As the Bank of Canada’s rate hikes and QT goose mortgage rates, some practically funny price spikes are getting unwound very fast.

By Wolf Richter for WOLF STREET.

Canada’s housing market is trying to figure out where reality is? After the era of ridiculous house-price spikes, triggered by the Bank of Canada’s interest rate repression and QE, the BoC now gets to grapple with raging inflation by hiking interest rates and shedding assets (QT), which has been pushing up mortgage rates, which renders them indigestible for hyper-inflated markets, though not all markets are hyper-inflated, as we’ll see in a moment.

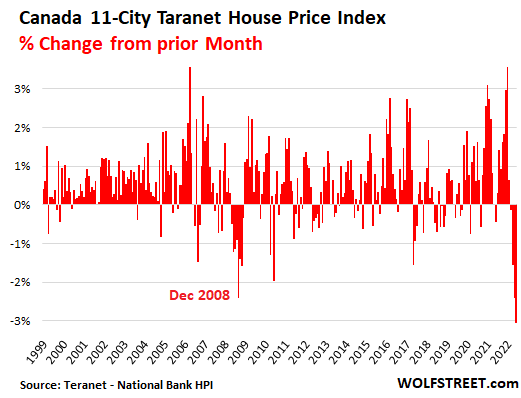

So, the overall 11-City Teranet-National Bank House Price Index plunged by 3.1% in September from August, the biggest month-to-month plunge ever, after having plunged 2.4% in August from July, which had matched the then biggest ever Lehman-bankruptcy plunge in December 2008.

Over the past four months, the index dropped 7.0%, the biggest four-month drop ever. The four months of declines slashed the year-over-year spike from the 19% range in March and April to 6.0% in September.

House prices in Victoria plunged by 6.9% in September from August. In Vancouver, prices plunged by 3.9% in September, after the 2.0% drop in August. In Hamilton, prices plunged 3.3% in September after the 5.8% plunge in August, and are down 13.5% in three months. In Toronto, prices plunged 3.0% in September, after having plunged 4.0% in August, and are down 11.1% in three months. in Ottawa, prices plunged by 3.5% for the month, after the 3.1% plunge in August; etc. But in the two oil towns, Calgary and Edmonton, where prices hadn’t moved much over the past 14 years, the index ticked up to new highs.

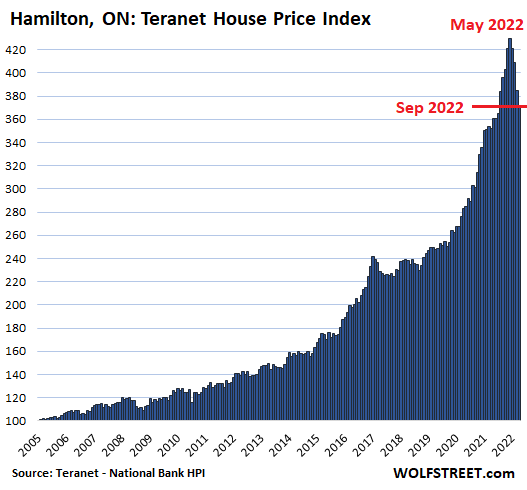

Hamilton, Ontario, had become the #1 All Time Ever Most Splendid Housing Bubble in Canada in January 2021 when it surpassed Vancouver, as measured by the Teranet-National Bank House Price Index (the index was set at 100 in June 2005 for all cities). Hamilton had already surpassed Toronto months earlier. These price increases were so extreme that they were funny.

But now the hot air is coming out of this most splendid housing bubble. In September, prices plunged by 3.3% from August, after the 5.8% plunge in August from July. Over the past four months – since the ridiculous spike-tippy-top in May – prices plunged by 13.5%, which cut the year-over-year price increase to 5.6%.

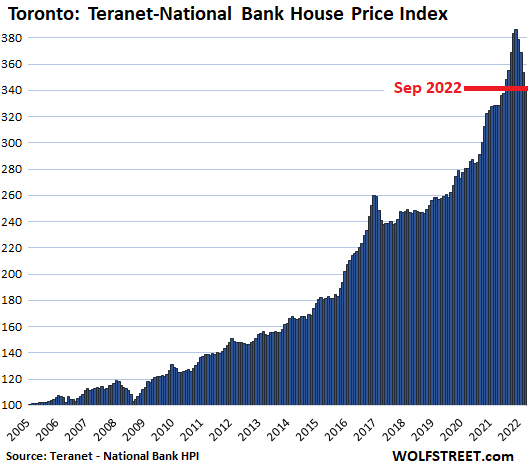

In the Greater Toronto Area, after the ridiculous spike peaked in May, home prices plunged 3.0% in September from August. Over the four months, the index has plunged by 11.1%, cutting the year-over-year gain to 4.5%:

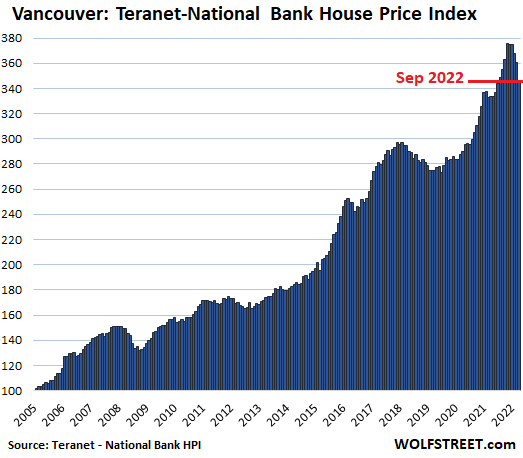

In Greater Vancouver, house prices plunged 3.9% for the month after having dropped 2.0% in the prior month. Since the peak in April, prices have dropped 7.8%, which cut the year-over-year increase to 3.9%:

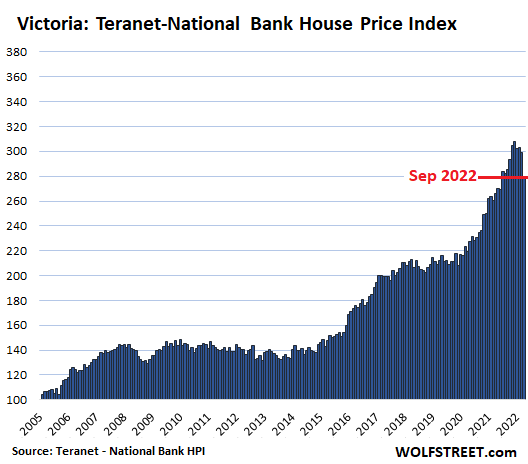

In Victoria, house prices plunged 6.9% in September from August and are down 9.4% from the peak in May. This whittled down the year-over-year gain to 4.7%:

The methodology of the Teranet-National Bank House Price Index is based on “repeat sales” that tracks the price of the same home each time it is sold over time. Unlike median prices, the “repeat sales” method is not impacted by a shift in mix of the homes that sold. The data here is not seasonally adjusted.

