Wealth of the “Top 0.1%” drops by $12 million per household; the wealth of the “Bottom 50%,” who have nearly nothing, rises.

By Wolf Richter for WOLF STREET.

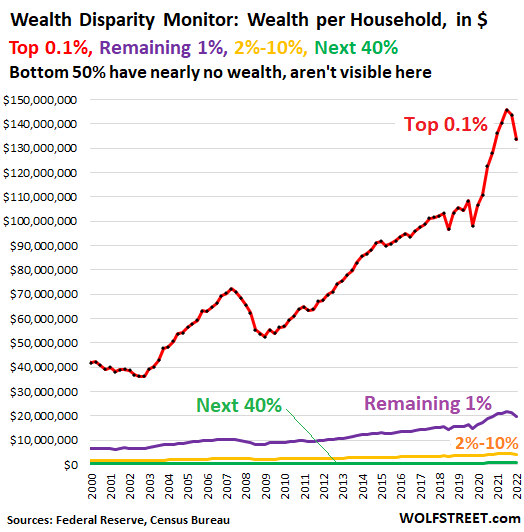

The Fed, in its new release of data on the distribution of wealth in the US, cut its classic category of the “Top 1%” into two new categories: the “Top 0.1%” and the “Remaining 1%.” And then there are the three classic categories of wealth or lack of wealth: the top 2% to 10%; the Next 40%; and the “Bottom 50%.”

The results of splitting out the 0.1% are shocking – though we’ve known it all along: Just how much wealthier the “Top 0.1%” are than even the “Remaining 1%,” and what kind of outrageous gift they got from the Fed’s money-printing and interest-rate repression. While the “Bottom 50%” have nearly no wealth.

Fed’s QT and rate hikes reduce the enormous wealth disparity.

The new release is for Q2, when the selloff in the stock market and the bond market was in full swing. The selloff hit the total wealth (assets minus debt) of the “Top 0.1%” the most, because they own the most stocks and bonds, and those got hit the hardest: The “Top 0.1%” lost $12 million in wealth per average household, compared to the end of 2021. And the unbelievably enormous and mind-boggling wealth disparity in America actually shrank visibly.

QE ended in early 2022. The Fed started raising rates in March. QT started in June. By now, interest rates have shot up, bond yields have shot up, and bond prices have fallen. The Nasdaq started falling late November. The S&P 500 Index started falling at the beginning of this year. In terms of Q2, by the end of June, the S&P 500 Index was down 24%.

And in effect, the Fed’s reversal of QE and interest-rate repression is deflating the Everything Bubble and is therefore deflating a portion of the horrendous wealth disparity that QE and interest rate repression had made so much worse.

So here is the average wealth (assets minus debts) per household, by wealth category in Q2, 2022, and by how much it changed from the end of 2021 (in bold). Note the gain by the Bottom 50%:

- “Top “0.1%” (red in chart below): $133.8 million (-$12 million, -8.2%)

- “Remaining 1%” (purple): $19.8 million (-$2.0 million, -9.1%)

- The 2% to 10% (yellow): $4.4 million (-$253,000, -5.5%)

- “Next 40%” (green): $768,000 (-$16,500; -2.1%)

- “Bottom 50%” (not show in the chart): $69,100 (+$10,500; +15.5%).

The “Bottom 50%” of households don’t show on the chart below because they have so little, and a big part of what little they have are durable goods, such as cars, a little home equity, and pension entitlements. They own nearly no stocks and no bonds, directly or indirectly. But their net worth actually jumped from minuscule to a little less minuscule! Kudos!

So here it is, my Wealth Disparity Monitor. It shows the wealth (assets minus debts) in dollars, per average household in each category. To get there, I divided the total wealth for each category (Fed data) by the number of households in that category (number of households per Census data). The bottom green line is the average household wealth of the better-off portion of the middle class, the folks below the top 10% and above the Bottom 50%, which is an indictment of the wealth distribution in America:

Primary beneficiaries of QE and interest-rate repression: “The 0.1%”

The explosion of the wealth of the “Top 0.1%” households through 2021 (red line) shows that they were the primary beneficiaries of the Fed’s policies since March 2020. These policies were designed to inflate asset prices, and only asset holders benefited from that. The more assets they held, the more they benefited. And those that already held the most assets, benefitted the most.

From Q2 2020, the beginning of the Fed’s crazy QE and interest rate repression, through the end of 2021, the average 0.1% households gained $47 million in wealth!

This was an obscene gift that the Fed handed this small number of households for a monstrous increase of their wealth, and for an exponential increase in the already ridiculous wealth disparity to the rest of the households, even to the “Remaining 1%.” It was also the greatest economic injustice committed in recent US history over such a short period of time.

These monetary policies are largely responsible for the worst inflation in 4 decades that is mauling the “Bottom 50%” of households because they have so little, and spend all their money on necessities.

By Q2, the “Top 0.1%” households gave up $12 million of that $47 million in gains they’d made since March 2020. So the Fed has a long way to go with its tightening policies before this Wealth Disparity gets back to something that doesn’t tear up the American society.

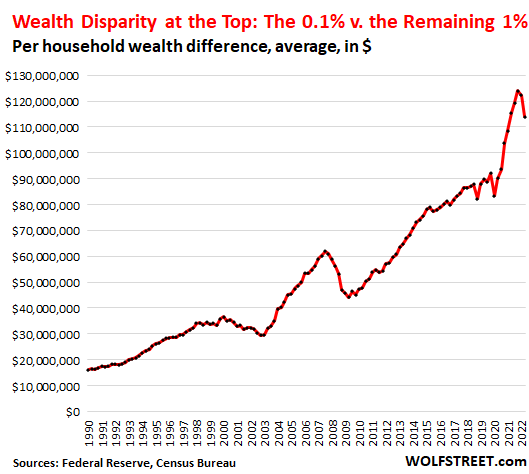

Wealth Disparity between “The 0.1%” and “The 1%”

The wealth disparity even at the very top is just astounding. As we have long suspected, it’s not the 1% that get all the goodies; it’s the minuscule number of households that make up the top 0.1%: QE and interest rate repression since the Financial Crisis, and particularly since March 2020, simply blew out the wealth disparity between “The 0.1%” and the “remaining 1%.”

The effects of the Fed’s tightening are now beginning to dial back a small portion of that disparity; and there’s a long way to go:

My Wealth Disparity Monitor is a quarterly report card on the effects of the Fed’s monetary policies. The official reasoning for QE and interest rate repression is the well-known but dubious “Wealth Effect” which is the monetary equivalent of trickledown economics, where the Fed tries to make the already wealthy far wealthier by inflating asset prices with QE and interest rate repression, based on the doctrine that these households will then spend some of this newly gained wealth, which will then trickle down….

What we got instead of the wealth trickledown is a huge bout of inflation, of global inflation, since central banks globally have pursued similar policies of interest rate repression and QE.

Now the Fed and other central banks are furiously backpedaling, and as tightening progresses, there will be more progress in reducing the disastrous wealth disparity.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Inflation is just wealth transfer.

It used to be nearly impossible to accumulate insane amounts of wealth when the top Federal Tax rate was 94%. In 1981 an actor became President and slashed taxes and dropped the marginal tax rate from 70% when he was inaugurated to just 28% when his term ended, and had a 74% top approval rating so it seems giving out free money worked better in the 80s vs 2022…

Yet today if the top capital gains rate for billionaires was say 60%, they could simply borrow off their shares and never pay a dime like the current scheme to avoid taxes today. The proposed billionaire taxes are not going to pass as the billionaires buy out Congress via lobby funds. And lobby reform is not going to happen as it takes tens to hundreds of millions to win elections. Catch-22…

That 0.1% chart looks like Fed’s balance sheet chart. Can we plot them together?

Thinking about it. Topic for another project.

I’m seeing Dow/ Nasdaq / S&P price history chart.

And the housing bubble charts..

Hey Yort,

Your assertion that taxes are what kept people from accumulating wealth is both wrong and foolish. Wrong in that the amount of tax exemptions that were utilized by the wealthy at the time (1930s) made it so that their effective tax rate was under 30%. Foolish in that you assume that people would choose to live under a government that take 94% of their income over a certain amount. Name a time in history where where people voluntarily gave up 95% of their income because “government said so”, especially in America. Whiskey rebellion anyone?

