This raging inflation will keep dishing up a lot more surprises.

By Wolf Richter for WOLF STREET.

On Sunday at the Mortgage Bankers Association Annual Convention & Expo in Nashville, the MBA’s chief economist Mike Fratantoni forecast that by the end of 2023, the average 30-year fixed mortgage rate would drop to 5.4%. And this made some headlines in the news.

In its regular monthly forecast, the MBA predicted the same: Mortgage rates would drop to 5.4% by the end of 2023. But it also forecast that mortgage rates, which are now around 7%, will drop to 6.2% by the end of March 2023, and will then continue dropping for the rest of the year until they reach 5.4% at the end of 2023.

But wait a minute… In October 2021, exactly a year ago, the MBA forecast that the average 30-year fixed mortgage rate would be 4% by Q4 2022, which is right now. And right now mortgage rates are 7%.

It was and remains just incomprehensible to the mortgage industry that mortgage rates could actually go back to what used to be the old normal before QE. And wishful thinking sets in.

Along with many others, the MBA is forecasting a recession for the first half next year, or at least the good folks there are hoping for a recession by then, because they’re hoping that a recession would bring down mortgage rates, because the surge in mortgage rates this year has crushed and battered the mortgage bankers’ business.

The mortgage industry makes its revenues from writing mortgages and then selling the mortgages to Fannie Mae, Freddie Mac, and other financial institutions that then securitize the mortgages into MBS. And those revenues have collapsed.

There have been mass-layoffs across mortgage lenders, some of the bigger ones are teetering, and some smaller ones already shut down or filed for bankruptcy. The stocks of the biggest mortgage lenders have collapsed from their highs by 79% (United Wholesale Mortgage), by 85% (Rocket Companies, former Quicken Loans, the #1 mortgage lender in the US), and by 96% (Loandepot), and they’re all featured in my Imploded Stocks. For more on the plight of this industry, read Mortgage Lender Woes.

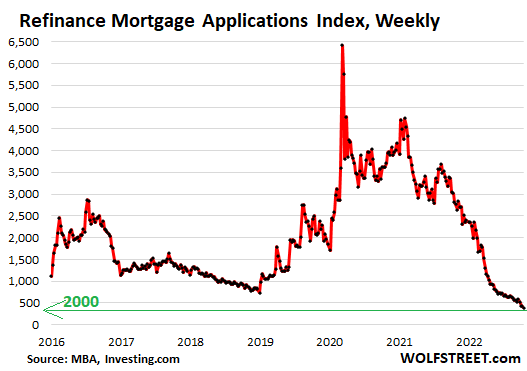

The mortgage refinance business has collapsed by 85% from a year ago, to the lowest level since the year 2000, according to mortgage applications data from the MBA, because hardly anyone would be refinancing a 3% mortgage into a 7% mortgage, except to pull out cash, and then sell the home asap.

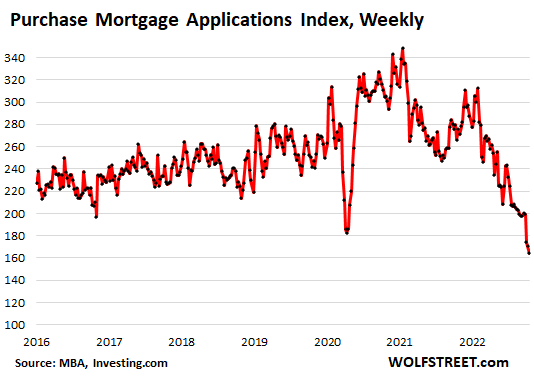

And the business of writing mortgages to purchase a home has plunged by 35% from the still gloriously heady days a year ago:

So praying for a recession, and hoping that the recession will cause the Fed to relent and cut interest rates and end this horrible cruel QT, and start buying MBS and do QE all over again to bring down mortgage rates, while inflation is tearing up the economy, is the logical thing to pray for, if your industry is getting battered by collapsing revenues.

“The upside of that [recession] potentially for the industry is, that’s the thing that’s likely going to bring rates down a little bit,” Fratantoni said, as reported by MarketWatch.

“Mortgage rates will drop as the global economy slows, settle at 5.4% by the end of 2023,” a slide in his presentation said.

The average 30-year fixed mortgage rate is 7.29% today, according to the daily measure by Mortgage News Daily. The weekly measures from Freddie Mac and the MBA last week rose to 6.94%, over twice the rate a year ago.

“We are holding to our view that this is a spike right now, driven by financial-market dislocation, heightened level of volatility in the market and this global slowdown we’re about to experience, the likelihood of recession in the U.S. will begin to pull this number,” Fratantoni said.

Forget about this raging inflation just to save the revenues and profits of this industry?

So mortgage rates would have to drop by 1.6 percentage points from around 7% now to 5.4% by the end of 2023, according to the MBA.

But a year ago, the MBA allowed its wishful thinking to dominate its forecast. At the time, inflation was already spiking, and CPI had blown through the 6% line and was shooting straight up, and the Fed had had its infamous pivot where it started taking inflation seriously. And the MBA still forecast 4% mortgage rates for Q4 2022. Because reality would have been too painful to bear.

And this inflation has dished up lots of surprises. Inflation in some goods is backing off, but inflation is now spiking in services, where it is a lot stickier than in goods and very difficult to dislodge, and services is where consumers do nearly two-thirds of their spending. The CPI for services spiked for the 13th month in a row, by 0.7% in September from August, and by 7.4% year-over-year, the worst increase since 1982.

Anyone forecasting anything in this environment of raging inflation is going to be waylaid by surprises. This inflation has spent the past 20 month dishing up lots of nasty surprises, and there are likely a lot more to come. And mortgage rates don’t exist in a universe of their own without inflation.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

This is what happens when you feed the ” free money”animals which the Fed has done for a decade or more. They have followed them home. Pretty soon they will be in the trash bins out back at the Fed.

The Hitchhiker’s Guide to the Galaxy states the meaning of life is…42

Elon Musk states the meaning of life is….420

The American Mortgage Dream states the meaning of life is….4.200%

Maybe, just maybe, the Fibonacci patterns of the Universe are predicting 4.200% mortgages rates in the next few hundred million years…¯\_(ツ)_/¯

42% or 420% mortgages are also possible. Venezimbargenturkey scenarios.

In today’s environment, trying to predict out past 2-3 months is absolutely futile. By January, we should know if the Fed will be forced to sell of MBS to meet its runoff cap of $35B. Even if they don’t have to sell MBS, it seems reasonable that, for as long as they runoff MBS, this is going to keep rates pushed up, until we hit a real recession with real, widespread job losses & a real tanking housing market. By December, we should have a clearer picture of how bad housing may get in 2023. A big slowdown in housing should tip the US into a real recession. I for one believe that the Fed knows housing has to roll over at least 20% for there to be some semblance of affordability with rates staying at or above 5.5% long-term.

The real recession is apparent when goods and services turn unobtainable. Not by high price, but the vendor just closing business as there is no market at the prices needed to provide the goods and services. Or that some needed raw material, half-fabricate or part is no longer made and no substitute viable.

The assets of these debt burdened companies will be bought up for pennies on the dollar and goods will be produced at a price that makes sense. Capital doesn’t just disappear and unless there is no energy to operate then the goods will still be available.

