Bank of England: won’t “hesitate” to hike rates “as much as needed.” Bond market fears much higher inflation and interest rates, for much longer.

By Wolf Richter for WOLF STREET.

It was thought that central banks, with their QE and interest-rate repression, had killed off any remaining bond vigilantes that used to hound governments that trafficked in reckless fiscal policies and high inflation rates. Under these conditions, bond vigilantes – big institutional investors that were tired of getting beaten up by government policies – refused to buy bonds at low yields, thereby pushing up interest rates and imposing high costs of borrowing as punishment. But maybe these dreaded but long-buried bond vigilantes are now rising from their unmarked graves as central banks have turned away from propping up bond markets, have turned to QT, and have started raising policy rates.

In the UK bond market, the bond vigilantes have come back to life with a vengeance after the new government announced a massive package of tax cuts for the rich (by scrapping the top income tax rate and cancelling an increase in corporate taxes, in the classic form of trickle-down economics) accompanied by a surge in spending due to very expensive energy subsidies for businesses and households. While inflation is already raging at around 10%.

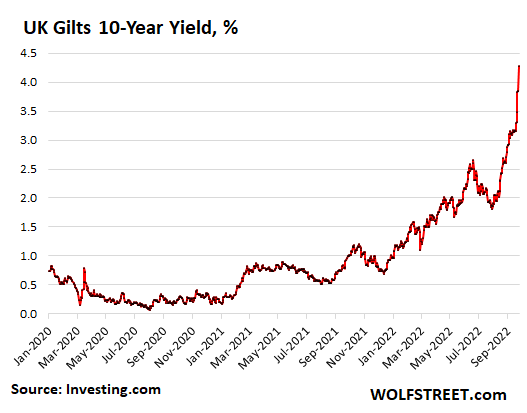

The yield on the 10-year UK government bond (gilts) spiked by 44 basis points, to 4.28% at the moment, bringing the spike since Tuesday last week to 113 basis points, as bond prices plunged:

The one-year yield on UK gilts spiked by a monstrous 65 basis points today to 4.16% at the moment, bringing the spike that started on Tuesday to 121 basis points. These are huge gigantic multiday moves:

The British pound flash-crashed to a record low of $1.035 early this morning, after the plunge on Friday, before bouncing off to $1.07 at the moment, which is still down by 23% from mid-2021. Back in 2007, the pound was still trading above $2, before the financial crisis knocked it down to the $1.50 range.

The initial issue was the “Growth Plan” by new Prime Minister Liz Truss, whose details were announced at the end of last week. This was then made a lot worse with exemplary efficiency by finance minister Kwasi Kwarteng on Sunday when he talked to BBC about it.

He said to the world – practically daring the bond vigilantes to come out of their graves – when asked about the plunge of the pound and the spike in yields last week, that he wasn’t focused on market moves.

“As chancellor of the exchequer, I don’t comment on market movements,” he said. “What I am focused on is growing the economy and making sure that Britain is an attractive place to invest.”

Further tax cuts could be coming, he suggested, which didn’t help either. When challenged in the interview that the new policies of tax cuts and spending increases would further heat up the already red-hot inflation, he said that it was the responsibility of the Bank of England to deal with inflation, following the doctrine Truss had spelled out weeks earlier, that inflationary government policies amid the already worst inflation in decades were OK because it wasn’t the job of the government to deal with inflation, but the central bank’s job.

“They’re tasked to deal with inflation,” he said. “They don’t work in isolation, and that’s why I said that I will see the governor twice a week. And we share ideas, but of course, he’s completely independent.”

The Bank of England addressed this situation in a statement today, pointing out that it would not “hesitate” to hike rates “by as much as needed to return inflation to the 2% target”:

“The role of monetary policy is to ensure that demand does not get ahead of supply in a way that leads to more inflation over the medium term. As the MPC [the BoE’s Monetary Policy Committee] has made clear, it will make a full assessment at its next scheduled meeting of the impact on demand and inflation from the Government’s announcements, and the fall in sterling, and act accordingly. The MPC will not hesitate to change interest rates by as much as needed to return inflation to the 2% target sustainably in the medium term, in line with its remit.”

Last week prior to the announcement of the government’s economic plan, the BoE had raised its policy rate by 50 basis points to 2.25%. The next rate hike is due on November 3. It also confirmed QT, as laid out in August: it would reduce by nearly 10% its holdings of securities over the next 12 months.

The BoE now has a much more difficult challenge, as the government is throwing more fuel on inflation, and it might have to react with more and bigger rate hikes, and more QT, to try to slow this inflation.

And the bond market seems to be reacting to the simultaneous threats of much higher inflation than previously feared, fueled by these policies, and a much more vigorous inflation crackdown from the BoE with much higher interest rates for much longer than previously feared.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

At first…it breaks slowly. Then… All at once.

