhaps grocery prices and other over-inflated items may back down eventually. It’s hard to imagine running a mining company or farming with these crazy swings.

Are there many here who invest in futures? What are some of the basics and best ways to do it? The best info is always from this website.

Brant, with all due respect, if you have to ask, don’t do it. Futures can be dangerous AF with that volatility. Study up thoroughly first.

Agreed. Brant, why not get a guaranteed 5% return on 6mo Tbills along with some sleep at night?

Futures can be brutal. In the short term, your stops will all get taken out. Then when you finally hit buy at just the right moment, you don’t get filled. If looking for longer-term trades, the volatility will cause you a margin call. And since futures contracts (even mini and micro) are highly leveraged, the losses can wipe you out. Don’t listen to the “experts” that promise you success. They just look at yesterday’s graph and make up entry and exit points. There a zillion chart studies but remember that they all show you yesterday’s news. They are not predictive in any way. Even the venerated MACD.

In this building, it’s either kill or be killed. You make no friends in the pits and you take no prisoners. One minute you’re up half a million in soybeans and the next, boom, your kids don’t go to college and they’ve repossessed your Bentley.

No, there is no way to invest in futures.

Like most other supposed “investing”, its actually speculation, in this instance almost always with leverage.

I traded full sized contracts in energy, monetary, financial, metal, and a few other categories for about 10 years in my own account for myself. It is a tough way to make money, but you’ll find a lot about yourself.

In the end, one of my prime rules about the commodity markets was broken in 2018 and I decided to exit the markets altogether. I have not even considered going back; the markets appear to have gotten even choppier over time…

Go read the r/WallStreetBets classic lore “I Am Financially Ruined”, starring ornamental gourd futures.

I constantly trade futures. I mainly do options with futures because it’s not as risky as buying contracts. I do pretty well. I usually wait for a market equilibrium and play the range.

I do agree this website is awesome, but I wouldn’t seek advice from comments here. It is full of bearish sentiment and will definitely cloud your judgement when assessing any risk. The energy industry and ag industry constantly hedge their resources for protection via the futures market. Just go look at their financial statements. You can see for yourself. I will fly away now. :)

Perhaps reintroducing competition might reduce pricing.

Are eggs a commodity?

Yes, just not exchange-traded, only over-the-counter. Literally.

The charts tell the tale. Most of these commodities bottomed and are reflating. U.S. oil inventories have been rising, but are way below what they were before the Russia-Ukraine war. U.S. oil production has been increasing. A spike in lithium prices may have increased lithium mine exploration and production. The Salton Sea area has a large lithium brine resource. CATL a large lithium battery manufacturer recently cut prices.

Lithium is still selling for ten times what it was in November 2020. But hey, who needs lithium?

Sometimes I think most Americans.

HaHa They just don’t take it carobonated.

“Mood Stabilizers should be used as a last resort in “rapid and short mood changes;” They are divided into three main categories; Lithium and most of the anticonvulsant mood stabilizers are contraindicated in pregnancy; All mood stabilizers are not created equal”

He who wants soft landing buys cushioned toilet seat. – Confucius

LOL. They used squatter toilets at the time… so maybe substitute “messy landing”?

Gunpowder, paper money and flush toilets — I’ve heard all were invented in China.

Flushable squatter toilets.

The Romans had flush toilet, public ones too — a couple of thousand of years ago. Seems like a no-brainer in a big city with running water, such as Rome.

And the romans new already that sh1tting is better done sitting down xD.

Under my local german town is a roman town (Sumelocenna). It only existed for a bit over 150 years some 2000 years ago. The only exavated ruins are a public bathroom :P under a parking garage. That has been turned into a small roman museeum. They build quite a bit of infrastrucure in a “short” amount of time.

Walls, an aqueduct, a thermal bath…

Eliminating fecal stuff is much better ”squatting” Toby, per very clear evidence, science based, anecdotal , and personal…

”Squatted” into holes in the slab on grade in Europe many decades ago and learned this personally, and continued to do so balancing on top of ”toilets” for four or five decades after in many places worldwide.

Then, with wounds/trauma to ankles and feet, could not do so, and the stuff was never quite so totally eliminated in spite of same diet and other related habits…

Anecdotal far damn shore, but just look carefully at other mammals, and it’s very damn clear…

Hope all y’all have a very clearing day,,, definitely part of overall ”happiness.”

