A political decision to solve Japan’s horrid fiscal mess by fueling inflation, and forget that 2% target.

By Wolf Richter for WOLF STREET.

The outgoing boss of the Bank of Japan, Haruhiko Kuroda, and the incoming boss, Kazuo Ueda, sang from the same hymn as the worst inflation figures since 1981 came to light on Friday: This inflation will go away on its own, and we’re going to keep the reckless negative interest-rate and money-printing policies.

Kuroda stakes his entire tenure at the BOJ on these policies and cannot now back off, no matter what inflation does, and inflation is doing it; and Ueda cannot contradict Kuroda. He will become boss in April, and until then, he will sing from the same hymn. Then eventually, there will be a monetary policy review, which will find that these policies worked great but maybe it’s time to adjust them a little. All this will take till the second half of this year, and until then, the BOJ will fuel this inflation with all its might.

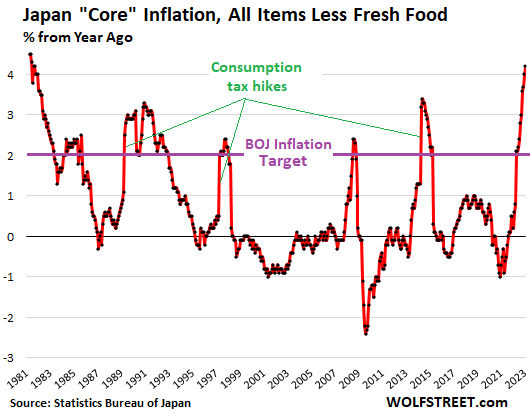

Japan’s “core” Consumer Price Index for all items less fresh food, which the BOJ uses for its 2% inflation targeting, jumped by 4.2% in January from a year ago, the worst rate since 1981, according to data from Japan’s Statistics Bureau today. The index is now more than double the BOJ’s target, having blown past all the prior four spikes, three of which had powered by consumption-tax-hikes. Inflation blew through the BOJ’s inflation target (purple line) in April 2022.

This time, there was no consumption tax hike, but widespread and worsening price increases across a broad range of goods and services as inflation pushes deeper into the economy.

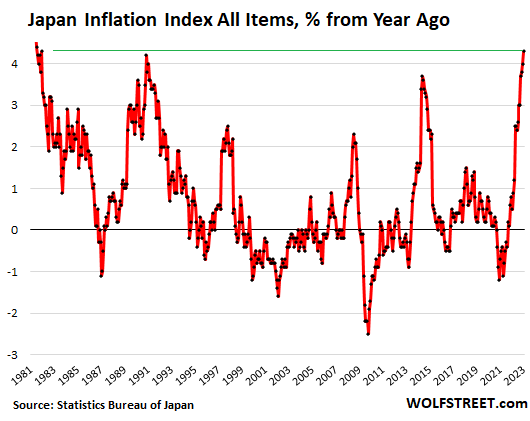

The CPI for all items jumped by 4.3% from a year ago, also the worst inflation since 1981.

On a month-to-month basis, the CPI jumped by 0.5%, the biggest jump since October. In this whole episode of inflation, there are only three month-to-month jumps of 0.5% or more (January 2023, October 2022, and July 2022). There is nothing slowing down about this inflation.

This comes despite the government’s energy assistant program that holds down inflation; and despite large parts of the economy where nearly all aspects of consumer-facing prices are either set or controlled by the government, including the large universal healthcare system, the public transportation system, and education.

Major categories of inflation.

- Food: +7.3%, the worst since 1980. Includes: fresh fish and seafood +17.2%; meats +7.6%; dairy products and eggs +9.5%; vegetables & seaweeds (+3.4%); fruits (+2.7%); beverages (+6.3%).

- Meals outside the home: +5.9%.

- Housing less imputed rent: +4.7%

- Repairs and maintenance: +8.2%

- Household electricity, gas, water, sewage: +14.9%

- Household durable goods: +11.1%

- Communication: +7.1%

- Clothing and footwear: +3.1%

- Services related to clothing: 5.0%.

Governments hold down inflation where they control prices.

