At first in baby steps, and then in big chunks. Remember the “pivot to QE” mongers at the time? What a hoot.

By Wolf Richter for WOLF STREET.

Practically laughing at the pivot folks, the Bank of England announced today that it sold the entire £19.3 billion in UK government bonds — £12.1 billion of long-dated conventional gilts and £7.2 billion in inflation-protected gilts – that it had purchased between September 28 and October 14 during the UK pension fund crisis that had threatened to send contagion in all directions. And it sold the gilts for £23.1 billion, making a profit of £3.8 billion, or 19.7% in about three months!

The BOE thereby became the first major central bank to actually sell government bonds outright, rather than just patiently letting them mature and run off the balance sheet that way over the years, as other central banks are doing with their QT programs.

What the BOE did was an experiment in how to speed up QT by selling long-dated bonds outright, and it worked just fine. In terms of QT, this is quite a milestone.

The whole story has been kind of a hoot. The BOE had started purchasing those gilts to give leveraged pension funds in the UK some breathing room to deleverage. Those pension funds had for years been using an investment strategy, called liability-driven investment (LDI), which were composed of about £1 trillion in gilts-based derivatives that were apparently designed for perma-ZIRP, and that were blowing up when yields of long-dated gilts rose far faster and far further than their models had anticipated.

The pension funds got margin calls from the same investment banks that had sold them those LDI funds. And when they had to unload their holdings of gilts to prevent or meet those margin calls, thereby becoming forced sellers, the market got frazzled and gilts threatened to go into a “death spiral.”

So the BOE stepped in with a lot of rhetoric about buying huge amounts of gilts, and then ended up only buying puny amounts of them, and then in November, it started selling those bonds that it had bought in September and October, and now it has sold all of them.

“The purchases were made to restore orderly market conditions following dysfunction in the UK gilt market, and in doing so reduce risks from contagion to credit conditions for UK households and businesses,” it said today in the press release.

We talked about this show quite a bit from the beginning to the end, why this wasn’t a pivot to QE in the first place, though the pivot mongers were all over this, spreading the fantasy that this was the first pivot back to QE by a big central bank, and that the Fed would soon follow with its own pivot back to QE. Which hasn’t happened either: Instead, the Fed has unloaded $458 billion so far under its QT program, but by letting maturing bonds roll off the balance sheet without replacement.

What we did learn was the that BOE has successfully demonstrated that selling government bonds outright during QT worked just fine and wasn’t the end of the world, and it has thereby broken a sort of sound barrier of QT.

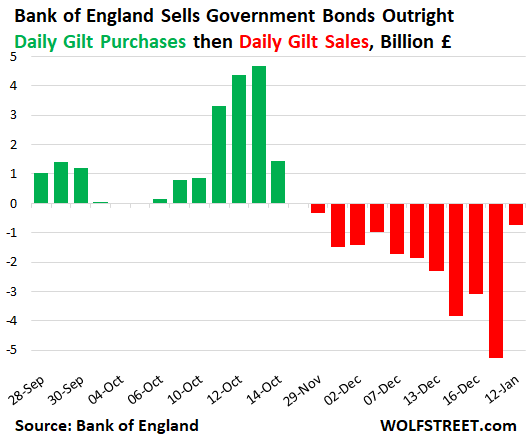

The green columns reflect the purchases per day of these long-dated gilts during the pension fund crisis; and the red columns represent the sales of those same long-dated gilts. Note how the pace of the sales started out very gingerly and then picked up pace with each day until the last day when there wasn’t much left over to sell:

“To ensure the Bank delivered on its commitment that the purchases would be temporary in nature” – and not QE – “the Bank began unwinding these purchases on 29 November,” it repeated for the umpteenth time today.

“The gilts in this portfolio were made available to interested buyers via reverse enquiry windows. This approach helped ensure that the unwind was responsive to market demand and did not trigger renewed dysfunction,” it said. And so the BOE has shown other central banks and the Fed how to sell government bonds outright and into a blistering rally.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Zerohedgers awfully quiet right now.

ZeroHedgers are never quiet. They are like Fox News.

There is always a new “scandal” to focus on. Forget that old stuff. It is old news.

They build an atmosphere.

All of the fictitious news media are like that, not just Fox. It is very rare to see the broadcast media cover anything of substance.

Honestly, the reason to stop reading ZH is not because they’re “too extreme” — that’s one of the likable things about that place. The reason to stop reading ZH is because they keep making wrong predictions and don’t learn from their mistakes. I’m not surprised, as it is clearly run by different people than in the old days and it is now filled with clickbait and questionable (i.e. fictitious) material, whereas in the old days they posted articles of substance.

Sorry I’m back I’m heading to Frisco gonna find some fine summer weather after the storm, going to stick my head into the sand.

It’s going to be a fantastic time of year on the coast!

Just one more thought,

“The gilts in this portfolio were made available…”

“Into a blistering rally.”