(( Apologize Wolf,,, just could not resist )) ,,, for sure I am one of those who follow Oscar Wilde’s mandate/confession,,,

” I can resist anything except temptation.”

At least everything is lower than mid 2022. So we should see some decreases in CPI.

Increases are slowing down which in theory means decelerating inflation rates.

Sure they are still high but at least it is not increasing MOM like in 2022.

Services inflation seems to be lagging goods inflation as people are demanding higher wages ta pay for higher prices for all the goods they have to buy.

Last year the federal gov’t spent $6.5 trillion, but only collected $5 trillion in taxes. Not being political here — that is where your inflation comes from. This is nothing new. It was hidden for decades as it was being offset by outsourcing to lower cost countries. The ukraine war may have changed that permanently.

To get inflation back in the bottle, either DC has to stop borrowing so much money, or the fed has to slow down the economy. I wouldn’t expect any of these ups and downs to be a new trend.

Well put my friend, well put!

Agreed.

The price volatility has less to do with the supply/demand of given commodities (with a handful of exceptions) than it has to do with the supply/demand of the dollars they are (sadly) denominated in.

(Similar “commodity” volatility in Housing Implosion 1.0 since all insiders knew DC is a one-trick Potemkin pony…and that pony is printing/inflation/dilution…so better to hold real assets…thus the price spikes.)

Most people have been bred to focus on the goods…not the measuring stick (which is sorta viewed like a constant…like gravity…which it most certainly aint.)

But it allows the G to perpetually shift blame to the actual *producers* rather than the schmucks controlling the printing press.

great article! that energy shortage panic we had has turned into a energy flood ! ng and oil inflation adjusted sell for less than in 2000! remember the food shortage ?? same as the energy shortage ! brazil and argentina are producing massive amounts of corn/soy beans for world markets

patrick,

This was in Monday’s Farm News out of Grand Forks regarding corn & Argentina:

‘Argentina Outlook Adds Fuel to the Fire’

Farmers Business Network Chief Economist Kevin McNew says there’s a lot of optimism around the corn market. “Between the U.S. dollar strength and transportation struggles, it’s been a struggle in the last year to get corn exported to world buyers.” With transportation hick-ups that plagued 2022 leveling out and export markets gaining interest, McNew says he’ll be looking for solid prices in 2023 for corn. “The other thing is the struggles (third time with that word, Kevin) that Argentina is having with their growing season that could add more fuel to the fire.”

As far as soybeans go, I’ve commented a few times on the huge soy crush plants being built. One of the three in North Dakota will take one-fourth of the state’s harvest this season to produce biodiesel and soy meal, which is used primarily for livestock feed. One would think that the market sees this and has it priced in already, but my guess is that the soy market will see less supply with these plants in operation.

The Inflation Reduction Act recently passed extends the $1 per gallon subsidy on biodiesel. And California’s rules and legislation have created huge demand to have our 18 wheel trucks roll down the road fueled in part by soybeans.

Since Dad and I ran a wheat seed genetics business for 18 years, I’m of the opinion that farms should grow food for people to eat, or perhaps malting barley for a cold beer, eh?

I believe that to see the situation of commodity prices it is necessary to start at least from the year 90.

and look at the trends, it is very surprising what happens after the year 2003

Yep, there was a sudden shift to much higher volatility and prices. Lots of factors in play. In general this is when under investment in supply met emerging market demand.

Corn, soy and hay had bumper crops last harvest here in the northland. The hay is still sitting out in the fields because the farmers can’t sell it. Lumber went skyward due to Covid, the mills were shut down.

Here in Texas there is a shortage of hay due to the 2022 drought. If you can find hay the asking price ($120 per big round bale) is double the normal price. And transportation cost for delivery from up north is prohibitive. This caused a large selloff of cattle last year. Ranchers are feeding out baled corn stalks (mostly from failed corn crops) to attempt to get through winter (mild so far) but corn stalks are low in protein and act more as filler than nutritious. Such is the life of a rancher/farmer.

Sorry to hear that. Cows here are stuffed. Former Dallas resident.