- Healthcare inflation: In Japan’s system of universal healthcare, the government largely decides what consumers have to pay:

- Medical care: +0.5%

- Medicines: +1.6%

- Medical supplies and appliances: +1.2%

- Medical services: -0.3%

- Public transportation: +0.6%

- Education: +0.7%

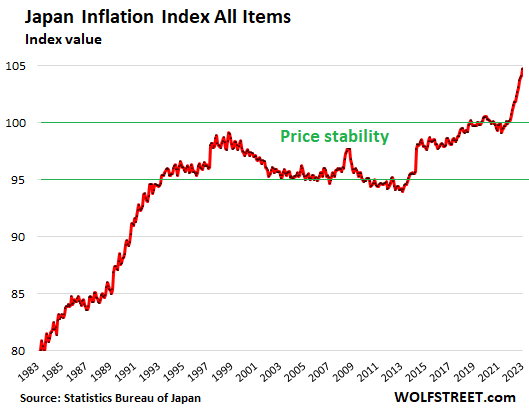

Bye-bye price stability.

Between about 1993 and 2021, the all-items Consumer Price Index has remained in the same narrow range, with some fluctuations in between, with the brief one-off jumps provided by the consumption tax hikes. This was an era where mild inflation and mild deflation followed each other, the era of more or less true price stability, a rare occurrence in modern world. And it’s over.

A political decision to fuel inflation to solve the fiscal mess.

Kuroda, speaking at the G20 event in India, said that he expected inflation to be below 2% for the fiscal year 2023, which starts April 1, and in fiscal 2024. He will be out at the beginning of fiscal 2023, so it’s not his job anymore to bring inflation down to 2% in fiscal 2023 and 2024. He’s ostensibly clinging to the fiction that this inflation is “transitory,” but he can say whatever he wants. It’ll be his successor’s job to deal with it.

His successor will be Kazuo Ueda. But he’s still not in that job, and his confirmation is still pending, so he’s not going to rock the boat before he even gets into it with both feet. He said today that the BOJ’s negative interest rate policy and money-printing is appropriate. And like Kuroda, he still blamed this inflation on supply issues, which is a strategy that even the Fed abandoned a year ago after it got broadsided by it.

One thing is for sure, even under the new leadership, the BOJ will take months to do anything, even just a monetary policy review, and inflation will be fuel further so that it can rage in all its glory.

While inflation is sacking Japanese households, it is also a way to whittle away at Japan’s gigantic and unsustainable fiscal debt.

It is now clear that a political decision has been made to deal with this fiscal mess by letting inflation rage and by in fact fueling this raging inflation – and forget that 2% target.

In all reality, what else could they do? That’s always how this type of crazy fiscal profligacy and money-printing ends: in raging inflation, which solves that fiscal problem in an insidious way, at the expense of households – but it does solve that problem.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Watch the JPY get hammered hard, then have the BOJ throw billions/trillions to sustain it around 150 JPY per USD. At least that will be how it plays until the BOJ gives up on it, and they have a LOT of ammo to chuck at defending the JPY.

The United States Debt to GDP although lower than Japan is still historically very high at around 130% (only at the end of WWII was the debt ratio anywhere near this high).

I wonder if the seemingly very slow US Fed reaction to raise interest rates (that are still way lower than the inflation rate) is also for the same reason as the Japanese.. they want inflation to let-er-rip for a (long?) while to get that GDP-vs-debt ratio down.

There are only 4 ways to reduce debt:

1)Raise taxes and pay down debt

2)Cut spending and use money to pay down debt

3)Grow the economy

4)Print money and deflate the debt with dollars that are now smaller

Politicians are generally unwilling to do (1) and (2), and (3) is quite difficult in a mature economy.

That leaves choice (4).

Yes, it hurts the economy (badly) to have inflation, but perhaps they need to get that debt ratio down at the expense of the general economy (and the middle class) as maybe they see that as a worse problem than inflation?

Just a thought..

Excellent post, Sea Creature

I checked the Federal Reserve Bank of St Louis website and it shows the Debt to GDP ratio at 120.2% as of December 2022. I bring this up not to correct you, but to state that option 4 is effectively working.

It peaked around 135% in mid 2020, so it looks like it may continue to at least reach pre pandemic level of around 107% as we inflate ourselves out of a debt crisis.

It will be interesting to see how debt service fares as a percentage of the US federal budget in the current interest rate environment. Will it get to the point that it will force tax increases and/or spending cuts including another historic reform to social security ?

Inflation is akin to a tax on the working class especially with wage growth not keeping up with housing and food.

One solution to the Federal Reserve’s method of funding the government through inflation might be to not buy anything unnecessary; then take the extra money and buy the historic safe haven of gold or something. Of course the economy will go into stagflation, but that is the government and the Federal Reserve corporations problem.

This morning PCE numbers mean Higher For Longer and trillion$$ plus annual interest payments by the federal Gvt!

