One heck of an earnings season for tech and social media companies so far.

By Wolf Richter for WOLF STREET.

It got started with Snap last week, then Meta made a huge mess afterhours on Wednesday and during regular trading on Thursday, after its fiasco of an earnings report caused its shares to plunge by 24%. And Thursday afterhours we got Amazon, Intel, and Apple.

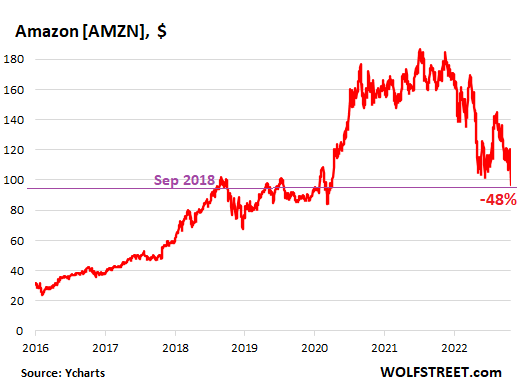

Amazon shares plunged 20% in afterhours trading on Thursday, moments after releasing its earnings report for Q3 and its projections for the holiday shopping quarter. At the moment, shares are down 14%, after having already dropped 4.1% during regular trading. Now at $96.84, the stock [AMZN] has plunged by 48% from its high in July 2021 and is back where it had first been in September 2018 (data via YCharts):

Revenues in Q3 rose by 15% to $127 billion, including by 20% in North America. At its cloud services division AWS, revenues jumped 27% to $20 billion.

But operating expenses jumped by 17.6%. Operating income plunged by 48%. Net income was only $2.87 billion – despite the operating profit at AWS of $5.4 billion, so losing money hand over fist in its retail division. On a per-share bases, net income fell to $0.28, from $0.31 a year earlier.

That was bad, but the killer was the forecast.

Amazon said that revenues in Q4 would rise 2% to 8%. Even the high figure would be the slowest holiday-quarter growth in its history. It expects Q4 revenues of $140 to $148 billion, when analysts expected $156 billion. Amazon expects an operating income between $0 and $4.0 billion, compared with $3.5 billion a year ago.

Amazon is “optimistic about the holiday, but we’re realistic that various forces are weighing on people’s wallets,” CFO Brian Olsavsky told journalists during a call after the report.

“We’re taking actions to tighten our belt,” he said. So Amazon would pause hiring in some divisions and wind down some products and services.

This comes after reports that Amazon would close four of its five call centers in the US and switch these people to working from home; and that Amazon was halting construction on five office towers and would not start construction on a sixth tower in downtown Bellevue, Washington, and that it was halting construction on its office tower in Nashville, Tennessee, and that it cut the amount of additional office space it had planned on leasing at Hudson Yards, in Manhattan, and that it closed or cancelled 44 warehouse facilities and delayed the opening of 25 additional facilities.

Intel reported a fiasco. Mass-layoffs perked up the stock.

Intel reported a 20% plunge in revenues, including a 27% plunge at its data-center division and a 17% plunge in its PC division. It reported a 13.4-percentage-point plunge in profit margin, a restructuring charge, and a loss before taxes. Had it not been for a $1.2 billion “tax benefit,” Intel would have had a net loss.

It cut its revenue forecast for Q4 by another 10% or so, and cut its revenue forecast for all of 2023 further, to amount to about a 20% year-over-year plunge in revenues.

What saved the evening for Intel’s stock was the announcement that it would cut costs by $3 billion in 2023, “growing to $8 billion to $10 billion in annualized cost reductions and efficiency gains by the end of 2025,” as it said. Everyone knows what those kinds of cost-cuts mean: mass-layoffs.

Sure enough, CFO David Zinsner said in a phone interview with Barron’s that there would be a “meaningful number” of layoffs, thereby confirming a Bloomberg report earlier this month of big layoffs that would reach 20% of the staff in some divisions, such as sales and marketing.

“The worsening macro was the story and is the story,” CEO Pat Gelsinger told Bloomberg in an interview. “There’s no good economic news,” he said, and predicting a bottom for the semiconductor market would be “too presumptive.”