Funny how no one talks about the gold confiscation by FDR or the FED exacerbating the recession of 1929 into the great depression.

When Regan “slashed” the tax rate, he was actually bargaining with the wealthy to get them to effectively pay more. Last I checked it worked and tax revenues increased under Regan in particular.

Lastly, if every one of the top 0.1% had their wealth confiscated, it would barely pay for the US government to operate for 6 months. We don’t have a tax problem, we have a spending problem.

DEI & ESG Slave,

“Lastly, if every one of the top 0.1% had their wealth confiscated, it would barely pay for the US government to operate for 6 months.”

hahahaha, problems with basic math? “The 0.1%” have a combined wealth (assets minus debts) of $17.1 trillion. So that would pay off half of the total US gross national debt. Or it would cover the federal deficits at the current rate for about 17 years. Just to get the math right.

Me, it’s all fictitious ‘wealth’. It’s not backed by anything really valuable. Will the creditors accept Facebook or Tesla paper instead of (scarce) USD? At what rate?

I would add that the KNOWN wealth of the US ultra rich is that $17.1 trillion. Hidden wealth, as discussed as to UK and some other users of British Commonwealth tax shelters was apparently estimated various years ago to be 55 trillion UK pounds (then worth much more than dollars.) See “Britain’s Second Empire: The Spider’s Web” documentary. US ultra rich are far, far wealthier if you count hidden assets and by hiding assets they have long avoided US taxation: see Gizmodo story re Apple, $50 billion, and taxes.

The top 26 wealthiest people in the world combined wealth is more than the bottom 3.2 billion. Crazy

If governments wants to do transfer payments. There is your targets

That is the sloppiest collection of unsubstantiated “look over here” arguments I have seen in quite a while, but by no means the sloppiest…..so…..no prize.

Just noticed your 1980 savior’s name was misspelled twice. Sacrilege! And how could an actor know how to “bargain with the wealthy”? Was The Art of the Deal even out back then?

JFK, a DEMOCRAT, lowered the tax rate 1st!!

selective amnesia @ work

He said from 70%, and that was the JFK cut level. R(and understand)TGDFC!

I read the 1960 tax rate schedule..(look it up!)….there was one hell of a lot more than 4 brackets…..just a guess, 25-50? Progressive rates.

I do remember the tax on $12,000/yr (after deductions) was pretty high, relatively, and that was the assessed value of the 3 bed, 1 bath, 1 wall heater appx 1100-1300 sq foot 3-4 floor plan tract house we bought in Fontana, CA. Seville St, it’s still there, and at that time almost everyone worked for Kaiser Steel…Union jobs plus they had just decided they were big enough to run their own hospital….cheaper.

Check out Kaiser Health News.com. It is put out by the Kaiser family. I seems they are a bit guilty over what they may have started, managed health care.

They were just into making steel and stuff out of it, anyway.

The so called “Kennedy Tax Cut” was actually passed by Congress in 1964 when LBJ was president.

Yort, I’d like to avoid politics here and I think it’s fair to ask a couple of functional questions…

First, the top 0.1%ers have their wealth stored in things like assets and securities, not cold hard cash. How do we tax that wealth without destroying a lot of it? If all the hyper rich started liquidating stocks and property to pay their fair share, how would the government be able to access that wealth via taxation while the wealth itself evaporates due to crashing stock and property prices caused by forced sales?

Second, let’s say we could magically unlock all of that paper wealth to tax it and redistribute it to the lower & middle classes through the government’s usual channels: programs, public spending, direct cash payments, maybe debt forgiveness, etc. Wouldn’t a sudden redistribution of that buying power cause massive inflation?

I’m not trying to be a billionaire’s advocate, but I’d sincerely like to know if anybody has answers to these questions… We dug ourselves into a massive wealth-gap hole and I can’t wrap my head around how we would be able to unwind so much fake paper wealth and use the revenue from it without causing other huge unintended disasters.

You impute a reasonable rate of income to hidden and other wealth and tax that. Of course they may then sell a part of those assets, move the funds, and hide them elsewhere. The G7 would have to participate to discourage this as to most economies and would have to require disclosure of beneficial owners. They need the USA, so we could pressure them to do that.

Aggressive, loophole-free, and wholly enforced estate tax.

@poor like you

Your aggressive loophole free inheritance tax would promptly be applied to the middle class. See the history of the income tax for reference.

The estate tax only applies to a very small number of households.

How would “we” tax that wealth?

Effectively, by replacing the tax on work with a very high tax on privilege. That means labor income, even by highly-compensated folks, is tax-free. But privilege, meaning income that does not come from producing anything, is heavily taxed, ideally approaching 100%. Privilege includes ownership of land and other natural resources, electromagnetic spectrum, “intellectual property”, water rights, geosynchronous orbits… and you can probably think of some others. An incidental benefit would be that a lot of affluent lobbyists and other grifters get their income from manipulating privileges, so they’d have to find another way to make a living.

That’s what “we” would do if “we” had any influence.

Deflating asset prices increases the value of lower earner’s dollars and enables them to (hopefully) to buy shelter, food and medical. And most importantly- time.

When you have billionaires who pay their employees less than a surviving wage and constantly increase the prices of necessities like shelter, food medical etc you have an very strangulated and unhealthy economy.

It also actively destroys culture as more and more people have very little time or money to spend on reading, science, museums, art, theater or on creating such expressions or understandings. These are the things most societies use to define themselves with and take pride in; ideas, innovations and I suppose, taste.

A society which destroys it’s own culture is dead inside and pitiful. It has very little empathy or understandings outside of it’s own mechanized and sterile little head and so has poor communication skills and has retarded innovations.

Happy1,

The 2022 estate tax exemption for a married couple (their combined unified credit) is $24 million. That’s why it applies to so few households. With modest planning it doesn’t apply to most of the top 1% of households based on net worth from Wolf’s charts. The estate tax can be expanded some without applying it to even the modestly wealthy. The estate tax doesn’t apply to the middle class now so I doubt any changes will promptly be applied to the middle class. We don’t need to look at the history of the income tax since we can look at the history of the actual estate tax.

Likely what we would see is a shift from the ultra wealthy to the better politically connected ultra wealthy as the government confiscated and redistributed wealth.

It’s the GD government again, eh TS?

The “who needs it and for what” programming, and you have no dog in the race to think that, you just don’t know it.

“prey” on the prejudices of the people WORKS, what prejudice was used to hook you?

Which is why sometimes revolutions are not a bad thing. I hope things keep getting worse…. Until you have some meaningful riots (not the paid for ones we saw in 2020) and some real existential threat to the upper class, nothing will change. Someone needs to tell the people to eat cake.

Sometimes I wonder if that’s the plan. Then call for and get LAW and ORDER and really button things up TIGHT!…Cops everywhere…Set fire to the Reichstag…..I mean Capitol……blame….the…uh…..well……whoever is easiest for starters……..worked before…..and corps still did great, even better, in fact.

Not that I wouldn’t mind seeing planet trashing displays of excess burning.

Words are tricky….for me anyway….put quotes on “displays of excess”…..had a friend that used that phrase, as in, “There’s a good display of excess” when he saw one.

lol “we need some riots … just not the ones that actually happened, that I have some BS reason I can dismiss”

Valerie from Australia (born, raised and worked in the U.S.)

wrote:

“I have always paid about a third of my income in Federal Income Tax – in every country I’ve lived. I don’t consider the money I pay to the government “my money.” What I find unfair is that billionaires don’t pay a similar rate and they have all kinds of tax loopholes where they can hide their profits from being taxed at the same rate I pay……”

Valerie, Reagan gave the .01% a hell of a deal. A lot of us worker bees here in the USA are paying more in Social Security tax than, uhmmmm, a certain career criminal (& former president) paid in his income taxes.

So allowing people to keep their own money is now “giving out free money”?

You’re also in need of both history and economics lessons.

JFK cut rates first in the 60s, as others pointed out. Also as others pointed out, people tax sheltered like crazy in the 70s, no one paid those top line rates.