“Truss had spelled out weeks earlier, that inflationary government policies amid the already worst inflation in decades were OK because it wasn’t the job of the government to deal with inflation, but the central bank’s job.“

Uncle Ben don’t care. He’ll blame you anyway, and vote yer asses out.

So, Britain central bank is hiking slower than Fed with rate of 2.25%, but it’s 10 year bond yields have crossed US 10 year. That means investors have started selling British bonds when central banks are no longer buying.

At the same time government needs to print more money that will causes an even higher inflation that means bond yields will need to go higher to attract investors, more so as the pound keeps plunging.

I guess the only way Britain can stabilize pound is by increasing interest rates by 800 basis points ASAP. However Britain’s zombies cannot handle a 10% interest rate and this will cause huge pain.

If they hesitate, pound crashes making Britain very poor very fast in dollar terms and more so in real terms (because dollar itself is inflating fast).

Yep, the markets are on the HemingWay to heck…

Bonus – If you take those “gone vertical” charts, flip ’em over and rotate them 90 degrees, they show “permanently high plateaus”!

A good question is why exactly price collapses are…well…collapses.

Usually, a large number of people know that mkts/government policies are in dangerous territory and have been for a very long time…but they hang on and on, only exiting in a sudden, mad dash for the doors.

The question is why.

Why not exit gradually, long before the panic.

Perhaps it is simple fear/distaste of the alternates…or perhaps an absurd number of mkt players only pay attention to price movements, not the long poisoned economic fundamentals.

“only exiting in a sudden, mad dash for the doors.”

————————————————

and where have they put the exited money? what better?

I hear ruble has been getting stronger lately for some reason…

why? because its planned, its a party you are watching between a few players shuffling their decks, a show, manufactured news, an illusion, a twin collapse, an own goal, a soliloquy to provide background to next debutante gameshow for your pocket notes, so you buy in, fall over, suck up, all the while not focusing on fixing the root cause.

I love how the FX markets are basically saying the US is the world’s paragon of fiscal responsibility.

These are the kinds of market moves that causes something somewhere to blow up. Some hedge fund or pension with the wrong derivatives on. I’m rather excited to see who it will be.

One has to wonder how many more Archegos there are out there. Kinda like cockroaches… If you see one crawl across your kitchen floor, it’s a safe bet that there are hundreds of others crawling around that you don’t see. Tighter monetary policy and crumbling markets will drive them all out into the light soon enough.

MoreCreativeMatt: Not saying something (or the plural version) won’t blow up soon, but I’m surprised at how quiet the bankruptcy front has been these past few weeks.

Bill Hwang’s Archegos (Tiger Management) blew up in a much lower rate environment than this, and we’ve mostly only seen crypto-related blowups recently (Celsius, Voyager, etc.)

Maybe everybody already knows what’s coming and are adequately preparing for it, so that nothing will happen to anyone going forward…upsetting the anticipatory popcorn tub holders?

Bankruptcy is quiet because earnings haven’t been hit hard. As wolf has patiently shown again and again, US consumer spending and employment are at record highs. When this changes you’ll see leveraged companies doing mass layoffs as a desperation move to stay in business. Then banks holding a lot of mortgages.

This is still the early innings. We don’t know how far or fast it will go.

Things should get more interesting soon with 3Q financial results coming. On the plus side we’re prepaying lots of Europe lodging now for next year’s trip. Thank you King Dollar.

A lot of near junk companies were able to lock in 3% financing because of the Fed policies during pandemic. If you can’t pay a 3% rate in a 8% inflationary climate you deserve to go under.

I wouldn’t say the US is a paragon of fiscal responsibility. It’s more like the cleanest dirty shirt in the laundry right now.

but the Inflation Reduction Act

It hasn’t been a laundry in a lonnng time…much closer to a sewer.

Cas-a problem being that the washing machine has been broken for some time, now, the repair parts aren’t available due to supply-chain issues and most older, experienced technicians have left the firm in favor of retirement…

may we all find a better day.

The dollar is strong because that’s where scared investor money flees. Imagine yourself an investor in japan, europe or south america. Where do you put your money where it has the best chance to be safe?

For now, the US still has a rule of law. In much of the world your money can just be taken by a greedy official.

Take one dollar to the grocery store and tell me it’s strong.

Not sure we still have a rule of law. The 2nd Circuit just ruled that the state can bully insurance companies into not doing business with politically disfavored groups. That’s banana republic territory

Gee, didn’t the US freeze somebody’s money recently?….with blowback

I agree — something breaks somewhere very soon.

Yes.

[link deleted by wolf]

This is the link you should have posted, same source, same numbers, same everything, except in dollars rather than than week to week percent change. Now check and see if it’s still that impressive:

https://fred.stlouisfed.org/series/DPSACBW027SBOG

Zactly.

MoreCreativeMatt, we dont know blows up, but we sure know who will pay for it.

Perhaps the world is saying the US has a strong military and a lot of taxing power.