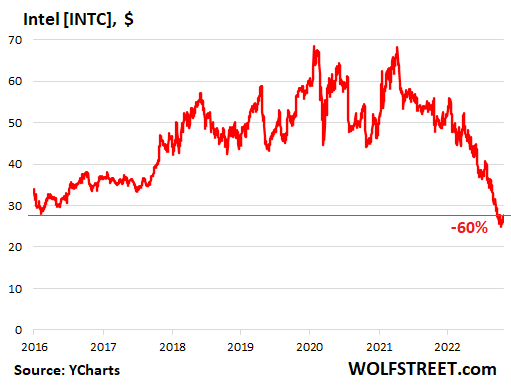

And there’s nothing like the charming sound of a “meaningful number of layoffs” to perk up the share price. Intel’s shares [INTC], beaten down by 60% from the high in April 2021, had initially dropped afterhours, but then rose on the “meaningful number of layoffs,” and ended just a little above where they’d been in the morning, at $27.72.

Incidentally, Intel is a Dotcom Bust survivor, and its shares are down 63% from its all-time Dotcom Bubble high in August 2000 of $75. The time to buy Intel was in 1972, and the time to sell and go away was in August 2000 (data via YCharts):

Thankfully, Apple didn’t offer a forecast.

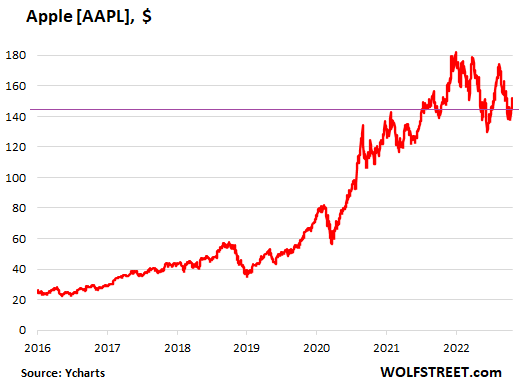

Apple’s shares, which had dropped 3% during the day, initially fell afterhours upon its earnings report but then recovered to about unchanged at the moment, at $145.35 a share, down only 20.5% from the high in January 2022, and only back where it had been in July 2021.

It reported a mixed bag of flat net income, and an 8% gain in revenues, beating expectations on the top and bottom lines, but missing by a little on service revenues and iPhone revenues, amid “a challenging and volatile macroeconomic backdrop,” as it said.

But share repurchases were gigantic – using up all of its cash flow to buy back $25 billion of its own shares in the quarter and $89 billion in the 12-month period – thereby reducing its cash and marketable securities to $48 billion, the lowest in many years, and less than half the amount in 2019.

In line with its pandemic era habit, Apple did not offer a forecast beyond the “challenging and volatile macroeconomic backdrop,” and that may have been a good thing, because some spooky number and a big drop in Apple’s stock would have been a nightmare at this point (data via YCharts):

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

FB stock down yuge…

Amazon stock down big…

Twitter communist board out on their as*es in the first hour…

I almost don’t want today to end.

I can’t count the number of times that guests on CNBC were recommending Facebook, Amazon, and Microsoft over the past six months. These analysts are poorly programmed robots, with no sense of the big picture.

They’re selling what they’re paid to sell. The sheep who buy what CNBC chuckleheads tell them to deserve to lose everything.

Apple revenue growth was only 8%. That is 0% when corrected for inflation. Somehow no-one questioned Apple.

Intel did lip-service to financial discipline by announcing possible layoffs of thousands. Intel doesn’t need to wait for holliday season, as time to market is huge and inventory is high, so it’s only waiting for elections.

Apple will remain elevates till its cash is all used up in share buybacks. After sucking the company dry, its big investors will dump the stock in the true American way.

At that point Apple will be left with inferior products, with no R&D budget, with negative revenue growth when corrected for inflation, with a proprietary stack of hardware and software that doesn’t interoperable with other product stacks and so is very expensive to maintain.

That’s when Apple will implode big with no come back.

I say that Apple stack is proprietary because:

1. Many PC manufacturers make PCs and laptops that can run windows and Linux, but only Apple makes PCs and MacBook for Mac OS.

2. Similarly many manufacturers make Smartphones and tablets that can run open source Android OS, but only Apple makes IPhones and IPads for IOS.

3. Other companies that did same like Nokia and Blackberry completely vanished once products lost edge as re-engineering was too costly.

