QT is starting to make a visible dent.

By Wolf Richter for WOLF STREET.

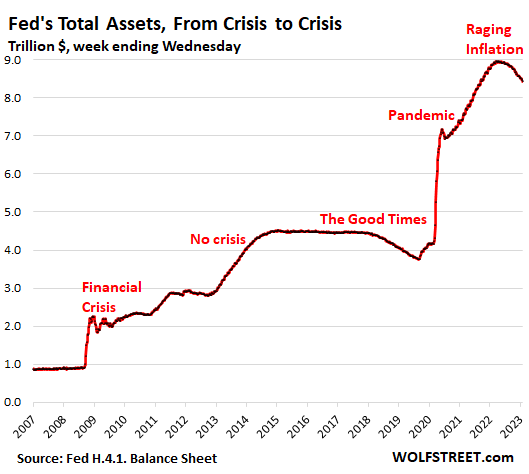

The Federal Reserve has shed $532 billion in assets since the peak in April, with total assets falling to $8.43 trillion, the lowest since September 2021, according to the weekly balance sheet released today. Compared to the balance sheet a month ago (released January 5), total assets dropped by $74 billion.

Quantitative Tightening is starting to make a visible dent:

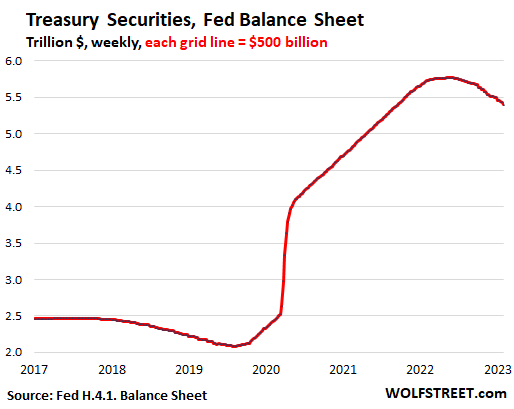

Treasury securities: -$374 billion from peak.

Since the peak in early June, the Fed’s Treasury holdings fell by $374 billion to $5.34 trillion, the lowest since September, 2021. Over the past month, the Fed’s holdings of Treasury securities fell by $60.4 billion, a hair above the cap of $60 billion.

Treasury notes and bonds come off the balance sheet when they mature mid-month and at the end of the month, which is when the Fed gets paid face value for them. The monthly roll-off is capped at $60 billion.

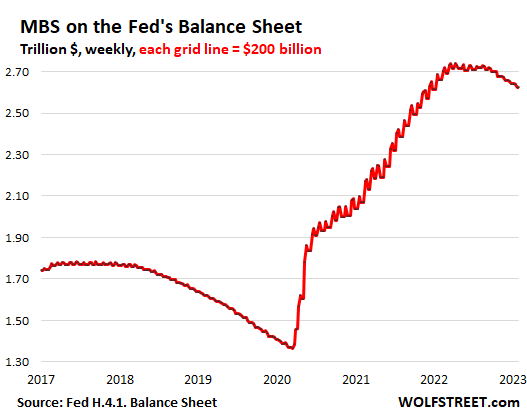

Mortgage-backed securities: -$115 billion from peak.

The Fed has shed $115 billion of MBS since the peak, including $17 billion over the past month, with the total balance dropping to $2.62 trillion.

Each month since QT started, the total amount in MBS that came off the balance sheet was well below the cap of $35 billion.

MBS come off the balance sheet primarily as a function of the pass-through principal payments that all holders receive when mortgages are paid off, such as when mortgages are refinanced or when mortgaged homes are sold, and as regular mortgage payments are made.

As mortgage rates have spiked from 3% to over 6%, people are still making their mortgage payments, but mortgage refi volume has collapsed and home sales have plunged, and the torrent of pass-through principal payments has fizzled.

Pass-through principal payments reduce the MBS balances, which show up as the downward zigs in the chart below.

The upward zags in the chart occurred back when the Fed was still buying MBS, but it stopped this sordid practice entirely in mid-September, and the upward zags in the chart petered out.

Selling MBS outright?

We’re still waiting for the Fed to give any indication that it is seriously considering selling MBS outright to bring the roll-off up to the cap of $35 billion a month. At the current rate, it would have to sell $15 billion to $20 billion a month to get to the cap. Several Fed governors have mentioned that the Fed might eventually move in this direction.

Note in the chart above that in 2019 and 2020, MBS rolled off the balance sheet at the pace of the cap as dropping mortgage rates caused refis and home sales to surge. QT-1 ended in July 2019, but MBS continued to roll off through February 2020, and the Fed replaced them with Treasury securities, whose balance began to rise again in August 2019, as you saw in the prior chart.

The Fed has said many times that it doesn’t like to have MBS on its balance sheet, in part because the cashflows are so unpredictable and uneven, which complicates monetary policy, and in part because holding MBS gives preference to one type of private-sector debt (housing debt) over other types of private-sector debt. This is why we may see some serious discussions soon about selling MBS outright.

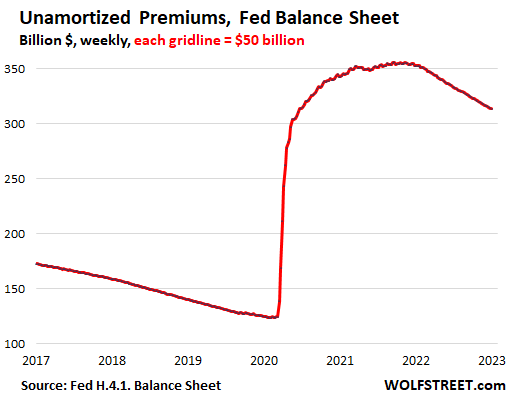

Unamortized Premiums: -$45 billion from peak.

Unamortized premiums dropped by $3 billion for the month and were down by $45 billion from the peak in November 2021, to $311 billion.

What is this? The securities that the Fed bought in the secondary market, at a time when market yields were lower than the coupon interest of the securities, the Fed, like everyone else, had to pay a “premium” over face value. But when the bond matures, the Fed, like everyone else, gets paid face value. In other words, in return for the above-market coupon interest payments, there will be a capital loss in the amount of the premium when the bond matures.

Instead of booking the capital loss when the bond matures, the Fed amortizes the premium in small increments every week over the life of the bonds. The Fed accounts for the remaining premiums in a separate account.