Thanks my friend for the daily chuckle.

ZH is fine paper to arise spirits while WS serves its readers with sobering notes. The WS way… eer… street.

It seems that there are speculators who believe that interest rate policy is like day trading: Hike one day and cut the next day.

Apparently, Econ 101 states that interest rates take at least 6 months to 18 months for it to be felt in the economy.

Inflation is still around 6-7% in Canada and USA.

The target for both the BOC and FED is still around 2-3% inflation.

But there are speculators who want back the days of 0.25% interest rates.

“Inflation is still around 6-7% in Canada and USA.”

Who really believes this ? I say around 15%. Same as Volcker’s CPI ….

The bureaucrats don’t use Shadowstats.

But the speculators want interest rates to be cut now. They want to pump RE, stonks and crypto again.

Bitcoin as I type this is about to cross 21k.

Anyone else think another crypto firm is about to implode?

crypto.com? More layoffs todays.

Binance? Too opaque to see.

In Italy, the inflation is 11,6% (The OFFICIAL) and in Europe, avg 10%…and the Euro is gaining against the US$!! 🧐

Yup.

As I started pointing out in early September….

In order to maintain some sort of anti-Russia coalition – the USA will not have the luxury of exporting its inflation to its allies.

And – et voila – the US Fed is no longer front-running other central banks in performing monetary tightening.

Agree, the inflation reports are way low.

By the way, has anyone detailed just how seasonal adjustments work?

Do they always tamp down negative trends?

I do… Truflation says around 5.5% which I think meshes with the 6% Core CPI… Some components are going down YoY (like fuel!) Others like Food are still way too high.

But what Wolf has pointed out, the real inflation worry is embedded in Services and it will take a while to wring that out to get to the Fed’s 2% overall target!

That’s why the Fed will stay the course of incremental rate increases through at least the next two meetings! How much they raise is the real $64M question!

My worries are that if and when services inflation finally slows down, goods inflation will be heating up again. That’s always the thing: inflation Whac A Mole. We’re already seeing the first signs of it in other data, including import prices for non-petroleum products (+0.8% MoM). They shot up as the dollar weakened. Part of the low goods inflation comes from plunging import prices in dollars last year, when the dollar was super strong against the EUR and the YEN and the currencies of other major trading partners. But the dollar has been backtracking, and voila, import prices shot up.

Yeah… I get ya! Even more reason the Fed will hold off on any easing, regardless of the pressure.

It is like a Whac A Mole.

Avian flu causes mass amount of egg laying chickens to be slaughtered.

Now there is a shortage of eggs so egg prices go up.

However, slaughtered chickens are now a glut on the market so chicken prices go down. (97 Cents/pound at many grocery stores. )

What do you want? Cheap chickens or cheap eggs?

Many adapt and buy what is cheap or in season. Other people and media outlets focus on what is expensive. Glass half full vs half empty.

Avian flu is not in our control.

What I want, and would absolutely make happen IF king, is chickens running loose all day, or at least from when the last hen made the world know she had just laid the best egg ever laid.

IF treated right, chickens will go back into their home roost without any need for coaxing, coaching, or other forms or coercion.

And, while out and about, will do their best to eradicate many many species known as pests to human species, including termites, ants, roaches, etc., etc.

FKA ” a chicken in every pot.” WE the PEOPLE must absolutely insist that motto is changed to, ”One chicken per person ON EVERY LOT.”

(BTW,,, clearly a much more cost effective program than any and every current mass distribution one.)

BTW: I was ”in charge” of 250 chickens in five combined houses/runs in the mid 1950s for a 4H project– and of course for profit and family food.

Been taking care of many since.

Just saying to confirm hands on experience over the last 70 years or so…

As the Dxy decreases, oil prices increase which will only add to the inflation number.

The Fed had better raise .50 or .25 a few more times to keep the dollar up and pray it knocks down oil prices or reaching even 3% will be a dream

Time for investors to hit back at wallstreet starting today with big bank earnings.

Wallstreet lowered estimated earning growth for past quarter to -4% in a 7% (official avg) inflation environment. That’s a pathetic 11% decline in real terms. Now Wallstreet is building up expectations of a rally on expected 0.25% earnings beat (real 10.75% decline).

Wallstreet thinks that its investors are either foolish enough to allow this pivot bluff, or that they lack the balls to punish these companies for not cutting costs as earnings decrease.

Also, our new corporate leaders feel that they are no longer accountable to investors and can keep waiting on Pivot as stock prices keep declining.

“Wallstreet thinks that its investors are either foolish enough to allow this pivot bluff, or that they lack the balls to punish these companies for not cutting costs as earnings decrease.”

Wall street seems to be right too! It is able to find enough investors (or should we say suckers) to pump and dump.

Tim Cook took a voluntary,pay cut never seen this before .This won’t end well

Seeing he is worth a billion and a half, he can afford it. It was a symbolic gesture! He still will be making millions per year though.