Wolf pointed out they have $48B in cash and securities, but are spending at a run rate of $25B on stock buybacks. That’s less than 6 months and they’re out of all cash. They also have almost $84B in debt due within 1 to 5 years. They probably funded that at 2% and will have to refund at 4.5% (notionally) and it’ll be refunded in 2.5 years (approximately). That’ll cost them an additional $1.68B in annual expenses. It’s not going to sink them, but they are going find themselves (as Leo points out), without money shortly to buy back shares and with a reduced R&D budget.

Apple will be fine. The problem is that finding that game-changing, hot, mass consumer product like an iPhone is something that’s becoming harder and harder for *any* company, not just Apple.

I think all the fast money opportunities and “great leap forwards” that have typified the last couple decades for technology companies is over. I’d be interested in seeing how the tech industry moves forward and what it emphasizes after the burning of the underbrush created from the easy money of ZIRP.

FYI, Apple’s “lack of interoperability” / proprietary systems is what some might call a *positive* depending on who you are. Its closed ecosystem keeps bad actors / malicious code off their platform and holds people who sell on the Apple platform to a certain minimum quality standard. I don’t like, as a consumer and an engineer, having to buy *their* widgets instead of everyone playing by some common standard, but I bet investors and other business minded folks love how they corral people into Apple-advantaged upsells and other revenue boosters.

I wish I had a dollar for every time somebody counted Apple out for their supposed proprietary weaknesses, and narrow range of products. (including myself). As much as Apple annoys me, I still have to admit that I will continue buy their overpriced products because they work so well.

@leo – Apple revenue growth was only 8%. That is 0% when corrected for inflation. Somehow no-one questioned Apple.

If a company can sell the same amount of gadgets (no more or no less) YOY and if there is inflation they can pass inflation onto the consumer, the stock of a particular stock will rise at the rate of inflation as will their revenue and EPS.

Even Jim Kramer semi apologized for his recommendation of Meta.

Did he apologize for not seeing the overpriced Nasdaq that has corrected by 33% and instead asking gullible retail investors to Buy, Buy, Buy, Buy, Buy.

Always take financial advice from a paid expert who is legally required to act in your best interest.

The free ones may just line you to get culled, while bailing out their own financers by selling you the bag of crap.

Anyone acting on advice gleaned from MSM propagandists deserves what they get.

Particularly Cramer. I’d rather take financial advice from a carnival barker. Which is basically what he is.

While I’m happy to celebrate bad news for Bezos and Zuckerberg, I just can’t celebrate anything good happening to Musk. If anything, he might be worse than the other two. He isn’t satisfied being obscenely rich, he wants to be loved, too, and might have the thinnest skin of any human alive. Whenever anyone makes the smallest criticism, he flips out, and his relationship with the truth is strained, at best. Having him in charge of a large media platform can’t be a good thing, regardless of who he’s replacing. We’re all going to hear a lot more from him from now on.

Hilarious, better get used to him as the Hughes-Ford of our time….

Must haters crack me up….

Sounds like you’re triggered by things you have no control over, but want to control. It’s very Musk-y of you.

NEWSFLASH: All of these billionaires are narcissists. Every last one of them.

Let that sink in and plumb a big ass commie drain pipe on it to the sewer.

That’s a heck of a range…

“Amazon expects an operating income between $0 and $4.0 billion, compared with $3.5 billion a year ago.”

All that work for 20 years just to get back to $0 profit. But, Jeff Bezzos flew to “space” in his phallus rocket. So that’s something.

I never saw Bezos and Austin Powers’ “Dr. Evil” at the same place and time. Just sayin’.

Is it me or is China the dog and us is the tail ,there system started cracking 6-12 months before ours now tech,housing,stocks ,gold all down . The balloon is deflating.By the way things don’t make us happy

Who would’ve thunk that of all the FAANG+M stocks, Netflix has been the best performer these last several months, almost doubling from it’s lows earlier this year…

I guess Apple squeezed out an acceptable quarter, but the tightening and recessionary effects have only just begun there. It’s interesting to see that marketeers, who supposedly look a few quarters ahead are propping this one up…

The bigger they are…. as the saying goes, time will tell.

PS Same deal w/ Intel…. any real improvement is years away. It’s been dead money for a long time and will continue to be so for the foreseeable future.

Not so much bigger Rosarito Dave – operating outside of national competition laws, bypassing national regulatory protections for consumers, using advertising mind control techniques that supermarkets use to sell shelves, and sobering legal jurisdiction discussions lever big tech into line with other businesses which do pay to meet regulatory landscape to ensure a fair exchange by all. The can was kicked until it wasnt.

