Plenty of fuel for inflation. Powell is not going to like this.

By Wolf Richter for WOLF STREET.

Employment in the relatively small tech and social media sector is getting hammered by hiring freezes and layoffs, and this is in the headlines every day, though these are global layoffs and only a portion take place in the US, when they become reality sometimes months after the announcements.

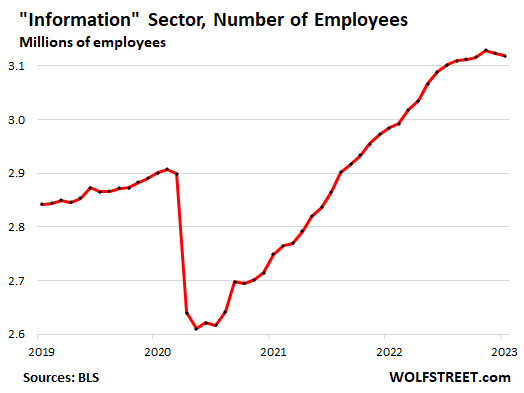

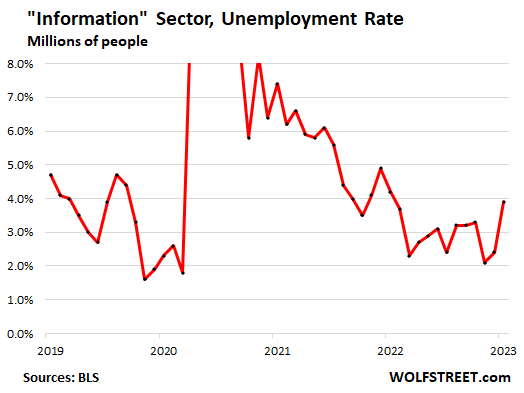

And we can see it starting to crop up in the employment data that was released today, as the unemployment rate in the “Information” sector, where some of the tech and social media companies are included, spiked in January, and the number of employees in that sector dropped for the second month in a row.

But in the overall vast US economy, the rest of the labor market remains hot, though not quite as hot as it was, according to the employment report today, after having been confirmed month after month by other data on the labor market from other sources, from job openings and actual layoffs and discharges to applications for unemployment insurance: rising number of jobs, longer work-weeks, and rising wages.

“Biggest ever” seasonal adjustments for the biggest ever workforce.

As every time when a strong employment report is released, the nitpicking starts, in order to show why this is in fact a terrible report, month after month the same thing, and they’re poking through all kinds of stuff to prove their point, such as today for January’s jobs report, blaming the “biggest seasonal adjustments ever” for the strength of the data.

Well yeah, employment is very seasonal, with huge hiring of seasonal workers before the holidays and before summer, followed by a big reduction in this seasonal workforce. This occurs predictably every year, and big seasonal adjustments are used to iron out the seasonal fluctuations.

And for this January, sure the seasonal adjustments were “the biggest ever” – because the economy is the biggest ever and the number of people with jobs is the biggest ever, and seasonal adjustments move in tandem.

But the “Information” sector is starting to get hammered.

“Information” is a small sector, with a little over 3 million employees, or roughly 2% of US workers. Not all tech and social media companies are in the Information sector. Some are in Professional and Business Services, others are in manufacturing, etc. But “Information” does capture some of the companies that are generally considered in tech and social media.

Information includes: software publishing, traditional publishing, publishing exclusively on the Internet; motion picture and sound recording industries; broadcasting industries, including over the Internet; telecommunications industries; Web search portals, data processing industries, and the information services industries.

We saw a couple of days ago that job openings in Information collapsed by half, the worst drop since the Dotcom Bust. That was for December, and it was a function of the hiring freezes.

The actual layoffs are cropping up in today’s data by the Bureau of Labor Statistics – amid an otherwise rocking and rolling job market.

The number of employees in the Information sector fell by 5,000 for the second month in a row, for a total of 10,000 jobs that vanished in two months, the first declines since October 2020, the biggest declines since June 2020, the first back-to-back declines since April and May 2020.

So this is just the beginning, and compared to the huge hiring binge over the past two years it’s just a dip, but that’s how it starts:

The unemployment rate for people looking for jobs in the information sector spiked to 3.9% in January, the highest since January 2022, when it was coming down from much higher unemployment rates during the pandemic. And this is also just the beginning:

Overall Labor Market Still Rocking & Rolling.