Rare earth metals were discovered in the 1800’s in nordic European countries, they are all over the earth. The problem with mining is that they are associated with radioactive ores. Hence the ban in the US thanks to the EPA and the Sierra Club. And hence the concentration in China and hence the pricing.

Not quite. Albemarle Corporation operates a lithium mine in Silver Peak, Nevada which produces enough lithium to power 80,000 vehicles annually. A large new lithium mine is under development at Thacker Pass, Nevada. It could produce enough lithium for a million vehicles annually. Some Native American tribes and environmental groups currently have it tied up in court but the Biden Administration is in support of the mine.

That’s a good thing, Moi. We’ll tap ours when prices are sky high! Genius!

The Sierra Club is a really goofy club.

A few years ago, they fiercely objected to a recycling facility in Metro East (Illinois across the river from STL).

This is the kind of thing that you would *think* they would support. I forget their brain dead reasoning, but they threw the kitchen sink at it.

The person I know (very well) that worked on the facility permit went to Ohio and toured an existing plant (identical to the proposed Metro East plant).

Garbage comes in one end. Regular everyday garbage. It goes on conveyor belts. The workers have specific items to retrieve. Glass, aluminum, cardboard and so on. Each worker had their own “take home” pile. Many of them fix/clean/whatever and sell their stuff for extra money.

I forget the exact %, but the output was drastically less than the input (much less headed to the landfill). Everything else was recycled one way or another.

Additionally, these unskilled workers had better pay and benefits than they ever dreamed of before.

The recycling company gave up the legal battle with the Sierra Club and the facility was not constructed.

I have no idea what else they do to hurt people and the environment, but I’m not a supporter.

I tie wrap my waste metal, the truck waste guys store the copper in the cab. It’s going to a good cause and I’m happy for it.

A quick Google search leads you to an explanation of their position, and explains that the proposed facility was only about plastic, and was not about any kind of recycling.

Nat Gas price has been clobbered harder than a lot of other commodities.

There is something different going on in the world in AG commodities .In Canada the number 4 exporter of wheat in the world has a government that wants to cut fertilizer use by 30%.Uktaine is number 5 in exports of wheat and how to judge what is happening there.Germany is talking about cutting fertilizer use plus I believe Holland is doing the same.For the first time in history governments are looking at cutting food production.The consequences will be coming but I would not try to trade futures as it will become very political

Crop rotation and letting fields lie fallow for a year are classic and very functional ways of minimizing fertilizers, and they project the soil. But fertilizer companies hate it.

My neighbor, Dr. Anna Cates, works at the University of Minnesota as a soil scientist.

Dr. Cates is getting funding from General Mills, and her current research project is: ‘Implementing Soil Health Practices to Improve Soil Health and Improve Water Quality in the Red River Basin.’

Last year with a very dry mid and late season, we saw a lot of soil erosion.

Protecting the soil is something that has been neglected. A repeat rotation of Roundup-ready corn and beans year after year is a recipe for trouble. Diversity of crops and using cover crops is the way to go.

As a bonus, Anna makes great apple pie from the haralson apple tree in my front yard!

Monoculture is very destructive. I read a book from the 1800’s saying that, rotation and fallow is how it works. All soil studies on the eastern seaboard were completed in 1905. This ain’t news.

As a soil scientist still in the “field”, not the classroom, or research station, it is truly amazing the advances made in agriculture.

Sadly today, fear porn sells. Yes Borg, we are led by idiots who would have a hard time identifying a tractor. Of course it will not be their family that goes without.

Soil is a non-renewable resource. While we can extract more food out of a a given soil there is a cost to it. More than one civilization has fallen because the ground got overtaxed and couldn’t support the grown population anymore.

And countries like Germany, Netherlands or Canada are not only self sufficient for calories they are hughe exporters. The problem is intensive animal farming that produces more nitrogen (piss) than any soil can absorb. The rules in Netherlands and Germany come from elevated nitrogen levels in the groundwater. It has nothing to do with using fertilizer to grow crops.

And I hope you agree that (especially your local) groundwater is a loooot more important than dirt cheap pork. And I’m no vegetarian by any means.