Probably means it’s a great time to short Netflix.

The big stocks which are a huge component of sp500 and nasdaq such as Microsoft, amazon, meta, etc are down a lot but the index’s are not down as much compared to them. Even other (non major component of index) stocks are down a lot too.

Shouldn’t the sp500 and nasdaq be down a lot more than where they are?

Some pharmaceuticals are still going up. Apple is kind of hanging in there still. Oil stocks, etc. But yeah, about time for sp500 to lose the next 20%.

Many tech stocks have sky high valuations (not so much anymore) that should only make sense if you think the high growth will go on for years, even decades. It’s rare that actually happens. We get caught every so often when we play that game of ignoring that fact, with devestating results. There are many Sp500 stocks that have boring growth and solid fundamentals. Pick your poison.

Most “tech” stocks aren’t tech. It’s more Wall Street marketing BS.

AWS is a legitimate tech business but the rest of the company isn’t.

Big melt-up in markets this morning despite bad headlines everywhere? Despite FAANGS in near free-fall?

I chuckle at theories about a “plunge protection team,” but what’s up? Who is throwing dollars at this picture?

Market is responding to the positive GDP number. Everything is wonderful again and Santa will make an appearance this year.

The DOW has rocketed almost straight up to the tune of 4,000 points in a month. This is, quite frankly, almost disturbing at this point, and shows that the FED is grossly behind the 8 ball.

Anthony A

Front running with strong hopium that ‘some thing’ will break. if Fed keeps on raising the rates.

Large cap lower beta stocks are holding the averages up. I haven’t looked at anywhere near all of these but the ones i have are down less than the averages. AAPL is also down less than average, for now.

I think Wolfspeed a chip maker reported bad earnings too. They are s

breaking ground on a multi billion dollar plant near me in NC with a lot of taxpayer handouts. Ditto with an Vietnamese EV plant and a Toyota battery plant.

Why are we breaking the bank to subsidize corporations while raising rates to cause a recession? Strange world or stupid economic policy.

Don’t forget the handouts to Apple too. Meta and Google are supposed to come here too, but I haven’t seen much impact from that yet.

There was a $50B or better handout provided to Apple in the 2017 tax law change, which allowed Apple to repatriate foreign profits at a greatly reduced tax rate.

None of that money was invested back into the business. It went towards stock repurchases.

I was talking about what North Carolina is giving them for a new headquarters. But point taken. It’s a shame they aren’t more creative and forward-thinking with their cash.

World views and markets have shifted faster than lots of pieces and projects can pivot. Musk’s twitter buy at $54.20 is only the most glaring example.

Public-private projects have a lot of lag in them. Is that a feature or a bug? It depends. Things being too fluid and nimble could be a disaster too.

But the college where I work, still building huge on-ground classroom capacity, is questionable.

If higher ed really wanted to provide inexpensive education to the masses (versus graft to their political supporters), the technology (video, online, etc) has been there for over 20 to 25 *years*.

Like a lot of G spending, it is much, much more about buying votes at the expense of the taxpayer/dollar saver than it is about the loudly proclaimed missions.

There is only so one reason why clearly uneconomic major projects get done – graft (laundered through loud proclamations of social nobility).

share buyback at these valuations is value destroying.

capital allocation is supposed to work for the company, not for the CEO’s bonus based on share price.

they took henry singleton’s playbook and made it work for them, sadly.

Not if you borrow money to buy back shares. Then it’s a shrewd investment.

andy

Not when the global economy is contracting.

Just goes to show how weak those companies are without QE. It also shows how investor greed clouded every bit of common sense.

With that said, i just read an article in one of manufacturing magazines, stating how chip shortage will negatively affect output and production cost in automotive industry in 2023…

abs paper in precarious position if layoffs accelerate

Layoffs.

And so it begins.

Layoffs? You misread the article, what’s beginning are “efficiency gains.” ;-)

Or a “strategic realignment of resources.” The euphemisms always fly fast and furious during layoffs, and they are sometimes packaged with an indirect benefit reference to the customer or shareholder.

I wonder if the stock splits by Amazon were factored into the numbers above, because if not, the picture would change dramatically, since the value of the number of “spit” shares after the splits would have to have their current prices summed up (and adjusted into US dollars valued as as of the time before the split or splits). See stocksplithistory’s

AMZN Split History Table

Date Ratio

06/02/1998 2 for 1

01/05/1999 3 for 1

09/02/1999 2 for 1

06/06/2022 20 for 1

The last split seems very relevant.

