Meta shares plunge 19% after hours, for a total plunge of 24% for the day: metaverse woes, online advertising, expenses.

By Wolf Richter for WOLF STREET.

So now, after the mess that Big Tech and Social Media companies made during the day, Meta Platforms is making a huge mess afterhours, after it released its quarterly earnings, with its shares down 19% at the moment, after having already plunged by 5.6% during the day. Combined during regular trading and after-hours trading, shares have plunged 23.8%.

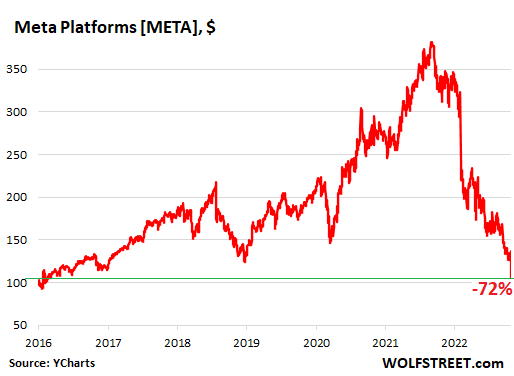

Shares are now trading at $104.78, the lowest since February 2016, down 72% from their high in September 2021 (data via YCharts):

Inducted into my “Imploded Stocks.”

Having plunged by over 70% from the high, Meta now qualifies for, and is thereby officially inducted into my Imploded Stocks. It’s the biggest name in this noble group so far, that started out in the spring of 2021 with just a bunch of crazies, SPACs, and IPOs but has been encompassing ever larger companies since then, in a sign of how the greatest stock market bubble ever started coming unglued beneath the surface in February 2021 and just keeps coming unglued.

With impeccable timing, the stock reached its high in September 2021, right before the company announced in October 2021 that it changed its name from stodgy Facebook to the somehow cool Meta, as in metaverse, in a bet-the-farm move. Turns out, the metaverse isn’t performing, but it’s swallowing up a lot of money.

The stock has not only worked off the entire free-money bubble since March 2020, but also the relentless surge since the December 2018 swoon, plus a bunch more, establishing a new six-year low. Long live the metaverse.

Online advertising, oh dearie.

Meta reported “near-term challenges on revenue” this evening, as revenues, most of which came from online ads, fell 4%.

It said that “ad impressions delivered across our Family of Apps increased by 17% year-over-year and the average price per ad decreased by 18% year-over-year.” In other words, each ad pays a bunch less.

While revenues declined, costs and expenses jumped by 19%, and its income from its “foreign operations” collapsed by 46%, and therefore its net income plunged by over half (-52%). And while at it, Meta lowered its revenue forecast for Q4.

Incinerated $65 billion in cash on share buybacks in less than two years.

It also said that it wasted and incinerated $6.55 billion in cash in Q3 on buying back its own shares. This brings the total cash that it wasted and incinerated in the seven quarters since January 2021 to $65.8 billion. And it incinerated those $65.8 billion at share prices that were far higher than the current price. But incinerating cash on share buybacks is no biggie; it’s just cash.

Cutting costs is expensive.

Meta is trying to figure out what to do. And one thing it knows it will do: cost cutting. It has for months been talking about its staffing levels. It said today that it would keep its headcount “roughly flat with current levels” in 2023.

And its massive office footprint is going to get trimmed, but those cost cuts are going to cost money “near term” it said in its earnings report, including $2 billion for its office footprint “rationalization”:

“We have increased scrutiny on all areas of operating expenses. However, these moves follow a substantial investment cycle so they will take time to play out in terms of our overall expense trajectory.”

And there are lots of new expenses to be added, including for “infrastructure-related expenses and, to a lesser extent, Reality Labs hardware costs driven by the launch of our next generation of our consumer Quest headset later next year.”

Competition from TikTok, problems with Apple’s privacy policy.

Whatever will happen with the metaverse, user attention has been shifting away from Meta’s products toward TikTok. Apple’s App Tracking Transparency policy is also causing a lot of heartache at Meta, where tracking of everyone on the entire internet is key to its revenues, and Apple is making it harder.

This whole mess comes on top of the stuff thrown out there by Microsoft, Alphabet, Texas Instruments, and Seagate late yesterday and early today.

Yesterday afterhours, Microsoft and Alphabet shook up markets with weak revenue growth and stirred up further worries about the online ad business – after Snap had already made a mess of itself last week over the same thing – and about the cloud business, which then took down Amazon, which derives most of its profits from its cloud services division AWS. And the plunging demand for PCs caused Microsoft’s Windows revenues to plunge 15%. There has been talk of hiring freezes and layoffs for months.

Seagate Technology, which makes disc drives including for PCs, added to it this morning when it said that it plans to cut 8% of its global workforce, or about 3,000 people, “to sustainably lower costs,” as CEO Dave Mosley put it during the earnings call, after reporting that revenues in the quarter plunged by 35%, and that its net income essentially vanished, plunging by 94%.

Here are how some of the tech and social media stocks performed today. Meta includes today’s afterhours trading. All others are as of the close today:

| Today $ | Today % | From peak | Peak date | ||

| Apple | [AAPL] | 149.35 | -2.0% | -18.4% | Jan-2022 |

| Microsoft | [MSFT] | 231.32 | -7.7% | -33.8% | Nov-2021 |

| Alphabet | [GOOG] | 94.82 | -9.6% | -37.7% | Nov-2021 |

| Amazon | [AMZN] | 115.66 | -4.1% | -38.7% | Jul-2021 |

| Salesforce | [CRM] | 159.91 | -3.2% | -48.7% | Nov-2021 |

| Meta | [META] | 104.78 | -23.8% | -72.7% | Sep-2021 |

| Seagate | [STX] | 53.39 | -8.0% | -54.6% | Jan-2022 |

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Anyone not quietly humming Nat King Cole’s Smile today?

Does a little schadenfreude make me a bad person?

Actually wallstreet has been very kind to these stocks:

1. Alphabet’s 6% yoy revenue increase when corrected for 8% inflation is 2% revenue decrease.

2. A 27% earnings drop when corrected for inflation is a 35% earnings drop.

3. On top of that this company that rapidly expanded operations, and has no chance of increasing revenues, failed to state how it will reduce expenses and instead dared investors by saying it will keep the headcount growth slow!

So I expect more drops instead coming weeks unless there are significant layoffs. No one likes a cash burning company when QT is going on.

Leo

“Actually wallstreet has been very kind to these stocks:”

An observation that seems vaguely familiar from the perspective of the life experience during an above statistically expected life span. Sends a chill through my body. What’s the angle I’m missing in this high stakes poker game of life.

In the glow of the finance centric mania that the world is stepping away from, the organized business community is planning and plotting how to maximize profits in the chaos.