Keeping an eye on potential warning signs.

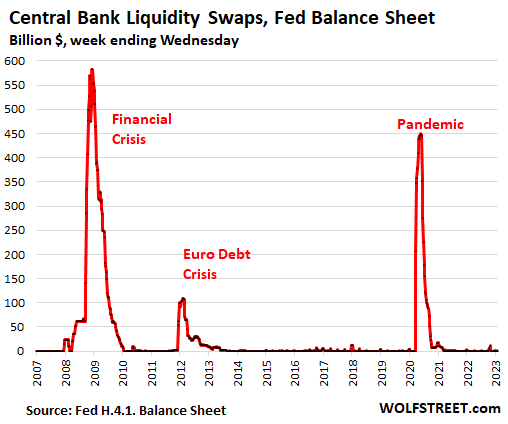

Central Bank Liquidity Swaps.The Fed has long had swap lines with major other central banks, where that central bank can swap local currency for US dollars with the Fed, via swaps that mature over a certain time period, such as seven days, at which point the Fed gets its dollars back and the other central bank gets its currency back. There are currently only $427 million (with an M) in swaps outstanding:

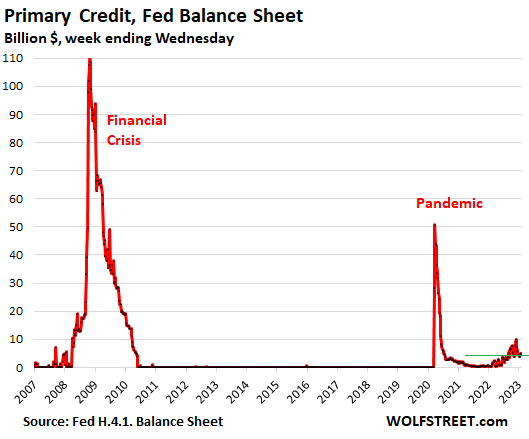

“Primary Credit” – the Discount Window. The Fed lends money to the banks at the “Discount Window,” for which it charges banks 4.75% in interest, following the rate hike yesterday. So this is expensive money for the banks. They could borrow money for much less if they can attract depositors. So having to borrow at the discount window at this high rate would cause eyebrows to be raised.

About a year ago, Primary Credit started rippling higher just a little, and at the end of November 2021 hit a still small $10 billion. In mid-January, the New York Fed published a blog post, “The Recent Rise in Discount Window Borrowing.” It didn’t name names, but surmised that mostly small banks were coming to the discount window, and that quantitative tightening may have temporarily reduced their liquidity positions.

But borrowing at the Discount Window has dropped off since November, and today the balance was $4.7 billion. Just keeping an eye on it:

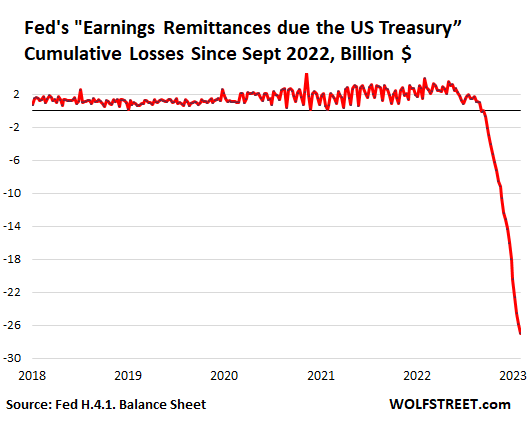

The Fed’s cumulative losses.

The Fed’s vast securities holdings are usually a money-making machine. And they still are, but last year, it started paying much higher interest – as it began hiking rates – on the cash that banks deposit at the Fed (“reserves”) and on the cash that mostly Treasury money market funds send the Fed via overnight reverse repurchase agreements (RRPs). Since September, the Fed started paying out more in interest on reserves and RRPs than it was making in interest on its securities.

From September through December 31, the Fed lost $18.8 billion, but it had made $78 billion from January through August, and so for the year as a whole, it still had a net income of $58.4 billion. Last month, it reported that it remitted its income through August of $78 billion to the US Treasury, which the Fed is require to do.

Those remittances stopped with the losses starting in September. The Fed tracks those losses weekly in an account, called “Earnings remittances due to the U.S. Treasury.”

The cumulative losses since September reached $27 billion on the current balance sheet.

But don’t worry. The Fed creates its own money and can never run out of money, and can never go bankrupt, and how to deal with these losses is just an accounting question. It solved the question by treating the losses like a deferred asset and putting it in the liability account, “Earnings remittances due to the U.S. Treasury.”

With the losses squared away in the liability account, the Total Capital account has remained unchanged at roughly $41 billion. In other words, the losses will not deplete Fed’s capital.

Funniest looking account — in more than one way — on the Fed’s balance sheet:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

So about $3,5 trillion to go. Actually, I don’t mean to sound sarcastic or cynical. They’ve exceeded my admittedly weak expectations from a year ago.

A journey of a thousand miles begins with a single step. Lao Tzu

Sure…but it wasn’t 6 trillion miles.

More broadly, does that total “asset” chart really suggest anything resembling competence or control over the US economy or events?

Creating inflation (ratio of “money” to real assets) to “fix” disasters created earlier (and successively) is not a trendline to success, it is a record of pathology.

you had very low expectations. with the stock market recovering most of the losses and once again becoming a giant bubble, you would think they would want to reduce the balance sheet at a faster pace, but i guess the problem here is that they cant sell off the balance sheet without incurring losses. so the Fed must first crush inflation and bring interest rates back down and then liquidate the balance sheet at a faster clip.

it is my theory that the Fed is willing to raise interest rates to kill off inflation, because that hurts the real economy, but it is not willing to sell off assets because that would remove the support from the markets and thus it would hurt the pockets of all their rich friends. after all, the Fed is just a bunch of bankers. they dont care about anyone but themselves.

I don’t agree with your theory, at least in its stronger forms, but it poses an interesting puzzle. As in a casino, the house must allow some value to be captured by players. The house has the power to grab all value, but that would end the game. The Fed, to me, is not as ruthlessly self-interested as a clique of bankers, as all that. I as a nobody not in the club, have captured plenty of value from this system of credit and money, across multiple decades and situations.

The Quantitative Tightening (QT) of MBS is so slow that it allows an indirect stimulus because money that would be holding MBS is free for providing mortgages or outright purchases.