Split shares not “spit” shares. Child interrupted. Apparently, I no longer can type and speak at the same time.

Stock splits are ALWAYS factored in. ALWAYS ALWAYS. Look at the numbers.

Even without a recession 10 year Treasury going from 1% to 5% with 3% risk premium says SP500 is worth 1/2 as much if that happens. Buy and hold investors better hope 10 year doesn’t get to 7% plus or it’s going to get really ugly.

not an energy, no worries there…just more yield

Apple products are the epitome of discretionary spending.

Waiting for this to drop Bigly in next few quarters.

But the phones are free with your data plan.

But the watches aren’t, and they’ve been a massive seller recently, given by all the people I see around me with one.

I’ve stuck with my old phone (not apple) and no watch.

Nothing ie Free,your paying.on it in monthly bill,wise up,it’s like 0% interest on cars it’s factored into price dah

I see no evidence that “spend whatever” mentality has abated. It seems like you could slap a random 10-30% markup on just about anything and barely affect unit sales. People have lost their collective minds. Aggressive QT and massive job losses are the only way to bring back discipline, it seems. Current QT levels are obviously nowhere near enough.

Just learned this morning that natural gas, i.e. methane, is going up 25% in my area.

90% of my entire life is on my iPhone.

Wolf Street, Calendar appointments, grandkid photos, texting, Social Media, E-mail, GPS maps, security cameras, thermostat controls, travel reservation apps, Solitaire, search engines, and of course, the little used phone and voicemail.

I consider my iPhone an absolutely essential part of my life.

Maybe that’s my problem.

Even my crockpot has an Iphone app.

I found this to be only marginally useful so I deleted it.

I am getting better.

Gosh, I don’t have an iPhone so I guess I have no life? LOL

Just a plain old Android Motorola phone and the only thing I control with it is my sprinkler system. Well, I do use it for a phone and texting.

A 6 year old Chromebook handles this site and everything else.

have you ever tried Android? :)

The battery in my 5 year-old iPhone is finally starting to crap out, so I started looking new phones. There are tons of unlocked choices with great features for under $200, why anyone would spend $1,400 for a new iPhone is puzzling to say the least.

Marketwatch reported by Anviksha Patel on 27 October 2022 that Facebook Reels has made $3 billion in ad revenue so far for 2022, and there has been a 50% increase in use of Facebook Reels over the last 6 months.

So Facebook Reels has done real well considering many said Zuckerberg was wasting money on it.

I read also that Meta is also looking to further monetize Instagram.

There has been nothing about monetizing WhatsApp.

I just hope the VR sets by Meta also have education and entertainment activities. I liken it to how Disney makes learning fun such as mixing education and entertainment at Disney Epcot.

Everybody at the same time says they will “monetize” more and raise revenue streams. Twitter, Apple, Meta, etc. This, in a time of actually falling revenues and shaky demand. An interesting magic trick to conjure more out of less. Sounds so good in a press release.

How many tweaks of online videos, chat or Apple watch can justify yet another full payout?

Hence, I suppose, Zuckerberg’s hunger for the Next Big Thing.

The social media firms are all simple advertising companies, the digital equivalents to Lennar.

DTC ads are their bread and butter. DTC startups had basically zero profits and depended entirely on a steady stream of VC cash to fund their Social ad programs. That stream of cash was in turn dependent upon low rates of return elsewhere.

Those days are over.

no one plays in the metaverse except little college kids now getting a 70’s high school education at a cost

I can only imagine what Disney is supposedly “teaching”.

I never was sold on Amazon’s retail business. AWS was the profit center. Mass retail is a low profit business with Walmart netting out about 3% and you are gathering up the goods and checking yourself out. Hard to get over the expense of paying a driver and transport expenses to put the single box by your door.

As a business model, I never thought of it (Amazon’s retail business) in that way.

Good insights, Old school.

Interestingly, even Walmart’s ecommerce site hosts independent vendors.

Check out Walton’s wealth from that 3% margin

NQ monthly is a green doji. In Dec 2021 NQ reached DM #12. If Nov 2022 will be green NQ will reach DM #13.

Dec/Jan 2023 might be volatile, but the uptrend will cont until the Dow and SPX will celebrate Bar Mitzva.