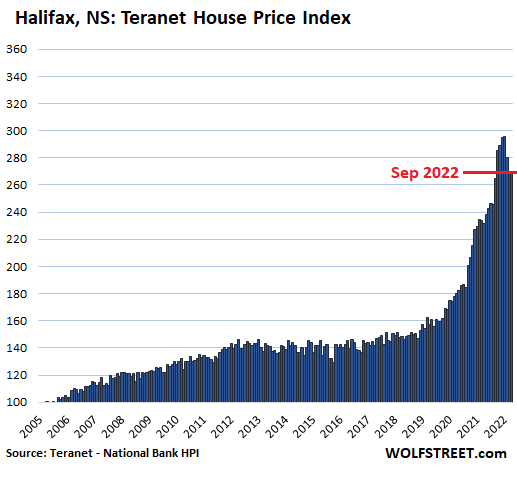

In Halifax, after its hugely splendid housing bubble with year-over-year price spikes in the 35% range, prices dropped 8.8% since the peak in June, with September about unchanged from August, after prices had plunged 5.3% and 3.6% in July and August respectively. Over those months, the year-over-year gains have been cut roughly in half, to 16.4%:

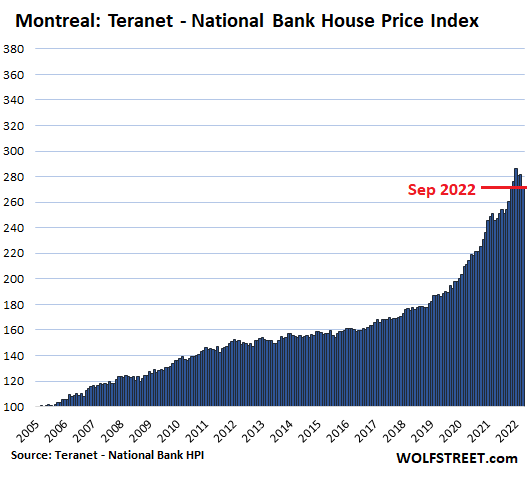

In Montreal, house prices fell 3.3% in September from August, and 4.9% from the peak in June, which cut the year-over-year gain to 10.8%:

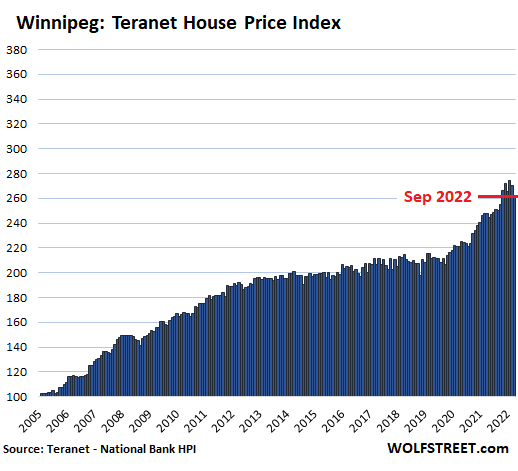

In Winnipeg, house prices fell 3.2% for the month, and are down 4.5% from the peak, which cut the year-over-year gain to 5.9%:

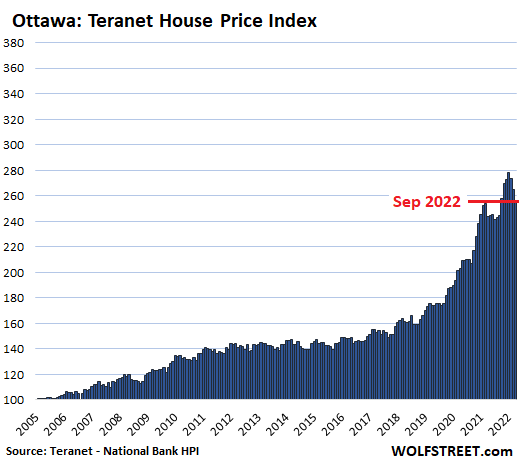

In Ottawa, house prices plunged 3.5% in September after having plunged 3.1% in August and are down 8.0% from the peak in June. They’re still up 5.0% year-over-year:

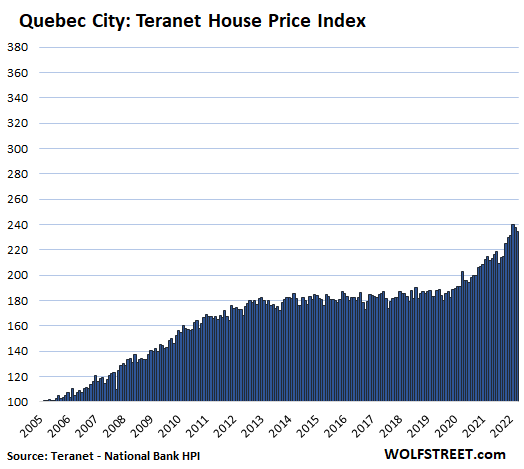

In Quebec City, house prices fell 1.4% in September and are down 2.4% from the peak in July. This left the year-over-year gain at 10.5%.

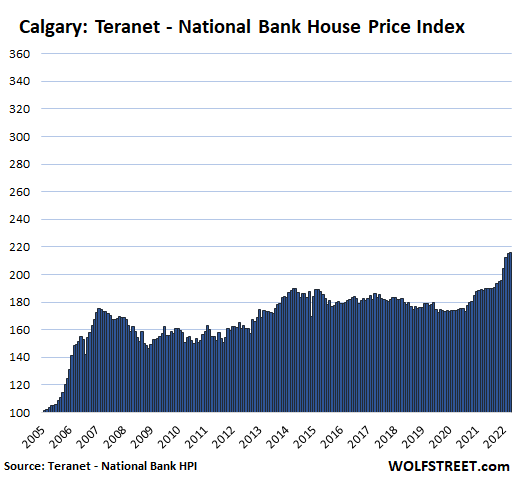

In Calgary, oil capital of Canada, house prices edged up in September by 0.3% to a new high, and are up 14.7% year-over-year. Prices had been roughly flat from mid-2007 until mid-2020 when the Bank of Canada’s money-printing binge goosed the market. Not much of a housing bubble anymore, though it was quite splendid into mid-2007:

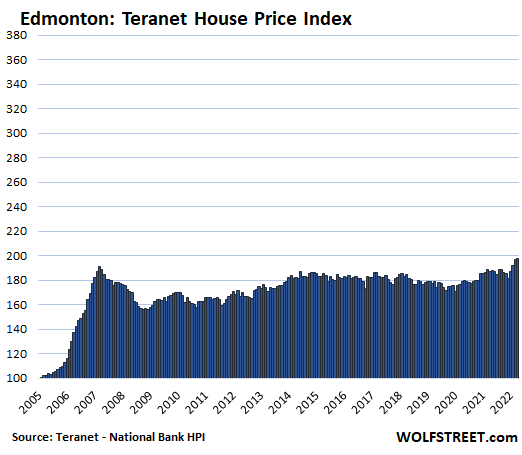

In Edmonton, also in Canada’s oil patch, house prices also edged up 0.3% to a new high, bringing the year-over-year gain to 5.6%, after 15 years of essentially no house price increases, following the oil bubble through mid-2007:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Like a Canadian Goose?

Ok…no more tequila.

“As the Bank of Canada’s rate hikes and QT goose mortgage rates,”

“until mid-2020 when the Bank of Canada’s money-printing binge goosed the market.”

Ah, tequila is not big in Canada. Try Canadian whisky or Labatt’s Blue beer,

The most important thing to notice is that the rate of drop is atleast mirroring the rate of rise and in many cities os faster than rise.

This makes those real estate agents look really bad who were quoting 2007 to say that prices correct gradually over 5 years. Their customers have realized that the drop will be really sharp for the first year (> 30% in hottest markets) and they made a stupid decision to buy at peak over last 1 year.

I expect real estate markets to freeze with buyer strike, thanks to the 7% mortgage rates that make houses crazy unaffordable. I also expect Real Estate agent earnings, that depend on commissions to drop significantly. The sale volume may resume next spring, only if, the prices have corrected significantly.

Yes – the difference this time is that now central banks are doing their level best to crash their housing markets as soon as possible to stop inflation from becoming entrenched whereas last time the central banks were desperately trying to prop up the collapsing markets to prevent a deflationary depression. So this time should be fast and deep.