It’s not an “indirect stimulus.” It’s just tightening at a slower pace. But it’s still tightening.

It seems like everyone is looking for some excuse to lose money by going long in a bear market. This might be a good time to read again the book “Reminiscences of a Stock Operator” by the nom de plume Edwin Lefevre who was actually Jesse Livermore, a plunger. Nothing has changed. The stock market is exactly the same.

It is appropriate to now paraphrase Livermore:

What I see now is a pile of gold coins, a shovel, and a wagon with Harry Houndstooth Hauling Company painted on the sides.

Short the markets with reckless abandon. This is the rally we were expecting and it is time to step on the gas.

SQQQ peaked, SRTY is peaking, SPXU also and SDOW is finally realizing (like Wile E. Coyote stepping off the cliff) the big leg down is just in front of us.

If the markets go higher short more.

Algorythmic trading has become very sophisticated, able to go after both the long and short stops. They use the rolling sells and buys coming in at the speed of light to determine where they can push the market to cause the most pain to average investors.

For example the stop runs on the bankrupt companies of the most shorted stocks, running every moving average, fibornicci, volume weighted average etc…

The people owning these algorythmic trading businesses are an elite group with the potential to monopolize and collude a large portion of the market.

This is one of the reasons that this bear market will go on for a long time.

It is too bad the fed. reserve couldn’t get some strong software that considers all the economic variables (like above) crunches the numbers for various inputs/time slots to accomplish its goals -like 2% inflation. The alogrithim would probably crash trying how to accomplish that in a year

No holdings long or short. Had a position in gold but sold too soon December 28th 2022. If I go short I’ll post it as a warning to short sellers.

I expect the CPI to be marginally higher month over month January compared to December in America. In Canada month over month the CPI to be a lot higher January compared to December. I would have got killed as I would had gone heavy short at the start of January due to the increase in the CPI figures month over month.

Harry,

Totally agree. And love that book. Having sold all Tesla puts in Dec, i even bought couple of tesla calls for a rebound. Now

Buying puts again for Sept/Jan – Nvidia, Apple, Msft, etc.

Hoping the next leg is sharper and longer like in other bear markets.

“I sold all I can. And then the stocks rallied again, to quite a high level. It cleaned me out. There I was, right and busted.”

Btw, Edwin Lefevre was a real writer and columnist. He interviewed Jesse Livermore, and wrote the book from interviews. Livermore had another book he wrote himself, cant remeber the name now. He was not profesional writer of course and it shows.

Wolf,

Do you expect to witness a massive spike in the “Discount Window” by years end.

I’ve listened to a few talks including Lacy Hunt which seems to indicate that may very well be the case.

TIA.

I don’t expect that. Banks are now trying to attract more deposits and are raising their offerings, especially by selling brokered CDs to new customers, rather than offering higher rates to existing customers (they’re still paying the loyalty tax). Banks have plenty of time to ramp up this type of wholesale funding, and they’re doing it. I see it in my brokerage account, when I look at the offerings of brokered CDs, with rates of 4.5% to 5%. Banks are competing for deposits now. There is a lot of money in money market funds, and if the banks offer higher rates, they’re going to cause some cash to shift from money market funds into CDs and savings accounts. Banks are loathe to do that because it raises their costs of funding, and pressures their profit margins, but they’re doing it.

Pulling on one end of a 200ft rope folded in half by 10ft is not tightening.

You people are funny, LOL

“We’re still waiting for the Fed to give any indication that it is seriously considering selling MBS outright to bring the roll-off up to the cap of $35 billion a month. At the current rate, it would have to sell $15 billion to $20 billion a month to get to the cap. Several Fed governors have mentioned that the Fed might eventually move in this direction.”

As much as I despise Pow Pow, if they manage to start doing this, I will give credit where credit is due. Hopefully this will really have an effect on bringing down home prices and speed up the current rate of price drop. Question is, why are they waiting so long to even start? Couldn’t the FED start selling MBS, maybe at smaller amount at the same time QT started? I understand they are letting it roll off but if they truly don’t like having MBS on their books, you would think rolling off + selling at the same time would be a better solution.

Phoenix_Ikki, I’m having a difficult time finding out how much MBS the Fed owned prior to 2006-2009. Did the Fed own any? And if the Fed at any time in the past did not own any MBS, and the mortgage market was doing fine, why would the Fed now selling its MBS have a deleterious effect on mortgage rates and the housing market?

The Fed bought MBS for the first time ever in February 2009.

Fed never bought them any time before since 1913 until ’09

They favored the Housing debt over the others, which is NOT in the mandate. They also bought Corp/Junk bonds, though minimal, also NOT in the mandate. Neither is ‘suspending mkt to mkt accounting standard.

They are adding ‘new mandates, willy-nilly without Congressional approval. As long their portfolio is getting fattened (Pelosi- insider trading) no one cares. Whole scale day light robbery with the active assistance of Fed.

No wonder why we are here, now

Fed bought RMBS to prop up housing market after 2007 crash, even though that is not their mandate. Fed has decided housing market is on its own going forward, and if buyers foolishly inflated house prices, then the market will correct itself.

The point you would like to focus on is the 4% long-term appreciation trend line for housing. When house prices caught up to the trend line in 2018/19, Fed started getting out of RMBS. Covid reversed that action, and now the reversal is being reversed, albeit slowly.

“Fed has decided housing market is on its own going forward,…”

I don’t agree. So long as the Fed maintains a cap on RMBS rolling off its balance, it’s still implicitly supporting the housing market. For example, if home sales pick up this May, and say $45B of its RMBS would roll-off, the NY Fed would step in and schedule $10B in RMBS purchases (to maintain the cap of $35B).

The answer is twofold. One, if they start to sell MBS while interest rates are high, they will generate losses, so they want to just keep rolling the stuff off. Second reason is that bankers love rich people. Selling off the balance sheet at a much faster pace will cause drops in markets and the Fed loves a good bubble as much as anyone.

Except that here, the asset bubble is causing inflation, and the Fed has admitted as such. They can’t bring down the latter without popping the former.

Gamete,

I fear you explain it well, they explicitly support the wealthy at the detriment of their mandate and the larger economy. They refuse to allow the rich to suffer losses.

LOL! Gamete is the best autocorrect I’ve seen on this site.

Everybody pat the FED on the back now for doing the right thing?

Better late than never? Late was too late.

Yes, they are idiots.

Very wealthy ones no doubt!