Also, the rates you’re referring to are for regular income. These apply mostly to salaried people and s Corp owners. Those aren’t billionaires, they are run-of-the-mill affluent people and the middle class. The Reagan era tax cuts benefited the mass affluent, small business owners, and upper middle class enormously. But those rate cuts are not relevant to billionaires.

Reagan cut capital gain rates, which are the ones that apply to billionaires, from 28% to 20%, a much smaller proportional change. The Reagan tax cuts aren’t the reason we have such massive disproportionate well at the top of the income ladder, those cuts have been walked back.

The Fed is almost entirely to blame. There has been easy money which has pumped up venture capital and private equity since the ’90s. This has taken place regardless of which party has been in charge.

Yet there are still politicians who demagogue about the wealth discrepancy and claim that changing marginal income tax rates is the solution. The solution is to turn off the Fed fire hydrant and have relatively low tax rates for everyone for both income and capital gains. And maybe to rein in federal spending which is completely out of control.

I find it amazing that no one here realizes Ronnie Reagun actually raised taxes on the working people (while cutting them for the wealthy).

How did he do that? He raised the Social Security taxes. Those are paid by wage earners, not the PMC crowd.

I knew a number of people who saw their net Federal Tax bill go up because of Ronnie’s shenangans.

@Old Ghost

Reagan tax cuts applied to all brackets. The increase in Soc Security taxes was a bipartisan compromise with strong support from all parties, it was not a partisan project, and it was necessary because the ponzi scheme that is SS never anticipated people living older than 70 and needed to be adjusted or it would have run out of funds. Remember per FDR this was to have been something you earned based on the work you did.

Happy1 wrote: “Reagan tax cuts applied to all brackets. ”

Happy1. Wage earners on the very bottom of the tax scale did not benefit from the Reagan income tax cuts. But they did pay more in taxes.

Every worshipper seems to have forgotten that Saint Ronnie actually screwed over the poorest of the working poor.

S.viii Effects of the 1981 Tax Act August 1986

“The tax system was less progressive in 1983 than in 1980, despite the increased share of taxes paid by the top percentile.

Summary measures based on the distribution of after-tax income, arguably the best way to determine progressivity, show that the distribution of after-tax income was less equal in

1983 …

the share of taxes paid by tax-payers in the bottom half of the income distribution increased slightly from 6.9 percent to 7.0 percent…”

I have always paid about a third of my income in Federal Income Tax – in every country I’ve lived. I don’t consider the money I pay to the government “my money.” What I find unfair is that billionaires don’t pay a similar rate and they have all kinds of tax loopholes where they can hide their profits from being taxed at the same rate I pay. I also don’t consider buying stock in a stock market that is rigged in favour of the stock owners, hard work. So no, I don’t think they should be paying less than I do in taxes that benefit all of us.

We’re still living in Reagan’s America. It’s the only one I’ve ever known.

Yort,

“……the corporations have become enthroned….they are at my back and I fear them more than the Southern Army in front of me…….all the wealth will be in the hands of a few…..and they will prey on the prejudices of the people…….and the Republic will be destroyed.”

-Abe Lincoln

The Gettysburg address was a plea to not let it come to this.

The CNN special on Rupert Murdoch pts 1 and 2 last Sun nite shows how one preys on the prejudices of the people given enough money and media power….sort of another Catch 22, CNN being a huge media corp itself, yes?

Also see the Barry Goldwater religion quote, yet he was as right wing as one can get.

We live in interesting times, but perhaps since the Neolithic Revolution, all Homo sapiens have………

Yeah, this is something on everyone’s mind.

I am sorry, but if keeping thr fruits of one’s own labor is ‘free money’ you and me is fixing to fight.

“Common sense is a collection of prejudices usually accumulated by about age 18”

-Albert Einstein

You still like a “playground government” best, I guess…..

Eh Wolf, thanks as usual for the very informative slides.

Would like to see a precise chart comparing the 0.1% to the 1% so they are roughly same height.

My point is that the % increase, say during the pandemic, for the 2 groups probably grew by a fairly similar % . (We might be surprised if we also look at the other groups)

If it’s simply an application of the Matthew effect…

The numbers are still grotesquely obscene though for the top 0.1.

“You can kill someone with the reckless application of percentages” – that’s a Wolf Street Dictum, similar to “Nothing goes to heck in a straight line.”

If I give $5 to a homeless guy who already has $5 in his pocket, his wealth increases by 100%.

If the Fed’s QE increased the wealth by only 10% of a guy who has $1 billion in wealth, his wealth increased by $100 million.

So one guy’s wealth increased by 100% and the other guy’s wealth increased by 10%, has that decreased the wealth disparity?

Hahahaha, nope, the billionaire made $100 million and the homeless guy made $5, and the wealth disparity has increased by $99,999,995 approximately.

That’s why it’s so popular with political and financial elites. It also happens that there is a strong historical correlation between interest rates and wealth and income dispersion … the lower the interest rates, the wider the wealth gap.

Steve, inflation can also be described as a distributional struggle.

Just another unfortunate result of ongoing Class Warfare.

Jamie Dimon should be in prison, with no longer a dime to his name. Ditto Lloyd Blankfein. The list is long. Very long.

Greenspan, Bernanke, and Yellen would head the list. Felony counterfeiting and fraud.

Meanwhile wallstreet trying to spin up another rally with cnbc showcasing Fed President EVAN who is suddenly “Nervous about going too far, too fast”.

Fed is too slow and it will remain behind to never catch inflation!

They need Bunker construction money.

Evans is retiring. He’s outa there in January.

We the people need to save this republic,this looks more like Rome every day .UNIED We stand divided we fall truer words were never spoken.Russia will become a puppet for China,boy China is smart ,get America – Russia in a conflict deplete military stockpiles then just rule the world .except financial mafia won’t let that happen,although it’s the reason we won the war

Easier congress,hor clean house

Jamie Dimeless?

So if I ever make it to the 1% I still have the .1 percenters I can blame it all on.

It’s unfortunate, but there seems to be no good economic news anywhere at this point, and probably for the foreseeable future. My worries have been that we fall into a depression, which is already being signaled by many analysts who are using terms like prolonged recession, bad recession, worse than 2008, etc. I think they’re covering their bases for what’s about to happen. I hope the best for everyone

I’m hoping for a depression at this point. It’s what we badly need. No lessons were learned from the last housing bubble, and then they doubled down and blew the most massive everything bubble imaginable – a truly disgusting display of arrogance and recklessness.

Let it all crumble into oblivion. 12X median income house prices are a sham. Let’s get back to 2X gross income, where they were for over a hundred years before these money printers hijacked the country.

The problem is a depression hurts the poor the most. If you have 10 million you can afford to lose 8 million and still be fine.

That’s a soundbite propagated by the top 1% as an excuse to protect the wealthy class. Think about it. If asset prices drop, those who don’t own assets have a chance to purchase them as bargain levels. Rents go way down. Transportation cost goes down. An asset price crash is a huge benefit to the poor and middle class.

Plus, with unemployment and other safety mechanisms in place, there is cushion for those who temporarily lose jobs.

This red herring is really getting old and smelly.

The poor are already poor its the rich that become the new poor in a depression.

Nope…. poor are already poor, we need the bloodsucking vermin top 10% and their paid for boot lickers in congress to join the ranks. Thats the only way they get to keep their head, otherwise its going to be Marie-Antoinette time. People are getting more volatile by the day, watch your daily commute, drivers are getting more nasty. Shows the state of mind of the person behind the wheel. There will come a time when a large enough number of these people will have nothing left to lose.

Apparently you have no idea the consequences of a depression,

I would say you don’t. It’s the only thing that is going to wipe out asset prices and level the playing field.

Too dc hope you like holes in your shoes and your grandkids wearing flour bags for dresses lol

A huge section of the population is already in a depression. The middle class is slowly getting pushed to join that group. If your choice of meal goes from hungry man meatloaf @3.99 to 79 cent Raman noodle bowl, that’s you cue that you are now in the group. Meantime, the connected few are buying elections, fixing laws so they and their descendents can continue the orgy..And it is not like they work hard to make their money, it’s all grift and thievery. So yes bring on the depression, if you keep eating the steak while whittling away my piece of bread then I don’t give a damn, burn it all down.