With market sentiment against them, it’s the end of the road for “kicking the can” in the UK. And in making this comment, I’m an Anglophile though not for the UK as it has existed recently.

Crashing currency, high inflation, low but rising interest rates, and a stagnant economy. All at once.

Next up? A bursting of their housing bubble and disappearance of most middle class “wealth” with noticeably higher rates.

Of course, the UK is only slightly ahead of the curve versus other countries (like the US) where a similar dilemma isn’t that far off.

The outcome is falling living standards for most, no matter which door they choose.

“The outcome is falling living standards for most, no matter which door they choose.”

This is what’s so disgusting about these central bankers and politicians. Everything they do steals the wealth and standard of living of the middle class and poor.

When are we finally going to see some honest conversations about Bernanke’s bullshit “wealth effect” and the role of central bankers in destroying their associated currencies and the standard of living of the masses to pump up the net worths of the moneyed set? This is a despicable way to run economies.

The decision to print with reckless abandon and flood the world with money, especially the past 2.5 years, will go down as perhaps the worst failure of central banks in history. Yet people, namely politicians, still look at them as the saviors. There are no honest conversations, only more and more perverted, deranged actions.

That’s why we have guns.

Inane comment.

Frank, is it? The line between civilization and anarhcy is a lot less pronounced than people realize sometimes.

Bankers and politicians don’t associate with the middle and lower classes. All their chatter is with the wealthy that agree they were doing the right thing keeping rates low for business and the overall trickle down economy. I’m sure their friends were very persuasive and supportive, as well as greedy, entitled, arrogant, and helpful in providing lucrative advice.

When was the last time you heard any one called a statesman?

joe2-a Francis Fukuyama moment…

may we all find a better day.

DC’s comment is spot on. John Hussman’s latest market commentary goes into great detail on the Fed’s deranged policies, as well as showing how early we could be in this market collapse. One of his best ever this month.

And for Frank and Einhal: the veil of civilization is very thin.

Let’s be real. The Brits have more inflation than the USA. Their 10-year gilts are less than half of the rate of inflation even after today’s large climb up. The Tory government is trying a version of Reaganomics — tax cuts for the upper class and spending subsidies for the middle class. This will end in more inflation, higher interest rates, currency depreciation, and lower UK stock prices. Anyone who expects some different outcome short term is deluding themselves.

They have very little manufacturing base

There’s really nothing western economies can do at this point. They’ve loaded on the debt for various schemes to buy votes and convince their citizens they can have a free lunch. The party is over now. The bill has been presented, and it’s a whopper.

When you are loaded up with debt, you can’t shut down your economy and hope supply chains can magically produce goods. You can’t embargo the largest oil producer and expect power and heat to magically come out of a wall socket. Crops don’t grow without fertilizer, so it has to be purchased no matter what it costs.

Politicians only know how to smile and make promises. They don’t actually understand how anything works.

They are career-long professional email writers and PowerPoint presenters. None of them have ever produced, transported, or maintained physical goods.

Crops do grow without fertilizer. But yield is less and you need a mixed (animals and plants) farm for best results. No fertilizer, no monocrops.

Harrold-could be they DO know, but they’re just better at skating from the table before the check arrives…

may we all find a better day.

The most dangerous financial statement is the guy who says, “I’m an economist and I have an idea.” Soon, the new breed will come out.

Wait until the vigilantes hit Italy

They tried but the ECB’s “special military operation” or whatever it’s called is paving over it. For now.

Meloni & Co get a nice free peek at how this stuff works by watching the UK.

…or Spain.

As with the Greeks, the Italians can vote in a posturing government, only to get some lessons in limits. Meloni, Mussolini or whoever.

But what concerns me are more inroads in UK for foreign oligarchs, kleptocrats and their ilk, and in Italy for the PRC bearing gifts.

phleep-check.

may we all find a better day.

Wait until housing prices come down and banks/companies holding under-water mortgages have to be bailed out.

The ECB is going to be printing euros like never before… right into all this inflation that’s out of their control.

Printing broke the worlds’ economies, sending inflation soaring and the masses scrambling just to keep a roof over their head as shelter prices have run away from all but the most wealthy. Yet the pivot crowd is crowing, thinking that which broke everything is coming back real soon. No. No it’s not. What broke shit is not coming back, because then you’d just be breaking shit worse.

My reply is to this post and your reply to mine.

I’d attribute the “printing” behavior to two reasons.

First, there really are people (many economists) who are dumb enough tgo believe that 1+1=3. That’s what use of government “tools” represents: “printing”, outsized deficit spending, and politically motivated economic guarantees. It’s actually “can kicking”.

Second, at least some of these people must know it’s “can kicking” but do it anyway out of expediency.

The actual problem which cannot be fixed by these policies is extended social and economic decay. I’ve read posts here disagreeing with this view claiming there is nothing particularly new, but the aggregate data contradict this claim.