Yes, the punchbowl this time was weirdly prolonged. But being a regulator, especially with this, the most awkward cluster of variables ever, means some punters on one side or another will always be disappointed. We can’t test the counter-factual, as if it had been done otherwise. Most of us as pretty buoyant and prosperous, judging by leisure keyboard time for reflection and recriminations.

“When all else fails, do the right thing.”

Does anyone think that if the FED begins selling mortgage backed securities outright and dropping the interest it pays the banks on reserves cause market interest rates to increase moreso than two more 25 basis point increases?

LT Lurker.

The selling of MBS would obviously raise rates in that sector; but what would be the effect of lowering rates on reserves? Firstly, that might be difficult w/o lowering the whole matrix of Fed related rates. But if you did it, wouldn’t that be ultimately inflationary? I defer to monetary economists.

The amount of overreaction by our policy makers is so obvious on those charts. Sheer incompetence.

History wont judge them kindly, not that they care.

No one reads history books anymore, anyway. Kids nowadays don’t know what Viet Nam was about, and never heard of it.

@Anthony A,

I agree with you, but it isn’t just the Kids. I’m 59 and I’m guessing that a lot of my peers don’t know anything about the Vietnam war, Korea, WW2, the Great Depression, yada yada yada.

McQueen’s Ghost – sorrowfully second your observation…

may we all find a better day.

Visible? Per Wolf’s graph, their balance sheet has expanded by 8 trillion since 2008. Also look at 2020, that’s a straight line going up from 4 to about 7 trillion. When the next crisis hits, it’s another straight line up by 5 trillion, thereby wiping out the so called Quantitative Tightening.

The US is already a banana republic at this point.

I think the one area where Wolf is not hard enough on the Fed is the rate of reducing the balance sheet and also the way the Fed tightened financial conditions through increases in interest rate policy, rather than selling off the financial assets when it could. The Fed should have seen that the proper path was to sell off assets rapidly once inflation and market insanity has gripped the economy. That would have had the same impact as raising interest rates, but it would have deflated the asset bubbles too.

It is my belief that by holding a large balance sheet of assets, the Fed is increasing the risk to the economy and the taxpayer. They are distorting markets outright. If for some reason inflation gets a second wind, this is really going to bite the central bankers because the higher interest rates go the greater the unrealized losses on those assets would be.

The truth is that this is a situation where as long as the Fed and Federal government keep increasing debt levels, noone feels any pain. But once they try to stop the increase in debt or even reverse it, then the you-know-what hits the fan.

The Fed needs to think more deeply about the impact its actions have on the economy, not just a simple calculation of prices and employment. It needs to look at the impact of promoting mal-investment and the impact of creating an a massive wealth gap between the rich and middle class.

The fact that the markets are so impacted by central bank policy tells us just how distorted these markets are. We have companies delivering poor performance, yet the stock prices rocket higher because the market is looking for a Fed pivot. The stock market is just getting ready for the next round of the Fed pumping markets higher again with even larger purchases.

This is insanity. Hopefully the Republicans will finally act like conservatives and will reign in federal spending, which could finally bring some reality to our economy, before it is too late.

Yep, the Congress is completely out of control with their spending. That’s where the real problem is now. The Fed is just pushing on a string. None of these interest rate increases are doing squat. They should start unloading securities from their balance sheet at a much faster pace. At the rate they are going they will never get anywhere as the next recession will cause them to get cold feet.

The FSA (Free S*** Army) is more than half the population. No surprise.

Withdrawing the free stuff is a radical experiment, by now. It is taking a long-enfeebled patient off life support.

“Society is always three meals away from chaos.” -Lenin

So, observing that the situation is crazy, or unsustainable, is not the same as having an answer to dig out from here, a path or policy that is sustainable. Congress is under tight constraints, and various members will be told, play your theatrics, but at the end of the day, keep the game going, because pulling the band-aid off may result in immediate uncontrollable hemorrhaging. Like, crimson gushers in the streets. Easier to print onward, no?

Here here, right on

“The Fed needs to think more deeply about the impact its actions have on the economy, not just a simple calculation of prices and employment. It needs to look at the impact of promoting mal-investment and the impact of creating an a massive wealth gap between the rich and middle class.”

They’re too myopic. Those are long-term dangers, and they are only focused on the short term.

Game TV

I agree with you but what about the political side of JPow? He needed to be re-appointed before he could even think about cracking down. Few Fed persons would risk their job to do the right thing on a timely basis.

Yes, if you zoom out on those charts, the trend line is UP. Right now is just a pause for the next “Crisis”

Wolf, will there be a preference in your opinion for what they dump going forward? I can see UST’s in an attempt to keep the USD down, but would that severely impact future UST sales when Treasury needs the funding?

Man what a tangled web they wove.

The strange part is Fed officials almost never get asked about the balance sheet. All anyone talks about is rates.

Reporters are like: “I see you added an ungodly amount of cash into the banking system, pushed long rates to the floor, and now asset valuations are through the roof…

…But aren’t you worried another 25bps hike on rates will crush US businesses and governments?!!! Are you actually going to force positive real rates on us?! Isn’t that irresponsible?”

Sigh

“Reporters”? Did you mean “plants”? Who, after all, is invited to the “press conferences”? Wolf Richter?

The public needs (and wants) things bumper-sticker simple. Such is “democracy.”

It is pure insanity that the “reporters” dont ask anything about the balance sheet. But they dont want to spook markets.

Noone in that room cares about the real economy, they care about asset prices. Keep the bubble going higher.

De facto state run media.

Where “the state” = Wall St (aka. “the elites” + the military industrial complex).

Viewers of big media will tune out of anything that doesn’t fit a ten-second sound-bite. These are our neighbors in our “republic of virtue.”

Would be interesting if Jerome Powell still sounded weak when talking. But increased the QT at the same time.

That would be one way to get a sneaky uppercut at the defiant markets!

Thanks Wolf! Your data is great, but some of us need some interpretation of what the data reflects.

I mean, what does the rate of MBS roll off effect?

Inquiring minds want to know!

It raises rates, the fed has lessesned purchases, and the risk becomes greater without the fed’s support. There is less available liquidity to rely upon.

Nativediver,

QT (including MBS roll-off) destroys money in the reverse process with which QE created money. QT is the opposite of QE and undoes QE and undoes the effects of QE.