Misenome,

“Capital doesn’t just disappear and unless there is no energy to operate then the goods will still be available.”

You sound like the Fed back in 1930.

They believed that when a stock closed at $100 one day and opened the next day at $50 that the investors had taken that money out of the market and it was sloshing around in the economy. They kept tightening money supply which prolonged the Great Depression.

When farmers do not harvest their crop that season crop is gone even if someone buy the assets for pennies.

Then there is energy, even after buying the assets for pennies the price to extract oil and gas may be higher than the marktets purchasing power.

Capital, in the form of money, may not dissapear, purchasing power may dissapear. Capital in the form of resources, manpower and technology may not be available or affordable within the purchasing power of the customers.

You both missed the point. If you miss your car payments, they take your car and sell it to someone else. If you can’t make money operating your factory then they sell your factory to someone else for way less reducing their base costs and the employees take a pay cut to keep their job. When debt clears in bankruptcy it causes deflation. The factory still exists but at a much lower cost basis allowing for goods to be made at the price customers can now pay. If the cost basis to extract the energy was higher than people could pay, even for pennies on the dollar then they wouldn’t buy the capital at that or any price. Bankruptcies are good for reducing costs.

A real recession is apparent when first time unemployment claims move towards 300K and then towards 400K and above if the recession gets bad enough. In the last few months, we’ve been at or below 220K, so there’s a long way to go.

Not only that, a recession doesn’t come with bumper to bumper traffic everywhere, with restaurants sold out and everybody naming their price on everything, and getting it.

All of these “pivot people” totally brain-farted on how much money is still sloshing around out there. We’re not in a recession, and I don’t even see a recession coming in the next 6 months. You can’t print that much and then expect it all to be exhausted and inflation “fixed” in a short period of time. That money has staying power.

Depth Charge’s comment nicely summarizes the situation on the ground *today* and is exactly why the pace of QT should be increased dramatically.

I believe in real terms the economy will have contracted on a 1 year basis when third quarter is recorded. Real wages down and real output down, but more people working with poor productivity for many reasons.

“By January, we should know if the Fed will be forced to sell of MBS to meet its runoff cap of $35B”

We already know the answer to that question–it’s no. A cap is a cap, not a target. The Fed can’t be forced to sell MBS. They can choose to sell them, but Powell was specifically asked about that at one of his most recent press conferences and he said that it wasn’t being considered.

“trying to predict out past 2-3 months is absolutely futile”

Futile, indeed. The Fed is likely to stick with the idea of a pause coming up for “some period” of time. In a year, they could be holding tight with an FFR of 4-5% and some QT with inflation still a little hotter than they’d like. Or they could be cranking the FFR up further to fight hot inflation that just doesn’t want to give up. Or inflation could be abating and the Fed could be loosening gently. Or we could be sitting at an FFR of 0% with QE back on tap after some massive economic factor blows up causing a credit freeze (bond market, derivatives, corporate debt, whatever). Or maybe by this time next year, the few of us that survive could be packing in for a chilly nuclear winter after WWIII broke out. Forecasting a year out with so many mechanisms of our economy still so far out-of-whack is a hopeless endeavor.

That’s why we’re doing our farewell world tour now. Eleven countries over three different trips in the next eight months. We’ll spend the money before they take it. Sorry about the inflation dust we’re stirring up behind us.

I agree as at least a 20% drop will wipe away most of the COVID gains in housing.

S&P 500 had a negative real return from February 2020 when it recently bottomed 26% below its all time high of 4818.

And Wolf or Wolfman showed here a lot of stocks lost at least 60% ranging from Facebook to AMD to Shopify.

In my townhome community in Florida panhandle (2 miles from beach) the homes peaked in 2021 at $330,000. A sale last week was for $310,000.

The first ones to be built here were sold for $270,000 in 2006, and then crashed to $125,000 by 2012.

Back in February 2020 they were selling for $240,000. So I figure the value will over-correct and bottom around $235,000.

We bought ours new for $187,000 in summer 2016 with a VA mortgage at 3%. Have about a $155,000 balance.

The VA mortgage just like FHA mortgage can be assumed by any qualified buyer, so that is a selling point for those who want to sell their home and have a mortgage with a rate below 4.5%.

2 miles from beach is good AD, but might take 20 miles next time, as folks in DeSoto county would be happy to testify after Ian and Charley.

While prices in panhandle MAY eventually stabilize north of 2012 prices, they MAY go lower or MUCH LOWER until then, with the most likely low being an inflation adjusted amount equal to their low in 2005-08.

Have seen RE, good stuff, go down 75% in the last crash, but nothing compares to the crash after 1929, when land in now desirable locations in FL was selling for $1.00 PER ACRE.

And the possibility exists for that to happen again per the comments of AF on here, correct IMHO.

I wouldn’t hold my breath on the ‘assumable’ notion.

Not many folks walking around with the cash to payoff your equity. Unless,

a.) you’re willing to carry a ballon note with a 30 yr amortization,

or b.) folks can afford a high interest line of credit (which doesn’t make sense).

So my trusty old HP19B calculator tells me that back in February 2020 when interest rates were 3.5% the monthly payment on a $240,000 home bought with a 20% down ($192k mortgage) would have been $862.

At 7% the monthly would be $1277 almost 50% higher. Or with the same monthly payment and $48k down payment, the mortgage amount would be $129,590, and the home price $177,590. Even if we assume buyer’s income up 10% since February the price would still need to be under $200k.

But since the buyer’s cost of living in other areas, e.g., gas, electricity, food, insurance, cable, etcetera has probably gone up rather more than 10%, even a $200,000 price might be more than they could afford.

I find it hilarious that some people are writing that homeowners are in great shape because the transiently inflated home (asking) prices make it appear they have huge amounts of equity in their homes.

In reality anyone who bought or did a cash-out refinance in the low-rate years will get out no equity at all if forced to sell, and so in most cases will have no down payment money for a next-home purchase. A new crop of renters.

Much of housing market is leveraged at 10:1 to 33:1. If we have asset normalization to 4% treasuries and 7% mortgages anyone that bought on high leverage in the last few years will be underwater at least on paper.

I liked what El Arian said. Basically Fed has a trilemma 1. Inflation 2. Unemployment 3. Financial stability. How do you solve inflation without blowing up 2 & 3?

crack pipe dreams that realtors and sellers love to glob onto. here’s to hoping for DDD exits and here’s to hoping buyers actually put sellers where they belong (in a full nelson).

“crack pipe dreams that realtors and sellers love to glob onto. ”

I like the term ‘hopium.’ There has never been a more optimistic group than realtors and affiliates. Of course, they have to believe that sometime must be the best time to buy!

Of course, excess or unfounded optimism could be construed as delusionary.

Realtors could be talking their own book: inducing hopeful buyers to go in on that adjustable rate mortgage. But in the mid-2000s, the roughly same kind of pitch (housing prices are going nowhere but up) was an invitation to be a bagholder, whereas various housing providers walked away with their fees paid.

It is always in my best self-interest to say, [whatever I do] is going in a great direction!

If realtors were talking their own book, they would be trying to talk prices down. Having four customers a year at nosebleed prices is not as profitable as having nine customers a year at prices 20% lower.

Tell that to the auto industry.

I look at Real Estate agents at least providing some level of protection for the buyer and seller. As a seller, my seller’s agent gives me some protection against shark investors (i.e., flippers and bottom dweller landlords) and scam artists.