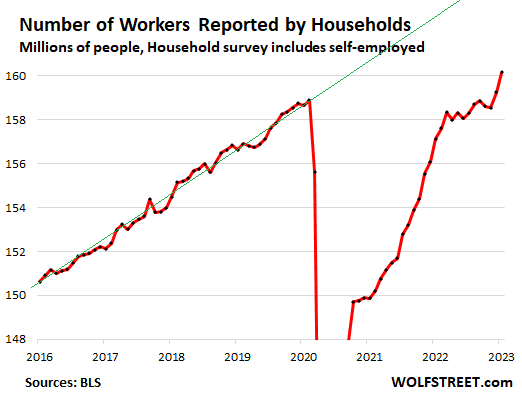

The number of workers, including self-employed, jumped by 894,000 in January, the second big jump in a row, to a record 160.1 million, seasonally adjusted. This is reported by households.

For the past three months combined, the total number of workers soared by 1.54 million. But it remains well below pre-pandemic trend (green line):

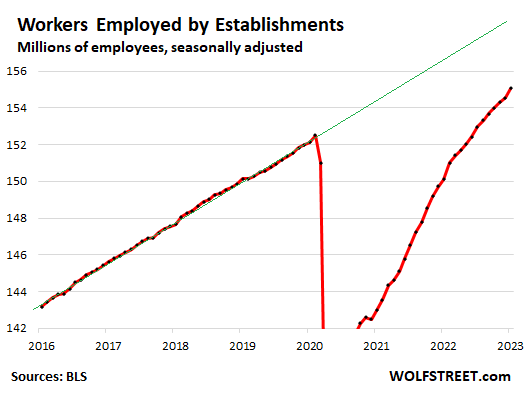

The number of employees on regular payrolls jumped by 517,000 in January, and by 1.07 million over the past three months, to a record 155.0 million employees, according to the survey of employers. But the number of employees still remains below pre-pandemic trend:

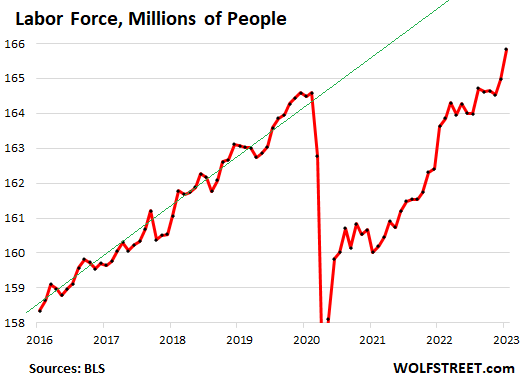

The labor force jumped by 866,000 people in January, and by 1.19 million over the past three months, to a record 165.8 million. These are people who either have jobs or are actively looking for jobs. It is a measure of the supply of labor. Despite the big increase in January, it remains well below pre-pandemic trend, which is why the labor market is tight – though it’s getting a little less tight:

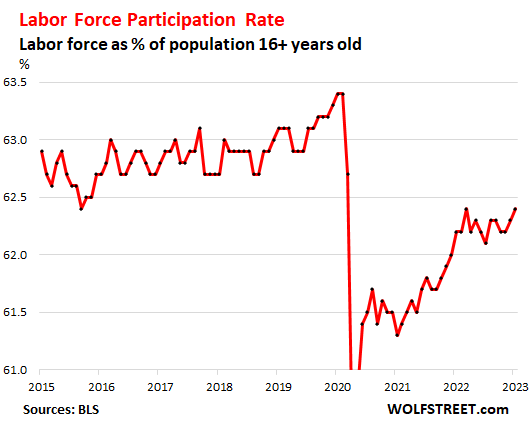

The labor force participation rate is another sign the labor market is tight, and it has improved very little over the past year. In January, it rose to 62.4%, same as in March 2022.