QE = lower long-term yields, higher asset prices

QT = higher long-term yields, lower asset prices

Wolf,

It might be helpful to briefly step through *how* MBS rolloff (QT) “destroys” QE-created money.

It is pretty intuitive how *buying* MBS “creates” money (“Fed Fic” fiat gets printed (backed by no real asset) and injected into economy via MBS purchase).

Money supply (relative to real assets) goes up.

But the reverse is a little less obvious.

The Fed-Held MBS matures without being replaced.

So I guess the premise is that the “money” represented by the value of the MBS vanishes as the MBS itself ceases to exist.

(I do wonder a bit if the process is as completely symmetrical as the Fed makes it sound like. QE *printing* allows for money multipier based expansion of money supply. Does Fed-held MBS maturity/extinction really accomplish the opposite? In multiplier terms? Hmmm).

The Fed gets the pass-through principal payments from the MBS in cash. And the Fed destroys this cash. Poof, gone.

The Fed doesn’t have a “cash” account, like companies do. When it takes in cash, it destroys it. When it pays out cash, it creates it. On net, over the past seven months, it has destroyed $532 billion in cash.

>>It is pretty intuitive how *buying* MBS “creates” money (“Fed Fic” fiat gets printed (backed by no real asset) and injected into economy via MBS purchase).

Nope. The money is printed directly against the MBS being bought, in a single indivisible operation (also called “atomic operation” in computer science :)). The MBS **is** the backing for the new money.

cas127, you are among the top3 best commenters lately. I’m not picking on you in order to pick on you! But the above is important.

>>Wolf said:

>>The Fed doesn’t have a “cash” account

Exactly. Cash (really: RESERVES) are only created in an indivisible operation against receiving ownership of the backing asset (govt bond, MBS pseudo-govt bond).

“QT = higher long-term yields, lower asset prices”

Does it? I am guessing without QT the 10 year would be at 2%?

I assume you have seen the recent treasury auctions? Even the short term rates have almost inverted there is almost no premium longer dated bills.

That gets to an interesting issue. Wolf has called the RRPs a form of stealth QT, so to the extent that the $532B reduction in the Fed’s asset since the peak have come from RRPs on the liability side of its balance sheet, has there really been any net new QT? In theory, if all of the reduction in assets came from a reduction in RRPs (which isn’t the case of course), aren’t you just trading one form of QT for another? The impact to the financial markets would have already come from the stealth QT implemented via the RRPs, right?

Or, to put it another way, the reduction in assets on the Fed’s balance sheet is obviously destroying money (while the use of RRPs wasn’t), but if its just destroying money that was “parked on the sidelines” in RRPs, what’s the real net effect on the financial markets?

I don’t know myself, but I’m curious if anyone has any thoughts on this.

Johnny5,

QT destroys liquidity. Liquidity is in excess, and it’s everywhere, and it flowed everywhere back when the Fed was creating it, including into reserves and RRPs. That’s why QT brings down reserves and RRPs. It’s draining funds from the system, even if those funds have been stashed at the Fed to earn interest (reserves, RRPs).

TBH, describing RRPs as “stealth QT” in 2021, when this was building momentum, was not the best descriptor I ever came up with. And it didn’t have a QT effect.

RRPs are a place for excess money-market liquidity to go. Maybe more importantly, there also has been a shift from reserves to RRPs, because funds have shifted from bank deposits to money market funds. That shift has zero impact on QT/QE. But it reduces bank cash and increases money market fund balances.

Wolf,

So your intimating they don’t want to reduce mbs asset prices but that always was the outcome; to reverse the wealth effect. They act against reducing inflation.

Or, do they hope to just buffer or drag out the housing correction. One can only suspect they delay the sale of mbs until conditions make it untenable to sell mbs, that’s where my thoughts are but I had hoped they’d adhere to their stated schedule of 30 bil shedding.

I believe the slow bleed will prove.more deleterious to the economy.

You’re understanding it.

They are doing both, fighting inflation and allowing inflation to linger, at the same time!

It’s the “best of both worlds” (sarcasm), and they probably planned it all along.

There are obvious benefits doing it this way. Their *official stance* is they are fighting inflation, which is exactly what they are doing, nobody can say they’re not, so they’re definitely not lying.

But while they’re fighting it slowly, that means they’re also allowing it too, because it’s going to take a lot more time to get down to 2%.

…but remember they don’t want deflation…*quel horreur* :). They just want inflation at 2%, not -2%, lol.

**If they can manage to avoid deflation**, they get the benefit of temporary high inflation to accomplish their money printing financial goals, but they know it’s wrong to make inflation an official policy, so it’ll just be *transitory*, which is exactly what it is, and obviously they continue to “fight it” to bring it down.

That’s why it’s moving so slowly for the lot of you:)

Get it? It’s actually brilliant:) (lol, ugh).

I have read this very interesting article by a “Former Fed”. It should be great to have a comment from WOLF. THANKS!

“A tremendous credit boom took place in 2022 and it may not even be over. The combination of healthy banks, financially strong households, and attractive rates appears to have to led to a surge in bank lending. Banks and credit unions together created $1.5t in cash last year that likely has not yet fully filtered into economic activity. The total size of the banking sector was little changed over 2022, but the static surface obscures a boom in lending of epic proportions. Banks changed the composition of their assets by replacing their cash and security holdings with loans to the real economy. Around $1.2t in loans were made in 2022, a level around three times higher than that of recent years. The same explosive growth is also seen in credit unions, which are functionally similar to small banks. Credit union loans outstanding grew $0.23t from 2021Q3 to 2022Q3 (Q4 data not available), a level also three times higher than in recent years. Loan growth was strong across categories and appeared to persist despite rising rates. Note that explosive loan growth is likely the key reason banks recently increased market borrowings, as deposit growth usually lags loan growth. Banks may be temporarily borrowing from Federal Home Loan Banks and even the discount window to keep up with loan growth.”

My brother was fed up with non-competitive rates at our credit union. He finally got a phone call with the branch manager and the manager told him the board of directors wanted him to focus on loans backed by the stimulus money.

My friend owns shares in a very tiny bank. They had a good year because the stimulus loans were profitable.

My parents, my brother and myself have moved about $200,000 – $250,000 out of bank deposits to treasuries. This must be getting repeated across the country.

It’s a complicated fiat world with Federal government and Fed playing a bigger and bigger role.

I see the number $250,000 debt per taxpayer. Don’t think that is going to get paid back without more negative real rates in the decade ahead.