Top executive compensation is 95% stock and 5% fixed salary. So a 100% salary cut is still nothing.

“It’s not us. It’s our model.”

We bail out their model.

Nothing personal.

Next in line!

Right now current 20 year inflation is 2.67 percent. Pretty much what they want. They were running around 1percent for a long time

Been retired 22years.

I noticed inflation only in the last year and having worked in oil I invested in the same. Satisfied to this point. Also admit the free money was to our benefit as we still have it in savings.

In remembering back to 08-09 time a friend and I were motorcycling and tent camping over the west. One time a maintenance worker stopped by and welcomed us to the campground. He said “It’s good to see Americans in the camp as most are Europeans.” Dollar was cheap for foreigners.

This was during the last downturn and I’m wondering how the dollar will fare this time?

Softail – had a similar experience riding trans-CDN/US, albeit in the summer of 1980…

may we all find a better day.

Hadn’t seen this elsewhere. Excellent insight from Wolf

Ditto

Respectfully and thank you for your service.

This short episode was in response to disorderly markets. The BOE were clear they intended to the status quo of gentle QT when they could. They have.

However we might like it.

It is unlikely CB’s across the world will learn to speed their QT using reverse enquiries. They don’t want to and conditions are different.

Thank you for your service and respectfully

This was an isolated incident in disorderly markets. The BOE has returned to gentle QT as they announced they would at the outset.

CB’s across the world are unlikely to be swayed to speed up QT.

Wolf, it seems worth pointing out that other than this little October-November stabilization (er, that would be ‘stabilisation’ to our Limey friends) exercise, the Bank of England hasn’t really done much QT to speak of, judging from its gilt holdings: https://www.ons.gov.uk/economy/governmentpublicsectorandtaxes/publicsectorfinance/timeseries/mex2/pusf

Not sure what types of gilts your link is limited to. Total gilt holdings have been much higher than that — currently £830 billion as of Jan 11. But that is down from about £850 billion in mid-2022.

You can get more info here:

https://www.bankofengland.co.uk/markets/bank-of-england-market-operations-guide/results-and-usage-data

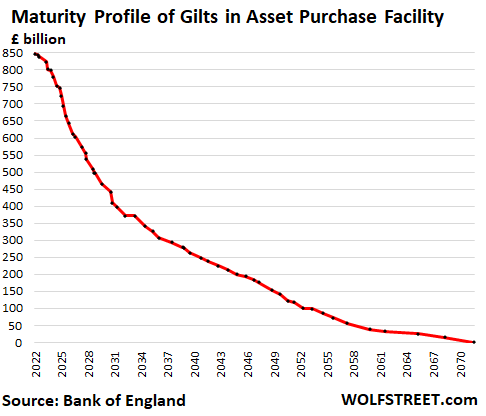

Much of this is long-dated guilts that will mature many years out, so they come off only when they mature. The longest-dated bonds it holds will mature in 2070!

There were only 2 issues that matured in the second half of 2022 (Jul, Sep), totaling £8 billion. In 2023, two issues will mature: in July (£14 billion) and in September (£21 billion), totaling £35 billion. In 2024, three issues will mature (Jan, Apr, Sep), totaling about £50 billion.

This is one reason why it started selling gilts outright because of the long maturity of its holdings. Since it started selling its QE holdings in November (not including the pension fund chaos bonds), it has sold outright £7.3 billion in gilts.

Here is the maturity schedule – if none of the gilts are sold.

Thank you, I stand corrected.

U.S. still has the biggest balance sheet. Mbs’s have not reached their selling amount per month stated by the Federal Reserve. Are the regulations stopping the banks from buying them? Are institutions hesitant to buy or is it the fed not selling? Something else we don’t know about?

In terms of the MBS questions: BS. You still don’t understand how MBS work? Why do you REFUSE to read my articles about the Fed’s balance sheet and MBS and then post BS here? I have been talking about this for a year.

MBS come off the balance sheet via pass-through principal payments, which occur when a mortgage is paid off (house sold or mortgage refi) and with regular mortgage payments. But home sales have plunged, and refis have collapsed, so these mortgage payoffs of turned into a trickle. That’s why they’re coming off the balance sheet so slowly.

READ THIS:

https://wolfstreet.com/2023/01/05/feds-balance-sheet-drops-by-458-billion-from-peak-january-update-on-qt-and-the-feds-losses/

What do you think the prospects are that the US Fed will actively sell MBS?

There’s a good chance. They really want to get the MBS off their balance sheet because they’re unpredictable (pass-through principal payments); and because with these MBS, the Fed has shown a preference for one industry (housing) over others (such as corporate or consumer debt), which violates their principles. They have spoken out about this numerous times. They tried to get rid of them last time during QT, and they did make good progress, and even when they ended QT, they kept shedding MBS and replacing them with Treasuries, until March 2020, when it all stopped again.