For what it’s worth, I am entertaining the idea that the next generation, to whom I relinquished control, so that I could focus on having fun during the last years of my waning summers, have come up with a solution.

Deflation of the asset bubbles: Housing, stocks, bonds, miliary, etc.

An economic earthquake is about to unleash it’s fury.

Isn’t that what is preferred? Vice ESG, Climate Change, social justice, etc.?

Yes, you can count my 😁from ear to ear. Couldn’t have happened to better candidates👿

Nope, make you perfectly human and the non FOMO kind might I add.

I reserve this level of schadenfreude when the SoCal housing market can resemble something similar to Meta stock..

SoCal home owners can file a class action lawsuit against zillow. The text would go like:

1. Zillow provided highly inflated Zestimates for our houses that were far from market reality.

2. We priced our houses for sale based on these Zestimates. However ours houses failed to sell as the market kept correcting at 3% per month to 18% in 6 months.

3. We have still not been able to sell our house and lost the opportunity to sell at peak and this resulted in millions of dollars of cumulative losses.

4. We, the people, believe that Zillow manipulated Zestimates way over actual appraisals and hid the real appraisal figures with malicious intent to value its own inventory higher. This act caused us tremendous losses and we would like to Sue Zillow to recover our losses.

Just another pump and dump, Zillow that is, only they’ve missed the dump, and will soon be flushed down the bubbly toilet they created and manipulated to everyone’s detriment. As Charlie Munger says, “it’s a turd”. Oops!

I have thought that same can be done against the Fed.

“same can be done against the Fed”

Yes, but it’s hard to prove standing against Fed.

The Fed really Effed the Dems and this would be very visible on 11/9. Its important to make Dems realize what Powell did:

1. Lied about “Inflation is Transitory” and “Soft Landing” and completely failed to control inflation in time for midterms by delaying QT.

2. Conducted very slow QT that allowed wallstreet to suck in retail investors and meme crowds into fake rallies in stocks, bonds, cruptos and real estate, and then brutally crush their hopes of beating inflation through speculation, and taking their QE cash, and making them really miserable and demotivated.

I hope Dems would see Powell’s true face and deal with him correctly.

“I hope Dems would see Powell’s true face and deal with him correctly.”

And appoint Lael as the new chief? I like the sound of MMT money in my bank account.

Leo, this is completely ridiculous. Biden and his administration were cheerleading the Fed all along, as the printing and interest rate suppression allowed them to pass the March 2021 stimulus bill (despite warnings from many economists, including left leaning ones like Larry Summers, that doing so would overheat the economy) without obvious negative effects. They were also cheerleading the “booming” economy, which is how printing always appears before the pain ultimately sets in.

And now, the Democrats (Hickenlopper and several others) are demanding that Powell stop raising rates, as it’ll cause job losses. Well, yes, that’s the point. Inflation has to be brought under control.

We’ll see if Powell succumbs to the pressure.

I love it when CNBC cites the junior Senator from Colorado as if he were the word of god. CNBC just doesn’t let up being ridiculous.

Shadenfreude, ya.

😆

“Does a little schadenfreude make me a bad person?” Nope

Faceplant banned me a year ago , ever since they wrongly identified me as a Republican.

They deserve everything they get.

I’m sleepy, it’s raining and I need to waste some time. Pedantry is always fun, and thus, let me suggest a cromulent English substitute for the German “Shadenfreude.” — Epicaricacy — Larned it yesterday!

@IanCad Never heard of that til just now. What a great word. Thanks!!

That was cute, Mark. But very shallow….use MORE nuance, my boy…if you can…..or…..

Take a course from a Russian troll farm if they offer them…(most likely do, if you know where to go)……..

……..it’s an art!

Imagine where FB would be today if…

They didn’t censor and ban half their user base for not getting with the narrative?

Didn’t interfere with elections?

Didn’t steal your data?

Was still a fun place to hang out and watch your nephew’s birthday video?

Never heard of the metagulag?

And…

Still made oodles of money as one of the best advertising platform???

If they “Didn’t steal your data?”

This IS their business model. Accumulate (steal if you wish) ever bit of data about its users and sell it to anyone desiring to buy it for any purpose.

The two most destructive words in the English language are “Easy” and “Free”. All those “Free” apps are simply collectors of data that is sold thousands of times. Don’t delude yourself into thinking EVERYTHING about you is offered for sale.

You can’t steal something that’s being given away for free.

Face Book has a childish sound. Zuck finally went through puberty, I guess.

A couple years ago there was a high level sector/industry reclassification that now looks really dumb. They took consumer ad-driven companies like GOOG and META and such out of Tech, and put them into “communication services”, which used to just be telecommunications like Verizon, Comcast, AT&T etc – generally very stable, dividend-paying companies.

That basically ruined those sector funds now that the cyclical ad-dependent companies are getting hammered.

Well, are Google and Facebook not communications services companies?

No – ask yourself where their revenues come from, and you can see that they’re advertising companies. From their perspective, all the websites and apps are basically just glorified billboards and stadium walls, places where “eyeballs go” to view “content”.

By contrast, Verizon, Comcast and the genuine telecommunications companies deliver data and are paid by subscribers rather than advertisers.

The classic telecomms are utility services, which customers are reluctant to cut, whereas advertisers cut their budgets whenever the economy gets tight.

P.S. The name of the sector wasn’t “communications services” before the change, either.

Google search results are almost exclusively “seller offerings” now. Very little in terms of research data or actual information. Even then, a lot of that is click bait or behind paywalls.

Well, have you ever paid a single dollar to Facebook or Google for communications?

GOOD question ndy, but have to consider NEVER been on ”FACE HOOK” and never wanted to be after looking carefully at their policies and practices.

SO very sorry for family and friends who have been done badly by that company.

Google, yes, but only as far as WE, in this case the PEEDONs WE, have to have something like their platform, and in spite of the various and sundry comments, almost all of that venue appears to have the same challenges…

VVNV-your first sentence should always be observed, and sadly, appears to be too-often observed in the breach…

best to you, and-

may we all find a better day.

Yep and Yep.

I would say they are content producers and distributers. They should be put in the same class as movie studios, cable channels, gamers, publishers, etc.

How did Cathie Woodshed somehow miss this stellar opportunity to vaporize obscene amounts of investment capital?

To busy writing letters to FED

She probably didn’t know that

1. Metaverse is worse than a cheap VR video game,

2. Its headsets give you a headache in 1 hour

3. Its supposed to be worth 1000 times more than other better VR games.

They made Second Life: Wii Graphics edition. 20 years later than the first Second Life, worse in every way. Incredible. Jesus, this guy Zuck could’ve given us good money a la Libra. He would’ve been a god and a savior. To come to such a fate.