Janet will not be happy! Will be hilarious how she tries to spin that sheet show!

The USG will be forced to make hard choices when the DXY really heads south. 70 is the all-time low and presumably the critical level. It’s somewhat above 100 now.

Going much below that risks losing global reserve currency status, regardless that there isn’t an alternative on the horizon. There is no law in economics or money requiring a global reserve currency at all.

Without global reserve currency status, the Empire is toast, as their is no way to pay for it. Those with the most influence will impose whatever REAL austerity (not the fake pretend ones you hear about occasionally) is necessary on the population, with no reservations.

It’s not like they give a hoot anyway.

“The USG will be forced to make hard choices when the DXY really heads south. 70 is the all-time low…”

How is the DXY going to drop to 70 when the Fed is the most hawkish central bank of the six that manage the six currencies in the DXY with the ECB and the BOJ on top? The ECB is at 2.5% and the BOJ at -0.1% NIRP, while the Fed is at 4.75% and going over 5%.

Right now the opposite might be the problem — and it was a problem last year when the dollar became too strong against those currencies (actually, the yen and the euro swooned against the dollar).

But these things go in long cycles, so sure, many years down the road, the DXY might be once again at 70.

Hey Wolf,

I see you have a position on the upcoming Fed action, being; “…while the Fed is at 4.75% and going over 5%.”

I’m not a betting man, but I always seem to calculate odds on everything I can see. I’d bet, (if I was a betting man…) that you are feeling a half-percent increase is coming up…

The only way I myself could see the Euro head higher against the Dollar is if Germany, (finally responding to Newland), says, “f**k the US, they suckered us into a war against Russia, then they went and blew up our pipeline, and now we are for offering Russia real security gaurentees, (against the historic trend of US/NATO encroachments on Russia since end of Cold War), the return of historic Russian lands (read into the history of Eastern, “Ukranine”), and buying as much Russian energy as we can,” which would save German, if not European Industry and business from near extinction, and would turn Germany off the direct path to a fiscal cliff all of Europe is now racing towards.

Our leaders deindustralized and peasantized the US, and are now performing the same service for the EU. But, the bottom line is how many, “old,” (2012-on), Euro Bonds are/were priced far below the pre-inflation (pre 2020) inflation rate? I’d say a continent full…

I can’t calculate the losses accured on those bonds already, and can’t see the damages they have, and are doing to the institutions holding them. Those are not good for the long term value of the Euro.

In the current situation the Euro economies are very, “non-competitive,” even after the, “relaxation,” in energy prices. This coup-driven war has, “backfooted,” the Europeans economically and politically much more than the Russians. And the Russians appear very willing and able to, “wait it out,” despite the brayings of the corporate press.

That potential action, breaking with the US on Russia, would also affect the dollar very negatively, which would drametically affect the DXY, to say the least…

In any case, these potential currency outcomes are dependent on two hard to calculate outcomes. First, the military situation in the field. Meaning the rate at which Russia militairly consumes Ukraine.

I believe defeat in Ukranine will affect the dollar. I feel the Russians will extend this defeat as long as possible to expand and deepen its economic, social, and political consequences to the 3rd world, and especially Europe, and finally, to the US. The second is the political/electoral consequences of the war-driven depravations in Europe.

I believe Germany, at the very least, is going to experience serious political repercussions for allowing itself to be herded into a proxy coup, proxy civil war, and now proxy war in Ukraine, by which the US is clearly driving it and its population into 3rd world poverty.

Well, it’s easy to calculate values/odds on the way up with ultra low interest rates, but a lot harder on their way down, as, “nothing goes to hell in a straight line.” Naw, we are hitting the sides of the hole as we plunge down it…

AD

Once a DEBT to GDP of a country exceeds 90% according to many economists it will become a drag on the economy. May it didn’t matter for ZRP era. NOT going forward. USA national debt is soon 33T if not higher.

No country in human history has prospered by spending debt on debt! May be American Exceptionalism will overcome, right?

=4)Print money and deflate the debt with dollars that are now smaller

common misconception.

if it was so easy there would have been NO hyper inflation in Germany in 20x prev century.

Germany lost ww1 and was forced to pay reparations.

thus they thought ‘ lets print more marks and pay off debt ‘. ONLY PROBLEM IT NEVER worked in history.

lets you are rational person. and Germany owes you 1 bln of debt bonds in d-marks, and you know Germany would print new marks/debt to repay you !