Wolf, wouldn’t selling MBS outright be less effective in taking money out of the economy than letting them roll off over the long run? The rates at which they bought MBS are lower than market rates now so they’d have to sell them for less to get a buyer and that difference in money can’t then be destroyed, right? I.e. buy MBS for $100, sell for $80, and that $20 extra is left in the economy can’t be taken out by the Fed. Or am I missing something? The BoE did the opposite with this last Fall bond-buying. They bought when rates high, sold when rates were lower, profited and therefore took more money out of their economy…

1. Selling MBS would be in addition to letting MBS come off via pass-through principal payments.

2. If they sell MBS of $1,000 book value for $800, at a $200 loss, they would still remove $800 from the economy (the sales price).

3. If someone years later makes $200 profit on the MBS (either at maturity or getting the pass-through principal payments over time), it would then be a net drain of $600. So you would have the immediate drain of $800 and later a form of come-back of $200.

Wolf, with all due respect, I’m not buying the FED’s BS about not wanting to favor an industry. That was their intention. They knew exactly what they were doing. They blew a massive housing bubble for reasons unknown, and nobody anywhere questions their actions or intentions. The damage they did to our society is incalculable.

For the FED to actually suggest they really didn’t want to favor the housing industry is as believable as Jeffrey Dahmer stating he really doesn’t like killing humans because it isn’t fair to favor one species. The BS they’re shoveling is insulting to the intelligence of the human race.

MBS’s exist because Americans have a mindset that a 30 year fixed mortgage is a birthright, not so in other countries. It’s inheritance, cash or variable. Often wondered what was going on in the real world but don’t have the strenght to look.

Meanwhile, here in the US, 30-year mortgage rates are close to dropping below the 6% floor and the Fed still insists on not selling MBSs (which they shouldn’t have bought in the first place), even though the Fed is barely even hitting 50% of the cap they set for themselves for rolling off their MBS portfolio. It’s totally ridiculous!

If I were the Fed, I’d do a classic Pump and Dump.

Lower interest rates to drive MBS prices higher. Sell all of the the MBS’s at a higher value. Say “Oops” and THEN continue to raise rates to fight inflation.

Of course, if I were in charge, it was obvious this was going to happen so I would have sold my MBS’s before raising rates. Oops.

Agree Max & Bob

They are jawboning that they want mbs off their portfolio. Could have sold them last year or this year and won’t even sell last 2 Mos when they’re 50% below their own meagerly set min limit.

Perhaps they want to avoid price discovery in that derivative market as the investor class will lose.confidence in the cdo sales pitch, God forbid.

Then we would be in the same position as during the 1970s. No loan money available so no sales of houses. I remember those days and did come out ahead. But I was one of a few and many could not buy as credit was extremely tight.

About this time was when the Fed, Fannie/Freddy, became the investor/loaner of last resort. As such they have now become the owner of last resort. I’m not sure I like that situation. The Fed is, I think exempt from RE taxes. So the communities lose revenue.

Selling MBS at a loss will come back to bite us in the end. Just as Wolf hinted earlier. The only benefit I see here is the gain in taxes paid, if any with current regulations/deductions.

They did buy them though. So who has the liquidity? I say banks.

It would be interesting to see who the biggest buyers were.

Wonder what the profit was on the TIPS sales compared to the rest of the long dates gilts.

You would think the TIPS would be bought up quicker, and for less profit than long gilts in this inflationary environment that does not have a clear ending time.

The UK, the US and many other western nations and Japan are issuing debt at rapid pace. In the US, the Federal debt is expected to grow to roughly $40+T by the end of this decade – an non of this debt will be retired just rolled over. Given foreign investors have been reducing their U.S. government-bond holdings who will be purchasing all of these bonds/gilts/bunds/…

Can the non-Central Banks absorb all of it?

There is no specific point which if exceeded will result in negative “blowback”, aka “black swan” which is supposedly an unanticipated event which actually isn’t. Occasionally, someone will compare to Japan but that’s not conclusive.

It’s all confidence driven. There will be a point of recognition when market participants lose enough confidence in central banks and governments, and it will be reflected in the bond and currency markets as crashing prices.

Backing out to 50,000 feet I just saw world GDP is heading toward 3.66 X GDP. So much of last 30 year boom has been because debt has grown faster than GDP.

I just don’t see how it’s going to play out, but I am leaning toward government interest rate suppression as world can’t handle much higher rates.

“I just don’t see how it’s going to play out, but I am leaning toward government interest rate suppression as world can’t handle much higher rates.”

The end result is going to be lower living standards for the vast majority of the population. Interest rate suppression won’t change this outcome and ultimately won’t change the reduction of geopolitical influence in the western world either.

Exactly.

Most of the world’s useful physical capital is positioned in the East.

What happens when they will no longer accept Western currencies in exchange for them?