What will happen is citizens will lose their jobs and houses and the hedge funds and private equity companies will be bailed out and see no hurt. The Fed will pick a couple of small firms to make examples of and let them go back.

The gamblers will all get a free pass because their risky bets could cause a crisis. That is what we will be told. The government did not need to bailout anyone during the 2009 crisis. athe just should have taken over and nationalized the troubled companies, fired the execs, put in a few team and let them go public again. This playbook has worked many times throughout global history

The Bob who cried Wolf,

You’re not seeing the good news right in front of you, right here on this site in these charts: The stock market decline and the bond market decline will have very little impact on demand and the overall economy because most people in the US don’t own stocks and bonds and don’t really care. See the “Bottom 50%” who own nearly no stocks and bonds, and the next 40% who own only small amounts of stocks and bonds.

In other words, the Fed can keep taking down stock and bond prices, to unwind the insidious damage it has done, and very little will happen to the economy.

And another good thing: rising yields will turn savers and yield investors into spenders again.

There’s lots of good news right in front of you, right here.

Agreed Wolf. We need a crap ton more of the QT and rising rates, and no pivot, or no gutless Fed who capitulates in a few short months, bc it gets cold feet. The Fed is so damn far behind the curve, and a lot of people, that are in the 99% should be really angry about what the Fed has done the past 22 years. Because what happens when all the largesse is collapsed, is we will get a couple decades of really ugly blood letting out of the bloated system. The debt to gdp ratio indicates zero growth for years. The deficits are untenable and they’ve got to be stopped cold turkey. The government is bloated and has to be cut by a minimum of 80%. The worst part is with all the debt, the existing infrastructure cannot be repaired, upgraded or replaced. That’s our roads, our power grids, our water and sewer systems. All horribly under maintained and extremely fragile. It’s a very sad state of affairs here in the US, if not world wide. The Fed has been highly immoral and reckless.

“the 99% should be really angry about what the Fed has done the past 22 years.”

Sadly, Congress and local governments have done more damage than the Fed.

Mike R, the sad truth is that half the people that vote on election day won’t get mad or angry because they don’t even know what the FED is. The other 40% only vaguely know about the FED, but couldn’t tell you or me what they do or what their purpose is. I am probably being generous when I say only about 10% of those who voted on election day two years ago could have an intelligent conversation about the FED and their purpose. Next time you are out and about or at the work water cooler, start talking with someone about the last 14 years of damage that QE and interest rate suppression has created. How it caused massive asset inflation and wealth disparity. Tell them how QT and interest rate hikes are on the right track to get raging inflation under control…and look at their faces for the deer in the highlights look…and if one of them is brave enough, they will ask you what QE and QT is, and when you respond with Quantative Easing and Tightening, they will reply , ” never heard of it. ” And, that is rudimentary stuff compared to the depths that Mr. Richter routinely dives into. The average electorate on both sides of the aisle are too naive and ignorant to ever get mad and blame the FED for anything.

CB is not cb

Hi Wolf,

To your last point, how do rising yields turn savers into spenders?

Wouldn’t it be the other way around?

Ask the retirees that counted on the cash flow from their savings, and when that cash flow dried up, starting with QE and interest rate repression in 2008, they cut back their spending. As cash flow improves due to higher interest payments, they’re going to spend this cash flow because that’s what it is for.

This was one of the big negative economic effects of interest rate repression since 2008 on consumer spending, and why the economy recovered only so slowly — with at the time $8 trillion in savings not generating cash flow from interest anymore, and that money that stopped flowing couldn’t get spent. This has been well-documented.

Everything is connected in an economy. If you start manipulating one thing in one corner, there are counter-effects somewhere else.

Warren, this retiree who has not been able to make a plug nickel on our savings for several years now finally has the opportunity to buy 4% brokered CDs and treasury bills and make a few bucks that will go a long way in paying bills and buying much needed dry goods.

Amen! To Wolf and Warren’s replies.

I meant, “To Wolf and Anthony A.’s replies. Careless.

I spend a lot more when interest rates rise. So do many of my relatives some of who are in the class of the .01 percent.

A very sincere thank you, Wolf

“In other words, the Fed can keep taking down stock and bond prices, to unwind the insidious damage it has done, and very little will happen to the economy.”

It’s too bad there are circuit breakers to prevent something like a “flash crash” to zero on the DOW. Imagine all of a sudden the entire DOW is worth zero for a few minutes. The “little guy” needs something like that – you know, a win for once.

I disagree. With each of the last crashes, those in charge gave themselves more power. I think the solution lies somewhere in corporate governance and also how executive stock compensation is determined and taxed. Not just income tax.

The central bankers allowed excesses to become pent up. They constantly attempted to iron out natural business cycles, corrections that flush excesses and leave markets and economies healthier.

Thus the excesses become large and the eventual flush becomes systemic threatening.

Enter the central banker to cure the problem, and in so doing, accrue more power….again.

The Fed became more powerful after 2008…..they became the most important thing to the markets.

@wolf “ the Fed can keep taking down stock and bond prices, to unwind the insidious damage it has done, and very little will happen to the economy.”

I’m an avid reader of yours but the above sounds like it was rushed. The economy is going down, as you explained in many articles about the housing market, for example. IMHO this return to reality is badly needed so, unpleasant as it is, the severe downturn is very healthy. But it will impact everyone.

If I misinterpreted your comment perhaps you’d like to post a piece on this topic, it would be very interesting.

I’ll give it a shot right here. These two things are not the same: asset prices and the real economy (jobs, GDP, etc.). The stock market decline will not contribute significantly to any economic slowdown. QT is reducing asset prices just as QE inflated them, and that doesn’t impact the economy much. Sure, there’s some impact, but it’s not much.

In terms of the rate hikes, yes, they will eventually have enough impact on the broader economy to reduce demand – at least that’s the goal — so that lower demand changes the pricing dynamics and therefore brings down inflation.

@Tight Purse,

Think about what QE did for the real “main street” economy – basically nothing (and, as Wolf argues, it did a lot of harm to retirees, and such). So why should reversing it with QT do much damage?

Seems to me like a bit of an inverse correlation between the fed balance sheet assets and U-6 unemployment, although chicken or the egg situation may apply.

https://fred.stlouisfed.org/graph/?g=UerL

“You’re not seeing the good news right in front of new” (“you” ?)

Just think, at this rate in 200 years we’ll approach a fair and open society! Free of multi-millionaire predators. Yeah ! I can hardly wait.

Just about in time for Star Trek!

Elon Musk has to invent the Warp Drive and then we will follow the Star Trek storyline.

The Vulcans will save us!

I’m sorry but I can’t see the good news in a correction like this. Yes the top 10 percent will have their frothy wealth chopped down a bit, but how does that help the bottom 50 percent? Having a few points of yeild is pretty irrelevant when you have nothing to invest.

Those that “invest” by going to work every day, and work there asses off for a paycheck to paycheck lifestyle, may finally after 40 years get some leverage for higher pay. They need it, and deserve it.

The wealthy don’t loss money ,they short the market and make more money,by the way fools your 401k created this mess .stop giving them your labor to steal.VERY few people will get any money back

The bottom 50% will have rapidly growing wages and higher secure savings rates. Not all of us poor people are are speculator/gamblers in the equities/crypto markets. We missed out.

In other words, we will return to normal.

The top 10% probably sold or shorted there shares .making even more money

Rich people have assets. Lower middle class and poor people have jobs. A recession that lowers home values is going to increase unemployment. What good is a 25% drop in housing prices if you don’t have a job and can’t get a loan?

[Also 8% construction loans kills new construction].

The solution to a housing shortage [or unaffordabillity] is too increase the supply.

But you can’t build a house without getting government permission. Government controls the supply of housing.

[Of course another solution is to reduce the demand by not subsiding people to have kids but no one ever, ever, ever wants to talk about that-world population almost 8 billion people and racing towards 10 billion].

“how does that help the bottom 50 percent?”