——-

are you going to hold those marks-debt? no!! big fat NO!!

either you will sell d-marks, thus all currency rates against mark are up, and mark is way weaker. THUS INFLATION ( imports, etc)!

or you would buy physical assets nominated in d-marks ( land, gold, coal , etc) thus PRICE of everything tangible is up inside germany!

thus INFLATION IS UP AGAIN!!

alx

ps

guess what happened in Germany?

Inflating away debt works only for for debts denominated in ones own domestic sovereign currency.

Other debts denominated in USD (except for USA), gold, coal, etc cannot be inflated away.

It works for US because the status of RESERVE CURRENCY. Else, I do not foresee the pandemic induces Inflation that ravage around the world will ever happened in the first place. Trillions are magically created during the pandemic years.

While I do not foresee the same episode from repeating itself in the future as the dedollarization force is intensify day by day.

Else, I do not foresee the pandemic induces Inflation that ravage around the world will ever happened in the first place.

——

overall $ nominated assets are about +- $100 trln in world.

fed/USA printed what $ 5 ,6 trl during covid ?

it is nothing.

and it is not like they dumped directly $ 5 tlrn into USA consumer’ hands ?

In a way it did work. The government got rid of their huge domestic debt it gathered to pay for the war. In another way it did work too, ie part of the external debt was written down because especially the US did realize it was unsustainable.

Under the 1919 Treaty of Versailles, Germany’s reparations were set at 132 billion gold marks (US $33 billion), based on pre-WWI foreign exchange rates. So they could not be simply inflated away. Average Germans bore the brunt of the inflation as their savings bought less and less at the store. Highly leveraged industrial companies were able to repay their bonds in increasingly worthless currency. When the Great Depression hit Europe in the early 1930’s, average Germans had little in the way of savings to fall back on. Of course, American politicians don’t run for office based on what happened in Germany 70 or 80 years ago.

Germany only ended up paying about ℳ20 billion.

Yep. During inflationary times, debt can be good if applied correctly.

Not sure but about the only way a consumer can leverage debt is to buy a house as inflation protection.

Right now, if someone bought a home from 2010 up to 2020 might turn out to be a smart move if the FED cannot get under control.

They didn’t hyperinflate to offset the reparations to foreign powers, which were paid in gold or in kind.

They hyperinflated to wipe out the real value of the war bonds that had been purchased by millions of people in Germany. Some of those purchases had been mandatory during the war.

The hyperinflation had major distributional effects in Germany. The lower middle class got hit the hardest. Because of the tie to the war bonds issue, the hyperinflation felt like even more of a betrayal than most other currency debasements.

The stench of betrayal, of quick-and-dirty politics of the most disreputable kind, hung over the Weimar regime, which lurched from one emergency decree to the next, until its ignominious and unlamented death a few years later.

Of course, then came the next slouching beast…

The financial system of most countries of the world is based on creating money from nothing , called credit. Usually the banks are allowed to do that to increase the money supply in a growing economy, directed by the central banks. The central banks are supposed to be independant of the government . But the last stop ,or where the Buck stops or is created ,is the government ,which really means everybody.

The most convenient way to reduce government debt,is through inflation.

At least in theory. Everybody becomes a little poorer.

So ,basically all 4 things you mention are usually done,with varying success.

“At least in theory. Everybody becomes a little poorer.”

Except that this time there is so much debt that is also someone else’s “wealth”, practically everyone is destined to become poorer or a lot poorer.

The excesses didn’t start with the pandemic or even GFC. That’s when fiscal and monetary policy went completely “off the rails” but it was hardly “normal” prior to that.

So, this debt which is someone else’s “wealth” will get debased while on top of it, the asset mania will implode gutting net worth while credit standards flip from the loosest in history to at least something resembling normality, at minimum the early 80’s but eventually probably stricter than that.

The idea that resolving these distortions only requires a “little spot of bother” much less a “soft landing” is a complete myth.

No that’s not the way it works. It works based on created new assets, debt is just another asset as is a new house or widget or service provision company. The wealth of the economy expands based on the size and valuation of assets and the size of the economy expands based on the trading of these assets i.e. GDP. You can see this reflected in concepts on the stock exchange i.e. P/E ratio.

Or choice 5) which is taxing the enormous 506 trillion yen cash holdings by corporate japan (~5 trillion USD), which is way higher than anywhere else. Its already been mooted by the government as a tax to pay for defence, on the grounds that japan defence is effectively defending the corporates.