But I see local seller agents managing seller expectations by having the price lowered every couple of weeks in steady increments for sellers who can list their homes for at least 6 months.

The MBA says one of the reasons rates are high is due to “this global slowdown we’re about to experience.”

Riiiiiight, that makes a ton of sense. Economy hitting the skids makes mortgage rates rise.

Rates are going up because inflation is raging, and the Fed is trying to get it under control by raising rates, plain and simple (and MBS purchases are done).

I wouldn’t be surprised if mort rates hit double digits by end of 2022, especially if the Fed raises 0.75-1.00 in about a week.

Wait till the next post-November Fed meeting. If it is anything under 75%, the relief rally will be deafening. Hope springs eternal.

I will take that occasion to strengthen my short bets, because it appears masses of folks are underestimating inflation. There are so many deep structural reasons forme to believe that is wrong.

Big Rob, yes as CPI or inflation was generally tame from 2000 to 2021.

The Fed Funds rate was 6% and the 30 year mortgage rate was 8.5% in 2000. I remember getting a rate of 6.75% in late 1998 and thinking it was a good deal.

The 30 mortgage rate had steadily declined from 8.5% in 2000 to 2.75% in 2021.

Now the 30 year rate is about 7.25% and you are forecasting it to rise to 10% at end of 2022 :-(

Fortunately the end of the year is a very slow time for real estate so a 10% rate won’t have as much of a relative effect on slowing sales.

I’m reading that the FED wants to pivot. Trading Economics is also reporting that.

Are we in a feudal society where the property investments are too big to fail, like what Canada is trying to do with their housing bubble?

There’s an argument for the Fed to pivot, which is basically, the inflation doesn’t appear to come from labor, but from companies choosing to raise prices and increase profits, and so therefore the Volcker playbook doesn’t make sense right now. All that will get us is inflation *and* higher unemployment.

I don’t know if that’s true, but, more importantly, I don’t think the Fed, having finally decided to change course a few months ago, is going to change their strategy again so quickly.

I agree with Wolf that the most likely scenario is continued rate raises through the end of the year, followed by perhaps a brief pause and re-assessment.

Rent and food prices appear to be gouging in Canada. That’s why the “communist” NDP wants an inquiry into grocery store profits.

But lower mortgage rates fuel the housing bubble though. So we are stuck in a tight spot where the feudal lords benefit regardless.

Corp profits are at their highest point since 1950 in the US.

“Inflation” has been very good to the corporations.

Speaking of Fed to pivot…here we go again with this stupid A$$ market…once again getting drunk on the FED to should pause and pivot narrative rally all over again, even a ill behaved dog would learn the trick by now after how many rounds..

On the other hand, I am sure PPT team will be happy though, more time for them at the bar based on action from last Friday and today and possibly more to come this week.

Seems like the FED wants to cater to the stock gamblers using leverage, and the real estate speculators. No care for the working class facing gig levels of inflation and tent cities.

The current inflation comes from “companies choosing to raise prices and increase profits”? Are you kidding me? How about the inflation comes from historically unprecedented fiscal and monetary stimulus. It’s frightening that so few people grasp this basic fact.

Exactly. Too much money chasing too few goods and services. They printed way too fuc*ing much and now they’ve got a big fuc*ing problem.

Inflation is always and everywhere the devaluing of the currency. The devaluing of the currency can be achieved by increasing the quantity of money. Price increases are a result of the devaluing as the currency no longer buys as much.

Roosevelt achieved the same results of devaluing the currency by changing the price of an ounce of gold from $27 to $35 when the US was on the gold standard.

Google “sources of inflation corporate profits” and the top link is an analysis that corporate profits account for a bit more than 50% of current price growth, versus 8% for labor costs. By comparison the average from 1979 – 2019 was 11.4% corporate profits, 61.8% labor costs.

Duh, MarMar. That’s what happens when you have too much money chasing too few goods – prices shoot the moon irrespective of the cost to produce.

Inflation is a by product of Ukraine war ,they are in top10 in most commodities,real reason there is massive inflation .look up lorimer Wilson he shows real charts

Flea,

Inflation was surging for a year before the Ukraine war started. In fact, Powell even retired the word “transitory” in November 2021, almost 3 months before the war. While the war probably has exacerbated some price increases, to suggest inflation is a byproduct of the war is simply not correct. The unprecedented stimulus is the much more direct cause.

“Inflation doesn’t appear to come from labor, but from companies choosing to raise prices and increase profits.”

LOL! I’m not surprised that this is what people find on Google when looking for the cause of inflation. I’m sure Google’s top search results will also tell us that Modern Monetary Theory is good economic policy too.

I think that playbook of blaming companies is BS. If companies can raise prices and people still buy, it means there is excess demand/inflation.

In a normal economy, when companies raise their prices, they will lose sales. So they choose a sales price that is optimized to bring in the maximum profit.

E.g the candy costs 1$ to make. They sell it for 2$ and they will sell a million of them. 1M profit.

They sell it for 3$, they will sell 900k units. 1.8M$ profit.

They sell it for 10$, they will sell 50k of them. 450k profit.

So the top price point is 3$ in theory.

In this economy, you raise and raise, and people keep buying. So keep raising until you hit the optimized profit… It’s totally normal that they do it, and they should to balance demand/supply.

Cheers

Untill other considerations are done. It may be considered best business to make 50k candies, sell them for 10$ a piece and get the largest revenue, 9$, per item.

There is a question about maximum total profit vs. maximum profit per unit sold. Return on investment may look better in the later case.

“There’s an argument for the Fed to pivot, which is basically, the inflation doesn’t appear to come from labor, but from companies choosing to raise prices and increase profits, and so therefore the Volcker playbook doesn’t make sense right now. All that will get us is inflation *and* higher unemployment.”

I could see that argument if the answer was instead to quadruple the runoff of QT. But they don’t want that either, do they?

Gen Z,

“I’m reading that the FED wants to pivot.”

You’re reading BS. The Fed doesn’t want to “pivot.” The Fed said at its September meeting that it will likely raise 75 in Nov 50 in Dec and 25 in January. And that caused markets to swoon. The Fed heads spent the last few weeks confirming that course — slowing down the pace of the rate hikes as they go over 4%. The Wall Street journal said that this is likely the course it will take — and there will be some discussion at the December meeting about 50 or 75, the WSJ said, which was very hawkish, that they would even discuss 75 in Dec. And this WSJ article was called the “pivot article” here by some moron.

Only morons call a FF rate of 4.25% of 4.5% and then pause a “pivot.” This is far higher than expected a few months ago.

We all live in a world of wishful thinking except when you’re an industry insider, you call them forecast. My wishful thinking is that SoCal market especially in LA and OC goes down in price for 50%..that’s my wishful thinking but since I am not an industry insider, I can only call this day dreaming but when Zillow tells you the same in the opposite direction, they call it “forecast” what a freaking joke.

Yesterday I was doing some comps on properties on the market in South OC.

More than a few homes are on the market recently which had been purchased between October ‘21 and March ‘22. They are coming on listing in the 1.2m – 1.4m range (roughly at the original purchase price to $200k over).

Now the fun part: compare the payment on these homes from when the buyers purchased them vs now (at their original purchase price, not the new asking price).