Not gonna happen; Canada has a target of over 430,000 immigrants per year, a rate that will only increase.

There aren’t enough homes (especially affordable ones); they will be building for decades.

Nicko2, it’s already happening, and the bulk layoffs have not even started yet. Home buyer traffic has already collapsed to GFC level.

Immigrants coming form third-world countries depend on high paying jobs that are vanishing. Third-world world savings are not enough for downpayment in first world.

Nicko,

So every new immigrant is guarnteed to own a house? Is that like a law in Canada or something? Will they build enough in time?

Leo, why do you think most immigrants are moving to Canada are from 3rd world countries?

Many are highly skilled, although there are a percentage that are not. It’s a mix.

Josap, Third world doesn’t mean unskilled.

Awwwwwk

Awwwwk

Polly wanna cracker!!

Awwwkkkk!!

It is always a good time to Buy!!!

Awwwwwwk!!

Real Estate Agents make their nut when they sell a property. Therefore, they sell more homes when they present the correct price to the market plus an opener above the market price. They’re salespeople.

I can’t argue with your plainly stated outlook as expressed in the first sentence of your last paragraph.

The second part, to me, is not pleasant in the sense that I will not celebrate hard times for working people which most real estate agents surely are.

Eben though the transparency of their sales tactics drive me crazy.

Wrong

Besides that this is old wolferism.

Why rehash home after home year after when it was perfectly clear and wolfstreet proved correct long ago?

Right?

Lower interest rates to zero ,never happened in 5000 years,expand money supply for 90 years,fiat currency not backed by anything but a printing press .Blew up the balloon to far ,next sound you hear POP

Central bankers are making history the last 20 years. Lowest interest in thousands of years, biggest US housing bubble ever, highest US stock market on price to sales basis, highest corporate margins ever, highest wealth inequality, fastest development of a large country, fastest increase in money supply, fastest raising of US short term rates. Softest landing of economy? Don’t bet on it.

Soft landing for whom? I highly doubt the top 40% will suffer much, and the bottom 50% of the population have practically zero assets.

Re-shoring his happening; new factories breaking ground on a daily basis; oil/natural gas export bonanza. Where is the crash?

You have to be joking. I’m in the top 5% and everyone I know in this bracket is taking major hits to their equities holdings, RE values, business incomes/sales, and now even used car values are falling as Wolf noted yesterday which is starting to cause the lower income demographics to suffer in addition to the inflationary hits. Sales of housing is plummeting and there will be no soft landing for anyone who owns anything.

“…now even used car values are falling … which is starting to cause the lower income demographics to suffer”

No, when used car values are dropping, folks are happy because they can buy the same car for less — or a better car for the same amount. It’s that free upgrade feeling!

Even if they trade, they don’t really care because when used car values are dropping, they’re dropping across the board, and the trade-in value roughly drops in line with the retail price, and so the difference is roughly the same, and they’re going to pay and finance the difference.

The only time they would not like it is if they sell the car for cash and don’t buy anything else.

Because of stock market crash a lot of my friends are already suffering and tightening their belts big time

You need to wait for year or more for the show to unfold fully.

You must think this economy and the entire 21st century in the US is mostly normal.

The lopsided proportion of the top 40% are middle class and many, barely that. To make the 60th percentile, the source I found claims about $85K for 2021 which is consistent with FRED’s median of $67K.

That’s usually two incomes and more than two in the household. A noticeable proportion live in high-cost locations. I’d call these “working class”.

At the 80th percentile, $141K. That’s “comfortable” in most of the US, as long as the usually two income earners are employed.

To make the 60th percentile in net worth, $121K. That isn’t “squat” in 2022. Most of it is also usually housing equity (in a housing bubble), may include personal effects (if calculated the same way as the FRB), and retirements accounts (which usually isn’t fully accessible). These people don’t have meaningful accessible savings.

At the 80th percentile, $533K. Same pattern except that I would describe this profile as the “mass affluent”. Most still don’t have significant accessible savings.

If the mania is actually ending, most of these people and in higher percentiles are absolutely going to get “hammered”

It won’t be universal or immediate, but their apparent affluence is based upon a fake economy (for income) and the biggest asset mania ever (for net worth).

Most of the purported 735 billionaires as of 2021 are going to have most of their net worth wiped out too.

Augustus, I’d still take the first 22 years of the 21st century over the first 22 years of the 20th century.

And hopefully the next 22 years also won’t be as bad as 1923-1945.

Augustus,

It really doesn’t matter what “percentile” I, or anyone, am/is in. But many humans are competitive by nature. Long ago, I was driven as an athlete to be not only the best I could be, but to be better than everyone else. Now, as I start my seventh decade on this rock, my goal is to stay strong, healthy, and yeah, be as fast as possible when I ride.

Your last sentence about 735 billionaires being wiped out of most of their net worth is an interesting one. As my portfolio has decreased a bit in the last year, life is not much different for me on a day-to-day measure.

Wealth has many components to it. And if my portfolio dips a bit more, I’ll still have the pieces in place that make life excellent.

“Yeah, I wonder if it’s over

On the day you live to learn

If the slowest get to be oldest

Or if it’s just the opposite…

Everybody’s fast on wheels

They don’t know how good

The ground feels

I don’t think I want to move

I’m home soon…

Along the crazy journey

Peace was what I’ve found”

-‘Fast On Wheels’ by D-A-D

If you’re in the top 5% and taking major hits on your equities, do you still have a good life?

“Life is good on the northern Prairie.”

“Fastest development of a large country.”

I know you are not referring to the US in the 21st century.

Moreover, whatever development occurred, FRB had nothing to do with it.

China. Couldn’t have happened that fast without printed money I don’t think.

I’m not sure, that the next sound will sound like a pop. Assuming you are referring to the various markets that are currently distorted with a belief that differs from your particular outlook.

As a Canadian living in the national capital city of Ottawa I see a proliferation of weed stores opening and they all seem quite busy.

Been waiting for the housing bubble to pop. Unloaded my housing and associated renting headaches. Wife died and I am now happy in a 600 square foot apartment with no mortgage and only somewhat outrageously high condo fees to pay.

Hopefully house prices will drop enough so that everyone who wants to buy a home can do so.

How much will prices sink? I am betting it will be more than 30 percent from the peak. Just disgusted by the greed of some people. We need to think of the common good and not just ourselves !

Will a 30% decrease be enough for “everybody who wants to buy a home?”

I suspect it will need to come down much more than that.

So true.

Growing up in the sixties our suburban neighborhood of three bedroom one bath houses had a wide range of workers, from professional engineers, doctors, dentists to TV repairman, fireman, police officers, highway department laborers and the like. The point is that all of them could afford to live there. Now, this is definitely not the case. Something went very wrong in the last half century, and it is not good for the country.

What happened was the Suburban Experiment. The second wave of the experiment is crashing down.

We have a country full of fragile cities that have overdeveloped their infrastructure and are almost all financially insolvent. Hence our constant “F Grade” infrastructure reports and gov bailouts for infrastructure.

The subsidies that attracted those workers to suburbs originally are now the same policies keeping them out.

Chuck Marohn at Strong Towns talks quite extensively about this.

Something definitely went wrong.

It’s called extended social and economic decay which has been mostly disguised by borrowing.

What went wrong was the US dollar’s anchor to gold was broken.

It has nothing to do with “The Suburban Experiment” as Ray asserts.