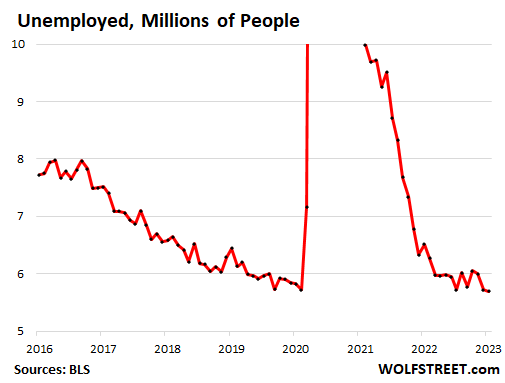

The number of unemployed and actively looking for a job dipped to a 20-year low of 5.69 million. There are always a lot of people – around 6 million even during the best of times – who don’t have a job and who want to work, and who actively looked for work during the survey period. They constitute part of the supply of labor and part of the churn in the labor market. And they’re another sign that the overall labor market refuses to roll over – despite the layoffs in tech and social media after two years of over-hiring and over-paying:

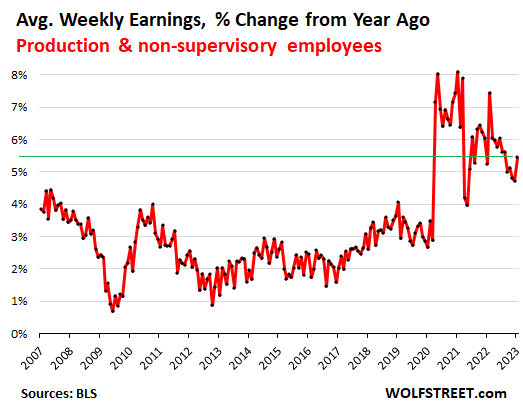

Average hourly earnings of production and nonsupervisory employees – engineers, teachers, bartenders, technicians, drivers, retail workers, etc. who do not manage other people – rose by just 0.25% in January from December, and were up 5.1% from a year ago, the smallest increases since early and mid-2021, but still hefty increases.

But the average weekly earnings of production and nonsupervisory employees, powered by an increase in weekly hours worked, jumped by 0.8% in January from December, the biggest month to month increase since February 2022.

Year-over-year, average weekly earnings of production and nonsupervisory employees jumped by 5.4%, the biggest increase since August – another sign that this labor market refuses to roll over.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Strength in the jobs market is more related to people returning to the workforce and taking jobs. The labor participation rate is still very low.

This is more a result of people running out of pandemic cash and needing to return to work. Companies will be pulling back on hiring more employees soon as we head into 2023, as sales volume is falling in many sectors.

Can we stop this nonsense about “Low participation rate”.

High in the 25-54 labor participation rate pre pandemic: 82.9

This month’s 25-54 Labor participation rate: 82.7

I have no idea why the “No one wants to work” narrative keeps getting pushed other than good olde propaganda.

Companies need an excuse for not paying wages high enough to attract workers.

People work to keep there standard of living.

.2% is still a lotta jobs as a raw number

I agree though the narrative that young people in certain generations don’t want to work is silly and older generations will always say that about younger generations

.2 % of the current workforce is 3.2 million (about 160 million workers, I am napkin mathing here!) . If JOLTS is true, and there are 11 million open jobs out there, it isn’t going to make up the difference.

No I shouldn’t raise wages because they’re (kids, racial minorities, old folks) all lazy! I want more for less!!

Most of us are sellers rather than buyers in the labor market, so I continue to be befuddled the credulity to the argument that inflation was fine and transitory in goods, but is a huge fucking problem in wages.

It isn’t that no one wants to work. It’s that no one wants to work at crappy jobs at slave wagers where the customers are rude and obnoxious. And over the past couple of years a ton of workers have done just that, leaving lower wage paying jobs for higher wages, better benefits, and a more stable yet flexible schedule. And why are people still talking about pandemic free money? Those programs ended two years ago, so it isn’t as though people have been getting free money for the past two years.

“Information” sector hired / promoted too many executives in pandemic. These organizations are too top-heavy to be productive and they are now laying off productive workers at bottom level for 1% to 2% cost reduction.

It’s a sham with only one purpose: Reduce employee salaries artificially below inflation levels. It’s not meant to cut real costs from executive stock compensations and stock buybacks.

Leo,

Your comment …

‘ “Information” sector hired / promoted too many executives in pandemic.’ is 100% correct. They didn’t hire ‘techies’ (programmers/coders/sysadmins). They added administrators.

Whatever your personal opinion of Elon Musk might be, his comment that Twitter had

10 managers for every developer is likely true about most, if not all, “Information” sector

firms.