The human brain does more visual processing than any super computer can or ever will do. AI my ass….self crashing cars, etc, etc……but good for very simple but scary human defined drone missions. Computers are just fast at defined missions, that’s ALL!!!!!!!!!!!!!!!!!!!!!

Just put your smart ass phone on record, hold it on top of your head where your eyes are facing and look around the whole room your are in for 5-10 sec.

Then view it.

THAT IS (closer to) REALITY…

..we call it Electromagnetic radiation….and are fairly good at producing and playing with it….lot of resolution loss, which doesn’t matter much, as it exceeds our sample rate…..which we know little to nothing about.

children even have to LEARN how to watch TV…..to not look around the screen too much, just focus at infinity.

Meta at $100 still seems expensive, maybe $50 meta, $70 Alphabet are coming soon… And the rest of them, especially Apple are to expensive too.

Agree. $75 Apple (if iPhone sales hold up). $25 Tesla (where BMW or Toyota would buy it; big maybe).

More like Kia or Hyundai, same quality level.

Too many headwinds:

1. Interest rates were 0% when Google was at $50.

2. Companies fight recession by reducing marketing and ad expenditures. These companies are hopelessly dependent on retail expenditure and respective ads.

One more year of QT with 5% interest rates would mean:

1. Alphabet at $30 (last seen in 2015).

2. Meta at $30 (last seen in 2013).

Meta’s Q3 2019 was $17.3 billion vs Q3 2022’s $27.7 billion.

They still sell a lot of ads.

Yes, but who needs them. No one that’s who.

I am paying for PPC ads to Adsense. This is worth doing since they bring good leads.

It is annoying when small businesses exclusively use FB as their storefront and their only internet-user interface. I have never used FB and therefore I cannot access business sites that do not have a conventional internet site. This is primarily true for local small businesses.

Dumb to be stuck in that narrow of a venue.

EXACTLY andy:::

cannot understand WHY any biz would limit their presence on web when it is SO cheep to do a website, etc.,

But, what do I know other than I spend a lot of time and a few $$$ trying to keep up with my grandfather who lived, deliberately, on his income ONLY FROM SS, while keeping his powder (capital) dry, just in case…

He is still the longest living by age of any of my MALE ancestors, and these days my only long term agenda/goal is to best him…

And many thanks to THE Wolf and all the commenters on here for their wonderful help in keeping me ”on my toes” and continuing to learn a ”bunch” of stuff that should have been and should CERTAINLY NOW be taught in every high school.

Is Google a scam? I mean the changes Apple made was supposed to badly affect all advertising companies, not just Meta, but the later has taken the brunt of the impact while Google is still growing. Sure Google missed both top and bottom line projections for this quarter, but they are still GROWING quarter after quarter. What’s so unique about their business model?

I might not be totally correct but Google has a lot of great properties (Google, YouTube, Maps etc.) that drive revenue and Apple does not control the desktop. I have to imagine an inordinate amount of FB access is through iPhone whereas google is used plenty on desktop and of course android. I don’t use FB much but the last time I used it on desktop was probably 2017.

I don’t buy your argument that FB users are mostly iPhone users. That just does not make sense. FB is available in both platforms. What are Android users supposed to use for their Social Media needs? Orkut?

Google has Youtube, but FB has Instagram.

Youtube ad revenue is down apparently. Much was related to crypto scams that were trying to lure in suckers.

Apple seems like the next domino to fall. Cant think of much theyve done lately that created significant interest, their operations in china are probably in jeopardy, and the strong dollar has to be choking their profits

Thanks to adblockers, I never see any ads, except the ones served by Brave browser, for which I get paid. But anyway, almost all ads there are crypto related.

I can image the demise of crypto has caused a massive loss of revenue for many industries, including advertising. Also, a 70% reduction in crypto “wealth” (going from $3T to below $1T market cap) must also be felt by everybody. For many millenials/GenZ crypto was their last hope to ever get ahead (yes really, many have said that).

Actually for YS:

While it may be true that folks you cite are convinced by the propaganda, it is absolutely NOT TRUE that crypto or any other FAD is their or anyone’s last or best hope to become long term stable, financially or otherwise.

Long term, the very best way is, as it always has been, in spite of the interference of the FRB, set up by the oligarchy to rob/steal the wealth of WE the PEEDONs who work and MAKE wealth:

Work first of all to increase your skills and value, in college or in trade school or in OTJ training…

Work then to make yourself ever more valuable by experience and expertise.

Work then to continue to increase your net pay.

And these three clear metrics are why every working person in the world wants to come to USA where they can get the most ”PAY” for their hard work.

@VintageVNvet,

To be clear: I was not suggesting that I think this way! But I have read this type of comment posted by young people many times on reddit etc.

Judy

“Cant think of much theyve done lately that created significant interest”

Agreed.

I certainly am not interested in any of the content they’ve been producing for AppleTV. I have watched a few episodes of “SEE”, “SERVANT”, and “FOUNDATION” and am not impressed. It appears as if they are sinking millions into a lot of these episodes, as they are well produced, but I can’t imagine them gaining the subscriptions needed to justify the spending as they try to hit a “Game of Thrones” jackpot.

Sidenote: Black Bird is superb BUT it’s a limited series. One and done.

With lousy original content and no catalog, this may be something to keep an eye on. With so many better choices out there in the streaming business, AppleTV would be at the bottom of my list.

So, yea, like you said.

Google has its own Android operating system which runs on far more smartphones than iPhone OS, and it controls the android ad policies. Google also controls search ads, which are huge. Google controls the ad policies on Chrome, by far the biggest browser. Google owns a lot of the plumbing that online ads are being delivered through.

Yep. I SEE Google ads. I don’t see anything in the metaverse. Nor do I wish to.

Mark Zucchiniberg is off his freaking rocker.

LOVE the zucchiniberg H!!!

Thanks

Yeah, I’ve been able to avoid FaceBorg completely and most of Apple, but Alphabet is well nigh unavoidable barring retreat into the most isolate of caves.

Google even owns some undersea fiberoptic cables. Now it’s muscling into healthcare data. If you make a list of all the things it has its hands in, it’s really scary. This company needs to be broken up into 50 pieces.

I don’t know about others, but Google is ridiculously pervasive in my life… Gmail, Calendar, Drive, Maps all used for personal & business, all meshed in with my phone, kids using Google services at school for education, carrying chromebooks instead of paper, all with Google suite installed, etc. That’s gotta be worth a lot.

Does this mark the end of the tech boom officially? Will Wall Street start demanding free cash flow instead of top line growth from big tech companies and these horribly over staffed businesses go from hiring freezes to widespread reductions of people who have been coasting?