The housing market will be weak for a long time now, but people will hold their assets as long as inflation is alive and employment is strong enough to carry the rent. I’d rather keep my best properties for a 2% return on rental income than sell them to fund my government. A 20% decrease on the average home under $1 million could take 1-3 years. The $2+ million dollar bubble will see 30% within a year from now because there’s a ton speculative froth in that price range.

People would like to hold but may would be forced to sell.

Home prices like stocks are decided by the margin sales.

I am guessing many will first tap the Home Equity before they sell. I know at the peak housing earlier this year I read Home Equity was at 27 trillion. During HB1 home equity peaked at 11 trillion.

I read the amount of HELOCS is increasing and crazing enough, people are refinancing at higher rates but 95% of the refinancing is cash out.

Thus there is still a lot of home equity to be used to help keep spending like the Joneses

ru:

If values are falling, so will the equity available to tap. Banks aren’t going to lend that far into the cushion. In the GFC, HELOC were being canceled by the banks. One guy I worked with had a house in Palos Verde, CA that was worth somewhere around $2M. He owned it outright. Took a HELOC to give him some flexibility. The bank canceled it. Period. No reduction. Canceled.

El Katz,

I am a bit confused by how things played out when reading your reply regarding the HELOC loan that was canceled.

Did your friend and the bank sign papers and have a cash transfer from the bank to him before cancellation? Or did the bank back out before funds were transferred?

(To me, debt is to be avoided. And leverage? That is what I use to torque down nuts, bolts and fasteners on my machines. But I am not a gambler… )

Thanks, and curious to hear the timeline of a bank cancelling a HELOC loan.

Mission yesterday was to ride my 150 cc bike from Sanford to Louisburg, NC on rural roads a 75 mile trip if I had used my car, but probably 125 mile on rural roads. The challenge was to pick my way between Raleigh and Durham.

It was an interesting trip to see the at least appearance of wealth as the population has grown. Endless number of new multi-family and single family developments that are shiny new or under construction now reaching out to 30 miles from downtown Raleigh.

Seems like too many single family home developments are underway and will get stranded by 7% mortgages, but that’s just observation from riding around.

It’s a mixed bag of course. Get out in really rural areas there is still beautiful farmland but signs of poverty in run down housing of various types and closed up mom and pop businesses.

Old Weaver Trail around Falls lake was the reward for my journey. Very little traffic with winding roads and beautiful fall scenes. Never been there before though only 50 miles from my home.

I look at all the charts and see and upward accelerating trajectory, tarnished by the beginnings of a reversal. I can’t help but believe price drops have a LONG way to go. The frenzy had died.

Continued upward movement relies on a central bank pivot, but I don’t see that happening anytime soon. Central banks finally realize that ordinary people are getting crushed by inflation. Sustained rate increases are necessary to ward off revolution and systematic collapse. 80% of the population has their back against a wall. 20% are wondering whether the gravy train will continue.

Just listened to a recent, brief interview with Sheila Bair, former chair of the FDIC, who gained some fame as she described the closures of banks during the GFC and the shenanigans that led up to it. She described what she thinks the FED should be doing right now: Slow down the FED Funds rate hikes which will be damaging at this point and, instead, stop buying debt and accelerate QT. She thinks the inflation fix is to remove the excess money in the system.

The FED needs to tamp down inflation expectations. The point of the shock and awe of these .75% hikes is to break the inflationary mindset. If the markets get a whiff of a pivot, expectations go in the opposite direction. Bair’s remedy – reduce the money supply – might have been better from the get-go, but I think the FED rate hikes are the only way to get this done at this point, recession or not. And these brief market rallies are only going to strengthen the FED’s conviction that they can’t back down now.

Regarding the stock market, as these rates climb, short-term treasuries rates are drawing off money from core stock holdings, so the market should continue to decline. Today, I saw 6 mo. rates at 4.4%.

Until bankruptcies and layoffs are daily news, I don’t think the inflation cycle will end.

They need to do both (keep raising rates AND QT).

QE was (to a point) necessary to realise ultra low interest rates (per liquidity preference curve). Now QT is necessary to move them up. Or they will have to pay high interest rates on reserves, which is basically a carry trade with a deeply negative carry, imposing gigantic losses on the Fed, undermining credibility and “independence”.

It will be interesting to see how Fed manages it. They try to be the tail that wags the dog, but mainly they can pull demand forward and then have to deal with the consequences of their manipulation. Sometimes people panic and makes it all worse.

WRT Sheila Bair, is that not what the Fed is doing and said it would do?

I believe the Fed has been spooked by events in the UK and by the FRA-OIS spread (that’s not my domain so I tread carefully).

However, nothing has been announced by the Fed that is new. Maybe we expected this to come out during the FOMC but it’s really not a shift in position. What is valid to note is that CPI data is no longer the only item of concern, and rightly so.

More credible people are starting to get nervous and are hedging their reputations.

AB, she was arguing that rate hikes are going to inflict unnecessary damage to the economy, and that QT/monetary reduction is the better way going forward.

Regarding the CPI as the major metric the FED looks at, I remember that there were several instances that the Fed used some metric as a decoy while they were more focused on another, M2 was held out as the key drive once, but they were really concerned about other measures. Can’t give an example but I remember that they used that strategy. Greenspan once joked about how some of what he said in testimony was incomprehensible, intentionally so.

You don’t necessarily need bankruptcies and big layoffs to curb inflation.

High rates would cure inflation to large extent.

Case in point.. car sales have come down quite a lot due to higher rates.

Same for home sales and prices.

Jon, I don’t know if the antidote to inflation is actually known. Volcker pulled it off, but was it the interest rate hikes and maybe forms of QT that fixed it?

I don’t think it’s known what actually ended the great Depression, but it’s attributed to the onset of WWII and the industrial response here in the U S, largely through borrowed money. That was a classical Keynesian scenario, btw.

In the 70s and early 80s, the FED tried to raise funds rates gradually and “pivoted” before inflation was fully buried. Volcker tried that approach as well. It was when inflation resurfaced, at higher levels in ’82, that Volcker effectively shut down the credit system. Inflation expectations were pretty much put to bed. High unemployment, lots of bankruptcies, the building industry was particularly hard hit.

I believe her last name is spelled Bair, so it sounds perfect.

From wikipedia: Sheila Colleen Bair (born April 3, 1954) is an American civil servant who was the 19th Chair of the U.S. Federal Deposit Insurance Corporation (FDIC)

It is Halloween, so maybe thinking of Linda Blair, who would in any event have done better than Liz Truss, and scared people less. ;)

I do wonder what Sheila Bair’s publicly stated position was on QE & ZIRP. I have no idea. Anyone who wants to mitigate the current risks is clearly unaware that they cannot be mitigated.

I’m preparing myself for the ugly spectacle of the Ponzi players seeking to blame anyone but themselves. The only line I have for when I’m asked for my opinion, which they should well know, is, “people must try to work this out for themselves”. It’s not great – it’s bland and aloof and I’m running out of time. The distance is to avoid schadenfreude or outright confrontation.

The Fed needs to increase QT by another $25 billion/month in Treasuries. There is plenty of slack in the reverse repo facility to do that safely.

There is already a lot of turmoil in the markets. QT is fine for now. The Fed needs to get to 4.5%-ish and pause and let the dust settle, and let markets adjust to the new rates and QT. There is too much chaos right now. Markets need some time to adjust to this new reality.

Helocs are a trap to financial hardship

If you have a non-recourse state, do you need to pay back the HELOC if you walk away from the house after spending all the HELOC money? If not I’m guessing it’s free money. Unethical free money…

For the record, I do not live in such a state…

Can’t Canada just sell more citizenships and import more debt slaves to keep the financial and housing industries propped up?