If one were to put 20% down at the original purchase price, the homes would have to drop between $300k to $500k just to have the SAME payment as a year ago (with that same 20% down, which is about $240k).

So a home sold at $1.2m 9 months ago would need $612k down payment for the payments to be the SAME. Or it would need to drop by $375k if the buyer were to put that same $240k down ($825k sale price with 27% down). It’s stunning.

Sellers today are simply not even close to where the buyers are. And the buyers probably would buy, but most can’t afford a $7500+/mo payment.

I’m not sure how the market finds it’s way down (slow or in a crash), but at this point in time it’s clear the only way it can go is down… a lot.

Real interest rates remain negative, and until they become positive and back to historical norms, they need to keep rising.

Where it stops;, nobody knows.

b

Negative real rates of change are the outcome of FED policy.

Trying to prevent price crash by predicting distant salvation? Ear candy to greedy sellers who ‘know what they’ve got’, and the FOMO buying crowd too, I suppose.

So, has wishful thinking set in with the stock market as well, or is it likely the Fed has been convinced to stop or drastically reduce their rate hikes?

The Fed is going to go to 4.25% or 4.5% and pause, which is far higher than expected a few months ago.

“The Fed is going to go to 4.25% or 4.5% and pause, which is far higher than expected a few months ago.”

And that would be “pausing” at 4.25% when true inflation (Non-Chinese Volcker CPI) is over 15%.

Gee pausing with inflation at a true 15%. Not pivoting. Right.

1. Your inflation figure is whatever. So whatever.

2. A lot of commenters here, the way their comments sound, want to just shut down everything and say f**k it, but in their real lives, they don’t want the lights to go out either.

3. Inflation doesn’t just go away even if you raise interest rates. And raising them so high that they just shut down the economy and turn off the lights to everything is just stupid, and everyone knows that. There is no red knob they can just turn. But there is a “long and variable” lag between changes in monetary policy and inflation reacting to it. This lag is usually 12-18 months. So you will not see how inflation is reacting to today’s monetary policy until 12-18 months from now. So it’s important to get to a certain point and letting markets adjust and letting them transmit the higher rates into the economy and to demand to where it might squash inflation. We may need a recession to squash this inflation. And recessions taka a while to build and play out. What we don’t want is shutting down the economy.

Yes. I think we have ushered in a new bull market.

hardly.

I think it’s pretty normal in financial markets when you go to extremes in asset value highs to swing to extreme with asset value lows. Extremes with money printing to extremes in inflation. If we really swing to high inflation and record low price to sales on stocks that’s about 800 on SP500 and a 50% haircut on house prices.

As some say 1 in 100 year statistical events happen every decade or two in modern financial markets.

I think we’re paying the price for decades of very poor and politically motivated economic decisions. Add to that the fact that governments around the world can’t pay for the obligations they’ve made (vote buying via ponzi schemes). Unless they walk back those agreements they’ll have to keep printing paper to pay the debts and keep raising rates to somehow keep inflation at bay. This doesn’t work. Nobody knows exactly what’s coming, but it’s safe to assume it’s gonna be bad.

Looks to me as though the MBA is launching a meme: Buy now in this softened market. Use an adjustable rate mortgage. In a year or so, you can refi when the rates fall.

This is unconscionable. There are naive, inexperienced buyers that could get shafted by these weasels.

Double the commission; same for the garbage fees.

The front page article in todays Chicago Tribune is that the cost of a “Chicago hot dog” is now six bucks. The cost of relish, mustard, potatoes (French Fries) all up astronomically.

I’m still seeing massive price increases in all sorts of items. It’s groceries, materials, services – across the board.

I just got notice that my homeowner’s insurance is going up 36%, hahahaha, I can hear them laughing all the way to the bank.

Services inflation is going haywire.

If you don’t have a mortgage it’s time to tell them go to hell. Self insure.

Yeah, but I’ve got an umbrella insurance, for reasons that are important to me, and they require it.

If you revalue your insurance off of current construction costs your insurance will be closer to doubling. I shared cost per foot amounts with my insurance agent and his eyes about popped out. He said that virtually all of his clients became woefully under insured across the last two years. Most people don’t up their insurance every few years so become very under insured in a short period of time. This fact only gets ink when there’s a catastrophe like a massive fire and hundreds of folks start yelling at their insurance companies for not having adequately insured them. A good agent will stay on this and let folks know. I’m very in tune with what construction costs have done in the last few years so beat my agent to the punch this time.

My homeowners ins went up to $1,475/yr. In 2010 it was $625. They have no offices here and all their employees are WFH all over the country. I asked the agent why it went up so much. She said, INFLATION. They also failed to cover a large claim I just submitted. I haven’t ever filed a claim in decades. I switched to another company at renewal time. I didn’t even have to tell them. The new company wrote them a letter telling them to GET LOST!

What was it before?

It’s all about supply. Most of the relish, mustard and potatoes moved to Florida.

I got a hot dog on the mall here in the Swamp for $1.50

It looks like the mortgage industry is predicting a recession to bring down mortgage rates. I hope it is a high employment recession since in the depths of the GFC recession, in 2010, unemployment was at 10% and not many were taking out loans to buy the houses during massive foreclosures. I think the mortgage industry is doomed for awhile until the next bubble starts inflating. They hired all of the warm bodies they could during the massive 2020-2022 boom.

They are predicting rates will drop early next year while the Fed is still committing to raising rates until then? They don’t believe the Fed.

Housing prices are starting to fall (7%) after a massive 30-40% increase during the last few years.

IMHO, the Fed will continue to raise rates and implement QT:

1) Until inflation has fallen to 4-5%.

Or until the wheels start falling off the economy (ie a massive recession).

1) 30% drop in house prices (Down to 2019 prices). – Currently 7%. If

you purchased before 2019, there will be no need for Jingle Mail.

If you purchased after 2019 with a 3% mortgage, it would be

financially better to keep your underwater house than to try to rent.

2) 7+% unemployment. – Currently 3.5%

Both of these could take months if not years.

I hope it is the former instead of the latter.

These Mortgage lenders will be lucky to land a job selling hot dogs from a truck on the mall here. They are History.

Great article! I saw this headline yesterday and smh and wondered what Wolf would think about it.

“Forget about this raging inflation just to save the revenues and profits of this industry?”

Exactly, Wolf. Another greedy scvmbag wants to throw the masses to the wolves to line the pockets of he and his buddies. He’s going to be sorely disappointed, because we’ve now got some sort of stock market melt-up going on on top of raging inflation. The market never got the FED’s message, is actively in “fight the FED” mode, and needs to be scolded and disciplined like a defiant young child. “Hot cheeks,” coming right up in the form of more massive rate hikes.

With you DC.

Anyone that works for a bank or banking association that has the title “economist” is not an economist but a lobbyist.

Mere sock puppets whose personal bonuses depend on peddling their organisation’s distorted narratives.

“Mere sock puppets whose personal bonuses depend on peddling their organisation’s distorted narratives.”

That’s a big club. Our economy EVIDENTLY depends on it.

If you accept as a major premise the proposition that the Fed’s “rescue” (re-inflation) of the economy circa 2009-2021 (roughly) did NOT address core economic issues–aka the real causes of 2009–then you might be inclined to see the current collapse of the everything bubble as inevitable. The only question, then, is how long the collapse will take and exactly how bad things will get. The Press is playing the same game it played last time around: talking up the market and downplaying the hard evidence. Real Estate Boards play right along, of course. What else can they do?