FRED median household income and net worth data show that both have flatlined this entire century. It took a 5X increase in the national debt, a 14X increase in the FRB’s balance sheet, the loosest credit conditions in history, and the biggest asset mania in history to produce this pathetic economic performance. Not much different in much of the rest of the world and no, it’s not mostly due to unequal distribution either. That’s only part of it, since most increased “wealth” is fake and so is much of GDP which isn’t even real production.

Related to the above is hopelessly unrealistic public expectations for future higher consumption and living standards in the face of what I wrote.

Some of those in charge know there is no possibility of reconciling these contradictions, so they use these policies to disguise the true state of society as long as possible.

AF, a great way to illustrate your point is to look at the wealthiest people on earth. A lot of the folks we call “billionaires” aren’t billionaires at all. They hold assets & securities theoretically valued in the billions at a moment in time. But their billions are not entirely accessible since the very act of selling any substantial portion of those assets and securities in exchange for cash would destroy much of their value.

I agree that most of the wealth effect is fake, and I think the inaccessibility of that fake wealth is proof. Real wealth would be fairly liquid and wouldn’t self-destruct the minute the holder tries to access more than a small fraction of it. It’s a mirage… The water is only there until you actually get close to it.

Home equity isn’t much different. It’s only as strong as a buyer’s wallet. If demand drops off, equity evaporates. What remains to be seen is whether or not our central bank will allow it to evaporate very much. If asset prices collapse far enough fast enough, weakening the job market and knee-capping inflation, how long before the Fed steps in to inflate the next bubble? A matter of days? I think they’ll try to keep the charade going and re-inflate post haste. Maybe the dollar even has another couple bubble cycles left in it… The dollar has been the reserve currency for about 7 decades, and reserve currency transitions often take a century or more. After all, the USD is still the cleanest rag in a basket of heavily soiled laundry.

Historically gold was money and inflation could never be higher than what was mined. Each time some “bankiers” let to much interest be accrued the amount of money on the books ran away from the amount of gold existing the system crashed.

In the next iteration fiat money was gold backed. This time the system was dumped when the amount of money had inflated well beyond the amount of gold that backed the money.

Today money is debt and much of the debt is backed by real estate. The catch with dwindling real estate values is that the backing of a lot of the money loose value. I would not be surprised if this do cause the system to break as accrued interest broke the gold money systems and monetary inflation the gold backed fiat money system.

“If asset prices collapse far enough fast enough, weakening the job market and knee-capping inflation, how long before the Fed steps in to inflate the next bubble? A matter of days? I think they’ll try to keep the charade going and re-inflate post haste.”

This comment indicates you are not grasping what’s happening. The printing is the CAUSE of the problems. That’s why we are where we are right now. More printing just makes the problem worse. The fact that you think it’s some sort of solution is odd.

Depth,

You are misreading what he is saying.

He isn’t suggesting a Fed pivot would work…he is simply pointing out that the DC degenerates are reliably…degenerate.

They have traded on global forgery for decades…so the safe assumption is that they are likely to try it again, regardless of the consequences for anybody else, other than themselves.

Imagine a zombie apocalypse, where DC makes zombies to send out to the states, in the service of stopping all the criticism of zombie making.

“…so the safe assumption is that they are likely to try it again…”

I don’t believe that. QE was a recent harebrained idea by Bernanke’s FED. It has failed spectacularly. As much bullshit as they shovel talking about their “wealth effect,” etc., they know damn good and well it has led to horrific effects. QE is played out.

If for some reason they actually did try to start it again, you’d probably see riots and worse. These people were playing with fire and I guarantee they are getting scared behind closed doors. They know the monster they created. They sit up there in public and try to lie and say that the FED doesn’t cause bubbles and doesn’t understand inflation, but they are lying through their teeth.

Cas127 pretty much nailed it DC. Printing more money and/or monetizing debt in the next post-bubble downturn is not my solution at all and I despise what the Fed has done, but it’s very likely to be the Fed’s solution. I’m just following the pattern that they’ve set for decades and extrapolating today’s conditions into the future.

I think our economy is so deeply dependent on cheap credit that it won’t be able to stand against QT and a measely 4%+ FFR. I think it will break and the Fed will reliably do their usual thing. Add all the despicable new tools that the politicians have too (both parties)… Forbearance, unchecked forgiven loans, debt “cancellation,” and whatever other crazy things they can think up under pressure. The next recession/depression will be an orgy of short-sighted vote buying and fraud.

Augustus Frost said: ” it’s not mostly due to unequal distribution either. That’s only part of it,”

————————————————————

a big part

Not only should the economy and population stop growing, it should shrink to deal with the realities of limited resources and climate change. The industrial civilization is rolling over, peak energy was in 2008, society is now reverting to pre industrial levels.

Pound, I’d like for you to step out back for a moment.