That’s how it’s been for decades …

First it was the Hong Kong Chinese buying properties with cash above listing price. Now it is Indian and Pakistani families bundling their cash and buying property to build a 10 br/ba homestead for the extended family to share.

I wonder who owns the mortgages on these bubbles? Pension funds? Or is it all Chinese flight capital cash?

When I stayed in Vancouver in 2018, both B&Bs were Chinese owned and they had multiple properties in the same street. The whole city was full of real estate advertisements, clearly catering to Chinese. It all looked so “top of the bubble” I couldn’t believe it.

Even with the current “plunge” prices are still too high. People who bought before this year are probably still in the money. It is tough to find any investment that is somewhat “safe”.

Looking at the graphs I get the impression that this is just the tip of the iceberg.

I guess residential real estate is 15% or more of the economy. Seems like 7% mortgages is enough to slow economy in US. Don’t know why Fed wants to get to 8% or more. Even a dim bulb would think that is over kill. Just need time for policy to work.

At least this sinking part of the economy might have hit an iceberg (but only after ascending like a rocket).

All that steepness hints to me, maybe there’s a cluster of inter-related icebergs to come. It happened in ’08 — though I think Canada sailed through OK then? that was a long time and many deteriorations of balance sheets ago.

B of A’s Brian Moynihan says consumers’ balance sheets are OK, Roubini seems to think swarms of asteroids will sweep us away. The world has tended to muddle through a murky middle — on average.

Canadians would also like to know quick dick mcdick’s thoughts.

Lets wait for 1 year and see if they are still in the money.

“People who bought before this year are probably still in the money”

Nuh uh. Commissions. Knock another 5% off the top.

We assume that the buyers of the last 5 years are as leveraged as any Chinese RE buyer in China. That will definitely hurt.

For reality in housing prices we need to consider multiple factors.

Yes interest rates are key, but comparative costs of renting also figure in, as does to cost to construct a new housing unit.

Rents have been skyrocketing as have construction costs. If these do not come down they put a floor under housing prices.

Then look at incomes. If incomes start increasing at say 6% then a mortgage with a fixed rate may not look too bad. Rate fixed, income increasing. Like the old days.

You have a bad assumption.

Over the past couple years, rents went up 5-10%. Mortgage payments went up 80%. Home prices were NOT anchored to rents the past couple years. Home prices have a long way to fall to get back in line with rents.

Renter exodus/collapse inevitable and underway already in spite of current job strength. This will wipe out any floor in house prices. Same as 08.

Housing prices are not based upon the relative cost versus renting or construction.

It’s based upon ability to pay out of incomes and cash flow.

It’s not an “either” or an “or” choice. There is also “none of the above”.

People who can’t afford to rent or buy will double or triple up, more if necessary.

The 1st world (Canada or US) isn’t exempt from math.

James W., you reminded me of something that happened back in ’82 and ’86. Oil prices collapsed due to political events, primarily, and the increased efficiency of autos, alternative sources for power due to the oil crisis of the late ’70s, etc. But what happened was that in the states that were highly dependent on oil production, employment got slammed. The best jobs in those regions were in the moving business. Unemployment soared.

I remember that Colorado, Alaska, Oklahoma, Arizona and Texas had collapses in real estate values and anything related to that sector. I knew a r.e. broker who was selling a rental complex at 3 times annual Gross Income. He had several complexes but with 50% + vacancies.

Federal, provincial and municipal governments are spending and investing huge right now in Canada. There’s construction on every other road and commercial/industrial buildings are popping up in places that were vacant for years. Those who flip and build homes for a living are cutting their burn for the long haul, but they’re usually well off to begin with and there’s still a lot of activity running on cheap financing from last year yet to be completed, so the first half of next year should still be busy. Ontario is full of workaholics, people live to work mostly. Mortgage resets will affect about 25% of loans next year; banks are already offering deals to lengthen terms of cheap mortgages for additional 40-50 basis points. Grocers are now freezing prices on no name brands. I haven’t experienced any shortages other than some gourmet grocery items. I don’t think most people realize how high interest rates and inflation could go, but it’s happening gradually enough to be able to adapt for most people. If you can’t pay your mortgage, the banks will work with you and they won’t kick you out of your home for at least a year if you pay nothing. It’s not like the 80’s anymore, that’s for sure. If you didn’t read any news you would still think the economy is booming here, but that can change quickly if our currency shits the bed while CB rates go to 5 points or more. Canadian exports to the US are generating healthy profits with our cheaper loony. The stock market and the housing bubble is the first casualty, but with bonds nearing 5% I think people invested in this space will spend their yields chasing inflation.

Russell Napier believes “the power to control the creation of money has moved from central banks to governments and engineering a higher nominal GDP growth through a higher structural level of inflation (4-6%) is a proven way to get rid of high levels of debt.”

This is probably a good example of what we are seeing in Canada right now, as long as the currency survives! But, the UK is providing a better test case subject of what’s to come when the value of a periphery currency is collapsing and government spending is finally challenged by the deterioration of its ability to sell debt.

Charles Hugh Smith says Napier misses three critical factors:

1) The energy cliff, as hydrocarbon production declines faster than new sources can be brought on line to replace them.

2) The demographic cliff as workforces decline and the cohort of retirees to be supported balloons.

3) The impossibility of funding massive new CapEx and infrastructure spending, supporting the ballooning cohort of retirees and consumer spending to keep the “waste is growth / Landfill Economy” humming while keeping inflation tamed to 5%.

Mark,

I read Russell Napier’s essay you refer to seven days ago, and think he is spot on. Three days ago, a Scotsman who eats oatmeal for breakfast and who likes to swim in cold water (much as Wolf, who also partakes in this exercise) referenced “his old chum,”Mr. Napier’s thesis, and I also agreed with the Scotsman’s viewpoint on the subject.

I have not yet read C H S’s take, but will soon, and thanks for the heads up.

Yes, inflation is here to stay for quite a while in most of the Western Economies. Yes, the private and public sector debt levels are simply too high for sustainability. In the USA (I know this is about housing in Canada), public & private debt added together equals 290% of GDP.

Napier maintains that we have a structural change happening right now. Recently, the USA government printed trillions of dollars to hand out for Covid Relief, and that ended up on the Fed’s balance sheet, as an example of this change. Government fiscal policy is overtaking central banks’ monetary policy as the force behind the creation of money. But in order to deal with the huge national debt ($3.1 x 10^13), the GDP simply has to grow from 6% to 8% per year. Much of that growth has be from inflation, as GDP, from what we think of as “traditional” GDP measurements, just can’t get turned up from the 2% or so we now have like you can turn up the volume on your preamp.

In my opinion, we are in for at least a decade of high interest rates, high mortgage rates, and inflation will cool off only a bit towards 5% or so. Housing costs will adjust accordingly. Gets used to it folks…

James from Toronto both parents from Scotland.

Agree with inflation being sticky. At the moment CB’s pause/pivot inflation will roar back again mainly due to the employment situation.

Also there is an illusion of a housing shortage IMHO (in Toronto at least) … there just not priced right yet.

I read Napier’s recent articles/essays and it is a fresh perspective however I’m still un-decided.

“If you can’t pay your mortgage, the banks will work with you and they won’t kick you out of your home for at least a year if you pay nothing. It’s not like the 80’s anymore, that’s for sure.”

No, it’s not the 80’s (or earlier) anymore, until the creditors experience their own funding crisis.

Because of the extended credit mania, everyone is used to artificially (and unsustainably) low cost of borrowing and the loosest (unsustainable) credit standards in history. That’s the root cause behind what you describe.