Reset ,depression start over guide simple really. New dollar,worth only 10 cents of existing dollar problem solved .And only a high school diploma

I like the term “Pivot Mongers” Wolf. There are so many of them on bubble vision with their shrieking getting louder and head nodding more pronounced as their bubble portfolios fall. Of course the Central Banks must save THEM, cut rates and then bring back the Bond Trade, cigars, brandy and bonuses all round. THOSE little people, what’s 4-5% inflation, THOSE people can handle that. Just think of it, if THEY can get QE and low interest rates along with inflation, it’s a new Bentley and beach front home in every bond trader’s pot. After all it’s good for the (read their) economy as inflation will make real wages lower and keep them falling. Nirvana ….nominal negative rates, monthly bonuses, a chauffeur for the Bentley and an Island for the Beach House…..

Hey Wolf…

“but ‘my’ letting maturing bonds roll off the balance sheet without replacement.”

Think you meant ‘by’.

You nailed it Wolf

In October the market could not find 19.2 billion to buy these bonds, but in 3 months the market could find 23.1 billion? Does this mean that there is more liquidity today than 3 months ago? How did this happen?

On the dollar side, same question applies to the selling of treasuries. In total, non-Fed buyers are buying more. There is the new debt issued by the government ($1.6T), the debt being rolled off the Fed’s balance sheet ($1T) and the debt being sold by other reserve banks (Japan, China) to prop up their own currencies. Before QT there was only approximately $1T ($1.8T deficit-QE of $1T) in money spent on treasuries by non-Fed buyers. Now there is $2.6T+???

The prices on these assets should be crashing as liquidity is destroyed, but it does not appear to be based on this article. Bond prices have fallen, but there does appear to be liquidity available in the volume needed. Where does it come from?

I agree, with the Fed draining liquidity and the ever growing Federal budget deficit there is a huge amount of bonds for the private sector to absorb. The figure is nearly 10% of GDP, something has to give?

To your first paragraph, it was entirely psychological. Liquidity dried up in the gilt market due to fear.

The Bank of England created a huge mess for itself by not asserting itself in advance of reckless tax cuts.

This did lead to money printing purchases and subsequently, as set out above, sales.

I became ensnared by using the fateful term “return to QE” or similar in a literal sense.

My outlook is quite consistent. QT, if maintained, will vanquish inflation, a new financial emergency will arise (liquidity shortfall, deflation, asset collapse etc), QE will restart. After a relatively short period of time, QE will fail because it only buys time and time’s up. The most costly and overextended business cycle will end and through acute economic pain, a new business (asset price) cycle will begin.

“I became ensnared…?” or “IT became ensnared?”

“……QE will fail because it only buys time and time’s up.”

Would you be able to expand on why time really is up now, perhaps including why time wasn’t up in any of the period, say 2015-2019?

my thought is that price stability *really* broke after 2019.

ChrisR,

I think what is meant is, inflation persistently didn’t arrive 2015-2019, despite all the pump-priming then. Then, it did arrive. Time’s up. Continued pump-priming feeds raging inflation now, which would quickly spiral.

I leave inflation to Wolf. There were alarm bells before inflation took off and before the pandemic.

For the period you mentioned, it went like this: 2015 – deflation, 2016 – no change, 2017 – inflation returned, but not as high as today, through 2019. The pandemic brought it up another level. I will also remind readers that Jerome Powell and the Fed wanted to do QT as early as 2019, but the administration at the time strong-armed them into abandoning it. I am surprised the Fed of today has found the resolve to do it consistently and it makes me think that, whatever the headlines say, the current administration tacitly supports what they are doing.

ChrisR

QT is unveiling, belatedly, a late-cycle yield curve, which presages an unwinding of many of the natural and prosaic inefficiencies and misallocations that build up over every cycle.

If it is no longer possible to borrow from a drained pool of credit at the end of the allocation cycle, you sell or are forced to sell assets that require downgraded valuations.

The winners and losers of the cycle are declared.

QE implemented a yield curve and promoted economic activity more appropriate for a world with limitless resources. So not this world. Without QE, today’s yield curve would have likely appeared between 2015-2019.

Fantasy is bumping up against reality. We are nearing the end of the cycle that last renewed in 2009. Quite bizarrely and insidiously, money printing accompanied the current cycle from the outset. There’s a lot of unwinding to do.

Warren Buffett precisely stated, “WHEN the tide goes out….”, not “IF”.

Bingo AB,

It’s just starting. Your as skilled as a surgeon whisper words of wisdom into a scared wide eyed patient breathing the last breath of their financial folly.

Excellent I await more.

Put bluntly are UK banks, today, still “too big to allow to fail?”

Or, “are they too big to make bigger and fail later”?