Having spent more than 4 decades in that field, it certainly matches my “lived experience”

Great comment Leo!

Higher for longer on rates. Say it with me

Don’t confuse the market with the facts…its mind is already made up.

pretty quiet on the recession front – for the foreseeable future its as yosemite sam would say – CHARGE!- risk off – full speed ahead as long as it has one and zeroes for a product/service anyway – if its actually made with real materials its a lot tougher –

Okay, here is my report on the Jobs situation at the company where I work.

1.) At the end of summer 2021 the company went on a hiring binge. They hired so many additional manufacturing people that we ran out of parking spaces. Salaried employees had to park off site and take a shuttle to the plant.

2.) At the end of summer 2022 the company started letting manufacturing people go. So many were let go that the salaried employees were once again able to part on site.

3.) October of 2022 the company laid off some salaried employees, engineering was included.

4.) Last week of January 2023 the company laid off more salaried employees. These were Purchasers and Commodities planners (commodities meaning stuff we have built for our end products).

5.) First week of February the company announced the closure of a plant in Southern California. I’m in So. Cal also, but my facility is okay.

I don’t understand, without people to manufacture stuff how do you have stuff to sell, or does the company manufacture at other locations? Is this electronics or not tech and do you do any business in China? TIA

Demand fell in the goods sector and increased in the services sector. People no longer want to buy things, they now want to buy the experiences they missed during covid.

The kids don’t need another pair of pjs to stay at home in, they want to go to the movies.

People don’t buy pjs, factories don’t make as many as their warehouse gets full. Manufacturing jobs fall, then desk jobs fall. Then factories close locations. Then companies go BK. Or things pick up and the work continues.

Polaris makes products here in the USA. They reported their numbers earlier this week. “Polaris ended the year strong,” Mike Speetzen, CEO said.

“On the retail side, the strong demand of the pandemic years waned some. But Polaris’ sales in the utility markets don’t go through the the same channels, and demand from farmers, ranchers and contractors purchasing utility vehicles is more stable.”

Polaris had record results in the fourth quarter. For the year, sales were $8.6 billion & earnings were $447 million.

They make Indian motorbikes in Iowa and some damn fast sleds up in Roseau, Minnesota.

“The SnowCheck exclusive INDY VR1 is built on the rider first Matryx platform delivering ferocious acceleration, effortless control and intelligent technology–unlocking the next dimension in dominating trail performance.”–their advertising sales pitch.

The owner of my gas station’s son just bought one, and the owner, who’s a motor head, was blown away by the machine’s performance when he drove it recently. Faster off the line to 100 kph than just about anything there is. People are buying them. They run $16k on up.

@Heron,

Our products are similar to appliances, such as large water heaters, air conditioners, heat pumps, etc. So there are many parts involved. There is a control board that has electronics components like microcontrollers, and various semi conductors. There is a Titanium heat exchanger, copper tubing, injection molded plastic enclosure. So we buy the PCB assemblies from China or Mexico, plastic injection molding done in house. Basically parts and assemblies come from all over and are assembled into a finished good here in the USA and sold in (mostly) North America.

Note: The company had its biggest year ever… but I think they must be nervous about how things will work out in 2023.

Good real world comment. I worked on planes all my life, sometimes parking lots overflowing and sometimes empty. It is very volatile. What idustry are you in?

@Moi,

I’ve always been a big aviation buff, but I’ve never worked in that industry. However, when I was starting off my career, I got a job with a company that made high speed video cameras. One of our jobs was to film a remotely controlled fully fueled airliner (Boeing 720B) crash onto a dry lake bed at Edwards Air Force base in So. Cal. The FAA was testing out a fuel additive that was supposed to keep the fuel from burning out of control during crashes. Officially they said the test was a success, but I watched it burn for two hours, so…

You can google it. It was called the “Controlled Impact Demonstration” CID, or as others called it “The Crash In The Desert”.

I still follow all incident reports, catastrophic fire-only accidents are extremely rare. Since fires are caused by impacts your odds are not good anyway. Worthwhile test I suppose, thanks for the info, I will look it up, never occured to me. Gracias.

Thanks for the real world update.

What is the end product or industry that your company is in?

Swimming pool equipment manufacturer. About 20% of our market is dependent on new home construction. A large percentage of our customers are in Florida, Southern CA, Arizona. So a housing slowdown will effect us.