When the lender’s creditors really put the squeeze on them (including governments), what you just described will change radically, eventually much tighter than the 80’s which were hardly tight.

What’s happening in 2022 is mostly higher cost of borrowing but I haven’t read much evidence that it’s translated to much (if any) tightening in credit standards.

Only at the margin for the weakest commercial borrowers and weak governments. Certainly not US consumer credit because of artificially low defaults (from the pandemic) and the current labor market.

This is going to change drastically in the future.

Is the Fed engineering a controlled demolition of leveraged credit markets? Is this is the only path out of complete and utter global economic collapse?

A government/insider funding crisis will lead to authoritarianism before some meaningful resistance challenges the noose around free markets.

The seeds of socialism are planted with massive leverage and when that leverage unwinds, people sow these seeds by fighting each other to keep their wealth and power and retirement.

Governments are then forced to reign in the abuse of power that threatens the survival of the status quo/state with authoritarian interventions.

The end result is losing the free market until new seeds are planted that are sown by the independent actions of people to become self-reliant and defiant.

Where freedom is visible it will spread once again, but not without a bloody affair.

Now, no more comments about leaving money on the table, LoL.

The Chinese investor class has to decide if they have diamond hands, or if they can ever even use the banked property.

Never have so many people done remote property as a store of wealth.

As for liquidity, this is the beginning of a very long march …

Long march towards what? A bit too cryptic for me.

@ How Now I believe Citizen is talking about the China’s Long March. Over a year, October 1934 thru October 1935, the bulk of communist forces escaped encirclement, and fled almost 4000 miles on foot. Of approximately 80,000 people who started, about 8,000 survived to October, 1935. It sucked really bad.

Why were housing price rises much more muted in Edmonton and Calgary? Any Canadians have thoughts on that?

Are these cities losing appeal? Poor economic growth? No Chinese money?

The private market has more latitude in Alberta and the supply of raw land is lightly regulated by the Province in comparison to Ontario.

Alberta also has an overall tax advantage compared to other provinces, with no sales tax, no payroll tax and no health premium.

Several reasons:

– Calgary hasn’t recovered from the last oil bust; still many empty office towers and former corporate headquarters.

– They have a well regarded Progressive Mayor….but increasingly batshit insane provincial leadership (although an election is due soon, which may improve the situation).

— It gets to -40C in Calgary in the winter; wealthy Chinese prefer not to freeze.

In fact…. Calgary is the only major Market in Canada seeing healthy increases in prices. Albeit, prices are still recovering from the last oil bust-up. It all depends when you bought.

Alberta is producing more tar sands than ever, billions$$$ are rolling in again.

Anyway, we own in Calgary, recently hiked our rental 15% (which is fairly conservative, and a bargain compared to Vancouver/Toronto).

Calgary has a bright future. Consistently rated as one of the best cities in the world for quality of life.

Canada just banned the sale of handguns today; And look at that cheap Canadian currency! You’d be a fool not to invest in Canada.

For a major city, Calgary would be my first choice to build in Canada.

One can’t even pay me to live in Calgary.

This is just me.

Talking about delusional. Not even going to look up Calgary on the map.

I’d say the exact opposite: you’d be a fool to invest in Canada with the, using your own words, “batshit insane” Premier of Canada by the name of Trudeau.

The weather is atrocious and the politics at the national level has gone left-wing nutter.

Canada could have been a huge exporter of natural gas and that has been ruined the by boy wonder in charge of the country.

Agricultural production will also fall based on the new Federal government guidelines.

Not a pretty picture for Canada if these policies remain in place.

I live in Calgary as well. The saving grace right now is Oil and Natural Gas. The Alberta provincial government receives an off the top or “Gross Overriding Royalty”, the Crown Royalty that equates to about about 10% of most oil and gas revenues in the province (very few landowners have mineral rights, they are retained by the Province or Crown). This allows lower taxes than most jurisdictions in Canada as well as more subsidies for Health, Education, and other government services. Moreover, the O&G industry pays a lot of corporate taxes , as well as paying good wages, employing highly skilled workers, providing a diversified supplier base, including well paying manufacturing or plant jobs in both rural and urban areas. Another key advantage is that we have a lot of land, there is land on all sides of Edmonton and Calgary-no lakes, oceans, mountains, or other cities to restrict growth, just open Prairie. Our Achilles heal is the price of oil and gas, if it goes down, we go down. And therein lies the problem, if O&G is phased for environmental reasons out what happens to Alberta? Do we shrink to the size of other Prairie provinces or states, say Saskatchewan or Montana-because we are not that different, beyond our concentration of O&G. As for Canada, IMHO, the Canadian $’s relative strength is due to the high price of oil and natural gas. If oil and goes goes down, down goes the Canuck Buck.

I may buy some rural acreage near Calgary. My eldest daughter works in Edmonton and I keep a sailboat near my uncles in Sandpoint ID. We shall see what happens, there may be some deals forthcoming…..I have too much invested in Ontario, time to diversify a bit.

We have some good friends who live in the Ottawa area.

They are empty nesters now. Last time we chatted their plan was to swap their big ‘ole house for the Condo one of their kids own. Not sure about the Income Tax implications of that would be.

But they did say their kids, who are all “white collar” types felt as though they were being priced out of the housing market up there.

So this is probably good news for them.

And it hasn’t started yet!

The common theme going forward is that economic indicators return to trend.

The graphs from Wolf’s article show that all prices should drop between 30 to 60% if trend lines hold true.

Canada is in for a lot of pain.

It’s here now, no one can change that trajectory.

And 30-60% price drop in many of those cities would be a bubble correction, not a crash, considering how fast the bubble inflated.

Oh my … Toronto is number 1 on UBS’ Global Real Estate Bubble Index. Vancouver is 6th.

correction to 3 times earnings which might not be bottom in Toronto is another 55% or 70% from top the.UK has just recently reduced max mortgages from 5 times to 4 times. 3 times is normal but markets sometimes go lower. The recovery might not happen Calgary prices are only just getting back up to thier peak in 2007

It is hard to knock the US consumers down.

American Express stated their consumers are record spending. Specifically travel, entertainment, eating out.

spending is up 21% YOY and at record levels.

They just don’t want to buy houses

anymore. It is all about traveling. lol

At some point, you realize you can’t have everything.

Still waaaayyyyy too much money sloshing around. A US clothing maker that I sometimes buy from just released their fall/winter lineup, and they completely sold out of $975 coats in a day. Normally it would take months, and they may even have them on sale late winter.

Things are not going much better in Seattle. In my area, I saw a house sell for $2.6M in March, which I thought was high. The Redfin estimate is now $2.0M, only six months later. That’s more than a 20% loss, so the home may already be underwater with poor prospects of recovery.

Several other houses that sold earlier this year are down about 10% per Redfin estimate, and continuing to drop quickly.

The price spike in early Spring was ridiculous, obviously.

Interestingly, I’m also seeing houses purchased earlier this year being put up for sale only 6 months later, likely by people who fear big losses or getting stuck in the home forever. Or, perhaps they are over-levered invesetors, and the clear downward trend is causing them to panic like its 2007.

Quite a few of the houses (NY) I looked at over the past year and either walked away or was outbit by cash offers, are now back on the market. The ones I walked away from needed significant repairs, guessing the new owners finally did the math. The cash offers may have been non-mortgage loans and the owners thought they could make $ off the deal but timed the market too late. Gonna be real interesting real soon.

We were having the same issue. Got outbid by all cash offers well above asking price or by contractors looking for a flip. Nice home in Bellmore been on the market over a year. Owner thinks his 100yr old home is worth 599 and refused several offers at 550.