What’s your timeframe?

Eventually, the biggest mania in history should lead to the biggest bust in history, both in the economy and major asset classes.

There will be no “re-set” by another temporary GFC type event unless enough excess debt is wiped out and enough corporate zombies go bust or liquidate. Even then, many other problems I’m not going to get into.

Price wise, stocks should retrace most or the entire mania, back to 1995. If not in nominal prices, definitely inflation adjusted. That’s happened regularly in numerous markets in prior manias.

Interest rates should ultimately “blow out” well past the 1981 peak, since the actual long-term fundamentals are terrible. Credit quality and credit standards (including for supposedly “prime” borrowers) is in the (sub) basement, only appearing prudent due to a fake economy and debt mania.

Real estate is more overpriced than ever, especially residential but commercial too until recently anyway.

“We need to get back to a place where supply and demand are back together. And where inflation is down low again and mortgage rates are low again.”

-Jerome Powell 6/15/2022

That was uttered by Powell only 4 months ago. Let’s be clear, the goal is to get to a point where they can taper interest rates back down. There is a lot of money still flouting around and that could keep inflation hot for a while. On the other hand, rate hikes and QT are clearly having a big impact. With a year for markets and consumers to adjust, it’s not impossible to imagine inflation cooling and the Fed tapering down a bit. We don’t know how inflation will react this time around. It’s tempting to use the Volker Fed as our main point of reference, but he didn’t have trillions of excess anti-dollars to deploy via QT.

I made a point to RTGDFA at the financial news outlet from which I suspect this headline was derived, and I see they also predict a recession. A recession is likely to cool inflation, and our Fed would follow suit with lower rates like they have in every recession over which they have presided (even under Volker). The MBA’s prediction could be wishful thinking, but it’s certainly not impossible or ever particularly unreasonable.

“Anyone forecasting anything in this environment of raging inflation is going to be waylaid by surprises.”

I remember the raging debate during the 2008 financial crisis (and ensuing money printing) about whether we would experience inflation, deflation or stagnation.

The answer turned out to be “yes”.

Some areas of the economy deflated harshly (e.g. consumer goods). Other areas (e.g. housing) recovered astonishingly quickly and went to the moon.

Others inflated with no real growth (e.g. autos).

In a global economy where inflation-adjusted wages are declining pretty much everywhere, the can be no broad-based inflation. It’ll be more like squeezing a balloon where it pops out here seemingly randomly but still dependent on where pressure is applied.

The balloon is already likely popped. One of Wolfie’s favorite indicators, the Weekly Economic Index (WEI) has been on a steady march toward zero all this year.

“The Weekly Economic Index (WEI) is an index of ten daily and weekly indicators of real economic activity, scaled to align with the four-quarter GDP growth rate. “

I read a comment from an AirBNB owner about the crazy cleaning fees and she said it wasnt her choice as an owner but the maids/cleaning services raising their rates. That speaks to Wolfs point that inflation in services is hitting hard. Friend of mine was looking to do a getaway with the girlfriend and he said he saw some cleaning fees of $200 or more for just a weekend stay.

Also, look at the some of the RE companies like Redfin and Opendoor. Stock price heading to zero, they will go out of business soon if rates keep up. Also read Opendoor is taking an absolute beating on its flips in phoenix and elsewhere. Those prices as well as the slashed prices from builders are setting the new comps so RE is toast.

Yes, this flywheel-feedback inflationary effect is well underway. The cleaning person must charge more to pay for the ridiculous price hikes in everyday life. A price decrease in one or another input (say, the cleaning rags supply chain opens up) doesn’t stop the overall effect which seeps across the whole economy into every end user price through services.

Similarly, a rising cost of credit might or might not plug these leaks of services inflation which has taken root.

Most AirBnB owners will have to start cleaning their properties to stay in business. Imagine that, actually having to work.

$200 cleaning fee is insane.

Cleaning their own properties won’t keep them in business, having the financial ability to carry the properties through long, lean times where they are cash flow negative with no customers is their only hope. Most have no ability to do that. Given that a large amount of these STRs were just purchased in the past 2 years, most are destined for foreclosure.

“Given that a large amount of these STRs were just purchased in the past 2 years, most are destined for foreclosure.”

This, all day long. Don’t need to pay cleaning fees when there’s nobody renting out your STR. But oh wait, I forgot about the actual mortgage payment.

These people are so screwed, and zombies haven’t really even started laying people off yet. Once that domino falls, the jingle mail will sound like cathedral bells.

This economy is toast, they just don’t know it yet.

It’s a safe bet that a lot of the multiple-STR (short-term-rental) owners were realtors or mortgage brokers, are now unemployed, and will need to find a full-time job just to live, so they won’t have much time to be cleaning their STRs. Also, in many cases they bought properties in hot vacation destinations other than where they live, paying management companies to handle the operations, so they have no choice but to hire cleaners.

It sounds insane. But… $50 and hour for 4 hours and there you go. That’s what it costs on the west coast unless you have a very friendly source of labor. And no, I do not have any short term rentals, I just know people who do. Even in Italy, it’s more expensive than you’d think. Everyone wants everyone else to work cheap (I know I want them to!), but reality gets in the way…

The Airbnb forums are full of owners complaining about very slow (or no) business. A lot of travelers are returning to hotels because of the high cleaning fees plus inconsistency of STRs (dirty, weird hosts, unsafe, etc.). Apparently the last two years have seen the STR market get totally saturated by new rentals (AirDNA has the stats if anyone cares to look). I know that’s the case in my small town in Colorado. Won’t be long before some owners are forced to sell.

As an aside, the Airbnb next door was burglarized last week. They caught the guy and he’s in jail with no bond. Airbnb hates these kind of stories and pays to keep them out of the news. A lot of people see Airbnb as a slimy dishonest business (the platform itself, as well as some of the actual STRs).

Agreed, @Colorado Kid: My anecdotal is that wife and me used to use VRBO rentals on trips all the time. Most recent was Colorado Springs. The “check out manual” included a three page list of chores we had to complete before leaving and also baked in a $299 cleaning fee.

That was the last straw for us. Unless traveling with a large group of people or a very unique property in a special location, we’ll stick to accumulating our Marriott points, thank you…

“Won’t be long before some owners are forced to sell. ”

Or convert them to long-term rentals forcing rental availability to rise and rent prices to fall.

The ski towns in Colorado are desperate for places to house their workers since many of the former rentals have become STR driving up prices.

One data point from the field… When I sold and moved out of my house in Denver last spring (not an airbnb), I had a cleaner who worked for herself come and clean for 2.5 hours. When I gave her $250 or $100/hour, she was visibly irritated as she told me she expected $300 for the job. And she was the cheapest cleaner I could find. Services inflation is out of control right now.

Heron,

Do the cleaning fees go up depending on length of stay?

They stay the same regardless of the length of stay.

“We are holding to our view that this is a spike right now”

Might as will just say rates are transitory lol

What a 🤡😂😂😂

I’d say more likely to be 10% then back to 5% since apparently the customer is so resilient to inflation I.E. people STILL have too much F***in money and don’t care how much things cost.