Loan growth occurred when 30yr mortgage interest rates were 2.5%. Talk to any loan officer/broker now…. DEAD. No business. The $$ lent often went to home improvement, sometimes investments (bubble, anyone?). The home improvement surge is over – go into Lowe’s or HD – drywall @$9.89 sheet stacked double deep in the aisles because there is no demand.

1) Moderate inflation : 10% to 20%. High inflation : 20% to 80%. //

DX breached Mar 2015 high. After completing this rd trip DX might takeoff.

2) Inflation : There is a downtrend line coming from : 1921 to 1947 and 1980 highs. June 2022 breached it, but we are back below. We are not far

from deflation. In June 2023 inflation y/y might be negative for the first time since 2009. Options :

3) option #1 : after backing up, moderate inflation, for the first time since the 1980’s.

4) Option #2 : we can easily breach 2009 lightweight deflation of (-)2.1% and test the 1921 deflation @ (-)15.8%, when the Liberty bonds became worthless and the Fed net assets were negative.

Fiscal policy is the elephant in the Fed boardroom.

Spending continues to force the Fed to “accommodate” massive expanding government programs.

We’ll see if congress has the courage to reduce spending.

B

Chicken and egg. IF the Fed stopped accommodating, then Congress would see the negative consequences to their spending.

5) Option #3 : congestion. Several quarters/ years of osc between lightweight inflation and lightweight deflation, under the 100Y downtrend line, back inside a Lazer aiming low, coming from Oct 1990 to July 2008 highs and 2002 lows.

Good to hear real estate agents are getting a break’ (‘ home sales have plunged’)particularly when Apple stock was in short supply ( less phone updating,)Roads should be safer (less dealing behind the wheel) and tv more interesting as Million Dollar listing could have a break.Seriously though Congress could take a note out of the Feds actions.

PS. From Ray Dalio’s recent letter.

“We all know that there is no real debt limit because what is called a debt limit never actually limits the debt. It’s a farce that works like a bunch of alcoholics who write laws to enforce drinking limits, and when a limit is reached, they do a farcical negotiation that temporarily eliminates the limit which allows them to have the next drinking binge until they reach the next limit at which time they go through the next farcical negotiation and continue to binge. I gather that this is the 79th farcical negotiation that has taken place.”

It’s only the 44th farcical negotiation….(44th time debt limit will be increased…)

Ray should get his data straight….

Dr J, I think Dalio was including the times when Congress failed to pass the budget on time due to political or policy fights.

You are right. But don’t miss the forest for trees.

i think the changes to the republican house will actually force some spending reductions or they will allow this to go into default for the first time and we will see how that impacts things.

inflation changed the equation because people started to realize that all the debt could actually hurt them economically. polls show a higher concern for debt levels than in a long time.

It will be quietly explained in the cloakroom that after the grandstanding, the limit will go up. Even a temporary technical “default” will be seen as the head-fake it is. The global economy needs a backbone that is alive and passing on its value and signals. There is no other game in town. The global financial system and domestic markets would be freaking if they thought any real showdown and default would occur. You can be traveling 85 mph and hit reverse and take the clutch out, and guess what happens. 1917 Russia, or something like it.

Republicans always growl. But no bite. They always concede to the opposite side.

“opposite” is a strong word to describe the difference in those sides

info – usually after considering the polling. They then recall vp Cheney’s comment on deficits and decided they can spend, but not tax, with relative impunity…

may we all find a better day.

In public they put on a good show, behind the scenes there all in the same country club .The show must go on

Just to put things in perspective, market cap of Apple, Google, and Amzn will drop by about $150 billions today.

Facebook alone gained $100 billion yesterday, give ir take.

Market cap is for the rubes.

(Nothing meant personally…I just hate the use of “market cap” as something particularly enlightening)

Try liquidating 100% of the shares and see what the impact on share price is (hard for WS hustlers to continually find enough suckers to pay 50 PE ratios…).

Also, there is a reason why IPOs only sell 15-20% of outstanding shares (or less)…it is a *lot* harder to round up 5 or 6 times the number of punters.

A *lot* goes on behind the scenes in NYC.

“Try liquidating 100% of the shares and see what the impact on share price..”

Yet you are talking about market cap. Number of shares × price.

Easy come, easy go.

The Irish gang might follow Xristalina Georgieva and David Malpass way :

raise taxes to pay debt, cut entitlements to send shingle mums and the zombies of the blue states to the labor force, to INCREASE the labor force

pie, because it’s too tight now.

Whoooo that’s a tight labor market

Let’s see if the momentum changes

Rate cuts with 3.4% unemployment😂

Big tech earnings yesterday continued deteriorating also😳

Finally a legit earnings report from Apple. My brother-in-law has a big holding in Apple. You know what they say in horseracing “the favourite is overbet to win”. The same is true in the stock market.

Speaking of F**KIN Apple…. They did the same thing last earnings season.

Bad report followed by big rip the next day then tanked the next week

Friggin Apple.

People probably thinking they’ll pull a Meta-Faceborg – dip into the enormous cash stash for an alleged $40 billion in buybacks.

Apple’e ER shows people still have lot of money to spend on $1000 iPhones.

I’d assume under duress, iphones would be the first to be thrown out.

There is absolutely no slow down in spending in the real world.

Even after Powell said they are not done hiking, CME’s Fedwatch tool on Thursday showed a 14% chance of no hike in March.

A day later, after a 500k+ NFP report, the market is still pricing in a 5.5% chance of no hike. At least now it’s down to only a 39% chance of rate cut(s) by December.

I just don’t get the stubbornness of the pivot narrative in the face of reality. Do people think that if the Fed Funds futures trade lower that they can bully Powell into staying put in March or cutting after that? That’s all I can think of.

I got to say it. Sorry off-topic.

Anyone who using tech layoffs as a leading indicator of the jobs market is wrong in hindsight.

Maybe Musk, Zucker, et al. not geniuses?

At best they overhired during an obviously transitory circumstances (all pandemics end, eventually).

At worst, they are herding and will spend more for a temporary reprieve from Wall Street insisting on a focus on profits rather than revenue.

They over-hired to show their success to Wall Street so their stock option compensation would go up. They are now laying off to show Wall Street they are conservative so their stock option compensation will go up.

It is mostly about upper management.

The remaining employees who are paid with RSUs and stock aren’t complaining.