I see this as quite likely because there is so much cash available to be potentially spent its hard to see what else they can do, because 4) seems like it would be extremely inflationary when the population and corporates wake up, and the Japanese have now without doubt become aware of inflation.

Or 6) sell off the 1 trillion USD treasury holdings.

However, Japan has a low (by UK standards) consumption tax that they could increase to raise taxes.

Additionally they -could- still cut wasteful spending, but won’t because the place is corrupt. My experience is Sapporo in Hokkaido, where they are just completing a new bridge over the central river, despite there being no congestion on the already plentiful supply of bridges, and also going forward a reducing number of cars. Also the shinkansen line is going through to Sapporo even with the costs of tunnelling and building the line through the city to the end station, even though it can’t compete with flights if it were to attempt to cover costs.

Japanese people were thrilled at the late 80’s market crash. The rapid deflation cut the price of their lunch in half. The Nikkai has not recovered anywhere near it’s 40K top back then and has hovered between 8k and 20k, that’s over thirty years.

Sea Creature

“but perhaps they need to get that debt ratio down”

Why?

So they can do the entire irresponsible thing once again?

That’s not how it works, IMO. You cannot inflate the debt away while you are continually loading on the new debt at a ever higher borrowing cost and “raising the debt ceiling”. That’s ludicrous. Trying to outrun the inflation with more borrowing. It’s “Martingale system” in essence, and if you’ve ever played the Black Jack, you know that it doesn’t work since there are bet limits for each table.

5. Debt Jubilee. Worked for literally centuries in the past. Of course the oligarchs and mercantilists will never allow it. Totally forbidden to even mention it. Let the proles eat cake.

People who say that don’t understand how the modern financial system works. EVERY debt is someone else’s asset. A debt jubilee destroys those assets. No more bank account, no more paycheck, no more insurance of any kind, no more grocery store, no more internet, no more WOLF STREET, no more commenting, no more supply of goods… return to the barter society.

However, we have a process to relieve/forgive specific debts on a case-by-case basis. The process is called “debt restructuring,” and it usually takes place in bankruptcy court.

Commenters abusing my site to promote debt jubilees are treated the same as commenters promoting MMT: comments are auto-sent to the shredder.

He’s clueless.

Wolf

““debt restructuring,” and it usually takes place in bankruptcy court’

Does this save the Economy and or the markets/asset bubbles? I mean in a meaningful way?

May be a very slow car crash!?

It removes debts that cannot be paid in kind of a fair or at least systematic way. Debt that can be paid isn’t a problem, and will be paid.

Debt is a form of capital (debt capital). The other form of capital is equity (equity capital). Companies need capital to invest and grow. Both have their advantages and disadvantages. It’s important to have the right balance as to how much of each type of capital a company should use.

In a debt restructuring, the equity capital typically gets wiped out, and the debt holders get the restructured company (the new equity).

It might work if people know it’s coming. You can’t just implement it after loans are made without the expectation of a debt jubilee.

We need to stop fighting deflation – EVER. The tech industry is in a constant state of deflation and is the most productive and dynamic industry imaginable. Deflation is bad for unproductive companies (and just plan greedy people) and great for consumers and society. Dont listen to the malarky by economists about deflation pushing off consumption. That is a GOOD THING. People consume way more than they need to consume of frivolous things. Deflation wont cause people to put off necessary purchases, only purchases that really are not important.

Deflation will absolutely increase productivity gains and that is what drives an economy.

If you want your people to be productive, dont shackle them with an economy that is frozen in time. Let the markets find true valuations. But also, heavily regulate financial players and enforce those regulations because financial players will always try to game the market in a way that makes them short term profits and pushes the future losses on others. (like giving massive bonuses and then letting the toxic assets fail on a future generation).

The central bankers should liquidate ALL assets on their balance sheets to stop the distortion of markets. We should allow the economy to sink into recession or even depression, because it will weed out unhealthy companies and unproductive employees. We should reign in the financial industries – private equity, investment banking, credit card companies, etc.

I’m not at all against capitalism, but tired of the game being rigged for billionaires who have created monopolies and duopolies across our whole economy.

gametv

;We should reign in the financial industries – private equity, investment banking, credit card companies, etc’

LOL!

They own the Congress, the President and the Country. Oligarchy via Corporatocracy.

Remember in 2014 SCOTUS with 5-4 ruled that a Corporation is a citizen and the MONEY is Free Speech!

…remembering that 2014 decision, seems to me they should be registering for the draft…

may we all find a better day.