Looking over the pond, there is a hughe looming water crisis in the american west wich gets way to little coverage. At a certain point farmers will need to drastically scale back irrigation. And not only in califonia. Well, I guess the US could just scale back Soy exports and plant-fuels. There’s still a few sqare miles in the amazon which aren’t burned/ logged…

Mother Earth doesn’t understand Political Science and tends to take instructions from the Sun.

http://cdec.water.ca.gov/cgi-progs/products/swccond.pdf

California’s Snow Pack, measured in SWE (Snow Water Equivalent) varies from 140% to 207% of normal at the moment and with the exception of 2 Reservoirs, California’s Reservoirs have been filling up rapidly. The Snow Pack is similar on the Eastern side of the Sierra’s and into the Rockies.

Lake Mead and Lake Powell were created by Government without any consideration for the range of water and snow pack available to the Colorado River.

Toby:

”Soil” is an ABSOLUTELY ‘RENEWABLE” resource, as any and every seriously committed gardener/farmer can testify.

Our ‘last’ farmstead was on a ”rocky top” side hill farm that had been forest for ever before the rancher we bought from bulldozed the trees down into the ”hollar”.

The ”TOP SOIL” Was definitely thin, but we added SO much mulch and natural/local manures from ‘free’ sources, including mostly our own harvesting of lawn and pastures, that within a couple of years, our ”soil” could take a hand thrust down into it at least 12 inches…

And the harvest was very bountiful for the next 10 years as we continued to add, mostly just from mowing.

Folks really need to stop sending ”stuff” to the land fill or incinerator, and apply to their gardens.

I have an ancient valuation index that I pull up every blue moon.

S&P GSCI Total Return CME

Divided by

S&P500

That’s supposed to show you if it’s a good time to buy equities or commodities. My old file from about 2019 came up with a value of 0.92, which indicated a low reading, similar to dotcom crash and 74 oil crisis

Current reading is 0.828

Last May it was at 0.9822

I think that’s indicative of the slow uncertainty and likelihood that equities will remain unattractive

This isn’t advice but just a hallucinating post from a ghost.

Nostradamus

Aljazeera English today had a news clip of rationing fruits & veggies and no Tomatoes because of heat & drought conditions in parts of Europe…..

Got a Tomato chart?

.

Most veggies are very local, cannot be traded fresh on global scale as they’d spoil in transportation. But I can testify that recently Spanish, Moroccan, Italian and Dutch tomatoes are more expensive and at the same time a lot smaller and less tasty due to glasshouses trying to save on natural gas. That may only apply to winter months though as they will likely return to normal operations in the summer.

Nah, thats ust the UK where local farmers have it 100x more difficut due to Brexit. Be it workers, fertilizers, logistics, imports or exports. The nail in the tomato box has been the sky high energy costs which the torys (incompetency sqared) failed to adress. The Tomatos need a lot of energy in the glasshouses in the winter.

Due to brexit imports take longer and that is a bit difficult for fresh fruit.

The pickers here are migrants. They start in South America and work north to Vermont as the seasons change. There is special bunk housing for them. I know that because I had fields in my yard across the canal near the Keys. Berries all go to one brand, look at the packaging and you will see it.

One commodity here stands out like a giraffe in a herd of cows: lithium carbonate. It was down 34% in last year but was up 1500% since 2 years ago. Still a heck of a chart and looks like a hot prospect to go prospecting.

I concluded after reading several of Wolf’s articles that it’s essentially some guy just describing some charts and trying to make some money off of that and unfortunately he made a little money off of me and I regret that immensely. The articles are a colossal waste of time. They don’t really say anything he doesn’t really draw any conclusions he just describes charts which any reasonably intelligent 12th grader can do.

Sometimes I think Wolf is a little rough in his replies. I don’t think I’ll feel that way this time.

LOL, Brian. Adios amigo.

Does Brian wear a wetsuit?

LOL!

Having worked in the media, I can assure you that as in every field, including science, there is a huge amount of recapitulation of data, with however, varying interpretations. Of course, WR, a one- man shop, passes on a lot of stuff on the grape vine, but his interpretation, unlike, say, Cramer’s, has been that of a pretty fundamental bear. It would appear that this view is being vindicated and that anyone who listened a year ago would have profited.

Cramer….. Chief cheerleader of Jamie Dimon and the banksters.

LOL LOL LOL 😂😂🤡🤡

As we say here in the South, “Well bless your heart.”

Nonsense and NO sense AT ALL B..