I’m looking forward to the layoffs. Many of their staff are highly skilled programmers. Just imagine these folks now becoming available to do stuff that benefits society.

I actually saw the best credit decision engine workflow generator this week made by former Facebook engineers at fintech event.

“credit decision engine workflow generator” LMAO!

I gave up at why some managers liked squares and some liked ovals in their flow charts.

Of course they all liked check the box and coded forms for their easy data inputs to calculate whatever it was they thought they were calculating.

I put the code u-j (think that was it) on every single work order I turned in for over a year before my pissed off manager dragged me in and said, “No more raise/lower urinal !” I don’t have any idea where in the chain of managers it was noticed….probably him because he knew I was a troublemaker….to managers only, I fixed the machines quick and right, depending on how soon it was needed.

Well… The AH market now, is (once again) trying to show that this bear market bounce still has legs….. From the lows of the sell-off on Oct 13 before exploding upwards (day of CPI print), before today’s action, the markets were up over 11% (that’s in 9 days!). Even today after the tech carnage, the Dow ended up slightly, while the Nasdaq managed to turn a 230 point opening declineinto the green, before selling off again in the afternoon.

Until Powell speaks at the press conference on Nov 2 after the 75 basis point hike (AND..IMHO, will bring out the hawkish hammer, like at Jackson Hole), Tech is pinning A LOT on Apple’s results tomorrow, which will tell the market’s trajectory for the next several days…

as seems to happen every month, there is once again the belief the Fed HAS to slow down/pause, sooner rather than later.

Once again, they will be WRONG! Don’t Fight The Fed!

I’ve been reading the headlines…the Fed Pivot Believers are still out there. They are still talking. Cope springs eternal.

Cytotoxic

Pause and or pivot are NOT tolerated at WFST. I am surprised yours went through but NOT mine, irrespective of the context.

Hopium and front running remains strong especially at DJIA.

All pivots pivot to moderation to control the pivot mongers. And if Wolf pivots, the pivots pivot out of moderation. Your pivot and Cytotoxic’s pivot pivoted out of moderation in a New Nork pivot. You just couldn’t find your pivot, it’s way down there

Let me know when the pivot’s Timken tapered roller bearing wears out…I’m good at replacing/repacking them fast.

I’m hoping this company dies altogether. I know, shocker. I’ve never been a customer, and I never will be. I see it as the face – the epitome – of everything that is wrong with social media and the entire system today.

Hey Depth –

What ? Someone else doesn’t love this CIA front ? And all their info going straight to the Politburo?

My my

NSA/FBI….get your bigger intelligence agency’s general missions straight! I don’t mess with any social media because I simply think it’s stupid…..except for WS where I often have doubts as it is.

Still think you need troll training from overseas….try dark web or whatever it is. DC is just an adjective specialist….pretty good, though.

“It said that “ad impressions delivered across our Family of Apps increased by 17% year-over-year and the average price per ad decreased by 18% year-over-year.” In other words, each ad pays a bunch less.”

Thanks for the translation!

America printed up money and handed it over to 100’s of unproven entities. Most of them tanked and are bankrupt or soon will be. While the proven entities did nothing much but buy stock to keep inflating the ego’s of their founders in an attempt to maintain their positions on the World’s richest people. We shoulda copied China…. it put a lot of its cash into concrete & rebar to build high-rises. At least when you build something over time that building will bring back more dollars than were spent for it. That Meta name change was just useless as a lot of people don’t see life as one spent in a megapixel world

“We shoulda copied China…. it put a lot of its cash into concrete & rebar to build high-rises. At least when you build something over time that building will bring back more dollars than were spent for it.”

This is not true in many cases. It is only true if the building is used by people willing to pay more than it cost to build, service any mortgage on it, and pay for ongoing maintenance and taxes. Misallocations of capital into infrastructure and other projects that don’t pay for themselves happen all the time, especially at the end of economic booms. China’s property development sector has enormous problems right now. Possibly bigger than Meta’s problems.

Yes exactly, one just needs to google “Chinese ghost cities” to get a sense of the immense waste, it’s actually breathtaking, a look into the Evergrande fiasco is worthwhile as well.. Finally, if anyone thinks it’s all concrete and rebar going in like in most other countries then the term “tofu-dreg” is totally worth a spin on the Google and YouTube machines.

Those ghost cities are all filled now.

China has 1.5 billion people after all.

Not having lived in China for 10-20 years, I gotta agree with Harold. This IS an article about media…..after all.

AC, um, can you say “ghost cities?” Plus I’d guess much of the concrete actually didn’t have rebar in them either…The Chinese model is not something I would want anyone anywhere to emulate, but that’s just me.

Agree, the Chinese building model is not for long term nor does it consider maintenance, there is none.

Housing, or better stated housing “spaces” is a commodity for investment in China, not necessarily for occupation. It is literally investment in the housing “space”, held for appreciation and resold, as “space” seldom intending to be built out or finished. It is against Chinese culture and belief to buy or leave someone else’s build out in place. Bad karma etc. Better to buy and sell unfinished space as an investment.

Only time will tell if and when no maintenance and deterioration of those poorly constructed, and unfinished spaces overtakes their appreciation and losses begin to multiply. In a way, not too different than Wolf’s Imploding stocks list. Maybe he should start an “imploding Chinese housing” list? It’s like folks gathering the pretty shells on the newly exposed beach, they don’t know when that tsunami arrives in earnest.

But then, I’m just a dinosaur, watching the passing parade.

Facebook is the new myspace.

It will be interesting to see when businesses and consumers really cut back on discretionary spending.

I recently read an interesting article from the Wells Fargo Economic Insight group titled ‘Eating the Seed Corn’ that started to scratch the surface on how consumers are burning through their liquidity. I don’t think links are welcome here, so not going to try to figure out how to do that.

The article also had some really good charts, the funny part was, my first thought was, ‘These are almost as good as Wolfstreet charts’.

Interesting report Wells Fargo made and yes the charts do look similar to Wolf’s! They are saying the excess savings from 2020 and 2021 should be wiped out entirely around Q3 2023 the rate it’s going now and they think recession starting Q2. If that’s the case, these tech stocks still got a long way to go down as does the rest of the market for that matter (more to add to Wolf’s list coming up). Good riddance to Fb/Meta. I don’t use any of their apps and refuse to even though my friends and family keep trying to get me on them.

Never used twitter or facebook or any of that jazz. Always seemed a little like the Walmart of social media. Even despite the ceaseless collective appetite for facile time sinks, I’ve been astonished at the staying power of this stuff.

FB & Twitter are both consistently terrible user experiences. FB’s UI in particular has been steadily getting worse for years and years.

American Express last Friday say their card holders spending is up 21% YOY. AMEX said their cardholder are record spending.