No, they should not be made bigger. Not out of taxpayer generosity. I was stunned in 2009 by the bailouts. The socialisation of bank losses as Vince Cable remarked in Parliament, was harmful. We cannot keep recklessly adding to the national debt by bailing out failed banks that fully expect to be bailed out and take spectacular risks confident that a bailout will be coming. Next time they need to be put down ,”Iceland style, ” or fully nationalised, their boards, senior directors, bondholders and shareholders cleaned out. In government ownership then also investigated, by the SFO with no confidentiality barrier in the way. The strange precedent of the Blue Arrow judgements in the late 1980’s put aside. Senior bankers doing jail time should be an option. No fines, not next time. We’ve done those. Clearly if we have to bail out, or bail in, again, it must show that fining is no deterrence whatsoever.

Thank you for taking the time to reply.

Who is surprised by this? Both you and your audience called this swindle out years ago, right?

These are not my friends and I caution others to realize this.

Peace brothers I have a road trip to partake in today.

Happy traditional trading and as always hedge according to the parlor.

Its very sad for pensioners who are in the main forced to buy UK gilts. There is an estimate in the Telegraph today that you know need 18% more in your cash pension fund to obtain the same standard of living.

i.e. the inflation tax on the UK pension sector has been 15%. A 15% loss in two years.

These are supposed to be multi-decade safe funds.

> These are supposed to be multi-decade safe funds.

Yes, but years of leveraged one-way bets on a setup that cannot be sustained, must have its consequences. It doesn’t turn on the expectations of pensioners, which are to some extent, now demonstrated to have been unrealistic.

It would be in those pensioners’ interests ex ante to live not according to their most fulsome expectations, but rather with extraordinary modesty. Living according to my most sunny hopes has never worked for me, for one second. What makes them different? daydreams of holidays abroad?

I am looking stateside at prices for not-extravagant used cars, 3 years old, like RAV-4 and CR-V, $30,000. Makes me shudder. Means the holiday for overconfident pensioners had to end.

Raise the retirement age. Problem solved.

France is looking to raise the retirement age to 64 in order to deal with the massive costs of support seniors. The US will have to follow suit with the Social Security and Medicare debacles that are approaching. The problem is anyone proposing this would face political death so we will just issue new debt until the issue is finally addressed.

Here’s the problem with that in the USA.

Huge portions of our economy (Healthcare is 18% of US GDP) rely on rent-seeking made possible by US entitlement spending.

Not a house of cards you want to prod.

Retired for the fourth and last time at 75, and been loving the schedule ever since, since I got none!!!

Folks really and truly need to learn basics:

1. REDUCE,,, ReUSE, ReCYCLE, etc., etc

2. THRIFT for all ”possible, must be ”safe” NEEDs, almost all wants, especially ”bric a brac.”

3. Savings WILL and have done gone out of style from time to time, including when FDR’s folks mandate taking savings in gold to support GUV MINT decisions, similarly with Nix doing the degrade of USD to take it off gold standard to protect our gold from various entities; ( this move, IMHO was thought up and majorly promulgated after it was seen how innocent and easy were Dulles bros, et alia for taking over problems of SE Asia. )

We been paying the price for that stupidity ever since, if for no other way than the incredible corruption appearing on all sides of the political spectrum.

This corruption of the political classes and at least parts of the entire GUV MINT apparatuses WILL END.

We can just hope the strength of the will of the people for democracy, capitalism controlled, freedoms of all reasonable kinds will prevail to prevent massive unrest and associated evils.

My brother bought brand new Honda cr-v o Daniel honda Omaha ne for 34k

The UK has put the retirement age up, it was 60 for women and 65 for men. After equality is is now 66 for women and 66 for men,,,,,,soon to rise to 67 for both sexes.

Welcome to the club old boy:

Now for many, ”full” retirement per USA SS is 67, but many, if not most, either must or, more frequently WANT to work, some for respite from boredom; some of the first for money needed, or wanted; some of the wanters for boredom of course, and some to follow the experience of the spouse saying, ”Honey, I married you for better or worse, but NOT for lunch. Get the hell out of here and find something to do.”

Boredom for me first few tries, so folks, find something you really like to do ASAP.

Simple to say, not SO easy to do each time, but ALWAYS can be done with persistence.

Look at the difference between the nominal value of financial claims and political promises versus the real wealth in the world supporting it.

It’s bad enough even with an asset mania, never mind when prices return to historical valuation levels.

The reason the financial levitation act must end is because eventually – no matter how long it takes – reality reasserts itself. There is never something for nothing.

Surely would like to see at least a WAG of the delta you mention AF: ”Look at the difference between the nominal value of financial claims and political promises versus the real wealth in the world supporting it.”

Last seen, the ”derivatives” alone were now valued at north of one million millions of USD, and growing; previous time saw, it was only six hundred trillions, but ya know what they say, ”a trillion here, a trillion there, and pretty soon you’re talking real money.”

I’ve seen partial data but that’s all.

Most common one is the ratio of financial assets to GDP but that’s not comprehensive.