Due to clarity of articles AND moderation of comments, including mine, Wolfstreet.com is the ONLY blog I continue to support with regular $$s, though admittedly not as much as I would do if not retired on fixed income…

Brian

We use information from Wolf’s charts and articles in our Appraisal business in our reports to justify value and document market trends. The articles are right on the money, accurate and give timely information. They are better than any information gathered from other sources. Your assertion that they are a colossal waste of time is bogus.

Yes – I can’t believe that hot air bag Creamer gets air time at all…..

I like this article for it’s look at minerals like Lithium. A number of weeks ago I watched this video on YT

It predicts how EV And Alternative Energy will quickly outstrip the world’s ability to produce needed minerals, and metals for this transition. Wolf’s chart on Lithium may just be the beginning of what this person talks about in this video. Price increases do correspond to upticks in EV Sales, Look at China.

The conclusion I draw is that I would like to invest in Mining & Development of these new “Transition” materials, for a while anyway,

looks like there could be a great return, but then after it becomes clear that needs will not be met – I think there will be a very serious crash.

Think about today with Catalytic Converter thefts, The converters are worth some big bucks, and they are easy to get to, especially on SUV’s which are pretty high off the ground. (Palladium Something like $1,400./oz.)

Imagine EV’s and the cost of recycled batteries, will easy-to-get-at batteries be robbed from cars 10 years from now because commodity prices will be so high?

For Range to not be an issue they really need to move to a system where batteries are replaceable and instead of charging, for long trips you just drop off your depleted battery & slide in a fully charged one and take off…. So in a way you don’t actually own the battery…. But, this will make theft easier….

Yah, not really owning the battery, just like the tanks for welding gas. You buy it, but then when you need it refilled, you drop it off and take a filled one home, never really seeing the tank you “bought” ever again….

.

A catalytic converter weighs 7bs, a battery pack 1000lbs. A very good ant-theft deterrent

“We’re going to look at a few spectacular wild rides in commodities – but not including crude oil, gasoline, and natural gas which I discuss here separately quite a bit and in greater detail.”

Good to separate them for comment reasons. However, each commodity discussed has a cost component, reliant upon the petro industry, crude, gas, (diesel) and natural gas. Those petro associated costs are significant production and transport costs rolled into their market pricing.

I suspect that the volatility of these commodities is partly, perhaps significantly, due to volatility in petro pricing. Although operating capital loans and credit lines also come into play especially in the farming sector requiring large outlays in planting season and betting it all on a good harvest season. The Fed has seen to inflating those financing costs.

If we are looking for reasons why there are crumpled and collapsed buildings we can’t ignore the earthquake’s shifing ground below our feet….so to speak.

I frequently allude to nonlinear activity related to the pandemic. Looking at long term technical charts for commodities, the last 2+ years have been nothing less than erratic and chaotic, unstable, unpredictable, annoying, destructive, excessively speculative, dangerous.

There’s the possibility that current volatility may be the result of too many retail speculators, being far more active, during the pandemic era, which also gave too many people too much play money to bet with.

Without pointing fingers, it seems as if commodity markets need far more regulation, greater oversight and enforcement. The important consumer-related commodities which are traded (like crypto with excess leverage) shouldn’t be available to reckless speculative forces.

There are volatile periods in inefficient markets when speculation betting can add too much chaos. We literally don’t need systemic accidents unfolding because of absolute stupidity.

Possible fix: Want to buy October grain? You must prove you have the ability to take delivery. No your Mahattan office does not quality.

Yeah, I know, a pipe dream.

Addedendum:

From Iowa State University 2023 corn crop cost planner versus the same planner from 2019, just some of the bottom line input costs per acre and per bushel. Many of these are petro driven.

Then there is mother nature’s impacts over a 90 to 120 day period. Any wonder why some commodities are “volatile” and hard to predict.

Cited costs 2019 vs 2023:

Seed up 10.6%

Nitrogen up 118.4%

Phosphate up 78.6%

Potash up 132.3%

Lime up 52.4%

Crop Ins up 121.1%

Interest Pre harvest variable up 82.5%

Drying LP gas up 139.1

Labor & Land up 27.8%

Total cost per acre up 43.1%

Total cost per bushel up 40.7%

Only an amateur observer here but my guess is for most commondities similar cost inputs exist.