The stock market downturn so far has not dampened demand it appears

Hotels are killing it to.

their business model is to compile and sell all of YOUR personal info and internet/app use.

if you don’t like that, then take the appropriate steps necessary to stop it.

I never touched (visited, used) facebook and never will. But they have files on me and you. They track us all over the Internet. And of course they monetize that. It’s fine with me if they fail.

I block everything from Facebook.com and Facebook.net from ever loading in my browser using Ublock Origin. I never see Facebook buttons, Facebook comments, and can’t even open Facebook website. I also block all cookies related to that. They can’t track me. I like it that way. Down with the Zuck

This is the way

Don’t kid yourself. There is no way to get a reasonable degree of privacy on the internet. That are several players who have ability to see and scan your data.

Your ISP

Your browser company

Your search engine company

Your operating system provider

Your virus software provider

Your VPN provider

Your shopping and news sites

Your credit card company

Your bank

Credit rating agencies

Etc.

There is no way to know what all these players are doing with your data, because its done behind closed doors and there are few checks or audits in place. It entirely relies on self-regulation and self-disclosure. On top of that, even in the case of ethical players, they almost always lack sufficient internet security to house and protect data. Note the hundreds of known cases where internet data was abused or stolen.

Thus, attempts to secure internet privacy are like a fish twitching on the filet table.

There has never been internet regulation, because that’s the way the business lobbies want it. The internet players did what they wanted, like they were in the Wild West, and now nobody in Congress has the balls or smarts to fix it.

They distract people by focusing on censorship and free speech, when the real issue is invasion of privacy and manipulation/use/dissemination of your data without your consent.

My kids talked me into FB a while back. What a joke. I got tired of all that crap that I had to read from relatives from way back who were losers back then and are even worse losers today. The happiest day was when I deleted all my so called “friends” from FB. The next happiest day was when I deleted my FB account altogether.

I had a broker call me earlier this year when it tanked down to $230/share. He said, “Our analysts have a strong buy on it!” My answer was, “I don’t invest in companies where I don’t like and buy their products, so no thanks.” So glad I stuck to my principles. Facebook sells fixes to dopamine addicts. That’s all it is.

I get a good dopamine fix when I find holes in receptor theory. Which is REALLY ironic as hell in several ways, but I might as well write this comment on a bathroom wall somewhere. Maybe a medical school…..

1001+ Imploded Stocks, but extremely low unemployment. That is good for the employee and their families, but not for decreasing overall demand and inflation.

This is what is different from the dot com bust, correct?

Care to guess when unemployment will begin to rise?

Perhaps when companies realize the Fed will not pivot or begin QE4? They are all counting on cheap money in the near future?

The dotcom bust started in March 2000, with record low unemployment, big wage increases, booming economy. A mild recession started a year later, likely caused in part by the dotcom bust.

I remember escaping yahoo to gold via advice from B Brinker. I made a $hit load of money!

So did Brinker. That call made him shitloads* of money. Had friends that stayed true to him and bought his expensive newsletter…even long after he missed the GFC completely….some probably still do to this day. Think his kid has been running it for a while.

*I mean “critical mass” PLUS!

There was also a big bust in tech employment around that time – there were a lot of programmers employed to fix y2k issues, and once that was done, a lot of jobs evaporated.

Both Y2K and the Tech Bubble busting caused many jobs busting in 2001 in Silicon Valley. This also caused a local housing bust.

Today we still have a ramp-up in a few areas.

1) People always want the latest tech gadget. Software engineers are still in high demand. Can people still afford the latest tech gadget?

2) Software and hardware security has become a major job creator. Both for security people and for hackers (both government supported and independent.)

3) The US is currently bringing tech and manufacturing back to the US. That will create millions of jobs that were formerly in Asia. It will likely also cause more inflation since US employees generally are paid better.

Yep. Our team of of about 15 engineers actually hired 3 expensive contractors in 1999 just to work full time on y2K.

Yep, they were let go in 2000. So Y2K had some impact too.

As I recall, these big tech firms (FAANG or whatever) were taking up an ever-larger share of the whole stock market including the S&P 500. So; when the tent-poles fall, then what?

The stock market seems like the breathless cheerleader awaiting the favor of the quarterback (Fed), maybe while the bleachers are collapsing. If the Fed blinks, or equivocates, it is back to the slippery slope of inflation, the road to heck and ruin. It seems to me the Fed’s official statements have been very sober and cognizant of this. But any remark that hits the press from any member seems to buoy up stocks. And workers apparently are still pressing for wag increases. Meaning, if true, perhaps a long season of high inflation and high interest rates.

The leading indicator for me, looking ahead, seems to be buyers’ strikes, in more assets than just stocks.

Still like a-hole Cramer’s description (probably one of many) of the market……A Fashion Show.

Isn’t Tesla nearly touching the bar from its highs? Love to see an electric car in the carnage (pardon the pun).

Tesla was down 50% a few days ago, and is down slightly less now (the bar is -70%).

But just about every other US EV makers is in my Imploded Stocks. I’ve covered them quite a bit. Some of them are penny stocks. One of them already went bankrupt.

Read that Theranos “ain’t over by far” and that the era of “personalized medicine” based on a blood sample is coming and soon……totally laughable to me.

But NOT to the “health” community. Get ready for a lot more for a lot more Implosions on the way….I’m not kidding…..wish I were.

I think I found a use for the Metaverse: The Zuck will need the Metaverse to pretend he’s back at the corporate offices when his company is operating out of his dorm room again.

You might be right. Imagine that meta has there whole company running on ai and he only needs 1 employee but he’s bringing in excess of 100 billion a year in revenue. My oh my would his margins be good.

“Imagine that meta has their whole company running on ai and he only needs 1 employee but he’s bringing in excess of 100 billion a year in revenue.”

I think I saw those movies. You are describing SkyNet or The Matrix.

I’m sure there is a non-dystopian movie that has a better outlook.

Before that happens, the share price will have really collapsed on the news that the Meta project did a review of new code and found out there wasn’t any. The coders in the headsets, without being aware of it, had only been simulating writing code.

“You mean we weren’t … we didn’t … It seemed so real!”

All of these cutting edge, high tech companies from 20 years ago, are more than mature and are destined to the dust bin of history, I sometimes think.

Is public computing better than it was 20 years ago ?

I don’t think so. I sometimes think that monetization has corrupted and corralled the free exchange of life at the root of the purpose for the creation of the medium in the first place.

Meta, YouTube, Alpha etc pay big money to Influencers … then people sheep follow, subscribe, and buy what their Influencers tell them.

Destroy this business model. Be a wolf … 😊

Group of scam companies not making anything or just selling cheap Chinese made parts/products are worshipped as best of the best. Time for a new way of capital allocation and reward companies who actually produce value for us.