Having watched Debt/GDP over the years especially Japan at 350% it occurs to me that countries simply don’t care. Number 4 wins handsdown. They inflate it away. Good thought.

Andrew Jackson ran the National Debt down to $35,000.

Does anyone know of an elegant analysis that demonstrates that the amount of repayment of national debt derives from the amount of theft of purchasing power from the powerless citizenry, via “inflation?”

I’m from Brazil and here there were a lot of studies about it. At the worst, hyperinflationary times, it amounted to the equivalent of a ~5% GDP budget surplus (as the nominal budget deficit in Brazil was higher, it just made the “real” deficit grown slower. The best, more didatic works were those of economist Fabio Giambiagi.

But then, Brazilian economy was highly inflation indexed, with contracts, salaries and taxes automatic reajusted for inflation. On a more normal, nominal indexed economy, the outcome would be that of Weimar Germany.

I visited Brazil twice, in late 1992 and earlier 1993.

The last time I was there, monthly inflation was purportedly 30% or 40% and my employer’s joint venture with a local credit card issuer charged real interest rates of 10% PER MONTH. Credit limits were typically the equivalent of a few hundred dollars.

Living standards in any developed country can never sustain anything like that, as the population is far too dependent upon cheap borrowing and loose credit standards.

Borrowing with at high “real” rates the way Americans typically use credit will compound you into insolvency in no time.

It has bettered a lot now that we have only 6% inflation yearly. But the nominal rates for credit card debt here are presently at 400% yearly, or 15,4% per month.

it is all indicators of nominal growth in prices. doesn’t make much sense for real life for avg person.

——–

lets say prices are up 10% but avg income up by 20 %. so it is all good!

lets say prices are down 10%, but avg income is down 20%. it is bad for avg person!!

——-

PEOPLE FORGET simple chart from 101 economics all the time

it is called supply-demand.

supply is ‘goods’. demand is ability to pay for goods aka salary=income.

if half of country is unemployed no matter what prices are up or down. demand doesn’t exist!

——

MOST IMPORTANT INDICATOR is purchasing power aka how much

physical stuff you (avg person) can buy for avg salary in particular country.

and that is just half of picture !!!

cause we live in debt based monetary system, thus gov and=or elected persons always seek ways to give away income to boost demand to get re-elected.

so those CPI and stuff is just small detail in big picture of real life on planet Earth,

alx

The example holds only if you assume people live paycheck-to-paycheck.

But what about savings?

If you bought 30 year zero coupon US Treasury bonds back in 1982, your yield to maturity would have been about 15 or 16% and you would come out very well after inflation. But investors who bought similar bonds in 2020 can expect to come out much worse, as long term bond yields had dropped considerably by 2020.

It would seem the trick is to buy long term bonds when interest rates are relatively high. Of course nobody knows for sure when that is.

I’m in Japan right now and as a Canadian, I’m like a pig in sh*t. The yen is on par and the prices here are MUCH lower than in Vancouver. (i.e restaurants, groceries and general products such as a bicycle and helmet I bought for the month I’m here. *would have been 25% more in canafa)

Gas is also less in Japan (160¥/L) than Vancouver when I left ($1.85/L)

Anyhow, I’m sure most of the Japanese get paid horribly, but great if you want to visit.

It all depends on where it is in Japan, there are big differences from city to city in Japan.

速度を落とすと速くなります

That’s what she said!

“Slow down and go faster”?

… or, as my Norse grandma used to say: “…the hurrider I go, the behinder I get…”.

may we all find a better day.

Japan looking good compared to America, Europe and Britain!

Japan is just somewhat behind, and the government controls some big parts of the pricing system, such as healthcare.

My Norse relatives used to say “Uff da!”

:-)

Whoops, I meant for that last message to go to @91B20 1stCav (AUS)

Repost it in the correct place, and I’ll delete this.

McQueen’s Ghost – ja, that too…

may we all find a better day.

Japan is looking like Turkey. That’s not something to brag about.

To save costs, BASF is closing a number of energy-intensive factories, including two ammonia plants and related fertilizer facilities, resulting in 700 job cuts at its main Ludwigshafen plant in Germany. Many other fertilizer plants have shuttered across the EU and Britain. Soils around the world are nutrient depleted and will only yield crops of any significance with copious amounts of fertilizer!

The days of cheap food and energy for the West are in the rear view mirror!

Like I said earlier: Crop rotation and letting fields lie fallow for a year are classic and very functional ways of minimizing fertilizers, and they project the soil. But fertilizer companies hate it.