I’ve never seen this in my life– investors all but refusing to buy the government bonds of a world power. Think about this– if you’re in the UK right now and get paid in pounds, I’m pretty sure gasoline is going to cost 7% more next week because of these tax cuts. I don’t know if the UK government is doing this as a deliberate policy to weaken the pound, but it’s working as such. And then what’s the solution? Raise rates a ton more and drive up the cost of mortgages. The UK’s fiscal position is in some ways better than the US’s (lower debt to GDP I believe), so this is a potential wake-up call for America.

> “a world power.”

A long-ago ex world power. Many of us Yanks have still pretended because it is so much of our heritage. We will see Brits living like Croats, sooner rather than later.

Brittania is breaching the waves. I’m not happy to say it.

UK is still a world leader in many important things e.g. scientific and medical research.

If you think about the countries that led the world in overcoming the last global threat from 2020 to 2022:

US, Germany (EU), UK, Russia, China, India

These are basically the world powers.

Only Japan is missing from this list.

US gov might shut down this week

I was just praying for our government leaders. The Lord said we could bury them out back in the orchard.

And poison the fruit?

one can only hope.

It’s like Crazy Eddie: everything for sale! Student loan forgiveness! Half a trillion! They’re GIVIN’ it away!

UK and US lower 50 percent are dragging on the sidewalk. It’s just been papered over up until now.

Haven’t you heard? There’s an election coming up. Why not buy votes from young people with student loan debt? It doesn’t cost them anything. The fed will just print it for them.

Sell the bloody lot of them!

The Bank of England raised rates last week by only 0.50% — much lower than the US Fed’s 0.75% hike. That is what caused most of the fall in the pound. The UK went too low.

Liz Truss’s tax giveaway is not really that big. Her 1-5% tax cuts are mostly cancelled out by the (quietly announced) 5-10% “fiscal drag” of the unchanged tax allowances at £12k and £100k earnings. It is classic smoke and mirrors. The markets only saw the smoke.

And don’t forget Brexit. Almost all London financial analysts and UK financial journalists miscalled the 2016 Brexit vote, got it wrong, got humiliated, and now they want their revenge. Every little policy from the UK ruling party (Conservative) is met with negative commentary, even if it is the same as the rest of the G7. For example, America’s $600b tax freebie (for student loans) dwarfs anything the UK is doing.

In short…

1. The BoE needs to hike rates higher and faster.

2. The UK tax giveaway is much smaller (in totality) than we think.

3. Brexit humiliation for Remainers continues to (unfairly) dog financial UK commentary.

I suspect that the BoE may do an “emergency” rate hike to get a grip on this before it turns into a crisis. Emergency anything isn’t good for a new government. But that’s what they might get.

Unless they’ve done a 180, the latest was they’re sticking to the November 3 date for the next meeting..

“In short…

1. The BoE needs to hike rates higher and faster.

2. The UK tax giveaway is much smaller (in totality) than we think.

3. Brexit humiliation for Remainers continues to (unfairly) dog financial UK commentary.”

R2D2 – well put summary

Questions we should all ask

“Why all the noise about a relatively small tax decrease – and no noise about $Billions and $Trillions in QE” – to your point someone’s upset at the change in the policy direction

“Why do any of us have to pay taxes if you can just print money” – the amount of printing has dwarfed tax revenue

to R2D2’s point – someone or somebodies not happy

look though the smoke and you’ll see the real problem

Regarding interest rates, can anybody tell me why GSE bonds pay 1% higher interest than US treasuries, for an equivalent 3-year period? Aren’t the GSE bonds guaranteed, or is that just an expectation?

Mortgage backed securities were also rated AAA by the ratings agencies.

The FDIC or the Pension Guarantee Corporation are under Resourced by breathtaking amounts of money.

When it goes it goes for all.

Are you talking MBS?

If yes, there’s an explanation for part of the reason: the nature of MBS – with MBS, you get pass-through principal payments, and your 30-year MBS will shrink on a continual basis, and you’ll end up having to buy new MBS over time to maintain your portfolio balance. That is one reason they yield more than Treasuries.

These charts are looking pretty parabolic, usially a signal change in direction is comimg.

But then again, parabolic charts lasting longer than expected seems to be the new normal in recent years.

To paraphrase slightly- parabolic curves can go on longer than you can remain solvent.

Parabolic is misleading when you started at 0. I suggest you look at a long term chart to get a fuller understanding. This is more like regression to the mean.

How on earth Governor Andrew Bailey of the Bank of England didn’t get ahead of this crisis last week is inexcusable. Most of the damaging and ultra loose fiscal measures were leaked in advance and he probably had a direct briefing. The 0.5% rate increase days ago was effectively a rate cut against expectations. He’s complicit in this mess.

Now all the pressure is on him to intervene, which may not turn out well. Emergency intervention, if required and whatever might be announced, signals a very high degree of weakness and vulnerability.