Yeah but… Yeah but….

The US economy is do’in just fine.

The US economy is like a coiled spring or a lily bulb planted in a nurturing soil.

The boomers retired en masse and the young, who were denied a future by capitalism are now being called upon to be competent in filling the minimum wage jobs offered by American, asset lite business’ that sell their goods here.

The companies really want to come home. Their BFF Xi is not as nice as he once was.

I seriously doubt that a forty year old Zuckerberg has the vision afforded by the recklessness of youth to reinvent a platform doomed to become yesterday’s news, like the Beatles.

Even though, I agree that virtual reality will have an extraordinary run. The problem is that tech is so mercenary that innovation is drowning. My 2 cents. Probably wrong.

I just wish “innovation” would drown….there is a shitload of serious old time mostly off the shelf work that needs to be done….Like a Comprehensive Green New Industry and Infrastructure Package. But the FN “free market” will never drive it…no immediate profit.

Damn we are a stupid country.

The fact that OLD re-runs of “Shark Tank” still make ad money for CNBC is evidence….in fact all reality shows are.

“”” And it incinerated those $65.8 billion at share prices that were far higher than the current price.”””

Burning such a large amount of billions should be regarded as market manipulation and therefore condemned to thousands of years in prison.

Glad for your comment in the sense that it illustrates several basic concepts of the basis of our national belief of the independents of the so called “free markets”.

In this case, the tragedy is that investors in a speculative stock, a risky asset, suffer as their bet comes up snake eyes.

Having lived in Reno long enough to become familiar with the rote:

You bet, you may win or lose. Not my problem.

I cannot over emphasize the profound difference between the time I was growing up. There were 1.5 billion people in the world.

As compared to now, with 8 billion people trying to live a virtuous life.

That is one of the reasons that I voluntarily turned the stewardship of the world, the future, to the younger generation, some time ago.

The only reason I mention it is that, it seems, you kids aren’t doing any better of a job than we did.

The price of Meta stock, has at least another multiple to fall to be properly priced to it’s NPV.

As does the next category of over priced capital assets, bubble babies, if you will. The potential for loss is similar to 29 but the stock market crash is unlikely to disrupt commerce at the same extent.

The next few months are likely to be remembered by myself as either prescient or foolish.

The kids did not have the best teachers.

$65 billion would buy an Oculus VR headset for everyone in the USA.

That would’ve got them at least a load of users interested, playing their games, analytics info yadda yadda.

Instead it’s just evaporated.

When Meta aren’t pursuing their apparent core focus with all their efforts it’s a worrying sign.

They could have matched Epic Games and Roblox and Quixel and all the others for that much money, and had everyone playing/making free VR games on their free VR headsets for that much money.

I just don’t get how they can fail so badly with these sums of money to use.

Meta needs to focus more on games with its Virtual Reality headsets.

Then use it for entertainment in regards to watching movies.

Then scale or tailor to make it for education like use it to teach science such as having virtual labs.

One Meta advertisement I saw was using the VR headset to virtually visit museums like science museums and art museums.

Education can be entertaining with these VR headsets.

Make it first about Entertainment in regards to Games, Movies, and Education. Just like Disney Epcot mixes entertainment with education.

Then they can look at VR for other means like for virtual meetings, etc.

$RBLX holding very strong in the down market sure crushed from peaks but at $45 up from $21 range and still at $25B + market cap. Based on kid games in metaverse. Makes no sense…. $BMBL too garbage dating site saturated with Match. Lots of fluff still there.

Roblox is an absolute juggernaut. The biggest cash machine you’ve never heard of. Pretty sure it takes in more money than multiple AAA games routinely.

Well, for a behemoth like Meta, I don’t think a niche like gaming is likely to generate the revenues required to keep this walking wounded company alive.

The only hope for them is to find a way to make facebook relevant. Since I don’t have a facebook account, I can’t recommend a remedy.

Nobody I know has ever been interested in social media, or spending hours and hours on a computer. A few younger men get addicted to video games. But the entire FB/instagram concept is for teen girls trying to virtue signal and be the most popular.

I don’t think there’s much hope for these platforms to grow. Once people grow up (over 25), most seem to leave their phones at home and go do things in the “real” world. Under 25, stare at your hand as you walk across a steet. Over 30, text messages answered hours later.

This is more than a bit sexist, and almost certainly not true. I know nothing about facebook, but there are lots of guys on insta.

I have seen a lot of people over 30 staring at their phones. I see them at the grocery store walking very slowly and not looking where they are going. I have seen people pull halfway out of parking spaces or just come to a dead stop in a parking lot because they are looking at their phone. And the woman who moved in across the hall from me literally cannot go a minute without yelling into her phone. I just do not get the appeal of these devices.

For some reason, it reminds me of that line by Blaise Pascal: Man’s problems are caused by his inability to sit in a quiet room alone. Except now people are putting their pathology on display for everyone.

Kind of like when my thirty something children ( a dead give away) ask me what should I do. I have developed a response that seems to work:

do you really want to have a recommendation from someone as old as me. Well then, which is the least risky strategy ?

You know of course, that I’m not sufficiently proud of my own history, and therefore I’m not sure my recommendations would appropriate.

I love you and am sure whatever you decide to do will have it’s own outcome.

I am old, against my will, cursed with an uncertainty of what the whole thing was about.

Deserving comeuppance to some of my enemies dissolved away when I learned that my niece was dying of cancer at 40. A sweetheart that never even conceived of the dangerous crap I got away with.

Good one dang, and somewhat similar to my efforts a while back to get my now 40s kids to stop already, asking my advice…

They seem to be doing much better since then.

LOL

Behemoth being an accurate description.

This article hits the spot for me. I will need to take pause before I “spam” out.

No one wants this crap. The power of Facebook was the social network aspect. Holographic games virtual worlds are interesting to a much smaller demographic. This Meta thing is a disastrous cash vortex and a waste of revenue.

WRT nobody wanting VR: I read a comment that Zuck wants it because then he can sell you the headset and now he owns the channel. Unlike Apple, Google or MS, Facebook does not control a browser or an OS. With VR, they can. That is assuming there are enough people willing to buy yet another $1000+ gadget.

Meta has a lot of headwinds at the moment (inflation, Tik Tok, Apple changing their privacy settings on iPhones), but I wonder if Sandberg no longer being around is a factor. She seemed like the only one who could tell MZ he was wrong about something. Is anybody in Meta telling MZ that there is not a lot of interest in VR? The basic reaction is: “I didn’t want Second Life a decade ago, I don’t want it now.”

Like I said, there are several factors at play, but Meta having trouble after she is out is an interesting coincidence.