I just realized that I’ve become cynical in my old age. Maybe because I am not upper management.

Market thinks that Powell is bluffing and he’d fold easily like 2018.

Inflation is coming down and come down eventually but the high prices would stay put thus making life essentials out of reach of common joe.

There will be a huge head fake with CPI. It will come down for a few months then take back off like wildfire. If the FED falls for it, it will be yet another miserable failure in the extremely pathetic legacy of Jerome Powell, who is already the worst FED chair in history, hands down.

The FED’s “soft landing” narrative is about stabilizing prices at a new, higher plateau. They don’t want deflation in anything, they just want to slow inflation. In other words, they want to keep things where they are right now, since everything’s so “great,” dontcha know.

They don’t want the working class and the poor to enjoy any meaningful quality of life, they want to destroy them financially, and take everything they ever had and give it to the rich. And that’s what has transpired over the past several years, and will continue as inflation and stubbornly high prices hollow them out.

This truth is borne out in Wolf’s charts which show the gains of the top 1% versus the bottom 99% since this latest FED orgy began, and then really eye-opening when you look at the bottom 50% who have nothing and never enjoyed any gains at all. They want financial oppression – a boot on the neck of the majority of people.

“When everybody’s rich, nobody’s rich.”

“who is already the worst FED chair in history, hands down.”

An utterly ludicrous statement that makes it clear the rest of your comment is worth ignoring. J Pow is the 2nd best since Volker just behind Yellen and will soon surpass her. He is ending the cheap money era. Powell couldn’t be worse than Burns, Bernanke, or most of all, Greenspan even if he tried.

An over-abundance by number and decibel of people like you has discredited skeptics of central banking.

See, with NEGATIVE Interest Rate of – 2%, no wonder Business is still borrow to expand, Employment BLOW OUT STRONG.

And yet, Fed Minions are applauding Fed for slow slow slow DRAGGING feet over 2 years in raising rate tiny bit, and cut tiny slice out of mountain of Balance Sheet!

Of course people want to quickly spend their money away or face losing purchasing power to 6.75% inflation rate, on top of losing 30% already last 2 years.

In this particular instance – Powell said and did the right thing.

The signs of moderating inflation we’ve experienced during the past 6 months are probably down to little more than the drop in energy prices. That, itself, owes itself largely to the SPR draws and China’s Zero-COVID lockdowns (which both depreciated the Yuan and suppressed their local consumer demand – whilst NOT decreasing exportable production). Both programs have ended/are ending.

Given how inelastic energy demand is proving (see the latest headlines from Germany concerning their serial missing of monthly energy-saving goals) – re-awakened oil/gas demand in China could send energy prices quite a lot higher. No amount of rate hikes obviates the need to truck in farm produce or heat one’s home in winter. Those are not problems of financial engineering.

So if the FOMC were to aggressively-tighten right now – they’d simply be giving the game away and exposing the ultimate (and not-very-high) limits of Fed Policy in the face of a supply squeeze affecting the most basic inputs of production.

I suppose I should have added that – in addition to energy price reduction – there have been smaller contributions to reduce inflation – such as the post-pandemic pent-up demand for travel and the pandemic surge in used car sales playing out. But the good news there is largely over, also. In fact used car prices have been UP the past two months.

Don’t forget the ridiculous “adjustment” in healthcare expenses which is miraculously helping lower CPI. Everything is tortured statistics.

Quantitative Tightening is only one component in the so-called war on inflation (personally, I do not believe there is a war because throughout history, empires in decline use inflation to prolong their reign) one also needs to look at productivity in any effort to combat inflation.

According to the Department of Labor, the average productivity metric fell 1.3 percent in 2022, the biggest annual drop since 1974. This is a measure which computes the total output of goods and services in our economy to the number of hours worked to produce each of these.

In a non-Clown Show world, attention would be paid to falling productivity. The only thing I see here is the Federal Government spending more dollars on favored industries and not following up to see if these resources improved productivity. i.e. backdoor to keep inflation raging

Concerned Citizen,

“Productivity” is a measure of output (from the GDP data by the BEA) versus the number of workers (from the jobs data by the BLS) that produce this output. If you hire a lot or over-hire – see the current growth in jobs – productivity falls as production ramps up more slowly than hiring.

If you cut employment, productivity spikes at least initially, because you have fewer people with the same amount of production. This works until output falls faster than the reduction in workers, then productivity declines again.

That’s what “productivity” shows you.

Wolf all my comments are in moderation ,also I am not receiving your articles in my e-mail = thanks

Flea,

My system is sending you emails, including the one earlier today. And they’re not bouncing back. I just checked. If you don’t see them, check your spam filter. Maybe they get hung up there. If you find them in the spam filter, report them as “not spam” (if you have that kind of button in our email system, such as Gmail) or whitelist them.

As the Earnings Remittances going negative and being accounted for through representation on the liability side, I could see losses on the sale of MBS treated similarly.

But I think patience is the answer. Eventually interest rate raises will pause and eventually reverse. In time reduction of the MBS portion of the asset balance sheet will accelerate and with luck achieve Zero.

The Fed response time on reacting on MBS’s is disgraceful.

It’s as if the Fed were too drunk after their 5 martini quarterly lunches to make any decision. I am sad to inform you, the Fed Supercomputer was offline.

When the housing bubble exploded in 2020 and 2021, the Fed should have reacted slowly and stopped buying MBS’s. THis would have tamed the housing bubble. They did the opposite and now are stuck with worthless MBS’s that they have to sell at a loss after they raised rates. Idiots! Even I could see MBS’s crashing after raising rates.

Please hire me.

Hire me to make decisions and not as their Coffee/Martini Boy.

I look at the chart of MBS on the Fed’s balance sheet, between 2021 and 2022, and I ask.. why it had to grow I don’t know, they wouldn’t say. I paid something wrong now I long for yesterday..

Why did they do that Wolf?

I cannot speak for Wolf but Mortgage-backed securities purchases were rising even when the average Joe and Jane via MSM knew the housing market was a bubble yet the Fed kept pumping. The Fed masters need inflation. The Fed’s job now is to work achieve a palatable level of inflation which will been seen by the masses as economic progress ergo, the status quo will remain.

I admit some frustration with the repetitive shortfalls of the $95B cap on asset reduction.

There should be a provision to offset slack MBS rolloff with additional Treasury Securities. Set say… $20B as a cap.