It’s an eye opener still explaining why a $1M was real money between 1960 and 1980 making someone rich while it’s “mass affluent” now and sinking fast.

AF,

If you think about it, it shouldn’t be an eye opener explaining why $1M no longer makes you rich. Just applying the 4% rule to that nest egg, $40K was a very nice income from 1960-1980, particularly during the 1960s. Now, not so much.

It’s interesting to look at 2 year Treasuries the last 12 months. High yield was early November at 4.8%, back down to 4.2%. 3 month – 10 year spread is over 1%.

Money market pays 4.2%, Duke Energy dividend is 3.8%. People have rotated to dividend stocks. Patience to see if recession comes and what Powell is going to do.

Re-opening of China is the largest wildcard. There’s remarkably little mention of that in FOMC minutes.

On the one hand – re-opening could be rocket fuel for commodity prices.

But on the other hand – if internal consumption in the PRC does not recover quickly – we could well see the PRC become a large buyer of US Treasuries again.

And apropos to the above, it’s worth noting that the dollar has weakened more than 8% against the Yuan in a matter of just 9 weeks.

I believe the lowest valuation of the $ against the Yuan (post-1993 Yuan devaluation) was about 6.04 in Jan. 2014. If China’s reopening does succeed in stimulating their domestic demand – I would not be surprised to see that eclipsed before the end of July.

I’m staying short term. Mostly, 3,4,6 months in Treasuries. Yields are higher.

Maybe I’m an optimist, but I think inflation will be resolved in less than 2 years. If the Fed pivots in less time, I will rotate cash back into equities. Reasonable large cap equities with dividends and low P/E. Equities are down 20-30% so that could be a huge upside if the Fed pivots. The upside may be due to Wall Street irrational exuberance but I want to take advantage of the irrational.

I don’t want to tie up cash longer than 1 year in such a dynamic and controlled market. And I don’t want to lose money.

I’m already sad that my 4 month Treasuries are making 4.8% when inflation is still at 6.5%. However, 4.8% is the best I got now until equities start recovering.

I don’t want to be stuck in 10/30 year treasuries paying less than 4%. I would want to be stuck at 8-10% for 30 years but I don’t think my dreams of the 1980s will happen. The Fed has reacted fast and strong this time.

“Reasonable large cap equities with dividends and low P/E. ”

Where do you expect to find this?

Certainly not at anything resembling today’s valuations.

The US stock market is about 15% higher versus the pre-pandemic peak. All “growth” since then has been from the same source as post-2008, more debt and basement level credit standards/cheap money.

Balance sheets are garbage, including Duke Energy. I’ve looked ta that stock. Interest coverage ratio is high because of artificially low interest expense.

Your expectation will only pan out with a continuation of the mania. That’s what most people need to meet their financial goals or stay solvent.

I agree on Duke. Just saying anyone buying it today for a 3.8% dividend seems to be over paying.

Augustus,

These companies are always there. You have to watch for large companies being unfairly punished by Wall Street and the masses.

Last year the low P/E, high dividend oil companies were being punished by the Green Machine. I wish I would have purchased Exxon last year at 55 with a P/E of 5 and a dividend of 6%. Now it is 113 with a P/E of 9, and dividend of 3%. I missed out on this poor downtrodden company because I was exiting the market.

Investors woke up and said, oil ain’t going away forever soon.

100% gain in one of the worst stock market years in history.

Today, airlines are being severely punished by investors (ie Southwest) due to flight delays they will likely resolve. I’m not ready to jump back in yet. LUV has a fairly low P/E and pays a 2% dividend. By the time I jump in again, it might be better when memories start to fade. This reminds me of the food poisoning scares of McDonalds or Chipotle. The stocks plunge 50% but then everyone forgets and the stock climbs back up 100%.

Intel is also being picked on by investors today. P/E of 9, Dividend of 4.85%. Despite rumors that AMD is taking over the world, Intel will be back. Especially with all of the Build In The USA money being handed out.

I’m not buying any of these now until the Fed stops raising rates and inflation is somewhat tamed. Then I will find the companies I mentioned above that Wall Street has temporarily punished despite good P/E and dividends.

There are occasional anomalies like the oil majors in 2020,

Yes, that was a real opportunity.

Buying Duke Energy at anywhere near current prices isn’t one.

I am with you that it’s ok to be short term and take the minimal hit with inflation. All investing is about relative pricing in my mind and a 4% short term rate is relatively better investment than a 10 year or most stocks on risk adjusted basis.

I’m in short term treasuries as well and also looking forward to buying equities *some day*.

But as AF said… “Where do you expect to find this?”

If the FED pivots while equities are still 40% overvalued, would you really jump in there?

Halibut

When did the OVERVALUATION really mattered since March of ’09?

It is all about the Fed, interest rate and inflation numbers.

S&P may stay in a trading range more than expected, with all the cross currents and volatility.

Div paying stocks( especially Energy), Equity income EFT/MFunds ‘may’ ride out this period.