In the short term, they feel some pain. In the long term, they do better off. The essential goods and services needed today will still be needed after everything goes bankrupt, so the bottom 50% will still have a job after the bust. What will change is that the cost of living will fall as the price of home, auto, and medical fall substantially. Overall, expect a better standard of living over the long term.

How many of the bottom 50% are involved in the housing market in some way? I remember in 2009 a lot of those people lost their jobs.

Simple they didn’t lose anything so they become richer.

Talking about the short term and long term effects on the ragged people is bull. There’s no long term when you’re broke. What can we pay for today? tomorrow never comes.

Laying low, seeking out the poorer quarters where the ragged people go.

Something tells me I’ll have company.

“Very little will happen to the economy”

Not sure how you make that claim. If the economy roared due to these policies shouldn’t the economy contract when you reverse them?

Higher rates will kill zombie companies thus increasing unemployment. Many of these are hi-tech companies that pay high wages.

While the top .1% lost 12 million, that is a rounding error for them. The 50-90% crowd absolutely depend on the stock market and asset prices, especially when it comes to their 401K. They also do most of the spending in this country. If prices of goods and services remain elevated, these folks will be hit hardest as their wealth declines thus reducing spending which cascade to reduced profitability.

I agree that it is a good thing to reduce the very damaging wealth disparity. But this adjustment will be the middle class who were told assets only go up and suckered into depending on that notion.

Arya,

“If the economy roared due to these policies shouldn’t the economy contract when you reverse them?”

The economy didn’t roar. We didn’t see any 5-10% GDP growth, even including the government spending component. China has routinely had higher growth than then US did throughout this era of super easy money. ASSET PRICES roared. Totally different thing.

The working class will get screwed like we always do. Even when the fed comes in with all kinds of aid for the working class we all know it’s basically gonna be a fat cat bail out, and will be nothing more than the same sort of meddling that got us here in the first place. The correction is needed, there’s no doubting that, but the pain it’s gonna inflict is unimaginable to virtually everyone living today. In 2008-2010 I remember my mom saying that we all had no idea what a real downturn was like (she’s the silent generation so remembers the depression). Now she’s watching this one unfold and is very concerned.

I’m sure there’s good news somewhere in this, but certainly not for the masses. They will continue to work their asses off, but only if there’s jobs to work at.

On another note, regarding the bottom 50, my guess is that their net worth is up only because of the used car market driving up the costs of their only main asset. That market is starting to tank, too.

There’s a lot to digest in the numbers above, and yes, some is good, but the bulk of it is bad.

I’m seeing what you’re seeing, too, but I think you should look a move or two further on the chessboard.

Wealth Management strategies have moved towards “wealth preservation”. That’s no longer bonds – it’s hard assets. Thus, as the prospect of paper wealth losses grows – the lure of hard asset acccumulation (e.g. real estate, rent-bearing housing) really only seems likely to increase.

I’ve provided a list of at least 3 reasons why the Fed. might still pivot that have little to do with inflation. I won’t restate them here, except to say that I think some co-ordination of monetary policy with the UK, EU, Japan (and others) seems inevitable now that the dollar is off to the races at the expense of the currencies of those other countries.

He Wolf, speaking off damage, what do you think of this chart?

https://fred.stlouisfed.org/graph/fredgraph.png?g=Uebh

For sure this will hurt the asset holders of housing…housing prices have far out run disposable income.

At some point, declining stock prices and tightening financial conditions will lead to millions of layoffs. C-suites aren’t going to sit around forever and watch their stock price crash while doing nothing.

This is the biggest asset bubble in history, not even close. A continuation of both the dot.com bubble and pre-GFC, it’s lasted over 20 years. If the credit cycle turned in 2020, it will later turn into the biggest bust in history too.

There has never been a major bear market in history without a recession or economic depression, not even once. All economic contractions in my adult life (since the 80’s) have been brief even if sharp due to government distortions.

There is one coming up and soon which won’t be as brief or shallow.

The layoffs are aimed at white collar workers. Blue collar folks are still in demand. It’s a good time to be a working person.

And the laid off white collar workers cancel their planned home improvements, dine out less often, buy fewer clothes, etc., which reduced demand for blue collar employment.

Pure wisdom served up fresh daily.

I must admit, I was a encouraged by this article after months of worrying about a world-wide deep recession / even a depression. If the Fed can manipulate the money supply and finance so that the stock market, which has enjoyed enormous gains for years, is deflated whilst the middle and working classes aren’t thrown into poverty, THAT is a good result IMHO.

The “conventional wisdom” my area of the middle class has been sold is that our retirement funds are all invested in the stock market. So if the stock market declines greatly, so do the retirements and pension funds of every day Americans. Is this just a obfuscation sold to us by the 1% to make us believe that a bloated stock market benefits all of us? I get that big declines in the stock market hurt the ones who own the most stock but because of low interest rates, the only place people like me felt they had to save for their retirement was to invest what little they had extra in the stock market.

You can not overestimate the amount of damage malinvestment of capital has done to both the economy and to society. If prime rate can stay at around seven percent for the forseeable future (once it gets there), the ability for economic distortions to dominate and permeate the world we live in will effectively disappear. There will be little real ability for fake businesses to form, or for “sick” businesses to undercut prices of “healthy” businesses and drag them down.

Wealth DispAIRity Monitor might be more appropriate these days considering what is being valued and how hollow those promises of forking it over are proving in certain sectors.

I believe the increasing disparity of wealth is a function of the increasing leverage in the economy that began in the mid-1980s.

The ratio of total US debt (public & private) to GDP has increased from its longterm average of 1.5x to its current 3.7x — more than doubling over 40 years, with the gains accruing to those who were most levered.

Several WSJ reports after the GFC pointed out the biggest losses in net worth befell private-equity & real estate titans.

The trade has worked this way:

The political Leftwing, advocating on behalf of poor people, extolls policies intended to create tight labor markets, which invariably resulted in political backing for interest-rate suppression and “Greenspan’s Put” — a godsend for the highly geared.

Never forget, in the fall of 1990 Citicorp had weekly auction-rate preferred stock outstanding costing it 16% — that they could not refinance more cheaply. At the same time S&Ls, and the LBO/RE – operators like Robert Campeau and Donald Trump were dead in the water.

But they were all “saved” when Greenspan cut the FFR from (almost) 9% in 1989 to 3% by 1993 — a move aided & abetted by the Left because it would help the downtrodden.

Ask yourself: Is our world better off today because policymakers saved Citicorp and LBO/PE operators (Donald Trump, Henry Kravis, Leon Black, Schwarzman, David Rubenstein, et al.) from certain destruction in the early 1990s?

I think not. But the gains that accrued to the highly leveraged over the last 4 decades never would have happened without the intellectual ground paved by New Keynesians, most prominently James Tobin (Yellen’s diss. advisor.) See his testimony at the Clinton 1992 Economic Summit on youtube.

For the last several decades many “mini-Trump” wannabes have sought to achieve “intergenerational wealth” by buying houses with little or no downpaymet.

As Aeschylus wrote in the Oresteia : May it turn out well.

FYI: Wealth disparity “decreased” so far this year.

Wolf

Thanks again for a timely set of facts.

One thing I would like to point out that many of the comments miss is that voters repeatedly choose candidates who lie and hurt them, not because of paid lobbying, but psychological tendencies is to side with the rich

People want to look and feel rich. Look at all name brands endorsed by the top 1%. Celebrities and sports figures make obscene wealth and no one complains about them.

It is just like casinos advertising the rare big payout: the manipulation of the bait of this culture’s wannabee “star system” lures the votes. The votes are vital, so the very few very rich have a keen interest in media that can manufacture a narrative to attract the wannabees to slit their own throats. Hence a cult of bait-and switched people ready to die for a guy whose main accomplishment was cut taxes massively to the top dogs, while debt kept towering and a phony stock market was fed (more bait). And DC is a particle collider where money converges massively.

And the left consistently promotes higher marginal income tax rates as a panacea to cure inequality, when they know that this affects the upper middle class and small business owners but leaves the billionaires untouched. Both parties are at fault.