Might take a little longer then these scumbags want before a recession actually hits

This is more about the cost of money than the number of mortgage applicants. There is an ETF fpr MBS (MBB) which only has 19B in it and yields 1.4%. Must be some high expensive fees?

I think everyone skims their fees along the way.

Many of the 30 year loans were about 3% the last 2 years.

The path to an MBS involved.

1) The loan originator sold them to Fannie or Freddy for a fee or %.

2) Fanny or Freddie bundled them into an MBS for a fee or %.

3) Fanny or Freddie pay the loan servicers to collect the mortgage from homeowners, mail statements, customer support, and provide tax forms for a fee.

4) The MBS originator has some % fees charged to provide the “honor” of supplying this low interest product. They also have to provide statements and tax forms.

A 1.4% yield could be about right.

I’d expect this fund to start paying more in 5-10 years if rates stay at 7% instead of being loaded with 3% loans.

So if the yield rises on price depreciation and you expect yield to rise as the maturities extend you sort of have a floor underneath, there might be a reason to own this stuff?

I believe they are like Treasury Funds/ETFs.

If they contain all low yielding bonds/mortgages, the price of the fund/ETF plummets until the underlying bonds mature and are flushed out as mortgage/Interest rates increase.

Holding MBS funds or 10 year treasury funds are similar until the underlying bonds/mortgages are flushed out in 10 years.

MBS’s could be unique since if everyone holds their 30 year mortgage to maturity at 3%, the fund will continue to pay 1.4% for 30 years. 1.4% last year was a great ROI. Not so much now.

Unlike Treasuries, there is skimming of interest along the way as described above. Who knows if the fund manager may raise their cut. Or the loan servicing people may raise their fees for loan servicing.

Just my observations and opinions. I wouldn’t buy MBS bonds unless mortgages hold at 7+% for 10 years (expected lifetime of a mortgage) and then the FED starts QE and interest rate suppress again. The bonds at this point may be paying 5% interest for the next 10 years while mortgages are at 3% again.

It will take time to flush the 7% mortgages out of the fund.

I’ve been to a lot of similar events. Very rarely have I listened to an economist do anything besides support whatever constituency pays their salary, so it’s almost always pro-establishment / conventional wisdom fluff designed to quiet down the nagging feeling that huge structural issues need addressing in this country. What a shame.

“The only function of economic forecasting is to make astrology look respectable.”

– John K Galbraith

I seem to remember Wolf doesn’t want links posted, but I thought the interview with Russell Napier entitled “We Will See the Return of Capital Investment on a Massive Scale” was interesting.

I’d have to listen to the interview to know exactly what he meant, but it sounds like more wishful thinking to me.

Higher rates to be followed later by increasing risk aversion will make actually uneconomical investments unviable and no one will find it. Increased risk aversion leads to a similar outcome. For starters, all these money losing cash burn machines publicly listed stocks, private equity, and venture capital.

The entire 21st century has been a period where all kinds of garbage were funded because this has been the greatest asset, credit and debt mania in history.

Volvo P-1800,

So did I and ‘Mark Stoneweapon.’

https://wolfstreet.com/2022/10/21/the-most-splendid-housing-bubbles-in-canada-october-update-prices-plunge-at-fastest-pace-on-record/#comment-474625

“In the options marketplace, the relative cost of contracts that pay off if the S&P 500 Index sinks another 10% has collapsed to the lowest since 2017. Appetite for bullish wagers is on the rise. And the popular Cboe Volatility Index is sitting far below multi-year highs even as equity benchmarks plumb bear-market lows.”

Fresh from Bloomberg

NBay, yes, its a bear rally.

The Put to Call ratio for S&P 500 has trended down over the last few weeks. It peaked at 1.1 on 29 Sept and now is at 0.93.

It last bottomed at 0.91 back on 12 Sept.

My main concern is that 10 year yield is driven mostly by investor sentiments/expectations. Current market participants don’t set a high bar in terms of expectations, value analysis etc. They just watch the fed. And when the inflation hits a reasonable number, say 5%, my concern is that market suddenly will start expecting a pivot and 10 year yield will plummet taking down the mortgage rates.

Reverse is equally likely. MBS market is already under a lot of stress. A couple of big names going belly up might even drive the rates into double digits. 5.4% is equally likely as 10.8%

All financial prices are ultimately driven by sentiment or expectations. Even with monetary policy, central banks can’t ignore it without destroying the currency. Look at the UK for a recent example.

True. But wouldn’t one expect those expectations to be roughly in sync with the ground reality? UK is definitely an example but bigger example is June/july rally here in the US. mortgage rates almost dropped below 5 and that was based on a CPI number that was still terribly high.

In short, when market expects something far removed from reality, where does that lead to and how does it get resolved? Not asking you per se, just venting: ))

Here we go again, Wolf, the “pivot” narrative is making its way around the media!

From Yahoo news:

“U.S. stocks closed higher on Monday, extending last week’s rally as signs of economic weakness led investors to hope the Federal Reserve might ease up on its aggressive interest-rate hikes.”

PAAARRRRRTAAAAAAAAYYYYY!

Is there ANY evidence at all that the Fed is considering pivoting, or is this purely a pump and dump scheme whereby insiders spread narrative, pump stocks up, dump their stocks on unsuspecting retail bagholders, and then everything plummets when the next inflation reading comes in hot.

I believe the latest round of pivot cheerleading started with a report from the WSJ last Friday. I don’t have a WSJ sub, but here are some quotes from the CNBC that referenced the WSJ report:

“The Wall Street Journal reported Friday morning that some Fed officials were growing uneasy with the current pace of rate increases and are starting to worry about the risks of overtightening.”

The only source referenced in the CNBC article was SF Fed Pres Mary Daly:

“San Francisco Fed President Mary Daly said Friday that she would like to see a “step down” of rate increases but said she needed to see a more notable decline in inflation.”

“My own view is that it should at least be something we’re considering at this point. But the data haven’t been cooperating,” Daly said to laughs from the audience.

So no, there doesn’t appear to be any new evidence to support claims of a Fed pivot or even a slow down in rate hikes. It’s just click-bait garbage.

Here is what the Fed said at its Sep meeting and what the WSJ said — I quoted from the article. The WSJ article was hawkish in terms of the 50 v 75 at the December meeting. I thought it would be 50, but now they’re discussing 75 in Dec?

I posted this a couple of days ago:

Here is what the Fed said at its last meeting (see my article on this):

— Nov meeting: 75 bpts

— Dec meeting: open but maybe 50 bpts

— Jan meeting: another rate hike.

Here is what the WSJ article said:

— Nov meeting: 75 bpts

— Dec meeting: 75 bpts but maybe 50 bpts

WSJ cited a comment made by Waller in a public speech 2 weeks ago:

“We will have a very thoughtful discussion about the pace of tightening at our next meeting,” Fed governor Christopher Waller said in a speech earlier this month.”

WSJ, based on public speeches by other Fed heads:

“Some officials have begun signaling their desire both to slow down the pace of increases soon and to stop raising rates early next year to see how their moves this year are slowing the economy. They want to reduce the risk of causing an unnecessarily sharp slowdown. Others have said it is too soon for those discussions because high inflation is proving to be more persistent and broad”

WSJ also said (excerpts):

“Fed policy makers face a series of decisions. First, do they raise rates by a smaller half-point increment in December? And if so, how do they explain to the public that they aren’t backing down in their fight to prevent inflation from becoming entrenched?”