I’d really like to know the reason(s) why Sandberg left (of course, we never will get to know). It seem like FB has been going straight downhill after her departure.

Maybe she saw the writing on the wall, so to say.

Meta layers are investigating her use of company resources and employees to write her book, work on her foundation Lean In, and work on other personal projects she had going back several years.

You can do that maybe if you own the company. You cannot do that if you’re an employee, like she was.

But it seems it was tolerated years ago, and now it’s a problem, which shows that something big changed.

Thanks Wolf, I wasn’t aware of her legal problems.

Games, amusement, entertainment, distractions, mindless diversions from Reality. More of the Modern Bread And Circuses to keep the Great Unwashed from noticing what’s going on.

Look at NASDAQ and from its peak in 2000 to present day, it only has appreciated about 3.5% annually.

If NASDAQ crashes a lot more, then the last two decades have essentially been lost decades.

“And it incinerated those $65.8 billion at share prices that were far higher than the current price.”

Just another reason investors should demand dividends on mega cap stocks. They can put those billions to better use.

I was about to point out the same incongruity that you pointed out, the financial waste by a company buying it’s own shares. Philosophically, it doesn’t make sense,

because, once the company issues shares, the company is expected to use the money to develop the next generation of industrial processes. When the best opportunity is purchasing the company shares on the stock exchange, is a thinking man’s concern. A waste of precious capital that should be employed to meet the customer demand.

Excess profits wasted buying shares is an obvious indication that market concentration has increased to the point that competitive capitalism has been displaced by a more sinister ownership.

I’ve heard no compelling argument as to why share buybacks should be legal. None.

Einhal

Buy-back shares was ILLEGAL before 1986. But Wall St including Banks influenced their bought out, Congress to change it.

Love buy-back shares $ being burned. It has social redeeming value except to pad their options.

It’s outright fraud or misrepresentation to buyback shares in an overall stock market that’s 5 to10 times what it should be. It sends out all the wrong messages to the clueless and gullible public.

Where are the legs which took you long, harooh harooh!

Where are the legs which took you long, harooh harooh!

Where are the legs which took you long,

When the tech boys made ya bang yer gong,

Indeed you’ll be dancin’ to a brand new song,

Nazzy we hardly knew ya!

MIT fight song?? Ha

This research diverts all of my attention to Twitter. Taking an average of its peers, it’s effectively down 40% without Musk’s bid and even more when you discount the premium to acquire it and assess that it’s more of a FB than an Apple. Plus, the market is nowhere close to a trough, which would require Bitcoin to exchange for well below $500.

Buying Twitter at a grossly inflated price, with the collateral of an even more grossly inflated auto company, must feel like walking the plank. Despite all of the recent commentary, one-sided legal advice, and the evidence (the sink), I can’t quite see Musk consummating this deal voluntarily.

I agree Musk didn’t buy Twitter at this price voluntarily. His massive ego thought he could get away with playing buyout chatter games & Twitter’s board burned him by legally calling him to task.

Bust a deal, face the wheel.

Musk learned a valuable lesson here. I bet this is the last time he signs a purchase contract for $52 billion dollars on a whim.

Maybe he didn’t notice all the zeros after the $52….LOL!

Also that he couldn’t seem to find a way to intimidate the Delaware Chancery Court the way he has every other regulator in the USA. There’s a decent case to make Kathleen McCormick Person of the Year for 2022.

Musk is planning an all hands meeting at Twitter HQ when he takes over. He will tell everyone in there what a great job they have done over the years. He will have his goons hold up an “Applause Sign”. Those who stop applauding will be the first to go. They will be escorted out of the hall and fired right on the spot. He will then tell everyone in the hall who is left to hand in their resignations. Those who he wants to keep (25%) of the workforce will be hired back at half their former salary. The stock price will soar.

There is growth, there is time and there is change.

When you pay 30 times earnings for a stock, there had better be a load of growth because paying for 30 YEARS worth of earnings up front in a rapidly changing world where companies rarely stay dominant for more than a couple of years is insane.

If the growth stops (or slows) and change continues, the valuations implode.

“There is growth, there is time and there is change.”

Facebook has just bought a nice little bungalow in the same retirement community where MySpace lives.

Remember MySpace? Some day people will say “remember FaceBook?”

Zuck is very much aware of this. This is why Facebook has acquired over 100 companies in the past decade.

Instagram and Whatsapp being far and away the best acquisitions.

But he was totally blindsided by the success of Tiktok.

Harold, do you think that the US government will actually block TikTok?

Would definitely impact the ecosystem.

We saw Zuck, Bezos, Gates, Musk, and some Google and Apple Exec’s dumping shares in Nov-Dec of last year. That should have made everyone’s eye BUG out.

These folks preferring to weigh the cost of dealing with the IRS over the loss in share price over the next year was like a giant neon light saying LOOK.

I can’t help but to wonder what is happening behind the scenes at some of these places – especially Meta and Google. The decisions they make definitely are not in the best interest of the shareholder (if there any – I haven’t checked the %’s – probably all institutional).

What IS this business model? Gov’t in the shadows of Big Business?

If it wasn’t apparent how these 1st time entrepreneurs (Zuck, Bezos) were able to build global monsters right out of the gate, it’s becoming more-so

“Get woke – Go broke” might be the catchphrase of 2022-23?

When are the public protectors at the SEC going produce an update to their “meme-stock” parody on YouTube? They can add Meta and Google. Oh, wait…YouTube is Google. They would have to shadow ban the SEC. Don’t buy meme stocks kids…buy these other imploded stocks.

The circus show must go on! What’s next?

apple is the 800 lb. gorilla . We’ll see if Wall Street can hold it up after it releases its earnings after the Thurs. close. If it faceplants there goes the market.

This is funny for me, personally. I receive their advertise with us messages – but – cannot speak with a person. Yet somehow the magazines find time to ring us up. The owners of forums find time to reach out, also in person. Facts are we have money in the ad-budget but nobody on their side has time for us. So beyond funny, it’s downright weird and strange how anybody can run a media business this way.

Us? We’re like, OK, whatever . . . but I promise you this, we’re not ever running after them because we’re the client. The money is in our pockets. They’re the ones that want a piece of it. Bottom line? The ball is in their court to figure this out.

I am a huge Sci-Fi fan.

If you believe novels like “Ready Player One” where the population is so large in the world that people put on their haptic suits to enjoy their free time in the virtual worlds, then Meta is positioned to be a key player in this arena.

Of course, after Meta invents the “Matrix”, we become blobs constantly living in the virtual Matrix world. Well, at least until the revolutionaries overthrow the Matrix. Sell Meta before that point.