Happy 1, you’re blaming the “left” for taxing the wealthy to reduce inequality.

So you must have a better idea. What is it?

It seems the whole economic game is now oriented towards knowing what is to come in order know what moves to make. Data science focuses on making it easy to predict while most have no clue until it is done and even then they do not know what really happened. There are so many data points to achieve this and the most revealing was Robin Hood selling data on the “sardines” to the sharks and whales ahead.

The new investing reality seems to have less and less to do with any of the concepts taught in the last 50 years. How they tell you it is and how it really is breathless treachery…. Every man for himself and eat what you kill. Amazing to witness the permutations constantly changing….

This is happening in every sector of the economy and is behavioral economics at its finest.

I had a highly successful run with military surplus. I also was able to manufacture and compete with China on one product and even then I could not get a foothold except in the wholesale market which was not online. After 10 years of Amazon, EBay and PayPal I finally understood why China was able to prevail as they were chosen and I was not. The minions who are effectively serfs to the online system might make enough to call it a business but it would and could be shut down in a moment as I witnessed many times. Brutal at best.

Really, most here seem to be older and still believing in and operating in older system with some so savvy that it may work to some degree but the the elephant in this room is the reality that most are dinosaurs still hunting by the old rules. Wolf continually points out the treachery and foolishness easy to see and some not so easy to see.

Living in the outrage makes it hard to know what actually one might evolve in this truly dog eat dog reality unfolding before us.

What is the future for those here in the few remaining years?

AdamSmith,

“What is the future for those here in the few remaining years?”

Based on history, I don’t see much hope for improvement in the (former) United States of America. Therefore I have taken the same action that my German grandparents did in the 1920s when they left Germany for America.

I have “bugged out ” for a country where I can grow my own food, I have a fully paid for house and the people are wonderful and speak English.

I wish you well.

I’ll come and join you. Which country am I buying a ticket to?

There is no “outside.” There is no panacea immune from global linked (and fast-acting) forces, be they financial, climate, etc. Every person in the world thinks they can find this hidden patch, even as every other is beating the bushes to crowd in there. Good luck.

Garden of Eden

Your parable breaks down when your German grandparents didn’t “bug out” to a country that spoke German in the 1920s.

I just want to point out that this train wreck took place under both Democrats and Republicans.

Actually, more like a plane wreck that crashed into a heavy population of innocent bystanders on the ground.

E. L.

Consider this is big “Thumbs Up”.

What happened in Italy is about to happen here.

What? That we’ll elect a moderate leader with a relatively volatile/fragile coalition, who will then be grossly exaggerated as “hard right” and “extreme”?

The US would be lucky to have a leader like Meloni.

Italy is nothing like the US. Businesses and individuals there have always lied to Rome. And now Brussels.

Here it made economic sense for big business to co-opt the government, because it would be around long enough to pay them back with interest.

If you mailed a bribe in Milan in the seventies, the government might be out of power by the time your bribe reached Rome. Italy has always had a few too many mouths to feed for what comes out of the Italian soil. That’s why they came here. Rich Italians hide their money and families in other countries. Rich Americans mostly hide out here. Love the place, but it’s been a mess since before the visigoths moved in. Hope Georgia Meloni lasts, but it’s unlikely.

“Tanti nemici, tanto onere”(Matteo Salvini).

So your recommendation? Anarchy? Self-policing? (Sound of uproarious laughter.)

Why can’t you have fiscal responsibility in an enlightened democracy?

Why do I have to choose between a corrupt two party system or a dictatorship or anarchy?

What Libertarian wants a democracy?

enlightened democracy? is that the democracy that embraces all the Libertarian values or lack of values for that matter?

“A democracy will continue to exist up until the time that voters discover they can vote themselves generous gifts from the public treasury. From that moment on, the majority always votes for the candidates who promise the most benefits from the public treasury, with the result that every democracy will finally collapse due to loose fiscal policy, which is always followed by a dictatorship.”

@ elbowwilhelm –

you think maybe it’s funny money that kills the deal?

without funny money and borrowing of such, it is very difficult to have loose fiscal policy.

never trust the bankers ……………………

they want something for nothing

and your productive capacity is want they want

Thanks for your reporting Wolf, great work as always! Just noticed a small correction needed…

“Next 40%” (purple): $768,000 (-$16,500; -2.1%) –> should be “(green)”

Thanks. I shouldn’t do stuff this late ;-]

I have every confidence that the selloff in equities and bonds, and the resulting far higher interest costs for lending is going to severely impact the UHNW households, I’m far less sanguine that the damage will be contained there.

A household that is at $160 million and sees $12 million in net worth? I doubt it will impact them much in a nuts-and-bolts way. But when tens of thousands of people (so far) are walking away from new home buys because of skyrocketing mortgage rates, that impacts the Main Street economy in many, many ways.

The founders of FB and Google have more money than God, and are responding by . . . . putting a hard freeze on new hiring, and announcing layoffs. The guy who cleans Zuck’s pool still has a job, but anyone who thought they were going to be laying carpet or bricks for FB’s new offices won’t be.

I’m not much of a trickle-down guy when economic times are good. But I’m very much a **it-rolls-downhill guy when things go pear-shaped.

Over the spring and summer in our neighborhood there were at least 10 landscape installs. There are currently zero. This was the main indicator I missed when the whole thing popped in 2008. I distinctly remember a friend saying the last install he did was for a referral I gave him in 2008. His business closed shortly thereafter. Since then I’ve made myself pay attention to these indicators, anecdotal as they are. Any one of us can walk around now and count the amount of houses being landscaped, painted, stuccoed, new windows, and even roofed (most roofs in need of replacement actually have five years to go). The masses of work trucks zooming up and down the streets has plummeted. Aside from the roof, most things we do to our houses is elective and can wait. The money has tightened big time in this type of construction. What’s scary is that interest rates are no where near what they were in the 80’s and we all know we have a long way to go to tame inflation. Everyone knows that 8% is a total bs number. Inflation of what we need is way higher.

Independent contractors have been knocking on my door asking if I need my driveway power washed for $125.00. Then the tree guys are leaving their business cards at my door also looking for work. It’s getting slow around here too.

I have been a builder in SoCal for many years. I have three times gone from nothing to hefty net income then back to nothing then on to other things.

I am waiting for the construction prices to drop when I see the young studs with 100K trucks and huge mortgage payments I know this will be soon….

In a rolling fashion over the next few years there will be all kinds of tools, equipment, and vehicles being sold way below market prices.

It is my turn to get things done for nothing and I welcome watching the young turks “get some” reality training like I did….

Problem is the government keeps these people from facing reality but it is clear to see it cannot last forever so I would say this looks like it will be a very hard and fast landing affecting most people at all levels of the market.

I have no hope in the current economic policy and am unshakeable in believing the outcome of Capitalism is always superior to the outcome of socialism.

That capitalism always privide a superior outcome to socialism may not always be true.

Capitalism may precede, in forms like crony capitalism, feudalism and corporatism. If there is a really hard landing and power structures stay intact, be not surprised if capitalism have turned corporatism. Captialsm in an old wrapping, but facism good as ever…

You make a good case for progressive tax rates and taxing extreme wealth at higher rates.

As someone solidly in the bottom 50%, I’m still amazed by the resentment against the stimulus checks that merely refunded $5K in tax money to working class families. The real stimulus money never reached the bottom.

Refunded? How much federal tax are those in the bottom 50% paying? Redistribution is more like it. Also, the federal budget has a deficit, year after year, so this added to the national debt. Yes, I resent that and so should you.

Tight Purse,

There’s much bigger stuff that you should put on your resent list. The forgivable PPP loans that just about everyone got, and the huge amounts in bailout money that the airlines and other entities got in 2020, that were far larger than the stimulus checks. And you should resent that the richest companies – semiconductor makers such as Intel, many of which wasted billions of dollars on share buybacks – are now getting $50 billion. And that automakers are getting billions via all kinds of incentives in the EV area (some of it in tax credits to consumers which will instantly be eaten up by the automakers in form of price increases). And the monetary policies that have largely contributed to or caused this inflation that is now wreaking havoc on the economy.