I live in a bit of a dump of a town on Vancouver Island, the kind of place where, to borrow from the inimitable Bret “the hitman” Hart, you’d stick the hose if the island needed an enema. Anyways, listings have been piling up here all summer, from a low of 150ish during the winter to around 800 now, in the area I track. According to the VIREB (Vancouver Island Real Estate Board) statistics, average sale prices peaked here in January at a bit over 1 million, not counting waterfront and acreages. Truly insane. The most recent report (September) showed the average sale at 800k. Still an outrageous price, of course, but the fools who bought the average clump of glue and particle board in January have been losing about 20k a month. Very curious about the October report.

Still irrational out there, though. Lots of sellers letting their places rot on MLS at early 2022 pricing, refusing to drop their prices more than a token amount. Lots of empty houses for sale, too. Just for kicks, I went to an open house here recently – a real beater of a place on the water, formerly owned by a now-deceased 90-something, and I needed a shower just after walking around in there. Literally every room was a disaster. Listed at 1.2 million and it sold within a week. All I can say is interest rates cannot go up fast enough here for my liking/sanity, nor can the foreign buyer ban kick in soon enough (scheduled for January 2023). I sometimes feel like the only sane man on the planet.

1) It’s all about volatility. CD for 4.8%. KEY Bank 4.6% dividends. KEY up 6.62% yesterday. PNC up 5.67%. JPM 5.25%/day…something is wrong.

2) Those who work day and night to produce real stuff and those 100Y blue zone SOB are working real hard. The rest are travelling and feasting. They don’t care.

3) After 14 years of negative rates mortgage rate are 7% and TLT is bleeding since Apr 2020.

4) The weekly DOW made a new all time high in Feb 10 2020. In Oct 10

2022 the Dow closed below Feb 10 2020 & Feb 17 2020 low. That was itchy.

5) If enough people bought a house paying 2.5% – 4.5% and if

enough people invested in money market funds when rates were negative in real and nominal terms, banks and large institutions might/ might not become JUNK.

We’re in the thick of it (Toronto). Rented a lovely apartment in a big house 2012-2020, but got “renovicted” Christmas 2020. This was the second time (first was 2010 when the condo owner wanted family use). Since spouse didn’t want to be displaced again, we bought a 2-bdrm condo we could afford Feb 2021. 1.5% fixed rate for 5 years, but rate will reset Jan 2025. Things looked good for a year, but now market is tanking and condo is only worth what we paid ($850K, which was among the cheapest condos in downtown Toronto at the time). They have kept this market soaring for so long. Wish we would have waited, but renting here is very precarious even if you pay your rent and are good tenants.

So 18 months later the condo is only worth what you paid? In Toronto? That is outrageous is what that is. No gain in 18 months. Who will buy it now without appreciation.

Well right now, but going down every month, and if you add transaction costs, we would be at a net loss. Can’t go anywhere because kids need a stable home and I don’t want to change their school district.

Who know for sure what it is worth, and buyer sentiment is way down.

The mentality around here has been to expect big increases year over year for so long.

If you have bought it for your personal use and shelter

Then its not a big deal.

What matters is you enjoy every moment in your place.

I don’t even look at the price of my primary shelter at all.

Of course it is going down week after week in Southern California

Jon,

Your reasoning is why we have a housing bubble. People are attempting to legitimize home purchases, regardless of price.

Purchasing an overpriced house, which allows you to avoid some rent cost, will mitigate financial damage, but not nearly eliminate it.

If you buy an overpriced home, it can be a financially disastrous decision when compared to renting in the short-term. Sure, you can lock yourself into a 30-year payment, but what if you have to move in a few years, due to unemployment, divorce, or other circumstances, and the home is worth 40% less than your purchase price?

Also, what is the opportunity cost of putting all your available cash into a high long-term housing payment? Even if you manage to make the high payments for 30-years, you have severely impaired your potential to build wealth and retire at a desirable age.

If you look at a home for any other reason than shelter, you’re nuts. Period. End of conversation.

House values go up. They go down. People move all the time. So what? I moved 9 times for work and every time I sold and repurchased a home in the new location. Did I worry about the value of the house? Not really. My goal was always to break even. If I did better, cool. If I lost some, so what? I had banked the money from the last profitable sale as a cushion and, odds are, the next house I bought would also have proportionately dropped in value so it’s a push if I didn’t overreach. As has been noted, not all markets rise and fall at the same time.

Honestly, I have no idea what this crackerbox would sell for. The best advice I can give you is to stop looking at real estate listings unless you’re in the market to buy or move. It will drive you nuts watching the numbers ping pong. Remember: Nothing is worth anything until someone pays you for it. No amount of ermagerding is going to change that. The only exception is if the neighborhood is changing – and not for the better. But that is a simple observation. But if you chose well, it’s rarely a concern.

And the advice to not purchase a home but put it into equities? Have you bothered to look at the stock market lately? It can’t be doing well for many as the “geezers” in our circle of acquaintances are whining profusely. I go to bed with “x” and wake up with at least “x”. The house value never even enters my consciousness.

Do what’s important to you. If it’s a home for your family, then figure it out. If it’s being a paper millionaire, go for it. It’s your life.

So prices have PLUNGED to the levels of…2021.

Wake me when they hit the levels of 2015.

I’m going to be buying acreage (US) for 1998 prices in nominal dollars.

Ya, and Canada will have open carry……

Just watch. Land prices crash much worse than houses.

Well experienced Expectation and results.

The new times series isn’t good at pointing out the inflections. But short-term money flows are up, so stocks are up. It won’t last past the 4th qtr. And long-term money flows are down until Dec. So, inflation should fall. Those lags are ex-ante.

How do you define money flows?

1. The canary in the coal mine for housing bust will be AirBnB bust. or its phonogram ArabianB.

2. Housing shortage means, vacant homes owned by out of country investors, cannot be sold or rented out.

3.[Read in David Attenboro’s voice]…Here we see a humble lettuce outlasted a Prime Minister who in her time saw two Monarchs and three house secrataries….Also nearby, Larry the cat, known as the Prime Mouser saw four prime ministers….

3. Sound as a pound. Yen to the Bin. Dollar is king.

4. No new comer is going to buy 1 million dollar shack. He will wait patiently. You have to rent that house to him. May be

5. David grath (who post dog pictures on his blog) is predicting housing bust for the past 12 years. Little did he know.

6. SNAP did not expanded to third world countries like facebook and gmail did. The facebook company released “whatsapp”, a free software to inhibit the SNAP growth

7. Can we have more updates on NFT sir?

8. Feds are one trick pony. They will decrease the rates because of some another reason. Its different this time.

1) The economy is shifting : CVE was junk before and in Mar 2020, but now became a major energy co bringing a lot of good strong dollars to Canada. Alberta is freezing, but the TM pipeline will make it hot.

2) In US the economy of the south is booming, but the stock markets

will not show it. 40% of S&P co profit is coming from the rest

of the world.

3) The upper 10% are hurting after 11 months of plunging stocks, two

years of bleeding bonds and RE “adjustments”, but the south and the mid west are booming. US economy is shifting from

four decades of made in China to made in US internally. China isn’t good enough.

4) Those who produce phones with starlight – SLS – cameras made in China don’t know if/when their orders will come. China became an enigma, a casino. U never know what u get.

5) Just in time from the south, might be cheaper than ordering

from China half a year in advance. The dots are shorter despite the road works.

6) From deep inside inland China to Tianjin, Tianjin to Long Beach and from Long beach to co stores via warehouses, is longer and perhaps more expensive than made in US, for the first time since 1978.