SIA Bob… Actually, I think there is a decent chance that the Metaverse becomes HUGE, and I say that as someone who has NO interest in it… however technology keeps on marching on and things change, Especially young folks and kids, who didn’t develop normal social skills because of Covid and the obsession with various social media platforms creating a generation or more of phone and computer focused zombies. THAT is Meta’s target audience.

Unfortunately for Meta (kind of like driverless cars), the technology is not ready and won’t be in the next few years or longer. The question is will Zuck (like Ahab) be allowed to continue the pursuit of his White Whale before he runs out of money or causes a revolt of the shareholders…

Zuck owns the majority of the voting stock of FB. He doesn’t really care about shareholders.

Jim Cramer’s rant against Meta and FAANG was epic last night.

He is an entertainer.

Well… if Cramer says he’s done w/ Meta, might be time to nibble. He touted FB all the way down lol… there is not a Contrary Cramer EFT I might look into (if you think about it, that concept is hysterical!)

That should read there is NOW a Contrary Cramer ETF…

Headline I just saw over at CNBC: “Cramer: I was wrong about Meta, never thought Zuckerberg would spend without any discipline”

In other news, Jim Cramer was born on October 26, 2022

The world seems full of people who flap their jaws excessively and get paid absurdly for it. They just wing it, and everybody forgets about last week’s flim flams and lies. And the suckers keep coming.

This would be in “music,” investment, and politics. The star systems have become such ludicrous lurid cartoons I can’t believe it.

The antidote, I think, oddly, is: stop printing all that funny money! Attributed to Andrew Mellon: “Liquidate labor, liquidate stocks, liquidate the farmers, liquidate real estate. It will purge the rottenness out of the system. High costs of living and high living will come down. People will work harder, live a more moral life. Values will be adjusted, and enterprising people will pick up from less competent people.”

Mellon’s prescription is a recipe for violent revolution.

He also has been called the clown of Wall Street! Not a fan.

SF go to hell, for fun and entertainment only : GOOGL, MSFT, META have failed, but if AAPL popup the monthly DOW will rise, cancel DM #9 in favor DM #13.

QQQ is green. If Nov will be green QQQ will reach DM #13 first, before the

Dow and SPX and win the race…

Yes, but what do I do with DM’s # 4 & 7?

Here’s a couple of random data points: At work, we’ve found that we have to spend an incredible ten times the amount of money for ads on Facebook (‘Meta’ ~whatever) to get the same return as we do with Google ad-buys.

A few years ago the difference was roughly four times. So, it’s always been a not-great proposition in our industry (healthcare), but it’s also getting much worse.

Pause and pivot talks have reached a fever, after Dem Sen Sharad Brown is ‘dictating’ Mr. Powell to ignore inflation b/c of increasing unemployment. Currently the unemployment is around 3.6%. Labor mkt remains tight due to demographic changes with 22 millions above 60y in the employment force, slowly exit in the coming 5-10 yrs. Front running remains strong b/c strong hopium and narrative spin from the Wall ST.

The credibility of Mr. Powell is online.

I think he is too far deep into this situation to do a reverse. His credibility will be shot and inflation will rage on (it may do so anyway). Note that the ECB today raised 75 basis points today.

“Meta” is literally Hebrew for “Death” (feminine form). Zuck should have learned his Hebrew!

This is probably the first real down cycle for internet companies in 13 years, if not 20.

Many zoomers & millennials, who have been pampered their entire adult working lives, have been posting Tik Tok videos showing off their lavish $300k+/yr lifestyles & company perks including Michelin-starred chefs, on-site massages, nap pods, etc.

Honestly it’s hard to feel too sorry for them.

The vast majority of Imploded Stocks comprise companies that have negative EPS, some for long periods of time, making them true cash incinerators that simply cannot survive without the constant stupidity of “investors” stoking the incinerator fire with more cash. This will come to an end and no doubt many of these imploded stocks will cease to exist. In contrast, META has been a cash generating machine for a long time with positive EPS & Cash Flow and increasing revenue. Sure they made what appear to be stupid decisions like incinerating cash on buybacks and going “all in” on the metaverse (I own a Quest Headset, and love it, but never use it). No one is perfect and mistakes will be corrected. Cash machines like META selling at low prices are what successful investments are all about. I bought $10K of META at 120/share and have bought another $10K at 98. If the Price to Tangible Book value gets to 1.5 then I’ll be buying another $100K of META. Laugh if you want, but don’t forget that “he who laughs last, laughs best”. My bet is on full recovery and more.

Craig Hamilton-Parker a world famous psychic gave his opinion on Facebook back in November 2021. So far he’s been spot on. He didn’t say they’d file for bankruptcy. I said they’d eventually file for bankruptcy. My mother and her mother were also psychics by profession.

Pretty funny, tech company burning cash on stock buybacks instead of allocating to R&D. Buy high sell low. And the Metaverse pictures I have seen, pathetic. Years ago there were tools that let you add to game environments.

And lusting after TicToc, the aging current thing bound to go into decline after the Chinese launch their next greatest time wasting data vacuum? Typical lack of imagination from taking your eye off the core business.

Amazon getting shredded after earnings too.

Good to see but the U.S. stock market is still 100 percent rigged to the bull’s tits. What was it a decade or so where earnings didn’t matter? In fact for many stocks as earnings kept on falling the stock prices went higher.

1) GOOGL, MSFT, META, AMZN fell, but there is still hope, because the monthly NQ is a green doji. The news are worst at the bottom. If Nov will be green we are in a Xmas rally. Can u live without AAPL.

2) Long Beach and Savannah boom is over, but road works all over US replaced them. Gov spending is up.

3) Export is rising. We supply energy and weapon to our many old and new friends.

4) CA GDP is largest, but the mid west and the south are the heart of industrial US. They replaced the loss of adds and fake news. CAT instead of used cars. Boeing, Toyota, DG, LMT and new chips in upstate NY and Cincinnati, pine trees, cotton instead of C/S bs…

Jim Cramer has a big position in Meta and Google with his charitable trust. No wonder he was becoming unhinged and sh$itting in his pants during the Mad Money show last night even before the recent 30% drop in Meta. I noticed he had another set of clothes on when he came back from a short station break.

I thought Cramer invested cash in Midtown emporiums.

My brother closed his short out too early on Meta I played it like a man and stayed short the entire time since November 2021. I never liked Facebook and still think the stock will eventually go to zero. I’ve been arguing for almost a decade with people who don’t believe Facebook can go bankrupt.

I fully understand it’s only notional, ephemeral paper wealth…but I really have to wonder how Zuckerberg must be feeling this past year. He’s literally lost over $100 billion in wealth during this time period ($138 billion in Nov ’21 to $38 billion now).

I would think that would be enormously depressing or agitating for most humans to bear, even with $38 billion left over.

The operative word is “humans”.

If the shoe fits, wear it.