Hey Wolf, as a recovering alcoholic/addict, I have learned that RESENTMENT is the #1 offender leading to relapse. :-)

Therefore, while I shake my head at the sheer absurdity of these giveaways, I choose to see my personal powerlessness over these people/institutions and just TRY to find what my personal solution is, by trying to SEE the reality of the present situation.

I’m a glass half-full sort of guy, who’s usually pretty damn grateful and content with my lot in life, having somehow survived my former lifestyle and now living on the beach in Rosarito, MX (BTW, I’m probably somewhere near the 40th percentile in net worth, MAINLY due to having bought and paid off a house in San Diego in 1999 and sold it to move here in 2018).

I do resent each of those, and more! Too depressing to mention them all. Maybe we should all wish for a gigantic crash that will bring the end of most such nonsense.

Cheers!

High five Rosarito Dave. Some guys I went to high school with are in that crew, and the survivors definitely are the sober ones. That is a special breed. Those tools for life are amazing.

1000% agree.

1000% agree with Wolf.

Precisely.

Don’t forget that a house earns more by just sitting empty than I do from my labor. My house makes more money than me.. Peak insanity?

What we should resent, is the money wasted on the military industrial complex.

Don’t forget $50B or more of unemployment fraud, plus $300B of wasted PPP handouts to fraudulent businesses, as well as amounts wasted on businesses that did not suffer revenue loss during the pandemic.

Rewarding fraud is the worst use of money.

Flashman,

Without war/welfare state, this would be a completely different economy and planet. I doubt any of us can even begin to imagine it. It has mortal hazards too, but is so counter-factual it is fiction.

Bro, nobody cares about the national debt at this point.

Tight Purse:

What I resent is the massive amount of tax dollars spent on waging war in countries all over the world so that multi-national corporations can steal their natural resources for a song of a price – and the massive amount of government debt due to bailing out the stock market and salvaging the “too big to fail” banks. What I don’t resent is some piddly amount that allows the working poor, who probably don’t even have health insurance, to have some kind of income so they can feed their children, pay rent and pay their bills.

I didn’t perceive much resentment about helping working families.

There did seem to be a lot of criticism about 1) youngsters playing the unemployment bennies and stimulus checks to fund a life of Riley, and 2) employers defrauding the government for tens of billions.

Like with foreign aid, the United States is grossly incompetent at implementing programs to help people in real need without blowing most of it on grifters.

If you bring gum, you have to bring it for everybody. Some will squander it. Welcome to Earth.

The payouts were on such a short-term, emergency basis, it would be impossible to meet the standard you impose. Talk is cheap.

The greater moral hazard and failure was the situation going in, the overall laxity that became much worse when an actual (foreseeable) shock of some kind happened, and the extended printing spree into 2021.

The $20,000 in (student loan) debt relief certainly wasn’t distributed to everybody. A large chunk of it was distributed to people who live and work near Washington, D.C.

Highest Average Student Loan Debt per Borrower

1. Washington, D.C. ($55,508)

2. Maryland ($43,619)

3.

4. Virginia ($39,892)

There should be no resentment against the stimulus checks, but against people that got excited about those checks and at the same time failing to notice that they were getting pennies on a dollar of new national debt created in the name of the coronavirus aid.

I’m not going to speak for others, but I resent that “stimulus” because most of the lower income households don’t pay anywhere near that much in taxes to begin with. Someone who pays $800 in taxes and gets $8,000 in “stimulus checks” is not getting a “refund.” They’re getting “free stuff.”

“The official reasoning for QE and interest rate repression is the well-known but dubious ‘Wealth Effect’ which is the monetary equivalent of trickledown economics, where the Fed tries to make the already wealthy far wealthier by inflating asset prices with QE and interest rate repression, based on the doctrine that these households will then spend some of this newly gained wealth, which will then trickle down….

What we got instead of the wealth trickledown is a huge bout of inflation…”

So, that somehow doesn’t register much larger on your sensitive resentment meter?

I don’t know why people continue to think this is a compelling argument.

“People shouldn’t get free stuff at others expense.”

“But, but, but other people got free stuff too and you’re not complaining about that!” HAHA GOTCHA!

“Uhh, actually, I have been speaking out forcefully against QE for the past 12 years, and I opposed the PPP loans at the onset, because they didn’t require any proof of lost income. Try again.”

Einhal – you spew about resenting lower income households not paying much tax. But many of the largest corporations and oligarchs pay ridiculously little tax. That’s the core rot in the system. Resenting small time grifters is a disingenuous diversion.

It’s not a game of gotcha. It’s facts. Try again.

Reading comprehension not your strong suit, eh?

” I resent that “stimulus” because most of the lower income households don’t pay anywhere near that much in taxes to begin with.”

driftwood,

I agree with Einhal. Everyone should pay their fair share even low income households. Everyone should have skin in the game. The problem now is too many freeloaders. They should go back to work and take a second job if necessary and stop whining.

Lyndon B. Johnson:

“If you can convince the lowest white man he’s better than the best colored man, he won’t notice you’re picking his pocket. Hell, give him somebody to look down on, and he’ll empty his pockets for you.”

How Now,

Good quote!…..I figured it out on my own, but never knew LBJ actually said it. When he got his “fairness” laws passed, I do remember he told his celebrating staff, “What are you all so damned happy about, we just lost the South forever”. (the Dixiecrats all went GOP, for the same promised reason, and got it.

How do you think Jerry Springer and his ilk got rich?

I assure you, the work-output-to-grift ratio is *much* lower among the poor working class than the rich working class, in aggregate. Poor workers often put their health and life at risk, while rich “workers” spend their day talking on the phone, or moving a paper/file from one place to another after a few annotations.

There are dishonest people in every income spectrum.

JeffD, society has definitely prioritized things poorly, but the fact is, a higher percentage of people can dig ditches than can program high-quality code. How much people are paid has a lot to do with the scarcity of their skills, not danger or “worth” to society.

I get that. All I’m saying is that the continuous indirect dividends the working poor pay to society are many multiples of the $5K in stimulus check they received. Not sure I can say the same about the subsidized wealthy.

The primary reason there are rich grifters is because every single time in history without fail, they use the power of government to plunder the populace.

The ignorant share the fantasy that the common man can “turn the tables” on the elites but it’s never happened more than temporarily. Any common man elites replacing the old ones simply resume the plundering.

The only way to limit elite plundering is to limit the scope of government but then, the rich grifters can’t be plundered either.

AF, your point is that Government causes the rich to run the table and get richer. A quick look back in history shows the opposite: the serfs, slaves, untouchables have been at the mercy of kings, emperors, royalty, the clergy for thousands of years, rulers that actually owned the lower class (which was almost everyone). Rule by government is truly a recent phenom and, with more ninnies thinking and echoing thoughts like yours, we’ll be back to fascism (rule by oligarchs and dictators) in no time.

Freshen up, AF. Get a cup of coffee. Some of your ideas need more caffeine.

How Now,

Well said….again…..stick around. Democracy is hard, very hard, but it beats fascism, which is what corporations are, little fascist states existing within an attempt at Democracy, benefitting from it, yet preferring it went away entirely.

They have become ENTHRONED, as Lincoln said/warned

The only resentment I have with stimulus checks is that they were paid out to families making 200K with jobs. I believe that it should have been a safety net below a much lower income or tied with unemployment.

I do resent the fraud with forgiven PPP loans. Some business owners paying themselves millions in salary and buying expensive cars and houses.

Of course, they also paid their minimum wage employees in order to be forgiven.

Agreed and agreed. The fact that retail sales skyrocketed right after the stimulus is proof positive it was poorly allocated and distributed.

It was marketed as keeping struggling people afloat. Instead, it went to people to go splurge.

Wasn’t that splurging designed to have a net-healthy effect for local economies that are better than 70% consumer spending-driven? In that case, why should you care how people below the green line spent their stimulus checks? And can we stop calling them stimmies, like they were some kind of cheap club drug? It was the fond scraped from the bottom of the pan and spread thin across the poor and working classes.