Truss, Kwarteng (Chancellor) and Bailey are all simply hoping this is a knee-jerk response by the markets which will self-correct. Sooner or not much later, they are in for one almighty shock. What they will be most concerned about is a total loss of capacity to export blame. It’s on them.

Big devaluation, hat in hand to IMF. Gruel for breakfast, lunch and dinner.

It’s the 70’s, except Bowie is dead.

My hunch is that the BOE will do a shock-and-awe emergency rate hike to get a grip on this.

09/28/22

The incompetence of the BoE is simply breathtaking. It’s actually loosened the UK’s monetary stance.

The UK mortgage market is breaking down, so the Bank of England targeted lower rates with the money printer and temporarily suspended Gilts issuance.

I didn’t think it would go with emergency intervention to raise rates, despite the sound logic, but thought instead the Bank of England would signal a higher rise at the next meeting…and only yesterday it did.

And now this.

I would say that the GB Pound has more of a future than the Euro.

I would also expect the GB Pound to rise against the US Dollar within the next 6 months.

What is surprising is that the US Dollar is coming close to parity with the Swiss Franc as it has US Dollar is usually 90% of the Swiss Franc.

The Swiss Franc is a bankers’ mirage. The Swiss can’t let CHF wander too far from the Euro or their trade gets totally screwed up. See what happened 2007-2012.

This is because the Swiss economy is small, somewhere between Ohio and Pennsylvania in size. And landlocked within the Eurozone.

With the Euro now below parity with the dollar, the CHF is being dragged along. People holding “Swiss bonds” as a safe haven will find that it’s not there when they need it most.

Who cares about the UK… This is Merika!!

Would not like to see the Truss government fold up quickly. At the turn nations began raising their sovereign bond rates, in order to attract foreign investment, as the global monetary base contracts. Competition for a dwindling resource, capital. That hasn’t sunk into financials yet, that investment capital is becoming scarce. The US is the premier money printing regime, by virtue of reputation. I don’t think we have seen the highs in inflation by a long ways.

“The US is the premier money printing regime, by virtue of reputation.”

You mean, by virtue of being the world’s dominant reserve currency.

“Competition for a dwindling resource, capital. ”

————————————————-

there’s a laugher, or maybe I should say,

a laffer

I’ll tell you it looks good on Europe. Payback time for all those years of stupid negative interest rates.

GBP/USD monthly breached Feb 1985 low, but closed above.

Wolf,

What does this mean for Americans? How will it hurt the US?

It means that “Dream Vacation” to the UK just got a little cheaper.

Not a huge issue for us here. We’ve got our own problems to deal with tho.

It means that the engines are just firing up, Deutsche and buds got a taste for it and once they are turfed out the UK through exposure, they’ll be coming round again but next time a little more hungry.

What “central banks, with their QE and interest-rate repression, had killed off” is prudent investors, who will never recover from this thuggery.

Wolf hit it on the head

Good Charts : Bond Yields +++

Dollar crazy Hi

But Inflation driven surge continues

Perfect Gold Short . Check it out

Wyckoff Market Rating : 1.0

” Gold Technical Analysis for the Week of September 26, 2022 “

I have respect for bri’sh people. Hard workers and heavy drinkers. Uk once ruled half of the world and extracted wealth from the colonies and lived happily. Now, they are the size of Michigan? Yes, they have the old diplomacy, moderate military for EU and important country in the west. Their economy is somewhat the same as PIIGS of the EU. They might soon need bailout from the IMF or London Laundromat.

In the early 1950’s my mom emigrated from Switzerland to the USA. Before she came to the USA she went to England for a year to learn English while working as a Nanny. She always said how nice the English and Scottish people were, and how well she was treated.

For me, an incendiary, well written article, full of the stuff that increases the blood pressure and the heart rate. Most people have not followed, as well as a victim, of QE, these past 15 years.

The current valuation of the pound seems like a classic opportunity to “catch the falling knife”. The plan is for the unwashed to buy the dreg that the washed are offering. The long term interest rate in the UK is what ?

Four and a half pct, when it should be 17 pct ?

Well, were I actually being so flagrantly insulted by the new King, who obviously is brewing for an altercation.

Wait a minute, I am being insulted. Bond vigilantes seem rather timid.

Growing up, the only thing about the UK was what my Irish ancestors told me about the cousin jacks. It really wasn’t a balanced view of the UK, especially since they still had income from their colonies. Well, that has since dwindled to the point where they’re on their own.

Well, the pound is an example of the flaw of Bretton-Woods style agreements, a fiat currency that is automatically supported by the operation of the Fed, essentially. By codified agreement. Which is fine when the agreement is written, I suppose, but, as it ages, it becomes an inefficient support structure for the status quo.

Would I dissolve the agreements on relative currency valuations ,like Bretton-Woods. No.

When the US bond vigilantes in the US increase the interest rate to >8.3 pct, I will have a legitimate comment on the absurd valuations of the European interest rates.