“If officials are entertaining a half-point rate rise in December, they would want to prepare investors for that decision in the weeks after their Nov. 1-2 meeting without prompting another sustained rally.

“One possible solution would be for Fed officials to approve a half-point increase in December, while using their new economic projections to show they might lift rates somewhat higher in 2023 than they projected last month.

“Cleveland Fed President Loretta Mester has signaled she would favor rate rises of 0.75 point at each of the Fed’s next two meetings because there hasn’t been progress on inflation. “We can’t let wishful thinking drive our policy decisions,” she said on Oct. 6.

“Some officials have said they want to see proof that inflation is falling before easing up on rate increases. “Given our frankly disappointing lack of progress on curtailing inflation, I expect we will be well above 4% by the end of the year,” said Philadelphia Fed President Patrick Harker in remarks Thursday in Vineland, N.J.

“Meanwhile, Fed Vice Chairwoman Lael Brainard and some other officials have recently hinted at unease with raising rates by 0.75 point beyond next month’s meeting. In a speech on Oct. 10, Ms. Brainard laid out a case for pausing rate rises at some point, noting how they influence the economy over time.

They are already talking about the FED pivoting on CNBC. Jim Cramer and the Wall Street crybabies are salivating

The crybabies are crying afterhours today.

GDPnow has Q3 real GDP at 2.9%. BEA releases Q3 GDP this Thursday and GDPnow has been very very close to the actual release. Any argument that economic weakening will have the Fed pivot should disappear on Thursday 8:30AM when it shows how positive GDP is and the Fed has more room to tighten to try to slow things down.

Economy growing, or gdp growth with lower imports?

GDPnow contributions to growth shows net exports being the biggest contributor for the current forecast at 2.23 (Q1 net exports per BEA was -3.13 and Q2 was 1.16). It’s on the ATL Fed’s GDPnow website as a pdf on the right.

Fed announced at Sept. meeting that schedule for rate increases is: 0.75% in November; 0.5% in December and 0.25% in January 23. No reason to think that is going to change as inflation is still far above interest rate.

It seems to me, this is the absolute worst time to buy a house in the past 50 years. Mortgage interest rates have more than doubled in a year, yet prices haven’t had time to respond, so affordability is sky high. Unemployment increases and layoffs are targeted by the Fed. WFH environment will make layoffs EASY. Recession is around the corner. Home prices are at incredible levels, relative to wages. The Fed will be selling MBS back into the market. Builder inventory is high, so new home prices will be dropping. Lumber and materials have already dropped 50% or more. Chinese wealth is drying up quickly. Chinese stock just lost another 10% today. Chinese RE is dropping hard. Bond yields are still low but are starting to look somewhat interesting as an alternative. Some value stocks are also starting to look interesting.

Most importantly, the speculative frenzy has turned to doubt.

Not looking good for RE prices the next two years. As I said in another post, a person in my area bought a home for $2.6M, which is now worth $2.0M per Redfin, only 6 months later. RE speculators are being out behind the woodshed, and this is still first inning.

“Chinese wealth is drying up quickly. Chinese stock just lost another 10% today. Chinese RE is dropping hard. ”

And as that wealth effect reverses and that entire country liquidates everything, including all that real estate they’ve been buying in the US (looking hard at you, Clownifornia), they’ll fire-sale everything here to come up with the cash to pay for shelter and food back home.

Our own wealth effect is getting its own ass kicked lately, and of course layoffs haven’t even started yet. “Zombie Corps Unlimited” layoffs are gonna decimate our economy once those borrowed-money coffers run dry.

“The FED will be selling MBS back into the market.”

And what fool would buy them? The line forms behind you.

They’re all guaranteed by the US taxpayer. So if the price is low enough (and the yield high enough), investors will line up to buy them, just like Treasuries.

I agree. It is the worst time to buy a house.

However, just like if you purchased a house in 2006, and held for 15 years, you are doing quite well with appreciation. Also, if you had a 15 year loan, you can safely retire and never have to worry about rent increases for the rest of your life. If you purchased with a fixed rate loan in 2006, you are way ahead due to the massive rent increases over the last 15 years. If you refi’d your original 2006 6.4% loan to 3% during this time, you are doing even better.

I’d still buy now if I was sure that I could hang on for 10-15 years and liked the house so much that I planned on retiring there.

A house is a long term investment to live in and enjoy. The ROI calculation has to be long term and is more tied with the long-term savings vs rent instead of appreciation. Housing prices have historically never gone down over any 15 year period.

I was raised in a high priced area in S. CA. The parents of the kids that I went to high school with are still there even if they purchased at in the late 70’s with a 15% mortgage. It was still considered high priced during the 70’s-80’s massive inflation. The families that rented are long gone. They were forced out when rent increases didn’t make sense for them to stay. The people who stayed had 30 year fixed housing payments. Prop 13 also helped.

“And the business of writing mortgages to purchase a home has plunged by 35% from the still gloriously heady days a year ago”

Down more than 50% from peak around 20 months ago? Is that an all time record drop, or did the GFC beat that?

I predict mortgage rates will top out somewhere around 8.5% sometime next year based on how much more the Fed is predicted to raise rates.

I’m not a mortgage banker, so take my prediction with a grain of salt.

That is if everything goes exactly according to plan. That can happen but more likely case is that it won’t. Plenty of ticking time bombs. If MBS market starts freezing, 15% is within the realm of possibilities.

The Fed can’t forecast either … as bad or worse than the MBA. Economics is not a science so really ANY answer that you want to ANY question can be found via ‘economics’ – all dressed up in some ridiculous algorithm. Economists are terrible at forecasting anything but everyone insists on asking them for their thoughts on the future. Let’s stop asking … please?

🤣😂👍….but, it’s real math!

Gotta hand it to you people in the USA.

You are doomed.

Your economy is a mess, your education system is a mess, your crime is out of control, your politics is more like a mini cultural revolution than a republic, and now all the mess created by your central bank, the Fed, is coming home to roost.

Huge inflation numbers caused by money printing causing interest rates to rise and mortgage rates to increase at at greater rate than those interest rate increases. Increased borrowing costs are causing house prices to start to fall.

What a mess.

By the way, in Japan there are 35 fixed year mortgage rates at 1.5% called “Flat 35”.

Enjoy your 7% plus mortgage rates along with a falling housing market.

You deserve them.

The thing is, “we” didn’t want any of this garbage, our politicians and bankers just went ape sh!t doing whatever the hell they wanted, enriching themselves, their buddies and their donors.

Elections have consequences.

You people voted for what you got.

Now you suffer the consequences.

Tough luck, hey.

You are a bit thick between the ears, EH? Elections don’t matter. We have what’s called the “uniparty,” and they serve their corporate masters and special interests.

You do know Jerome Powell is unelected right?

He is right. This is apparently the best we can do.

Lousy but expensive schools, lousy but very profitable “healthcare”, 850 military bases around the world, woke morons and war mongers running the country.

Sadly, the enemy is us. But things are changing. The unipolar moment ended. The wind is blowing towards the East.

Eh. Maybe use a handle with a bit more gravitas than Jimbo when making sneery declarations.

Meanwhile, Murica’ll be just fine.

Your post proves exactly my point.

You are an uncultured, no nothing American.