And while we’re at it, let’s retrain our crosshairs away from the kid who bought a new Honda Civic and focus them solidly onto our saviors, the “job creators” and their newly outfitted 25K sq ft Armageddon Bunkers built on their private islands staffed by underaged runaways. This is not just a question of larcenist scale, either. One is US and the other is THEM.

I was in line behind a little old lady buying a banker’s weight in various meats from the deli a few months back; a shocking amount of meat. I watched her pay with her WIC card and then proceed to roll her cart out to her food truck in the parking lot. A lot of slobs would bridle at that kind of thing, but I thought it was a clever maneuver. It was a good hustle.

We work-addled Calvinist weirdos reflexively bridle at the idea of handouts or free lunches — ok; but again, the engine of our economy is based on spending and wealth effect is the active ingredient in that scheme.

It’s probably good policy to ensure everyone gets a slice, even them what don’t need it — just to deprive anyone who might’ve delighted in the narrative of water carriers v water drinkers.

Meanwhile, lambasting the proles for getting a bit of crust tossed back their way seems a little bit low-brow. There’s a parable from where or when I don’t recall, but it goes something like this: a genie reveals itself to a man and tells him that he will grant him any wish his heart desires with the condition that the man’s neighbor will receive double that of whatever he wishes; at this, the man wishes his left eye to be removed.

It’s all a nasty, brutish hustle – esp for anyone at/below the green line – and then you’re dead. I salute anyone who can sneak past the reaper by any means available. As with the path to hell, survival & the pursuit of happiness doesn’t map in a straight line, either.

Well said, bf. Hat tip on your comments.

It was a gift from your future. In hindsight the prudent thing to do was to early buy necessities before inflation kicked in from the money drop.

I didn’t like the stimulus checks, Petunia, because I said they’d be inflationary, and I don’t like the government just handing money out to anybody, myself included. It wasn’t a tax refund because people who didn’t pay taxes got them, too. That being said, those were the least of my gripes.

The PPP “loans” (let’s call them financial windfalls, what they really are) were, BY FAR, the most outrageous stunt that CONgress has ever pulled. Almost a trillion dollars was essentially handed to the people who least needed it – wealthy business owners. And then there are the fraudsters who stole hundreds of billions through essentially zero oversight.

Next, the “extra $600” per week in UE bennies was equally disgusting. Never, EVER should somebody earn more on unemployment than they did at their job, under any circumstances. And this went on for over 1 1/2 years.

I know a woman whose late teens/early 20s daughter was making less than $200 per week part time. They let her go in 2020, and she started getting that “extra $600” plus her regular UE check. The first thing she did is went and bought a brand new car – a little Honda Civic or something. Her mom didn’t love the idea, but that’s beside the point.

The government essentially started buying unemployed people brand new cars and toys and all sorts of things as a result of a public health crisis. And let’s never forget that this was ON TOP of the rent/mortgage eviction/forbearance. So, these people effectively saw $4k to $5k per month of financial windfall, for doing absolutely NOTHING.

It is beyond outrageous and morally reprehensible. And now they wonder why there’s inflation and companies can’t hire workers? Many small businesses are gone forever because the PPP loans favored wealthy insiders, and then the people who would normally apply for the jobs were sitting on the couch collecting their windfalls, uninterested in working anymore.

Well said. And when the eviction moratorium was finally listed by the Supreme Court, idiots like Kathy Hochul went political and said it was “cruel.”

These people are despicable.

We would need quotas in Congress according to these wealth brackets and in other parliaments too of course.

One simple way to manage this would be to make anyone over the age of 60 eligible to serve in any office. Enough with the gerontocracy! I am 68 myself but I am sick and tired of being ruled by rich white old codgers who don’t give a d*** about the future.

That should be ineligible! Darn autocorrect!

lol… you don’t think there are thousands of young men and women that would jump at the chance of getting access to dark money for acquiring wealth and power?

Fine. Better that than that the current geriatric oligarchy! I absolutely loathe old people because most of them care nothing about future generations. For me my grandchildren are the loves of my life!

Wow, my fellow Americans are struggling, that’s my read. Our personal story follows. My interpretation based on Wolf’s explanations is that we’re doing extremely well based on our income, but we somehow are made to feel by society that we’re not keeping up based on what we see. Glad to have this reinforcement of knowledge instead to show the truth.

On the spreadsheet where I track our personal wealth, I never increased our asset values to post-pandemic pricing because we had no intentions of selling our real estate and because I never believed the gains were real or sustainable (thanks Wolf!). And even though we are both in our early 40s, and even though neither one of us have any inheritance or ever had an income (excluding capital gains and real estate income) higher than $50k in a year, somehow by this chart we’re in the top 30%. We live modestly, but not miserly. We have a kid and pets and hobbies, take European vacations to see distant family, eat well, go out for dinner and things like that. But we also live rurally and have a house that cost us just above $100k that we paid off a while back. I’m a tradesman, work on my own house, and also the household mechanic (late model cars bought at auction or on the cheap through Craigslist always, never having paid more than 25k for a vehicle, which was a work truck). We never found it hard to invest 40-50% of or earnings per year. We own no stocks besides whatever minimal amount my wife puts into her retirement fund to get the match.

So my read on this data is that the bulk of American households, based on our personal situation, are bad at money management. I need to stop looking at their overpriced cars, houses and toys and equating that with success. I guess you can’t see the debt attached to it.

FYI all of our excess income has gone into real estate, and the same type – small apartment buildings producing about 20% ROI on cash invested, with working class tenants and respectable income (but not exorbitant), 100% of which goes back into the properties. Many of our tenants, about 50%, make more than we do. We had just gotten up to the pace where we could start buying properties more frequently (closed in March 2020 on the last one), then the pandemic happened.

Hopefully during the next crash we will focus on shoring up the bottom for necessities and will ignore the needs of the top. And hopefully a more fair society will emerge.

DD:

It’s rarely how much you make and always how much you keep.

Can the 0.1% collectively even sell off much of their stock in this decline without taking a big price hit? Or even sell off a second home? I don’t see the markets being liquid enough to allow for that.

Well, if a .1 percenter has owned the same DJI stocks for the last two years, s/he is still, on average, up 6%. So maybe a bitter pill to swallow, but no big price hit.

I wonder what the real strategy is now for the Zuckerbergs and such. Have they already borrowed against their stock when rates were below 1%? It seems they have to forever hold a major portion of their company stock, what would it look like selling off your company? But can they just watch their precious wealth go down the drain?

Unless of course you are the Musk man. One day he is in court being sued for a 46 billion tab to buy Twitter. The next he’s joyriding in his spaceship. It’s all good.

Musk is building rockets to go to mars @97 million apiece,taxpayers got it no worries

Of course they can sold out Microsoft around 16 months ago then price of stock is down ,but it’s not a rigged game. Or musk taking profits hahahahaha

No, they can’t collectively sell without crashing the price of whatever they own.

Terrific article, thanks

I’d like to dig deeper in to the data.

Please provide a link to the underlying Federal Reserve data.

https://www.federalreserve.gov/releases/z1/dataviz/dfa/

Are these figures nominal or “real” i.e. inflation-adjusted?

The above “Wealth Disparity Monitor” chart shows the top .1% households average about 135 million in assets. The bottom 50% average such a relatively insignificant fraction of household assets, in can be considered nearly zero compared to the .1%’ers.

If the difference was adjusted for inflation, then one would have to assess how much harder the inflation hit the bottom 50%’ers. Simply adjusting for inflation would assume that inflation

hurt both groups equally.

Because no self-respecting conservative or libertarian will read the research (“Capital”) by Thos. Pikkety, they won’t know how, from the tax changes of the Reagan era onward, wealth has moved unchecked into the hands of the wealthier and wealthiest members of America. Tax reductions… who would’ve thought? And, what the knuckleheads that parrot the wishes of the .01%, the capitalist system was working well prior to Reagan: with high tax rates for the wealthiest, all classes were benefitting, at about the same rate.

And that was also a time (prior to the “Reagan Revolution”) when corporations believed in a “social contract” – that they had some moral responsibility to care for their workers.

Not inflation adjusted.

Presumably the wealthiest have done worst recently because a higher proportion of their wealth is in financial assets (stocks, bonds, crypto etc.) that have already suffered a deep draw down.