Thank goodness that love is a viable, but not modern, option for the world. Love is incorrectly assigned as a young persons passion, which is the commercial version versus the boring truth.

That wealth is a relative thing. Money seems to be only important when there is not enough.

US 10 year treasury yield spiked today. Just below 3.9 as of writing this. UK 10 year treasury yield spiked over 100 bps over past 4 days. Many analysts saying US was a spillover from UK.

Any insights on how these two are related? Is it just a psychological relationship or is there any solid economics to it?

The competitive closing time for t-bills is normally 11:30 a.m. Eastern Time on auction day… Selloff and upward pressure in yields was kicked off around 11:30

2YR Note auction had weaker than expected bidding with similar ‘vigilante’ action…

5YR Note Auction tomorrow, 7YR Note Auction Wednesday. Can we get a no-bid :)

For decades at least 3 the retirement plan for my British friends was to buy apartments and homes in London. And that has worked for decades. Hope they cashed out and moved to Dubai.

So the next issue with Britain is their lack of energy production. For a century or longer there was British Gas, So now Britain will have to import most of their energy and pay in USD. Energy just jumped 20 percent so that inflation has not hit the country yet. Wolf says the term best “wack the inflationary mole and see where the mole pops up which is now the Pound.

The scary thing is how the US has printed 10’s of trillions since 2008, and the country is declining. Roads, bridges, power and water, airports and ports are sorely behind in maintenance. Cities have worsening crime. Medical care is now 20% of GDP and people are getting fatter and sicker.

What happens if gov’t is forced to stop printing because of inflation? How do we ever rebuild society and turn around the rot? It’s a horrible catch 22. In the past humans just moved somewhere else, but now there is nowhere else to go.

Promises will be broken. In a just world, the important stuff will rise up the list again and the dumb projects will disappear. Politicians are currently acting like the status quo will go on forever.

I call BS on “Roads, bridges, power and water, airports and ports are sorely behind in maintenance.”

I did a lot of travel around the US this year and nowhere much did I see any of that.

There are always exceptions but the ports cleared the backlog, the airports have more capacity than the airlines can fill given the pilots available, the roads are on average in the same shape they’ve always been for the past 40 years. Yes bridges and roads need routine maintenance but nothing extraordinary. As for power and water, those systems are mostly suffering from self-inflicted wounds from poor planning choices, not “maintenance needs”.

One thing that deserves comment is that raising rates will stanch inflation.

Maybe. Maybe it makes it worse.

Case in point for the latter is the German hyperinflation. Debt rates there were exactly at the rate of inflation and too hi so no debt was issued. It all went into current debt: Currency. If 30 year debt were even issued there, no one would buy it because no one had enough cash. The costs of such debt would drive country debt so high that they would have to accelerate the issuance of more currency to pay for the debt maintenance.

At some point the higher debt accelerates the inflation rate. It cannot slow it down as the debt issuance is pointless.

You’re welcome. I printed money and now we have more of it. We are all richer!!! Why everybody complaining???

I am complaining because of the loss of respect for what money should stand for. Honest labor,whether with a pencil, shovel, a key board, or a piece of equipment. Way too many handouts, bailouts, and free shit has made us all weak as a community. I especially hold Congress in contempt for the 2008 fiasco. I wasn’t hurt financially, I was totally out of the market in early 2007. My employees were hurt though and I believe and will always believe the country in general was not served well. There, I’ve gave my answer to you.

Damn straight. 2008-2009 was the biggest bank robbery in history: the banks robbed us. Homeowners, taxpayers, students, pensioners, 401K investors… everyone got screwed to make the criminals whole.

The Great Inflation of 2020-2022 is equally bad, but in a much more insidious way. We are only just beginning to see the outlines of how unwisely and wastefully our leaders handled the COVID response.

I’ll never forget CONgress pretending like they weren’t going to bail out the banks, then welching on the American people in favor of the greedy, fraudulent, disgusting bankers.

I’ll never forget CONgress pretending like they weren’t going to bail out the banks, then welching on the American people in favor of the greedy, fraudulent, disgusting bankers.

100% +1

Nail on the head that says it all , Reap what you sew

Debt to GDP ratio by country:

Japan 237%, Italy 135%, United States 107%, France 98%, Canada 89%, UK 80%, Brazil 75%, China 50%, Mexico 45%, Turket 44%, Sweden 35%, Russia 12%. For the deadbeat nations, even a moderate rise in interest rates can crush an annual budget. Hence, the Japanese have been running ZIRP and NIRP for going on 30 years and the USA for 15 years.

So, why don’t all the bond vigilantes just purchase US treasuries?

Why would any entity use their own capital to go after their own Government’s fiscal recklessness?

If it was my money, I would just purchase US treasuries and wait the whole thing out.

Kwasi Kwarteng will meet with Bank of America, Citigroup, JPMorgan Chase, and Morgan Stanley execs, here we go here we go here we go. who is the wolf and who is the lamb. we shall see.