7) It’s all about value investing by Napier…

” which has been pushing up mortgage rates, which renders them indigestible for hyper-inflated markets, ”

: exactly correct, I’m currently thinking.

It seems like an appropriate time to remind the general populace, a lesson learned from the 2006 bankers fraud holiday, that jingle mail, early, may be a smart move.

I’ve been fleeced for so long by the reputable businesses that the idea of trying to pay off an onerous debt to debutantes seems like a 3rd or 4th choice. I guess I would rather screw them before they screw me.

I’m not currently in that situation but I was in 1982 or so. With a 14 and a half pct mortgage plus a half for PMI when I lost my job and my wife was pregnant.

The Canadian and British conundrum is the ARM, the adjustable rate mortgage. For the past 20 years, the COB and the BOE,like the Fed have embarked on a campaign of increasing asset values to absurd levels.

I doubt we will ever hear an honest answer as to the purpose of such an apparently foolish course of monetary experimentation.

I am aware that the ARM was a factor in families losing their domicile during the great depression.

For the people that own homes, the relative loss of income from a 35% loss in ” market value”is zero. The potential loss of wealth, based on the hypothetical dream that if I sold my house I would be set for life is worth a cup of coffee and a rehash, nothing more.

Which brings me to the kernel, whose going to lose when the asset market bubbles collapse. The people that own the assets, the risk takers. Should they be bailed out again ?

Well, I was a fool and carried that debt burden for 18 months before I was able to sell it for what I bought it for. It was a different time.

A new headline says that the “mortgage bankers association expects mortgage rates to decline to 5.4% in 2023.” So, in essence, they’re the latest industry to be predicting – or shall I say praying for – a FED pivot.

Saw this tweet recently:

“Most of the whining for FR to stop are those who’ve benefited massively from cheap money. They’re wealthy. 70% of Americans don’t have a pot to piss in. They’re getting killed by price rises. I don’t believe FR can fix but they’ve got to keep going to stop the rampant speculation.”

That’s it in a nutshell. A bunch of rich people are begging the FED to destroy the middle class and poor so they don’t have to lose money, and can make even more. Filthy scvm that they are…

OK, the mortgage rates decrease to 5.4 pct while inflation is idling at say 8 pct so that a majority of someones will be willing to purchase mortgage debt at a negative real interest rate for the next 30 years. I think the Mortgage Bankers Association is simply displaying what the are famous for:

Foul smelling predictions.

There are alternative scenarios being bandied about, concerning the correct way to deflate the multiple asset bubbles.

I think the Fed has recently been approaching a plan that I am thankful about that they are not completely insane, anymore.

I must admit that every time the grossly overpriced stock market rally’s, I feel depressed.

Depth Charge,

Hahaha, these are the same morons that in Dec 2021 forecast that mortgage rates would be 4% by the end of 2022. We’re now at 7% with two months more to go.

Half of them have gotten laid off by now. I wonder if there are enough mortgage bankers left to ask.

Haha, exactly Wolf. Their “predictions” seem to be Kool-Aid tinged fantasies where they harken back to the halcyon days of 2021, reminiscing and praying for a return to such ludicrousness.

I don’t think we’ll ever again see such a ridiculous speculative frenzy in housing in our lifetimes.

Article coming :-]

Home inventories still need some time to rise to the point where there is extreme pressure on prices to fall. I think the next four months will do the trick.

In have a feeling that the people buying homes now are primarily selling one home and buying another with equity from the home sale. Not buyers putting in the savings from their labor. That can only last for a short period of time.

I sometimes have the same impressions of where I think the markets are likely to go. According to your analysis, I should not buy a house for at least four months.

If I get your drift, you are saying that the increase in inventory of homes ( and anxious sellers)for sale will, like a pressure cooker create sufficient uncertainty in the seller that they may consider offers 25% below the asking price ?

Just one more discussion of one of your salient points: People buying overpriced housing with the proceeds from selling their overpriced home.

We used to be talking about one of the worlds largest economies, California, the American ideal, where asset price increases became a way of life.

But, no, we’re talking about general asset inflation, in every nook and cranny of this great America. Every speculator large and small is at risk of being cutoff from low cost financing.

You’d be lucky to get 5 percent below the asking price. Edmonton, Alberta is the only major city where bidding 25 percent under the asking price works.

They haven’t “broken” the lowest end of the housing market where all the speculators are people with multiple properties in Ontario and British Columbia. This is the reason for the low inventory. Interest rates may never get high enough to break the lowest end of the market so my guess is inventory will stay low. The greatest of all fools are still buying at the low end of the housing market price wise. The low end of the housing market has fallen the least.

Virtually no one is selling a house to buy another house except retirees but they’re selling in Ontario and British Columbia to buy in a cheaper province or buy outside of Canada.

Resale apartments and resale townhouses today in Edmonton are still selling at fifty percent less than the 2007 highs the exact same townhouses and apartments that sold in 2007. Honestdoor has all the selling figures in Edmonton back to the 1950’s. Apartments and townhouses are still selling at 10 percent less than the average price in 2019 in Edmonton.

I made the big mistake of buying house to keep, and have a decent place to live among decent people who are a pleasure being around.

This big mistake has left me with a nice walk out basement 2,800 sf ranch, zero debt, a park like 10 acres on a small lake with great fishing, and utilities I can still afford for the time being. Sleeping well without drugs too!!

I guess I just missed out on the agony over high debt, adjustable interest rates, being forced to sell and the utter joy of the “rich wannabes” in leased Beemers telling me how wonderful their equity appreciation is….that they took out with a 3rd mortgage and spent on Mexican vacations.

Ah well, shoulda, coulda, woulda, too late now. I’m just on the dock, in my deck chair, casting the lure again, we’ll see if the fish are biting today.

Hope the Canadians are OK up north, sure is a bitch to be forced to sell out in a downward spiraling market. All that great equity up in smoke so to speak.

Mr. Jagmeet Singh of the NDP here in Canada says there is no merit for the Bank of Canada to raise interest rates again. The fact is the low interest rate, cheap money gray train is over and it lasted for almost 25 years. You got to like the left leaning, liberal socialist type politicians complaining of higher interest rates. The higher interest rates needed to reign in debt that they did so dramatically to pay for bloated, wasteful, social programs, government departments caused higher inflation, debt service interest payments. These higher interest rates, in this case mortgage rates already going to 7.25%+ is a tax on their personal finances. Another NDP leader back many years ago refinanced his house 11 times since the 1980’s as interest rates came down years after years and Canadian real estate prices kept going up, up and up.

It is about time I am getting some decent interest on my money. My 5.25% 10 year GIC will compound interest for the next 10 years to a total of 66.81%. They always lied about real inflation, cost of living figures and I will take the higher interest rates any day thank you very much. My future goal right now being achieved this year is $15,000 annual compound interest.

The Bank of Canada is now being to timid. They should of raised the key bank rate of at least 1% point so what did they do, they raised by only 50 basis points or 0.50% point. It is now 3.75% which is still too low with 7%+ current inflation. It may look like it is getting better now but I would not be surprised in the next 12 to 14 months or so inflation will rear it’s ugly head alot more than central banks want to admit or believe.

How about the elite Canadian who own more than 2+ properties. I know someone who owns 8+ properties with very basic jobs. A lady working in grocery shop purchased 1.4 million home just by flipping, other example of 2013 husband & wife both lost jobs but end up buying a property in Cambridge Ontario. Is there any law and order in this country? Corruption is on the highest. Fake mortgagee, line of credit and flipping will kill Canadian economy.