If that was fiscally prudent for farmers they wouldn’t need any fertilizers! Ever wonder why organic produce is 2 to 3 rimes more expensive? So less planting and planting of $$$ losing crops means less necessary crops and higher prices! Farmers aren’t planting…drumroll…cause they can’t afford fertilizers!

We’re not talking about “organic” but conservative soil management practices that usually include some fertilizer but a lot less. Plenty of farmers are doing it.

This fearmongering about fertilizers is getting very old. But I understand that’s your schtick: for years, you’ve been trying to post comments here that say that the dollar is going to collapse, the US is going to collapse, the West is going to collapse, that the food supply is going to collapse… FYI, I delete most of this BS.

I spent many summers helping out on my Uncle’s farm in South Dakota. They always rotated crops (at least when I was there in the 1970s). They were paid by the government to set aside some land fallow, but I think that was for reasons other than the health of the land.

Just out of curiosity, if you leave depleted soil fallow how does it get repleted?(I know it says to do so every 7 years in the Bible)

Savings ha I’m debt free have been for two decades and the ZIRP did nothing for me other than inflate my salary . Once I retired the ZIRP and now reversal has eroded my middle class lifestyle permanently. I feel very poor but am blessed with peace of mind . I’m not that poor because I could go to work . However I had perfect health but now am 65 had problems are cropping up the fact of life about aging .

Fed should sell MBS to do more QT. Japan will have to deal with it.

If they sell, they will have to take a loss (likely) and thus will not be able to stuff it into the “special asset” category.

I would like to see more discussion on the paper losses now at the Fed.

I only heard that there was a footnote in a Fed report that suggested the paper losses well exceed $1 Trillion.

This makes clear why for decades the Fed did not accumulate long term paper, for they would get into a box of having to raise rates with a big portfolio of long term paper.

LS, About the “paper losses,” Wolf has talked about this before, for instance towards the end of this article: https://wolfstreet.com/2023/02/02/feds-balance-sheet-drops-by-532-billion-from-peak-cumulative-loss-reaches-27-billion-february-update-on-qt/

fascinating stuff!

Steve

That article ( I saw it when posted) deals more with cashflows. I am referring to the “marked to market” (if the Fed ever did this) of their portfolio.

What happens to the actual value of all the Treasuries and all the MBSs held by the Fed? As I said, smart people have said the unrealized losses are now over $1 Trillion as noted by a foot note to a Fed financial report (I have not seen it and can’t find it)

Maybe Wolf can.

longstreet,

“I am referring to the “marked to market” (if the Fed ever did this) of their portfolio.”

The Fed marked to market the securities that were traded in the stock market, such as the bond ETFs it bought in 2020. I reported on it at the time. It sold those in late 2021 at a profit.

Since it doesn’t hold Treasury securities for sale, but intends to hold them to maturity, it doesn’t mark them to market. It has always done it that way. It never sold any Treasurys. So it doesn’t mark them to market because market is irrelevant if you hold them to maturity.

If it marked them to market, the Fed would have shown HUUUUGE GAINS on its portfolio through 2020. Somehow, no one bothered to be angry about this at that time, or demanded that it marks to market to show those gains. LOL

But now that it would be giving up some of those paper gains, suddenly there is all this clamoring for mark-to-market. It’s nuts.

I don’t mark my Treasury securities and CDs and I-bonds to market either. Market is irrelevant if you don’t intend to sell. That’s how bonds are different from stocks: You know what you get at the end.

Wolf has addressed it in previous articles, but ultimately it comes down to who cares? The Fed is a central bank (more so it is the central bank of the US dollar), not a for-profit entity. They can carry an unrecognized loss around for 5 to 10 years and amortize it slowly with gains later on. Does this change anything? I would rather have the loss than the asset, if I had to choose between the two.

I’m sorry. I guess I didnt make myself clear.

But in an article written in May of 2022, it was said

“Bill Nelson, chief economist at the Bank Policy Institute, said that adjusting for the appreciation in its assets the Fed had seen through the end of last year (2021), the unrealized losses were an even larger $458 billion.”

Note the date…..that was May of 2022.

And yes, I understand they made a bunch of money on the way up. But how much value lost in the past 12 months is an interesting question , I believe.

I fully understand about not worrying about short term Treasury values. It is the long portfolio of which I am curious, which I think is around $5 Trillion. (ten yr or more)

Shocking that Central Bankers would ignore the mandates and instructions under which they are allowed to exist.

This all started (ZIRP) with the BOJ 23 years ago…with the guidance of “economists” like Krugman.