NQ is down since Nov 2021. JP might slow down on raising rates, not for

NDX, but for madam ECB to catch up, because JP is too fast for her. Once they coordinate their actions they can produce higher rates with less pain and friction.

Can anyone explain why TLT (20+ Year Treasury Bond ETF) only yields 2.4%.

IEF (7-10 Year Treasury Bond ETF) only yields 1.5%.

Even SHY (1-3 Year Treasury Bond ETF) only yields 0.8%. Shouldn’t this be yielding closer to 4%?

My understanding is that the bond fund holds bonds that slowly roll off depending on how if it’s an index or actively managed. This can take a long time on long duration funds. Also the funds expenses are subtracted out of interest rate.

I use Vanguard short term Treasury fund admiral shares as my hold for savings. Expense ratio 0.1% and 7 day SEC yield of 4.23%. I think their etf expense is 0.04%.

For immediate liquidity I use Vanguard money market expense ratio 0.1%.

0.15% expense fee does not explain the missing 2-3% in interest.

We will need Wolf to explain this paradox :-]

Probably something simple I’m missing.

Perhaps its the aggregate interest of bonds owned over time including those made part of the ETF at much lower interest rates. Over time and with additional purchases at today’s higher rates I expect this to correct.

My best guess.

That was my first thought, however..

– this does not explain 0.8% on the shorter term ETF (1-3 years).

– even for long term, shouldn’t ETF trade up or down to “price in” the current interest rates?

Long-term bond funds or ETFs own a lot of bonds that yield below market rates, which were purchased in prior periods. The interest payment (or yield) on those bonds is low, maybe only .5%, but the market is pricing those bonds at a discount, so part of your return will be achieved through amortization of the discount, similar to a capital gain.

To get a true picture of the return, look at the SEC 30-day yield, which includes the cash interest payment plus amortization of the bond discount (otherwise known as the fund’s net income).

Thanks Bobber, I will check it out. I still do not get how an ETF does not trade to the known to market state.

The day after and the market, including the NASDAQ is up nicely.

The market trades on one thing and one thing only: Hope for the great pivot in the sky. Nothing else, including earnings, matters.

I think the addict is reaching the terminal phase.

Maybe they noticed savings are depleted and credit cards maxed out. In other words the US consumer has been drowned by inflation and has tapped out. I bet they have the data to show the tapped out consumers are primary customers and look for a dismal Christmas season ahead.

Just another float in the passing parade.

CreditGB

The top 10% own nearly 90% of wall st wealth. Their spending contributes nearly 50% of consumption index. They can afford to spend until mkts tank 50% or more.

The irrationality of the Market is everywhere. In Canada on the TSX Shopify (SHOP.TSX) Market Cap $44,533,481,584

This is an Amazon clone for Canada and had the following results which sent the stock up significantly. Don’t recall if they’ve ever had a true profit! LOL!!!

Gross profit dollars grew 9% to $662.3 million, compared to the prior year, reflecting primarily a greater mix of lower-margin Merchant Solutions revenue, lower margins from Shopify Payments and Deliverr revenue as well as increased investments in our cloud infrastructure. On a three-year basis, the gross profit CAGR was 45%.

Adjusted gross profit4 dollars grew 11% to $681.8 million, compared to the prior year. On a three-year basis, the adjusted gross profit CAGR was 46%.

2022 Outlook

The following outlook supersedes all prior statements made by Shopify and are based on current expectations. These statements constitute forward-looking information within the meaning of applicable securities laws and are based on a number of assumptions and risks, many of which are beyond our control. As these statements are forward-looking, actual results could vary materially from our expectations. Please see “Forward-looking Statements” below for more information.

Our financial outlook for the rest of 2022, which includes the expected impact of Deliverr, our new compensation system, and currency headwinds from the stronger U.S. dollar, assumes higher inflation and rising interest rates will continue to negatively affect the consumer’s purchasing power of discretionary goods and services.

For 2022, we now expect:

GMV growth will continue to outperform the broader U.S. retail market in the fourth quarter aided by our omnichannel capabilities;

Merchant Solutions revenue growth year-over-year will be more than double that of Subscription Solutions revenue growth for full year 2022;

Both GMV and total revenue in 2022 to be more evenly distributed across the four quarters, similar to 2021;

Because of this larger mix of Merchant Solutions contributing to overall revenue and the dilutive impact of Deliverr, gross profit dollar growth will meaningfully trail revenue growth; and,

We continue to anticipate that operating expense growth year-over-year in Q4 will sequentially decelerate from Q3.