Just for you and the other readers that made disparaging comments:

Jimbo (神保)

Last Name :

Jimbo

Last Name in Japanese Kanji(Hiragana) :

神保(じんぼ)

Meaning :

神 meaning gods, mind, soul./ 保 meaning protect, guarantee, keep, preserve, sustain, support.

Estimated Population in Japan :

17,100

Population Rank :

1059 out of 10,000 entries

So expand your education and don’t post comments that make you and the other following posters total idiots.

Hahaha. I hope the Yen’s crash and rising inflation from Japan’s own money printing don’t spiral out of control. Your smug attitude notwithstanding, the Japanese people don’t deserve that.

I think he’s been eating radioactive fish. He’s brain damaged.

I thought you were joking, but Jimbo’s response to Bulfinch now makes me think otherwise. Generally, people don’t take pleasure in disparaging an entire nation and its people, but Jimbo apparently does. No amount of education can make up for basic politeness.

I finally had some time to check “Jimbo” out. He’s not in Japan, and he is certainly not Japanese because no Japanese would ever say this kind of BS about other nations. This is a very un-Japanese thing to do.

Instead, “Jimbo” turns out to be the same troll that has been been trolling my site for years under different logins.

I apologize for not having mopped this stuff up sooner. I just got too busy and my dog ate my homework and I didn’t get a round tuit.

Yeah, the United States (and the rest of the world) is in for a hellacious decade or two, but I wouldn’t hold my breath waiting for someone to take our place at the top. There are no serious rivals to North American hegemony, and there won’t be for a long time, if ever.

Sorry to burst your bubble.

Good thing about USA is we are blessed with two of the requirements of modern life 1. Cheap grain and protein 2. Cheap energy. Politicians can screw that up too though.

Jimbo

Yep, we copied all the screwed up economic policies that your country implemented 20 years ago, and are getting slammed as a result.

Not a huge fan of the US economy, but I think I’d rather be in the US than anywhere in Europe. Australia looks pretty good as well.

Doesn’t Australia have a huge inflation and housing bubble problem?

Sure, but at least you won’t freeze ……

$1.5M+ homes keep selling in my ‘hood in Seattle (Queen Anne, where I am a lowly renter). I’m trying to guess who these buyers are. Are they:

1. Fools who don’t understand how rates will affect prices? Probably unlikely at this price tier.

2. Fools who assume long-term prices always go up, and rates will always go down? Perhaps.

3. Buyers who assume they have downside protection with a non-recourse loan in WA state?

I don’t really understand how non-recourse loans affect demand. Does anyone have a POV?

The more I think about it, the more it seems non-recourse loans (and prop 13, smh) are designed to foster housing speculation. Non-recourse states certainly seem to be some of the most bubblicious: California, Arizona, Idaho, Washington, Oregon.

“I don’t really understand how non-recourse loans affect demand. Does anyone have a POV?”

Yes. I would venture that 98% of mortgage borrowers have no concept of “non-recourse”. They barely understand compound interest.

I spoke with a mortgage broker Recently about who is buying right now. In his experience right now the buyers are people who couldn’t get in when the frenzy was going nine months ago.

So imagine someone who makes a good income but is poor with her money and has low credit scores and doesn’t look good on paper when in competition with others who have their stuff together.

These people see this dip and slow down as their opportunity to finally get in. I don’t believe the people buying right now are generally astute on what the rates will do to this market. And that applies everywhere even though there are many people in your area that probably could just buy those homes in cash.

Why would believe anything a “broker” tells you?

I think typical homebuyers don’t think of non-recourse.

I had heard of some during 2006 that knew what they were doing and continually refi’d their house to 100% LTV and then just walked away with the cash and Jingle Mailed the keys after the crash. The banks that gave them the loans had no recourse. The Federal government bailed out these banks. The criminals got away.

This time it is different, right? Everyone is qualified and not over 20% LTV?

We are not going to see ultra low rates again in our lifetimes. Even (former) central bankers are now starting to admit that ultra loose money was a mistake. And the unwind hasn’t even properly started.

Also, when you cannot afford a 7% mortgage (which is a very normal rate historically and actually ultra cheap considering current rate of inflation), then you bought a house that you cannot afford.

“Lifetimes” is a long stretch of time. As we are in a post-industrial and post-real-employment world, don’t be surprised when ZIRP again takes center stage.

Well, we are talking about mortgage bankers here no? This is like their livelihood. Predicting things like an interest rate of 7% and above is akin to saying: our profession will be severely impacted and by this time next year, a lot of us will be waitressing at the local joint.

“Mortgage Bankers Predict”

There’s the problem. Here are a few more:

“The Fed predicts”

“The ECB predicts”

“The IMF predicts”

How will the FED be “fighting inflation” if their BS terminal rate is 4.25% or whatever, and the CPI (which of course is ridiculously low) is over 8%? Pathetic.

Look at housing and stocks and bonds! And we’re only at 3% now. having a huge impact already.

“Not to worry, just a little paint scraped of the port side, she’ll be fine”

Captain Smith – RMS Titanic.

From the user manual for my trusty old HP19B calculator:

Example: A Home Mortgage. You’ve decided that the maximum monthly mortgage payment you can afford is $630. You can make a $12,000 down payment, and annual interest rates are currently 11.5%. If you take out a 30-year mortgage, what is the maximum purchase price you can afford?

jm:

You can afford a $47,000 home! Congratulations

Mortgage bankers are scared, which is why they are promoting non-sense. For 30-year to get back to 5.3%, Fed Funds has to be around 2.25%. Probably not happening.

As for inflation, Volcker proved you can push down inflation when you raise Fed Funds above the rate of inflation. Not happening here per Fed. They are trying to pull down inflation by raising rates a bit to around 5%. Over the longer-term (24-36 months) that probably works. Inflation will abate slowly using this method. (The so-called soft landing?)

Re: all the extra $$$ sloshing around, is this the $2TT in Reverse Repo’s? Where else would this show up?

but otherwise it does look like the market wants to RUN UP, I covered my short for a meager 8% gain LOL

Update- just sold Inner sunset, SF home at full asking price

Ok, now homes can drop 20%

Also, at fintech conference in Vegas and no doom at all, just deal making and lots of changes in how money moves or who is the real person vs fraud

You shoulda said, “at $1 million over asking.” That would have gotten some clickbait attention. Asking (and over/under) is irrelevant in reality. It’s part of the big hype-and-hoopla scam in real estate. The asking price is whatever you want it to be. So don’t even bother to mention it here.

Network Capitol Funding, based in Irving California, just went off the air here on WMAL after 7 years and 400 shows. They specialized in refinancing. They were replaced by a garden show. These are the first casualties of the coming Real Estate meltdown. More to come.

Those with sizable financial assets are seeing those values plunge, that is their biggest concern right now.

Those without many assets are seeing prices on everything spike higher, that is their biggest concern right now.

Those in the middle are seeing both, so they are getting double kerploomphed right now.

And yet, everyone still has any job they want. What happens when that goes away?

Jim Cramer became unhinged on his “Mad Money ” show this evening. May be because a lot of his investments for his charitable trust like Google, Facebook, Microsoft, Netflix are off 30% to 50% and heading lower. They may have to get a new fund manager sooner rather than later.

He invented a new term “Hurricane pain” to describe the market for the FAANG stocks.