Sunny

That’s just it. Overvaluation doesn’t matter until it does matter.

Then, there’s a reckoning.

I’ve been staying the course with periodic rebalancing on a US stock, overseas stock, bond index portfolio at roughly 50/25/25, as I have for some time. I’ve been waiting 20 years for overseas stock to do anything other than deliver dividends. I am leaving much more dry powder in muni money fund right now earning about 3.2% tax free, it feels like a better short term situation than the market. But it’s a tiny fraction of my portfolio.

My understanding is that M2 velocity of money has been tracking CPI (with a lag) rather well, and apparently M2 has had a sharp decline.

Is this where they start to diverge and a liquidity crisis ensues?

M2 seems to be the big daddy about driving inflation. It went up at the fastest rate and then down at the fastest rate. We already felt the expansion of M2, but the downside is yet to be determined.

Hussman says there are no good predictors of inflation. He says best indicator is what the current inflation rate is. Maybe he is right, but a lot of data was before Fed got drunk on its power.

Central bankers know inflation tends to be sticky.

Sorry to double post but having read it again this line

“What we did learn was the that BOE has successfully demonstrated that selling government bonds outright during QT worked just fine ”

except that when they were selling government bonds and the government announced an increase in spending plans the whole thing blew up spectaculary * toppling the government *. The government fell over it! The UK faced bankruptcy or kicking out the elected politicians. So it was not fine really. (We also have to pay Truss 120K USD per year for the rest of her life as PM graft to rub it all in).

So actually it only works fine as long as all the public sector workers take real term pay cuts, there is no hospital investment, or any government investment for that matter. I don’t see the Biden administration cutting any spending plans.

For the UK even this isn’t going to be enough because -with QT-, the amount of debt issuance over the next 5 years is -staggering-, leaving alone the off-accounts public sector pensions at 75K per employee.

The DMO needs to sell 240bn per year for the next 5 years, this is separate from the BoE tightening which is 8K GBP/worker (almost 10K USD per year!! and thats only that cheap because GBP per USD has gone down so much).

So I don’t think the UK is a poster child for QT, actually I agree with some commenter somewhere which is that the disastrous chronic blow up in gilt yields under Truss (our stabbed Prime Minister) is going to be on a slow burn over the years going forward. Quite aside from a potential crushing up of the housing market that we await to see even now from the spike in gilt yields. When gilt yields spiked, the BoE immediately did QE again. This BTW is with the UK hiding the inflation figures as the US is doing.

The travesty is that pension funds, which are supposed to invest conservatively, got over their head in high-risk derivatives requiring action by the central bank. Why are investment banks allowed to sell products to pension funds that create systematic risks? Are monetary authorities and regulators captured by large investment banks? Why is there so much governmental bias in the financial system that favors big profitable players?

To the extent that they took these risks, they did so because central banks forced the yield on conservative investments down to near 0. At that rate, there was no way they’d ever be able to meet their obligations.

The pension funds should have spoken up when it became clear interest rate repression was going to leave them insolvent. Instead, they tried to sweep the problem under the rug. Pension funds must operate with transparency.

If I lose my job and have trouble finding another, is that an acceptable excuse for robbing a bank, or spending my last precious dollars on lottery tickets? Of course not. I should head over to the unemployment office.

But I agree central bank policies are the root of the problem. Unfortunately, our central banks decided to take control of our economies even though they did not understand the obvious long-term impacts of interest rate repression and QE. We can attribute many problems to central bank decision-making over recent decades, including inflation, wealth concentration, bank bail-outs, high debt levels, poor economic growth, and much more.

In order to reign in inflation below 2% and financial loosening from the pivot angle, the Fed needs to accelerate QT by selling bonds and/or signaling an intention to target long term interest rates. The prevailing faith is still on eventual return to QE, low interest rates, and the Fed Put. For signaling, the Fed could simply make a historically reasonable comment like saying that they believe that long term real interest rates should be [2%]. We have gone thru a long period of zero to negative real rates.

I was vocal about this “pivot” at the time it happened, decrying their willingness to cave at the first sign of trouble. It’s been nice to see them use their incredible powers appropriately in this case: temporary liquidity as a lender of last resort, removed after the crisis passed.

That makes the score for BOE Idiocy 23, Responsibility 1.

Did they also extract penalty interest or achieve meaningful reform from the perpetrators? Did anyone go to jail, get banned from the industry, or was otherwise prevented from doing this again? Was there reform?

To me, BOE has been more realistic and frank in their recent pronouncements. The others are still toddlers trying to stand up. But it’s all going in the right direction and speed so far, I’ll give you that. For the Fed, the test occurs when employment stumbles and their dual mandates are then in conflict with each other.

Well we will see how that works for the US! A country addicted to QE and low interest. Take away a addicts dope and they have withdrawals! I’m still betting on a turn around with that QT or some serious withdrawals for the country.