Considering all of these expectations, we continue to expect an adjusted operating loss for the full year. For the fourth quarter, based on our updated outlook, we now expect an adjusted operating loss amount that will be fairly comparable to the adjusted operating loss amount in the third quarter.

Finally, the full year estimates of stock-based compensation and related payroll taxes, capex and amortization of acquired intangibles are $575 million, $125 million and $55 million, respectively.

Operating loss was $345.4 million, or 25% of revenue, versus a loss of $4.1 million, or 0.4% of revenue, for the comparable period a year ago.

Adjusted operating loss4 was $45.1 million, or 3% of revenue, compared with adjusted operating income of $140.2 million or 12% of revenue in the third quarter of 2021. The difference primarily reflects increases in headcount including Deliverr, and to a lesser extent changes to our compensation framework. Additionally, third quarter 2022 adjusted operating loss excludes one-time charges from severance related costs connected to the workforce reduction announced in July and two accruals for pending litigation cases.

Net loss was $158.4 million, or loss of $0.12 per basic and diluted share, compared with net income of $1.1 billion, or $0.905 per diluted share for the third quarter of 2021. Third quarter 2022 net loss includes a $171.9 million net gain on our equity and other investments, while our net income in the third quarter of 2021 included a $1.3 billion net unrealized gain from equity and other investments.

Adjusted net loss4 was $30.0 million, or loss of $0.02 per basic and diluted share, compared with adjusted net income of $102.8 million, or $0.085 per diluted share, for the third quarter of 2021.

At September 30, 2022, Shopify had $4.9 billion in cash, cash equivalents and marketable securities, compared with $7.8 billion at December 31, 2021.

Brevity is the soul of wit.

Shopify should be taking a much bigger hit today because of the fall in Amazon’s stock. Maybe they’ll figure it out over the weekend. I only remember the U.S. stock market before around 1993 when everything made sense now nothing has made any sense for the last 29 years.

Going forward in time one would expect Shopify’s earnings and revenue to fall which doesn’t necessarily mean their share price will fall. Canadians can’t borrow against their homes as interest rates have risen too high and like in America soon all the credit cards will be maxed out. Things don’t look so rosy for Shopify in 2023. These addons weren’t in the speech.

Once again the Buffet name saves Apple stock. In America there’s rules for the rich and rules for the poor. It’s sickening to say the least these rules for the rich.

All I can say, just IMAGINE what would have happened today if AMZN/AAPL reported GOOD #’s lol

I’ll give Buffet the benefit of the doubt but I do frequent all the Apple stores in Ontario to follow the flows of people in and out of the stores and what’s bought. I only track the stores in Ontario, Canada. I just hope bad earnings still matter for the foreseeable future. The last decade or so bad earnings were never reflected in medium and high cap stocks.

That just means there’s still too much cash out there, and that the central banks will have to do more to bring inflation under control.

Einhal

NOT, if the Treasury mkt goes on sudden freeze

See my comment below.

This is either another pump and dump by the “pivot” crowd, or there has indeed been some chatter that the Fed is going to only raise by 50 bps next week, and this buying is front running.

My sister is a shopaholic both online and at the malls. Her day consists of getting clothes/dresses retailored/refitted and shoes modified. Her history of products bought at Amazon runs into the thousands.

I don’t know enough about Apple and Intel, but I am sure Amazon and Meta should be avoided. GLTA.

I definitely wouldn’t short Meta at these levels. If Zuckerburg cut back on his metaverse mission and targeted initiatives that would produce higher profits in the shorter-term, I think the stock price would recover a lot of the recent loss rather quickly.

Meta ultimately will be forced to change its focus to something more conventional. Zuckerburg just doesn’t realize it yet. Between the huge stock buybacks and whimsical metaverse initiatives, Facebook has lost all common sense. They will not be allowed to keep squandering massive amounts of capital, unless they desire a $1 stock price.

I think when you might not be taking into consideration, is this is Zuckerberg White Whale… Like Captain Ahab, he’ll go down with the ship before he changes his focus. But I could be wrong ha ha ha ha

I’m not going to spend the time to dive into Amazon’s financials, but just wanted to note that – even after this pullback – AMZN PE ratio is 60.