The MMT train of thought…..fight inflation with higher taxes, which further punishes people and businesses attempting to cope with inflation, and send that money to the government which will grow larger and spend to feed further inflation.

Hmmm didn’t Wolf mention in the article that Japan had a really really long period of stable prices up until last year? I mean there could be hell to pay for how they achieved it but you cannot say that prices were unstable until recently.

I read an article yesterday that they are pressuring large firms (Toyota, etc) to give raises above inflation. So it would appear that they are actively throwing gasoline on the fire. Should be interesting.

And I thought Turkey’s economic policies were a basket case.

Re: he will sing from the same hymn

These hymn worship books are ancient and everybody knows the same traditional songs — that solidarity and community building brings about social cohesion — it’s the glue that binds everything in the casino together.

The shame in not accepting dogma might create chaos and discord, versus being able to bath in the holy waters. Are we seriously going to allow a witch-hunt and humiliate our revered economic priests and then allow some aliens with AI to lord over our tribe?

I say sing from the hymn books as loud as your voices are able and heed not the paralysis of being tone deaf.

At the same time, Japan is facing the cost of military build-up as the Chinese giant shadow looms ever darker. Japan is also North Korea’s favorite target. Not a cheap comfortable location on the map.

All true, but lets not forget that China and North Korea have huge problems of their own right now.

It is a fascinating moment to see some real inflation come into markets long dormant. On the other hand, the Yen is merely back to 1996 levels versus the dollar.

So they will now lead the slide into the abyss. All I note was the last article showed a huge spike up in commodities, followed by a crash in most of them. I would note the metals markets seem to be predicting regime change in Russia and a subsequent peace in Ukraine with commodities shortages a thing of the past.

I don’t see that, but the silver price of sub $21 this morning does. And natty gas, and oil, and copper sub $4. This spike has passed for now. The real long term question is how finance with real interest rates influences the real economy. Like house building. Like production lines. And yeah, wages for everything.

A very interesting time awaits, with huge imbalances to be worked out. In the west, and Japan, let alone in China. The world’s biggest country is vainly engaged in a territorial expansion into a former vassal state? Nuts.

The biggest question is what are the terms of trade going to be in 20 years? Tell me that, and I will tell you who is in charge of the global economy.

Ultimately, in a world of 8 billion people, who gets fed on a regular basis will do more to predict outcomes than who gets a cell phone.

Someday this war’s gonna end…

The Fed has no control over supply and is not exercising its limited control over demand.

Are you joking? What do you think monetization of the debt means? It means they are printing trillions of dollars to buy bonds. But what the Fed and the other CB’s are working like mad 24/7 behind the scenes is to impose central bank digital currency(CBDC) that will 1. save the forests and 2. Enable the imposition of NIRP because everyone will now be like fish in the barrel unable to escape (whereas once upon a time you could just stuff your cash in the mattress if they were not only not paying any interest but threatening to charge you for saving with them). As for not exercising its limited control over demand, you mean not raising interest rates fast enough? The banks that own the Fed are charging their cardholders 20-30% APR

Speaking of inflation, that PCE price index release today was a doozy.

There are inflation targets, and there are actual inflation results. If central banks continually avoid recessions by printing money whenever times get tough, how will inflation ever be close to target? There will be permanent price step-ups every few years, which are never targeted or communicated.

If central banks really wanted to stick to their inflation targets, they’d target deflation after periods of very high inflation. Of course, they are not doing that. They only seek to reduce the rate of inflation. Evidence is showing they want to pile small price increases onto large price increases, as part of an artificial stimulus policy that permanently avoids recessions and increases prices through big and small steps.

Until central banks raise rates into an actual recession and allow some deflation to occur, a person should plan based on actual 3-6% inflation results over time.

LOL. All of this chatter about debts, and inflation.

But nobody brought up bankruptcy to clear away debts that can not be repaid. How much of that debt would exist if the 1% paid the tax rate that was collected 70 years ago?

Japanese economy is wild, yet again. The stuff their central bank can get away with is impressive.

Random thought — any chance that Japan is crazy as a fox and deliberately tanking their currency because of a globalization reshuffle, or are the efficiency idiots putting their money back into the China trap?

If you’re a Japanese importer, you wouldnt think them so smart.

In the ’90’s, President Clinton sent a team of economists to Japan to recommend the economic policies that Japan has been implementing. At the time I thought it was strange because the Clinton administration was not following these policies themselves. Everyone has forgotten this, but I haven’t.