“Trickle down-economics”? Really, Wolf? You should know better.

The proper term is “supply-side economics” which is based on the fact that taxation of capital raises the cost of capital to companies while lowering the returns to investors. The reduction in incentives for both capital users and capital providers results in a deadweight loss to society due to forgone investment. This deadweight loss increases disproportionately as tax rates approach 100%, and has an outsized effect on the economy when applied to high income taxpayers who have surplus capital that they may or may not choose to risk, depending on the post-tax rate of return.

Please don’t kill the golden goose…

“Supply-side economics” had its opportunity and failed the majority of Americans spectacularly. Certainly some wealthy people did extraordinarily well as income and wealth inequality has soared dramatically over the past 40 years. It’s no surprise there are still supporters for a system biased to benefit the wealthy who keep nearly all the gold the goose can provide.

It’s simply not credible to claim high income taxpayers will put their money under a mattress (i.e. not choose to risk it) if they aren’t given huge tax incentives. They may choose less risky investments or put their money in a bank, but that money will still be available for investment in new businesses or increased productive capacity without the lopsided tax benefits “supply-side economics” provides to the already wealthy.

Yes, let us go more socialist like the last few years. That does not clearly work. It is about time interest rates jump and the new norm will be 7% to 9% mortgage rates for years. Just be glad we are not going back to 14%+ mortgage rates but if you guys keep pushing that is where socialist, money printing, tax policy will bring us like $400 billion loan forgiveness will do. Knowing government it will cost double that or more, $1 trillion+. This is just one example there are hundreds that keep piling up the racking up the debt clock.

Lol, do you even understand what my comment is about? If so, please explain why you think supply side economics makes good tax and social policy.

Supply-side economics is about the supposed benefits to the lower and working classes from lower tax rates on capital, which disproportionately benefits high income taxpayers (as acknowledged in the comment by kramartini). I don’t believe the alleged benefits of supply-side economics trickle down to the lower and working classes in any significant way. My comment has nothing to do with socialism, so you can relax. My comment does matter for tax policy, and collecting more taxes might reduce the “racking up of the debt clock” you’re worried about.

Personally, I would love 14% interest rates since I’m an investor, not a debtor. However, I would rather have a healthy economy so a small return slightly above inflation is fine by me. Part of having a healthy economy is also implementing a fair and balanced tax policy, no money printing, and if debt is to be forgiven it should be done through the bankruptcy process. Advocating a tax policy that doesn’t favor capital over labor is not about socialism, it’s about fairness and not arbitrarily favoring certain sources of income.

Lots of errors in this article.

He cut the basic rate of tax from 20% to 19%. Cut national insurance by 1.25%. Both cuts benefitted those earning under £50k.

And he cancelled a planned hike in corporation tax from 19% to 26%.

It was a pro-business budget, not a trickle down one.

Though if everyone in the market didn’t read the detail either, I can see why they’ve used the pretext of catchphrases like “trickle-down” to go Full Hysterical.

BTW, UK debt to GDP is 95%, lowest in G7. And the UK hasn’t defaulted on debt since the 13th century.

Candy,

Your comment is NUTS. I’ll just shoot down one point because I don’t have time to shoot down the rest: Cutting corporate tax rates is the ultimate tax cut for the rich because they run them, they get the stock compensation packages, and they own them since the bottom 80% on the wealth scale hold nearly no stocks and get no stock compensation packages.

It’s this kind of thoughtless BS that qualifies as propaganda.

Candy, they also eliminated the top marginal tax rate of 45%. Which group does that benefit?

Today the BoE was just forced to postpone QT and restart unlimited QE. Mark my words, in due course the ECB and, eventually, the FED will too. As I warned before on these pages (see links) they are all grabbing the tiger by the tail as described in the article linked at the bottom.

The Bank of England has been forced to step into bond markets amid market turmoil that has sent government borrowing costs soaring.

The central bank has delayed plans to sell bonds and will start buying them instead to stabilise what it described as “dysfunctional markets”.

It said: “Were dysfunction in this market to continue or worsen, there would be a material risk to UK financial stability.”

The Bank didn’t give a figure on the size of the purchases but said they will be carried out on “whatever scale is necessary”.

https://wolfstreet.com/2022/09/13/services-inflation-spikes-core-cpi-jumps-food-inflation-worst-since-1979-even-durable-goods-rise-but-gasoline-airfares-plunge/#comment-465125

https://wolfstreet.com/2021/01/16/massive-inflation-in-shipping-costs-and-the-reasons/#comment-312217

Economist Friedrich Hayek famously described this situation as like grabbing a “tiger by the tail”; once the central bank decides to accelerate the process of credit expansion and inflation in order to head off any recession risk, then it continually faces the same choice of either accelerating the process further or facing an ever greater risk of recession as distortions build in the real economy.