But executives got their bonuses right? That’s the important thing.

Haha, don’t get me started!

My question is “Why did the Fed not know about this employment report when they met two days ago?” And if they did know about it, why didn’t they raise rates by 0.50% ?

Powell clearly spelled out that the labor market is still very tight and out of balance.

These are some of the things he said about the labor market, quotes from my article, which quoted Powell:

https://wolfstreet.com/2023/02/01/what-powell-actually-said/

“Despite the slowdown in growth the labor market remains extremely tight.”

“Although the pace of job gains has slowed over the past year and nominal wage growth has shown some signs of easing, the labor market continues to be out of balance. Labor demand substantially exceeds the supply of available workers and the labor force participation rate has changed little from a year ago.”

“Reducing inflation is likely to require a period of below-trend growth and softening of labor market conditions.”

If the number of people working AND the number of hours they work is increasing enough to push up weekly earning by .8%, then doesn’t that just compound the .8% increase? Hourly wage gain increases become somewhat irrelevant, do they not? I’m guessing that just means that worker productivity isn’t anything to write home about and that companies are increasing hours and payrolls to meet demand… How can anyone find any good news in this data? Bad for inflation and bad for workers who will have to run faster for longer on the treadmill just to stay on the same rung of the ladder. What a mess!

👍

Only when people are afraid of losing their job and don’t see an easy path to finding a new job will they work harder for less money.

For over a year people were not afraid to lose a job that no longer existed during covid. That stress was gone. People came to the conclusion that they no longer needed to live with the stress.

I will do my job, for the hours I was hired to work. I will not do 10% more for the same pay. If the employer wants to lay off 10% of labor, don’t put it on my back because the little bit of overtime is cheaper for you, the employer, than the cost of a new employee.

The only way this changes is if you can cause me to be afraid of no new job, no pay check, no way to afford the rent. And that is only going to happen with a high unemployment recession.

This is the logic that so many people miss. I hear them complaining about the lack of service or lack of work ethic or whatever and asking why they can’t find people to work or why workers are so lazy. I say why would they? People are going to do exactly as you say and (at best) do the job they were hired to do for the wage they agreed to work for and if you push them then you are going to push them right out the door. That’s the pressure that causes hours worked and/or wages to inflate. Much easier for an employer to reduce overtime than hire more workers, especially now. Not surprised to see that happening.

Thankfully some people understand that treating work so purely transactionally = dead end career. And thankfully some managers understand that treating employees so transactionally = turnover, and poor development of staff.

josap…. Yeah, I know, you’re great at your job, they love you, and you’ve had so many promotions.

Don’t confuse the market with the facts…its mind is already made up.

The Federal Reserve bank of St. Louis performs extensive economic research. Considering that the Federal Reserve’s FOMC just raised interest rates a “dovish” 0.25%, to be “surprised” by the labor report would mean that the St. Louis Fed’s work product is substandard or that Jerome Powell & Company have other motivations as in maintaining inflation and stimulus (low interest) rates for as long as the public will bear it.

Perhaps it may be helpful to look at Empires throughout history in that the purpose of their treasury systems were invariably to 1) Fund the regime; and 2) Maintain the value of the Treasury and the Elites balance sheets. Those money changers Jesus came across in the temple were there for some other reason than just to offend the creator.

Conclusion: A return to historical fundamentals of a monetary system’s purpose may be more enlightening than accepting the “dual mandate” of employment and monetary stability.

The 3.4% unemployment rate is the lowest since 1969.

Looks like everyone’s hope for a recession has been crushed.

Give it time.

Yet, we’re not even back up to pre-pandemic trend.

No one finds this odd?

Lotta people died and lotta people retired so it’s just not the same economy anymore

More the reason to believe that the next ten years will be just like the 70s then.

It would be nice to think that whenever the unemployment rate gets this low, it stays there forever. But in reality..

“The Federal Reserve bank of St. Louis performs extensive economic research.”

That’s a misconception. The St. Louis Fed has created a vast automatic database (FRED) and charting system that automatically collects data from all over the world and makes it easily available to the public in one place. That’s what it does. Each chart by the St. Louis Fed will tell you where it had obtained this data.