The modern-era average PE for the S&P500 is right around 20, suggesting that, well, you get the idea…

Tech stocks massive misses getting massacred … and the market is way way up on the news.

Don’t give me “watch out for bear market rallies” We had a massive one from June through August and now the world is like 1000 times worse then it was before this rally and yet we aren’t any lower now then we were in June despite this.

Things like HYG are even up, how is that possible? “So the safest possible debt (treasuries) is now offering returns closer to the highest risk debt (“junk,” such as HYG) than it has for the last decade or two and companies servicing that debt are more screwed then ever … so said debt is in high demand and now going to the MOOOOOON!”

This market has nothing but disfunction. Anyone who believes in market efficiency in any regards to reality as opposed to just efficient high speed trading games and slamming options hedging to “wag the dog” has not been trading much this year. Yes I am bitter because I have massive HYG shorts, but I still feel like it is a legitimate question why that is being bid hand over fist given the rapidly decaying fundamentals it is based on.

Something is off all right. Something has been off for a while. Today I was expecting things to be red all over.

I think central banks are directly buying stocks…who else is gonna buy, seriously?

Hedge funds, Algoes and Momo traders

Nat

“market efficiency” is a myth to start with. Definitely not after March ’09, when the the so called ‘ Free mkt’ along with price discovery were murdered by Fed in open day light.

Every thing on ZRP and Fed’s put. Now hopium for pause or pivot. Hence the front running.

A lot of brainpower and computer power that you are up against. Your position seems logical, but might be a tough one to hold.

Probably the next couple of years are going to be where the people that really know their stuff will make money.

So the stock still goes up due to forthcoming massive layoffs? What do these “analysts” think is going to drive Intel sales, or anybody else’s sales, when well paid people are being let go left and right and those still working have inflation eating their salary cheques?

Announcement of a mass layoffs is a beloved and classic trick to pump up the stock price.

This works only temporarily though.

A company cannot shrink itself into growth.

Mkts melt up continues.

No one is worried about 75 basis increase next month or 50 or 75 basis points in Dec.

Something is going on and hardly makes any sense.

Bear market rally? We just went through one over the summer which ended in a lower low. And now we’ve got another one, seems to me. This is just how it works.

Primary reason for the ongoing ‘front running’ and the mkt melt up.

“A crisis in the Treasury market is likely much greater than the Fed realizes. That is why, according to Bloomberg, there are already potential plans for the Government to step in and buy back bonds.

“When we warned last week that Treasury buybacks might begin to enter the debt management conversation, we didn’t expect them to jump so abruptly into the limelight. September’s liquidity strains may have sharpened the Treasury’s interest in buybacks, but this is not just a knee-jerk response to recent market developments.”

If something is breaking in the Treasury market, it will likely be time to buy both stocks and long-dated Treasuries as the next “Fed or Treasury Put” returns.”

(h/t RIA)

Peter Drucker was the brain and Jack Welch was the best ceo of the century, for fun and entertainment :

1) Cut your losses. Every year HR should cut the lowest productive employees.

2) Every part of the conglomerate should be number #1 or #2 in their sector.

3) Six Sigma, just in time.

4) AMZN built warehouses for just in time, during the pandemic, but

goods arrived after half a year.

5) AMZN made a round trip to 2019 high. AMZN might test it’s Jan 29/Feb 5 2018 backbone.

” Jack Welch was the best ceo of the century’

Also famous for announcing 1 penny more than expected (whisper#) earnings, almost every qtr.

Beat the expectation. creative accounting. Wow!

So Wolf what’s behind the disappointing Amazon’s numbers? I’ve always have thought Amazon’s business model was suspect at best. When they were growing they relied on UPS and FedEx. That began to bleed their bottom line. So they switched to their independent delivery system, Amazon Prime.

Then with their massive growth they began opening warehouses around the country, thereby hiring tens of thousand workers. That’s a crapload of overhead when their margins are pretty thin on most goods.

After that they decided to charge sales tax which was a big selling point buying from Amazon. Since then Walmart has done some nice things to counter Amazon strategy with online grocery and pickup as well as Walmart employees delivering groceries. Best Buy was almost killed off by Amazon and they too seemed to have weathered the storm. Prices between Amazon, Best Buy and Walmart are pretty much even for most goods.

Has any of this had an impact on Amazon’s numbers? Do you see further trouble ahead for Amazon?