Come on. We’ve got to have some resolve in reducing the assets. Simply washing hands of not reaching $95B by blaming it on MBS is unacceptable.

Better yet, sell $3 trillion in the next two months. They printed that much in 2 months in March and April of 2020, so no reason they can’t go the same pace in reverse.

“Better yet, sell $3 trillion in the next two months. They printed that much in 2 months in March and April of 2020 …”

I like that idea very much!

And those BS Anal-yst and Fed minions kept blaming inflation on other minor-factors. I say, let’s cut the balance sheet by 5 trillion next 2 months, and then we shall see if other factors matter at all.

The Elephant in the room is the Demand Printed by $5 Trillions dollars!!

@Wolf –

Help a rookie out: What are the implications of “selling MBS outright”?

Thanks.

It would bring QT back to plan. Now QT is below plan.

It might put some upward pressure on mortgage rates, and more broadly long-term yields, as was intended in the original QT plan.

The Fed has already sold outright its corporate bonds and ETFs in late 2021, so it wouldn’t be the first time that it would sell securities.

Weird how some folks want to crash the economy to implement their idea of justice.

The facts are the facts, but the narrative, is psychology.

Social Justice and Economics are not synonyms.

AJD – short of an asteroid-strike, definitely in the running as the coldest equation…

may we all find a better day.

First Cav, most excellent.

“The Fed has said many times that it doesn’t like to have MBS on its balance sheet … in part because holding MBS gives preference to one type of private-sector debt (housing debt) over other types of private-sector debt.”

Absolutely. It’s beyond the scope of monetary policy to pick and choose sectors. And the Fed absolutely says it doesn’t like to hold MBS.

Yet there they are, by the trillions. And the Fed wonders why markets haven’t been taking its words seriously.

Don’t listen to what they say, watch what they do. The idea that the FED doesn’t like MBS is like saying “Jeffrey Dahmer didn’t like killing.” Are you gonna believe that?

The NAR is the largest lobby in DC. Don’t think for a moment they haven’t greased the palms of every bureaucrat they needed to. MBS purchases were no mistake. The housing bubble was no mistake. It was all by design.

D C,

Your last paragraph brings up a quote from FDR to me. But first, the Roosevelt family was, or is, of Dutch origin, and in the banking business. Back in 1784, Isaac Roosevelt and Alexander Hamilton founded the Bank of New York, which a few years later in 1792, became the first corporate stock traded on the New York Stock Exchange.

FDR’s quote: “In politics, nothing happens by accident. If it happens, you can bet it was planned that way.”

And late last summer, the Fed’s MBS holdings equated to 23.8% of all the mortgage paper in the USA.

QEs in Trillions. 5 Trillions added in two (2020-2022) years. 9 trillions on the balance sheet since ’09.

QTs in billions! snail pace. in how many years/decades? Wow!

Guess Fed doesn’t want to shock the mkts, right. Have to look after the interests of 15 mega global banks who own them

Same story repeated every Qtr.

This is really really good reporting! Thank you. I’ve been curious about the substance of this piece, but its not easy finding answers. So its really useful information.

Great article.

Your deconstruction of the Fed’s balance sheet ignites repressed opinions in me that seem to be validated by the obvious excess illustrated by the graphic.

Your first graph, Fed’s Total Assets vs Time, is a panagraphic of the Manhattan project implementation of a brand new economic plan, QE. An innovation that classical economists warned against as bad policy.

In my opinion, as we relax in the relative comfort of the quiescent period before the economic storm makes landfall, we should batten down the hatches as the Fed bubbles deflate.

From the graph, visually, QT hasn’t really yet taken a bight from the QE excess liquidity that fulfills one of the required criteria for the implementation of QE’s first cousin, abundant reserve Central Banking operations.

A famous graph of the the 0.98 R2 linear correlation between the S&P valuation with the expansion of QE is not a coincidence. Asset price inflation has been the goal of the monetary agents for, at least, the past 15 years.

Since the criminal banks were insolvent and we pulled out all the stops too make sure that their bad bets were covered and they were sufficiently rehabilitated financially to return to their rightful place at the first at the trough. QE.

In the mean while, we get up every morning hoping that nothing bad happens that day. Resolute in making this world a good place to be alive in.

That’s all there is really.

Which brings me back to the tragedy of QE.

The power of the financial industry is a testament to the degree of corruption that permeates our, naive, pristine view that comes with wealth.

The financial industry is a parasite, creating nothing but their own wealth.

How does an economically worthless human being like the official from the hedge fund that claimed to have made 16 billion while the elderly that were investing in long term treasuries lost as much as 30 pct of their retirement capital after 15 years of zirp.

What is this noise about QT neutralized/diluted by a drawdown in Treasury Dept. General Account?

$400b cited…by month or year?

Could somebody be squeezing juice?

What I would say, given the ambiguous clues that you emitted,

I tend to think that an unprecedented number of Federal employees have to be interrupted from their duty before they respond as a statistically representative population.

I’d say the ‘visible dent’ is plenty visible in the price of gold and oil today (yes I know that’s tightening in general…seems some people read Wolf’s ‘What Powel Really Said’ article and acted).

“But don’t worry. The Fed creates its own money and can never run out of money, and can never go bankrupt, and how to deal with these losses is just an accounting question. It solved the question by treating the losses like a deferred asset and putting it in the liability account, “Earnings remittances due to the U.S. Treasury.”

How stupid where USSR central planers, they where creating their own money but nevertheless they went bankrupt and closed shop.

The USSR destroyed their currency. And then they defaulted on their FOREIGN-currency debt (you cannot get out of foreign-currency debt by printing your own currency). It never defaulted on its ruble debt. It just annihilated it with inflation.

The Fed doesn’t have foreign currency debt, so it cannot default, but it can destroy the currency through raging inflation, which we now have. But the Fed is trying to slow that down, hence the rate hikes and QT.

“Earnings remittances due to the U.S. Treasury.”

Accounting for losses as negative ER-due seems to me is just a reflection of some law that says that Fed losses can be carried forward as subtractions from future earnings, as far as the “100% taxation via remittance” of Fed profits goes. I think that is the simplest way to look at it.

Also: Nobody should feel sorry for the Fed’s “100% tax rate”: Fed already gets to deduct all the Interest on (Excess) Reserves” that they hand over to their masters at Wall St banks (i.e. the “primary dealers” and other Fed member banks).