Im not sure where the earnings numbers come from, because theyre pitifully low. In both south Florida and north Texas labor costs for virtually any kind of laborer has gone up 50-100%. That includes the undocumented guys in the Home depot parking lot too.

Word’s out. You can get pretty much name your price.

Maybe the undocumented guys don’t report their income.

Maybe???? LOL!

So the Labor Force chart has a trend line that is off the chart, how many workers “should” there be if it had stayed on trend compared to the current 165.8 million workers?

I believe many folks are leaving the workforce so there are many jobs opening to fill the void. Consider the year 1957, there were 4,308,000 babies born. Many of those have retired as they reached 65 last year! 1957 was the year with the most births in the US so we are feeling the loss of those great folks.

SS is not broke. SS is not part of the budget. SS is not part of the deficit.

Color TV must have been invented in 1958.

Initial thoughts reading the first part of the article is information technology is in, or on the cliff of recession. While the rest of the economy is chugging along just fine.

Tech earnings yesterday would support the idea that tech is already in a recession I’d say.

Big problem for tech is the Fed won’t be coming to bail them out with rate cuts as inflation is still high overall.

Maybe the tech sector will show us an example of what happens when recession hits at the same time as rising rates

Yep, and the RE markets where tech is more dominant are getting hit the hardest. Tech has so many junk companies that burn cash and that sort of thing doesn’t seem to be tolerated in other industries.

I wonder if there is a breakdown on specifically tech jobs in Crypto/Blockchain programming?

From what I read the programing skills needed for that type of design work are very specialized? Anyone know? Wolf.

If so would be interesting to track.

Kind of amazing the recent run up in BTC and some of these others.

Wonder what the employment situation looks like there.

Best of luck to anyone short or long or even just in bonds

You hear that? That’s the sound of a soft landing. The recession mongers and Fed bashers are apoplectic at this news.

No, it’s actually not. It’s the sound of very high inflation for many more years to come, if more isn’t done.

mmm…there is something “strange” in the payroll numbers. With the very NEW Control Factor they added + 517,000 but without the Control Factor, they added just 84,000!

Excluding the Control Factor, the BLS numbers show that from March 2022, during 10 months, the job market gained 3.65 million and the Household survey, instead, declared just 1 million (which is not good)

This kind cherry-picked data salad thrown around ignorantly as fact is what gives the internet a bad name.

I spent three paragraphs in the article shooting down your nonsense in advance, and I wrote it directly for you, LOL

Maybe the Fed can increase QT whilst sounding weak on camera.

Just a few billion more each month.

The story of this downturn is WFH to WFF. From a Twitter content moderator to a fry operator ( wff, work from fryer) at Chipotle. Employment in the world of online schemes to attract advertising dollars ( why this is called tech baffles me) is falling while employment numbers in fast food and such are rising, with Chipotle as one example. The “released” WFH crowd will probably cling to their ” pajama work dreams” until the money runs out and then head out to the fry huts, and big box stores to make money for the Tesla payments.

What is with this unrelenting bias against WFH? For some jobs it’s great, for others it doesn’t work as well. Assuming that working from home makes people unproductive or spoiled or whatever makes you sound like a fool.

This is wonderful new for the Information companies, an excess of workers means less compensation required.

A few million more h1b and they will be able to pay minimum wage, with maybe a free tent to live in the parking lot.

Stocks will rocket!

God bless America.

I retract this post.

Economics snark is not really my thing.

Is there any chance that, if the job market stays this strong (a big if), policymakers will debate the possibility that “neutral” interest rates might be higher than the ~2.5% estimated by economists?

Do you mean inflation rates? I have a feeling not. This time around is a little different. They seem to want to keep people alive.. They have already been bleeding out the lower part of the economy for decades. Maybe they are trying to bleed out the upper most parts now as it’s become cannibalistic.

Many people could work that are not working. Where do they get the money to live on?

Lots of households have lots of money.

Average wealth per household, by wealth category in Q3, 2022. The top 50% of households (= 65 million households = 132 million people) are in bold:

“Top 0.1%”: $132.4 million

“Remaining 1%”: $19.3 million

“Next 9%”: $4.4 million

“Next 40%”: $768,000

“Bottom 50%”: $70,800.

https://wolfstreet.com/2022/12/21/fed-tightening-reduces-horrendous-wealth-disparity-that-qe-and-interest-rate-repression-have-wrought-fed-data/